Abstract

We propose that the concept of complementarity can take two distinct meanings in evolutionary economics: one referring to Adam Smith’s notion of increasing specialization and the division of labour, which we denote ‘downward complementarity’ (wholes into new parts); and a second type that refers to the discovery of emergent complementarity between extant or new components and products, which we call ‘upward complementarity’ (parts into new wholes). We outline this new conception and explore some of its analytic and theoretic implications.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

1 Complementarity in Generic and Operant Analysis

Progress in science often takes the form of either: (a) realizing that things thought to be different are actually similar; or (b) realizing that things thought to be similar are actually different. Neoclassical economics is often at its best in the first mode seeking topological equivalence of the structure of different decision problems: for example when Theodore Schultz and Gary Becker showed that what appeared to be qualitatively different phenomena—investment in plant and factories and educating children—could both be studied as investment in capital. But evolutionary economists have long been at their best when operating in the second mode of elaborating differences. The basic Schumpeterian approach to economic dynamics distinguishes between growth that comes from without—or exogenous growth, as accumulated factors of production or new technologies—and growth that comes from within the economic system—endogenous growth through entrepreneurship and innovation. In evolutionary economics structure matters because there is no representative actor. Neoclassical economics, in the work of Robert Lucas and Paul Romer in the late 1980s, took this distinction and (reverting to the first mode) sought to make it conceptually similar again in their capital investment theory of technological change in so-called endogenous growth theory which portrays economic growth without development because of freeze-framed structures. But along the Schumpeterian line of advance, the purpose of the new distinction between things once thought similar was to elaborate new mechanisms and processes—such as the role of the entrepreneur, or the process of creative destruction, or the changing composition of the industrial setting of an economy, or long-term technological waves (Nelson 2005; Foster et al. 2006; Perez 2009; Saviotti and Pyka 2013; Aghion et al. 2013).

It is instructive to consider why complementarity plays a special role in evolutionary economics. Whereas neoclassical economics can be said, to a first approximation at least, to be a general theory of substitution (all goods are substitutes), evolutionary economics is to a first approximation a general theory of complementarity (economic evolution is a process of generic change in economic connections). Potts (2000) explained how neoclassical economics is built on field-theoretic foundations in which ‘everything is connected to everything else’ and therefore the only way that dynamics can be expressed is through re-allocation on the basis of known knowledge. The reason that neoclassical economics is built around a generalized analysis of price coordination in markets is that this approach best expresses a framework of generalized substitution at the level of ongoing market operations. But this does not describe economic evolution, which Potts (2000) defines over a ‘non-integral space’ in which the elementary dynamic is change in the knowledge connections within the system. Economic evolution is thus not a general theory of substitution—i.e., a reorganization of who has what—but a general theory of complementarity—a reconfiguration of what is connected to what. This is the sense in which evolutionary economics is at base a theory of entrepreneurs and firms, which are the agents of such change (Nelson and Winter 1982; Nelson and Dosi 1994; Hanusch and Pyka 2007), or of knowledge as generic rules, which are the objects of such change (Dopfer and Potts 2008; Dias et al. 2014). Thus where neoclassical economics generalizes the notion that agents make substitutions in markets, evolutionary economics generalizes the notion that entrepreneurs create complementarity in firms (micro), sectors (meso) and the economy as a whole (macro). Obviously there are agents, firms and markets in both neoclassical and evolutionary economics, but in the same way that sub-stitution (at the margin) is fundamental analytic focus in neoclassical economics, the dynamics of complementarity are the fundamental focus in evolutionary economics. It follows that any basic classification of types of complementarity will ramify through evolutionary economics, yet may be rather incidental to neoclassical economics.

The purpose of this paper is to elaborate the core of a theory of long run economic growth by noting that the often singular conception of complementarity—which is used in supply-side analysisFootnote 1 as a way to recursively construct the division of labour and technology: the division of labour is a modular decomposition of a technology in an organization; a technology is an organization of complementary inputs—can actually be separated into two distinct meanings. We will call them ‘downward complementarity’ and ‘upward complementarity’ (Dopfer 2015). Downward complementarity is essentially Smithian and Marshallian—proceeding by division, differentiation and reorganization; but upward complementarity is essentially Schumpeterian, and can also be read in the work of Herbert Simon (1985)—proceeding by new combination or cross-fertilization among seemingly different inputs.

These two types of complementarity follow from a clear distinction between generic and operant levels of economic analysis (Dopfer et al. 2004; Dopfer 2005; Dopfer and Potts 2008)—between knowledge (the generic level of analysis, over knowledge space) and the operations that knowledge enables (the operant level of analysis, over operant space)—which is to say between economic operations on the one hand, such as production and consumption, and the knowledge upon which economic operations are performed. This distinction matters for evolutionary economic analysis because it is the generic knowledge level that evolves, and which, as we point out here, expresses two different meanings of complementarity. The generic knowledge space is the locus of evolution as continual change of structure of complementary knowledge. The operant space is the layer of ongoing operations that in the main embrace production, consumption and market transactions. Economic statics and economic dynamics deal with the layer of individual operations posited as a cumulated pay-off matrix and equilibrium in commodity space. Complexity-based evolutionary—i.e., generic—economics deals with the static and dynamic of operations in relation to structure and evolution of knowledge. At the generic layer the field of analysis is not operant but instead generic static and generic dynamic.

2 Meso: The Analytical Unit of Evolutionary Structure and Change

We can now advance two points: first, the phenomenon of complementarity governing economic operations resides in the generic knowledge layer; and, second, that both the static aspects of knowledge structure and the dynamic aspects of knowledge evolution represent major fields of theoretical investigation. The question then is how to define an analytical unit of knowledge that captures both its structure and its evolutionary dynamic as they govern economic operations.

We suggest the concept of meso. The integrated core element is a knowledge ‘bit’—a generic rule (Dopfer et al. 2004; Dopfer 2012; Dopfer and Potts 2008)—that is actualized by a population along a trajectory detailing the generation, adoption and retention of the rule. As a single (generic) rule meso is a structure component, for instance, a particular technology (a structured composite of technical rules) is a component part of a larger technological structure. As a rule trajectory, meso is a process component. The rule originates in a micro unit such as a firm and is adopted by other firms and retained—as a meso rule—for recurrent operations.

Many micro units make up a meso unit—they share a meso rule and are members of a meso population—and the meso unit is a component part of a structure and evolutionary process of macro. Meso is the core element of the resultant micro–meso–macro architecture. Downward and upward complementarity driving economic evolution as a process of continual restructuring of knowledge originates in and develops from meso.

3 Classical Economics Revisited

Adam Smith drew a comprehensive picture of the emerging modern market economy. Though he did not address expressly the distinction between the two kinds of complementarity or employ this exact language he did variously acknowledge the significance of both. Yet his theory of the dynamics of production clearly emphasized ‘downward complementarity’ as epitomized in his famous example of pin factory: the many specialized operations are the downwardly complementary parts, of which further subdivisions may be possible.

Adam Smith’s specialization and the division of labour (as limited by the extent of the market) are the starting point for all exchange-based theories of long-run economic growth (classical, neoclassical and evolutionary alike). Downward complementarity emerges from a process of ongoing modularization that breaks or decomposes an extant whole into parts—which firms, consumers and markets then put back together again. This is a source of economizing gains, due to specialization at the level of the parts, resulting in greater efficiency at the level of the whole. This concept is developed and expressed for instance in Alfred Marshall’s evolutionary conception of the firm (Raffaelli 2003); in Young (1928) conception of ‘increasing returns’; and in Baumol et al. (1988) concept of ‘economies of scope’ when the costs of production of two or more goods produced together by the same firm are lower than the costs of producing them separately by specialized firms. This increasing variety at the modular level also drives increasing economic complexity at the level of substitute inputs and the economic space of adjacent technological possibilities (Hidalgo and Hausmann 2009).

Downward complementarity is an expression of technological organization and operational scale in firms, as coordinated in markets. It is the primary account of the wealth of nations as an economic process that takes place in firms and markets. At the core of this is a particular conception of complementarity in which a whole—say one of Smith’s pins—is seen as a particular suite of complementary parts that can be modularized into an assembly of sub-systems—the drawing of wire, straightening, cutting, making and fixing the head, whitening, and so on, each step of which can be a target of specialization and scale. Smith’s point was that by having different people specialize in these (complementary) stages, or parts, greater productive efficiency was gained in the manufacture of the whole (Leijonhufvud 2007). Ricardo and Marshall noted that this could extend to entire firms or even countries in the parts within a conception of a whole that is then reassembled within a firm, an industry, or by global trade. Downward complementarity, in this example, is a story about pins and the economic efficiency and productivity potential that lies latent in their structure of complementarity—the parts that compose a pin and the limits to which these can be decomposed.

Furthermore, the idea that downward complementarity might be the only sort of complementarity is a hazardous thing to believe. Because if you do, then it is also easy to believe that economic planning might extend to planning economic growth by seeking to rationalize all the economies of specialization, scale and scope that lie latent in the downward complementarities of any particular meso conception of an economy, i.e., within a given set of demanded outputs: this many guns, that much butter, this much wine, that much cloth, and so forth in the optimization of an economy conceived as an assembly line. The problem is that the downward-complementarity view misses half of the evolutionary dynamics of complementarity, and which lies in a completely different direction. From the meso perspective of pin factories, we bring into focus structure looking ‘up’ to see a web of upward complementarity with other meso wholes—perhaps garment makers, iron foundries, transport services, and so on—for which the pin factory meso is a part of a larger (macro) whole. These are both complementarities, but they are very different in their evolutionary expression. Yet both are essential in explaining long-run economic growth and development.

Upward complementarity calls for the task to assemble entities into a whole previously considered to be unrelated. The mode of analysis is mereology: the study of the logic of relationships between entities as parts of a whole (Antonelli 2011; Dopfer 2011; Dias et al. 2014). As an evolutionary process, upward complementarity is the creation of new wholes from extant or new parts, which is in the first instance a creative act of entrepreneurial vision. The idea of a re-combining agent is partly captured in models of recombination that form the conceptual underpinnings of endogenous growth theory (Romer 1990; Weitzman 1998) but these models retain a reductive sense of part and whole, such that recombination is reduced to a mere probability issue as if rules are combined and recombined through some mysterious agency.

4 Unified Evolutionary Growth Theory

Modern growth theory is built on factorial aggregates describing growth as input–output function on the basis of exogenous shocks and simultaneously restored equilibria. It deals with downward complementarity, yet suffers from the inherent methodological difficulty of dealing with non-linearity which complementarity usually implies (Arthur 2014). While the issue of non-linearity may be partly resolved by “linearizing” non-linear functions (Tinbergen 1991), the aggregate view applied in modern growth theory proves essentially inadequate when it comes to dealing with upward complementarity. The process of recombining entities into a new whole is entirely different from that of comparing various degrees of differentiation and specialization of extant knowledge, such as the subsequent downward-scaling of a given technological or institutional rule. Not only are static and dynamic ‘totally different kinds of analysis’, as Schumpeter famously remarked (Schumpeter 1908), but also is the dynamic based on upward and on downward complementarity of an entirely different nature.

A unified evolutionary growth theory must embrace and integrate both dimensions of complementarity if it is to give a complete account of economic growth. This builds on the well-established distinction between the exploitative and explorative orientation of research and development on a firm level introduced in management theory (March 1991). This distinction re-appears at the macro-level of growth theory which depends in the short run on the profitability of mature industries and in the long run from the creativity of emerging industries. A comparative view highlighting the essential features of the two kinds of complementarity and of their implications shall suffice here as a first step in erecting the theoretical edifice.

First, the conventional measure of economic performance—efficiency—may be reconsidered. Efficiency means to do an existing task better, say to improve the input–output ratio or capital coefficient. The measure of downward complementarity is typically efficiency. Performing the task of assembling individual entities into a new whole requires not only efficient behavior but also one that relates to the task of combining these entities, independent of whether or not that task is performed efficiently. The idea of efficiency cannot meaningfully be applied because of its inherent mereological feature. The criterion defining here the economic task is structural adaptability and the fitting of parts. The key performance measure therefore is effectiveness rather than efficiency (Dopfer 2005). The dynamic of upward complementarity builds primarily on the task of combining entities into a functioning new whole and calls for behavior that is effective.

Second, the distinction into downward and upward complementarity suggests two kinds of entrepreneurship. Entrepreneurship in the mode of the former is perhaps the most common form of entrepreneurial action, in that the agent is alert to opportunities that can be seen in firms or in markets to exploit inefficiencies (Kirzner 1999). It is a kind of ‘activation trigger’ (Zahra and George 2002) alert to the creative prospect of an opportunity (Kirzner 1999) arbitraging (hidden) inefficiencies. For upward complementarity we absolutely need to invoke some visionary agent—the entrepreneur in general, but it may also be a user, producer or consumer (von Hippel 1986)—because they are creating novelty (Witt 2009) by assembly of existing parts into new wholes. Entrepreneurship in the mode of upward complementarity is closer to Schumpeter’s original heroic and visionary conception, but we represent it here more analytically as the assembly of parts into new wholes.

This suggests a new classification system of entrepreneurship that is consistent with but differs from the equilibrating versus dis-equilibrating axis, a.k.a. the Austrian model of alertness to an opportunity (Kirzner 1999; Shane 2000) versus the Schumpeterian model of a novelty generating, dis-equilibrating agent (Baumol 1990, 2015; Metcalfe 2004, 2014). It also differs from the ‘fourth factor of production’ approach associated with the Marshallian model of the firm (Casson 1982), as well as the Knightean model of entrepreneurship as a special type of decision-making, namely judgment under uncertainty (Shackle 1972; Foss and Klein 2012). The taxonomy of upward and downward complementarity makes sense of the complexity of the entrepreneurial function having all of these aspects simultaneously but each representing different aspects of meso structure and meso process. The exclusivity of each singular entrepreneurial ability must be considered as artificial. To be entrepreneurial requires that the right abilities are called for at the right stage of the entrepreneurial process. Furthermore, while entrepreneurship associated with upward complementarity is expected to have a positive effect along the lines of the new meso trajectory, it will also have a disruptive or destructive effect at the meso–macro level as existing meso structures are re-coordinated (Dopfer and Potts 2008). A better understanding of the types of complementarity leads us toward a more unified approach to evolutionary economics in general and entrepreneurship in particular.

Third, the concept of complementarity duality sheds new light on the nature of networks in general and of innovation networks in particular. A dynamic modern economy is characterized by a strong interrelatedness between heterogeneous agents and heterogeneous knowledge. So-called combined technologies are the rule rather than the exception (e.g., Teece 1986). In many cases firms are unable of keeping pace with the development of all relevant technologies and therefore, they seek access to external knowledge sources. As a consequence, innovation networks have gained increasing significance as a mean of generating and coordinating industrial research and development (R&D) when exploiting upward and downward complementarity (Pyka 2015).

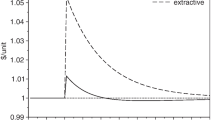

The evolution of innovation networks can be described by the development of network density that measures the number of realized cooperative links for joint knowledge development in relation to the maximum number of relationships in a fully connected network. Agents focus on their core competences and combine them with core competences of other agents leading to an increase in the number of network linkages and/or the number of agents connected in the network. The network density increases or decreases accordingly. Rationale and motivation for engaging in network relationships will depend on the kind of complementarity agents decide to engage in.

The exploration of and engagement in upward complementarity are informed by the integration of new competences and actors in the network. Consequently, the integration of new actors leads to the emergence of network structure. Economic evolution becomes change stated in terms of increasing upward complementarities monitored by network relationships. Network density is generally decreasing in the stage of exploring upward complementarities. In contrast, following the downward course an increase in the number of network interrelationships will increase divisibility, number of production steps and scale size within a network, which with respect to size remains constant. Therefore, the network density is increasing in the case of the exploitation of downward complementarities. In both kinds of complementarity quantitative change stated as change in relative frequency of network relationships co-relates with qualitative change stated as change of structure.

Let us illustrate the theoretic distinction by way of an example. Innovation networks were first studied in the 1980s as a new form of organization of industrial R&D observed in pharmaceuticals (Pyka and Saviotti 2005). Large diversified pharmaceutical companies tried to get access to the new biotechnologies via cooperation with small dedicated biotechnology start-up firms. Acquiring competences in molecular biology and unlocking new extensive technological opportunities by exploring the possibilities of cross-fertilization between inherent and innovative knowledge has led to a particular focus on upward complementarities. The aim was to reinvigorate the innovative dynamics of an industry that relied on an expiring business model based on so-called block-busters medical compounds. Each of these was expected to provide financing for R&D for another round of block-busters self-sustaining the R&D process and profits over time. However, skyrocketing costs and various other factors related to R&D challenged this old business model. A completely new way of doing things was called forth and the advent of an industrial application of biotechnology offered promising opportunities.

Traditional industrial economics considers innovation networks as a merely temporary phenomenon. For instance, in the present case innovation networks would disappear as soon as the pharmaceutical companies have built up the new biotech competences. In this picture some of the small biotech companies may become the pharmaceutical firms of the future replacing the incumbents with their outdated competences. To cooperate with existing large firms aimed at generating new knowledge by way of discovering upward complementarities was out of imagination. The advent of molecular biology and its industrial application was considered as being simply a competence destroying technological change, not a tool of sustained co-operation on the basis of increasing upward complementarities. From the viewpoint of the traditional doctrine the early innovators were bound to become big, or to be swallowed, or to be wiped out. They were bound to be a temporary phenomenon. Nothing like that happened, and still in the second decade of the twenty-first century large pharmaceutical and small dedicated biotech firms sprightly co-exist and cooperate. A view of the development of the underlying network densities, which first decrease and then increase again, reveals the switch from the exploration of upward complementarities to the exploitation of downward complementarities.

Fourth, the approach also suggests two kinds of industrial dynamics. The filling out of an industry through ongoing specialization, which may extend outward through industrial districts and clusters through to global patterns of specialization and trade (Kling 2011), can be characterized as downward complementarity. This leads first to the establishment of a dominant design, which then is exploited by an increasingly more efficient industry, which simultaneously matures. But the creation of a new industry or sector of the economy is the process of upward complementarity in seeing complementarity between parts that can be assembled into a new whole. With the exploration of the technological opportunity space opened by the discovery of the upward complementarity new seeds for economic development are spread out which eventually lead to new and pronounced economic growth. Upward complementarities are the factorial re-combinations between technologies, products or services to create new technologies, products and services that result in new industries and sectors (Aldrich and Fiol 1994; Cantner and Graf 2006; Antonelli 2011; Tether and Stigliani 2012; Saviotti and Pyka 2013; Kerr et al. 2014). The result is a cumulative circular causation that is propelled by the dynamic of upward complementarities between the entrepreneurial discovery of novelty and the ongoing process of the division of labour (Sarasvathy 2001; Metcalfe 2001, 2014). Long run economic growth and development is propelled by the co-evolutionary link between upward and downward complementarities: With downward complementarity, the resources required to explore potential upward complementarities are set free for entrepreneurial discovery (Arthur 2014; Hidalgo and Hausmann 2009). Upward complementarity refreshes the opportunities for further development, which are exploited over time by the operationalization of the process of specialization. The rise of the so-called ‘sharing economy’ of internet-based platforms is an example of this. Long-run evolutionary economic development is thus an interactive process of both downward and upward complementarity.

Fifth, it follows from these two conceptions of entrepreneurship and two conceptions of industry dynamics that the distinction between downward and upward complementarity will also express in two kinds of industry and innovation policy as built around the different mechanisms and institutions that support these different forms of complementarity and division of labour. Downward complementarity seeks to develop clusters associated with coordination efficiencies, scale economies, incentives to invest in R&D and spillovers. Most contemporary innovation policy is built on the logic of downward complementarity addressing market failures and system failures in innovation investment. However, evolutionary economic policy can additionally be built on the logic of upward complementarity, but here it becomes a creativity-based and experimental discovery-based approach that seeks to build connections and to develop feedback loops between existing and new technologies (Hausmann and Rodrik 2003; Potts 2011; Bakhshi et al. 2011; Foster 2013; Teubal 2013; Safarzyńska et al. 2012; Blind and Pyka 2014; Yoguel and Pereira 2014; Nelson 2016). Instead of the incentive reducing interpretation of technological spillovers, upward complementarity focuses on the idea-creation effects of technological spillovers and collaborative knowledge sharing.

5 Upward Complementarity Is the Engine of Economic Evolution

Upward complementarity is in the long-run the prime engine of evolutionary economic growth and development. But the concept has arisen piecemeal and fragmented in such a way that it has been difficult to see all of various aspects as different views on the same underlying reality. The entrepreneurial aspect, the recombination aspect, the aspects that express the formation of new goods, markets, firms and industries are all different parts of a single story that can be captured with the concept of upward (as distinct from downward) complementarity.

Upward complementarity also got lost to some extent with the increasing emphasis on the short run. Upward complementarity occurs in a time-consuming process, which could be assumed away by focusing on short-term optimal decisions. As a conjecture about the long-run pattern of economic development, we can expect that the relative importance of upward complementarity, as a species of division of labour, will increase as the number of new consumer products increases, or as factor inputs (as structured wholes) are substituted increasingly by new ones. This is especially the case in the digital and software economy that allows greater modularity and prospects for recombination (Beinhocker 2011). But the broader implication is that a conception of upward complementarity is central to an evolutionary account of macroeconomic development, and indeed is likely to become more so with the increasing complexity of economic systems. It would seem to us, therefore, that concept and language of upward and downward complementarity serves as a useful addition to the analytic lexicon of evolutionary economics.

Notes

- 1.

Complementarity is also defined on the demand side as the dual of substitution, specifically as a way of classifying goods in a preference ordering: two goods are substitutes or complements depending on whether cross-price elasticity is negative or positive. Neoclassical economics is an operational analysis of price coordination that expresses a framework of generalized substitution—viz. agents reallocate by making substitutions in markets.

References

Aghion P, Akcigit U, Howitt P (2013) What do we learn from Schumpeterian growth theory? Mimeo, New York

Aldrich H, Fiol M (1994) Fools rush in? The institutional context of industry creation. Acad Manag Rev 19(4):645–670

Antonelli C (2011) The complexity of technological change: knowledge interaction and path dependence. In: Antonelli C (ed) Handbook on the economic complexity of technological change. Edward Elgar, Cheltenham

Arthur B (2014) Complexity economics. Oxford University Press, Oxford

Bakhshi H, Freeman A, Potts J (2011) State of uncertainty: innovation policy through experimentation. NESTA, London

Baumol W (1990) Entrepreneurship: productive, unproductive, and destructive. J Polit Econ 98(5):893–921

Baumol W (2015) Joseph Schumpeter: the long run, and the short. J Evol Econ 25(1):37–44

Baumol W, Panzar J, Willig R (1988) Contestable markets and the theory of industry structure. Harcourt Brace, New York

Beinhocker E (2011) Evolution as computation: integrating self-organization with generalized Darwinism. J Inst Econ 7(3):393–423

Blind G, Pyka A (2014) The rule approach in evolutionary economics: a methodological template for empirical research. J Evol Econ 24(5):1085–1105

Cantner U, Graf H (2006) The network of innovators in Jena: an application of social network analysis. Res Policy 35(4):463–480

Casson M (1982) The entrepreneur: an economic theory. Oxford University Press, Oxford

Dias M, Pedrozo E, da Silva T (2014) The innovation process as a complex structure with multilevel rules. J Evol Econ 24(4):1067–1084

Dopfer K (2005) Evolutionary economics: a theoretical framework. In: Dopfer K (ed) The evolutionary foundations of economics. Cambridge University Press, Cambridge

Dopfer K (2011) Mesoeconomics: a unified approach to systems complexity and evolution. In: Antonelli C (ed) Handbook on the economic complexity of technological change. Edward Elgar, Cheltenham

Dopfer K (2012) The origins of meso economics: Schumpeter’s legacy and beyond. J Evol Econ 22(1):133–160

Dopfer K (2015) Evolutionary economics. In: Faccarello G, Kurz H (eds) Handbook of the history of economic analysis, Schools of thought in economics, vol II. Edward Elgar, Cheltenham

Dopfer K, Potts J (2008) General theory of economic evolution. Routledge, London

Dopfer K, Foster J, Potts J (2004) Micro, meso macro. J Evol Econ 14:263–279

Foss N, Klein P (2012) Organizing entrepreneurial judgment. Cambridge University Press, Cambridge

Foster J (2013) Energy, knowledge and economic growth. J Evol Econ 24(2):209–238

Foster J, Metalfe JS, Ramlogan R (2006) Adaptive economic growth. Camb J Econ 30(1):7–32

Hanusch H, Pyka A (2007) Principles of Neo-Schumpeterian economics. Camb J Econ 31:275–289

Hausmann R, Rodrik D (2003) Economic development as self-discovery. J Dev Econ 72(2):603–633

Hidalgo C, Hausmann R (2009) The building blocks of economic complexity. Proc Natl Acad Sci 106(26):10570–10575

Kerr W, Nanda R, Rhodes-Kropf M (2014) Entrepreneurship as experimentation. J Econ Perspect 28(3):25–48

Kirzner I (1999) Creativity and/or alertness: a reconsideration of the Schumpeterian entrepreneur. Rev Austrian Econ 11:5–17

Kling A (2011) Patterns of sustainable specialization and trade: a Smith-Ricardo theory of macroeconomics. Capital Soc 6(2):1–18

Leijonhufvud A (2007) The individual, the market and the division of labor in society. Capital Soc 2(2):1–19

March J (1991) Exploration and exploitation in organizational learning. Organ Sci 2(1):71–87

Metcalfe JS (2001) Evolutionary approaches to population thinking and the problem of growth and development. In: Dopfer K (ed) Evolutionary economics: program and scope. Kluwer, Dordrecht, pp 141–164

Metcalfe JS (2004) The entrepreneur and the style of modern economics. J Evol Econ 14:157–175

Metcalfe JS (2014) Capitalism and evolution. J Evol Econ 24(1):11–34

Nelson RR (2005) Technology, institutions, and economic growth. Harvard University Press, Cambridge, MA

Nelson RR (2016) Behavior and cognition of economic actors in evolutionary economics. J Evol Econ 26:737–751

Nelson RR, Dosi G (1994) An introduction to evolutionary theories in economics. J Evol Econ 4(3):153–172

Nelson RR, Winter S (1982) An evolutionary theory of economic change. Harvard University Press, Cambridge

Perez C (2009) Technological revolutions and techno-economic paradigms. Camb J Econ 34(1):185–202

Potts J (2000) The new evolutionary microeconomics. Edward Elgar, Cheltenham

Potts J (2011) Creative industries and economic evolution. Edward Elgar, Cheltenham

Pyka A (2015) Avoiding evolutionary inefficiencies in innovation networks. Prometheus 32:265–279

Pyka A, Saviotti PP (2005) The evolution of R&D networking in the biotechnology-based industries. Int J Entrep Innov Manag 5:49–68

Raffaelli T (2003) Marshall’s evolutionary economics. Routledge, London

Romer P (1990) Endogenous technical change. J Polit Econ 98:71–102

Safarzyńska K, Frenken K, van den Bergh JCJM (2012) Evolutionary theorizing and modeling of sustainability transitions. Res Policy 41(6):1011–1024

Sarasvathy S (2001) Causation and effectuation: toward a theoretical shift from economic inevitability to entrepreneurial contingency. Acad Manag Rev 26(2):243–263

Saviotti PP, Pyka A (2013) The co-evolution of innovation, growth and demand. Econ Innov New Technol 22(5):461–482

Schumpeter JA (1908) Wesen und Hauptinhalt der theoretischen Nationalökonomie. Duncker & Humblot, Leibzig

Shackle GLS (1972) Epistemics and economics. Cambridge University Press, Cambridge

Shane S (2000) A general theory of entrepreneurship. Edward Elgar, Cheltenham

Simon H (1985) What do we know about the creative process? In: Kuhn R (ed) Frontiers in creative and innovative management. Ballinger, Cambridge, MA

Teece D (1986) Profiting from technological innovation: implications for integration, collaboration, licensing, and public policy. Res Policy 15:285–305

Tether B, Stigliani I (2012) Toward a theory of industry emergence: entrepreneurial actions to imagine, create, nurture and legitimate a new industry. Paper presented at DRUID

Teubal M (2013) Israel’s ICT-oriented, high tech, entrepreneurial cluster of the 1990s: a systems/evolutionary and strategic innovation policy perspective. KDI, Global Industry and Economy Forum, Seoul

Tinbergen J (1991) The functioning of economic research. J Econ Issues 25(1):33–38

von Hippel E (1986) Lead users: a source of novel product concepts. Manag Sci 32(7):791–805

Weitzman M (1998) Recombinant growth. Q J Econ 113(2):331–360

Witt U (2009) Propositions about novelty. J Econ Behav Organ 70(1–2):311–320

Yoguel G, Pereira M (2014) Industrial and technological policy: contributions from evolutionary perspectives to policy design in developing countries. Munich University, MPRA

Young A (1928) Increasing returns and economic progress. Econ J 38:527–542

Zahra S, George G (2002) Absorptive capacity: a review, reconceptualization, and extension. Acad Manag Rev 27:185–203

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this chapter

Cite this chapter

Dopfer, K., Potts, J., Pyka, A. (2017). Upward and Downward Complementarity: The Meso Core of Evolutionary Growth Theory. In: Pyka, A., Cantner, U. (eds) Foundations of Economic Change. Economic Complexity and Evolution. Springer, Cham. https://doi.org/10.1007/978-3-319-62009-1_4

Download citation

DOI: https://doi.org/10.1007/978-3-319-62009-1_4

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-62008-4

Online ISBN: 978-3-319-62009-1

eBook Packages: Economics and FinanceEconomics and Finance (R0)