Abstract

Mineral supply is controlled by a feedback mechanism. When there is a shortage of a commodity in a market economy, prices will rise, triggering this mechanism. The expectation of high financial returns will encourage inventiveness and creativity in the quest for new solutions. On the supply side, for primary resources, the appropriate response is to cut losses in the mining process, to lower the cut-off grade, to improve recoveries in the beneficiation and smelting processes, to expand existing production facilities, and to discover and bring into production new deposits. For secondary resources, the key to increasing the supply lies in improving recycling rates by better technology, reprocessing lower-grade scrap which becomes economic because of increased prices, and reducing downgrading to optimize the usefulness of secondary materials. On the demand side, implementation of new and more efficient processes, development of substitution technologies, material savings, and the invention of entirely new technologies that fulfill the same function without the need of using the scarce and suddenly more expensive material are effective reactions to a price rise. The effectiveness of this self-regulating mechanism can be shown by examples of historical price peaks of metals, such as Mo, Co, and Ta, and the current rare earth elements peak. Concerning supply from secondary resources, a model is developed in order to determine how far the supply from this resource domain can be achieved and how the recycling rate is influenced by growth rate and lifetime. The feedback control cycle of mineral supply is influenced on the demand side by ever shorter life cycles, by products getting more complex with ever more elements involved in their production, and by an increase in element dispersion. All these factors have an immediate effect on the feasibility of sourcing raw materials from the technosphere. The supply side of primary materials is influenced by increasing lead times for new production and by relatively low flexibility in responding to changing demand.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In the 1980s and 1990s, the opinion prevailing in industry circles and among many economists was that raw materials would always be readily available on world markets, despite concerns regarding limits of supply voiced already in the 1970s. The tide turned at the beginning of the twenty-first century when commodity prices reached levels never seen before, resulting from an increasing demand by heavily populated developing nations. China consumed 8 % of the worldwide steel in 1990, but today consumes nearly 45 % and is now the leading consumer of every major commodity with the exception of crude oil and natural gas. The price increases starting in 2002 made industries, politicians, and governments aware of the vulnerabilities of raw material supply, especially from foreign sources, and resulting supply shortages. “Criticality” studies were commissioned by governments and supranational organizations.

“Criticality” is an estimate of the supply risk for raw materials, a shortage of which may endanger the functioning of a society. The supply risk may be related to the political–economic stability of the producing countries, the level of concentration of production, the potential for substitution, and the recycling rate. Criticality indicators are usually a measure of supply security and the impact of supply restrictions to define a “critical zone” within such a two-dimensional criticality matrix. As the indicators are static, the assessment typically provides a snapshot of the criticality of a certain material at a particular point in time. The best known relevant studies include the National Research Council of the USA (NRC 2008) and the one by the EU Commission defining 14 critical materials, the so-called EU-14 (EC 2010). These are antimony, beryllium, cobalt, fluorspar, gallium, germanium, graphite, indium, magnesium, niobium, platinum group metals (PGM), rare earth elements (REE), tantalum, and tungsten. A comparison of recent studies with those from 30 years ago shows, however, how limited the value of these indicators can be. While in the 1970s most studies listed chromium as the most critical raw material (BGR et al. 1977), it is no longer mentioned in the recent NRC and EU lists.

Criticality defines possible supply disturbances, and in most cases, criticality is not reflected in the price of a commodity. As long as supply and demand are in balance, there will be no price signal unless a “hype” develops, indicating that there might be a shortage. When, however, the flow of supply is disrupted, prices will react. Such a price signal is needed for the functioning of the feedback control cycle of mineral supply, as outlined below.

The aim of this paper is to show the power of the feedback control mechanism to regulate supply and demand in the markets for raw materials.

Fundamental principles of the feedback control cycle of mineral supply

The basis for the applicability of the feedback control cycle of mineral supply is twofold:

-

(a)

A market economy system in which shortages result in price signals, meaning price rises produce incentives to find new solutions, first to alleviate and then to end the shortage.

-

(b)

Human creativity and ingenuity, the most important resources for finding solutions (McKelvey 1973). It is widely acknowledged that scientific curiosity is an important driver to find new solutions for raw material problems. Experience, however, shows—as illustrated below—that the price incentive, as an indicator of an urgent need, is a much stronger motivator for finding a solution to a concrete problem quickly because it promises financial rewards for those who are first to be successful.

To comprehend the mode of operation and the effectiveness of the feedback control cycle of mineral supply, one has to visualize the wide spectrum of opportunities available. In this context, it is important to understand that mankind generally does not need raw materials as such but only an intrinsic property thereof to fulfill a function, which offers a broad field for creative substitutions for the functions of raw materials. There are only three exceptions to this rule: nitrogen, potassium, and phosphorus, all used as fertilizers in agriculture, which the plants need as such and which cannot be substituted, all three elements are as essential for our life as water or air. For potassium and nitrogen, there does not exist a problem because sea water or air, respectively, provides an inexhaustible source for both. This does not apply to phosphorus. Fortunately, the ratio of reserves to annual mine production of phosphorus is about 400, providing ample time for man’s creativity to find a solution for a closed-cycle phosphorus system (USGS 2011; Scholz and Wellmer 2012, submitted for publication).

The normal case, however, is that functions need to be fulfilled irrespective of the kind of raw material used. Thus, taking copper as an example, the electrical conductivity of copper is the main function intrinsic to its material properties. However, other commodities can perform this function just as well, often in conjunction with fundamentally different technologies. Or to further use this example, copper wires in telecommunication had until recently been extensively used for transmitting information via electric pulses but have now been largely replaced by glass fiber cables made of silica which is virtually inexhaustible. Another method of information transfer that no longer depends on copper wire is wireless transmission using directional antennae or satellites. So, there is material substitution in the narrow sense (glass fiber versus copper) and functional substitution (Ziemann and Schebek 2010). Every technical solution has its own raw material profile. In the field of photography, not so long ago, silver was needed for the function of capturing pictures, but today, digital cameras with completely different raw material requirements have largely replaced the use of film. In the printing industry, lead was formerly indispensable as type metal, but it has been replaced by offset or computer printing.

It has been argued that this line of reasoning is purely theoretical for some elements because there are no substitutes, as for example, for some REE at present necessary for permanent magnets, such as dysprosium, to be discussed in more detail below. This, however, is a static reflection that does not take into account dynamic developments which might occur in the future. If there is a shortage and prices rise, the feedback control cycle of mineral supply again becomes effective and yields unforeseen solutions—if not substitution in the narrow sense, then substitution on a functional basis. The cobalt crisis in 1978, triggered by the Shaba conflicts in the Democratic Republic of Congo (formerly Zaire), the main cobalt supply country, can serve as a good example. Cobalt prices spiked due to the disruption caused by political upheaval. In areas of application where cobalt used to be considered strategic because substitutes were thought to be unavailable and cobalt hardly recyclable (BGR et al. 1977), all of a sudden, new materials were invented. For permanent magnets, these were ferrites, which took away a significant market share of cobalt. Whereas before the crisis 30 % of the cobalt supply went into the making of permanent magnets, after the crisis and the invention of ferrites, the share of cobalt for this application fell to only 10 % and stayed there for the coming years, i.e., a percentage of market share was lost forever (Wellmer and Dalheimer 1999). The same is likely to happen with the REE, much sought after in various high-tech industries and at present in critically short supply.

We have further to take into account that raw materials fall into two extreme groups as far as their usefulness is concerned: (1) natural resources which are totally consumed and cannot be recycled and (2) natural resources which can be recycled and used again. The first case of total consumption applies to fossil fuels as energy raw materials. In the process of power and heat generation, entropy is increased and fossil fuels can never be recycled. Although, according to the first law of thermodynamics, energy cannot be lost, the usable portion for human requirements, the so-called exergy, is irrevocably consumed and thus irretrievably lost. The other extreme, usage without consumption, is illustrated by water which can always be recycled if enough energy is available and, in principle, by metals. All resources that are not irrevocably consumed, like energy resources, are only transferred from one sphere to the other, in one form or the other: from the geosphere with its primary resources to the technosphere with its secondary resources. They are used, not consumed. “Atoms do not get lost.”

The upshot of all is that man has at his disposal three resource domains to solve mineral supply problems:

-

(a)

the primary resources of the geosphere,

-

(b)

the secondary resources of the technosphere,

-

(c)

and last but not least, the most important resource, human creativity and ingenuity.

Functioning of the feedback control cycle of mineral supply

Principle

The feedback control cycle of mineral supply (Fig. 1) operates in the following way:

When there is a shortage of a commodity in a market economy, prices will rise, triggering the feedback control cycle. The expectation of high financial returns will encourage inventiveness and creativity to find new solutions.

The feedback control cycle in mineral markets. This box model was developed by the German Federal Geological Survey (BGR) in the 1990s to explain the demand and supply mechanism acting in the raw material markets: How do markets react when the market equilibrium for minerals is disturbed and how will a new equilibrium in raw material markets develop? Modified from Wellmer and Dalheimer (1999)

On the supply side, for primary resources from the geosphere, this burst of innovation will entail:

-

in the mining process, increasing the tonnage of metal produced by lowering the cut-off grade and generally enhancing ore extraction, e.g., by improved mining technology,

-

improved recovery in the beneficiation and smelting processes,

-

enlargement of existing production facilities,

-

discovery of and production from new deposits.

For secondary materials in the technosphere, the same process will result in:

-

improved recycling rates by better technology,

-

reprocessing of lower-grade scrap which becomes economic because of increased prices,

-

reduced downgrading to optimize the use from the technosphere.

On the demand side, the supply-side improvements are supported by the initiation of new and more efficient processes, development of substitution technologies, material savings, and invention of entirely new technologies that fulfill the same functions without the need of using scarce materials, as described above for the cases of copper in the transmission of news, of silver in photography, or of lead for printing.

The consequence: with less demand and more supply, a new price equilibrium is found. The feedback control cycle of mineral supply is to all intents and purposes the same as the hog cycle in agriculture or the cobweb theorem of Ezekiel (1938), shown in Fig. 2. It is translated into the raw materials world by taking into account the various possibilities of the demand and supply side with primary and secondary materials allowed to react to shortages entailing price peaks as well as the much longer lead times and inelasticities existing in the raw materials sector compared to agriculture.

The cobweb theorem of Ezekiel (1938)

In the graph of the cobweb theorem in Fig. 2 supply and demand curves are plotted as functions of price versus quantity. The higher the price of a commodity the larger the supply, but the smaller the demand. The two curves intersect each other at point S1, i.e. demand and supply are in balance. Let us assume the market believes there is a shortage of a commodity. The price rises from P1 to P2. At price P2 the quantity a2 can be produced, e.g. new mines come on stream. However, because of the higher price, demand falls and the price now falls from P2 to P3, only a smaller quantity a3 can be produced economically, etc. This shows that supply and demand counteract each other.

This simple model assumes instantaneous reactions. In the real world of raw material markets, long lead times and high capital requirements for new projects often force mines to continue operating even when demand and prices fall. They try to stay in business as long as at least some of the capital invested can be repaid. On the demand side, improvements for material savings are usually irreversible as shown above for the case of cobalt. Therefore, demand increases only very slowly after a price decrease. The consequence: In the world of raw materials, only the first or, at most, the first two reaction cycles of the cobweb theorem are realized before a new equilibrium is found. This can be shown with the molybdenum and cobalt price peaks of 1978 (Wellmer and Becker-Platen 2002; Wellmer 2009) or the tantalum peak of 1980, as explained below. In the case of the molybdenum peak at the end of the 1970s, the prices fell back below the former level, as predicted by the model (Wagner and Wellmer 2009), whereas in the other cases, the new equilibrium was reached before such a negative price deflection.

Example: tantalum price peak at the end of the 1970s

The tantalum price peak at the end of the 1970s/beginning of the 1980s of the last century will serve as an example to show that solutions leading to a new equilibrium can readily be found both on the supply side and on the demand side (ETH-NSSI 2007).

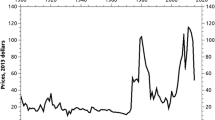

At that time, the world felt a shortage of tantalum, which is necessary for capacitors in electronic circuits. This assumed situation created a very pronounced price peak, as shown in Fig. 3, in comparison to the copper price development as an example for a typical base metal price.

On the supply side, reaction was quick: At that time, about 50 % of tantalum came from primary resources and about 50 % from tin slags from Malaysia and Thailand. During periods of low prices, much of these tin slags were too low grade to be processed for tantalum. They were used for landfill in road construction and building of houses. In the tantalum boom, these slags were discovered as a readily available tantalum resource and often dug up again and reprocessed, a case of unconventional mining by ripping up the ground beneath shopping centers and recreational properties.

On the demand side, one could observe an acceleration in the improvement of the tantalum powder quality. This is shown in Fig. 4: the increase of the specific capacitance went hand in hand with the decrease of the volume of the tantalum anodes (logarithmic scale) needed. Both curves are learning curves. As can be seen in Fig. 4, the slope of the volume curve steepened around 1975, heralding the decline in quantity of tantalum required to achieve a certain capacitance. This curve is a balanced curve of best fit, i.e., the curve is smoothed by not showing the actual data for each year. In fact, around 1978/1979, the learning curves for volume and capacitance showed a flattening. They responded to the price peak by more or less simultaneous steepening. In consequence, with supply increasing and demand dropping, the price level returned relatively quickly to normal levels, as shown in Fig. 4.

It has been argued that the tantalum price peak did not reflect an actual shortage, but was caused by traders’ manipulation, or a “hype.” Everybody got the tantalum needed. Hocquard (2010) has attempted to model such developments with the “hype cycle” of Fenn (1995), especially for the so-called high-tech or electronic materials. The term “hype cycle” was coined in 1995 by the information technology consulting company Gartner (Fenn 1995). It is a graphic representation of the adoption, maturity, and social application of specific technologies. In Fig. 5, the original hype cycle concept and its application to raw materials by Hocquard is shown.

For the functioning of the feedback control cycle of mineral supply, it is irrelevant if there is a “hype” or an actual physical shortage. Relevant for the functioning of the feedback control cycle is only the price signal. If the market believes there is a shortage, real or not, and prices rise as a consequence, the promise of financial reward creates in short order an incentive to find creative solutions that result either in increased supply or diminishing demand, or both.

This effect is also the reason why there are so many false raw material forecasts, and the twentieth century has been called the “mass grave” of forecasting (Sames et al. 2000). If the market believes a shortage will occur, it reacts both on the supply side and on the demand side and belies the forecast by a burst of creative solutions. This is an outflow of the theorem of Thomas and Thomas (1928): If a situation is believed to be real, the consequences are real.

Developments influencing market reaction times

The tantalum example in the previous chapter showed relatively short reaction times both on the supply side and demand side. This is, however, not normally the case, especially on the supply side. One can observe that the reaction times on the demand side and supply side are diverging more and more. This will be examined in the following sections. Generally, the question arises whether the life and innovation cycles on the supply side and the demand side are synchronous or not. Whenever economic stress situations become obvious, usually manifested by price peaks, i.e., when the feedback control cycle of mineral supply is triggered, good opportunities are created for studying the influence of life and innovation cycles.

Trends on the demand side

It can be observed that the cycles of market penetration are becoming shorter and shorter and the products themselves more and more complex, requiring an increasing number of raw materials. This is a process which influences not only the demand side but also the supply side for secondary materials from the technosphere.

Berner (2000), for instance, took the US market as a representative example to show that telephone and radio equipment introduced into the market at the beginning of the 1920s of the last century took 90 and 40 years, respectively, to reach 100 million customers. At the end of the 1990s, the electronic children’s game Tamagotchi reached 60 million customers within15 months (Fig. 6). Recently, it was reported that the company Apple sold 35 million of its mobile telephone iPhone within 3 months in China (FAZ 2012).

Market penetration times on the US market (Berner 2000)

A car can serve as a good “indicator” of technological progress. In the past, a car consisted mainly of only a few metals, besides rubber and synthetics, such as iron and steel, copper for cables, tin for soldering, and lead for batteries. Today, it is a high-tech product with many electronic components, a “computer on wheels.” It may contain more than 150 microprocessors with more than 6,000 semiconducting elements. In a frequently quoted study of the US National Research Council (NRC 2008), the example is given, based on information from the company Intel, that in the 1980s of the last century, a chip needed 12 elements; in the 1990s, 16 elements; today, it may be more than 60. In addition, there are other elements like REE for permanent magnets in the main drive or in auxiliary motors or alloy elements in the steel itself. Often only minute amounts of an element are needed to produce a high-tech product. For example, an average car contains 0.07 g of beryllium in an electrically conductive copper–beryllium alloy for spring terminal contacts used in connectors for critical electric and electronic systems (BEST 2012).

The dynamics of the application of elements for which earlier there was hardly any or no use at all can best be illustrated with the case of scandium. Forty or 50 years ago, the publication of the US Bureau of Mines “Mineral Facts and Problems” reported: “No commercial uses have been developed for scandium or its compounds” (USBM 1960). In contrast, the successor publication “Mineral Commodity Summaries” of the US Geological Survey (USGS 2011) lists a wide range of uses: in aluminum alloys for sporting equipment, metallurgical research, high-intensity metal halide lamps, analytical standards, electronics, well tracers, and lasers. In a study commissioned by the German Federal Ministry of Economics and Technology about the future outlook for high-technology raw materials (Fraunhofer ISI and IZT 2009), scandium occupies the fifth most critical position for technologies relevant for the future, especially for solid oxide fuel cells (SOFC) and as an aluminum alloying agent; in an update by the BGR, it has even become the third most critical element (Elsner et al. 2010) (see Table 1).

Fraunhofer ISI and IZT (2009) estimated the future raw material needs of about 100 emerging high-tech technologies. Out of these, 32 were selected as relevant for future raw material demand. An indicator was introduced by comparing the raw material demand of emerging technologies with today’s total world production of each raw material. This indicator states what share of today’s world production of a specific commodity will be required for emerging technologies in 2030. It is at the same time an indicator for the expansion needs of the mining industry (Table 1). For gallium, for example, the indicator shows that, in 2006, only 18 % of the 2006 production was used in emerging technologies; in the year 2030, it is forecast that nearly 400 % of the 2006 production would be needed. The Fraunhofer ISI/IZT study lists 19 elements. Only seven are given in Table 1, namely, those elements for which the factor for 2030 is larger than one.

Hagelüken (2012) clearly illustrates with the graph shown in Fig. 7 the rapid growth in recent years in the use of these high-technology elements which he defines as the precious metals gold and silver, the PGM, and the special metals, such as indium, gallium, germanium, REE, antimony, selenium, silicon, tellurium, i.e., elements of specific importance for clean technologies and high-technology equipment. At least 80 % of the cumulative mine production of the PGM and of gallium, indium, REE, and silicon, for example, has occurred over the last 30 years only. Most of them also belong to the top group of critical metals of the Fraunhofer ISI/IZT study shown in Table 1.

Share of mine production since 1980 compared to total mine production since 1900 for a selected group of high-tech metals (Hagelüken 2012)

Besides the relentless proliferation of chemical elements that are used in the manufacture of high-tech products, a second important aspect of technological advance is the increasing degree of dispersion. For instance, tantalum capacitors were formerly discrete units which could easily be recycled; today, they are part of an integrated circuit (IC) which is far more difficult to recycle. For beryllium, an example was given above. A few other examples:

-

Tungsten interconnectors in microchips where ultrahigh-purity tungsten plugs in stacked wafers in 3D IC are so highly dispersed in the final product that recycling is practically impossible (Garrou 2008). The same applies in the case of tungsten for catalytic converters for the chemical industry as DeNOx catalysts or in drill bits for oil, gas, and ore exploration and production (Gille 2012).

-

High dispersion is also typical of REE in optical applications, several materials owing their special properties to simple doping with rare earths at very low concentration, for example, 35 ppm of erbium oxide (Er2O3) in silica optical fibers (Eliseeva and Bünzli 2011). For magnets, a few percent of dysprosium make neodymium–iron–boron permanent magnets heat-resistant (Watanabe 2012).

To summarize: Important trends in the demand for raw materials that are relevant for the feedback control cycle of mineral supply are mainly threefold:

-

cycles get shorter and shorter,

-

products get more complex, with ever more elements involved,

-

the degree of dispersion increases.

Trends on the supply side

First, we will concentrate on the technosphere for two reasons:

-

we have just examined the demand side and concluded that developments there influence directly the raw material composition in the technosphere;

-

most of the industrialized nations are not so much producing countries as consuming ones, and for these countries, the technosphere plays an ever increasing role as supplier, as will be outlined below.

Trends in the field of secondary materials of the technosphere

In former years, the valuable metals in scrap materials were concentrated to a high degree, a situation that has since changed drastically. This is shown with the example of copper scrap in Table 2.

Pure metal scrap is the ideal and, therefore, highly desirable raw material for producing new metal by recycling because the process is the least energy intensive (Table 3). It is, therefore, not surprising that some countries are tempted to apply unfair trading practices in an attempt to divert good metal scrap from the world markets to their internal markets by offering very favorable treatment charges (Kirchner 2007). As a consequence, nowadays, more and more low-grade material with a complex composition has to be recycled in industrialized countries. The recycling industry claims that the scrap composition, especially from electrical and electronic sources (so-called WEEE), changes so quickly—as the consequence of ever shorter life cycles that we discussed earlier—that technological development for optimal recycling with maximum recovery of minor elements can hardly keep pace (Kawohl 2011).

Electronic scrap is highly valuable and has much higher grade than primary deposits (Table 4), if enough of the used consumer goods can be collected.

However, there are two problems:

-

(a)

The specific unit metal value in a single device is very low. For a single mobile phone, for example, it is about 1€/phone. It contains about 250 mg Ag, 24 mg Au, 9 mg Pd, and 9 g Cu (Hagelüken 2011). No wonder there is hardly any economic incentive for the individual user of the mobile phone to bring it to a recycling place. The political challenge is to build up efficient national recycling systems. In France, for example, mobile phones are collected also in laundry shops.

-

(b)

The consequence of technological advance is that humans are creating “ore deposits” in the technosphere that are far more complex than nature-created deposits in the geosphere as they combine elements which do not normally occur together in nature. Typical examples are lithium, tantalum, or REE that occur in nature in pegmatites. Lithium, common in brines, can be found in devices in combination with other high-technology metals such as indium, germanium, or gallium that occur in nature jointly in lithium-free base metal deposits but never in brines. Lithium-ion batteries contain cobalt. In nature, cobalt is never associated with lithium deposits but with nickel deposits. Thin-film solar panels contain the component CIGS/CIS (copper–indium/gallium selenide = Cu(In,Ga)Se2) on a thin film of molybdenum. In nature, molybdenum occurs together with copper in porphyry copper deposits. After mining, it is metallurgically separated from copper during beneficiation and goes mainly into steel making. Indium occurs with zinc in volcanogenic massive sulfide deposits, whereas gallium occurs in bauxite deposits, in lateritic weathering products, the raw material for the production of aluminum. Thus, trying to reuse the products of our modern world by “urban mining” is technologically far more challenging than mining the geosphere.

The standard technologies for metallurgical treatment of metal associations from the geosphere, which, however, are also relevant for reprocessing of materials from the technosphere, have been summarized by Verhoef et al. (2004) and Reuter et al. (2005). These authors introduced the “metal wheel” (Fig. 8) for the main metallurgical processes for iron, manganese, chromium, aluminum, magnesium, titanium, tin, nickel, copper, lead, and zinc. The concentric rings show the interconnectivity between the main metals as carrier metals and the coproduct and by-product metals: the inner ring shows the carrier metals, which are the bulk metals in present-day use, and the three outer rings show the impurities and minor metals present in the ores of the bulk metals with which they are associated. The two middle rings show those elements which are or can be recovered to maximize economic benefit and minimize environmental impact. The outermost ring contains the elements lost to process residues and emissions. As Fig. 8 shows, in the outer ring III, for example, the pegmatite metals lithium and tantalum are lost in residues in standard processes. The high-tech metals, discussed above, like gallium, germanium, indium, tellurium, or the PGM are placed predominantly in the outer ring II as co-elements with limited production infrastructure only. This presents a challenge for future metallurgical research to improve the recoveries of these minor metals, a problem addressed exemplarily in a new German research program “Economic-strategic raw materials for the high-tech position of Germany” (BMBF 2012).

The metal wheel. Ring I co-elements with considerable own production infrastructure. Valuable to high economic value; some used in high-tech applications. Ring II co-elements that have no, or limited, own production infrastructure. Mostly highly valuable high-tech metals, e.g., essential in electronics. Ring III co-elements that end up in residues or as emissions. Costly to recover because of waste management or end-of-pipe measures (Verhoef et al. 2004; Reuter et al. 2005; with permission of A.M. Reuter)

Present recycling quotas are shown in Fig. 9 (UNEP 2011). Whereas high recycling rates have already been achieved for the main metals like aluminum, copper, or lead, the status is deplorable for many high-tech metals with low recycling rates, such as indium, germanium, gallium, tellurium, or REE.

Global end-of-life functional recycling rates for 60 metals (UNEP 2011). Functional recycling is recycling in which the physical and chemical properties that made the materials desirable in the first place are retained for subsequent use. Unfilled boxes indicate that no data or estimates are available. These estimates do not consider metal emissions from coal power plants. Recycling rate for metals is defined as the share of the total use of this metal over 1 year which is sourced from secondary material (with permission of UNEP)

We have previously explained that nonenergy mineral resources are only transferred from the geosphere to the technosphere; they are used but not consumed. Since the stock of special metals is continuously increasing in the technosphere and the recovery rates will increase with ongoing research and development, we have to examine the question how high are the chances that the technosphere can become the primary source of raw materials.

Taking aluminum as an example, it can be shown that the recycling rates (share of the total use in 1 year which is sourced from secondary material) are improving. Figure 10 shows the relative increase of secondary against the relative decrease of primary aluminum, although in absolute amounts, the primary share still increases due to the growth in consumption. According to the International Aluminium Institute, the global recycling rate was 17 % in 1960, 30 % in 2009, and is forecast to reach 37 % for 2020 (IAI 2011).

Relative recycling rates of aluminum against total use (Gerber 2007)

In some quarters of society, expectations are high that a new age of living entirely off the technosphere is just around the corner (e.g., Rat für Nachhaltige Entwicklung 2011). This vision overlooks two important factors: the lifetime of metals in the economy before they become available for recycling and the growth rate of commodity use. This is displayed in Fig. 11 which will best be explained with the concrete example of copper use in Germany:

The used scrap—not fabrication scrap such as metal shavings produced in machine shops, that has not completed a life cycle and goes back directly into the process chain—has gone through a life cycle. The life cycle for copper products normally lasts between 30 and 50 years. Let us assume a life cycle of 40 years. Today, copper use in Germany is 1.4 million tonnes, double of what it used to be 40 years ago at almost 700,000 tonnes. If we assume an optimistic collection rate of 80 % and also optimistically assume nothing is lost in chemicals etc. there would be only 560,000 tonnes available as scrap today, i.e. the technosphere could only cover 40 % of demand even under optimistic assumptions!

Idealized growth curve of commodities illustrating constraints of availability for recycling. Case 1 growing consumption causes a deficit of available secondary material at a later date. Case 2 constant consumption means that, at a later date, there is theoretically the same amount of secondary material available as at the beginning of the lifetime of the products (Steinbach and Wellmer 2010)

The consequence is that, as long as we have growing consumption rates, we will always be short of secondary material and will need primary mining. But one can envisage a different future (Steinbach and Wellmer 2010). Consumption patterns for all raw materials follow a learning curve, as shown in Fig. 11: a slow start, a period of high growth, and then a leveling off. One can envisage a future in which about 80 % of the world would have caught up with the level of development of the industrialized nations that prevailed at the turn of the millennia. It is conceivable that, in such a future, the world economy may reach a stage at which total demand and secondary material supply from historical consumption are in balance as a result of leveling off of growth rates in consumption. This is case 2 in Fig. 11.

Here, the lead market can be a model (Wellmer and Wagner 2006). Most lead is used for lead-acid batteries in which the lead is not diluted or dispersed but concentrated as elemental lead in the electrode plates and is easily recyclable. By far, the biggest source of lead scrap is the battery market. In industrialized countries, the lead market is more or less stagnant and fluctuates with demand from the car industry. The lifetime of lead batteries normally lies between 5 and 7 years. The recycling rates in industrialized countries approach 100 %. A recent study for the USA, for example, showed a recycling rate of 99.2 % for the period 1999 to 2003 and 96 % for the period 2004 to 2008 (Savage 2009). So we have a model for the flat part of the idealized growth curve in Fig. 11: No growth, short life cycle. Table 5 compares the total German consumption of lead in batteries with the amount of lead available from recycling. It becomes obvious that, during the period from 1998 to 2003, for which satisfactory statistics for recycling figures are available, practically the total demand for lead in batteries could be supplied by recycled lead. Over the 7 years from 1998 to 2003, the balance between demand for lead in batteries and supply from recycled lead practically evened out. Note, however, that this situation applies only to the very small part of the present-day world with a saturated car market.

Another caveat against the assumption of elevated rates of raw materials obtainable from the technosphere in the near future becomes evident if the energy spectrum of recycling is taken into account (Steinbach and Wellmer 2010). As demonstrated above, countries like Germany have to use more and more lower-grade scrap. There is, however, a limit on what reasonably can be reprocessed if we do not want to spend excessive amounts of energy. Energy requirements for recycling increase as the grade of scrap drops and rise exponentially to prohibitive levels for highly dispersed metals in chemicals or for the recycling of complex equipment such as electronic components which requires excessive energy for disaggregating. As outlined above, the degree of dispersion increases in our advanced economy. Since even in our optimistic future scenario energy is not going to be a free lunch, one will always try to minimize costs, especially energy costs, by mixing primary materials from the geosphere with secondary materials from the technosphere. Steinbach and Wellmer (2010) conducted a thought experiment by mixing increments of primary and secondary material, the results of which are displayed in Fig. 12:

As stated above the energy requirement for producing metal from primary sources is always higher than for using pure scrap. For example, the energy consumption for producing copper metal from 0.8 % Cu ore is reported as 95 MJ/kg, but from pure scrap as 15 MJ/kg only (Norgate 2010; MacLean et al. 2010). However, because of the exponential rise of the energy consumption curve for secondary material there is an intersection (point A in Fig. 12) and consequently an optimum can be achieved by mixing. In the theoretical case of Fig. 12, the optimum mix is about 35 % primary and 65 % secondary material. As a matter of fact this comes close to the situation in Germany where the recycling rate for copper and lead is between 50 and 60 %. A very detailed study about the recycling rate of aluminium in light-weight packaging material, a very simple product, showed that the optimum recycling rate was 90 %, not 100 % (Rombach 2006).

The energy requirements for producing metals either from primary or secondary raw materials. Primary and secondary materials are classed in numerous small increments, each increment requiring a different amount of energy to produce the final metal product. The increments are then ranked according to their energy requirements, the increments with the lowest requirements to the left

Trends in the field of primary materials of the geosphere

Reaction times are not so crucial for the major metals where a relatively continuous stream of new project developments prevails, but they are critical for many high-tech metals. Here, due to technology changes, sudden demand peaks may occur. As stated above and displayed in the “metal wheel” (Fig. 8), many of the high-tech metals are by-products and/or coupled products. This is particularly true for Re, Ga, In, Ru, Pd, Rh, Ir, and REE. Rhenium is even a by-product of a by-product, i.e., a by-product of molybdenum which predominantly is a by-product of copper production.

By-products are elements that can be produced from ores, concentrates, or slags of principal elements according to market circumstances (like indium or germanium from zinc concentrates, or gallium from bauxite, the raw material for aluminium).

Coupled elements are those elements which have to be produced at the same time as, and together with the wanted principal element, at least to the stage of intermediate products, regardless of market circumstances. These elements occur together because they are chemically very similar and cannot readily be separated. The rare earth group of elements (REE) or the platinum group metals (PGM) typically belong to this category.

Being a by-product or a coupled product results in certain inelasticities in the response to market requirements. If there is a shortage of indium, as an example, a producer of zinc (the relevant bulk carrier element) will not increase zinc production in response. The mines are not always explicitly paid for the by-products contained in the concentrates they produce so they have little incentive to maximize production, even where differential mining methods would allow them to do so (Crowson 2012). But even here, for by-products in a market economy system, the feedback control system of raw materials supply functions, maybe with a certain time delay. Reactions are possible if there are price incentives. On the supply side, the mix of the concentrates treated in a smelter could be changed to maximize the grade of the by-product element or a new circuit could be installed to recover the wanted by-product hitherto not recovered. Bailley (2012) estimates that <10 % of the gallium resources available in solution from bauxite processing in alumina plants is recovered and 30 % of indium-containing base metal concentrates still do not reach “indium-capable” smelters and this indium continues to be lost; the recovery rate of indium in “indium-capable” smelters is well below 50 %. Reuter et al. (2005) describe how dynamic processes of base metal smelting and refining work and how learning and adaptation processes flexibly respond to market forces. The lead time to react, therefore, could actually be shorter for by-products because the raw material source—even if low grade—is at hand and must neither be brought into production from scratch nor be newly discovered such as for major metals. The same applies in principle to the by-product elements in “deposits” of the technosphere: there is the possibility to reprocess scrap mixed with higher diluted material. Since these high-technology elements are consumed in very specialized niche markets, the entrance barriers for new production are very high and normally require a strong alliance between producer and consumer right from the beginning of planning a new production facility (Wellmer et al. 2008).

For the “coupled elements,” balance problems are typical. Each element is produced in different quantities determined by the characteristics of the ore deposits and seldom in agreement with the quantities required by the market. In consequence, there is one element or a group of elements which are the “drivers” for the production level of one particular family. For PGM, it is normally platinum. For REE, it is the group of heavy REE, especially dysprosium which is nowadays necessary for making highly efficient neodymium–iron–boron permanent magnets heat-resistant (Watanabe 2012). At present, it is mainly dysprosium which is seen to be in undersupply (Kingsnorth 2012), whereas the light REE are in oversupply. The present REE market is the victim of complacency that became prevalent in western industrialized countries in times of plentiful availability. The customers in these countries unfortunately forgot the iron rule for safeguarding future mineral supplies: diversification. Because China offered REE cheaper than any competitor, today it has practically a monopoly for REE production even though the resources are widespread over the globe. By cutting back export quotas and creating shortages, China is driving prices up by orders of magnitude, in the case of dysprosium by a factor of over 100, compared to 2003 (Liedtke and Elsner 2009; Elsner 2011).

Since every REE deposit has a different REE spectrum and because the mix of REE elements needed by industry is in a constant flux due to changing technological developments, there is not only the entrance problem mentioned above for future production but also the risk that the element spectrum of a new mine may not correspond to market requirements when such a mine finally is coming on stream.

REE and other high-tech metals as by-products are typically niche commodities. Only smaller companies are active here, not the major companies with their financial power. The latter ones prefer to invest in so-called tier 1 projects: large, long-lived deposits with prospectively low production costs, typically such as iron, copper, gold, or coal deposits.

Concerning new supply from primary deposits, the question of lead times for new production arises. An increase in production in existing mining operations can normally be achieved relatively fast. But for new production plants, the time from discovery to production can be very long and vary widely, the main reason being long-term price fluctuations (Table 6).

Raw material price fluctuations can be significant (Fig. 13). The price risk normally is the greatest risk for a new mining investment. Therefore, the general price level and the fluctuations have a significant influence on the willingness of mining companies to take on the investment risk for a new mine. This means, prices have a large influence on lead times.

Index of nonfuel mineral prices in real terms (1992 = 100) (source Crowson 2012). Calculations based on prices of a wide range of metals and nonfuel minerals weighted by global output in the early 1990s and deflated by the US implicit GDP price deflator (with permission of the author)

The International Strategic Mineral Inventory group (Geological Surveys and Natural Resources Agencies of Australia, Canada, Germany, South Africa, United States of America and the United Kingdom) conducted a lead time study in the 1990s of the last century for the so-called lead time III (Wellmer 1992). Lead time III was defined as the time from the point in time when a project had been taken up the last time—either after a discovery if there were no interruptions or after a shelving stage—to bring it into production. Average lead times III are commodity-dependent and vary from 3 years for gold to 7 years for porphyry copper (Fig. 14). They, however, showed no increase over the observed time span of about 30 years. It has to be questioned if this conclusion is still valid today. Taking as an example a sector in which raw material price fluctuations are totally irrelevant, namely, housing planning, a Dutch study showed that, between 1970 and 2008, the planning and permitting time had tripled in the Netherlands (Opinar 2008). Considering the growing public opposition to any natural resources exploitation activities around the world, a similar extension of planning and permitting time in the field of natural resources is likely to be expected.

Conclusion and outlook

On the demand side, we see:

-

product cycles getting shorter and shorter,

-

many products becoming more complex with ever more elements involved in their manufacture,

-

increase in the degree of dispersion.

On the supply side, we can recognize:

-

longer lead times,

-

relatively low flexibility.

What kind of solutions can we expect to emerge in the future for balancing demand and supply in a shortage/stress situation despite the constraints we dealt with above? We can rely on the feedback control cycle of mineral supply to continue to work, meaning that, for as long as a solution on the supply and/or demand side is not found, a price alert is signaled. The time required for finding the necessary solutions might, however, increase in the future. As a result, periods of high prices are likely to last longer. This applies at the moment to the situation of heavy REE. On the supply side, there are about 300 REE exploration projects in different stages (Kingsnorth 2012) which are reported about in technical journals, all pursued by small- and medium-sized companies, often venture capital companies, so-called junior companies without own cash flow. Purely from a statistical point of view, only a few will ever reach the production stage.

The odds of success for such a project is only between 1 in10 and 1 in100, not counting the high entrance barrier into the market for such niche projects (Wellmer et al. 2008) and the problem of a project coming into the market at the right time to benefit from high prices which is essential, especially in the start-up phase. Sames and Wellmer (1981) studied a wide range of exploration projects and derived the statistical chances of success for exploration projects given in Table 7. All REE projects reported show at least some mineralization, i.e., a “showing”, meaning a drill target has been identified. This translates into a chance of success of 1 in100 to 1in 80. In some of the projects where tonnage can already be calculated, the chance has improved to 1 in 3.

The large number of projects pursued in various stages of exploration offers a chance for the future. Most of the about 300 projects pursued at present will have to be abandoned and shelved because prices will come down, the normal consequence of the feedback control cycle of mineral supply as outlined above. The sum total of the shelved projects constitutes a ready reservoir for the future. Given rapid technological change and since each deposit has its specific REE pattern, a deposit with the “right” spectrum of elements can then always be taken off the shelf and brought into production quickly in response to changing market conditions, as Fig. 14 for lead time III shows.

The feedback control cycle of mineral supply works not only on the supply side but also on the demand side. Sometimes quick solutions are found which at times of low prices were ignored. Lützeler (2012), for example, reports about dysprosium savings of one third by merely placing auxiliary motors in a different place in the engine room of a car, thereby reducing the temperature and consequently the necessary amount of dysprosium; or Rollat (2012) about europium savings by a special design of phosphors for lightning purposes. The VDI, the German Engineers Association, recently illustrated various avenues to reduce the amount of dysprosium required in wind turbines (VDI 2012).

Consequently, we firmly believe that, due to the effectiveness of the feedback control cycle of mineral supply, the REE “hype” will sooner or later also come to an end. Maybe due to excess production as a consequence of reduced demand, perhaps prices in the end will even be lower than before the tremendous price rises started.

References

Bailley L (2012) Where are the high-tech and green metals to be found? Paper LE STUDIUM Conference Life and Innovation Cycles in the Field of Raw Materials Supply and Demand—a Transdisciplinary Approach, 19–20 April 2012, Orléans, France

Berner G (2000) Grenzenlose Mobilität. Siemens Standpunkte 1(2000):16–21

BEST (Beryllium Science and Technology Association) (2012) Beryllium. Presentation BRGM, 15 May 2012, Orléans, France

BGR, DIW, IETE (1977) Ausfallrisiko bei 31 Rohstoffen. Bundesanstalt für Geowissenschaften und Rohstoffe, Deutsches Institut für Wirtschaftsforschung, Institut zur Erforschung technologischer Entwicklungslinien, Berlin, Hamburg, Hannover

BMBF (Bundesministerium für Bildung und Forschung) (2012) Nationales F & E-Programm für neue Rohstofftechnologien “Wirtschaftsstrategische Rohstoffe für den Hightech-Standort Deutschland”, Bonn, p 56

BRGM (2011) Un enjeu vital pour l'économie européenne. Géorama 23, November 2010

Crowson P (2012) Solving the minerals equation? Demand, prices and supply. Paper LE STUDIUM conference Life and Innovation Cycles in the Field of Raw Materials Supply and Demand—a Transdisciplinary Approach, 19–20 April2012, Orléans, France

EAA (European Aluminium Association) (2008) Environmental profile report for the European Aluminium Industry—life cycle inventory data for aluminium production and transformation processes in Europe. April 2008, Brussels

EC (European Commission) (2010) Critical raw materials for the EU. Report of the ad-hoc Working Group in defining critical raw materials, Brussels, Belgium. Available at http://ec.europa.eu/enterprise/policies/raw-materials/files/docs/report-b_en.pdf. Accessed 8 May 2012

Eliseeva SV, Bünzli JCG (2011) Rare earths: jewels for functional materials of the future. New J Chem 35:1165–1176

Elsner H (2011) Kritische Versorgungslage mit schweren Seltenen Erden—Entwicklung “Grüner Technologien” gefährdet? Commodity Top News 36. Federal Institute of Geosciences and Natural Resources (BGR), Hannover, p 8

Elsner H, Melcher F, Schwarz-Schampera U, Buchholz P (2010) Elektronikmetalle—zukünftigee steigender Bedarf bei unzureichender Versorgungslage? Commodity Top News 33. Federal Institute of Geosciences and Natural Resources (BGR), Hannover, p 13

ETH-NSSI (Natural and Social Science Interface) (2007) Workshop Scarce Raw Materials, 31 August 2007, Davos, Switzerland

Ezekiel M (1938) The cobweb theorem. Q J Econ 52(1):255–280

FAZ (Frankfurter Allgemeine Zeitung) (2012) Apple kontert Zweifel mit Glanzzahlen, 26 April 2012, p 15

Fenn J (1995) Word spy: hype cycle. Available at http://www.wordspy.com/words/hypecycle.asp

Fraunhofer ISI (Fraunhofer Institut für System- und Innovationsforschung), IZT gGmbH (Institut für Zukunftsstudien und Technologiebewertung) (2009) Rohstoff für Zukunftstechnologien. Fraunhofer IRB Verlag, Stuttgart, p 383 (Summary in English: Raw Materials for Emerging Technologies. Available at http://www.bmwi.de/BMWi/Redaktion/PDF/P-R/raw-materials-for-emerging-technologies.property=pdf,bereich=bmwi,sprache=de,rwb=true.pdf)

Garrou P (2008) How might 3-D ICs come together? Semicond Int 10:1

Gerber J (2007) Strategy towards the red list from a business perspective. In: Proceedings of the ETH Workshop on Scarce Raw Materials, Davos, Switzerland, 1–2 September 2007

Gille G (2012) Personal communication, Goslar/Germany, 3 April 2012

Hagelüken C (2011) Die Bedeutung des Recyclings für die Verfügbarkeit von strategischen Metallen. Paper WING-Conference, Session 3—Strategic Raw Materials, Substitution, Chemistry, 5 October 2011, Berlin

Hagelüken C (2012) Secondary raw material sources for precious and special metals. In: Sinding-Larsen R, Wellmer F-W (eds) Non-renewable resource issue: geoscientific and societal challenges. Springer, Berlin

Hocquard C (2010) Rare earths (REE). Ifri Energy Breakfast Roundtable, 20 May 2010, Brussels

IAI (International Aluminium Institute) (2011) Personal communication with BGR, Paris

Kawohl C (2011) Recycling komplexer Metallzusammensetzungen. Paper at acatech-workshop “Rohstoffe-Werkstoffe-Neue Technologien”, 26 October 2011, Berlin

Kingsnorth D (2012) Secure rare earth supply: reality or imagination. Paper 4. Freiberger Innovations-Symposium “Risk-Provisioning for Strategic Raw Materials” 19–20 April 2012, Freiberg, Germany

Kirchner G (2007) Nonferrous metals recycling in Europe—present status and future developments. World Met 6:327–331

Liedtke M, Elsner H (2009) Seltene Erden. Commodity Top News 31. Federal Institute of Geosciences and Natural Resources (BGR), Hannover, p 6

Long KL, Van Gosen BS, Foley NK, Cordier D (2012) The principal rare earth elements deposits of the United States: a summary of domestic deposits and a global perspective. In: Sinding-Larsen R, Wellmer F-W (eds) Non-renewable resource issue: geoscientific and societal challenges. Springer, Berlin

Lützeler R (2012) Dynamics of raw material changes and how it affects the automotive industry. Paper LE STUDIUM conference Life and Innovation Cycles in the Field of Raw Materials Supply and Demand—a Transdisciplinary Approach, 19–20 April 2012, Orléans/France

MacLean HL, Duchin F, Hagelüken C, Halada K, Kesler SE, Moriguchi Y, Mueller D, Norgate TE, Reuter ME, van der Voet E (2010) Stocks, flows, and prospects of mineral resources. In: Graedel T, van der Voet E (eds) Linkages of sustainability. Strüngmann Forum Report, MIT, 4:199–218

McKelvey VE (1973) Mineral resource estimate and public policy. Am Sci 60:32–40

Norgate TE (2010) Deteriorating ore resources—energy and water impacts. In: Graedel T, van der Voet E (eds) Linkages of sustainability, Strüngmann Forum Report, 4th edn. MIT, Cambridge, pp 132–148

NRC (National Research Council of the National Academies) (2008) Minerals, critical minerals, and the U.S. economy. National Academies, Washington, DC, p 245

Opinar (2008) Opinar May 2008, 1. Available at http://www.nvb-bouw.nl

Rat für Nachhaltige Entwicklung (2011) Wie Deutschland zum Rohstoffland wird - Empfehlungen des Rates für Nachhaltige Entwicklung an die Bundesregierung, 2011. Available at http://www.nachhaltigkeitsrat.de/uploads/media/RNE_Rohstoffland_Deutschland_texte_Nr_39_Juni_2011_01.pdf

Reuter MA, Boin UMJ, van Schaik A, Verhoef EV, Heiskanen K, Yang Y, Georgalli G (2005) The metrics of material and metal ecology, harmonizing the resource, technology and environmental cycles. Elsevier, Amsterdam

Rollat A (2012) Recycling of the REE. Paper LE STUDIUM Conf “Rare Earth Elements in our Environment: from Ores towards Recycling through the Continental Cycle” 9–10 May 2012, Orléans, France

Rombach G (2006) Limits of metal recycling. In: von Gleich A, Ayres AU, Gößling-Reisemann S (eds) Sustainable metals management. Springer, Dordrecht, pp 295–312

Sames CW, Wellmer F-W (1981) Exploration I: Nur wer wagt, gewinnt. Risiken, Strategien, Erfolg. Glückauf 117:580–589

Sames CW, Kegel K-E, Johannes D (2000) Millennium—100 Jahre Bergbau im Rückblick. Erzmetall 53(12):759–760

Savage J (2009) North American core collection and aftermarket. In: Proceedings of the Meeting of International Lead and Zinc Study Group, Lisbon, 19 October 2009. Available at http://www.ilzsg.org/generic/pages/list.aspx?table=document&ff_aa_document_type=P&from=1. Accessed on 12 March 2010

Steinbach V, Wellmer F-W (2010) Consumption and use of non-renewable mineral and energy raw materials from an economic geology point of view. Sustainability 2:1408–1430

Thomas WI, Thomas DS (1928) The child in America: behavior problems and programs. A.A. Knopf, New York

UNEP (2011) Recycling rates of metals—a status report. A Report of the Working Group on the Global Metals Flows to the International Resource Panel. In: Graedel TE, Allwood J, Birat JP, Reck BK, Sibley SF, Sonnemann G, Buchert M, Hagelüken C (eds). With permission of UNEP

USBM (US Bureau of Mines) (1960) Mineral facts and problems. USBM Bulletin 585

USGS (US Geological Survey) (2011) Mineral commodity summaries, p 198

VDI (2012) Verfügbarkeit von Rohstoffen diktiert technologische Entwicklungen—VDI-Nachrichten, 27 April 2012, pp 17–18

Verhoef EV, Gerard PJ, Reuter MA (2004) Process knowledge, system dynamics and metal ecology. J Ind Ecol 8:23–43

Wagner M, Wellmer F-W (2009) A hierarchy of natural resources with respect to sustainable development—a basis for a natural resources efficiency indicator. In: Richards JP (ed) Mining, society and a sustainable world. Springer, Heidelberg, pp 91–121

Watanabe Y (2012) Exploration of dysprosium: the most critical element for Japan. Paper EGU General Assembly, 26 April 2012, Vienna, Austria

Wellmer FW (1992) The concept of lead time. Miner Ind Int 1005:39–40

Wellmer F-W (2009) Reserves and resources of the geosphere, terms so often misunderstood. Is the Life Index of Reserves of Natural Resources a guide to the future? Z Deutsche Ges Geowiss 159:575–590

Wellmer F-W, Becker-Platen JD (2002) Sustainable development and the exploitation of mineral and energy resources: a review. Int J Earth Sci (Geol Rundsch) 91:723–745

Wellmer F-W, Dalheimer M (1999) Trends und Perspektiven der Rohstoffversorgung Deutschlands im 21. Jahrhundert. In: Slaby D, Brezinski H (eds) Rohstoffwirtschaft im Prozess der Transformation. Freiberger Forschungshefte 05 (Wirtschaftswissenschaften):11–52

Wellmer FW, Wagner M (2006) Metallic raw materials—constituents of our economy. From the early beginnings to the concept of sustainable development. In: von Gleich A, Ayres AU, Gößling-Reisemann S (eds) Sustainable metals management. Springer, Dordrecht, pp 41–68

Wellmer F-W, Dalheimer M, Wagner M (2008) Economic evaluations in exploration. Springer, Berlin, p 250

Wirtschaftsvereinigung Metalle (WVM). Various annual reports. Available at http://www.wvmetalle.de/welcome.asp?page_id=172&sessionid. Accessed 9 March 2010

World Bureau of Metal Statistics (WBMS) Metall-Statistik/Metal Statistics, 1998th edition and following years, Ware, UK

Ziemann S, Schebek L (2010) Substitution knapper Metalle—ein Ausweg aus der Rohstoffknappheit? Chemie Ingenieur Technik 82:1965–1975

Acknowledgments

This paper was prepared when the senior author occupied the Research Chair “Sustainable Management of Natural Resources” at LE STUDIUM Loire Valley Institute of Advanced Studies, Orléans, France, and is an extended and modified version of an oral presentation at the LE STUDIUM conference “Life and innovation cycles in the field of mineral supply and demand—a transdisciplinary approach” Orléans/France 19 and 20 April 2012. The authors thank B. Bognar, Friedberg, who critically reviewed the manuscript and made numerous helpful suggestions for improvement and an unknown reviewer for his comments.

Author information

Authors and Affiliations

Corresponding author

Additional information

Editorial handling: B. Lehmann

Rights and permissions

About this article

Cite this article

Wellmer, FW., Dalheimer, M. The feedback control cycle as regulator of past and future mineral supply. Miner Deposita 47, 713–729 (2012). https://doi.org/10.1007/s00126-012-0437-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00126-012-0437-0