Abstract

In this chapter, we consider approaches to express the risk preferences of a newsvendor by means of the risk measures value at risk (VaR), conditional value at risk (CVaR), and the mean-CVaR rule, which usually is defined as a convex combination of expected profit and CVaR. With these risk measures the decision maker can exploit risk-averse or risk-neutral behavior. In addition, we introduce a more general mean-CVaR measure where also risk- taking behavior can be expressed. The overall goal of the paper is a comparative analysis of these risk measures in the newsvendor framework. On the one hand VaR, CVaR and the (general) mean-CVaR, measures are used as objective functions to derive the respective optimal order quantity. Extensions of the basic models are reviewed. On the other hand the risk measures, especially VaR, are constraints of the model. We first review models with the expected profit as objective. Then the general mean-CVaR measure is taken as objective function and a service constraint and a loss constraint are added. In this framework, the risk attitudes of the newsvendor can be deduced from the characteristics of a product together with the specified service target and loss target.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Historically, in inventory management the newsvendor model is formulated with the objective to maximize the expected profit. Later on important streams of research suggest, e.g., to maximize the expected utility of profit (see Eeckhoudt et al. 1995) or to use the mean-variance objective (Lau 1980; Choi and Chiu 2012). There is some critique from a theoretical and/or from an empirical point of view on these (and other) approaches and there are still new suggestions for objective functions in the literature (see, e.g., Gao et al. 2011). Another early objective function is the probability to exceed a specific target profit (Lau 1980); this approach is closely related to the value at risk (VaR) measure which is a central concept for this chapter.

VaR and CVaR (conditional value at risk) are risk measures originating in the theory of finance. They are used in the newsvendor context to express and to formulate the risk attitudes of the decision maker. The CVaR measures the expected profit falling below a quantile level of the profit distribution known as VaR. In literature, these risk measures are not only used as objective functions but also as constraints. CVaR is a coherent risk measure, which is an important decision-theoretical feature (see, e.g., Artzner et al. 1999); this property does neither hold for VaR nor for the mean-variance measure.

A more general class of risk measures are the so-called mean-deviation rules. An example is of course the mean-variance measure. Recently, the CVaR is also used as a deviation measure in inventory management. Usually, a convex combination of the expected profit and the CVaR for a specified quantile level is considered; then the mean-CVaR model is coherent. In this framework, risk-neutral as well as risk-averse attitudes of the decision maker can be expressed. In general, this means that the optimal order quantity of a risk-averse newsvendor is smaller than that of a risk-neutral, profit-maximizing decision maker. In the sense of Fisher (1997) this seems reasonable for functional products with focus on cost minimization. But for innovative products, the focus should be on high levels of product availability where a risk-taking behaviour—the random profit is preferred to the expected profit—is more appropriate. Thus, a general mean-CVaR measure is used where the decision maker can exploit risk-averse, risk-neutral, as well as risk-taking behavior. For a recent review of newsvendor models including risk preferences of the decision maker, we refer to Li et al. (2011), Sect. 1.1 and Qin et al. (2011).

The overall goal of this chapter is a comparative analysis of VaR, CVaR, and mean-CVaR as objectives and as constraints, respectively, in newsvendor models. We start the analysis with preliminaries stating the notation and the basic results of the classical, risk-neutral newsvendor model in Sect. 8.2. In Sects. 8.3–8.5, the risk measures are used to formulate the objective function. Beside the basic model we refer to some extensions, e.g., concerning multi-product and price-setting newsvendor models. The third section is devoted to the VaR objective and the related objective to maximize the probability of exceeding a specified target profit. Then the CVaR criterion is presented in Sect. 8.4 and the CVaR-optimal order quantity is derived. In the fifth section mean-deviation rules are discussed, especially the mean-CVaR objective. We present the optimal order quantity depending on the risk parameters and compare in a numerical example the profit functions and the optimal order quantities of risk averse, risk-neutral, and risk-taking decision makers.

In Sect. 8.6, some risk measures are used as constraints. E.g., to avoid low profits or even high losses. First, VaR is used as constraint when the objective is to maximize expected profit. Then a general model is formulated using the general mean-CVaR measure of Sect. 8.5 as objective function. In addition, two constraints are added. The loss constraint is a specific VaR—constraint which is specified by an upper bound for the probability to result in losses. Moreover, the service constraint defines a lower bound for the cycle service level, i.e., the probability not to run out of stock. Here, the optimal order quantity is given by a two-sided control limit policy depending on the risk parameters. The characteristics of the product together with the loss target and the service target provide information to specify the risk preferences of the inventory manager with respect to the product under consideration.

In Sect. 8.7, we discuss some recent generalisations concerning the mean-CVaR rule as objective function. Finally, the basic intentions of the chapter are summarized in Sect. 8.8.

2 Preliminaries

We introduce our notation for the classical single-product newsvendor model.

Let X denote the random demand with nonnegative support and let p, c, z be the per unit selling price, purchase cost, and salvage value, respectively. We assume p > c > z.

Let y be the order quantity. Then the random profit is given by

with \({\left (y - X\right )}^{+} =\max \left (y - X,0\right )\).

Let F denote the distribution function of X; we assume that F − 1 exists. It is well known that the solution of

is given by

Even if F is invertible the distribution function F y of the profit (8.1) has a point of discontinuity at (p − c)y, more precisely (Jammernegg and Kischka 2007, see Fig. 8.1)

We have

In the following, we consider risk measures as objectives or constraints for the classical newsvendor model. Extensions of the basic model, e.g., by including shortage cost or price-dependent demand, are mentioned in the respective sections.

3 Value at Risk Criterion

3.1 General Definition

Let Z be some profit variable with distribution function F Z and let α ∈ [0, 1].

The value at risk of Z is

If F Z is continuous at z 0 and strictly increasing in a neighborhood of z 0 we have for α = F(z 0)

The VaR is a widespread measure of risk in finance: The probability that the profit Z is below VaRα(Z) equals the prescribed α. Note that in decision theory, -VaR often is denoted as a measure of risk whereas VaR is denoted as a preference functional.

3.2 Newsvendor Model With VaR Objective

Let g(y, X) be the profit in the newsvendor model (see (8.1)).

From (8.4) and (8.5), immediately follows:

Moreover, for α < F(y) : P(g(y, X) ≤ VaRα(g(y, X)) = α.

The newsvendor problem with the objective VaR is given by

This objective can also be interpreted as the maximization of the probability to achieve a given target (see (8.11) and (8.12) and the following discussion).

As can be seen from (8.8), VaRα is an increasing linear function in y for y ≤ F − 1(α) and a decreasing linear function in y for y > F − 1(α). Thus, the VaR-optimal order quantity y ∗ (α) is given by

Note that the optimal solution is independent of p, c, z; it only depends on F and the prescribed α. In Chiu and Choi (2010), a price-setting newsvendor problem is considered with the value at risk as objective function. There the optimal order quantity depends on the stochastic part of demand and on the optimal price only via c. Another (single-period) inventory model with VaR objective is discussed in Tapiero (2005).

We illustrate the previous analysis by comparing the distribution functions of the profit for the classical newsvendor, the VaR newsvendor, and the newsvendor ordering the expected demand. The random demand is exponentially distributed with expected demand E(X) = 100 units; furthermore, p = 10, c = 6, z = 5, and α = 0. 5.

Depending on the respective optimal order quantity y for the different objectives in Fig. 8.1, the intervals of possible profits [(z − c)y, (p − c)y] are shown.

Compared with the classical newsvendor, the probability of resulting in loss is just about half the amount for the VaR newsvendor. But on the other hand, the maximum VaR profit is only 277 currency units whereas that of the classical newsvendor is 643 currency units. This trade-off is a significant explanation why an inventory manager in praxis often pursues the pull-to-center strategy, i.e., they order the expected demand (the maximum expected demand profit is 400 currency units). In addition, small order quantities result in low levels of customer service which in any case is not advantageous for products with high profit value; remember that y ∗ (α) is independent of p, c, and z.

Up to now the value α is prescribed and the corresponding profit for an order quantity y is computed, which is to be maximized. Alternatively, one can prescribe a target profit B and look for an order quantity such that the probability of exceeding B is maximized. The seminal paper of this approach is Lau (1980). The formal problem and its solution is

Note that the optimal solution is independent of F and z. In case of positive shortage cost, the optimal order quantity depends also on the demand distribution (Lau 1980, p. 531).

The corresponding maximal probability is

Note that (see (8.4))

There are also models where the target profit B is not assumed to be fixed but depends on the order quantity y; an example is the expected profit E(g(y, X)) (see Parlar and Weng 2003). Shi and Chen (2007) show that for objective (8.11) the wholesale price contract is Pareto-optimal which does not hold for the expected profit criterion. For a price-setting newsvendor, in addition to a target profit, a target revenue is considered leading to a model with two objective functions (see Yang et al. 2011).

The approaches (8.9), (8.10) and (8.11), (8.12) are closely related.

Define for a given satisfying profit B

Then from (8.10), we have

and therefore

Conversely, for a given α define

Then from (8.12), we have

and therefore

Summarizing, from the results obtained so far it is evident that the optimal VaR order quantity is independent of the selling price, the purchase cost, and the salvage value whereas the optimal order quantity for the target profit newsvendor does not depend on the demand distribution. The risk measures used in the following objective functions do not result in optimal decisions that show these deficiencies.

4 Conditional Value at Risk criterion

4.1 General Definition

There are different possibilities to define the conditional value at risk (see, e.g., Acerbi and Tasche 2002; Rockafellar and Uryasev 2000).

For β ∈ [0, 1], the generalized (lower) inverse function of the distribution function F Z of a random variable Z is defined by

The conditional value at risk of Z given α ∈ [0, 1] is

Alternatively, the CVaRα can be defined by the generalized upper inverse function.

From Rockafellar and Uryasev (2000), we have

If F Z − 1 exists, we have

Note again that in decision theory -CVaR often is denoted as a measure of risk whereas CVaR is denoted as a preference functional.

4.2 Newsvendor Model With CVaR Objective

For Z = g(y, X), we have (see Jammernegg and Kischka 2007, p. 108)

and therefore:

CVaRα is monotonically increasing in α (see, e.g. (8.14)) and therefore

Since the CVaRα of a constant equals the constant the expected value E(g(y, X)) is preferred to CVaRα(g(y, X)), and therefore for any α < 1 the preference functional CVaRα represents a risk-averse behavior; α is sometimes called “degree of risk aversion” (see, e.g., Chen et al. 2009).

Now the order quantity is derived that maximizes CVaRα:

Several authors consider the CVaRα as objective function (see, e.g., Gotoh and Takano 2007; Gao et al. 2011). The CVaR measures the expected profit falling below a quantile level of the profit distribution. From (8.16) and (8.17), the solution of (8.18) can be derived:

As can be immediately seen, the CVaR order quantity (8.19) is only a fraction of the optimal order quantity y ∗ of the classical risk-neutral newsvendor given in (8.3), especially for small values of α. The higher the degree of risk aversion is, i.e., the smaller the α, the smaller is the order quantity (8.19).

Note that the optimal order quantity converges to F − 1(α) as z → c. This implies that the decision maker will not order the maximal demand even if P(g(y, X) ≤ 0) = 0. If the newsvendor can realize almost the same salvage value z for leftover products as the purchasing cost c, then the maximal profit \((p - c){F}^{-1}(\alpha )\) is achieved. Of course the order quantity y CVaR ∗ (α) is smaller than the order quantity y ∗ (α) of a VaR-newsvendor (see (8.10)) for all p, c, z.

The basic model with CVaR objective has been extended in several ways. Chen et al. (2009) consider the price-setting newsvendor with CVaR criterion. Xu (2010) analyzes this model with the possibility of emergency procurement, i.e., in a dual sourcing context where the newsvendor has a second ordering opportunity during the regular selling season if demand turns out to be larger than the first order quantity. Furthermore, the optimal solution is derived for positive shortage cost (Xu and Chen 2007). There are models for supply chain coordination using CVaR as objective function (see Yang et al. 2009). Also multi-product newsvendor models with CVaR objective have been investigated (see, e.g., Tomlin and Wang 2005; Choi et al. 2011).

5 Mean-CVaR Criteria

5.1 Convex Combination

Mean-deviation rules, e.g., the mean variance approach, are well known in portfolio theory. Gotoh and Takano (2007), Gao et al. (2011) and others consider mean deviation rules in the newsvendor context assuming that the deviation is measured by the CVaR of the profit.

The objective function is a convex combination of expected profit and CVaR

with γ ∈ [0, 1].

Note that for γ = 1, the classical newsvendor problem is given. For γ < 1, the objective function describes risk averse behavior, i.e., the expected profit E(g(y, X)) is preferred to g(y, X). For γ = 0, we have the CVaR newsvendor of Sect. 8.4.

Of course, the degree of risk aversion increases the smaller γ and/or the smaller α; a small γ gives a high weight to the risk measure CVaRα, a small α gives a high weight to high losses.

The solution of the above objective function is a special case of the approach in Sect. 8.5.2.

5.2 A General Mean-CVaR Criterion

In Jammernegg and Kischka (2007), a generalization of objective function (8.20) is provided. Consider first a profit variable Z with invertible distribution function F Z . Let B denote a target profit and let α : = F Z (B). Then E(Z | Z ≤ F Z − 1(α)) and E(Z | Z ≥ F Z − 1(α)) are conditional expected values of “bad” or “good” profits, respectively. Let λ ∈ [0, 1] be a weight of these expected profits (pessimism parameter).

Then the objective function is

For the profit variable g(y, X) in the newsvendor model, we use the generalized inverse of F y ∗ introduced in Sect. 8.4.1 and replace the conditional expected values

This can be rewritten as (Jammernegg and Kischka 2007, p. 100)

Note that for α > λ, the objective function describes a risk-taking behavior, i.e., the random profit g(y, X) is preferred to E(g(y, X)):

For α = λ, α < λ, risk-neutral and risk-averse behavior, respectively, prevails.

The objective functions (8.18) and (8.22) are consistent with dual utility theory. Dual utility theory as developed by Yaari (1987) is based on the idea that the probability of a bad result is judged differently from the same probability of a good result. Whereas in expected utility theory the monetary results are transformed with a utility function, in dual utility theory the probabilities of the monetary results are transformed. In Jammernegg and Kischka (2005), it is shown that for every pair (α, λ) with 0 < α < 1, 0 ≤ λ ≤ 1 there exists a transformation of probabilities such that the objective function (8.22) is consistent with the axioms of dual utility theory.

Maximizing the objective functions (8.21) or (8.22), we get (Jammernegg and Kischka 2007, p. 101)

Note that a risk-averse (risk-taking) decision maker orders less (more) than a risk-neutral decision maker. For a demand distribution with bounded support, the maximal demand is ordered as z → c. This is in contrast with a related conclusion for the CVaR criterion in Sect. 8.4.

For λ = 1, the solution for the objective function in Sect. 8.4 is given. For λ ≥ α, the objective function (8.20) with \(\gamma = \frac{1-\lambda } {1-\alpha }\) is given. If λ = α, i.e., γ = 1, we have the special case of the classical risk-neutral newsvendor (8.2) and (8.3).

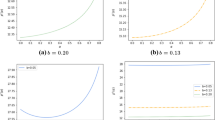

In the following, we compare the optimal order quantities and values of the objective functions. In Fig. 8.2, the graphs for the following objectives are shown: CVaR, VaR, expected profit, and risk taker with λ = 0. The data are the same that have been used for the profit distributions in Fig. 8.1, especially α = 0. 5.

As already mentioned before, Fig. 8.2 shows that the CVaR newsvendor is dominated by the VaR newsvendor also with respect to the expected profit if the respective optimal quantities are ordered. Therefore, CVaRα is sometimes called a relatively conservative criterion. Figure 8.2 also shows that the expected profit curve is quite flat around its maximum; this is typical for many operations management models, think, e.g., of the economic order quantity model. Thus, a slight deviation from the optimum only leads to a small decrease of the expected profit; the optimal expected profit of the classical risk-neutral newsvendor is about 239 currency units (y ∗ = 160 units) whereas for the most risk-taking newsvendor with y ∗ (0. 5, 0) = 230 units the expected profit would be 220 currency units, a reduction in profit of about 8%. High order quantities result in high levels of customer service but also lead to a high probability to end up with a loss. Of course the opposite is true for low order quantities. We will come back to this trade-off between conflicting performance measures when dealing with constrained newsvendor models.

The following extensions of models using the mean-CVaR criterion consider the objective function (8.20). Like in the previous section there are multi-product newsvendor models (Choi et al. 2011) and models with positive shortage cost (Ahmed et al. 2007; Xu and Chen 2007). In a recent paper, the newsvendor not only decides the order quantity but also adopts a weather hedging strategy. Using the mean-CVaR criterion, the weather-derivative hedging can increase the order quantity and can improve the expected profit as well as the CVaR-profit (Gao et al. 2011).

6 Constraints

In this section, first we present a single-product newsvendor model with a VaR constraint, where the objective is to maximize the expected profit. Then we introduce a model with a loss constraint and a service constraint. The loss constraint specifies an upper bound for the probability resulting in loss, i.e., it is a special version of the VaR constraint where the target profit is equal to zero. In the service constraint, a lower bound for the cycle service level is prescribed.

6.1 VaR Constraint

Remember that for order quantity y, the maximum profit is (p − c)y and the minimum profit is (z − c)y. Let B be some target profit (see Sect. 8.3.2) and let η be some probability with

If the quantity y is ordered, the probability that the profit is not higher than the target profit B is at most η.

Consider the following newsvendor problem with a so-called VaR-constraint (Gan et al. 2005):

Using (8.4) we can rewrite the constraint (8.24) as follows:

Of course an admissible solution only exists if \(B \leq {F}^{-1}(\eta )(p - z)\).

Remember that y ∗ denotes the solution of the classical newsvendor (see (8.3)). Then the solution of (8.25) is given by

This result can be found in Gan et al. (2005), Özler et al. (2009), and Zhang et al. (2009). Gan et al. (2005) use this result to derive a coordinating contract between a risk-neutral supplier and a retailer with a VaR constraint. In Yang et al. (2007), the optimal order quantity is derived for the newsvendor model with positive shortage cost if the cost target is fixed or given by the expected cost. Özler et al. (2009) extend this model to a multi-product newsvendor problem with VaR constraint. In Zhang et al. (2009), instead of a VaR constraint a CVaR constraint is proposed. Furthermore, they use this framework for multi-period inventory models.

6.2 A Mean-CVaR Criterion With Service and Loss Constraints

In this section, we extend the approach of Sect. 8.6.1 in two ways (Jammernegg and Kischka 2011). First we use the general objective function (8.22); note that for α = λ, the risk-neutral case of the above Sect. 8.6.1 is included.

Second we assume that the optimal order quantity is chosen according to some constraints given by performance measures. E.g., such constraints are also considered in Sethi et al. (2007) and Özler et al. (2009). Contrary to these papers, we simultaneously use internal and external performance measures. It is intuitively clear that these measures may collide and there is no admissible solution. In the following we discuss the set of admissible solutions and give the optimal order quantity under the constraints.

As internal performance measure we use the probability of loss, i.e., we consider the VaR-constraint (8.24) with B = 0:

From (8.26), it is clear that admissible solutions fulfilling (8.28) always exist.

As external performance measure, we use the cycle service level which is defined as the probability to fulfill demand, i.e., for order quantity y the cycle service level is given by F(y):

Constraint (8.29) states that the cycle service level at least must be δ.

Combining (8.28) and (8.29), the set A of admissible solutions is given by

Denoting the profit value of the product \(pv = \frac{p-c} {p-z}\), we have the following condition for the existence of an admissible order quantity:

Thus, the higher the profit value of the product the more likely is the existence of an admissible solution. Moreover, a solution exists the larger is the prescribed acceptable probability of loss η and/or the smaller is the prescribed cycle service level δ.

There is no existence problem if either the internal or the external performance measure is considered. This can be easily seen if the probability of loss η = 1 and the cycle service level δ = 0, respectively. For η ≥ δ, an admissible solutions always exists. Of course, this specification is not plausible from an economic point of view. For the relevant case, η < δ (8.30) represents the problem of considering internal and external performance measures simultaneously.

The optimal order quantity is the solution of the following constrained model (see (8.22), (8.30)):

Solving (8.31) gives the optimal order quantity of an inventory manager who may have some special kind of risk preferences depending on the relation of α, λ (see Sect. 8.5.2) and simultaneously tries to fulfill some constraints concerning internal and external performance measures.

From Jammernegg and Kischka (2007), we know that the objective function (8.22) is a concave function of y. Therefore, if an admissible solution (see (8.30)) exists, there exists also an optimal solution of (8.31) which we denote by \(\hat{y}(\alpha,\lambda )\). Moreover, from the concavity we can conclude

-

(1)

\({y}^{{_\ast}}(\alpha,\lambda ) \leq {F}^{-1}(\delta ) \Rightarrow \hat{ y}(\alpha,\lambda ) = {F}^{-1}(\delta )\)

-

(2)

\({y}^{{_\ast}}(\alpha,\lambda ) \geq \frac{{F}^{-1}(\eta )} {1-pv} \Rightarrow \widehat{ y}(\alpha,\lambda ) = \frac{{F}^{-1}(\eta )} {1-pv}\)

-

(3)

\({F}^{-1}(\delta ) \leq {y}^{{_\ast}}(\alpha,\lambda ) \leq \frac{{F}^{-1}(\eta )} {1-pv} \Rightarrow \widehat{ y}(\alpha,\lambda ) = {y}^{{_\ast}}(\alpha,\lambda )\).

E.g., if—for given α, λ—the optimal unrestricted solution y ∗ (α, λ) (see (8.23)) would exceed \(\frac{{F}^{-1}(\eta )} {1-pv}\), then the solution of the restricted problem is the right corner of the set of admissible solutions (see (8.30)). Since y ∗ (α, λ) is increasing in α and decreasing in λ, we see that this situation is more probable for λ < α, i.e., for a risk-taking inventory manager.

6.3 Deduction of Risk Parameters From Specified Target Values

Using the general mean-CVaR objective function (8.31) in Jammernegg and Kischka (2011), it is shown that every admissible solution y ∈ A is optimal with respect to some (α, λ)-combination, i.e., some risk attitude. From the monotonicity properties of y ∗ (α, λ), we can deduce consistent risk attitudes from the prescribed performance measures. Thus, the newsvendor must not be able to specify the risk parameters. Instead the risk preferences can be derived from the target values for the probability of loss η and for the cycle service level δ. The results are summarized in Table 8.1.

A product is characterised by its profit value pv, its demand distribution F, the loss target and the service target. For these product characteristics Table 8.1 shows whether an admissible solution exists and in the positive case the associated risk preferences of the newsvendor are noted.

If the loss target is low and the service target is high with respect to the profit value and the demand distribution then no admissible order quantity exists; this is described by the upper left area in Table 8.1. Contrary, in any case admissible solutions exist if both target values η and δ are not very challenging for the specific product. In Table 8.1, this is represented by the lower right area. Especially for products with high profitability pv the decision maker can exploit any risk attitude.

If both constraints are fulfilled as equalities then the only admissible solution is the optimal order quantity (8.3) of the classical, riskneutral newsvendor which is represented in the centre of Table 8.1. Finally, in the boxes at end of the off-diagonal one constraint is dominating provided an admissible order quantity exists. The upper right corner characterizes a high service target for the product; here the newsvendor shows risktaking behavior. If the loss constraint is dominating the decision maker is a risk averter. This situation is shown in the lower left corner of Table 8.1

In Fig 8.3 we use the data of the examples in Figs 8.1 and 8.2 to illustrate the findings of Table 8.1 for fixed cycle service level δ = 0. 6 and different probabilities of loss η. Here, the vertical lines denote the corresponding boundaries of the admissible sets. Since the profit value of the product is pv = 0. 8 the last row of Table 8.1 is relevant. If η = 0. 1 and η = 0. 2 then \(pv < 1 - {F}^{-1}(\eta )/{F}^{-1}(pv)\) holds. As can be seen from Fig 8.3 for the low probability of loss η = 0. 1 the loss constraint (upper bound) is smaller than the service constraint (lower bound); thus, no admissible solution exists. For η = 0. 2 admissible solutions exist, but the newsvendor in any case is a risk averter (remember that the optimal risk-neutral order quantity y ∗ is 160 units). If in addition to the predetermined cycle service level δ = 0. 6 the probability of loss η = 0. 3 is not very challenging, too, then \(pv > 1 - {F}^{-1}(\eta )/{F}^{-1}(pv)\) holds, i.e. the existence of admissible solutions is guaranteed. From the lower right area in Table 8.1 we know that in this case the decision maker can exploit any risk preference. From Fig. 8.3 we see that the newsvendor is a risk averter if the chosen order quantity is from the interval [91.6, 160] in contrast, for an order quantity in the interval [160, 178.4] risk-taking behavior is expressed. As indicated before the classical risk-neutral newsvendor orders 160 units of the product.

The relationship of the product characteristics and the implied risk preferences may not match with the basic intentions of the responsible inventory manager. Then the findings from Table 8.1 also can be used to reposition the product. According to Fisher (1997) for a functional product it could be reasonable to increase the profit value by reducing the purchasing cost, e.g. by renegotiating the supply contract in place or to lower the loss constraint. Innovative products are characterized by high profitability. Thus, a high level of product availability is necessary to fulfil the entire demand in order to generate as much revenue as possible. Of course, in this case the service target should be increased. Especially for innovative products the demand distribution should be updated as soon as additional relevant information becomes available to make it less variable, e.g. by reducing its coefficient of variation.

7 Spectral Risk Measures

So far we have considered approaches to formulate the risk preferences of a newsvendor by means of the risk measures VaR, CVaR, and mean-CVaR either as objective function or as constraint. Furthermore, we have presented some reasonable extensions of these basic models.

In this concluding section, we will consider some rather new developments in the theory of risk measures, which are also relevant for the newsvendor model. VaR and CVaR originated in the theory of finance. Because of lacking subadditivity and other deficiencies, the VaR risk measure is criticized and the focus is now on coherent risk measures like CVaR and the convex mean-CVaR measure.

Remember that the presented objective functions can be seen as negative risk measures; e.g., − CVaRα(g(y, X)) is a coherent risk measure; this holds also for (8.2) and (8.20). A special subset of the coherent risk measures is the class of spectral risk measures (Acerbi 2002). It can be shown that every spectral risk measure ρ is of the form

where F Z ∗ is the generalized inverse of the random variable Z (see (8.13)) and φ denotes the so called risk spectrum, i.e.:

Conversely, every function φ fulfilling (8.33) defines a spectral risk measure (8.32).

The objective functions (8.2), (8.18), (8.19), and (8.20) all can be derived from a spectral risk measure; e.g., with

we have for the corresponding risk measure ρ

which is the mean-CVaR measure (8.20) (Brandtner 2011).

In general, we have for the newsvendor problem with a spectral risk measure ρ

where Φ denotes the primitive of φ (Fichtinger 2010).

With the risk spectrum φ, the quantiles of Z, i.e., in the newsvendor context the quantiles of the profit distribution F y can be weighted. With a special risk spectrum, e.g., the exponential risk spectrum, special kinds of risk aversion can be modeled (Fichtinger 2010; Brandtner 2011).

Spectral risk measures are also a subset of the set of convex risk measures (Föllmer and Schied 2002); first applications of convex risk measures to the newsvendor problem are given in Brandtner (2011).

8 Summary

In this chapter, we considered the single-product newsvendor model where the risk preferences of the decision maker were expressed by the risk measures VaR, CVaR, and (general) mean-CVaR. With the general mean-CVaR measures it is possible to describe not only risk-averse and risk-neutral but also risk-taking behavior. These risk measures were included in the newsvendor model as objective functions and as constraints. The basic intention of the paper are comparative analyses of the risk measures with respect to their impact on the distribution functions of profit as well as on the respective optimal order quantities and optimal profits.

For the presented basic models, we reviewed the literature and referred to extensions, e.g., multi-product models and models with price-dependent demand. Finally, we briefly described spectral risk measures where CVaR and mean-CVaR are special cases. A deeper analysis of these risk measures seems to be a promising stream for future research for newsvendor models with risk preferences.

References

Acerbi, C. (2002). Spectral measures of risk: a coherent representation of subjective risk aversion. Journal of Banking and Finance, 26, 1505–1526.

Acerbi, C., & Tasche, D. (2002). On the coherence of expected shortfall. Journal of Banking and Finance, 26, 1487–1503.

Ahmed, S., Cakmak, U., & Shapiro, A. (2007). Coherent risk measures in inventory problems. European Journal of Operational Research, 182, 226–238.

Artzner, P., Delbaen, F., Eber, J.M., & Heath, D. (1999). Coherent measures of risk. Mathematical Finance, 9, 203–228.

Brandtner, A. (2011). Newsvendor-Modelle mit spektralen und konvexen Risikomaßen. Working paper, Jena: Friedrich Schiller University.

Chen, Y., Xu, M., & Zhang, Z. (2009). A risk-averse newsvendor model with CVaR criterion. Operations Research, 57, 1040–1044.

Chiu, C.H., & Choi, T.M. (2010). Optimal pricing and stocking decisions for newsvendor problem with value-at-risk consideration. IEEE Transactions on Systems Man, and Cybernetics–Part A: Systems and Humans, 40, 1116–1119.

Choi, S., Ruszczinsky, A., & Zhao, Y. (2011). A multi-product risk-averse newsvendor with law-invariant coherent measures of risk. Operations Research, 59, 346–364.

Choi, T.M., & Chiu, C.H. (2012). Mean-downside-risk and mean-variance newsvendor models: implications for sustainable fashion retailers. International Journal of Production Economics,135, 552–560.

Eeckhoudt, L., Gollier, C., & Schlesinger, H. (1995). The risk-averse (and prudent) newsboy. Management Science, 41, 786–794.

Fichtinger, J. (2010). The Single-period Inventory Model With Spectral Risk Measures. WU Vienna: Doctoral Dissertation.

Fisher, M. (1997). What is the right supply chain for your product? Harvard Business Review, March-April, 83–93.

Föllmer, H., & Schied, A. (2002). Convex measures of risk and trading constraints. Finance and Stochastics, 6, 429–447.

Gan, X., Sethi, S., & Yan, H. (2005). Channel coordination with a risk-neutral supplier and a downside-risk-averse retailer. Production and Operations Management, 14, 80–89.

Gao, F., Chen, F.Y., & Chao, X. (2011). Joint optimal ordering and weather hedging decisions: mean-CVaR model. Flexible Services and Manufacturing Journal, 23, 1–25.

Gotoh, J., & Takano, Y. (2007). Newsvendor solutions via conditional value-at-risk minimization. European Journal of Operational Research, 179, 80–96.

Jammernegg, W., & Kischka, P. (2005). A decision rule based on the conditional value at risk. Jena: Friedrich Schiller University.

Jammernegg, W., & Kischka, P. (2007). Risk-averse and risk-taking newsvendors: a conditional expected value approach. Review of Managerial Science, 1, 93–110.

Jammernegg, W., & Kischka, P. (2011) Risk preferences of a newsvendor with service and loss constraints. International Journal of Production Economics. doi:10.1016/j.ijpe.2011.10.017.

Lau, H. (1980). The newsboy problem under alternative optimization objectives. Journal of the Operational Research Society, 31, 525–535.

Li, J., Chen, J., & Wang, S. (2011). Risk management of supply and cash flows in supply chains. New York: Springer.

Özler, A., Tan, B., & Karaesmen, F. (2009). Multi-product newsvendor problem with value-at-risk considerations. International Journal of Production Economics, 117, 244–255.

Parlar, M., & Weng, Z. (2003). Balancing desirable but conflicting objectives in the newsvendor problem. IIE Transactions, 35, 131–145.

Qin, Y., Wang, R., Vakharia, A., Chen, Y., & Seref, M. (2011). The newsvendor problem: review and directions for future research. European Journal of Operational Research, 213, 361–374.

Rockafellar, R., & Uryasev, S. (2000). Optimization of conditional value-at-risk. Journal of Risk, 2, 21–41.

Sethi, S., Yan, H., Zhang, H., & Zhou, J. (2007). A supply chain with a service requirement for each market signal. Production and Operations Management, 16, 322–342.

Shi, C., & Chen, B. (2007). Pareto-optimal contracts for a supply chain with satisficing objectives. Journal of the Operational Research Society, 58, 751–759.

Tapiero, C. (2005). Value at risk and inventory control. European Journal of Operational Research, 163, 769–775.

Tomlin, B., & Wang, Y. (2005). On the value of mix flexibility and dual sourcing in unreliable newsvendor networks. Manufacturing & Service Operations Management, 7, 37–57.

Xu, M. (2010). A price-setting newsvendor model under CVaR decision criterion with emergency procurement. International Journal of Systems Science and Systems Engineering, 19, 85–104.

Xu, M., & Chen, F. (2007). Tradeoff between expected reward and conditional value-at-risk criterion in newsvendor models. Proceedings of the 2007 IEEE International Conference on IEEM (pp. 1553–1557) Singapore: IEEE Press.

Yaari, M. (1987). The dual theory of choice under risk. Econometrica, 55, 95–115.

Yang, L., Gao, C., Chen, K., & Li, J. (2007). Downside risk-aversion analysis for a single-stage newsvendor problem. Wuhan University Journal of Natural Sciences, 12, 198–202.

Yang, L., Xu, M., Yu, G., & Zhang, H. (2009). Supply chain coordination with CVaR criterion. Asia-Pacific Journal of Operational Research, 26, 135–160.

Yang S, Shi C, & Zhao X (2011) Optimal ordering and pricing decisions for a target oriented newsvendor. Omega, 39: 110–115.

Zhang, D., Xu, H., & Wu, Y. (2009). Single and multi-period optimal inventory control models with risk-averse constraints. European Journal of Operational Research, 199, 420–434.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2012 Springer Science+Business Media New York

About this chapter

Cite this chapter

Jammernegg, W., Kischka, P. (2012). Newsvendor Problems with VaR and CVaR Consideration. In: Choi, TM. (eds) Handbook of Newsvendor Problems. International Series in Operations Research & Management Science, vol 176. Springer, New York, NY. https://doi.org/10.1007/978-1-4614-3600-3_8

Download citation

DOI: https://doi.org/10.1007/978-1-4614-3600-3_8

Published:

Publisher Name: Springer, New York, NY

Print ISBN: 978-1-4614-3599-0

Online ISBN: 978-1-4614-3600-3

eBook Packages: Business and EconomicsBusiness and Management (R0)