Abstract

The Global Entrepreneurship Monitor (GEM) is the largest and longest-running social science research project in the world and the GEM Adult Population Survey database now runs to millions of cases of individuals from 114 economies since it started in 1999. In this chapter, the authors show that entrepreneurial activity among minorities may in practice be more a result of, rather than a solution to, a lack of basic economic alternatives (such as social security), while a theme of unfulfilled intentions points to discrimination during and after start-up. On the positive side, it does appear that entrepreneurship may be a stepping-stone to more regular employment or better business opportunities for individuals at risk of discrimination, such as immigrants.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Introduction

The Global Entrepreneurship Monitor (GEM) is the largest and longest-running social science research project in the world. From the first experiment with eight countries in 1999, 114 economies have since participated. Most of these are independent countries; the exceptions being special economic areas including Hong Kong, Puerto Rico and the Azores. Each year, participating national academic teams survey at least 2000 adults at random and survey at least 36 experts in different aspects of the business environment regarding entrepreneurship in their economy. Participants in the adult population survey are approached by whatever means are most appropriate in their economy. They are asked a wide range of questions that probe their entrepreneurial attitudes, activity and aspirations. Over the years, the survey medium has shifted from telephone interviews via random digit dialling of fixed line telephones to a mix of landline, mobile and face-to-face interviews. In several countries, experiments have been conducted with online panels. A central data team ensures that surveys are harmonised and are as equivalent as possible.

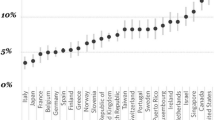

The GEM database now runs to millions of cases of individuals. Government data on business creation tends to focus on business registrations. GEM’s unique contribution is its focus on individuals and what makes some individuals behave entrepreneurially. Because GEM has been running for so long, it is possible to see the effect of economic cycles on entrepreneurship and to begin to understand the complex relationship between national economic and social context and the types and rates of entrepreneurship. Clear patterns across the world are evident for individuals with different demographic profiles, in different economic and cultural contexts. This chapter reviews some of these patterns, in particular for women, younger and older people, people who are not working because of a disability, the unemployed, immigrants and ethnic minorities. Published research using GEM data that reveal patterns in minority entrepreneurship are also reviewed. At the time of writing, 2017 was the latest year that global individual-level data was available to national team members, so global comparisons of entrepreneurial activity will mainly focus on the combined 2016 and 2017 databases, containing survey data on 344,757 individuals aged between 18 and 64 in 70 countries. Immigrant entrepreneurship was a special topic in GEM 2012 and data from this year is used in the section comparing immigrant and non-immigrant entrepreneurship.

What Does GEM Tell Us About Entrepreneurship and Gender?

According to the GEM data, rates of business start-up intention, start-up activity and business ownership vary by gender across stages of economic development (as Table 1 shows). In most economies (but not all), female entrepreneurial activity is around two-thirds of male entrepreneurial activity. This ratio tends to vary with an economy’s stage of economic development. In the least developed economies, female entrepreneurial activity is high, on par with or even higher than male entrepreneurial activity. More female than male entrepreneurial activity is driven by necessity rather than opportunity. The ratio of female-to-male rate is higher in poorer countries and it declines across the entrepreneurial process from intention to closure. Furthermore, it also tends to be lower, the higher an economy’s stage of economic development.

de la Cruz Sánchez-Escobedo et al. (2014) studied entrepreneurial intentions of men and women (i.e. at the individual level) in factor-driven, efficiency-driven and innovation-driven countries using the GEM 2008 database and found very different drivers between men and women. Across the three country-groups, women tended to have higher start-up intention rates if they were unemployed and had at least a secondary education, suggesting that a mismatch between their economic status and their abilities was pushing them to consider entrepreneurship. Fear of failure also seemed to have a negative effect on women in efficiency-driven and innovation-driven countries; perhaps in the poorest countries, women had little to lose. For men, the drivers seemed to be more pull than push, such as self-efficacy, work experience and knowing another entrepreneur, and drivers tended to vary more across the country-groups. Tsai et al. (2016) measured the moderating effect of gender on how opportunity perception and fear of failure mediated the effect of self-efficacy on intention in China and Taiwan. Each of these studies provided glimpses of a complex set of influences on entrepreneurial intention that researchers are only beginning to understand.

At a national level, Verheul et al. (2006) found in a sample of 29 countries surveyed in 2002 that, in general, female and male entrepreneurial activity rates were influenced by the same national-level factors and in the same direction. However, using different GEM survey years and different statistical methods, Arenius and Kovalainen (2006), Langowitz and Minniti (2007) and Minniti and Cardone (2009) found that the difference in early-stage entrepreneurial activity between men and women at the individual-level could be mostly ‘explained’ by differences in perception, specifically in entrepreneurial self-efficacy, fear of failure and, to a lesser extent, opportunity perception. Koellinger et al. (2013) found that lower rates of female business ownership were primarily due to women’s lower propensity to start businesses rather than to differences in survival rates across genders and confirmed again that this was due to perceptual differences. Minniti (2010) showed that the stage of economic development was a critical factor in rates of entrepreneurship among women, because in poorer countries, out of necessity, more women were likely to start businesses, closing the ‘gender gap’.

While women may be less likely than men to start businesses (at least in most countries), a study by Koellinger (2008) using 2002–2004 data found that women nascent entrepreneurs were more likely than men to have innovative rather than imitative businesses. The evidence on gender and growth aspiration of entrepreneurs is mixed. Terjesen and Szerb (2008) found that, across 35 countries, male entrepreneurs were more likely to have high growth aspirations, but Verheul and van Mil (2008) found no direct gender-related difference in growth aspiration for the Netherlands, arguing instead that there might be indirect effects (e.g. gender differences in export propensity). Lepoutre et al. (2013) and Brieger et al. (2019) made use of special questions asked in 2009 GEM surveys on social entrepreneurship. While Lepoutre et al. found that social entrepreneurs are more likely to be men than women, Brieger et al. discovered that women entrepreneurs were more likely to be pro-social in their goals, and that this gender effect was even stronger in countries where human empowerment was high. Overall, it would appear that while there are indications of some under-representation of women in certain types of entrepreneurial activity, the situation with women’s entrepreneurship globally is highly complex, multifaceted and context-dependent. Further, it is not always a case of disadvantage.

What Does GEM Say About Youth Entrepreneurship?

Table 2 shows clear patterns in entrepreneurship among young people (aged between 18 and 29) compared with older people. Business start-up intention rates are the same among youth as among older people in the least developed economies and these are about twice those of young people in the most developed economies. Generally, the more developed an economy, the lower the business start-up intention rates among young people, but this reduction is even more marked among older people. Moving from intention to start a business in the next three years to actively trying to start a business or running a new business (early-stage entrepreneurship), the data broadly shows similar rates between youth and older people in each stage of development, but much more of a significant decline in the frequency of engagement in more developed economies compared with the least developed economies.

Older people have much higher rates of established business owner-managers than youth in all stages of development. This is, naturally, a consequence of age: older people have simply been around longer, but another reason may be greater experience and thus greater business sustainability. However, the ratios of closure to business ownership (early-stage and established) are quite similar for youth and older people in each stage of development (being slightly higher in the middle stages of economic development), which is not what one would expect to find if the businesses of younger people were being closed faster than those of older people. While older people have higher closure rates, this is because they also have higher rates of business ownership overall. Coduras et al. (2018) examined the GEM 2014 sample (over 188,000 individuals in 63 countries) and confirmed an inverted U-shaped relationship between age and early-stage entrepreneurial activity across stages of economic development, and this result is robust to controlling for other demographic variables and motivation (opportunity versus necessity).

What Does GEM Say About Seniors and Entrepreneurship?

Comparing seniors (aged 50–64) to other working age adults (aged 18–49), Table 3 shows that seniors have significantly lower intention of starting a business in the next three years than other adults, but that this difference is less marked in the least developed economies, where prevalence rates are high. A similar picture is apparent for early-stage entrepreneurial activity prevalence, which for seniors is around half to two-thirds the rate of other adults in all economic stages, except the least developed economic stage where it is closer to nine-tenths the rate of other adults. In contrast, seniors are around 1.5 times more likely to be established business owners than other adults. They have similar closure rates to other adults and a similar ratio of closure to business ownership at all stages of development. This is because lower early-stage entrepreneurship rates are compensated by higher established business ownership rates. Unsurprisingly, retirement is a significant reason for closure among seniors, with around one-in-ten seniors in all economies (except the least developed) citing this as a reason, compared with just one or two percent of other adults. Conversely, other adults were more likely to cite another job or business opportunity as the reason for closing the business.

Levesque and Minniti (2006) employed Becker’s theory of time allocation to develop an explanation regarding why entrepreneurship prevalence varies with age. They argued that as individuals grow older, the value of future income declines relative to current income, and that since entrepreneurship is a form of investment in possible future income, its attractiveness relative to wage income declines as individuals age. Bohlmann et al. (2017) added declining physical and fluid cognitive abilities as individuals age to the notion of time allocation, although this did not explain their finding of an inverted U-shape relationship between age and entrepreneurial activity in the 2013 survey of 70 economies, in which rates across the combined sample of over 240,000 individuals peaked around age 30 and then slowly declined at a decreasing rate. Kautonen et al. (2014) cast some light on these puzzles by separating out those who expected to be self-employed and employ no one to those who expected to employ others in the future. Using a non-GEM, Eurostat sample of 2566 respondents from 27 countries in Europe, they showed that among the former, entrepreneurial activity increased almost linearly with age, whereas among the latter it increased up to a critical threshold age (late 40s) and then decreased. They also found that age has a considerably smaller effect on reluctant entrepreneurs. This is an illustration of the value of digging deeper into motivations and context, and of the dangers for GEM scholars of categorisation using relatively crude demographic variables alone.

Using GEM 2013 data, Ruiu and Breschi (2019) found some associations between the innovative behaviour of entrepreneurs and age. Older entrepreneurs were more likely to introduce novel products and services, but younger entrepreneurs were more likely to employ new technology. However, Colovic et al. (2019) found that ‘third-age’ (senior) entrepreneurs tended to lag behind younger entrepreneurs in both technology adoption and innovation. One example of the possible impact of context on the propensity of seniors to engage in entrepreneurship is provided by Estrin and Mickiewicz (2011) who suggested that the absence of certain informal institutions in transitional economies of Eastern Europe and the former Soviet Union explained particularly low rates of senior entrepreneurial activity, causing an entrepreneurial generation gap. Another example is an article by Velilla et al. (2018) who used QCA fuzzy set analysis to uncover relatively high rates of necessity-driven entrepreneurship among seniors in developing economies, which they interpret as a response to a lack of employment opportunities. In summary, while the relationship between age and entrepreneurship parallels that between employment and age in some regards, with less dynamic activity generally associated with age, this can vary with national economic context, with both high and low levels of entrepreneurial activity shown by youth and seniors in different countries.

What Does GEM Say About Going from Unemployed to Self-Employed?

Perhaps surprisingly, entrepreneurial intention and nascent entrepreneurial activity rates in the less developed economies are the same among the unemployed as among other people, while they are higher in more developed economies (see Table 4). Nascent entrepreneurial activity among the unemployed in less developed economies is typically only two-thirds the rate of other people, whereas it is the same as other people in developed economies. Given the lack of social security in less developed economies, this suggests higher barriers to entry for unemployed people in less developed economies. One of these may be basic education as unemployed individuals in the less developed economies tend to be more likely to have no education, while unemployed individuals in more developed economies tend to be less likely to have post-secondary education.

Hill et al. (2018) bring these issues to life in a vivid way with a focus on the Middle East and North Africa (MENA) countries, which have very high youth population percentages, but also the world’s highest unemployment rates. They state that in Morocco, 49 per cent of youths aged 15–24 are not employed or in school (NEET); in Jordan, more than half the entire population is under 25 years of age and 25 per cent of these youths are unemployed. They suggest that the ineffective and outmoded public education systems that currently exist throughout MENA not only prevent the spread of entrepreneurship, but also increase overheads for existing employers. Koellinger and Minniti (2009) found in a cross-country panel of 16 OECD countries from 2002 to 2005, that higher unemployment welfare benefits reduced nascent entrepreneurial activity, whether necessity-driven or opportunity-driven, and whether imitative or innovative. For unemployed persons, low education levels may inhibit entrepreneurial entry in all contexts, with the presence of a social safety net further dampening any necessity ‘push’ effects in developing countries.

What Does GEM Tell Us About Entrepreneurial Intentions and Attempts by People with Disabilities?

In 2016, GEM surveys split a category of occupation which stated ‘I am not working because I am retired or disabled’ into two separate categories, enabling an estimate for the first time of entrepreneurial intentions and attempts by people who are not working due to a disability. Table 5 shows the results for the combined 2016/17 database. Some caution should be applied to these results because they are based on country averages from very small samples of people with disabilities (2 per cent of national samples on average). Further, it is highly likely that people with certain disabilities could not take part in the survey and that this exclusion varied by country. Given these caveats, the results do suggest a pattern of low participation in the least developed economies on average relative to other people in the sample.

In the least developed economies (stage 1 and transition to stage 2), on average approximately one-third of people who were not working because of a disability stated they intended to start a business in the next three years, compared with around two-thirds in more developed economies (stage 2 and above). The relative proportion of people who are not working because of a disability who were actively trying to start a business was also lower, with around three-quarters of people in more developed economies becoming nascent entrepreneurs compared with one-quarter to a half in the least developed economies. In a way, this finding is not surprising, because in the least developed economies, job opportunities are scarce, social services may be rare or non-existent, and in some countries there may be cultural reasons surrounding economic inactivity among people with disabilities. In more developed economies, as people with disabilities are encouraged to engage in the mainstream economy, entrepreneurship may be actively promoted as a solution to a lack of employment opportunities for people with disabilities, because it may offer more flexibility than regular employment (Halabisky 2014). On the other hand, while people with disabilities may need the opportunity that entrepreneurship can offer even more in the least developed economies than in more developed economies, they may struggle to cope in brutally competitive market environments. In addition, in some collectivist family-oriented cultures, it may be taboo for people with disabilities to be seen ‘out there’ fending for themselves.

What Does GEM Tell Us About Entrepreneurship Among Immigrants?

Table 6 shows that in every stage of development (except in the least developed economies), immigrants tend to have higher business start-up intention rates, early-stage entrepreneurial activity and business closure rates than non-immigrants. In the least developed economies, immigrant intention, early-stage entrepreneurial activity and business closure rates are lower on average than equivalent rates for non-immigrants. In contrast, relative established business ownership rates of immigrants and non-immigrants vary with stage of development as more developed economies tend to have lower rates of established business ownership among immigrants relative to non-immigrants, while less developed economies tend to have higher rates of established business ownership among immigrants than non-immigrants. One possible reason for this difference in relative entrepreneurial activity between immigrants and non-immigrants in the least developed economies and other economies is that immigrants in the least developed economies are markedly better educated than non-immigrants. They may be taking jobs that require high levels of education to which non-immigrants do not have access. On the other hand, in more developed economies, immigrants may face discrimination in the labour market, including non-recognition of their education qualifications, forcing them to consider other economic alternatives, such as entrepreneurship.

Across all stages of economic development, immigrants are much more likely than non-immigrants to cite ‘another job or business opportunity’ as a reason for shutting down their business. It may be that, faced with challenging integration issues such as language or culture, or real or perceived discrimination in the labour market, immigrants turn to entrepreneurship as a temporary way of making a living until something more attractive comes along. Several authors have used GEM data to understand both immigrant entrepreneurship and the effect of immigrants on national and local entrepreneurship rates. Using GEM UK data from 2003 and 2004, Levie (2007) found that migration increases the odds of engaging in new business activity, that the independent effect of ethnicity is marginal and that being a recent ethnic minority migrant decreases the odds of new business activity, after controlling for other individual-level factors. Using data obtained from the GEM Spain 2009 survey, Hormiga and Bolívar-Cruz (2014) found that immigrants to Spain, irrespective of their origin or ethnicity, are less likely than native Spaniards to perceive business creation as a risky situation (using fear of failure as a proxy for risk perception), and that the perception of risk has a significant impact on the decision to engage in business start-up activity. Contin-Pilart and Larraza-Kintana (2015) found evidence in the GEM Spain 2006 database to support the hypothesis that because of their lower sociocultural fit (operationalised by cultural distance and time in region), immigrants are less likely to be influenced in their entrepreneurial activity by past and present entrepreneurs in the region where they live compared with the native population. Peroni et al. (2016) found in a study of GEM Luxembourg 2013 and 2014 data that first-generation immigrants, particularly those better educated, were more interested in starting a new business than non-immigrants, but found no differences in subsequent entrepreneurial phases. Širec and Tominc (2017) found that immigrant early-stage entrepreneurs tended to have higher growth aspirations than native entrepreneurs in north-west Europe, but not in south-east Europe. The decision to migrate is arguably itself entrepreneurial and therefore looking to start a new venture may not be as daunting a consideration for immigrants as for non-immigrants. Entrepreneurial success beyond entry is however driven by multiple factors which may favour or disfavour immigrant entrepreneurs in complex ways in different contexts.

What Does GEM Tell Us About Ethnic Minority Entrepreneurship?

Data on ethnicity is not routinely collected by GEM, because this varies so much by economy. It is not really possible to compare ethnic minorities across countries on a like-for-like basis. However, some national GEM teams have collected data on ethnicity and these have revealed interesting findings. For example, in the USA, using 2002 GEM data, Koellinger and Minniti (2006) found that black Americans tended to exhibit more optimistic perceptions of their business environment than other racial groups and were almost twice as likely as white Americans to try starting a business. Yet, they were under-represented among established entrepreneurs, possibly due to stronger barriers to entry and higher failure rates. Levie and Hart (2011) found similar results for Black Caribbean individuals in the UK. Kwong et al. (2009) also used the UK GEM database to explore differences among different ethnic groups in the level of entrepreneurial activity by women, their attitudes towards entrepreneurship and the social capital available to them when starting a business, and found that there were considerable differences between the four main ethnic groupings (white, mixed, black, and Asian). The general under-representation of ethnic minorities in entrepreneurship is seemingly not for lack of trying. More, importantly, however, different ethnic groups appear to face different barriers, and gender factors within the various ethnic groups complicates the matter further, thereby making ethnic minority entrepreneurship too multifaceted for coarse-grained, generic inferences to be drawn.

Conclusion

One theme running through the sections of this chapter is that distinct differences are seen in the relative rates of entrepreneurial activity among minorities of different types across stages of economic development. A second theme is that, despite these clear patterns by stage of economic development, there are also large differences in minority (and mainstream) entrepreneurial activity between economies at the same level of economic development. Therefore, a difference in prevalence of entrepreneurship between one type of minority and the mainstream in one economy could be reversed in another economy. A third theme is that high intention rates among some minorities (e.g. the unemployed in less developed economies and certain ethnic minorities in some countries) are not matched by high rates of entrepreneurial action. Something is preventing these individuals from achieving their intentions. A fourth theme is that higher rates of entrepreneurial activity among a minority group is not necessarily a positive signal. It may demonstrate a response to adverse economic circumstances or job discrimination. While entrepreneurship may be an economic alternative for some minority individuals, it may not be their ideal choice, but a necessary one.

These themes of wide differences in the rates of minority entrepreneurship and of broad but inconsistent patterns across countries and stages of development, highlights that entrepreneurial activity is determined by many contextual as well as individual factors. The theme of necessity entrepreneurship underscores that entrepreneurship among minorities may in practice be more a result of, rather than a solution to, a lack of basic economic alternatives (such as social security), while the theme of unfulfilled intentions points to discrimination during and after start-up. On the positive side, it does appear that entrepreneurship may be a stepping-stone to more regular employment or better business opportunities for individuals at risk of discrimination, such as immigrants. The information that GEM provides on minority entrepreneurship also gives hints regarding how entrepreneurship rates may change in the future. For example, across the European Union, the median age of the population is likely to shift from 42.4 years in 2015 to 46.6 years in 2080, suggesting that entrepreneurship rates in this region of the world might decline (Eurostat 2017). Cross-border migration has increased substantially in recent decades, with one United Nations estimate putting the increase from 173 million in 2000 to 258 million in 2017. Climate change is likely to significantly increase migration in the future (IPCC 2019). Understanding immigrant entrepreneurship may become vital for stabilising society as populations shift in geographic space over the coming decades.

There is much more to be learned from the GEM database. By combining annual datasets, scholars can create samples that are large enough to put a spotlight on subsamples and begin to understand multilevel effects. An example might be the combination of the finding of de la Cruz Sánchez-Escobedo et al. (2014) of gender differences in drivers of entrepreneurial intentions and the finding of Schmutzler et al. (2019) of cultural influences on drivers of entrepreneurial intentions, where gender was marginally significant as a control variable. Analysis of separate samples for males and females might reveal different cultural influences on drivers of entrepreneurial intention at different stages of development. It may also be that comparing younger versus older entrepreneurs masks important interactions between age, gender and preferred mode of entrepreneurship (for example, solo self-employment versus organisation creation). Finally, in 2019, major changes to the main Adult Population Survey were made, based on the latest research on entrepreneurial mindset, motivation, mode of governance and impact. These may well reveal further discoveries about the nature of minority entrepreneurship, particularly as scholars combine individual and contextual effects.

References

Arenius, Pia, and Anne Kovalainen. 2006. “Similarities and Differences Across the Factors Associated with Women’s Self-Employment Preference in the Nordic Countries.” International Small Business Journal, 24, no. 1: 31–59.

Bohlmann, Clarissa, Andreas Rauch, and Hannes Zacher. 2017. “A Lifespan Perspective on Entrepreneurship: Perceived Opportunities and Skills Explain the Negative Association Between Age and Entrepreneurial Activity.” Frontiers in Psychology, 8: 1–11.

Brieger, Steven A., Siri A. Terjesen, Diana M. Hechavarría, and Christian Welzel. 2019. “Prosociality in Business: A Human Empowerment Framework.” Journal of Business Ethics, 159: 361–80.

Coduras, Alicia, Jorje Velilla, and Raquel Ortega. 2018. “Age of the Entrepreneurial Decision: Differences Among Developed, Developing, and Non-developed Countries.” Economics and Business Letters, 7, no. 1: 36–46.

Colovic Ana, Olivier Lamotte, and Manoj C. Bayon. 2019. “Technology Adoption and Product Innovation by Third-Age Entrepreneurs: Evidence from GEM Data.” In Handbook of Research on Elderly Entrepreneurship, edited by Adnane Maâlaoui, 11–124. Cham: Springer.

Contin-Pilart, Ignatio, and Martin Larraza-Kintana. 2015. “Do Entrepreneurial Role Models Influence the Nascent Entrepreneurial Activity of Immigrants?” Journal of Small Business Management, 53, no. 4: 1146–63.

de la Cruz Sánchez-Escobedo, Maria, Juan C. Díaz-Casero, Ángel M. Díaz-Aunión, and Ricardo Hernández-Mogollón. 2014. “Gender Analysis of Entrepreneurial Intentions as a Function of Economic Development Across Three Groups of Countries.” International Entrepreneurship Management Journal, 10: 747–65.

Estrin, Saul, and Tomasz Mickiewicz. 2011. “Entrepreneurship in Transition Economies: The Role of Institutions and Generational Change.” In The Dynamics of Entrepreneurship, edited by Maria Minniti, 181–208. Oxford: Oxford University Press.

Eurostat. 2017. People in the EU—Population Projections. Brussels: Eurostat. ISSN 2443–8219.

Halabisky, David. 2014. “Entrepreneurial Activities in Europe—Entrepreneurship for People with Disabilities.” OECD Employment Policy Papers, no. 6. Paris: OECD Publishing. http://dx.doi.org/10.1787/5jxrcmkcxjq4-en.

Hill, Victoria, Shahamak Rezaei, and Silvia C.L. Rocha. 2018. “Increasing Entrepreneurial Impact in the MENA Region”. In Entrepreneurship Ecosystem in the Middle East and North Africa (MENA), edited by Nezameddin Faghih and Mohammed R. Zali, 113–65. Springer, Cham: Contributions to Management Science.

Hormiga, Esther, and Alicia Bolívar-Cruz. 2014. “The Relationship Between the Migration Experience and Risk Perception: A Factor in the Decision to Become an Entrepreneur.” International Entrepreneurship Management Journal, 10: 297–317.

IPCC. 2019. Special Report: Global Warming of 1.5 °C. Geneva: Intergovernmental Panel on Climate Change.

Kautonen, Teemu, Simon Down, and Maria Minniti. 2014. “Ageing and Entrepreneurial Preferences.” Small Business Economics, 42, no. 3: 579–94.

Koellinger, Philipp. 2008. “Why Are Some Entrepreneurs More Innovative Than Others?” Small Business Economics, 3, no. 1: 21–37.

Koellinger, Philipp, and Maria Minniti. 2006. “Not for Lack of Trying: American Entrepreneurship in Black and White.” Small Business Economics, 27: 59–79.

Koellinger, Philipp, and Maria Minniti. 2009. “Unemployment Benefits Crowd Out Nascent Entrepreneurial Activity.” Economics Letters, 103: 96–8.

Koellinger, Philipp, Maria Minniti, and C. Schade. 2013. “Gender Differences in Entrepreneurial Propensity.” Oxford Bulletin of Economics and Statistics, 75, no. 2: 213–34.

Kwong, Caleb Y., Piers Thomson, Dylan Y. Jones-Evans, and David Brooksbank. 2009. “Nascent Entrepreneurial Activity Within Female Ethnic Minority Groups.” International Journal of Entrepreneurial Behaviour and Research, 15, no. 3: 262–81.

Langowitz, Nan, and Maria Minniti. 2007. “The Entrepreneurial Propensity of Women.” Entrepreneurship Theory and Practice, 31, no. 3: 341–64.

Lepoutre, Jan, Rachida Justo, Siri Terjesen, and Niels Bosma. 2013. “Designing a Global Standardized Methodology for Measuring Social Entrepreneurship Activity: The Global Entrepreneurship Monitor Social Entrepreneurship Study.” Small Business Economics, 40, no. 3: 693–714.

Levesque, Moren, and Maria Minniti. 2006. “The Effect of Aging on Entrepreneurial Behavior.” Journal of Business Venturing, 21, no. 2: 177–94.

Levie, Jonathan. 2007. “Immigration, In-Migration, Ethnicity and Entrepreneurship in the United Kingdom.” Small Business Economics, 28: 143–69.

Levie, Jonathan, and Mark Hart. 2011. “The Contribution of Migrants and Ethnic Minorities to Entrepreneurship in the UK.” In The Dynamics of Entrepreneurial Activity, edited by Maria Minniti, 101–24. Oxford: Oxford University Press.

Minniti, Maria. 2010. “Female Entrepreneurship and Economic Activity.” The European Journal of Development Research, 22: 294–312.

Minniti, Maria, and Carlo Cardone. 2009. “Being in Someone Else’s Shoes: The Role of Gender in Nascent Entrepreneurship.” Small Business Economics, 28: 223–38.

Peroni, Chiara, Cesare A.F. Riillo, and Francesco Sarracino. 2016. “Entrepreneurship and Immigration: Evidence from GEM Luxembourg.” Small Business Economics, 46: 639–56.

Ruiu, Gabriele, and Marco Breschi. 2019. “The Effect of Aging on the Innovative Behavior of Entrepreneurs.” Journal of the Knowledge Economy, 10: 1784–807.

Schmutzler, Jana, Veneta Andonova, and Luis Diaz-Serrano. 2019. “How Context Shapes Entrepreneurial Self-Efficacy as a Driver of Entrepreneurial Intentions: A Multilevel Approach.” Entrepreneurship Theory and Practice, 43, no. 5: 880–920.

Širec, Karin, and Polona Tominc. 2017. “Growth Aspirations and Growth Determinants of Immigrants Early Stage Entrepreneurs.” Ekonomický časopis, 65, no. 7: 618–43.

Terjesen, Siri, and Laszlo Szerb. 2008. “Dice Thrown at the Beginning? An Empirical Investigation of Determinants of Firm-Level Growth Expectations.” Estudios des Economía, 35, no. 2: 153–78.

Tsai, Kuen-Hung, Hui-Chen Chang, and Chen-Yi Peng. 2016. “Refining the Linkage Between Perceived Capability and Entrepreneurial Intention: Roles of Perceived Opportunity, Fear of Failure, and Gender.” International Entrepreneurship Management Journal, 12: 1127–45.

Velilla, Jorge, Jóse A. Molina, and Raquel Ortega. 2018. “Why Older Workers Become Entrepreneurs? International Evidence Using Fuzzy Set Methods.” The Journal of the Economics of Ageing, 12: 88–95.

Verheul, Ingrid, André van Stel, and Roy Thurik. 2006. “Explaining Female and Male Entrepreneurship at the Country Level.” Entrepreneurship and Regional Development, 18, no. 2: 151–83.

Verheul, Ingrid, and Linda van Mil. 2008. “What Determines the Growth Ambition of Dutch Early-Stage Entrepreneurs?” International Journal of Entrepreneurial Venturing, 3, no. 2: 183–207.

Acknowledgements

The authors wish to acknowledge the GEM national teams who administered the GEM survey in their economy and provided data for this research.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Levie, J., Mwaura, S. (2021). What Does GEM Say About Minority Entrepreneurship?. In: Cooney, T.M. (eds) The Palgrave Handbook of Minority Entrepreneurship. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-030-66603-3_3

Download citation

DOI: https://doi.org/10.1007/978-3-030-66603-3_3

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-030-66602-6

Online ISBN: 978-3-030-66603-3

eBook Packages: Business and ManagementBusiness and Management (R0)