Abstract

As collaborations in supply chains increase, governance of relationships and profit sharing between supply-chain members emerges as a critical issue. Different supply-chain members have different incentives: a retailer who incurs inventory costs would focus on order quantity, while a supplier who incurs production and scheduling costs would focus more on shipment schedules. Without proper incentives, members may be willing to withhold critical information. Information-sharing systems that reduce either lead-time uncertainty or variability in shipment quantity benefit downstream members, but may not necessarily benefit the supplier, and thus create uneven incentives to adopt such systems. In this work, we discuss two-tier supply chains and determine channel profit and members’ profit under different information sharing and inventory locations. We further discuss the case when the supplier tends to be more informed than the downstream members. In this case, the supplier may purposely choose to only partially resolve demand uncertainty or to share information only with select downstream members.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

With technology-enabled collaboration among supply-chain members, the basis of competition has shifted from the firm level to the supply-chain level. In this new environment, firms can reduce procurement times, increase velocity of material flow and provide process-to-process integration. Firms are increasingly collaborating with their partners to reduce inefficiencies in the procurement processes and extend the supplier base (and for downstream activities, extend the distribution channels) globally. As technology enables deeper process-to-process integrations, firms are moving from a low level of integration, which involves the simple exchange of procurement and payment data to synchronized supply, where integrated planning and collaboration are put into place. This eventually leads to the co-creation of value through joint innovation in products and processes.

Replenishment cycles are becoming shorter and shorter through the automation of many inter-organizational processes. Because the flow of demand information is more accurate, inventory levels at different points in the supply chain have dropped (and in many cases, inventory buffers have been eliminated). In procurement processes, simple reorder point policies and later point-of-sale-based systems like QR and ECR have been replaced by Collaborative, Planning, Forecasting and Replenishment (CPFR) systems where supply-chain members at different echelons keep each other informed of the inventory levels, forecasts and planned productions.

These IT-led collaborations have resulted in reduced replenishment cycles, and more efficient use of production and warehousing facilities. In many industries, we saw the emergence of industry-owned neutral collaborative marketplaces (e.g. GHX in the healthcare supply industry) that makes supply processes much more transparent and cost effective by bringing buyers and suppliers together (Applegate and Ladge 2003). In the merchandising industry, there has been an emergence of sourcing agents like Li and Fung that allow retail chains such as Bed, Bath and Beyond to reach out to global suppliers and, if necessary, use connectivity and tools provided by Li and Fung to design products collaboratively with their suppliers (McFarlan et al. 2012).

Collaborative supply chains eliminate the “bullwhip effect”—wild fluctuations in inventory levels—by eliminating unnecessary noise as the demand for information propagates upstream (Chen et al. 2000). Collaborative supply chains also increase systems-wide flexibility. They allow participants in large global supply chains to “embrace complexity while better serving the customer” (McKinsey Quarterly 2011). In other cases, the information-sharing mechanism may allow a firm to splinter its supply chain by keeping a conventional production and supply network for low-variability, high-volume products and implementing a specialized production system for high-variability and low-volume products that may demand a high degree of customization, giving the firm a further differentiation (McKinsey Quarterly 2011). A smart supply chain can increase transparency in the buyer–supplier relationships, allow supply-chain members to reduce cost, manage risks, facilitate customer collaboration and innovation and build a global network of supply-chain and distribution partners (IBM 2009).

Despite significant investments in implementing real-time supply chains, in many cases the desired visibility and risk management efforts have not been achieved. According to a recent study by McKinsey, as many as 68 % of executives expect the supply-chain risk to increase in the future. The IBM study on the future of the supply chain found that only 20 % of managers that have adopted real-time supply chains in the auto industry have achieved a desired level of visibility, and many feel that the supply chain does not provide the desired level of flexibility. Similarly, the Grocery Manufacturers Association (GMA) found that “67 % of GMA member companies are engaged in some form of collaborative planning, forecasting and replenishment activity, with only 19 % moving beyond pilot studies (GMA 2002).” Even in synchronized supply chains that are dispersed over long distances, lead-time uncertainty sets in, or products may show short-term fluctuations, creating “wriggles” in information flow, potentially mitigating the benefits of synchronization. Similarly for perishable goods, the opportunity to collaborate on inventory level is limited, as inventories are kept and managed in short cycle times (Holweg et al. 2005; Sherman 2007).

While an information-sharing system may lead to a better outcome for the entire supply chain, individual members can potentially achieve higher performance, especially on a short-term basis, by making myopic decisions or by not participating in any collaboration. Collaborative supply chains that integrate processes across firm boundaries provide much larger benefits than simple B2B commerce (Riggins and Mukhopadhyay 1994; Rai et al. 2006). However, all participants do not achieve the benefits evenly; as pointed out by Zhang et al., an information receiver always gains from information-sharing systems, but the information provider may not gain in all situations (Zhang et al. 2006). Different supply-chain members have different incentives; a retailer who incurs inventory costs would focus on order quantity, while a supplier who incurs production and scheduling costs would focus more on shipment schedules. An information-sharing system that reduces lead-time uncertainty or variability in shipment quantity benefits downstream members, but may not necessarily benefit the supplier, and thus creates uneven incentives to adopt such systems (Iyer and Bergen 1997). Even when information systems are in place, one or more members may be willing to hold back on critical information. A manufacturer who becomes aware of an adverse forecast may delay sharing it with retailers in an effort to prevent retailers from reducing order sizes (Guo and Iyer 2010). Similarly, in cases where the information gathering is sequential, an information collector may not resolve all of the uncertainty if its profits will not increase with further information. Thus, along with the information-system implementation, the governance of the relationship and profit sharing between supply-chain members emerges as a critical issue. In cases when the manufacturer has the option of sharing information systems with some but not all retailers, there may be diminishing returns in rolling out information systems to additional retailers (Gal-Or et al. 2008).

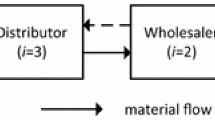

In this chapter, we analyze a two-tier supply chain with a single supplier and multiple retailers and examine the social and individual profitability under different collaboration mechanisms for developing forecasts and inventory locations. In particular, we consider uncertainties that arise due to global factors that affect overall reception of the product in the marketplace and each retailer individually. We consider a number of different information-sharing scenarios and their implications for price and inventory decisions. In many of these cases, we will use the context of a one-time event like a product introduction or a product promotion. These cases are interesting as the information asymmetry between the different supply-chain members can be high and therefore the value of collaboration across supply chains can be high. Where the demand is relatively stable, the supply-chain performance can be improved through synchronization, but the value of collaborative forecasting can be low (Iyer and Bergen 1997; Gal-Or et al. 2008; Kurtulus et al. 2012). The information systems for reducing uncertainty can possibly include forecasting tools implemented separately by the supplier, and retailers who can then choose to share information (collaborative forecasting) or not share information. A manufacturer may choose to build a global forecast using its own resources or build a global forecast based on demand reported by individual retailers. It can then choose to share the information with all or some retailers. The actual sharing will be specified by the contract between the supplier and individual retailers.

We begin with the discussion of a simple scenario of identical retailers (i.e. the demand is an independent, identically-distributed random variable for each of them), and the supplier is constrained to offer the same information-sharing contract to every retailer. We examine the social and individual profitability under different collaboration mechanisms for developing forecasts and inventory locations. We then discuss the cases when the supplier has the option to selectively reveal information to select retailers. Finally, we consider the case when the supplier can deliberately choose to improve on forecast, lest the improved forecast makes retailers choose lower order quantity.

2 Identical Retailers—Uniform Contracts

In the simplest case, all of the retailers operate in independent markets (so that a sale is lost if a retailer faces stock-out condition in its market) and the manufacturing cost (marginal), transfer price and retail prices are set. Each player solves its own Newsboy Problem based on the information available. We further assume that even though the retailers do not compete, they do not share any information with each other either. In other words, any reduction in a retailer’s uncertainty about the demand can only be the result of the supplier’s information sharing.

Case 1: No Information Exchange

If there is no information-sharing system in place, each retailer uses a common prior distribution function for the demand to set the service level (i.e. set the order level) in its own market. The supplier then acquires just enough quantity to meet the retailer’s orders. The supplier bears no cost of shortage or holding excess inventory; any cost of shortage or excess inventory is borne only by the retailers.

Case 2: Supplier Determines Global Demand and Retailers Manage Inventory

The supplier can use information-collection processes and forecasting methods on its own to determine the global demand (or rather, revise parameters of the distribution function for the demand). Alternatively, the supplier can ask each retailer to determine a preliminary forecast for its own market. These forecasts are then used as realizations of the global demand and help determine the posterior distribution of the global distribution function. The supplier then informs the retailers of its posterior global demand function. Retailers combine the supplier’s posterior with their priors to set the service level and place the appropriate order. Similar to Case 1, the supplier acquires just the right amount to meet the retailer’s order. The supplier bears no cost of shortage or holding excess inventory; any cost of shortage or excess inventory is borne only by the retailers.

Case 3: Supplier Determines Global Demand and Manages Inventory

The supplier can use information-collection processes and forecasting methods on its own to determine the global demand (or rather, revise parameters of the distribution function for the demand). Alternatively, the supplier can ask each retailer to determine a preliminary forecast for its own market. However, rather than sharing information with individual retailers, the supplier manages all inventory at all retail stores. We further assume that the supplier has the flexibility of shifting unsold items from one store to another in a costless manner. This case then is equivalent to a centralized environment with the retailer acting as a pass-through agent and receiving a fixed per-item fee for facilitating sales. The supplier bears all cost of shortage or holding excess inventory, whereas retailers do not bear any inventory-related cost.

Using the generalization of the Newsboy Problem, we can easily determine order quantities and profits for retailers and suppliers (Chandra and Saharia 2013). The insights that follow from the model are that the pooled demand with centralized decision making, Case 3, leads to the highest service level and highest channel profit. In other words, retailers enjoy the benefits of a high service level without having to undertake inventory risk. Thus, retailers would like to support an information-sharing system and a supplier-based inventory-management system. On the other hand, the quantity ordered is highest when there is no information sharing, Case 1, and retailers bear all the inventory risk. This allows for the highest profit for the supplier. Thus, the supplier benefits from higher-demand uncertainty and has no incentive to adopt an information-sharing system. If it must, it would like to pass on the pooled demand to retailers and then follow a make-to-order approach. Further, in the two cases where retailers bear the inventory risks, the supplier’s profit increases as the global as well as local uncertainty increases. Thus, the supplier has incentives to mislead retailers into thinking that the demand is more uncertain than it actually is. Thus, the supplier has to be rewarded for sharing, an amount equal to the profit it would forgo if information systems were in place. Even when information systems are in place, retailers have to ensure that the supplier does not inject an unwarranted uncertainty to induce retailers to place higher orders. These issues are addressed in the next section.

3 Generalizations

There are a number of generalizations of the simple model that have been proposed to examine incentives of the members of a supply chain. Gal-Or et al. consider heterogeneous retailers who are allowed to compete with each other. The transfer price charged to the retailer is not set ex ante but is set when the supplier has developed it according to the global forecast. A retailer can then use the transfer price to infer the demand as seen by the supplier (Gal-Or et al. 2008). The magnitude of this inference effect depends on a number of factors including the precision of the forecast determined by the individual retailer and the degree of competition. A retailer with a precise forecast will not benefit much for such an inference as it already has enough information about the demand. On the other hand, a retailer with poor information will gain much more from such an inference and is more likely to use it. Gal-Or et al. further show that such an inference on the part of the retailer forces the supplier to distort the price downwards so as to imply that the demand is higher than it actually is. Based on the assumptions that these authors make, they arrive at two key hypotheses: (i) In a more competitive retail environment, there are fewer incentives for information-sharing between suppliers and retailers; and (ii) In channels where retailers have invested heavily in information systems (which allow them to determine local demand more carefully), there are fewer information-sharing alliances between suppliers and retailers.

One of the key assumptions in the work by Gal-Or et al. is that the supplier has to agree to the information sharing ex ante. The only strategic flexibility that the supplier has is that it can inject uncertainty about the actual global demand via the transfer price. Guo and Iyer consider an alternate scenario, for a single supplier and a single retailer, in which the supplier can decide ex post whether to share information with the retailer (Guo and Iyer 2010). They consider two different dimensions: information gathering and information sharing. For information collection, they consider a possible situation where the supplier can gather information sequentially so that each step of its posterior distribution improves further. In an extreme case, the supplier may undertake an infinite number of steps to resolve the demand uncertainty. In this case, an inflexible contract can potentially commit the supplier to a specific level for precision. However, if the contract does not commit the supplier to a specific level of precision, the supplier will continue to collect further information only if it is economically beneficial. On one hand, it would stop collecting any more information if it perceives that additional precision will not change the retailer’s ordering decision because the posterior distribution the retailer will build is good enough. On the other hand, it would stop collecting additional information if it perceives that the additional precision will adversely affect it because the retailer will order less because of the improved forecast. In other words, the supplier can gain by introducing strategic uncertainty. This is similar to the ambiguity introduced in Gal-Or et al. through intermediate price. In the extreme case, the supplier may choose not to undertake any forecasting and let the retailers base their order quantities on the local forecast only. This is similar to Case 1 discussed in the previous section.

For information sharing, they consider a possible situation where the supplier can enter an ex-ante contract and reveal all the information it has collected or it chooses not to enter any contract and reveal information it has collected. On the sharing dimension, the supplier can either enter a contract in which it is obligated to share demand information with the retailers (irrespective of the degree of precision) or it can choose not to share any information and once it has arrived at its posterior distribution, choose to share information with retailers. Guo and Iyer show that when a supplier has committed to a fixed contract, the manufacturer has incentive to collect more information. Also when the prior belief on consumer preference is low, the supplier is more likely to enter a fixed contract that commits it to information sharing. Thus, in situations where the product fit can be potentially low, committing to a mandatory information-sharing mechanism may induce the retailer to order a higher quantity.

4 Multi-Period Systems

Supply-chain coordination for an established product takes significantly different form. For such products, retailers and suppliers typically set up procurement policies based on the historic sales data, and account for short-term fluctuations by adjusting order quantities and/or ordering time. With advances in technology, underlying ordering, fulfillment and settlement processes are increasingly supported by inter-organizational IT systems (Riggins and Mukhopadhyay 1994; Cachon 2003; IBM 2009). In addition to technology supporting the underlying physical flows, members of the supply chain may share their inventory positions with each other or undertake collaborative forecasting.

A number of authors have examined the effect of information sharing and collaborative forecasting on supply-chain performance. Cachon and Fisher examine a two-tier supply chain with a single supplier and multiple identical and non-collaborating retailers. In an information-sharing environment, the supplier has access to retailers’ inventory positions and can adjust its supply allocation based on this information. They find that such increased transparency can potentially improve the supply-chain efficiency, but the overall effect is small. By comparison, the improvements that can be achieved by reducing lot sizes or reducing cycle time can be an order of magnitude larger (Cachon and Fisher 2000).

Aviv examined a two-tier supply chain with a single retailer and a single supplier, both facing significant lead times. In the absence of any forecasting systems, the replenishment decisions are based on long-term demand characteristics. However, the supply-chain performance can be improved by augmenting the long-term demand by the forecast for individual period(s). The variation of the individual-period demand from the long-term demand is the result of local conditions such as weather forecasts, competitors’ announcements, etc. In a localized forecasting environment, each player builds its own forecasts for future periods and bases its replenishment decisions on these forecasts. In a collaborative environment, the retailer and supplier share their individual forecasts and develop a joint forecast and then make replenishment decisions. Through a series of simulations that allow for demand variability, Aviv finds that both local and collaborative forecasts allow both players to fine-tune their order quantities, thereby improving supply-chain efficiencies. The collaborative forecast is much more cost-effective than the local forecast. However, the benefits of the collaborative forecasting are meaningful only if the collaborating parties bring something unique to the table. In other words, if both parties use the same environmental condition to develop a new forecast, the collaboration does not lead to any improvement over individual forecasts (Aviv 2001). Thus, it is not only important to collaborate, but also to look for different factors that cause variances from established demand patterns. Further, the benefits of collaborative forecasts are greater when lead times are shorter.

5 Competition among Supply Chain Members

In the works described above, the main factor has been demand uncertainty. In supply-chain relations, there are many other factors that create inefficiencies, like lead-time uncertainties, competition at different levels of the supply chain and costs associated with investments in forecasting technology by individual members. Shin and Tunca incorporate the competitive behaviour of retailers who operate in a common market. They show that if the market allows for private investments in technology, retailers can potentially invest more than optimally to improve their private forecast, which in turn would have a significant negative impact on the overall supply-chain surplus. If competing members can observe one another’s investments, they tend to invest even more, thereby increasing inefficiencies even more. The effect increases as demand uncertainty increases and as the number of retailers increases (Shin and Tunca 2010). (Such a competition among retailers leads to a situation where a fixed-transfer price fails to achieve market coordination. In such a case, Shin and Tunca propose a uniform price auction that makes retailers reveal their price-quantity equilibrium and then the supplier chooses an aggregate quantity that clears the market.)

6 Lead-Time and Shipment Quantity Uncertainties

Yet another factor that is responsible for supply-chain inefficiency is uncertainty in lead time that may arise because of uncertainty in transportation systems and variability in administrative processes. In cases where orders can be partially filled by the supplier, because of stock-out conditions, retailers also face uncertainty as to the actual amount of the goods that would be delivered to the retailer. In collaborative supply chains , implementing a shipment information system can reduce this uncertainty. In case no information systems are in place, the retailer gets to know the actual shortfall in the future at the end of lead time (that may include a number of ordering cycles). Zhang et al. consider the situation where the retailer is informed immediately in each period of the shipment sent by the supplier, so that the retailer can adjust the order in the next ordering cycle. They show that if the demand uncertainty is high, a shipment information system can reduce the supply-chain inefficiencies. If the supplier commits to fulfilling the backlogged demand within a fixed period, the improvements are not significant. They further show that while the information receiver, in this case the retailer, always benefits from having a collaborative information system in place, the provider, in this case the supplier, may not always benefit from such a system (Zhang et al. 2006).

7 Conclusion

Many of the works described here provide useful insights on the role of information systems in supply-chain coordination. In particular, several have examined collaborative forecasting as a means of reducing inefficiencies. However, most of these works have significant limitations. Suppliers do not face any competition (only one supplier is considered); only a few cases have considered completion at the retail level. In real life, it would be unusual for a supply-chain member to depend on a single supplier. The price charged to the retailer by the supplier is considered fixed; only Gal-Or et al. allow for the price to be determined after the demand uncertainty has been (partially) resolved. (But even there, the supplier has incentive to introduce price ambiguity.) Only Aviv allows for price to be determined through a common price auction so that the retailers reveal their price-demand continuum truthfully. We look forward to upcoming research works that address many of these issues.

References

Applegate LM, Ladge J (2003) Global healthcare exchange. Harv Bus School Case, 804–002

Aviv Y (2001) The effect of collaborative forecasting on supply chain performance. Manage Sci 47(10):1326–1343

Cachon GP (2003) Supply chain coordination with contracts. In Graves S, de Kok T (eds), Handbooks in operations research and management science: supply chain management. Elsevier, Amsterdam, pp. 229–339

Cachon GP, Fisher M (2000) Supply chain inventory management and the value of shared information. Manage Sci 46(8):1032–1048

Chandra M, Saharia A (2013) Information systems and coordination in supply chains,46th hawaii international conference on system sciences (HICSS 2013), pp. 4146–4153, doi:10.1109/HICSS.2013.274

Chen F, Drezner Z, Ryan J, Simichi-Levi D (2000) Quantifying the bullwhip effect in a simple supply chain: the impact of forecasting, lead times, and information. Manage Sci 46(3):436–443

Gal-Or E, Geylani T, Dukes AJ (2008) Information sharing in a cannel with partially informed retailers. Mark Sci 27(4):642–658

GMA (2002) CPFR Baseline Study: Manufacturer Profile, KJR Consulting for the Grocery Manufacturers of America

Guo L, Iyer G (2010) Information acquisition and sharing in vertical relationships. Mark Sci 29(3):483–506

Holweg M, Disney S, Holmström J, Småros (2005) Supply chain collaboration: making sense of the strategy continuum. Eur Manage J 23(2):170–181

IBM Institute for Future Value (2009) The smarter supply chain of the future. http://www-07.ibm.com/sg/manufacturing/pdf/manufacturing/Auto-industry.pdf. Accessed May 9, 2014

Iyer AV, Bergen ME (1997) Quick response in manufacturer-retailer channels. Manage Sci 43(4):559–570

Kurtulus M, Ulku S, Toktay BL (2012) The value of collaborative forecasting in supply chains. Manuf Serv Oper Manage 14(1):82–98

McFarlan FW, Chen MS, Wong KC (2012) Li & Fung 2012, Harvard Business School Case 196–061

McKinsey Consulting (2011) Building the supply chain of the future. Mckinsey Quarterly, Available at: http://www.mckinsey.com/insights/operations/building_the_supply_chain_of_the_future. Accessed May 9, 2014

Rai A, Patnayakuni R, Seth N (2006) Firm performance impacts of digitally enabled supply chain integration capabilities. MIS Quarterly 30(2):225–246

Riggins FJ, Mukhopadhyay T (1994) Interdependent benefits from inter-organizational systems: opportunities for business partner reengineering. J Manage Inf Syst 11(2):37–57

Sherman RJ (2007) Why has CPFR failed to scale? Supply chain quarterly http://www.supplychainquarterly.com/topics/Strategy/scq200702collaboration/. Accessed May 9, 2014

Shin H, Tunca TI (2010) Do firms invest in forecasting efficiently? The effect of competition on demand forecast investments and supply chain coordination. Oper Res 58(6): 1592–1610

Zhang C, Tan G-W, Robb DJ, Zheng X (2006) Sharing shipment quantity information in the supply chain. Omega 34(5):427–438

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2016 Springer India

About this chapter

Cite this chapter

Saharia, A. (2016). Incentives for Information Sharing in Collaborative Supply Chains. In: Sushil, ., Bhal, K., Singh, S. (eds) Managing Flexibility. Flexible Systems Management. Springer, New Delhi. https://doi.org/10.1007/978-81-322-2380-1_11

Download citation

DOI: https://doi.org/10.1007/978-81-322-2380-1_11

Published:

Publisher Name: Springer, New Delhi

Print ISBN: 978-81-322-2379-5

Online ISBN: 978-81-322-2380-1

eBook Packages: Business and ManagementBusiness and Management (R0)