Abstract

In this paper I to ask an old fashioned question, “Why do capitalist economies evolve in the way that they do?” The answer will lie, in the nature of human curiosity and the corresponding growth of knowledge and in the particular instituted rules of the game that induce the self transformation of each particular economic order. The essential idea is this; the manner of self transforming is contingent on the manner of self-ordering, so that different instituting frames have different dynamic consequences. The notion of order provides the bridge to the systemic properties of the economy, the nature of its parts and the manner of their interconnection, while the notion of transformation provides the link with evolution and the open-ended, essentially unpredictable, development of capitalism. From my perspective capitalist economies are ignorance economies, in which highly specialised individuals and teams know a great deal about very little, so that the productive strength of the system, its collective knowing, depends on how the pools of specialised, narrow understandings are connected. Connectivity requires organisation and organisation depends on rules of the game and on belief and trust so that we can rely upon the testimony and actions of others. Failure of trust leads to failure of connectivity and a corresponding loss of system coherence. Order is central to the notion of economic evolution and, in practice, economic configurations demonstrate immense richness and subtlety but order is not equilibrium. Systems in equilibrium do not evolve. That the day to day structures of capitalism are the product of ordering processes in the epistemic as well as the material realm seems to me self evident and it is equally self evident that these structures are restless, that their development is open-ended and unpredictable.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Because different people can develop different skills, a knowledge rich society must be an ecology of specialists; knowledge is distributed within each human brain, within each organisation and within the economic and social system; and being distributed it can grow, provided that it is sufficiently coordinated to support increasing interdependencies (Loasby 1999, p. 130).

We can save men from hunger or misery or injustice, we can rescue men from slavery or imprisonment and do good. . . but any study of society shows that every solution creates a new situation which breeds its own new needs and problems (Berlin 1991, p. 14).

We are active, we are constantly testing things out, constantly working with the method of trial and error (Popper 1987, p. 53).

Always history is being made; opinions, attitudes and institutions change, and there is evolution in the nature of capitalism. (Knight 1935, 1930 , p. 176)

1 Introduction

In this paper I pose an old fashioned question “Why do capitalist economies evolve in the way that they do?” My answer will lie in the relationship between the nature of human curiosity and the corresponding growth of knowledge and the particular instituted rules of the game that induce the self transformation of each particular economic order. The essential idea is this; the manner of self transforming is contingent on the manner of self-ordering so that different instituting frames have different dynamic consequences. The notion of order provides the bridge to the systemic properties of the economy, the nature of its parts and the manner of their interconnection, while the notion of transformation provides the link with evolution and the open-ended, essentially unpredictable, development of capitalism.

By evolution we do not mean change simpliciter but rather change that is the result of variation-cum-selection processes, the outcome of which is development in the relative importance of different activities according to their differential growth or economic fitness. Individual fitness, it is to be noted, is not an intrinsic property of any particular economic agency but rather a derived consequence of its interaction with other agencies within specified rules of the game. That is to say, fitness is an emergent property of the formation of economic order. However, there is a catch in the evolutionary process. Since economic selection destroys effective variation within the system, some process is needed to replenish that variety. This is where innovation fits as the generator of novelty and that too is based, in general, on variation cum selection processes in the epistemic as well as the economic realm. Schumpeter captured this perfectly with his characterisation of capitalism as a process of creative destruction, a process in which, in principle, every economic position is open to challenge.Footnote 1 But the same theme is to be found in economists as distant from one another as Marx, Marshall and Hayek. From this double dynamic of innovation and adaptation to imminent possibilities flows the rise in the material standard of living and overall scale of activity which is the leitmotif of the modern capitalist epoch.Footnote 2

I shall explore this theme through the lens of restless capitalism by which I mean two phenomena: the incessant search for alternatives to the status quo; and the uncomfortable consequences of unforeseen economic change, the mismatches that are engendered in the evolution of economic activities and social arrangements. The first theme takes us to creativity and enterprise, the second to the uneven, uncomfortable welfare consequences of system evolution: progress there is but it comes at a price and the gainers do not usually compensate the losers. Why social arrangements should evolve differently from their economic counterparts is a difficult question. I neither know the answer nor do I want the problem to be completely overlooked in our discussion.Footnote 3

We should begin by asking, “What is meant by the economic evolution of modern capitalism?” The answer clearly depends on what are considered to be the salient properties of such economies. For present purposes I draw attention to the following by no means exhaustive list:

-

Capitalist economies are highly ordered systems of interconnected decision making processes based on an extended division of labour. The division of labour is reflected in a great variety of economic components which are rendered productive and viable by the largely self organising properties of the market process. That is to say, its functionings depend on its connectivity.

-

They are open systems because the knowledge on which they are grounded constitutes an open system; both knowledge and the economy are self transforming as well as self organising and the principle means of self transformation are innovation and adaptation to the possibilities for change created by innovation.

-

From this viewpoint innovations are the primary, variety generating events; they are instabilities from the point of the status quo, emergent novelties that invade the prevailing economic order. Emergent novelty is essential to development but it is augmented by market processes through which innovations displace already established activities. Consequently, a completely stable capitalism would be a stationary capitalism.

-

The systems are mixed systems, neither a pure market nor a pure command structure but a combination markets and organised command structures in ways that are important in relation to its long run dynamic behaviour. This is particularly so in relation to the modes of generating new knowledge through research and of disseminating knowledge through processes of education, which are primarily but not exclusively organised outside of the scope of the market system.

In sum, a modern capitalist economy is a system organised and instituted for the continuous creation of business experiments, very many of which come to nought but, as in all evolutionary systems, a small number of outliers have quite disproportionate transformative effects.Footnote 4 Contrary to much economic methodology, the system’s dynamics cannot be understood solely in terms of average behaviours; economic history is written by the few though it is lived by the many. These are the principal ideas that link the development of an economy as a whole to the development of its constituent components. As we shall see, the essential attributes of the system are captured in the four quotations at the head of the paper. With them continually in mind, I shall develop an answer to our opening question in terms of four themes. The first concerns the concepts of order and transformation, the second the link between knowledge and organisation, the third the nature of the instituted frame of the system and the fourth its variation cum selection cum developmental properties. The combination of these ideas underpins the operation of a system that is remarkably productive and remarkably creative, yet it is a system whose emergent future is necessarily unpredictable: we simply do not know how it will be structured ten, thirty, fifty years hence, just as no one standing in 1960 could have predicted the contours of the present day situation. These are the attributes expected of a complex system, it turns out that complexity and evolution have a good deal to say in support of one another.Footnote 5

2 Order and transformation

Modern economic theory is almost exclusively presented in terms of the idea of equilibrium, by which is meant the mutual consistency of the decisions that impart structure to human action. However, it is intrinsic to the very meaning of equilibrium as a net balance of forces that there can be no escape from it for internally generated reasons; all developments must be the product of external forces and explained by arguments additional to those which have established the position of rest. But equilibrium is a fiction and we may instead interpret the idea less rigidly and see it as a temporary answer to a particular problem, with the latent possibility that the process of discovering the answer may change the problem.Footnote 6 Equilibrium in these terms is solely a matter of provisional consistency with underlying present conditions and we do not need to suggest that this exhausts the internal reasons for change. For an evolutionist such a position would be anathema, modern capitalist economies may be strongly ordered but they are always out of equilibrium. Indeed, the status quo is always the focus of internal challenge. As soon as we admit that different decisions can be based on different understandings and expectations, as they are with every act of enterprise, we must accept that some expectations must be falsely held and that mistakes are essential components of evolutionary change. Expectations cannot be correct in total, so every economic situation invites some of its participants to change what they believe and revise their intended behaviour. Such endogenously creative systems need have no long term rest points, they just keep evolving. Yet structure is needed for evolution to work, so it is better to think in terms of the Hayekian concept of order, a structure of mutually determined behaviours which, in economic terms, usually reduces to the idea that, for any commodity or service, willing sellers can find willing buyers and conversely. The resulting market prices are the solution to a problem of establishing a present order not to a problem of establishing timeless equilibrium.Footnote 7

‘If order is a matter of structure, this suggests the idea of economic arrangements as a solution to a jigsaw puzzle, the mutual placement of countless activities relative to one another under the sway of constraints and incentives. In economic terms it reflects a pattern of human activities that is causally established, there is a logic to the underlying structure, a logic which works in terms of the solution to specific problems. The principle dimensions to this logic are the profit motive on the supply side and the human need motive on the demand side, together they impart a finely detailed structure to any economy that is reflected in a corresponding division of labour. Together they give texture to the idea of an ordered system of interconnected parts. A concept of economic order is extremely important, if one thing is certain, capitalism is not chaotic, but it is only part of the story, as the past masters from Marx to Marshall to Schumpeter to Knight and Hayek understood. Something is missing, namely, an understanding of how any given order develops over time from within. They perceived correctly that the capitalist system is never stationary and cannot be stationary unless human knowing is rendered stationary. There is continual development in the qualitative and quantitative dimensions of the prevailing order, the economic furniture is not only rearranged it changes in form. The evidence we have is the evidence that the economic historians bring before us.Footnote 8 History speaks eloquently to the restless nature of economic systems that in relatively short periods of time replace one constellation of activities with another of quite different scope and composition. The possible examples are innumerable and the disjuncture between the lives of even close generations is remarkable and appears on the surface as innovation and the creation of new industries and firms and the demise of old.Footnote 9 They are Henry Adams’ impossibilities rendered actual. Indeed, one might reflect on why industrial and technology museums proliferate and are an established part of the cultural framework in many advanced economies; and one should take this as a marker of the nature of capitalism. To preserve the past serves to remind us that the future will be different from the present. The system is never stationary and never has been: the economist’s fabled stationary state is a fiction that far from being an analytical masterstroke serves only to disguise the fundamentals of capitalism as a system that develops from within.

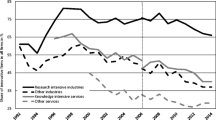

Indeed, economic growth never occurs without uneven development and, even at very high levels of aggregation, there is a persistent change in the relative importance of broad activities pertaining to agriculture, to the manufacture of goods, and to the production of services.Footnote 10 The more we disaggregate below these aggregates the more we find compelling evidence of differential growth rates and the consequential changes in economic structure. Indeed as a general evolutionary rule, the more we disaggregate the greater the diversity in the growth rates of specific activities.Footnote 11 Corresponding to the changing physical pattern of activity there are continual changes in the pattern of relative prices and a persistent tendency for real incomes to increase on average even though the distribution between wages and profits in the round and the rewards for particular occupations are ever changing.

We generally think of these aspects of restless capitalism in relation to advances in human knowing, whether science, the understanding of laws of nature, or technology and engineering, the understanding of the human built world. But these important categories by no means exhaust the knowledge relevant to the development of a modern economy. Knowledge of how to organise to achieve a particular outcome is also crucial; indeed, very many kinds of non scientific and non technological knowing are to be found in the workings of modern capitalism. If so, is the clue to the capitalist dynamic necessarily to be found in the idea of a knowledge based economy?

3 Knowledge, information and organisation

From a broad evolutionary perspective this is the wrong question. All societies and economies are necessarily knowledge based and could not be anything else. If the label is to have purchase it must identify the salient properties of different kinds of knowledge based economy, in terms of the kinds of knowledge that are in play, their processes of accumulation and dissemination, and the uses to which different kinds of knowledge are applied. Not all that is known is of economic significance but a great deal is and here the fundamental point was well made by Adam Smith almost two and a half centuries ago. The division of labour is a division of knowing and, moreover, the division of labour applies to the development of knowledge as well as to its application. From this follows Smith’s most penetrating insight, that the development of knowledge is intertwined with the development of the economy, the dualism which gives rise to a most powerful form of positive feedback and thus increasing returns.Footnote 12 Economists are also rightly fond of the idea of scarcity as an organising principle within the logic of a market economy. But scarcity is an invitation to think since it suggests that desirable ends cannot be attained in the present state of knowing. In this guise it becomes a pervasive stimulus to the solution of problems, a continual, restless searching for better ways to meet human needs. Moreover the capacity to think is limited by the constraints of the individual human mind, limited mental capacity is the most fundamental of scarce resources which is why human understanding is localised and different for each individual and why problem solving is distributed across the system as a whole. Increasing returns and scarcity are the two features of the knowledge-economy nexus that underpin the particular evolutionary dynamics of capitalism. Taken together they explain why capitalism never could be stationary.

The foundation for the whole process is grounded in the nature of human action and here there is an important distinction to be made between calculation and curiosity. Economic theory, with its focus on rational deliberation as the basis of order, naturally privileges the idea of calculation in relation to the allocation of scarce means to competing possible ends. Calculation is not unimportant but nor does it in any way require a commitment to the fully informed Olympian rationality that is presumed by the economic mainstream. A capacity to do the best one can to meet particular goals in the perceived circumstances is all that is required for intelligible economic action. In particular, in any choice situation the list of alternatives through which to express rational conduct cannot be presumed to be known, a priori, it has to be constructed, and so imagination and the capacity to conjecture alternative possibilities must have at least equal weight in any understanding of the nature of human action. Capitalism is both calculative and creative and the later is the more important of the two from an evolutionary perspective. To focus on calculation alone simply will not work, it is a too limited and mechanistic approach.Footnote 13 In fact, as soon as we allow for creativity and imagination the way is open to understanding differential behaviour and the variety of routes that may be reasonably followed to reach a particular end.Footnote 14 Smith’s insight is a far better place to start, for that leads us not to individuals who have a greater breadth of knowledge but to individuals who know a great deal about very little. Rather than a knowledge economy we may just as reasonably speak of an ignorance economy, in that specialisation is the consequence of a division of labour and the consequence of specialisation is ignorance of the wider field. Capitalism is as much a system of distributed ignorance as it is a system of distributed knowing. The Western world is collectively rich in relation to the idiosyncratic uniqueness of its individual members and it can function only because their highly specialised individual knowings can be connected and rendered interdependent. What are the consequences of this view?

First and foremost our useful knowledge is systemic in nature; we depend for our daily living on the knowings of individuals who we do not know and can only be so dependent to the extent that we are somehow connected to them. Connection requires coordination which in turn requires organisation to integrate the efforts of the contributing individuals. Without organising principles, there is fragmentation and lack of communication, a failure to spread understanding, a failure to benefit from the testimony of others. In other words, the power of the division of labour as producer of knowledge depends on complementary arrangements for the communication and coordination of human action, that is to say, it requires all levels of organisation to have the properties of a connected information system. Marshall grasped this fundamental fact with his distinction between the internal and external sources of increasing returns and the different forms of organisation that capture those economies. The internal organisation of each firm is a particular instantiation of a division of labour but no firm can function in isolation, its survival and development depend on connections with the division of labour in its outside world. Hence the need for every firm to have an external organisation that connects with its internal structure. External economies do not come for free they have to be gathered and integrated within the firm’s operations.Footnote 15 As we shall see below, commanded hierarchy and the market are the main principles of organisation in modern capitalism.

Firms, households, universities, hospitals, markets are different exemplars of the powerful rule that organisation realizes connections between specialised individuals no one of whom commands the totality of understanding contained at that level of organisation.Footnote 16 Connections are made by rules and an organisation such as a firm is a system of many different rules, each one designed to cover a particular unit of activity within the firm. The bundles of rules constitute its interconnected instruction set. Many rules function as precise templates for action; they serve to routinise behaviour, to ensure predictability by restricting variation in response and so economize on the need to give orders and on the need to monitor behaviour. This aspect of the instruction set is designed to facilitate understanding in common, to encourage individuals to attach the same meaning to messages they receive and thus to act in the same way when they receive the same information. However, not all rules can be precise prescriptions for action if an organisation is to have any adaptive capacity in the face of unexpected changes in its environment. So, at the other extreme from template rules, are creative rules, rules that allow a far greater flexibility in their responses, rules that encourage inquisitive behaviour and may deliberately encourage the formulation of different answers to the same problem.

A working organisation then is a rule based order, a caused structure of activities in which a flow of variegated information induces the many different actions required to achieve the programme and goals of the organisation. Moreover, whenever the understanding of the required rules requires generic skills applicable across multiple organisations, it becomes effective for specialised education and training organisations to be created. Similarly with the development of new knowledge of nature and of the human built world. Before the 19th century the site of the development of useful knowledge was the unit of production, be it monastry, farm or manufacture. One of the major developments in the development of capitalism from this period is that the accumulation of useful knowledge has moved offline into specialised, non commercial organisations, particularly universities but also specialised public research laboratories.Footnote 17 Philosophers and men of speculation can enjoy a great increase in their productivity as a consequence, new divisions of intellectual labour emerge and with them new forms of connection in the institutions and rules of scientific endeavour, just as Adam Smith argued. Thus arise two of the most important of external economies in the development of capitalism in which firms draw upon a supply of independently educated and trained individuals able to follow instructions or think creatively and rely upon the complementary growth in specialised human understanding. Untrammeled by the immediate problems o f the workplace, specialised research and teaching organisations have generated an incalculable growth in the body of understanding that underpins a modern capitalist economy. We shall say more on the instituting frame below but first we need to say a little more about what we mean by knowledge and information. These are not easy concepts to deal with but the distinction is needed.

Only individuals can be said to know, for knowledge is verified belief, an internal state of mind, and what is known depends on processes of perception, introspection, memory and inference, in short, on the processes that generate individual and differentiated life experiences allied with reason and imagination (Audi 1998; Goldman 1999). The internal processes, by which we come to know as individuals, are greatly augmented by external social processes that generate exchanges of information in countless forms. This is what is meant by the social situation of individuals in organised contexts whether formal or informal. However, communicated information is not knowledge; it is testimony to, a representation of, particular human knowings, which is not at all the same thing. The content of a given message may be only a partial representation of what the sender believes to be known and different again from the point of view of the recipients. It seems to be quite wrong to expect that all flows of information correspond to similar states of knowing in the respective transmitters and recipients, as if they were mere automata. Such a view would see information flow as a passage to uniform human knowing, a sure way of making evolution impossible. Here lies the nub of the distinction between order and transformation in economic life. Order depends on agreement and the correlation of understanding in respect to particular sets of problems and their defining circumstances, while transformation requires agreement to be abandoned and for our understandings to be decorrelated in response to newly perceived problems and circumstances. But no order can be complete and immutable for if it where emergent novelty would be ruled out. No social system can generate the variety necessary for it to evolve unless processes are allowed to exist to challenge the prevailing view of the world.Footnote 18

Take first the idea of order. We have suggested that order is the outcome of organisation and that organisation is designed to shape cooperative action between individuals who know differently. Since cooperative action depends on the generation of sufficient understanding in common, the role of organised communication processes is to correlate understanding to the degree that is necessary for behaviours to be coordinated at many different levels. What matters for the economic order is not that knowledge is held in common but that understanding is shared in common within each kind and level of organisation. This is what organisational rules do, they form the connections necessary to channel and distribute the necessary flows of information that arise from within and without. Action may then arise that is compatible with the environment in which the organisation operates.

If information flow is to correlate understanding with the requisite accuracy, there must be common standards of communication, of language and other forms of symbolic representation, and agreed standards for the justification of that which can be said to be known. There must be physical technologies too, for generating, transmitting and storing information, and they fit into place as a central aspect of modern capitalism. The book, newspaper and scientific journal, the public library and its book stacks, the telegraph, telephone and television, the computer and the internet find their significance in great reductions in the costs of handling information.Footnote 19 Every organisation has to invest in information generating, transmitting and storing processes and accumulate the corresponding organisational capital (Arrow 1974; Penrose 1959). Face to face correlating processes are still important but they are of only a fraction of the importance they once were. Yet if increasing numbers of individuals gain access to a greater flux of information on ever more economical terms this cannot leave unchanged the conditions for accumulating new knowledge. The functioning of organisations is not simply a question of correlating the understanding made possible by a given state of distributed human knowing but of inducing new additions to that pattern of human knowing. If knowledge has the properties of a connected system it invites the suggestion that that system is autocatalytic.

What of economic transformation? Just as order depends on the correlation of understanding, the transformation of order depends on its decorrelation, on the sowing of doubt where confidence once ruled. This is what new knowledge does, it challenges the status quo, it induces localised variations in the system on which selective processes can act. In any given state of distributed knowing, a change in the pattern of information flow will bring new facts to the attention of individuals, some of whom will be induced to change their knowing and in unpredictable ways. No two individuals need draw the same change in knowing from the same flow of information and this heterogeneity of response is a vital reason why organisations might adapt differentially to changes in a shared environment. Since much information is generated in the course of economic life the market process is not only an information generating process it is a knowledge changing process too (Potts 2001; Loasby 2001). Thus the very process of enabling organisation through the correlation of understanding contains a subversive possibility, and this is made manifest in the role of imagination and its translation into enterprise. Needless to add, enterprise as a category has no place in an account of economic or epistemic equilibrium.

By enterprise in general I mean challenges to the status quo of understanding, whether in respect of the economic, natural or material worlds. Enterprise is the essential concept required by evolutionary economic theory for it is the origin of variation, the origin of the potential for change. What is unique about each enterprising act is the formulation of a different view of the world. Entrepreneurs in the economy, like inventors in the human built world and paradigm breaking scientists, believe something that nobody else believes; they share much of the information flux of their immediate fellow citizens but they conjecture (and act upon) possibilities that others do not. Many, no doubt most, of these conjectures fail but without their challenge development is not possible and so the chief characteristic of the Schumpeterian entrepreneur or the path breaking scientist is to de-correlate the prevailing state of understanding. Hence, the emphasis on novelty, on creative originality, on challenging existing practices that is typical of the Schumpeterian entrepreneur and typical of the Kuhnian notion of the paradigm-breaking scientist. Thus, entrepreneurs have a dual role, one creative the other destructive. They develop understandings that are new to their sphere of influence and they undermine the correlated understanding that others possess. The few among them who are successful open up the routes to new patterns of understanding, patterns that render existing patterns of behaviour obsolete. Since the gains to the innovators are losses to their established rivals, it is no wonder they are rarely thanked for their pains. Thus we arrive at one of the central aspects of evolutionary economic theory. Economic order is essential if there are to be structures to evolve and order depends on processes for the correlation of understanding. However the development of order depends on processes for the decorrelation of understanding and the boundary between the two cannot be irrelevant to the evolution of capitalism. Too much decorrelating and the order may fall apart, too little and it ceases to develop.

This distinction between the correlation and decorrelating of understanding, the distinction between order and transformation has several wider economic implications that deserve a brief comment. The first concerns the limits to the idea of the stationary state or its equivalent in a regularly expanding economy, as a fruitful way of thinking about the economic process. To entertain the idea of stationarity is to treat individuals as mere signal processors, individuals in name but lacking the capacity to imagine and creatively express their individuality.Footnote 20 But as Marx, Marshall, Schumpeter and Hayek well understood a stationary state is a chimera; modern capitalism is incompatible with such a construct. The fundamental point is that economic order is always transient; no order is an equilibrium state precisely because every economic order necessarily generates the means for its subversion from within. If, following Knight, we accept that human behaviour is inherently ‘explorative and experimental’ we must also accept that the solving of problems is not a closed process, every problem solved is a new set of problems created in a process of action and reaction to the consequences of new understanding. Economic order is the solution to a problem that in its emergence transforms the problem. Thirdly, an economy as a system of distributed knowing will generate rich possibilities for the combinatorial combination of different ideas, the major ideas opening up many possibilities for emergent combination. This is how we might distinguish the truly significant changes in knowledge, the radical breaks as they are sometimes called, from the more mundane advances. They are the breakthroughs that open up “large” design spaces for exploration, the breakthroughs that may take many years and the engagement of many individuals and organisations for their full realisation. In the economic world such radical innovations give rise to sequences of problems and to connected trajectories of development, or as Giovanni Dosi so clearly expressed it they have paradigm like properties (Dosi 1982).

As an aside, it is perhaps worth saying that the conduct of science (including engineering and fundamental technological knowledge) and the conduct of a market economy contain remarkable parallels, not surprisingly since they are both systems for generating, and conserving knowledge by testing the validity of conjectures and distributing the consequential information. In each sphere, high rewards attach to original claims that pass the accepted tests for valid accretions to knowledge, though the tests are very different, as are the rewards. A scientific claim may be true according to the canons of its discipline but this is quite different from the viability of an innovation which is tested by its profitability. It is in this respect that the instituted rules of science and the instituted rules of a capitalist economy share a remarkable property, they sustain durable patterns of behaviour while enticing and rewarding challenges to that durability. Little can occur without order but development entails the challenge of order and so depends on breaking connections. In both science and the economy the challenging of order is in all its essentials an evolutionary process of conjectured variation, innovation and selection. The nature of the conjectures and the modes of selection may be radically different but they are inherently evolutionary. As Hayek pointed out, this imposes on economic behaviour an unavoidable burden in that the future of any knowledge based system is fundamentally uncertain. We cannot by the meaning of the word prefigure human knowing so we cannot predict who will innovate, or when or to what degree in the economy as in science. What we can form are reasonable judgments about the processes involved in novelty creation, as well as of the processes of subsequent system adaptation to the possibilities that are latent in novelties. Thus an evolutionary history is a non-determinist history in which human action is meaningful; it is purposeful but constrained, active but indeterminate in its full effects.Footnote 21

While non-deterministic enterprise is certainly a necessary condition for economic evolution it is scarcely sufficient. As Schumpeter was well aware, there can be powerful inhibitions to innovative activity and its uneven consequences. Enterprise depends on a social frame and set of instituted rules that accommodate deviant behaviour and it is important that the sources of deviance are inherently widespread, that they are distributed though out the system in an unpredictable way. The frame of economic order must be open to the challenge of novelty, it must be possible for innovations to spread beyond their initial applications in the production system, and this implies processes of economic adaptation. This is where our second broad class of organisation, the market, fits.

4 Markets and the instituted frame

Thus far we have dealt in terms of organisation in a narrow sense, organisations such as firms and households. The central idea has been that organisations are systems and that the order they exhibit is dependent on the articulation of an instruction set defined by idiosyncratic rule bundles. But, as we have already insisted, a focus on internal connectivity is obviously incomplete; the organisations of a modern capitalist system reflect an intense, external division of labour which, in turn, is rendered viable by the connectivity of the component parts of the economy. Without connectivity there is no economic system, without connectivity there can be no division of labour between organisations, without connectivity each organisation must be self sufficient. Hence Adam Smith’s remarkable insight that the division of labour is limited by the extent of the market, that the two are mutually conditioning and give rise to the most powerful of the sources of economic increasing returns. So pervasive is the operation of this principle that scarcely any individuals in a modern economy consume what they produce. They are dependent for their livelihood and standard of living on processes of trade and exchange.Footnote 22

Enter markets, the primary means of organising trade and exchange by bringing together potential buyers and sellers to render compatible their intended behaviours. The primary way this is achieved is by the generation and dissemination of information. This is what markets do, they are information systems too and, as such, they must be rule-based like any form of organisation. It is through their role in dispelling ignorance that households and firms can make the consumption and production decisions that constitute the prevailing order. Of course, markets come in many different guises each one having its own instruction set. Some relate to present exchanges others are based on the exchange of promises as to future behaviour and, as Richardson (1972) explains, they cover a very wide range of arrangements as to the behaviour of the trading parties. Some markets have a discrete physical location, others are distributed without boundaries, some are organised as private firms and others are the organisational property of no one agency. But they all have one purpose to organise the generation and dissemination of the information needed to coordinate decisions to buy with decisions to sell. This is as true of labour and capital markets as it is of markets for particular goods and services. Economic decision is conditional on information, how the information is created and deployed is the key to how the particular market operates.

Every market, therefore, has its associated instruction set defining who can trade, the terms on which trades take place, the conventions for payment and the nature of redress in face of purported breach of agreement. Hayek famously suggested that the rules are based on the emergence of spontaneous order, the antithesis of centralized design, yet this view is incomplete, market rules are also the product of public intervention from outside the market frame. Product markets, capital markets and labour markets all sit within a frame of publicly imposed rules of behaviour and always have since capitalism emerged as a recognisable economic form.Footnote 23 From this perspective, polity, law and economy are inseparable and coevolving systems for designing, implementing and enforcing the rules of the game (Commons 1924; Nelson and Sampat 2001; Hodgson 2007).

Within the operating rules, the primary information that markets provide is in the form of the money prices attached to particular transactions. Money prices economise on the information required to co ordinate decisions and they are necessarily set by some agency, they do not appear by magic.Footnote 24 Most prices for manufactured goods and for services are set by suppliers in relation to their costs and what they consider consumers will pay. In the case of homogeneous goods, prices are often set by organised exchanges in which traders, who hold stocks of the goods in question, set interdependent prices for present and future trades. Stock exchanges, bond markets, commodity markets are familiar examples of this type and they are markets where the decorrelation of understanding about the correct price can lead to great volatility in actual prices (Pratten 1993; Shiller 2000). In other kinds of market, prices are set by auction, especially when the goods or sought-after rights are in fixed supply, such as antique paintings of licenses to supply particular kinds of service. When this connecting process breaks down the markets no longer generate the requisite information to coordinate trade. If this happens in a single market it is an inconvenience but when it happens across the system as a whole it is a serious malfunction, paralyzing the conduct of economic activity in general.Footnote 25 Growth in the knowledge of how to organise market processes is thus of considerable importance in the development of modern capitalism, not everything that has induced the economic transformation of the past three centuries can be reduced to the development of science and technology alone.

As well as the instruction sets that relate to the exchange of particular goods and services there is a broader frame of rules that is widely acknowledged to be of crucial importance to the market system as a whole. Familiar instantiations would include rules about the rights and obligations of bondholders and equity holders when a business is wound up, rules in relation to the limited liability of shareholders, rules in relation to wage bargaining and the rights of organised labour, rules about working conditions and hours of work. Essentially these are rules in relation to the institutions of money, property and contract.Footnote 26 How do they matter?

Economists are prone to emphasise their importance for the emergence of an interconnected order but here I suggest that their role is even more fundamental. It is a remarkable feature of the capitalist frame that the rules which encourage the formation of order by correlating understanding also encourage and render possible the subversion of that order. That is to say, they underpin economies that are necessarily open systems. Economies need not be organised in this way, they could be instituted to protect the status quo and suppress the application of new knowings. Under the capitalist rules, however, any activity many be undertaken by anyone in any way within the general rule of law, social convention and whatever specific regulatory rules apply, so that, in principle, every activity is open to challenge. While rules generate order and give rise to predictable, repetitive behaviour they equally encourage the formation of new ways of conducting economic activity. In turn this rewards and stimulates the development of further useful knowledge in terms of innovations and the adaptation of the system to the opportunities opened up by innovation. In a capitalist economy the principle incentive is to be found in the concept of profit and its relation to the rules of property and contract. That they constrain is important but so is the fact that they enable. It is the peculiar feature of the capitalist frame that it is open to innovation, that it is tolerant of disparities in wealth and income, and that the disruption caused by innovations is accepted, even though the resultant gains and losses are unevenly distributed.

We may consider the dynamic implications of the order forming rules in several ways. Consider the price system and, of course, prices constitute the information that guides the formation of order as economists will rightly insist. But prices also define the profitability attached to each particular way of producing goods within a particular class so, for any prospective entrepreneur, prices signal the potential rewards to challenging the status quo. Nor is it simply a matter of prices, the prevailing scale of activity is also suggestive of the profits that will be made. All innovations fit into the prevailing order; at some point they are intended to displace some existing activities. In fact it is the price system generated by the prevailing order against which all innovations are judged. If they are profitable and to the extent that they spread, the innovations eventually redefine the constellation of prices so that it takes on characteristics appropriate to the new goods and methods of production. In so doing, this changes the terms on which future innovation is induced, so there is an inevitable path-dependent nature to the evolution of the system.

Consider next the notion of property rights, the rights to dispose of ones assets as one may wish. Quite crucially this right is not a right to a particular stream of income, far from it. Returns to property are decided by the market process not by law. While the theft of business assets by a competitor is ruled out in law, the destruction of their economic value through competition is not and there is no requirement at all that the losers need be compensated for the debasement of their earning power. There can be resort to law only if the competition is deemed to be “unfair” through resort to practices, such as selling below cost (dumping), or “tying-in” of customers through bundling arrangements that distort the market. Similarly with intellectual property: copy me and I will sue, invent around me with an economically superior device and I must take the consequences. This is what the patent holder must accept.Footnote 27

Of course, the rules themselves are not given but evolve as new situations arise and have done so over centuries, whether in relation to narrowly defined markets or in relation to the framing of the system as a whole. Practices and rules co evolve and the law adjusts accordingly, the development of accounting standards provides a very pertinent case in point. I don’t at all wish to imply that money, property and contract exhaust the instituted frame, clearly they do not. Cultural rules matter too, whether deeply embedded in ethical precept- trade in body organs is effectively banned by this means in many western societies- or in more febrile matters of fashion and convention, as in the markets for shoes or clothing or socially positioned goods more generally. The framing rules matter not simply because they constrain but because the also enable and in so doing impinge on the direction of change.Footnote 28

5 The process of economic evolution

We have suggested so far that capitalism is a rule based system of economic organisation based on the principles of the division of labour and that the division of labour entails a division of knowing. We have also claimed that this division of knowing is restless and that the human characteristic to question is, as Popper (1987) suggests, the root source of the growth of knowledge. Not everyone needs to be so inquisitive, and not every inquisitive mind needs to formulate structure breaking changes in understanding, in fact the development of knowledge and the development of the economy are remarkably uneven processes in time and space. A vital few are sufficient, provided the instituted frame of rules allows their ideas to spread and develop.Footnote 29

How then does the system evolve? Schumpeter provided the answer that most evolutionary economists ascribe too. Innovations are the key transforming events; they are new ways of conducting a business. Innovation is more than invention; it involves knowledge of organisation and of consumer needs and the crucial point is that every innovation is an economic event which requires the deployment of existing resources in new ways. But every innovation at its point of inception is of negligible importance. Only if it spreads will it be of significance so that it is the adaptation of the system to the potential associated with the innovation that makes the difference. This process of adaptation necessarily involves the accumulation of productive capacity to capitalise on the innovation, in terms of physical plant, in terms of skills and in terms of organisational form. Moreover, it requires that consumers and users also adapt, accepting the new products and services and rejecting the old. These adaptive processes are further augmented by imitations, with or without modification of the innovation, and by post-innovation innovations.Footnote 30 As we suggested above, important innovations open up design spaces for exploration and the associated trajectories of development reflect the lessons learnt as the innovation spreads into use. Economic adaptation and the development of knowledge around the innovation are mutually determining so that the full development of the associated activities may take decades to come to fruition.Footnote 31 Innovations elsewhere in the system may have reinforcing or restricting effects on the development of any one field of activity and few if any of these developments are fully predicted in advance. Innovation and adaptation to innovation are the major reasons why the economic future is necessarily uncertain, why we have little idea of how the order will look even half a lifetime ahead. The broader lesson is sharp and compelling, no economy ever grows in a balanced, equiproportional way, the disparities in growth within the system and the structural changes they correspond to are the essential prerequisites of an advance in living standards. As Schumpeter rightly stressed it is a matter of doing things differently. Yet Schumpeter’s account only hints at the evolutionary processes in play. We need to be more precise and the precision is to be found in the interplay between variation and selection. That is to say it is to be found in modern evolutionary theory and the connection with the market process. Indeed, the case for capitalism lies not in its alleged equilibrium properties but in the fact that it is a system of experimentation and adaptation, a discovery process in Hayekian terms. The case for the market does not of course imply that governments have no role to play. Quite the contrary, whether in respect of the regulation of the market process or in respect of the fostering business experimentation the state and the market constitute complementary aspects of a mixed system.Footnote 32

Economic variation is the outcome of innovation and selection is the means by which the economy adapts to variety, this is the core of the matter.Footnote 33 The context for this variation-cum-selection process is the particular market for the good or service in view and, from a simplified evolutionary perspective, markets are defined by the interaction of two distinct populations, one of suppliers and one of consumers.Footnote 34 In Schumpeter’s scheme the population of consumers play a passive role, responding to but not determining changes in what is supplied, which is the role of the population of supplier firms. Different suppliers offer goods of different qualities and, in general, they will produce them using different methods, according to the knowledge that is in the command of each business. These are the primary dimensions of economic variation and they are underpinned by the technological and organisational instruction set of the firm, the capabilities and skills of its employees, its goals and the ambitions of its leadership. These performance characteristics, quality of goods and the way of producing them, are necessary for economic differentiation but, under the capitalist rules of the game, the economic characteristics that ultimately matter are the firm’s selective characteristics, the characteristics from which it derives its competitive standing in the industry. These are its costs of production and the value which consumers place on the type of good it produces. The price set by a firm normally lies within the limits set by production cost and product value and determines the profitability of the firm and the value for money enjoyed by its customers. Very different accounts can be given of the formation of prices but they all involve some idea of prices serving to render compatible the intentions to produce and consume between the two populations.

The details will differ in different formulations of the market process but the key to understanding the contours of any formulation depends on two phenomena. The first involves the connection between prices, profitability and the incentives to invest in the accumulation of productive capacity. Prospective profit serves as a stimulus to change; actual profit tests the veracity of those expectations and provides the resources to expand those activities which generate higher real value than rival options. The second engages the connection between the value for money that consumers enjoy from their present supplier and their willingness to switch to suppliers that offer greater value for money. A market in which the consumers never switch supplier implies an associated industry that cannot evolve. In any market a margin can then be identified, in principle, at which the cost of production of some producer is equal to the worth of the good in question and both are equal to the price set by this producer who is necessarily on the edge of viability. Firms with lower costs (including the costs of capital) or better quality goods generate positive profits and there is a close connection between the underlying variety in the industry, and the distributions of profitability and value for money. Taking any two firms producing the same quality of good, the one with lower costs will be more profitable and, similarly, of two firms with the same costs the one with the “better” good will be the more profitable per unit of the goods sold.

The outcome of this order formation process is a joint distribution of profitability and consumer value for money and this is the key to the transformation of any particular market order. Differences in value for money are the basis for the differential growth of the particular market for each rival firm. Differences in profitability are the basis for the differential growth rates of the productive capacity of the rival firms, and differential growth rates are what we mean by differential fitness. The link between profitability, investment and growth is in fact the key relationship in the evolution of capitalism. Whenever the growth rates of rival suppliers differ, the structure of the industry is necessarily changing such that the different firms increase or fall in relative importance as they grow more quickly or more slowly than the industry average. The dynamics of change are further enriched by the fact that differences in profitability need not translate into equivalent differences in growth rates. For any one firm we expect it to grow faster when it is more profitable but this does not mean that a more profitable firm will grow more rapidly than a less profitable firm. There is no reason why different firms should have the same propensities to invest and grow, accumulation is a reflection of strategy and ambition as well as profitability. Consequently, there is no compelling reason to expect that the most profitable firms are the fittest, fastest growing firms. It is a matter of record that many firms decide not to expand as fast as their access to resources might suggest, while others have ambitions that far exceed their internal means to grow. At any point in time growth and profitability need not be strongly correlated across the population o f suppliers. Nor need a firm’s investment behaviour be constant over time, as Marshall’s metaphor of the trees in the forest suggests, a business has a life of its own and with it come variations in its ambition and capability to grow. Thus the relation between the prevailing order, the distribution of profitability and the distribution of fitness is far more subtle than might at first be imagined. Profit is the test of viability not the measure of fitness.

This brief account of economic evolution within and industry and its market is in fact an account of the competitive process, a process o f rivalry that is ultimately grounded in differences between firms in their operating rules, capabilities and goals. Firms compete by being different, by expressing individuality, and the role of the market process is to translate those differences into a pattern of change. This is far removed from the static notion of competition that fills the textbooks with its depiction of the uniform firm. Evolutionary competition is a process, not a state of affairs; it is a matter of changing order and structure not of equilibrium. All the great economists interested in development-Marx, Schumpeter, Marshall, Hayek- understood this point. As a process it is necessarily rule based, there need to be competitors who differ, there need to be criteria for who can participate in the process, there need to be definitions of acceptable behaviour, there need to be criteria to determine the prizes, and there need to be rules of disqualification. Knight (1923) expressed this eloquently and he also understood that competition is a self exciting process not a matter of equilibrium. Consequently, since economic competition is akin to a race it is interesting because it is unpredictable, because the winner cannot be identified in advance, that the presumed favourite may fail along the way, that the victor is a dark horse. So it is in economic evolution.

Evolutionary competition, as sketched above, defines an open-ended process in which the output of the industry would concentrate in the “fittest” firm only if all other influences remain constant. But other things rarely remain constant. New firms enter, existing firms make decisions to combine or split into different firms, and most crucially of all, innovation and imitation occur. Each of these processes of population change enriches the evolutionary dynamic, particularly innovation, for it is the means to regenerate the underlying variety in an industry and maintain an evolutionary potential. Few firms stay at the front of their industry indefinitely, there is continual flux in their fortunes and this is a pervasive evolutionary phenomena. Of course, any economy is comprised of many such industries that are to a degree interdependent in their evolution. The general order resolves into meso orders and the meso orders into micro orders such that change at each level is conditioned by innumerable linkages (Dopfer and Potts 2008; Metcalfe and Foster 2010). The general evolutionary story focuses on these interdependencies but it is beyond our present remit. It is sufficient to say that different industries are tied together by virtue of competing for access to the same kinds of inputs, skills of different kinds, capital market loans with different terms and conditions, and by competing for customers who buy many different kinds of goods and services supplied by different industries. The aggregate economic requirement that money income equals money expenditure gives a degree of coherence to the system as a whole; and sets a top down condition on its evolution such that the aggregate rate of expansion and the evolution of its entire structure are one interconnected skein. As well as evolution within industries we have evolution between industries, a far more complicated general evolutionary economics.

The three stage variation- cum-selection-cum development logic is really quite compelling. The logic of the market process gives to the economy as a whole far more adaptive potential than is contained in any one industry, and any industry far more adaptive potential than is contained in any one firm. In sum the logic of economic evolution is the logic of a system of experimentation ultimately grounded in the evolution and application of useful knowledge.

6 Reprise

In sum, I have suggested that the way in which capitalist economies are instituted allows them to operate as non-ergodic systems, they do not forget the events along the way and their evolution is deeply history dependent. I have certainly not argued that we abandon many of the insights of economic theory, only that we abandon the idea that we are explaining economic equilibrium. Order is central to the notion of evolution and, in practice, economic configurations demonstrate immense richness and subtlety but order is not equilibrium. That the day to day structures of capitalism is the product of ordering processes seems to me self evident and it is equally self evident that these structures are restless, that their development is open-ended and unpredictable. Fundamentally, they could only be at rest if human knowing is at rest and I know not what to make of the idea that human knowing could be rendered stationary. In this belief I doubt if I am alone.

Notes

See, for example, the authoritative treatment of Andersen (2011).

I have attempted to connect the ideas of Hayek, Marshall and Schumpeter in relation to economic evolution in Metcalfe (2008).

To state that part of the problem lies in inadequate labour mobility is not too helpful. The stickiness of social ties relative to the fluidity of economic ties is perhaps the more productive way to pose the problem. Of itself the mismatch provides ample justification for a welfare state to compensate for the loss of human capital that occurs when firms and industries are forced into absolute decline. For example, the growth of the Lancashire cotton industry stimulated the growth of numerous urban centres (the ones famously characterised on canvas by L.S.Lowry) but as the industry declined after 1920, and disappeared in the mid 1980s, those urban centres were left without their primary economic rationale. Manchester adjusted well, eventually, other towns did not.

Even Schumpeter expressed the view that “a majority of would be entrepreneurs never get their projects under sail and that, of those that do, nine out of ten fail to make a success of them” (1939, p. 117).

See Shackle (1966), p. 36 for an interpretation of Marshall on similar lines.

See, for example, the discussion in Kirman (2011), chapter 4. We may note that the theory of the pricing of financial assets as developed by Keynes and Shackle rests exactly on a diversity of views as to how those prices will evolve in the future. I am grateful to a referee for drawing my attention to this point.

A model study of its kind is Landes’ account of the evolution of the international clock and watch industry (1983).

The evolutionary nature of Smiths theory of knowing and connecting is detailed in Loasby (1999). In Smith’s theory of knowledge (first outlined in his Essay on Astronomy, published posthumously in 1795) knowledge is derived from the connection of disparate phenomena and is thus a product of human imagination and has no existence beyond human minds.

The weaknesses have been admirably exposed by Mirowski (1989).

Dopfer and Potts (2008) call this the bimodal axiom, that the same broad idea may admit many alternative instantiations in practice. Thus when we talk of the method of producing a particular class of commodity we are in effect talking about a population of alternative methods.

See Loasby (1990) for further elaboration of this Marshallian theme. We should also note the relevance here of Edith Penrose’s theory of the firm, that it is an incompletely connected administrative structure premised on many specialised knowings and thus constrained in its development by the limitations on the rate at which new knowings can be generated and old understandings abandoned. Penrose (1959).

See Potts (2000) for a very clear articulation of the view that the use of fields in economic theory is a means to avoid the significance of connection, to replace specific relations and interactions with the idea of complete and anonymous immersion in a field of forces acting equally on all.

Quite remarkably, Marshall writes of this in Industry and Trade (1919), where he depicts a tripartite ecology of research organisations, an almost exact description of a modern innovation system. For, an excellent exemplar, see the penetrating account of the role of Stanford university in the development of semiconductor technology by Lecuyer (2007).

A referee rightly drew my attention to Herbert Simon’s emphasis on the quasi-decomposability of evolving systems. The incompleteness o f connectivity, the mutability of connectivity are two essential aspects of organisation in capitalism and the immanent possibilities for creative destruction. See Simon (1969). The referee also pointed out that this is the reason why Marshall developed his reasoning in partial equilibrium terms; since he was writing about an evolving system it necessarily could not be completely and immutably connected. The impossibility of general equilibrium as an economic frame is, of course, premised on the incompleteness of market connectivity, which, in turn, is premised upon our ineluctable ignorance of the future. “Would someone please write me a contract to purchase an unspecified device to solve an unspecified problem at some indeterminate date beyond today” is not a request that is likely to elicit action.

The reader puzzled by a claim that libraries and book stacks constitute technologies might care to read Petroski (1999).

Shackle (1966) captures this with his usual élan, “To ask for a non-determinist history is to ask for a history which is not completely structured, a history, that is to say, in which we need not regard every situation or event as the inevitable, sole and necessary consequence of antecedent situations and events, a history in which, therefore, a situation or event can be essentially and inherently not fully explainable, not fully analysable, not fully assignable to conditions or causes which are sufficient to guarantee the occurrence of it and it alone” (p. 107, italics in original) The connection with age-old debates on the distinction between “free will” and “determinism” is drawn in Popper (1972).

Richardson (1975) has provided a very cogent account of this non-equilibrium dimension to Smith’s economic dynamics.

Just as scandals that arose with new medical products lead to strict regulation so the scandals that have arisen more recently about the conduct of financial organisations may instigate a raft of new rules and regulations as to “innovative” lending practices and the design of financial instruments.

It is one of the canons of economic theory that decisions to produce and consume depend on relative prices not absolute prices. If an economy, a simple economy, trades one hundred goods or services this generates 4,950 relative prices, a considerable volume of information. The same information is contained in 99 money prices (one of the goods being taken as money or the accounting unit) from which any relative price can be deduced. The effect this has on the economy of information when keeping track of transactions and changes in the ownership of property will be obvious.

The post 2008 financial crisis was a phenomena based on the breakdown of trust in financial markets, a breakdown that arose from an inability to access the true risk profile of an important class of financial assets (innovations in fact) held on the balance sheets of retail banks and other financial institutions. Lacking this information, no counter party could be confident in the solvency of those it lent to. I recall being told, some years ago, of a shop in Buenos Aires, at a time of very high inflation, being “closed for lack of prices”. It is the same point, when information breaks down so does trade and our ignorance is manifest.

One might add that the rules which facilitate the establishment of new business entities are of central importance to a Schumpeterian view of economic evolution. The wider lessons in relation to inter society differences in development potential has been drawn by De Soto (2000).

This is why the disclosure rules attached to patents are so important. The information placed in the public domain signifies the ideas which must be avoided if a patent is to be invented around. The wider point of relevance is the transience of the innovator’s profits, a central part of Schumpeter’s theory of economic development. “No industrial company of the type indicated gratifies its shareholders with a constant shower of gold; on the contrary it soon declines into a stage that has the most lamentable similarity with the drying up of a spring.” (Schumpeter 1912, p. 209).

Note the importance of the recent rebirth of the economic sociology of markets. For very different contributions see Callon (1998), Harvey (2010) and Beckert (2009). That economists do not seem much bothered by the organisation of real markets is oft’ said (e.g., Richardson 1972) but see Kirman (2011) for an outstanding counterexample. There is a connection here to the debates on markets as evolving systems of computable rules. Consult Mirowski (2007) and the commentaries on this paper for further elucidation of the point. Richard Nelson has long emphasized the importance of rule sets as social technologies and their associated innovations. On this see Nelson and Sampat (2001).

The “Vital Few” is the perceptive title of Jonathan Hughes’ (1966) instructive account of American enterprise.

As explored in Georghiou et al. (1984).

The intra ocular lens, an astounding development in the treatment of cataract, was first used in London in 1948. It took four decades for a sequence of problems to be identified and solved that turned the treatment from a surgeon’s craft into a quasi-industrial process, a procedure that is today the most frequently performed medical intervention in the world. A new branch of cataract surgery was instigated to train the practitioners and channel the growth of understanding, a new industry emerged to produce the devices and process equipment required, and, along the way, new rules for regulating practice were introduced. The pace at which these changes occurred differed between the USA and the UK as a result of their differentially instituted medical systems. See Metcalfe et al. (2005) for an account of this radical innovation. Here too one might also remember Marshall’s, dictum “constructive movements which had long been in preparation” (Marshall 1920, p. xiii).

For a complementary view see Nelson (2013).

Simplified not least because of the neglect here of the role of labour and capital markets in the process of economic change.

References

Andersen ES (2011) Joseph A. Schumpeter. Palgrave Macmillan, London

Arrow K (1974) The limits of organization. W.W. Norton, New York

Audi R (1998) Epistemology. Routledge, London

Beckert J (2009) The social order of markets. Theory Soc 38:245–269

Berlin I (1991) The crooked timber of humanity. Fontana, London

Callon M (1998) The laws of the markets. Blackwell Publishers, London

Clark C (1944) The conditions of economic progress. Macmillan, London

Commons JR (1924) Legal foundations of capitalism. Macmillan, London

De Soto H (2000) The mystery of capital. Basic books, New York

Dopfer K, Potts J (2008) The general theory of economic evolution. Routledge, London

Dopfer K, Foster J, Potts J (2004) Micro-meso-macro. J Evol Econ 14(3):263–280

Dosi G (1982) Technological paradigms and technological trajectories. Res Policy 11:147–162

Foster J (2005) From simplistic to complex systems in economics. Camb J Econ 29:873–892

Georghiou L, Metcalfe JS, Evans J, Ray T, Gibbons M (1984) Post innovation performance. Macmillan, London

Goldman AI (1999) Knowledge in a social world. Oxford University Press, Oxford

Harvey M (2010) Markets, rules and institutions of exchange. Manchester University Press, Manchester

Hausmann R, Rodrik D (2003) Economic development as self-discovery. J Dev Econ 72(2):603–633

Hodgson G (2007) The enforcement of contracts and property rights: constitutive vs. epiphenomenal concepts of Law. In: Harvey M, Randles S, Ramlogan R (eds) 2007, Karl Polanyi. Manchester University Press, Manchester

Hodgson G, Knudsen T (2010) Darwin’s conjecture: the search for general principles of social and economic evolution. University of Chicago Press, Chicago

Hughes JRT (1966) The vital few: American economic progress and its protagonists. Houghton Mifflin, Boston

Hughes TP (1989) American genesis. University of Chicago Press, Chicago

Jorgenson D, Timmer M (2011) Structural change in advanced nations: a new set of stylised facts. Scand J Econ 113:5–29

Kirman A (2011) Complex economics. Routledge, London

Knight F (1923) The ethics of competition, reprinted in Knight F., 1977. The ethics of competition. Transactions Publishers, New Brunswick, New Jersey

Knight F (1935) Statics and dynamics, reprinted in Knight F., 1977. The ethics of competition. Transactions Publishers, New Brunswick, New Jersey

Kuznets S (1954) Economic change. Heinemann, London

Kuznets S (1971) Economic growth of nations: total output, structure and spread. Belknap Press, Cambridge, MA

Kuznets S (1977) Two centuries of economic growth: reflections on US experience. Am Econ Rev 67:1–14

Landes DA (1969) The unbound Prometheus. Cambridge University Press, Cambridge

Landes DA (1983) Revolution in time. Belknap Press, Boston

Lecuyer C (2007) Making silicon valley: innovation and the growth of high tech, 1930–1970. MIT Press, London

Loasby BJ (1990) Firms, markets and the principle of continuity. In: Whitaker JK (ed) Centenary essays on Alfred Marshall. Cambridge University Press, Cambridge

Loasby BJ (1999) Knowledge, institutions and evolution in economics. Routledge, London

Loasby B (2001) Time, knowledge and evolutionary dynamics: why connections matter. J Evol Econ 11(4):393–412

Maddison A (1995) Monitoring the world economy. OECD, Paris

Marshall A (1919) Industry and trade. Macmillan, London

Marshall A (1920) Principles of economics, 8th edn. Macmillan, London

Mathias P (1979) The transformation of England. Methuen, London

Metcalfe JS (1995) The economic foundations of technology policy: equilibrium and evolutionary perspectives. In: Stoneman P (ed) Handbook of the economics of innovation and technological change. Blackwell, Oxford

Metcalfe JS (2008) The broken thread: Marshall, Schumpeter and Hayek on the evolution of capitalism. In: Shionoya Y, Nishizawa T (eds) Marshall and Schumpeter on evolution: economic sociology of capitalist development. Edward Elgar, Cheltenham

Metcalfe JS, Foster J (2010) Evolutionary growth theory. In: Setterfield M (ed) Handbook of alternative theories of economic growth. Edward Elgar, Cheltenham

Metcalfe JS, Mina A, James A (2005) Emergent innovation systems and the development of the intraocular lens. Res Policy 34:1283–1304

Metcalfe JS, Foster J, Ramlogan R (2006) Adaptive economic growth. Camb J Econ 30(1):7–32

Mirowski P (1989) More heat than light. Cambridge University Press, Cambridge

Mirowski P (2007) Markets come in bits: evolution, computation and markomata in economic science. J Econ Behav Organ 63:209–242

Mokyr J (2002) The gifts of Athena. Princeton University Press, Princeton

Mokyr J (1990) The lever of riches. Oxford University Press, Oxford

Nelson R (2013) Demand, supply and their interaction in markets, as seen from the perspective of evolutionary economic theory. J Evol Econ 23(1):17–38

Nelson R, Sampat B (2001) Making sense of institutions as a factor shaping economic performance. J Econ Behav Organ 44:31–54

Penrose ET (1959) The theory of the growth of the firm. Basil Blackwell, Oxford

Petroski H (1999) The book on the book shelf. A.A. Knopf, New York

Popper KR (1972) Of clouds and clocks: an approach to the problem of rationality and the freedom of man. In: Popper KR (ed) Objective knowledge: an evolutionary approach, chapter 6. Oxford University Press, Oxford

Popper K (1987) The epistemological position of evolutionary epistemology, reproduced in Popper, K. (1994). All life is problem solving. Routledge, London

Potts J (2000) The new evolutionary microeconomics. Edward Elgar, Cheltenham

Potts J (2001) Knowledge and markets. J Evol Econ 11(4):412–432

Pratten C (1993) The stock market. Cambridge University Press, Cambridge

Richardson GB (1972) The organisation of industry. Econ J 82:883–896

Richardson GB (1975) Adam Smith on competition and increasing returns. In: Skinner AS, Wilson T (eds) Essays on Adam Smith. Oxford University Press, Oxford

Rodrik D (2004) Industrial policy for the 21st Century, mimeo. J.F Kennedy School of Government, Harvard University

Schumpeter JA (1912) The theory of economic development. First English translation, 1934. Harvard Economic Press, Harvard

Schumpeter JA (1939) Business cycles, volume one. McGraw-Hill, New York

Shackle GLS (1966) The nature of economic thought. Cambridge University Press, Cambridge

Shiller RJ (2000) Irrational exuberance. Princeton University Press, Princeton

Simon HA (1969) The sciences of the artificial. MIT Press, Cambridge, MA

Author information

Authors and Affiliations

Corresponding author

Additional information