Abstract

Can consolidation policy be made consistent with macro-prudential supervision? In this study, we seek to provide new insights on this key-question using a network approach. We study how the resilience of a banking network evolves as we shock an initially homogenous competitive market with a sequence of M&A activities that significantly alter the topology of the network. We study how different M&A treatments impact the structural vulnerabilities that can propagate through the system and we show that the severity of contagion and default dynamics depends on the chosen treatment. The desirability of alternative competitive settings (such as a hub-centered market or a more concentrated and yet symmetric market) are assessed against a homogenous benchmark case. We show that the choice depends crucially on the size of the interbank market and the level of bank capitalization. The existence of a large highly connected hub is beneficial in a capitalized network with a well-developed interbank market, but it can significantly weaken the system’s resilience in a poorly capitalized market. Antitrust and competition authorities should adopt a state-contingent approach to M&A activities according to the market conditions in which banks operate.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The Global Financial Crises (GFC) of 2007-08 has put to the fore two additional dimensions to the established trend of consolidation in the banking sector registered worldwide during the last three decades.

The first one has to do with the operational framework underlying the regulatory strategic response to the GFC. A consensus is emerging among experts and practitioners on the idea that the tighter standards for capital and liquidity requirements brought about by the Basel III agreement, as well as the investment needed to comply with the regulation, will force a decrease in the returns on equity, which will likely drive a new wave of domestic and cross-border mergers among banks.Footnote 1

Second, regulators, urged by compelling considerations of systemic stability, thoroughly arranged - and in some cases forced - the acquisition of troubled banks by in-market competitors as a crisis-management tool to be added to traditional resolution procedures and state-supported bailouts. While this occurred repeatedly in the USA (see e.g. the acquisitions occurred between April and October 2008 of Bear Sterns by JP Morgan Chase, of Wachovia by Wells Fargo, and of Countrywide Financial and Merrill Lynch by Bank of America), in the UK (where HBOS was taken over by Lloyds TSB in September 2008) and in the Euro area (where BNP Paribas acquired a 75 % stake in Fortis in September 2008, and a brand new institution called Bankia was created in Spain from the integration of seven regional cajas in December 2010)Footnote 2, very little is known as to the consequences these actions may have on the financial soundness of the newly created legal entities, on the one hand, and on the stability of the banking system as a whole, on the other.

Regardless of whether banking consolidation occurs through unassisted transactions under standard market conditions or as emergency actions orchestrated by regulators as a means of resolving a banking crisis, antitrust authorities and central bankers have the opportunity to shape the structure of the industry by exercising their authority to recommend, to approve or to block any single merger. Our starting point is that M&A activities alter the topology of a network of interbank lending-borrowing obligations for three reasons: 1) large players are formed that did not exist before (i.e., the size distribution of nodes changes); 2) the total number of active banks decreases (i.e., the total number of nodes changes); 3) larger banks typically have more borrowing-lending relationships than smaller banks (i.e., the degree distribution of the network changes). Hence, in addition to affecting the competitive environment in which banks operate, different strategic approaches followed by regulators in managing consolidation processes (i.e., let just one very big bank form by allowing it to acquire a large number of smaller banks; or limit the size of each merger to just two small units at once) lead to different interbank network topologies, which could in principle be characterized by different degrees of resilience to shocks and vulnerability to financial contagion. If this is the case, banking consolidation policy can be conceived as an additional tool for macroprudential regulation aimed at preventing or taming systemic crises.

In this paper, we employ agent-based techniques to study the issues of the resilience to shocks and the unfolding of systemic risk in an evolving interbank network, where we explicitly account for the possibility that banks can be merged or forced to be separated (for instance, in terms of business lines) over time. By developing a flexible computational platform, we perform a set of simulation experiments aimed at assessing the potential for contagion associated with alternative M&A regulations. In particular, moving from a benchmark structure with a given number of banks that are homogeneous both in terms of size and of interbank connectivity, we compare three different network-changing M&A licensing policies in order to evaluate their effect on the resilience of the system to an idiosyncratic shock causing the insolvency of a node. In a first treatment, a single bank is allowed to expand its business and grow in size by acquiring, from time to time, its smaller competitors. In the other two treatments, we assume that a bank can be disassembled and its activities evenly distributed to all other operating institutions, and that a merger can be admitted only between two equally-sized small banks, respectively.

The three treatments we consider can be seen as epitomes of various strategies practically adopted by regulators over time in managing the consolidation of the industry. While sequences of mergers leading to regional or national champions characterized the banking sector in USA and Europe during the 1990s (Boot 2003), in many cases antitrust concerns forced the new post-merger entity to sell off several branches (and all associated assets and liabilities) to other financial institutions, in order to preserve a target level of market concentration (Pilloff 2002). In turn, programs favoring the aggregation of small banks by banning mergers among major banks had been followed until the 2000s in Australia and Canada (IMF 2012).

Our results suggest that the systemic properties of the interbank topologies emerging from different approaches to drive market consolidation are not all alike, since they depend on key characteristics of the system. For instance, the creation of a large highly interconnected bank operating as a hub turns out to decrease systemic risk if institutions are well capitalized and interbank obligations represent a sufficiently high share of banks’ total assets, but its effect on resilience is reversed in a poorly capitalized market. The clear policy implication is that, when deciding on how to manage the consolidation of the banking sector, a regulator may closely monitor the evolution over time of the interbank network that ensues from the deal, its interactions with capital requirements, and the structural funding policies followed by all banks participating to the market.

The ideas in this paper are related to several strands of earlier work. One branch of the literature has extensively used mean-field approximation and simulation techniques to assess the issue of contagion in banking systems. See, among others, Nier et al. (2007); May and Arinaminpathy (2010); Gai et al. (2011); Battiston et al. (2012); Krause and Giansante (2012); Gaffeo and Molinari (2015). One key finding is the existence of a non-monotonic (inverted M or U-shape) relation between the degree of connectivity and the number of defaults due to failure cascades occurring in a network of mutual financial obligations. Connectivity acts first as a means to increase the contagion effect, but beyond a certain threshold it contributes to enhance risk-sharing and eventually the resilience of the system. Although contagion dynamics is central to our story as well, we differ from these other works by explicitly exploring how the propagation of idiosyncratic shocks may be affected by different regulations aimed at altering the topology of the network through M&A transactions. Furthermore, we add to the literature balancing the “stability” and the “fragility” views on how market structure and competition policies in the banking sector affect financial stability (Beck 2008; Berger et al. 2009; Vives 2011), a perspective focused on how the complex web of balance-sheet interdependencies among financial institutions can be altered to tame systemic risks, thus reinforcing the case for a macroprudential approach to bank consolidation policy (Ratnovski 2013). Finally, we extend previous work analyzing bank merger decisions in stressed financial networks (Leitner 2005; Rogers and Veraart 2013) by adopting an ex-ante approach. Previous studies focus on the conditions under which the private sector in a distressed scenario would have an incentive to save defaulting banks by acquiring their assets and taking on their losses as well. Whilst (Leitner 2005) focus on the endogenous optimal formation of links, Rogers and Veraart (2013) take the network as given, and show that viable banks have both the incentives and the means to intervene whenever the cost of rescuing a failed institution is smaller than the losses they would have incurred if contagion had spread through the system. This ex-post approach allows one to understand whether and under what conditions the banking sector can effectively self-regulate and put in place damage-control interventions in the form of private rescuing. Nonetheless, it is silent about the resilience of the new self-organized system that may emerge as a result of these private bail-outs. The desirability of the new entities born as a result of the post-default merges is yet to be assessed especially from a macro-prudential viewpoint, and this paper is a first attempt to do this. Without an a-priori knowledge of which bank will fail, merge or be acquired by another, a regulator aimed at deploying a consolidation plan should compare alternative approaches to consolidation policies, in order to gauge which one has superior properties in terms of macroprudential objectives.

On top of this, our paper clearly speaks to the need of securing a stable financial system as a prerequisite for sustainable economic growth. The causal process moves from the reduction of uncertainty as regards prospective financial distress, to the strengthening of the credibility of private financial institutions and an improvement of the overall macroeconomic environment, to an increase of investment rates causing an acceleration of growth (Kliesen 2013).

The structure of the paper is as follows. Section 2 introduces a model of the banking system and shows how idiosyncratic shocks can propagate through the network of interbank obligations. Section 3 discusses the design of the three treatments we use to simulate alternative M&A rules, and describes how different consolidation policies alter the topology of the network. Section 4 presents the results we obtain from Monte Carlo simulations, and Section 5 provides robustness checks. Finally, Section 6 concludes with some final remarks.

2 The model set-up

The network generating process (henceforth NGP) and the shock propagation mechanism used in this paper draw upon Gaffeo and Molinari (2015). Hence, here we only outline their basic features and the interested reader may refer to it for further details. Consider a banking network populated by n banks. Each bank i ∈n is assumed to have a balance-sheet as the one depicted in Table 1. Bank Assets comprise interbank assets (I A i ) and a broad category labeled external assets (E A i ) that capture the sum of all non-interbank assets such as loans to firms and households, treasury bonds and other risk-free assets, cash-reserves etc. The liabilities are made up by core liabilities (see Hahm et al. 2013) in the form of retail deposits (D i ), and interbank liabilities (I L i ) as an additional source of funding. In our model, the “interbank market” is just a short-cut for a set of instruments comprising overnight transactions, short-term and long-term interbank debt and wholesale funding. The accounting identity between assets and liabilities is ensured by the bank’s equity or net-worth (N W i ).

Each entry of each bank’s balance-sheet is retrieved in the following way. First, we create a weighted liability matrix X l of mutual exposures.

Each element \(x^{l}_{ij}\) reads the interbank fund borrowed by bank i from bank j. By construction, this is equal to the amount lent by bank j to bank i. As a benchmark, we use a random Erdös-Rényi scheme in which each element x i j takes a positive value with a given independent probability p. A variant of the model in which the network obeys a preferential attachment scheme is presented in Section 5 as robustness check.

Once the liability matrix is specified, the interbank liabilities I L i of each bank are computed as:

and the interbank assets I A j as:

It follows that the deepness of the interbank market is given by:

External assets are imputed as a fixed proportion of interbank assets E A = α I B. The capital buffer is assumed to be homogenous across all banks and is governed by the parameter β that defines the equity ratio with respect to total assets: N W i =β[E A i +I A i ].

As will become clearer later, the interbank liabilities of a troubled institution act in our model as the channel through which financial distress can spread to affect other healthy nodes. This is the reason why we want to have perfect control over the size of interbank exposures. To this end, we need to make some adjustments to the weighted liability matrix in order to constrain the elements of each row to sum up to the same amount. This implies that all banks borrow the same interbank amount, and we let interbank assets be determined endogenously in a fashion similar to Gai and Kapadia (2010) or Gai et al. (2011). As a consequence, some banks will be net borrowers and some will be net lenders in the interbank market. In order to achieve this result, we set ex-ante the value of non-zero elements and divide this number by the number of links that each bank has in each realization of the network. In this way, I L i is given for each bank and it is evenly distributed across all creditors, but the size of the single interbank loan is not fixed ex-ante and may vary across banks.

Following the literature (see, for instance, Nier et al. (2007) and Gai and Kapadia (2010)), we trigger contagion at time t = 1 with a targeted shock (γ i ) that wipes out the external assets of one bank in the system. Our assumption can be motivated as a large idiosyncratic shock due to credit or operational losses that, although rare, can in fact occur (like the Leeson affair that drove Barings to bankruptcy in 1995) or, alternatively, as the outcome of a common shock resulting in a loss for a single institution so severe to force it into default, while leaving all the others viable.

The propagation of losses throughout the network works as follows: whenever a bank i is buffeted, it fails if it does not have enough capital to cope with the shock. Bank distress is managed under a resolution scheme the main purpose of which is to avoid the premature closure of the financial institution, in order to preserve specific know-how and asset value without recurring to taxpayers funds. In particular, a supervisory authority forces a recapitalization of the bank at the expense of the creditors with a conversion of external debt into equity. This allows a restoration of a minimum viability threshold aimed at ensuring an ordered resolution.Footnote 3

The dynamic adjustment works as follows: At time t=1, we set into default a random bank i by exogenously destroying its external assets. In the following time-round t+1, each bank j holding interbank claims against that failing institution will be required to bail-in, and some (or all) of their interbank assets will be written off. We define as non-distressed claims those interbank assets that are not marked down for bail-in purposes. Starting from the initial weighted liability matrix, we build a new matrix of non-distressed claims (NDC), updated according to the following rule of motion of interbank exposures:

where N D C j i (t) is the value of the outstanding loan at time t made from bank j to bank i and 𝜃 is the loss-given-default.Footnote 4

The total value of interbank (non-distressed) assets for each bank j at each time-round t is simply computed as:

and:

1−𝜃 i (t) is the share of non-distressed loans made to bank i at each time-round during the contagion process, and one can think of it as the recovery rate at time t for the banks connected to the failing bank i. 1−𝜃 i (t) is bank-specific, time-varying and consistent with a par condicio creditorum principle. Those neighbor banks that suffer a residual loss larger than their equity base will enter a bail-in scheme and contagion will spread to their creditors.Footnote 5 Higher-order default avalanches can unravel through the network and contagion stops when 1−𝜃 i (t) equals one for all banks at a given time t+k.

This set-up is now modified to embed the possibility to alter the structure of the network via a series of M&A shocks, and the next section provides an accurate description of these experiments.

3 Treatment design

In our view, competition policy should be explicitly recognized as part of the macroprudential toolkit to safeguard the banking system, for reasons that go far beyond crisis-management purposes. The extensive microprudential regulation to which banks are subject (Basel I-II, plus national legislations) - in terms of codes of conduct, laws, rules, standards as well as capital and liquidity requirements - implies severe compliance costs (Elliehausen G 1998). Since a large part of compliance costs are fixed costs, there are huge economies of scale to be exploited. A further increase of compliance costs associated with new regulatory reforms due to be applied in the next few years (Basel III) could force (especially small) banks (for instance, cooperative and savings&loans banks) to merge for reasons different from the pursuit of efficiency in lending and borrowing activities. Since mergers among banks are scrutinized and approved by antitrust authorities and central banks, these latter have the opportunity to design the structure of the industry by choosing how banks are allowed to merge.

We design a flexible network platform that allows us to measure how the resilience of an interbank network changes as we implement three different types of M&A treatments. We define Vertical Merge Process (henceforth VMP) as one in which there is only one big bank in the system, and as such is the only one allowed to acquire other banks, so that it becomes larger and larger; a pure Horizontal Merge Process (henceforth HMP) as one in which a bank is disassembled and its shares are evenly distributed to all other surviving institutions. Finally, we envisage an intermediate or semi-horizontal (SHMP) case in which a merger is only allowed between two small banks. For exposition purposes, we present the SHMP as treatment I, the VMP as treatment II and the HMP as treatment III.

Our starting point, equal for the three treatments, consists of a symmetric banking system populated by N=25 homogeneous small banks characterized by the same probability P = 0.2 of forming a link between one another.Footnote 6Haldane (2013) provides evidence that most modern banking systems exhibit high levels of concentration that have also increased over the last 20 years. The top three banks account for a market share of 40 % in the USA, 60 % in Switzerland, 70 % in Germany, reaching a remarkable value of 80 % in the UK. Manna and Iazzetta (2009) report that the top 20 banking groups in Italy accounted for 80 % of the market and the top five groups had a share higher than 55 percent in 2007. Finally, Gai et al. (2011) characterize the network of large exposures between UK banks in 2008 with 24 nodes. With these trends in mind, we feel that a network of 25 financial institution is a reasonable choice with which to begin.

Our experiments are based on nine “merge-rounds”. The benchmark banking network just described is found at merge-round one, and we simulate one merge at each of the following eight merge-rounds. From merge-round two onwards, links are formed with probabilities that are adjusted to keep the expected number of links constant. In such a way, we can perform our resilience-analysis in a controlled environment in which the aggregate size of the network, that of the interbank market and the aggregate level of net-worth (which can be taken as a proxy for absorbing capacity net of network effects) are kept fixed for any given level of interconnectedness. To the extent that the M&A regulatory strategy varies the number of channels through which contagion can diffuse or the aggregate quantity of net-worth available as shock-absorbing buffer, our experiments would by construction alter the ex-ante degree of resilience. Here we shall want to keep that constant and we check instead the ex-post resilience which only depends on the within-network distribution of such links and equity.

Let us define P s as the probability of forming a borrowing link for a small bank. When large banks are formed, each one of them is assumed to have a borrowing probability P l >P s to be connected to other banks. As an illustrative example, let us consider the vertical merging process. Let N=25 be the total number of banks in the homogenous case. The expected number of links in this case is equal to E(L)=P N(N−1). In merge round two, we now have 24 banks, out of which 23 will be small banks and one large bank, the interbank liabilities of which will be twice as large as those of the other small banks. In the third round there will be 23 banks, out of which 22 will be small and one with interbank liabilities three times as large. Let N s be number of small banks and N l the number of large banks in the asymmetric network. The aggregate assets, defined as \(S={\sum }^{N_{s}}_{s=1}S_{s}+{\sum }^{N_{l}}_{l=1}S_{l}\) (where S s is the value of assets of a small bank and S l is the value of assets for a large one), remain unchanged and so does the aggregate net-worth. In order to keep E(L) constant, the following condition must be satisfied at all merge-rounds:

The left-hand side of Eq. 7 is the expected number of links in the benchmark case. The right-hand size gives us the expected number of links in subsequent merge-rounds when the network is possibly populated by large (N l ) and/or small banks (N s ). In this heterogenous environment, the total number of expected links is given by the sum of the expected links that small banks can form with the other N s −1 small banks P s N s (N s −1) or with large banks P s (N s N l ) plus the expected links that a large bank can form with other N l −1 large banks P l N l (N l −1) or with all the other small banks P l (N s N l ).

One important remark is in order. In the homogenous network P s and P l , the probabilities of borrowing for a small bank and a large one respectively, are also the probability of lending. However, in asymmetric networks, the lending probabilities are endogenously determined and no longer coincide with the borrowing probabilities.Footnote 7

Let us point out that the chosen treatment has an impact for two reasons. On the one hand, we alter the concentration level in the market. As shown in Fig. 1, the Herfindahl index is increasing at each round. Let us point out that we tried to work with sensible concentration levels resembling values observed across Europe.Footnote 8 On the other hand, the treatments have an impact on the degree of asymmetry of the network. The asymmetry can be measured along three different dimensions: difference in size (between large and small banks), difference in the number of large and small banks, and difference in interconnectedness. Let us note that neither aggregate assets nor the number of expected links are affected by considering different treatments.

The difference in size is captured by the size adjustment coefficient Φ(R) that we use at each merge round R to determine the size of interbank liabilities of large banks relative to that of small banks, and external assets are adjusted accordingly. The size of a large bank at each merge-round depends on the chosen treatment. Let us define the number of large banks at merge-round R, N l (R), as the number of banks to which the size-adjustment coefficient Φ(R) is applied. Φ(R) is worked out in such a way that aggregate interbank liabilities (and hence aggregate network assets) are kept constant across treatments and across mergers. Our benchmark network is homogenous with respect to total interbank liabilities, so that each bank has a total interbank exposure equal to IL(1) at merge-round one. The following condition on the aggregate value of interbank liabilities must then hold for all treatments and at any merge-round.

Once N s and N l have been set as shown in Table 2, Φ(R) is computed ex-post in order to satisfy (8). Table 2 sums up how each treatment impact on these dimensions of the network’s asymmetry and Table 3 provides a summary of the main variables, parameters and acronyms used in the paper.

4 Contagion simulations

In this Section, we present the simulation results of our paper. In what follows, we measure the resilience of the system to an exogenous idiosyncratic disturbance that randomly hits one bank. Let us stress that the size of the shock does not change as we implement the three treatments, and it does not depend on the size of the buffeted bank. In the benchmark case, we randomly pick one small bank, whereas along each M&A treatment we concentrate on shocking a large institution because this is where the mutation of the network is most visible, and hence where new structural vulnerabilities or additional resilience are likely to develop. We consider three different alternative scenarios for the banking system: a robust environment characterized by a four percent level of bank capitalization (β = 0.04)) and interbank market that attracts 16 percent of the banking system’s assets (α = 5). A second case in which we expand the size of the interbank assets up to about one third of total assets (α = 2) and keep aggregate net-worth still at four percent. At last, we investigate the properties of a more fragile environment in which banks are undercapitalized (β = 0.01).

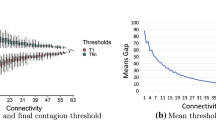

Figure 2 displays the average contagion multiplier computed as the (averaged over 100 Monte Carlo runs) ratio between dislocated assets (at the end of the default cascade) and the initial exogenous shock. Contagion multipliers do not always provide the full story and there is more to the picture. A more detailed analysis is hence presented in Fig. 3. In each panel, we display the contagion profiles obtained at merge-rounds one (benchmark case - homogenous system of 25 small banks), four and nine. Let us point out that, due to space constraints, we only display some treatments and scenarios defined by the parameters α and β).Footnote 9 The contagion profile allows us to sum up the distribution of the Monte Carlo experiments in a single plot. Indeed, one can track how the value of the banking network (i.e. the sum of total assets of all banks) evolves at different time-steps of the contagion process and easily compare the profiles across merge-rounds and across treatments. We plot the entire distribution obtained trough 100 Monte Carlo runs with a boxplot for each time-step. The pre-shock status is captured at time-step I. At time-step II, the system takes an exogenous idiosyncratic shock and the aggregate value falls by the size of this shock. At time-round III, the residual loss (if any) is transmitted to other institutions connected to the first bank and this is what we call contagion dynamics (henceforth CD). At time-step IV, we capture the first round of default dynamics (henceforth DD). In fact, at time-round IV there are two possible scenarios. In one case, neighbor banks that carry the residual loss at time-round III, withstand the shock and survive. Hence no default dynamics are triggered and the contagion profile flattens out. See, for instance, the top-right panel in Fig. 3 at merge-round 4 for Treatment III. Or else, they do not have enough net-worth to absorb the shock and , hence, they also fail. Should this be the case, further losses sweep through the network and the contagion profile keeps falling down even further, as shown in the bottom panels in Fig. 3. We also display the final time-step at the end of the adjustment process, when the spread of default is finished. The more severe are the (higher-order) default dynamics, the lower the boxplot will be.

Let us point out that the randomness of the network generating process is only visible at time-round IV onwards when DD start to kick in. At time-steps I, II and III the boxplots are, in fact, squeezed to a single line, reflecting the fact that there is no variation across the Monte Carlo runs. For example, in each run the starting value of aggregate assets is always 1500 and the Merge-Rounds and Treatments are implemented in such a way that we can perfectly control and set ex-ante the aggregate size of the network.

We start with the analysis of the robust environment, i.e. one in which banks comply with the minimum four percent of capital and interbank assets only account for 16 percent of total assets, shown in the top panels in Fig. 3. We observe that the M&A treatments make the system more prone to contagion dynamics but less subject to default dynamics, and this is true regardless of the chosen treatment. At time-step III, both the contagion profiles consistent with merge-rounds four and nine appear to be lower than that obtained with merge-round one. This means that contagion dynamics are stronger for the former ones. Yet, default dynamics are not recorded and the contagion profiles remain flat in subsequent time-rounds. With merge-round one instead, the boxplots at time-step IV and in the final step reveal that the default dynamics are not as rare and in some cases contribute to a non-negligible erosion of network assets.

One could argue that, in this scenario, the HMP (treatment III, top-right panel in Fig. 3) performs best. Although we observe some default cascades at M&A rounds four and nine, they are rather small in magnitude and rare (they appear as dotted outliers in the box-plot). Even though default dynamics disappear under the VMP (Treatment II - top-left panel in Fig. 3) and the SHMP (Treatment I, not shown), contagion dynamics are stronger and contribute to a greater aggregate loss, and this is particularly evident under the VMP. This is so because, as the large bank size increases, so does its interbank borrowing and thus its strength as a shock-spreader. Of course, it is possible for a bank to become so large that its role of shock-spreader is diminished by the enhanced value of its network. Indeed, this is precisely what we observe in Treatment II. In this case, from merge-round four onwards (see the left panel in Fig. 2) one can fully appreciate how the shock-absorbing capacity of the large bank more than offsets its strength as a shock-spreading unit, so that the contagion multiplier starts to fall.

A number of interesting remarks are worth making. First, in a robust environment, a more concentrated market is generally more stable, even though contagion multipliers are higher than in the benchmark case at M&A round one. Second, a concentrated and yet symmetric market does a better job at curtailing CD. An HMP is, hence, to be preferred ex-ante to other consolidation rules consistent with the creation of a more asymmetric network. Nonetheless, if the market is already dominated by a large bank, the regulator should favor the formation of a big hub that could keep contagion multipliers under control. The upside of having a hub can be even greater with a deep interbank market. See Fig. 2 middle panel. In this case, the shock absorbing capacity of the hub becomes so strong that its presence enhances the resilience of the system to the point where contagion multipliers become smaller than those observed in the benchmark case.

Given the topological structure induced by each treatment, we can analytically derive an expected value for the magnitude of contagion and first-order default dynamics. We compute CD and first-order DD for each treatment, as explained below, and columns 1 and 2 in Fig. 4 display some selected results. One can directly compare them with the contagion multipliers shown in Fig. 2.

Let us recall that I L(1) is the value of total interbank for a small bank at merge-round R = 1, while Φ(R) is the size-adjustment coefficient applied at merge-mound R. The value of interbank liabilities for a large bank at any merge-round R is computed as:

Let us stress that Φ(R), N l (R) and N s (R) are treatment specific and change, as shown in Table 2. The following two equations show how contagion dynamics (CD) and first-order default dynamics (DD) are computed at each Merge-Round R. In order to simplify notation, let us drop the Merge-Round index R, so that C D(R)=C D, Φ(R)=Φ, I L(R)=I L, P l (R)=P l , N l (R)=N l , etc.

γ−ΦS s β represent the residual shock, i.e. the part of the exogenous shock that has not been absorbed by the first bank equity. The size of a large bank is approximated as S l =ΦS s and its networth is as usual a fraction β of its size.

P l (N l +N s −1) gives the expected number of borrowing links of the first bank. \(\frac {CD}{P_{l}(N_{l}+N_{s}-1)}\) represents the expected value of dislocated assets that is passed on to neighbor connected banks. Some of these dislocated assets will possibly affect the other (N l −1) large banks with probability P l and some of the losses will instead be borne by the N s small banks with the same probability P l . So P l (N l −1)S s Φ(R)β and P l (N s )S s β are the expected aggregate pools of networth available, respectively, to large and small banks that can be used as buffer against the residual shock.

Let us point out that we only provide the general formulas that apply to all treatments with some specific restrictions. In Treatment III, for instance, N s is set to 0 from merge-round two onwards. See Table 2. This simply sets to zero the second part of Eq. 11. With Treatment II instead, N l =1 from merge-round two onwards, and this implies that the first part of Eq. 11 disappears.

We can use this analytical framework to enhance our understanding of contagion dynamics. Let us discuss the α = 2, β = 0.04 scenario for Treatment II as a means of example: the expected pool of networth of neighbor banks is given by P l (N s )S s β, and Fig. 5 (bottom-right panel) shows that it declines at each merge-round. Nonetheless, the shock-absorbing capacity of the large bank is so strong as to guarantee that the residual shock passed on to these other banks (given by \(P_{l}(N_{s})\frac {CD}{P_{l}(N_{s}+N_{l}-1)}\) in Eq. 11) is smaller than their reduced equity base. Hence, our analytical results on DD, presented in Fig. 4, top-right panel, show that no default dynamics are set in motion for Treatment II. In such an environment, the policymaker should have a preference for a hub-centered market.

This is no longer the case when the banking system is weakly capitalized. Here we present results obtained with a deep interbank bank (α = 2). As one can appreciate from the bottom-left panel of Fig. 3, the hub in treatment II is now working as a market de-stabilizer. Even though contagion dynamics and first-order default dynamics are weaker than those observed with SHMP (T1) (see Fig. 4 bottom-panels), contagion multipliers are higher with T2. This is due to a stronger effect of complex higher-order default dynamics, which we do not model analytically. As one can see, Fig. 6 shows how with VMP (T2) first-order default dynamics (at time-round four) are weaker but fifth-order (time-round eight) and higher-order losses are stronger than those recorded with Treatment I (SHMP). Higher-order losses are quantitatively important in a fragile environment as that depicted in Fig. 2 right panel and Fig. 3 bottom panels. In this environment, it is clear that policy makers should not encourage mergers or the creation of larger institutions. If necessary at all, unassisted horizontal mergers do provide a better alternative to other forms of M&A. This is so because the HMP (T3) is better able to curb higher-order default dynamics. The disruption brought about by higher-order default dynamics depends on the probability of being jointly hit by multiple shocks. The VMP and SHMP are characterized by a higher level of interconnectedness and this significantly amplifies the chances of a bank taking on losses from multiple counterparts. When the system is fragile, a homogenous competitive banking system maximizes the resilience of the system to higher-order distress, so that authorities should carefully ponder the desirability of any takeover, merger or acquisition that could significantly alter the topology of the network.

In Fig. 7, we plot on a log-log scale the in-degree (the number of interbank borrowing - left panel), the out-degree (the number of interbank claims - middle panel) distributions as well as the contract size distribution of interbank exposures (right panel).Footnote 10 In order to save space, we only display the results for Treatment I as a means of example, but we will comment on the other treatments as well in what follows.

In order to improve readability, we overlay on each panel only the distributions obtained at merge-rounds one, four and nine. The square markers correspond to merge-round I and this is the same for all treatments (apart from some random variation). This shows the link distributions before any of the network-altering merge processes have occurred. A visual inspection suggests that, at this stage, the in-degree and the out-degree distribution follow a similar truncated normal distribution (or Poisson) consistent with the random network generating process. The size distribution of interbank exposures are skewed to the right with a the majority of contracts being rather small (typically lower than two units) and this is not surprising given the constraint, imposed on all banks, on the size of their total interbank exposure and the relatively high density of the network.

As we implement the merge sequences according to the three treatments, the distributions start to depart from the initial one and differences start to emerge across the three treatments as well as between the in- and out-degree distribution within the same treatment. For example, one can appreciate how the in-degree distribution in Treatment I ends up being bi-modal and this reflects to a large extent the balance between the two types of banks populating the banking system. The bi-modality is not a feature of the in-degree distribution for all treatments, though. As a matter of fact, there is no evidence of this in Treatment III. This is expected, since this treatment is one that preserves the homogeneity among the banks operating in the network. Treatment II yields a single peak on the right tail of the distribution and this captures the large super-connected bank that gradually become bigger and bigger merge-round after merge-round.

It is worth pointing out that the in-degree distribution depends on the probabilities P l and P s set ex-ante, so that banks of different size have different probability of borrowing on the interbank market. By contrast, the out-degree is determined endogenously and does not depend on the size of each bank. This explains why the bi-modality does not emerge with respect to the out-degree. Let us also point out that the out-degree distribution is very similar across the three treatments. Again, this is reconcilable with the fact that out-going links are determined with endogenous probability that do not change a priori with the size of the bank nor change with the implemented treatments.

Note that a shift to the right is clearly detectable in both the in and out-degree distribution. This is so because the total number of links is kept constant across the merge-rounds and is redistributed among a narrower set of banks, so that each bank ends up being more tightly connected to the others.

At each merge-round the network shrinks, so that fewer and fewer banks are more connected to one another and distribute a fixed aggregate volume of interbank resources. Given that the series of mergers are constructed in such a way that the total number of links are preserved, the size of each single loan can either decrease or increase and, hence, their distribution can potentially shift. The distributions for treatment II and III (not shown) are characterized by a shift to the left, whilst the distributions consistent with treatment I become more erratic but do not clearly exhibit any movements in either directions.

5 Robustness checks

The core results presented in the previous section are obtained from random networks in which each bank (of the same type/size) has the same ex-ante probability of forming a borrowing link with another bank. The empirical evidence does suggest though that this may not be an accurate account of real-world banking networks. The literature indeed shows that real interbank networks exhibit power-law degree distributions that arise as a result of a network generation process that is well described by the model presented by Barabasi and Albert (1999).Footnote 11 Next, we implement an endogenous mechanism of links formation that embeds the two key features of such model, namely growth and preferential attachment. Starting from a very small network with only five nodes, we let the bank population grow as follows: we rely on a rewiring process in which at each time-step a new bank is added to the system and connected to some old pre-existing nodes with some freshly created links assigned with a probability that is proportional to the number of links that the latter nodes already have. The process continues until the desired network size is reached, i.e. 25 banks at merge-round I, 23 at merge round II, etc.

A few remarks are in order. This rewiring process allows us to set the desired size of the network but does not permit to fix ex-ante the density of the network. This forces us to fine-tune the rewiring process at each merge-round until we obtain a network the total number of links of which is comparable (although not exactly equal) to that used in the previous section (i.e. 120 expected links). While this guarantees internal consistency with our previous result, some important caveats still apply to this exercise. Note that the rewiring process consistently yields a power-law degree distribution when the final network is typically quite large (200 nodes or more) and the density rather small. This is not guaranteed, though, with small and dense networks such as the ones we work with in this paper. Deviations are in fact possible and become more and more frequent as smaller networks are put in place through the merge treatments.Footnote 12 Although the degree distributions obtained with preferential attachment (shown in Fig. 8) are clearly different from the ones we obtain with a random network, the left-tail of the distribution deviates from what would be predicted by a power law. Let us also note that the limited size of the network rules out the occurrence of extreme values in the right tail of the distribution. The rewiring process also affects the contract size distribution (see Fig. 9) that clearly departs from the benchmark case. Nonetheless, the homogeneity across banks with respect to the total size of their interbank liabilities still appears to drive the shape of the distribution and, again, its departure from a power-law.

Once all the new links and nodes are added, we sort banks by the number of links (from the most connected to the weakest ones) and the size adjustment coefficient (see Table 2) is applied to the first N l nodes in each treatment.Footnote 13 Hence, we now have an exact correspondence between bank size and degree. At this stage, we ignite contagion dynamics via an exogenous shock that is targeted to the largest bank in the market. As before, we consider three different possible scenarios and Fig. 10 displays the correspondent contagion multipliers. A visual comparison with those presented in Fig. 2 reveals that the patterns discussed in the previous sections remain qualitatively similar. Within each scenario, the evolution of the contagion multipliers is fully consistent with our previous comments. The only noticeable difference in this context is that the competitive network at merge-round one always exhibits the lowest contagion multiplier for any given setting of our parameters α and β.

6 Concluding remarks

In this paper we have aimed at shedding light on the channels through which different competitive settings can fuel default/contagion throughout an interbank network, in order to draw some conclusions towards the provision of macroprudential-oriented consolidation policy rules.

Some remarks on the limitations of our analysis are in place, however. First, here we have focused exclusively on a resolution mechanism assimilable to a bail-in scheme (Gaffeo and Molinari 2015). When studying a homogenous network, the value of dislocated assets and the number of defaults during a contagion spiral tend to move hand in hand and, hence, the number of defaults is taken as a sufficient statistic for network resilience. When the size can vary across banks, though, this may no longer be the case, and this is why we focus on dislocated assets. Let us also note that we have defined dislocated assets as those assets that are wasted during the contagion process and the bail-in mechanism is consistent with this idea. Other resolution mechanisms are not as suitable. If, for example, a failed bank is liquidated, some of its assets will be destroyed during the process (due to the initial shocks or further fire-sales) and yet some assets are not lost as such but simply transferred outside the banking system (such as the assets used to pay back depositors). The simple measure of assets available to the banking system is in this case an upward biased measure of contagion-induced stress. Under a bail-in scheme, the value of dislocated assets provides an unbiased measure of distress because the assets wiped out of the banking system during the episode of contagion are also lost by the economic system as a whole. Second, we have only studied the propagation of a shock via interbank liabilities, and we have provided an inspection of the role of large banks as shock-spreader through this channel. In real networks, this may not necessarily be the case. Indeed, structural vulnerabilities could also develop and propagate through interbank assets (rather than liabilities) and these dynamics would be captured with a liquidation mechanism in which interbank assets can be called back in and hence trigger a funding shock to neighbor debtors. These could of course amplify the dynamics discussed in this paper, and further research is certainly needed to shed light on this aspect.

Notes

Press reports on the emerging consensus abound. See, for instance, the ones published on the Bloomberg (Small banks feel the urge to merge, Oct. 3, 2013) and the Reuters (Top bankers expect EU stress tests to reignite banking M&A, Jan. 26, 2014) websites.

A similar approach was adopted by local regulators during the 1997-98 Asian financial crisis (Shih 2003).

Alternative contagion dynamics and channels can, of course, be envisaged. In their seminal work, Nier et al. (2007) rely on a liquidation mechanism in which failed nodes are simply removed from the network. On top of this, several amplification mechanisms have been discussed in the literature, such as fire-sales (Anand et al. 2013), funding shocks triggered by recalling interbank assets (Krause and Giansante 2012), financial accelerator (Battiston et al. 2012), haircuts (Gai et al. 2011). Distress can also be managed via a public bail-out, and this has occurred several times during the last crisis. Both these solutions require some sort of outside money to be poured into the system. A substantial amount of state funds (or tax-payer money) is required to finance bail-out, and liquidation implicitly assumes that someone from outside is willing to purchase the liquidated assets. Our mechanism does not rely on such infusion of external funds (that may not necessarily be there when needed). Gaffeo and Molinari (2015) provide a comparative analysis of the system’s resilience under the resolution scheme described above and the more standard liquidation rule. They show that the former scheme is more effective in shielding the network from default cascades and is, hence, more coherent with the macro-prudential vision that is at the core of this paper.

Let us assume that the exogenous shock is given to bank i at time t = 1. This means that \(NDC_{ji}(1)=X^{l}_{ij}\) ∀ i,j. The rule of motion as in Eq. 4 allows us to fill in the matrix of non-distressed loans (N D C j i (t)) for t>1) at each time-round during the contagion process.

The residual loss for any bank j γ j (t+k) for any k is defined a \(\gamma _{j}(t+k)={\sum }_{i\neq j} NDC_{ji}(t+k-1)-{\sum }_{i\neq j} NDC_{ji}(t+k)\).

We call this a symmetric system because banks belong to the same size-class and share the same probability of being connected to one another.

Let us define the probability of lending for a small bank \({P^{L}_{s}}\) and \({P^{L}_{l}}\) the probability of lending for a large bank, respectively. These probabilities are computed as: \({P^{L}_{s}}=[P_{l}N_{l}+P_{s}(N_{s}-1)](N_{s}+N_{l}-1)^{-1}\) and \({P^{L}_{l}}=[P_{l}(N_{l}-1)+P_{s}N_{s}](N_{s}+N_{l}-1)^{-1}\).

The ECB report on banking structures (ECB 2010) reports information on the Herfindahl index for most EU countries from 2005 to 2009. The average is around 11 percent but there is a great deal of cross-country heterogeneity. Italy (along with Germany and Luxembourg) stands out as a low-concentrated market with values increasing from 2.3 percent in 2005 to 3.53 in 2009. The Netherlands (or even more, Finland) appear at the other end of the spectrum with a market concentration starting at 17 percent in 2005, up to 20 percent in 2009.

The interested reader may refer to the working-paper version (Gaffeo and Molinari 2014), which features a detailed discussion of all possible cases.

These plots are obtained by pooling 100 Monte Carlo experiments in order to maximize the number of observations. In these simulations, we set α = 5 and β = 0.04.

An alternative modeling strategy would be to create a scale-free network with a power-law parameter in line with that estimated using real data. This would yield a scale-free network even with a small sample size but the total number of links would be much smaller than that required to have a meaningful comparison with the benchmark case presented in the previous section.

Let us note that N l is both treatment and merge-round specific, as it should be clear from Table 2.

References

Anand K, Gai P, Kapadia S, Brennan S, Willison M (2013) A network model of financial system resilience. J Econ Behav Organ 85(0):219–235

Barabasi AL, Albert R (1999) Emergence of scaling in random networks. Science 286(5439):509–512

Battiston S, Delli Gatti D, Gallegati M, Greenwald B, Stiglitz JE (2012) Default cascades: When does risk diversification increase stability J Fin Stab 8(3):138–149

Beck T (2008) Bank competition and financial stability : friends or foes ? Policy Research Working Paper Series 4656, The World Bank

Berger A, Klapper L, Turk-Ariss R (2009) Bank competition and financial stability. J Finan Serv Res 35(2):99–118

Boot A (2003) Consolidation and strategic positioning in banking with implications for europe. Brookings-Wharton Papers Finan Serv 1:37–83

Boss M, Elsinger H, Summer M, Thurner S (2004) Network topology of the interbank market. Quant Finance 4(6):677–684

ECB (2010) Eu banking structures. Technical Report 711, European Central Bank

Elliehausen G (1998) The cost of banking regulation: A review of the evidence. Working paper series 171, Board of Governors of the Federal Reserve System, U.S.

Gaffeo E, Molinari M (2015) Interbank contagion and resolution procedures: inspecting the mechanism. Quant Finance 15(4):637–652

Gaffeo E, Molinari M (2015) Interbank contagion and resolution procedures: inspecting the mechanism. Quant Finance 15(4):637–652

Gai P, Kapadia S (2010) Contagion in financial networks. Proc Royal Soc Lond, A 466(2120):2401–2423

Gai P, Haldane A, Kapadia S (2011) Complexity, concentration and contagion. J Monet Econ 58(5):453–470

Hahm JH, Shin HS, Shin K (2013) Noncore bank liabilities and financial vulnerability. J Money Credit Bank 45(1):3–36

Haldane A (2013) On being the right size. Speech delivered at the Economics Festival in Trento, Bank of England

IMF (2012) Global financial stability report. IMF

Kliesen KL (2013) Uncertainty and the economy. Reg Econ 21(4):1–3

Krause A, Giansante S (2012) Interbank lending and the spread of bank failures: A network model of systemic risk. J Econ Behav Organ 83(3):583–608

Leitner Y (2005) Financial networks: Contagion, commitment, and private sector bailouts. J Finance 60(6):2925–2953

Manna M, Iazzetta C (2009) The topology of the interbank market: developments in italy since 1990. Working Paper 711, Bank of Italy, Economic Research and International Relations Area

May R, Arinaminpathy N (2010) Systemic risk: the dynamics of model banking systems. J Royal Soc Interface 7(46):823–38

Nier E, Yang J, Yorulmazer T, Alentorn A (2007) Network models and financial stability. J Econ Dyn Control 31(6):2033–2060

Pilloff SJ (2002) What’s happened at divested bank offices? an empirical analysis of antitrust divestitures in bank mergers. Finance and Economics Discussion Series, Working Paper 2002-60, Board of Governors of the Federal Reserve System (U.S.)

Ratnovski L (2013) Competition policy for modern banks. Working paper no.13/126, IMF

Rogers LCG, Veraart LAM (2013) Failure and rescue in an interbank network. Manag Sci 59(4):882–898

Shih MSH (2003) An investigation into the use of mergers as a solution for the Asian banking sector crisis. Q Rev Econ Finance 43(1):31–49

Soramäki K, Bech ML, Arnold J, Glass RJ, Beyeler WE (2007) The topology of interbank payment flows. Phys A: Stat Mech Appl 379(1):317–333

Vives X (2011) Competition and stability in banking. Oxf Rev Econ Policy 27 (3):479–497

Acknowledgments

The authors wish to thank to Flavio Bazzana, Simone Giansante, Kevin J. Lansing, Stefania Ottone, Roberto Tamborini and two anonymous referees for their valuable comments. We are also very grateful to the audiences at the SIE (Italian Economic Association) 55th annual conference (University of Trento), the 2013 EBES Conference in Rome, the 2012 Latsis Symposium, Economics On The Move at the ETH Zurich, the 2012 IFABS Conference, Rethinking Banking and Finance: Money, Markets and Models in Valencia, and seminar participants at the University of Trento (Department of Economics and Management) the University of Bath (School of Management) and the Institute of Economics (Sant’Anna School of Advanced Studies) for their feedback on previous versions of this paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Edoardo Gaffeo and Massimo Molinari gratefully acknowledge the financial support from the Institute for New Economic Thinking (INET) grant on “Financial fragility and systemic risk”. The usual disclaimers apply.

Rights and permissions

About this article

Cite this article

Gaffeo, E., Molinari, M. Macroprudential consolidation policy in interbank networks. J Evol Econ 26, 77–99 (2016). https://doi.org/10.1007/s00191-015-0419-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-015-0419-3