Abstract

In today’s competitive environment, every leading organization wishes to improve the pricing strategies in order to increase revenue, credit policy is one of the best tools of it. This research work develops an economic order quantity (EOQ) inventory model for a deteriorating item that considers interval-valued inventory costs, price dependent demand, two-level credit policy, and shortages. Due to high and uncertainty in demand, sometimes organizations have to face the situation of stock out. So, keeping this scenario in mind, this work considers the situation of partially backlogging. Here, it is developed an EOQ inventory model by considering a non-linear interval-valued constrained optimization problem. Two types of particle swarm optimization (PSO) algorithm are used to resolve it, and then the results are compared. Sensitivity analysis is done in order to investigate the impact of key parameters on decision-making. Finally, conclusions along with some managerial insights are given.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Inventory

- Deterioration

- Price-dependent demand

- Partial shortages

- Interval-valued inventory costs

- Two-level credit policy

2.1 Introduction

In the inventory management literature, very little research work has been done in relation to considering that the inventory costs are represented in an interval-valued. Many researchers assume that the inventory costs such that the ordering cost, inventory carrying cost, and purchasing cost are expressed as a fixed value known. Nevertheless, in reality, all of the mentioned costs are imprecise numbers in nature instead of a fixed value due to the fact that generally, the inventory costs fluctuate by reason of several factors such as changes in prices. In order to explain why it needs to use an interval number rather than the fixed value number, the following reason is mentioned. Normally, the inventory carrying cost is distinct during the seasons of the year. For example, the deterioration rate is different in summer and winter. During summer time, it is necessary to use preservation technology with the intention of decreasing the deterioration percentage of some perishable products and therefore the holding cost is different from holding cost in the winter time. Another cost that also varies is the labor charges, which change over the period of time.

To overcome the problem of imprecise numbers, the researchers and academicians use the following approaches: (i) stochastic, (ii) fuzzy, and (iii) fuzzy-stochastic. In the case of the stochastic approach, the inventory data are considered as random variables with a given and known probability distribution. In the case of the fuzzy approach, the data of the inventory system and the constraints are expressed with fuzzy sets with a given and known membership function. In the case of fuzzy-stochastic approach, some inventory data are supposed to be represented by fuzzy sets and the rest of the inventory parameters are assumed random variables. But it is not an easy task to select the most suitable membership function or probability distribution.

With the aim of avoiding the complexity in the selection of the right membership function or the right probability distribution, it is suggested to use interval numbers. With this, the imprecise problem is converted to an interval-valued problem, which can be solved, by any soft computing optimization technique, such as the different versions of particle swarm optimization (PSO) or genetic algorithm (GA). In this connection, the reader can see the related works, which apply interval number into the area of inventory control. Gupta et al. [1] applied the interval concept in the field of inventory theory. They resolved an inventory problem with interval-valued inventory costs using a genetic algorithm approach. After that, Dey et al. [2] formulated an inventory model considering interval-valued lead time. Again, Gupta et al. [3] developed an inventory model using interval-valued inventory costs. Bhunia et al. [4] solved a stock-dependent inventory model with interval-valued inventory costs using particle swarm optimization (PSO). Afterward, Bhunia and Shaikh [5] built a two-warehouse inventory model with inflation, and they solved it using particle swarm optimization.

In the current competitive markets, the permissible delay in payment has a vital role in promoting the business. Normally, the suppliers give different types of facilities to retailers, and the retailers give some facilities to their direct customers. This is done with the aim of attracting more customers to acquire products. Table 2.1 presents research works related to single-level or two-level credit policy.

It is a well-known fact that inventory cost always is not a fixed value. This means that the inventory cost lies between certain interval numbers. Therefore, the major goal of this research work is to include the interval concept in an inventory model. In this direction, this research work derives an economic order quantity (EOQ) inventory model for a deteriorating item with price-dependent demand, and interval-valued inventory costs and shortages. The shortage is partially backordered according to a rate, which is reliant on the interval of waiting time till the occurrence of next lot. The inventory model is expressed as a nonlinear interval-valued continuous optimization problem. Then, different forms of particle swarm optimization (PSO) algorithm are applied to solve it. In continuous optimization, PSO gives better results than GA. For this reason, in this research work, the latest version of PSO is used.

The remnants sections of the research work are planned as follows. Section 2.2 defines the suppositions and the notations. Section 2.3 formulates the inventory model. Section 2.4 derives the mathematical solution for three different demand functions. Section 2.5 solves some instances. Section 2.6 does a sensitivity analysis. Section 2.7 provides conclusions and lines for research.

2.2 Suppositions and Notations

The suppositions and symbols that are used to build the inventory model are listed below.

2.2.1 Suppositions

-

(i)

The planning horizon is infinite.

-

(ii)

Inventory system handles a single item.

-

(iii)

Demand rate \( D(.) \) is influenced by the selling price (p).

-

(iv)

Inventory costs are interval-valued.

-

(v)

The order is supplied in one delivery.

-

(vi)

Replenishment is instantaneous.

-

(vii)

Lead time is zero.

-

(viii)

Stockout is partially backlogged with a backlogging rate given by \( \left[ {1 + \delta \left( {T - t} \right)} \right]^{ - 1} \).

-

(ix)

Two-level credit policy approach is assumed where the supplier gives a credit period (M) to his/her retailer, and the retailer also provides a credit facility (N) to his/her customer under certain terms and conditions. Here, it is established the following condition N < M.

2.2.2 Notations

Symbols | Description |

|---|---|

Parameters | |

\( I\left( t \right) \) | Inventory level at time t (units) |

\( \alpha \) | Deterioration rate (\( 0 < \alpha \ll 1 \)) |

\( [C_{oL} ,C_{oR} ] \) | Interval-valued replenishment cost ($/order) |

\( \delta \) | Backlogging parameter |

\( \left[ {C_{pL} ,C_{pR} } \right] \) | Interval-valued purchasing cost ($/unit) |

\( D(.) \) | Demand rate that is dependent on price (units/unit of time) |

\( [C_{hL} ,C_{hR} ] \) | Interval-valued holding cost ($/unit/unit of time) |

\( [C_{bL} ,C_{bR} ] \) | Interval-valued shortage cost ($/unit/unit of time) |

\( [C_{lsL} ,C_{lsR} ] \) | Interval-valued opportunity cost due to a lost sale ($/unit/unit of time) |

\( t_{1} \) | Time in which the stock level is zero (unit of time) |

T | Cycle length (unit of time) |

M | Credit period is given to the retailer by the supplier (unit of time) |

N | Credit period provided to the customer by the retailer: N < M (unit of time) |

\( I_{e} \) | Interest earned by the retailer (%/unit of time) |

\( I_{p} \) | Interest charged by the supplier to the retailer (%/unit of time) |

\( \left[ {Z_{L}^{(.)} ,Z_{R}^{(.)} } \right] \) | Interval-valued the total profit ($/unit of time) |

Decision variables | |

S | Stock level (units) |

R | Shortage level (units) |

B | The time period after reaching the prescribed credit time M (unit of time) |

2.3 Mathematical Derivation of the Inventory Model

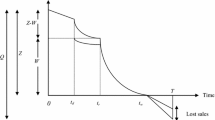

Initially, the retailer purchases a lot of (S + R) units. After fulfilling the backordered units of the preceding cycle, the stock level is S units at t = 0. Then, S units start to decrease due to both consumers’ demand and deterioration effect. Obviously, after a certain time period, the stock level reaches zero at the time \( t = t_{1} \). After that, at time \( t = t_{1} \), shortage occurs with a backlogging rate \( \left[ {1 + \delta \left( {T - t} \right)} \right]^{ - 1} \) till the time \( t = T. \) Then, a subsequent batch is received at T.

The behavior of the inventory \( I\left( t \right) \) is modeled by the differential Eqs. (2.1) and (2.2):

with the initial and boundary conditions

and

It is significant to state that the inventory level \( I(t) \) is continuous at \( t = t_{1} \). Using the conditions (2.3) and (2.4), the solutions to the differential equations (2.1) and (2.2) are given below:

From condition (2.3), \( I\left( t \right) = S \) at \( t = 0. \) Thus, the maximum inventory level is computed with

Using the continuity condition, hence, the shortage quantity is determined with

The total interval-valued inventory holding cost \( C_{hol} = \left[ {C_{holL} ,C_{holR} } \right] \) of the system is expressed as follows:

and

The total interval-valued shortage cost \( C_{sho} = \left[ {C_{shoL} ,C_{shoR} } \right] \) of the inventory system is given below:

The total interval-valued opportunity cost of lost sales \( OC_{LS} = \left[ {OC_{LSL} ,OC_{LSR} } \right] \) during the entire cycle is determined by

and

As it was mentioned before, in two-level credit policy, the supplier provides a credit period to his/her retailer with a duration of M. Then, the retailer also gives a certain credit period to his/her client with a duration of N, where N is always less than M. Furthermore, here two cases occur: Case 1: \( 0 < N < M \le t_{1} \) and Case 2: \( N < t_{1} < M \le T. \) Figures 2.1 and 2.2 show the behavior of the stock level over the period of time for Case 1 and Case 2, respectively. Below a discussion of these two cases is given.

Case 1: \( 0 < N < M \le t_{1} \)

In this case, the total amount of purchase cost of the retailer is within the following interval \( \left[ {C_{pL} \left( {S + R} \right),C_{pR} \left( {S + R} \right)} \right] \). This amount must be covered to the supplier at the time \( t = M. \) In this credit time period, the retailer accumulates money due to sales during [0, M] as well as the interest gained during [N, M]. Hence, the total collected amount is calculated with

Thus,

The retailer collects \( U_{1} \) and interval-valued for the purchase cost amount is \( \left[ {C_{pL} \left( {S + R} \right),C_{pR} \left( {S + R} \right)} \right]. \) Here, the following two subcases occur: Subcase 1: \( U_{1} \ge \left[ {C_{pL} \left( {S + R} \right),C_{pR} \left( {S + R} \right)} \right] \) and Subcase 2: \( U_{1} < \left[ {C_{pL} \left( {S + R} \right),C_{pR} \left( {S + R} \right)} \right]. \) These subcases are developed below:

Subcase 1: \( U_{1} \ge \left[ {C_{pL} \left( {S + R} \right),C_{pR} \left( {S + R} \right)} \right] \)

In this Subcase 1, the total interval-valued profit of the inventory system is written as

where

\( \left[ {X_{L} ,X_{R} } \right] \) = <Excess amount on hand after paying the cost of purchased goods to the supplier> + <interest earned for excess amount in \( \left[ {M,T} \right] \)> + <sales revenue in \( \left[ {M,t_{1} } \right] \)> + <interest earned in \( \left[ {M,t_{1} } \right] \)> + <interest earned in \( \left[ {t_{1} ,T} \right] \)> − <ordering cost> − <holding cost> − <shortage cost> − <cost of lost sale>

and

Therefore, the corresponding interval-valued nonlinear optimization problem of the inventory system is written as follows.

Problem 1

Subcase 2: \( U_{1} < \left[ {C_{pL} \left( {S + R} \right),C_{pR} \left( {S + R} \right)} \right] \)

In Subcase 2, the retailer collects an amount corresponding to sales and interest earned up to \( t = M. \) This amount is less than the amount of the purchase cost. Taking into consideration this situation, the following two subcases happen: Subcase 2.1: Supplier takes a partial payment at \( t = M \) of his/her retailer, and Subcase 2.2: Supplier does not take the partial payment at \( t = M \) of his/her retailer. Now, these two subcases are discussed below.

Subcase 2.1: Supplier takes a partial payment at \( t = M \) of his/her retailer.

In this subcase, it is considered that the supplier takes a partial payment and permits some time to the retailer regarding the payment of rest interval amount which is expressed as \( \left[ {C_{pL} \left( {S + R} \right) - U_{1} ,C_{pR} \left( {S + R} \right) - U_{1} } \right] \). The interval relax time is \( t = \left[ {B_{L} ,B_{R} } \right]\,{\text{where}}\,\left[ {B_{L} ,B_{R} } \right] > M \). In this situation, the supplier must charge the interest of unpaid amount \( \left[ {C_{pL} \left( {S + R} \right) - U_{1} ,C_{pR} \left( {S + R} \right) - U_{1} } \right] \) during the interval \( \left[ {M,\left[ {B_{L} ,B_{R} } \right]} \right] \) with interest paid rate \( I_{p} \).

Thus, the total amount that must be paid to the supplier at a time \( t = \left[ {B_{L} ,B_{R} } \right] \) is given by \( \left[ {C_{pL} \left( {S + R} \right) - U_{1} ,C_{pR} \left( {S + R} \right) - U_{1} } \right]\left\{ {1 + I_{p} \left( {\left[ {B_{L} ,B_{R} } \right] - M} \right)} \right\} \).

On the other hand, the total available amount to the retailer is determined as < total sales revenue during the time interval \( \left[ {M,\left[ {B_{L} ,B_{R} } \right]} \right] \)> + <total interest earned during the time interval \( \left[ {M,\left[ {B_{L} ,B_{R} } \right]} \right] \)>. So, the total interest earned is

and

As a result, at the time \( t = \left[ {B_{L} ,B_{R} } \right] \), the total payable amount available to the retailer is equal to the amount payable to the supplier, which is

Thus,

and

Consequently, the total interval-valued profit function of the inventory system is computed as

where

\( \left[ {X_{L} ,X_{R} } \right] \) = < sales revenue during the time interval \( \left[ {\left[ {B_{L} ,B_{R} } \right],t_{1} } \right] \) > + < interest earned thru the time interval \( \left[ {\left[ {B_{L} ,B_{R} } \right],t_{1} } \right] \) > + < interest earned through interval \( \left[ {t_{1} ,T} \right] \) > − < ordering cost > − <holding cost > − <shortage cost > − <cost of lost sale>

and

So, in this subcase, the interval-valued constrained optimization problem is formulated as follows.

Problem 2

Subcase 2.2: Supplier does not take the partial payment at \( t = M \) of his/her retailer.

In this situation, the supplier does not take a partial payment. In other words, the retailer needs to cover the credit amount to his/her supplier. This amount is calculated with \( \left[ {C_{pL} \left( {S + R} \right) - U_{1} ,C_{pR} \left( {S + R} \right) - U_{1} } \right] \) after the time \( t = M \). The interval time period \( t = \left[ {B_{L} ,B_{R} } \right] \) when the supplier gets the full creditable amount within this time interval. Regarding this situation, supplier charges the interest for the period \( \left[ {M,\left[ {B_{L} ,B_{R} } \right]} \right] \) with interest paid rate \( I_{p} \).

Therefore, the total on-hand amount available to the retailer is equal to the amount payable to the supplier at the time \( t = \left[ {B_{L} ,B_{R} } \right] \). Thus,

and

Consequently, the total interval-valued profit of the inventory system is as follows:

where

\( \left[ {X_{L} ,X_{R} } \right] \) = < sales revenue during the time interval \( \left[ {\left[ {B_{L} ,B_{R} } \right],t_{1} } \right] \) > + < interest earned for the duration of the time interval \( \left[ {\left[ {B_{L} ,B_{R} } \right],t_{1} } \right] \) > + < interest earned within the interval \( \left[ {t_{1} ,T} \right] \) > − < ordering cost > − <holding cost > − <shortage cost > − <cost of lost sale>

and

Thus, the interval-valued constrained nonlinear optimization problem is expressed below:

Problem 3

Case 2: \( N < t_{1} < M \le T \)

Owing to sales revenue and interest earned, the collected amount of the retailer is computed as

Here, the interval-valued profit of the inventory system is formulated as

where

\( \left[ {X_{L} ,X_{R} } \right] \) = < Excess amount available of retailer after paying the supplier > + < total interest earned for that excess amount in \( \left[ {M,T} \right] \) > − < ordering cost > − <holding cost > − <shortage cost > − <cost of lost sale>

and

For that reason, the corresponding interval-valued constrained nonlinear optimization problem is as follows.

Problem 4

2.4 The Solution for Three Demand Functions

\( D\left( \cdot \right) = a - bp,\,a,b > 0 \), \( D\left( \cdot \right) = ap^{ - \alpha } \quad a > 0,\alpha < 1 \), and \( D\left( \cdot \right) = ae^{( - p/k)} ,\; a,k > 0 \).

This section derives the mathematical expressions for three price demand functions.

4.1: When \( D\left( \cdot \right) = a - bp,\quad a,b > 0 \)

Here,

-

Case 4.1.1.

where

and

-

Case 4.1.2.

$$ \begin{aligned}& {\text{Maximize}}\,\,Z_{2}^{\left( 1 \right)} \left( {S,R,t_{1} ,T} \right) = \left[ {\frac{{X_{L} }}{T},\frac{{X_{R} }}{T}} \right] \\ & {\text{subject to}} \,\,0 < N < M \le t_{1} < T \\ \end{aligned} $$(2.23)$$ \left\{ {C_{pL} \left( {S + R} \right) - U_{1} } \right\}\left\{ {1 + I_{p} \left( {B_{L} - M} \right)} \right\} = p\int\limits_{M}^{{B_{L} }} {(a - bp)dt + pI_{e} \int\limits_{M}^{{B_{L} }} {\int\limits_{M}^{t} {(a - bp)dudt} } } $$

and

where

-

Case 4.1.3.

and

where

and

-

Case 4.1.4.

Here,

where

and

4.2: When \( D\left( \cdot \right) = ap^{ - \alpha } \quad a > 0,\alpha < 1 \)

Here,

-

Case 4.2.1.

$$ \begin{aligned}& {\text{Maximize}}\,\,Z_{1}^{\left( 2 \right)} \left( {S,R,t_{1} ,T} \right) = \left[ {\frac{{X_{L} }}{T},\frac{{X_{R} }}{T}} \right] \\ & \quad {\text{subject to}}\,\,0 < N < M \le t_{1} < T \\ \end{aligned} $$(2.26)

where

and

-

Case 4.2.2.

$$ \begin{aligned}& {\text{Maximize}}\,\,Z_{2}^{\left( 2 \right)} \left( {S,R,t_{1} ,T} \right) = \left[ {\frac{{X_{L} }}{T},\frac{{X_{R} }}{T}} \right] \\ & {\text{subject to}}\,\, 0 < N < M \le t_{1} < T \\ \end{aligned} $$(2.27)$$ \left\{ {C_{pL} \left( {S + R} \right) - U_{1} } \right\}\left\{ {1 + I_{p} \left( {B_{L} - M} \right)} \right\} = p\int\limits_{M}^{{B_{L} }} {ap^{ - \alpha } \,dt + pI_{e} \int\limits_{M}^{{B_{L} }} {\int\limits_{M}^{t} {ap^{ - \alpha } \,dudt} } } $$

and

where

and

-

Case 4.2.3.

and

where

and

-

Case 4.2.4.

Here,

where

and

4.3: When \( D\left( \cdot \right) = ae^{( - p/k)} ,\quad a,k > 0 \)

Here,

-

Case 4.3.1.

where

and

-

Case 4.3.2.

and

where

and

-

Case 4.3.3.

and

where

and

-

Case 4.3.4.

Here,

where

and

2.5 Numerical Examples

This section provides and solves three instances with the purpose of illustrating and validating the inventory model.

The solution procedure consists of applying the theory of interval numbers and two efficient and effective soft computing techniques: Particle swarm optimization constriction (PSO-CO) and weighted quantum particle swarm optimization (WQPSO). Both soft computing algorithms are programmed in C language. The computational experiments are done on a personal computer with the following technical characteristics: Intel Core-2-Duo, 2.5 GHz Processor, and LINUX environ. It is important to remark that Kennedy and Eberhart [27], Clerc and Kennedy [28], and Clerc [29] proposed the particle swarm optimization (PSO) and particle swarm optimization constriction (PSO-CO); and Sun et al. [30, 31] introduced weighted quantum particle swarm optimization (WQPSO). Sahoo et al. [32] introduced the definitions of interval order relations between two interval numbers with the aim of solving the maximization and minimization problems.

Example 1

Consider an inventory problem in which the demand function is given by \( D = a - bp \) and the following parameters: \( C_{oL} = \$ 195 \), \( C_{oR} = \$ 200 \), \( \theta = 0.1 \), \( a = 150 \), \( b = 0.7 \), \( \delta = 1.5 \), \( C_{hL} = \$ 1 \), \( C_{hR} = \$ 1.5 \), \( C_{bR} = \$ 10 \), \( C_{bL} = \$ 8 \), \( C_{pL} = \$ 22 \), \( C_{pR} = \$ 25 \), \( I_{e} = 0.12 \), \( I_{p} = 0.15 \) \( N = 0.16 \), \( M = 0.246 \), \( C_{lsL} = \$ 18 \), \( C_{lsR} = \$ 20 \), \( p = \$ 30 \).

The solution is exhibited in Tables 2.2 and 2.3, where Table 2.2 shows the solution obtained by PSO-CO and Table 2.3 displays the solution determined by WQPSO.

Example 2

Consider an inventory system in which the demand function is as follows: \( D = ap^{ - \alpha } \) and the following parameters: \( C_{oL} = \$ 195 \), \( C_{oR} = \$ 200 \), \( \theta = 0.1 \), \( a = 150 \), \( \delta = 1.5 \), \( C_{hL} = \$ 1 \), \( C_{hR} = \$ 1.5 \), \( C_{bR} = \$ 10 \), \( C_{bL} = \$ 8 \), \( C_{pL} = \$ 22 \), \( C_{pR} = \$ 25 \), \( I_{e} = 0.12 \), \( I_{p} = 0.15 \) \( N = 0.16 \), \( M = 0.246 \), \( C_{lsL} = \$ 18 \), \( C_{lsR} = \$ 20 \), \( p = \$ 30 \), \( \alpha = 0.2 \) (Tables 2.4 and 2.5).

Example 3

Consider that the demand function is \( D = ae^{{^{( - p/k)} }} \) and the following parameters: \( C_{oL} = \$ 195 \), \( C_{oR} = \$ 200 \), \( \theta = 0.1 \), \( a = 150 \), \( \delta = 1.5 \), \( C_{hL} = \$ 1 \), \( C_{hR} = \$ 1.5 \), \( C_{bR} = \$ 10 \), \( C_{bL} = \$ 8 \), \( C_{pL} = \$ 22 \), \( C_{pR} = \$ 25 \), \( I_{e} = 0.12 \), \( I_{p} = 0.15 \) \( N = 0.16 \), \( M = 0.246 \), \( C_{lsL} = \$ 18 \), \( C_{lsR} = \$ 20 \), \( p = \$ 30 \), \( k = 40 \) (Tables 2.6 and 2.7).

2.6 Sensitivity Analysis

This section provides a sensitivity analysis, which is done, based on Example 1. The sensitivity analysis is made by varying the parameters by −20 to +20%. The results of the sensitivity analysis for Example 1 are shown in Table 2.8.

From Table 2.8, the following interpretations are mentioned:

-

With the increment in the value of replenishment cost \( \left[ {C_{oL} ,C_{oR} } \right] \), the cycle length (T), the time at which the inventory level reaches zero (\( t_{1} \)), shortage level (R), and stock level (S) increase, but average profit decreases.

-

When the holding cost \( \left[ {C_{hL} ,C_{hR} } \right] \) increases, then the cycle length (T), the time at which the inventory level reaches zero (\( t_{1} \)), stock level (S), and average profit decrease, but shortage level (R) increases.

-

With the increment in the value of shortage cost \( \left[ {C_{bL} ,C_{bR} } \right] \), the time at which the inventory level reaches zero (\( t_{1} \)) and stock level (S) increase, but the shortage level (R), the cycle length (T), and the average profit decrease.

-

When the value of purchasing cost \( \left[ {C_{pL} ,C_{pR} } \right] \) increases, then the shortage level (R), the cycle length (T), the time at which the inventory level reaches zero (\( t_{1} \)), stock level (S) and the average profit decrease.

-

When the scale parameter (a) of demand increases, then the cycle length (T) and the time at which the inventory level reaches zero (\( t_{1} \)) decrease, whereas the shortage level (R), the stock level (S), and the average profit increase.

-

When the price elasticity parameters (b) of demand increases, then the shortage level (R), the stock level (S), and the average profit decrease, whereas the cycle length (T) and the time at which the inventory level reaches zero (\( t_{1} \)) increase.

-

With the increment in the value of the deterioration rate \( \left( \theta \right) \), the cycle length (T), stock level (S), the average profit, and the time at which the inventory level reaches zero (\( t_{1} \)) decrease, but the shortage level (R) increases.

-

When the value of the backlogging parameter \( \delta \) increases, then the shortage level (R), the cycle length (T) and the average profit decrease, but the time at which the inventory level reaches zero (\( t_{1} \)) and stock level (S) increase.

-

With the increment in the value of opportunity cost \( [C_{lsL} ,C_{lsR} ] \), then the shortage level (R), the cycle length (T), and the average profit decrease, but the time at which the inventory level reaches zero (\( t_{1} \)) and stock level (S) increase.

-

With the increment in the value of selling price (p), then the shortage level (R), the cycle length (T), the time at which the inventory level reaches zero (\( t_{1} \)), stock level (S), and the average profit increase.

2.7 Conclusion

This paper develops an inventory model for deteriorating items with interval-valued inventory costs, partial backlogging, and price-dependent demand under two-level credit policy. In order to make a more realistic scenario, the shortages are permitted, and these are partially backlogged. The proposed inventory model is very helpful for retail and manufacturing industries in developing countries where credit policy plays a significant role in decision-making. This research work aims to find the retailer’s optimal replenishment policy that maximizes the total profit of the system. To solve the inventory model, two soft computing techniques are used: the PSO-CO and the WQPSO. The efficiency and effectiveness of the proposed inventory model are validated with numerical examples and a sensitivity analysis.

Finally, this research can be extended by considering: (1) stock-dependent demand, (2) inventory costs represented by a fuzzy number, (3) finite-time horizon, (4) inflation, and (5) an integrated supply chain model with two or more players with the coordination between the players, among others. These are some interesting and challenge research lines to explore by academicians and researchers.

References

Gupta RK, Bhunia AK, Goyal SK (2007) An application of genetic algorithm in a marketing oriented inventory model with interval valued inventory costs and three-component demand rate dependent on displayed stock level. Appl Math Comput 192(2):466–478

Dey JK, Mondal SK, Maiti M (2008) Two storage inventory problem with dynamic demand and interval valued lead-time over finite time horizon under inflation and time-value of money. Eur J Oper Res 185(1):170–194

Gupta RK, Bhunia AK, Goyal SK (2009) An application of genetic algorithm in solving an inventory model with advance payment and interval valued inventory costs. Math Comput Model 49(5–6):893–905

Bhunia AK, Shaikh AA, Mahato SK, Jaggi CKA (2014) A deteriorating inventory model with displayed stock-level dependent demand and partially backlogged shortages with all unit discount facilities via particle swarm optimisation. Int J Syst Sci: Oper Logist 1(3):164–180

Bhunia AK, Shaikh AA (2016) Investigation of two-warehouse inventory problems in interval environment under inflation via particle swarm optimization. Math Comput Model Dyn Syst 22(2):160–179

Hwang H, Shinn SW (1997) Retailer’s pricing and lot sizing policy for exponentially deteriorating products under the condition of permissible delay in payments. Comput Oper Res 24(6):539–547

Chang CT, Ouyang LY, Teng JT (2003) An EOQ model for deteriorating items under supplier credits linked to ordering quantity. Appl Math Model 27(12):983–996

Abad PL, Jaggi CK (2003) A joint approach for setting unit price and the length of the credit period for a seller when end demand is price sensitive. Int J Prod Econ 83(2):115–122

Ouyang LY, Wu KS, Yang CT (2006) A study on an inventory model for non-instantaneous deteriorating items with permissible delay in payments. Comput Ind Eng 51(4):637–651

Huang YF (2006) An inventory model under two levels of trade credit and limited storage space derived without derivatives. Appl Math Model 30(5):418–436

Huang YF (2007) Economic order quantity under conditionally permissible delay in payments. Eur J Oper Res 176(2):911–924

Huang YF (2007) Optimal retailer’s replenishment decisions in the EPQ model under two levels of trade credit policy. Eur J Oper Res 176(3):1577–1591

Sana SS, Chaudhuri KS (2008) A deterministic EOQ model with delays in payments and price-discount offers. Eur J Oper Res 184(2):509–533

Huang YF, Hsu KH (2008) An EOQ model under retailer partial trade credit policy in supply chain. Int J Prod Econ 112(2):655–664

Ho CH, Ouyang LY, Su CH (2008) Optimal pricing, shipment and payment policy for an integrated supplier–buyer inventory model with two-part trade credit. Eur J Oper Res 187(2):496–510

Jaggi CK, Khanna A (2010) Supply chain models for deteriorating items with stock-dependent consumption rate and shortages under inflation and permissible delay in payment. Int J Math Oper Res 2(4):491–514

Jaggi CK, Kausar A (2011) Retailer’s ordering policy in a supply chain when demand is price and credit period dependent. Int J Strat Decis Sci 2(4):61–74

Jaggi CK, Mittal M (2012) Retailer’s ordering policy for deteriorating items with initial inspection and allowable shortages under the condition of permissible delay in payments. Int J Appl Ind Eng 1(1):64–79

Guria A, Das B, Mondal S, Maiti M (2013) Inventory policy for an item with inflation induced purchasing price, selling price and demand with immediate part payment. Appl Math Model 37(1–2):240–257

Taleizadeh AA, Pentico DW, Jabalameli MS, Aryanezhad M (2013) An EOQ model with partial delayed payment and partial backordering. Omega 41(2):354–368

Wu J, Ouyang LY, Cárdenas-Barrón LE, Goyal SK (2014) Optimal credit period and lot size for deteriorating items with expiration dates under two-level trade credit financing. Eur J Oper Res 237(3):898–908

Chen SC, Cárdenas-Barrón LE, Teng JT (2014) Retailer’s economic order quantity when the suppliers offers conditionally permissible delay in payments link to order quantity. Int J Prod Econ 155:284–291

Bhunia AK, Shaikh AA, Sahoo L (2016) A two-warehouse inventory model for deteriorating item under permissible delay in payment via particle swarm optimization. Int J Logist Syst Manag 24(1):45–69

Bhunia AK, Shaikh AA (2015) An Application of PSO in a two warehouse inventory model for deteriorating item under permissible delay in payment with different inventory policies. Appl Math Comput 256(1):831–850

Shah NH, Cárdenas-Barrón LE (2015) Retailer’s decision for ordering and credit policies for deteriorating items when a supplier offers order-linked credit period or cash discount. Appl Math Comput 259:569–578

Bhunia AK, Shaikh AA, Pareek S, Dhaka V (2015) A memo on stock model with partial backlogging under delay in payment. Uncertain Supply Chain Manag 3(1):11–20

Kennedy JF, Eberhart RC (1995) Particle swarm optimization, In: Proceedings of the IEEE international conference on neural network, vol IV, Perth, Australia, pp 1942–1948

Clerc M (1999) The swarm and queen: towards a deterministic and adaptive particle swarm optimization. In: Proceedings of IEEE congress on evolutionary computation, Washington, DC, USA, pp 1951–1957

Clerc M, Kennedy JF (2002) The particle swarm: explosion, stability, and convergence in a multi-dimensional complex space. IEEE Trans Evol Comput 6(1):58–73

Sun J, Feng B, Xu WB (2004a) Particle swarm optimization with particles having quantum behavior. In: IEEE proceedings of congress on evolutionary computation, pp 325–331

Sun J, Xu WB, Feng B (2004b) A global search strategy of quantum-behaved particle swarm optimization. In: Proceedings of the 2004 IEEE conference cybernetics and intelligent systems, pp 111–116

Sahoo L, Bhunia AK, Kapur PK (2012) Genetic algorithm based multi-objective reliability optimization in interval environment. Comput Ind Eng 62:152–160

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Shaikh, A.A., Tiwari, S., Cárdenas-Barrón, L.E. (2020). An Economic Order Quantity (EOQ) Inventory Model for a Deteriorating Item with Interval-Valued Inventory Costs, Price-Dependent Demand, Two-Level Credit Policy, and Shortages. In: Shah, N., Mittal, M. (eds) Optimization and Inventory Management. Asset Analytics. Springer, Singapore. https://doi.org/10.1007/978-981-13-9698-4_2

Download citation

DOI: https://doi.org/10.1007/978-981-13-9698-4_2

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-13-9697-7

Online ISBN: 978-981-13-9698-4

eBook Packages: Business and ManagementBusiness and Management (R0)