Abstract

The circular economy, which aims to increase sustainability, reduce waste, and optimize the utilization of resources in the supply chain, has received much attention in recent years from researchers. In addition, strict environmental regulations have required firms to accept responsibility for their end-of-life products. This research investigates a Closed-Loop Supply Chain (CLSC) that incorporates dual competitive channels in both the forward and reverse chains, in addition to a Reward-Penalty Mechanism (RPM), to address the issues of sustainability and end-of-life products in supply chains. The CLSC includes a manufacturer, a retailer, and a third-party collector. In the forward chain, the manufacturer and the retailer deliver new and refurbished products to customers through online and retail channels. In the reverse chain, the manufacturer collects the used products through retail and third-party collector channels to remanufacture the end-of-life products. This research examines the decisions related to pricing and collection rates of used products in the CLSC under the RPM. The problem is formulated and solved under decentralized, centralized, and coordinated structures with a game theoretic approach. The study’s findings indicate that the coordinated structure, utilizing a two-part tariff contract, outperforms the decentralized model in terms of collection rate and profitability for all members of the CLSC. Furthermore, the RPM enhances the benefits of remanufacturing activities for both the economy and the environment by increasing the collection rate of used products.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Over the past few decades, recycling and remanufacturing functions have received considerable attention from both academicians and practitioners because of resource shortages and requirements to implement sustainable development and environmental processes, such as waste disposal, that affect pollution levels in the air and water tables and ameliorate the natural resource depletion. In addition, the remanufacturing system consists of multiple decision makers, such as manufacturers, recyclers, consumers, and government (Wang et al., 2014). The decisions made by the forward supply chain members, customer behaviors (such as the willingness to return used products and accept remanufactured products), and government policies have a significant impact on the members of the reverse supply chain. Governments implement laws, regulations, and policies such as Extended Producer Responsibility (EPR) to compel businesses to recycle their products (Ameli et al., 2019).

EPR policies that address the handling of Waste Electrical and Electronic Equipment (WEEE) are particularly crucial (Ameli et al., 2016). These policies include subsidies, taxes, penalties, and Reward-Penalty Mechanisms (RPM). For example, the WEEE recycling management regulation went into effect in China in 2011, which specifies the establishment of a disposal fund to subsidize the WEEE recovery and treatment. The manufacturer should pay for the WEEE disposal fund, and it will be penalized if it fails to meet the WEEE recovery rate target (Wang & Da, 2008). The USA has provided $2.4 billion for electric vehicle corporations to support the manufacturing of green products (Gong et al., 2013). China has adopted subsidization for the manufacturers to stimulate the collection of the WEEE (Wang et al., 2015).

However, for an efficient recovery program implementation, it is necessary to manage reverse product flows properly and close supply chain loops. Studies on closed-loop supply chains (CLSCs) can be classified as production planning and inventory management (Kenné et al., 2012), network design (Kusumastuti et al., 2008), and channel management (Jiang et al., 2010), among others.

In current marketing systems, several channel structures feature reverse or forward flow. The forward supply chain comprises a retail channel, an online channel for direct sales over the internet, and a hybrid dual channel that combines elements of both retail and online sales. Therefore, companies have started to adopt both direct and traditional sales channels, leading to the emergence of hybrid dual channels. For instance, in recent years, many outstanding companies in various industries (e.g., Nike, Dell, and IBM) have sold directly to end users through an online channel (Chiang et al., 2003; Hua et al., 2010; Tedeschi, 2000; Tsay & Agrawal, 2004). However, motivated by earning more profit, other members of the supply chain, like third parties, are involved in collecting the used products. In the reverse supply chain, various channel processes have been identified, including direct collection by the manufacturer from consumers, manufacturer-retailer contracts for collecting used products, manufacturer-third party contracts for collection, and manufacturer contracts with both a third party and a retailer for collecting used items. In this paper, a three-level supply chain is assumed in which used items are collected by both the third party, and the retailer and channel structures of both forward and reverse supply chains are taken into account.

The emergence of dual-channel structures in both forward and reverse chains creates competition between channel members. One way to reduce this conflict in the supply chain is to use channel coordination contracts. Channel coordination is imperative for improving channel-wide performance because it has the potential to generate profit benefits. Channel coordination using the contract mechanism is the design of a contract between the channel members that effectively neutralizes the difference between the centralized solutions predicted by a single decision maker and decentralized solutions made jointly by the channel members. Various contracts are used to cut out double marginalization in the traditional profit-maximizing supply chains but are rarely applied in a CLSC. A two-part tariff contract is a coordination mechanism typically suggested by the manufacturer to other members. It is adjusted based on all members’ profits to incentivize coherent decision-making for optimizing the entire supply chain (Modak et al., 2015).

This research considers a CLSC, including a manufacturer, a retailer, and a third-party collector. The manufacturer produces new products from raw materials and remanufactures the collected (i.e., used) products. In the forward chain, the manufacturer sells new and remanufactured products through retail and internet channels. In the reverse supply chain, the retailer and the third-party collector competitively purchase used products from consumers at a fixed price and sell them to the manufacturer for reproduction. In the considered CLSC, the government determines an RPM for remanufacturing. Specifically, the government implements rewards or penalties based on the extent to which the collection rate deviates from the target collection rate (Wang et al., 2015). RPM is considered performance-based care. By evaluating end-of-life product collection at CLSC, the government will impose appropriate rewards and penalties for improvements to keep the non-collected used products within acceptable limits (Alvehag & Awodele, 2013). The purpose of this paper is to investigate the impact of the RPM on the collection decisions in the CLSC.

The CLSC in this research is modeled based on three centralized, decentralized, and coordinated models. Due to the competitive environment in the forward and reverse chain, a two-part tariff contract has been proposed to coordinate the CLSC members. No previous research has analyzed a CLSC that includes both retail and online channels in the forward chain and a dual collection channel in the reverse chain, along with RPM for remanufacturing, as far as the authors are aware. The following research questions are answered in this paper.

-

What are the optimal price, collection rates, and profits in a CLSC with two competitive recycling channels?

-

What are the impacts of collection rate RPM on the CLSC decisions and members’ profits?

-

How can a two-part tariff contract coordinate a CLSC, including a manufacturer, a retailer, and a third party?

-

How can the competition between the retailer and the third party influence the return rate of the used products and the profit of CLSC members?

The rest of this paper is organized as follows: Sect. 2 reviews previous research in CLSC remanufacturing operations, CLSC coordination, and government intervention in the CLSC. Section 3 describes model notations. Section 3.2 provides a profound description of the problem and model assumptions. Section 4 comprises problem formulation based on centralized, decentralized, and coordinated models. Section 5 gives a numerical example of the problem and sensitivity analysis to evaluate the proposed models. Finally, managerial insights are given in Sect. 7 based on the obtained results.

2 Literature review

The literature review studied in this section is divided into two parts:

-

(1)

CLSC performance according to collection agents and coordination through contracts

-

(2)

Roles and effects of government intervention.

2.1 CLSC performance according to collection agents and coordination through contracts

CLSC studies using game theory have examined how performance varies by channel leadership and collection agents. Huang et al. (2013) studied a CLSC with two collection channels in which retailers and third-party collectors competitively collect used products. They compared two competitive collection channels to one retail collection channel. Ovchinnikov (2011) reviewed the pricing of remanufactured products and demonstrated that the organization’s pricing strategy is influenced by various factors, such as the cost structure of product features and customer behavior. Zhang et al. (2018) investigated the pricing of new and refurbished products within a supply chain comprising a supplier and a retailer. Dwicahyani et al. (2019) studied pricing in a supply chain with two manufacturers producing different products, competing on price and quality. Yi et al. (2016) explored a CLSC with a dual recycling channel in the construction machinery industry, aiming to develop optimal collection strategies. Gan et al. (2017) considered a CLSC in which the manufacturer delivers new products to customers through a traditional retail channel and the reproducible products through a direct channel. They concluded that considering a separate channel for selling the reproduced products is of the manufacturer’s interest. Feng et al. (2019) investigated pricing and competition in a reverse supply chain with two manufacturers and two recyclers. Rajabzadeh et al. (2023) explored pricing decisions for two competeing CLSCs by considering supply disruption under a Stackelberg game. Rezaei and Maihami (2020) studied a multi-echelon CLSC including a manufacturer, a retailer/remanufacturer, and a collection center, where the used products are collected by the collection center in a reverse flow and sent to the retailer/remanufacturer for remanufacturing processes. Modak et al. (2015), Huang et al. (2017), Huang and Wang (2017), and Liu et al. (2017) compared the performance of supply chains under various collection channel structures. Their results showed that the collection channel structure affects the supply chain performance and the collection rate. In summary, these studies analyzed CLSC performance in different settings but did not examine whether the coordination methods could improve the performance.

Several researchers have investigated coordi006Eation strategies, considering waste recycling collection and management. Savaskan et al. (2004) conducted a comparative analysis of supply chain performance, examining scenarios where the manufacturer, retailer, and collector are each responsible for waste material collection. They demonstrated that two-part tariff contracts improve performance. De Giovanni et al. (2016) compared the performance of wholesale price contracts and Reverse Supply Chains (RSCs) in a CLSC including a manufacturer and a retailer. Choi et al. (2013) analyzed the performance of a three-level supply chain. They proved that two-part tariff contracts and RSCs optimize the performance of the chain. Han et al. (2017) studied the performance in the cases in which the manufacturer or the retailer collects waste materials when there is a disruption in the reprocessing cost. They discussed that RSCs could better handle cost disruption. Zheng et al. (2017) compared the supply chain performance with regard to the power structure in dual-channel CLSCs. They claimed that two-part tariff contracts perform better than wholesale price contracts. Taleizadeh et al. (2018) claimed that a manufacturer performs better in a dual-channel-forward/dual-channel-reverse supply chain than in a single-channel-forward/dual-channel-reverse supply chain. They also showed that the supply chain performance might improve using a contract combining collaborative advertising and two-part tariffs. Ranjbar et al. (2020) reviewed products’ pricing and collection policies in a CLSC with two competitive recycling channels under different power structures. In summary, the reviewed studies explored the types of contracts that improve supply chain performance. However, they did not examine the impact of government intervention.

2.2 The roles and effects of government intervention

Although the literature on supply chain coordination is extensive, few studies have addressed the effects of policies as government intervention. Wang et al. (2015) delved into the impact of the government’s RPM on the performance of a two-level supply chain. Their study revealed that the RPM led to an increase in the collection rate. Furthermore, they demonstrated that applying a higher reward-penalty to the collector enhanced the performance of the collector-dominated model. Ma et al. (2013) examined the impact of the government’s consumer subsidy program on a CLSC in which a manufacturer produces new products and a traditional retailer along with an online retailer. Xiong et al. (2013) considered a CLSC consisting of one supplier and producer. They demonstrated that reproduction is beneficial when the government subsidizes the manufacturer. Wang et al. (2017a) compared how a government’s reward penalty system affects performance when one manufacturer acts as the leader in a supply chain consisting of two manufacturers and one retailer. They showed that the collection rate increases under a reward–penalty system, as did the gains of the dominant manufacturers and retailers. Wang et al. (2017b) studied whether the government’s reward–penalty system can facilitate retailer collections when manufacturers are unaware of retailers’ collection efforts. They found that a system of rewards and penalties supports collection rates by increasing the price of waste. They also showed the government generally desired to identify which parties among manufacturers, retailers, and third parties (such as collectors) had a leading act. Nielsen et al. (2019) examined two government incentive policies in a green supply chain. One policy is that the government provides incentives for R&D investment, and the other provides incentives to produce a single product. Wan and Hong (2019) studied the effects of pricing and government subsidy policies on a CLSC. He et al. (2019) conducted a study on a CLSC that included a manufacturer, a retailer, and a third-party company. The research aimed to determine the optimal channel structure and pricing strategies for the manufacturer, as well as the most effective government subsidy policy.

To the best of our knowledge, there is a lack of prior research in the literature that examines a CLSC with dual channels in both the forward and reverse chains, while also considering the government’s legislation, such as the remanufacturing legislation (RPM), for used products. The considered CLSC in this paper is investigated under centralized, decentralized, and coordinated models. A brief review of the related literature is presented in Table 1.

3 Model notations, description, and assumptions

3.1 Model notations

The following notations are used to describe the proposed models.

Symbols | Definition |

|---|---|

\(M\) | The manufacturer |

\(R\) | The retailer |

\(T\) | The third-party collector |

\({\text{SC}}\) | The whole supply chain |

Parameters | Definition |

|---|---|

\(\rho\) | The market share of retail channel, \(0\le \rho \le\) 1 |

\(\varphi\) | The basic market demand for the products |

\(\phi\) | The self-price elastic coefficient |

\(\beta\) | The cross-price elastic coefficient |

\({c}_{m}\) | The manufacturer’s unit cost of producing a new product, w > \({c}_{m}\) |

\({c}_{r}\) | The manufacturer’s unit cost of remanufacturing a used product |

A | The price of returned products paid by the retailer or the third party to customers |

\(\Delta ={c}_{m}-{c}_{r}\) | Cost savings per unit of remanufacturing product, \(\Delta ={c}_{m}-{c}_{r}\) |

\({c}_{l}\) | Scalar parameter, coefficient of exchange between collection rate and investment |

\({I}_{i}\) | The financial investment of member i in the collection of used products; \(\forall i\in \{r,t\}\) |

\(\alpha\) | Competition coefficient between a retailer recycling channel and a third-party recycling channel |

\(k\) | Reward–penalty intensity decided by the government |

\({\tau }_{0}\) | Target collection quantity set by the government |

\(\lambda\) | The discount coefficient in unit wholesale price |

\({\delta }_{i}\) | The discount coefficient in unit transfer price of member \(i\); \(\forall i\in \{r,t\}\) |

\({\gamma }_{i}\) | The bargaining power of member \(i\); \(\forall i\in \{m,r,t\}\) |

Decision Variables | Definition |

|---|---|

\({p}_{m}\) | Manufacturer price per unit of products |

\({p}_{r}\) | Retail price per unit of products |

W | The unit wholesale price |

\(b\) | The unit transfer price: the manufacturer takes the products collected by the retailer and the third-party collector |

\({\tau }_{r}\) | The collection rate of the retailer |

\({\tau }_{t}\) | The collection rate of the third party |

\({\tau }_{T}\) | The total collection rate, \({\tau }_{T}={\tau }_{r}+{\tau }_{t}\) |

3.2 Model description

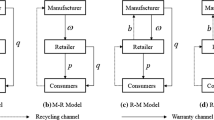

This paper examines a CLSC that includes a manufacturer, a retailer, and a third party, as illustrated in Fig. 1. In the forward chain, the manufacturer sells the products through both retail and online channels. In the reverse supply chain, the used products are collected competitively by the retailer and the third party and transferred to the manufacturer at the same price. As a facilitator, the government sets a target collection quantity \({\tau }_{0}\) and the reward–penalty intensity \(k\) for the manufacturer. In other words, if the total amount of collected used products by the third party and retailer surpasses the target collection amount, the government will reward manufacturers for the excess. Otherwise, the government will impose penalties if the target collection amount is not met. The intensity of reward and penalty is assumed to be equal to \(k\).

This paper considers that the manufacturer is the leader, while the retailer and the third party are followers who make decisions simultaneously. As a result, the following is a summary of the events sequence. To maximize its profit, the manufacturer must first determine the wholesale price and direct channel price. After that, the retailer and the third party compete for the best acquisition price for end customers in response to the manufacturer’s decisions. The profitability of the used products’ collection entices the retailer and the third party, which creates competition between the retailer and the third party. One of the solutions to reduce this competition and conflict between collectors is to use coordination schemes and contracts. Therefore, three decision-making models are used to model the examined CLSC: (1) decentralized, (2) centralized, and (3) coordinated models.

The Stackelberg game is usually used when a firm has higher commercial value than other firms, which can then act as a leader, and other firms depend on their leader. Within the decentralized models, one agent assumes the role of the leader, while two other agents function as followers, leading to a non-cooperative game between the two followers (Ranjbar et al., 2020). Under the decentralized structure, the decisions are made according to the Stackelberg game. The centralized structure as a benchmark optimizes the whole CLSC system and obtains the optimized value of CLSC decisions from the entire CLSC perspective. Finally, a two-part tariff contract is proposed to coordinate the investigated CLSC and ensure the participation of all CLSC members in the coordination model.

3.3 Model assumptions

The proposed models are formulated under the following assumptions:

-

1.

The demands of the manufacturer and retailer are linear functions of the own, cross, and buyback prices (Maiti & Giri, 2015). As a result, the market expansions in traditional and direct channels are obtained by Eqs. (1) and (2):

$$D_{r} = \rho \varphi - \phi p_{r} + \beta p_{m},$$(1)$$D_{m} = \left( {1 - \rho } \right)\varphi - \phi p_{m} + \beta p_{r}.$$(2) -

2.

The quality, warranty, and facilities of the remanufactured products are comparable to new goods. There are no distinctions between new and remanufactured products such that they can be sold at the same price and in the same market. For example, this assumption is used to sell Kodak single-use cameras, where the new and remanufactured products are sold to retailers at the same price.

-

3.

The unit cost of producing a new item is more than that of reproducing the returned products (Savaskan et al., 2004); that is, \({c}_{m}>{c}_{r}\).

-

4.

The collection rate is calculated as a function of the investment in collecting the used products (Savaskan et al., 2004). The retailer and the third party are competing to collect the used products. One side’s collection rate can be expressed as a monotonic increasing function of its investment and a monotonic decreasing function of the opposite side’s investment (Huang et al., 2013). The formulae are presented as follows:

$$\tau_{r} = \sqrt {\frac{{I_{r} - \alpha I_{t} }}{{c_{l} }}},$$(3)$$\tau_{t} = \sqrt {\frac{{I_{t} - \alpha I_{r} }}{{c_{l} }}},$$(4)$$0 \le \alpha \le 1.$$ -

5.

All members of the CLSC are interested in cooperating in an integrated system. Equation (5) should be held for the feasibility of the system:

$$p_{r} > w > 0, \Delta > b > A.$$(5) -

6.

Symbol \("A"\) represents the average price of returned products. There is no difference in the quality of used products.

-

7.

CLSC decisions are made in one period.

-

8.

The information is symmetric.

4 Model formulation

In this section, we present three distinct CLSC decision models incorporating the RPM.

4.1 Centralized decision model

Under the centralized model, the manufacturer, the retailer, and the third party collaborate and operate as an interconnected system. The profit function for the supply chain in a centralized model is shown by Eq. (6):

Proposition 1

In the centralized model, the condition (1–5) holds:

By using the first-order derivative test and its solution, the optimal retail price, the optimal manufacturer price, the optimal collection rate of the retailer, and the optimal collection rate of the third party are obtained by Eqs. (8)–(11):

The proof for the above equations can be found in Appendix.

4.2 Decentralized decision model

In the decentralized model, the manufacturer, the retailer, and the third party are independent decision-makers who want to increase their profits. The manufacturer acts as a leader, the retailer and the third party act as followers, and a non-cooperative game occurs between the two followers. The profit functions of the manufacturer, the retailer, and the third party based on assumptions are obtained by Eqs. (12), (13), and (14):

We use backward induction to obtain the equilibrium decisions of the members. Thus, first, the retailer determines its retail price and collection rate (\({p}_{r}^{{\text{Dec}}}\),\({\tau }_{r}^{{\text{Dec}}}\)), and so does the third party for its collection rate (\({\tau }_{t}^{M}\)). Then, the manufacturer considers the best responses of the retailer and third party and decides on wholesale price, online price, and the optimal transfer price accordingly (\({w}^{{\text{Dec}}},{p}_{m}^{{\text{Dec}}},{b}_{r}^{{\text{Dec}}},{b}_{t}^{{\text{Dec}}})\).

In the decentralized model, the third party problem is formulated in the form of Eq. (15):

The retailer problem is formulated as Eqs. (16) and (17):

The manufacturer problem is formulated as Eq. (18):

If condition (18) holds, then the optimal decisions Eqs. (19), (20), and (21) are obtained by placing the optimal answers of the retailer and the third party in the manufacturer profit function.

4.3 Coordinated decision model using two-part tariff contracts

The competing behaviors of the retailer and the manufacturer in the forward chain and the retailer and the third party in the reverse chain create conflicting interests, which causes inefficiency in the CLSC. Therefore, a two-part tariff contract is proposed to coordinate the retailer and the manufacturer in the forward chain and the retailer and the third party in the reverse chain. In the forward chain, the manufacturer sets the wholesale price to \(\lambda w\) for the retailer, and in the reverse chain, sets the transfer price to \({\delta }_{i}{b}_{i}, i=r,t\) for the retailer and the third party. Accordingly, the manufacturer charges \({F}_{1}\) and \({F}_{2}\) for the retailer and the third party, respectively. Furthermore, the retailer and the third party set the retail price and return rates in a way that is consistent with the centralized model.

The profit functions of the manufacturer, the retailer, and the third party in the coordinated model are formulated as shown by Eqs. (22), (23), and (24):

Proposition 2

The two-part tariff contract applied in the competitive link of the retailer and the manufacturer resolves CLSC misaligned motivations only if Eq. (25) holds:

Proof

see “Appendix”.

Proposition 3

The two-part tariff contract applied in the competitive link of the retailer and the third party resolves CLSC misaligned motivations only if Eq. (26) holds:

Proof

see “Appendix”.

Proposition 4

The two-way, two-part tariff contract conducted in the competitive forward and reverse links can motivate all CLSC members to accept the proposed coordination scheme if and only if the satisfaction conditions hold as follows:

4.4 Surplus profit sharing strategy

In this section, to determine payments (\({F}_{1}\), \({F}_{2}\)), a profit-sharing approach is presented based on the bargaining powers of CLSC members. The bargaining power of the manufacturer is defined by \({\gamma }_{m}\), and \({{\gamma }_{r}, \gamma }_{t}\) are the bargaining powers of the retailer and third party, respectively.

The achieved profit under the proposed coordinated two-part tariff contract is calculated as the difference between the profit of the whole CLSC in the centralized and decentralized models, as shown by Eq. (30):

Under the profit sharing strategy, the share of each CLSC member from the achieved surplus profit can be derived as the proportion of its bargaining power, obtained by Eqs. (31), (32), and (33):

Under the profit sharing strategy, the profit of CLSC members from the achieved surplus profit is formulated by Eqs. (34), (35), and (36) as follows:

Accordingly, the exact value of the \(F_{1}\) and \(F_{2}\) can be specified under simplification Eqs. (34), (35), and (36), which is shown by Eqs. (37) and (38):

5 Numerical examples

In this section, we have provided a numerical example using actual data from an Iranian refrigerator manufacturer. The Iranian refrigerator market consists of more than 25 million households, where 90% have at least one refrigerator at their home, and 36% have at least two refrigerators in use. The average lifespan of a refrigerator is estimated to be approximately 15 years. Information is gathered through interviews with relevant experts and research of existing records within the organization. Besides, some of the collected parameters are estimated with approximations to satisfy the problem assumptions and the conditions, so it is not far from reality to use these parameters for problem-solving (Table 2).

As shown in Table 3, in the coordinated model with a two-part tariff contract, the return rate of used products (Fig. 2) and the profit of all CLSC members is higher than that of the centralized and decentralized models.

6 Sensitivity analysis

6.1 Comparison between two structure

We compare the members’ optimal decisions and profits under the decentralized and coordinated game structures. Under the decentralized game structure and coordinated model, the total collection rate of used products over increasing competition degree between retailer and third party is demonstrated in Fig. 3. As shown in Fig. 3, increasing the competition degree on the collecting investment (\(\alpha\)) decreases the collection rate of used products under decentralized and coordinated models. Although by increasing the competition, the decrease in the collection rate of used products under the coordinated model is more than that of the decentralized model, the value of the collection rate is consistently higher in the coordinated model compared to the decentralized model. Hence, the proposed two-part tariff contract benefits the CLSC system from both environmental and economic perspectives. It can upgrade the collection rate by encouraging consumers to return their used products willingly.

Figure 4 shows the effect of the retailer and the third party competition on the profits of all CLSC members under decentralized and coordinated models. Increasing α leads to a decrease in the profit of all CLSC members in both decentralized and coordinated models, as illustrated in Fig. 4. However, under the proposed two-part tariff agreement in this research, the individual profits of CLSC members are higher than those in the decentralized model. In the case of the manufacturer, as the competition rate increases, the decreasing rate of the profit is higher in the coordinated model compared to the decentralized model. In the case of the retailer and the third party, by increasing the competition rate, the decreasing rate of the profit is almost the same at first in both coordinated and centralized models. After that, decreasing rate of the profit starts to get higher in the coordinated model compared to the decentralized model. The findings show the application and efficiency of the coordinated model in improving the supply chain profitability concerning the competitive behavior of the retailer and the manufacturer in the forward chain and that of the retailer and the third party in the reverse chain.

6.2 The impact of RPM on equilibrium solutions

This subsection illustrates the impact of reward-penalty intensity on the total return rate and equilibrium solutions.

As shown in Fig. 5, the total collection rate increases with the increase of k. We also note that if the reward-penalty intensity k is relatively small, the recycler’s collection rate may not reach the target value the government sets.

As shown in Fig. 6, there exists a threshold of \({k}^{m}\) of reward-penalty intensity. For \(0<k<{k}^{m}\), the manufacturer’s profit (\({\pi }_{m})\) decreases with\(k\); for\({k}^{m}<k\), the manufacturer’s profit \(({\pi }_{m})\) increases. The reason is that, an increase in \(k\) leads to economic penalties and a decrease in the manufacturer’s profit when the collection rate of used products does not meet the government’s specified target.

7 Conclusion, future research and managerial implications

This paper investigated the optimal pricing strategy and collection rate of the used products with Reward-Penalty Mechanism (RPM) in a Closed-Loop Supply Chain (CLSC) with dual competitive channels both in the forward and reverse chains. The effects of reward-penalty intensity on the return rate of used products and profits of the manufacturer are discussed as well. In the reverse channel, the used products are collected by a retailer and a third party and then transferred back to the manufacturer. The products are simultaneously sold to the end consumers through online and traditional retail channels. The centralized structure is used as a benchmark to optimize the whole CLSC. The decentralized structure of the considered CLSC is also investigated according to the Stackelberg game. In addition to centralized and decentralized structures, we proposed a coordinated structure in which a two-part tariff contract is utilized to coordinate the CLSC members. The following conclusions and insights can be summarized.

-

From an environmental point of view, remanufacturing and recycling the used products lessens the harmful effects of waste products on the environment. The proposed coordinated model can increase CLSC sustainability by increasing the collection rate and remanufacturing of the used products. The coordinated model also has a better collection rate performance under the RPM mechanism than centralized and decentralized models.

-

The proposed two-part tariff contract is also benefits the manufacturer as it can motivate retailers and third parties to increase the collection rate of the used products.

-

An RPM is composed of reward-penalty intensity and target collection rate to make remanufacturing activities beneficial to the economy and the environment. Our key findings are as follows. Considering the RPM can significantly improve the environmental sustainability of the CLSC from the government’s perspective. We find that the implementation of RPM by the government can lead to collectors receiving a portion of the extra profit resulting from an increase in the collection rate of used products. This finding highlights the potential benefits of government regulations in promoting sustainable waste management practices within the CLSC. For the manufacturer, we find that the threshold return rate is a crucial element in determining an increase in the profit. When the collection rate of used products does not reach the target value set by the government, the manufacturer’s profit decreases. In contrast, when the collection rate of used products surpasses the target value, the manufacturer’s profit increases. The increased collection rate of the used products improves the sustainability of the supply chain from environmental and economic perspectives.

-

Lower competition between the retailer and the third party also enhances the performance of the coordinated model in terms of CLSC members’ profit.

This research study could be enhanced in future studies through several avenues. First, all players are considered risk-neutral in this model, and the game can be studied for risk-takers or risk-averse players. Second, the existing research assumes a linear demand function. Expanding the research to consider stochastic or uncertain demands could be a valuable avenue for future exploration. Third, agent-based modeling could be utilized to incorporate additional players in the supply chain. This approach could provide a more comprehensive and realistic representation of the complex interactions and decision-making processes within the CLSC.

Data availability

All data generated or analysed during this study are included in this published article.

References

Alvehag, K., & Awodele, K. (2013). Impact of reward and penalty scheme on the incentives for distribution system reliability. IEEE Transactions on Power Systems, 29(1), 386–394. https://doi.org/10.1109/tpwrs.2013.2279859

Ameli, M., Mansour, S., & Ahmadi-Javid, A. (2016). A multi-objective model for selecting design alternatives and end-of-life options under uncertainty: A sustainable approach. Resources, Conservation and Recycling, 109, 123–136. https://doi.org/10.1016/j.resconrec.2016.01.011

Ameli, M., Mansour, S., & Ahmadi-Javid, A. (2019). A simulation-optimization model for sustainable product design and efficient end-of-life management based on individual producer responsibility. Resources, Conservation and Recycling, 140, 246–258. https://doi.org/10.1016/j.resconrec.2018.02.031

Chiang, W. Y. K., Chhajed, D., & Hess, J. D. (2003). Direct marketing, indirect profits: A strategic analysis of dual-channel supply-chain design. Management Science, 49(1), 1–20. https://doi.org/10.1287/mnsc.49.1.1.12749

Choi, T.-M., Li, Y., & Xu, L. (2013). Channel leadership, performance and coordination in closed loop supply chains. International Journal of Production Economics, 146(1), 371–380. https://doi.org/10.1016/j.ijpe.2013.08.002

De Giovanni, P., Reddy, P. V., & Zaccour, G. (2016). Incentive strategies for an optimal recovery program in a closed-loop supply chain. European Journal of Operational Research, 249(2), 605–617. https://doi.org/10.1016/j.ejor.2015.09.021

Dwicahyani, A. R., Rosyidi, C. N., & Pujiyanto, E. (2019). Minimizing gap of utility between consumer and producer in a duopoly market considering outsourcing decision, price, and product tolerance. Production & Manufacturing Research, 7(1), 23–43. https://doi.org/10.1080/21693277.2019.1571957

Feng, D., Yu, X., Mao, Y., Ding, Y., Zhang, Y., & Pan, Z. (2019). Pricing decision for reverse logistics system under cross-competitive take-back mode based on game theory. Sustainability, 11(24), 6984. https://doi.org/10.3390/su11246984

Gan, S.-S., Pujawan, I. N., Suparno, & Widodo, B. (2017). Pricing decision for new and remanufactured product in a closed-loop supply chain with separate sales-channel. International Journal of Production Economics, 190, 120–132. https://doi.org/10.1016/j.ijpe.2016.08.016

Gong, H., Wang, M. Q., & Wang, H. (2013). New energy vehicles in China: Policies, demonstration, and progress. Mitigation and Adaptation Strategies for Global Change, 18, 207–228. https://doi.org/10.1007/s11027-012-9358-6

Han, X., Wu, H., Yang, Q., & Shang, J. (2017). Collection channel and production decisions in a closed-loop supply chain with remanufacturing cost disruption. International Journal of Production Research, 55(4), 1147–1167. https://doi.org/10.1080/00207543.2016.1230684

He, P., He, Y., & Xu, H. (2019). Channel structure and pricing in a dual-channel closed-loop supply chain with government subsidy. International Journal of Production Economics, 213, 108–123. https://doi.org/10.1016/j.ijpe.2019.03.013

Hong, X., Wang, Z., Wang, D., & Zhang, H. (2013). Decision models of closed-loop supply chain with remanufacturing under hybrid dual-channel collection. The International Journal of Advanced Manufacturing Technology, 68(5–8), 1851–1865. https://doi.org/10.1007/s00170-013-4982-1

Hosseini-Motlagh, S. M., Jazinaninejad, M., & Nami, N. (2021). Coordinating a socially concerned reverse supply chain for pharmaceutical waste management considering government role. Environment, Development and Sustainability. https://doi.org/10.1007/s10668-021-01511-z

Hosseini-Motlagh, S.-M., Nematollahi, M., Johari, M., & Choi, T.-M. (2020). Reverse supply chain systems coordination across multiple links with duopolistic third-party collectors. IEEE Transactions on Systems, Man, and Cybernetics: Systems, 50(12), 4882–4893. https://doi.org/10.1109/tsmc.2019.2911644

Hua, G., Wang, S., & Cheng, T. E. (2010). Price and lead time decisions in dual-channel supply chains. European Journal of Operational Research, 205(1), 113–126. https://doi.org/10.1016/j.ejor.2009.12.012

Huang, M., Song, M., Lee, L. H., & Ching, W. K. (2013). Analysis for strategy of closed-loop supply chain with dual recycling channel. International Journal of Production Economics, 144(2), 510–520. https://doi.org/10.1016/j.ijpe.2013.04.002

Huang, M., Yi, P., & Shi, T. (2017). Triple recycling channel strategies for remanufacturing of construction machinery in a retailer-dominated closed-loop supply chain. Sustainability, 9(12), 2167. https://doi.org/10.3390/su9122167

Huang, Y., & Wang, Z. (2017). Dual-recycling channel decision in a closed-loop supply chain with cost disruptions. Sustainability, 9(11), 2004. https://doi.org/10.3390/su9112004

Jiang, C., Xu, F., & Sheng, Z. (2010). Pricing strategy in a dual-channel and remanufacturing supply chain system. International Journal of Systems Science, 41(7), 909–921. https://doi.org/10.1080/00207720903576506

Johari, M., & Hosseini-Motlagh, S.-M. (2019). Coordination of social welfare, collecting, recycling and pricing decisions in a competitive sustainable closed-loop supply chain: A case for lead-acid battery. Annals of Operations Research. https://doi.org/10.1007/s10479-019-03292-1

Kenné, J. P., Dejax, P., & Gharbi, A. (2012). Production planning of a hybrid manufacturing–remanufacturing system under uncertainty within a closed-loop supply chain. International Journal of Production Economics, 135(1), 81–93. https://doi.org/10.1016/j.ijpe.2010.10.026

Kusumastuti, R. D., Piplani, R., & Lim, G. H. (2008). Redesigning closed-loop service network at a computer manufacturer: A case study. International Journal of Production Economics, 111(2), 244–260. https://doi.org/10.1016/j.ijpe.2006.10.016

Liu, L., Wang, Z., Xu, L., Hong, X., & Govindan, K. (2017). Collection effort and reverse channel choices in a closed-loop supply chain. Journal of Cleaner Production, 144, 492–500. https://doi.org/10.1016/j.jclepro.2016.12.126

Liu, Y., Xia, Z. J., Shi, Q. Q., & Xu, Q. (2021). Pricing and coordination of waste electrical and electronic equipment under third-party recycling in a closed-loop supply chain. Environment, Development and Sustainability. https://doi.org/10.1007/s10668-020-01158-2

Ma, W.-M., Zhao, Z., & Ke, H. (2013). Dual-channel closed-loop supply chain with government consumption-subsidy. European Journal of Operational Research, 226(2), 221–227. https://doi.org/10.1016/j.ejor.2012.10.033

Maiti, T., & Giri, B. C. (2015). A closed loop supply chain under retail price and product quality dependent demand. Journal of Manufacturing Systems, 37, 624–637. https://doi.org/10.1016/j.jmsy.2014.09.009

Modak, N. M., Panda, S., & Sana, S. S. (2015). Pricing policy and coordination for a two-layer supply chain of duopolistic retailers and socially responsible manufacturer. International Journal of Logistics Research and Applications, 19(6), 487–508. https://doi.org/10.1080/13675567.2015.1085499

Nielsen, I. E., Majumder, S., Sana, S. S., & Saha, S. (2019). Comparative analysis of government incentives and game structures on single and two-period green supply chain. Journal of Cleaner Production, 235, 1371–1398. https://doi.org/10.1016/j.jclepro.2019.06.168

Ovchinnikov, A. (2011). Revenue and cost management for remanufactured products. Production and Operations Management, 20(6), 824–840. https://doi.org/10.1111/j.1937-5956.2010.01214.x

Rajabzadeh, H., Arshadi Khamseh, A., & Ameli, M. (2023). A game-theoretic approach for pricing in a two competitive closed-loop supply chains considering a dual-sourcing strategy in the presence of a disruption risk. Process Integration and Optimization for Sustainability, 7(1–2), 293–314. https://doi.org/10.1007/s41660-022-00292-w

Ranjbar, Y., Sahebi, H., Ashayeri, J., & Teymouri, A. (2020). A competitive dual recycling channel in a three-level closed loop supply chain under different power structures: Pricing and collecting decisions. Journal of Cleaner Production, 272, 122623. https://doi.org/10.1016/j.jclepro.2020.122623

Rezaei, S., & Maihami, R. (2020). Optimizing the sustainable decisions in a multi-echelon closed-loop supply chain of the manufacturing/remanufacturing products with a competitive environment. Environment, Development and Sustainability, 22(7), 6445–6471. https://doi.org/10.1007/s10668-019-00491-5

Savaskan, R. C., Bhattacharya, S., & Van Wassenhove, L. N. (2004). Closed-loop supply chain models with product remanufacturing. Management Science, 50(2), 239–252. https://doi.org/10.1287/mnsc.1030.0186

Savaskan, R. C., & Van Wassenhove, L. N. (2006). Reverse channel design: The case of competing retailers. Management Science, 52(1), 1–14. https://doi.org/10.1287/mnsc.1050.0454

Taleizadeh, A. A., Moshtagh, M. S., & Moon, I. (2018). Pricing, product quality, and collection optimization in a decentralized closed-loop supply chain with different channel structures: Game theoretical approach. Journal of Cleaner Production, 189, 406–431. https://doi.org/10.1016/j.jclepro.2018.02.209

Tedeschi, B. (2000). Compressed data; Big companies go slowly in devising net strategy. New York Times, 27.

Tsay, A. A., & Agrawal, N. (2004). Channel conflict and coordination in the e-commerce age. Production and Operations Management, 13(1), 93–110. https://doi.org/10.1111/j.1937-5956.2004.tb00147.x

Wan, N., & Hong, D. (2019). The impacts of subsidy policies and transfer pricing policies on the closed-loop supply chain with dual collection channels. Journal of Cleaner Production, 224, 881–891. https://doi.org/10.1016/j.jclepro.2019.03.274

Wang, W., & Da, Q. L. (2008). Decision-making model of electronic product manufacturer recycling and remanufacturing under the reward-penalty mechanism. Journal of Chinese Management Science, 34(5), 57–63.

Wang, W., Fan, L., Ma, P., Zhang, P., & Lu, Z. (2017a). Reward-penalty mechanism in a closed-loop supply chain with sequential manufacturers’ price competition. Journal of Cleaner Production, 168, 118–130. https://doi.org/10.1016/j.jclepro.2017.08.104

Wang, W., Zhang, Y., Li, Y., Zhao, X., & Cheng, M. (2017b). Closed-loop supply chains under reward-penalty mechanism: Retailer collection and asymmetric information. Journal of Cleaner Production, 142, 3938–3955. https://doi.org/10.1016/j.jclepro.2016.10.063

Wang, W., Zhang, Y., Zhang, K., Bai, T., & Shang, J. (2015). Reward–penalty mechanism for closed-loop supply chains under responsibility-sharing and different power structures. International Journal of Production Economics, 170, 178–190. https://doi.org/10.1016/j.ijpe.2015.09.003

Wang, Y., Chang, X., Chen, Z., Zhong, Y., & Fan, T. (2014). Impact of subsidy policies on recycling and remanufacturing using system dynamics methodology: A case of auto parts in China. Journal of Cleaner Production, 74, 161–171. https://doi.org/10.1016/j.jclepro.2014.03.023

Xiong, Y., Zhou, Y., Li, G., Chan, H.-K., & Xiong, Z. (2013). Don’t forget your supplier when remanufacturing. European Journal of Operational Research, 230(1), 15–25. https://doi.org/10.1016/j.ejor.2013.03.034

Xu, L., & Wang, C. (2018). Sustainable manufacturing in a closed-loop supply chain considering emission reduction and remanufacturing. Resources, Conservation and Recycling, 131, 297–304. https://doi.org/10.1016/j.resconrec.2017.10.012

Yi, P., Huang, M., Guo, L., & Shi, T. (2016). Dual recycling channel decision in retailer oriented closed-loop supply chain for construction machinery remanufacturing. Journal of Cleaner Production, 137, 1393–1405. https://doi.org/10.1016/j.jclepro.2016.07.104

Zeng, A. Z. (2012). Coordination mechanisms for a three-stage reverse supply chain to increase profitable returns. Naval Research Logistics (NRL), 60(1), 31–45. https://doi.org/10.1002/nav.21517

Zhang, Y., He, Y., Yue, J., & Gou, Q. (2018). Pricing decisions for a supply chain with refurbished products. International Journal of Production Research, 57(9), 2867–2900. https://doi.org/10.1080/00207543.2018.1543968

Zheng, B., Yang, C., Yang, J., & Zhang, M. (2017). Dual-channel closed loop supply chains: Forward channel competition, power structures and coordination. International Journal of Production Research, 55(12), 3510–3527. https://doi.org/10.1080/00207543.2017.1304662

Acknowledgements

This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

Author information

Authors and Affiliations

Contributions

The first draft of the manuscript was written by the first author, who had the idea for the article, conceptualization, methodology, and software implementation. Supervision of the research was done by the second author, who had participated in conceptualization, methodology, data analysis, and manuscript edition. The third author commented on all the versions of the manuscript for its improvement, read, and approved the final manuscript. The forth author organized and edited the manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors of the article A Game-Theoretic Approach for Pricing in a Dual-channel Socially Responsible Closed-loop Supply Chain, declared that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of Proposition 1

From \({\pi }_{{\text{SC}}}^{{\text{Ce}}}\), the Hessian matrix is obtained as follows:

By solving \(x \cdot \pi_{{{\text{SC}}}}^{{{\text{ce}}}} \cdot x^{T} < 0\), the following conditions are obtained:

Therefore, if the above conditions are satisfied, \({\pi }_{{\text{SC}}}^{{\text{Ce}}}\) will be a negative definite Hessian matrix. Thus, \({p}_{m}^{{\text{Ce}}*}\),\({p}_{r}^{{\text{Ce}}*}\),\({\tau }_{r}^{{\text{Ce}}*}\),\({\tau }_{t}^{{\text{Ce}}*}\) can be obtained by solving the first-order condition.

Proof of Proposition 2

The optimal discount factor offered to the retailer under the two-part tariff contract is obtained through a necessary condition \(\frac{\partial {\pi }_{r}^{{\text{Co}}}}{\partial {p}_{r}}=0\) which results in:

Then, by setting \({p}_{r}^{{\text{Co}}}={p}_{r}^{{\text{Cen}}}\), proposition 2 is proven.

Proof of Proposition 3

The optimal discount factor offered to the retailer and third party under the two-part tariff contract, by taking the first derivative of \({\pi }_{r}^{{\text{Co}}} and {\pi }_{t}^{{\text{Co}}}\), w.r.t \({\tau }_{r}^{{\text{Co}}} {\text{and}} {\tau }_{t}^{{\text{Co}}}\), is obtained as follows:

Then, by setting \({\tau }_{r}^{{\text{Co}}}={\tau }_{r}^{{\text{Cen}}}\) and \({\tau }_{t}^{{\text{Co}}}={\tau }_{t}^{{\text{Cen}}}\) the proposition 3 is proved.

Proof of Proposition 4

The proposed two-part tariff contract is accepted by the CLSC members if and only if each CLSC member earns at least the profit equal to that on the decentralized model; thus, proposition 4 is proven.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ziaei, M., Ameli, M., Rasti-Barzoki, M. et al. A game-theoretic approach for pricing in a dual-channel socially responsible closed-loop supply chain under reward-penalty mechanism. Environ Dev Sustain (2024). https://doi.org/10.1007/s10668-023-04448-7

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10668-023-04448-7