Abstract

Using a continuous-time, stochastic, and dynamic framework, this study derives a closed-form solution for the optimal investment problem for an agent with hyperbolic absolute risk aversion preferences for maximising the expected utility of his or her final wealth. The agent invests in a frictionless, complete market in which a riskless asset, a (defaultable) bond, and a credit default swap written on the bond are listed. The model is calibrated to market data of six European countries and assesses the behaviour of an investor exposed to different levels of sovereign risk. A numerical analysis shows that it is optimal to issue credit default swaps in a larger quantity than that of bonds, which are optimally purchased. This speculative strategy is more aggressive in countries characterised by higher sovereign risk. This result is confirmed when the investor is endowed with a different level of risk aversion. Finally, we solve a static version of the optimisation problem and show that the speculative/hedging strategy is definitely different with respect to the dynamic one.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

During the past 15 years, the market of credit default swaps (CDSs) has become one of the largest segments of derivatives markets, reaching its peak at the beginning of the global financial crisis. At the end of June 2008, the total notional amount of outstanding CDS contracts was USD 57,325 billion.Footnote 1

CDSs are bilateral derivative contracts under which an investor can buy protection against the credit risk of a reference entity by paying a periodic premium to the seller. This feature makes CDS functionally equivalent to insurance contracts. However, the main difference with respect to an insurance contract is the possibility of buying a CDS without owning the underlying asset (i.e. buying the derivative in the so-called uncovered or “naked” form).

The strong growth of the market and the possibility of buying uncovered CDSs has raised concerns regarding their use. One of the main arguments is that speculation on CDSs exacerbated the recent European sovereign crisis, driving CDS premia of some (distressed) countries to record highs and, consequently, influencing their cost of funding (Haugh et al. 2009; Sgherri and Zoli 2009; Fontana and Scheicher 2016). Instead, for an investigation about the link between the value of banks’ equity and the CDS market, the reader is referred to Calice et al. (2012).

The main practical consequence of these concerns has been the adoption, by the European Council, of a regulation aiming to ban any person or legal entity in the EU from entering into naked, or uncovered, CDS on sovereign debt. The regulation entered into force in November 2012.Footnote 2 The main objective of this intervention was to reduce the magnitude of speculation on sovereign CDSs. However, a number of weaknesses have been highlighted. Juurikkala (2012), for instance, lists three issues that threaten the effectiveness of the ban: (i) the over-the-counter nature of CDS contracts; (ii) the worldwide framework of financial markets; and (iii) the absence of a similar rule in the US.

In this work, we study the optimal asset allocation for an agent who wants to maximise the expected utility of his or her final wealth by investing in a riskless asset, a (defaultable) bond and a CDS written on the bond. This study aims to understand whether it is optimal for such an agent to invest in CDSs.

Investment decisions in the presence of CDSs are closely related to portfolio choices with mortality contingent claims. Actually, the default process of a firm can be modelled as the force of mortality of an individual or a population. There is extensive literature that explores this subject and successfully models the force of mortality by making use of well-known results about stochastic processes (see, e.g., Dahl 2004; Biffis 2005; Menoncin 2008; Menoncin 2009). However, literature on optimal investment choices with CDSs is scarce.

In this study we use a framework similar to that presented in Menoncin and Regis (2015), but we apply it to the case of an investment in CDS. We provide a closed-form solution to the problem of an agent endowed with a general hyperbolic absolute risk aversion (HARA) class of preferences. In addition, we calibrate the model on market data of six European countries, to assess the behaviour of an investor exposed to different degrees of sovereign risk. In this way, the investment strategy can be considered that of a financial institution that can sell or buy credit risk protection on a sovereign entity.

The results of the calibration show that (i) it is optimal to invest in CDSs and, specifically, to sell credit protection instead of buying it, and (ii) speculation in CDSs plays a crucial role in investment strategy. In the calibrated optimal portfolio, the investor always issues more CDSs than the bonds held in the portfolio. In addition, the magnitude of speculation is directly linked with the underlying risk of the reference entity: the higher is the sovereign risk, the stronger is the speculation. This result is robust to changes in the investor’s risk aversion.

Few studies empirically analyse the role of CDS trading on the European sovereign market and their conclusions are, to some extent, related to the results of our calibrated model. For instance, Delatte et al. (2012) highlight the link between the underlying risk of the reference entity and the magnitude of the speculation in CDSs. In assessing the potential influence of the growing CDS market on the borrowing cost of sovereign states during the European sovereign crisis, the authors conclude that speculation is a significant driver of activity in the CDS market during distress periods. A second empirical study that considers the role of speculation on the CDS market is Chiarella et al. (2015). In that study, a heterogeneous agent model is estimated to address whether the recent movements in European sovereign credit spreads are driven by weakened fundamentals or momentum trading behaviour. The authors conclude that, for troubled peripheral European countries, momentum or non-fundamental trading played a dominant role in increasing their sovereign CDS spreads beyond the levels justified by weakening fundamentals.

In our calibrated model, one consequence of the speculation strategy of the investor is an increase in liquidity on the CDS market. The market becomes more liquid as the investor optimally issues more and more CDSs. The role of liquidity has been investigated by a number of studies. For instance, Badaoui et al. (2013) argue that the surge in CDS spreads observed during the sovereign crisis was mainly due to a rise in market liquidity rather than an increase in default intensity. Aizenman et al. (2013) and Dewachter et al. (2015) analyse the role of macroeconomic fundamentals on CDS spreads in the Euro area. Both studies show how fundamentals are not able to fully explain changes in the sovereign risk of peripheral countries and show that liquidity effects and market overreaction play a dominant role during distress periods. Similarly, in assessing the sovereign credit and liquidity spread interactions over the recent periods of crisis, Calice et al. (2013) find that for several countries, including Greece, Ireland, and Portugal, the liquidity of the sovereign CDS market had a relevant influence on sovereign bond credit spreads. The authors argue that a sovereign debt market failure for several Eurozone countries was prevented by coordinated EU action.

The rest of this paper is structured as follows. Section 2 presents the model set-up, while in Section 3, investors’ preferences are described and the portfolio optimisation problem is solved in closed form. In Section 4, a calibration of the model, based on data of six European countries, is presented. Section 5 presents a one-period version of the optimisation problem, highlighting the differences between the portfolio strategies in a static and dynamic framework. Finally, Section 6 concludes.

2 The dynamic model set-up

We take into account a continuously open, arbitrage-free, complete, and frictionless financial market over the time set \(\left [t_{0},+\infty \right ]\), where the risk is modelled through a set of n (independentFootnote 3) Wiener processes \(W\left (t\right )\).Footnote 4

The whole economic framework can be defined by the following three (matrix) differential equations.

-

A set of s state variables exist, whose values \(z\left (t\right )\) solve the stochastic differential equation:

$$ \underset{s\times1}{dz\left( t\right)}=\underset{s\times1}{\mu_{z}\left( t,z\right)}dt+\underset{s\times n}{\Omega\left( t,z\right)^{\prime}}\underset{n\times1}{dW\left( t\right)}, $$(1)where \(z\left (t_{0}\right )\) is a deterministic vector that defines the initial state of the system. The set of the state variables may contain the interest rate (either spot or forward), the market price of risk, the stochastic volatility, the default intensity, and any other stochastic variable that affects the financial market.

-

In financial market, n risky assets are listed and their prices \(S\left (t\right )\) solve the (matrix) stochastic differential equation

$$ \underset{n\times1}{I_{S}^{-1}}\underset{n\times1}{dS\left( t\right)}=\underset{n\times1}{\mu\left( t,z\right)}dt+ \underset{n\times n}{\Sigma\left( t,z\right)^{\prime}}\underset{n\times1}{dW\left( t\right)}, $$(2)where I S is a diagonal matrix containing the elements of vector \(S\left (t\right )\). The initial asset prices \(S\left (t_{0}\right )\) are deterministic. The vector \(S\left (t\right )\) may contain the prices of stocks, bonds, derivatives, and any other financial asset listed in the market. We recall that the arbitrage-free and completeness hypotheses imply the existence of a unique vector of market prices of risk \(\xi \left (t,z\right )\in \mathbb {R}^{n}\) such that \({\Sigma }\left (t,z\right )^{\prime }\xi \left (t,z\right )=\mu \left (t,z\right )-r\left (t,z\right )\mathbf {1}\), where 1 is a vector of ones.

-

Finally, a riskless asset exists, whose price \(G\left (t\right )\) solves the ordinary differential equation

$$ G\left( t\right)^{-1}dG\left( t\right)=r\left( t,z\right)dt, $$(3)where \(r\left (t,z\right )\) is the instantaneously riskless interest rate. We assume \(G\left (t_{0}\right )=1\), that is, the riskless asset is the numéraire of the economy.

2.1 Credit risk market

Among the risky assets, whose prices are gathered in vector \(S\left (t\right )\) in Eq. 2, we assume there is a derivative written on the credit risk of an underlying asset. This credit risk is measured by a default intensity \(\lambda \left (t,z\right )\), which is one of the state variables, whose values are gathered in \(z\left (t\right )\). It is easy to demonstrate (e.g. Duffie and Singleton 2003) that the value in t 0 of an asset paying \({\Xi }\left (t\right )\) monetary units in t and whose issuer may go bankrupt with intensity \(\lambda \left (t,z\right )\) is given by

where \(\mathbb {E}_{t_{0}}^{\mathbb {Q}}\left [\bullet \right ]\) is the expected value under so-called risk neutral probability, given the information set available at time t 0. Furthermore, the value of cash flow available at the default time τ (we call this \({\Xi }\left (\tau \right )\)) is given by

where we assume that the default time is defined on the interval \(\left [t_{0},+\infty \right ]\) (see Lando 1998).

In this study, we analyse the case of a CDS written on a bond. The CDS is a derivative in which the protection buyer pays a spread at fixed dates, while the protection seller engages to pay the loss given default (LGD) on a certain reference entity if it goes bankrupt before the expiration of the derivative. The value of the CDS is presented in Section 4.1.1.

3 Investor’s maximisation problem

3.1 Investor’s wealth, consumption and revenue

The investor holds \(\theta _{S}\left (t\right )\in \mathbb {R}^{n}\) units of the risky assets and \(\theta _{G}\left (t\right )\in \mathbb {R}\) units of the riskless asset. Thus, at any instant in time, the total value of the investor’s assets (i.e. his or her financial wealth) \(A\left (t\right )\) is given by the static budget constraint

whose differential is the dynamic budget constraint

The first two components on the right hand side of Eq. 5 account for the changes in asset prices. The \(dA_{a}\left (t\right )\) component, which accounts for the dynamic adjustment of the portfolio allocation, must take into account the intensity of default between t and t + d t, which is given by \(\lambda \left (t,z\right )dt\). Thus, the investor’s wealth dynamics are

Once the static budget constraint (4) and the asset differentials (2) and (3) are suitably taken into account, d A(t) becomes

3.2 Investor’s preferences and objective

The investor obtains utility from the wealth at the end of the financial horizon

where δ>1 and the constant A m can be interpreted as the minimum subsistence value of final wealth. This utility belongs to the HARA family. In fact, the Arrow–Pratt absolute risk aversion index is \(\delta /\left (A\left (T\right )-A_{m}\right )\). Accordingly, the higher A m is, the higher is the risk aversion: an agent who has to guarantee a higher minimum level of final wealth will choose a safer investment. The case of constant relative risk aversion preferences is obtained with A m =0.

The investor chooses \(\theta _{S}\left (t\right )\), which maximises the expected utility of final wealth if the credit event has not occurred yet:

where \(\rho \left (t,z\right )\) is a possibly stochastic subjective discount rate. The budget constraint equalises the initial wealth to the expected present value of the final wealth under the risk neutral probability:

which is the expected value representation of the solution to the stochastic differential equation (7).

3.3 The optimal portfolio

Problem (8) under the constraint (9) can be solved either through dynamic programming via the so-called Hamilton–Jacobi–Bellman equation or through the so-called martingale approach. The latter method is viable in our framework because of market completeness.

Proposition 1

The optimal portfolio-solving problem ( 8 ) is

where

Proof

See Appendix A. □

In the solution, we use the new probability measure \(\mathbb {Q}_{\delta }\) defined in Eq. 13. It has two relevant properties: (i) for a log-utility agent, that is δ=1, the probability \(\mathbb {Q}_{\delta }\) coincides with the historical probability; (ii) when the agent is infinitely risk averse, that is \(\delta \rightarrow +\infty \), the probability \(\mathbb {Q}_{\delta }\) coincides with \(\mathbb {Q}\). In fact, we can think of the Wiener processes under \(\mathbb {Q}_{\delta }\) as a weighted mean of the Wiener processes under the risk-neutral and historical probabilities:

Some important properties of the optimal portfolio are worth highlighting.

-

The function \(H\left (t,z\right )\) is the expected value, under \(\mathbb {Q}\), of the minimum final wealth A m appropriately discounted for both financial and credit risk.

-

The function \(F\left (t,z\right )\) is the expected value under the preference-adjusted measure \(\mathbb {Q}_{\delta }\) of discount factors taking into account both the financial risk and credit risk and, thus, it can be thought of as a “global” discount factor.

-

We remark that the difference \(A\left (t\right )-H\left (t,z\right )\) is relevant for computing the optimal portfolio, which depends also on the sensitivities of \(H\left (t,z\right )\) and \(F\left (t,z\right )\) with respect to the state variables z.

-

We identify three components in the demand for the risky assets: (i) a speculative component, related to the risk premium ξ, (ii) a hedging component against the fluctuations of the global discount factor \(F\left (t,z\right )\), and (iii) a hedging component against the fluctuations of the expected imbalance to finance minimum wealth \(H\left (t,z\right )\).

-

The last two components depend on: (i) the risk aversion of the individual, (ii) the variance-covariance matrix of the state variables, and (iii) the sensitivities of \(F\left (t,z\right )\) and \(H\left (t,z\right )\) with respect to changes in the state variables.

4 A portfolio with a bond and a CDS

4.1 The state variables

In this section, we take into account a setting in which there are two state variables: the instantaneously riskless interest rate \(r\left (t\right )\) and the default intensity \(\lambda \left (t\right )\) (i.e. \(z\left (t\right )=\left [\begin {array}{cc} r\left (t\right ) & \lambda \left (t\right )\end {array}\right ]^{\prime }\)). Furthermore, the two state variables are assumed independent and follow a mean reverting square root process:

where \(r\left (t_{0}\right )\) and \(\lambda \left (t_{0}\right )\) are both known and for \(i\in \left \{ r,\lambda \right \} \) a i >0 is the constant strength of the mean reversion effect, b i >0 is the constant long-term mean that the process reverts toward. Here, we assume \(2a_{i}b_{i}{\geq \sigma _{i}^{2}}\), so that both \(r\left (t\right )\) and \(\lambda \left (t\right )\) are always positive.

Remark 1

The independence of \(r\left (t\right )\) and \(\lambda \left (t\right )\) is assumed only for the sake of simplifying both the computations and the calibration of the model. Nevertheless, we stress that the general model presented in Section 3 allows for any possible correlation structure among state variables.

In this section, we use the following result.

Proposition 2

If the stochastic variable \(y\left (t\right )\) follows the process

then

where

Proof

See Appendix B.

In order to keep the statistical properties of (15) unchanged when switching between probabilities (either \(\mathbb {Q}\) or \(\mathbb {Q}_{\delta }\)), we assume that the market prices of risk for \(W_{r}\left (t\right )\) and \(W_{\lambda }\left (t\right )\) are given by

where ϕ r and ϕ λ are constant. Under these assumptions, (15) can be rewritten under both \(\mathbb {Q}\) and \(\mathbb {Q}_{\delta }\) just by changing the mean reverting strength and the long-term mean as follows (with \(i\in \left \{ r,\lambda \right \} \))

Given these results, the function \(H\left (t,z\right )\) in (11) can be simplified as follows:

and, accordingly, the vector \(\frac {\partial H\left (t,z\right )}{\partial z\left (t\right )}\) has the following form:

In an analogous way, the function \(F\left (t,z\right )\) in (12) can be written as

from which we obtain the value of the partial derivatives \(\frac {\partial F\left (t,z\right )}{\partial z\left (t\right )}\frac {1}{F\left (t,z\right )}\) as follows:

In the following subsection, we define the prices of the assets listed in the financial market.

4.1.1 Financial assets

In the financial market, three assets are listed:

-

the riskless asset whose price \(G\left (t\right )\) solves (3);

-

a defaultable constant time-to-maturity (T B ) bond that pays a constant coupon δ B , whose price is

$$\begin{array}{@{}rcl@{}} B\left( t\right) & =1+\mathbb{E}_{t}^{\mathbb{Q}}\left[{\int}_{t}^{t+T_{B}}\left( \delta_{B}-r\left( s\right)-\left( 1-w\right)\lambda\left( s\right)\right)e^{-{{\int}_{t}^{s}}r\left( u\right)+\lambda\left( u\right)du}ds\right], \end{array} $$(18)where w is the constant recovery rate of the bond issuer; and

-

a constant time-to-maturity (T X ) CDS written on the bond \(B\left (t,T\right )\); the mark-to-market value of this CDS is

$$ X\left( t\right)=\mathbb{E}_{t}^{\mathbb{Q}}\left[{\int}_{t}^{t+T_{X}}\left( \left( 1-w\right)\lambda\left( s\right)-\delta_{X}\right)e^{-{{\int}_{t}^{s}}r\left( u\right)+\lambda\left( u\right)du}ds\right], $$(19)where δ X is the constant spread that is paid periodically.

Because of the independence between \(r\left (t\right )\) and \(\lambda \left (t\right )\), the values of the bond and CDS can be simplified as follows

where, all the expected values can be computed in closed form as shown in Proposition 1. In this framework the bond whose price is \(B\left (t\right )\) can be considered a derivative on the interest rate \(r\left (t\right )\) and, in the same way, the CDS whose price is \(X\left (t\right )\) can be considered a derivative on the default intensity \(\lambda \left (t\right )\). Accordingly, the volatility matrix \({\Sigma }\left (t,z\right )\) is given by the following terms

Some simple algebra allows as to conclude that the derivatives we seek can be written as follows:

where we note that the terms \(C\left (t;\bullet ,\bullet ,t+T_{B}\right )\) do not depend on t and, in fact, \(C\left (t;\bullet ,\bullet ,t+T_{B}\right )=C\left (0;\bullet ,\bullet ,T_{B}\right )\).

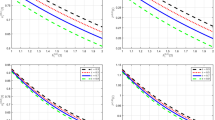

4.1.2 Calibration

In this subsection, we compute the optimal portfolio for an investor and show how it reacts to changes in both the levels of risk aversion and underlying risk. Accordingly, we set four scenarios, whose parameters are estimated from the market data of France, Germany, Ireland, Italy, Portugal, and Spain.

Calibrations of state variables in Eq. (15) are common to all scenarios, all the data are collected with a daily frequency, and parameters are estimated via maximum likelihood estimations, where ordinary least squares estimates are used as the starting point of the optimisation. To obtain default intensity parameters we first infer default intensities by bootstrapping the default probability curve from listed CDS spreads, as in Hull and White (2000). We use CDS daily quotes of each country from 21 July 2008 to 31 December 2014. Riskfree interest rate parameters are obtained using daily returns on the 3-month German Bund, from 18 November 2002 to 7 November 2011. The selected periods reflect the longest series available from Thompson Reuters Eikon; we remove the last 3 years from the 3-month Bund series due to negative rates. Estimates of the risk-free interest rate parameters are reported in Table 1.

To calibrate \(X\left (t\right )\) and \(B\left (t\right )\), we assume that the CDS and defaultable bond have the same constant maturity, equal to 5 years (T X = T B =5). The constant spread (δ X ) is estimated as the average of the listed 5-year CDS spreads for the selected reference entities, while for the constant coupon of the bond (δ B ), we calculate the average of coupons of fixed rate bonds of 5-year maturity issued by each selected sovereign country from November 2002 to December 2014.Footnote 5

To estimate ϕ r and ϕ λ , we numerically solve the following system for each country

where M is the estimated average return of the 5-year sovereign bond over the period 21 July 2008 to 31 December 2014 and x is the estimated price of a 5-year CDS with recovery rate of 40 % and notional value of 1. We infer CDS prices by using averages of spreads and bootstrapped default intensities. Estimated parameters by country are reported in Table 2.

Calibrated paths of state variables – This figure shows the result of the calibration of both the riskless interest rate (on the left) and default intensities (on the right) as in Eq. 15. The underlying Wiener processes are independent. However, for the country specific default intensities one common process is used

Figure 1 shows the evolution of calibrated risk-free rates and default intensities by country; the underlying Wiener process is common to all sovereign countries. The period selected for the estimation of default parameters also captures the European sovereign debt crisis. This can be shown in calibrated intensities: countries that have been affected more severely by the crisis (i.e. Italy, Ireland, Portugal, and Spain) show default intensities that are constantly above those of countries that have been affected less seriously (i.e. France and Germany).

Base scenario

In our base scenario we consider an investor whose preferences are described by the following parameters:

-

initial wealth A 0 equals 100;

-

moderately risk adverse, with δ=2.5;

-

desired wealth at the end of the period A m =120;

-

subjective discount rate ρ=0.01;

-

horizon of 5 years (T=5).

Finally, we assume the recovery rate constant at w=0.4. Fig. 2 shows the evolution of the investor’s wealth for each country and Fig. 3 shows the optimal asset allocation. The underlying sovereign risk plays a clear role: the higher is the risk, the higher are both the average and final investor’s wealth. Less risky countries, such as Germany and France, allow the investor to reach final wealth that is notably lower than the wealth obtained with an investment in riskier countries. In the same way, the underlying risk is positively correlated with the volatility of investor’s wealth.

Optimal portfolio shares in the base scenario – This figure shows the optimal portfolio percentage shares for each country and in the base scenario. The black line is the share of bonds, the bold black line is the share of credit default swaps, and the bold grey line is the share of the riskless asset

We stress that in most of the simulations, the portfolio shares do not show sharp movements and, accordingly, they do not imply overly expensive transaction costs. Actually, the smooth behaviour of portfolio shares could be approximated suitably by a piecewise function that allows keeping the portfolio unchanged for a given period of time.

Optimal portfolios are composed of long positions in the defaultable bonds and short positions in the CDSs: in other words, the investor issues the CDSs to speculate on the credit risk of the reference entity. The share of wealth invested in the bonds decreases over time, and this reduction is compensated by an increase in the risk-free asset share. The investment in the CDSs remains relatively stable during the 5-year period for less risky countries but shows a slight decrease for riskier countries. The only exception to this behaviour is Italy, where the share of the bonds remains stable on average and the slight increase in the riskfree asset is compensated by a small reduction in the CDSs.

The magnitude of credit risk speculation is directly linked to the sovereign risk: the higher is the risk, the higher is the amount of credit default swaps issued by the investor. In addition, in this case, the only exception is the portfolio calibrated on Italian data, which is characterised by the highest percentage of bonds and by the strongest issuance of CDSs. This result suggests that the Italian sovereign risk measured in the financial market is more than compensated for by the return, at least according to the risk aversion of the representative agent we consider.

The average percentage of wealth invested in CDSs ranges during the 5-year horizon from -3 % in the case of Germany, to -75 % in the case of Italy; while the percentage of defaultable bonds ranges from an average of 60 % for Germany to an average of 220 % for Italy.

The investment strategy as a percentage of wealth does not allow capturing the effective role of speculation. The investor significantly speculates on the credit risk of the reference entity by issuing more CDS contracts than bonds held in the optimal portfolio. Fig. 4 shows the evolution of the number of contracts for each calibration. The difference, in absolute terms, between CDS and bond contracts held in the portfolio increases over time; it is a minimum in the case of Germany and a maximum in the case of Italy. The number of defaultable bonds held in the portfolios at the end of the period is largely outweighed by the number of CDSs issued by the investor. This is also the case at the beginning of the period, with the only exception being the German portfolio, in which defaultable bonds overweight CDSs for the first 195 simulated days.

Number of contracts held in the optimal portfolio under the base scenario – This figure shows the evolution of the number of bonds (black line) and CDS contracts (bold black line) held in the optimal portfolio in the base scenario and for each country. The bold grey line is the absolute value of the difference between the number of CDSs contracts and bonds

The main rationale for short selling the CDS is that it provides positive cash flows, (coinciding with the spread δ X ) that can be invested in high-return assets in order to accumulate sufficiently high wealth over time both to face the credit risk and to obtain a positive return. Furthermore, if the investor wants to accumulate enough wealth, the CDSs necessarily must be overweighted with respect to the bonds.

Higher risk aversion scenario

We recalibrate the model with δ set to 4.5 to take into account a higher degree of risk aversion.

Figure 5 shows the evolution of the investor’s wealth for the six optimal portfolios: higher risk aversion determines a lower average in the wealth growth rate but also a lower value in its volatility.

As in the base scenario, the investor takes long positions in defaultable bonds and issues CDSs, with the share invested in bonds decreasing over time and compensated for by an increase in risk-free assets, as shown in Fig. 6. Higher risk aversion results in larger investment in risk-free assets and in a stronger substitution effect, particularly for low-risk countries. Portfolios calibrated on German and French data exhibit a decrease in bonds and an increase in risk-free asset that are nearly linear and constant over time.

Optimal portfolio shares with high risk aversion – This figure shows the optimal portfolio percentage shares for each country, when the investor’s risk aversion δ is set to 4.5. The black line is the share of bonds, the bold black line is the share of credit default swaps, and the bold grey line is the share of the riskless asset

The investor speculates on credit risk by issuing more CDS contracts, on average, than defaultable bonds purchased. The magnitude of speculation is positively correlated with the underlying risk of the reference entity. As shown in Fig. 7, the difference in the number of contracts is lower than in the base scenario and initially negative for three countries. Specifically, the initial portfolio composition includes more defaultable bonds than CDSs for Germany, France, and Portugal and this strategy lasts for 249, 63, and 180 days, respectively. This less aggressive behaviour of the agent reflects the higher risk aversion.

Number of contracts held in the optimal portfolio with high risk aversion – This figure shows the evolution of the number of bonds (black line) and CDS contracts (bold black line) held in the optimal portfolio for each country, when the investor’s risk aversion δ is set to 4.5. The bold grey line is the absolute value of the difference between the number of CDSs contracts and bonds

Lower target of final wealth scenario

Under this scenario, we recalibrate the model with A m =100, which coincides with the level of the initial wealth, that is the investor does not want to suffer any loss.

A lower value of A m entails higher willingness to take risks and this is reflected in a larger level of wealth obtained at the end of the horizon. As shown in Fig. 8, the investor’s wealth depicts, in comparison with previous scenarios, a higher level of volatility over the 5-year period for all countries.

By analysing the composition of optimal portfolios (Figs. 9 and 10), the evolution of the investment strategy for high-risk countries is very similar to that of the base scenario. The investor takes long positions in defaultable bonds and issues CDSs; however, for low-risk countries, two main differences arise: (i) the share of wealth invested in bonds and CDSs at the beginning of the horizon is larger, and (ii) the overtime substitution effect between risk-free assets and bonds is nearly null. This is a consequence of more aggressive speculation on credit risk, which results in a notably larger difference between issued CDSs and bonds held in the portfolio.

Optimal portfolio shares with low target on final wealth – This figure shows the optimal portfolio percentage shares for each country, when the target on final wealth A m is set to 100. The black line is the share of bonds, the bold black line is the share of credit default swaps, and the bold grey line is the share of the riskless asset

Number of contracts held in the optimal portfolio with low target on final wealth – This figure shows the evolution of the number of bonds (black line) and CDS contracts (bold black line) held in the optimal portfolio for each country, when the target on final wealth A m is set to 100. The bold grey line is the difference between CDS and bond contracts in absolute values

Lower risk aversion scenario

In order to examine the optimal portfolio for an investor with a higher risk appetite, we recalibrate the model with δ set to 1.5 and A m to 100.

Figure 11 shows the evolution of the investor’s wealth: lower risk aversion results in larger average values of final wealth with higher volatility. As in previous scenarios, portfolios written on riskier countries entail a larger level of wealth for the investor than safer countries. However, over the 5-year horizon, the volatility increases mainly for low-risk countries: wealth obtained from the German portfolio depicts an increase in standard deviation of 200 %, while for the Portuguese portfolio, the increase is 35 %.

As shown in Fig. 12, the evolution of portfolio shares is similar to other scenarios, with short selling of both CDSs and risk-free asset and long positions in bonds, while speculation on credit risk is stronger, mainly for France and Germany. As depicted in Fig. 13, the direct link between underlying risk and magnitude of the speculation does not seem to hold as in previous scenarios: the largest number of CDSs are issued in German and Italian portfolios.

Optimal portfolio shares with low risk aversion and low target on final wealth – This figure shows the optimal portfolio percentage shares for each country, when the target on final wealth A m is set to 100 and the investor’s risk aversion δ is set to 1.5. The black line is the share of bonds, the bold black line is the share of credit default swaps, and the bold grey line is the share of the riskless asset

Number of contracts held in the optimal portfolio with low risk aversion and low target on final wealth – This figure shows the evolution of the number of bonds (black line) and CDS contracts (bold black line) held in the optimal portfolio for each country, when the target on final wealth A m is set to 100 and the investor’s risk aversion δ is set to 1.5. The bold grey line is the difference between CDS and bond contracts in absolute values

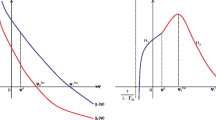

5 A Static (one-period) optimisation problem

In this section, we present a static (one-period) version of the optimisation problem in order to understand in a better way the intuition behind the speculative/hedging strategy in a dynamic framework. Again, three assets are listed in the financial market: (i) a riskless asset whose price is set to 1 and whose constant return is r, (ii) a bond whose price is set to 1 and whose return may be low (μ 1), high (μ 2) or w−1 if default occurs, where w is the recovery rate, and (iii) a CDS whose price is 0 and costs δ X when the issuer of the bond does not go bankrupt and pays 1−w otherwise. The initial prices of these assets at time t can be listed in the following vector

and their values in t+1 can be summarised in the following matrix notation

where each column contains the values of the corresponding asset in different states of the world (the third state coincides with the default of the bond’s issuer).

In this market, there is no arbitrage if a vector of market prices of risk q>0 exists such that

The unique solution to this system is

The price in the last state is always positive (\(w\in \left [0,1\right ]\)), while the prices in the two first states are positive if:

where we assume, without any loss of generality, μ 2>μ 1.

If we call \(\theta ^{\prime }=\left [\begin {array}{ccc} \theta _{G} & \theta _{B} & \theta _{X}\end {array}\right ]\) the vector containing the number of each asset held in the portfolio, the budget constraint on the initial wealth is given by \(A\left (t\right )=\theta ^{\prime }S\left (t\right )=\theta _{G}+\theta _{B}\) and the value of the wealth in t+1 is given by \(A\left (t+1\right )=\theta ^{\prime }S\left (t+1\right )\). If the constraint \(\theta _{G}=A\left (t\right )-\theta _{B}\) is substituted into \(A\left (t+1\right )\) and we call π i the probability of the i th state of the world (\(i\in \left \{ 1,2,3\right \} \)), then the final wealth is a stochastic variable that can be represented as follows

The optimisation problem for an agent characterised by HARA preferences can be written as

The system of the first-order conditions on 𝜃 B and 𝜃 X cannot be solved algebraically. Thus, in what follows we propose a numerical solution after calibrating the model to the market data. Nevertheless, before presenting the numerical solution, we show how to compute the optimal portfolio when there is no CDS in the financial market.

Remark 2

If no CDS exists in the financial market, the agent’s wealth at time t+1 is given by

and the optimisation problem can be written as

Again, there is no algebraic solution to this problem and we must resort to a numerical simulation.

5.1 Calibration

For the riskless interest rate, we take the equilibrium value of its stochastic process (i.e. b r ). The value of δ X is taken from Table 2. The default probability (π 3) in one period is estimated through the following relationship

where the default intensity λ is substituted by its equilibrium value b λ for each country.

Since we know the expected return under the historical probability of the bond in each country (i.e. \(\frac {1}{dt}\mathbb {E}_{t}\left [d\ln B\left (t\right )\right ]\)), then the unknowns π 1, π 2, μ 1, and μ 2 must solve the following system:

If the system is solved with respect to π 1 and π 2 we obtain

Now, since both probabilities must be positive, and we can μ 2>μ 1 set without any loss of generality, the following inequalities must hold

Thus, if we assume that μ 1 and μ 2 are symmetric with respect to the right-hand side of the previous inequalities, then we can write

for any constant κ, and the probabilities become

In order to define μ 1 and μ 2, we set κ = σ r , where σ r is the volatility of the interest rate.

The solutions to the optimisation problem with and without CDSs are shown in Table 3, in which the following relevant points are highlighted.

-

1.

When a CDS is listed in the market, the expected utility of final wealth is always greater. Thus, a complete financial market increases the agent’s welfare. This is perfectly in line with the literature, which demonstrates that even in a long-term model, an incomplete market leads to a reduction in an agent’s welfare (see, e.g., (Kubler and Schmedders 2001)).

Table 3 The upper part of the table shows the calibrated values of the historical probabilities and the returns on the bonds for the six countries of the sample. The middle and lower parts show, with and without CDS respectively, the optimal portfolio, the optimal future wealth in each state of the world, and the optimal expected utility of the final wealth. The parameters required for computing the numerical solution are r = b r =0.0106621, δ=2.5, \(A\left (t\right )=100\), A m =100, σ r =0.0800704. The values of λ = b λ , δ X , and \(\frac {1}{dt}\mathbb {E}_{t}\left [d\ln B\left (t\right )\right ]\) for each country are taken from Table 2 -

2.

The optimal strategy with CDSs is to invest most of the investor’s wealth in the riskless asset and to buy both bonds and CDSs. Nevertheless, the CDSs are bought in higher quantities than the bonds, leading to a kind of hyper-hedging. In the case of default, the CDS allows the investor to recover the notional value of the bonds, but it does not allow any positive return. Instead, in order to gain a return even in the case of default, it is necessary to over-buy CDSs, thereby earning more than what is lost because of default. This intuition is confirmed by the values of the investor’s wealth in the state of the world when default occurs, allowing for final wealth to be greater than 101 always.

-

3.

When there is no CDS on the market, the amount of wealth invested in the bonds is much lower, since it is impossible to hedge against the default. This is apparent from the value of the optimal wealth in the third state of the world (bankruptcy), which is always lower than 101. Furthermore, the amount of wealth invested in the bond is very low for all the countries, even those that have a higher default probability.

-

4.

If a CDS is present in the market, the amount of wealth invested in the bond is much higher, and mainly so for riskier countries because of the possibility of hedging against the higher risk.

In this static model, we are able to replicate the result of the so-called hyper-hedging and nevertheless, CDSs are purchased. Instead, in the dynamic framework they are sold short. This difference is due to the very nature of the dynamic problem. In dynamic optimisation, buying CDSs means that the spread (δ X ) must be paid while the default does not occur. In order to be able to pay these negative cash flows, the amount of money invested in other assets with higher returns must be lower. Thus, this is not optimal from a dynamic point of view. Instead, if the CDS is sold short, the spread (δ X ) is a positive cash flow that can be invested in other assets with a higher return in order to achieve higher final wealth.

6 Conclusion

This study computes the optimal portfolio for an investor who maximises the expected utility of his or her final wealth. The agent invests in a complete market in which a riskless asset, a defaultable bond and a CDS written on the bond are listed.

Once a closed-form solution of the problem is found, we calibrate our model to market data of six European countries in order to assess the behaviour of an investor exposed to different levels of underlying risk. We find that it is always optimal to issue more CDSs than bonds that are optimally purchased. The number of CDS contracts optimally issued is higher for countries characterised by higher sovereign risk. This result is obtained even when the investor is endowed with a different level of risk aversion. However, when both risk aversion and the final wealth target are lowered, such a relationship no longer holds.

Our results suggest that when it is possible to buy CDSs in the so-called “naked” form, financial institutions have incentives to speculate on the risk of sovereign entities. This may add support to the notion that speculation in CDSs exacerbated the recent European sovereign crisis. Consequently, regulatory intervention would be required to increase the effectiveness of the EU ban on uncovered CDSs.

The numerical application presented in this study assumes that the riskless interest rate and the default intensity are independent. An interesting extension of this study would be to analyse the optimal investment strategy when these two state variables are not independent.

Notes

Bank for International Settlements, OTC derivatives market activity in the first half of 2008, available at: http://www.bis.org/publ/otc_hy0811.pdf.

Regulation (EU) No 236/2012 of the European Parliament and of the Council of 14 March 2012 on short selling and certain aspects of CDSs.

The case with dependent Wiener processes can be easily obtained through Cholesky’s decomposition.

In order to calculate the average constant coupon, we seek 5-year fixed-rate bonds issued by the six countries from November 2002 to December 2014.

References

Aizenman J, Hutchison M, Jinjarak Y (2013) What is the risk of european sovereign debt defaults? Fiscal space, cds spreads and market pricing of risk. J Int Money Financ 34:37–59. The European Sovereign Debt Crisis: Background & Perspective

Badaoui S, Cathcart L, El-Jahel L (2013) Do sovereign credit default swaps represent a clean measure of sovereign default risk? a factor model approach. J Bank Financ 37(7):2392–2407

Biffis E (2005) Affine processes for dynamic mortality and actuarial valuations. Insurance: Mathematics and Economics 37(3):443–468

Björk T (2009) Arbitrage theory in continuous time, 3rd Edn. Oxford University Press

Calice G, Chen J, Williams J (2013) Liquidity spillovers in sovereign bond and cds markets: an analysis of the eurozone sovereign debt crisis. J Econ Behav Organ 85:122–143. Financial Sector Performance and Risk

Calice G, Ioannidis C, Williams J (2012) Credit derivatives and the default risk of large complex financial institutions. J Financ Serv Res 42:85–107

Chiarella C, ter Ellen S, He X-Z, Wu E (2015) Fear or fundamentals? heterogeneous beliefs in the european sovereign cds market. Journal of Empirical Finance 32:19–34

Dahl M (2004) Stochastic mortality in life insurance: Market reserves and mortality-linked insurance contracts. Insurance: Mathematics and Economics 35 (1):113–136

Delatte A -L, Gex M, López-Villavicencio A (2012) Has the cds market influenced the borrowing cost of european countries during the sovereign crisis? J Int Money Financ 31(3):481–497

Dewachter H, Iania L, Lyrio M, de Sola Perea M (2015) A macro-financial analysis of the euro area sovereign bond market. J Bank Financ 50:308–325

Duffie D, Singleton KJ (2003) Credit Risk – Pricing, Measurement, and Management. Princeton Series in Finance

Fontana A, Scheicher M (2016) An analysis of euro area sovereign cds and their relation with government bonds. J Bank Financ 62:126–140

Haugh D, Ollivaud P, Turner D (2009) What drives sovereign risk premiums? An analysis of recent evidence from the euro area. Economics department working papers, OECD

Hull JC, White AD (2000) Valuing credit default swaps i – no counterparty default risk. J Deriv 8(1):29–40

Juurikkala O (2012) Credit default swaps and the eu short selling regulation: a critical analysis. European Company and Financial Law Review 9(3):307–341

Karatzas I, Shreve ES (1998) Methods of Mathematical Finance. Springer-Verlag

Øksendal B (2000) Stochastic differential equations - an introduction with applications, 5th Edn. Springer–Verlag

Kubler F, Schmedders K (2001) Incomplete markets, transitory shocks, and welfare. Rev Econ Dyn 4(4):747–766

Lando D (1998) On cox processes and credit risky securities. Rev Deriv Res 2:99–120

Menoncin F (2008) The role of longevity bonds in optimal portfolios. Insurance: Mathematics and Economics 42:343–358

Menoncin F (2009) Death bonds with stochastic force of mortality. Actuarial and financial mathematics conference - interplay between finance and insurance. In: Vanmaele M, Deelstra G, De Schepper A, Dhaene J, Van Goethem P (eds)

Menoncin F, Regis L (2015) Longevity assets and pre-retirement consumption/portfolio decisions. EIC working paper series 2, IMT lucca

Sgherri S, Zoli E (2009) Euro area sovereign risk during the crisis. Imf working paper no. 09/222, international monetary fund

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix : A: Proof of Proposition 1

The financial market is assumed to be arbitrage-free and complete. In other words, a unique vector of market prices of risk \(\xi \left (t,z\right )\in \mathbb {R}^{n}\) exists, such that \({\Sigma }\left (t,z\right )^{\prime }\xi \left (t,z\right )=\mu \left (t,z\right )-r\left (t,z\right )\mathbf {1}\), where 1 is a vector of ones (i.e. \(\exists !\ {\Sigma }\left (t,z\right )^{-1}\)).

Girsanov’s theorem allows switching from historical (\(\mathbb {P}\)) to risk-neutral probability \(\mathbb {Q}\) as follows:

The value in t 0 of a cash flow \({\Xi }\left (t\right )\) available at time t can be written as

where \(\mathbb {E}_{t_{0}}\left [\bullet \right ]\) and \(\mathbb {E}_{t_{0}}^{\mathbb {Q}}\left [\bullet \right ]\) are the expected value operators under historical (\(\mathbb {P}\)) and risk-neutral (\(\mathbb {Q}\)) probabilities respectively, conditional on the information set at time t 0, and the martingale \(m\left (t_{0},t\right )\) solves

where \(m\left (t_{0},t_{0}\right )=1\).

We solve problem (8) through the martingale approach. Given constraint (9), its Lagrangian function is

where the functional dependencies on z have been omitted for the sake of simplicity, κ is the constant Lagrangian multiplier, and all the expected values have been written under historical probability. The first order condition on final wealth is

and optimal final wealth is

When the constraint is rewritten at time t instead of t 0 as follows

and optimal final wealth is substituted in it, we obtain the following expression:

where

While \(m\left (t,T\right )^{1-\frac {1}{\delta }}\) is not a martingale, \(m\left (t,T\right )^{1-\frac {1}{\delta }}e^{\frac {1}{2}\frac {1}{\delta }\frac {\delta -1}{\delta }{{\int }_{t}^{T}}\xi \left (s\right )^{\prime }\xi \left (s\right )ds}\) is. In fact, it can be written as a drift-less diffusion process:

Accordingly, we define the new probability

and write

The differential of (29), through Ito’s lemma, is:

where the drift term is neglected since it is immaterial to replication, and the subscripts on \(F\left (t,z\right )\) and \(H\left (t,z\right )\) indicate partial derivatives. Once the following relationship

is suitably taken into account, the differential equation for \(A\left (t\right )\) becomes

When \({\Sigma }\left (t,z\right )I_{S}\theta _{S}\left (t\right )\) is set equal to the diffusion term of (37), the optimal portfolio in Proposition 1 is found.

B: Computation of

\(\mathbb {E}_{t}\left [\left (1-\chi +\chi y\left (T\right )\right )e^{-{\int }_{t}^{T}y\left (s\right )ds}\right ]\)

If the stochastic variable \(y\left (t\right )\) follows the process

then the expected value

must solve the partial differential equation

with boundary condition

where the parameter χ can take value either 1 or 0. Now, we use the guess function

where the functions A, C, E, and F must be computed in order to solve the differential Eq. (38). The boundary condition implies the following conditions:

Once the partial derivatives of V are substituted into (38), we obtain

where the functional dependencies have been omitted for the sake of simplicity. Since this equation must hold for any value of y, we can split it into three ordinary differential equations as follows

We immediately see that the value of function \(C\left (t\right )\) can be obtained from the third equation. With the suitable boundary condition, the only solution of the differential equation for \(C\left (t\right )\) is given by

The values of all the other functions can be written in terms of \(C\left (t\right )\). Now, if we want to compute the probability to be solvable, we must set E=1 and F=0, and the function A should accordingly solve

with the boundary condition \(A\left (T\right )=0\). The only solution of this ordinary differential equation is

Given this value for \(A\left (t\right )\), the two first equations of system (39) become

We now compute the value of F from the second equation and obtain

The value of E can then be computed from the first equation

Finally, we can write

Rights and permissions

About this article

Cite this article

Ambrosini, G., Menoncin, F. Optimal Portfolios with Credit Default Swaps. J Financ Serv Res 54, 81–109 (2018). https://doi.org/10.1007/s10693-016-0264-z

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10693-016-0264-z