Abstract

Metal life cycles define and quantify the rates of supply and demand for metals currently used in modern society. Each metal life cycle stage is potentially influenced by material transformation losses, import/export flows, and stockpiling. Flows and stocks in metal life cycles, the rates of by-product extraction, determinations of metal stocks in use, and scrap generation rates remain difficult to quantify, rendering it difficult to make reasonable estimates of the future supply of secondary metals and, therefore, of the future demands for primary metals. This paper presents four grand challenges to geologists, materials scientists, product designers, and industrial ecologists. Addressing these challenges is a prerequisite to achieving better resource efficiencies, as well as to addressing our moral obligation to enable a resource-sufficient life for future generations.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

INTRODUCTION

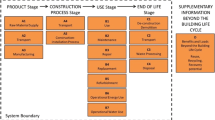

Metals and associated materials are essential to the technological activities of modern society. Metals are, of course, made available through the mining of metal ores, the processing of those ores into metals and alloys, the formation of “semi-products” (bars, tubes, sheets, etc.), and the manufacture of products for individual, industrial, and commercial use. Eventually, the metal-containing products are discarded and may or may not be recycled.

At many points within this life cycle (Fig. 1), information for all or some of the metals is scarce or nonexistent, a situation that inhibits industry and society from optimizing and conserving these vital non-renewable resources. Without reasonably accurate quantitative data on all the flows and stocks in metal life cycles, issues such as by-product extraction, metal stocks in use, and scrap generation remain difficult to quantify, making estimates of future needs for primary metals more challenging. This paper presents four grand challenges to geologists, materials scientists, and industrial ecologists: (1) improving resource estimation; (2) quantifying in-use stocks; (3) quantifying and improving end-of-life recycling rates; and (4) solving the balance problem. Meeting these challenges is a prerequisite to achieving better resource efficiencies.

The generic life cycle of metals (based on a diagram from Reck and Rotter 2012). The life cycle stages associated with each of the Grand Challenges of this paper (G1–G4) are indicated on the diagram. Mi mining; S smelting; R refining; F fabrication; Mfg. manufacturing; U use; W waste management

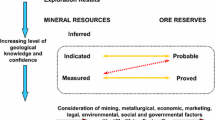

IMPROVING RESOURCE ESTIMATION

From the life cycle perspective, a grand challenge when considering societal needs and wants over the long term is determining the availability and quality of resource estimates, that is, the quantity of resources that could be available when needed and at affordable prices. Such estimates are as important to considerations of future sustainability as are estimates of global water supply or agricultural prospects. However, in the case of metals, it is currently possible to do little better than to estimate recoverable resource quantities to be a small multiple of crustal abundance. This is clearly a shaky foundation on which to anticipate prospective metal production several decades into the future, because mining is directed toward suitably rich ore deposits and not to average crustal rocks. Can we not arrive at more useful estimates?

Those who wish to fully (or better) understand the sustainability of a non-renewable resource must begin by knowing how much exists, and where. It is true, of course, that Earth contains a finite number of atoms of copper, europium, etc., distributed in complex ways within the crust, mantle, and core, the vast majority being unmineable. Society can use only those atoms that are concentrated in a mineable ore body, and what is “mineable” varies with technology, economics, and other factors. It is a common failing for those new to resource discussions to assume that what geologists term “Reserves” is the total mineable resource, and thus an absolute limit. Rather, it is a dynamic property, fluctuating over time as new deposits are discovered, improved processing efficiencies are put into place, and political decisions open or close access to mineral-rich regions.

An approximation to the quantity of a resource thought to have potential for production has traditionally been the US Geological Survey’s Reserve Base (RB), defined as “That part of an identified resource that meets specified minimum physical and chemical criteria related to current mining and production practices, including those for grade, quality, thickness, and depth” (USGS 2009). RB quantities were estimated by USGS through 2009 for many elements, but not all. However, the USGS has now ceased estimating RB values, and never felt able to expand them to many scarce metals in any case; this is a significant information deficiency for criticality assessors and a broken link between geologists and those wishing to utilize geological information for sustainability evaluation purposes.

It is important to recognize that USGS Reserve Base estimates, while of significant value historically, were somewhat compromised by the approach taken to estimate them: Information was obtained from firms and countries, the information was then combined with geological knowledge to arrive at the estimates, and the estimates were published without data exposition or source citation, often due to proprietary data concerns of mining and processing companies. That approach has now been superseded in a few cases by Mudd and colleagues of Monash University, Australia, who compile publicly available information from geological survey organizations, corporate annual reports, interviews with mining executives, and other sources. The associated publications list the estimated metal contents of each mine or region, the ore grades, trace constituents, and other useful information. Thus far, this project team has published resource information for gold (Mudd 2007), uranium (Mudd and Diesendorf 2008), nickel (Mudd 2010), platinum group metals (Mudd 2012), lithium (Mohr et al. 2012), copper (Mudd et al. 2013a), cobalt (Mudd et al. 2013b), the rare earth elements (Weng et al. 2015), indium (Werner et al. 2017), and zinc and lead (Mudd et al. 2017). These surveys expand upon Reserves reporting because they include planned as well as current exploitation.

The most expansive estimate of geological quantities that could be considered in assessing potential long-term supply is termed “Resources,” defined by the US Geological Survey (2009) as “A concentration of … material in or on Earth’s crust in such form and amount that economic extraction … is currently or potentially feasible”. Because “potentially” can be interpreted more or less at the whim of the analyst; however, this definition is of limited use. In any case, even if significant new resources are located, the deposits must be filtered for economic and environmental constraints in order to predict how much of those resources might be developed (Nickless et al. 2014; Robinson and Menzie 2014). It appears that the estimation of Resources may indeed be useful geologically, but not as a guide to mineable deposits in the foreseeable future.

Given this complexity and confusion, industries and governments for whom particular resources are essential need some rational way to approximate potential availability over both shorter and longer terms if they are to make logical decisions. To address this information gap, although quite approximately, a United Nations working group in 2011 (UNEP 2011a) explored the suggestion of Erickson (1973) that the potentially extractable global resource should “approach 0.01% of the total amount available in the crust to 1 km depth.” This idea may have been supported to at least some degree by the study of Mookherjee and Panigrahi (1994), who found a very strong positive correlation for 24 metals when plotting log [USGS Reserve Base] against log [upper crustal abundance] (Fig. 2). By drawing on recent upper crustal abundance determinations (e.g., McLennan 2001; Rudnick and Gao 2003; Hu and Gao 2008), the United Nations group was able to make resources estimates for 26 elements for which no values had previously existed. The results and current upper crustal abundance values are given in Table 1. The United Nations group emphasized that these results do not represent traditional scholarly determinations, but rather that “they provide rough working values that may be useful in preliminary studies of long-term metal criticality.” Grand Challenge #1—improving resource estimation—is thus directed to geologists: to develop more useful estimates of supply prospects for all metals over the next several decades.

Reserve base estimates as a function of upper crustal abundance (after a diagram by Mookherjee and Panigrahi 1994)

QUANTIFYING IN-USE STOCKS

Metals are mined and processed because of the demand for them, and that demand exists not because ownership of metals per se is desired (gold and other precious metals are exceptions, of course), but because individuals and corporations desire the services that metals provide—buildings, transportation, communication, and so forth. The sum of a metal in its uses constitutes a capital stock that will remain until the metal-containing products become obsolete and are discarded. In order to understand and to predict metal demand, accurate assessments of this in-use stock are necessary. The quantification of in-use metals stocks is the second grand challenge posed in this paper.

The simplest and often most useful estimation of in-use metal stock is that termed “top-down” in-use stock estimation. Top-down estimations take information regarding metal inflow to use, metal discards, and losses, and infer in-use stock by the cumulative difference between inflow and outflow. Mathematically, if S t is stock at time t, then in discrete time steps (usually one-year intervals):

where T o is the time of the initial time step, T is the current time step, and S o is the extant stock at the initial time step. Typically, the range from T o to T is 50–100 years for widely used metals such as iron. Copper is used in a wider suite of applications with more varied lifetimes. Many specialty metals are today used in electronics, with lifetimes of only a few years. Such short lifetimes have implications for recycling, as efficient systems for short lifetime applications need to be set up quickly in order to maximize metal recovery at the end of product life.

Outflow, for which data are not routinely available, is determined by assigning a lifetime to each use. Measurements of product lifetimes involve the collection of inflow data on products entering use over time. One then needs to determine the typical period in which the metal-containing products remain in use, a much more problematic situation because of the wide variability in product lifetimes. Figure 3 shows examples of estimates for several products used in private residences. As would be expected (and can be seen in the data), the variation in service lifetimes is substantial, and large amounts of data are needed to define lifetime distributions. Methods for assembling databases are discussed in Murakami et al. (2010), and an extensive but geographically limited database on product lifetimes is now available as a good general starting point (www.nies.go/jp/lifespan), but much remains to be done to determine in-use lifetimes for more products and more metals than has been done thus far. This is especially true for the scarcer metals whose uses are often difficult to quantify. Grand Challenge #2—quantifying in-use stocks—is thus directed to industrial ecologists: to better define metal in-use lifetimes and thus in-use stocks.

Product lifetime analysis for refrigerators, air conditioners, CRT TV sets, and CRT computer monitors in Branford, CT, using end-of-life data for June–September 2007. Units entering use are indicated in red on the left panels, and units (and their ages) that were collected are shown in blue. The survival functions and lifetime data in the center and right are fitted with normal (red), lognormal (blue), and Weibull (yellow) distributions (after Müller et al. 2007)

It is worth noting that in a growing global economy, Eq. 1 yields the result that S t is much larger than S o , generally making the contribution of S o quite small and therefore generally unnecessary to include in practice.

QUANTIFYING AND IMPROVING END-OF-LIFE RECYCLING RATES

Metals are contained in a wide variety of products used in industry and society, and end-of-life “production,” largely from “urban mines” is poorly tracked. Some perspective can be gained from the life cycle of Figure 1. Most flows in metal life cycles of metals occur relatively rapidly—typically weeks to a few months. Once the resources enter use as constituents of products, they remain in service for longer periods—often decades. Recycling technology must thus attempt to deal efficiently with a wide variety of products that have been manufactured well into the past. The information derived from these efforts provides the basis for recycling rate determination.

Recycling rates have been computed in various ways, and it is useful to provide a precise definition. As shown pictorially in Figure 4, the end-of-life recycling rate (EOL-RR) is the fraction of a discarded resource that is returned to use in such a way that its properties are preserved (as opposed to its being dissipated as a tramp constituent of another metal cycle, as when copper wiring is inadvertently recycled with steel). The EOL-RR is computed as flow g divided by flow d. For many base metals and some precious metals, EOL-RR is over fifty percent (Fig. 5), but not usually much over that amount. For scarce metals, in stark contrast, recycling rates are thought to be mostly low to negligible (Graedel et al. 2011).

Flows (letters and symbols) related to the life cycle of metals and the recycling of production scrap and end-of-life products. Prod production; Fab/Man fabrication and manufacturing; WM waste management; Rec recycling. The boundary indicates the global industrial system, not a geographical entity (reproduced by permission from Graedel et al. 2011)

The periodic table of end-of-life recycling (EOL-RR/MS) for 62 metals. Unfilled entries indicate that no data or estimates are available (UNEP 2011b)

A potential solution to low recycling rates could be the substitution of a widely available metal for a scarcer one. As it turns out, however, the efforts of modern technology to utilize the best metal for each industrial purpose have made satisfactory substitution without significant loss of product performance quite challenging. A review of substitution potential (Graedel et al. 2015) demonstrates that while substitution can sometimes occur, it should not be considered a universal solution to material scarcity.

Technology is never perfect, of course, and some fraction of resources is inevitably lost at each stage of the life cycle. If sustainability is to be approached for non-renewable resources, however, attention to loss reduction will be required at each step of the life cycle—in mining and milling, in fabricating intermediate products, in manufacturing final products, and in capturing, separating, sorting, and reusing the materials when they exit service. Product designers can play a major role by utilizing approaches that permit efficient disassembly, separation, and resource identification. These are all challenging jobs and will require diligence, ingenuity, and perhaps legislation at every stage.

Some metal uses are inherently dissipative; while for others, satisfactory recovery techniques remain to be developed. As a consequence, flows out of use do not automatically equate to metal available for reuse. A lack of data on discards and recycling impedes attempts at the quantification of recycled flows. This information deficiency needs to be improved, and Grand Challenge #3—quantifying and improving EOL-RR—thus falls to the recycling industry and the product designers, perhaps in collaboration with industrial ecologists: to acquire the data that will permit relatively precise determination of EOL-RR for all metals used in modern society and then to improve on those rates over time.

THE BALANCE PROBLEM

A final grand challenge relates to the occurrence of groups of minor metals in the ores of major “host” metals, and the varying levels of demand for the minor metal “companions” (Binnemans et al. 2013). Zinc ores contain highly valued indium, for example, but also the often undesired cadmium, while copper ores provide widely used selenium as well as generally unwanted arsenic. The degree to which metals are produced as companions is shown in Figure 6. It is striking that 61% (38 of 62) of the metals have companionality greater than 50%. For these metals, availability ultimately depends upon the demand for the host metals and the degree to which the companions are extracted from the hosts during host/companion processing (e.g., Werner et al. 2017), as even very high prices for the companions have only a minor impact on decisions to open or close most metal mines.

The periodic table of companionality on a global basis (2008). Metals that are mainly produced as hosts appear in blue, and those that are mainly produced as companions are in red (reproduced by permission from Nassar et al. 2015)

Table 2 lists the principal host metals, together with the companions associated with them. An important insight from this table is that the mining of host metal ores simultaneously extracts the related companions, whether they are wanted or not. Ideally, there should be incentives for primary metal processors (mines, smelters, refineries) to maximize by-product recovery, even if current market prices do not justify this and by-product recovery would lead to higher processing costs.

In the absence of strong markets for specific companion metals, the companions are generally stockpiled in mine tailings and slags, making future recoveries much more challenging, expensive, or even impossible. Such an approach may lead to environmental problems over the long term (e.g., Teck Cominco Alaska, Inc. 2004; Canadian Press 2005).

Table 2 also provides a rough indication of the metals that are typically extracted (with their hosts) at rates greater than existing demand. Because effort and energy have already gone into that extraction, whether or not that effort and energy are properly allocated to these inadequately used companions, it seems sensible to attempt to develop new or enhanced uses for them. Grand Challenge #4—the balance problem—is thus directed to materials scientists: to find a suite of uses for all metals that better match their occurrences in mineable ore bodies. Doing so could modify demand for some metals now perhaps overused, and minimize rates of stockpiling for those now underused. In the world of academia, research effort tends to follow levels of financial support, so the provisioning of support for this research is properly a role of governments.

DISCUSSION AND CONCLUDING REMARKS

All of the four grand challenges could be addressed if those with influence over a particular stage of metal life cycles were to realize the benefits of improved system-level quantification and analysis. Society’s dependence on metals is very high, but detailed knowledge of all aspects of supply and demand now and in the past is quite limited. As with many system-level situations, this is everybody’s problem and nobody’s, resulting in an inadequate basis for long-term thinking. The situation can only be improved by the collaborative efforts of actors at the various life cycle stages: geologists, materials scientists, industrialists, industrial ecologists, product designers, consumers, and recyclers.

A possible way to move forward in addressing the four challenges is to establish a collaborative effort among those organizations whose specialties are required if progress is to be made. Such collaboration might lead to a task force of economic geologists, industrial ecologists, materials scientists, and recyclers, perhaps formed with the oversight of the International Union of Geological Sciences, the International Society for Industrial Ecology, and the Materials Research Society. The results of data acquisition and analysis efforts by such a group would require formal task force sponsorship as well as a continuing commitment to establish and maintain the necessary information.

It is true, of course, that some of the best information needed to complete these tasks is proprietary in some cases and nonexistent in others. The problem is a global one, so perhaps an international collaboration along the lines suggested above could construct a framework within which data could be compiled while respecting the proprietary concerns of companies and countries. There will be considerable effort and negotiation involved in surmounting these challenges, but the benefits of meeting these challenges will be of great value to a wide variety of stakeholders.

Finally, one might ask why it is so important to devote time and effort to arriving at a more quantitative understanding of material unlikely to be mined and utilized for decades into the future. It is in the addressing of this question that geology, society, and our moral obligations interact. I believe there is merit in attempting to ensure, to the degree we can, that future generations of human and non-human inhabitants of our planet are not unfairly constrained by material resource-related actions taken in the short term. It may be that the exercise of some level of moderation in terms of the exploitation of material resources is advisable over the next few decades in order to enable a more stable planetary future, but we do not know that now. Unless we improve our understanding of potential future rates of supply and demand, we cannot make such an assessment, but in my view it is our responsibility to do so.

REFERENCES

Binnemans, K., Jones, P. T., Van Acker, K., Blanpain, B., Mishra, D., & Apelian, D. (2013). Rare-earth economics: The balance problem. JOM Journal of the Minerals Metals and Materials Society, 65, 846–848.

Canadian Press (2005). Deep freeze plan agreed for giant mine’s arsenic stockpile, www.resourcinvestor.com/deep-freeze-plan-agreed-for-giant-mine’s-arsenic-stockpile.

Erickson, R. L. (1973). Crustal abundance of elements, and mineral reserves and resources. In D. A. Brobst & W. P. Pratt (Eds.), United States Mineral Resources (pp. 21–25). Washington: Government Printing Office.

Graedel, T. E., Allwood, J., Birat, J.-P., Buchert, M., Hagelüken, C., Reck, B. K., et al. (2011). What do we know about metal recycling rates? Journal of Industrial Ecology, 15, 355–366.

Graedel, T. E., Harper, E. M., Nassar, N. T., & Reck, B. K. (2015). On the materials basis of modern society. Proceedings of the National Academy of Sciences of the United States, 112, 6295–6300.

Hu, Z., & Gao, S. (2008). Upper crustal abundances of trace elements: A revision and update. Chemical Geology, 253, 205–221.

McLennan, S.M., (2001). Relationships between the trace element composition of sedimentary rocks and upper continental crust. Geochemistry, Geophysics, and Geosystems, 2, 2000GC000109.

Mohr, S. H., Mudd, G. M., & Giurco, D. (2012). Lithium resources and production: Critical assessment and global projections. Minerals, 2, 65–84.

Mookherjee, A., & Panigrahi, M. K. (1994). Reserve base in relation to crustal abundance of metals: Another look. Journal of Geochemical Exploration, 51, 1–9.

Mudd, G. M. (2007). Global trends in gold mining: Towards quantifying environmental and resource sustainability? Resources Policy, 32, 42–56.

Mudd, G. M. (2010). Global trends and environmental issues in nickel mining: sulfides versus laterites. Ore Geology Reviews, 38, 9–26.

Mudd, G. M. (2012). Key trends in the resource sustainability of platinum group elements. Ore Geology Reviews, 46, 106–117.

Mudd, G. M., & Diesendorf, M. (2008). Sustainability of uranium mining and milling: Toward quantifying resources and eco-efficiency. Environmental Science and Technology, 42, 2624–2630.

Mudd, G. M., Jowitt, S. M., & Werner, T. T. (2017). The world’s lead-zinc mineral resources: Scarcity, data, issues, and opportunities. Ore Geology Reviews, 80, 1060–1090.

Mudd, G. M., Weng, Z., & Jowitt, S. M. (2010). A detailed assessment of global Cu resource trends and endowments. Economic Geology and the Bulletin of the Society of Economic Geologists, 108, 1163–1183.

Mudd, G. M., Weng, Z., Jowitt, S. M., Turnbull, J. D., & Graedel, T. E. (2012). Quantifying the recoverable resources of by-product metals: the case of cobalt. Ore Geology Reviews, 55, 87–98.

Müller, D. B., Cao, J., Kongar, E., Altonji, M., Weiner, P.-H., & Graedel, T. E. (2007). Service Lifetimes of Mineral End Uses, Final report, Award 06HQGR0174 of the U.S. Geological Survey, Yale University, November.

Murakami, S., Oguchi, M., Tasaki, T., Daigo, I., & Hashimoto, S. (2010). Lifespan of commodities part I: The creation of a database and its review. Journal of Industrial Ecology, 14, 598–612.

Nassar, N. T., Graedel, T. E., & Harper, E. M. (2015). By-product metals are technologically essential but have problematic supply. Science Advances, 1, e1400180.

Nickless, E., Bloodworth, A. Meinert, L. Giurco, D. Mohr, S., & Littleboy, A. (2014). Resourcing Future Generations White Paper: Mineral Resources and Future Supply, International Union of Geological Sciences.

Reck, B. K., & Rotter, V. S. (2012). Comparing growth rates of nickel and stainless steel use in the early 2000s. Journal of Industrial Ecology, 16, 518–528.

Robinson, G. R., Jr., & Menzie, W. D. (2014). Economic Filters for Evaluating Porphyry Copper Deposit Resource Assessments Using Grade-Tonnage Deposit Models, with Examples from the U.S. Geological Survey Global Mineral Resource Assessment. Scientific Investigations Report 2010-5090-H, Version 1.2, Reston, VA: U.S. Geological Survey.

Rudnick, R., & Gao, S. (2003). Composition of the continental crust. In H. D. Holland & K. K. Turekian (Eds.), Treatise on Geochemistry (Vol. 3, pp. 1–64). Oxford: Elsevier.

Teck Cominco Alaska Inc. (2004). Assessment of Water Treatment Methods Applicable for Closure Red Dog Mine, Alaska, Anchorage, AL, Project Number 1CT006.03. http://dnr.alaska.gov/mlw/mining/largemine/reddog/publicnotice/pdf/sde4.pdf.

UNEP (2011a). Estimating Long-Run Geological Stocks of Metals, United Nations Environment Programme (UNEP), Working paper, April 6, 2011. Available at http://www.unep.org/resourcepanel/Portals/24102/PDFs/GeolResourcesWorkingpaperfinal040711.pdf.

UNEP (2011b). Recycling Rates of Metals: A Status Report, United Nations Environment Programme (UNEP), Paris, ISBN 978-92-807-3161-3, http://www.unep.org/resourcepanel-old/Portals/24102/PDFs/Metals_Recycling_Rates_110412-1.pdf.

USGS (2009). Mineral commodity summaries 2009. Reston, VA: U.S. Geological Survey.

Weng, Z., Jowitt, S. M., Mudd, G. M., & Haque, N. (2015). A detailed assessment of global rare earth resources: Opportunities and challenges. Economic Geology, 110, 1925–1952.

Werner, T. T., Mudd, G. M., & Jowitt, S. M. (2017). The world’s by-product and critical meal resources Part III: A comprehensive assessment of indium. Ore Geology Reviews. doi:10.1016/j.oregeorev.2017.01.015.

ACKNOWLEDGMENTS

I thank Barbara Reck for helpful comments on the first draft of this paper, and for creating Figure 1.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Graedel, T.E. Grand Challenges in Metal Life Cycles. Nat Resour Res 27, 181–190 (2018). https://doi.org/10.1007/s11053-017-9333-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11053-017-9333-8