Abstract

Recently, Huang and Hsu (J Oper Res Soc Jpn 50:1–13, 2007) investigated the retailer’s optimal replenishment policy with non-instantaneous receipt under trade credit and cash discount. Basically, their inventory model is correct and interesting. However, they ignored explorations of interrelations of functional behaviors of the annual total cost to locate the optimal solutions so much so that the accuracy and reliability of the process of the proof of their solution procedure are questionable. The main purpose of this paper is to provide accurate and reliable mathematical analytic solution procedures to improve the findings in the aforementioned work of Huang and Hsu (J Oper Res Soc Jpn 50:1–13, 2007). Some related recent works on the subject-matter of this investigation are also cited with a view to providing incentive and motivation for making further advances along the lines of the supply chain management and associated inventory problems which we have discussed in this article.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the year 1998, Borde and McCarty [1] pointed out that, in inventory management, economic order quantities (EOQ) may be affected as a result of the payment delays associated with trade credit, which implies that interactions may occur between trade credit and other operational considerations. From a retailer’s viewpoint, not accepting the discount and paying later may be advantageous in the presence of rapid inflation in which case a finite fund would become worthless in real terms. On the other hand, from the supplier’s perspective, Hill and Riener [8] identified several benefits and costs which are associated with cash discounts. Cash discounts typically induce some customers to pay early in exchange for a pre-specified discount. To the supplier, cash is received sooner, thereby reducing the need to borrow. An early payment discount is, in effect, a price reduction. If retailers are price elastic, cash discounts may generate greater demand for the firm’s products. Thus, cash discount can be used as a tool in the process of fine tuning the product’s price. Early payment may reduce the possibility of bad debt losses as less time would be available for buyers to develop and resolve the payment-related problems. However, on the negative side, a cash discount may directly reduce total sales revenue if unit sales volume does not increase sufficiently to offset the unit revenue loss. This may occur if buyers are price inelastic and, therefore, are not induced to buy proportionally more units of the product in response to a price reduction.

Given the importance of trade credit and the fact that some features of the firm’s cash discount problem, a lot of published articles can be found in the literature such as those by (for example) Borde and McCarty [1], Rashid and Mitra [19], Huang and Chung [9], Stokes [22], Sarker and Kindi [20], Huang and Hsu [10], Chung et al. (see [3, 5, 6]), Liao et al. (see [12, 14, 15]), and Srivastava et al. [21]. In particular, Huang and Hsu’s model in [10] is correct and interesting. However, they seem to have ignored or missed explorations of interrelations of functional behaviors of the annual total cost to locate the optimal solutions. This means that their arguments about the solution procedure are not complete. The main purposes of this paper is to present accurate and reliable mathematical analytic solution procedures to provide the complete proof of, and thereby improve, the findings in the above-mentioned work of Huang and Hsu [10]. Finally, in Sect. 7 on concluding remarks and further observations, we have chosen to include citations of a number of related recent works on the subject-matter of our present investigations with the hope to provide incentive and motivation for making further advances along the lines of the supply chain management and associated inventory problems which we have discussed in this article.

2 Model formulation

2.1 Notation

- A :

-

Cost of placing one order

- c :

-

Unit purchasing price per item

- D :

-

Demand rate per year

- h :

-

Unit stock holding cost per item per year excluding interest charges

- \(I_e\) :

-

Interest which can be earned per $ per year

- \(I_k\) :

-

Interest charges per $ investment in inventory per year

- \(M_1\) :

-

The period of cash discount in years

- \(M_2\) :

-

The period of trade credit in years, \(M_1 < M_2\)

- P :

-

Replenishment rate per year, \(P>D\) \(\displaystyle \rho =1-\frac{D}{P}>0\)

- r :

-

Cash discount rate, \(0\leqq r <1\)

- s :

-

Unit selling price per item

- T :

-

The cycle time in years (decision variable)

- Policy I. :

-

The retailer accepts the cash discount and makes the full payment within \(M_1.\)

- Policy II. :

-

The retailer does not accept the cash discount and makes the full payment within \(M_2.\)

2.2 Assumptions

-

(1)

Demand rate, D, is known and constant.

-

(2)

Replenishment rate, P, is known and constant.

-

(3)

Shortages are not allowed.

-

(4)

Time horizon is infinite.

-

(5)

\(s\geqq c\;\) and \(\;I_k\geqq I_e\).

-

(6)

Supplier offers a cash discount after settlement of an order if payment is paid within \(M_1,\) otherwise the full payment is paid within \(M_2\). The account is settled when the payment is paid.

-

(7)

During the time the account is not settled, generated sales revenue is deposited in an interest-bearing account. At the end of the period, the retailer pays off all units sold and keeps his/her profits, and starts paying for the higher interest charges on the items in stock.

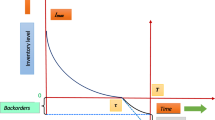

2.3 Mathematical model

According to Assumption (6), the retailer has the following two policies (Policy I and Policy II) to choose from:

- Policy I.:

-

The retailer accepts the cash discount and makes the full payment within \(M_1\).

- Policy II.:

-

The retailer does not accept the cash discount and makes the full payment within \(M_2\).

Huang and Hsu [10] divided the annual total relevant cost into two cases to be discussed as follows:

Case 1. The retailer adopts Policy I.

where

and

Case 2. The retailer adopts Policy II.

where

and

Combining Cases 1 and 2, the annual total relevant cost can be expressed as follows:

3 The Convexity of \(TVC_{ij}(T)\;\; (i=1,2;\;j=1,2,3)\)

For convenience, we treat all \(\displaystyle TVC_{ij}(T)\;\;(i=1,2;\;j=1,2,3)\) are defined on \(T>0\). Equations (2), (3), (6), (7), (8) and (10) yield

and

and

Let

and

Remark 1

Equations (22)–(25) imply that \(H_1>G_1,\) \(H_2>G_2\) and \(G_1>G_2\). Equations (11), (13), (15), (17), (19) and (21) imply the results asserted by Theorem 1 below.

Theorem 1

Each of the following assertions hold true :

-

(i)

\(TVC_{11}(T)\) is convex on \(T>0\) if \(G_1>0\) and concave on \(T>0\) if \(G_1 \leqq 0\). Furthermore, \(TVC_{11}'(T)>0\) and \(TVC_{11}(T)\) is increasing on \(T>0\) if \(G_1\leqq 0\).

-

(ii)

\(TVC_{12}(T)\) is convex on \(T>0\) if \(H_1>0\) and concave on \(T>0\) if \(H_1 \leqq 0\). Furthermore, \(TVC_{12}'(T)>0\) and \(TVC_{12}(T)\) is increasing on \(T>0\) if \(H_1\leqq 0\).

-

(iii)

\(TVC_{13}(T)\) is convex on \(T>0\).

-

(iv)

\(TVC_{21}(T)\) is convex on \(T>0\) if \(G_2>0\) and concave on \(T>0\) if \(G_2 \leqq 0\). Furthermore, \(TVC_{21}'(T)>0\) and \(TVC_{21}(T)\) is increasing on \(T>0\) if \(G_2\leqq 0\).

-

(v)

\(TVC_{22}(T)\) is convex on \(T>0\) if \(H_2>0\) and concave on \(T>0\) if \(H_2 \leqq 0\). Furthermore, \(TVC_{22}'(T)>0\) and \(TVC_{22}(T)\) is increasing on \(T>0\) if \(H_2\leqq 0\).

-

(vi)

\(TVC_{23}(T)\) is convex on \(T>0\).

Letting

and solving Eq. (26), we obtain

which provide the respective solution of Eq. (26). We also have

for \(i=1\) and 2. Furthermore, we also have

if \(G_1>0\) for \(j=1\) and \(H_1>0\) for \(j=2\), and

if \(G_2>0\) for \(j=1\) and \(H_2>0\) for \(j=2\).

4 Mathemsatical Analytic Solution Procedure Used by Huang and Hsu [10]

Let \(T^*_i\) denote the optimal solution of \(TVC_i(T)\) for \(i=1\) and \(i=2\). Huang and Hsu [10] recorded their conclusions as follows:

-

Conclusion (A):

\(T^*_1=T^*_{11} \text{ if } T^*_{11}\displaystyle \geqq \frac{PM_1}{D}\).

-

Conclusion (B):

\(T^*_1=T^*_{12} \text{ if } M_1\displaystyle \leqq T^*_{12}\leqq \frac{PM_1}{D}\).

-

Conclusion (C):

\(T^*_1=T^*_{13} \text{ if } 0< T^*_{13}\displaystyle \leqq M_1\).

-

Conclusion (D):

\(T^*_2=T^*_{21} \text{ if } T^*_{21}\displaystyle \geqq \displaystyle \frac{PM_2}{D}\).

-

Conclusion (E):

\(T^*_2=T^*_{22} \text{ if } M_2\displaystyle \leqq T^*_{22}\leqq \frac{PM_2}{D}\).

-

Conclusion (F):

\(T^*_2=T^*_{23} \text{ if } 0< T^*_{23}\displaystyle \leqq M_2\).

We just need to discuss Conclusion (A). The same arguments in Conclusion (A) can be applied to Conclusions (B) to (F). About Conclusion (A), the following inequality:

only means that the optimal solution \(T^*_{11}\) of \(TVC_{11}(T)\) lies in the interval \(\displaystyle \left[ \frac{PM_1}{D}, \infty \right) \).

Basically, the equations 1(a, b, c) reveal the fact that the graph of \(TVC_1(T)\) consists of those of \(TVC_{11}(T), TVC_{12}(T)\) and \(TVC_{13}(T)\) on the respective domain of \(TVC_1(T)\).

In fact, if

we can only conclude that \(T^*_{11}\) is the optimal solution of \(TVC_1(T)\) on the interval \(\displaystyle \left[ \frac{PM_1}{D}, \infty \right) \), but \(T^*_{11}\) is not necessarily the optimal solution \(T^*_1\) of \(TVC_1(T)\) on the whole domain \(T>0\). The function \(TVC_{11}(T)\) can not solely determine the optimal solution of \(TVC_1(T)\), since the graphs of \(TVC_{11}(T)\) and \(TVC_1(T)\) are different. It should explore the functional behaviors of \(TVC_{11}(T)\), \(TVC_{12}(T)\) and \(TVC_{13}(T)\) on the following intervals:

respectively, to jointly decide whether \(T^*_{11}\) is the optimal solution \(T_1^*\) of \(TVC_1(T)\) on the whole domain \(T>0\).

In spite of the above observation, Huang and Hsu [10] ignores the explorations of the interrelations of the functional behaviors of \(TVC_{11}(T),\) \(TVC_{12}(T)\) and \(TVC_{13}(T)\) on the respective domain of \(TVC_1(T)\) so much so that their arguments about the solution procedure are not reliable. So, their processes of proof of Conclusion (A) are questionable. The above arguments about Conclusion (A) can be applied to Conclusions (B) to (F). Thus, clearly, the processes of proof of Theorem 1 in the work of Huang and Hsu [10] are not complete.

5 Theorems for the Optimal Cycle Time \(T^*\) of TVC(T)

Case 1. The retailer adopts Policy I.

In this case, we recall from the equations 1(a,b,c) that

We then find that

Hence the function \(TVC_1(T)\) is continuous and well-defined. All of the functions \(TVC_{11}(T),\) \(TVC_{12}(T),\) \(TVC_{13}(T)\) and \(TVC_1(T)\) are defined on \(T>0\). Furthermore, we have

and

Case 2. The retailer adopts Policy II.

In this case, we recall from the equations 5(a,b,c) that

We then find that

Hence the function \(TVC_2(T)\) is continuous and well-defined. All of the functions \(TVC_{21}(T),\) \(TVC_{22}(T),\) \(TVC_{23}(T)\) and \(TVC_2(T)\) are defined on \(T>0\). Furthermore, we have

and

Let

and

Equations(40)–(43) reveal that

and

We then have the following results.

Theorem 2

If \(H_1\leqq 0,\) then

and \(T^*=T^*_{13}\) or \(T^*_{23}\) are associated with the least cost. Furthermore, there are three cases to occur :

-

(A)

If \(sI_e(M_1-M_2)+cr>0,\) then \(T^*=T^*_{13}\) and Policy I is better.

-

(B)

\(TVC_{12}(T)\) is convex on \(T>0\) if \(H_1>0\) and concave on \(T>0\) if \(H_1 \leqq 0\). Furthermore, \(TVC_{12}'(T)>0\) and the function \(TVC_{12}(T)\) is increasing on \(T>0\) if \(H_1\leqq 0\).

-

(C)

If \(sI_e(M_1-M_2)+cr<0,\) then \(T^*=T^*_{23}\) and Policy II is better.

Proof

If \(H_1\leqq 0\), then \(\Delta _2>0\). Equations (44) and (45) reveal that \(\Delta _1>0,\Delta _2>0, \Delta _3>0\) and \(\Delta _4>0\). Thus, together with Theorem 1, we can arrive at the following observations:

-

(i)

\(TVC_{13}(T)\) is decreasing on \((0, T^*_{13}]\) and increasing on \([T^*_{13}, M_1]\).

-

(ii)

\(TVC_{12}(T)\) is increasing on \(\displaystyle \left[ M_1, \frac{PM_1}{D}\right] \).

-

(iii)

\(TVC_{11}(T)\) is increasing on \(\displaystyle \left[ \frac{PM_1}{D}, \infty \right) \).

-

(iv)

\(TVC_{23}(T)\) is decreasing on \((0, T^*_{23}]\) and increasing on \([T^*_{23}, M_2]\).

-

(v)

\(TVC_{22}(T)\) is increasing on \(\displaystyle \left[ M_2, \frac{PM_2}{D}\right] \).

-

(vi)

\(TVC_{21}(T)\) is increasing on \(\displaystyle \left[ \frac{PM_2}{D}, \infty \right) \).

Now, by combining the equations 1(a, b, c), 5(a, b, c) and (i) to (vi), we conclude that \(T^*_1=T^*_{13}\) and \(T^*_2=T^*_{23}\). Equations 9(a, b) imply that

So, \(T^*=T^*_{13}\) or \(T^*_{23}\) is associated with the least cost.

Equations (30) and (32) reveal that \(T^*_{13}=T^*_{23}\). On the other hand, the equations (1c) and (5c) imply that

so that

There are the following three cases to occur :

-

(A)

If \(sI_e(M_1-M_2)+cr>0,\) then

$$\begin{aligned} TVC_2(T^*_2)=TVC_{23}(T^*_{23})>TVC_{13}(T^*_{13})=TVC_1(T^*_1), \end{aligned}$$so \(T^*=T^*_{13}\) and Policy I is better.

-

(B)

If \(sI_e(M_1-M_2)+cr=0,\) then

$$\begin{aligned} TVC_2(T^*_2)=TVC_{23}(T^*_{23})=TVC_{13}(T^*_{13})=TVC_1(T^*_1), \end{aligned}$$so \(T^*=T^*_{13}=T^*_{23}\) and Policy I and Policy II are not different.

-

(C)

If \(sI_e(M_1-M_2)+cr<0,\) then

$$\begin{aligned} TVC_2(T^*_2)=TVC_{23}(T^*_{23})<TVC_{13}(T^*_{13})=TVC_1(T^*_1), \end{aligned}$$so \(T^*=T^*_{23}\) and Policy II is better.

Incorporating the above arguments, we have completed the proof of Theorem 1. \(\square \)

Remark 2

If \(H_1\leqq 0,\) then \(0>G_1>G_2\). Equations (28), (29), (31) and (31) reveal that \(T^*_{11},T^*_{12}\) and \(T^*_{21}\) do not exist. Therefore, the assertions of Theorem 1(B, C, D, E, F) in Huang and Hsu [10] do not hold true.

Theorem 3

Suppose that \(H_1>0,\) \(G_1\leqq 0\) and \(H_2\leqq 0\). The following assertions hold true :

-

(A)

If \(\Delta _2>0,\) then

$$\begin{aligned} TVC(T^*)=\min \{TVC_1(T^*_{13}),TVC_2(T^*_{23})\} \end{aligned}$$and \(T^*=T^*_{13}\) or \(T^*_{23}\) is associated with the least cost. Furthermore, there are the following three cases to occur :

-

(i)

If \(sI_e(M_1-M_2)+cr>0,\) then \(T^*=T^*_{13}\) and Policy I is better.

-

(ii)

If \(sI_e(M_1-M_2)+cr=0,\) then \(T^*=T^*_{13}=T^*_{23}\) and Policy I and Policy II are not different.

-

(iii)

If \(sI_e(M_1-M_2)+cr<0,\) then \(T^*=T^*_{23}\) and Policy II is better.

-

(i)

-

(B)

If \(\Delta _2\leqq 0,\) then

$$\begin{aligned} TVC(T^*)=\min \{TVC_1(T^*_{12}), TVC_2(T^*_{23})\} \end{aligned}$$and \(T^*=T^*_{12}\) or \(T^*_{23}\) is associated with the least cost.

Proof

If \(G_1\leqq 0\) and \(H_2\leqq 0\), then \(TVC'_{11}(T)>0,\) \(TVC'_{21}(T)>0\) and \(TVC'_{22}(T)>0\).

Equations (40), (42) and (43) reveal that \(\Delta _1>0,\) \(\Delta _3>0\) and \(\Delta _4>0\). Therefore, in view of Theorem 1, we can get

-

(A)

If \(\Delta _2>0\), the proof of (A) is the same as that of Theorem 2.

-

(B)

If \(\Delta _2 \leqq 0\), we have

-

(i)

\(TVC_{13}(T)\) is decreasing on \((0, M_1]\).

-

(ii)

\(TVC_{12}(T)\) is decreasing on \([M_1, T^*_{12}]\) and increasing on \(\displaystyle \left[ T^*_{12},\frac{PM_1}{D}\right] \).

-

(iii)

\(TVC_{11}(T)\) is increasing on \(\displaystyle \left[ \frac{PM_1}{D},\infty \right) \).

-

(iv)

\(TVC_{23}(T)\) is decreasing on \((0, T^*_{23}]\) and increasing on \(\displaystyle [T^*_{23}, M_2]\).

-

(v)

\(TVC_{22}(T)\) is increasing on \(\displaystyle \left[ M_2,\frac{PM_2}{D}\right] \).

-

(vi)

\(TVC_{21}(T)\) is increasing on \(\displaystyle \left[ \frac{PM_2}{D}, \infty \right) \).

By combining the equations 1(a,b,c), 5(a,b,c) and (i) to (vi), we conclude that \(T^*_1=T^*_{12}\) and \(T^*_2=T^*_{23}\). Equations 9(a,b) imply that

so \(T^*=T^*_{12}\) or \(T^*_{23}\) is associated with the least cost.

Incorporating the above arguments, we have completed the proof of Theorem 3. \(\square \)

Remark 3

If \(H_2\leqq 0\) and \(G_1\leqq 0\), then \(G_2\leqq 0\). Equations (27), (30) and (31) reveal that \(T^*_{11},\) \(T^*_{21}\) and \(T^*_{22}\) do not exist. Therefore, the assertions of Theorem 1(C, D, E, F) in Huang and Hsu [10] are not valid.

Theorem 4

Suppose that \(H_1>0,\) \(G_1 \leqq 0, H_2>0\) and \(G_2\leqq 0\). The following assertions hold true :

-

(A)

If \(\Delta _2 >0,\) then

$$\begin{aligned} TVC(T^*)=\min \{TVC_1(T^*_{13}), TVC_2(T^*_{23})\} \end{aligned}$$and \(T^*=T^*_{13}\) or \(T^*_{23}\) is associated with the least cost. Furthermore, there are the following three cases to occur :

-

(i)

If \(sI_e(M_1-M_2)+cr>0,\) then \(T^*=T^*_{13}\) and Policy I is better.

-

(ii)

If \(sI_e(M_1-M_2)+cr=0,\) then \(T^*=T^*_{13}=T^*_{23}\) and Policy I and Policy II are not different.

-

(iii)

If \(sI_e(M_1-M_2)+cr<0,\) then \(T^*=T^*_{23}\) and Policy II is better.

-

(i)

-

(B)

If \(\Delta _4 >0\) and \(\Delta _2 \leqq 0,\) then

$$\begin{aligned} TVC(T^*)=\min \{TVC_1(T^*_{12}), TVC_2(T^*_{23})\} \end{aligned}$$and \(T^*=T^*_{12}\) or \(T^*_{23}\) is associated with the least cost.

-

(C)

If \(\Delta _4 \leqq 0,\) then

$$\begin{aligned} TVC(T^*)=\min \{TVC_1(T^*_{12}), TVC_2(T^*_{22})\} \end{aligned}$$and \(T^*=T^*_{12}\) or \(T^*_{22}\) is associated with the least cost.

Proof

If \(G_1\leqq 0\) and \(G_2\leqq 0\), then \(TVC'_{11}(T)>0\) and \(TVC'_{21}(T)>0\). Equations (40) and (42) reveal that \(\Delta _1>0\) and \(\Delta _3 >0\). Thus, in light of Theorem 1, we can get

-

(A)

If \(\Delta _2 >0\), then \(\Delta _4 >0\). So, the proof of is the same as that of Theorem 2.

-

(B)

If \(\Delta _4 >0\), then \(\Delta _2 \leqq 0\), then the proof of (B) is the same as that of Theorem 3(B).

-

(C)

If \(\Delta _4 \leqq 0\), then \(\Delta _2 <0\). We have the following cases:

-

(i)

\(TVC_{13}(T)\) is decreasing on \((0, M_1]\).

-

(ii)

\(TVC_{12}(T)\) is decreasing on \([M_1, T^*_{12}]\) and increasing on \(\displaystyle \left[ T^*_{12},\frac{PM_1}{D}\right] \).

-

(iii)

\(TVC_{11}(T)\) is increasing on \(\displaystyle \left[ \frac{PM_1}{D},\infty \right) \).

-

(iv)

\(TVC_{23}(T)\) is decreasing on \((0, M_2]\).

-

(v)

\(TVC_{22}(T)\) is decreasing on \([M_2, T^*_{22}]\) and increasing on \(\displaystyle \left[ T^*_{22}, \frac{PM_2}{D}\right] \).

-

(vi)

\(TVC_{23}(T)\) is increasing on \(\displaystyle \left[ \frac{PM_2}{D},\infty \right) \).

-

(i)

Thus, if we combine the equations 1(a,b,c), 5(a,b,c) and (i) to (vi), we conclude that \(T^*_1=T^*_{12}\) and \(T^*_2=T^*_{22}\). Equations 9(a, b) imply that

so \(T^*=T^*_{12}\) or \(T^*_{22}\) is associated with the least cost.

Incorporating the above arguments, we have completed the proof of Theorem 4. \(\square \)

Remark 4

If \(G_1\leqq 0\) and \(G_2\leqq 0\), then \(TVC'_{11}(T)>0\) and \(TVC'_{21}(T)>0\). Equations (27) and (30) reveal that \(T^*_{11}\) and \(T^*_{21}\) do not exist. Therefore, the assertions of Theorem 1(D, E, F) in Huang and Hsu [10] do not hold true.

Theorem 5

Suppose that \(G_1>0\) and \(H_2\leqq 0\). The following assertions hold true :

-

(A)

If \(\Delta _2 >0,\) then

$$\begin{aligned} TVC(T^*)=\min \{TVC_1(T^*_{13}), TVC_2(T^*_{23})\} \end{aligned}$$and \(T^*=T^*_{13}\) or \(T^*_{23}\) is associated with the least cost. Furthermore, there are the following three cases to occur :

-

(i)

If \(sI_e(M_1-M_2)+cr>0,\) then \(T^*=T^*_{13}\) and Policy I is better.

-

(ii)

If \(sI_e(M_1-M_2)+cr=0,\) then \(T^*=T^*_{13}=T^*_{23}\) and Policy I and Policy II are not different.

-

(iii)

If \(sI_e(M_1-M_2)+cr<0,\) then \(T^*=T^*_{23}\) and Policy II is better.

-

(i)

-

(B)

If \(\Delta _1 >0\) and \(\Delta _2 \leqq 0,\) then

$$\begin{aligned} TVC(T^*)=\min \{TVC_1(T^*_{12}), TVC_2(T^*_{23})\} \end{aligned}$$and \(T^*=T^*_{12}\) or \(T^*_{23}\) is associated with the least cost.

-

(C)

If \(\Delta _1 \leqq 0,\) then

$$\begin{aligned} TVC(T^*)=\min \{TVC_1(T^*_{11}), TVC_2(T^*_{23})\} \end{aligned}$$and \(T^*=T^*_{11}\) or \(T^*_{23}\) is associated with the least cost.

Proof

If \(H_2\leqq 0\) and \(G_2\leqq 0\), we have \(TVC'_{21}(T)>0\) and \(TVC'_{22}(T)>0\). Equations (42) and (43) reveal that \(\Delta _3>0\) and \(\Delta _4 >0\). Together with Theorem 1, we can get

-

(A)

If \(\Delta _2 >0\), then \(\Delta _1 >0\). So, the proof of (A) is the same as that of Theorem 2.

-

(B)

If \(\Delta _1 >0\), then \(\Delta _2 \leqq 0\), then the proof of (B) is the same as that of Theorem 3(B).

-

(C)

If \(\Delta _1 \leqq 0\), then \(\Delta _2 <0\). We have

-

(i)

\(TVC_{13}(T)\) is decreasing on \((0, M_1]\).

-

(ii)

\(TVC_{12}(T)\) is decreasing on \(\displaystyle \left[ M_1,\frac{PM_1}{D}\right] \).

-

(iii)

\(TVC_{11}(T)\) is decreasing on \(\displaystyle \left[ \frac{PM_1}{D},T^*_{11}\right] \) and increasing on \([T^*_{11},\infty )\).

-

(iv)

\(TVC_{23}(T)\) is decreasing on \((0, ~T^*_{23}]\) and increasing on \([T^*_{23},M_2]\).

-

(v)

\(TVC_{22}(T)\) is increasing on \(\displaystyle \left[ M_2,\frac{PM_2}{D}\right] \).

-

(vi)

\(TVC_{21}(T)\) is increasing on \(\displaystyle \left[ \frac{PM_2}{D},\infty \right) \).

-

(i)

Upon combining the equations 1(a,b,c), 5(a,b,c) and (i) to (vi), we conclude that \(T^*_1=T^*_{11}\) and \(T^*_2=T^*_{23}\). Equations 9(a,b) imply that

so \(T^*=T^*_{11}\) or \(T^*_{23}\) is associated with the least cost.

Incorporating the above arguments, we have completed the proof of Theorem 5. \(\square \)

Remark 5

If \(H_2\leqq 0\) and \(G_2\leqq 0\), then Eqs. (30) and (31) reveal that \(T^*_{21}\) and \(T^*_{22}\) do not exist. Therefore, the assertions of Theorem 1(C, E, F) in Huang and Hsu [10] is not true.

Theorem 6

Suppose that \(G_1>0, H_2>0\) and \(G_2\leqq 0\). The following assertions hold true :

-

(A)

If \(\Delta _2 >0,\) then

$$\begin{aligned} TVC(T^*)=\min \{TVC_1(T^*_{13}), TVC_2(T^*_{23})\} \end{aligned}$$and \(T^*=T^*_{13}\) or \(T^*_{23}\) is associated with the least cost. Furthermore, there are the following three cases to occur :

-

(i)

If \(sI_e(M_1-M_2)+cr>0,\) then \(T^*=T^*_{13}\) and Policy I is better.

-

(ii)

If \(sI_e(M_1-M_2)+cr=0,\) then \(T^*=T^*_{13}=T^*_{23}\) and Policy I and Policy II are not different.

-

(iii)

If \(sI_e(M_1-M_2)+cr<0,\) then \(T^*=T^*_{23}\) and Policy II is better.

-

(i)

-

(B)

If \(\Delta _4 >0,\) \(\Delta _1 >0\) and \(\Delta _2 \leqq 0,\) then

$$\begin{aligned} TVC(T^*)=\min \{TVC_1(T^*_{12}),TVC_2(T^*_{23})\} \end{aligned}$$and \(T^*=T^*_{12}\) or \(T^*_{23}\) is associated with the least cost.

-

(C)

If \(\Delta _4 \leqq 0\) and \(\Delta _1 >0,\) then

$$\begin{aligned} TVC(T^*)=\min \{TVC_1(T^*_{12}),TVC_2(T^*_{22})\} \end{aligned}$$and \(T^*=T^*_{12}\) or \(T^*_{22}\) is associated with the least cost.

-

(D)

If \(\Delta _4 > 0\) and \(\Delta _1 \leqq 0\), then

$$\begin{aligned} TVC(T^*)=\min \{TVC_1(T^*_{11}), TVC_2(T^*_{23})\} \end{aligned}$$and \(T^*=T^*_{11}\) or \(T^*_{23}\) is associated with the least cost.

-

(E)

If \(\Delta _4 \leqq 0\) and \(\Delta _1 \leqq 0,\) then

$$\begin{aligned} TVC(T^*)=\min \{TVC_1(T^*_{11}), TVC_2(T^*_{22})\} \end{aligned}$$and \(T^*=T^*_{11}\) or \(T^*_{22}\) is associated with the least cost.

Proof

If \(G_2\leqq 0\), then \(TVC'_{21}(T)>0\). Equation (42) reveals that \(\Delta _3>0\).

So, together with Theorem 1, we can get

-

(A)

If \(\Delta _2 >0,\) then \(\Delta _1 >0\) and \(\Delta _4 >0\). The proof of (A) is the same as that of Theorem 2.

-

(B)

If \(\Delta _4 >0,\) \(\Delta _1 >0\) and \(\Delta _2 \leqq 0,\) then the proof of (B) is the same as that of Theorem 3(B).

-

(C)

If \(\Delta _4 \leqq 0\) and \( \Delta _1 >0,\) then \(\Delta _2 <0\). The proof of (C) is the same as that of Theorem 4(C).

-

(D)

If \(\Delta _4 > 0\) and \( \Delta _1 \leqq 0,\) then \(\Delta _2 <0\). The proof of (D) is the same as that of Theorem 5(C).

-

(E)

If \(\Delta _4 \leqq 0\) and \( \Delta _1 \leqq 0,\) then \(\Delta _2 <0\). We have the following cases:

-

(i)

\(TVC_{13}(T)\) is decreasing on \((0, ~M_1]\).

-

(ii)

\(TVC_{12}(T)\) is decreasing on \(\displaystyle \left[ M_1,\frac{PM_1}{D}\right] \).

-

(iii)

\(TVC_{11}(T)\) is decreasing on \(\displaystyle \left[ \frac{PM_1}{D},T^*_{11}\right] \) and increasing on \([T^*_{11}, \infty )\).

-

(iv)

\(TVC_{23}(T)\) is decreasing on \((0, M_2]\).

-

(iv

\(TVC_{22}(T)\) is decreasing on \([M_2,T^*_{22}]\) and increasing on \(\displaystyle \left[ T^*_{22},\frac{PM_2}{D}\right] \).

-

(vi)

\(TVC_{21}(T)\) is increasing on \(\displaystyle \left[ \frac{PM_2}{D},\infty \right) \).

-

(i)

Combining the equations 1(a,b,c), 5(a,b,c) and (i) to (vi), we conclude that \(T^*_1=T^*_{11}\) and \(T^*_2=T^*_{22}\). Equations 9(a, b) imply that

so \(T^*=T^*_{11}\) or \(T^*_{22}\) is associated with the least cost.

Incorporating the above arguments, we have completed the proof of Theorem 6. \(\square \)

Remark 6

If \(G_2\leqq 0\), Eq. (30) reveals that \(T^*_{21}\) does not exist. Therefore, the assertions of Theorem 1(F) in Huang and Hsu [10] are not true.

Theorem 7

Suppose that \(G_2>0\). The following assertions hold true :

-

(A)

If \(\Delta _2 >0,\) then

$$\begin{aligned} TVC(T^*)=\min \{TVC_1(T^*_{13}), TVC_2(T^*_{23})\}, \end{aligned}$$so \(T^*=T^*_{13}\) or \(T^*_{23}\) is associated with the least cost. Furthermore, there are the following three cases to occur :

-

(i)

If \(sI_e(M_1-M_2)+cr>0,\) then \(T^*=T^*_{13}\) and Policy I is better.

-

(ii)

If \(sI_e(M_1-M_2)+cr=0,\) then \(T^*=T^*_{13}=T^*_{23}\) and Policy I and Policy II are not different.

-

(iii)

If \(sI_e(M_1-M_2)+cr<0,\) then \(T^*=T^*_{23}\) and Policy II is better.

-

(i)

-

(B)

If \(\Delta _1 >0,\) \(\Delta _2 \leqq 0\) and \(\Delta _4 > 0,\) then

$$\begin{aligned} TVC(T^*)=\min \{TVC_1(T^*_{12}),TVC_2(T^*_{23})\}, \end{aligned}$$so \(T^*=T^*_{12}\) or \(T^*_{23}\) is associated with the least cost.

-

(C)

If \(\Delta _1 > 0\) and \(\Delta _4 \leqq 0,\) then

$$\begin{aligned} TVC(T^*)=\min \{TVC_1(T^*_{12}),TVC_2(T^*_{22})\}, \end{aligned}$$so \(T^*=T^*_{12}\) or \(T^*_{22}\) is associated with the least cost.

-

(D)

If \(\Delta _1 \leqq 0\) and \(\Delta _4 > 0,\) then

$$\begin{aligned} TVC(T^*)=\min \{TVC_1(T^*_{11}),TVC_2(T^*_{23})\} \end{aligned}$$so \(T^*=T^*_{11}\) or \(T^*_{23}\) is associated with the least cost.

-

(E)

If \(\Delta _1 \leqq 0,\) \(\Delta _3 >0\) and \(\Delta _4 \leqq 0,\) then

$$\begin{aligned} TVC(T^*)=\min \{TVC_1(T^*_{11}),TVC_2(T^*_{22})\}, \end{aligned}$$so \(T^*=T^*_{11}\) or \(T^*_{22}\) is associated with the least cost.

-

(F)

If \(\Delta _3\leqq 0,\) then

$$\begin{aligned} TVC(T^*)=\min \{TVC_1(T^*_{11}), TVC_2(T^*_{21})\}, \end{aligned}$$so \(T^*=T^*_{11}\) or \(T^*_{21}\) is associated with the least cost.

Proof

We consider the following situations:

-

(A)

If \(\Delta _2 >0,\) then \(\Delta _1 >0,\) \(\Delta _3 >0\) and \(\Delta _4 >0\). The proof of (A) is the same as that of Theorem 2.

-

(B)

If \(\Delta _1 >0,\) \(\Delta _2 \leqq 0\) and \(\Delta _4 > 0,\) then \(\Delta _3 >0\). The proof of (B) is the same as that of Theorem 3(B).

-

(C)

If \(\Delta _1 > 0\) and \( \Delta _4 \leqq 0,\) then \(\Delta _3 >0\) and \(\Delta _2 <0\). The proof of (C) is the same as that of Theorem 4(C).

-

(D)

If \(\Delta _1 \leqq 0\) and \( \Delta _4 > 0,\) then \(\Delta _2 <0\) and \(\Delta _3 > 0\). The proof of (D) is the same as that of Theorem 5(C).

-

(E)

If \(\Delta _1 \leqq 0,\) \(\Delta _3 > 0\) and \(\Delta _4 \leqq 0,\) then \(\Delta _2 <0\). The proof of (E) is the same as that of Theorem 6(E).

-

(F)

If \(\Delta _3 \leqq 0,\) then \(\Delta _1 < 0,\) \(\Delta _2 < 0\) and \(\Delta _4 <0\). Thus, together with Theorem 1, we can get

-

(i)

\(TVC_{13}(T)\) is decreasing on \((0, M_1]\).

-

(ii)

\(TVC_{12}(T)\) is decreasing on \(\displaystyle \left[ M_1, \frac{PM_1}{D}\right] \).

-

(iii)

\(TVC_{11}(T)\) is decreasing on \(\displaystyle \left[ \frac{PM_1}{D},T^*_{11}\right] \) and increasing on \([T^*_{11}, \infty )\).

-

(iv)

\(TVC_{23}(T)\) is decreasing on \((0, M_2]\).

-

(v)

\(TVC_{22}(T)\) is decreasing on \(\displaystyle \left[ M_2, \frac{PM_2}{D}\right] \).

-

(vi)

\(TVC_{21}(T)\) is decreasing on \(\displaystyle \left[ \frac{PM_2}{D}, T^*_{21}\right] \) and increasing on \([T^*_{21},\infty )\).

-

(i)

Combining the equations 1(a,b,c), 5(a,b,c) and the items (i) to (vi), we conclude that \(T^*_1=T^*_{11}\) and \(T^*_2=T^*_{21}\). Equations 9(a,b) imply that

Consequently, \(T^*=T^*_{11}\) or \(T^*_{21}\) is associated with the least cost. Incorporating the above arguments, we have completed the proof of Theorem 7. \(\square \)

Remark 7

By combining all of the arguments of Theorems 2–7, we are led to the complete proof of Theorem 1 in Huang and Hsu [10]. We thus obtain the following result.

Theorem 8

Each of the following assertions hold true :

-

(A)

If \(\Delta _2 >0,\) then

$$\begin{aligned} TVC(T^*)=\min \{TVC_1(T^*_{13}),TVC_2(T^*_{23})\} \end{aligned}$$and \(T^*=T^*_{13}\) or \(T^*_{23}\) is associated with the least cost. There are three cases to occur in this case.

-

(i)

If \(sI_e(M_1-M_2)+cr>0,\) then \(T^*=T^*_{13}\) and Policy I is better.

-

(ii)

If \(sI_e(M_1-M_2)+cr=0,\) then \(T^*=T^*_{13}=T^*_{23}\) and Policy I and Policy II are not different.

-

(iii)

If \(sI_e(M_1-M_2)+cr<0,\) then \(T^*=T^*_{23}\) and Policy II is better.

-

(i)

-

(B)

If \(\Delta _1 >0,\) \(\Delta _2 \leqq 0\) and \(\Delta _4 > 0,\) then

$$\begin{aligned} TVC(T^*)=\min \{TVC_1(T^*_{12}),TVC_2(T^*_{23})\} \end{aligned}$$and \(T^*=T^*_{12}\) or \(T^*_{23}\) is associated with the least cost.

-

(C)

If \(\Delta _1 > 0\) and \(\Delta _4 \leqq 0,\) then

$$\begin{aligned} TVC(T^*)=\min \{TVC_1(T^*_{12}), TVC_2(T^*_{22})\} \end{aligned}$$and \(T^*=T^*_{12}\) or \(T^*_{22}\) is associated with the least cost.

-

(D)

If \(\Delta _1 \leqq 0\) and \(\Delta _4 > 0,\) then

$$\begin{aligned} TVC(T^*)=\min \{TVC_1(T^*_{11}), TVC_2(T^*_{23})\} \end{aligned}$$and \(T^*=T^*_{11}\) or \(T^*_{23}\) is associated with the least cost.

-

(E)

If \(\Delta _1 \leqq 0,\) \(\Delta _3 >0\) and \(\Delta _4 \leqq 0,\) then

$$\begin{aligned} TVC(T^*)=\min \{TVC_1(T^*_{11}), TVC_2(T^*_{22})\} \end{aligned}$$and \(T^*=T^*_{11}\) or \(T^*_{22}\) is associated with the least cost.

-

(F)

If \(\Delta _3 \leqq 0,\) then

$$\begin{aligned} TVC(T^*)=\min \{TVC_1(T^*_{11}), TVC_2(T^*_{21})\} \end{aligned}$$and \(T^*=T^*_{11}\) or \(T^*_{21}\) is associated with the least cost.

Remark 8

Basically, Theorem 8 is consistent with Theorem 1 in the work of Huang and Hsu [10]. Furthermore, Theorem 8(A) above simplifies Theorem 1(A) in this paper by Huang and Hsu [10].

6 Numerical Examples

Forty-two numerical examples are used here to explain and illustrate all of the results in the paper. The necessary parameters and the optimal solutions of the forty-two examples are presented in Tables 1 and 2. All dimensions of the parameters involved in this paper are the same as those in Huang and Hsu [10]. The optimal policies adopted by all examples in Huang and Hsu [10] are included in Policy I. However, the optimal policies adopted by all examples in this paper consist of Policy I as well as Policy II. Therefore, all of results presented in Table 2 are more informative and more meaningful than those in Huang and Hsu [10].

In Table 2 above, the following abbreviations and conventions have been used:

Theorem: Which Theorem is applied? N: No, it does not exist. Y: Yes, it exists.

(*): The optimal solution. \((\alpha )\): Which policy is adopted: Policy I or Policy II.?

7 Concluding remarks and further observations

According to the facts that \(H_1>H_2,\) \(H_2>G_2\) and \(G_1>G_2\), Theorem 1 characterizes the familiar convexity and concavity properties of \(TVC_{ij}(T)\;\; (i=1,2;\; j=1,2,3)\) into six situations (see, for details, [25]). These six situations represent six different types of graphs of \(TVC_{ij}(T)\;\; (i=1,2;\;j=1,2,3)\). Although Theorem 1 in the investigation by Huang and Hsu [10] is correct, Huang and Hsu [10] ignored explorations of interrelations of the functional behaviors of \(TVC_{ij}(T)\;\;(i=1,2;\;j=1,2,3)\) on the respective domain of \(TVC_{ij}(T)\;\;(i=1,2;\;j=1,2,3)\) such that the accuracy and reliability of the process of the proof of Theorem 1 in Huang and Hsu [10] to specify the optimal solution are questionable. This paper removes all of these drawbacks and presents a complete mathematical analytic proof for Theorem 1 in Huang and Hsu [10]. Numerical examples illustrate all of the results which are presented in this paper.

Finally, with a view to providing incentive and motivation for making further advances along the lines of the supply chain management and associated inventory problems which we have discussed in our present investigation, we choose to cite several related recent works including (for example) those by Cárdenas-Barrón et al. [2], Chung et al. (see [4, 7]), Khan et al. [11], Liao et al. (see [13, 16, 17]), Modak et al. [18], Tiwari et al. [23], Udayakumar and Geetha [24], and Wójtowicz [26].

References

Borde, S.F., McCarty, D.E.: Determining the cash discount in the firm’s credit policy: an evaluation. J. Financ. Strat. Decis. 11, 41–49 (1998)

Cárdenas-Barrón, L.E., Chung, K.-J., Kazemi, N., Shekarian, E.: Optimal inventory system with two backlog costs in response to a discount offer: corrections and complements. Oper. Res. Int. J. 18, 97–104 (2018)

Chung, K.-J., Liao, J.-J., Lin, S.-D., Chuang, S.-T., Srivastava, H.M.: Manufacturer’s optimal pricing and lot-sizing policies under trade-credit financing. Math. Methods Appl. Sci. 43, 3099–3116 (2020)

Chung, K.-J., Liao, J.-J., Lin, S.-D., Chuang, X., Srivastava, H.M.: The inventory model for deteriorating items under conditions involving cash discount and trade credit. Mathematics 7, 1–20 (2019). (Article ID 596)

Chung, K.-J., Liao, J.-J., Lin, S.-D., Chuang, S.-T., Srivastava, H.M.: Mathematical analytic techniques and the complete squares method for solving an inventory modelling problem with a mixture of backorders and lost sales. Rev. Real Acad. Cie. Exactas Fís. Nat. Ser. A Mat. 114, 1–10 (2020). (Article ID 28)

Chung, K.-J., Liao, J.-J., Ting, P.-S., Lin, S.-D., Srivastava, H.M.: A unified presentation of inventory models under quantity discounts, trade credits and cash discounts in the supply chain management. Rev. Real Acad. Cie. Exactas Fís. Nat. Ser. A ísicas y Naturales Serie A Matemáticas 112, 509–538 (2018)

Chung, K.-J., Lin, S.-D., Srivastava, H.M.: The complete and concrete solution procedures for integrated vendor–buyer cooperative inventory models with trade credit financing in supply chain management. Appl. Math. Inf. Sci. 10, 155–171 (2016)

Hill, N., Riener, K.: Determining the cash discount in the firm’s credit policy. Financ. Manag. 8, 68–73 (1979)

Huang, Y.-F., Chung, K.-J.: Optimal replenishment and payment policies in the EOQ model under cash discount and trade credit. Asia-Pac. J. Oper. Res. 20, 177–190 (2003)

Huang, Y.-F., Hsu, K.-H.: An EOQ model with non-instantaneous receipt under supplier credits. J. Oper. Res. Soc. Jpn 50, 1–13 (2007)

Khan, M.A.A., Shaikh, A.A., Panda, G., Konstantaras, I., Cárdenas-Barrón, L.E.: The effect of advance payment with discount facility on supply decisions of deteriorating products whose demand is both price and stock dependent. Int. Trans. Oper. Res. 27, 1343–1367 (2020)

Liao, J.-J., Huang, K.-N., Chung, K.-J., Lin, S.-D., Chuang, S.-T., Srivastava, H.M.: Optimal ordering policy in an economic order quantity (EOQ) model for non-instantaneous deteriorating items with defective quality and permissible delay in payments. Rev. Real Acad. Cie. Exactas Fís. Nat. Ser. A Mat. 114, 1–26 (2020). (Article ID 41)

Liao, J.-J., Huang, K.-N., Chung, K.-J., Lin, S.-D., Ting, P.-S., Srivastava, H.M.: Determination of the optimal ordering policy for the retailer with limited capitals when a supplier offers two levels of trade credit. Math. Methods Appl. Sci. 40, 7686–7696 (2017)

Liao, J.-J., Huang, K.-N., Chung, K.-J., Lin, S.-D., Ting, P.-S., Srivastava, H.M.: Retailer’s optimal ordering policy in the EOQ model with imperfect-quality items under limited storage capacity and permissible delay. Math. Methods Appl. Sci. 41, 7624–7640 (2018)

Liao, J.-J., Huang, K.-N., Chung, K.-J., Lin, S.-D., Ting, P.-S., Srivastava, H.M.: Mathematical analytic techniques for determining the optimal ordering strategy for the retailer under the permitted trade-credit policy of two levels in a supply chain system. Filomat 32, 4195–4207 (2018)

Liao, J.-J., Huang, K.-N., Chung, K.-J., Ting, P.-S., Lin, S.-D., Srivastava, H.M.: Some mathematical analytic arguments for determining valid optimal lot size for deteriorating items with limited storage capacity under permissible delay in payments. Appl. Math. Inf. Sci. 10, 915–925 (2016)

Liao, J.-J., Huang, K.-N., Chung, K.-J., Ting, P.-S., Lin, S.-D., Srivastava, H.M.: Lot-sizing policies for deterioration items under two-level trade credit with partial trade credit to credit-risk retailer and limited storage capacity. Math. Methods Appl. Sci. 40, 2122–2139 (2017)

Modak, N.M., Panda, S., Sana, S.S.: Optimal inventory policy in hospitals: a supply chain model. Rev. Real Acad. Cie. Exactas Fís. Nat. Ser. A Mat. 114, 1–21 (2020). (Article ID 109)

Rashid, M., Mitra, D.: Price elasticity of demand and an optimal cash discount rate in credit policy. Financ. Rev. 34, 113–126 (1999)

Sarker, B.R., Kindi, M.A.: Optimal ordering policies in response to a discount offer. Int. J. Prod. Econ. 100, 195–211 (2006)

Srivastava, H.M., Chung, K.-J., Liao, J.-J., Lin, S.-D., Chuang, S.-T.: Some modified mathematical analytic derivations of the annual total relevant cost of the inventory model with two levels of trade credit in the supply chain system. Math. Methods Appl. Sci. 42, 3967–3977 (2019)

Stokes, J.R.: Dynamic cash discounts when sale volume is stochastic. Q. Rev. Econ. Financ. 45, 144–160 (2005)

Tiwari, S., Kazemi, N., Modak, N.M., Cárdenas-Barrón, L.E., Sarkar, S.: The effect of human errors on an integrated stochastic supply chain model with setup cost reduction and backorder price discount. Int. J. Prod. Econ. 226, 1–15 (2020). (, Article ID 107643)

Udayakumar, R., Geetha, K.V.: An EOQ model for non-instantaneous deteriorating items with two levels of storage under trade credit policy. J. Ind. Eng. Int. 14, 343–365 (2018)

Varberg, D., Purcell, E.J., Steven, S.E.: Calculus, 9th edn, pp. 87–88. Pearson Education Incorporated, Upper Saddle River (2007)

Wójtowicz, M.: counterexample to the Fortune’s Formula investing method. Rev. Real Acad. Cie. Exactas Fís. Nat.Seri. A Mat. 113, 749–767 (2019)

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no conflicts of interest

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Srivastava, H.M., Chung, KJ., Liao, JJ. et al. An accurate and reliable mathematical analytic solution procedure for the EOQ model with non-instantaneous receipt under supplier credits. RACSAM 115, 1 (2021). https://doi.org/10.1007/s13398-020-00944-x

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s13398-020-00944-x

Keywords

- Mathematical analytic solution procedure

- Inventory model

- Retailer’s optimal replenishment policy

- Economic order quantities (EOQ)

- Trade credits

- Cash discounts

- Permissible delay in payment

- Cash discount