Abstract

I provide new results on how risk preferences affect optimal prevention. I identify a comparative risk aversion and a comparative downside risk aversion effect and highlight those cases where both effects are aligned. Alignment depends on a probability threshold, which, in turn, only depends on the preferences of the benchmark agent. This allows to define an entire class of decision-makers who all share the same comparative static prediction relative to the reference agent. I relate my findings to different intensity measures of downside risk aversion and apply them to parametric preference changes and specific classes of utility functions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The old adage “better safe than sorry” captures the common wisdom that there is value in preventing adverse outcomes. Prevention opportunities arise in a variety of contexts including for individuals and households, corporate risk management and at the societal level. Individuals may decide to undergo regular checkups to increase their chances of detecting illnesses early, which in many cases improves treatment outcomes. Households may decide to install burglar alarm and surveillance systems to reduce the probability of illegal entry. Businesses can invest in workplace safety trainings to reduce the frequency of accidents. Society’s efforts to mitigate climate change lower the probability of catastrophic consequences.Footnote 1

Almost 50 years ago, Ehrlich and Becker (1972) presented the first formal model of prevention and called it “self-protection.” The basic trade-off is that prevention involves an upfront investment at the benefit of lowering the probability of a bad outcome. One may conjecture that risk aversion stimulates the demand for prevention in the sense that more risk-averse agents should exert more effort. Using a simple model of prevention, Dionne and Eeckhoudt (1985) found that this is not necessarily true because an increase in risk aversion à la Pratt (1964) may well lead to less prevention, not more. This negative result has puzzled economists for decades and has produced a series of contributions to identify comparability conditions that allow for unambiguous comparative statics (see Sect. 7 for some literature).

In this paper, I revisit the question how risk preferences determine optimal prevention. I extend Eeckhoudt and Gollier’s (2005) approach to benchmark agents who are not necessarily risk-neutral. To do this, I rewrite the problem in terms of a risk-neutral probability distribution, which removes the endogeneity associated with Jullien et al.’s (1999) threshold result. Comparative risk aversion and comparative downside risk aversion may have conflicting effects on optimal prevention. I discuss those cases where effects are aligend and show how to adapt Dionne and Li’s (2011) approach to sign some of the indeterminate cases. The findings motivate the consideration of parametric preference changes, for which more specific results are obtained.Footnote 2 I also compare my results against alternative measures of downside risk aversion (see Chiu 2005b; Huang and Stapleton 2014; Modica and Scarsini 2005; Keenan and Snow 2012, 2009) and discuss parametric classes of utility functions for illustration.

The paper is organized as follows. I introduce the standard prevention model with a binary risk in the next section. Section three revisits Eeckhoudt and Gollier’s (2005) result for a risk-neutral benchmark agent. In the fourth section, I extend their result to arbitrary benchmark agents and use Dionne and Li’s (2011) approach to resolve some of the indeterminate cases. Section five interprets the results in terms of alternative measures of downside risk aversion and section six applies the results to parametric classes of utility functions. I summarize related literature in section seven and offer concluding thoughts in the last section.

2 Model and notation

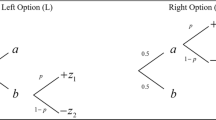

I consider an agent with initial wealth \(w_0\), who faces the risk of losing an amount \(L < w_0\). She can engage in prevention, also called self-protection, to mitigate this binary loss risk. Investing an amount \(e \ge 0\) decreases the probability of loss from p(0) to p(e). The agent’s final wealth in the bad state is then given by \(w_0-e-L\) and final wealth in the good state by \(w_0-e\). Consumption cannot be negative, which restricts effort by \(w_0-L\), and obviously the agent would never spend more than L because this would make her worse off compared to inaction. Therefore, I set \({\overline{e}}=\min \{w_0-L,L\}\) as the upper bound on the level of prevention. The collection of relevant prevention technologies is then given by

Throughout the paper, I assume that the agent’s preferences over consumption are characterized by a strictly increasing vNM utility function of final wealth. I denote the collection of relevant utility functions by

For prevention technology \(p \in {\mathcal {P}}\) and utility function \(u \in {\mathcal {U}}\), the agent maximizes the following expected-utility objective:

If p and u are continuous, then U is continuous as well and thus attains a maximum on the compact interval \([0,{\overline{e}}]\). I assume that U is concave in effortFootnote 3 and focus on interior solutions.Footnote 4 In this case, the optimal level of effort, denoted by \(e_u\), is characterized by the following first-order condition:

The first term represents the agent’s marginal utility benefit, and the second term her marginal utility cost of prevention. For optimality, the marginal utility benefit and the marginal utility cost of prevention must coincide so that there is no incentive to deviate.

If \(v \in {\mathcal {U}}\) represents the preferences of another agent, one may wonder whether agent v exerts a higher or lower effort than agent u. If V denotes agent v’s objective function and \(e_v\) her optimal effort level, the first-order approach yields \(e_v \ge e_u\) if and only if \(V'(e_u) \ge 0\). I will derive conditions that facilitate the comparison of both effort levels. Let

be the transformation function that maps utility levels under u onto utility levels under v. Both u and v are strictly increasing, and therefore t is strictly increasing as well. I will briefly revisit the risk-neutral benchmark case and then relax the assumption of risk neutrality.

3 Risk-neutral benchmark

Assume that u is linear representing risk-neutral preferences. In this case, first-order condition (1) simplifies to \(-p'(e_n) L -1 = 0\), where \(e_n\) denotes the risk-neutral agent’s optimal effort level. I denote by \(p_n = p(e_n)\) the associated probability of loss. I can take u to be the identity because any linear utility function represents risk-neutral preferences. Then, \(t=v\) so that the transformation function coincides with the other agent’s utility function. The following result holds.

Proposition 1

(Eeckhoudt and Gollier 2005) For \(p \in {\mathcal {P}}\), take the optimal effort level of a risk-neutral agent as a benchmark.

-

(i)

If \(p_n=1/2\), all agents with linear marginal utility select the same effort.

-

(ii)

If \(p_n=1/2\), all prudent (imprudent) agents select a lower (higher) effort.

-

(iii)

If \(p_n \ge 1/2\) (\(p_n \le 1/2\)), all risk-averse and prudent (imprudent) agents select a lower (higher) effort.

For completeness, I provide a proof in Appendix A.1. Result (i) corresponds to Proposition 1 in Eeckhoudt and Gollier (2005), result (ii) is their Proposition 2 and result (iii) is their Corollary 1. Relative to a risk-neutral benchmark, prudence tends to reduce optimal effort. While this may seem counterintuitive, the underlying reason is related to a prudent individual’s precautionary motive. If the loss is sufficiently likely, the prudent thing to do is to invest less in prevention because this increases consumption in the bad state. Prevention does not reduce risk in the sense of Rothschild and Stiglitz (1970); instead, it may raise the level of downside risk as was first pointed out by Briys and Schlesinger (1990). Intuitively, if the loss happens, having invested in prevention is unfortunate because all it did was to lower final wealth in the bad state. This is undesirable for prudent individuals because they are downside risk-averse (see Menezes et al. 1980).

4 Other benchmarks

Comparing effort choices against a risk-neutral benchmark is instructive for intuition but also restrictive. This section presents the main results, which facilitate the comparison of effort choices against other benchmarks. For \(u \in {\mathcal {U}}\) and \(p \in {\mathcal {P}}\), recall that \(e_u\) denotes agent u’s optimal effort level. Let \(p_u = p(e_u)\) be the associated probability of loss and

the distorted probability of loss. The distortion factors, \(u'(w_0-e_u-L)/[p_u u'(w_0-e_u-L)+ (1-p_u) u'(w_0-e_u)]\) for the bad state and \(u'(w_0-L)/[p_u u'(w_0-e_u-L)+ (1-p_u) u'(w_0-e_u)]\) for the good state represent a Radon-Nikodym derivative, and the distorted probability distribution is analogous to the risk-neutral probability distribution in asset pricing. The following result holds.

Proposition 2

For \(p \in {\mathcal {P}}\), take agent u’s optimal effort level as a benchmark and denote by \({\hat{p}}_u\) the corresponding risk-neutral probability of loss.

-

(i)

If \({\hat{p}}_u = 1/2\), all agents with \(t'''=0\) select the same effort.

-

(ii)

If \({\hat{p}}_u = 1/2\), all agents with \(t'''>0\) (\(t'''<0\)) select a lower (higher) effort.

-

(iii)

If \({\hat{p}}_u \ge 1/2\), all agents with \(t''<0\) and \(t'''>0\) (\(t''>0\) and \(t'''<0\)) select a lower (higher) effort.

-

(iv)

If \({\hat{p}}_u \le 1/2\), all agents with \(t''<0\) and \(t'''<0\) (\(t''>0\) and \(t'''>0\)) select a higher (lower) effort.

I provide a proof in Appendix A.2. The structural similarity between Propositions 1 and 2 is apparent. For an arbitrary benchmark agent u who is not necessarily risk-neutral, the distorted probability of loss \({\hat{p}}_u\) plays the same role in Proposition 2 as the risk-neutral agent’s probability of loss \(p_n\) in Proposition 1, and the transformation function t plays the same role in Proposition 2 as the other agent’s utility function in Proposition 1. Indeed, Proposition 2 reduces to Proposition 1 if u is risk-neutral because then \({\hat{p}}_u = p_u = p_n\) and t coincides with the utility function of the other agent. Tables 1 and 2 summarize the content of Proposition 2 in compact form. If one of the inequalities involving \({\hat{p}}_u\) or \(t'''\) is strict, so is the inequality between the two effort levels.Footnote 5

The intuition behind Proposition 2 derives from the presence of two economic effects.Footnote 6 There is a comparative downside risk aversion effect, which is negative when \(t'''>0\) and positive when \(t'''<0\). In addition, there is a comparative risk aversion effect, which is jointly determined by the curvature of t and agent u’s distorted loss probability. If \({\hat{p}}_u \ge 1/2\), the comparative risk aversion effect is negative for \(t''<0\) and positive for \(t''>0\). If \({\hat{p}}_u \le 1/2\) instead, the comparative risk aversion effect is positive for \(t''<0\) and negative for \(t''>0\). This is why there is alignment between the two effects for the combinations on the diagonal in Table 1 and for the combinations off the diagonal in Table 2. If the two effects point in opposite directions, the ordering between \(e_v\) and \(e_u\) remains inconclusive.

Proposition 4 in Jullien et al. (1999) states that an increase in risk aversion leads to more effort if and only if \(p_u\) is below an endogenous threshold. Proposition 2 in this paper also involves a probability threshold, and one may wonder about the difference between the two results. In Proposition 2, the threshold only depends on the benchmark agent u and not on the other agent. In Jullien et al. (1999), the endogenous threshold depends on both utility functions.Footnote 7 In other words, while one increase in risk aversion may produce an endogenous threshold above agent u’s loss probability, leading to more effort, a different increase in risk aversion may produce an endogenous threshold below agent u’s loss probability, thus implying less effort. Their result does not allow to define a class of agents who all exhibit the same behavior relative to agent u, and it is necessary to carry out a case-by-case analysis. Proposition 2 solves this problem at the expense of a restriction on the sign of \(t'''\).

While the comparison of \({\hat{p}}_u\) with 1/2 does not require knowledge of the other agent’s preferences, it does involve the benchmark agent’s marginal utilities. It follows easily from the definition of \({\hat{p}}_u\) in Eq. (2) that risk aversion of agent u implies \({\hat{p}}_u > p_u\) because \(u'(w_0-e_u) < u'(w_0-e_u-L)\). Hence, Proposition 2(iii) has the following corollary, see also Lee and Wong (2019).

Corollary 1

Assuming risk aversion, if \(p_u \ge 1/2\), all agents with \(t''<0\) and \(t'''>0\) (\(t''>0\) and \(t'''<0\)) select a lower (higher) effort.

Another corollary can be obtained by focusing on specific transformation functions.

Definition 1

The change in preferences from agent u to agent v is quadratic if \(t'''=0\). Specifically, \(t'>0\), \(t''<0\) and \(t'''=0\) represents a quadratic increase in risk aversion while \(t'>0\), \(t''>0\) and \(t'''=0\) represents a quadratic decrease in risk aversion.

To characterize quadratic changes in risk aversion, let \(u \in {\mathcal {U}}\) be a benchmark agent with utility levels ranging from \(u(0) \) to \(u(w_0)\). Then, any quadratic change in risk aversion takes the form \(t(u) = u - \alpha u^2\) with \(\alpha < 1/2u(w_0)\) to ensure positive monotonicity. If \(\alpha >0\), it is a quadratic increase in risk aversion, if \(\alpha <0\), it is a quadratic decrease in risk aversion.Footnote 8 While the assumption of \({\hat{p}}_u = 1/2\) in Proposition 2(i) and (ii) mutes the comparative risk aversion effect, \(t'''=0\) mutes the comparative downside risk aversion effect (see Keenan and Snow 2009). This provides the following result (see Appendix A.3 for a proof).

Corollary 2

For \(p \in {\mathcal {P}}\) and \(u \in {\mathcal {U}}\), take agent u’s optimal effort level as a benchmark and let \({\hat{p}}_u\) be the corresponding risk-neutral probability of loss.

-

(i)

If \({\hat{p}}_u \ge 1/2\), all agents who are quadratically more (less) risk-averse than agent u reduce (increase) effort.

-

(ii)

If \({\hat{p}}_u \le 1/2\), all agents who are quadratically more (less) risk-averse than agent u increase (reduce) effort.

For a general transformation function, several combinations of signs for \(t''\) and \(t'''\) do not admit a clear ranking between effort levels due to conflicting effects. The following concept will help resolve some of the indeterminate cases.

Definition 2

The relative curvature measure is given by \({\mathcal {C}}(u) = \left| \frac{u \cdot t'''(u)}{t''(u)} \right|\).

This definition is akin to the notion of relative prudence in utility theory (Kimball 1990). The relative curvature measure compares the curvature of t and the curvature of \(t'\). It can be equivalently defined as the elasticity of \(t''(u)\). I take the absolute value to ensure that \({\mathcal {C}}\) is nonnegative. When applied to those combinations in Tables 1 and 2 where the sign is indeterminate, I obtain the following result (see Appendix A.4 for a proof).

Proposition 3

For \(p \in {\mathcal {P}}\), take agent u’s optimal effort level as a benchmark and denote by \({\hat{p}}_u\) the corresponding risk-neutral probability of loss. Furthermore, \(u_g\) and \(u_b\) are shorthand for agent u’s utility in the good state and the bad state, respectively.

-

(i)

For \({\hat{p}}_u \ge 1/2\), any agent with \(t'' > 0\), \(t''' > 0\) (\(t''<0, t'''<0\)) and \({\mathcal {C}}(u) \le \frac{2 {\hat{p}}_u-1}{1-{\hat{p}}_u}\) for all \(u \in [u_b, u_g]\) selects a higher (lower) effort.

-

(ii)

For \({\hat{p}}_u \le 1/2\), any agent with \(t''< 0\), \(t''' > 0\) (\(t''>0, t'''<0\)) and \({\mathcal {C}}(u) \le \frac{1-2{\hat{p}}_u}{1-{\hat{p}}_u}\) for all \(u \in [u_b, u_g]\) selects a higher (lower) effort.

To apply this result, take the upper right cell in Table 1 as an example. The effect of the preference change on effort is inconclusive here because the comparative downside risk aversion effect is negative while the comparative risk aversion effect is positive. The upper bound on the relative curvature measure ensures that the comparative risk aversion effect dominates the comparative downside risk aversion effect, resulting in higher effort. Likewise, the lower left cell in Table 1 is indeterminate because the comparative downside risk aversion effect is positive, whereas the comparative risk aversion effect is negative. Again, the upper bound on the relative curvature measure ensures that the comparative risk aversion effect predominates, resulting in a negative net effect. Proposition 3(i) helps sign some of the indeterminate cases in Table 1 and Proposition 3(ii) does the same for some indeterminate cases in Table 2.

Proposition 3(i) has a corollary involving only the benchmark agent’s probability of loss but not her marginal utilities. The proof follows from \({\hat{p}}_u > p_u\), which holds by risk aversion.

Corollary 3

Assuming risk aversion, if \(p_u \ge 1/2\), any agent with \(t'' > (<)\ 0\), \(t''' > (<)\ 0\) and \({\mathcal {C}}(u) \le \frac{2 p_u-1}{1-p_u}\) for all \(u \in [u_b, u_g]\) selects a higher (lower) effort.

To provide a specific application, I introduce the class of iso-elastic preference changes.

Definition 3

For \(\gamma , \eta > 0\), the change in preferences from agent u to agent v is iso-elastic if the associated transformation function t has the following shape:

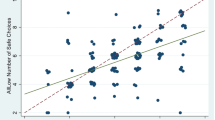

For t in Eq. (3) to be well-defined, I require \(u \ge 0\) for \(\gamma < 1\) and \(u \le 0\) for \(\gamma > 1\). This is without loss of generality because if u fails to have the appropriate sign, one can simply switch to a different utility representation of the same preference that does have the required sign.Footnote 9 The term iso-elastic is motivated by the observation that the elasticity of t(u) with respect to u is given by \((1-\eta ) / (1-\gamma )\). So the transformation function is unit-elastic if \(\eta = \gamma\), and then there is no change in preferences. In all other cases, the preference change affects risk aversion and downside risk aversion. An iso-elastic preference change exhibits \(t''<0\) if and only if \(\eta > \gamma\) and \(t'''>0\) if and only if \((\gamma -\eta )(2\gamma -\eta -1) > 0\), see Appendix A.5 and panel (a) in Fig. 1.

For an iso-elastic preference changes, I obtain \({\mathcal {C}}(u) = \left| 2 \gamma -\eta -1 \right| / \left| 1-\gamma \right|\). The case of \({\hat{p}}_u \le 1/2\) admits clear comparative statics for \(t''>0\) and \(t'''>0\) (less effort) and for \(t''<0\) and \(t'''<0\) (more effort). Proposition 3 then allows to speak to the case of \(t''<0\) and \(t'''>0\) as well. Define \(\tau = \frac{1-2{\hat{p}}_u}{1-{\hat{p}}u}\), which is between zero and one for \({\hat{p}}_u \le 1/2\); for \(\gamma > 1\), if \(\eta \le (2+\tau ) \gamma - (\tau +1)\), then \({\mathcal {C}}(u) \le \tau\) and more effort is optimal. This is shown in panel (b) of Fig. 1. The parameter combinations between a colored dotted line and the black solid line representing \(\eta = 2\gamma -1\) belong to the region where \(t''<0\) and \(t'''>0\) and Proposition 2(iv) does not apply. Proposition 3(ii) resolves the case because \({\mathcal {C}}(u)\) is small enough. The comparison of the dotted lines also shows that the upper bound on \({\mathcal {C}}(u)\) becomes larger the smaller \({\hat{p}}_u\) so that more cases can be signed.

5 Measures of downside risk aversion and optimal prevention

Proposition 2 is formulated in terms of \(t''\) and \(t'''\). Keenan and Snow (2009) provide a justification for interpreting \(t''' \ge 0\) as a measure of greater downside risk aversion in the large but other measures have been proposed in the literature, see Huang and Stapleton (2017). Here is an overview.

Definition 4

Agent u has the following coefficients related to her risk attitude.

-

a)

Arrow-Pratt risk aversion: \(R_u(w) = -\frac{u''(w)}{u'(w)}\).

-

b)

Coefficient of absolute prudence: \(P_u(w) = -\frac{u'''(w)}{u''(w)}\).

-

c)

Modica-Scarsini downside risk aversion: \(D_u(w) = \frac{u'''(w)}{u'(w)}\).

-

d)

Schwarzian derivative: \(S_u(w) = D_u(w) - \frac{3}{2} \left( R_u(w)\right) ^2\).

-

e)

The measure of DARA: \(d_u(w) = -R'_u(w)\).

The Arrow-Pratt measure is well known to economists as a ranking of utility functions in terms of risk aversion with useful local and global properties (see Pratt 1964; Arrow 1965). Kimball (1990) introduces \(P_u(w)\) to measure the strength of the precautionary saving motive. Chiu (2005b) states conditions under which prudence can be used to measure the intensity of downside risk aversion. Modica and Scarsini (2005) introduce \(D_u(w)\) to measure downside risk aversion and discuss its local properties (see also Crainich and Eeckhoudt 2008). Keenan and Snow (2002, 2012) identify invariance properties of the Schwarzian derivative that make it well-suited as a ranking of downside risk aversion. Liu and Meyer (2012) introduce the DARA measure as an alternative definition of increased downside risk aversion.Footnote 10

It is possible to rewrite \(t'''\) based on a given measure of downside risk aversion, which is summarized in the following lemma (see Appendix A.6 for a proof).

Lemma 1

If t denotes the transformation function from utility u onto utility v, then

Combining Proposition 2(iii) and (iv) with Lemma 1 then provides additional results.

Proposition 4

For \(p \in {\mathcal {P}}\), take agent u’s optimal effort level as a benchmark and denote by \({\hat{p}}_u\) the corresponding risk-neutral probability of loss.

-

(i)

If \({\hat{p}}_u \ge 1/2\) and \(P_u(w) \ge 3 R_u(w)\), an increase (decrease) in risk aversion coupled with an increase (decrease) in prudence leads to lower (higher) effort.

-

(ii)

If \({\hat{p}}_u \le 1/2\) and \(P_u(w) \le 3 R_u(w)\), an increase (decrease) in risk aversion coupled with a decrease (increase) in prudence leads to higher (lower) effort.

-

(iii)

If \({\hat{p}}_u \le 1/2\), an increase (decrease) in risk aversion coupled with a decrease (increase) in Modica-Scarsini downside risk aversion leads to higher (lower) effort.

-

(iv)

If \({\hat{p}}_u \ge 1/2\), an increase in risk aversion coupled with an increase in the Schwarzian derivative leads to lower effort.

-

(v)

If \({\hat{p}}_u \le 1/2\), a decrease in risk aversion coupled with an increase in the Schwarzian derivative leads to lower effort.

-

(vi)

If \({\hat{p}}_u \ge 1/2\), an increase in risk aversion by more than a factor of two coupled with an increase in the measure of DARA leads lower effort.

-

(vii)

If \({\hat{p}}_u \le 1/2\), an increase in risk aversion by less than a factor of two coupled with a decrease in the measure of DARA leads to higher effort; a decrease in risk aversion coupled with an increase in the measure of DARA leads to lower effort.

Results (i) and (ii) use the coefficient of absolute prudence and are consistent with Keenan and Snow’s (2010) Proposition 2 where they relate prudence to \(t''' \ge 0\). They also discuss the conditions \(P_u(w) \gtreqless 3R_u(w)\) for HARA utility and their occurrence in the principal-agent literature. Result (iii) uses the Modica-Scarsini measure. There is no corresponding result for \({\hat{p}}_u \ge 1/2\) because an increase in risk aversion coupled with an increase in downside risk aversion à la Modica-Scarsini does not guarantee \(t''' \ge 0\), see Proposition 3 in Keenan and Snow (2010). Results (iv) and (v) involve the Schwarzian derivative. Given how \(t'''\) depends on the change in risk aversion and the change in the Schwarzian (see Lemma 1), only the cases with \(t''' \ge 0\) are presented. Results (vi) and (vii) use the DARA measure. \(t'''\) depends on the DARA measure in such a way that only the case of a sufficiently strong increase in risk aversion can be signed for \({\hat{p}}_u \ge 1/2\) while both cases are possible for \({\hat{p}}_u \le 1/2\).

The coexistence of the different measures reveals that there is no dominant approach in defining comparative downside risk aversion. Likewise, Propositions 2 and 4 show that different measures of downside risk aversion explain optimal prevention differently. The commonality is that, for a high risk-neutral probability (\({\hat{p}}_u \ge 1/2\)), the effects of risk aversion and downside risk aversion are concordant because one can typically sign those cases where both changes go in the same direction. For a low risk-neutral probability (\({\hat{p}}_u \le 1/2\)), the effects of risk aversion and downside risk aversion are discordant because definitive results are often obtained when the changes go in opposite direction. This is evident from Proposition 2 but extends to measures of downside risk aversion other than \(t'''\).

When moving beyond directional changes, one can use Lemma 1 to express \(t'''\) as a function of the magnitude of the changes in risk aversion and downside risk aversion. The simplest case is that of the Schwarzian derivative. Let \(\varDelta R = R_v - R_u\) denote the change in Arrow-Pratt risk aversion and \(\varDelta S = S_v - S_u\) the change in the Schwarzian derivative, where I suppress wealth for compactness. In the \((\varDelta R, \varDelta S)\)-plane, condition \(t'''=0\) defines a parabola with vertex (0, 0) that opens downward. Combinations above the parabola represent \(t'''>0\) and those below the parabola correspond to \(t'''<0\). Combinations to the left of the y-axis imply \(t''>0\) while those to the right of the y-axis imply \(t''<0\) (see Fig. 2 for a graphical representation). This makes it simple to identify the areas in the \((\varDelta R, \varDelta S)\)-plane where optimal prevention admits unambiguous comparative statics. Starting from Lemma 1, similar graphs can be derived for the other measures of downside risk aversion.

6 Some results for parametric classes of utility functions

I will now consider several parametric classes of utility functions as applications including quadratic utility, negative exponential utility and iso-elastic utility. To show the versatility of the approach, I will also make a comparison between exponential and iso-elastic utility.

Quadratic utility. Consider \(u(w) = w-\alpha w^2\) with \(\alpha > 0\) small enough to ensure positive marginal utility, that is, \(\alpha < 1/(2w_0)\). Then, \(R_u(w) = \frac{2 \alpha }{1-2\alpha w}\), \(P_u(w) = D_u(w) = 0\), \(S_u(w) = - \frac{6\alpha ^2}{\left( 1-2\alpha w\right) ^2}\) and \(d_u(w) = - \frac{4\alpha ^2}{\left( 1-2\alpha w\right) ^2}\). Let \(v(w) = w - \beta w^2\) be another quadratic utility function with \(\beta > 0\) small enough to ensure positive marginal utility. Per Lemma 1

and v is more risk-averse than u if and only if \(\beta > \alpha\). Also per Lemma 1, I find that

so that \(t'\) is convex (concave) if \(\alpha > (<)\ \beta\). In particular, an increase (decrease) in risk aversion is always accompanied by \(t'''< (>)\ 0\).Footnote 11 Proposition 2 then implies the following.

Corollary 4

For quadratic utility, an increase (decrease) in risk aversion raises (lowers) optimal effort if \({\hat{p}}_u \le 1/2\).

This is consistent with Dionne and Eeckhoudt (1985) who show directly that an increae in risk aversion raises optimal prevention for quadratic utility agents if \(p_u < 1/2\). In our case, \({\hat{p}}_u \le 1/2\) implies \(p_u < 1/2\) because \(p_u < {\hat{p}}_u\) for risk-averse agents.

Negative exponential utility. If \(u(w) = 1-\exp (-Aw)\) for \(A>0\), then \(R_u(w) = P_u(w) = A\), \(D_u(w) = A^2\), \(S_u(w) = -\frac{1}{2} A^2\) and \(d_u(w) = 0\). If \(v(w) = 1- \exp (-Bw)\) denotes another negative exponential utility function with \(B>0\), Lemma 1 renders

and v is more risk-averse than u if and only if \(B > A\). Lemma 1 also implies that

The change from u to v is a quadratic increase in risk aversion if and only if absolute risk aversion doubles. If it increases by more (less) than a factor of two, then \(t'''> (<) \ 0\). If risk aversion decreases, \(t'\) is always convex. Proposition 2 implies the following result.

Corollary 5

For negative exponential utility:

-

(i)

If \({\hat{p}}_u \ge 1/2\) and risk aversion increases by a factor of two or more, effort decreases.

-

(ii)

If \({\hat{p}}_u \le 1/2\) and risk aversion increases by a factor of two or less, effort increases.

-

(iii)

If \({\hat{p}}_u \le 1/2\) and risk aversion decreases, effort decreases.

Dionne and Eeckhoudt (1985) state that “even the direction of the change in the marginal benefit and in the marginal cost are undetermined” for exponential utility. Dachraoui et al. (2004) use the notion of more mixed risk-averse, which applies to exponential utility, to show that, if \(p_u \ge 1/2\), an increase in risk aversion reduces optimal effort. Result (i) requires a sufficiently large increase in risk aversion; this is because \({\hat{p}}_u \ge 1/2\) includes cases where \(p_u\) may not exceed 1/2, for example if \({\hat{p}}_u = 1/2\). Dachraoui et al. (2004) remain silent about \(p_u \le 1/2\) other than saying it is necessary for an increase in mixed risk aversion to yield more effort. The discussion here reveals that it is not sufficient. However, if \(p_0 = p(0) < 1/2\) denotes the loss probability without prevention, results (ii) and (iii) imply a positive relationship between risk aversion and effort at least up to \({\overline{B}} = \ln ((1-p_0)/p_0)/L\), see Appendix A.7.

Iso-elastic utility. If \(u(w) = w^{1-\gamma }/(1-\gamma )\) for a positive \(\gamma \ne 1\) and \(u(w) = \ln (w)\) for \(\gamma = 1\), I obtain \(R_u(w) = \gamma /w\), \(P_u(w) = (\gamma +1)/w\), \(D_u(w) = \gamma (\gamma +1)/w^2\), \(S_u(w) = \gamma (2-\gamma )/(2w^2)\) and \(d_u(w) = \gamma /w^2\). Now if v(w) is another iso-elastic utility function with relative risk aversion \(\eta >0\), Lemma 1 yields

Obviously, v is more risk-averse than u if and only if \(\eta > \gamma\). For \(t'''\), Lemma 1 provides

A preference change within the class of iso-elastic utility functions is itself iso-elastic in the sense of Definition 3. It is quadratic if and only if \(\eta = 2 \gamma -1\). For example, an increase in relative risk aversion from 2 to 3 is a quadratic increase in risk aversion and a decrease in relative risk aversion from 3/4 to 1/2 is a quadratic decrease in risk aversion. For \(\eta > \gamma\), \(t'\) is convex (concave) if \(\eta > (<)\ 2 \gamma -1\), whereas for \(\eta < \gamma\), \(t'\) is convex (concave) if \(\eta < (>)\ 2 \gamma -1\). Proposition 2 implies the following corollary.

Corollary 6

For iso-elastic utility:

-

(i)

If \({\hat{p}}_u \ge 1/2\), all agents with \(\eta > \max (\gamma , 2 \gamma -1)\) decrease effort.

-

(ii)

If \({\hat{p}}_u \ge 1/2\), all agents with \(\eta \in (2\gamma - 1, \gamma )\) increase effort.

-

(iii)

If \({\hat{p}}_u \le 1/2\), all agents with \(\eta < \min (\gamma , 2 \gamma -1)\) decrease effort.

-

(iv)

If \({\hat{p}}_u \le 1/2\), all agents with \(\eta \in (\gamma , 2\gamma -1)\) increase effort.

The intervals in statements (ii) and (iv) are nonempty for \(\gamma < 1\) and \(\gamma > 1\), respectively, see Fig. 1(a). Parameter changes within the class of iso-elastic utility functions are iso-elastic preference changes so Proposition 3 applies. The only place in the literature where iso-elastic utility is discussed is Dionne and Eeckhoudt (1985) who use a specific log-utility function to provide a numerical example where increased risk aversion leads to less effort.

Negative exponential versus iso-elastic utility. Let \(u(w) = w^{1-\gamma }/(1-\gamma )\) for a positive \(\gamma \ne 1\) and \(u(w) = \ln (w)\) for \(\gamma = 1\). If \(e_u\) denotes agent u’s optimal level of prevention, let \(w_b = w_0 - e_u - L\) and \(w_g = w_0-e_u\) be shorthand for agent u’s final wealth in the bad and the good state, respectively. If \(v(w) = 1-\exp (-Aw)\) for \(A > 0\), Lemma 1 yields the following:

The transformation function approach simplifies the comparison between agents u and v to solving a linear and quadratic inequality on \([w_b,w_g]\). The following corollary holds.

Corollary 7

Take optimal effort for iso-elastic utility with parameter \(\gamma >0\) as a benchmark. Let agent v have negative exponential utility with parameter A.

-

(i)

If \({\hat{p}}_u \ge 1/2\), then \(A \ge \frac{\gamma }{2w_b} \left( 3+\sqrt{5+\frac{4}{\gamma }} \right)\) implies less effort.

-

(ii)

If \({\hat{p}}_u \le 1/2\), then \(A \in \left[ \frac{\gamma }{w_b}, \frac{\gamma }{2w_g} \left( 3+\sqrt{5+\frac{4}{\gamma }} \right) \right]\) implies more effort.

-

(iii)

If \({\hat{p}}_u \ge 1/2\), then \(A \in \left[ \frac{\gamma }{2w_b} \left( 3-\sqrt{5+\frac{4}{\gamma }} \right) , \frac{\gamma }{w_g} \right]\) implies more effort.

-

(iv)

If \({\hat{p}}_u \le 1/2\), then \(A \le \frac{\gamma }{2w_g} \left( 3-\sqrt{5+\frac{4}{\gamma }} \right)\) implies less effort.

A proof is provided in Appendix A.8. The gaps in the parameter space come from the fact that u and v may not be comparable in terms of risk preferences. Take, for example, A between \(\frac{\gamma }{w_g}\) and \(\frac{\gamma }{w_b}\); then t switches from convex to concave on \([w_b, w_g]\), and u and v are non-comparable in terms of risk aversion. Although specific, the results are consistent with those obtained within a class of utility functions. For instance, result (ii) shows that an increase in risk aversion from u to v raises effort if this increase is not too large because otherwise a positive comparative downside risk aversion effect cannot be ensured. For results (iii) and (iv), the round bracket is positive as long as \(\gamma > 1\), and a simple restriction on the loss size guarantees for the intervals in (ii) and (iii) to be non-empty, see Appendix A.8.

7 Related theoretical literature

Ehrlich and Becker (1972) introduced the dichotomy between self-insurance (loss reduction) and self-protection (loss prevention). The first term describes a costly activity reducing the size of a loss, the second term refers to a costly activity lowering the probability of loss.Footnote 12 While market insurance and self-insurance are complements, market insurance and self-protection can be complements or substitutes (Ehrlich and Becker 1972). Due to this discrepancy, many researchers maintain this distinction and analyze each activity separately.Footnote 13

It is natural to wonder how risk aversion affects the demand for risk-mitigating activities. Dionne and Eeckhoudt (1985) found that an increase in risk aversion in the sense of Pratt (1964) increases the optimal level of loss reduction but does not necessarily increase the optimal level of loss prevention. This seemingly counterintuitive result has generated a stream of research to understand why it arises and how it can be resolved. Briys and Schlesinger (1990) developed some intuition by showing that actuarially fair self-insurance constitutes a mean-preserving contraction in the sense of Rothschild and Stiglitz (1970). Actuarially fair prevention instead entails a mean-preserving spread at low wealth levels and a mean-preserving contraction at high wealth levels. This decomposition alludes to the role of downside risk attitudes in explaining optimal prevention.Footnote 14 Jullien et al. (1999) revisited the effect of comparative risk aversion on optimal prevention and formulate their well-known probability threshold result: Risk aversion raises optimal prevention if and only if the probability of loss is below an endogenous threshold. Their threshold depends on the preferences of the benchmark agent and the preferences of the other agent.Footnote 15

Eeckhoudt and Gollier (2005) study the relationship between prudence and optimal prevention. Their analysis relies on a risk-neutral benchmark agent and so does Dionne and Li’s (2011) who showed how to sign some of the indeterminate cases by restricting Kimball’s (1990) coefficient of absolute or relative prudence. Chiu (2000) studied the willingness to pay to self-protect and related it to the agent’s risk aversion and a probability threshold. He found that the threshold is governed by the decision-maker’s aversion to downside risk increases. Chiu (2005a) showed that under a condition implying that small changes in prevention are mean preserving, a lower prudence measure is associated with more effort. Meyer and Meyer (2011) use a Diamond and Stiglitz (1974) approach to extend the analysis of prevention to more than two states of the world. They too obtain results against a risk-neutral benchmark or restrict changes in prevention to yield mean-utility-preserving risk increases and risk decreases of equal size. The approach in this paper neither requires a risk-neutral benchmark agent nor that prevention be mean-preserving. Denuit et al. (2016) compared the preference over two given levels of prevention. If one decision-maker prefers the higher level, they define changes in certain intensity measures of risk attitude that preserve this preference. With two fixed prevention levels, neither one is necessarily optimal for the agents considered.

More recently, the analysis of prevention has been extended to two periods (see Menegatti 2009). In the absence of saving, prudence leads to more prevention but the monoperiodic results are restored when agents take optimal consumption-saving decisions (see Peter 2017). This is due to a substitution effect between saving and prevention (see Menegatti and Rebessi 2011; Hofmann and Peter 2016). Besides intertemporal motives, researchers have investigated wealth effects on prevention (see Sweeney and Beard 1992; Lee 2005) and the role of background risk (see Courbage and Rey 2012; Eeckhoudt et al. 2012). Outside of the expected utility model, the effects of ambiguity aversion on optimal prevention (see Alary et al. 2013; Snow 2011; Huang 2012; Berger 2016) and the role of probability distortions (see Konrad and Skaperdas 1993; Etner and Jeleva 2014; Baillon et al. 2019) have received some attention. Given the link between prevention and downside risk, viable areas of future research include regret-risk aversion (see Gollier 2018) and reference dependence (see Kőszegi and Rabin 2007; Lleras et al. 2019).

8 Conclusion

How do risk preferences determine optimal prevention? Since Dionne and Eeckhoudt’s (1985) negative result, this question has received continued research attention. I generalize several existing approaches in the literature, including Eeckhoudt and Gollier (2005) and Dionne and Li (2011), to obtain new results on how decision-makers trade-off comparative risk aversion against comparative downside risk aversion. For a risk-neutral probability of loss above 1/2, both changes affect effort in the same direction, and for a risk-neutral probability of loss below 1/2, they work in opposite direction. The threshold condition in this paper only depends on the preferences of the benchmark agent as opposed to the threshold in Jullien et al. (1999). I connect my results to different intensity measures of downside risk aversion and discuss parametric specifications as an application.

The findings provide new answers to the question who should exert more effort because they allow to define a class of agents who all share the same comparative static prediction relative to a benchmark. The approach with a risk-neutral probability of loss may also turn out to be useful in the context of incentive contracting or contesting. While the first experimental papers support the theoretical predictions (see Krieger and Mayrhofer 2017; Masuda and Lee 2019), more empirical work is needed to better understand the descriptive determinants of individuals’ prevention behavior.

Notes

Chiu (2000) provides additional examples of prevention and points out some links between the prevention problem, incentive contracting and the contesting literature.

Parametric preference changes are a “happy medium” between Pratt’s (1964) approach, which is fully nonparametric, and specific classes of utility functions that measure risk aversion with a single parameter, which is fully parametric. If only the transformation function is parametric, it may still be applied to any (nonparametric) utility function of a benchmark agent.

Fagart and Fluet (2013) provide conditions on the primitives for the objective function to be concave in effort. Their Proposition 2 shows that U is concave in e if the utility function exhibits nonincreasing absolute risk aversion and the cumulative distribution function of outcomes is log-convex. The latter is equivalent to p being log-convex, which characterizes a decreasing rate of return on prevention (Courbage et al. 2017).

If no effort were optimal, any preference change can only lead to more effort, and if the maximum effort was optimal, any preference change can only lead to less effort. Both cases are trivial for lack of trade-off.

Chiu (2012) establishes a correspondence between an individual’s willingness to pay and her optimal purchase of a stochastic improvement (see his Propositions 6 and 7). His results allow for an alternative proof of the statements involving \(t''<0\). My proof uncovers the analogy between Propositions 1 and 2 and identifies the probability threshold explicitly.

To develop this intuition, one can analyze agent v’s marginal utility benefit and marginal utility cost at agent u’s optimal effort level or by using a cubic Taylor series approximation of agent v’s expected utility. See Peter (2019) for details.

The fact that their probability threshold is a complex function of both agents’ preferences is particularly evident from their approximation for small losses on page 25. Their threshold is endogenous to the change in risk preferences.

In this case, the transformed utility function may no longer be risk-averse if \(\alpha\) is negative enough. Even in those cases, the first-order approach may remain valid, see Jindapon (2013).

Technically, this is achieved by a suitable positive affine transformation that either shifts u(0) upwards until it is nonnegative or that shifts \(u(w_0)\) downward until it is nonpositive.

Huang and Stapleton (2014) relate cautiousness, defined as \((1/R_u(w))'\), to a strong increase in skewness. I do not discuss cautiousness here for lack of a clear relationship with \(t'''\).

Both u and v are quadratic but the change in preferences is not because \(t''' = 0\) only if \(t''=0\). Furthermore, both u and v are downside risk-neutral despite the fact that \(t''' \ne 0\).

An exception is Lee’s (1998) work on self-insurance-cum-protection, a costly activity reducing severity and probability of a loss. See also Lee (2005) and Wong (2016). Some authors have studied self-protection with conditional payments that only become due in case of a successful outcome (see Liu et al. 2009).

Indeed, Menezes et al. (1980) define a mean-variance-preserving transformation precisely as a mean-preserving spread that precedes a mean-preserving contraction in the wealth distribution.

Dachraoui et al. (2004) derived a probability-threshold result based on a fixed threshold value. This requires strong comparability assumptions on the utility functions, namely comparative mixed risk aversion.

Solving the second integral yields \(\frac{1}{L}(w_g-w_b)\frac{1}{2}(v'(w_b)+v'(w_g)) = \frac{1}{2}(v'(w_b)+v'(w_g))\) because \(w_g-w_b=L\).

References

Alary, D., Gollier, C., Treich, N.: The effect of ambiguity aversion on insurance and self-protection. The Economic Journal 123(573), 1188–1202 (2013)

Arrow, K.J.: Aspects of the theory of risk-bearing. Yrjö Jahnsson Foundation, Helsinki (1965)

Baillon, A., Bleichrodt, H., Emirmahmutoglu, A., Jaspersen, J.G., Peter, R.: When risk perception gets in the way: Probability weighting and underprevention. Operations Research (forthcoming) (2019)

Berger, L.: The impact of ambiguity and prudence on prevention decisions. Theory and Decision 80(3), 389–409 (2016)

Briys, E., Schlesinger, H.: Risk aversion and the propensities for self-insurance and self-protection. Southern Economic Journal 57(2), 458–467 (1990)

Chiu, W.H.: On the propensity to self-protect. Journal of Risk and Insurance 67(4), 555–577 (2000)

Chiu, W.H.: Degree of downside risk aversion and self-protection. Insurance: Mathematics and Economics 36(1), 93–101 (2005a)

Chiu, W.H.: Skewness preference, risk aversion, and the precedence relations on stochastic changes. Management Science 51(12), 1816–1828 (2005b)

Chiu, W.H.: Risk aversion, downside risk aversion and paying for stochastic improvements. The Geneva Risk and Insurance Review 37(1), 1–26 (2012)

Courbage, C., Rey, B.: Prudence and optimal prevention for health risks. Health Economics 15(12), 1323–1327 (2006)

Courbage, C., Rey, B.: Optimal prevention and other risks in a two-period model. Mathematical Social Sciences 63(3), 213–217 (2012)

Courbage, C., Loubergé, H., Peter, R.: Optimal prevention for multiple risks. Journal of Risk and Insurance 84(3), 899–922 (2017)

Crainich, D., Eeckhoudt, L.: On the intensity of downside risk aversion. Journal of Risk and Uncertainty 36(3), 267–276 (2008)

Dachraoui, K., Dionne, G., Eeckhoudt, L., Godfroid, P.: Comparative mixed risk aversion: Definition and application to self-protection and willingness to pay. Journal of Risk and Uncertainty 29(3), 261–276 (2004)

Denuit, M., Eeckhoudt, L., Liu, L., Meyer, J.: Tradeoffs for downside risk-averse decision-makers and the self-protection decision. The Geneva Risk and Insurance Review 41(1), 19–47 (2016)

Diamond, P., Stiglitz, J.: Increases in risk and in risk aversion. Journal of Economic Theory 8(3), 337–360 (1974)

Dionne, G., Eeckhoudt, L.: Self-insurance, self-protection and increased risk aversion. Economics Letters 17(1–2), 39–42 (1985)

Dionne, G., Li, J.: The impact of prudence on optimal prevention revisited. Economics Letters 113(2), 147–149 (2011)

Eeckhoudt, L., Gollier, C.: The impact of prudence on optimal prevention. Economic Theory 26(4), 989–994 (2005)

Eeckhoudt, L., Huang, R.J., Tzeng, L.Y.: Precautionary effort: A new look. Journal of Risk and Insurance 79(2), 585–590 (2012)

Ehrlich, I., Becker, G.S.: Market insurance, self-insurance, and self-protection. Journal of Political Economy 80(4), 623–648 (1972)

Etner, J., Jeleva, M.: Underestimation of probabilities modifications: Characterization and economic implications. Economic Theory 56(2), 291–307 (2014)

Fagart, M.C., Fluet, C.: The first-order approach when the cost of effort is money. Journal of Mathematical Economics 49(1), 7–16 (2013)

Gollier, C.: Aversion to risk of regret and preference for positively skewed risks. Economic Theory (forthcoming) pp 1–29 (2018) https://doi.org/10.1007/s00199-018-1154-4

Hofmann, A., Peter, R.: Self-insurance, self-protection, and saving: On consumption smoothing and risk management. Journal of Risk and Insurance 83(3), 719–734 (2016)

Huang, J., Stapleton, R.: Cautiousness, skewness preference, and the demand for options. Review of Finance 18(6), 2375–2395 (2014)

Huang, J., Stapleton, R.: Higher-order risk vulnerability. Economic Theory 63(2), 387–406 (2017)

Huang, R.J.: Ambiguity aversion, higher-order risk attitude and optimal effort. Insurance: Mathematics and Economics 50(3), 338–345 (2012)

Jindapon, P.: Do risk lovers invest in self-protection? Economics Letters 121(2), 290–293 (2013)

Jullien, B., Salanié, B., Salanié, F.: Should more risk-averse agents exert more effort? The Geneva Risk and Insurance Review 24(1), 19–28 (1999)

Keenan, D.C., Snow, A.: Greater downside risk aversion. Journal of Risk and Uncertainty 24(3), 267–277 (2002)

Keenan, D.C., Snow, A.: Greater downside risk aversion in the large. Journal of Economic Theory 144(3), 1092–1101 (2009)

Keenan, D.C., Snow, A.: Greater prudence and greater downside risk aversion. Journal of Economic Theory 145(5), 2018–2026 (2010)

Keenan, D.C., Snow, A.: The Schwarzian derivative as a ranking of downside risk aversion. Journal of Risk and Uncertainty 44(2), 149–160 (2012)

Kimball, M.S.: Precautionary saving in the small and in the large. Econometrica 58(1), 53–73 (1990)

Konrad, K.A., Skaperdas, S.: Self-insurance and self-protection: A nonexpected utility analysis. The Geneva Papers on Risk and Insurance-Theory 18(2), 131–146 (1993)

Kőszegi, B., Rabin, M.: Reference-dependent risk attitudes. American Economic Review 97(4), 1047–1073 (2007)

Krieger, M., Mayrhofer, T.: Prudence and prevention: An economic laboratory experiment. Applied Economics Letters 24(1), 19–24 (2017)

Lee, K.: Risk aversion and self-insurance-cum-protection. Journal of Risk and Uncertainty 17(2), 139–151 (1998)

Lee, K.: Wealth effects on self-insurance and self-protection against monetary and nonmonetary losses. The Geneva Risk and Insurance Review 30(2), 147–159 (2005)

Lee, K., Wong, K.P.: Strong downside risk aversion, prudence, and self-protection. San Diego State University (Working Paper) (2019)

Liu, L., Meyer, J.: Decreasing absolute risk aversion, prudence and increased downside risk aversion. Journal of Risk and Uncertainty 44(3), 243–260 (2012)

Liu, L., Rettenmaier, A.J., Saving, T.R.: Conditional payments and self-protection. Journal of Risk and Uncertainty 38(2), 159–172 (2009)

Lleras, J.S., Piermont, E., Svoboda, R.: Asymmetric gain-loss reference dependence and attitudes toward uncertainty. Economic Theory 68(3), 669–699 (2019)

Masuda, T., Lee, E.: Higher order risk attitudes and prevention under different timings of loss. Experimental Economics 22(1), 197–215 (2019)

Menegatti, M.: Optimal prevention and prudence in a two-period model. Mathematical Social Sciences 58(3), 393–397 (2009)

Menegatti, M.: Optimal choice on prevention and cure: A new economic analysis. The European Journal of Health Economics 15(4), 363–372 (2014)

Menegatti, M., Rebessi, F.: On the substitution between saving and prevention. Mathematical Social Sciences 62(3), 176–182 (2011)

Menezes, C., Geiss, C., Tressler, J.: Increasing downside risk. American Economic Review 70(5), 921–932 (1980)

Meyer, D.J., Meyer, J.: A Diamond-Stiglitz approach to the demand for self-protection. Journal of Risk and Uncertainty 42(1), 45–60 (2011)

Modica, S., Scarsini, M.: A note on comparative downside risk aversion. Journal of Economic Theory 122(2), 267–271 (2005)

Peter, R.: Optimal self-protection in two periods: On the role of endogenous saving. Journal of Economic Behavior & Organization 137, 19–36 (2017)

Peter, R.: Who should exert more effort? Risk aversion, downside risk aversion and optimal prevention. SSRN Working Paper No 3383853 (2019)

Pratt, J.W.: Risk aversion in the small and in the large. Econometrica 32(1–2), 122–136 (1964)

Rothschild, M., Stiglitz, J.E.: Increasing risk: I. A definition. Journal of Economic Theory 2(3), 225–243 (1970)

Snow, A.: Ambiguity aversion and the propensities for self-insurance and self-protection. Journal of Risk and Uncertainty 42(1), 27–43 (2011)

Sweeney, G.H., Beard, T.R.: The comparative statics of self-protection. Journal of Risk and Insurance 59(2), 301–309 (1992)

Wong, K.P.: Precautionary self-insurance-cum-protection. Economics Letters 145, 152–156 (2016)

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares that he has no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

I would like to thank Louis Eeckhoudt for valuable discussions on this particular paper and, in general, for sparking my interest in the economic analysis of optimal prevention. I would also like to thank seminar participants at IÉSEG School of Management and two anonymous referees who provided thoughtful comments that improved the paper significantly. The usual disclaimer applies.

A Appendix

A Appendix

1.1 A.1 Proof of Proposition 1

I denote by \(w_b=w_0-e_n-L\) and \(w_g=w_0-e_n\) consumption in the bad state and the good state, respectively, at the risk-neutral agent’s optimal level of prevention. Then,

The equality uses \(-p'(e_n)L=1\), the fundamental theorem of calculus and the formula for the area of a trapezoid.Footnote 16 The third term vanishes for \(p_n=\frac{1}{2}\) and the first term is strictly smaller (equal, strictly larger, resp.) than the second one if \(v'''>0\) (\(v'''=0\), \(v'''<0\), resp.), which shows (i) and (ii). Result (iii) follows because risk aversion implies \(v'(w_b) > v'(w_g)\).

1.2 A.2 Proof of Proposition 2

By the concavity of V, agent v’s optimal effort is larger than agent u’s if and only if

When solving agent u’s first-order condition in Eq. (1) for \(p'(e_u)\), I obtain

Substituting this into \(V'(e_u)\), I arrive at

To sign the curly bracket, I denote by \(u_b=u(w_0-e_u-L)\) and \(u_g=u(w_0-e_u)\) agent u’s utility in the bad state and the good state, respectively, at her optimal effort level. Using \(v(w)=t(u(w))\) and \(v'(w) = t'(u(w))u'(w)\), the first fraction in the curly bracket can be rearranged as follows:

The second fraction in the curly bracket becomes

The same steps as in the proof of Proposition 1 then show that

Therefore, the sign of \(V'(e_u)\) coincides with the sign of

The third term vanishes for \({\hat{p}}_u=\frac{1}{2}\) and the first term is strictly smaller (equal, strictly larger, resp.) than the second one if \(t'''>0\) (\(t'''=0\), \(t'''<0\), resp.), which shows (i) and (ii). Results (iii) and (iv) follow because \(t''<0\) implies \(t'(u_b) > t'(u_g)\) while \(t''>0\) implies \(t'(u_b) < t'(u_g)\).

1.3 A.3 Proof of Corollary 2

In case of a quadratic change in risk aversion, (4) reduces to

The round bracket is negative (positive) if \({\hat{p}}_u \ge (\le )\ 1/2\). The square bracket is positive (negative) for an increase (decrease) in risk aversion. Corollary 2 follows by combining signs.

1.4 A.4 Proof of Proposition 3

From the proof of Proposition 2, I know that \(V'(e_u)\) has the same sign as

For \(u \in [0,u_g-u_b]\), I define the following auxiliary function:

Then \(H(0) = 0\), and the sign of \(V'(e_u)\) coincides with the sign of \(H(u_g-u_b)\). Furthermore,

so that \(H'(0) = 0\). The second derivative of H is

Therefore, if \(H''(u) \ge 0\) for \(u \in [0,u_g-u_b]\), then \(H'(u) \ge 0\) for \(u \in [0,u_g-u_b]\) and \(H(u_g-u_b) \ge H(0) = 0\) implying higher effort. Likewise, if \(H''(u) \le 0\) for \(u \in [0,u_g-u_b]\), then \(H'(u) \le 0\) for \(u \in [0,u_g-u_b]\) and \(H(u_g-u_b) \le H(0) = 0\) implying lower effort.

For \({\hat{p}}_u \ge 1/2\), the assumptions \(t''>0\), \(t'''>0\) and \({\mathcal {C}}(u) \le \frac{2 {\hat{p}}_u-1}{1-{\hat{p}}_u}\) are jointly sufficient for \(H''(u) \ge 0\) for \(u \in [0,u_g-u_b]\) whereas \(t''<0\), \(t'''<0\) and \({\mathcal {C}}(u) \le \frac{2 {\hat{p}}_u-1}{1-{\hat{p}}_u}\) are jointly sufficient for \(H''(u) \le 0\) for \(u \in [0,u_g-u_b]\). This proves (i). The argument for \({\hat{p}}_u \le 1/2\) is analogous.

1.5 A.5 Derivatives of t for iso-elastic preference changes

For \(\gamma = \eta = 1\), the transformation function is the identity and there is no change in preferences. For \(\gamma \ne 1\), I obtain the first three derivatives of t as follows:

This yields the sign conditions for \(t''\) and \(t'''\). Furthermore, \({\mathcal {C}}(u) = \left| \frac{u \cdot t'''(u)}{t''(u)} \right| = \frac{\left| 2\gamma -\eta -1 \right| }{\left| 1-\gamma \right| }\).

1.6 A.6 Proof of Lemma 1

By direct computation I obtain

Solving for \(t'\) yields \(t'(u(w)) = v'(w)/u'(w)\), which I substitute into \(v''\) to obtain \(v''(w) = t''(u(w)) \left( u'(w) \right) ^2 + v'(w)u''(w)/u'(w)\). Solving for \(t''\) renders

Substituting \(t'\) and \(t''\) into \(v'''\) and solving for \(t'''\) yields

The rest follows by using the definitions of R(w), P(w), D(w), S(w) and d(w) and rearranging.

1.7 A.7 Negative exponential utility and Corollary 5

Choose \(A = {\overline{B}}/2\); \({\hat{p}}_u \le 1/2\) is equivalent to \(p_u \le \left[ 1 + \frac{u'(w_0-e_u-L)}{u'(w_0-e_u)} \right] ^{-1}\). The ratio of marginal utilities simplifies to \(\exp (AL)\) in case of exponential utility. Therefore, \(p_u< p_0 \le \left[ 1+ \exp ({\overline{B}}L) \right] ^{-1} < \left[ 1+ \exp (AL) \right] ^{-1},\) and results (ii) and (iii) in Corollary 5 apply.

1.8 A.8 Proof of Corollary 7

\(t'' \ge 0\) if \(A \le \tfrac{\gamma }{w}\) for all \(w \in [w_b, w_g]\), which holds for \(A \le \tfrac{\gamma }{w_g}\). Likewise, \(t'' \le 0\) for \(w \in [w_b, w_g]\) is ensured by \(A \ge \tfrac{\gamma }{w_b}\). If \(A \in (\tfrac{\gamma }{w_g}, \tfrac{\gamma }{w_b})\), \(t''\) does not have a uniform sign on \([w_b, w_g]\) so that u and v are non-comparable in terms of risk aversion. To sign \(t'''\), I solve for the zeros of \(A^2w^2-3A\gamma w+\gamma (\gamma -1)\), which are given by

Therefore, if \(w_2 \le w_b\) or \(w_1 \ge w_g\), then \(t''' \ge 0\) for \(w \in [w_b,w_g]\), and if \(w_1 \le w_b < w_g \le w_2\), then \(t''' \le 0\) for \(w \in [w_b,w_g]\). In all other cases, \(t'''\) changes sign on \([w_b,w_g]\), and u and v are non-comparable in terms of downside risk aversion.

If \(A \ge \frac{\gamma }{2 w_b}\left( 3 + \sqrt{5+\frac{4}{\gamma }}\right)\), then \(w_2 \le w_b\) and \(t''' \ge 0\). Now \(\left( 3 + \sqrt{5+\frac{4}{\gamma }}\right) > 2\) for all \(\gamma > 0\) so the lower bound on A also implies \(A > \frac{\gamma }{w_b}\). Hence \(t'' < 0\) and Proposition 2(iii) applies, which proves result (i). If \(A \in \left[ \frac{\gamma }{w_b}, \frac{\gamma }{2 w_g} \left( 3 + \sqrt{5+\frac{4}{\gamma }}\right) \right]\), then \(t'' \le 0\) and \(w_g \le w_2\). But \(w_1 \le w_b\) holds as well because \(\left( 3 - \sqrt{5+\frac{4}{\gamma }}\right) < 2\) for all \(\gamma >0\) so that \(A \ge \frac{\gamma }{w_b}\) implies \(A \ge \frac{\gamma }{2w_b}\left( 3 - \sqrt{5+\frac{4}{\gamma }}\right)\). Therefore, \(t''' \le 0\) and Proposition 2(iv) applies, which proves (ii). The proof of results (iii) and (iv) is analogous.

If \(L \le \frac{1}{2}(3-\sqrt{5})w_0\), the intervals in (ii) and (iii) are non-empty. This follows because \(3-\sqrt{5}<1\) so that \(L < w_0-L\) and \({\overline{e}} = L\). But then

where the middle inequality uses \(L \le \frac{1}{2}(3-\sqrt{5})w_0\). This chain of inequalities implies \(\frac{\gamma }{w_b}<\frac{\gamma }{2 w_g} \left( 3 + \sqrt{5+\frac{4}{\gamma }}\right)\). The argument for (iii) is similar and uses the same restriction on L.

Rights and permissions

About this article

Cite this article

Peter, R. Who should exert more effort? Risk aversion, downside risk aversion and optimal prevention. Econ Theory 71, 1259–1281 (2021). https://doi.org/10.1007/s00199-020-01282-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-020-01282-0