Abstract

We develop a mineral resource balance model to assess sustainable supply for such as copper, zinc, and lead up to 2150. This constitutes from a demand projection model whose outputs are exogenously given to a supply-side model, which expresses simplified structure of material flow and stock, from ore production by mining, smelting, and refining, new and old scraps, manufacturing final product to satisfy the final demand, stocks for in-use and out-of-use, disposal, and recycling. Our model is distinct in the long term and global level, modeling both supply and demand sides in various mineral resources by applying linear programming to minimize discounted sum of overall system cost of the resources. Results indicate that the demand of copper, zinc, and lead in 2100 increases by some two to five times compared with those in 2010. This is similar level compared with those in existing studies that employed different modeling approaches. Mineral production from ore in copper and lead peaks out around 2040 satisfying the demand by scrap recycling, while zinc ore production shows continuous increase because of difficulties in metal recovery. Development of new ore deposit and promotion of scrap recycling are strongly demanded to meet the final demand projections.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The threat of long-run mineral resource depletion due to limited availability in the Earth’s crust has long been debated. These debates over availability occur not only for highly scarce minerals such as the rare metals of lithium, gallium, and indium that have received much attention recently but also for the base metals, such as copper, that have been widely used throughout history, the production and mining of which have been intense and long standing. The debates also include two opposite paradigms of long-run mineral availability, namely, the fixed stock paradigm versus the opportunity cost paradigm (Tilton and Lagos 2007). Recently, Humphreys (2013) argues that some observations suggest both constraint on mineral availability in the opportunity cost paradigm and ultimate constraint on resource and environment in the fixed stock paradigm. Therefore perspectives on resource exhaustion in the long run are unclear and uncertain. The problems associated with global, long-run sustainable resource supply and demand forecasts must be tackled in a way that comprehensively considers the constraints described above.

This paper analyzes the problems associated with the sustainable supply of mineral resources by developing a long-run mineral resource balance model that quantifies demand and supply including scrap supply. We examine the life cycle of mineral resources, starting from ore mining, followed by metal production, in-use and out-of-use of final products, disposal, and recycling at the global level. Of the base metals that have been consumed by massive amount in mankind history, our long-run model for supply and demand up to 2150 considers iron ore, bauxite (aluminum), copper, zinc, and lead, in addition to (non-metal) cement. Due to importance of non-ferrous sustainable supply and space constraints, we present only the results for copper, zinc, and lead in this article.

Caveating that our model neither shows forecast nor prediction but just scenarios based on economic programming by applying linear programming in economically idealized world, the linear programming consists of three sets of equations: an objective function, balance equations, and constraint equations. The objective function is generally expressed by the sum of the products of (cost) coefficients (c j ) with decision variables (x j ) determined via optimization: \( C=\sum_j{c}_j\times {x}_j \). While linear programming requires perfect foresight—weakness to determine various parameters such as resource endowment with its cost, technologies, and demand—the strength is to clarify shadow prices of resources, key to estimate inclusive wealth (Arrow et al. 2012; Smulders 2012), which is measured over the time horizon (Dupuy et al. 2017) by applying an integrated assessment model including this mineral resource balance model.

Outline of the long-run mineral resource balance model and comparison with existing studies

The long-run mineral balance resource model developed in this study comprises both demand projection and supply-side models. Long-term demand is estimated by considering the population and economic growth projected under the B2 scenario (“IPCC-SRES-B2” hereafter), which is considered moderate among the four scenarios in the Special Report on Emission Scenarios (SRES) of the Intergovernmental Panel on Climate Change (IPCC) (Nakicenovic and Swart 2001). The demand data estimated by the model, which are exogenously given to the supply model, are used to allocate the supply, scrap, and recycling resources for each region and each time interval (i.e., discrete time and region) by linear programming. For optimization, we formulate an objective function that minimizes the discounted sum of the overall supply-side cost for the entire life cycle, from the mining of mineral resources to product manufacturing, use, disposal, and recycling.

Controlling for the geographical distribution of mineral resources requires that input data be arranged that capture regional characteristics. The model divides the world into ten regions, each region consisting of neighboring countries with similar trends: North America, Western Europe, Japan, Oceania, China, other Asian countries, the Middle East and North Africa, Sub-Saharan Africa, Central and South America, and the Former Soviet Union and Eastern Europe. We establish 2150 as the long-term horizon when mineral resource constraints will become apparent and set a projection time period divided into 10-year intervals to calculate long-term trends. Our modeling has unique feature that differentiates from those discussed below.

Gordon et al. (1987) applied linear programming to develop a supply and demand model that focuses on North American copper between 1970 and 2150. Their model treated 21 types of end-use for copper, with demand given relative to the GDP growth rate. They treated resources such as aluminum as a substitute for copper.

van Vuuren et al. (1999) used system dynamic modeling to simulate mineral resource consumption up to 2100. Mineral resources were divided into abundant (iron, aluminum, chromium, and titanium) and scarce (copper, lead, zinc, tin, and nickel) types, and the model assumed two aggregated pseudo-resources named “AbAlloy” and “MedAlloy.” Demand was expressed as a function of intensity of use, while production cost was considered as a function of energy consumption, capital cost, and exploration cost.

Adachi et al. (2001) also developed a global copper supply and demand model for 150 years from 1970 using system dynamics. This model considered 12 primary copper production regions and three major final demands pertaining to a certain level of recycling rate and product lifetime, with geological constraints on resources more intensive than previous models. The result showed that copper demand would be satisfied via enlargement of secondary supply by recycling.

Ayres et al. (2003) created a demand and supply model for flows and stocks that covered copper’s life cycle up to 2100 on a global level. The model is based on a material balancing that divides the world into the four regions created in the IPCC-SRES-B2 in order to conduct simulations focusing on the relationship between the growing demand and the levels of recycling and disposal. The difference between theirs and this study is that their model does not give limitations on unmined resources (how much primary copper can be mined).

Tokimatsu et al. (2004) engaged in global demand estimates for copper to forecast timings of copper shortages and depletion in order to quantitatively evaluate the sustainable supply of copper.

This paper follows the demand projection model developed by Tokimatsu et al. (2004) whose essence is fully described in the “Demand projection model” section of this article. However, it differs in several ways: (1) the projection is revised through a reestimation using new data, (2) telecommunications and power industries are added for copper demand in cables, (3) resources other than copper are included, (4) the supply-side model is originally developed in consideration of the life cycle of the resources, and (5) the model optimizes (minimizes) total cost in order to obtain scenarios for the future demand and supply structure.

This study differs from previous studies in the following various aspects. Our study follows the study by Gordon et al. (1987) in line with computational time horizon (up to 2150), linear programming, and decomposition of final demand in sectoral basis or final use. However, our model differs in the following points. (1) Ours is global level while Gordon’s is North American, (2) ours treats other resources in addition to copper, (3) ours did not apply GDP elasticity (percent demand growth rate divided by 1 % GDP growth rate) in demand projection while Gordon et al. applied sectoral GDP elasticity in sectoral copper demand, and (4) ours decomposed final demand in each sector into factors such as intensity of use, final product demand expressed by GDP and/or population, and the future GDP and population scenarios while Gordon et al. did not apply sectoral decomposition technique similar to us. Our study is similar to the global copper flow analysis through 2100 of Ayres et al. (2003) in its geographical coverage and time horizon (based on the IPCC scenario); however, our study differs by including other base metals such as lead and zinc for cost minimization. Our model’s geographical coverage and time horizon are also similar to those by van Vuuren et al. (1999) and Adachi et al. (2001); in our model, however, (1) the IPCC scenario is applied, (2) non-ferrous metals are included and treated separately as copper, lead, and zinc, and (3) linear programming is applied instead of system dynamic techniques. The above summary holds true that a limited number of later publications are included since, which applied more detailed and complicated analysis, but their basic analytical frameworks are material flow (Glöser et al. 2013), (geological) supply side (Northey et al. 2013; Kerr 2014), and system dynamics (O’Regan and Moles 2006; Murakami et al. 2015).

Demand projection model

Outline of the model

The demand projection model includes four end-use industrial sectors as the major demand sources for the target mineral resources: automotive, civil engineering and construction, electric machinery, and telecommunications and power. We modeled sectoral relationships among intensity of use, final product demand expressed by GDP and/or population, and the exogenously given from the IPCC scenario for future GDP and population. The demand model structures developed in this study are basically those used in our previous study (Tokimatsu et al. 2004).

We use the “decomposition” approach widely employed in mineral resource economics instead of econometrics through the estimation of price elasticity from resource consumption and prices. While econometrics can be applied to a 30-year time horizon in energy economics, our approach separates out the three factors (i.e., intensity of use, final product demand, and socioeconomic scenarios) to identify robust trends based on past long-term trends at the global level. This approach, similar to the Kaya identity (Kawase et al. 2006; Kaya 1990) widely used in energy system analysis (Nakicenovic and Swart 2001), is more suitable for long-run analysis.

Sectoral models

Automotive industry

The formulation is expressed as follows: Resource demand in the automotive industry [Mt/year] = Intensity of resource use [kg/unit] × number of vehicles owned per person [unit/person] × (1/average lifetime [year]) × population [106 persons], caveating that this estimation is based on outflow from the stock and that it has a potential underestimation risk of demand (i.e., inflow) in stock growing economic stage by assuming that the outflow is equivalent to the inflow.

Intensity of resource use

Table 1 presents the data for intensity of resource use in the automotive industry. The consumption of zinc is not expected to be constant and shows a reduction of 100/1200 [kg/unit] every 10 years up to 2050 (i.e., yr = 2010, 2020,…, 2050). This decrease can be translated as a reduction of 100 kg per 1200 kg of steel due to the light weight of vehicle. Since the lead demand originates from lead car batteries, the demand is determined according to the need for battery replacement. The shipment data for copper, zinc, and lead are sourced from the year books and statistics containing various country data compiled by Japanese industrial associations and the Government (JAMA 2005a, b; JCBA, JEWCAA; JMIA; JOGMEC 2005; METI; RIETI; Wilburnk and Buckingham 2006).

Number of vehicles owned per person

According to the International Energy Agency Mobility Model (IEA-MoMo, Fulton et al. 2009), the equation is as follows, where dx t /x t is the annual growth rate of x (per capita GDP), y refers to the number of vehicles owned, and a and b are their coefficient and constant, respectively.

The number of vehicles equipped with a lead battery decreases exogenously provided that we assume that the market shares of plug-in hybrid electric vehicles (PHEVs) and electric vehicles (EVs) increase over the time horizon from 1 to 2% in current day to some 20 and 65%, respectively.

Average lifetime of a vehicle

Separate estimates are made for the average lifetime of a vehicle in Japan and countries other than Japan, using data from the references (Storchmann 2004; JAMA 2005a, b). Both cases are assumed to converge to 13 years in the long run. The relationship between per capita GDP (x) and average lifetime (y) is estimated using the following equations derived from the references (Storchmann 2004; JAMA 2005b).

Length of lead battery lifetime

The frequency of lead battery replacement is also considered. The life of the battery is shorter than that of the vehicle. The length of the battery lifetime is assumed to increase with increasing per capita GDP (x), since better-quality batteries are likely to be used in countries with higher x.

-

x < 5000: 2.0 years

-

5000 ≤ x ≤ 28,000: 2.5 years

-

28,000 < x: 3.0 years

Civil engineering and construction industries

The formulation is expressed as follows: Resource demand in the civil engineering and construction industries [Mt] = Intensity of resource use [kg/m2] × floor area per person [m2/capita] × population [106 persons] × 10−3.

Intensity of resource use

The references (Index 2001; MERI/J in various years; UN 1997; UN 2016; US 1986) are used to source the shipment data for copper and zinc to derive formulations between intensity of resource use (y) and per capita GDP (x). It is assumed that this industry does not use lead (Table 2).

Floor area per person

Data of the floor area of newly built housing (UN 2016) are used to estimate the relationship between per person floor y = 0.4664 ln(x) − 2.9348… (3).

Electric machinery industry

The formulation is expressed as follows: Resource demand for metals in the electric machinery industry [Mt] = Intensity of resource use [kg/‘00 US$] × share of GDP in electric machinery industry × GDP [109, ‘00 US$].

Intensity of resource use

The relationship between per capita GDP (x) and intensity of resource use (y) is formulated in Table 3. The shipment data for copper, zinc, lead, and GDP intensity pertaining to the Japanese electric machinery industry are sourced from the references (JCBA 2016; JEWCAA 2016; JOGMEC 2005; Wilburnk and Buckingham 2006; Committee 2006). The data for nominal GDP, purchasing power parity, and currency exchange rate are used (ESRI 2016) to derive the price levels, which are used to estimate the intensity of resource use.

Share of GDP in the electric machinery industry

The share of GDP in the electric machinery industry (y) is estimated using WDI data (World Bank 2016) and the following equations. The percentage is divided into three stages of economic development by per capita GDP (x), with the upper limit being 8%.

Telecommunications and electric power industries (for copper only)

The relationship between the GDP intensity of copper use (y) and electric power supply per capita (x) in the communications and electric power industries is estimated using the following equation in which also the shipment data are applied:

Other industries (for lead only)

The intensity of resource use of lead (y) in other industries (using the shipment data as well) is estimated using the per capita GDP (x) for each region, as in Table 4. Two stages of economic development (x), namely, increasing period and decreasing period, are assumed for the other regions.

The supply-side model

Basic framework of material flow

We divide the world into ten regions, set the time interval or “time step” as 10 years per period from the year 2010 to 2150 (i.e., 2010, 2020,…, 2150), and minimize the discounted sum of supply cost using dynamic linear programming. The processes comprising the material flow and stock in the supply-side model are shown in Fig. 1. The metals used in the manufacturing process of final products are produced via the smelting and refining process from mined minerals and minerals recovered from old and new scrap. After the end of life of the final products, they are separated into three categories: out-of-use stock, old scrap recycled into the smelting and refining process after collection and segregation, and remaining final disposal. Imports from and exports to other regions in the respective processes are also considered by giving balance equations (9, 12, 15, 20) and related data settings described in “Setting balanced out resources globally for final product manufacturing” and “Data” sections. The constraint conditions are formulated to balance the input and output resources throughout the overall system as well as individual processes. Two types of smelting and refining processes, namely pyrometallurgy and hydrometallurgy, are modeled for copper.

The objective function

The objective function and constraint equations seen below are used to obtain an optimal solution via linear programming. The suffixes rg and yr represent the target region and time step, respectively. The objective function of this model is expressed such that the discounted sum of the total cost of global supply is minimized. The descriptions of the cost coefficients, decision variables (symbols starting with an X), and subscripts are provided in Table 5.

NFC represents the total supply cost of the mineral resources in region rg at time step yr, while DF represents the discount factor using an annual discount rate of 2%. The total supply cost is the total cost for the entire process (the material flow and stock) (Fig. 1), including the mining of mineral ores, smelting and refining, final product manufacturing, recycling, and final disposal.

where

Constraint and balance equations

The major constraint equations used in the model are categorized into five processes within the material flow seen in Fig. 1: mining, metal production (smelting and refining), final product manufacturing, consumption (final demand), and recycling.

Mining process

Constraint on the amount of resources

The cumulative amount of mineral ore production P in region rg does not exceed the total amount of resource in each region, which is the sum of all the steps (see “Resource amounts and their classifications” section in detail) categorized by the amount of resources with respective supply costs (the step is expressed as RES).

Mineral concentrate input balance equation

The inputs of mineral concentrate X in the smelting and refining process in the respective regions are denoted by Eq. (8), where P, PI, and PE are the amounts of ore input, import, and export of mineral concentrate, respectively.

The amounts of exported and imported mineral concentrates must be balanced globally.

The product manufacturing process

Balancing metal production

Equation (10) balances the amounts of metal production, inputs of mineral concentrate, and old and new scrap. The amount of metal produced, R, is expressed by the amounts of mineral concentrate input X, scrap input Y, and new scrap ((1 − a)/a)D, where a and D refer to the yield and final product in the final production process, respectively. Here, the subscript pr represents the type of metal (refined products), while use denotes the final demand in products, and sc refers to the type of scrap, respectively.

Balancing metal inputs

Equation (11) denotes the metal supply input M to the final production process, where, R, RE, and RI refer to the amounts of metal in manufacturing, exports, and imports, respectively. It is assumed that RE and RI are balanced globally (Eq. (12)).

Balancing final products

Equation (13) balances the amounts of final products D and input metal M, where a is the yield.

Consumption and recycling

Balancing final product consumption

Equation (14) is used to balance the production and consumption, including exports and imports, of the final product. Final product consumption FD is calculated using Eq. (14), where D, DI, and DE refer to the amounts of final products manufactured, imported, and exported, respectively.

Balancing product collection

Equation (16) presents the equation for the amount of scrap Z recovered from end-of-life products. The lifetimes of the final products are assumed to differ. The amount of scrap Z is equal to the final demand FD within the time step yr m (which expresses the product’s lifetime as the number of time steps).

Balancing scrap

The amount of scrap produced Z is estimated using Eq. (17), which balances the amounts of scrap supplied through collection and segregation Yout, inbound (Sin) and outbound (Sout) scrap stock, and scrap disposed. The third term on the right-hand side of this equation indicates that scrap stocked as inventory is stored up to a maximum of three time steps (i.e., 30 years). b in the fourth term on the right-hand side of the equation denotes the rate of endogenously obtained scrap collection rate, the upper limit being b up (as described in “Scrap collection” section) and b up ≥ b (Fig. 1).

Balancing stock

Equation (18) is used to balance the amount of inbound stock Sin and outbound stock Sout in the scrap stock.

Balancing recycled scrap

Equation (19) balances the amounts of old scrap supply Yout, scrap input to metal production, scrap exports, and scrap imports, respectively. Input old scrap is represented by Y, while YE and YI denote the imports and exports of old scrap, respectively.

Major model settings

Resource amounts and their classifications

Mineral resource availability is modeled with a ladder shape according to resource categories and their availabilities. The following four classifications (called “steps” in this study) in the field of mining and resource geology are applied to the resources in our study: reserves, reserve base, resources, and subeconomic resource base, respectively. The definitions and data pertaining to reserves, reserve base, and resources are based on Mineral Commodity Summaries 2002 (USGS 2002). However, we give an additional amount of resource in the classification (or called step in this study) of subeconomic resource base with averaged 0.03% of ore grade. This is given by originally developed relations between ore degradation and cumulative tonnage in the ten regions, referred from our previous investigation (Adachi et al. 2001). This relation is identical to Lasky’s law (mineral occurrences by ore grade are fitted to a log-normal distribution, while our ore grade is multiregressed as a function of cumulative tonnage). Cu (3.9 Gton) is given by this relation to our model as the cumulative tonnage or the total amount of resource. This amount is somewhat similar to USGS 2006 (Tilton and Lagos 2007). The corresponding amounts of resource and supply costs are allotted to each step.

The yields from all the processes, from metal production to final product manufacturing, are given by the types of resources used and their demand, and these data are sourced from the references (Graedel et al. 2005; Hashimoto et al. 2008; Mao et al. 2008; Mao and Graedel 2009; Ando et al. 2010) pertaining to material flow and stock analysis based on interviews to experts and industries in Japan and various Japanese statistics. Since we can find no reasonable assumptions regarding yield improvement in the future, we use the current level as the constant level over the time horizon. For simplicity, we assume that there are no losses in the processes of mineral concentration, scrap collection and segregation, and new scrap production.

Setting balanced out resources globally for final product manufacturing

The amounts of resources are balanced out globally within the ten regions, in which the projected demand by the demand model refers to intra-regional, implying the produced amounts of final products minus those of net exports and imports. Based on the trade database (GTAP 2016) and number of vehicles produced and sold in the respective regions, the initial levels are set for the domestic demand ratio (i.e., internal final products needed to meet the demand in each region) as well as the rates of export and import among the regions in our model. We employ this simple arrangement since the objective of this study is not to analyze global trade but to tentatively determine the initial levels of demand and supply of resources.

Average lifetimes of the final products

While the average lifetimes of the final products from the automotive industry are assumed to converge to 13 years, we assign different lifetimes to the final products from other industries. Since no statistical data are available for final product lifetimes for the electric machinery industry, we set the lifetimes as follows from a reference (OECD 1993): 15, 12.5, and 10 years corresponding to per capita GDP [US$/capita] of below 5000; from 5000 to 10,000; and beyond 10,000, respectively. Since the data on final product lifetimes for the civil engineering and construction industries are also unavailable, the ten regions are categorized into two: one with an average final product lifetime of 30 years (i.e., Japan, China, South East Asia including ASEAN member countries, and India) and the other with an average final product lifetime of 60 years (i.e., all the other regions). Furthermore, the average lifetimes of the final products from the telecommunications and electric power sectors are set to 20 years, while that for lead storage batteries is set to 3 years.

Scrap collection

In this study, the scrap collection rate is defined as the percentage of scrap that can be collected from all used products. The scrap collection rate is expected to improve with increasing production costs of primary resources because of the degradation of mineral ore at mining sites. The upper limit for the scrap collection rate for a particular resource in each region (b in Fig. 1) is given by a step function (i.e., the ladder shape). The rate increases to a maximum of 90% from the current level of collection depending on resource category. Data for the current collection rates of the three metals are sourced from the references (Graedel et al. 2004, 2005; Hashimoto et al. 2008; Mao et al. 2008; Mao and Graedel 2009; Tabayashi et al. 2008; Ando et al. 2010).

Data

Costs for mining, beneficiation, smelting, and refining are set by the mine site database (SNL 2016). Since the mining and beneficiation costs are expected to increase with ore degradation, the costs of mining and beneficiation for each step are changed by the resource categories. The smelting and refining costs are set as constant regardless of the categories (assuming that the same mineral concentrates are supplied after the beneficiation process, the exception being mineral ores with extremely low ore grades). Global average costs are applied for the smelting and refining costs in regions with no cost data for the processes. The costs of hydrometallurgy are assumed to be uniform across the ten regions. The ratio of the costs of energy consumption to the total operating costs is sourced from a private research company, and it is assumed to be uniform across the ten regions. Then, the energy cost is calculated by applying the data (SNL 2016) for total operating costs. The future rise in the energy price is reflected from the results of shadow prices (i.e., theoretically idealized price derived from a linear programming) of energy resources using our model for energy systems (Tokimatsu et al. 2016).

Transportation costs are sourced from a report on international transportation costs for copper concentrates (Rosenkranz et al. 1983) and other studies after analyzing the ore grades and resource content in mixed metals. The costs of scrap collection and segregation are sourced from a report on the direct operating costs of vehicle shredders (Doi 2003). The costs of new scrap collection are set by comparing the costs of transportation and scrap collection and segregation. The costs of final disposal are set higher than the costs of transportation but lower than those of scrap collection and segregation in line with a previous study (Porter 2002). The costs of final disposal differ by region. These costs are higher for West Europe and Japan compared to North America and Oceania, and in general, the costs are higher in developed regions compared to developing regions. Based on the above assumptions, for 1 t of copper, the costs of mining in step 1 (i.e., least mining cost category) are set to about US$600 in most regions, while the costs of scrap collection and segregation, metal transportation, and scrap transportation are set to US$100, US$20, and US$50, respectively.

Results

We discuss the results on demand projection, mineral supply breakdowns, and recycling-related indicators by the model.

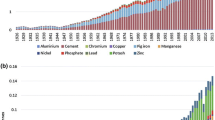

Demand projection

Figure 2 shows the future demand projections for copper, zinc, and lead with their breakdowns. Copper and zinc showed monotonic increases over time with different increase rates of demand, reaching some five times higher in 2100 compared with that in 2010 for copper. This result (increase by fivefold) shows a similar level by Ayres et al. 2003 (about 60–90 Mt/year in 2100) employing a different analytical method (i.e., global copper model).

Major demand in copper and lead is sourced from the electric machinery sector, followed by civil engineering and construction and by automobile. The copper demand in cables (telecommunication and electric power) is somewhat larger than that in automobile. The largest lead demand is sourced from automobile, followed by electric machinery and others. Although lead demand is expected to increase in developing countries, it is gradually decreased because of the toxicity and substitution to other mineral elements or technologies (e.g., lead-free solder, EVs, fuel cell vehicle). These estimated results are provided to obtain optimal solution as exogenous scenarios in the supply model.

Supply

Figure 3 reports results from the supply model, with regard to changes in material inputs (bar graphs) and recycling-related indicators (line graphs). “Ore,” “new scrap” (yielded by the final stage of the product manufacturing process), and “old scrap” (recovered from used products) refer to the ore production, and scrap fed back to metal production, which correspond to “P” (same as “X” in global level), “(1 − a)/a*D = R-Y-X,” and “Y” in Fig. 1, respectively.

Copper: changes in raw material inputs for metal production (ore, P; new scrap, (1 − a)/a*D; old scrap, Y in Fig. 1) and recycling-related indicators (RRUP, Y/Z; URRUP, Y/R)

“The recovery rate of used products (RRUP, corresponds to Y/Z in the figure)” is defined as “amount of used products recovered (i.e., undisposed) divided by amount of used products recovered and disposed of,” while “the use rate of recovered used products (URRUP, Y/R),” which is “amount of used products recovered divided by amount of material consumed” (Hashimoto and Moriguchi 2004), respectively.

Copper

As shown by this supply model, metal production from ore reaches its maximum in 2040 and then declines; however, metal production from old scrap increases rapidly thereafter. The results demonstrate that demand will be satisfied mainly by increased recycling to compensate for decreased ore production. Compared to the increase in demand for copper, the increase in the supply of conventional ore is small. These changes indicate that the sustainable supply of copper is threatened if metal production cannot be switched from ore to old scrap at an earlier stage.

The RRUP for copper increases rapidly from 2040 to reach 90% by 2060; old scrap becomes the dominant input for copper metal production. The URRUP remains at 60% even though the RRUP increases to 90%. These numbers (90% in RRUP, 60% in URRUP) are higher by some 20–30% compared to those by Ayres et al. (2003) who reports some 60–80% in RRUP (called “recycling efficiency” defined in page 70, Ayres et al. 2003) and 40–60% in URRUP (“recycling rate,” ibid), respectively (see Table C10, ibid). The difference can be considered by resource availability; Ayres et al. (2003) gave unlimited amount of unmined resources while we gave some 4 Gton of copper. In simplicity, even unlimited unmined copper resource requires these rates related to recycling reported by Ayres et al. (2003). In other words, the supply of mined ore is an indispensable input to the copper metal production process, since the amount of copper supplied by recycling has a limitation to some extent.

Zinc

The supply model results show that, unlike the production of copper and lead, zinc ore production does not decline and increases relatively monotonically over the time horizon. Zinc used in zinc-coated (galvanized) steel sheets is to some extent dispersed into the natural environment, even though with its high recovery rate from the large utilization of the zinc-coated steel. Zinc used in inorganic chemicals and for other uses is also unrecoverable.

The sustainable supply of zinc is more threatened than that of copper, because zinc production is dependent largely on production from ore due to the difficulty of recycling zinc products though the demand for zinc continues to grow similarly to that for copper.

The RRUP and URRUP for zinc almost remain constant at 40 and 20% at the end of this century, respectively, due to the difficulty of recycling zinc. Those rates are remarkably lower than those for copper and lead. As described earlier, zinc’s uses are less suitable for recycling and therefore generate little old scrap, which leads to little increase in the rates (Fig. 4).

Zinc: changes in raw material inputs for metal production (ore, P; new scrap, (1 − a)/a*D; old scrap, Y in Fig. 1) and recycling-related indicators (RRUP, Y/Z; URRUP, Y/R)

Lead

Lead ore production for lead metal production reaches its maximum in 2040 and then declines thereafter, shown in Fig. 5. In contrast, the supply of old scrap continues to increase, compensating for the decreased ore supply, reaching most of the demand in 2100. The share of old scrap supply increases because demand decrease begins in 2030 and battery scrap recovery is well established in the present day. Specifically, the routes and technology for recovery and recycling of lead are already established, which leads to a decrease in the lead ore production. Moreover, the decreasing demand for lead metal contributes to reducing lead ore production.

Lead: changes in raw material inputs for metal production (ore, P; new scrap, (1 − a)/a*D; old scrap, Y in Fig. 1) and recycling-related indicators (RRUP, Y/Z; URRUP, Y/R)

The sustainable supply of lead is considered to be possible and to be unconstrained by resource availability. The situation of lead differs from that of copper and zinc. However, because lead is a coproduct with zinc in mineral deposits, increased mining of zinc may generate excess supply of lead. The treatment of coproducts in the modeling is a future challenge in the consideration of supply and demand in zinc and lead.

In contrast, the RRUP for lead is currently high; therefore, due to decreased demand for lead metal, the RRUP for lead experiences remains constant over the time horizon. URRUP for lead decreases toward 2030 because demand increase is satisfied by growth of ore production (old scrap remains constant), which leads to an increase in URRUP over the time horizon.

Some concluding remarks

Copper shows rapid demand growth; thus, scrap recycling must be increased to meet the projected demand. The recovery rate for used products (RRUP) needs to be increased from earlier time horizon in order to reach a 60% use rate for recovered used products (URRUP) after 2070. It is a key task for establishment of recycling systems in especially emerging countries with extremely low recycling rates.

Since the uses of recyclable zinc are limited, the contribution of primary (or natural) resources in supply and demand is significant. Most zinc uses are currently unsuitable for recycling; thus, establishing the recyclability of zinc products to increase the RRUP will free up more resources than those suggested in this study.

Decreased lead demand was observed due to the introduction of EVs, which do not use lead batteries. In addition, an out-of-use lead recovery system for the dominant usage, automobile batteries, has already been established. However the recycling of automobile batteries is must still be promoted if the shift toward EVs is slower than anticipated in our model. Given the high recycling rates and the abundant geological reserves, a sustainable supply of lead is to be expected. A reduction of lead pollution may be a greater societal concern.

The possibility of a sustainable supply varies among the metals. However improving recovery rates for used products are essential in all cases, in particular for copper. Copper supply relies heavily on scrap recycling because of rapid demand increases from earlier time of the computational time horizon.

Some challenges left as future works and limitations are finally described. Because of space limitations, we prepared a second separate paper regarding some critical issues in long-term availability of copper, especially cumulative production versus ore degradation and related matters such as resource availability, mineralogical barrier, energy consumption penalty, and shadow prices of copper. Copper demand increase (e.g., Davidsson et al. 2014) because of rapid expansion of renewable energy technologies and EVs—energy and mineral nexus by using our modeling approach—is also addressed in the other paper (Tokimatsu et al. 2017).

Although our modeling has some unique features and original ideas described in “Outline of the long-run mineral resource balance model and comparison with existing studies” section earlier, several years have passed since the model was originally constructed. The data and modeling techniques applied, especially demand projections (in flow base) based on in-use stock changes (e.g., Gerst 2009; Murakami et al. 2015), must be revised based on this modeling exercise.

The linear programming applied in our supply-side model is a well-established technique and used in numerous energy models (see IPCC AR5 Chapter 6, Clarke et al. 2014); however, because of its deterministic nature, it cannot treat neither changes in availability both from unknown to accessibility to known deposits (e.g., Crowson 2011; Gordon et al. 2006; Tilton 2003; Tilton and Lagos 2007), nor in availability of recycling and scraps (e.g., Tilton 1999; Gómez et al. 2007).

It does neither forecast nor predict the future; it is just a scenario in one economically idealized world, compared with the real world, which is influenced by various political and governmental flaws and market distortions. Hence the results derived by the linear programming method differ compared to historical observations (Radetzki 1988, 2009). There is no perfect modeling approach. We believe that our exercise is a supplement, not a substitute to other methodological approaches, offering additional insights for better understanding of the future of mineral resources.

References

Adachi T, Mogi G, Yamatomi J, Murakami S, Nakayama T (2001) Modeling global supply-demand structure for mineral resources—long-term simulation of copper supply. J MMIJ 117(12):931–939 (in Japanese)

Ando S, Murakami S, Yamatomi J (2010) Material flow/stock analysis of lead in Japan. J MMIJ 126(8, 9):482–489 (in Japanese)

Arrow KJ, Dasgupta P, Goulder LH, Mumford KJ, Oleson K (2012) Sustainability and the measurement of wealth. Environ dev Econ 17(3):317–353

Ayres RU, Ayres LW, Rade I (2003) The life cycle of copper, its co-products and byproducts. Kluwer Academic Publishers, Dordrecht

Clarke L, Jiang K, Akimoto K, Babiker M, Blanford G, Fisher-Vanden K, Hourcade J-C, Krey V, Kriegler E, Löschel A, McCollum D, Paltsev S, Rose S, Shukla PR, Tavoni M, van der Zwaan BCC, van Vuuren DP (2014) Assessing transformation pathways. In: Edenhofer O, Pichs-Madruga R, Sokona Y, Farahani E, Kadner S, Seyboth K, Adler A, Baum I, Brunner S, Eickemeier P, Kriemann B, Savolainen J, Schlömer S, von Stechow C, Zwickel T, Minx JC (eds) Climate change 2014: mitigation of climate change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge University Press, Cambridge

Committee for Mineral Resource Economics in the Mining and Materials Processing Institute of Japan and The Institute of Industrial Science, the University of Tokyo (eds.) 2006 World mineral resource data book (ver. 2). Ohmsha, Tokyo, Japan. (in Japanese)

Crowson PCF (2011) Mineral reserves and future minerals availability. Miner Econ 24(1):1–6

Davidsson S, Grandell L, Wachtmeister H, Höök M (2014) Growth curves and sustained commissioning modelling of renewable energy: investigating resource constraints for wind energy. Energy Policy 73(October):767–776

Doi K (2003) Current status of iron scrap recycling and impacts by related recycling acts, material recycling and its challenges—shift from society of mass consumption and disposal. 52nd Shiraishi Kinen Kouza Text 71 (101) (in Japanese)

Dupuy L, Tokimatsu K, Hanley N (2017) Using Genuine Savings for climate policy evaluation with an integrated assessment model. University of St. Andrews, Discussion papers in Environmental Economics, Paper. http://www.st-andrews.ac.uk/gsd/research/envecon/eediscus/ (accessed 16 April 2017)

ESRI (Economic and Social Research Institute) (2016) Cabinet Office, Government of Japan. Statistical National Account. http://www.esri.cao.go.jp/jp/sna/menu.html (accessed 30th March 2016).

Fulton L, Cazzola P, Cuenot F (2009) IEA mobility model (MoMo) and its use in the ETP 2008. Energy Policy 37(10):3758–3768

Gerst MD (2009) Linking material flow analysis and resource policy via future scenarios of in-use stock: an example for copper. Environ Sci Technol 43(16):6320–6325

Glöser S, Soulier M, Tercero Espinoza LA (2013) Dynamic analysis of global copper flows. Global stocks, postconsumer material flows, recycling indicators, and uncertainty evaluation. Environ Sci Technol 47(12):6564–6572

Gómez F, Guzmán JI, Tilton JE (2007) Copper recycling and scrap availability. Resources Policy 32(4):183–190

Gordon RB, Koopmans TC, Nordhaus WD, Skinner BJ (1987) Toward a new iron age? Quantitative modeling of resource exhaustion. Harvard University Press, Cambridge

Gordon RB, Bertram M, Graedel TE (2006) Metal stocks and sustainability. Proc Natl Acad Sci 103(5):1209–1214

Graedel TE, Van Beers D, Bertram M, Fuse K, Gordon RB, Gritsinin A, Kapur A, Klee RJ, Lifset RJ, Memon L, Rechberger H, Spatari S, Vexler D (2004) Multilevel cycle of anthropogenic copper. Environ Sci Technol 38(4):1242–1252

Graedel TE, Van Beers D, Bertram M, Fuse K, Gordon RB, Gritsinin A, Harper EM, Kapur A, Klee RJ, Lifset R, Memon L, Spatari S (2005) The multilevel cycle of anthropogenic zinc. J Ind Ecol 9(3):67–90

GTAP (Global Trade Analysis Project) (2016). https://www.gtap.agecon.purdue.edu/products/demos.asp (accessed 30th March 2016)

Hashimoto S, Moriguchi Y (2004) Proposal of six indicators of material cycles for describing society’s metabolism: from the viewpoint of material flow analysis. Resour Conserv Recycl 40(3):185–200

Hashimoto S, Tasaki T, Nakajima K, Oguchi M, Umezawa O, Tanikawa H, Murakami S, Daigo I, Yokoyama K, Fuse M, Yamasue E (2008) Development of material stock account framework and its application: strategies for future waste and resource management. http://www.env.go.jp/recycle/waste_tech/kagaku/h20/kagaku/data/K2031.pdf (accessed 30th March 2016) (in Japanese)

Humphreys D (2013) Long-run availability of mineral commodities. Miner Econ 26(1):1–11

Index (2001) Financial and economic statistics Japan 2001. Yokohama, Japan

JAMA (Japan Automobile Manufacturers Association, Inc.) (2005a) The motor industry of Japan. Tokyo, Japan (in Japanese)

JAMA (Japan Automobile Manufacturers Association, Inc.) (2005b) World motor vehicle statistics. Tokyo, Japan. (in Japanese)

JCBA (Japan Copper and Brass Association) (2016). Statistics of Japan Copper and Brass Association. http://www.copper-brass.gr.jp/database/statistics.html (in Japanese) (accessed 30th March 2016)

JEWCAA (Japanese Electric Wire & Cable Makers’ Association) (2016) Statistics of the Japanese Electric Wire & Cable Makers’ Association. http://www.jcma2.jp/toukei.html (in Japanese) (accessed 30th March 2016)

JMIA (Japan Mining Industry Association) Kozan. Tokyo, Japan (in Japanese)

JOGMEC (Japan Oil, Gas and Metals National Corporation) 2005 Basic information of base metals. Kawasaki, Japan (in Japanese).

Kawase R, Matsuoka Y, Fujino J (2006) Decomposition analysis of CO2 emission in long-term climate stabilization scenarios. Energy Policy 34(15):2113–2212

Kaya Y (1990) Impact of carbon dioxide emission control on GNP growth: interpretation of proposed scenarios. Paper presented to the IPCC Energy and Industry Subgroup, Response Strategies Working Group, Paris (mimeo)

Kerr RA (2014) The coming copper peak. Science 343(6172):722–724

Mao J, Graedel TE (2009) Lead in-use stock: a dynamic analysis. J Ind Ecol 13(1):112–126

Mao JS, Dong J, Graedel TE (2008) The multilevel cycle of anthropogenic lead: I. Methodology. Resour Conserv Recycl 52(8, 9):1058–1064

MERI/J (2016) (Metal Economics Research Institute, Japan). Copper Data Book, Tokyo, Japan (in Japanese)

METI (2016) (Statistical Survey Department, Ministry of Economy, Trade and Industry). Yearbook of iron and steel statistics. Research Institute of Economy, Trade and Industry, Tokyo, Japan (in Japanese).

Murakami S, Kawamoto T, Masuda A, Daigo I (2015) Metal demand to meet SDG energy-related goals. Global Environmental Research 19(2):181–186

Nakicenovic N, Swart R (eds) (2001) Special report on emissions scenarios. Cambridge University Press, Cambridge

Northey S, Mohr S, Mudd GM, Weng Z, Giurco D (2013) Modelling future copper ore grade decline based on a detailed assessment of copper resources and mining. Resour Conserv Recycl 83:190–201

OECD 1993 Methods used by OECD countries to measure stocks of fixed capital: National Accounts: Sources and Methods, No. 2

O'Regan B, Moles R (2006) Using system dynamics to model the interaction between environmental and economic factors in the mining industry. J Clean Prod 14(8):689–707

Porter RC (2002) The economics of waste. Resources for the Future Press, Washington, D.C.

Radetzki (1988) Intellectually appealing? Resources Policy 14(1):63

Radetzki M (2009) Seven thousand years in the service of humanity: the history of copper, the red metal. Resources Policy 34(4):176–184

RIETI (Research Institute of Economy, Trade and Industry). Kogyo Binran. Tokyo, Japan (in Japanese)

Rosenkranz RD, Boyle EH, Porter KE (1983) Copper availability—market economy countries: a minerals availability program appraisal, Bureau of Mines Information Circular, IC8930, vol 20. Department of Interior, U.S.

Smulders S (2012) An arrow in the Achilles’ heel of sustainability and wealth accounting. Environ Dev Econ 17(3):368–372

SNL (2016) Mine Economics. http://www.snl.com/Sectors/MetalsMining/MineEconomics.aspx (accessed 30th March 2016)

Storchmann K (2004) On the depreciation of automobiles: an international comparison. Transportation 31(4):371–408

Tabayashi H, Daigo I, Matsuno Y, Adachi Y (2008) Development of a dynamic substance flow model of zinc in Japan. Tetsu to Hagane 94(11):562–568 (in Japanese)

Tilton JE (1999) The future of recycling. Resources Policy 25(3):197–204

Tilton JE (2003) On borrowed time?: assessing the threat of mineral depletion. Resources for the Future, Washington, DC

Tilton JE, Lagos G (2007) Assessing the long-run availability of copper. Resources Policy 32(1):19–23

Tokimatsu K, Ito T, Shinkuma T, Furukawa K, Ogiwara T, Kosugi T, Nishiyama T (2004) Copper demand and supply simulation in 21st century based on the IPCC SRES scenarios. J MMIJ 120(12):681–687 (in Japanese)

Tokimatsu K, Konishi S, Ishihara K, Tezuka T, Yasuoka R, Nishio M (2016). Global zero emissions scenarios: role of innovative technologies. Appl Energ, January, 1483–93

Tokimatsu K, Wachtmeister H, McLellan B, Davidsson S, Murakami S, Höök M, Yasuoka R, Nishio M (2017) “Energy modeling approach to the global energy-mineral nexus: A first look at metal requirements and the 2 °C target”. Applied Energy doi:10.1016/j.apenergy.2017.05.151

UN (United Nations) (1997) United Nations Statistics Division. International recommendations for construction statistics. United Nations, New York

UN (United Nations) (2016) United Nations Statistics Division. Statistical Yearbook. United Nations, New York., http://unstats.un.org/unsd/syb/ (accessed 30th March 2016)

US Department of Commerce (1986) Historical statistics of the United States, Washington D.C

USGS (2002) Mineral commodity summaries 2002. U.S. Geological Survey, Washington D.C. http://minerals.usgs.gov/minerals/pubs/mcs/2002/mcs2002.pdf (accessed 30th March 2016)

van Vuuren DP, Strengers BJ, De Vries HJM (1999) Long-term perspectives on world metal use—a system-dynamics model. Resources Policy 25(4):239–255

Wilburnk DR, Buckingham DA (2006) Apparent consumption vs. total consumption—a lead-acid battery case study. Scientific Investigations Report 2006–5155, U.S. Department of the Interior. http://pubs.usgs.gov/sir/2006/5155/sir20065155.pdf (accessed 30th March 2016)

World Bank (2016) World development indicators. Washington D.C., http://datacatalog.worldbank.org/ (accessed 30th March 2016)

Acknowledgements

The demand projection model in this study is extensively revised from related previous work, which was developed in the former Nishiyama Laboratory in Kyoto University; however, the revision is made by the authors’ responsibility. The first author would like to express his sincere thanks to professors Takashi Nishiyama, Toshihide Ito, Takanobu Kosugi, and Mr. Motoki Suzuki for their great contribution to model developments in previous and current versions. He also appreciates professors John Tilton, Marian Radetzki, Magnus Ericsson, and Anton Röf for their fruitful comments on the earlier version of this paper draft. All the errors remaining are due to him. He finally greatly appreciated the National Institute (AIST) and Arai Science and Technology Foundation for financial support to this work.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Tokimatsu, K., Murakami, S., Adachi, T. et al. Long-term demand and supply of non-ferrous mineral resources by a mineral balance model. Miner Econ 30, 193–206 (2017). https://doi.org/10.1007/s13563-017-0109-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13563-017-0109-8