Abstract

In this study, the impact of information sharing on bullwhip effect (BWE) is investigated using a four-echelon supply chain simulation model where each echelon shares some of the customer demand forecast information with a retailer, the lowest echelon. The level of the demand forecast shared at each echelon is represented as information sharing rate (ISR). Four different levels of ISR are considered to evaluate its impact on BWE. A full factorial design with 64 cases is used, followed by statistical analysis. The results show that (1) overall, higher ISR more significantly reduce BWE than lower ISR at all echelons; (2) further, the impact of ISR is not same between echelons. The ISR at an echelon where BWE is measured has the highest impact. However, its impact decreases at downstream echelons; (3) BWE is affected by not only the magnitude but also the balance of ISR’s across echelons, while the former has three times more impact than the latter; (4) lastly, we demonstrate that a highly unbalanced ISR may cause reverse bullwhip effect (RBWE), particularly when the level of unblance at downstream echelons is high and the uppermost echelon where BWE is measured has the highest ISR. Based on this demonstration, we derive a functional relationship between ISR’s and RBWE using regression analysis. We believe that results from this study provide useful implications and insights for better coordination and collaboration in a supply chain.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Orders in a supply chain are sensitive to demand change. Small changes in a customer order can create a progressive increase in order variation as the order information passes upstream in the supply chain. This phenomenon is referred to as the bullwhip effect (BWE). In the operations management discipline, BWE has been negatively described because it is partly responsible for inefficiencies such as a high inventory, a low service level, a low quality, and an increased operation cost, etc. Further, managing BWE to prevent or reduce the inefficiencies requires a significant amount of effort. For these reasons, among many BWE related topics, identifying its root causes and preventing or mitigating its impact have been focused. Several operational causes for BWE have been identified using analytical or simulation approaches, some of which include rationing and shortage gaming, time delay, demand signal, order policy, and poor coordination (Hall and Saygin 2012).

The rationing and shortage gaming refers to a situation where a manufacturer tries to ration its products, in case of shortage in supply. Accordingly, customers fear the consequence of the shortage, exaggerate their needs, and order more than what they actually need, which distorts the demand upstream (Devika et al. 2016). Several studies demonstrate that the time delay such as the longer manufacturing or supplier lead-time from upstream to downstream significantly contributes to BWE (Hussain et al. 2012; Hussain and Saber 2012; Paik and Bagchi 2007). Both demand signal processing with the customer demand forecast and specific order policies to control inventories have been considered important too. Thus, many studies identify and evaluate the impact of the different order policies and forecasting methods on BWE (Barlas and Gunduz 2011; Dejonckheere et al. 2004; Disney and Towill 2003a; Disney and Lambrecht 2008). The poor coordination has been recently more focused. According to Arshinder et al. (2008), the supply chain coordination (SCC) is the activity of managing dependencies among the members in the supply chain. Thus, it requires the joint effort of the members working together towards mutually agreed goals. They consider it as a prerequisite to integrate the operations of the members. To implement the integration, the members need to share information and should be able to explain the impact that their actions have on other members. For this reason, SCC has been mainly studied from the information sharing perspective. Particularly, sharing the customer demand or its forecasting information has been significantly focused. As a consequence, many studies identify and propose the information sharing among members as one of the most effective remedies to mitigate the impact of BWE (Paik and Bagchi 2007; Dejonckheere et al. 2004; Cannella and Ciancimino 2010; Hussain et al. 2012). All of these studies conclude that information distortion increases BWE while information sharing mitigates it. In addition to the operational causes, some studies investigate BWE from a network structure perspective. The ‘number of echelons’ or the ‘number of intermediaries’ has been particularly focused. It has been known that BWE increases as the number of echelons increases (Disney and Lambrecht 2008; Paik and Bagchi 2007). Thus, reduction of intermediaries is also recommended to mitigate BWE.

Although sharing information and reducing the number of the echelons have been considered as effective remedies to mitigate BWE, the detailed relationship between these two factors-information sharing and echelons-regarding BWE has not been fully studied. As previously discussed, SCC requires information sharing among the members. Thus, for better coordination or reduction of BWE, some of the important questions such as “what information to share?”, “how to share information?”, and “whom to share with” need to be answered. The first question has been already thoroughly investigated-most of the studies aforementioned share the customer demand forecast (CDF) information between echelons. However, relatively little research has dealt with other two questions. Thus, we attempt to provide some answers for these two questions. We note that the answers are related to both the level of information and the position of the echelon where information is shared since the impact of information sharing may be different from echelon to echelon. Hence, if we quantify the impact of the information sharing level on BWE for all echelons, it would be able to provide significantly meaningful answers to the under-researched questions.

In the study, we consider a serially connected four-echelon supply chain. The retailer echelon, serving the customer, forecasts its demand using the customer’s actual demand. Then, all other upstream echelons estimate their demand using either CDF through collaboration with the retailer or their own direct forecasting method based on the replenishment orders from their immediate downstream echelon. Thus, we can define the level of the CDF shared, referred to as the information-sharing rate (ISR), at each echelon. For example, if ISR is x%, it means that the echelon uses CDF provided by the retailer by x% and its own forecasting information by (100 – x)% to estimate its own demand. In this way, ISR represents the degree of CDF shared at each echelon. If an echelon fully shares CDF with the retailer, x is 100%. If x is zero, it means that the echelon conducts its own independent forecasting without any information sharing with the retailer. Since each echelon may have a different ISR level, a combination or distribution of ISR’s across echelons may have a different impact on BWE. We define a combination of ISR’s across all echelons as an information-sharing mode.

Most previous studies have focused on only two information sharing modes-no sharing, ISR = 0, and full sharing, ISR = 1.00, across all echelons. Of course, it is the most desirable for all members to have the full sharing mode. However, this is not an always-possible option due to some financial and non-financial issues. For example, sharing information requires an expensive investment in information technology. The investment in information technologies accounted for more than 50% of the capital expenditures in the United States when Yao and Zhu (2012) write their paper. Further, a non-financial issue such as the mutual trust among members in a supply chain also prevents the full sharing (Youn et al. 2012; Almeida et al. 2015). Thus, there is a need to analyze the diverse impact of ISR’s with both full and partial information sharing modes on BWE.

To explore the answers to the two under-researched questions for better collaboration, we present the following objectives to accomplish in this study: (1) investigate the impact of various ISR’s at each echelon on BWE and quantify it. We know that information sharing affects BWE, and its impact may vary at the position of echelons. Thus, understanding the impact of ISR and its relationship with echelon’s position provides useful insights on our questions since it shows more options and knowledge for better coordination; (2) analyze the impacts of the magnitude of ISR and its level of balance across echelons on BWE. The magnitude and balance level of ISR are represented by the average and degree of the variation of ISR’s across the echelons, respectively. While the first objective focuses on an individual echelon, the second one on the entire supply chain. The magnitude and balance level are helpful to decide the priority for SCC; finally, (3) attempt to explain the occurrence of reverse bullwhip effect (RBWE) with ISR at each echelon, and explain ISR as a cause of RBWE. To the best of our knowledge, there has been very limited amount of research on these objectives. Particularly, the second and third objectives are not discussed in the relevant literature. Thus, the results of the study will provide meaningful insights on the impact of the information sharing and its implementation for successful coordination.

To achieve the three objectives mentioned above, we use a system dynamics simulation approach to model the supply chain consisting of a retailer, a wholesaler, a distributor, and a producer. To simulate the model, we adopt the ‘shock lens’ (Towill et al. 2007) perspective, implying that an unexpected and intense change is introduced to the customer demand to infer on the performance of the supply chain. A full factorial design is used to evaluate BWE for all possible ISR combinations. Eventually, we apply the linear regression analysis and corresponding Analysis of Variance (ANOVA) method.

The rest of the paper is organized as follow: A literature review on information sharing in a supply chain is presented in the next section. Detailed description on the model is outlined in Supply chain simulation modeling section, followed by Design of experiments. The results of the simulation model are explained in Results and analysis section, followed by Implications and discussion section. Then, Conclusions are presented, followed by References and “Appendix A” explaining the acronyms.

Literature review

We focus on the demand or CDF information sharing to be aligned with the scope of the study.

Lee et al. (1997) show that demand sharing reduces BWE generated by demand signal processing. Following their research, many researchers demonstrate the information sharing with an inventory ordering policy to be an effective remedy to reduce BWE. Chen et al. (2000a, b) prove that BWE exists in a two-echelon serial supply chain with the order-up-to inventory policy, and it increases with the lead-time being longer and forecasting being less smooth. Dejonckheere et al. (2004) compare the order-up-to policy with the smoothing replenishment order (SRO) policy in a four-echelon serial model. They show that BWE increases at both policies when CDF is not shared. However, with CDF shared, the reduction of BWE is more significant in case of the SRO policy, particularly at higher echelons. Quyang (2007) applies the system control theory to a serial supply chain and shows that BWE occurs at an echelon whose inventory gain, defined as the marginal change in the steady-state inventory position for a unit change in the steady-state replenishment order at the echelon, is positive regardless of the information sharing. He also shows that the information sharing can reduce BWE. Barlas and Gunduz (2011) use a three-echelon serial model with a simple exponential smoothing forecasting method to evaluate BWE under three different order policies: an order-up-to-S level, an anchor-and-adjust, and an order-point s, order-up-to-S level, referred to as (s, S) policy. They demonstrate that sharing the CDF information significantly reduces BWE across all order policies. Chatfield et al. (2004) examine the effects of the stochastic lead-times, information sharing, and information quality in a four-echelon simulation model with the order-up-to-S level policy. They consider four different settings of the information quality based on the availability of the lead-times and customer demand information. They conclude that the lead-time variability exacerbates BWE, and both information sharing and information quality are highly significant for the BWE reduction. Cho and Lee (2012) develop the BWE measure and expression for the two-echelon model with a seasonable demand. They show that the replenishment lead-time must be less than the seasonal cycle to reduce BWE. Wright and Yuan (2008) demonstrate that the double exponential smoothing forecasting methods such as Holt’s and Brown’s reduce BWE more significantly than the simple exponential smoothing method, particularly when they are used with an appropriate ordering policy.

Hussain et al. (2012) and Hussain and Saber (2012) evaluate the impact of the production time delay, time to average sales, time to adjust inventory, time to adjust WIP, and the concept of information enrichment percentage at each echelon (for information sharing level). Through simulation study with the Automatic Pipeline Feedback Order-Based Production Control System, they demonstrate that the production time delay, time to adjust inventory and the information sharing level are sensitive to BWE in the same order of the magnitude. Costantino et al. (2014) analyze BWE and inventory stability in a multi-echelon supply chain through simulation. They identify that the lack of the information sharing is the most significant root cause of the BWE on top of a poor forecasting and a high safety stock, and show that it has a high interaction with inventory control parameters. Cannella and Ciancimino (2010) evaluate three different four-echelon supply chain configurations with the SRO policy, each of which has a different scope of the information sharing (i.e., traditional configuration without any information sharing; information exchange configuration with the demand forecast shared; synchronized configuration with the echelon inventory information shared in addition to all information shared in the information exchange configuration). Their results show that the synchronized configuration has the highest fill rate, the smallest system-wide zero replenishment, and the smallest system-wide average inventory as well as the lowest level of BWE among three configurations.

Rong et al. (2008) use a four-echelon serial model with the base order function from Sterman (1989), which is fundamentally equivalent to the SRO policy in Dejonckheere et al. (2004) and Cannella and Ciancimino (2010). They study the impact of the two smoothing parameters-one for the inventory level error and the other for WIP error-on the BWE. They define RBWE as the phenomenon where an order variance at any upstream echelon is smaller than that at downstream echelons. Further, they identify two ways to generate RBWE: (1) overweighting the smoothing parameter for the WIP error, the difference between the target WIP level and the actual WIP level; and (2) overreactions to upstream capacity shock.

Some coordination-based BWE mitigation strategies have also been proposed. Disney and Towill (2003b) suggest a vendor-managed inventory system as a tool to reduce BWE. In their system, a vendor is responsible for managing its customer’s inventory through the relevant customer’s inventory and demand information. They demonstrate through a simulation study that the vender-managed inventory system can reduce 50% of the BWE compared to the traditional supply chain configuration. Cannella et al. (2015) show that a coordinated, decentralized linear supply chain, where all echelons’ inventory, demand, and order information are available to their upstream members, can significantly avoid BWE by reducing information distortion. Costantino et al. (2014) are one of the very few studies that deal with the role of limited collaboration using CDF information. They consider only two information sharing modes-no sharing and full sharing. Using the two modes, they investigate six different combinations of collaboration. Eventually, they demonstrate that more benefits-reduction of BWE-are generated when the information sharing starts from downstream echelons rather than from upstream echelons.

While most of the studies mentioned above implicitly assume only two levels of ISR at an echelon-no sharing (ISR = 0.00%) or full sharing (ISR = 100%), Hussain et al. (2012) and Hussain and Saber (2012) consider the partial sharing, (ISR = 50%), too. Their studies further assume that all echelons should have the same ISR. Because of this further assumption, they cannot evaluate the detailed impact of ISR’s and their relationship with the position of echelons on BWE. We release the assumption in this study.

Supply chain simulation modeling

The present study uses a system dynamics simulation approach to accomplish the objectives previously presented. A traditional four-echelon supply chain consisting of a retailer, a wholesaler, a distributor, and a producer is used (see Fig. 1). At each period t, each echelon, i\((i = 1, {\ldots }, 4)\), receives an order (a dotted line arrow) from its immediate downstream echelon, \(i-1\). Note that a customer is represented as \(i = 0\). Each echelon also attempts to satisfy an incoming order as soon as possible using its own available on-hand inventory (a solid line arrow), and then issues a replenishment order (a dotted line arrow) to its immediate upstream echelon, \(i+1\). If an echelon does not have enough inventory, a partial fulfillment of the order is allowed, and the remaining portion of the order is backlogged without any loss.

We use ‘iThink’ modeling software with the following assumptions:

-

The stocking capacity at any echelon is unlimited.

-

The transportation capacity between adjacent echelons is unlimited.

-

The uppermost echelon (a producer) places an order to an unlimited source (supplier), so there is no backlogging in the uppermost echelon.

-

Each echelon works independently and estimates its demand by forecasting with the replenishment orders from its immediate downstream echelon and/or by sharing the retailer’s CDF. Note that the retailer directly forecasts its demand using actual customer demand information.

-

There is no time delay between any order receipt and the order shipment if inventory is available.

The following notations are defined for echelon i at time t:

- \(LI_i \left( t \right) \) :

-

local inventory or on-hand inventory

- \(W_i \left( t \right) \) :

-

work-in-progress (WIP) or inventory in transit

- \(A_i \left( t \right) \) :

-

actual quantity of shipment delivered from an upstream echelon to ith echelon

- \(S_i \left( t \right) \) :

-

actual quantity of shipment delivered to a downstream echelon from ith echelon

- \(B_i \left( t \right) \) :

-

backlog of orders

- \(I_i \left( t \right) \) :

-

net inventory or inventory level with consideration of backlogs

- \(D_i \left( t \right) \) :

-

actual demand

- \(\widehat{D} _i \left( t \right) \) :

-

demand forecasted based on the simple exponential smoothing method

- \(\hat{d} _i \left( t \right) \) :

-

demand estimate from \(\widehat{D} _i \left( t \right) \) with consideration of ISR

- \(O_i \left( t \right) \) :

-

replenishment orders to be placed to an upstream echelon

- \(TW_i \left( t \right) \) :

-

target WIP level

- \(TI_i \left( t \right) \) :

-

target inventory level

- \(Tp_i \) :

-

physical production/distribution lead-time between immediate echelons

- \(Tc_i \) :

-

cover time for inventory control to control the safety stock level

- \(Tw_i \) :

-

smoothing WIP parameter

- \(Ty_i \) :

-

smoothing inventory parameter

- \(\alpha \) :

-

smoothing constant in a simple exponential smoothing forecasting

- \(ISR_i \) :

-

information sharing rate

The important elements of the model are described as follows:

-

Demand the customer demand at each period t, \(D_0 \left( t \right) \), has 4 units per time for \(t < 140\), and surges to 8 units per time after that using the shock lens perspective. Note that the same step function is used in Sterman (1989).

-

Forecasting each echelon uses a simple exponential smoothing method when it forecasts its demand, \(\widehat{D} _i \left( t \right) \), at each period, t.

-

Time delay an echelon has production or distribution lead-time from its upstream echelon when the inventory is delivered. A simple built-in DELAY function in ‘iThink’ is used.

-

Order policy an echelon has a SRO policy, which is an extension of the inventory and order based production control system model by Towill (1982) and Automatic Pipeline, Inventory and Order Based Production Control System by Simon et al. (1994). The SRO policy is a general case of the linear production rule, and it has been shown to be robust and stable compared to other order-up-to policies. It has three components: forecast on the order from the downstream echelon, the smoothed WIP error, and the smoothed inventory level error.

The Eqs. (1)–(15), define the different states at each echelon i in each period t.

For simplicity and consistency, our simulation time is modeled as discrete time (DT), set to one. Thus, all states are updated at every DT = 1.00.

At each period t, the local inventory (on-hand inventory) at echelon i, \(LI_i \left( t \right) \), is determined by the arrival quantity of shipment from its upstream echelon, \(A_i \left( t \right) \), and the shipment quantity of goods to a downstream echelon, \(S_i \left( t \right) \) (Eq. 1). In-transit inventory, \(IT_i \left( t \right) \), represents the inventory-in-transportation from an upstream echelon, \(S_{i+1} \left( t \right) -A_i \left( t \right) \) (Eq. 2). The WIP, \(W_i \left( t \right) \), includes the inventory-in-transportation and the backlogged quantity, items ordered but not processed yet, at an upstream echelon (Eq. 3). If there is any inventory available, orders are shipped immediately to a downstream echelon whenever requested. Actual delivery quantity is constrained by the inventory availability, \(LI_i \left( t \right) \), and shipment requirement, \(D_i \left( t \right) +B_i \left( t \right) \) (Eq. 4). Any unfulfilled portion of an order, \(D_i \left( t \right) -S_i \left( t \right) \), is added to the backlogged orders (Eq. 5). Equation (6) defines the net inventory or inventory level. Equation (7) shows the simple exponential smoothing forecast for the demand based on replenishment orders from a downstream echelon.

Equation (8) indicates that each echelon’s demand estimate is affected by sharing the percentage between retailer’s CDF, \(\widehat{D} _1 \left( t \right) \), and its own forecast, \(\widehat{D} _i \left( t \right) \). For example, if retailer’s CDF is shared 100% with a current echelon (i.e., \(ISR_i = 1.00\)), the final demand estimate at the echelon becomes \(\widehat{D} _1 \left( t \right) \). However, when none of the CDF information is shared, the echelon should conduct its own forecasting using the simple exponential smoothing method, \(\widehat{D} _i \left( t \right) \).

Since the retailer forecasts its demand from the actual customer demand information, there is no difference between the demand forecast \(,D_i \left( t \right) \), and the demand estimate, \(\hat{d} _i \left( t \right) \) (Eq. 9). Equation (10) represents that the replenishment order from a downstream echelon, \(O_{i-1} \left( t \right) \), becomes the demand, \(D_i \left( t \right) \), at a current echelon. Equations (11) and (12) define the target WIP and target inventory level, respectively. Since the target WIP, \(TW_i \left( t \right) \), and the target inventory, \(TI_i \left( t \right) \), use the demand estimate, \(\hat{d} _i \left( t \right) \), they are also affected by ISR at each echelon. Note that the information sharing policy used in WIP and the inventory level in this study makes more sense than what the previous studies have used in their SRO policies. For example, Dejonckheere et al. (2004) and Cannella and Ciancimino (2010) use the same policy but their target WIP, \(TW_i \left( t \right) \), and the target inventory level, \(TI_i \left( t \right) \), are updated using the forecast information at each echelon without using the CDF information. Our rationale is that if CDF information is available, it is reasonable to apply it to the target values, developing more accurate replenishment order policy. Equation (13) is the order quantity decided by the SRO policy. As described before, it consists of the final demand estimate, the smoothed WIP error, and the smoothed inventory level error. All target values are determined in Eqs. (11) and (12). All order quantity should be non-negative (Eq. 14). Equation (15) describes the unlimited raw material supply condition at the producer since any quantity of the order required by the producer,\(O_4 \left( t \right) \), will be supplied from the supplier.

Design of experiments

We design a full factorial set of experiments to analyze and quantify the impact of the ISR on the BWE at each echelon. We consider four levels of \(ISR_i \)-0.00, 0.33, 0.67, 1.00-for each echelon (i = 2, 3, 4), indicating the information sharing level with the retailer. Note that \(ISR_i\) will be used in Eq. (8). Consequently, the target WIP, the target inventory, and the quantity of the orders, given in Eqs. (11)–(13), respectively, are also updated. Total 64 (\(4\times 4\times 4\)) cases (or information sharing modes) are generated from the full factorial design. The first four columns in Table 1 display all of those six-four cases.

The following operational parameters are used for the simulation:

-

simulation duration, \(T= 257\) time units; warmup duration = 50 time units. Thus, the effective simulation duration during which the statistical information is collected is 208 time units; after the warmup period, demand is 4 units for \(t < 90\) (note that it was 140 before the warmup) and surges to 8 units after that. During the warmup period, the impact of the initial state variables is eliminated.

-

values of the production/distribution lead-time, cover time for inventory control, and smoothing constant in the simple exponential smoothing forecasting are \([Tp_i, Tc_i, \alpha ] = [2, 3, 1/3]\) for all i.

-

values of smoothing WIP parameter, \(Tw_i \), and smoothing inventory parameter, \(Ty_i \), are \([Tw_i, Ty_i] = [2Tp_i , 2Tp_i ] = [4, 4]\) for all i.

-

values of initial state variables are \([W_i \left( 0 \right) \), \(LI_i \left( 0 \right) \), \(B_i \left( 0 \right) \)] = [\(Tp_i \hat{d} _1 \left( 0 \right) \), \(Tc_i \hat{d} _1 \left( 0 \right) \), 0] = [8, 12, 0] for all i.

Note that since the impact of \(Tp_i \), \(Tc_i \), \(\alpha \), \(Tw_i \), and \(Ty_i \) has been discussed in many previous studies, these values are fixed. The selection of the parameter values has been done according to Cannella and Ciancimino (2010) since they demonstrate that these settings are one of the best combinations in the SRO policy.

To measure BWE, many studies use the order rate variance ratio, proposed by Chen et al. (2000b), which is appropriate in a situation where the customer demand is stochastic and stationary, and the long-term performance of the system is used, referred to as the ‘variance lens’. Since we adopt the ‘shock lens’ perspective, a peak of the order rate is chosen to measure an extreme behavior in the order pattern as described in Towill et al. (2007). Dominguez et al. (2015) define a peak of orders at each echelon-they define BWE as the range of order changes at each echelon-to measure BWE and identify the impact of the network structure on BWE using the ‘shock lens.’ We adopt the similar approach. Thus, for the range information, we need to observe the maximum and minimum values of all orders at each echelon. The peak of orders at echelon i is defined in Eq. (16) as:

Results and analysis

Table 1 lists the results from the experiments. It shows ISR for each echelon from wholesaler to producer. For example, the first case, (1.00, 0.67, 0.33), indicates that the wholesaler, the distributor, and the producer share the retailer’s CDF 100, 67, and 33%, respectively, for their own demand estimate, according to Eq. (8). It also displays the range of the order rates for each echelon (from \(\mathrm{O}_{1}\)RN for the retailer to \(\mathrm{O}_{4}\)RN for the producer where RN stands for the ‘range’) and their average (avg RN).

Before starting any statistical analysis, we first consider four information-sharing modes with their corresponding ISR at an echelon in the order of \((ISR_{2}, ISR_{3}, ISR_{4})\). Case 62, (0.00, 0.00, 0.00), represents that none of the three echelons shares the CDF with the retailer while Case 17, (1.00, 1.00, 1.00), fully shares it. Cases 18, (0.33, 0.67, 1.00), and 20, (0.67, 0.67, 0.67), are examples of the partial sharing. Case 18 has a high variation in its ISR’s distribution-ISR is highly unbalanced with high ISR levels at upstream echelons-while in Case 20, all echelons share the same level of the partial information. Note that the average ISR per echelon in the two cases is identical in the value of 0.67. The order rates at the producer are displayed over time (x-axis) in Fig. 2, and the value of maximum orders at each echelon is displayed in Fig. 3. From Fig. 2, we observe that the order rates at all echelons oscillate around at \(t = 90\) when the demand shock occurs. In addition, the magnitudes of the oscillation are different in all cases. The wavelength of the peak is the smallest with the full information sharing (Case 17) and the largest with no information sharing (Case 62)-the peak in Case 62 is 2.9 times higher than that in Case 17. Note that Case 18 shows a more balanced and smaller oscillation than Case 20 notwithstanding that Cases 18 and 20 have the same ISR average.

Figure 3 displays the maximum order rate at each echelon for the same four information-sharing modes where x-axis represents an echelon from downstream to upstream. We see that the maximum order rate increases very slowly in case of the full information sharing (Case 17), whereas the slope of the line sharply increases when the information is not shared (Case 62). It is interesting to compare the trends between cases 18 and 20. We observe that the maximum order rate in Case 20 is less than that in Case 18 from the retailer to the distributor, but at the producer, the trend is reversed. Rong et al. (2008) discuss two different types of the RBWE: pure RBWE (the order variability at downstream echelons consistently is larger than that at upstream echelons) and non-pure RBWE where a downstream echelon has higher BWE than any of its upstream echelons. In the latter, the shape of the order pattern resembles an umbrella. We observe it in Case 20. We also recognize that a similar RBWE has been observed in some previous studies but not investigated (Cannella et al. 2015; Cannella and Ciancimino 2010; Mushara and Chan 2012).

Impact of ISR on BWE

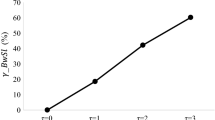

We first investigate the overall impact of ISR on BWE at each echelon using the data in Table 1. Figure 4 displays the main effect, the average BWE at each echelon, against ISR. It is apparent that the average BWE decreases as ISR increases at all echelons, confirming what Hussain et al. (2012) demonstrate. Further, it also shows that the upstream echelons have more benefit from the higher levels of ISR because BWE at higher echelons decreases faster at higher ISR levels. This observation indicates that sharing more CDF reduces BWE for all echelons, and the benefit increases at upstream echelons where higher BWE is observed.

ISR’s at downstream echelons also affect BWE at upstream echelons because BWE propagates from downstream to upstream through the order quantity at each echelon. Thus, if we quantify the impact of ISR’s at downstream echelons on the upstream BWE, it can provide more insights on SCC. We use the regression and ANOVA approaches. Table 2 summarizes the result for the BWE at the echelon of wholesaler using the data in Table 1. The BWE observed at the wholesaler is propagated from the retailer. It is directly affected by its own ISR and may be indirectly affected by ISR’s at its upstream echelons through the shipment from upstream echelons. Thus, we include all of the ISR’s from three echelons as explanatory variables for the BWE at the wholesaler. In Table 2, the ‘variance inflation factor’ (VIF) is closer to 1.00, indicating the explanatory variables are not correlated with each other. Note that ISR at the wholesaler, \(x_{2j} \), is the only significant factor (p-value\(< 0.000\)) among ISR’s from all echelons. The negative coefficient of, \(x_{2j}\), supports our observation in Fig. 4 with the coefficient of determination, \(R^{2}= 0.999\). The ANOVA shows that almost all variation in the BWE (99.995%) is explained by \(x_{2j}\).

The same analysis is applied to the BWE observed at the distributor, and its result is summarized in Table 3. The ISR’s at wholesaler, \(x_{2j}\), and distributor, \(x_{3j} \), are the two significant factors (p-value\(< 0.000\)) with \(R^{2}= 0.9652\). Note that ISR at the distributor has a higher impact on the BWE reduction (coefficient: \({-}\)7.203) than the ISR at the wholesaler (coefficient: \({-}\)4.303). ANOVA shows that the majority of the BWE variation is explained by the ISR at the distributor and the ISR at the wholesaler (25.38%)

Table 4 summarizes the result for the BWE at the producer. The regression analysis still has a high value of \(R^{2}= 0.8907\), and all ISR’s, \(x_{2j} \), \(x_{3j} \), \(x_{4j} \), from all echelons are strongly significant (p-value\(<0.000\)). The ISR’s at upstream echelons have a higher impact on the BWE and more significantly contribute to the variation reduction as seen in the Sum of Squares (SS) column.

The results from the three statistical analysis demonstrate that BWE observed at an echelon is affected by ISR’s at the current and its downstream echelons, and ISR at the current echelon has the highest impact. However, we have not observed any statistical evidence that the BWE is affected by ISR’s at its upstream echelons. Further, the impact diminishes as it goes downstream. Thus, to reduce the BWE at a specific echelon, we first need to increase the ISR at that echelon, and then share information with an immediate downstream echelon. The coordination priority decreases as we move downstream.

Magnitude and balance of information sharing

It is often useful to understand the priority between the magnitude and the level of the balance of ISR’s across echelons. Particularly, when financial or non-financial issues exist, a decision-maker often needs to choose one over the other. Among 64 cases in Table 1, some cases have a high variation between echelons (highly unbalanced) while others are well balanced. For example, cases (1.00, 1.00, 1.00) and (0.67, 0.67, 0.67) are perfectly balanced without any variation since all ISR levels are identical while cases (1.00, 0.00, 0.00) and (1.00, 1.00, 0.00) are highly unbalanced.

We use the BWE observed at the producer as a response variable with the arithmetic average and the standard deviation of the ISR’s across echelons as two explanatory variables. The average and the standard deviation measure the magnitude and the level of balance (variation) of ISR’s across the echelons, respectively. A higher average value represents higher magnitude whereas a lower standard deviation value implies higher ISR balance (lower variation) among the echelons.

Table 5 displays the result of ANOVA and regression analysis. The regression equation explains 88.25% of the total variation in the BWE \((R^{2}=0.8825)\). The two explanatory factors are strongly significant (p-value\(<0.000\)) in reducing the BWE. Specifically, the impact of the magnitude of the ISR (coefficient: \({-}\)25.99) is around three times higher than that of the balance level of the ISR (coefficient: \({-}\)8.74). Further, the majority (83.30%) of the BWE variation is explained by the magnitude of ISR. Thus, improving the overall magnitude of ISR is more effective than improving the balance of ISR in terms of the BWE reduction.

ISR and reverse BWE

According to Table 1, the maximum peak of the orders occurs either at the distributor (15 cases) or at the producer (49 cases). That is, those 15 cases represent the presence of RBWE. The RBWE is known to arise mainly due to disruption on the supply side (Özelkan and Çakanyıldırım 2009; Rong et al. 2008) and overweight of the parameter for the WIP error in the SRO policy (Rong et al. 2008). Overweighting the parameter for the WIP error means that \(1/Tw_i \) is very large compared to \(1/Ty_i \) in the SRO policy. In our study, the two parameter values are set to be equal (i.e., \(Tw_i =Ty_i = 2Tp_i\)). Since no finite capacity is considered in the model, there is no disruption on the supply side. However, we can still observe the RBWE. Thus, it indicates that there is another RBWE causing factor.

In Table 1, each value of the ISR is used 16 times at each echelon. Thus, we can observe 16 cases with the ISR value at the producer being 1.00 (i.e., \({ ISR}_{4} = 1.00\)). Note that RBWE occurs in 15 cases out of the 16 cases (‘a’ mark is used in Table 1 for RBWE). That is, the setting of \({ ISR}_{4}= 1.00\) works as a necessary condition for the RBWE. Case 18 in Fig. 3 is one of those 15 RBWE cases. Case 17, (1.00, 1.00, 1.00), is an exception even with \( ISR_{4}= 1.00\) due to the perfect information sharing and balance. Thus, very little BWE arises in the entire supply chain. The observation of the 15 cases suggests that the RBWE occur when severe information unbalance among downstream echelons and a very high ISR at the upstream echelon exist. The unbalanced information at downstream echelons triggers BWE and the BWE propagates to upstream echelons. During the propagation, the BWE significantly decreases at the uppermost echelon where the highest level of ISR is defined, generating the RBWE phenomenon.

To investigate the functional relationship between ISR’s at different echelons and the RBWE, we apply the multiple linear regression equations. Let \(\hat{y}_{3j} \) and \(\hat{y}_{4j}\) be the BWE estimate at the distributor and the producer, respectively. Then, Eqs. (17) and (18) represent the regression equation for BWE at the distributor (Table 3) and the producer (Table 4) with ISR at each echelon, \(x_{ij}\), as an explanatory variable, respectively.

Since the coefficients of determination in both equations are high enough, we claim that the difference \(\hat{y} _{3j} -\hat{y} _{4j} \) can approximately represent the actual difference of the BWE in our study. If the difference is non-negative, the RBWE arises. The condition, \(\hat{y} _{3j} -\hat{y} _{4j} \ge 0\), generates the following Eq. (19):

The equation suggests that for the occurrence of the RBWE, ISR’s should be unbalanced with ISR’s at upstream echelons being more weighted than ISR’s at downstream echelons. Further, the overall functional value should be larger than the threshold value, 11.082. In fact, among all 15 cases of the RBWE in Table 1, 14 cases satisfy Eq. (19). The only exception is Case 29, (0.00, 0.00, 1.00), which generates 10.985, less than 11.082. In addition, note that the 49 regular BWE cases (64 total cases less 15 RBWE cases) should not satisfy Eq. (19). In fact, all of those except Case 17, (1.00, 1.00, 1.00), do not satisfy it. Except for these two cases, Eq. (19) fairly well represents the functional relationship for the occurrence of RBWE.

Implications and discussion

This study provides several meaningful implications in terms of the SCC and collaboration.

Firstly, overall, higher ISR per echelon reduces more BWE, aligned with the results in Hussain et al. (2012) and Hussain and Saber (2012).

Secondly, in addition to ISR level, the regression studies show that an echelon’s position also affects BWE. When BWE arises at an echelon, ISR at the echelon has the highest impact on the BWE, and its impact reduces at downstream echelons. Our study shows that unequal ISR’s weights among echelons may introduce RBWE when a certain condition or relationship is met. That is, an unbalanced ISR may cause RBWE, and by recognizing this relationship, decision-makers may more effectively control and manage the SCC with information sharing. For example, when RBWE occurs, the echelon with the highest BWE should be provided with the highest level of information sharing with the retailer.

Thirdly, the study confirms that both higher magnitude and higher balance of the ISR across echelons contribute to the reduction of BWE. The regression analysis shows that the former is three times more effective than the latter in terms of the BWE reduction. Decision-makers should be aware of this priority.

Lastly, our study shows that although ISR at each echelon is a good indicator to predict and estimate the BWE/RBWE, its capability to explain BWE reduces as the number of echelons increases. For example, the coefficient of determination of the regression analysis \((R^{2})\) reduces from 99 to 89.07% through 96.52% as the number of echelons increases from two to four through three, respectively, indicating other factors may also affect BWE as the complexity of the supply chain increases.

Conclusions

In our study, the effect of sharing the customer demand forecast (CDF) information on the bullwhip effect (BWE) is investigated using the multi-layered supply chain simulation model. The four-echelon supply chain model consisting of a retailer, a wholesaler, a distributor, and a producer is developed with the smoothing replacement order (SRO) policy at each echelon. The retailer forecasts its demand with the actual customer demand while the other echelons estimate their demand with their own simple exponential smoothing forecasting method and/or the CDF information from the retailer. The information-sharing rate (ISR) at each echelon represents the degree of the CDF information shared with the retailer. We evaluate four levels of ISR at each echelon and measure BWE using ‘shock lens’ perspective. After the full factorial design and the corresponding experiments, the regression and analysis of variance (ANOVA) approaches are applied.

The linear regression analysis shows that improving overall ISR reduces BWE. In addition, the impact of BWE is different from echelon to echelon. When BWE is observed, ISR at an echelon where BWE is measured has the highest impact and the impact of the ISR decreases as it goes downstream. Both the magnitude and balance of ISR among echelons affect BWE reduction, and the magnitude has a greater impact than the balance. We further show that highly unbalanced ISR’s across echelons where the highest level of ISR is observed at the uppermost echelon cause the reverse bullwhip effect (RBWE) when a certain functional relationship is met. Lastly, we demonstrate the functional relationship between RBWE and ISR’s using the regression analysis. We claim that the results from the study provide useful implications and insights for better coordination and collaboration in the supply chain.

The current study presents a good opportunity for future research. Current study focuses on the linear structure of the supply chain where one member of each echelon works independently and the information flow is one-directional. Thus, a very interesting research opportunity arises from the extension of our work to a more complex network including a convergent and assembly structure.

References

Almeida, M., Marins, F., Salgado, A., Santos, F., & Silva, S. (2015). Mitigation of the bullwhip effect considering trust and collaboration in supply chain management: a literature review. The International Journal of Advanced Manufacturing Technology, 77(1), 495–513.

Arshinder, K., Kanda, A., & Deshmukh, S. (2008). Supply chain coordination: perspectives, empirical studies and research directions. International Journal of Production Economy, 115(2), 316–335.

Barlas, Y., & Gunduz, B. (2011). Demand forecasting and sharing strategies to reduce fluctuations and the bullwhip effect in supply chains. Journal of the Operational Research Society, 62, 458–473.

Cannella, S., & Ciancimino, E. (2010). On the bullwhip avoidance phase: supply chain collaboration and order soothing. International Journal of Production Research, 22(15), 6739–6776.

Cannella, S., López-Campos, M., Dominguez, R., Ashayeri, J., & Miranda, P. (2015). A simulation model of a coordinated decentralized supply chain. International Transactions Informational Research, 22(4), 735–756.

Chatfield, D., Kim, J., Harrison, T., & Hayya, J. (2004). The bullwhip effect-Impact of stochastic lead time, information quality, and information sharing: A simulation study. Production and Operations Management, 13(4), 340–353.

Chen, F., Drezner, Z., Ryan, J. K., & Simchi-Levi, D. (2000a). Quantifying the bullwhip effect in a simple supply chain: The impact of forecasting, lead times and information. Management Science, 46, 436–444.

Chen, F., Ryan, J. K., & Simchi-Levi, D. (2000b). The Impact of exponential smoothing forecasts on the bullwhip effect. Naval Research Logistics, 47, 269–286.

Cho, D. W., & Lee, Y. H. (2012). Bullwhip effect measure in a seasonal supply chain. Journal of Intelligent Manufacturing, 23, 2295–2305.

Costantino, F., Gravio, G., Shaban, A., & Tronci, M. (2014). The impact of information sharing and inventory control coordination on supply chain performances. Computers & Industrial Engineering, 76, 292–306.

Dejonckheere, J., Disney, S., Lambrecht, M., & Towill, D. (2004). The Impact of information enrichment on the bullwhip effect in supply chains: A control engineering perspective. European Journal of Operational Research, 153(3), 727–750.

Devika, K., Jafarian, A., Hassanzadeh, A., & Khodaverdi, R. (2016). Optimizing of bullwhip effect and net stock amplification in three-echelon supply chains using evolutionary multi-objective metaheuristics. Annals of Operations Research, 242(2), 457–487.

Disney, S., & Towill, D. (2003a). On the bullwhip and inventory variance produced by an ordering policy. Omega, the International Journal of Management Science, 31(3), 157–167.

Disney, S., & Towill, D. (2003b). Vendor-managed inventory and bullwhip effect reduction in a two-level supply chain. International Journal of Operations & Production Management, 23(6), 625–651.

Disney, S., & Lambrecht, M. (2008). On replenishment rules, forecasting, and the bullwhip effect in supply chains. Foundations and Trends in Technology, Information and Operations Management, 2(1), 1–80.

Dominguez, R., Cannella, S., & Framinan, J. (2015). The impact of the supply chain structure on bullwhip effect. Applied Mathematical Modelling, 39(23–24), 7309–7325.

Hall, D., & Saygin, C. (2012). Impact of information sharing on supply chain performance. International Journal of Advanced Manufacturing Technology, 58(1), 397–409.

Hussain, M., Drake, P., & Lee, D. M. (2012). Quantifying the impact of a supply chain’s design parameters on the bullwhip effect using simulation and Taguchi design of experiments. International Journal of Physical Distribution & Logistics Management, 42(10), 947–968.

Hussain, M., & Saber, H. (2012). Exploring the bullwhip effect using simulation and Taguchi experimental design. International Journal of Logistics: Research and Applications, 15(4), 234–249.

Lee, H. L., Padmanabhan, V., & Whang, S. (1997). Information distortion in a supply chain: The bullwhip effect. Management Science, 43(4), 546–558.

Mushara, M., & Chan, F. (2012). Impact evaluation of supply chain initiatives: a system simulation methodology. International Journal of Production Research, 50(6), 1554–1567.

Özelkan, E., & Çakanyıldırım, M. (2009). Reverse bullwhip effect in pricing. European Journal of Operational Research, 192(1), 302–312.

Paik, S.-K., & Bagchi, P. K. (2007). Understanding the causes of the bullwhip effect in a supply chain. International Journal of Retail & Distribution Management, 35(4), 308–324.

Quyang, Y. (2007). The effect of information sharing on supply chain stability and the bullwhip effect. European Journal of Operational Research, 182(3), 1107–1121.

Rong, Y., Max Shen, Z., & Snyder, L. (2008). The impact of ordering behavior on order-quantity variability: a study of forward and reverse bullwhip effects. Flexible Services and Manufacturing Journal, 20, 95–124.

Simon, J., Naim, M., & Towill, D. (1994). Dynamic analysis of a WIP compensated decision support system. International Journal of Manufacturing System Design, 1(4), 283–297.

Sterman, J. (1989). Modeling managerial behavior: misperceptions of feedback in a dynamic decision making experiment. Management Science, 35(3), 321–339.

Towill, D. (1982). Dynamic analysis of an inventory and order based production control system. International Journal of Production Research, 20, 369–383.

Towill, D., Zhou, L., & Disney, S. (2007). Reducing the bullwhip effect: Looking through the appropriate lens. International Journal of Production Economics, 108(1–2), 444–453.

Wright, D., & Yuan, C. (2008). Mitigating the bullwhip effect by ordering policies and forecasting methods. International Journal of Production Economics, 113(2), 587–597.

Yao, Y., & Zhu, K. (2012). Do electronic linkages reduce the bullwhip effect? An empirical analysis of the U.S. manufacturing supply chains. Information Systems Research, 23(3), 1042–1055.

Youn, S., Hwang, W., & Yang, M. (2012). The role of mutual trust in supply chain management: deriving from attribution theory and transaction cost theory. International Journal of Business Excellence, 5(5), 575–597.

Acknowledgements

This material is based upon work that is supported by the National Institute of Food and Agriculture, U.S. Department of Agriculture, under Project Number SCX 3130315.

Author information

Authors and Affiliations

Corresponding author

Appendix A

Appendix A

- BWE:

-

Bullwhip effect

- CDF:

-

Customer demand forecast

- ISR:

-

Information sharing rate

- RBWE:

-

Reverse bullwhip effect

- SCC:

-

Supply chain coordination

- SRO:

-

Smoothing replenishment order

- WIP:

-

Work-in-progress

- ANOVA:

-

Analysis of variance

- VIF:

-

Variance inflation factor

Rights and permissions

About this article

Cite this article

Jeong, K., Hong, JD. The impact of information sharing on bullwhip effect reduction in a supply chain. J Intell Manuf 30, 1739–1751 (2019). https://doi.org/10.1007/s10845-017-1354-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10845-017-1354-y