Abstract

The populations of economically developed countries are rapidly aging. This represents a sign of demographic success but at the same time it poses several problems for these societies, among which would be an eventual loss of entrepreneurial spirit. Concomitant with the latter idea, the body of empirical literature has shown that the probability of starting a business seems to increase with age up to a threshold point (between 35 and 44 years of age) and to decrease thereafter. However, this does not automatically imply that the innovative attitude of those who opt for an entrepreneurial career in an older population is lower than that characterizing a younger population. One may, indeed, surmise that more efforts will be exerted to introduce innovations as a strategy to compensate the negative effects produced by the shrinking in labor force size and in human capital productivity. Establishing whether population aging has an impact on the innovation attitude of entrepreneurs is crucial to offering a better understanding of the ways through which aging my affect economic growth.

In the present paper, we implement a cross-country analysis aimed at answering the following research questions: are older individuals characterized by a lower probability of becoming entrepreneurs? If this turns out to be true, then are the entrepreneurs operating in older societies less or more prone to innovate?

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

In the existing body of empirical literature, it is widely accepted that entrepreneurship matters for economic growth. In particular, various studies have focused on the positive impact entrepreneurship has on GDP growth, employment, and productivity (see among others, Wong et al. 2005; Van Praag and Versloot 2007; Haltiwanger 2009; Braga et al. 2018, etc.). As sustained in the seminal contribution of Schumpeter (1934), entrepreneurs are vital to economic development because they introduce innovations into economic activity (new products, new technological and organizational ways to produce, etc.). However, it is not only the innovation introduced by new firms that drives economic development, but also the crowding out effect. This reflects Schumpeter’s ideas of “creative destruction”: new firms improve the economy, not only by introducing new goods or more efficient ways to produce, but also by forcing inefficient firms out of business so that their resources can be redeployed for better use. It follows that understanding why some people decide to become entrepreneurs and the characteristics that these individuals possess represents an important and intriguing challenge.

According to Schumpeter, the entrepreneur is a subject that can translate inventions into innovations; in other words, he/she gives a practical application to new knowledge. However, it is important to note that this new knowledge does not necessarily emanate from the very same subject who produced it; i.e., the inventor. The focus of Schumpeter’s analysis was, therefore, on the process of exploitation of new opportunities, independently from the provenance of opportunities, and the ability of an entrepreneur can be defined in this ambit as the ability to exploit new opportunities.

The body of literature on entrepreneurship has shown that entrepreneurial ability depends on a variety of innate and acquired traits, such as IQ, creativity, imagination, persistence, formal education, on-the-job experience, and risk attitude (see Parker 2009 for a review). Among the identified demographic traits, it is well known that there is a gender gap in entrepreneurial rate (see, among others, Thébaud 2010; Lindberg et al. 2014; Bӧnte and Piegeler 2013). Parker (2009) reported that the U-reverse shaped relationship between age and the probability of becoming an entrepreneur is one of the most robust findings in the empirical literature about entrepreneurship.

In particular, the body of empirical literature has shown that the probability of starting a business seems to increase with age up to a threshold point (between 35 and 44 years of age) and to decrease thereafter. Building on the theory of time allocation originally proposed by Becker (1965), Levesque and Minniti (2006) proposed a theoretical model to explain this empirical finding. In particular, they argued that since, over the lifespan, time is relatively less scarce for younger individuals than it is for older individuals, the discount rate younger individuals attach to a future stream of payments is lower than the discount rate applied by older persons and, as a result, the present value of such a stream is higher. An individual who opts for wage-labor receives income at the same time at which he/she performs his/her activity. However, an individual who opts for starting a new firm does not receive income instantaneously; rather, he or she receives a stream of future returns. Hence, younger individuals who are more likely to collect the rewards of starting a new firm are also more likely to prefer firm creation (see also Levesque and Minniti 2011). Further explanations of the non-linear relation between aging and entrepreneurship can be traced back to variations in the risk aversion levels of young and old people (Hallahan et al. 2003) or to life-cycle effects in of social capital accumulation (Glaeser et al. 2002).

When looking at aging from the macropoint of view, there is no doubt that it represents a sign of demographic success in terms of increase in life expectancy; however, it also poses several problems. For example, societies that have an aging population experience challenges related to the sustainability of the health and the pension system, have a reduced labor force and labor productivity, and, as noted more than 60 years ago by the demographer Sauvy (1948), suffer an eventual loss of entrepreneurial spirit.Footnote 1 Recently, Lamotte and Colovic (2013) found that the age distribution of a population is, indeed, related to entrepreneurial activity. More specifically, a high percentage of young people in a country positively influences nascent entrepreneurship, whereas a high share of older people has a negative influence. This presents severe challenges for advanced economies in which the population is rapidly aging.Footnote 2

Hence, entrepreneurship seems to be a young man’s game for a young population. However, this does not automatically imply that the intensity of the innovative attitude of the members of the older population who opt for an entrepreneurial career is lower than that exhibited by the younger population. Different opportunities may emerge in different societies. For instance, according to Drucker (1985), an entrepreneur is someone who can recognize the opportunity to innovate in response to changes. Among the source of changes, Drucker places a particular emphasis on the possibilities of exploiting the emersion of new needs that result from demographic change. One may surmise that more efforts will be exerted to introduce innovation as a strategy to compensate for the negative effects of the shrinkage in the size of the labor force and reduction in human capital productivity. In addition, innovation may stem from the emergence of new markets and, thus, business opportunities that result from the aging population (e.g., private assistance for old people, new technology for improving the quality of life of the elderly). Establishing whether individual and population aging have an impact on entrepreneurs’ attitudes toward innovation is crucial to offering a better understanding of the channel through which aging may affect economic growth. From the macroeconomic point of view, research efforts have been largely devoted to studying the direct effect of the size of the older population on economic growth or on total factor productivity (see Bloom et al. 2010), without considering the fact that a significant portion of the effects that aging may have on economic output will pass through the effect produced on entrepreneurship. This paper aims to fill this gap.

As preliminary evidence, in Fig. 1, we plot the GEM total early-stage entrepreneurial activity driven by opportunity (hereinafter, TEAopp) index calculated in 2013 for 69 countries against the percentage of the population that were over the age of 65.Footnote 3 The TEAopp index is based on an international survey that was carried out among members of the adult population and is calculated as the percentage of nascent (those who declared being involved in starting a business) or young entrepreneurs (those who own and manage a firm with less than 3.5 years of existence). We will provide further information about this data source in the third section, but what is important now is that GEM allows us to distinguish between two types of entrepreneur according to their declared motivations for starting a business: necessity-driven entrepreneurs and opportunity-driven entrepreneurs. Necessity-driven entrepreneurs include those who have declared being involved in a business start-up because they had no other options for work. Opportunity-driven entrepreneurs are, instead, those who have declared having been driven by a business opportunity that they have identified, as opposed to being out of work. We will consider the latter class of entrepreneurs as high-quality entrepreneurs, i.e., those who are more likely to introduce innovations into the economy. Indeed, these individuals decide to become entrepreneurs because they are pulled to that choice by the value of an opportunity rather than being pushed by the poor working alternatives that are available to them. Figure 1 highlights a clear negative relationship between opportunity-driven entrepreneurship and the percentage of the population that consists of people over the age of 65. It is noteworthy that this is only a correlation that may be driven purely by the stage of economic development. Indeed, countries that are in the factor-driven stage of development are generally characterized by a higher rate of entrepreneurship than developed countries. However, the greater part of the efforts of entrepreneurs is concentrated on the production of low value-added goods (see Porter et al. 2002). At the same time, developing countries are also characterized by a very young population, and this may be the reason behind the observed correlation. Thus, a deeper investigation is needed to confirm this relationship.

In our paper, we implement a cross-country analysis aimed at answering the following research questions: are older entrepreneurs less innovative than younger ones? Are the entrepreneurs that operate in older societies less or more prone to innovate?

The remainder of this paper is organized as follows: in the “Entrepreneurship and Aging” section, we will clarify the definition of entrepreneur used in this work and the channel through which individual and population aging may affect entrepreneurship; in the “Data and Methods” section, we will present the data and the methodology; in the “Empirical Results” section, we discuss our results; finally, in the “Conclusion” section, we present some final considerations.

Entrepreneurship and Aging

Few things in academic literature have generated so little consensus as the concepts of entrepreneur and entrepreneurial ability (Verheul et al. 2005). Contributing to this debate goes well beyond the aim of this paper; however, there is a need to clarify what we mean when we use the term entrepreneur before we progress to examine the relationship between aging and entrepreneurship.

In neoclassical models, occupational choices are based on a process of maximization by which individuals compare the expected value of different income-generating alternatives (these represent the opportunity cost of becoming an entrepreneur) and choose the one that ensures the highest lifetime utility (Lucas 1978; Jovanovic 1994; Lazear 2005, etc.). For instance, according to Lucas’s well-known model, all individuals who are endowed with a managerial ability above a given threshold decide to become entrepreneurs, while the rest of the population chose to become employees. But what is managerial ability and where does it come from? In Lucas’s context, managerial ability is an individual trait of the entrepreneur that must be combined with production factors to allow gains in productivity. According to Meyers et al. (2013), there are three main views on the source of managerial ability: that it represents an innate trait (nature), that it is an entirely acquired skill (nurture), and that it is a combination of innate ability and experience (nature and nurture). However, it can be sustained that managerial ability is only one aspect that influences entrepreneurial choice. For instance, in situations in which managerial ability is equal, the love of risk may induce individuals to evaluate more entrepreneurship opportunities than opportunities to access wages (Kihlstrom and Laffont 1979). Similarly, the presence of culturally prescribed roles may lead women to attach a low value to an entrepreneurial career (Thébaud 2010; Verheul et al. 2005); and individuals who are ambiguity averse will be discouraged from undertaking a process of business creation (Schere 1982). At the opposite, high levels of self-confidence may encourage individuals to opt for an entrepreneurial career instead of wage-earning employment because they are convinced they are better than average and that this will give them advantages in a competitive market (Camerer and Lovallo 1999; Koellinger et al. 2007, etc.). Hence, if one is willing to consider entrepreneurship in the ambit of occupational choices, he/she has to deal with the study of the individual traits that could enhance the value of firm creation and/or the perception of this value (independently from the correspondence between perception and reality) making it greater than the payoff that could be obtained on the job market. However, this approach leads to another question: where does the value of starting a new business come from?

According to Schumpeter (1934), the entrepreneur is the destroyer of the existing economic equilibria. It is well-known that neoclassical theory predicts that, in the long-run, the process of entry and exit of firms will result in the zero-profit condition. In this context, the only way to obtain profit is to exploit a new discovery (for instance, produced in hard science) to introduce innovations into the economic system. So, motivated by the pursuit of profits, the entrepreneur-innovator is the subject that destroys current equilibrium and moves the economy toward a new one. A misunderstanding of the concept of alertness (i.e., the ability to perceive unexploited opportunities) proposed by Kirzner (1973) has led to a contraposition between the Schumpeterian entrepreneur (the innovator) and the Kirzenerian entrepreneur (the pure arbitrageur). In particular, the Kirzenerian entrepreneur has been defined as someone who is aware of the presence of market imperfections; for instance, the opportunity to buy resources where or when prices are too low, recombine them, and sell the outputs where or when prices are too high. However, as Kirzner recently explained, alertness is perfectly compatible with innovation: “… [P]ure profit opportunities present themselves in a dizzying multitude of forms—all of them consisting of price differentials. Such price differentials may exist in simple single-commodity or single-resource-service contexts, in which space or knowledge barriers have permitted price discrepancies to emerge. They may exist in intertemporal markets in which today’s resource services do not accurately reflect the future strength of demand for the products being produced by these services. And, of course, price differentials (the most important for the Schumpeterian vision) may occur in contexts in which the entrepreneurs who are today buying resource services do so in order to introduce dramatically more efficient methods of production…” (Kirzner 2009, p. 150).Footnote 4

However, it should be noted that the perception that an opportunity exists is a necessary but not sufficient condition for entrepreneurship. As underlined by Shane and Venkataraman (2000), once an opportunity has been discovered,Footnote 5 the potential entrepreneur must also be able to exploit it. Furthermore, the perceived value of doing so must be higher than alternative activities (as in traditional neoclassic occupational choice model). In this work, therefore, we focus on those entrepreneurs who have been pulled to entrepreneurship by the value of the discovered opportunity and, in particular, on the subset (in the Kirzerian vision) that has led to the discovery of an opportunity to innovate. We focus on this kind of entrepreneurs because, as argued by Baumol and Strom (2007), they are vital for economic growth and, thus, studying whether aging has an impact on the innovative attitude of the entrepreneur is crucial to developing our understanding of the economic consequence of aging. To simplify the exposition, in the following, we will refer to this individual as the Kirzenerian-innovator.

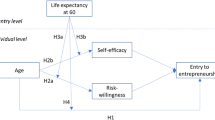

Focusing on the abovementioned U-reverse shaped relation between individual aging and probability of entering into entrepreneurship, Kautonen et al. (2015) recently furnished an explanation that has received empirical support, at least in a representative sample of the adult population of Finland. In particular, building on the theory of planned behavior (Ajzen 1991), they argued that when an individual has a positive perception of their entrepreneurial potential in terms of their age, he/she will be also more likely to turn his/her initial entrepreneurial intention into subsequent behavior.

In this context, the upward trait of the curve that links age with the likelihood of becoming an entrepreneur may be explained as follows: through formal education and work experience, young individuals accumulate resources in terms of human, social, and financial capital. This induces them to perceive their entrepreneurial potential as getting stronger and stronger. In other words, an additional year of age implies an increase in perceived entrepreneurial self-efficacy (see McGee et al. 2009). At the opposite end of the spectrum, even though older individuals (those who are above 45 years old of age) have generally more financial resources than younger ones, they are discouraged from entering into entrepreneurship mainly for two reasons: (i) they tend to have better job positions and, therefore, more to lose in comparison to younger workers (in other words, they have higher opportunity cost); (ii) they have less time to collect the rewards of an activity that will pay an uncertain payoff in the future (Levesque and Minniti 2006) and less time to recover their economic situation in the case of business failure (Wainwright and Kibler 2014).

Therefore, older individuals have more barriers to entrepreneurship than younger individuals. However, this also means that if an older individual decides to become an entrepreneur, despite the fact that all the other incentives go against this decision, the opportunity that he/she has access to should be worth the risk. This is another reason why we focus on opportunity-driven entrepreneurs as opposed to their necessity-driven counterparts (i.e., those who decide to become entrepreneurs because they have no other work options). In contrast, as younger individuals have lower opportunity costs, they are induced to become entrepreneurs even if they have discovered a relatively less valued opportunity.Footnote 6 Along this line of thinking, our hypothesis on the relationship between individual aging and the probability of being a Kirzenerian innovator may be formulated as follows:

H1: Once an individual who is aged above 45 years old of age has decided to become an entrepreneur due to the identification of an opportunity, the likelihood of observing him/her introducing an innovation should be higher than that associated with a younger opportunity-driven entrepreneur.

Switching from the individual level to the macrolevel, two concepts would be worth investigating: The extent to which population aging leads to a decline in nascent entrepreneurship and whether entrepreneurs who are living as a member of an aged population are more or less prone to innovate. The theoretical model proposed by Levesque and Minniti (2011) leaves little doubt about the first topic: given that very young and old individuals have the lowest probability of becoming an entrepreneur, older populations will be characterized by lower entrepreneurial rates. This prediction was empirically confirmed by Lamotte and Colovic (2013). However, both these studies consider nascent entrepreneurship without making a distinction between necessity- and opportunity-driven entrepreneurship.

As the population gets older, it seems reasonable to assume that the focus of the society will be increasingly oriented toward the needs of the older members of the population with the emersion of the so-called “silver markets.” Coherently with this idea, Acemoglu and Linn (2004) have shown that, in the pharmaceutical industry, the future size of the age groups significantly increases the investment in R&D in drugs that are intended for the older part of the population. This reflects the idea proposed by Drucker (1985), who asserted that demographic change is a source of innovation for those who can recognize such changes. Adopting this point of view, one could expect that even though fewer individuals become entrepreneurs in an aged society, they will have new opportunities to innovate. Obviously, as shown by Acemoglu and Linn, the emersion of the silver market also implies the decline of investments in less promising markets (in the specific case in drugs mainly consumed by the young). On the one hand, the new needs of an old population will probably drive the introduction of new products and services (see also Kohlbacher et al. 2015); on the other, we will observe fewer innovations in the sectors that are oriented toward the less promising markets in terms of both size and spending potential (e.g., the markets that consist of mainly young individuals). From a theoretical point of view, it is, therefore, difficult to establish which of these two forces will prevail. As such, an empirical investigation could shed light on this theoretical ambiguity. More formally, from an empirical point of view, an interesting question should be:

Q1: Are the entrepreneurs who are operating in aged societies more innovative than those operating in societies that are characterized by a young population?

A related empirical question stems from a study carried out by Choi and Shepherd (2004) who found that entrepreneurs are more willing to exploit the opportunity to introduce a new product when they perceive that they have an adequate knowledge of the needs of the potential customers (see also Santoro et al. 2018). Indeed, this reduces the uncertainty over the value of the discovered opportunity. Thus, assuming that the answer to Q1 is affirmative, we may surmise that older entrepreneurs are also those who better understand the needs of the members of their cohorts. Thus, older entrepreneurs will also be those who are more likely to exploit the opportunities offered by an aged society. More formally, our question should be formulated as follows:

Q2: Does individual aging and population aging exert a joint positive effect on the probability of exploiting the opportunities offered by the emersion of the silver market?

Data and Methods

The Problem of the Lack of Longitudinal Data on Entrepreneurship

To the best of our knowledge, the existing studies in which the relationship between age and probability of switching into entrepreneurship have been investigated, are based on point-of-time comparisons of the observed occupational status related to age.

This is also true for those research works that pool data over the course of more than 1 year because these studies typically include survey year dummies as a control and, thus, consist of a succession of averaged cross-sections over time. However, pooled cross-sections are an uncertain basis for generalizing results about life cycle experience because the implicit assumption is that those who are aged 30 today, for instance, will follow the same life course trajectory as those who are 70 years old today and were 30 years old 40 years ago.

This problem is mainly due to the lack of long panel data in which the occupational choices of the individuals are followed from their young age to their older age. Even when those kinds of data exist—for instance, the 1979 National Longitudinal Survey of Youth for the USA—the information is collected only for one country and, thus, does not allow the results to be generalized across different cultural and institutional settings. For instance, it is difficult to sustain that a retired worker in Sweden, where the system of public pension is particularly generous, has the same incentives for starting a business as his/her US-based peer.

The same arguments may be applied to cultural aspects. For instance, in countries where intergenerational ties are strong but the public system of child care is inadequate (for instance, Italy and other southern European countries), older individuals play a fundamental role in supporting their grandchildren and are, consequently, at least in part, excluded from the possibility of opting for an entrepreneurial career.

Furthermore, even if it is possible to compare panels surveyed in different countries in principle, they are generally not designed to investigate entrepreneurship (for instance, it is frequently impossible to distinguish a self-employed person from an entrepreneur) and the related innovative attitude.

To the best of our knowledge, the largest international survey specifically created to study entrepreneurial intentions and behaviors is the Global Entrepreneurship Monitor. The Global Entrepreneurship Monitor (GEM, hereinafter) is a research program that is managed by the GEM consortiumFootnote 7 and takes the form of an annual assessment of the national level of entrepreneurial activity. The aim of the research program is to obtain internationally comparative high-quality research data on entrepreneurial activity at the national level. As part of the research, representative samples (composed by at least 2000 individuals) are annually drawn from the adult population of every participant country. In our analysis, we will use microdata for the period 2002–2013 (the latest survey was carried out in 2016, but microdata are released with a lag of some years) for a large set of countries (in our sample 131), characterized by different levels of economic development.Footnote 8 The total number of interviewed people included in our sample is 1,322,193. Not having a panel component, the use of GEM data implies the above-depicted problem that is inherent to time-pooled cross-country studies. Therefore, even when using GEM data, it is not possible to assess the effect individual aging has on the probability of becoming an entrepreneur. However, it is possible, to test whether controlling for the probability of being selected into entrepreneurship, the probability of being a Kirzenerian innovator, is positively related to age or not (H1). This will be assessed through the bivariate probit model described in the next section. Furthermore, one could also test whether, once selected into entrepreneurship, the probability of introducing an innovation is influenced by the fact that the subject lives in an aged society (Q1). This can be readily evaluated by introducing macrolevel control for population aging in a statistical model that is designed to estimate the probability of observing someone introducing a novelty in the economic system. Indeed, GEM allows the analysis of the relationship between age and entrepreneurial innovative attitude, thanks to its inclusion of apposite questions that aim to both identify the entrepreneurs (using a cross-country harmonized definition of entrepreneur) and the self-declared degree of innovation in the product/service they offer.

In particular, a GEM early-stage entrepreneur is defined as someone who is a nascent entrepreneur or a new firm owner. More specifically, to be considered a nascent entrepreneur, the following three requisites must be satisfied: (1) the individual has been active in start-up behavior in the past 12 months; (2) the subject owns all or part of the new firm; and (3) the firm had no paid owners’ salaries and wages for more than 3 months. To be considered a New Firm Owner-Manager, one must fulfill the following requirements: (1) the individual was active in the management of a firm; (2) he/she owned all or part of the business; and (3) the firm had paid owners’ salaries and wages for more than three months but less than 42 months. Once an individual is classified as an early-stage entrepreneur, GEM allows further discrimination between an opportunity-driven entrepreneur and an out-of-necessity entrepreneur, thanks to the following question: “Are you involved in this start-up to take advantage of a business opportunity or because you have no better choices for work?”. In our analysis, we will focus on those who have disclosed that they decided to start a business because they have seen a business opportunity. The assumption under this choice is that people who decide to start a business only because they lack income-generating alternatives are less likely to introduce innovations into the economic system with respect to someone who has decided to become an entrepreneur because he/she has identified a golden opportunity. This assumption is supported by previous empirical findings produced by Acs and Varga (2005). Specifically, using the OECD patents database, they show that the number of patents application is positively and significantly related to opportunity driven entrepreneurship, while the relationship with necessity driven turns to be weak and not significant. Thus, we created a dummy named teaopp. This is equal to one if an individual is an early-stage opportunity-driven entrepreneur, and 0 otherwise. The degree of novelty in the offered good/service could be measured using the answers to the following question: “Will all, some or none of your potential customers consider this product or service new and unfamiliar?”. We created a dummy named newproduct to be used if the entrepreneur has declared that his/her product/service is new to all his/her customers. This question was introduced into the GEM questionnaire in 2002, and it is for this reason that we opted for the period 2002–2013 (GEM surveys have been carried out since 1999). The variables teaopp and newproduct will, therefore, be used as dependent variables in a bivariate probit model that is aimed at analyzing the effect of age on the probability of having introduced an innovative product. The importance of separating necessity and opportunity entrepreneurs has been recently confirmed by van der Zwan et al. (2016). In particular, they show that opportunity driven business owners have individual characteristics that are considerably different from necessity driven ones.

This empirical model will be described in the following section. Table 1 presents some descriptive statistics on our sample.Footnote 9

Methodology

In our case, we have two binary dependent variables: teaopp and newproduct. We could observe newproduct equal to one only if an individual has opted to start a business, and only if teaopp is also equal to one. Thus, we can completely observe the decision of becoming an entrepreneur or not, but we have only a censored sample for the second dependent variable. This situation leads to several problems for traditional multivariate methods (ols, probit, logit, etc.). In particular, as explained by Sartori (2003), traditional regression techniques fail to take into account the fact that when variables influence both the selection into a status (in our case, selection into entrepreneurship) and the outcome we want to study (in our case, having introduced an innovation), the estimation of two separated equations for the selection and outcome leads to inconsistent estimates because of the presence of selection bias (see Heckman 1979 for a detailed explanation). One solution to this problem is to estimate a bivariate probit model (to account for the correlation between the error terms) with an exclusion restriction; i.e., with an extra variable that can influence selection but not the outcome (Achen 1986). As highlighted by Sartori (2003), the problem with this approach is that finding this extra variable is not always an easy task. We will now present the bivariate probit model. Following that, we will discuss our exclusion restriction.

Switching to the equations of our bivariate model, we have three types of observations (not entrepreneurs, non-innovative entrepreneur, Kirzerian-innovator) in a sample with the following probabilities:

In Eq. 1 (which represents the probability of not being an entrepreneur), age represents a set of dummy variables that capture the age category of the ith individual (18–29, 30–39, 40–49, 50–59, > 59), Popaging is the percentage of over 65 in the country of residence of the ith individual, and age*Popageing is an interaction term that is aimed to test our Q2. In particular, as explained by Hall and Sammons (2013), the inclusion of a statistical interaction is the most appropriated way to test whether two variables have a joint effect on a third variable. X represents a set of other individual controls (gender, formal education, etc.) and Z represents a set of country-level controls that are designed to cope with the problem depicted in the first section, consisting of a possible confusion between the effect of population aging and the effect of economic development (the controls are the log of the GDP per capita, the GDP per capita growth rate, the percentage of the workforce occupied in the primary sector). Ф(.) is standard normal density. To simplify notation, let us denote the matrix of regressor with V1β1 and the associated vector coefficients used for explaining teaopp.

Ф2 in Eq. 2 is the bivariate normal distribution and V2β2 are the set of explicative variables of the innovative behavior and the associated coefficients, respectively. ρ is the correlation coefficient between the error terms of the two probit equations for teaopp and newproduct. Equation 2 aims to capture the selection into non-innovative entrepreneurship, and it is obtained by inverting Eq. 1 and subtracting the joint probability of being an entrepreneur and an innovator. Finally, Eq. 3 estimates the probability of being a Kirzerian-innovator. Obviously, if ρ turns out to be equal to 0, there is no need to estimate a bivariate model, but the two binary models can be separately analyzed with two distinct probit models. As suggested by Achen (1986), to allow identification, at least one of the variables included in the selection equation should not be in the outcome equation; i.e., we need a variable that affects selection into entrepreneurship, but not his/her innovative behavior, so that V2 ≠ V1 in at least one element. In our case, we identified a question in the GEM survey, in which the individuals are asked whether they personally knew someone who had started a business in the 2 years preceding the survey (the variable is called knowent). According to Koellinger et al. (2007), knowing other entrepreneurs might reduce the ambiguity of the entrepreneurial process and, thus, have a positive influence on start-up. Our assumption is that knowing someone who has decided to start a business may provide information that would help to reduce uncertainty and ambiguity in the initial phase of the start-up and, therefore, may positively influence an individual’s decision to become an entrepreneur. However, discovering an opportunity to introduce an innovation depends on individual innate or acquired traits rather than on simply knowing another person who has decided to become an entrepreneur. This assumption has been shown to hold by Koellinger (2008). In particular, using GEM data for the period of 2002–2004, he found that the variable knowent is not a significant determinant of the probability of being an innovative entrepreneur when one controls for the possible effects of other individual characteristics and of an important perceptual variable such as the perception of having sufficient skills and abilities to start a business. Also, in our analysis, we use the latter self-evaluation of ability as one of the determinants of entrepreneurial choice (this variable is named suskill).

Summing up, our model can answer the following question: controlling for the fact that an individual i of age X has entered into entrepreneurship, what is the effect of his/her age (controlling also for the effect of other possible explanatory variables) on the probability of observing that the product/service that he/she has introduced into the market is innovative?

Empirical Results

Table 2 reports the results of our estimation whereby in column I is shown the selection equation; i.e., teaopp is the dependent variable (Eq. 1 of the previous section). In column II, the outcome equation is shown whereby the dependent variable is newproduct (Eq. 3 in the previous section). Column III shows the marginal effect of each significant predictor on the conditional probability of having introduced an innovation given the probability of being an opportunity-driven entrepreneur (i.e., on Φ2(V1β1, V2β2, ρ)/Φ(V1β1)). Note that, at the bottom of the table, we reported the result of the test H0:ρ = 0 vs H1:≠ ρ ≠ 0. The null hypothesis of independence of the equations is strongly rejected, thus suggesting that our biprobit model is more indicative than estimating two separate probit models. In column IV, we replicated the analysis reported in column II, but the selection equation includes all types of entrepreneur, regardless of their motivations (opportunity or necessity). Finally, in column V, we use a more comprehensive definition of innovator. In particular, we consider an entrepreneur as innovator whereby either he/she has introduced a product/service that is new to all of his/her customers (as in column II), or he/she used a technology that has less than 1 year of existence (henceforth, we will refer to this variable as newtec). The latter variable is obtained from the following GEM question: “Have the technologies or procedures required for this product or service been available for (1) less than one year, (2) between one to five years, (3) longer than five years?” The latter question was only introduced into the GEM questionnaire in 2005. This forces our sample into the period of 2005–2013, and it explains why we observe the drop in the number of observations in column V.Footnote 10

Our results are in agreement with the previous findings in the body of empirical literature (see Levesque and Minniti 2006 for a review) about the non-linear effect of age on the probability of becoming an entrepreneur (column I). With respect to the reference category (those who are between 29 and 39 years old of age), all of the other age classes have a lower probability of being an early-stage entrepreneur, with the strongest negative effect being estimated for the oldest class. Furthermore, being in a country that is characterized by a large percentage of people over the age of 65 exerts a further discouraging effect on entrepreneurship. Note that the latter result is in line with the theoretical prediction proposed by Levesque and Minniti 2011. Looking at the interaction terms, for older individuals (those who are above 59 years of age), living in an old population has an additional discouraging effect while being in an aged society seems to yield weaker effects for those who are between 40 and 49 years of age. The interaction between the oldest age category/the category 40–49 and the percentage of over 65-year-olds in the country is indeed negative/positive and strongly significant. Thus, older individuals are less likely to switch to entrepreneurial activity, and this effect is magnified when people are living in an aged (and probably less dynamic) society.

Now focusing on the results of the model reported in column II and column IV, we find instead that the oldest individuals are more likely to have introduced a new product or service, thus confirming our H1. It is noteworthy that when the use of new technology is considered (column V), we are not able to observe an age dividend in the probability of being innovative; i.e., older individuals are as innovative as those individuals in the reference category. In this case, the youngest age class seems to be that characterized by a higher probability of being innovative. However, it must be noted that studies exist (e.g., Ellis and Allaire 1999; Tacken et al. 2005) that demonstrate that older adults exhibit less comfort in using technology and less confidence in their ability to use these systems successfully. Hence, it is likely that when we extend our definition of innovativeness to include the use of new technology, we are also capturing the discomfort aged individuals may experience due to their lack of familiarity with new technologies. Therefore, our results suggest that older entrepreneurs are more likely to introduce new products/services. However, this advantage disappears if we extend the definition of innovation to the introduction of new technologies. The latter type of innovative behavior seems, indeed, to be a prerogative of the youngest age classes.

Another interesting result is that, once we control for the probability of being selected into entrepreneurship, living in an aged society is not an obstacle to innovative behavior. As outlined above, one possible explanation for this is that, since the exigencies of an older population are different to those of a younger population, new possibilities and markets are emerging, and this opens space for the introduction of new products or services. Thus, the answer to our Q1 is affirmative. This interpretation is concomitant with the fact that in column V, the positive effect of Popageing seems less strong than in other columns, thus indicating that it is especially exerted on the introduction of innovative products rather than on the use of the most modern technologic tools.

Looking at the interaction terms in column II, we can see that coefficients are not statistically significant, thus excluding the possibility that individual age and population aging have a joint positive effect on the probability of exploiting an opportunity to innovate (Q2).

We now discuss the results, relative to other control variables. Having reasonable results for these variables is, indeed, a sign of an adequate model specification. An interesting result is associated with education. Econometric studies have generated contrasting findings that have not clarified the role of education on entrepreneurial selection (see van der Sluis et al. 2008, for a discussion). In all of the specifications, our results support the view that education plays a positive role, both on entrepreneurial selection and on the probability of seeing an entrepreneur introducing an innovation. In particular, an entrepreneur who graduated from university has 1.8% more probability of having introduced an innovation than an entrepreneur with only a secondary education. This finding is coherent with that obtained (using a completely different source of data) by Marvel and Lumpkin (2007). In particular, they concluded that a formal education is even more important than market experience in determining the propensity to introduce radical innovations. Perhaps the contrasting findings in the previous literature are due to the impossibility of separating necessity- and opportunity-driven entrepreneurs. It is reasonable to surmise that those with a lower level of education are also those that are more likely to be unemployed and, therefore, are pushed toward entrepreneurship out of necessity. Thus, if the researcher is unable to distinguish between entrepreneurial types, then it is likely that the coefficients associated with lower levels of education will be upward biased, because they are, at least in part, catching the “refugee” effect of entrepreneurship. In accordance with the previous literature, females are less likely to become entrepreneurs (see Thebàud, 2010 for a discussion). However, we do not observe a gender gap in the probability of having introduced an innovation. Therefore, our findings suggest that once women become entrepreneurs, they are just as innovative as men. Focusing on the two perceptual variables included in our model, i.e., knowent and suskill, we have confirmed the findings obtained by Koellinger et al. (2007) that both variables favor the choice of becoming an entrepreneur. However, suskill is not significant in determining the probability of having introduced a product innovation. Moreover, suskill is negatively correlated with the probability of observing both a product innovation and a technology innovation (see column V). Following Koellinger et al., the latter negative sign may be due to a problem of over-confidence characterizing those who choose to become entrepreneurs. Indeed, in their analysis, they show that, similar to our empirical exercise, the variable suskill is positively related to the probability of starting up a business; however, at the same time, it is negatively correlated with the probability of business survivorship, thus indicating that entrepreneurs have a tendency to overestimate their own abilities. Considering country-level controls, it seems highly reasonable that the higher the level of economic development (as captured by the GDP per capita and the percentage of individuals in the primary sector), the higher the probability of being an opportunity-driven entrepreneur. Higher economic development reflects higher demand for goods and services and this, in turn, implies more opportunities to start new businesses. High GDP per capita growth leads to higher a probability of having introduced an innovation. This finding is concomitant with that obtained by Lucchese and Pianta (2012). Specifically, using data from 21 manufacturing sectors, they found that faster economic growth is sustained by efforts to develop new products.

Conclusion

The rapid rate of population aging that is characterizing many high-income countries in the contemporary world is a source of great concern for future well-being given its negative consequences on labor supply, health and social support systems, and national saving rates (Bloom et al. 2015). Despite the existence of robust empirical findings that demonstrate age is an important explicative variable in the choice of becoming an entrepreneur, the analysis of the possible effects produced by both the process of individual aging and of living in an aged country on the innovative behavior of the entrepreneurs has been surprisingly neglected. This neglect is even more surprising if one considers that entrepreneurship is commonly considered an engine of economic growth. Establishing whether aging has detrimental effects also for entrepreneurship and innovation is, at least in our opinion, fundamental to better assessing its consequences and understanding how these could be counteracted. To the best of our knowledge, this paper is the first that aims to fill this gap.

To this end, in the current paper, we used GEM data for the period of 2002–2013 to analyze the relationship between aging and entrepreneurial innovative attitude. On the one hand, concomitant with the previous empirical literature, we found a non-linear (reverse U-shaped) relationship between age and the probability of starting a business. Our results suggest that the probability of being involved in a start-up process increases with age until the thirties and decreases after the forties. On the other hand, once this lower probability of becoming an entrepreneur is taken into account, older individuals are not less likely to innovate than younger individuals. This may seem surprising since common sense suggests that the youngest members of the population should really also be the most dynamic and innovative. Perhaps even one of the most innovative entrepreneurs of the twenty-first century, Mark Zuckerberg, was influenced by this conception when in his speech for Stanford students in 2007 stated: “I want to stress the importance of being young and technical. Young people are just smarter.”

Contrary to these beliefs, in this paper, we argued that older individuals are characterized by higher barriers to entrepreneurship both in terms of opportunity costs (they tend to have more to lose in the case of business failure) and of time to collect the rewards (Levesque and Minniti 2006); thus, they are induced to start a business only when they have discovered a golden opportunity to innovate. Hence, age does not seem to be an obstacle when the opportunity is perceived to be worth the risk. In this paper, we show that being young seem to be neither a necessary nor a sufficient condition for being innovative. For instance, Santoro et al. (2018) show that in a sample of SMEs of Piedmont (Italy), the introduction of new products and services stems mainly from internal sources and from the knowledge of market. Hence, the experience of a mature entrepreneur could be of help in this innovative process.

We believe that previous empirical papers that highlight the negative effect of individual aging on entrepreneurship do not take into account the distinction between necessity and opportunity driven entrepreneurship (van der Zwan et al. 2016).

Furthermore, on the one hand, we find that the older the population, the lower the entrepreneurship rate, but on the other, that entrepreneurs who are members of older populations also seem to be more innovative than those from younger ones and this effect is not due to the different level of economic development of their respective countries since our analyses take into account these economic differences. The latter finding supports the idea originally proposed by Drucker (1985) who considered demographic change to be an important source of innovation for those who can recognize that things are changing.

Our findings imply that a rapidly aging country, as observed in countries such as Italy, Japan, and Germany, should experience an inevitable drop in the entrepreneurship rate. The good news is that older individuals do not seem to lose innovative capacity and, therefore, sustaining old-age entrepreneurship may represent a policy to counterbalance the negative effect of population aging. Another useful policy instrument seems to be formal education. Indeed, we find that individuals who have a degree tend to be more innovative than individuals who completed their education at a lower level. The previous contrasting findings obtained in empirical literature may depend, also in this case, on the confusion between necessity-driven and opportunity-driven entrepreneurs. Indeed, given that, for the former, the choice of becoming an entrepreneur is mainly driven by the low value (or the absence) of working possibilities, we may expect a negative correlation between progressing to a high level of education and being without alternatives. At the opposite end of the spectrum, education may spur the perception of opportunities by improving cognitive ability (Parker 2006; Levie and Autio 2008; Braga et al. 2018). Without a distinction between these two types of entrepreneur, we confound the former negative effect with the positive one, and this may lead to inconclusive results.

Obviously, this work has some limits. One stems from the fact that we are using a self-evaluated measure of product/service innovativeness. As such, if individuals are affected by the so-called self-serving bias in their evaluation, i.e., the tendency to consider themselves to be better than average (see Badcock and Loewenstein 1997), they will tend to exaggerate the degree of innovation of their products. We believe that there are no reasons to believe that this kind of biased perception is specific to any particular age group, so the probability of observing someone declaring that his/her product is innovative when, in reality, it is simply an imitative one, should not depend on age.

Finally, another note of caution in interpreting our results as a definitive evidence in favor of the idea that the process of population aging will not have a detrimental effect on innovativeness is needed. We are far from reaching a full understanding of the factors that underpin entrepreneurial innovativeness (Koellinger 2008), both theoretically and empirically. Perhaps, even a universally accepted definition of both innovation and entrepreneur does not exist. With this in mind, it is difficult to sustain, especially in a cross-sectional context, that an analysis has not left out some important entrepreneurial traits which, in turn, may be correlated with age (for instance, Almund et al. 2011 show that personality traits tend to be more flexible than cognitive traits during lifecycle). This should, in fact, produce a bias of unknown sign on the coefficient associated with the demographic variable. For these reasons, this paper highlights a surprising and, to some extent, counterintuitive finding that will need further research efforts (and perhaps panel data) to confirm.

Notes

In particular, Sauvy (1948) observed that “In countries suffering from aging, the spirit of enterprise, and hence the willingness to accept risks without which capitalism cannot function, gradually atrophies and is replaced by a new feeling: the desire for security” (p.118).

To give an idea of the magnitude of this phenomenon, the World population prospects (2017) elaborated by the population division of the United Nations report that in high income countries (i.e., those countries with GDP per capita greater than 12,000$) the old-age dependency ratio (i.e., ratio of population aged 65+ per 100 population 15–64) will pass from the 25.7 registered in 2015 to the 46.3 in 2050. This means that in 2050 for every two individuals in the work-force we will have an over 65, presumably out of it. The previsions could be consulted at https://esa.un.org/unpd/wpp/

The acronym GEM stands for Global Entrepreneurship Monitor; it is an international survey realized by the GEM consortium to investigate entrepreneurship across a wide set of countries.

We will not focus on the discussion of the origin of these opportunities. The interested reader is referred to Shane (2000).

For opportunities, they intend “ … [S]ituations in which new goods, services, raw materials, and organizing processes can be introduced and sold at greater than their cost of production .” (Shane and Venkataraman 2000, p.220). The Kirzerian definition is wider including entrepreneurs that could be both innovator and non-innovator. It must be noted that in a recent contribution, Davidsson (2015) has criticized the concept of opportunity sustaining that is should be reviewed to better drive theoretical and empirical analysis. It is not an aim of this paper to enter in this discussion

Interestingly, Jones (2010), analyzing the time evolution of the characteristics of those who have introduced great innovations both in the academic sector and in business sector, found that these are less and less coming from the young.

For more details, see http://www.gemconsortium.org/. See also Braga et al. (2018) for a brief description of this data source.

Not all countries are present in each wave. Detailed information on the combination of country and year are available upon request to the corresponding author. Alternatively, this information may be obtained from Global Monitor Entrepreneurship Report written each year by the GEM consortium to illustrate the main results of the survey.

Please note that with the exception of age, the other statistic presented in Table 1 are sample proportions. See also https://www.gemconsortium.org/about/wiki for information about sampling strategy.

We were unable to also estimate a model a biprobit model for newtec because of a problem with convergence in the algorithm for the optimization. In all the models that we present, both country and year dummies are included. The associated results are available upon request to the corresponding author.

References

Acemoglu, D., & Linn, J. (2004). Market size in innovation: theory and evidence from the pharmaceutical industry. The Quarterly Journal of Economics, 119(3), 1049–1090.

Achen, C. H. (1986). The statistical analysis of quasi-experiments. Berkeley: University of California Press.

Acs, Z. J., & Varga, A. (2005). Entrepreneurship, agglomeration and technological change. Small Business Economics, 24, 323–334.

Ajzen, I. (1991). The theory of planned behaviour. Organizational Behavior and Human Decision Processes, 50(2), 179–211.

Almund, M., Duckworth, A. L., Heckman, J., & Kautz, T. (2011). Personality psychology and economics, Institute for the study of Labor (IZA), Discussion paper No. 5500. Downloadable at http://ftp.iza.org/dp5500.pdf. Accessed 24 June 2019.

Badcock, L., & Loewenstein, G. (1997). Explaining bargaining impasse: the role of self-serving bias. Journal of Economic Perspectives, 11(1), 109–126.

Baumol, W. J., & Strom, R. J. (2007). Entrepreneurship and economic growth. Strategic Entrepreneurship Journal, 1(3–4), 233–237.

Becker, G. S. (1965). A theory of the allocation of time. The Economic Journal, 75(299), 493–512.

Bloom, D. E., Canning, D., & Fink, G. (2010). Implications of population ageing for economic growth. Oxford Review of Economic Policy, 26(4), 583–612.

Bloom, D. E., Canning, D., & Lubet, A. (2015). Global population aging: facts, challenges, solutions & perspectives. Daedalus, 144(2), 80–92.

Bӧnte, W., & Piegeler, M. (2013). Gender gap in latent and nascent entrepreneurship: driven by competitiveness. Small Business Economics, 41(4), 961–987.

Braga, V., Queirós, M., Correia, A., & Braga, A. (2018). High-growth business creation and management: a multivariate quantitative approach using GEM data. Journal of the Knowledge Economy, 9(2), 424–445.

Camerer, C., & Lovallo, D. (1999). Overconfidence and excess entry: an experimental approach. American Economic Review, 89(1), 306–318.

Choi, Y. R., & Shepherd, D. A. (2004). Entrepreneurs’ decisions to exploit opportunities. Journal of Management, 30(3), 377–395.

Davidsson, P. (2015). Entrepreneurial opportunities and the entrepreneurship nexus: a re-conceptualization. Journal of Business Venturing, 30(5), 674–695.

Drucker, P. F. (1985). Innovation and entrepreneurship. New Iork: Harper.

Ellis, E. R., & Allaire, A. J. (1999). Modeling computer interest in older adults: the role of age, education, computer knowledge, and computer anxiety. Human Factors, 41(3), 345–355.

Glaeser, E. L., Laibson, D., & Sacerdote, B. (2002). An economic approach to social capital. The Economic Journal, 112(November), F437–F458.

Hall, J., & Sammons, P. (2013). Mediation, moderation, & interaction: definitions, discrimination & (some) means of testing. In T. Teo (Ed.), Handbook of quantitative methods for educational research (pp. 267–288). Rotterdam: Sense Publishers.

Hallahan, T., Faff, R., & McKenzie, M. (2003). An exploratory investigation of the relation between risk tolerance scores and demographic characteristics. Journal of Multinational Financial Market, 13(4–5), 483–502.

Haltiwanger, J. (2009). Entrepreneurship and job growth. In Z. J. Acs, D. B. Audretsch, & R. J. Strom (Eds.), Entrepreneurship, growth and public policy (pp. 119–145). Cambridge: Cambridge University Press.

Heckman, J. J. (1979). Sample selection bias as a specification error. Econometrica, 47(1), 153–161.

Jones, B. F. (2010). Age and great invention. The Review of Economics and Statistics, XCII(1), 1–14.

Jovanovic, B. (1994). Firm formation with heterogeneous management and labor skills. Small Business Economics, 6(3), 185–191.

Kautonen, T., Hatak, I., Kibler, E., & Wainwright, T. (2015). Emergence of entrepreneurial behaviour: the role of age-based self-image. Journal of Economic Psychology, 50, 41–51.

Kihlstrom, R., & Laffont, J. (1979). A general equilibrium entrepreneurial theory of firm formation based on risk aversion. Journal of Political Economy, 87(4), 719–748.

Kirzner, I. M. (1973). Competition and entrepreneurship. Chicago: University of Chicago Press.

Kirzner, I. M. (2009). The alert and creative entrepreneur: a clarification. Small Business Economics, 32(2), 145–152.

Koellinger, P. (2008). Why are some entrepreneurs more innovative than others? Small Business Economics, 31, 21–37.

Koellinger, P., Minniti, M., & Schade, C. (2007). ‘I think I can, I think I can’: overconfidence and entrepreneurial behavior. Journal of Economic Psychology, 28(4), 502–527.

Kohlbacher, F., Herstatt, C., & Levsen, N. (2015). Golden opportunities for silver innovation: how demographic changes give rise to entrepreneurial opportunities to meet the needs of older people. Technovation, 39-40(May–June), 73–82.

Lamotte, O., & Colovic, A. (2013). Do demographics influence aggregate entrepreneurship? Applied Economics Letters, 20(13), 1206–1210.

Lazear, E. P. (2005). Entrepreneurship. Journal of Labor Economics, 23(4), 649–680.

Levesque, M., & Minniti, M. (2006). The effect of aging on entrepreneurial behavior. Journal of Business Venturing, 21(5), 177–194.

Levesque, M., & Minniti, M. (2011). Age matters: how demographics influence aggregate entrepreneurship. Strategic Entrepreneurship Journal, 5, 269–284.

Levie, J., & Autio, E. (2008). A theoretical grounding and test of the GEM model. Small Business Economics, 31(3), 235–263. https://doi.org/10.1007/s11187-008-9136-8.

Lindberg, M., Lindgren, M., & Packendorff, J. (2014). Quadruple helix as a way to bridge the gender gap in entrepreneurship: the case of an innovation system project in the Baltic Sea region. Journal of the Knowledge Economy, 5(1), 94–113.

Lucas, R. E. (1978). On the size distribution of business firms. Bell Journal of Economics, 9, 508–523.

Lucchese, M., & Pianta, M. (2012). Innovation and employment in economic cycles. Comparative Economic Studies, 54(2), 341–359.

Marvel, M. R., & Lumpkin, G. T. (2007). Technology entrepreneurs’ human capital and its effects on innovation radicalness. Entrepreneurship: Theory and Practice, 31(6), 807–828.

McGee, J. E., Peterson, M., Mueller, S. L., & Sequeira, J. M. (2009). Entrepreneurial self-efficacy: refining the measure. Entrepreneurship: Theory and Practice, 33(4), 965–988.

Meyers, C. M., van Woerkom, M., & Dries, N. (2013). Talent — innate or acquired? Theoretical considerations and their implications for talent management. Human Resource Management Review, 23(4), 305–321.

Parker, S. C. (2006). Entrepreneurship, self-employment, and the labour market. In M. Casson, B. Yeung, A. Basu, & N. Wadeson (Eds.), Oxford handbook of entrepreneurship (pp. 435–460). Oxford: Oxford University Press.

Parker, S. (2009). The economics of entrepreneurship. Cambridge: Cambridge University Press.

Santoro, G., Ferraris, A., Giacosa, E., & Giovando, G. (2018). How SMEs engage in open innovation: a survey. Journal of the Knowledge Economy, 9(2), 561–574.

Sartori, A. E. (2003). An estimator for some binary-outcome selection models without exclusion restrictions. Political Analysis, 11(2), 111–138.

Sauvy, A. (1948). Social and economic consequences of the ageing of Western European populations. Population Studies, 2(1), 115–124.

Schere, J. L. (1982). Tolerance of ambiguity as a discriminating variable between entrepreneurs and managers. Academy of Management Proceedings, (1), 404–408.

Schumpeter, J. (1934). The theory of economic development. Cambridge: Harvard University Press.

Shane, S. (2000). Prior knowledge and the discovery of entrepreneurial opportunities. Organization Science, 11(4), 448–469.

Shane, S., & Venkataraman, S. (2000). The promise of entrepreneurship as a field of research. The Academy of Management, 25(1), 217–226.

van der Sluis, J., Van Praag, M., & Vijverberg, W. (2008). Education and entrepreneurship selection and performance: a review of the empirical literature. Journal of Economic Surveys, 22(5), 795–841.

Tacken, M., Marcellini, F., Mollenkopf, H., Ruoppila, I., & Szeman, Z. (2005). Use and acceptance of new technology by older people: findings of the international MOBILATE survey: ‘enhancing mobility in later life’. Gerontechnology, 3(3), 126–137.

Thébaud, S. (2010). Gender and entrepreneurship as a career choice: do self-assessments of ability matter? Social Psychology Quarterly, 73(3), 288–304.

Van Praag, M., & Versloot, P. (2007). What is the value of entrepreneurship? A review of recent research. Small Business Economics, 29(4), 351–382.

Verheul, I., Uhlaner, L., & Thurik, R. (2005). Business accomplishments, gender and entrepreneurial self-image. Journal of Business Venturing, 20(4), 483–518.

Wainwright, T., & Kibler, E. (2014). Beyond financialization: older entrepreneurship and retirement planning. Journal of Economic Geography, 14(4), 849–864.

Wong, P. K., Ho, Y. P., & Autio, E. (2005). Entrepreneurship, innovation and economic growth: evidence from GEM data. Small Business Economics, 24(3), 335–350.

van der Zwan, P., Thurik, R., Verheul, I., & Hessel, J. (2016). Factors influencing the entrepreneurial engagement of opportunity and necessity entrepreneurs. Eurasian Business Review, 6, 273–295.

Funding

The research activity carried out by Gabriele Ruiu has been in part financed by the “Fondo per il finanziamento dei dipartimenti universitari di eccellenza” (Law nr. 232/2016).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ruiu, G., Breschi, M. The Effect of Aging on the Innovative Behavior of Entrepreneurs. J Knowl Econ 10, 1784–1807 (2019). https://doi.org/10.1007/s13132-019-00612-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13132-019-00612-5