Abstract

In this paper, we analyse a market where the risky assets follow defaultable exponential additive processes, with coefficients depending on the default state of the assets. In this market we show that when an investor wants to maximize a utility function which is logarithmic on both his/her consumption and terminal wealth, his/her optimal portfolio strategy consists in keeping proportions of wealth in the risky assets which only depend on time and on the default state of the risky assets, but not on their price or on current wealth level; this generalizes analogous results of Pasin and Vargiolu (Econ Notes 39:65–90, 2010) in non-defaultable markets without intermediate consumption. We then present several examples of market where one, two or several assets can default, with the possibility of both direct and information-induced contagion, obtaining explicit optimal investment strategies in several cases. Finally, we study the growth-optimal portfolio in our framework and show an example with necessary and sufficient conditions for it to be a proper martingale or a strict local martingale.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In recent years, mainly after the 2008 financial crisis and its aftermath, growing attention has been paid to financial models where the possibility of default of one or more firms is explicitly taken into account. This brought to various multiasset models where one or several risky assets are exposed to default (or bankruptcy) risk and where the classical problems of optimal investment/consumption and pricing of contingent claims are studied. However, in many of these models (see e.g. Bielecki and Jang 2006; Bo et al. 2010; Callegaro 2013; Callegaro et al. 2012; Capponi and Figueroa-López 2014; Capponi et al. 2014) only one risky asset can encounter a loss (total or partial) of its value due to the possibility of default, while the other ones are assumed to be default-free, with the notable exception of Backhaus and Frey (2008) and Cousin et al. (2011), whose models allow for several defaultable entities but only study the pricing problem of very specific derivatives, i.e. CDS and CDO.

To fill this gap in the literature, we here present a model for a financial market where all the risky assets can possibly exhibit shocks in their dynamics, as a consequence of the default of the issuing companies, resulting in a total (or partial) loss of their value. In particular, we can distinguish two cases. In the first case, the risky asset represents a defaultable bond, which loses its value (or a fraction of it) in case of default of the firm that issues the bond. In this case we can properly refer to this asset as a defaultable asset. Alternatively, the risky asset might represent the stock of a company that can possibly default on a loan or a bond, or in general fail to repay the creditors for their investment. In the latter case, the value of the stock can experience a downward jump in its dynamics, and possibly jump to a bankruptcy state, when the default of the firm occurs. Even though in this case the term defaultable asset is not properly justified, in the sequel we will sometimes abuse this terminology to indicate one of the two assets’ typologies previously described. As the examples of Sect. 6 will illustrate, the model that we introduce is flexible enough to consider a portfolio containing several assets issued by the same defaultable company, typically bonds or/and stocks. In this case, these assets will share the same default time.

More in detail, we analyze a market model given by \(n\) risky assets \(S^i\) and one riskless asset \(B\), where any risky asset process is supposed to be the stochastic exponential

with \(R=(R^1,\ldots ,R^n)\) being an \(n\)-dimensional additive process with regime-switching coefficients, as for example in Antonelli et al. (2013), Capponi and Figueroa-López (2014), Capponi et al. (2014) and Valdez and Vargiolu (2013). This market model naturally allows for defaults events, by assuming that the \(i\)th driving process \(R^i\) can jump with amplitude equal to \(\Delta R^i=-1\). We here study the case when the regimes correspond to the default indicators of the risky assets. In other words, the coefficients of the dynamics of the risky assets can depend on the current default configuration, i.e. on which assets are already defaulted.

Under suitable conditions on the jump measure (where jumps can be related to the default or to the risky assets’ dynamics), we obtain the optimal consumption and portfolio strategy for an investor who wants to maximize a logarithmic utility function of both his/her consumption and terminal wealth. The optimal consumption turns out to be proportional to the current level of the agent’s wealth, while the optimal portfolio strategy turns out to depend only on the default configuration process, i.e. it does not depend on the current value of the risky assets \(S^i\) but only on the current default configuration. This represents a generalization of the model and the findings in Pasin and Vargiolu (2010), where the authors did not consider the case of one or multiple defaults, or of intermediate consumption. On the other hand, the optimal consumption/investment strategies still depend on time as in Pasin and Vargiolu (2010) (this is also due to the non-stationarity of the increments of the driving process \(R\)). After having characterized the optimal strategies in the general case, we present several examples with one, two or several defaultable assets, where we usually succeed in obtaining optimal strategies in closed form. Our results also allow to study with little effort the so-called growth-optimal portfolio (GOP), and we exhibit an example where the GOP is a proper martingale or a strict local martingale depending on some boundary conditions.

The model in Eq. (1.1) has been chosen as a compromise between analytical tractability and flexibility in modelling various situations where risky assets are allowed to default and can have pre-default dynamics driven by diffusion and/or jump processes, possibly with infinite random activity. The naive way to model this would have been to take the dynamics in Eq. (1.1), which generalizes several models where one (Bellamy 2001; Benth et al. 2001; Benth and Schmeck 2012; Framstad et al. 2001; Jeanblanc-Picqué and Pontier 1990; Liu et al. 2003; ksendal and Sulem 2005) or several (Callegaro and Vargiolu 2009; Kallsen 2000; Korn et al. 2003; Pasin and Vargiolu 2010) assets can exhibit jumps in their dynamics and which was already present in Pasin and Vargiolu (2010), with \(R\) still being a \(n\)-dimensional additive process, and allow for it to jump with multiplicative increments \(\Delta R^i = -1\). This allows for direct contagion, as for suitable choices of the jump measure (see for example Sect. 6.5) simultaneous defaults are possible, but not for information-induced contagion, i.e. where the knowledge that previous defaults had occurred does modify the dynamics of the undefaulted assets, as well as their default probabilities. This naive model is sketched out in Sect. 2. However, in order to take into account also information-induced effects in both the dynamics and the default probabilities, in Sect. 3 we show how to incorporate dependencies on past defaults in the risky assets’ dynamics. This is done via a probabilistic construction, in the spirit of the one proposed in Becherer (2001), where a process \(R\) with independent increments in each time interval between two consecutive defaults is built; thus, in this model \(R\) can be considered a regime-switching additive process, with regimes corresponding to the default indicators of the risky assets. Let us observe that the term regime switching has to be interpreted here in a non-canonical way, if compared to the existing literature concerning multiple-regime market models. Indeed, regimes are usually associated with types of markets (bull/bear) defined by risk factors (market indices). By contrast, in this case the regimes correspond to a current default configuration, which are irreversible states. Here the idea is that, as in the classical regime-switching models where assets’ characteristics like returns and volatilities can change depending on a market regime (for empirical evidences in literature, see e.g. Ang and Bekaert 2002; Dai and Yang 2007; Giesecke et al. 2011), in this case they can change due to default/bankruptcy events of third parties in the market: this has been empirically studied e.g. in Dumontaux and Pop (2012), Gentile and Giordano (2012), Kazi and Salloy (2013) for the Lehman default and in Bhanot et al. (2014) for the Greek sovereign crisis.

For the model in Eq. (1.1), in Sect. 4 we study the problem of maximizing a logarithmic utility function; to do this, we characterize a domain for the portfolio strategies in order for the wealth process to remain strictly positive. We then solve the utility maximization problem by means of the dynamic programming method (in Sect. 5), succeeding in proving a verification theorem based on the Hamilton–Jacobi–Bellman (HJB) equation and in exhibiting an explicit smooth solution to the HJB equation. The main conclusion of this is that the optimal consumption is an explicit linear function of the current wealth, while the optimal portfolio strategy turns out to be the maximizer of a suitable deterministic function depending only on time and on the current default indicators, but not on the current asset prices or wealth level. This allows us to present several examples in Sect. 6, where one, two or several defaults can occur, possibly simultaneously. Particularly, several models already present in literature Backhaus and Frey (2008), Bielecki and Jang (2006), Callegaro (2013), Cousin et al. (2011) can be obtained as specific cases of this general framework or as starting points for the models presented here. In most of the examples, we obtain optimal investment strategies in closed form and discuss them.

In Sect. 7, we turn our attention to the characterization of the GOP, here defined as the portfolio which maximizes a logarithmic utility (for equivalent definitions of the GOP see for instance Christensen and Larsen 2007; Fontana and Runggaldier 2013). In mathematical finance, the existence and the properties of the GOP have been widely studied by many authors, due to its relation with the numéraire portfolio. In particular, in Christensen and Larsen (2007) it has been shown in a quite flexible semi-martingale model that the GOP is such that all the other portfolios, evaluated with the GOP as numéraire, are supermartingales; this is called the numéraire property, which can be exploited to develop non-classical approaches in pricing derivative securities. For instance, in the benchmark approach by Platen (2006) this can be done even in models where an equivalent martingale measure (EMM) is absent. Christensen and Larsen (2007) proved that, even when a classical risk neutral measure does not exist, the existence of the GOP implies the existence of a numéraire under which an EMM exists. Nevertheless, GOP-denominated prices might fail to be martingale and being instead strict supermartingales. Examples of this phenomenon are also given in Becherer (2001), Bühlmann and Platen (2003), Cvitanić and Karatzas (1992) and Kramkov and Schachermayer (1999). In this regard, we will show that in our model the inverse GOP process is either a martingale or a strict supermartingale depending on whether the growth-optimal strategy is an internal or a boundary solution with respect to the domain of the admissible strategies.

We now give a brief outline of the paper: in Sect. 2 a naive model, where the risky assets’ prices are defaultable exponential additive models, is presented. In Sect. 3 we build a more general model where asset prices are driven by regime-switching additive models, with regimes corresponding to default indicators. In Sect. 4 we frame the portfolio optimization problem and characterize the portfolio strategies such that the portfolio wealth stays strictly positive. In Sect. 5 the portfolio optimization problem is solved with the dynamic programming method using the HJB equation. In Sect. 6 we present several examples, with many optimal portfolios written in closed form and commented. In Sect. 7 we study the GOP and show in an example under which conditions the GOP is a strictly local martingale or a true martingale.

2 A simplified model

Before rigorously defining our framework in its full generality, we aim in this section to give a heuristic description of a simplified version of it. This approach allows the reader to get a quite intuitive idea of the dynamics involved in our model. After this brief introduction, the definition of the general setting in Sect. 3 will seem a natural extension of this simple one.

We consider a portfolio composed of a locally riskless asset \(B\) and \(n\) risky assets \(S^i\), \(i=1,\ldots ,n\). By considering discounted prices, we can assume without loss of generality that \(B\equiv 1\). For the risky assets we assume the dynamics in Eq. (1.1) where in this section \(R=(R^1,\ldots ,R^n)\) is an \(n\)-dimensional additive process, i.e. a process with independent increments Cont and Tankov (2004), that can exhibit jumps with size \(-1\) in any of its components, possibly simultaneously. We notice that we can rewrite Eq. (1.1) in the vectorial form

where \({\mathrm {diag}}(v)\) is the diagonal matrix in \({\mathbb {R}}^{n\times n}\) with principal diagonal containing the elements of \(v\). This allows one to represent the \(n\)-dimensional additive process \(R\) in Eq. (1.1) explicitly via the Levy–Ito representation as

with \(\mu =(\mu _1,\ldots ,\mu _n):[0,T]\rightarrow {\mathbb {R}}^n\), \(\sigma =(\sigma _{ij})_{ij}:[0,T]\rightarrow {\mathbb {R}}^{n\times k}\) deterministic measurable functions, \(W=(W^1,\ldots ,W^k)\) a \(k\)-dimensional Brownian motion and \(N({\mathrm {d}}t,{\mathrm {d}}x)\) a jump random measure on \({\mathbb {R}}^+\times {\mathbb {R}}^n\) with compensating measure \(\nu _t({\mathrm {d}}x)\). The solution of Eq. (1.1) is

(see Protter 2004, Theorem II.37), where \(\Delta R^i_u:= R^i_u -R^i_{u-}\) represents the jump of \(R^i\) at the time \(u\).

Equation (2.2) shows first that we shall impose \(\Delta R^i_u\ge -1\) for \(S^i\) to stay non-negative, and furthermore that the process \(S^i\) reaches the value \(0\) as soon as the process \(R^i\) jumps with amplitude \(\Delta R^i=-1\), and stays there forever from that moment on. Therefore we assume that \({\mathrm {supp}}(\nu _t) \subseteq X^n\) for all \(t \in [0,T]\), where \(X^n\) is defined as

to have \(S_t^i \ge 0\) for all \(t \in [0,T]\), and define the default time \(\tau ^i\) as the time when \(S^i\) jumps to \(0\), i.e.

Now, for every \(i=1,\ldots ,n\), we introduce the default indicator process

Note that \(D^i\) admits the differential representation

According to this setting, two or more \(S^i\) may simultaneously jump to \(0\) with positive probability. Indeed, this scenario is verified any time two or more \(R^i\) jumps simultaneously with size \(-1\). Nevertheless, the driving process \(R\) has independent increments, and thus, \(D^i_t\) is independent of \((D^j_u)_{u<t}\), for any \(j\ne i\). To sum up, simultaneous defaults (and simultaneous bankruptcy) are allowed, but defaults occurred in the past cannot change the probabilities of future ones. Financially speaking, within this framework we are able to capture instantaneous contagion but not information-induced one.

To overcome this shortcoming, a natural extension seems to let the jump measure \(N({\mathrm {d}}t,{\mathrm {d}}x)\) depend on the current default configuration \(D_t\); this will be done in the next section.

3 The general setting

In this section, we generalize the construction of Sect. 2 by introducing different regimes for the jump measure, the drift and the diffusion of the driving process \(R=(R^1,\ldots ,R^n)\), regimes consisting in the default indicators’ vector \(D=(D^1,\ldots ,D^n)\). This construction is analogous to the one in Becherer (2001).

Let \(n,k\in {\mathbb {N}}\), \(T>0\), and \((\Omega ,{\mathcal {F}},{\mathbb {P}})\) be a probability space rich enough to support:

-

a \(k\)-dimensional Brownian motion \(W=(W^1,\ldots ,W^k)\);

-

a family \((N^d,\nu ^d)_{d\in \{0,1\}^n}\), where \(N^d\equiv N(d,{\mathrm {d}}t,{\mathrm {d}}x)\) are independent Poisson measures on \([0,T]\times {\mathbb {R}}^n\), and \(\nu ^d_t\equiv \nu _t(d,{\mathrm {d}}x)\) are the respective compensating measures.

Next, by analogy with (2.4)–(2.5), we define the default time of the \(i\)th firm \(\tau ^i\) by means of the respective default indicator process \(D^i\).

Definition 3.1

Let the \(\{0,1\}^n\)-valued process \(D\equiv (D_t)_{0\le t\le T}=(D^1_t,\ldots ,D^n_t)_{0\le t\le T}\) be the unique strong solution of the \(n\)-dimensional system

with the initial conditions

Then, denoting with \({\mathbb {F}}=({\mathcal {F}}_t)_{t\ge 0}\) the filtration generated by \((D_t)_{t\ge 0}\), we define the \({\mathbb {F}}\)-stopping times

Remark 3.2

(Construction) The process \(D\) can be constructed pointwise in the following way. We first consider two families of random variables \((t_k)_{0\le k\le n}\), \(t_k\in {\mathbb {R}}^+\cup \{\infty \}\), and \(({\zeta }_k)_{0\le k\le n}\), \({\zeta }_k\in \{0,1\}^n\), recursively defined as

and

Note that, in the above construction, the random variable \(t_k\) represents the \(k\)th default time in chronological order, whereas the random vector \({\zeta }_{k+1}\) represents the default indicators’ configuration when the \(k\)th default event occurs. We prefer to remark one more time that index \(k\) in \(t_k\) is referred to the chronological order, and that \(t_k\) is in general different from the time \(\tau ^k\), when the \(k\)th firm defaults.

Then, for any \(t\in [0,T]\) we define

It is easy to verify that the \(\{0,1\}^n\)-valued process \(D\equiv (D_t)_{0\le t\le T}\) is a solution for (3.1)–(3.2).

We now define the driving process \(R\equiv (R_t)_{0\le t\le T}=(R^1_t,\ldots ,R^n_t)_{0\le t\le T}\) in (1.1) as the unique strong solution of the \(n\)-dimensional system

where \(\mu (\cdot ,d):[0,T]\rightarrow {\mathbb {R}}^n\), \(\sigma (\cdot ,d):[0,T]\rightarrow {\mathbb {R}}^{n\times d}\) are deterministic measurable functions for any \(d\in \{0,1\}^n\). Afterwards we will denote with \({\sigma }_i(t,d)\) the \(i\)th row of \(\sigma (t,d)\). For Eq. (3.3) and the further computations to make sense we need the following assumptions to be satisfied.

Assumption 3.3

(Finite variance) For any \(d\in \{0,1\}^n\),

where the \(\left\| \cdot \right\| \) represent the Euclidean norms on \({\mathbb {R}}^n\) and \({\mathbb {R}}^{n\times d}\).

Assumption 3.4

(Non-negativity of prices) For any \(d\in \{0,1\}^n\) and \(t\in [0,T]\), \({\mathrm {supp}}(\nu ^d_t) \subseteq X^n\), where \(X^n\) is defined in Eq. (2.3).

Assumption 3.5

(Continuity in time of the compensator) For any \(d\in \{0,1\}^n\) and for any Borel set \(B\subset {\mathbb {R}}\), \(\nu ^d_{t}(B)\) is continuous in \(t\).

Finally, as in the previous section, we let the locally riskless asset \(B \equiv 1\) and the risky assets \(S^i\), \(i = 1,\ldots ,n\), be the solution of Eq. (1.1), where now the driving processes \(R^i\), \(i = 1,\ldots ,n\), are as in Eq. (3.3). As seen in the previous section, Assumptions 3.4 and 3.5 are equivalent to saying that the risky assets’ prices stay a.s. non-negative for each \(t\in [0,T]\). Indeed, the solution of the SDE (1.1) is still

(see Protter 2004, Theorem II.37) with \([R^i,R^i]^c\) being the continuous part of the quadratic variation process of \(R\), and (2.3) implies \(1+\Delta R^i_t\ge 0\) for any \(i=1,\ldots ,n\) and \(t\in [0,T]\). On the other hand, Eq. (3.5) shows that the process \(S^i\) jumps to \(0\) as soon as the process \(R^i\) jumps with amplitude \(\Delta R^i=-1\), and stays there at any future time. Eventually, by Definition 3.1 combined with Eq. (3.3) we get

and thus, as in the previous section, the default of \(i\)th firm coincides with its reference asset value jumping to \(0\).

Notice that, from the credit risk point of view, our model can be framed within the existing literature in both the classes of structural and intensity-based (or reduced-form) models. Indeed, in light of identity (3.6), the default time \(\tau ^i\) can be interpreted as the first time when the reference asset value of the firm \(S^i\) crosses a barrier value placed at \(0\), thus providing a structural interpretation of the default time.

On the other hand, by construction (Remark 3.2) it can be shown that the stopping time \(\tau ^i\) coincides with the first jump time of a Cox process with stochastic intensity

Therefore, \(\lambda ^i\) can be regarded as a default intensity, and \(\tau ^i\) as the default time given by the first time \(t\) such that the stochastic hazard rate \(\int _0^t \lambda ^i_s \,{\mathrm {d}} s\ge {\mathcal E}_i\), with \({\mathcal E}_i\) being an independent exponentially distributed random variable. It is important to underline that, from this perspective, the jump of the risky asset value \(S^i\) to the bankruptcy state \(0\) is a consequence of the default and admits a double interpretation. One way is to look at \(S^i\) as the stock value of a certain firm; in this case the value loss of the stock can be viewed as the effect of the bankruptcy induced by the default of the firm on a particular loan or bond. Another way is to consider \(S^i\) itself as the value of the debt, e.g. a bond price, on which the company might default. In this case, the value loss of \(S^i\) is the immediate consequence of the impossibility of the firm to pay back such debt.

As it is also made clear in Sect. 6, the model is flexible enough to consider both these effects simultaneously. Note also that the choice of the bankruptcy state \(S^i_{\tau ^i}=0\) is not restrictive. Indeed, both the previous construction and the following analysis can be extended to consider a generic cemetery state of the form \(S^i_{\tau ^i}=(1-\xi )S^i_{\tau ^i -}\), with \(\xi \in [0,1]\). To this extent, all the examples in Sect. 6 are reported in this more general fashion.

4 The portfolio optimization problem

Let now \(\pi _t=(\pi _t^1,\ldots ,\pi _t^n)\) be a trading strategy representing the quantities of the risky assets \((S^1_t,\ldots ,S^n_t)\) held in a self-financing portfolio, whose value at time \(t\) is given by

where \(\langle \cdot ,\cdot \rangle \) represents the scalar product in \({\mathbb {R}}^n\). In the case when \(V^{\pi }_t>0\), we can represent the portfolio in terms of its proportions invested in each risky asset, defining the vector \({\mathfrak {h}}_t:=({\mathfrak {h}}_t^1,\ldots ,{\mathfrak {h}}_t^n)\) componentwise as

Furthermore, we consider a strictly positive process \({\mathfrak {c}}_t\) denoting the instantaneous consumption at time \(t\). By the self-financing property we have

[by (4.3)]

where we denoted by \(V^{{\mathfrak {h}},{\mathfrak {c}}}\) the portfolio value to remark that it is expressed as a function of its proportions \({\mathfrak {h}}\) and the consumption \({\mathfrak {c}}\). Here we used

which is still true also for \(t>\tau ^i\) because, by (4.1), we have

Nevertheless, if \({\mathfrak {h}}\) is a generic \({\mathbb {F}}\)-predictable process, the solution of

still depends on \({\mathfrak {h}}^i\) even after the time \({\tau }^i\). Thus, we should impose the condition (4.4) on the control variable \({\mathfrak {h}}\) when using Eq. (4.5) for optimization purposes, but this would lead to a problem with very non-standard control constraints.

In alternative, we prefer to define \(V^{{\mathfrak {h}},{\mathfrak {c}}}\) as the solution of the SDE

where \(\underline{1}=(1,\ldots ,1)\in {\mathbb {R}}^n\), as in Callegaro et al. (2012). In this way, we need no additional conditions on \({\mathfrak {h}}\), as the process \(V^{{\mathfrak {h}},{\mathfrak {c}}}\) is independent of \({\mathfrak {h}}^i\) after \(\tau ^i\). To shorten notation we introduce the following definition.

Definition 4.1

For any \(d\in \{0,1\}^n\) and \(x\in {\mathbb {R}}^n\), we define the vector \(x^d\in {\mathbb {R}}^n\) as

In other words, \(x^d_i\) is equal to \(x_i\) if \(d_i=0\), i.e. the \(i\)th firm did not default yet, whereas \(x^d_i=0\) if \(d_i=1\), i.e. the \(i\)th firm asset already defaulted. A necessary condition for \(V^{{\mathfrak {h}},{\mathfrak {c}}}\) to stay \({\mathbb {P}}\)-a.s. positive for any \(t\in [0,T]\) is that

Indeed, by (4.6) we have

and therefore, as long as \(V_{s}^{{\mathfrak {h}},{\mathfrak {c}}}\) is positive for \(s\in [0,t]\), \(V_{t}^{{\mathfrak {h}},{\mathfrak {c}}}\) jumps with size less or equal \(-V_{t-}^{{\mathfrak {h}},{\mathfrak {c}}}\) if \(\langle {\mathfrak {h}}^{D_{t-}}_{t-},\Delta R_t\rangle \le -1\). A sufficient condition for (4.7) to hold is

Example 4.2

If the jumps of the process \(R\) are unbounded from above, i.e. \({\mathrm {supp}}(\nu ^d_t)\equiv X^n\) for any \(d\in \{0,1\}^n\), with \(X^n\) as in (2.3), then \(H_t\) is the \(n\)-dimensional unit simplex in \({\mathbb {R}}^n\), i.e. \(H_t\equiv \{ h\in {\mathbb {R}}^n |\ h_i \ge 0,\ \sum _{i=1}^n h_i < 1 \}\).

We now define the set of admissible strategies.

Definition 4.3

An \({\mathbb {R}}^{n+1}\)-valued \({\mathbb {F}}\)-predictable process \(({\mathfrak {h}},{\mathfrak {c}})\equiv ({\mathfrak {h}}_u,{\mathfrak {c}}_u)_{t\le u\le T}\) is said to be an admissible strategy if

-

(a)

\({\mathfrak {h}}_u\in H\) \({\mathbb {P}}\)-a.s. for any \(u\in [t,T]\), where \(H\) is a compact convex set \(H\subset {\mathbb {R}}^n\) such that \(H\subset \hbox {int}(\cap _{u\in [t,T]}H_u)\);

-

(b)

\({\mathfrak {c}}_u>0\) \({\mathbb {P}}\)-a.s. for any \(u\in [t,T]\).

-

(c)

For any initial condition \(V_t=v>0\) and \(D_t=d\in \{0,1\}^n\), the \((n+1)\)-dimensional system (3.1)–(4.6) has a unique strong solution \((V,D)^{{\mathfrak {h}},{\mathfrak {c}};t,v,d}=(V^{{\mathfrak {h}},{\mathfrak {c}};t,v,d}_s,D^{t,d}_s)_{s\in [t,T]}\) such that \(V_s>0\) for any \(s\in [t,T]\).

We denote by \({\mathcal A}[t,T]\) the set of all admissible strategies.

Sometimes in the sequel, to shorten the notation, we will suppress the explicit dependence on \(t,v,d\) in \((V,D)^{{\mathfrak {h}},{\mathfrak {c}};t,v,d}\).

We aim to find the optimal control process \((\bar{{\mathfrak {h}}},\bar{{\mathfrak {c}}}) \in {\mathcal A}[t,T]\), whether it exists, which maximizes in \(({\mathfrak {h}},{\mathfrak {c}})\) the utility

where \(U,u\) are logarithmic utility functions

with \(A,B,\delta \ge 0\) such that \(A+B>0\).

The choice of the logarithmic utility function, both for the intermediate consumption as well as for the terminal wealth, has the advantage of offering analytical tractability, which is however shared by other utility functions, e.g. those of the form \(U(x) = x^\gamma /\gamma \) for \(\gamma < 1\). However, beyond being merely an analytically convenient choice, the logarithmic utility function has also other peculiarities which are not shared by other utility functions, and which we illustrate in the following three remarks.

Remark 4.4

The natural interpretation of a logarithmic utility of terminal wealth without consumption (i.e. when \(B = 0\)) is the growth rate of the portfolio. In the case when an agent also wants to consume in the time horizon \([0,T]\), this can be easily incorporated into this problem by setting \(B > 0\). Thus, we can say that this is an optimal capital growth problem (in the sense of optimal growth rate), possibly incorporating intertemporal consumption.

Remark 4.5

The logarithmic utility function allows naturally to incorporate stochastic interest rates in the model. In fact, assume that the riskless asset has the dynamics

instead of being identically one, with \(r\) a stochastic interest rate, and that each \(S^i\) has the dynamics given by Eq. (1.1), with the driving process \(R\) having the stochastic differential as in Eq. (3.3) plus \(r_t \underline{1}\) in the drift term. This would again give us the same problem that we are facing now, but where we maximize the utility of discounted consumption and terminal wealth. What if instead we wish to maximize the utility of real consumption and terminal wealth? This could be obtained immediately from our results. In fact, if one assumes that \(V_t\) and \({\mathfrak {c}}_t\) are the real (i.e. not discounted) wealth and consumption at time \(t\) and define the discounted quantities \({\tilde{V}}_t := V_t/B_t\) and \(\tilde{{\mathfrak {c}}}_t := {\mathfrak {c}}_t/B_t\), the problem in the non-discounted quantities can be written as

by the properties of the logarithmic utilities in Equation (4.10), i.e. this is equivalent to a problem in the discounted quantities minus the constant term in line (4.11). In this problem, by applying the Itô formula the self-financing condition for the discounted portfolio becomes

where the new driving process \(\tilde{R}\) has the stochastic differential \({\mathrm {d}} \tilde{R}_t = {\mathrm {d}} R_t - r_t {\mathrm {d}}t\), with \(\tilde{R}\) being now a regime-switching additive process as in Eq. (3.3). Thus, the optimal portfolio would be the same for both the problems (i.e. in the real and discounted wealth), while the optimal consumption of the discounted problem would simply be the discounted optimal consumption of the problem in the real wealth.

Remark 4.6

By considering a null utility function \(u(t,c)\equiv 0\) for the consumption, i.e. \(B = 0\) in (4.10), the optimal strategy \((\bar{{\mathfrak {h}}}_t)_{0\le t\le T}\) that solves the problem (4.9)–(4.10) is called, when it exists, the growth-optimal strategy, and the related wealth process \(V_t^{\bar{{\mathfrak {h}}}}\) is called Growth-Optimal Portfolio (GOP). As already said in the Introduction, the GOP can be used for example in the benchmark approach Platen (2006) to price contingent claims even in models where an equivalent martingale measure is absent. Thus, the maximization of a logarithmic utility function gives as a byproduct a mean to price contingent claims in very general settings. This will be the topic of Sect. 7.

For these reasons, from now on in this paper we concentrate on solving the problem for the logarithmic utility function, while the problem with more general utility functions is left for future research.

5 Dynamic programming solution

Here, we use dynamic programming to solve the optimal control problem (4.9).

For any \( ({\mathfrak {h}},{\mathfrak {c}}) \in {\mathcal A}[t,T]\), \(t\in [0,T]\), \(v\in {\mathbb {R}}^{+}\) and \(d\in \{0,1\}^n\) we define the function

Moreover we define the value function \(J:[0,T]\times {\mathbb {R}}^+\times \{0,1\}^n\rightarrow {\mathbb {R}}^+\) as

Following the approach in Fleming and Soner (2006), by formal arguments we obtain that \(J\) solves the so-called HJB (Hamilton–Jacobi–Bellman) equation

where, for any \(h\in H\) and \(c>0\) , \(A^{h,c}\) is the infinitesimal generator of the process \((V,D)^{h,c}\), i.e.:

with

and where the function \(\chi :\{0,1\}^n\times R^n\rightarrow \{0,1\}^n\) is defined as

Moreover, by (5.1)–(5.2) we directly obtain the terminal condition

The next theorem rigorously connects the optimal control problem (4.9) with the HJB equation and gives us a useful characterization of the optimal control process \((\bar{{\mathfrak {h}}},\bar{{\mathfrak {c}}})\) when it exists. Before stating the verification theorem, we formally define the domain of the operator \(A^{h,c}\).

Definition 5.1

We denote with \({\mathcal D}\) the set of the functions \(f\in C^{1,2}([0,T]\times {\mathbb {R}}^+\times \{ 0,1 \}^n)\) such that for any \((t,v,d)\in [0,T]\times {\mathbb {R}}^+\times \{0,1\}^n\) and for any \(({\mathfrak {h}},{\mathfrak {c}})\in {\mathcal A}[t,T]\) the so-called Dynkin formula holds, i.e.

We can now state the following verification theorem, which is a particular case of (Fleming and Soner (2006), Theorem III.8.1).

Theorem 5.2

Let \(K\in {\mathcal D}\) be a classical solution of (5.3) with terminal condition (5.7). Then, for any \((t,v,d)\in [0,T]\times {\mathbb {R}}^+\times \{0,1\}^n\) we have

-

(a)

\(K(t,v,d)\ge J^{{\mathfrak {h}},{\mathfrak {c}}}(t,v,d)\) for any admissible control \(({\mathfrak {h}},{\mathfrak {c}})\in {\mathcal A}[t,T];\)

-

(b)

if there exists an admissible control \((\bar{{\mathfrak {h}}},\bar{{\mathfrak {c}}})\in {\mathcal A}[t,T]\) such that

$$\begin{aligned}&(\bar{{\mathfrak {h}}}_s,\bar{{\mathfrak {c}}}_s) \in \arg \max _{(h,c)\in H\times {\mathbb {R}}^+} \left( A^{h,c} K(s,(V,D)^{\bar{{\mathfrak {h}}},\bar{{\mathfrak {c}}};t,v,d}_s)+u(s,c) \right) \quad {\mathbb {P}}\text {-a.s.}\ \forall s\in [t,T],\nonumber \\ \end{aligned}$$(5.9)then \(K(t,v,d)=J^{\bar{{\mathfrak {h}}},\bar{{\mathfrak {c}}}}(t,v,d)=J(t,v,d)\).

Now we use Theorem 5.2 to solve the optimization problem (4.9). Analogously to Pasin and Vargiolu (2010) it turns out that the optimal control \((\bar{{\mathfrak {h}}},\bar{{\mathfrak {c}}})\) in (5.9) is a Markov control policy. In particular we are going to find out that

where \({\bar{h}}:[0,T]\times \{ 0,1 \}^n\rightarrow H\) and \({\bar{c}}:[0,T]\times {\mathbb {R}}^+\rightarrow {\mathbb {R}}^+\) are deterministic functions such that

for any \((t,v,d)\in [0,T]\times {\mathbb {R}}^+\times \{0,1\}^n\). We are now in the position to characterize the value function \(J\) and the optimal strategy \((\bar{{\mathfrak {h}}},\bar{{\mathfrak {c}}})\). Before stating our main result we introduce the following

Definition 5.3

For any \(d\in \{ 0,1 \}^n\), let \(F^d:[0,T]\times H\rightarrow {\mathbb {R}}\) be the function

where \(h^d\) is defined as in Definition 4.1.

Theorem 5.4

Let \(U(v)\) and \(u(t,c)\) be the logarithmic functions defined as in (4.10). Then:

-

(a)

Equation (5.3) with terminal condition (5.7) has a classical solution \(K\) given by

$$\begin{aligned} K(t,v,d)=\left\{ \begin{array}{l@{\quad }c} \left( A +\frac{B}{\delta }\left( 1- \mathrm{e}^{-\delta (T-t)} \right) \right) \log v + \Phi ^{d}(t)&{} \hbox {if } \delta >0,\\ \left( A +B(T-t) \right) \log v + \Phi ^{d}(t) &{} \hbox {if } \delta =0, \end{array} \right. \end{aligned}$$(5.13)for any \((t,v,d)\in [0,T]\times {\mathbb {R}}^+\times \{0,1\}^n\), where \((\Phi ^{d})_{d\in \{0,1\}^n}\) is a family of suitable \(C^1\) deterministic functions such that \(\Phi ^{d}(T)=0\).

-

(b)

\(K\) belongs to \({\mathcal D}\).

-

(c)

\(K=J\) and an optimal control process \((\bar{{\mathfrak {h}}},\bar{{\mathfrak {c}}})\) is given by

$$\begin{aligned} (\bar{{\mathfrak {h}}}(t),\bar{{\mathfrak {c}}}(t)):= \left( {\bar{h}}(t,D_{t-}), {\bar{c}}(t)V^{\bar{{\mathfrak {h}}},\bar{{\mathfrak {c}}}}_{t-} \right) , \end{aligned}$$(5.14)where \({\bar{h}}:[0,T]\times \{ 0,1 \}^n\rightarrow H\) is a function such that

$$\begin{aligned} {\bar{h}}(t,d)\in \arg \max _{h\in H}F^{d}(t,h) \end{aligned}$$(5.15)with \(F^{d}(t,h)\) as in (5.12),

$$\begin{aligned} {\bar{c}}(t):= \left\{ \begin{array}{l@{\quad }l} \frac{B \mathrm{e}^{-\delta (T-t)} }{ A+\frac{B}{\delta }\left( 1- \mathrm{e}^{-\delta (T-t)} \right) }&{} \hbox {if }\delta >0, \\ \frac{B}{ A+B(T-t) }&{} \hbox {if }\delta =0, \end{array} \right. \end{aligned}$$(5.16)and where \(V^{\bar{{\mathfrak {h}}},\bar{{\mathfrak {c}}}}\) is the unique positive solution of

$$\begin{aligned} \frac{{\mathrm {d}}V^{\bar{{\mathfrak {h}}},\bar{{\mathfrak {c}}}}_{t}}{V^{\bar{{\mathfrak {h}}},\bar{{\mathfrak {c}}}}_{t}}= \langle {\mathrm {diag}}(\underline{1}-D_{t-}){\bar{h}}(t,D_{t-}),{\mathrm {d}}R_t\rangle -{\bar{c}}(t) {\mathrm {d}}t, \quad t\in [0,T], \end{aligned}$$(5.17)

The proof of Theorem 5.4 is quite long and technical and is presented in Appendix. Instead, here we present some remarks.

Remark 5.5

A function \({\bar{h}}\) such that (5.15) holds exists and for any \(d\in \{0,1\}^n\) is unique in its component \({\bar{h}}^i\) such that \(d_i=0\). In fact, \(F^{d}\) in (5.12) does not depend on the \(i\)th components of \(h\) if \(d_i=1\), and on the other hand, \(F^{d}\) is a strictly concave function and \(H\) is a compact convex subset of \({\mathbb {R}}^n\). Roughly speaking, the \(i\)th component of the optimal strategy \({\bar{h}}\) is not relevant after the bankruptcy of the asset \(S^i\), which is consistent with Eq. (4.6).

Remark 5.6

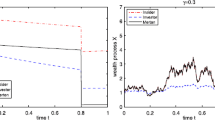

The most relevant information that the agent here wants to know is how to find the function \({\bar{h}}\) in Eq. (5.15). Unfortunately, there is no analytical solution to the problem in general, while analytical solutions exist for very specific models (see Sect. 6 for some examples). This lack of explicit solutions is typical of models with jumps. A common way to circumvent this is to use numerical methods to maximize (5.12). Another way is to use the analytical approximation of solving a Merton problem with the diffusion matrix substituted by the total variance–covariance operator of \(R\), i.e. the sum of \(\Sigma (t,d)\) plus the second moment of the jump process, given by

This method is justified in Benth and Schmeck (2012) and gives the approximation

whose numerical goodness is illustrated in Pasin and Vargiolu (2010).

Remark 5.7

In analogy with (Pasin and Vargiolu (2010), Remark 3.2), we point out that the optimal Markov policy \({\bar{h}}\) does not depend on the variable \(v\). Thus, the optimal strategy only depends on \(t\) and \(D_{t-}\) through \(\mu (t,D_{t-})\), \(\sigma (t,D_{t-})\) and \(\nu _t(D_{t-},{\mathrm {d}}x)\), but not on the current level of wealth \(V_t\). The dependence on the risky asset prices \(S^i_t\), \(i=1,\ldots ,n\), is just when the process \(S^i\) jumps to zero; otherwise, the optimal strategy is a completely deterministic function as in Pasin and Vargiolu (2010). In the time-homogeneous case, i.e. \(\mu (t,d)\equiv \mu (d)\), \({\sigma }(t,d)\equiv {\sigma }(d)\) and \(\nu ^d_t\equiv \nu \), \(\bar{{\mathfrak {h}}}\) is piecewise constant in time, jumping only at the default times \({\tau }^i\), \(i=1,\ldots ,n\).

Remark 5.8

By contrast, for any \(t\in [0,T]\), \(\bar{{\mathfrak {c}}}_t\) is a linear function of \(V_t\) that only depends on the parameters \(A,B,\delta \) of the utility functions \(U\) and \(u\). Therefore, the optimal consumption \(\bar{{\mathfrak {c}}}_t\) does not depend explicitly on default configuration \(D_t\), or on the model parameters \(\mu (t,d),\sigma (t,d),\nu _t(d,\mathrm{d}x)\). Furthermore, consistently with the financial intuition, the optimal consumption \(\bar{{\mathfrak {c}}}_t\) is increasing in \(B\), and constantly equal to \(0\) when the utility function \(u(t,c)\) for the consumption is constantly null, i.e. \(B=0\).

6 Examples

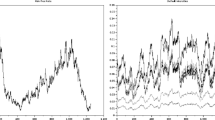

In this section, we present several examples of market models with one, two or several assets subject to default or bankruptcy. In particular, in Sect. 6.1 we present a general model with three assets, the first representing the stock of a default free firm, and the others being respectively the bond and the stock of a defaultable firm. In case of default of the second firm, we allow for the bondholders to recover part of the bond market value. Sections 6.3 and 6.4 are particular cases of this general example, where the agent cannot trade either in the vulnerable stock or in the defaultable bond, respectively. These two cases have already been dealt in the literature in Bielecki and Jang (2006) and Callegaro (2013), respectively. Section 6.4 presents a market model, inspired by Backhaus and Frey (2008), Cousin et al. (2011), with several defaultable bonds that cannot default simultaneously; as a consequence, the optimal portfolio proportion of each bond depends only on its dynamics and not on that of the other ones. Instead in Sect. 6.5 we study the same market model, with only two defaultable bonds, where we introduce the possibility of a simultaneous default; as a consequence, the optimal portfolio proportion of each bond prior to any default turns out to depend also on the dynamics of the other bond.

In the light of Remark 5.8, in the following examples we only focus on the optimal investment strategy \(\bar{{\mathfrak {h}}}_t={\bar{h}}(t,D_t)\), as the optimal consumption \(\bar{{\mathfrak {c}}}_t\) does not depend on the choice of the model.

6.1 Diffusion dynamics with default

In this section we present an example of market model with three risky assets, namely one stock \(S^1\) issued by a default-free entity, one bond \(S^P\) and another stock \(S^2\), the two latter assets being issued by the same defaultable entity. This model generalizes two models in Bielecki and Jang (2006), Callegaro (2013), which can be obtained by imposing a null strategy in the defaultable stock or in the defaultable bond, respectively.

The risky assets’ dynamics (1.1)–(3.3) takes now the form

where \(N\) is a \(1\)-dimensional Poisson processes with intensity \(\lambda \), acting on \(S^2\) and \(S^P\), and where (following Bielecki and Jang 2006)

In other words, both the stocks \(S^1\) and \(S^2\) follow a standard Black–Scholes dynamics, with the only admissible jump of the process \((S^1,S^2,S^P)\) having amplitude equal to \((0,-S^2,-\xi S^P)\), and causing the default of the bond \(S^P\) and the bankruptcy of the stock \(S^2\). In this case the stock loses all its value, while the bond loses a fixed fraction \(\xi \in [0,1]\) of its value, thus allowing for a partial recovery. Notice that the drift of the defaultable bond \(\mu _P\) is proportional to the difference between the intensity \(\frac{\lambda }{\Delta }\) of \(N\) under an equivalent martingale measure and the intensity \(\lambda \) of \(N\) under the real-world probability measure, under which the utility is maximized. In Bielecki and Jang (2006), the quantity \(\frac{1}{\Delta }\) is called default event risk premium.

The compensating measure \(\nu ^0_t\) is now equal to \(\lambda (t) > 0\) times the Dirac delta distribution concentrated in \(\{x_1=0,x_2=-1,x_3 = - \xi \} \in {\mathbb {R}}^3\), i.e.

Note that, by contrast, the post-default compensating measure \(\nu ^1\) can be actually set identically equal to \(0\) without loss of generality, as none of the jumps of the process \(R^2\) (thus also of \(R^3\)) occurring after the default time \(\tau ^2\) have any impact on the price \(S^2_t\), or on the price \(S^R_t\). Indeed, the former process has already jumped to the absorbing state \(0\), whereas the latter is constant because \(\mu _P(t,1) \equiv 0\), and thus its dynamics is identically equal to the riskless asset.

Under this particular choice of \(\nu ^d_t\), \(d=0,1\), the subset \(H_t\subset {\mathbb {R}}^2\) defined in (4.8) takes the form

For sake of simplicity we can assume, without losing generality, the convex compact subset \(H\subset {\mathbb {R}}^3\) of Definition 4.3(a) expressed in the form \(H = H_1 \times H_2\), where \(H_1\) and \(H_2\) are convex compact subset of \({\mathbb {R}}\) and of the half-plane \(\{(h_2,h_P)\ |\ h_2 + \xi h_P < 1 \} ,\) respectively. Now, Equation (5.12) can be written, in extended form, as

where we denote

as the diffusion component of the risky bond \(S^P\) is null.

Now, as \(F^{1}\) is strictly concave in \(h_1\), the maximization problem with respect to \(h_1\) over \(H_1\) has a unique solution that can be either internal or on the boundary. A necessary and sufficient condition under which the maximum over \(H_1\) is internal is that the solution of the first-order condition

given by \(h_1(t)=\frac{\mu _1(t,1)}{\left\| \sigma _1(t,1)\right\| ^2}\), belongs to \(\hbox {int}(H_1)\). Thus, under this condition, the first component of \({\bar{h}}(t,1)\) in (5.12) is univocally determined by

Analogously, assuming the matrix \({\mathrm {rank}}\, \Sigma (t,0) = 2\), \(F^0(t,h)\) is a strictly concave function and so the maximization problem over \(H\) has a unique solution. Moreover, we have the following

Proposition 6.1

For any \(t\in [0,T],\) the unique maximum of \(F^0(t,h)\) over \(H\) is an internal point if and only if \(h_1^*(t) \in H_1\), where \(h_1^*(t)\) is the first component of

and \((h_2^*(t),h_P^*(t)) \in H_2,\) where

Under these assumptions\(,\) the unique maximizer of \(F^0(t,h)\) is

Proof

Being \(F^0(t,h)\) strictly concave on \(H\) with respect to \(h\), the unique maximum over \(H\) is an internal point if and only if it is the solution of the first-order condition

Condition (6.12) is explicitly given by

(recall that \(\Sigma _{ij} = \langle \sigma _i, \sigma _j \rangle \)). Now, by substituting the third equation into the second, the first two equations in (6.18) become

which results in a modified Merton problem on the stocks, whose solution is given by Eq. (6.1). Once we have \(h_2\), we can easily obtain \(h_P\) from the third equation of (6.18), resulting in Eq. (6.17). It is also very easy to assess that \(h_2 + \xi h_P < 1\), so the triple \((h_1,h_2,h_P) \in H\). Thus, the conclusion follows. \(\square \)

Corollary 6.2

Let \((h_1^M(t),h_2^M(t)) := \Sigma ^{-1}(t,0) (\mu _1(t,0),\mu _2(t,0))\) be the Merton optimal strategy for the undefaultable log-normal dynamics of the risky assets. Then, by calling \(\rho := \frac{\langle \sigma _1, \sigma _2 \rangle }{\Vert \sigma _1\Vert \Vert \sigma _2\Vert }\) the correlation between \(S_1\) and \(S_2\), under the assumptions of the previous proposition we have that

In particular,

Proof

A direct computation shows that

By inverting \(\Sigma \), the conclusions follow. \(\square \)

Remark 6.3

If \(\rho = 0\), i.e. when the default-free asset is independent of the vulnerable part of the portfolio (bond and stock), then the optimal portfolio in the default-free asset is exactly equal to the Merton portfolio, as in Bielecki and Jang (2006).

6.2 One standard stock and one defaultable bond

As already said, if we impose the portfolio constraint \(h_2 \equiv 0\), i.e. we do not allow our agent to invest in the vulnerable stock, we obtain exactly the market model treated in Bielecki and Jang (2006). In this case, the set of all admissible strategies becomes

and again we can assume without losing generality the convex compact subset \(H\subset {\mathbb {R}}^3\) of Definition 4.3(a) expressed in the form \(H = H_1 \times \{0\} \times H_2\), where \(H_1\) and \(H_2\) are convex compact subset of \({\mathbb {R}}\) and of the half-line \((- \infty , 1/\xi ),\) respectively. Now, Eq. (5.12) can be written, in extended form (by omitting the variable \(h_2 \equiv 0\)), as

Now, as \(F^{1}\) is again strictly concave in \(h_1\), the maximization problem with respect to \(h_1\) over \(H_1\) has a unique solution that can be internal or on the boundary of \(H_1\), leading to the exact same conclusion as in the general case in Sect. 6.2. We also notice that \(F^0(t,h)\) is a strictly concave function and so the maximization problem over \(H\) has a unique solution.

Proposition 6.4

For any \(t\in [0,T],\) the unique maximum of \(F^0(t,h)\) over \(H\) is an internal point if and only if

and

Under these assumptions\(,\) the unique maximizer of \(F^0(t,h)\) is

Proof

Being \(F^0(t,h)\) strictly concave on \((-\infty ,1)\times {\mathbb {R}}\) with respect to \(h\), the unique maximum over \(H\) is an internal point if and only if it is the solution of the first-order condition

which now reads as

Thus the conclusion follows easily. \(\square \)

Remark 6.5

We obtain the same conclusion as in Bielecki and Jang (2006) (notice that there the utility function is \(U(x) = x^\gamma /\gamma \), so mathematically speaking we obtain the same conclusions in the limiting case \(\gamma \rightarrow 0\)). In particular, the investment in the riskless stock is independent of the default possibility of the risky bond. Plus, due to the log-utility function, the optimal strategy of the risky bond is myopic, i.e. it does not depend on the residual investment horizon \(T-t\).

6.3 Two stocks, one of which subject to bankruptcy

We now impose the portfolio constraint \(h_P \equiv 0\), i.e. we allow our agent to only invest in the standard stock \(S^1\) and in the vulnerable stock \(S^2\); thus, we obtain the same market model treated in Callegaro (2013). In this case, the set of admissible strategies becomes

and again we can assume without losing generality the convex compact subset \(H\subset {\mathbb {R}}^3\) of Definition 4.3(a) expressed in the form \(H = H_1 \times H_2 \times \{0\}\), where \(H_1\) and \(H_2\) are convex compact subset of \({\mathbb {R}}\) and of the half-line \((- \infty , 1),\) respectively. Now, Eq. (5.12) can be written, in extended form (by omitting the variable \(h_P \equiv 0\)), as

Now, as \(F^{1}\) is again strictly concave in \(h_1\), the maximization problem with respect to \(h_1\) over \(H_1\) has a unique solution that can either be internal or on the boundary of \(H_1\), leading to the exact same conclusion as in the general case in Sect. 6.2. We also notice that if we again assume that \({\mathrm {rank}}\; \Sigma = 2\), then \(F^0(t,h)\) is a strictly concave function and so the maximization problem over \(H\) has a unique solution.

Proposition 6.6

For any \(t\in [0,T],\) the unique maximum of \(F^0(t,h)\) over \(H\) is an internal point if and only if

and

belong to \(H_1\) and \(H_2,\) respectively. Under this condition\(,\) the function \({\bar{h}}(t,0)\) in (5.12) is univocally determined by

Proof

Being \(F^0(t,h)\) strictly concave on \((-\infty ,1)\times {\mathbb {R}}\) with respect to \(h\), the unique maximum over \(H\) is an internal point if and only if it is the solution of the first-order condition

Condition (6.12) is explicitly given by

Now, by solving for \(h_{1}\) in the first equation and by substituting it and multiplying for \((1 - h_{2}) \sigma _{11}(t, 0)\) in the second equation, (6.13) becomes

where

Thus, System (6.13) may have two solutions: \(h^*=(h^*_1,h^*_2)\) as in (6.11), and \(g^*=(g^*_1,g^*_2)\) given by

where \(\Delta (t)\) is defined as in (6.10). To conclude it is enough to observe that \(g^*\) cannot belong to \(H\subset {\mathbb {R}}\times (-\infty ,1)\). Indeed, let us assume that \(g^*_2<1\). Then \(h^*_2<g^*_2\) implies \(h^*_2<1\) and so \(F^0(t,h)\) has two stationary points on \({\mathbb {R}}\times (-\infty ,1)\), which is impossible because it is strictly concave with respect to \(h\). \(\square \)

Corollary 6.7

Let \(h^M(t) := \Sigma ^{-1}(t,0) \mu (t,0)\) be the Merton optimal strategy for the non-vulnerable log-normal dynamics. Then

if and only if \(h^M(t)\in H\). In particular, if

we can always find a compact \(H\subset (-\infty ,1)\times {\mathbb {R}}\) such that (6.15) holds. In this case, we have

with

Proof

A direct computation shows that \(h^*(t)=h^M(t)\) when \(\lambda (t)=0\). Then the limit follows by continuity of \(h^*(t)\). For the first-order asymptotics, we have that

Hence Eq. (6.16) follows. \(\square \)

Remark 6.8

In this case, if the two assets are independent, then \(\Sigma _{12} \equiv 0\), and the same conclusion of the previous sections follows “at first order”; in fact, by Eq. (6.16), one has that \({\bar{h}}_1 = h_1^M + o(\lambda (t))\), i.e. the deviations from Merton’s portfolio of the non-vulnerable asset are of higher order with respect to \(\lambda (t)\).

6.4 Several defaultable bonds

In this section we present an example of market model with several defaultable bonds, with dynamics analogous to Sects. 6.1 and 6.2; namely

where

and where now, the intensities of the Poisson processes \(N^i\) (both under the real-world probability measure and the risk-neutral one) can possibly depend on the default state \(D_{t-}\) of the other bonds. This model is inspired by Backhaus and Frey (2008) and Cousin et al. (2011). Precisely, we can distinguish two relevant cases: the case when simultaneous defaults cannot occur (as in Backhaus and Frey 2008; Cousin et al. 2011), and the case when they can. In the first case we only have information-induced contagion among bonds, whereas in the second one it is also possible to model direct contagion.

While in the next example we will focus on the case when simultaneous defaults can occur, here we focus on the case when they cannot. This is obtained by imposing that the \(N^i\), \(i = 1,\ldots ,n\), are independent Poisson processes conditional to the default state \(D\). The compensating measure \(\nu _t\) is then equal to

where \(e_i\) is the \(i\)th coordinate vector in \({\mathbb {R}}^n\), with 1 in the \(i\)th component and 0 in the other ones.

Under this choice of \(\nu _t(d,\cdot )\), the subset \(H_t \subset {\mathbb {R}}^n\) defined in (4.8) takes the form

Again, for sake of simplicity we can assume the convex compact subset \(H \subset {\mathbb {R}}^n\) of Definition 4.3(a) expressed in the form \(H = \prod _{i=1}^n H_i\), where \(H_i\) are convex compact subsets of the interval \((- \infty ,\frac{1}{\xi _i})\). Now, Equation (5.12) can be written as

for all \(d \in \{0,1\}^n\). Now, as each \(F^d\) is strictly concave in all the non-null components of \(h^d\), the maximization problem with respect to these variables over \(H\) has a unique solution that can be internal or on the boundary. In particular, we have the following

Proposition 6.9

For any \(t\in [0,T]\) and \(d \in \{0,1\}^n,\) a unique maximum of \(F^d(t,h)\) over \(H\) is an internal point if and only if

for all \(i = 1,\ldots ,n\) such that \(d_i = 0\). Under these assumptions\(,\) \(h^*(t)\) is a maximizer of \(F^d(t,h)\).

Proof

Being \(F^d(t,h)\) strictly concave on \(H\) with respect to the non-null variables of \(h^d\), the unique maximum over \(H\) is an internal point if and only if it is the solution of the first-order condition

which now reads as

Thus the conclusion follows easily. \(\square \)

Remark 6.10

In this particular example, where there is no direct contagion, it turns out that the optimal portfolio on the \(i\)th bond (if still alive) is uniquely determined by its coefficients, with no dependence on the coefficients of the other defaultable bonds.

Corollary 6.11

If \(\xi _i \equiv \xi \) and \(\Delta _i \equiv \Delta \), then the optimal portfolio for all the defaultable bonds is

Remark 6.12

The assumptions of the corollary above are qualitatively known as “name homogeneity” Backhaus and Frey (2008), and hold when default risks of the bonds are exchangeable, for example when bonds are of the same credit rating and/or of firms from the same industrial sector. Notice that for this conclusion it is not necessary to assume that \(\lambda _i \equiv \lambda \).

6.5 Two defaultable bonds with direct contagion

In this section, we specialize the previous example to \(n = 2\) but add the possibility of simultaneous default, by modifying the dynamics as

where \(N^1\), \(N^2\) and \(N\) are independent Poisson processes and this time

and where now the intensities of the Poisson processes \(N^i\) (both under the real-world probability measure and the risk-neutral one) can possibly depend on the default state \(D_{t-}\) of the other bond, while the Poisson process \(N\), with intensity \(\lambda \), acts on both the defaultable bonds when they are still non-defaulted.

The compensating measure \(\nu _t\) is now equal to

where again \(e_i\), \(i=1,2\), is the \(i\)th coordinate vector in \({\mathbb {R}}^2\), and we also have the possibility of a simultaneous jump to \((-1,-1)\) with intensity \(\lambda \).

Under this choice of \(\nu _t(d,\cdot )\), the subset \(H_t \subset {\mathbb {R}}^n\) defined in (4.8) takes the form

Also in this example, for sake of simplicity we can assume the convex compact subset \(H \subset {\mathbb {R}}^n\) of Definition 4.3(a) expressed as \(H = H_1 \times H_2\), where \(H_i\) are convex compact subsets of the interval \((- \infty ,\frac{1}{\xi _i})\).

Now, Eq. (5.12) can be written, in extended form, as

Now, as each \(F^d\) is strictly concave in all the non-null components of \(h^d\), the maximization problem with these variables over \(H\) has a unique solution that can be internal or on the boundary. More in detail, we have the following

Proposition 6.13

For any \(t\in [0,T],\) for \(i = 1,2,\) if

then \( h_i^*(t)\) is the optimal portfolio proportion of the \(i\)th bond after the other one is defaulted. For the case \(d = (0,0)\) \((\)i.e. prior to any default\(),\) if the unique solution \((h^*_1,h^*_2) \in H_t\) of the system

also belongs to \(H_1 \times H_2\), then it is the optimal pre-default portfolio.

Proof

The situation when the \(i\)th bond is already defaulted is analogous to the previous example, with exactly the same results.

Let us now pass to the case \(d = (0,0)\). Since in this case \(F^d(t,h)\) is strictly concave on \(H\), the unique maximum over \(H\) is an internal point if and only if it is the solution of the first order condition

corresponding to Eqs. (6.20–6.21). Thus the conclusion follows.\(\square \)

Remark 6.14

In this example with a direct contagion, it turns out that the optimal portfolio in the \(i\)th bond prior to any default depends (via a non-linear relation) on its coefficients and also on the coefficient of the other bond. Thus, the possibility of simultaneous defaults introduces a (non-linear) dependence among the defaultable bonds, which is somewhat analogous to the correlation effect arising in diffusion models.

Note that solving the system (6.20)–(6.20) requires solving a third-order algebraic equation. When \(\lambda \) tends to \(0\) we have the following continuity property.

Remark 6.15

Let us denote by \(\big (h_1^{*,\lambda }(t),h_2^{*,\lambda }(t)\big )\) the optimal strategy when both the bonds are still alive, i.e. \(d=(0,0)\). Then we have

Indeed, \(F^{(0,0)}(h_1,h_2;\lambda )\) in (6.19) is continuous, and thus uniformly continuous on the compact \(H_1\times H_2 \times [0,\bar{\lambda }]\), for any \(\bar{\lambda }>0\). Thus,

tends to

as \(\lambda \) tends to \(0\). In particular, for \(i=1,2\), by Proposition 6.9 we have

if \(\frac{1}{\xi _i} \left( 1 - \Delta _i(t) \right) \in H_i\).

7 GOP and GOP-denominated prices

As already outlined in Remark 4.6, in this section we study the problem of determining the GOP: this follows from the previous results by simply letting \(u(t,c) \equiv 0\), i.e. \(B = 0\) in (4.10). In light of Theorem 5.4, this is equivalent to considering the optimization problem with terminal utility function \(U(v)\), with null consumption rate \({\mathfrak {c}}_t\equiv 0\). Furthermore, we will enlarge the set of admissible strategies \({\mathcal A}[t,T]\). In particular we drop part (a) of Definition 4.3 and we only assume that \({\mathfrak {h}}_t\) belongs to \(H_t\) defined as in (4.8). Under this more general assumption, the optimal strategy \((\bar{{\mathfrak {h}}}_t)_{0\le t\le T}\) that solves the logarithmic maximization problem (4.9)–(4.10) with \(A=1\) is called, when it exists, the growth-optimal strategy. The related wealth process \(V_t^{\bar{{\mathfrak {h}}}}\) is called Growth-Optimal Portfolio (GOP).

As already said in the Introduction, the GOP has the so-called numéraire property Christensen and Larsen (2007), in the sense that all the other portfolios measured in terms of the GOP are supermartingales. The numéraire property can be used for example in the benchmark approach Platen (2006) to price contingent claims even in models where an equivalent martingale measure (EMM) is absent. GOP-denominated prices might however fail to be martingale and being instead strict supermartingales Becherer (2001), Bühlmann and Platen (2003), Cvitanić and Karatzas (1992), Kramkov and Schachermayer (1999). We will now show that in our model the inverse GOP process is either a martingale or a strict supermartingale depending on whether the growth-optimal strategy is an internal or a boundary solution with respect to the domain of the admissible strategies.

Hereafter assume that a growth-optimal strategy \(\bar{{\mathfrak {h}}}\) exists, and it is characterized as

where \({\bar{h}}(t,\cdot ):\{ 0,1 \}^n\rightarrow H_t\) is a deterministic function such that

for any \(t\in [0,T]\), with \(F^d(t,h)\) as in (5.12). For sake of simplicity, we can always assume without any loss of generality that \(\bar{h_i(t,d)}=0\) if \(d_i=1\). Then, by the Itô ’s formula, the dynamics of the inverse GOP process \(I_t:=\frac{1}{V_t^{\bar{{\mathfrak {h}}}}}\) is

Now, observe that

From this we get that \({\mathbb {E}}[\sup _{0\le t\le T}|I_t|^2] < + \infty \) (see Protter 2004, V.Theorem 67) and that

is the stochastic differential of a martingale. Therefore, \(I_t\) is a martingale if and only if

Of course, by (7.1), \({\bar{h}}(t,d)\in \hbox {int}(H_t)\) implies \(\nabla _h F^{d}(t,{\bar{h}}(t,d))=0\), and thus, for \(I_t\) to be a strict supermartingale the optimal strategy \({\bar{h}}(t,D_t)\) has to be a boundary solution. The latter case is only possible when \({\mathrm {supp}}(\nu _t^d(\mathrm{d}x))\) are not compact subsets of \({\mathbb {R}}^n\), and in the next subsection we will provide an example where this fact is evident.

7.1 Strict supermartingale inverse GOP

We consider a market model with only one risky asset, that is \(n=1\). Therefore, we can refer to \(\mu (t,0)\), \(\sigma (t,0)\) and \(\nu ^0(t,\mathrm{d}x)\) as \(\mu (t)\), \(\sigma (t)\) and \(\nu (t,\mathrm{d}x),\) respectively. Furthermore, the pre-default growth-optimal policy \({\bar{h}}(t)\equiv {\bar{h}}(t,0)\) is the value that maximizes over \(H_t\subset {\mathbb {R}}\) the function

Now, let us set \(0 \le m_t \le 1\) and \(M_t \in [0,+ \infty ]\) such that \({\mathrm {supp}}(\nu _t) \subseteq [- m_t,M_t]\) for any \(t\in [0,T]\), and consider the following scenarios.

-

(a)

\(\nu _t(\{-m_t\}) > 0\), \(\nu _t(\{M_t\}) > 0\). According with (4.8) we have \(H_t=(-\frac{1}{M_t},\frac{1}{m_t})\) for any \(t\in [0,T]\). In this case the growth-optimal policy exists and is an internal point. Indeed, the function \(F(t,h)\) is concave in \(h\) and

$$\begin{aligned} \lim _{h\rightarrow -\frac{1}{M_t}^+}F(t,h)=\lim _{h\rightarrow \frac{1}{m_t}^-}F(t,h)=-\infty . \end{aligned}$$In this case the inverse GOP \(I_t\) is a martingale.

-

(b)

\(\nu _t(\{-m_t\}) = 0 < \nu _t(\{M_t\})\). We have \(H_t=(-\frac{1}{M_t},\frac{1}{m_t}]\) and the growth-optimal policy still exists because \(F(t,h)\) is concave in \(h\) and

$$\begin{aligned} \lim _{h\rightarrow -\frac{1}{M_t}^+}F(t,h)=-\infty . \end{aligned}$$In this case, differently from (a), \(\arg \max _{h\in H_t}F(t,h)\) might correspond to the boundary point \(\frac{1}{m_t}\). A necessary and sufficient condition for this is

$$\begin{aligned} \lim _{h\rightarrow \frac{1}{m_t}^-}\partial _h F(t,h)=\mu - \sigma (t)h + \int _{-m_t}^{M_t}\left( \frac{x}{1+h x}-x \right) \nu _t({\mathrm {d}}x)\ge 0, \end{aligned}$$(7.2)that of course implies

$$\begin{aligned} \int _{-m_t}^{-m_t+\epsilon } \frac{x}{1+\frac{x}{m_t}} \nu _t({\mathrm {d}}x)>-\infty . \end{aligned}$$Therefore, if (7.2) holds the inverse GOP \(I_t\) is a strict supermartingale.

-

(c)

\(\nu _t(\{M_t\}) = 0 < \nu _t(\{-m_t\})\). In analogy with (b), we have \(H_t=[-\frac{1}{M_t},\frac{1}{m_t})\) and the condition

$$\begin{aligned} \lim _{h\rightarrow -\frac{1}{M_t}^+}\partial _h F(t,h)=\mu - \sigma (t)h + \int _{-m_t}^{M_t}\left( \frac{x}{1+h x}-x \right) \nu _t({\mathrm {d}}x)\le 0, \end{aligned}$$for \({\bar{h}}(t)\) to coincide with boundary point \(-\frac{1}{M_t}\).

-

(d)

\(\nu _t(\{-m_t\}) = \nu _t(\{M_t\}) = 0\). Totally analogous to (b) and (c), with \({\bar{h}}(t)\) possibly corresponding to either \(-\frac{1}{M_t}\) or \(\frac{1}{m_t}\).

The above example shows that a boundary solution \(1/m_t\) (or \(-1/M_t\)) is impossible when the compensator \(\nu _t\) puts mass on the boundary \(m_t\) (or \(M_t\)) of the respective support. Indeed, as the proportion invested in the risky asset gets closer to the the boundary, the log-portfolio value gets arbitrarily close to \(-\infty \) with positive probability. Note that this phenomena is actually independent of \(m_t\) being or not equal to one, and so independent of the risky asset being or not defaultable.

References

Ang A, Bekaert G (2002) International asset allocation with regime shifts. Rev Financ Stud 15:1137–1187

Antonelli F, Ramponi A, Scarlatti S (2013) Option-based risk management of a bond portfolio under regime switching interest rates. Decis Econ Financ 36:47–70

Backhaus J, Frey R (2008) Pricing and hedging of portfolio credit derivatives with interacting default intensities. Int J Theor Appl Financ 11:611–634

Becherer D (2001) The numeraire portfolio for unbounded semimartingales. Financ Stoch 5:327–341

Bellamy N (2001) Wealth optimization in an incomplete market driven by a jump-diffusion process. J Math Econ Spec Issue Arbitr Control Probl Financ 35(3):259–287

Benth F, Schmeck M (2012) Stability of Merton’s portfolio optimization problem for Lévy models. Stochastics 85(5):833–858

Benth FE, Karlsen KH, Reikvam K (2001) Optimal portfolio management rules in a non-Gaussian market with durability and intertemporal substitution. Financ Stoch 5:447–467

Bhanot DHK, Burns N, Williams M (2014) News spillovers from the Greek debt crisis: impact on the Eurozone financial sector. J Bank Financ 38:51–63

Bielecki T, Jang I (2006) Portfolio optimization with a defaultable security. Asia Pac Financ Mark 13:113–127

Bo L, Wang Y, Yang X (2010) An optimal portfolio problem in a defaultable market. Adv Appl Probab 42:689–705

Bühlmann H, Platen E (2003) A discrete time benchmark approach for insurance and finance. Astin Bull 33:153–172

Callegaro G (2013) Optimal consumption problems in discontinuous markets. Optimization 62(11):1575–1602

Callegaro G, Vargiolu T (2009) Optimal portfolio for HARA utility functions in a pure jump multidimensional incomplete market. Int J Risk Assess Manag Spec Issue Meas Manag Financ Risk 11:180–200

Callegaro G, Jeanblanc M, Runggaldier WJ (2012) Portfolio optimization in a defaultable market under incomplete information. Decis Econ Financ 35:91–111

Capponi A, Figueroa-López J (2014) Dynamic portfolio optimization with a defaultable security and regime-switching markets. Math Financ 24(2):207–249

Capponi A, Figueroa-López J, Nisen J (2014) Pricing and semimartingale representations of vulnerable contingent claims in regime-switching markets. Math Financ 24(2):250–288

Christensen MM, Larsen K (2007) No arbitrage and the growth optimal portfolio. Stoch Anal Appl 25:255–280

Cont R, Tankov P (2004) Financial modelling with jump processes. Chapman & Hall/CRC financial mathematics series. Chapman & Hall/CRC, Boca Raton

Cousin A, Jeanblanc M, Laurent J-P (2011) Hedging CDO, tranches in a Markovian environment. In: Paris-Princeton lectures on mathematical finance 2010. Lecture notes in mathematics, vol 2003. Springer, Berlin, pp 1–61

Cvitanić J, Karatzas I (1992) Convex duality in constrained portfolio optimization. Ann Appl Probab 2:767–818

Dai KJSQ, Yang W (2007) Regime shifts in a dynamic term structure model of U.S. treasury bond yields. Rev Financ Stud 20:1669–1706

Dumontaux N, Pop A (2012) Contagion effects in the aftermath of Lehman’s collapse: measuring the collateral damage. LEMNA Working Paper, vol 27, pp 1–45

Fleming WH, Soner HM (2006) Controlled Markov processes and viscosity solutions, 2nd edn. Stochastic modelling and applied probability, vol 25. Springer, New York

Fontana C, Runggaldier W (2013) Diffusion-based models for financial markets without martingale measures. In: Biagini F, Richter A, Schlesinger H (eds) Risk measures and attitudes. EAA series, Springer, pp 45–81

Framstad NC, Øksendal B, Sulem A (2001) Optimal consumption and portfolio in a jump diffusion market with proportional transaction costs. J Math Econ Spec Issue Arbitr Control Probl Financ 35(3):233–257

Gentile M, Giordano L (2012) Financial contagion during Lehman default and sovereign debt crisis. Quaderni di Finanza CONSOB 72:3–46

Giesecke SSK, Longstaff F, Strebulaev I (2011) Corporate bond default risk: a 150-year perspective. J Financ Econ 102:233–250

Jeanblanc-Picqué M, Pontier M (1990) Optimal portfolio for a small investor in a market model with discontinuous prices. Appl Math Optim 22:287–310

Kallsen J (2000) Optimal portfolios for exponential Lévy processes. Math Methods Oper Res 51:357–374

Kazi IR, Salloy S (2013) Contagion effect due to Lehman Brothers’ bankruptcy and the global financial crisis—from the perspective of the credit default swaps’ G14 dealers. Working Paper Université Paris Ouest, 06, pp 1–49

Korn R, Oertel F, Schäl M (2003) The numeraire portfolio in financial markets modeled by a multi-dimensional jump diffusion process. Decis Econ Financ 26:153–166

Kramkov D, Schachermayer W (1999) The asymptotic elasticity of utility functions and optimal investment in incomplete markets. Ann Appl Probab 9:904–950

Liu J, Longstaff F, Pan J (2003) Dynamic asset allocation with event risk. J Financ 58:231–259

Øksendal B, Sulem A (2005) Applied stochastic control of jump diffusions. Springer, Berlin

Pasin L, Vargiolu T (2010) Optimal portfolio for HARA utility functions where risky assets are exponential additive processes. Econ Notes 39:65–90

Platen E (2006) A benchmark approach to finance. Math Financ 16:131–151

Protter PE (2004) Stochastic integration and differential equations. In: Stochastic modelling and applied probability. Applications of mathematics (New York), vol. 21, 2nd edn. Springer, Berlin

Valdez A, Vargiolu T (2013) Optimal portfolio in a regime-switching model. In: Seminar on stochastic analysis, random fields and applications VI—Centro Stefano Franscini-Ascona. Progress in probability, vol 67. Springer, Berlin, pp 435–449

Acknowledgments

A significant portion of the research reported in this paper was done while the first author was a PhD student in the Department of Mathematics at the University of Padova. This work was partially supported by the grant CPDA138873-2013 of the University of Padova ’Stochastic models with spatial structure and applications to new challenges in Mathematical Finance, with a focus on the post-2008 financial crisis environment and on energy markets’. The authors would like to thank Giorgia Callegaro, Wolfgang Runggaldier and two anonymous referees for constructive comments which contributed to improve the quality of this manuscript.

Author information

Authors and Affiliations

Corresponding author

Appendix: Proof of Theorem 5.4

Appendix: Proof of Theorem 5.4

We first need to introduce the following notation.

Definition 8.1

Given \(d\in \{0,1\}^n\), we call the length of \(d\) the positive integer defined as

Moreover we establish on \(\{0,1\}^n\) the following (partial) order relation:

Note that given \(D_t=d\) for a certain \(t\le 0\), the states \(d'<d\) are the only states accessible for \(D\) after the time \(t\).

Roughly speaking, the length of \(d\) is equal to the number of risky asset that are still alive. In particular, when every firm has already defaulted we have \(l(d)=0\), whereas when every firm did not we have \(l(d)=n\). We also explicitly observe that

Hence by (5.4), given a state \(d\in \{0,1\}^n\), \(A^h J(t,x,d)\) depends only on the states \(d'\le d\), i.e. the states whose alive assets are a subset of the alive ones in \(d\); in other words, \(A^{h,c} J(t,x,d)\) does not depend on the assets whose entities have already defaulted.

We also need the following

Lemma 8.2

Consider the function

with \(A,B\ge 0,A+B>0\). Then, for any \(t\in [0,T]\) and \(v>0\) we have

where \({\bar{c}}\) is defined as in (5.16). Moreover,

if \(\delta >0,\) whereas

if \(\delta =0\).

Proof

We only prove the case \(\delta >0\). For any \(t\in [0,T],v>0\) we have

if and only if \(c={\bar{c}}(t)v\). Thus, \({\bar{c}}(t)v\) is the only stationary point for \(\psi (t,v,\cdot )\), and since \(\lim _{c\rightarrow 0}\psi (t,v,c)=\lim _{c\rightarrow \infty }\psi (t,v,c)=-\infty \), we obtain (8.2). Eventually, (8.3) follows from a direct computation. \(\square \)

We now prove Theorem 5.4.

Proof of Theorem 5.4

We only prove the theorem for \(\delta >0\), as the case \(\delta =0\) is totally analogous.

Part (a). By induction on \(k=l(d)\). We start proving the statement when \(k=0\). In this case we clearly have \(d={\mathbf {1}}:=(1,\ldots ,1)\), i.e. all the entities have defaulted. If we search for a solution of the kind \(K(t,v,d)\) as in (5.13), we clearly obtain

so that the HJB equation becomes

with \(\psi (t,v,c)\) as in (8.1). Thus by Lemma 8.2 we have

Therefore, we define \(\Phi ^{{\mathbf {1}}}\) as the unique solution of (8.6) provided with the terminal condition \(\Phi ^{{\mathbf {1}}}(T)=0\), so that \(K(t,v,{\mathbf {1}})\) solves Eq. (5.3) with the terminal condition (5.7).

We now assume the statement to be true for any \(d'\in \{0,1\}^n\) such that \(l(d')\le k-1\) and prove it to be true for any \(d\) such that \(l(d)=k\). We set

where \(\Phi ^{d}\) is a \(C^1\) deterministic function such that \(\Phi ^{d}(T)=0\). Then we have

Therefore we obtain

[by (5.6)]

where

[by (8.7)]

with

and where

(by induction hypothesis)

[by (5.6)]

where \(\varphi ^{d}\) is the continuous deterministic function

with

Thus we obtain

with \(F^d\) as in (5.12), and the HJB equation becomes

with \(\psi (t,v,c)\) as in (8.1). Let us observe that \(\arg \max _{h\in H}F^{d}(t,h)\) is not empty for any \(t\in [0,T]\) because \(H\) is a compact subset of \({\mathbb {R}}^n\) and \(F^{d}\) is continuous, and thus

with \(F^d\) as in (8.1). Therefore, plugging (8.11)–(8.2) into (8.10) we get

[by (8.3)]

Furthermore, note that \(\varphi ^{d}(t)\) and \(\nu ^d_t\left( \Theta ^{d}\right) \) are continuous in \(t\) by Assumption 3.5. Thus, setting \(\Phi ^{d}(\cdot )\) as the unique solution of the ODE (8.12) with terminal condition \(\Phi ^{d}(T)=0\), we have that \(K(t,v,d)\) solves Eq. (5.3) with terminal condition (5.7), and Part (a) is proved.

Part (b). To prove \(K\in {\mathcal D}\) it is sufficient to prove that for any \(\bar{t}\in [0,T]\) and \(({\mathfrak {h}},{\mathfrak {c}})\in {\mathcal A}[\bar{t},T]\),

is a martingale. Now, by applying the Itô formula, we obtain

where

and where we have set \(a(t):=A +\frac{B}{\delta }\left( 1- \mathrm{e}^{-\delta (T-t)} \right) \). Therefore, to prove the theorem it is sufficient to check that \(M_t\) is a martingale. Since

the continuous part is a martingale. We observe now that since \({\mathfrak {h}}\) takes values in the compact set \(H\subset \hbox {int}(\cap _{t\in [\bar{t},T]}H_t)\), there exists a constant \(\delta >0\) such that \(1+\langle {\mathfrak {h}}_t,x \rangle \ge \delta \) \(\nu ^d({\mathrm {d}}x)\)-a.s. for any \(d\in \{0,1\}^n\), \(t\in [\bar{t},T]\). Thus, the function \(x\rightarrow \log {(1+\langle {\mathfrak {h}}_t,x \rangle )}\) is bounded from below and with linear growth, and so there is a constant \(C>0\) such that

for any \(d\in \{0,1\}^n\), \(t\in [\bar{t},T]\). According now to the notation used in the proof of part (a), we define

and finally, to verify the pure jump stochastic integral to be a martingale, we only need to check that for any \(d\in \{0,1\}^n\)

(by the triangular inequality)

[by (8.14) and Assumption 3.3]

Part (c). By (8.9), (8.11) and Lemma 8.2 we have

for any \(t\in [0,T]\) and \(d\in \{0,1\}^n\). Therefore, the process \((\bar{{\mathfrak {h}}}_t,\bar{{\mathfrak {c}}}_t)\) defined in (5.14) satisfies (5.9) and the statement follows by Theorem 5.2. \(\square \)

Rights and permissions

About this article

Cite this article

Pagliarani, S., Vargiolu, T. Portfolio optimization in a defaultable Lévy-driven market model. OR Spectrum 37, 617–654 (2015). https://doi.org/10.1007/s00291-014-0374-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00291-014-0374-7