Abstract

This paper investigates the degree of integration among markets using wholesale electricity prices, which arises from the link between the long-run dynamics of fuel prices and electricity prices. We address the question of whether European electricity markets have experienced convergence patterns in recent years, using the stochastic definitions of convergence and common trend based on cointegration analysis. We apply a vector error correction model to a representative sample of electricity spot prices of European markets, including those of Italy, France, the Netherlands, Poland, and the integrated market of Germany and Austria. We analyze both the long- and the short-run system properties, studying their persistence profiles. The short-run analysis reveals the non-significance of adjustment coefficients of the market prices in the Netherlands and Poland. Moreover, the Netherlands Granger causes Poland and the integrated market of German and Austria, but the reverse is not true. A unidirectional Granger causality is also found for France and Germany and Austria toward Italy. Given the cointegrating equilibrium, all country-specific price dynamics converge toward the steady state, but most of the exogenous shocks have permanent effects. Forecast error variance decomposition analysis clearly highlights that orthogonalized shocks largely affect the variance of neighboring markets.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The liberalization process of electricity markets in Europe is more than two decades old. It is based on three steps (European Union Directives in 1996, 2003, and 2009), all with the common objective to push member countries to modify their national electricity market architecture to achieve market integration.Footnote 1

The goal of market integrationFootnote 2 has been pursued by promoting the unbundling of existing vertically integrated companies, competitiveness in the wholesale generation capacity, free entry of new plants, creation of independent (or state-owned) transmission system operators, increasing consumer choice, and regulating trade across international inter-connectors (Pollitt 2009). As highlighted by Green (2007), the first step represents a compromise that takes into account heterogeneity in the liberalization processes of national electricity markets, and the second step focuses on regulatory issues, such as the creation of “independent national regulatory authorities” (Cornwall 2008). Finally, the third package of directives is based on the results of an inquiry conducted by the Commission (European Commission 2006) throughout 2005–2006, showing the existence of excessive horizontal concentration in generation, excessive vertical integration between generation and transmission, and insufficient interconnection among national grids (Trillas 2010). During this relatively long period, former national monopolies have been broken up, antitrust measures have been enacted to attempt to spur competition, and mergers and restructuring of big players in generation have taken place at the international level. In the meantime, fuel prices have rolled up and down, and a major financial crisis has shocked the financial and the real markets. The aim of this study is to investigate the degree of integration among markets using wholesale electricity prices. The reason arises from the link between the long-run dynamic of fuel prices and electricity prices. It is undeniable that the restructuring of the European market has made it more likely that decisions are taken and price strategies implemented simultaneously on several markets, based on a common set of available information. Fuel price information (de Menezes et al. 2016), such as other commodity price information (Aatola et al. 2013), can be shared among different markets. This gives rise to the idea that signaling may spread quickly around markets, even if these are separated physically; i.e., even if there are no relevant physical interconnections that enable significant cross-border trade among countries, thus suggesting that efficient competition structure should prevail.

In European electricity markets, prices have been found to reflect the development of fuel prices, as fuels generally account for a large share of the costs of generation, which, in turn, account for a large share of the electricity prices within the competitive markets. Given this situation, we know that price formation in a competitive model should be influenced primarily by international fuel price fluctuations. For these reasons, we do not test either market efficiency or the success of European Union policies; i.e., that electricity markets are evolving consistently with the European Commission projects, as has been done in the prevailing empirical literature (Lu et al. 2005; Bosco et al. 2010; Castagneto-Gissey et al. 2014; Charfeddine 2014). The primary focus of this paper is to investigate whether there is some information signaling between different European markets. Information signaling refers to the mechanism used by markets to deal with information gaps, increasing integration, and price convergence. Therefore, the paper does not focus on the analysis of the structural relationship between fuel and electricity prices; it simply assumes that any rational supplier or buyer adjusts their behavior according to the available information. We examine the long-run dynamics of the electricity prices of six European markets—Austria and Germany, France, Italy, the Netherlands, and Poland—to assess their degree of price integration using Johansen’s (1995) maximum likelihood (ML) extension of the Engle and Granger (1987) cointegration framework. We use hourly prices from 2007 to 2017 to include the boom of the new renewables (wind and solar).

The paper is structured as follows. In Sect. 2, the literature and the empirical framework is outlined. Section 3 presents the data and preliminary analysis. In Sect. 4, results from dynamic simulations based on forecast variance decomposition are discussed. Some final remarks follow in the concluding Sect. 5.

2 Literature and empirical framework

In recent years, many scholars have focused on the degree of integration across the restructured spot electricity markets using as their core pillar convergence analysis of the electricity prices (e.g., Zachmann 2008; Bunn and Gianfreda 2010; Balanguer 2011; de Menezes and Houllier 2016; Grossi et al. 2018; Parisio and Pelagatti 2019). All the studies have suggested convergence and a decreasing path of price differences, especially when analyses differentiated between peak/off-peak load periods. Zachmann (2008) showed that 59% of the analyzed hourly pairs of national wholesale electricity prices converged in the period 2002–2006, especially in off-peak periods. Among the countries analyzed by Zachmann (2008), Germany seems to be the most integrated market, with high correlation with the French market. Bunn and Gianfreda (2010) used multivariate long-run dynamic analysis and showed an increasing trend of integration between July 2001 and July 2005 for the main European markets (France, Germany, Great Britain, the Netherlands, and Spain). Balanguer (2011) analyzed market prices between 2003 and 2009, highlighting the convergence between the Danish and the Swedish power markets and the price divergence among France, Germany, and Italy. de Menezes and Houllier (2016) analyzed the degree of convergence of spot electricity prices of nine European countries, applying fractional cointegration analysis in a time-varying framework going from 2000 to 2013. They found that the persistence of price convergence depends on geographical distance and grid interconnection.

Market integration has also been studied, with a focus on the common long-run dynamics of the energy markets and the relevance of the price of fuel mix, as price convergence appears to be strongly linked to the fuel mix used in electricity generation (Kalantzis and Milonas 2010; Bosco et al. 2010; Moutinho et al. 2011; Simpson and Abraham 2012; Aatola et al. 2013).

Kalantzis and Milonas (2010) assessed the degree of market integration across eight mature electricity wholesale markets in Central and Western Europe and the determinants of their price fluctuation using base-load, peak, and off-peak wholesale prices for the period 2006–2009. The results showed the convergence of electricity spot prices that suggests market integration. In particular, price convergence was stronger during peak load periods and in interconnected markets of neighboring countries. Finally, they found that oil price fluctuations negatively affected electricity market integration, as its increase had favored the production of electricity with indigenous sources, whose mix was different across countries. Bosco et al. (2010) investigated the interdependencies in power prices among six major European wholesale markets from 1999 to 2007 applying a multivariate long-run dynamic analysis. The results revealed the presence of four highly integrated central European markets (France, Germany, the Netherlands, and Austria) that share a common trend with the gas market structure, for example, but not with the oil market structure. The common marginal generation technology and the similar markets can explain the existence of common long-term dynamics in electricity prices and between electricity prices and gas prices. The same conclusions were derived in Moutinho et al. (2011), which applied cointegration analysis to the spot electricity and fuel prices, such as coal, oil, and natural gas, using the daily data recorded in the Spanish energy markets from 2002 to 2005. Even these authors found a significant cointegration relationship between electricity prices and natural gas prices as well as between electricity prices and coal prices. Simpson and Abraham (2012) assessed the decoupling and convergence processes of the electricity markets and energy sectors in several countries within the Organisation for Economic Co-operation and Development (OECD), Latin America, and Asia from 2000 to 2011. They observed that many countries showed long-term equilibrium relationships in their electricity and energy stock market sectors. The strength of cointegration between electricity and energy sectors was indicative of greater progress in electricity market liberalization, as electricity prices were more influenced by the global fossil fuel dynamic rather than by domestic factors, such as local supply and environmental regulation.

Other contributions have considered the effects of the penetration of renewable energy sources (RES) on market integration and the long-run price dynamics (Aatola et al. 2013; de Menezes et al. 2016; Gianfreda et al. 2016). Aatola et al. (2013) investigated how the European Emission Trading Scheme (EU-ETS) and carbon prices have affected the integration of the European electricity market and the convergence of electricity prices. They applied time series analysis to daily forward data divided into three sub-periods: before the implementation of the EU-ETS (2003–2004) and during the two phases of the EU-ETS (2005–2007 and 2008–2011). The results from using pairwise Granger causality, correlation, and cointegration analysis suggested that integration in electricity prices has increased over time and that the carbon price has a positive but uneven impact on the integration of prices. Opposite conclusions were reached in de Menezes et al. (2016) and Gianfreda et al. (2016), who stated that the RES penetration and the policies pushing green technology are reducing integration among European markets. de Menezes et al. (2016) investigated how the consistent RES penetration in the fuel mix has changed the long-run dynamics of spot electricity prices. They applied cointegration analysis to the spot electricity price time series (differentiated by peak and off-peak hours) of five European markets (France, Germany, Nord Pool, Great Britain, and the Netherlands) from 2005 to 2013. Results suggested that the country-specific fuel mix, market coupling, and cross-border interconnections were relevant for spot price formation and can reduce Europe’s fuel price dependency. Electricity spot prices in all markets showed time-varying behavior, during which there may be stronger associations with fuel and carbon prices. Furthermore, the strength of the electricity–fuel price nexus depended on cross-country grid interconnection: in the well-connected markets, as supply and demand could be managed more flexibly with cross-border trading, the nexus was weaker. Gianfreda et al. (2016) focused on the effects of RES penetration on the European market integration using wholesale prices from 2006 to 2014. They showed that over 2010–2014, the long-run dependence of the electricity price from fuels decreased dramatically as RES penetration increased. The lower fuel dependency resulted in lower integration among European markets: RES have inverted the traditional relationship between electricity and fuels, which drove the common dynamic and produced the convergence of EU markets. Another relevant aspect concerns the corporate analysis in terms of competitive positions. In his frequent reports, Thomas (2007, 2009) showed that, among the “seven brothers” (Thomas 2003), E.ON, Endesa, EDF, and Electrabel played a crucial role in several markets. The pervasive presence of the major companies in several markets can determine both a high concentration ratio and strategic interactions in different markets that can lead to anticompetitive behaviors. In this vein, Bunn et al. (2015) investigated the price dispersion in the British wholesale electricity market, considering several resource-based properties, such as the company size, the degree of vertical integration, and the portfolio asset management, to explain the price heterogeneity. They analyzed the half-hourly prices submitted by similar coal-fired plants owned by the four major British generation companies, highlighting the heterogeneity of their pricing behaviors: the multi-asset ownership affects the pricing process, leading companies to signal higher prices.

3 The vector error correction model

We address the question of whether European electricity markets have experienced convergence patterns in recent years. According to stochastic definitions of convergence and common trends based on the cointegration analysis of Bernard (1991), a necessary (but not sufficient) condition for convergence among countries and/or markets is that there should be n − 1 cointegrating vectors for a sample of n countries or markets. Thus, we use a multivariate specification for the system of n electricity spot price equations according to a vector autoregressive (VAR) process of order p:

where yt is an n-dimensional vector of electricity log-prices. Equation (1) can be represented in a vector error correction (VEC) form:

where \({\mathbf{ }}\varvec{\varPi}= - \left( {\varvec{I}_{\varvec{n}} - \sum\nolimits_{{\varvec{l} = 1}}^{\varvec{p}} {\varvec{A}_{\varvec{l}} } } \right)\) and \(\varvec{\varGamma}_{\varvec{l}} = - \sum\nolimits_{{\varvec{j} = \varvec{l} + {\mathbf{1}}}}^{\varvec{p}} {\varvec{A}_{\varvec{j}} \cdot \varSigma\varvec{\varepsilon}}\) is the time-invariant variance–covariance matrix associated with the vector of residuals \(\varvec{\varepsilon}_{\varvec{t}}\). VEC modeling builds on the association between the economic concept of long-run dynamics and the statistical concept of stationarity and focuses on the identification of cointegration vectors.

In the presence of cointegration, \(\varvec{\varPi}\) has reduced rank r < n and can be decomposed as \(\varvec{\varPi}=\varvec{\alpha}\cdot \varvec{\beta^{\prime}}\), where \(\varvec{\alpha}\) and \(\varvec{\beta}\) are both r × K matrices of rank r. The matrix \(\varvec{\alpha}\) contains the feedback coefficients (loadings), and matrix \(\varvec{\beta}\) contains r < n long-run relationships to which the series converge, once all the effects of transitory shocks have been absorbed (Johansen 1995). Without further restrictions, the cointegrating vectors are not identified: the parameters \(\varvec{\alpha},\;\varvec{\beta}\) are indistinguishable from the parameters \(\varvec{\alpha Q\beta Q}^{{ - \varvec{1^{\prime}}}}\) for any r × r non-singular matrix Q. Because only the rank of \(\varvec{\varPi}\) (the number of cointegrating vectors) is identified, we apply the conventional Johansen restrictions (Johansen 1995) to determine the cointegrating vectors \(\varvec{\alpha}\) and \(\varvec{\beta}\). The VEC form in Eq. (2) also nests two important special cases. If the variables in yt are I(1) but not cointegrated, \(\varvec{\varPi}\) is a null matrix, r = 0, and, in this case, it will be impossible to identify a long-run equilibrium condition among electricity prices. If all variables are I(0), \(\varvec{\varPi}\) has full rank, and, in any intermediate result with a reduced rank of matrix \(\varvec{\varPi}\), we can identify a long-run representation of the integration process between markets.

4 Data and preliminary analysis

4.1 Data description and unit root analysis

For the empirical analysis, we employ data registered in four wholesale national markets—Powernext (France), IPEX (Italy), APEX (the Netherlands), and PSE (Poland)—for hourly time series of spot electricity prices labeled, respectively, FR, IT, NET, and PL. As Germany and Austria can be considered as a unique marketFootnote 3 with no congestions observed, we use the EPEX spot market to collect the price vector (labeled “DEAU”) characterizing this fully integrated bidding.Footnote 4

All prices are expressed in EUR/MWh. These countries differ in fuel mix, as their levels of RES penetration differ consistently. Power generation mixes and their evolution through the years are depicted in Table 1, which shows the shares of each generation technology and the RES penetration levels.

Mixed fuels and nuclear power largely dominated the German power generation mix until 2011, when the German Parliament decided to phase out nuclear power generation by 2022. This decision is aimed at spurring strong growth in renewables in order to increase their share in the generation mix. The same dynamic has been followed by the Netherlands, which decreased the shares of nuclear and fossil fuels in favor of RES, whose share doubled over the period investigated.

The opposite situation is found in France, where the energy production has been almost constantly dominated by nuclear power, with a share of more than 70%. The share of electricity production from fossil fuels has been very low, and it has been further reduced by the increased use of RES.

Austria, Italy, and Poland do not use nuclear power in electricity generation. RES, whose share has been stable over the whole period, dominates the Austrian power generation mix. Remarkably, Austria always has the highest RES penetration among the markets considered, with RES covering more than 76% of power generation in 2015. Italian electricity production exhibits dramatic changes, moving from the predominant fossil share observed in 2007 (and equal to 83%) to a more RES-oriented generation, with a total share of more than 38% since 2013. In Poland, RES are gradually substituting fossil fuels, and they have doubled since 2010 reaching a share of 14%. Summarizing, a deep change is involving the European electricity markets. A general decline of both fossil fuel power and nuclear power jointly characterize the generation mix to a massive increase in renewables. European electricity systems are moving from stable and concentrated energy sources to distributed, variable, and uncertain ones. This change is a common scenario across investigated countries in regard to their size, their institutional framework, their interconnection degree, and the specific country fuel mix. RES at least double in all countries but Austria, where RES are already 75% of the generation mix, and in France, where RES increase by 40% reaching 17% of the mix. In 2017, renewables were the main source only in Austria; in Germany and Italy, the shares were 34% (fossil fuel 53%) and 36% (fossil fuel 63%), respectively, with a massive and constant growth of RES. Nevertheless, massive RES growth also involves other countries in which the renewables reach shares between 14 and 16% in 2017.

This deep change is the main challenge for the European electricity system because it is necessary to adjust it to the large and increasing share of renewables that are distributed, uncertain, and variable. More flexibility is required given that is crucial to be able to modify electricity production and/or consumption in response to variability, expected or otherwise (IEA 2011).

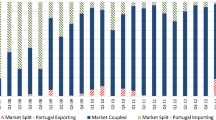

Another important aspectFootnote 5 refers to the European goal to form an interconnected electricity market using the“market coupling” tool. Market coupling aims to reduce price differences across countries by linking both control and market areas and by harmonizing different systems of electricity exchanges. Focusing on our sample, we notice that several countries are involved in market coupling agreements. Since 2006, France and the Netherlands have coupled their day-ahead markets into the Trilateral Market Coupling (Belgium was the third country). In 2010, Germany and Luxembourg joined this market coupling, while Austria became a member in 2013. In 2014, Poland also coupled its system with the Western European electricity system, and in 2015, Italy coupled its borders with France, Austria, and Slovenia. In 10 years, the number of countries involved in market coupling agreements has increased from 3 to 19, including Scandinavian, Baltic, Mediterranean, and Eastern European countries. Finally, since 2015, flow-based market coupling has been used as an advanced market coupling approach in order to facilitate the exchange of electricity flows between the markets in Central Western Europe. Among other benefits, the adoption of market coupling mechanisms is expected to be able to manage the electricity flows, pushing them from the low-price surplus areas toward the high-price deficit areas, also favoring electricity price convergence between market zones.

Waiting for an adequate and wide reshaping of the Europe electricity market,Footnote 6 the current “green energy revolution” puts heavy stress on the national electricity systems and also the existing market coupling agreements. The European electricity market is fragmented given that separate rules for wholesale and retail markets exist jointly with several policy tools with different, and sometimes not coordinated, implementations among countries. Further, networks are often inadequate both from institutional and technological point of views. First, networks are natural monopolies that tend to have a delayed response to market signals; second, they have been built for concentrated generation and distributed consumption. In the age of RES deployment, these two characteristics are both severe drawbacks for numerous national electricity markets. Frequently, renewable electricity cannot be consumed in the domestic market due to insufficient national network capacity, and, consequently, electricity flows are pushed to grids of neighboring countries, resulting in recurring and severe congestion problemsFootnote 7 that can slow integration and the convergence process across European countries. In order to analyze the convergence process, we compute the logarithm of the daily mean of the hourly daily market clearing prices recorded in the markets over the period 2007–2017. Prices refer only to working days, accounting for 2864 days for a total of 14,320 observations. This choice is due to the availability of only daily data for the price of the integrated market of Germany and Austria. Holidays (such as Christmas, New Year's Day) are instead included if having occurred in a day different from Saturday or Sunday. That makes the sample representative of holiday dynamics as well, but it may alter the weekly dynamic: as we will see later, the short-run effects run out after 18 lags, disclosing a dynamic pattern proportional to a period between 3 and 4 weeks.

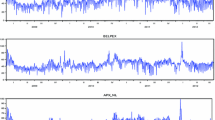

As is well-known, electricity spot prices are characterized by volatility, extreme values, and seasonality. Figures 1 and 2 depict the price dynamics of the logarithm of the daily mean of the five markets considered.

Time patterns of the daily average electricity prices in levels (2007–2017) [prices in EUR/Mwh; from January 1, 2007 to December 31, 2017 (Saturday and Sunday excluded); Obs. 2864—on October 19, 2009, the daily average in FR was higher than 500 EUR/MWh; red lines show the national average price (FR 48.80; IT 65.67; NET 48.07; PL 174.56; DEAU 50.47)] (Color figure online)

Time patterns of the logarithm of daily average electricity prices (2007–2017) (prices in EUR/Mwh; from January 1, 2007 to December 31, 2017 (Saturday and Sunday excluded); Obs. 2864—on October 19, 2009, the daily average in FR was higher than 500 EUR/MWh; red line (log price = 4.5) is the overall daily average of log prices) (Color figure online)

All price logs in levels show a drift lying around four, except for Poland, with a drift higher than five. This last deregulated market also shows higher volatility in mean price, as highlighted in Fig. 2, where the daily mean and median of prices are depicted over time. Table 2 sums up the previous graph, offering the main summary statistics for the mean prices in their levels and their logarithms.

Summary statistics confirm previous graphs: the highest average price and volatility are recorded in Poland. However, the spikiest market is France, with its maximum mean price of 612 EUR/MWh and even its volatility, according to the sample standard deviation, is one of the highest, excluding Poland. Moreover, France is the market, along with the Netherlands, that recorded the lowest average price. The measures of the skewness and kurtosis suggest, as in most power market studies, a rejection of the normality hypothesis.

The objective is to determine whether the close proximity and integration of the electricity markets results in significantly different price convergence in the long run. If so, there is evidence that electricity market integration and convergence have occurred in the European Union.

4.2 Model specification and cointegration tests

In a preliminary exercise, we test for the unit root behavior of each of the five series. Because of the spike and volatility, unit root testing for stationarity in an electricity time series can be confounded, and often depends on the time intervals for investigation. Moreover, to deal with the well-known low power of the “first-generation” unit root tests—the augmented Dickey and Fuller (1979) and the Phillips and Perron (1988) tests—we apply the Dickey–Fuller generalized least squares (DF-GLS) test of Elliot, Rothenberg and Stock (1996). In the latter case (Elliott et al. 1996), the series (both in levels and in first differences) have been transformed by a generalized least-squares regression, rather than the ordinary least squares. It has been shown that the DF-GLS test has considerably higher power and better performance in terms of small sample sizes.

The DF-GLS test allows the lag selection to be driven by the modified Akaike information criterion (MAIC) proposed by Ng and Perron (2001) that improves the procedure for choosing the truncation lag for the size of the unit root test, taking better account of the cost of under-fitting with a penalty factor that is sample-dependent. The MAIC leads to the choice of an auto-regression order equal to 18, which means the persistency is between 3 and 4 weeks, given the daily frequency of prices.

We also apply the Kwiatkowski, Phillips, Schmidt, and Shin (KPSS) test to confirm our findings. This test (Kwiatkowski et al. 1992) reverses the null hypothesis, checking if series are trend-stationary. In both cases, evidence suggests that the series in levels are I(1) at conventional nominal levels of significance, and we find evidence of stationarity in the series when we take the first difference.

In the first columns of Table 3, we test the null hypotheses that the log variables in level contain the unit root and drift by applying the DF-GLS test. They are accepted, as the statistical tests are always lower (in their absolute values) than are the critical values. The last column shows the results of the KPSS test, where the null hypothesis is reversed. The tests confirm the DF-GLS findings, as the null hypotheses are rejected for the log variables in levels where the test statistics are greater that the critical values, whereas the test statistics are always lower for the first difference log variables.

Thus, each electricity price series has a unit root (or a stochastic trend) at its univariate time series representation. The next step is to consider the multivariate representation of these series and test whether there are common stochastic trends. From an empirical point of view, given the evidence of I(1)-ness for all individual electricity spot market prices, testing for cointegration among them is the logical next step.

Long run associations can be obscured by the presence of large spikes in the data. In electricity markets, spikes are one of the most pronounced features of the price dynamics, essentially caused by the bidding strategy of players. Consequently, the first step involves smoothing the price series before assessing their long-run dynamics. Various pre-processing schemes can be used, some in which price spikes are limited (the “limit or the damped” schemes), others where they are excluded (the “similar-day” scheme). The first class of methods involves setting an upper limit on prices and substitutes the spikes with a given threshold. The second class treats the spikes as outliers and substitutes the original data with the running median, or the moving average, or the de-seasonalized, or the de-noised time series. As shown in Weron (2007), the “similar-day” scheme performs better than the “limit or the damped” schemes. In this study, smoothed values are obtained by taking the medians of the eight points around the observation (the overall span of the smoother is nine). The median smoother is nonlinear and resistant to isolated outliers, so it provides robustness to spikes in the data. Moreover, if the time series does not show a sequence of spike prices, the running median is a more robust preprocessing filter than the standard moving average. Indeed, one of the possible drawbacks of the procedure is that it does not properly work when there are many adjacent outliers. However, spikes are normally quite short-lived, and they fall back to a normal level as soon as the weather phenomenon or outage is over. As the time horizon increases and prices are aggregated in means, spikes reduce; for weekly or monthly averages, the effects of price spikes are usually neutralized. In this study, working with daily average prices makes unlikely the presence of consecutive spikes. Furthermore, the length of the span equal to nine is long enough to circumvent possible side effects of adjacent spikes.

We estimate Eq. (2) with n = 5 (DEAU, FR, IT, NET, PL), using a two-step strategy. Firstly, a pre-estimation procedure is applied to select the lag order of the VEC model (Table 4). The former MAIC criterion suggested using a number of lags equal to 18. However, we want to corroborate this fitting and pre-estimate different VAR models with a different autoregressive order.

When we shift to the multivariate model, the pre-estimation procedure confirms the MAIC results since the likelihood ratio tests highlight a multivariate model with 18 lags. That means the short-run effects run out after 3–4 weeks.

Secondly, the long-term component of the model is based on the Johansen multiple trace test procedure that determines the dimensions of the cointegration space (Table 5).

The Johansen testing procedure begins with a test for zero cointegrating equations. If the likelihood of the unconstrained model that includes the cointegrating equation is significantly different from the likelihood of the constrained model (where the cointegrating coefficients are null), we reject the null hypothesis of no cointegration. Then, the test accepts the first hypothesis that is not rejected. Each row of Table 6 shows the different trace statistics for different ranks. The null hypothesis is that the number of cointegrating equations is equal to r, against the alternative hypothesis that there are more than r cointegration relationships. The test is applied using different trend specifications and a lag equal to 18. With a restricted constant, the trace statistic is lower than is its critical value at r = 3, so we cannot reject the null hypothesis that there are three cointegrating equations stationary around a nonzero mean. Therefore, we apply a VEC with three cointegrating equations and a deterministic constant trend. Tables 6 and 7 show coefficients of the three cointegrating vectors. In the cointegrating equations, \(\varvec{\beta}\) parameters are jointly significant.

The Johansen identification scheme has placed constraints on the parameters in all three cointegrating equations. We interpret the results of all the equations as indicating the existence of a long-run equilibrium relationship between the average log price of France, Italy, and the Netherlands, and the average prices of Poland and of the integrated market of Germany and Austria. The short-run dynamics of the model are shaped by the statistically significant parameters of the \(\varvec{\alpha}\) matrix that gives useful information about how national market models move around the long-run equilibrium path. Moreover, the (absolute) values of the feedback coefficients indicate the speed of adjustment toward equilibrium. Tables 8 and 9 report the coefficient estimates.

The analysis of the elements of the loading coefficient matrix allows some interesting results to be highlighted. Transient impulses hit each country in an asymmetric way according to the countries’ different degrees of interdependency. The NET’s coefficients are jointly insignificant, meaning that the short-run dynamics of NET prices is not conditioned by changes in the other countries. The reverse situation is recorded in Italy, where all the \(\varvec{\alpha}\) coefficients are instead significant, attesting to a short-run dynamic receptive to foreign electricity price changes. Overall, the significance of the coefficients of the \(\varvec{\alpha}\) matrix means that there are spill-over effects between markets and other interesting relationships between other countries that characterized the process of convergenceFootnote 8 of the European electricity markets. Figures 3, 4, and 5 depict the predicted values of prices in first differences and in levels and the dynamics of the cointegrating equations, respectively.

The Lagrange multiplier test for autocorrelation in the residuals of a vector error correction model (VECM) is implemented. Table 10 reports the test statistics. At the 5% level, we cannot reject the null hypothesis that there is no autocorrelation in the residuals for the tested orders 1 and 2. Thus, this test suggests no strong evidence of model misspecification. Although we have already identified three cointegrating equations, assuming all variables to be I(1), from Eq. (2) we use the estimates from the previous fitted VECM to first back out the coefficient estimates of the corresponding VAR and then compute the eigenvalues of the companion matrix.

These eigenvalues give us a hint of the dynamic of the corresponding VAR (Table 11). Given five endogenous variables and three cointegrating vectors, there must be two unit moduli in the companion matrix. If any of the remaining moduli computed are too close to one, either the cointegrating equations are not stationary or there is another common trend, and the rank specified is too high.

Figure 6 plots the 90 eigenvalues of the companion matrix, with the real component on the x axis and the imaginary component on the y axis.

Besides the two roots lying at the point (1, 0), all the remaining roots lower than 0.92 support the conclusion that the predicted cointegrating equations are probably stationary, although there is no distribution theory to measure how close each root is to one (Johansen 1995). We then analyze the long-run properties of system (3), studying their persistence profiles (Pesaran and Shin 1996), to assess how long the system takes to revert to its steady-state path after being hit by a system-wide shock. The shock transmission in the electricity price in levels is revealing. We have investigated the dynamics of transmission of shocks among European markets estimating the orthogonalized impulse response functions (OIRFs), where shocks, as they are usually correlated, are transformed using the traditional Cholesky decomposition (Figs. 7, 8, 9, 10, 11).

In contrast with the OIRFs from a stationary VAR, OIRFs from a cointegrating VECM persist, as the I(1) variables modeled in a cointegrating VECM are not mean-reverting, as has already been suggested by the unit moduli in the companion matrix.Footnote 9 It is important to distinguish between transitory and permanent shocks. Graphs indicate that orthogonalized shocks to the average log price have permanent effects on the log mean price in all countries. An FR shock has a transitory effect on Italy’s market, as does a DEAU shock on Poland’s market, and a PL shock on the Netherlands’ market. Besides the IRF of NET, in all the other cases, convergence toward the steady state follows a decreasing trajectory, with adjustments from disequilibrium ending within the fifth year. The half-life of the deviation from the steady state is close to 5 months, even if it seems to be higher for Italy.Footnote 10 After defining the possible long-run equilibrium, we test the short bilateral Granger causality to check possible short-run relations among markets. The null hypothesis is that the lags of each market are jointly insignificant in conditioning the adjustments of the other markets. Table 11 shows the p values of the Chi-squared tests applied in each short-run component of the dynamics of each market. Rows refer to the short-run component, whereas columns refer to the country of the price vectors whose significance in the short-run component is tested. If the p value is lower than 0.05, we can reject the null hypothesis of no Granger causality. Looking at the first rows, where the significance of price vectors are tested on the Italian price dynamic, the integrated market of the Germany and Austria Granger causes the Italian price dynamic; however, the reverse causality is not true, and we cannot reject the null hypothesis of the non-significance of Italian electricity prices in the DEAU’s short dynamic. NET and PL prices (whose p values are 0.127 and 0.85, respectively) do not Granger-cause IT prices. The Italian and Polish price vectors are not significant for the Netherlands’ market, as their p values are 0.385 and 0.455, respectively. Looking at the last row, Poland’s market prices are Granger-caused by DEAU (we can strongly reject the null hypothesis of no significance).Footnote 11 We see a unidirectional causality between PL and NET: NET prices affect the short-run dynamics of PL, but the reverse relationship is not true. Moreover, we see a unidirectional relation between the integrated market of Germany and Austria and France, that is the FR price vector affects the DEAU electricity price dynamic (at a significance level of 0.05, we strongly reject the null hypothesis of no Granger causality), but the DEAU does not Granger-cause the FR market (the p value equals 0.857). Bidirectional Granger causalities are also found between the pairs DEAU and NET,Footnote 12 and DEAU and PL.

4.3 Robustness: oil price relevance

The identification of the cointegration space described in the previous section allows us to interpret the three long-run relations as convergence patterns among national electricity prices. Given the growing body of literature assessing the link between energy sources and electricity prices (e.g., Asche et al. 2006; Bosco et al. 2010; Kalantzis and Milonas 2010; Mjelde and Bessler 2009; Mohammadi 2009), we want to verify if the common long-run price dynamics would reflect the changes in energy source prices and the cost of generation. According to this literature, we consider an augmented version of the original model including oil Brent prices. In particular, we estimate a new VEC model, in which we control for oil prices. We test for the cointegration rank using both restricted and unrestricted constant models. We expect that the identification of the cointegration space should increase, signaling common long-term dynamics between electricity prices and oil prices. Cointegration tests for the model augmented by the oil price are shown in Table 12.

Considering the model with the drift (the Rconstant model), the test statistic suggests that we cannot reject the null hypothesis of the presence of four cointegrating vectors for both the 5% and the 1% significance levels. This new long-run relation signals that, despite the differences in the mix of generation technologies, countries are conditioned by fuel price dynamics, probably due to the common marginal generation technology.Footnote 13

5 Dynamic simulation: the role of global and regional shocks

In this section, we move from a reduced form to a structural representation of the multivariate time series model to ascertain the role of global and regional (idiosyncratic) shocks hitting the European electricity markets considered. We employ the forecast error variance decomposition (FEVD) tool, which provides information on the relative importance of the forecast error variance of each shock as a function of the simulation horizon. The reduced form and the structural residuals, ut and vt, respectively, are linked through the relationship \(\varvec{u}_{\varvec{t}} = \varvec{B} \cdot \varvec{v}_{\varvec{t}}\), where B is a nonsingular matrix (Warne 1993). Retrieving \(\varvec{v^{\prime}s}\) from \(\varvec{u^{\prime}s}\) implies the unique determination of the n2= 25 elements in B. In our identification scheme, a first set of 15 constraints arises by assuming that structural shocks are orthonormal. The choice of cointegration produces r(n − r) = 6 additional restrictions and allows us to distinguish transitory shocks (three in our case) from permanent (one) innovations. The remaining restrictions are obtained by imposing a recursive scheme in the transitory shocks matrix, in which the causal order of the variables is chosen according to the estimated adjustment coefficient size and the boundary adjacency order. Thus, the causal order is the following: Italy, France, Germany and Austria, the Netherlands, and Poland. The permanent shock is derived from the system common trend (i.e., its permanent component) and represents the global external shock that hits all markets in a symmetric way. By contrast, transient impulses hit each country in an asymmetric way according to their different degrees of interdependency. Furthermore, temporary shocks are aggregated to quantify the overall relevance of regional factors in explaining electricity price fluctuations. The percentage of the variance of each variable explained by the five shocks is reported in Table 13 over the entire simulation spans.

The main driver of IT variance is FR and DEAU market price shocks, with percentages of 8.31% and 7.56%, respectively, as its variance is conditioned by foreign prices for approximately 55%. DEAU and NET instead explain 55% of the forecast variance of the French electricity price. The DEAU price variance is conditioned particularly by Poland and the Netherlands; the variances of these last two countries have low responsiveness to foreign shocks.

6 Conclusions

In this paper, we have estimated a model to test integration and convergence among five European electricity markets. Our identification strategy allows us to verify the presence of three different long-run equilibrium conditions between the DEAU, IT, FR, and PL market prices. Long-run cointegrating equilibrium also reflects the oil price dynamic. Including countries representative of the North and East Europe has amplified the framework, highlighting new results. The short-run analysis reveals the non-significance of NET and PL adjustment coefficients, showing that these two countries are not responsive to exogenous shock. Moreover, a unidirectional Granger causality of NET and PL to DEAU and of DEAU and FR to IT has been found. Given the cointegrating equilibrium, all country-specific price dynamics converge toward the steady state, but exogenous shocks have permanent effects. Impulse response function analysis has shown that only FR has transitory effect on the Italian market, and the same is the case for DEAU on PL, and PL on NET. The speed of adjustment toward equilibrium and the degree of convergence is higher for FR. This is not surprising, given that the French electric system is the least flexible (because of its very high nuclear share). Forecast error variance decomposition analysis indicated clearly that an orthogonalized shock affects the variance of neighboring markets more than it affects the variance of non-connected markets.

Notes

The milestones of the European Union electricity market deregulation process are the following (EC 2007). In 1996, a Parliamentary agreement was reached on a market liberalization directive; in 1997, the Directive 96/92EC was enacted concerning common rules for the internal market in electricity; in 1999, the transposition period ended; in 2001, a directive was adopted on the promotion of electricity from renewable energy sources in internal electricity markets; in 2003, directive 2003/54 was adopted; 2007 saw the publication of the results of an investigation criticizing the state of competition in the electricity sector; and in April 2009, the third package of directives concerning electricity markets was enacted (2009/28).

In October 2018, there was a split between the German and Austrian market zones. Further details are provided in Sect. 4.1.

Data source is Data Stream for DEAU, FR, NET, and PL, and the IT data are freely available online on (http://www.mercatoelettrico.org/En/Tools/Accessodati.aspx?ReturnUrl=%2fEn%2fStatistiche%2fME%2fDatiSintesi.aspx). For DEAU, the distinction between the Austrian and German day-ahead electricity prices is quite difficult. The EXAA day-ahead electricity market enables electricity to be physically delivered not only in the Austrian control area, but also in the four German control areas. Similarly, the German segment at the EPEX SPOT day-ahead electricity market allows electricity to be physically delivered both in the four German transmission system operator (TSO) control areas and in the Austrian TSO control area. Using the data provided by these two markets, the DEAU data have been obtained computing the weighted average of the countries' series; authors have used daily exchanged quantities as weights. Finally, for oil, we use the London Brent Crude Oil Index.

We would like to thank the Editor for this helpful comment.

“Integration of renewable generation represents a key pillar of the European Commission's broader energy and climate objectives in reducing greenhouse gas emissions, improving the security of energy supply, diversifying energy supplies and improving Europe's industrial competitiveness.” (EC 2014, p. i)

Since October 2018, the German and Austrian market zone has been split due to regional congestion problems. Germany's RES growth resulted in a massive increase in cheap wind power in the north of the country, but the lack of a connecting network in the industrialized south of the Germany pushed green electricity surplus toward (and through) the grids of Poland and Czech Republic compromising their stability. Furthermore, the absence of any trading limitations on that border has also reduced energy exchange capacities available on other regional borders. Finally, this market separation is determining opposite price dynamics in German and Austrian markets with a second market that is characterized by an appreciable electricity price increase.

The size of all the shocks analyzed in this section is set equal to one standard deviation.

Half-life is defined as the number of months after which the deviation from the steady state falls to half the size of the initial shock.

We recall that Germany's green energy transformation resulted in severe congestion problems in the region, undermining the stability of Polish and Czech grids, and reducing their borders' electricity exchange capacities.

Between these two countries, several interactions occurred. Among others, the average wind speed in Germany negatively affects Dutch electricity prices. This effect is fairly constant despite the significant increase in German wind energy capacity (Mulder and Scholtens 2013). Further, the Netherlands is currently the biggest importer of Germany’s extra power, with a net 12.7 TWh flowing across the border into its power grid already since 2016.

This result is consistent with the evidence provided by Bosco et al. (2010), where a long-run relation between electricity and oil price is detected.

References

Aatola, P., Ollikainen, M., & Toppinen, A. (2013). Impact of carbon price on the integrating European electricity market. Energy Policy,61(Oct), 1235–1251.

Apergis, N., Baruník, J., & Lau, M. C. K. (2017). Good volatility, bad volatility: What drives the asymmetric connectedness of Australian electricity markets? Energy Economics,66(Aug), 108–115.

Asche, F., Osmundsen, P., & Sandsmark, M. (2006). The UK market for natural gas, oil and electricity: Are the prices decoupled? The Energy Journal,27(2), 27–40.

Balanguer, J. (2011). Cross-border integration in the European electricity market. Evidence from the pricing behavior of Norwegian and Swiss exporters. Energy Policy,39(9), 4703–4712.

Beirne, J., Caporale, G. M., Schulze-Ghattas, M., & Spagnolo, N. (2013). Volatility spillover and contagion from mature to emerging stock markets. Review of International Economics,21(5), 1060–1075.

Bernard, A.B. (1991). Empirical implications of the convergence hypothesis. CEPR-Center for Economic Policy Research-Publication 239, Stanford University.

Bosco, B., Parisio, L., Pelagatti, M. M., & Baldi, F. (2010). Long-run relations in European electricity prices. Journal of Applied Econometrics,25(5), 805–832.

Bunn, D. W., & Gianfreda, A. (2010). Integration and shock transmission across European electricity forward markets. Energy Economics,32(2), 278–291.

Bunn, D. W., Koc, V., & Sapio, A. (2015). Resource externalities and the persistence of heterogeneous pricing behavior in an energy commodity market. Energy Economics,48(2), 265–275.

Castagneto-Gissey, G., Chavez, M., & De Vico Fallani, F. (2014). Dynamic Granger-causal networks of electricity spot prices: A novel approach to market integration. Energy Economics,44(Jul), 422–432.

Charfeddine, L. (2014). True or spurious long memory in volatility: Further evidence on the energy futures markets. Energy Policy,71(Aug), 76–93.

Cornwall, N. (2008). Achieving electricity market integration in Europe. In F. P. Sioshansi (Ed.), Competitive electricity market—Design, implementation, performance (pp. 95–138). Oxford: Elsevier.

de Menezes, L. M., & Houllier, M. A. (2016). Reassessing the integration of European electricity markets: A fractional cointegration analysis. Energy Economics,53(Jan), 132–150.

de Menezes, L. M., Houllier, M. A., & Tamvakis, M. (2016). Time-varying convergence in European electricity spot markets and their association with carbon and fuel prices. Energy Policy,88(Jan), 613–627.

Dickey, D. A., & Fuller, W. A. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association,74(366a), 427–431.

Elliott, G., Rothenberg, T. J., & Stock, J. H. (1996). Efficient tests for an autoregressive unit root. Econometrica,64(4), 813–836.

Engle, R. F., & Granger, C. W. J. (1987). Co-integration and error correction: Representation, estimation and testing. Econometrica,55(2), 251–276.

European Commission (EC). (2006). Communication from the Commission to the Council and the European Parliament—Prospects for the internal gas and electricity market. COM(2006)841 final. http://ec.europa.eu/energy/electricity/package_2006/index_en.htm. Accessed 15 Mar 2011.

European Commission (EC). (2007). Third energy package of the European Commission. http://ec.europa.eu/energy/electricity/package_2007/index_en.htm. Accessed 10 Jan 2011.

European Commission (EC). (2014). Integration of renewable energy in Europe. Study prepared by KEMA Consulting, DNV GL—Energy, Imperial College and NERA Economic Consulting on behalf of DG Energy, Brussels.

Gianfreda, A., Parisio, L., & Pelegatti, M. (2016). Revisiting long-run relations in power markets with high RES penetration. Energy Policy,94(Jul), 432–445.

Green, R. (2007). EU regulation and competition policy among the energy utilities. In: IESE conference on the 50th anniversary of the Treaty of Rome. ftp://bham.ac.uk/pub/RePEc/pdf/08-01.pdf. Accessed 22 Aug 2010.

Grossi, L., Heim, S., Hueschelrath, K., & Waterson, M. (2018). Electricity market integration and the impact of unilateral policy reforms. Oxford Economic Papers,70(3), 799–820.

Huisman, R., & Kilic, M. (2013). A history of European electricity day-ahead prices. Applied Economics,45(18), 2683–2693.

International Energy Agency (IEA). (2011). Harnessing variable renewables. Paris: OECD.

Johansen, S. (1995). Likelihood-based inference in cointegrated vector autoregressive models. Oxford: Oxford University Press.

Kalantzis, F., & Milonas, N. (2010). Market integration and price dispersion in the European electricity market. Energy Market (EEM) 2010. In: Proceedings of the 7th international conference on the European IEEE.

Kwiatkowski, D., Phillips, P. C. B., Schmidt, P., & Shin, Y. (1992). Testing the null of stationarity against the alternative of a unit root: How sure are we that economic time series have a unit root? Journal of Econometrics,54(1–3), 159–178.

Lu, Z., Dong, Z., & Sanderson, P. (2005). The efficient market hypothesis and electricity market efficiency test. In: IEEE Transmission and Distribution Conference and Exhibition: Asia and Pacific, IEEE/PES. https://doi.org/10.1109/tdc.2005.1547036.

Mjelde, J. W., & Bessler, D. A. (2009). Market integration among electricity markets and their major fuel source markets. Energy Economics,31(3), 482–491.

Mohammadi, H. (2009). Electricity prices and fuel costs: Long-run relations and short-run dynamics. Energy Economics,31(3), 503–509.

Moutinho, V., Vieria, J., & Moreira, A. C. (2011). The crucial relationship among energy commodity prices: Evidence from the Spanish electricity market. Energy Policy,39(10), 5898–5908.

Mulder, M., & Scholtens, B. (2013). The impact of renewable energy on electricity prices in the Netherlands. Renewable Energy,57(Sep), 94–100.

Ng, S., & Perron, P. (2001). Lag length selection and the construction of unit root tests with good size and power. Econometrica,69(6), 1519–1554.

Parisio, L., & Pelagatti, M. (2019). Market coupling between electricity markets: Theory and empirical evidence for the Italian-Slovenian interconnection. Economia Politica,36(2), 527–548.

Pesaran, H. M., & Shin, Y. (1996). Cointegration and the speed of convergence to equilibrium. Journal of Econometrics,71(1–2), 117–143.

Phillips, P. C. B., & Perron, P. (1988). Testing for a unit root in time series regression. Biometrika,75(2), 335–346.

Pollitt, M. (2009). Evaluating the evidence on electricity reform: Lesson for the South East Europe (SEE) market. Utility Policy,17(1), 13–23.

Simpson, J., & Abraham, S. M. (2012). Financial convergence or decoupling in electricity and energy markets? A dynamic study of OECD, Latin America and Asian countries. International Journal of Economics and Finance,4(12), 1–14.

Sola, M., Spagnolo, F., & Spagnolo, N. (2002). Testing for volatility spillovers. Economic Letters,76(1), 77–84.

Thomas, S. (2003). The seven brothers. Energy Policy,31(5), 393–403.

Thomas, S. (2007). Corporate concentration in the EU energy sector. Report commissioned by: European Federation of Public Service Unions. http://gala.gre.ac.uk/3139/1/PSIRU_9722_-_2007-03-E-Energyconcentration.pdf. Accessed 12 Apr 2011.

Thomas, S. (2009). Corporate policies in the EU energy sector. Report commissioned by: European Federation of Public Service Unions. http://gala.gre.ac.uk/1746/1/2009-03-E-corppolicies.pdf. Accessed 3 Oct 2012.

Trillas, F. (2010). Electricity and telecom reforms in the EU: Insights from the economics of federalism. IESE Business School, University of Navarra WP 861. http://www.iese.edu/research/pdfs/DI-0861-E.pdf. Accessed 22 August 2012.

Warne, A. (1993). A common trends model: Identification, estimation and inference. IIES Seminar Paper, Stockholm, Stockholm University, WP 555. http://www.texlips.net/download/ctiei93.pdf. Accessed 10 Aug 2012.

Weron, R. (2007). Modeling and forecasting electricity loads and prices. Chichester: Wiley.

Zachmann, G. (2008). Electricity wholesale market prices in Europe: Convergence? Energy Economics,30(4), 1659–1671.

Acknowledgements

This research was supported by the Italian Ministry of Education, University and Research: project PRIN 2007, “Real structure and empirical models of the Italian electricity market: an analysis for the design market transfer to the South Eastern European countries”. A preliminary version of this paper was presented at the: XIX International “Tor Vergata” Conference on Money, Banking and Finance “New Frontiers of Banking and Finance after the Global Crisis”, Rome, December 13–17, 2010; 30th USAEE/IAEE North American Conferences: “Redefining the Energy Economy: Changing Roles of Industry, Government and Research”; October 9–12, 2011; WASHINGTON, DC; 34th IAEE International Conference—Institutions, Efficiency and Evolving Energy Technologies—Stockholm, June 19–23, 2011; 53rd Annual Conference of the Italian Economic Association, October 18–20, 2012, Matera (Italy); we are indebted to all participants. The authors are also thankful to Simona Bigerna, Carlo Andrea Bollino, Paolo Bruno Bosco, Paolo Falbo, Lucia Parisio, Matteo Pelagatti, Silvana Stefani, an anonymous referee, and the Editor for their helpful suggestions and remarks. The usual disclaimer applies. Finally, we would like to thank Associate Editor and reviewers for careful reading, and constructive suggestions for our manuscript.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The views expressed in this paper are our own and do not necessarily reflect those of Cassa Depositi and Prestiti SpA.

Rights and permissions

About this article

Cite this article

Ciferri, D., D’Errico, M.C. & Polinori, P. Integration and convergence in European electricity markets. Econ Polit 37, 463–492 (2020). https://doi.org/10.1007/s40888-019-00163-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40888-019-00163-7

Keywords

- European electricity market

- Electricity spot price

- Cointegration analysis

- Vector error correction model