Abstract

Previous research on age and entrepreneurship assumed homogeneity and downplayed age-related differences in the motives and aims underlying enterprising behaviour. We argue that the heterogeneity of entrepreneurship influences how the level of entrepreneurial activity varies with age. Using a sample of 2,566 respondents from 27 European countries, we show that entrepreneurial activity increases almost linearly with age for individuals who prefer to only employ themselves (self-employers), whereas it increases up to a critical threshold age (late 40s) and decreases thereafter for those who aspire to hire workers (owner-managers). Age has a considerably smaller effect on entrepreneurial behaviour for those who do not prefer self-employment but are pushed into it by lack of alternative employment opportunities (reluctant entrepreneurs). Our results question the conventional wisdom that entrepreneurial activity declines with age and suggest that effective responses to demographic changes require policy makers to pay close attention to the heterogeneity of entrepreneurial preferences.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

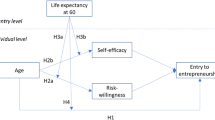

A recent review of econometric evidence on the factors influencing entrepreneurial behaviour concludes that age is one of the most important determinants of entrepreneurship and self-employment (Parker 2009). In light of significant changes in the age composition of the workforce and population dynamics worldwide, the relationship between age and entrepreneurial activity has attracted increasing scholarly and policy interest (Lévesque and Minniti 2011). For example, particular attention has been paid in both research and policy to senior entrepreneurship: mature individuals in their late working careers starting in business for themselves.Footnote 1 Our work contributes to these scholarly and policy debates by investigating the effect of ageing on entrepreneurial behaviour when the heterogeneity of entrepreneurial activity is accounted for.

Prior research suggests that the effect of age on the probability of engaging in some form of entrepreneurship follows an inverse U-shape. That is, the probability of an individual becoming an entrepreneur increases with age up to a certain point (usually between 35 and 44 years) and decreases thereafter (Lévesque and Minniti 2006; Parker 2009). Previous studies have also shown that the willingness to start a business decreases with age, while the opportunity to do so increases (Blanchflower et al. 2001; van Praag and van Ophem 1995). The opportunity for starting a business increases with age, because many entrepreneurial resources—such as the amount of disposable income, assets that can serve as collateral for bank loans, social capital, and professional and industry experience and knowledge—accumulate with age (Henley 2007; Singh and DeNoble 2003; Weber and Schaper 2004). Lévesque and Minniti (2006) (LM hereafter) explain this declining willingness with the opportunity cost of time, which increases with age and discourages older individuals from selecting forms of employment that involve risk or deferred gratifications, such as starting a new business.

Building upon the LM model of the effect of ageing on entrepreneurial behaviour, we argue that individuals’ heterogeneous preferences influence their assessment of the opportunity cost of time, and thus their likelihood of taking entrepreneurial action, over their working life span. We explicate and operationalise the heterogeneity of individual preferences with three entrepreneurial types. Based on this typology, we propose and empirically demonstrate that the inverse U-shaped age effect applies only to those individuals who seek to own and run a business and invest in it (owner-managers), while the effect of ageing is different for those who aspire to become own-account workers but who do not anticipate hiring employees (self-employers) and those who are pushed towards self-employment even if they prefer salaried employment (reluctant entrepreneurs).

Our results complement and expand existing literature. First, we provide empirical evidence for the inherent effect of age on entrepreneurial decisions described in the LM model. Second, we show that the LM model generates valid predictions even when the heterogeneity of entrepreneurial activity is accounted for. Third, we demonstrate that the relationship between age and entrepreneurial activity varies significantly depending on the individual’s preferences. Finally, and perhaps most importantly, by investigating how and why different types of entrepreneurial activity decline or grow with age, we provide valuable information for policy, since alternative types of entrepreneurial activity generate different social externalities and respond to different incentives and programmes.

2 Ageing and entrepreneurial preferences

2.1 Lévesque and Minniti’s (2006) model

LM propose a model in which each individual maximises their expected well-being by deciding how to allocate their time between work and leisure and how to distribute the hours devoted to working between waged labour and entrepreneurship. For each individual, the model shows the existence of a threshold age. After that threshold age is reached, an individual’s willingness to choose entrepreneurship declines. The intuition is that, ceteris paribus, since time is a relatively more scarce resource for older individuals, the present value they attach to the stream of future payments from entrepreneurship is lower than for younger people. In addition, the wage rate from dependent labour increases over time as individuals gain more work experience. Therefore, older people have an incentive to allocate more of their working time to waged labour and less to entrepreneurship.

Formally, the individual’s utility function for their overall well-being (W t ) is described by

In Eq. (1), the time parameter t captures the individual’s age, τ t describes the individual’s number of working hours, h t denotes the portion of working hours devoted to entrepreneurship, and ω t describes the wage rate that the individual commands.

The first term on the right-hand side of Eq. (1), ω t [τ t −h t ], captures the waged labour income at time t. The parameter, 0 < β < 1, denotes the value of independence. Individuals who value independence highly receive less utility from waged labour and thus possess lower βs. The second term, δ T−t f(τ t ), represents the well-being that the individual receives from leisure, which is negatively related to the number of work hours. The final term in Eq. (1), λ t v(h t , ϕ t , x t ), represents the discounted income from entrepreneurship at time t. Here, v captures the idea that entrepreneurial income is positively influenced by the number of hours an individual invests into the business (h t ), the individual’s wealth (ϕ t ) and exogenous risks resulting from macroeconomic conditions that are beyond the individual’s control, x t . The discount parameter, 0 < λ < 1, accounts for the idea that, unlike waged employment, entrepreneurial labour generates income with some delay and it is thus collected over future periods. Furthermore, since λ varies with age (t), it also incorporates the opportunity cost of time.

Finally, LM assume that individuals possess an exponential utility function \( U(W_{t} ) = - e^{{ - \alpha_{t} W_{t} }} \), where α t > 0 captures the individual’s risk propensity at age t, which decreases with age as individuals accumulate experience, confidence and know-how.

2.2 Sensitivity of optimal time allocations to heterogeneous entrepreneurial preferences

While the LM model provides a useful first step in understanding the relationship between age and entrepreneurship, we believe this relationship to be significantly more nuanced and to be dependent on the entrepreneurial preferences of the individual. As mentioned in the introduction, these nuances are important since they may have significant implications for the level of entrepreneurial activity especially in developed countries where the age distribution of the population is becoming increasingly skewed towards older cohorts.

Leveraging Singh and DeNoble’s (2003) taxonomy of early retirees as entrepreneurs, we identify three groups of mature individuals who exhibit different entrepreneurial preferences, namely, owner-managers, self-employers and reluctant entrepreneurs.Footnote 2 While somewhat crude, our typology of entrepreneurial preferences is very useful for isolating distinctive characteristics that make some individuals behave differently than others. Furthermore, our typology has the heuristic merits of simplicity, operationalisability with generic international data sets and clear policy implications. With respect to the LM model, while the individual maximisation problem and the representative utility function remain the same across all entrepreneurial typologies, the values of the three key parameters that influence entrepreneurial behaviour should change significantly between alternative entrepreneurial preferences. The three key parameters in Eq. (1) are the subjectively perceived discount rate attached to the potential payoff from entrepreneurial activity (λ), the individual’s risk propensity (α) and the value individuals attach to independence (β).

2.2.1 Owner-managers

Owner-managers are individuals whose enterprising ambitions extend beyond employing themselves, to owning and running a business and hiring others. Owner-managers tend to attach a high value to independence (β) (Croson and Minniti 2012) and exhibit comparatively higher levels of risk propensity (α) (Thurik et al. 2011). Since risk propensity is also assumed to increase with age, these parameters suggest that, ceteris paribus, enterprising activity in this preference group should increase with age. However, since owning and managing a business requires a significant time commitment, the acceptance of deferred gratifications and higher risks, the discount rate owner-managers apply to entrepreneurial income (λ) increases over time.

This trade-off implies that there exists a critical time point, \( t^{\ast} \), after which the optimal number of hours owner-managers allocate to entrepreneurship decreases. That is, owner-managers who have passed \( t^{\ast} \) are less likely to allocate working hours to entrepreneurship because for them, time is a scarce resource, the present value of future streams of income declines quickly and waged labour becomes a more desirable choice. Against this backdrop, we expect that the effect of ageing in the case of owner-managers will follow the usual inverse U-shaped curve.

2.2.2 Self-employers

Self-employers are individuals for whom self-employment is a desired employment status, but who seek to employ themselves instead of investing in the business and hiring employees. Compared to owner-managers, these individuals are less likely to pursue growth-oriented strategies and more likely to seek non-pecuniary benefits, such as flexibility and autonomy (Kelley et al. 2010). Self-employers are interested in maintaining a lifestyle and attach a comparatively high value to independence (β) (Croson and Minniti 2012). They are also inclined to reduce exposure to risk. Thus, the risk propensity (α) of self-employers will be comparatively lower than that of owner-managers but, similarly to that of owner-managers, will increase with age as they gain more experience, skills and confidence.

Based on the risk propensity (α) and independence parameters (β) alone, the LM model predicts that, ceteris paribus, both owner-managers and self-employers will allocate more hours to entrepreneurship as they age. The distinctive difference between these two types of entrepreneurial preferences lies in the discount parameter λ. On average, just employing oneself involves a relatively lower level of uncertainty and a shorter time span between work and pay than the ones faced by owner-managers who invest in their business and hire employees (Thurik et al. 2011). In other words, given the type of entrepreneurship they seek, self-employers perceive entrepreneurial income as being a closer substitute for waged income than owners-managers do. Thus, the relative discount of future payoffs from entrepreneurship (λ) is lower for self-employers than for owner-managers. Hence, we expect the age profile of self-employers to differ from owner-managers and the number of hours devoted to entrepreneurial activity not to exhibit an inverse U-shaped curve, but to keep increasing in the later portion of individuals’ working ages.

2.2.3 Reluctant entrepreneurs

Reluctant entrepreneurs are individuals pushed into self-employment by the lack of waged employment options (Galbraith and Latham 1996; Singh and DeNoble 2003). These individuals prefer waged employment, but are willing to engage in entrepreneurial activities until waged employment becomes available. Reluctant entrepreneurs tend to choose low-risk forms of self-employment (Singh and DeNoble 2003). They attach a comparatively lower value to autonomy (β), exhibit a low propensity towards risk (α) and have a shorter investment horizon (Reynolds et al. 2005). Since the value that reluctant entrepreneurs attach to independence is considerably lower than the value attached to it by self-employers and owner managers, the general entrepreneurial propensity of reluctant entrepreneurs should be lower, resulting in a downward shift of the age curve (the parameter β is not age-dependent) compared to the other groups. This is also consistent with the intuition that reluctant entrepreneurs are entrepreneurs because of necessity and, as a result, their preferences towards entrepreneurship should be less sensitive to ageing.

Yet, ceteris paribus, the shorter time horizon of their investment implies a relatively low discount of future payoffs from entrepreneurship (λ). Since risk propensity increases with age, reluctant entrepreneurs facing unemployment should be more likely to allocate working time to entrepreneurship as they get older. Thus, based on risk propensity increasing with age and the discounting of entrepreneurial income being moderate, we would expect a mildly upward sloping age curve for this type of entrepreneurial preference. In the end, we expect the net result to be a lower and flatter age curve (compared to those of the other groups), which is slightly upward sloping.

Of course, while the three individual types described above each have distinctive preferences with respect to entrepreneurship, the extent of these differences, their relationship to age and their impact on the level of entrepreneurial activity can only be assessed empirically.

3 Data and methods

3.1 Data

The following analysis utilises individual-level data from the European Commission’s 2007 Flash Eurobarometer Survey on Entrepreneurship (European Commission 2008) data set. The analysis focuses on individuals aged 18–64 years in the EU-25 European Union countries (that is, excluding the 2007 entrants Bulgaria and Romania), Norway and Iceland. The national sample sizes in this telephone survey vary from 500 to 1,029, and the data are representative of the population aged 15 and above. Since the aim of the analysis is to examine early stage entrepreneurial activity rather than long-term business ownership, we removed respondents who have been self-employed for more than 3 years from the sample. While this choice has the potential to introduce a bias, not doing so would make it impossible to distinguish between new entrepreneurs and individuals who have been self-employed their entire life. Instead, our choice allows us to de facto analyse first-time transitions from (un) employment to self-employment making the data particularly suitable for our purpose. Our specific cutoff is consistent with existing studies showing that most failures take place within the first 3 years from inception, which is why this period is described as the early stage phase of a business (Parker 2009; Reynolds et al. 2005). Moreover, since a central assumption of the model is that the individuals under study prefer economic activity to unemployment or retirement, the analysis focuses only on those individuals who prefer either paid employment or self-employment (only 3 % of the survey respondents do not prefer either form of economic activity).

Finally, since the theoretical model analyses the distribution of work hours between waged labour and entrepreneurship, the empirical analysis excludes individuals who have never even thought of starting a business—and who would thus by definition not want to spend any time on start-up related activity. In other words, the sample comprises individuals who are either thinking about becoming self-employed, engaged in nascent activities aimed at starting a business, or who have started a (still active) business in the last 3 years. Altogether 2,566 individuals satisfy these criteria and form the sample used in the analysis. For the country-level variables, we have derived data from public databases maintained by the OECD and Eurostat.

3.2 Dependent variable

Due to the structure of the available data, we have to treat entrepreneurial activity and waged labour as mutually exclusive choices, even though the LM model allows both types of employment to occur at the same time. As a result, the binary dependent variable in the empirical model (henceforth: entrepreneurial behaviour) distinguishes between those who at the time the cross-sectional survey was conducted were engaged in entrepreneurial activity and those who were not. Since the sample excludes people who have never thought of starting a business, the individuals in the reference category are ones who consider starting a business as a potential career alternative but who have not yet taken concrete action.

The operationalisation of this variable is based on the question ‘Have you ever started a business or are you taking steps to start one?’ and on respondents who chose one of the following three response options: (1) ‘You are thinking about starting up a business’ (coded as 0 in the dummy). (2) ‘You are currently taking steps to start a new business’ (coded as 1). (3) ‘You have started or taken over a business in the last 3 years which is still active today’ (coded as 1). The latter two categories are roughly equivalent to the concepts of nascent entrepreneurs and new business owner-managers in the Global Entrepreneurship Monitor, where they form the basis for the early stage entrepreneurial activity index (Reynolds et al. 2005).

3.3 Explanatory variables

The explanatory variables in this model are age and entrepreneurial preferences. The former is measured as the respondent’s chronological age, which is included in the regression model in a quadratic specification in order to allow the effect of age to be curvilinear.

The three types of entrepreneurial preferences form an unordered categorical variable. Two questions provide the basis for the empirical distinction, after the respondents have fulfilled all the aforementioned criteria for inclusion in the sample. The first question concerns employment status preference: ‘Suppose you could choose between different kinds of jobs, which one would you prefer: being an employee or being self-employed’? (see Blanchflower et al. 2001 for a discussion of the merits and drawbacks of using this type of question). If the individual responded ‘being self-employed’, they were categorised as either owner-managers or self-employers, while those whose preference is waged employment were coded as reluctant entrepreneurs (these individuals in our sample are, after all, at least thinking about starting a business). The distinction between the self-employers and the owner-managers is based on the following question, which assumes an interest in self-employment and was thus not answered by the respondents who were categorised as reluctant entrepreneurs: ‘Would you prefer to run your own company and invest in it or rather just work for yourself’? Those who said that they prefer to run their own companies and invest in them were coded as owner-managers, while self-employers are those who just prefer to work for themselves.

3.4 Control variables

The analysis further includes a number of individual-level control variables that might influence the relationships under study. The demographic covariates are the respondent’s gender, educational level, occupational background and the existence of a self-employed parent as an entrepreneurial role model. These variables are commonly employed in empirical entrepreneurship research for control purposes. Thus, we refrain from a detailed discussion and instead refer interested readers to Parker (2009) for a general overview of econometric results concerning these variables and to van der Zwan et al. (2011) for a more comprehensive discussion of their general effects on entrepreneurial engagement in the 2007 Flash Eurobarometer Survey on Entrepreneurship. In addition to the demographic control variables, we include the perceived lack of financial support for starting a firm as a proxy for liquidity constraints (Evans and Jovanovic 1989) and the individual’s tolerance of risk as a way to account for variations in risk propensity that are not captured by the entrepreneurial preferences (Cramer et al. 2002).

We also include four country-level control variables: the unemployment benefit and pension replacement rates, the employment rate of older workers and the tax wedge. The logic behind the inclusion of these variables is that they represent specific realisations of macroeconomic conditions that influence the utility that an individual receives from entrepreneurship by affecting the wage rate (ω t ) or the level of entrepreneurial income (via the parameter x t in Eq. 1).

The unemployment benefit and pension replacement rates capture the ratio of benefits-based earnings (unemployment allowance or state pension) out of work relative to earnings while at work. Hence, the higher the replacement rate is, the higher the opportunity cost of any form of employment versus non-employment (Duval 2003). Moreover, prior research suggests that higher unemployment benefits (Parker and Robson 2004; Staber and Bögenhold 1993) and access to pensions (Fuchs 1982; Zissimopoulos and Karoly 2007) discourage self-employment compared to waged employment. Thus, if we equate benefits income with income from waged labour (ω t ) in the LM model, high benefits render the entrepreneurial option less desirable by increasing the attractiveness of its alternatives (ω t increases).

The employment rate of older workers serves as a proxy for the general appreciation of older workers in a country. That is, a high employment rate can be interpreted as a relative lack of age-based discrimination by employers, customers, financial institutions and other stakeholders relevant for salaried and self-employed older individuals. A high employment rate of older workers could also stand for a ‘push’ effect, suggesting that many older individuals are employed because of insufficient benefits and the resulting necessity to work. Since this analysis controls the effects of benefits rates, the remaining effect of this variable should stand for the positive role of older workers in the economy. Importantly, this effect may favour either entrepreneurship or waged labour. On the one hand, we could expect a positive effect on the individual’s evaluation of entrepreneurial income (x t ): if older workers are generally appreciated, they will find it easier to start and run a business and generate a satisfactory entrepreneurial income. On the other hand, the positive role of older workers in the economy may cause higher demand for older workers in the labour market, which raises the wage rate they command (ω t ) and hence the opportunity cost of entrepreneurship.

The tax wedge controls the institutional incentive for entrepreneurship. Even though extant empirical results concerning the effect of taxation on entrepreneurship are not consistent, the majority of the studies suggest that high tax rates encourage self-employment over paid employment because self-employed individuals have generally greater opportunities for tax deductions of work-related expenses and tax avoidance (Evans and Leighton 1989; Parker and Robson 2004). According to this logic, higher tax rates should increase the evaluation of the future payoff from entrepreneurship (x t ) in the LM model.

Table 1 displays the operational definitions of all variables.

3.5 Model

The data used in this analysis are hierarchically structured. The dependent variable and a number of covariates are measured at the individual level and the responses to these variables are clustered at the country level. Further, the model includes four covariates that only vary at the country level. The hierarchical structure has two important consequences for the econometric strategy adopted in this analysis. First, the clustering of individual responses in the 27 countries means that we cannot assume that the responses within a country are independent, because the entrepreneurial propensity of individuals living in the same country is subject to the same environmental influences. As a result, we need to address the Moulton problem arising from the clustered nature of the data, since it could affect the reliability of the standard error estimates (Angrist and Pischke 2009). Second, in order to examine the extent to which the effect of age on entrepreneurial behaviour is inherent, that is, not caused by environmental influences, we require information concerning the variance of this effect across the 27 countries included in the data set.

Based on these requirements, the econometric technique of our choice is multilevel regression (these models are also referred to as hierarchical linear models, variance component models, random-coefficient models and mixed effects models, cf. Hox 2010). This technique not only solves the Moulton problem of clustered data by distinguishing between the individual-level and country-level error components, it also provides information on the variance of the age effect across countries by allowing the effect of age to vary at the country level (Hox 2010).

Since the dependent variable in the analysis is binary, we estimate a random-coefficient logit model. The model has country-specific random intercepts and country-specific random coefficients for age. Thus, each country has its own intercept that is a linear function of an ‘average’ intercept and an error term. Similarly, a country’s age coefficient depends on an ‘average’ age coefficient and a country-specific error component. The principal econometric model to be estimated is given by

In Eq. (2), the variable \( y^{\ast}_{ij} \) is an unobserved continuous variable linked to the observed binary variable y ij denoting whether an individual i who lives in country j (j = 1, …, 27) is engaged in early-stage entrepreneurial activity (y ij = 1 if \( y^{\ast}_{ij} > 0 \) or whether they are merely thinking about starting a business (y ij = 0 if \( y^{\ast}_{ij} \le 0 \)). The variable x 1ij denotes age (quadratic specification), while x 2ij and x 3ij denote entrepreneurial preferences (a dummy each denoting self-employers and reluctant entrepreneurs, owner-managers being the base category). The model specification further includes an interaction between age and entrepreneurial preferences, individual-level control variables (x 4ij , …, x pij ) and country-level control variables (z 11j , …, z qj ). In order to facilitate interpretation, age (x 1ij ) is grand mean centred and the country-level variables are included as deviations from the median of the 27 countries. The residual error terms for the intercept (u j ) and the coefficient of age (v j ) measure country-specific effects that are not included in the model and thus control for unobserved heterogeneity across countries. The country-level error terms are normally distributed with zero means and variances to be estimated. Since the estimation uses the logit link function, the individual-level error component ε ij is assumed to have a logistic distribution with zero mean and variance π 2/3. Finally, while u j and v j are allowed to correlate, they are assumed to be independent from ε ij .

4 Results

4.1 Descriptive statistics

Tables 2 and 3 present the descriptive statistics for the individual-level and the country-level variables, respectively. In addition to the mean and standard deviation of age presented in Table 2, it is useful to know further descriptive statistics regarding the distribution of age within the three types of entrepreneurial preferences. The full range of ages from 18 to 64 is present in each category. The median values (first and third quartiles) for reluctant entrepreneurs, self-employers and owner-managers are 38 (29 and 48), 36 (27 and 46) and 33 (25 and 43), respectively. Hence, the subsample of respondents categorised as owner-managers is somewhat younger than the other two subsamples.

4.2 Main results

In the first stage of model estimation, we fit an intercept-only model to establish whether there is a significant amount of variance at the country-level. The estimation shows a significant variance component, suggesting that a multilevel design is required for these data. However, the intraclass correlation coefficient indicates that only 5.6 % of the variation in the model is explained by the grouping structure of the sample. Hence, the country of residence minimally affects the threshold of whether an individual only thinks about starting a business vis-à-vis engaging in actual entrepreneurial behaviour.

In the second stage, we first estimated a model with all individual-level covariates and a random intercept, and second, we added a random slope for age to the model specification. A likelihood-ratio test for the addition of the random slope indicates that the effect of age varies significantly between countries (χ 22df = 19.88; p < 0.01). Model 1 in Table 4 reports the estimations from the model including all individual-level covariates and random effects for the intercept and the slope of age. In order to examine the robustness of this model specification, we also estimated the same model with country fixed effects instead of random effects. The estimates of the individual coefficients and their standard errors are virtually identical in these two models.

Regarding age, the coefficient of the linear term in model 1 is positive and significant, whereas the coefficient of the squared term is negative and significant. This suggests that the effect of age is curvilinear and concave. Since the curve reaches its peak at the age of 53, its shape resembles that of an inverse U, which is congruent with previous research.

In order to examine the expected differences in the effect of age when the three entrepreneurial preferences are accounted for, we next added an interaction between age (mean-centred) and entrepreneurial preferences to the model specification. A likelihood-ratio test shows that the interaction improves the model fit significantly (χ 24df = 12.15; p < 0.05), suggesting that the effect of age varies significantly between the different types of entrepreneurial preferences. The full estimation results are reported as model 2 in Table 4. The Wald tests reported in Table 4 suggest that the effect of age for the self-employers differs significantly from that of the owner-managers, whereas the age effects for reluctant entrepreneurs and owner-managers have a similar shape. Figure 1 illustrates the effect of age on the predicted probability of entrepreneurial behaviour computed for the ages 18–64 at 1-year intervals, while Fig. 2 tells the same story from another angle by plotting the average marginal effect of age on entrepreneurial behaviour also for the ages 18–64 at 1-year intervals. Figure 2 includes the 95 % confidence interval for the marginal effects, which enables an interpretation of their statistical significance.

For the owner-managers, the probability curve (Fig. 1) shows the expected inverse U-shape, reaching its peak at 48 years. The marginal effect of age (Fig. 2) is positive and significant at the 1 % level (two-tailed test) from the age 18 to age 42, after which it becomes non-significant until the age 55. For the ages 56–64, the effect of age for the owner-managers is negative and significant at the 5 % level. Therefore, as expected based on the LM model, the likelihood of entrepreneurial behaviour for the owner-managers increases until a critical age, after which it decreases.

For the self-employers, the probability curve (Fig. 1) is upward sloping and concave, indicating that the likelihood of an individual taking entrepreneurial action increases as the person ages even for people in their 50 and 60s. More specifically, the marginal effects (Fig. 2) show that for the self-employers, the effect of age becomes significant only after the age 35. The effect is significant at the 5 % level for the ages 36–38 and 51–64, while it is significant at the 1 % level for individuals aged 39–50. Again, this finding concurs with the expectations drawn from the LM model.

For the reluctant entrepreneurs, the probability curve (Fig. 1) is relatively flat, suggesting that age has a marginal impact on these individuals’ decisions to engage in entrepreneurial activity. Moreover, as expected, reluctant entrepreneurs are less likely to opt for entrepreneurship at any age compared to the other two groups. The marginal effect of age is significant at the 10 % level for the 18–40 year olds, in which case it is small and positive. Also this finding is on par with the predictions based on the LM model.

At the final stage of the model estimation, following Hox (2010), we added the four country-level control variables to the equation (model 3 in Table 4). A likelihood-ratio test suggests that the addition of these variables does not improve the model fit significantly (χ 24df = 3.75; p > 0.1) and the Wald tests for the individual coefficients reported in Table 4 support this conclusion. Most importantly, the addition of the country-level covariates does not change the results of the preceding analysis.

In summary, these findings support the predictions outlined in the LM model very well. For the ageing population, our findings mean that the most probable type of enterprising activity in the 50-plus age group is employing oneself, while the other two types of entrepreneurial preferences are less likely to be turned into action.

4.3 Sensitivity analysis

4.3.1 Standard errors

In order to examine the robustness of the standard error estimates underlying the Wald tests in Table 4, we estimated model 3 as a conventional binary logit model (without variance components) with asymptotic, cluster-robust and bootstrapped (1,000 resamples) standard errors. The differences to model 3 are marginal and, if there is a small difference, the standard errors derived from the random-coefficient model provide the most conservative Wald test result. Thus, we are reasonably confident of not having underestimated the standard errors, a concern with clustered data (Angrist and Pischke 2009).

4.3.2 Influential observations

In order to examine the sensitivity of the results to potential outliers, we examined the Pearson and deviance residuals for model 3 in Table 4. The graphs of these residuals suggest the presence of three outliers. However, excluding these observations from the sample does not cause notable changes in the results. Further, we dropped countries one at a time from the sample. This exercise suggests that the model estimates do not seem to be sensitive to the inclusion of any particular country.

4.3.3 Cross-level interactions

Given that age was found to have significant slope variance, we followed Hox (2010) and examined cross-level interactions between the four country-level variables and the existing interaction between age and entrepreneurial preferences. The purpose of this exercise was to investigate whether these four covariates explain some of the cross-country variation in the effect of age. In order to facilitate interpretation, each interaction was estimated separately. Again following Hox’s (2010) recommendations, we used likelihood-ratio tests to examine whether the addition of any of these interactions improves the model fit with statistical significance. The p-values for all four likelihood-ratio tests were greater than 0.1. Thus, the cross-level interactions do not improve the fit of the model.

4.3.4 Gender differences

Since the descriptive statistics in Table 2 show notable differences in the gender distribution among the three entrepreneurial preferences, we estimated a model where an interaction between the gender dummy and the existing interaction between age and entrepreneurial preferences was added to the equation. A likelihood-ratio test comparing the extended model to the one reported as model 3 in Table 4 suggests that the addition of this further interaction does not improve the model fit significantly (χ 28df = 6.40; p > 0.1).

5 Concluding remarks

We examined how the effect of age on entrepreneurial behaviour varies across three different types of entrepreneurial preference captured in the ideal types of reluctant entrepreneurs, self-employers and owner-managers. Our results support the idea that age has an inherent effect on entrepreneurial activity. The intuition is that the opportunity cost of time increases with age and discourages older individuals from selecting forms of employment that involve risk or deferred gratifications (Lévesque and Minniti 2006). The study uncovered four principal findings.

First, the effect of age for the owner-managers resembles an inverse U-shape, which is congruent with the LM model. These individuals are engaged or planning to engage in entrepreneurial activity that involves an uncertain stream of income in the future. Hence, they face a high opportunity cost of time, which decreases the willingness to translate business ideas into action among the older members of this group. This, in turn, shows in the declining rate of enterprising activity from the late 40s onwards.

Second, the age effect in the case of self-employers, whose entrepreneurial activities tend to involve a lower level of risk and a more rapidly produced income, is significantly different from that of the owner-managers. Instead of turning negative in the middle age, the marginal effect of age on entrepreneurial behaviour for the self-employers increases with age even for people in their 60s. Again, this finding is on par with LM’s explanation. The opportunity cost of time for entrepreneurial activity involving a small risk and almost instant payoffs is close to waged work, which means that the willingness to transition into self-employment should not decrease with age. Since older individuals tend to have a better resource base for starting a business compared to younger individuals, the effect of age as a balance between opportunity and willingness to start a business is positive and increasing (van Praag and van Ophem 1995).

Third, for reluctant entrepreneurs, based on the LM model and the idea that older individuals have better resources to become self-employed even in an adverse situation, we predicted a lower, flatter and slightly upward sloping curve. In fact, our results suggest that the threshold from thinking about starting a business to actually engaging in early stage entrepreneurial activity is relatively unaffected by age for individuals whose self-employment considerations are driven by ‘push’ motives. While in many respects similar to the self-employers, reluctant entrepreneurs do not compare the benefits and costs of self-employment with those of waged work as such, but with the prospective benefits and costs of waged work weighted by the estimated probability of finding suitable employment. Their assessment is further influenced by their standard of living while out of work (benefits, savings, etc.), which determines whether and how long these individuals can afford to wait for employment opportunities to emerge (Beckmann 2005; Rupp et al. 2006). Older individuals are more likely to be able to draw upon savings and higher benefits levels than younger people and are thus more likely to be able to afford to wait for suitable opportunities to emerge in the labour market—or take advantage of early retirement options (Piekkola and Harmoinen 2006).

Fourth, even though the effect of age varies significantly between the 27 countries included in the analysis, the robustness of the effect to the inclusion of several interactions with theoretically justified institutional variables suggests that age has an inherent effect on entrepreneurial propensity, which is a basic premise in the LM model. At the same time, the significant between-country variance indicates that the effect of age on entrepreneurial behaviour is also socio-culturally embedded. Therefore, a future extension of our work could seek to examine the influence of further institutional factors in order to understand the causes behind the variation of the effect of age between countries.

Our results have important implications for policy and practice. When applied to policy, the conventional wisdom of an inverse U-shaped effect of age on entrepreneurial behaviour would assume incorrectly that those who positively aspire to become self-employed in older age would decline in numbers. Our research, on the other hand, shows that older individuals who are willing to at least consider entrepreneurship are more likely to employ themselves than their younger counterparts when self-employment is the preferred option, but rarely start more growth-oriented owner-managed businesses or turn to self-employment for want of suitable opportunities in the labour market. This finding thus concurs with other research showing that older entrepreneurs contribute less to job creation as they are less likely to hire workers and, if they do employ some, the number of their employees is lower than in firms established by younger entrepreneurs (Curran and Blackburn 2001; de Kok et al. 2010).

This somewhat negative assessment of the potential for owner-managed business formation at older ages is not especially surprising, but where policy investment choices are subject to limited ‘austerity’ budgets, it is important to have concrete evidence on where best to invest. On the other hand, assuming more socially oriented policy objectives, increasing positive awareness of entrepreneurship in the older age segments might have a positive effect on the participation of ageing individuals in social and economic life in broader terms, including but not limited to social enterprise and voluntary work, which may both generate modest economic benefits and contribute towards a better quality of life (Kautonen et al. 2008).

Furthermore, if declining traditional employment markets are to continue in developed economies, many in the older age group will increasingly need to seek self-employment. Obviously governments have an interest in encouraging this (through further flexibilisation of labour laws and through enterprise support measures, for instance), if only to mitigate against increased welfare, unemployment benefits and pension payments. For the time being, however, older individuals are not particularly keen to engage in self-employment as a last resort, as our results show a low probability of actual entrepreneurial behaviour among those who consider self-employment for want of suitable opportunities in the labour market.

Finally, when interpreting the findings of this study it is useful to keep in mind its limitations and possible future extensions. First, our identification strategy relies on differentiating between individuals in alternative inception stages of the entrepreneurial process. It is possible, however, for our sample to capture (at least to some extent) a chronological transition between these stages. Since we are interested in the relationship between age and entrepreneurial preferences at a given time, this is not a problem for our study. Nonetheless, it would be interesting to have panel data allowing us to test for some of the temporal dimensions of our argument. Unfortunately, this is not an option with our data. Access to panel data would also allow us to discriminate more finely on the basis of individuals’ previous work experience. Last, in terms of policy implications, the principal limitation of our research is its static nature: it reports on what is, and not on what will be. Our study suggests that if current economic and employment trends continue, older self-employers will likely become more prominent in the future, especially given the rise of the service economy and the outsourcing and downsizing trends (Gold and Fraser 2002; Román et al. 2011). Of course, the middle-aged of today will face different labour market choices in the future, as will those young individuals who enter middle age. Yet, we are confident that our work helps us to begin uncovering how age changes individuals’ incentives and behaviours in fundamental ways that are not context or institutions related.

Notes

Examples of research include Curran and Blackburn (2001), Kautonen et al. (2011), Sing and DeNoble (2003) and Weber and Schaper (2004). Examples of relevant policy initiatives include the Prince’s Initiative for Mature Enterprise in the United Kingdom (www.prime.org.uk), the 50 + Course as part of the Australian New Enterprise Incentive Scheme (http://www.gramets.com.au/what_is_neis.html) and the OECD-EU Project on Self-employment and Entrepreneurship in Europe in which one of the foci is senior entrepreneurship (http://www.oecd.org/document/60/0,3746,en_2649_34417_49308796_1_1_1_1,00.html).

For a discussion of the differences between entrepreneurial types comparable to our owner-managers and self-employers, see Kelley et al. (2010).

References

Angrist, J. A., & Pischke, J.-S. (2009). Mostly harmless econometrics: An empiricist’s companion. Princeton and Oxford: Princeton University Press.

Beckmann, M. (2005). Age-biased technological and organizational change: Firm-level evidence for West Germany. German Economic Association of Business Administration (GEABA) Discussion Paper No. 05–13.

Blanchflower, D. G., Oswald, A., & Stutzer, A. (2001). Latent entrepreneurship across nations. European Economic Review, 45(4–6), 680–691.

Cramer, J. S., Hartog, J., Jonker, N., & van Praag, C. M. (2002). Low risk aversion encourages the choice for entrepreneurship: An empirical test of a truism. Journal of Economic Behavior and Organization, 48(1), 29–36.

Croson, D., & Minniti, M. (2012). Slipping the surly bonds: The value of autonomy in self-employment. Journal of Economic Psychology, 33(2), 355–365.

Curran, J., & Blackburn, R. (2001). Older people and the enterprise society: Age and self-employment propensities. Work, Employment and Society, 15(4), 889–902.

de Kok, J. M. P., Ichou, A., & Verheul, I. (2010). New firm performance: Does the age of founders affect employment creation? EIM Research Report No. H201015, EIM, Zoetermeer.

Duval, R. (2003). Retirement behaviour in OECD countries: Impact of old-age pension schemes and other social transfer programmes. OECD Economic Studies, 37(2003/2), 7–50.

European Commission (2008). Flash Eurobarometer 192 Entrepreneurship, January 2007, ZA 4726. The Gallup Organization, Hungary (Producer) and GESIS, Cologne (Publisher).

Evans, D., & Jovanovic, B. (1989). An estimated model of entrepreneurial choice under liquidity constraints. Journal of Political Economy, 97(4), 808–827.

Evans, D., & Leighton, L. (1989). The determinants of changes in US self-employment, 1968–1987. Small Business Economics, 1(2), 111–119.

Fuchs, V. C. (1982). Self-employment and labor force participation of older males. Journal of Human Resources, 17(3), 339–357.

Galbraith, C. S., & Latham, D. R. (1996). Reluctant entrepreneurs: Factors of participation, satisfaction, and success. In Frontiers of Entrepreneurship Research 1996. Babson Park: Babson College.

Gold, M., & Fraser, J. (2002). Managing self-management: Successful transitions to portfolio careers. Work, Employment and Society, 16(4), 579–597.

Henley, A. (2007). Entrepreneurial aspiration and transition into self-employment: Evidence from British longitudinal data. Entrepreneurship and Regional Development, 19(3), 253–280.

Hox, J. J. (2010). Multilevel analysis: Techniques and applications. New York: Routledge.

Kautonen, T., Down, S., & South, L. (2008). Enterprise support for older entrepreneurs: The case of PRIME in the UK. International Journal of Entrepreneurial Behaviour and Research, 14(2), 85–101.

Kautonen, T., Tornikoski, E. T., & Kibler, E. (2011). Entrepreneurial intentions in the third age: The impact of perceived age norms. Small Business Economics, 37(2), 219–234.

Kelley, D., Bosma, N., & Amorós, J. E. (2010). Global entrepreneurship monitor 2010 global report. Wellesley: Babson College.

Lévesque, M., & Minniti, M. (2006). The effect of aging on entrepreneurial behavior. Journal of Business Venturing, 21(2), 177–194.

Lévesque, M., & Minniti, M. (2011). Age matters: how demographics influence aggregate entrepreneurship. Strategic Entrepreneurship Journal, 5(3), 269–284.

Parker, S. C. (2009). The economics of entrepreneurship. Cambridge: Cambridge University Press.

Parker, S. C., & Robson, M. T. (2004). Explaining international variations in self-employment: Evidence from a panel of OECD countries. Southern Economic Journal, 71(2), 287–301.

Piekkola, H., & Harmoinen, L. (2006). Time use and options for retirement in Europe. The Research Institute of the Finnish Economy, Discussion Paper No. 868, ETLA, Helsinki.

Reynolds, P. D., Bosma, N. S., Autio, E., Hunt, S., de Bono, N., Servais, I., et al. (2005). Global entrepreneurship monitor: Data collection design and implementation 1998–2003. Small Business Economics, 24(3), 205–231.

Román, C., Congregado, E., & Millán, J. M. (2011). Dependent self-employment as a way to evade employment protection legislation. Small Business Economics, 37(3), 363–392.

Rupp, D. E., Vodanovich, S. J., & Credé, M. (2006). Age bias in the workplace: The impact of ageism and causal attributions. Journal of Applied Social Psychology, 36(6), 1337–1364.

Singh, G., & DeNoble, A. (2003). Early retirees as the next generation of entrepreneurs. Entrepreneurship Theory and Practice, 23(3), 207–226.

Staber, U., & Bögenhold, D. (1993). Self-employment: A study of seventeen OECD countries. Industrial Relations Journal, 24(2), 126–137.

Thurik, R., Hartog C., Stam E., & van Stel A. (2011) Ambitious Entrepreneurship and Macro-Economic Growth. In: M. Minniti (Ed.) The Dynamics of Entrepreneurship: Evidence from GEM Data, Oxford University Press pp.11-30.

van der Zwan, P., Verheul, I., Thurik, A. R., & Grilo, I. (2011). Entrepreneurial progress: Climbing the entrepreneurial ladder in Europe and the United States. Regional Studies,. doi:10.1080/00343404.2011.598504.

van Praag, C. M., & van Ophem, H. (1995). Determinants of willingness and opportunity to start as an entrepreneur. Kyklos, 48(4), 513–540.

Weber, P., & Schaper, M. (2004). Understanding the grey entrepreneur. Journal of Enterprising Culture, 12(2), 147–164.

Zissimopoulos, J. M., & Karoly, L. A. (2007). Transitions to self-employment at older ages: The role of wealth, health, health insurance and other factors. Labour Economics, 14(2), 269–295.

Acknowledgments

This research received support from the Academy of Finland (grant numbers 135696, 140973). We thank the editor and the two anonymous reviewers for their invaluable comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kautonen, T., Down, S. & Minniti, M. Ageing and entrepreneurial preferences. Small Bus Econ 42, 579–594 (2014). https://doi.org/10.1007/s11187-013-9489-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-013-9489-5