Abstract

In today’s competitive markets, only retailer is not focused on selling products in the retail market. The manufacturer focuses on product remanufacturing that can fulfill the customer’s demand and increase manufacturer’s revenue earnings. This study optimizes the selling price and remanufactures products with a similar commitment as to the fresh one. The urge for remanufactured products highly delineates their price and carbon emission reduction, as these two features are most important to customers for indicating the value and standard of the renovating products. This research explores a classical optimization process under a closed-loop supply chain management with declining the emission of \(\text {CO}_2\) considering carbon tax and selling price-dependent market demand. Here, Stackelberg game theory is utilized to solve the model with distributor and manufacturer both. Both distributor and manufacturer remanufacture together, where they sell new and remodeled products. The analytical solution gives the optimum selling price with reduced carbon emission.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

In today’s supply chain, it leads to a challenging situation to maintain a balance between environmental issues and economic issues. The carbon tax restricts carbon emission from the manufacturing section in a closed-loop supply chain management (CLSCM) to decrease carbon emission. The manufacturer involves in remanufacturing instigates a carbon tax scheme with dual tax payments on manufacturing and remanufacturing levels. This work is done in the following process: first, take an optimal strategy to store products. After that, consider carbon tax to decrease \(\text {CO}_2\) and earn more profit in the supply chain by manufacturing new and used products. It helps to find out the values of decision variables. Further, a CLSCM with reduced \(\text {CO}_2\), exchange strategy, quality improved product, carbon tax, and selling price-dependent market demand of products is shown under remanufacturing scenarios for supply chain performance. The manufacturer and distributor remanufacture returned products where the third-party logistics (3PL) is liable for gathering used products from the customers. In this case, the manufacturer gives a technology license to the distributor to remanufacture a portion of the collected used products. The remainder portion is taken back to the manufacturing company for remanufacturing. Here, Stackelberg game is used for decision making to optimize the supply chain’s profit. Different researchers have constructed different models where price-dependent demand is analyzed or the customer’s attraction for green products. This study helps to answer the research queries mentioned below:

-

Which supply chain is the best among two remanufacturing structures?

-

How does carbon emission related with the remanufacturing of the supply chain?

-

How can the selling price affect the demand for products in the market?

-

What is the relation between the return strategy, carbon emission, and quality improvement effort in supply chain management?

-

How does the technology license sharing impact supply chain management (SCM)?

The remaining portion is equipped as follows: Sect. 2 is introduced for a brief description of a similar effort in literature. Secondly, Sect. 3 is presented for problem description, notation, and assumptions. Next, in Sect. 4, the mathematical model is introduced. After that, Sect. 5 consists solution methodology and Sect. 6 consists numerical example. Managerial insights are discussed in Sect. 7. At last, in Sect. 8, the conclusion of the research is penned.

2 Literature Analysis

Some authors focused on product quality development’s and suggested coordination agreements without not considering different collecting and remanufacturing propositions for greening. This research concentrates on the selling price-dependent market demand, quality improvement effort, remanufacturing, and carbon tax for carbon emission declination to instigate customer’s requirement.

2.1 Selling Price-Dependent Demand

Market demand is important in the supply chain to fulfill the business goal. Generate a sufficient amount of market demand through a traditional policy is getting tough day by day due to increase use of internet. Amidst the variables, the most important is the buyer’s income, quality, the price of related products, the standard of the brand, and the choice of customers. Xu et al. [28] explored the deterministic model by introducing the Stackelberg game theory to meet market demand disruption. Teunter and Van der Laan [26] analyzed the remanufacturing process where the demand depends on the initial returning rate. Yadav et al. [19] analyzed a production process for deteriorating products but without discussing a remanufacturing process or a hybrid manufacturing process for a selling price-dependent demand. Chaudhari et al. [17] discussed a payment policy for a supply chain model with a selling price-dependent demand. A study was inferred to prove the inverse proportionality of selling price with market demand [2].

2.2 Carbon Tax

Lower emission of \(\text {CO}_2\) is an essential subject in recent research. Ji et al. [11] inspected a coupling retailer’s inventory strategy to decrease \(\text {CO}_2\), tax, cap, and trade for greening. Moreover, they considered different methods with supporting examples. Zhao et al. [32] analyzed \(\text {CO}_2\) policies to decrease the cost of advanced techniques in two-stage SCM. They set up low \(\text {CO}_2\) commodities with more expenses. Qin et al. [15] established an inventory model with environmental concerns and credit interval. They explored the greening influence on the inventory model under the tax for \(\text {CO}_2\) and cap and trade strategy. Kugele and Sarkar [18] examined different carbon emission reduction policies from a system with carbon tax. Datta [4] developed some different environmental inventory model to detect optimum greening profit for decreasing emission by carbon tax strategy without scarcity. A carbon tax is an alternative approach to deal with climate change [6]. Allan et al. [1] examined that greenhouse gas emission is decreased for an adequate carbon emission tax in northern Europe, Taiwan, and Scotland. Still, an reduction tax has a negative result on the economy. Liu et al. [13] presented an alternative path for utilizing the income from \(\text {CO}_{2}\) tax. They proved that subsidizing carbon tax and introducing new technique extend the spread for low carbon economy. In this current model, carbon tax for emission reduction is introduced in a CLSCM to optimizing profit between two scenarios.

2.3 Supply Chain Management

Giovanni [7] scrutinized the relation between a fixed refund and variable refund impacts. Customers’ decisiveness to build an exchange argued that the maximum pays off in CLSCM by fixed abatement scheme is an ideal Markov solution under random insistence conditions. When a manufacturing company producing new products, then random exchange rates and manufacturing defects describe a severe role in exchanging remaining products. Giri and Sharma [8] traditionally estimated the exchange policies, by taking an exchange strategy to give back used products and compensate them. Xu et al. [29] analyzed the give back policy variously to demonstrate that the manufacturing company and retailers can collaboratively complete the exchange strategy, regardless of the individual or way. In this study, depending upon the analysis of CLSCM, product design, manufacturing, distributing, and reconstructing are developed. An application under various backgrounds and constraint was accomplished for optimizing the total cost of CLSCM by Demirel et al. [5]. They studied the problems of multi-product CLSCM and utilized mixed-integer linear programming to resolve the end-of-life vehicle recycling process. Yang et al. [30] studied an optimizing network stability grown in a CLSCM structure, which depends on different discrimination theory. Savaskan et al. [21] wrote a survey on three steps for the renewing convey of CLSCM, in which manufacturer’s recycling, distributor’s remanufacturing, and 3PL’s remanufacturing were explained. Savaskan and Wassenhove [20] imposed a game theoretical structure to find benefit of the manufacturing company to remanufacture alone with recycling over competing distributors. Jacobs and Subramanian [10] considered the procedure to deliver remanufacturing responsibility amidst the supply chain participants to boost the payoff. Chen and Chang [3] proposed a cooperative and other strategies to examine the conditions by which an original equipment manufacturing company can take an interdependent proposal for remanufacturing. Shi et al. [22] discussed the optimization model for the market value of new and waste products in CLSCM. Taleizadeh et al. [23] developed the consequences for participants’ maximum benefits in different CLSCM structures and planned tariff arrangement in two directions. Ramani and Giovanni [16] established participants’ activity in CLSC and considered other competitive games by the profit-generating commitment to collaborating firms. Assuming the distributor’s concern, Zeng et al. [31] analyzed the optimum decisions and benefits under pentagonal non-cooperative and cooperative game structures, which proved the process for the maximum payoff in a coordination agreement. This specified coordination had shown the possible deal of the CLSCM by stimulating backgrounds and the competitive quality of the participants in CLSCM.

2.4 Research Gap

Several kinds of research have considered many structures where the requirements depend on the products’ market value or reduction of carbon emission, and carbon tax on the supply chain performance. This study examines a selling price-dependent demand, carbon tax for emission reduction, and servicing effort in a production system under a game theoretical environment. Table 1 presents the work of earlier authors to define the research gap. This paper is an extension of Taleizadeh et al. [24]. Different remanufacturing scenarios are derived in the present study. This study considers carbon tax for low carbon emission, quality improvement, and selling price-dependent demand to addresses the question mentioned in the introduction section. Taleizadeh et al. [25] analyzed the performance of a CLSCM where two carbon reduction options like investing money in the emission reduction procedure together with a trade and cap regulation are introduced. Here, this model distinguishes the supply chain’s optimal decision procedure and inspects the results in two remanufacturing cases. Here, Stackelberg game is used to analyze the model.

3 Problem Description, Notation, and Assumptions

The problem description is defined to mention the way of research. Similarly, notation and assumptions are defined to determine the problem with the appropriate format.

3.1 Problem Description

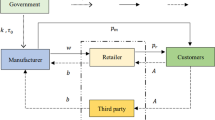

In this research, a CLSCM is considered, where a manufacturing company, distributor and a third party are involved for remanufacturing products. This model is considered for motivating the customers to buy the remanufactured items. This paper considers two remanufacturing approaches like E and F to establish several decision variables. For case E, the manufacturer and distributor return products in the form of high quality. In this case, customers get payment (j) per unit return product from the distributor. The manufacturer then receives the fees for a license (l) from the distributor to remanufacturer x units of the returns. The remaining portion of return products \((1-x)\) is sent to the manufacturer by the distributor for remanufacturing and distributor receives b per unit returned product from the fabricator. For case F, the third-party is added to collect the used products in supply chain. Here, the manufacturer give technology licenses to a third-party for remanufacturing. The third-party remanufacturers x units of the returned products and the manufacturer remanufacturers the remainder portion \((1-x)\). In this study, a carbon tax is introduced along with price-dependent demand for the popularity of products. Here, Stackelberg game is used to find optimum selling price, tax for carbon, and to optimize partners’ profits in the supply chain.

3.2 Notation

Parameters | |

\(c_{m}\) | Production cost per new manufactured product ($/unit) |

\(c_{1}\) | Manufacturer’s remanufacturing cost per unit ($/unit) |

\(c_{2}\) | Unit remanufacturing cost of the distributor ($/unit) |

\(c_{3}\) | Unit remanufacturing cost of the 3PL ($/unit) |

\(T_{1}\) | Money saving from unit remanufactured product obtain by the manufacturer ($/unit) |

\(T_{2}\) | Money saving from the remanufactured product for each unit obtained by the distributor ($/unit) |

\(T_{3}\) | Money saving of the 3PL from unit remanufactured product ($/unit) |

x | Portion of exchange product which distributor or 3PL remanufacturers |

l | Manufacturer received fees for technology license of each unit of item |

from the 3PL or the distributor ($/unit) | |

w | Wholesale price of items per unit from the manufacturer ($/unit) |

\(\mu \) | Fixed portion of the exchange items (unit) |

c | Influence positive coefficient of the recompense for exchange items ($/unit) |

y | Coefficient of the rate of quality for exchange items |

\(\eta \) | Unit carbon emission rate (grams/unit) |

\(G_{v}\) | Government permit to each firm for carbon emission (grams) |

\(P_{v}\) | Price per unit carbon emission by cap and trade policy ($/grams) |

M | Produced quantities per order (units) |

x(.) | PDF (probability density function) |

X(.) | CPDF (cumulative probability distribution function) |

G | Stands for Stackelberg game for the market leadership of the manufacturer |

F, Y, H, S | Denote the manufacturer, distributor, 3PL, and supply chain, respectively |

\(p_{\text {max}}\) | Maximum selling price per unit product ($/unit) |

\(p_{\text {min}}\) | Minimum selling price per unit product ($/unit) |

Decision | Variables |

v | Reduced carbon emission rate |

j | Distributor or 3PL give unit recompense to consumer for exchange items ($/unit) |

k | Quality improvement |

I | Distributor’s expected inventory function (units) |

p | Average selling price of the product ($/unit) |

s | Service variable |

Performance | Indicator |

\(\pi _{S}\) | Profit of the supply chain ($) |

\(\pi _{F}\) | Profit of the manufacturer ($) |

\(\pi _{Y}\) | Profit of the distributor ($) |

\(\pi _{H}\) | Profit of the 3PL ($) |

3.3 Assumptions

The assumptions described below are provided to understand the developed models.

-

1.

A single type of product is involved for different economic and environmental constraints under the remanufacturing scenarios. The manufacturer does not support the stock, low costs, and does not accept returned amounts to avoid trifling cases, which is the goal of this research (Taleizadeh et al. [24], Wang et al. [27]).

-

2.

There is a condition \(c_{m} \le w\le p\) which must hold for both the manufacturer and the distributor such that their profit margin remains positive. To ensure success with the return strategy, the payback mandatory to meet. As the factories cannot reduce all emissions, the carbon emission reduction rate (v) follows \(0\le v\le 1\). The decreasing rate of \(\text {CO}_{2}\) is zero when the carbon emission is not reducing by the factories [27].

-

3.

Only a portion of the return products meets their manufacturing ability and the remanufacturing is done by the downstream members such that the 3PL and the distributor. The manufacturing ability (x) is determined by an manufacturing technique, the remanufacturing scale, and the exchange deterioration products. When \(x=0\), it indicates that the downstream members are not a recycling participants, and when \(x = 1\), it implies downstream members are recycled all products [29].

-

4.

To maximize every member’s profit, a Stackelberg game is used to obtain competitive decisions. This paper leads that manufacturer plays the dominant role, and the downstream members pursue him. Reversely, the manufacturers optimize the result determiners by the participation of downstream members.

-

5.

The parallel work was done by Chen et al. [3]; they considered that original and remanufactured products are the same. They can motivate the customers to choose remanufactured products equally as the new products at new prices [24].

-

6.

For exploring a remanufacturing scenario, it should be confirmed that the manufacturing cost of new products is higher than the remanufacturing price of every exchange product that is \(c_{1}< c_{m}\), \(c_{2}< c_{m}\), and \(c_{3}< c_{m}\) [27]. Selling price-dependent market demand is introduced here.

-

7.

Carbon tax is constructed by the manufacturer and distributor’s effort levels in scenario E. The carbon tax function is \(p_{v}[\eta (1-v)M-G_{v}]\). The manufacturer constructs the carbon tax and 3PL’s effort levels in scenario F. Each item constructs the function of a carbon tax which is \(p_{e}[\eta (1-v)M-G_{v}]\).

4 Mathematical Model

In this model, the stochastic demand function is considered. For variable demand of the products in the market, various decision variables like selling price of products, quality improvement, carbon emission reduction, the cost to buy return products, and servicing efforts are considered. In many research, the cost of product and demand are in an inversely proportional relationship, but the relation between product and demand price is proportional in this present study. The partners of the CLSCM are manufacturer, distributor, and 3PL, respectively. For maximizing the supply chain’s profit, it is needed to increase the market demand for products. The demand function is elaborated as

in which \(a_{0}\) is the potential market size, which does not depend on selling price (p), the decreasing rate of \(\text {CO}_{2}\) emission (v), the used product return cost (j), and improving quality (k). Furthermore, \(a_{1}\) is the positive coefficient of the selling price, \(a_{2}\) and \(a_{3}\) are the coefficient for the positive effect of the low carbon emission rate, \(a_{4}\) and \(a_{5}\) are the coefficient for the positive impact of the return price, \(a_{6}\) and \(a_{7}\) are the coefficient for the positive effect of quality improvement effort, a is scaling parameter for service, \({\gamma }\) is the shape parameter for service, which gives positive impact in market urge, and over the uniform distribution function in \([0,k_{1}]\), \(\epsilon \) is a random market demand. Money savings by remanufacturing per unit product by the manufacturer \((T_{1})\), by the distributor \((T_{2})\), and by a 3PL \((T_{3})\) are shown below.

The investment cost for quality improvement of the products is introducing a technique for decreasing emission of \(\text {CO}_{2}\) along with accumulating the exchange commodities and tax for \(\text {CO}_{2}\) ejection and, increasing the price of the items. This strategy negatively affects the market demand for the product. For finding return quantity of used products, we establish a relation between the price of return and improve quality of goods, which is shown in Eq. (5).

in which parameter \(\mu \) is a constant portion of the return used product which is not dependent on compensated cost and improvement quality of the products, c is the coefficient which gives positive effects for refund price on the return products, and y is the coefficient which gives adverse effects for improved quality on the return products.

4.1 Manufacturer’s Mathematical Model

In this CLSCM, the manufacturer is a market leader, but the products do not sell without a distributor. The manufacturer helps the distributor to renew the used products in better quality. The manufacturer does not support the stock, and low costs do not accept return amounts to avoid trivial cases. There is a condition \(c_{m} \le w\le p\) which must hold for both the manufacturer such that their profit margin remains positive. The manufacturer’s optimal profit is calculated by subtracting all his costs from the earned revenue.

Carbon emission reduction cost

The cost is investing to decrease the carbon emission along the manufacturing period, which is the most essential for low carbon emission. For motivating customers to purchase environment-friendly products, investment is needed for this purpose which is shown by

where \(\theta \) is the investment coefficient, which is not changing for decreasing the \(\text {CO}_{2}\) emission rate.

Cost for quality improvement of the product

This cost function for improving the quality of products is shown by

where \(\phi \) is the investment coefficient, which is not changing for developing quality. To compete with the increasing market demand of the product, it is required to increase the quality of goods.

Cost for buying used products

The distributor (or the 3PL) gives the remainder portion of used products \((1-x)\) to the manufacturing company, then the manufacturing company pays b per unit used product to the distributor (or the 3PL). For buying a used product, there is a cost known as product return cost.

Remanufacturing cost

The manufacturer remanufacturers (\(1-x\)) portion of used products. For remanufacturing, the returned product requires \(c_1\) unit remanufacturing cost per product. The remanufacturing cost is

Within this representation, manufacturer only collects end-of-life products for remanufacturing from a distributor or 3PL.

Manufacturing cost of new product

Within this model, each unit new product manufacturing cost is \(c_{m}\). Thus, the total manufacturing cost of the new product is dependent on the order quantity (M) of the product. The manufacturer produces (\(M-R\)(j, k)) amount of new products, where R(j, k) is the remanufactured used products. The manufacturing cost is

Each new product’s cost is fixed.

Carbon tax

The manufacturer bears carbon emission costs under a carbon cap and with trade strategy. The manufacturer invests \(\text {CO}_{2}\) emission tax to decrease \(\text {CO}_{2}\) emission for the green environment and benefit of the supply chain. The manufacturer has the emission cap of \(G_v\) grams from the government. If the total emissions for producing M quantity of products exceeds the carbon cap, then the manufacturer pays carbon tax for that extra carbon emission. Besides, the manufacturer emits carbon in a reduced rate of v. The total carbon emission cost is

This cost has a definite effect on reducing \(\text {CO}_{2}\) emission. In this scenario, the manufacturer pays the carbon tax to the government for recycling the products.

Revenue

The manufacturer generates revenue by selling products to the distributor at a wholesale price w. The wholesale price for new product is \(w(M-R(j,k))\). Wholesale price and cost savings from the remanufactured products is \((w+T_1)(1-x)R(j,k)\). Besides, the manufacturer receives price for technology sharing as lxR(j, k). Thus, total revenue of the manufacturer is \(w(M-R(j,k)) + (w+T_1)(1-x)R(j,k) + lxR(j,k)\).

4.2 Distributor’s Mathematical Model

The distributor takes major roles in the supply chain for product selling and maximizing profit in the supply chain. The distributor always gives holding costs and shortage costs. In one scenario, the distributor remanufactures the used products as new by his technical ability and sells them in the market to earn a profit along with new products (Scenario E). In the other scenario (Scenario F), the distributor earns a profit margin by selling new and remanufactured reproducts but does not take part in remanufacturing. To increase the demand for products in the market, the distributor uses a servicing investment. Here, distributor’s optimal profit is calculated by subtracting all costs from the revenue.

Again E(M) is the anticipated trading amounts, which is acquired by using the following equation:

Selling price

The distributor sells products in the market and generates revenue. If M be the total quantity to sell and w be the product’s unit selling price, then the total selling price is wM.

Holding cost

\(s^{+}\) is the unit holding cost of products that are not sold in the market. Z(M) is the function of the distributor’s inventory leftover.

Thus, total holding cost is \(s^{+}Z(M)\).

Shortage cost

Product shortage is a negative effect on the market. The shortage cost is \(s^{-}\) per unit product. S(M) is the function of the distributor’s expected lost sales.

Thus, total shortage cost is \(s^{-}S(M)\).

Cost for buying used product

The return product quantity and return product cost are proportional, but the supply chain’s return product cost and profit are inversely proportional. In this model, the distributor pays the compensated price j per unit return product. If the quantity of the returned product is R(k, j), then the total cost for returned products is jR(k, j).

Remanufacturing cost

The distributor is remanufacturing the quantity of x portion of the returned products. Thus, the total cost for remanufacturing is

In this model, remanufacturing cost and return product quantity are in a proportional relationship.

Cost for technology licensing fees

When the distributor takes part in the remanufacturing process, then the distributor needs a technology license for remanufacturing. The distributor buys a technology license from the manufacturer. The technology licensing fees per unit item is l, then total technology licensing fees for remanufacturing is

The manufacturer gives the authority to the distributor of supply chain to remanufacturer the returned products that are similar quality as the manufacturers.

Servicing investment

The distributor bares a servicing investment for increasing the market demand. This service gains customer’s attraction and increases the selling quantity. The servicing investment for the products is below.

4.3 Mathematical Model of Third Party Logistics (3PL)

The 3PL is a collector of used products from customers by giving them refund price. A 3PL comes into the CLSCM when the distributor does not take part in the remanufacturing process. Then, the manufacturer shares the technology license with the 3PL for remanufacturing (Scenario F). In this case, the 3PL only remanufacturers a portion of used products. The distributor sells all products to the market. In this case, the 3PL’s optimal profit is calculated by subtracting all the costs from revenue earned by the 3PL.

Remanufacturing cost

Here x portion of the total returned products R(k, j) is remanufactured by the 3PL each unit cost for remanufacturing is \(c_{3}\). Thus, the total cost for remanufacturing is

In this scenario, 3PL remanufactures the return products based on their remanufacturing ability. Here, we consider a remanufacturing process by a manufacturer and third party.

Cost for technology licensing fees

The 3PL pays a per unit licensing cost to the manufacturer for buying the technology license. In this case, l is the licensing fees for remanufacturing each unit product. The entire technology licensing fees cost is

In this model, the 3PL considers himself partners for remanufacturing the products under the technology license taken from the manufacturer to decrease manufacturing costs.

Cost for buying used item

In this context, the 3PL pays customers an exchange price b for per unit end-of-life used product. For x unit returned products, the cost of a 3PL is

In this scenario, a higher return product cost positively affects return product quantity but negatively affects supply chain profit.

Now we consider two scenarios E and F for profit of the supply chain which are as follows.

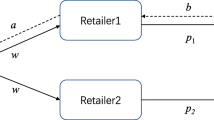

4.3.1 Scenario E

End-of-life used products are remanufactured by the manufacturer and distributor under a technology licensing sharing contract. The distributor remanufacturers a portion of used products and sells products in market. 3PL is not a part of this CLSCM. Scenario E forms a two-echelon CLSCM.

By the previous discussion, we get the profit function of the manufacturer in Scenario E.

The distributor’s expected profit is determined as

where,

For calculation, with originality, the components of the distributor’s profit are transferred from the ordering quantity (M) to the expected inventory (I). Keeping this in mind, Eq. (24) must hold.

Accordingly, the estimated profit function of distributor is represented as

The diagram of scenario E is shown in Fig. 1.

4.3.2 Scenario F

In this scenario, the manufacturer shares technology license with the 3PL. The products are remanufactured by the manufacturer and 3PL in a hybrid remanufacturing. Then, this forms a three-echelon CLSCM, where the distributor only sells products to the market.

The manufacturer profit function for Scenario F is

which simplifies to

Furthermore, the expected profit of the distributor is as below

Besides, the profit function of the 3PL is

The diagram of scenario F is shown in Fig. 1.

5 Solution Methodology

Within the context, the main target is to optimize decision variables v, k, s, I, j, and p for optimal profit of the CLSCM in two scenarios E and F, respectively.

5.1 Stackelberg Game in Scenario E

In this case, manufacturers acts as a leader and the distributor follows him. Using optimal I, j, p, s in manufacturer’s profit function and we get optimal v, k. The values of decision variables of the distributor is mentioned below.

Proposition 1

In this case, the equilibrium condition is applied to the distributor’s profit to achieve the distributor’s optimum decision variables \(I^{*}\) , \(j^{*}\), \(s^{*}\), \(p^{*}\) in Eqs. (30)–(33) which are given below.

where

\(X_1=-\mu +yk^{*}+c(w-c_{M}+T_{2}-l-b)x-bc-(p^{*}-w)a_{4}\)

where , \(H_{1}\) = \(I+a_{0}+a_{2}v^{*}+a_{3}{v^{*}}^{2}+a_{4}j^{*}+a_{5}{j^{*}}^{2}+a_{6}k^{*}+a_{7}{k^{*}}^{2}+a{s^{*}}^{\gamma }+\frac{1}{2k_{1}}\) and \(H_{2}\) = \(p_{\text {max}}H_{1}+a_{1}w(p_{\text {max}}-p_{\text {min}})+p_{\text {min}}p_{\text {max}}.\)

Later, to find out the manufacturer optimal decision variables \(v^{*}\), \(k^{*}\), we apply equilibrium condition on the manufacturer’s profit function.

Proposition 2

The manufacturer’s decision variables \(v^{*}\), \(k^{*}\) are define in Eqs. (34) and (35) as below:

\(H_{3}\) = \(I+a_{0}+a_{1}\frac{p_{\text {max}}-p}{p-p_{\text {min}}}+a_{4}j+a_{5}j^{2}+a_{6}k+a_{7}k^{2}+as^{\gamma }\),

\(H_{4}\) = \(2a_{3}(w-p_{v}\eta -c_{M})+2a_{2}p_{v}\eta -\theta \),

and \(H_{6}\) = \(H_{3}p_{v}\eta +a_{2}(w-c_{M}-p_{v}\eta )\)

5.2 Stackelberg Game in Scenario F

In this case, the manufacturer acts as a leader, then the distributor, and 3PL follow the manufacturer. Here putting the optimal values of I, j, p, s in the manufacturer profit function, we get v, k.

Proposition 3

In this case, applying equilibrium condition on 3PL and distributor’s profit function, the optimal decision variables \(j^{*}\), \(I^{*}\), \(s^{*}\), \(p^{*}\) are given in Eqs. (36)–(39).

where, \(L_{1}\) = \(I+a_{0}+a_{2}v^{*}+a_{3}{v^{*}}^{2}+a_{4}j^{*}+a_{5}{j^{*}}^{2}+a_{6}k^{*}+a_{7}{k^{*}}^{2}+a{s^{*}}^{\gamma }\) and \(L_{2}\) = \(\frac{I^{2}}{2k_{1}}\).

Also, \(L_{5}\)= \(p_{\text {min}}^{2}(L_{1}-L_{2})-a_{1}p_{\text {max}}p_{\text {min}}+a_{1}(w(p_{\text {max}}-p_{\text {min}})).\)

To find out the manufacturer’s optimal decision variables \(v^{*}\), \(k^{*}\), we are applying equilibrium condition on the manufacturer’s profit function.

Proposition 4

In this case, applying equilibrium condition on the manufacturer profit function, optimal decision variables \(v^{*}\), \(k^{*}\) are defined in Eqs. (40) and (41).

where , \(L_{3}\) = \(I+a_{0}+a_{1}\frac{p_{\text {max}}-p}{p-p_{\text {min}}}+a_{4}j+a_{5}j^{2}+a_{6}k+a_{7}k^{2}+as^{\gamma }\),

and , \(L_{4}\) = \(2a_{3}(w-p_{v}\eta -c_{M})+2a_{2}p_{v}\eta -\theta \).

Also, \(L_{6}\) = \(L_{3}p_{v}\eta +a_{2}(w-c_{M}-p_{v}\eta )\)

6 Numerical Analysis

This study uses input data from Mondal et al. [14] and Taleizadeh et al. [25]. The proposed analytical solution process is used to solve numerical examples.

6.1 Example 1

Example 1 gives numerical results for Scenario E. Table 2 gives input value of parameters. Total profit and optimum values of decision variables for Scenario E are shown in Table 3.

6.2 Example 2

Example 2 gives numerical results for Scenario F. Table 2 gives the parametric value for Example 2. Maximum profit and optimal values of decision variables are given in Table 4.

Results show that Scenario E has more profit than Scenario F. This happens because Scenario E has a known distribution function. Thus, all information about demand is known to the management and thus, it is easy to optimize the objective. But, in reality, there are a lot of risks and uncertainties that evolve along with information. Then, the management needs to justify that information more than the known case, as Scenario E.

6.3 Sensitivity Analysis

The sensitivity investigation of the main specifications of this study is summarized in Table 5 based on the Example 1.

7 Managerial Insights

Some managerial insights derived from this study are given below.

-

1.

The industry manager must focus on the hybrid remanufacturing process where the 3PL and the manufacturer both remanufacture the return products (scenario F), and distributor only sells the products. It is lesser successful policy to earn more profit than Scenario E. Therefore, the manufacturer with information about the best remanufacturing strategy can reach the environmental goal (Figs. 2–3).

-

2.

Managers of the industry must focus on servicing efforts. This paper analyzes the impact of servicing actions on total profits. In order to increase the demand for the product, some costs should be invested for the purpose of service to customers. In this competitive market, this service strategy plays an important role. Thus, the results of this study helps industry managers increase their profits.

-

3.

Another important aspect of this study is that higher refund prices positively affect the end-of-life used product return process. A higher return price leads to a higher return process and helps the CLSCM to make more profit. Therefore, a manager with knowledge about the impact of return price on remanufacturing, carbon emission, and quality can determine an optimal return price to achieve all goals regarding environmental, economic, and quality concerns.

8 Conclusions

The servicing effort had an huge impact on market demand, decreasing the selling price, which positively impacts the supply chain profit. This study used emission reduction, quality improvement of the products, and reduction policy for remanufacturing of return products. Result showed that a three-echelon CLSCM gained more profit than a two-echelon CLSCM. Analytical approach was used to reach this result, and the arithmetical findings provided a global optimal solution. The production cost and carbon tax were considered as continuous type in this model. This study can be extended by using discrete type of price and tax. Besides, some other motivation factors like customer awareness are not considered in this research. In the future model, these factors can be considered.

References

Allan, G., Lecca, P., McGregor, P., Swales, K.: The economic and environmental impact of a carbon tax for Scotland: a computable general equilibrium analysis. Ecol. Econ. 100, 40–50 (2014)

Kar, S., Basu, K., Sarkar, B.: Advertisement policy for dual-channel within emissions-controlled flexible production system. J. Retail. Consum. Serv. 71, 103077 (2023)

Chen, J.M., Chang, C.I.: The co-opetitive strategy of a closed loop supply chain with remanufacturing. Transp. Res. Part E Logistics Trans. Rev. 48(2), 387–400 (2012)

Datta, T.K.: Effect of green technology investment on a production inventory system with carbon tax. Adv. Oper. Res. (2017)

Demirel, E., Demirel, N., Cen, H.G.: A mixed integer linear programming model to optimize reverse logistics activities of end-of-life vehicles in Turkey. J. Cleaner Prod. 112(3), 2101–2113 (2016)

Khan, I., Malik, A.I., Sarkar, B.: A distribution-free newsvendor model considering environmental impact and shortages with price-dependent stochastic demand. Math. Biosci. Eng. 20(2), 2459–2481 (2023)

Giovanni, P.D.: A joint maximization incentive in closed-loop supply chains with competing retailers: the case of spent-battery recycling. Eur. J. Oper. Res. 268(1), 128–147 (2018)

Giri, B.C., Sharma, S.: Optimal production policy for a closed loop hybrid system with uncertain demand and return under supply disruption. J. Cleaner Prod. 112(3), 2015–2028 (2016)

Harris, L.C., Ogbonna, E.: Exploring service sabotage: the antecedents, types and consequences of frontline, deviant, antiservice behaviors. J. Serv. Res. 4(3) (2002)

Jacobs, B.W., Subramanian, R.: Sharing responsibility for product recovery across the supply chain. Prod. Manage. 21(1), 85–100 (2012)

Ji, J., Zhang, Z., Yang, L.: Carbon emission reduction decisions in the retail-/dual-channel supply chain with consumers’ preference. J. Cleaner Prod. 141, 852–867 (2017)

Liu, Y., Holzer, J.T., Ferris, M.C.: Extending the bidding format to promote demand response. Energy Policy 86, 82–92 (2015)

Liu, L., Huang, C.Z., Huanga, G., Baetzd, B., Pittendrigha, S.M.: How a carbon tax will affect an emission-intensive economy: a case study of the Province of Saskatchewan. Canada. Energy 159, 817–826 (2018)

Mondal, A.K., Pareek, S., Chaudhuri, K., Bera, A., Bachar, R.K., Sarkar, B.,: Technology license sharing strategy for remanufacturing industries under a closed-loop supply chain management bonding. RAIRO-Operat Res. 56(4), 3017–3045 (2022)

Qin, J., Bai, X., Xia, L.: Sustainable trade credit and replenishment policies under the cap-and-trade and carbon tax regulations. MDPI, Open Access J. 7(12), 16340–16361 (2015)

Ramani, V., Giovanni, D.P.: A two-period model of product cannibalization in an atypical closed-loop supply chain with endogenous returns: the case of DellReconnect. Eur. J. Oper. Res. 1009–1027 (2017)

Chaudhari, U., Bhadoriya, A., Jani, M.Y., Sarkar, B.: A generalized payment policy for deteriorating items when demand depends on price, stock, and advertisement under carbon tax regulations. Math. Comp. Simul. 207, 556–474 (2023)

Kugele, A.S.H., Sarkar, B.: Reducing carbon emissions of a multi-stage smart production for biofuel towards sustainable development. Alexan. Eng. J. 70, 93–113 (2023)

Yadav, D., Chand, U., Goel, R., Sarkar, B.: Smart production system with random imperfect process, partial backordering, and deterioration in an inflationary environment. Mathematics 11(2), 440 (2023)

Savaskan, R.C., Wassenhove, L.V.: Reverse channel design: the case of competing retailers. Manage. Sci. 52(1), 1–14 (2006)

Savaskan, K.C., Bhattacharya, S., Wassenhove, V.: Closed-loop supply chain models with product remanufacturing. Research Collection Lee Kong CHIAN School of Business, Publication Type, Journal Article (2004)

Shi, J., Zhanga, G., Shab, J.: Optimal production planning for a multi-product closed loop system with uncertain demand and return. Comput. Oper. Res. 38(3), 641–650 (2011)

Taleizadeh, A., Zerang, E.S., Choi, T.M.: The effect of marketing effort on dual-channel closed-loop supply chain systems. Systems 1–12 (2016)

Taleizadeh, A., Moshtagh, M.S., Moon, I.: Optimal decisions of price, quality, effort level and return policy in a three-level closed-loop supply chain based on different game theory approaches. Eur. J. Ind. Eng. 11(4), 486 (2017)

Taleizadeh, A.A., Basban, N.A., Niaki, S.T.A.: A closed-loop supply chain considering carbon reduction, quality improvement effort, and return policy under two remanufacturing scenarios. J. Cleaner Prod. 232, 1230–1250 (2019)

Teunter, R., van der Laan, E.: On the non-optimality of the average cost approach for inventory models with remanufacturing. Int. J. Prod. Econ. 79(1), 67–73 (2002)

Wang, Y., Chena, W., Liu, B.: Manufacturing/remanufacturing decisions for a capital-constrained manufacturer considering carbon emission cap and trade. J. Cleaner Prod. 140(3), 1118–1128 (2017)

Xu, M., Qi, X., Yu, G., Zhang, H., Gao, C.: The demand disruption management problem for a supply chain system with nonlinear demand functions. J. Syst. Sci. Syst. Eng. 12, 82–97 (2003)

Xu, L., Li, Y., Govindan, K., Yue, X.: Return policy and supply chain coordination with network-externality effect. Int. J. Prod. Res. 56(10), 3714–3732 (2018)

Yang, G., Wang, Z., Li, X.: The optimization of the closed-loop supply chain network. Transp. Res. Part E Logistics Transp. Rev. 45(1), 16–28 (2009)

Zeng, J., Yao, Q., Wang, X., Zhang, Y.: Game research on coal mine workers’ off-post behaviors. Math. Probl. Eng. (2019)

Zhao, R., Liu, Y., Zhang, N., Huang, T.: An optimization model for green supply chain management by using a big data analytic approach. J. Cleaner Prod. 142(2), 1085–1097 (2017)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper

Mondal, A.K., Pareek, S., Sarkar, B. (2023). Optimal Pricing with Servicing Effort in Two Remanufacturing Scenarios of a Closed-Loop Supply Chain. In: Castillo, O., Bera, U.K., Jana, D.K. (eds) Applied Mathematics and Computational Intelligence. ICAMCI 2020. Springer Proceedings in Mathematics & Statistics, vol 413. Springer, Singapore. https://doi.org/10.1007/978-981-19-8194-4_16

Download citation

DOI: https://doi.org/10.1007/978-981-19-8194-4_16

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-19-8193-7

Online ISBN: 978-981-19-8194-4

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)