Abstract

In a financial network where mark-to-market accounting rules apply, the sale of assets enforced by behavioral constraints such as minimum capital requirements can induce an amplification effect of additional asset sales that further depresses the market price. This paper explores these contagious processes through simulation exercises under some different sets of network structures. We introduce a complete graph, clusters and core periphery while varying the composition of banks’ portfolios and observing their effects on outbreaks and the spread of a financial contagion. This paper also investigates ex ante conditions that could prevent a contagion and examines some ex post measures that could restrain the propagation of a contagion. Securing a certain level of liquidity in a financial system that includes large-scale banks can be an effective ex ante regulatory measure. Additionally, certain ex post operations, such as a price-supporting purchase of risky assets and/or a capital injection into a bank, could be effective countermeasures to prevent the contagion from spreading under some limited conditions.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Behavioral constraints of financial institutions

- Mark-to mark accounting rules

- Deleverage

- Liquidity

- Interbank network structure

1 Introduction

The 2007 to 2008 financial crisis (the crisis) exerted a negative influence on the global economy through far-reaching propagation of investment losses. Funds that had circulated globally during the time of credit expansion in the early 2000s drastically counterrotated with the eruption of the crisis and elicited the propagation of negative externalities throughout the world. In describing the crisis, Brunnermeier and Pedersen (2009) introduce a model that links an asset’s market liquidity (i.e., the ease with which it is traded) and funding liquidity (i.e., the ease with which traders can obtain funding). Brunnermeier (2009) notes that the mechanisms that explain why liquidity can suddenly evaporate function through the interaction between market liquidity and funding liquidity.

To understand financial contagion through asset price, Adrian and Shin (2009) explain that in a financial system where balance sheets are continuously marked to market, asset price changes immediately appear as changes in net worth. These changes elicit responses from financial intermediaries who adjust the size of their balance sheets particularly in cases where the financial intermediaries are subject to behavioral constraints such as minimum capital requirements. In terms of the influence of the accounting system on the contagion, Eboli (2010) notes that for any network and any shock, the flow of losses generated with the mark-to-market rule is greater than the losses generated by accounting at historical cost. The author indicates that a financial network is more exposed to default contagion, both in terms of scope and threshold of contagion, under the marking-to-market accounting regime than with the historical cost regime.

Regarding contagion through network structure, Watts (2002) notes that the threshold rules of global cascades have local dependencies that is, the effect that a single infected neighbor will have on a given node depends critically on the state of the node’s other neighbors, and the threshold is the corresponding fraction of the neighborhood. Additionally, the cascade conditions are induced from the degrees of the vulnerable vertices. Eisenberg and Noe (2001) indicate that one of the most pervasive aspects of the contemporary financial environment is the rich network of interconnections among firms, where the value of firms is dependent on the payoffs they receive from their claims on other firms. The author describes this feature of financial systems as cyclical interdependencies and shows, via a fixed-point argument, that there always exists a “clearing payment vector” that clears the obligations in the clearing system under mild regularity conditions.

Acemoglu et al. (2015) introduce an economy composed of financial institutions that lasts for three periods and examine the extent of financial contagion as a function of the interbank liability structure. The authors investigate the robustness of financial networks and provide the results including the fact that as the magnitude or the number of negative shocks crosses certain thresholds, the types of financial networks that are fragile against contagions change drastically. Fricke and Lux (2014) consider an interbank network as directed and valued linkage among banks. Using overnight interbank transaction data for the Italian interbank market from January 1999 to December 2010, the authors investigate the market situation before and after the global financial crisis and show that the core-periphery structure may well be a new “stylized fact” of modern interbank networks. Elliott et al. (2014) consider that financial contagions can propagate through cross-holdings of shares, debt, or other liabilities and investigate the influence by introducing the notion of integration (mutual holdings of equities) and diversification (the extent of the holding). The authors also consider contagion through asset holdings and price by simulation.

Cifuentes et al. (2005) extend Eisenberg and Noe (2001) and combine the discussions on contagion through interbank networks and asset prices as described above. Considering the effectual validity of the model of Cifuentes et al. (2005), this paper extends the model and examines some realistic factors that might contribute either to the occurrence or the arrest of contagion. First, we explore contagious processes under some different sets of network structures such as a complete graph, clusters, and a core periphery through simulation exercises while attempting to quantify the implication of the contagion and to examine some factors that might assume significant importance concerning a contagion outbreak. Second, we investigate some countermeasures to prevent a contagion from spreading, such as a price-supporting purchase of risky assets in the market and a capital injection to a bank. We examine the validity of these measures quantitatively. The results show that the form of outbreaks and contagion processes differ depending on the network structure, and it is suggested that the location and linkages of large-scaled nodes within the network assume some importance concerning the occurrence of contagion. Some ex ante regulatory measures, such as securing a certain level of liquidity in a financial system including the asset holdings of large-scale banks, can be effective in preventing contagion. Similarly, ex post measures such as a price-supporting purchase of risky assets in the market and capital injection to a bank can be effective ex post countermeasures to containing contagion.

This paper is organized as follows. Section 2 illustrates the model. Section 3 describes the algorithm and simulation. In Sect. 4, we analyze the effect that interbank networks have on financial contagion. Section 5 discusses the effectiveness of countermeasures for contagion. Finally, Sect. 6 concludes the paper.

2 Model

Our model is based on that of Cifuentes et al. (2005) with some modifications. We assume N linked financial intermediaries (for simplicity, here considered as banks) and their balance sheets. Each bank has a balance sheet described in Table 1 and forms an interbank network with mutual financial relationships each other (here considered as an \(N\times N\) debts and credits matrix). On the liability side, bank i has deposit liability denoted by \(d_i\). The interbank liability of bank i to bank j is denoted by \(L_{ij}\) with \(L_{ii}=0\). The total liability of bank i is then \(\overline{x}_i=\sum _ {j=1}^N L_{ij}\).

On the asset side, bank i’s endowment of risky assets is given by \(e_i\). The price p of the risky asset is determined in equilibrium as described in Sect. 2.2. Bank i also has liquid asset holdings given by \(c_i\). Liquid assets have a constant price of 1. Let \(\pi _{ij}=L_{ij}/\overline{x}_i\). Interbank claims are of equal seniority, so that if the market value falls short of the notional liability, the bank’s payments are proportional to the notional liability. Then, the payment by j to i is given by \(x_j \pi _{ji}\) where \(x_j\) is the market value of bank j’s interbank liabilities. This can be different from the notional value because the debtor may be unable to repay these liabilities in full. Accordingly, the total payment received by bank i from all other banks is \(\sum _{j=1}^N x_j \pi _{ji}\).

In the interbank network, the ability to clear the debt of the respective banks is interdependently determined according to the simultaneous equation below.

As shown in Eisenberg and Noe (2001), a unique clearing vector \(\mathbf {x}\) is determined as fixed point of (1) under suitable conditions on the liability matrix \(\mathbf {L}=(L_{ij})\).

2.1 Minimum Capital Requirements

Assets held by banks attract a regulatory minimum capital ratio, which stipulates that the ratio of the bank’s equity value to the mark-to-market value of its assets must be above a pre-specified ratio \(r^*\). This constraint is given by

where \(A_i\) denotes the units of cash received as the proceeds of both risky and liquid assets sales. In Cifuentes et al. (2005), it is assumed that the assets are sold for cash, and cash does not constitute a risky asset under the minimum capital requirements. In the simulation process, cash is consecutively accumulated in balance sheets as the proceeds of the asset sales and thus affects the respective banks’ capital adequacy status. In this paper, we, therefore, explicitly incorporate the process of cash accumulation in the algorithm. When a bank finds itself violating this constraint, it must sell some of its assets to reduce the size of its balance sheet. That is, bank i sells \(s_i\) units of risky assets and \(t_i\) units of liquid assets to satisfy

As in Cifuentes et al. (2005), we assume that bank i first sells liquid assets, and in the case where bank i cannot achieve \(r^*\) with the sale of liquid assets only, it is forced to additionally sell risky assets in the amount required to satisfy (3).

2.2 Equilibrium Price

By rearranging the minimum capital requirements (2) together with the condition that \(s_i>0\) only if \(t_i=c_i\), the sale \(s_i\) can be written as a function of p:

Hence, \(s(p) = \sum _{i=1}^N s_i(p)\) is the aggregate sale of the risky assets given price p. To satisfy the minimum capital requirements, bank i sells the risky assets at the amount of \(s_i(p)\times p\) at the price level p, thus, \(s_i(p)\) is a decreasing function of p. Accordingly, the aggregate supply function s(p) is also decreasing in p.

The inverse demand curve for the risky asset is assumed to be of exponential form

where \(\alpha >0\) is a positive constant and D is the accumulated number of risky assets sold after the initial shock. We impose the condition whereby when the price of the risky asset is its highest price no bank is required to sell its risky assets. Accordingly, we have \(s(1)=d(1)=0\) and there is at least one equilibrium price at \(p=1\). This is the price where no exogenous shock exists. If banks are forced to sell risky assets, the amount of units to sell exceeds the demand so that the price is decreased from 1 and the new equilibrium price \(p^*<1\) is formed at the intersection \(s(p^*)=d(p^*)\). Since the two curves are both convex, we must ascertain whether the equilibrium price is determined uniquely or not in the following simulation experiments. Let \(\underline{p}=d(\sum _{i=1}^N e_i)\) be the floor price of the risky asset when all of the risky assets are sold in the market. In our experiments, we choose \(\alpha \) to satisfy the prescribed \(\underline{p}\).

2.3 Contraction of an Interbank Debts and Credits Matrix

In the case where bank i becomes insolvent, the bank is forced to exit from the interbank network. As a result, the interbank assets are assumed to be redirected or redistributed at face value proportionally among the holders of the bank’s liabilities in the model. This process is materialized as a stepwise contraction process of the interbank debts and credits matrix \(\mathbf {L}\).

3 Simulation

Given the level of the minimum capital ratio \(r^*\), the algorithm checks the capital adequacy ratio of each bank; that is, whether it satisfies condition (2) or not. Failure to comply with this requirement triggers a resizing of the bank’s balance sheet and possibly the liquidation of the bank. If the bank violates the minimum capital requirements and needs to liquidate assets, depending upon the size of its equity capital, the bank can resize its balance sheet by scaling down the size of its assets to a new level consistent with the actual level of equity capital available. Alternatively, if this is not possible, the bank is liquidated. Accordingly, the bank will assume one of the following four statuses depending upon its condition and whether it satisfies the minimum capital requirements or falls insolvent.

-

\(\text{ status }=0\): insolvent (minimum capital requirements cannot be satisfied or the bank already has excessive liability).

-

\(\text{ status }=1\): minimum capital requirements are satisfied if all the liquid assets and certain units of risky assets are sold.

-

\(\text{ status }=2\): minimum capital requirements are satisfied if certain units of liquid assets are sold.

-

\(\text{ status }=3\): minimum capital requirements are satisfied without any action taken.

After a bank experiences an initial shock, the statuses of all the banks are judged according to the flow below.

-

1.

Initial shock.

-

2.

Judgment of the status (\(\text{ status }=0/1/2/3\)).

-

3.

Loop until all the banks are \(s=0\) or all the surviving banks are \(\text{ status }=3\):

-

(1)

if any \(\text{ status }=0\) exists (liquidation routine)

-

All holdings of liquid and risky assets are sold.

-

Interbank debts and assets are divided proportionally and redistributed, and the interbank liability network is contracted.

-

The equilibrium price is calculated.

-

Mark-to-market the surviving banks’ asset holdings.

else if any \(\text{ status }=1\) exists (resizing routine 1)

-

All liquid asset holdings and the amount of risky assets necessary to achieve minimum capital requirements are sold.

-

The equilibrium price is calculated.

-

Mark to market the surviving banks’ asset holdings.

else if any \(\text{ status }=2\) exists (resizing routine 2)

-

The amount of liquid assets necessary to achieve minimum capital requirements are sold.

end

-

-

(2)

Judgment of status

-

(1)

In the case where the numbers of the banks with \(\text{ status }=0\) is greater than one, the liquidation routine is applied to only one bank per loop. Hereinafter, one loop is called one round. In the simulation, we set the liquidity ratio and the initial shock. Each represents a market condition where the contagion breaks out and spreads along with the shock that triggered the contagion. The liquidity ratio (hereinafter, LR) is \(c/(c+e)\) of each bank’s risk (e) and liquid (c) asset holdings. Thus, \(c/(c+e)\) of the aggregated amount represents the LR of the whole financial system in this model. The initial shock (hereinafter, IS) is an idiosyncratic loss on the liquid asset holdings (c) of a bank.Footnote 1 The size of IS is hereinafter represented as a percentage of the initially shocked bank’s equity capital. In the simulation, we vary the level of LR gradually and observe the occurrence of the contagion at the respective LR level. The IS level is either varied or fixed depending on the purpose of the experiments, but in most of the cases unless indicated otherwise, we fix IS as 100% to measure the influence of LR. In the experiments in Sects. 4 and 5, we set the minimum capital requirement \(r^*=7\%\). Additionally, the initial price of risky asset is 1, and the floor price of the risky asset is set at \(\underline{p}=0.6\).

4 Network Structure and Contagion

While varying the composition of banks’ portfolios, the effects on the outbreaks and the spread of the financial contagion are observed. The processes and consequences of the contagion are measured by the number of insolvent banks, equilibrium price, and the capital adequacy ratios of the respective banks. Cifuentes et al. (2005) analyzed the case where all banks are homogeneous, that is, they all have identical balance sheets at the outset, and an interbank network constitutes a complete graph. To investigate the effect of the difference in network structures on risk contagion, we examine other types of networks such as clusters and a core periphery with differently sized nodes as described in Fig. 1. A complete graph expresses the base case where every bank has a direct financial relationship with each other. Clusters are composed of two large banks and several smaller banks in the respective clusters while only the two large banks constitute a sole direct linkage between the clusters. A core-periphery structure has been adopted from the models of Imakubo (2009) and Imakubo and Soejima (2010) that describes real international finance networks at the time immediately prior to the 2007 to 2008 crisis. According to the studies, this is the structure that (i) has a two-tier structure of a core and periphery, (ii) nearly all nodes in its core are linked to every other node in what is close to a complete network, (iii) the core serves as a hub for the periphery, and (iv) the periphery has clustering. In this section, we identify each of these networks using an abbreviated notation described in Fig. 1 such as CG-I for complete Graph with identical nodes.

In Fig. 1, each node shows the size of a bank’s balance sheet, and each link shows the financial relationships (lending and borrowing) between two banks. To represent the network of the financial relationship, we set up a debts and credits matrix \(\mathbf {L}\) for the simulation. To form the matrix, we set the size of the balance sheet of each bank and the proportion of the difference in size between the large and small banks, if applicable, considering the degrees of respective nodes. This assures the utmost consistencyFootnote 2 of the matrix with the characteristic structure of the respective networks.

4.1 The Difference Between the Complete Graph and Clusters

The first set of examinations is the comparison between a complete graph and clusters in terms of the LR level where the first full-scale (all banks go insolvent) contagion breaks out. To assure the comparability of the difference, we compare the two types of networks with identical balance sheets among the banks in the respective networks; that is, the comparison between CG-I and CL-I and between CG-LS and CL-LS. In the case of CL-I, because of the difference in the degree of hub nodes and peripheral nodes, we set the balance sheets with the utmost identity. As for the CG-LS and CL-LS, the size of a large bank’s balance sheet is 10 times as much as that of a small bank,Footnote 3 as shown in Table 2. IS is given for bank number 1 for CG-I in Fig. 1. For the debts and credits matrix \(\mathbf {L}\) of CG-LS, we set the financial relationship between the large nodes as the largest of 236 with each other considering the prominent size of their balance sheets. The second largest is the relationship between the large and small nodes which accounts for eight, and the smallest is between the small banks of which there are two. In the case of CL-LS again, the financial relationship between the large nodes are the largest of 240, and the second largest is 15 between the large and the small, lastly five is between the smallest.

a Number of insolvent banks. b Extent of contagion (Initially shocked are shown in (\(\Leftarrow \)) and insolvent banks are shown in red circles) . c Status transitions in each round (initially shocked node is shown by (\(\Leftarrow \)) and color of each circle represents status of the node) and price change by the sale of risky asset

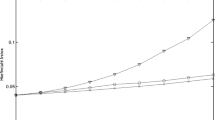

Figure 2 depicts the number of insolvent banks as the LR changes. As LR is reduced by 10 percentage points from 90%, in case of CG-I in the left panel, full-scale contagion breaks out at \(\text{ LR }=30\%\), and all banks go insolvent in the case of CL-I, a slightly higher \(\text{ LR }=40\%\). On the other hand, in the case of CG-LS in the right panel of Fig. 2, in case that IS is given on a large node, the first contagion breaks out at an LR as high as 90%, which spreads to all the small nodes except the other large node and spreads to the entire network at \(\text{ LR }=60\%\). The robustness of a complete graph is commonly recognized as indicated by Allen and Gale (2007). From the result, under the coexistence of large and small nodes, such characteristics were not particularly observed. In the case of CL-LS, in case that IS is given on a large node, the first contagion breaks out at \(\text{ LR }=90\%\), the same level as CG-LS, but the extent of the contagion differs. In case of CL-LS, five nodes go insolvent at \(\text{ LR }=90\%\), but contagion exists within the same cluster of the initially shocked large node, while CG-LS contagion spreads to all the small banks in the network (Fig. 2b). The result indicates the possibility that the location of a large node could matter for the robustness of the network against contagion.

On the contrary, when IS is given to a small node, the LR level where a full-scale contagion is observed for the first time is much lower. In the case that IS is given to a small node number 5, a full scale contagion breaks out for the first time at LR = 40% with IS = 70% in CL-LS (Fig. 2c). However, it is the sale of risky assets by large nodes that plays a critical role in eventually triggering a full-scale contagion. In Fig. 2c, the sale of risky assets at round 7, of which 83.3% are made by large nodes (number 1 and 6), triggers a sharp decline in price, thus cause the full-scale contaign.

Additionally, the LR level at which the first full-scale contagion breaks out in the two panels in (Fig. 2a) shows a significant difference between the left and right panels. While the left panel shows robust-yet-fragile characteristics in terms of networks’ LR with identical nodes, the right panel shows that the LR level of the first full-scaled contagion outbreak is much higher. Considering the prominent difference in the size of the large bank’s balance sheet in CG-LS and CL-LS, under the financial system composed of the coexistence of mega-sized and small-sized institutions, the result here suggests that to maintain a certain level of liquidity in the financial system can be an effective ex ante regulatory measure to prevent contagion.

4.2 Core periphery

As explained in Sect. 4, core periphery is adopted from the studies of Imakubo (2009) and Imakubo and Soejima (2010), where the authors conjecture the core periphery structure by analyzing the linkages among the respective regions through the distribution of the degree of links and clustering coefficient. Here, we set up the composition and the proportion of balance sheets by calculating the least common multiple of the degrees of respective nodes; that is, 2, 3, 4, 6, and 7 degree. We allocate the least common multiple 42 among the interbank asset (and liability) holdings of the large nodes in the core domain while the units distributed to the nodes in the peripheral domain are mostly proportional. Lastly the fraction is adjusted at node number 8. Table 3 shows the result and we form the matrix \(\mathbf {L}\) accordingly.Footnote 4 Here, we implement three different experiments giving IS for three different nodes: numbers 1, 3, and 8. Number 1 is the hub in the core domain while number 3 is the non-hub, and number 8 is a peripheral node.

Figure 3a shows the number of insolvent banks at various levels of LR. As we can see, the LR level of the full-scale contagion outbreak is mostly proportional to the location and size of the initially shocked nodes. Status transitions at each round in the cases that IS is given to number 1 (a hub in the core domain) and to number 3 (a non-hub in the core domain) respectively are shown in Fig. 3b. These status transitions describe the cases of number 1 and number 3 at LR = 60% level in Fig. 3a. For a comparsion, insolvent banks remain denoted in Fig. 3b in red circles even after being forced out of the network. In the case that IS is given to number 1, a full-scale contagion propagates throughout the network at around 9. On the contrary, in the case that IS is given to number 3, no contagion breaks out. Again, this indicates importance of the location of a large node in the network.

4.3 Overall Description of Results

We implemented the same simulation in other types of networks while varying the composition of the banks’ portfolios and the size of the initial shock. We measured the liquidity ratio and the size of the initial shock given where the full-scale contagion breaks out. The overall results are given in Table 4.

Table 4 shows that in cases where the large nodes are initially shocked, full-scale contagion (all 10 banks become insolvent) breaks out at comparatively high levels of LR (e.g. complete graph L/S with shock on a large node \(=90\%\), clusters L/S with shock on a large hub node \(=70\%\), core periphery with shock on a large hub node \(=60\%\)). On the contrary, in cases where the initial shock is given to small and/or peripheral nodes, the full contagion breaks out only at the lower LR levels of 20% or less (e.g., complete L/S with shock on a small node \(=20\%\), core periphery with shock on a small hub node \(=10\%\)), and no contagion occurs in the case of core periphery shocked on a small peripheral node.

Additionally, we compared the extent of contagion at each level of LR while the initial shock is fixed at 100% for the sake of simplicity. In Fig. 4, no full-scale contagion breaks out at all while only three cases (in shadowed boxes) out of 11 show a contagion. Within these three cases, two are partial contagions (the contagion spreads only within the same cluster of initially shocked nodes). In these cases, one large node is initially shocked, and in all the other cases no single contagion is observed regardless of the position or size of a node where the initial shock is given. On the contrary, at the extremely low LR of 10% (Fig. 5), a full-scale contagion appears in as many as 10 cases except for a single case where the initial shock is given on a small peripheral node (shown in a shadowed box).

The figures show that as long as liquidity is maintained abundantly in the financial system, the robustness of the financial networks is assured as no full-scale contagion is observed. Although some partial contagions are observed, the occurrence of those contagions are limited to cases where a fatal shock (in this case, 100% of net worth) is given to a large node, particularly a hub (Fig. 4).

On the other hand, in a system with extremely limited liquidity, the difference in network structures including the position and size of nodes has less relevance to the extent of a contagion as full-scale contagion propagates in almost all cases (Fig. 5).

One possible interpretation for the phenomenon is that the effect of an asset price decrease caused by the forced sales by banks in the system described in Sects. 2 and 3 surpasses the potential robustness embedded in a network structure under the condition of limited liquidity in the system, and this construction is intuitively understandable. To this extent, our observation suggests that a major path of a contagion may as well depending on market conditions in this case, particularly in terms of liquidity.

5 Effectiveness of Countermeasures against Contagion

According to the observations in Sect. 4.3, in cases where the liquidity in a market is abundant (=higher LR), the extent of a contagion differs depending on the network structure and the position of a large node matters. In this regard, the observations suggest that to maintain a sufficient level of liquidity in respective banks’ balance sheets can be an effective ex ante measure to prevent a full-scale contagion from occuring.

On the other hand, cases where risk asset holdings on banks’ balance sheets are large, in other words when the risk appetite of market participants is elevated, the asset price effect promotes the propagation of a contagion regardless of the difference in network structures. A negative spiral effect of forced sale abruptly appears in the financial system as a whole and can lead to a full-scale contagion. What, then, are the possible ex post countermeasuresFootnote 5 against a contagion that is ready to break out?

We examine the effectiveness of some virtual remedial actions taken by governments or financial supervisory authorities to prevent financial contagion from propagating, such as price-supporting purchase of risky assets in the market and capital injection into a bank.

5.1 A Price-Supporting Purchase in the Market

The process of a price-supporting purchase and its effects are described as follows.

5.1.1 The Process of a Price-Supporting Purchase

Let \(p_{n-1}\) be a price of the risky assets at the termination of Round \(n-1\). If it is the case that any sales of assets are implemented at Round n, the number of units sold is denoted as \(f_n\) and the equilibrium price is \(\widehat{p}_n < p_n\). If we set \(Q_n\) as the amount of funds disposable for the price-supporting purchase at Round n, the price increase per unit of the risky assets at the full disposal of \(Q_n\) for the purchase is calculated by \(Q_n/f_n\). Here, we set the price cap at \(p_{n-1}\) as we consider that an unrealistically excessive price increase should be excluded. Thus, the price-supporting purchase is implemented with the upper limit of \(p_{n-1}\) at the price level of

As the amount of funds necessary for the supporting purchase is denoted by \((p_n-\widehat{p}_n)f_n\), the total amount of funds disposable for the purchase at the following round is depicted as \(Q_{n+1} = Q_n - (p_n-\widehat{p}_n) f_n\). The price-supporting purchase is consecutively implemented at every round where the risky assets are sold to the extent that \(Q_n=0\) is achieved, except at the round where no risky assets are sold as the withdrawal procedure of the failed bank from the network is implemented.

We selected three types of networks from Sect. 4; complete graph with identical nodes, complete graph with large and small nodes, and core periphery. Additionally, we extended the size of the networks to 20 nodes to add reality to the simulations to some extent.

For the complete graph with large and small nodes again, each of two large nodes (numbers 1 and 11) has interbank assets (and liabilities) of 30, and all the small nodes have interbank assets of three (Table 5). Each of the two large nodes has a financial relationship of 18.3 with each other and has financial relationships of 0.65 with all the small banks while all the small banks have financial relationships of 0.1 with each other. For the complete graph with identical nodes, we adopted the same balance sheet as the small nodes above and every node has a financial relationship with each other of 19/3. For the core periphery, each node within the same domain (either core or periphery) has a mutually identical balance sheet. Accordingly, the composition of the matrix L is comparatively simple. A large node has interbank assets (and liabilities) of 30, and has a financial relationship of eight with three other large nodes and a relationship of 1.5 with four small nodes within its own cluster. The small nodes have a relationships of 1.5 with one small node and with one large node in its own cluster.

5.1.2 Effects of the Price-Supporting Purchase

To quantify the effectiveness of the price-supporting purchase, we measured the number of insolvent banks at the termination of each simulation. The common initial shock of \(\text{ IS }=100\%\) is given for node number 1 shown in Fig. 6, which is one of the large nodes in the case of the complete graph with large and small nodes and one of the large hub nodes in the case of the core periphery. While setting the amount of disposable funds to purchase the risky assets in three different amounts of 10, 50, and 100, we examined the effects of the purchase implemented at various levels of LR from 90 to 10% and observed the effectiveness of the operation, particularly at lower levels of liquidity. We executed two sets of the simulation to examine the differences in effectiveness in terms of purchase timing. In Case one, the purchase starts from Round 1, and the purchase commences from Round 2 in Case two.

Figure 7 shows that the early commencement of the purchase at Round 1 has remarkable effects in restraining a contagion from spreading to the entire network regardless the network configuration. Without the supporting purchase (\(Q_0=0\)), full-scale contagion breaks out at various levels from LR 90% (complete graph with L/S nodesFootnote 6) to LR 20% (Complete graph with identical nodes). On the contrary, the supporting purchase with the smallest fund \(Q_0=10\) restrains the contagion from spreading in every case; that is, the sole insolvent bank is only the initially shocked bank in the case of complete graph with identical nodes and core periphery while in the case of complete graph with large and small nodes, the initially shocked banks also escape insolvency. The operation shows its effectiveness even at the lowest level of LR 10%.

On the other hand, the purchase starting in Round 2 has somewhat different consequences. Even with larger amount of purchasing fund of 50 or 100, full-scale contagion cannot be prevented in the cases of complete graph with large and small nodes and core periphery. Figure 8 shows the comparison of the number of insolvent banks in cases with a purchasing fund of \(Q_0=10, 50\), and 100. In every network structure, the purchase with fund size \(Q_0=10\) shows results completely identical to \(Q_0=0\), which means the supporting purchase is ineffectual. \(Q_0=50\) is valid in the case of complete graph with identical nodes, but in cases of complete graph with large and small nodes and core periphery, even \(Q_0=100\) is not valid to prevent contagion.

Figure 9 shows the transition of the price of the risky assets (Upper-left), the number of risky assets sold (upper-right), and the net support amount (lower) at the fixed purchasing fund at \(Q_0=10\) to examine the effects of purchasing timing and the influence of LR. Here, we examine the case of core periphery with regard to (i) purchase at Round 1 under \(\text{ LR }=10\%\), (ii) purchase at Round 2 under \(\text{ LR }=60\%\) and (iii) purchase at Round 2 under \(\text{ LR }=50\%\). The net support amount represents (\(p_n-\widehat{p}_n)f_n\) in Sect. 5.1.1. We see that the early purchase at Round 1 is valid at the extremely low \(\text{ LR }=10\%\) (lower panel) as it can support the price level at 1 (upper-left panel) while the purchase at Round 2 is only valid at \(\text{ LR }=60\%\), (lower panel). At \(\text{ LR }=50\%\), the supporting purchase is ineffectual (all of 20 banks go insolvent). The results suggest that initiating a supporting purchase in the early stages of a crisis could considerably improve the effectiveness of the countermeasure in preventing a contagion, and it could be an effective ex post measure to restrain contagion.

5.2 Capital Injection into a Target Bank

We also examined the effectiveness of a capital injection as a countermeasure against a contagion. The same set of networks and parameters are used as in Sect. 5.1. The nodes receiving the initial shock are shown with arrows aside, and the nodes where funds are injected are shown as shadowed circles in Fig. 10. We measure the effectiveness of a capital injection by counting the number of insolvent banks after injecting the funds to enlarge the net worth of the injected node to reach twice, five times, and 10 times its original size. We inject the funds in the cases where the first full-scale contagions are observed in terms of LR at the level of \(\text{ IS }=100\%\). The cash injected is registered as a liquid asset on the balance sheet of the injected bank as we consider it is unlikely that the capital injected bank would immediately invest the funds in risky assets.

The results for capital injection are distinctive. The successful cases are limited to those where the node where the capital is injected is identical to the node initially shocked. All the other cases of capital injection failed regardless of the size of injection.Footnote 7 We can interpret this in the following way; (i) the amount of injected capital is limited (even 10 times the original net worth of a bank is comparatively small compared to the entire asset holdings in the system) and (ii) the limited capital is not used to purchase risky assets (see the balance sheet registration described above); thus, there is no price lifting effect. Figure 11 shows the injection failure cases except for the nodes that were initially shocked. Even in the case that IS is much lower than 100 % (in Fig. 11, IS = 40% at LR = 50% which is the threshold level for a full scale contagion), we see a sharp decrease in the price which leads a substantial decline in the captial adequency ratio of the banks.

The success cases are shown in Table 6. We see that the full-scale contagion caused by an initial shock to small nodes does break out, if the case occurs under lower LR levels. In those cases, a capital injection into small banks can save the entire system from contagion. The percentage of injected capital to the bank’s original net worth is comparatively high, but the absolute amount necessary for the injection is much smaller compared to cases where injection were administered to larger banks under similar liquidity conditions (see \(\text{ LR }=10\%\) in Table 6).Footnote 8 Some argue the legitimacy of spending tax money to bail out troubled mega financial institutions at times of financial crisis, but our observation suggests the possibility that even under lower liquidity (the risk appetite is elevated in the case here), a comparatively small capital injection to a small bank could prevent a collapse of the entire financial system. If that is the case, the countermeasure is socially meaningful.

6 Conclusion

The path of a contagion may vary depending on market conditions, particularly in terms of liquidity. When liquidity is abundant in a market, the form of the outbreak and the process of the contagion differ depending on the network structure, and the location and linkages of large-scale banks have critical significance. On the other hand, when the risky asset holding in banks’ balance sheets are large, in other words the risk appetite of market participants is elevated, the asset price effect could promote the propagation of a contagion, and the difference in network structures including the position and size of nodes has less relevance to the extent of a contagion.

Thus, maintaining a sufficient level of liquidity in financial institutions’ balance sheets can be an effective ex ante measure to prevent a contagion. For ex post countermeasures, the results here suggest that to initiate a price-supporting purchase at the early stages of the crisis could be effective in restraining a contagion. When lower liquidity exists in the market, a limited capital injection into a shocked small bank could protect the entire financial system by preventing a full-scale contagion.

Notes

- 1.

The liquid assets here can possibly be considered a money market fund (MMF). MMFs are basically traded at their notional values, but in cases where the prices of the investment objects, for example, bonds values decrease, the value of the MMF can go under per. Such a case occurred in Japan in 2001 when the price of the bond issued by ENRON Corporation sharply declined.

- 2.

In case of CL-1, the difference in the degree of nodes in a network makes it impracticable to set an entirely identical balance sheet among the corresponding nodes. In this case, we set the balance sheet as identical as utmost.

- 3.

As the difference in total asset size between the mega financial groups and the regional financial groups in Japan is around this range or larger, we believe the assumption here is not considerably unrealistic.

- 4.

Imakubo (2009) defines the degree of nodes as indegree when calculating the clustering coefficient. Here, we calculate the clustering coefficient by defining the sum of indegree and outdegree as the degree of nodes as we assume that all banks are mutually lending and borrowing in the financial system.

- 5.

Ex post countermeasures here are measures to be taken to prevent the possible occurrence of a contagion in response to the fact that an initial shock has been given to a certain bank.

- 6.

In simulation settings here, the initial shock \(\text{ IS }=100\%\) to the large node in the complete graph with L/S is fatal to the whole system. Thus, the price-supporting purchase is not effective regardless of the LR level or the size of the fund. We adopted the marginal IS level where the supporting purchase is effective; that is, \(\text{ IS }=70\%\) in this case.

- 7.

In some cases of large capital injections (e.g., five or 10 times as much as the net worth), the injected bank can survive until all the other banks are insolvent. But in the simulation here, we define such cases as insolvent for the injected bank also. If all the other banks are insolvent, the entire financial relationships of the bank have also ceased to exist, and we consider the entire system extinct.

- 8.

At each LR level, if the injection could be implemented at a smaller IS; that is, before the entire market condition had worsened to the level of an initial shock of \(\text{ IS }=100\%\), the amount of purchasing fund necessary to prevent a full-scale contagion could be much more limited. Examples are in Table 6 at \(\text{ LR }=10\%\). Here, at \(\text{ IS }=40\%\) for core periphery shock on a small peripheral and at \(\text{ IS }=60\%\) for complete L/S shock on a small node, the first full-size contagion breaks out at \(\text{ LR }=10\%\). If the injection at these IS levels is implemented, the amount of fund necessary to prevent a full-scale contagion could be much smaller at 0.0014 and 0.004, compared to the cases of where \(\text{ IS }=100\%\) (the amount of fund necessary is 0.293 and 0.425, respectively). We consider that recognizing the early warning signs is important despite its difficulties.

References

Acemoglu, D., Ozdaglar, A., & Tahbaz-Salehi, A. (2015). Systemic risk and stability in financial Networks. American Economic Review, 105(2), 564–608.

Allen, F., & Gale, D. (2007). Understanding financial crises. Oxford University Press.

Adrian, T., & Shin, H. S. (2009). Financial intermediaries and monetary economics. Federal Reserve Bank of New York Staff Report No. 398.

Brunnermeier, M. (2009). Deciphering the liquidity and credit crunch 2007–2008. Journal of Economic Perspectives, 23(1), 77–100.

Brunnermeier, M., & Pedersen, L. H. (2009). Market liquidity and funding liquidity. The Review of Financial Studies, 22(6), 2201–2238.

Cifuentes, R., Ferrucci, G., & Shin, H. S. (2005). Liquidity Risk and Contagion. Journal of the European Economic Association, 3(2/3), 556–566.

Eboli, M. (2010). Direct contagion in financial networks with mark-to-market and historical cost accounting rules. International Journal of Economics and Finance, 2(5), 27–34.

Eisenberg, L., & Noe, T. (2001). Systemic risk in financial systems. Management Science, 47(2), 236–249.

Elliott, M., Golub, B., & Jackson, M. O. (2014). Financial networks and contagion. American Economic Review, 104(10), 3115–3153.

Fricke, D., & Lux, T. (2014). Core-periphery structure in the overnight money market: evidence from the e-MID trading platform. Computational Economics, 45, 359–395.

Imakubo, K. (2009). The global financial crisis from the view point of international finance networks. Bank of Japan Review (in Japanese).

Imakubo, K., & Soejima, Y. (2010). The transaction network in Japan’s interbank money markets. Monertary and Economic Studies, Bank of Japan, 107–150.

Watts, D. (2002). A simple model of global cascades on random networks. Proceedings of the National Academy of Sciences of the United States of America, 99(9), 5766–5771.

Acknowledgements

The authors would like to thank the editors and the participants at The 23rd Annual Workshop on Economic Science with Heterogeneous Interacting Agents for helpful suggestions and comments. This research was supported by JSPS KAKENHI Grant Number 16K01234 and 16H01833.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Sakazaki, J., Makimoto, N. (2020). Financial Contagion through Asset Price and Interbank Networks. In: Pichl, L., Eom, C., Scalas, E., Kaizoji, T. (eds) Advanced Studies of Financial Technologies and Cryptocurrency Markets. Springer, Singapore. https://doi.org/10.1007/978-981-15-4498-9_2

Download citation

DOI: https://doi.org/10.1007/978-981-15-4498-9_2

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-15-4497-2

Online ISBN: 978-981-15-4498-9

eBook Packages: Economics and FinanceEconomics and Finance (R0)