Abstract

The aim of this article is to investigate an inventory model with discounted partial advance payment in a single supplier–single retailer supply chain in the presence of credit period when the demand rate is price sensitive. The lengths of the credit period, advance period, as well as rate of discount on advance payment, are specified by the supplier. Conditions for unique optimal values of the decision variables, namely, the retailer’s selling price and cycle length are obtained. Optimal values of the decision variables are determined iteratively. An algorithm is developed and a numerical example is presented to demonstrate the solution algorithm. Sensitivity analysis is conducted. It is observed that optimal cycle time is affected by the two interest rates. Optimal net profit is affected by the demand rate and the discount factor. Both, the optimal cycle time, as well as the optimal net profit is affected by the supplier’s selling price and the proportion of units for which the advance payment is made. Optimal retailer’s selling price is significantly affected by the discount factor, supplier’s selling price, price elasticity of the demand function as well as the proportion of units for which advance payment is made. We also observe that the retailer’s net profit does not decrease significantly on increasing the advance period.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

13.1 Introduction

In the competitive situation prevailing in the market, a major effort is required by suppliers to provide facilities which would, in turn, attract orders from retailers. One such facility popular in a supplier–retailer contract is to offer goods on credit for some interest-free period—generally termed as the trade credit period or permissible delay in payment. The retailer may pay the entire amount or a part of it to the supplier at the end of the credit period. Once the credit period is over, interest is charged by the supplier on the remaining dues.

The benefits of trade credit policy in the context of marketing are identified as leading to increased sales and as a tool to attract new retailers who deem credit policy as a kind of price reduction. Another advantage is that due to trade credit, an established retailer may pay more promptly resulting in a reduction in the outstanding sales dues. Trade credit provides financial support to the retailer along with providing a certification of quality from the supplier.

During the last few decades, many inventory models have been developed considering the trade credit facility. Goyal [8], Teng [27], Chang et al. [3], Sarkar [22], Chen and Teng [5], Taleizadeh et al. [26], Tiwari et al. [30], Jaggi et al. [14] and many others have considered trade credit when the demand is constant.

In practice, quite often, the end customer demand at the retailer is price-sensitive. In such a situation, decisions regarding setting the retailer’s selling price and order quantity are to be made by the retailer. Price-sensitive demand without trade credit has been considered by many authors, e.g., Banerjee and Sharma [2]. For an inventory model under trade credit contract with price-sensitive demand, optimal pricing policies were obtained by Hwang and Shinn [13]. Under cooperative and noncooperative structures, Abad and Jaggi [1] developed a model with price-dependent demand to obtain the retailer’s optimal unit price and replenishment cycle as well as the seller’s optimal selling price and credit period. Teng et al. [28] found the optimal selling price and replenishment policies considering a model with price-sensitive demand for deteriorating items. They concluded that under trade credit, the cycle time, and order quantity will decrease. Price-sensitive demands for integrated inventory models that involve trade credit have also been developed by Ouyang et al. [21], Chen and Kang [4] and Chung and Liao [6].

Ho et al. [12], Shah et al. [23] analyze the decision policy when the buyer receives a cash discount if he pays any fraction of purchase cost within a shorter allowable credit period and then clears the remaining balance in the long credit period. Such a policy is called a two-part permissible delay.

Some more realistic models have considered revenue earned through sales as well as interest earned during the credit period and even later for price-sensitive demand [15, 16, 19, 20, etc.].

Retailers are generally in search of long credit periods for the purchase of their goods, whereas this tendency may lead to financial complications for small suppliers and hence to supply crunch for the retailer. Hence, sometimes, it may be worthwhile for the supplier to demand advance payment. Zhang et al. [32] stated that advance payment is a known practice in the Chinese automobile and steel industries. Maiti et al. [18] observed that in the bricks and tiles factories in India, sometimes a price discount on advance payment is offered to the retailer if made at his own discretion.

In inventory literature, very little consideration has been given to the advance payment and its influences on inventory decisions. Maiti et al. [18] developed a stochastic inventory model with advance payment. They assumed that the retailer’s procurement price depended on the fraction of the advance payment. Their model was extended by Gupta et al. [9]. However, these two papers do not consider trade credit policy. Both advance payment and trade credit were considered by Thangam [29] for constant demand. Full advance and partial advance partial credit were incorporated by Zhang et al. [32] for constant demand. They conclude that in both the payment policies, length of the period of advance payment does not affect the retailer’s optimal policy.

Taleizadeh [25] studied a lot sizing model without credit period under price-dependent demand with advance payment policy when the equal installments of the advance payment of the purchase cost are specified by the supplier. For constant demand, Wu et al. [31] studied the model when the seller requires an advance-cash-credit (ACC) payment.

From the above-detailed literature review, we find that till now, very few papers have considered advance payments. Out of these few papers, some have not considered trade credit [18, 24] while others, who have considered advance payment, as well as trade credit, have regarded demand to be constant [17, 31, 32, 33] or time dependent [7]. Although Diabat et al. have considered both advance payment as well as delayed payment, the two are for different echelons in the supply chain with upstream advance payment and downstream delayed payment.

In the present paper, we consider iso-elastic price-dependent demand with partial advance payment before the supply is received when the credit period is also allowed. The aim of this article is to study an optimal inventory model that considers ordering and pricing decisions under discounted partial advance and partial credit period when the customer demand is an iso-elastic function of the retailer’s selling price. We obtain the optimal price and optimal length of replenishment cycle when shortages are not allowed. We also examine how the variations in the model parameters affect the optimal solution.

The rest of this paper is organized as follows: Sect. 13.2 presents the assumptions and notations. Section 13.3 explains the working of the model, Numerical example is given in Sect. 13.4 along with algorithm, sensitivity analysis and managerial insights. In Sect. 13.5, we present the conclusions.

13.2 Notations and Assumptions

The following notations are used in this paper:

- D:

-

demand dependent on retailer’s price rate per unit. D = α P -βR , α, β > 1.

- h:

-

unit inventory holding cost per unit time.

- A:

-

ordering cost per order.

- I1:

-

the interest rate paid per unit time to supplier by retailer.

- IPR:

-

the interest rate per unit time to be paid by retailer to financer for loan.

- IER:

-

the interest rate earned per unit time by retailer.

- t0:

-

epoch of advance payment

- MA:

-

the retailer’s advance period stipulated by the supplier.

- MR:

-

the credit period provided by the supplier to the retailer.

- Net:

-

the retailer’s net profit per unit time.

- A1:

-

proportion of Q for which an advance payment is made by the retailer at epoch MA.

- A2:

-

proportion of Q for which payment is paid by the retailer at epoch MR. 0 ≤ A1 + A2 ≤ 1.

- ρ:

-

discount factor for advance booking, 0 < ρ < 1. The discount percent is 100(1–ρ).

- T:

-

the retailer’s inventory cycle length (Decision variable)

- PS:

-

supplier’s unit selling price.

- PR:

-

retailer’s unit selling price \( ( {\text{P}}_{\text{R}} > {\text{P}}_{\text{S}} ) \). (Decision variable)

- Q:

-

the retailer’s order quantity per cycle (Decision variable). Q = DT

* With any decision variable indicates its optimal value.

Assumptions

The model is developed with the following underlying assumptions:

-

1.

The supplier provides a fixed credit period MR to the retailer for settling the accounts.

-

2.

The end consumer market demand rate declines with an increase in the retailer’s selling price, D(PR) = αP -βR , where α > 0 and β being, respectively, the scaling factor and the index of price elasticity. For notational simplicity, we will be interchangeably using D(PR) and D in this work.

-

3.

The retailer starts selling the goods as soon as he receives it.

-

4.

The earnings accumulated by the retailer is withdrawn only at epoch T, or later.

-

5.

For the payments made to supplier at t0 and MR, the retailer has to take loan from the financial institution like banks—which we call financer, while for the payment made at epoch T, the retailer uses a part of the earnings accumulated till time T.

-

6.

Shortages are not allowed.

-

7.

Replenishment rate and time horizon are infinite.

13.3 The Model

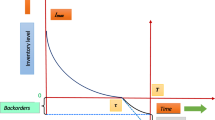

The model is developed with the stated advance period under trade credit with a price-dependent demand so as to maximize net profit for the retailer. The retailer orders for Q units of inventory at epoch t0, which is MA time units before the beginning of the selling season. The ordered units arrive at the beginning of the selling season. The payments for the ordered units are made by the retailer in three parts:

-

1.

An advance payment at epoch t0 for proportion A1 of Q units is made at the discounted rate ρPS. 0 ≤ A1 ≤ 1.

-

2.

For the remaining quantity, payment has to be made depending on the following two cases.

Case I: MR ≤ T

In this case, a payment at the rate PS for proportion A2 of Q units is made at the epoch MR. No interest is paid to the supplier for this delayed payment under the credit policy. 0 ≤ A1 + A2 ≤ 1. Payment for the remaining proportion 1 – (A1 + A2) of Q units at the rate PS along with interest charged by the supplier from MR to T at the rate I1. is made at epoch T.

The payments at t0 and MR are made by taking a loan from financer. The retailer starts selling his goods from the beginning of the selling period. The sales earnings up to Tare invested as they accumulate and interest is earned on it at the rate IER. When the selling period ends, the payment to the supplier and loan repayment and payment of interest for the loan to the financer will be made by the retailer from the sales as well as interest earnings up to T (Fig. 13.1a).

Case II: MR > T

In this case, a payment for the remaining proportion (1 – A1) of Q units is made at the rate PS at epoch MR so as to take advantage of the credit period. No interest is to be paid for this payment, the credit period MR being larger than the cycle length T, and no loan is to be taken by the retailer for the payment. Repayment the loan taken from the financer at t0 and interest on it is to be repaid to the financer at epoch T, i.e., when the selling period ends (Fig. 13.1b).

13.3.1 Computation of Net

The retailer’s net profit for the cycle is given by

Net = Total revenue earned – (Ordering cost + Stock holding cost + Purchase cost + Interest paid) where

Total revenue earned = Sales revenue + Interest earned

Ordering cost is A

Stock holding cost is \( \frac{{{\text{h}}\left( {{\text{DT}}^{2} } \right)}}{2} \)

The total revenue earned, interest earned, interest paid and net profit per unit time for Case I and Case II are as follows:

Case I: MR ≤ T

The total purchasing cost paid at epoch MA, MR and T of quantity (A1Q), (A2Q) and (1 – (A1 + A2))Q, respectively, is

The interest paid by the retailer till T, for the loan taken at the epochs t0 and MR, is \( \left( {{{\text{T + M}}}_{{\text{A}} }} \right)\left( {{\text{A}}_{1} {\text{Q}}} \right)(\uprho{{\text{P}}}_{{\text{S}}} ){{\text{I}}}_{{\text{PR}}} + \left( {{{\text{T}}} - {{\text{M}}}_{{\text{R}}} } \right)\left( {{{\text{A}}_{2}} {{\text{Q}}}} \right){{\text{P}}}_{{\text{S}}} {{\text{I}}}_{{\text{PR}}} \)

The interest paid by the retailer to the supplier for the amount paid at T is \( \left( {{{\text{T - M}}}_{{\text{R}} }} \right)(\left( {1 - \left( {{{\text{A}}}_{{1}} + {{\text{A}}}_{{2}} } \right)){{\text{Q}}}} \right){{\text{P}}}_{{\text{S}}} {{\text{I}}}_{{1}} \)

Total revenue earned by the retailer is

Hence, the net profit per unit time of the retailer is

Case II: MR > T

The total purchasing cost paid at epoch MA and T of quantity(A1Q) and (1 – A1)Q, respectively, is

The interest paid by the retailer till T to the financer for the amount paid at the epoch t0 is

Total revenue earned by the retailer is

Hence, the net profit per unit time of the retailer is

The overall net profit per unit time is

13.3.2 Analysis

Using assumption 3 and Q = DT, it is apparent that Net is a function of decision variables PR and T. In order to obtain the optimal values of the decision variables analysis of the net profit function for Case I and Case II are presented:

13.3.2.1 Necessary Conditions

The first-order (necessary) conditions for maximization of Netj with respect to T and PR are

Differentiating (1) with respect to T and PR, we get, respectively

and

where

We note that RHS of (5) is zero iff R1 = 0.

On equating (13.4) and (13.5) to zero, we get, respectively

And on substituting for R1, we get

Similarly, differentiating (2) with respect to T and PR,we get respectively

and

where

On equating (13.8) and (13.9) to zero, we get, respectively

and

13.3.2.2 Sufficiency Conditions

The second order (sufficiency) conditions for Netj, j = 1, 2 to be maximum with respect to T and PR, respectively, are

(i) \( \frac{{{\partial^{2} {{\text{Netj}}}}\left( {{{\text{T}}}, {{\text{P}}}_{{\text{R}}} } \right) }}{{{\partial {{\text{T}}}^{{2}} }}} < 0 \), (ii) \( \frac{{\partial^{2} {\text{Netj}}\left( {{\text{T}},{\text{P}}_{\text{R}} } \right)}}{{\partial {\text{P}}_{\text{R}}^{2} }} < 0 \)

for which, wide sufficient conditions are derived in Appendix 1

For Net j to be jointly concave with respect to both the decision variables T and PR, we require that Netj satisfies (i) or (ii) and

(iii) \( \frac{{\partial^{2} {\text{Netj}}\left( {{\text{T}},{\text{P}}_{\text{R}} } \right)}}{{\partial {\text{T}}^{2} }}\frac{{\partial^{2} {\text{Netj}}\left( {{\text{T}},{\text{P}}_{\text{R}} } \right)}}{{\partial {\text{P}}_{\text{R}}^{2} }} - \left( {\frac{{\partial^{2} {\text{Netj}}\left( {{\text{T}},{\text{P}}_{\text{R}} } \right) }}{{\partial {\text{T}}\partial {\text{P}}_{\text{R}} }}} \right)^{2} > 0 \)

Condition (iii) has been further discussed in Appendix 2.

13.4 Algorithm

On the basis of above theoretical results, the following solution algorithm has been developed to determine an optimal solution of the model for the given parameters α, β, A, h, IER, IPR, I1, ρ, A1, A2, PS, MA, MR.

Step 1: Input values of all the parameters.

Step 2: We find the optimal values of T and PR for T ≥ MR, i.e., T *1 , P *R1 as follows:

-

(i)

Put j = 0. Select the initial value P *R1 of PR1 as PR10 = PS.

-

(ii)

Substitute PR = P *R1j in (6) and compute T *1j .

Set j = j + 1.

-

(iii)

Substitute T = T *1j in (7) to obtainP *R1j+1 .

-

(iv)

Repeat (ii) – (iii) till the values of T *1j and P *R1j stabilize, say, to T *1 and P *R1 , respectively.

-

(v)

Substitute T *1 and P *R1 in (1) to obtain the optimal value of Net1*

Step 3: We find the optimal values of T and PR for T ≥ MR, i.e., T *2 , P *R2 as follows:

-

(i)

Put j = 0. Set PR20 = PS a guess value of PR2.

-

(ii)

Substitute PR = P *R2j in (10) and compute T *2j .

Set j = j + 1.

-

(iii)

Substitute T = T *2j in (11) to obtainP *R2j+1 .

-

(iv)

Repeat (ii) – (iii) till the values of T *2j and P *R2j stabilize, say, to T *2 and P *R2 , respectively.

-

(v)

Substitute T *2 and P *R2 in (2) to obtain the optimal value of Net2*

Step 4: The optimal net profit is Net* = Max (Net1*, Net2*). Stop.

13.4.1 Numerical Example

In this section, we provide a numerical example to illustrate the results satisfying both the above necessary and sufficient conditions of maximization obtained in Sect. 13.3. We apply the above algorithm to obtain optimal values of the decision variables and to conduct sensitivity analysis. We consider the following values for the input parameters in proper units.

Example: Let us take the following parameter values of the inventory system as follows:α = 1,000,000, β = 2, h = 0.65, A = 50, IER = 0.06, IPR = 0.09, I1 = 0.1, ρ = 0.4, A1 = 0.2, A2 = 0.4, PS = 5, MR = 0.08, MA = 0.04.

Plots of Net1 and Net2 with respect to T and PR for Case I (T ≥ MR) and Case II (T < MR) are presented in Fig. 13.2a and Fig. 13.2b, respectively. From the figures, it is clear that for this set of input parameters, Net is jointly Concave function of PR and T for both the cases.

The optimal values are as follows:

Decision variable | Case I | Case II |

|---|---|---|

T* | 0.0908 | 0.0790 |

PR* | 8.8525 | 8.8385 |

Net* | 56084.2 | 56075.6 |

Case I provides a larger value of Net. Hence, the column under Case I provides the optimal set of values.

13.4.2 Sensitivity Analysis

We now study the effects of changes in the values of the system parameters α, β, h, A, IER, IPR, I1, ρ, A1, A2, PS, MR, MA on the optimal values of retailer’s price, cycle length and net profit.

The sensitivity analysis is performed by changing each of the parameters by +50%, +25%, −25%, and −50% taking one parameter at a time and keeping the values of the remaining parameters unchanged.

The results for the cost parameters and other parameters of the model are presented in Table 13.1 and Table 13.2, respectively.

Table 13.1 shows the change in optimal values of the decision variables and the optimum net profit with changes in the cost parameters. We observe that increase in Ps by 50% results in increase in T* by almost 40%, increase in PR* by almost 50% and decrease in Net* by 33%. Increase in IER by 50% results in about 18% increase in T* whereas surprisingly, this does not significantly affect the net profit. A 50% decrease in IPR andI1 results in almost 14% and 13% increase in T*, respectively. Increase in ρ by 50% results in increase in optimal cycle time by 4% and the retailers’ selling price by about 5% and net profit decreases by 4.40%. Increase in A by 50% results in about 23% increases in T*. A 50% decrease in h results in about 23% increase in T*.

Table 13.2 shows the change in optimal values of the decision variables and the optimum net profit with changes in the model parameters, where the significant changes are written in bold characters. It is seen that increase in the credit period MR by 25% results in decline in T* and hence, Case II becoming optimal, i.e., the inventory ordered should be such that it is sold off before the end of the credit period.

The parameters α and β are major factors that affect—the optimal values of the cycle time, retailer’s price, as well as the net profit. A 25% increase/decrease in the value of α result in a proportionate increase/decrease in the value of net profit. A 25% decrease in α results in about 16% increase in the optimal cycle length, while 50% increase in β results in 84% increase in the optimal cycle length.

The results of sensitivity analysis presented above are also shown below graphically in order to enable a quicker comprehension (Fig 13.3a,b,c).

13.4.3 Managerial Insights

We find that among cost factors, increasing supplier’s selling price results in a significant increase in the optimal cycle time, but a drastic decrease in the optimum profit. Other factors that result in a significant change in optimal time are the rates of interest to be paid by and earned by the retailer, ordering cost, discount factors well as the holding cost. However, other than the supplier’s price, net profit is not significantly affected by cost factors. Hence supplier’s price must be negotiable to attain a profitable level for the retailer. Increase in the proportion of advance payment will result in decline in optimal value of the retailer’s selling price and hence increase in end customer demand. Thus, an increase in the proportion of order quantity obtained at discounted price and increase in revenue earned due to increased demand together lead to an increase in the net profit rate of the retailer. Further, an advantage of increasing A1 is that it will contribute to increase in supplier’s corpus fund. A completely opposite effect is seen when the discount factor is increased. The retailer’s net profit is significantly affected by both the demand parameters. Hence, the demand rate must be estimated with care. Increase in duration of advance payment by the supplier will not result in a reduction in the retailer’s net profit as in Zhang [18].

13.5 Conclusion and Future Scope

In this paper, we have discussed a payment policy for supply chains with permissible delay in payment and partial advance payment at a discounted price where the retailer’s selling price is a decision variable. Iso-elastic price-dependent demand function has been considered and useful managerial insights are obtained from sensitivity analysis.

In future, other types of price-dependent demand functions may be explored for other real-life problems. Further, being an important determinant of the retailer’s payment policy, discount may be optimally determined using procedure similar to Gupta et al. [10] for constant demand and Gupta et al. [11] for iso-elastic demand.

This research did not receive any specific grant from funding agencies in the public, commercial, or nonprofit sectors.

References

Abad PL, Jaggi CK (2003) A joint approach for setting unit price and the length of the credit period for a seller when end demand is price sensitive. Int J Prod Econ 83(2):115–122

Banerjee S, Sharma A (2010) Inventory model for seasonal demand with option to change the market. Comput Ind Eng 59(4):807–818

Chang CT, Ouyang LY, Teng JT, Cheng MC (2010) Optimal ordering policies for deteriorating items using a discounted cash-flow analysis when a trade credit is linked to order quantity. Comput Ind Eng 59(4):770–777

Chen LH, Kang FS (2010) Integrated inventory models considering the two-level trade credit policy and a price-negotiation scheme. Eur J Oper Res 205:47–58

Chen SC, Teng JT (2014) Retailer’s optimal ordering policy for deteriorating items with maximum lifetime under supplier’s trade credit financing. Appl Math Model 38(15–16):4049–4061

Chung K-J, Liao J-J (2011) The simplified solution algorithm for an integrated supplier–retailer inventory model with two-part trade credit in a supply chain system. Eur J Oper Res 213:156–165

Diabat A, Taleizadeh AA, Lashgari M (2017) A lot sizing model with partial downstream delayed payment, partial upstream advance payment, and partial backordering for deteriorating items. Journal of Manufacturing Systems 45:322–342

Goyal SK (1985) Economic order quantity under conditions of permissible delay in payment. J Oper Res Soc 36(4):335–338

Gupta R, Bhunia A, Goyal S (2009) An application of genetic algorithm in solving an inventory model with advance payment and interval valued inventory costs. Math Comput Model 49(5):893–905

Gupta R, Agrawal S, Banerjee S (2017) Buyer’s Optimal Policy for a Deterministic Inventory Model with Discounted Advance Payment and Trade Credit in a Supply Chain System. Amity Journal of Operations Management 2(1):51–64

Gupta R, Banerjee S, Agrawal S (2018) Retailer’s optimal payment decisions for price-dependent demand under partial advance payment and trade credit in different scenarios. Int J Sci Res Math Stat Sci 5(4):44–53

Ho CH, Ouyang LY, Su CH (2008) Optimal pricing, shipment and payment policy for an integrated supplier–buyer inventory model with two-part trade credit. Eur J Oper Res 187(2):496–510

Hwang H, Shinn SW (1997) Retailer’s pricing and lot sizing policy for exponentially deteriorating products under the condition of permissible delay in payments. Comput Oper Res 24(6):539–547

Jaggi CK, Cárdenas-Barrón LE, Tiwari S, Shafi AA (2017a) Two-warehouse inventory model for deteriorating items with imperfect quality under the conditions of permissible delay in payments. Sci Iranica Trans E, Ind Eng 24(1):390–412

Jaggi CK, Tiwari S, Goel SK (2017) Credit financing in economic ordering policies for non-instantaneous deteriorating items with price dependent demand and two storage facilities. Ann Oper Res 248(1–2):253–280

Khanna A, Gautam P, Jaggi CK (2017) Inventory modeling for deteriorating imperfect quality items with selling price dependent demand and shortage backordering under credit financing. Int JMath Eng Manag Sci 2(2):110–124

Lashgari M, Taleizadeh AA, Ahmadi A (2016) Partial up-stream advanced payment and partial down-stream delayed payment in a three-level supply chain. Ann Oper Res 238(1–2):329–354

Maiti AK, Maiti MK, Maiti M (2009) Inventory model with stochastic lead-time and price dependent demand incorporating advance payment. Appl Math Model 33(5):2433–2443

Mishra U, Tijerina-Aguilera J, Tiwari S, Cárdenas-Barrón LE (2018) Retailer’s joint ordering, pricing, and preservation technology investment policies for a deteriorating item under permissible delay in payments. Math Probl Eng

Molamohamadi Z, Arshizadeh R, Ismail N (2014) An EPQ inventory model with allowable shortages for deteriorating items under trade credit policy. Discret Dyn Nat Soc

Ouyang L, Ho C, Su C (2009) An optimization approach for joint pricing and ordering problem in an integrated inventory system with order-size dependent trade credit. Comput Ind Eng 57(3):920–930

Sarkar B (2012) An EOQ model with delay in payments and time varying deterioration rate. Math Comput Model 55(3–4):367–377

Shah NH, Shah DB, Patel DG (2015) Optimal transfer, ordering and payment policies for joint supplier–buyer inventory model with price-sensitive trapezoidal demand and net credit. Int J Syst Sci 46(10):1752–1761

Taleizadeh AA (2014) An EOQ model with partial backordering and advance payments for an evaporating item. Int J Prod Econ 155:185–193

Taleizadeh AA (2017) Lot-sizing model with advance payment pricing and disruption in supply under planned partial backordering. Int Trans Oper Res 24(4):783–800

Taleizadeh AA, Lashgari M, Akram R, Heydari J (2016) Imperfect economic production quantity model with upstream trade credit periods linked to raw material order quantity and downstream trade credit periods. Appl Math Model 40(19–20):8777–8793

Teng JT (2002) On the economic order quantity under conditions of permissible delay in payments. J Oper Res Soc 53:915–918

Teng JT, Chang CT, Goyal SK (2005) Optimal pricing and ordering policy under permissible delay in payments. Int J Prod Econ 97(2):121–129

Thangam A (2012) Optimal price discounting and lot-sizing policies for perishable items in a supply chain under advance payment scheme and two-echelon trade credits. Int. J. Production Economics 139:459–472

Tiwari S, Cárdenas-Barrón LE, Khanna A, Jaggi CK (2016) Impact of trade credit and inflation on retailer’s ordering policies for non-instantaneous deteriorating items in a two-warehouse environment. Int J Prod Econ 176:154–169

Wu J, Teng JT, Chan YL (2017) Inventory policies for perishable products with expiration dates and advance-cash-credit payment schemes. Int J Syst Sci: Oper Logist 1–17

Zhang Q, Tsao YC, Chen TH (2014) Economic order quantity under advance payment. Appl Math Model 38(24):5910–5921

Zia NP, Taleizadeh AA (2015) A lot-sizing model with backordering under hybrid linked-to-order multiple advance payments and delayed payment. Transp Res Part E: Logist Transp Rev 82:19–37

Acknowledgements

The authors wish to thank the anonymous reviewers for their suggestions leading to some improvement in the presentation of this paper.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendices

Appendix 1 (Sufficiency Conditions)

For Case I (T ≥ MR), the second-order derivatives with respect to T and PR are given by differentiating (4) and (5), respectively, i.e.,

At PR* since \( \frac{\partial Net1}{{\partial P_{R} }} = 0 \), we have R1 = 0.

Since R1 = 0,

For Case II (T < MR), the second-order derivatives with respect to T and PR are given by differentiating (8) and (9), respectively, i.e.,

Since R2 = 0

Appendix 2 (Determinant of the Hessian Matrix)

For Case I, T ≥ MR, we have

On differentiating (5), we get

The determinant of this Hessian matrix for Case I is

Since R1 = 0

i.e.,

where

Since \( \frac{{\partial^{2} {\text{Net}}1}}{{\partial {\text{T}}^{2} }} < 0 \), the condition for joint concavity of Net1 with respect to T and PR is AA > BB.

For Case II, for T < MR, we have

On differentiating (9) with respect to T, we get

The determinant of the Hessian matrix for Case II is

Since at PR2*, R2 = 0,

i.e.,

where

Since \( \frac{{\partial^{{2}} {{\text{Net}}2}}}{{{\partial {{\text{T}}}^{{2}}}} } < 0 \), the condition for concavity of Net2 is CC > DD.

Rights and permissions

Copyright information

© 2020 Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Agrawal, S., Gupta, R., Banerjee, S. (2020). EOQ Model Under Discounted Partial Advance—Partial Trade Credit Policy with Price-Dependent Demand. In: Shah, N., Mittal, M. (eds) Optimization and Inventory Management. Asset Analytics. Springer, Singapore. https://doi.org/10.1007/978-981-13-9698-4_13

Download citation

DOI: https://doi.org/10.1007/978-981-13-9698-4_13

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-13-9697-7

Online ISBN: 978-981-13-9698-4

eBook Packages: Business and ManagementBusiness and Management (R0)