Abstract

The goal of achieving a single European market for electricity has been one of the main objectives for European countries since the “Single European Act” of 1988. The main purpose of this study is to examine whether the aim of unified electricity market has been achieved in terms of the convergence of electricity prices. β-Convergence and σ-convergence tests, are applied for 12 European Union states electricity price data through the period of 2003–2017. For this reason, along with conventional applied techniques, recently improved unit root tests are implemented for both linear and nonlinear data generating processes. The results suggest that convergence did not occur for most of the considered countries.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

1 Introduction

The goal of achieving a single European market for electricity has been one of the main objectives for European countries since the “Single European Act” of 1988. Over time various legislative measures were created by the European Union (EU) to reach this goal, for instance, Electricity Directive of 1996. This directive provides the members with the set of guidelines required to achieve a single European market for electricity. The convergence of electricity prices toward an equilibrium price may also indicate the competitiveness of electricity market.

There is ever-increasing amount of empirical literature on convergence hypothesis.Footnote 1 According to the theoretical literature, there are two kinds of convergence which can be defined as β-convergence and σ-convergence. The former relates to convergence of the series through the “catching-up” process, while the latter indicates the convergence of cross-sectional dispersion of the series (Barro and Sala-i-Martin 1995). According to Sala-i-Martin (1996: 1020), there is β-convergence if one of series tends to grow faster than others, and a group of series are converging in the sense of σ if dispersion of the series levels tends to decrease over time.

Bernard and Durlauf (1996) is the first study which uses a time series technique to analyze the convergence hypothesis. This study defines convergence as equality of long-term forecasts at a fixed time and uses the following definition; series i and j converge if the long-run forecasts of both series are equal at fixed time t:

where It represents the information set available in time. Equation (1) indicates that the convergence between the observed series does not derive if (yi, t + k − yj, t + k) does not converge to a limiting stochastic process. According to Bernard and Durlauf (1996), if (yi, t + k − yj, t + k) equals 1 in even periods and −1 in odd periods, observed series will fail to converge, even though the sample mean of the differences is equal to zero. Thus, if de-meanded series as (yi, t + k − yj, t + k) contain either a zero mean or follow stochastic pattern, then the convergence between the series will be ignored.

One of the well-known studies in this field is Bower (2002) which investigates the convergence of day-ahead electricity prices for 15 European locations by the end of 2001. It concludes that law of one price for electricity is held for observed series. Similar results are obtained by Zachmann (2005) and Robinson (2007) insisting that there is a convergence between the electricity prices of mentioned European Union countries during the observed time period. However, according to Boisseleau (2004), the level of integration of electricity prices of EU countries at the international level is low, which implies that the goal of an integrated or single electricity market has not been achieved yet.

The main purpose of this study is to examine whether the aim of unified electricity market has been achieved in terms of the convergence of electricity prices. This analysis also helps us to understand whether the structure of the electricity market is competitive. For this reason, along with conventional applied techniques, recently improved unit root tests are implemented for both linear and nonlinear data generating processes. It is well known from empirical literature that possible nonlinearities inevitably make the results drawn from a linear structure spurious (Ceylan et al. 2013). To overcome this predicament, along with conventional ADF (Dickey and Fuller 1979) unit root test procedure, we utilize recently improved Kapetanios et al. (2003) nonlinear unit root test procedure which considers the asymmetric adjustment with smooth structural changes in the data generating process.

This paper is organized in the following way. The second section provides the brief overview of the econometric methodology. The third section presents the data set and empirical analysis. The fourth section finalizes study with concluding remarks.

2 Econometric Methodology

Most of the economic time series may follow nonlinear processes. Following Granger and Teräsvirta (1993), in order to get statically significant results, it is crucial to take into account these possible nonlinearities during the data generating process. Moreover, Kapetanios et al. (2003) insist that conventional unit root tests have lower power if the observed data generating process is subject to regime changes. If any investigated time series are globally stationary but follow nonstationary pattern in one of the regimes, then the test procedures which ignore regime-dependent dynamics and nonlinearities might be biased against stationarity.

2.1 Linear Unit Root Test

Conventional Augmented Dickey Fuller technique which can be denoted as Eq. (2) is widely used in the applied literature to investigate the stochastic features of the time series. Let yt denote electricity price. The ADF test is based on the following:

Here, Δ indicates difference operator; \( {x}_t^{\prime} \) is a vector of optional exogenous repressors, which may consist of a constant or a constant and trend; ɑ, βi, δ are coefficients intended to be estimated; and finally the et is assumed as white noise. The null hypothesis of unit root is (H0 : ɑ = 0) against alternative of a stationary process; (H1 : ɑ < 0)can be tested by using the usual t-statistics for ɑ as represented below:

where \( \hat{\alpha} \) is the estimation of ɑ and \( \left(\hat{\alpha}\right) \)is the coefficient of standard error.

2.2 Nonlinear Unit Root Procedure

As it well known from empirical literature, nonlinear patterns of series may meaningfully weaken the results of conventional unit root test. Following Hasanov and Telatar (2011), one of the limitations of the ADF process is that it does not provide statistically significant results when adjustment to equilibrium is nonlinear. To overcome this issue, we employ Kapetanios et al. (2003) procedure based on the following exponential smooth transition (ESTAR) estimation model, which, unlike conventional unit root tests, allows for nonlinearities in data generating process:

where yt is the series under consideration and θ indicates the speed of transition between two regimes that correspond to extreme values of the transition function. The global stationarity of the process qt can be established by testing the null hypothesis H0 : θ = 0 against the alternative H1 : θ > 0. Since the parameter γ is not identified under the null, Kapetanios et al. (2003) substitute the transition function \( F\left(\theta, {y}_{t-1}\right)=1-\exp \left(-\theta {y}_{t-1}^2\right) \) by its first-order Taylor approximation around θ = 0, yielding the following auxiliary regression:

where et contains εt and the error term resulting from Taylor approximation (Ceylan et al. 2013). The test statistic for null hypothesis of unit root δ = 0, against the alternative one δ < 0, is obtained as below:

where \( \hat{\delta} \) is the OLS estimate of δ and s.e. (\( \hat{\delta} \)) is the standard error of \( \hat{\delta} \).Footnote 2

3 Data and Estimation Results

We use the annual electricity price data set for 12 European Union countries from 2003 to 2017 which is obtained from Eurostat Data Base and indicated in euro per kWh.

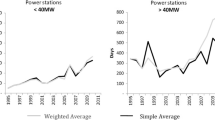

By visual inspection of the plot of data in Fig. 1, one might conclude that the price of electricity of countries converges to a common mean as time progresses.

Similarly, the plot of cross-sectional standard deviation against time in Fig. 2 reveals that there is a convergence among themselves which is σ-convergence as defined in Sala-i-Martin (1996).

The price gaps from the electricity price of Germany data are depicted in Fig. 3, and almost all these deviations approach to zero as time progresses.

After these visual inspections, we now turn to formal analysis. We first test the stationarity pattern of squared de-meaned prices and price gaps from the electricity price of Germany series ignoring possible nonlinearities in data generating process. Dickey–Fuller test is implemented to examine whether series are stationary or follow a unit root process. The ADF unit root results are presented in Table 1.

The ADF test results suggest that squared de-meaned price series for Austria, Belgium, Ireland, Portugal, and the UK are I (0), whereas the rest of the series are nonstationary. Moreover, the ADF test results indicate that there is no strong evidence of convergence between Germany and sample countries. The null of unit root for the series of price gaps from Germany is rejected for Spain, consistent with the convergence hypothesis. Since the conventional ADF test does not consider nonlinear adjustment in data generating processes, the policy implication of this test can be misleading.

To examine whether the series are linear or not, we use conventional LM-type test for d = 1, 2, 3 against general nonlinearity in the series.

As it is demonstrated in Table 2, the null hypothesis of linearity is rejected for most of observed countries. Next, we consider nonlinear unit root tests of Kapetanios et al. (2003).

Table 3 presents the result of Kapetanios et al. (2003) unit root test for the de-meaned price and the price gap from Germany. In 5 of the 12 de-meaned price series, the unit root of the null is rejected. Germany, Greece, Ireland, Italy, the Netherlands, and Spain are the countries for which we cannot reject the null hypothesis of unit root in the series. Additionally, the null hypothesis of non-convergence can be rejected in 3 of 11 price gaps from Germany series (Austria, Belgium, Denmark, France, Ireland, Italy, the Netherlands, the UK).

4 Results and Discussion

The aim of creating a single European market for electricity has been a challenging issue since the single European Act of 1988. This paper investigates the degree to which this aim has been achieved in the sense of the price convergence. Two commonly used tests of convergence are applied, namely, β-convergence and σ-convergence. We investigate the convergence hypothesis by testing the stationary of de-meaned price and gap price series of 12 European countries. This study employs not only linear time series method but also nonlinear time series approach.

Overall estimation results of both linear and nonlinear unit root test procedures are able to reject a unit root in de-meanded price and in the price gap from Germany series for several EU countries. Our results imply that, for most of the considered countries, neither β-convergence nor σ-convergence occurs. It means that the single electricity market for EU countries does not exist and internal dynamics of each country play an important role in terms of determining electricity prices in observed time period. These results correspond with the findings of Boisseleau (2004) which conclude that the aim of an integrated electricity market for European countries has not been reached yet. Liberalization process in the electricity market needs to take into account of political considerations, interest groups, technical constraints, and economic efficiency aspects. According to Boisseleau (2004) overall it is a complicated process that does not happen immediately. Moreover, another issue in Europe is that the intention is not just to develop competitiveness in any country, but it is also to integrate the different markets.

We might conclude that one must be cautious and take account of both possible structural changes and nonlinearities while examining the convergence hypothesis. Convergence among countries might be nonlinear due to some country-specific economic, technological, and political factors. However, linear unit root tests cannot capture nonlinearities and structural changes in the data if the true data generating process is nonlinear or the size of the change in the mean or slope of the trend is relatively high.

Notes

- 1.

The Solow Growth Model, which is based on diminishing marginal productivity of capital, is considered to be the origin for the convergence hypothesis. According to this model, production level of different countries with similar level of technological advancement should eventually even up, regardless of initial endowment.

- 2.

See Kapetanios et al. (2003) for more detailed discussion.

References

Barro R, Sala-i-Martin X (1995) Economic growth. McGraw-Hill, New York

Bernard AB, Durlauf SN (1996) Interpreting tests of the convergence hypothesis. J Econ 71:161–173

Bower J (2002) Seeking the single European electricity market: evidence from an empirical analysis of wholesale electricity prices. Economics working paper archive at WUSTL

Boisseleau F (2004) The role of power exchanges for the creation of a single European electricity market: market design and market regulation. Available from http://inis.iaea.org/search/search.aspx?orig_q=RN:49103806

Ceylan R, Telatar E, Telatar F (2013) Real convergence in selected OECD countries. Ege Acad Rev 13(2):209–214

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 7474(366):427–431

Granger CWJ, Teräsvirta T (1993) Modelling nonlinear economic relationships, Advanced texts in econometrics. Oxford University Press, Oxford

Hasanov M, Telatar E (2011) A re-examination of stationarity of energy consumption: evidence from new unit root tests. Energy Policy 39(12):7726–7738

Kapetanios G, Shin Y, Snell A (2003) Testing for a unit root in the nonlinear STAR framework. J Econ 112:359–379

Robinson T (2007) The convergence of electricity prices in Europe. Appl Econ Lett 14(7):473–476

Sala-i-Martin X (1996) The classical approach to convergence analysis. Econ J 106:1019–1036

Zachmann G (2005) Convergence of wholesale electricity prices in Europe? A Kalman filter approach, DIW Berlin, German Institute for Economic Research, Working paper

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this chapter

Cite this chapter

Telatar, M.E., Yaşar, N. (2020). The Convergence of Electricity Prices for European Union Countries. In: Dorsman, A., Arslan-Ayaydin, Ö., Thewissen, J. (eds) Regulations in the Energy Industry. Springer, Cham. https://doi.org/10.1007/978-3-030-32296-0_4

Download citation

DOI: https://doi.org/10.1007/978-3-030-32296-0_4

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-32295-3

Online ISBN: 978-3-030-32296-0

eBook Packages: Economics and FinanceEconomics and Finance (R0)