Abstract

The rapid development of electric vehicles (EVs) has caused a problem for the industry: what happens to the batteries at the end of their useful life in EVs? Repurposing those batteries for a less-demanding second-life application, e.g. stationary energy storage, could provide a potential solution to extract more value than just recycling or disposal. This paper explores the current battery second use (B2U) business models and the key challenges of implementing B2U. Based on empirical interview data from stakeholders involved in B2U, this paper presents a typology of current B2U business models—standard, collaborative and integrative business models—and offers implications for designing business models that incorporate sustainability at the core. The findings also show that innovative business model is a key to addressing the B2U challenges and overcoming the ‘inferiority’ of second-life batteries as used products.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Electric vehicles (EVs) hold great promises for a more sustainable transportation in the future. Governments of several European countries such as France and Britain have set ambitious goals for no more petrol or diesel cars to be sold by 2040.Footnote 1 Overtime, when the batteries are no longer able to provide sufficient power and range due to their ageing characteristics, there will be millions of tons of batteries coming out of the cars. If not properly treated, those retired batteries could place tremendous burden on the environment.

In general, an EV battery could retain 70–80% of its original capacity intact upon reaching the end of its vehicular life [1], and replacement is recommended in order to satisfy the driving range demand of EV owners [2]. Upon retirement, there would still be sufficient capacity left in the batteries to support less-demanding applications such as load shifting, renewable energy storage and backup power [1, 3,4,5,6]. Compared with recycling which entails costs, energy and wastes, recapturing the residual value from retired EV batteries for non-vehicular applications could generate alternative revenue streams to help overcome EV cost-hurdles and create synergic value for energy storage [7]. Major automotive companies such as Nissan, BMW and Daimler have started initiatives to investigate or even commercialise battery second use (B2U).Footnote 2

This paper explores the current B2U business models (BMs) and the key challenges of implementing B2U to understand how to improve business models to extract more value from second-life batteries. In-depth semi-structured interviews with major players in the B2U industry provide substantial data to draw lessons for business models of second-life batteries. First, a typology of current B2U business models generated from empirical case studies is presented. Second, critical challenges of implementing B2U are discussed. Third, innovative business models are identified as the key to addressing the B2U challenges and overcoming the ‘inferiority’ of second-life batteries as used products. Finally, we present three critical business model design elements that will help companies better extract value from B2U.

2 Case Study Data

In the nascent stage of B2U, only a handful of cases can provide substance to studying business models at the commercial level. Most of the B2U projects are still in the planning, piloting or demonstration phases and are more focused on technical or economic aspects. In this study, the unit of analysis is the business model of B2U. A firm could have several B2U business models in parallel which are treated as separated cases.

Seven case studies were selected from the existing B2U markets that have passed the phase of demonstration or pilot projects to reach the early commercialisation stage. In-depth semi-structured interviews were carried out with experts from both automotive and energy industries. Each interview lasted 0.5–3 h and followed a pre-defined interview protocol to gain an in-depth understanding of the B2U business models. The interviews were recorded, transcribed and coded for analysis according to the qualitative case study methodology [8]. A list of the case study interviews is presented in Table 1.

3 A Typology of Current B2U Business Models

The complete set of interviews shows that the automotive OEMs are creating and capturing value from B2U in different ways. In most cases, OEMs are adopting battery selling as their main business model. However, due to the lack of knowledge and resources in applying the batteries to the energy market, the OEMs interact, in different ways and to different extents, with stakeholders from the energy sector to help develop and deliver the final solutions to the end-customers. In this paper, the key stakeholder from the energy sector who offers the final solution to the end-customers is termed ‘B2U solution provider’. The major stakeholder roles generalised from the seven case studies are the automotive OEM, the B2U solution provider and the end-customer.

The data show that the main differences between the business models in the case studies originated in the various relationships and interactions between the OEM and the B2U solution provider. The degree that the OEM integrates B2U into their businesses varies from nearly zero to full integration. Compared across cases, it was found that the value generated for the OEMs from B2U increases as the degree of integration raises. For example, in case V where the OEM retains the battery ownership, they benefit from the energy services provided by the batteries during their entire second-life while in case I the OEM only get additional revenues through selling the batteries at a very cheap price ($85/kWh as referred to by one of the interviewees). This indicates the degree of integration as a key factor in the value creation and capture for the OEMs. Based on the business model analysis in the seven individual case studies, a typology of existing B2U business models is presented to illustrate how key stakeholders across the automotive and energy sectors interact to create and capture value from B2U in different ways.

The business models examined from the seven empirical case studies can be categorised into three types: standard business model, collaborative business model and integrative business model. These categories correspond to the various relationships between the cross-sector stakeholders, namely (a) pure supplier–customer relationship, (b) collaboration and (c) the OEM internalising the role of the B2U solution provider. Accordingly, the degree of integration increases from standard to collaborative and to integrative business models. Within the collaborative business model type, there are subtypes, depending on the degree of integration and the relative dominance of stakeholders in the final solution development. Examples from the case studies are given for each subtype.

A schematic illustration of the typology is shown in Fig. 1. The degree of integration in the business model types increases from left to right. The boxes represent key stakeholders involved in B2U: the OEM, the B2U solution provider and the end-customer. The height of the OEM box represents the relative degree of integration. The red and green arrows represent the flow of battery ownership and the knowledge and information flow between the OEM and B2U solution provider, while the purple arrow represents the delivery of final solutions to the end-customers.

3.1 Standard Business Model

The standard business model is where the OEM simply sells second-life batteries to the B2U solution provider (e.g. case I). The B2U solution provider develops the final solutions for the batteries and delivers that solution to the end-customers. The interaction between the OEM and the B2U solution provider is just supplier–customer relationship, like in most business models under the ‘sell-and-disengage’ logic. In that case, the OEMs involve in B2U to generate additional revenues from selling the battery property in the free market. The OEM’s degree of integration is nearly zero. They are not engaged in the final B2U solution development, and there is almost no knowledge and information flow between the OEM and the B2U solution provider. This type of business model requires little OEM engagement, but the value captured by the OEM is also small. In addition, the standard business model is very vulnerable to competitors.

3.2 Collaborative Business Model

Most of the manufacturing firms developing B2U fall into the second type—collaborative business model (case II, IV and VI). Under this type, the OEMs collaborate with B2U solution providers and involve in the final solution development. Instead of just selling the battery asset, OEMs under this type collaborate with B2U solution providers in different ways and to different extents to add to the value of second-life batteries and capture more benefits than just selling the batteries. Three subtypes of collaborative business models are generalised, depending on the relative dominance of the final solution development between the OEM and B2U solution provider. The three subtypes are (a) assistant collaborative where OEMs assist B2U solution providers in the final solution development; (b) OEMs co-develop the final B2U solution with B2U solution providers; and (c) B2U solution providers develop the final B2U solution for the OEMs. These subtypes are discussed in turn below.

3.2.1 Subtype 1. Assistant Collaborative—OEMs Assist B2U Solution Providers in the Final Solution Development

In this subtype, the final solution is still developed and delivered by the B2U solution provider. Unlike the standard business model, however, the OEM also collaborates with the B2U solution provider to share knowledge and resources that contribute to the final solution development, in addition to selling the batteries. In case II and VI, for example, the OEMs collaborate with the B2U solution providers to share their expertise and information on the batteries (e.g. battery historical data and remained performance evaluation) to make second-life batteries better fit into the storage systems developed by the B2U solution providers. In case IV, the OEM provides consultancy services and tailor-made batteries to the B2U solution providers to help them better develop the final solutions. In this subtype, the OEM’s degree of integration is higher than the standard business model but is still very low. The B2U solution provider is dominating the final solution development. The OEMs provide knowledge and information on the battery side to assist the B2U solution provider but are not actually engaged in developing and providing the final solutions. The value captured by the OEM in this business model type is higher than that in the standard business model but is still small because the OEM does not benefit from the final solutions.

3.2.2 Subtype 2. Co-development Collaborative—OEMs Co-develop the Final Solution with B2U Solution Providers

In this subtype, the final solution is co-developed by the OEM and the B2U solution provider. Each stakeholder has its own set of knowledge and resources. Through the collaboration, the two stakeholders integrate complementary capabilities to design and optimise the battery systems, as well as develop and deliver the final products and solutions. The OEM’s degree of integration is higher than in subtype 1 because the OEM is engaged in integrating the capabilities of the two parties to co-develop the final solution, in addition to selling batteries. There are bidirectional and interacting flows of knowledge and information between the two stakeholders because the final solutions are their mutual objectives and outcomes. The value captured by the OEM in this business model type is higher than the previous two business model types because the OEM shares the benefits from the final solutions together with the B2U solution provider. A typical example of this business model subtype can be found in case III.

3.2.3 Subtype 3. Integration-Collaborative—B2U Solution Providers Develop the Final Solution for the OEMs

In this subtype, the OEM retains the ownership of the battery and gather its partners (including the B2U solution provider) together to develop and market the final solutions for them. Retaining the ownership of the batteries allows the OEM to continuously engage in B2U to extract value throughout the second-life of the batteries. The degree of integration is higher than in the previous two subtypes because the OEM created a joint venture where they exploited the B2U solution provider to help them develop and deliver the final solutions to the end-customers. The OEM dominates the final solution development in this subtype. There are also bidirectional and interacting knowledge and information flows between the two stakeholders. The value captured by the OEM in this business model subtype is higher than the previous business models because the OEM retains the battery ownership, which enables them to continuously optimise and extract value from second-life batteries. A typical example of the business model subtype can be found in case V.

3.3 Integrative Business Model

The integrative business model is where the OEM internalises B2U into their own business, developing and delivering the final solutions for the end-customers. In this case, the OEM leverages its own networks to maximise the value that they can obtain from delivering that final product or service to the end-customers. The integrative business model requires very high OEM engagement and diversified resources and capabilities of the company and is likely to be restricted to certain applications due to OEMs’ limited access to certain markets (e.g. grid-scale applications). The OEM’s value capture portion is the highest among all the business model types because the OEM internalises the role of B2U solution provider which enables them to obtain all the potential value delivered by the final solution. However, the value captured from second-life batteries might not be the highest because of the OEM’s limited access to the energy market.

In summary, a typology of B2U business models is proposed. The typology compares existing B2U business models in practice to illustrate how automotive OEMs interact in different ways with stakeholders from the energy sector to create and capture value from second-life batteries. The standard and integrative business models are the two extremes of the existing B2U business models. Evidence from the case studies shows that the standard business model requires little OEM engagement but is very vulnerable to competitors. The integrative business model, on the other side, allows the OEM to capture higher value portion from B2U than other business models but is restricted in terms of markets and applications.

4 Challenges of Implementing B2U

Despite the envisioned benefits of repurposing retired EV batteries for stationary storage, there are manifold challenges regarding B2U that could significantly reduce the value of second-life batteries. Four critical challenges are found from the seven case studies: competitiveness, uncertainty, design and regulation. The four critical challenges are refined and generalised from the individual case studies to reflect the more general nature of the cross-case findings. For example, the ‘uncertain flow of batteries’, the ‘uncertain second-life battery performance’ and ‘customers’ concerns over second-life batteries’ are grouped into the challenge of ‘uncertainty’.

4.1 Competitiveness

The competition that comes from new batteries was commented on by interviewees from all seven case studies. In four out of the seven cases (case I, II, III and IV), the competition from increasingly cheap new batteries was described by the OEMs as one of the most critical B2U challenges. The existing data show that currently, the relatively cheap price of second-life batteries compared with new batteries is regarded as the main motivation for many companies to develop B2U. However, it is also expected that by the time the 8- or 10-year-old batteries are taken out of the cars, there will be new generations of batteries in the market with not only cheaper price but also much better quality and performance, which would make the life of second-life batteries more difficult. In that case, the cost competitiveness and thus the attractiveness of second-life batteries would be diminished. The OEMs are now trying to reduce the cost of battery repurposing, for instance, using the whole battery pack as it is to avoid costs regarding opening the pack, so as to keep the cost competitiveness of second-life batteries (case IV, V and VI).

4.2 Uncertainty

4.2.1 Uncertain Flow of Second-Life Batteries

The other critical challenge most clearly mentioned by the OEMs is managing the flow of second-life batteries (case I, III, VI, VII). Unlike new batteries, the volume of second-life batteries that will come back to the OEMs is somewhat out of control because it depends on the customer’s behaviour—when they retire the batteries, and whether they will trade their old EVs into the second-hand car market. This adds to the uncertainty in terms of the volume of batteries available for the OEMs. And if the OEMs sell second-life batteries to their customers, the uncertain return flow of the batteries also causes anxiety for the purchasers of the battery due to a lack of steady supply. This would make the business more difficult, especially for large-scale applications which require a steady supply of batteries with a large volume.

In case I, for example, the energy storage start-up (Company B) expressed their concerns about the amount of second-life batteries available from the OEM. They are not too concerned now because the scale of their business is small. However, they said they need to be sure about the volume in order to scale up their businesses; otherwise, they will stop using second-life batteries in the future. This is not mentioned in case II, and it might be because the core business of Company E is using new batteries and second-life battery is just an option for them. And in case V, the business model is service-based rather than selling the batteries so the OEM does not need to make their customers feel ‘secure’ about the battery supply. The OEM in case IV did not indicate the challenge, but they said they have sold out of second-life batteries which imply a lack of steady battery flow.

In the author’s view, it seems that the scale of second-life batteries would solve this problem in the future but it might also generate more competition for the volume out there. When second-life battery supply scales up, it becomes a competitive issue where the best models that offer the highest price will be able to obtain the most batteries.

4.2.2 Uncertain Second-Life Battery Performance

The uncertainty in the remained battery lifetime and performance degradation in various energy storage applications is perceived as another B2U challenge for both the second-life battery providers and buyers (case I, III, V and VI). Unlike new batteries that are designed for energy storage, the lifetime and degradation of second-life batteries are quite uncertain, depending on both how they were used in their first life in the EVs and how they are going to be used during their second-life in stationary storage applications.

This uncertainty is said to be caused by (a) the lack of systemic and sophisticated data collection onboard; (b) the lack of effective data analysis; and (c) the lack of sharing with downstream stakeholders on the battery health over its first life in vehicles. One of the OEMs said: ‘We have the global data centre so the data is enough. What matters is how we can analyse the data. For the time being, we can’t precisely predict the remained lifetime but it is under the way…’ (O-1-1). However, the interviewee of one of the downstream energy companies said: ‘They (the OEM) don’t track all the information we would like to have…at least not in such an efficient way as we would like it to be…If they track all the information, we would get much more proper picture about the quality of the battery at the end of life…’ (E-4). In addition, one of the interviewees commented on current battery testing: ‘This testing is not going to tell you the performance forward because that requires a lot more information from the OEM’ (L-1). It can be seen from the data that there is information asymmetry between the battery provider and downstream stakeholders, which indicates the need for closer communication and information sharing between B2U stakeholders.

Besides, there is a lack of understanding of second-life battery ageing behaviours in specific energy storage applications and a data sharing platform among stakeholders. Since each battery ages differently under the varying historical operating conditions in the EVs and complex usage profiles in energy storage, it is difficult to predict the exact ageing behaviour of the batteries during their second-life. Without a proper tracking of the historical usage data of the batteries and evaluation of the second-life battery performance, it is not very likely that the in the long-term OEMs could persuade customers to buy their second-life batteries.

4.2.3 Customers’ Concerns Over Second-Life Batteries

The data show that from the customer’s side, the major challenge of acquiring second-life batteries is their concerns over second-life batteries (case III and IV). As one of the interviewees said: ‘Another challenge is that people often have low price expectation for second-life batteries, so we have to tell them the value of the system…’ (E-3). In general, customers have a bias against used products—they feel insecure about second-life batteries and they have low price expectations. Besides, customers have poor understanding of the value of second-life batteries. They do not have the knowledge about the functionalities of the battery storage system, and they lack the skills or experience for operating the system. Those concerns could strongly influence customers’ buying decisions and impair the real value of second-life batteries.

4.3 Design

From the B2U repurposer’s perspective, one of the challenges of B2U is in regard to the initial battery design. As commented by one of the interviewees in case V: ‘Currently the car manufacturers design the batteries only for being used in the car’ (E-4). The data show that the battery repurposing cost is significantly affected by how the batteries were initially designed. For example, if the BMS does not properly track and collect the battery usage data over its first life in EVs, the battery state of health (SOH) could not be evaluated, and thus batteries would need to be sent to a third party for testing. This incurs extra cost in battery transportation and testing. Besides, if the components inside the battery pack such as the BMS are not compatible with stationary storage applications, a new BMS needs to be built and implemented to the battery system which brings additional costs for battery repurposing.

It is obvious that the car manufacturers will always prioritise the battery design for the EVs. However, a systemic design thinking that incorporates second-life repurposing into the initial battery design would greatly smooth the whole repurposing process and reduce/avoids relevant costs. And as one of the interviewees commented: ‘It is a matter of consideration, not cost’. Some OEMs are aware of the importance of design for repurposing and have taken measures either in the form of battery architecture redesign or the improvement of battery control and data tracking system (e.g. case IV).

4.4 Regulation

In terms of regulation, the data show that there are three major challenges existing, depending on the countries and regions. The first is the waste and transportation regulation. Currently, second-life batteries are not clearly defined in the regulation in most countries. As the interviewee of case VI said: ‘Because the battery is considered to be dangerous goods, the transportation is very expensive…the second-life battery is not really defined…it shouldn’t be regarded as waste, otherwise there will be other regulations and complicated stuff’.

The second regulatory challenge is regarding battery storage for the energy market. As commented by one of the interviewees in case VI, for example, ‘If the regulation is not open, the business model could not fly’. The large amount of confirming data from other interviews also shows that the electricity market regulations in most regions are not open and transparent yet, which might kill many potential business cases. Stakeholders in the case studies expect that the regulators could understand more about the role and value of batteries in the energy market and accept battery storage as equal to other means of storing or creating energy to support the power grid.

The third challenge is that in some regions such as California, there are incentive programmes that only subsidise new batteries but not second-life batteries, which is unfavourable for second-life batteries to compete in the energy market.

In summary, the four critical challenges identified across the seven case studies, namely competitiveness, uncertainty, design and regulation, show that B2U is still at its emerging stage with multiple challenges facing B2U players. A summary of the B2U challenges is presented in Fig. 2.

5 Role of Business Models in B2U

Many of the critical challenges confronted by B2U stakeholders are still perceived as operating under the ‘business-as-usual’ scenario with the traditional product selling model. Offering the repurposed battery as a discounted product (compared with new batteries) is pushing the ‘inferior’ second-life batteries into increasingly fierce competition with new batteries, which reduces the real value of the battery and is not sustainable. Under the ‘sell-and-disengage’ logic, the only way for second-life batteries to compete is to lower the price continuously with the decreasing cost of new batteries. The reward from selling the battery asset is thus very low. And one day when the cost advantage of second-life batteries becomes negligible, the ‘inferior’ aged batteries will be driven out of the market. The data from the seven case studies suggest that the ‘sell-and-disengage’ business model is not helping stakeholders extract the potential value of second-life batteries in energy storage.

To achieve the potential benefits that can be delivered from B2U, a new perspective of perceiving the value of second-life batteries more than a physical product is needed. As one of the interviewees in case I commented: ‘One important thing to keep in mind is that it (B2U) doesn’t diminish the utility of the battery, the battery is just as good as any energy storage device. And regardless of what the price point is comparatively, it still has a good function and capability. It is, how can you create a structure that makes it worthwhile to pursue that matters’ (O-1-1). Though somewhat degraded in terms of capacity, the value of the storage capacity of second-life batteries should not be discounted. When applied in certain applications, a second-life battery could deliver just the same functions and services as a new one. The key is to best utilise the remained capacity of second-life batteries in the right energy storage applications to generate value.

However, a second-life battery itself does not have a value proposition, and it is the business model that creates value for second-life batteries and helps stakeholders capture the benefits. Business models and the logic of value exchange were a constant part of the case study interviews even when speaking to the technical people. One of the interviewees, for example, emphasised the importance of a good business model on B2U: ‘A good business model is the key so the customer can pleasingly accept the storage system’ (BJV-1). In some cases, customers do not really care whether the battery is new or old, they only want the power or capacity services delivered by the batteries. As captured in the following quotes: ‘A battery doesn’t do anything—it is what you built around the battery to solve what pain points for your customers. Our customers don’t care whether you use second-life batteries, as long as it does what they tell us to do’ (E-1).

A shift to services in the B2U business models was found in some case studies. The data suggest that the ‘inferiority’ of second-life batteries could be overcome by delivering the solutions customers want rather than selling the physical asset. In that case, what matters most is not how fancy the battery itself is, but the value of the solutions delivered by the battery through the business models. The value that stakeholders capture from delivering that solutions could also be optimised because they can continuously engage in and benefit from the various services provided through the battery rather than the one-off product selling.

Due to the very nature of second-life batteries, which are used products, the business model plays a pivotal role in achieving the potential value of the batteries. The data indicate that a good business model could help address the challenges of B2U to overcome the ‘inferiority’ of second-life batteries as used products.

6 How to Better Design Business Models for B2U

Three aspects, namely lifecycle thinking, system-level thinking and the shift to services are proposed as helpful perspectives for stakeholders to better design their BMs so as to achieve the potential value of second-life batteries. The three aspects are discussed in turn below.

6.1 Lifecycle Thinking for Analysing the Potential Value of Second-Life Batteries

In the light of the earlier discussion of the critical challenges of B2U (Sect. 4) that might impair the real value of second-life batteries, we can now ask the question what is the potential value of second-life batteries? At the nascent stage of B2U, the value of second-life batteries is still poorly understood and B2U stakeholders are not very good at extracting value from second-life batteries. All seven case studies show that there are actually more B2U benefits available that manufacturing firms are not accessing. Across the data, it is found that there are value opportunities existed in various stages of the battery life cycle. In this section, a battery lifecycle thinking perspective is proposed to help analyse the potential value of second-life batteries and identify opportunities for improved value creation along the battery life cycle.

Second-life batteries, by definition, are ‘inferior’ to new batteries in terms of performance, lifetime and functionalities for some specific applications. However, the potential value of second-life batteries could be as high as or even higher than that of a new battery if equipped with a good business model. At this emerging stage of B2U, it is important for stakeholders to understand the potential value of second-life batteries so as to identify value opportunities to better design business models for increased value creation. Based on the value creation and capture analysis in the seven case studies, it is found that a whole lifecycle thinking, which integrates the battery’s first life in EVs, second-life in storage applications and end-of-life recycling, is helpful to understand the value created for various stakeholders and potential value opportunities along the whole battery life cycle.

Unlike new batteries designed for stationary storage, the data show that second-life batteries involve many different stakeholders at various stages of its life cycle. B2U itself is considered as an end-of-life strategy for vehicle batteries and a circular approach to creating value from ‘waste’. However, repurposing a second-life for the batteries also means that those once scrapped batteries will start a new life cycle in a different application. For second-life batteries, the initial battery conditions depend on how they were designed and used during their first life in the vehicles. In other words, the battery’s first life partially determines the performance and remained value of second-life batteries. On the other hand, the value analysis should also include the final EOL when the batteries could not be utilised anymore, for example, the value of recycling.

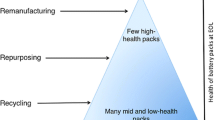

Therefore, analysing the value of second-life batteries should be embedded in considering its whole life cycle in a broader sense that includes multiple lives: (a) the first life in the EVs, (b) the second-life in, for example, stationary storage applications and (c) the EOL when the batteries are recycled/disposed. The key stages of the battery life cycle are illustrated in Fig. 3 to help analyse how second-life battery value could be improved by considering the entire battery life cycle.

-

(a)

Battery first life

As shown in Fig. 3, the battery first life includes battery design and manufacturing, vehicle use and return for collection. The battery is designed and manufactured for the EVs by the automotive OEMs and/or battery producers. Then the batteries are used as the vehicle traction by the EV customers. After 8–10 years when the batteries could not satisfy EV drivers’ demands such as driving range, acceleration and charging rate, the EV owners will return the old batteries to the OEMs. The initial status and thus the remained value of the second-life batteries depends on how they were initially designed and used during their first life. The data indicate that three aspects of the battery first life, namely initial battery design, EV battery ownership and education for consumers, could be considered to facilitate B2U and increase the battery value.

-

Initial battery design

As discussed in the previous section, incorporating B2U into the initial EV battery design through, for example, better data tracking and collection, as well as improved reusability and durability of the battery pack components, could greatly reduce the battery repurposing cost and smooth the process of B2U.

-

EV battery ownership

The second is the EV business models regarding battery ownership. One challenge discussed above is the management of the second-life battery flow. In most cases, once the OEMs sell the EVs they do not have the ownership of the batteries anymore. They might have the liability for battery recycling, depending on regions, but they actually have little control over the battery flow in terms of when the retired batteries will come back, for example. Interestingly, in one of the case studies (case VI) where 80 to 90% of the EV batteries are on the leasing mode, the OEM remains the ownership of the battery and, thus, has much more control over the volume and quality of the batteries coming back. In addition, because the OEM owns the battery property, they provide various maintenance services to the EV customers to keep the battery running under the best possible conditions. When the battery capacity drops to a certain level, the OEM swaps the batteries and keeps the old ones for repurposing or recycling depending on the battery conditions. In that case, the battery quality is also more unified which enables more efficient and profitable B2U.

-

Education for the consumers

The third aspect of improving the residual value of second-life batteries is to educate the EV customers on better utilising the batteries. OEMs could give advice to the EV drivers in terms of how to take care of the batteries during EV driving and help them understand the value of their batteries after the vehicle life. Rewarding mechanisms could also be built where customers get a better price if they return batteries with higher quality. Besides, the OEMs could offer maintenance services on a regular basis to check the batteries and repair any degraded components if necessary to avoid further deterioration of the batteries. In that case, the customer relationship is strengthened which also brings value for the OEMs in terms of more valuable EV offerings for the customers.

-

(b)

Battery second-life

As shown in Fig. 3, the battery second-life includes battery collection, repurposing (e.g. testing, grading, system integration) and second use in various energy storage applications. After the batteries are retired from the EVs, the automotive OEMs collect the batteries through their car dealers, test them and decide whether to repurpose or recycle them. For batteries that could be further utilised, they will be graded according to their remained capacity and then sorted and repackaged. Depending on the applications, the batteries are integrated to build the energy storage systems by the automotive OEMs and/or the energy companies. The storage system composed of second-life batteries is then sold to the customers in the energy market or operated to provide various energy services. Since the batteries are repurposed for a different application (energy storage) than in the automotive industry, multiple stakeholders across sectors might be involved at different stages and it is essential to coordinate among stakeholders to optimise the cost structure and improve the total value creation. The data suggest that four aspects of the battery second-life, namely battery redemption, battery repurposing strategies, and battery testing and grading should be taken into consideration to increase the value of second-life batteries.

-

Battery redemption

In terms of battery collection, normally the EV customers will return the old batteries to the car dealers who then send the all the batteries, good or bad, back to the OEMs. Interestingly, in one of the case studies (case VII) the interviewees proposed a fast testing plan where the batteries are tested at the dealers to quickly check their conditions. Only the batteries qualified for further utilisation will be transported to the OEMs while the bad quality ones will be sent directly for recycling which saves cost in battery transportation. In another case study, the OEM outsourced a third party to do the logistics who collect the batteries for them from their car dealers. The OEMs need to weigh the cost of battery collection against their specific situations to decide a most cost-efficient plan.

-

Battery repurposing strategies

Based on the seven case studies, the data show that there are generally two different battery repurposing strategies: (a) to disassemble the battery pack into modules and repackage the modules and (b) to reuse the whole battery pack as it is. According to the case studies, both strategies are used in practice by different OEMs. Most of the OEMs adopt the latter strategy to reuse the whole battery pack in that the costs regarding opening the battery pack, testing individual modules and repackaging can be avoided. In addition, key components such as the BMS and cooling functions could also be reused to avoid additional cost. However, some of the OEMs insist that reassembling the modules of similar conditions could extend the lifetime of the battery and thus increase its residual value. Currently, there is no consensus on which strategy is more economically viable but both will require the incorporation of second use into the initial battery design. For example, if you want to disassemble the battery pack into modules for reuse, the battery should be designed for easy disassembling. On the other hand, if you want to reuse the pack as it is in stationary storage applications, you need to ensure the reusability and durability of the battery components needed for second-life applications so that they could also be reused as a whole in a more sustainable way.

-

Battery testing and grading

The batteries are then tested, graded and sorted for different second-life applications. In some cases, battery testing and grading are done by external parties which incur extra costs. How much the cost can be internalised depends on how much efforts the OEMs make in tracking the battery data during its first life in EVs and being able to analyse that data. Depending on the capacity remained, the batteries are then graded and sorted for different stationary storage applications. However, knowledge in energy storage is also required to determine what is the best usage profile for each battery to better utilise the battery value. In most cases, the OEMs bring in partners from the energy sector to develop or assist them in designing the final solutions that commercialise second-life batteries into the right energy market.

-

(c)

Battery EOL

Depending on the battery conditions after its first life and its usage profiles during second-life, second-life batteries could be used in stationary storage applications for another 5–15 years. After that when the batteries could not be further utilised, they will be recycled. Currently, the recycling system for lithium-ion batteries is not established yet, so the cost of recycling EV batteries could be quite high in the near term. According to the case studies, battery recycling incurs cost nowadays but it is possible that in the future, recycling will bring profits instead of incurring expenses. Through deploying second-life batteries in stationary storage applications for another 5 or 10 years, for example, the OEMs could defer the recycling phase and turn the cost into revenue opportunities. As one of the OEMs said: ‘This (recycling) is important to follow up because recycling cost will always change. Today there might be a cost to it, tomorrow it might be a benefit’ (O-3). In B2U, the stakeholders should also make clear the battery recycling responsibilities for the very end of the battery life.

In summary, thinking about B2U from the lifecycle perspective is helpful to analyse the potential value of second-life batteries and identify opportunities where possible for increased value creation. At the emerging stage of B2U, it is essential that stakeholders understand the potential value of second-life batteries at this system level so as to better design their business models to achieve that value. The lifecycle thinking helps integrate resources and knowledge from cross-sector stakeholders to optimise the cost structure over the entire battery value chain.

6.2 System-Level Design for Achieving the Potential Value of Second-Life Batteries

The value of second-life batteries in energy storage is delivered to the end-customers either in the form of the battery products or the services provided by the storage systems. How to best utilise the value of the batteries requires the integration of knowledge and expertise from both the automotive and the energy sectors, as well as a good business model that helps deliver that value to various stakeholders involved. The business model analysis in the seven case studies shows that the system-level perspective which transcends the firm boundaries is helpful to analyse the total value creation for second-life batteries. This section aims to present how system-level thinking could help achieve the potential value of second-life batteries.

It can be seen from the data that if the OEM only looks at the benefits of B2U from the firm perspective, the perceived value of second-life batteries is segmented because the full value of the battery is not achieved until the final battery solution is delivered to the end-customers. From the OEM’s perspective, for example, in cases where they sell the batteries, the value of second-life batteries for them is just the sales of the battery asset. However, there are much more benefits delivered through the batteries, for example, the value of various energy services, that the OEMs are not accessing. The system-level thinking is helpful for the B2U stakeholders to analyse the full potential value of the batteries, identify value opportunities and design business models to better achieve that value.

On the other hand, thinking about B2U only from the firm perspective is not helping extract the potential value from second-life batteries. The data show that under the ‘selling and buying’ logic, some of the systems are badly designed and they are fragile. In that case, people just want to sell the batteries to obtain additional revenues without trying to optimise the value system. They seem to work for a period of time when they can predict second-life battery price is lower than new batteries, but they are not sustainable business model in the medium term because other things are changing. For example, one of the interviewees of Company B complained: ‘If we can’t get a warranty then we will stop using Company A’s second-life batteries… In order to scale up, we need to be 100% certain that Company A is going to keep providing us batteries, but I can’t be sure about that, not today…If the OEMs are too difficult to work with, then we will simply move to other suppliers… and because battery price is falling so quickly, we think in the long run our main suppliers would be new battery manufacturers’ (E-2).

When Company B is small and only doing business on a small scale, it is not so concerned about the transparency of the schedule, but if they want to scale it, they have to be sure about the battery supply and they need proper contracts and warranties. However, the OEM (Company A) in this case is not helping make the life easier for Company B. They are not concerned about how Company B creates value for second-life batteries, and they are not helping optimise the total value creation for the batteries. The consequence of that is their reward from B2U is very small, and their business model is very vulnerable to competitors.

At the system level, the total value creation for second-life batteries determines the ‘overall size of the value pie’, which is also the upper limit of the value that stakeholders can capture from. The data suggest that if one is only trying to create and capture value from the firm perspective, they are partially optimising the value without increasing the ‘overall size of the value pie’. In order to increase the total value creation for the batteries and thus their value capture potential, stakeholders should also consider the value creation of other players and design business models to facilitate value creation for the whole value system. The system-level thinking that considers value creation and capture of various stakeholders as well as the synergies between them help stakeholders better understand how to increase the system-level value creation for second-life batteries to enlarge the ‘value pie’.

In summary, system-level thinking is helpful for stakeholders to analyse the potential value of second-life batteries and identify value opportunities. It could also help stakeholders increase the total value creation for the batteries and thus optimise the ‘overall size of the value pie’. B2U stakeholders should take the system perspective into their business model design to enlarge the ‘value pie’ so as to achieve the potential value of the batteries and enable more value capture for themselves.

6.3 Shift to Services

As discussed in Sect. 6.1, business model is a key in overcoming the B2U challenges and achieving the potential value of second-life batteries. The data suggest that the traditional ‘selling and buying’ logic is no longer suitable for B2U, and a shift to services has been observed in all seven case studies. The section further synthesises the previous findings and discusses how the concept of service could help achieve the battery value and how stakeholders could better integrate this concept into their business models.

In terms of providing the final battery solutions to the end-customers, the business model analysis shows that in most cases, the B2U solution providers are offering substituting or adapting services that either extend the value propositions of the battery or replace the purchase of a product altogether. The interview data suggest that integrating services into the business models changes the perceived value of second-life batteries. Interestingly, in three out of seven cases, the B2U solution providers are offering energy storage as a service without selling any physical products. Customers in these cases are not so concerned about how good the battery is, and they are not comparing the prices because they do not own the battery asset. What matters to them is the energy storage solutions and the value of the services provided through the batteries. For example, one of the interviewees in case I commented: ‘Our customers don’t care whether you use Company A’s old batteries, as long as it does what they tell us to do’ (E-1). One of the interviewees in case II also said: ‘Customers won’t care that it’s used batteries because they can get more savings. In our case, it becomes our risk where we own the asset’ (E-2). The data suggest that offering substituting services allows companies to take full advantage of the remained value of the batteries to design differentiated value propositions that satisfy customers’ demands in energy storage. Furthermore, it reduces the risks on the customers, which makes it easier and faster to enter the market. It proves to be useful, especially in the ferment stages of B2U, when customers are not familiar with the technology and feel unsecured about used products.

In terms of the OEM’s business model, the data show that apart from case V and VII where the OEMs retain the battery ownership, in all the other five cases the OEMs are selling the batteries to the B2U solution providers. Most of them provide smoothing services such as warranties and technical support that complement their battery offers. They are not separately providing and benefiting from the services, but they obtain higher revenues from selling the more ‘premium’ battery product compared with the pure selling model. In case III, the consultancy service is also an important part of the OEM’s value proposition. The OEM profits from providing consultancy services apart from selling the batteries. In those cases, the OEMs benefit more or less from providing the services. However, they are still selling the batteries and once they sell the batteries they stop profiting from the potential value of the various energy services provided by the batteries. In case V, the OEM retains the ownership of the battery and brings the batteries into the joint venture. The B2U solution provider is providing services to the OEM to help them develop and deliver the final solutions to the end-customers. The OEM shares the revenues from the energy services provided by the batteries, and they are able to continuously capture value from the batteries during the entire second-life of the battery.

The data suggest that integrating the concept of service could help OEMs generate more value from B2U than the traditional selling model. If the main value proposition for the OEM is the sales of the battery, there are various transaction costs involved and the OEM also fails to profit from the potential value of the energy services provided through the batteries. As commented by one of the interviewees: ‘If OEMs sell the battery they are in huge competition because there will always be someone who sells cheaper. As the most valuable asset, it doesn’t make sense for OEMs to sell the battery’ (E-4). With new battery price dropping rapidly, the selling model for second-life batteries would put OEMs in increasingly fierce competition in the battery market. The interviewee continued: ‘As an OEM, you know the value, how long the battery can last and so on…they should provide the battery and they also know the battery best. If they sell the battery, the customers ask for warranty for several years and so on and these are all the cost factors that you pay for.’ (E-4)

In summary, in the nascent phase of B2U, there is no established market for second-life batteries. B2U stakeholders are still exploring how to approach potential customers—whether to just sell the batteries, or add some services to the battery offers, or just offer services. The findings from this research suggest that in this early stage of the industry characterised by high uncertainties of both the supplier and customer, B2U stakeholders could either provide complementary services or retain the ownership of the battery to reduce risks on the customers. In particular, providing energy storage as a service instead of selling the physical product enables stakeholders to differentiate their value propositions and overcome the ‘inferiority’ of second-life batteries as ‘used product’. Result-oriented services also lead to opportunities for B2U stakeholders to develop innovative business models for second-life batteries.

7 Conclusions

In summary, this paper has provided insights concerning the value system of B2U. Through seven in-depth case studies with multiple B2U stakeholders, a typology of current B2U business models has been proposed that show how B2U stakeholders are interacting with each other to generate value from second-life batteries. Four critical B2U challenges have been identified (competitiveness, uncertainty, design and regulations) that help understand the factors that might impair the potential value of second-life batteries. The findings also show that innovative business model is a key to addressing the B2U challenges and overcoming the ‘inferiority’ of second-life batteries as used products. Three critical business model design elements, namely lifecycle thinking, system-level design and shift to services, have been proposed as helpful aspects for B2U stakeholders to consider for better designing their business models and extract more value from B2U.

References

J. Neubauer, A. Pesaran, J. Power Sources 196, 10351 (2011)

E. Cready, J. Lippert, J. Pihl, I. Weinstock, P. Symons, Technical and Economic Feasibility of Applying Used EV Batteries in Stationary Applications, Sandia National Laboratories, Albuquerque, New Mexico, 2003 (http://www.rmi.org/Content/Files/Technicalandfeasible.pdf)

P. Wolfs, An Economic Assessment of “Second Use” Lithium-Ion Batteries for Grid Support. Universities Power Engineering Conference (AUPEC), 20th Australas. IEEE, 2010

V.V. Viswanathan, M. Kintner-Meyer, IEEE Trans. Veh. Technol. 60, 2963 (2011)

S. Beer, T. Gómez, S. Member, D. Dallinger, I. Momber, C. Marnay, M. Stadler, J. Lai, I.E.E.E. Trans, Smart Grid 3, 517 (2012)

M. Knowles, A. Morris, Br. J. Appl. Sci. Technol. 4, 152 (2013)

B. Gohla-Neudecker, M. Bowler, S. Mohr, Battery 2nd life: Leveraging The Sustainability Potential of Evs and Renewable Energy Grid Integration. 5th International Conference Clean Electrical Power, Taormina, Italy, 2015

M.B. Miles, A.M. Huberman, J. Saldaña, Qualitative Data Analysis: A Methods Sourcebook (3rd Ed.), Sage Publishing, 2014

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG

About this chapter

Cite this chapter

Jiao, N., Evans, S. (2018). Business Models for Repurposing a Second-Life for Retired Electric Vehicle Batteries. In: Pistoia, G., Liaw, B. (eds) Behaviour of Lithium-Ion Batteries in Electric Vehicles. Green Energy and Technology. Springer, Cham. https://doi.org/10.1007/978-3-319-69950-9_13

Download citation

DOI: https://doi.org/10.1007/978-3-319-69950-9_13

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-69949-3

Online ISBN: 978-3-319-69950-9

eBook Packages: EnergyEnergy (R0)