Abstract

In this paper, we model the competition between two firms that each firm can choose a “buy online and pick up in store” (BOPS) channel strategy or an offline channel strategy. We find out when it is optimal for a retailer to offer a BOPS channel by comparing the equilibrium outcomes. Whether to adopt the BOPS channel depends largely on the difference between the inherent values provided by two firms. Further, we prove that a prisoner’s dilemma exists under certain condition when two competing firms offer the BOPS channel. We also examine the impact of heterogeneous channel acceptance on the profits of two firms. We find that when only a firm offers the BOPS channel, the higher acceptance of BOPS means the higher profit of this firm and the less profit of its competitor. However, when both firms offer the BOPS channel, whether a firm can benefit from the increase in acceptance of BOPS depends on the inherent value it provides.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

The advent of the e-commerce era has significantly changed the way consumers shop [1]. As offline retailers realize the advantages of online channels, they begin to offer multiple channels and conduct cross-channel integration, thus, promoting the rise of omnichannel retailing, which carries out cross-channel integration in all available shopping channels to meet the shopping needs of customers in different scenarios [2]. According to the 2018 report compiled by Total Retail and Radial, 52% of omnichannel retailers among the top 100 offer the “buy online and pick up in store” (BOPS) channel. Although the BOPS channel is relatively new for some consumers, it has been widely adopted in many industries, such as the clothing, catering, and retailing industries.

From the consumer’s perspective, the BOPS channel has both advantages and disadvantages when compared to the offline channel. To some extent, the BOPS channel has combined some superior qualities of the online and offline channels, and can offer a higher convenience level. For example, consumers can easily get a greater variety of products through the BOPS channel, than through the offline channel, because the physical store has limited space. In addition, the BOPS channel provides consumers with more conveniences when they visit to pick up their purchases, such as dedicated parking lanes and quick cashier lines [3]. All the above characteristics of the BOPS channel enable consumers to enjoy a more convenient shopping experience. However, the BOPS channel is not always superior to the offline channel. If a consumer finds that a product he purchased does not fit him when he picks it up in the store, he cannot get a full refund right away. Considering that the BOPS order is prepaid online, it usually takes a few business days to return the refund to the original payment account, which mainly depends on the bank’s processing time. Besides, some retailers may require consumers who choose the BOPS channel to pay an extra fee, such as, Kmart and IKEA in Australia. In some instances, certain new releases are only sold through the offline channel, instead of the BOPS channel. For example, in Toys “R” Us, new releases are not available for the BOPS channel [2].

Our paper considers the different strategic combinations generated by two firms’ choices between the offline channel and the BOPS channel. We specifically concentrate on answering the following three research questions. First, under what conditions will the firm be better off offering the BOPS channel rather than offering the offline channel? Second, what factors affect the price and channel convenience level of a firm and how? Finally, in different sub-games, are the payoffs in the equilibrium of two firms optimal? If external factors change, what will the impact on the profits of two competing firms be?

To analyze the above questions, we set up a model in which two competing firms sell differentiated products, and each firm can offer the BOPS channel to provide their consumers with a more efficient shopping experience. We take heterogeneous channel acceptance, consumer convenience sensitivity coefficient, and cost coefficient into consideration. We arrive at a few valuable conclusions on whether to offer the BOPS channel in the competition environment or not. First, we show that a firm’s strategy concerning the decision to provide the BOPS channel depends on the difference between the inherent value that consumers obtain from two competing firms, and sometimes, also on its competitor’s strategy. When the difference in inherent value for purchases from two firms is not obvious, choosing the same strategy (i.e., BOPS channel or offline channel) is the best option for both firms. In this scenario, a firm’s channel strategy is mainly affected by the competitor’s channel strategy. However, when a firm has a significant advantage in inherent value for a purchase, a unique equilibrium prevails. Second, we find a prisoner’s dilemma for the two firms choosing the BOPS channel when they offer similar inherent value to consumers. In this scenario, although the firm’s original intention is to increase demand and improve market competitiveness by adopting the BOPS channel, the extra cost of adopting the BOPS channel has a significant negative impact on its profit. However, when the purchases are differentiated enough in the inherent value they provide to consumers, the firm that offers lower inherent value would be better off when both firms sell products through the BOPS channel.

The rest of our paper is structured as follows. Section 2 reviews the literature. In Sect. 3, we first introduce the setup of the model and then show the optimal prices and optimal channel convenience levels of the two firms in the four sub-games. Section 4 compares the equilibrium outcomes in relation to the two firms’ channel strategies. Section 5 concludes the paper.

2 Literature Review

Our paper is related to two streams of work: retailing channel choice in the omnichannel environment and competition strategy in a duopoly.

With the booming development of e-commerce, channel integration has been regarded as a promising strategy for retailers. In this context, omnichannel retailing has received considerable attention in academia [4]. Many studies address ways to serve consumers better in the omnichannel retailing industry. Gallino et al. [5] empirically test the impact of introducing the ship to store option (one of the most widely used omnichannel fulfillment options) on the retailer’s sales dispersion and investigate the effect of channel integration on inventory management. Gao and Su [6] study three information mechanisms including physical showrooms, virtual showrooms, and availability information, and they focus on the efficiency of online and offline information transferring from retailers to consumers who face product value uncertainty and availability uncertainty in an omnichannel environment.

The stream of work on the retailing channel choice in the omnichannel environment has studied the BOPS channel, from both, empirical and theoretical perspectives. Gallino and Moreno [7] conduct an empirical test on the effect of the BOPS channel on the sales in both online and store channels of a retailer. They show that if the BOPS channel is adopted, then the online sales will decrease and offline sales will increase. In addition, there are some theoretical models in this area as well [3, 8]. Cao et al. [3] investigate the impact of the BOPS channel on demand allocation and the profitability of a retailer adopting multiple channels to sell its products. They find that not all products are suitable for sale through the BOPS channel. Jin et al. [9] establish a theoretical model where a store retailer offering the BOPS channel fulfills online and offline orders through a recommended service area and they find that the unit inventory cost and the consumers’ arrival rate of BOPS channel play a decisive role in the scale of service area. Gao and Su [10] focus on the application of self-service technologies including online and offline technologies in the restaurant industry and analyze the impact of self-order technologies on the demand and profits of a restaurant. While most studies in this area consider the case of a retailer with multi-channels and examine the effect of the BOPS channel on the retailer’s profits, our paper analyzes competition between two retailers in a game theoretical framework to determine the optimal decisions of the two retailers in different situations. Our paper also considers heterogeneous channels and investigates their impact on the firms’ profits. Moreover, considering the variable consumer convenience sensitivity coefficient, we set the endogenous channel convenience level and introduce a quadratic function of the additional cost related to the channel convenience level. Furthermore, we analyze the optimal strategies for both firms under different conditions and find a prisoner’s dilemma.

Our paper is also relevant to the work on the competitive strategies of two firms. In this stream, a majority of studies adopt the game theory to analyze the price competition in a duopoly. Etzion and Pang [11] investigate the competition between two firms selling a differentiated physical product and each firm can choose to provide a complementary online service that exhibits network effects and is independent of the product. They find that while network effects intensify price competition, the growth of the network effect benefits the firm. In the supply chain setting, Chen and Guo [12] focus on the case where a common supplier provides two downstream retailers with uncertain supply and investigate the price competition between two retailers in a horizontally differentiated product market. Jena and Sarmah [13] investigate the co-operation problems and price competition in a closed-loop supply chain with two competitive manufacturers and a common retailer. Different from the above studies, our paper not only examines the case where the price competition exists between two firms but also studies the case where price competition and convenience level competition co-exist. In particular, when both firms offer the BOPS channel, competition for convenience level is added to the existing competition between the two firms. In addition to the above on price competition, there is some related literature considering non-price competition. Xiao et al. [14] study strategic outsourcing decisions in the context of two manufacturers competing on the quality of products. Ding et al. [15] consider the inventory factor and environmental constraints to investigate the service competition between two retailers in an online market. Zhao et al. [16] focus on quality disclosure strategies for two small business enterprises (SBEs) in a competitive supply chain setting, and show that the information asymmetry does have an effect on an SBE’s strategy on whether to disclose the quality to customers through the retailer or not. The above studies all think that the price is not the only determinant of consumer decisions, most of which are concerned with quality competition in a duopoly. However, the convenience level provided by a firm is also playing a crucial role in consumers’ purchase choice, which remains to be studied. In this paper, we focus on the competitive model in which there are two firms that choose to provide the BOPS channel or a pure offline channel according to the situation. Further, we consider that the two firms compete not only on price, but also on channel convenience level. We investigate four possible pairs of channel strategies with regard to the sub-game of both firms adopting the BOPS channel, the two sub-games of only one firm adopting the BOPS channel, and the sub-game of neither firm adopting the BOPS channel.

3 Model

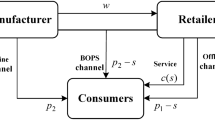

Consider two firms selling differentiated products in a common market. Each firm chooses to sell through the offline channel or offers the product to the customer via the novel BOPS channel. Since we only consider the competition between two firms in one market and the number of firms is fixed without considering new entrants, it is appropriate to adopt the Hotelling setup [17]. We assume that the product of Firm 1 is located at 0 and the product of Firm 2 is located at 1 in our model. Considering the different travel costs for consumers going to the store, consumers in the market are heterogeneous in the matter of their product preferences. When a consumer located at point x buys from Firm 1, the travel cost can be denoted by tx, which is proportionate to the distance between the consumer and the product, and when the consumer located at point x buys from Firm 2, the travel cost is t(1−x). Without loss of generality, we set t = 1, where t means the per-unit travel cost [18, 19].

For consumers, the offline channel and the BOPS channel are different in two aspects: convenience level and channel acceptance. We denote convenience levels for the BOPS channel and offline channel by s and c, respectively. Herein, we assume that s > c. Without loss of generality, we set c = 0 and make s represent the extra convenience of the BOPS channel when compared to the offline channel. The extra utility a consumer obtains from the BOPS channel is given by rs, where r is convenience sensitivity and 0 < r < 1. The more sensitive consumers are to convenience, the more utility they can get from the BOPS channel.

Compared with the offline channel, the BOPS channel has advantages in terms of channel convenience level, but it is still insufficient in terms of channel acceptance. It is common sense that the offline channel is more mature and has accumulated a large consumer base. In contrast, the BOPS channel has some immature phenomena now, such as unreasonable store recommendation [9]. Therefore, it is reasonable to assume that the inherent value for a purchase from Firm i when Firm i chooses the offline channel is \( v_{i} \left( {i = 1, 2} \right) \) which depends on the inherent value of the product and on the variety of products in a firm, while the value for a purchase from Firm i when Firm i chooses the BOPS channel is \( \theta v_{i} \left( {i = 1, 2} \right) \), where \( 0 < \theta < 1 \).

When a firm offers the BOPS channel, there will be an additional cost due to the higher convenience level. In this model, we assume that the additional cost is a quadratic function and is denoted by \( \frac{{ks^{2} }}{2} \), where k represents the cost coefficient of improving the convenience level and when the value of k decreases, the cost efficiency increases. The quadratic cost function is very common in previous literatures [20, 21]. What’s more, the quadratic functional form for the additional cost is the most tractable way of getting an analytic solution in our model.

Based on the above model descriptions, we can summarize the consumer utility functions as follows:

where Eq. (1) is the consumer utility when a consumer buys from the offline channel provided by Firm 1, Eq. (2) is the consumer utility when a consumer buys from the BOPS channel provided by Firm 1, Eq. (3) is the consumer utility when a consumer buys from the offline channel provided by Firm 2, and Eq. (4) is the consumer utility when a consumer buys from the BOPS channel provided by Firm 2.

There can be four pairs of channel strategies: both firms offer the offline channel, marked as (O,O), Firm 1 chooses the offline channel while Firm 2 chooses the BOPS channel, marked as (O,B), Firm 1 chooses the BOPS channel while Firm 2 chooses the offline channel, marked as (B,O), and both firms offer the BOPS channel, marked as (B,B).

3.1 Sub-Game (O,O): Competition Between Two Firms Offering the Pure Offline Channel

Under sub-game (O,O), both firms choose to provide the pure offline channel, and all the consumers go shopping through the offline channel of Firm 1 or Firm 2. Considering that different consumers have different preferences for the two firms, the market can be divided into two segments by the marginal consumer whose location is denoted as \( x_{0} \). By setting consumer utility function \( U_{O}^{1} = U_{O}^{2} \), we can derive the point of indifference \( x_{0} = \frac{{v_{1} - v_{2} - p_{OO}^{1} + p_{OO}^{2} + 1}}{2} \), where the marginal consumer is indifferent to purchase from the channel provided by Firm 1 or Firm 2.

In this sub-game, the two firms need to set their prices \( p_{OO }^{1} \) and \( p_{OO }^{2} \) to maximize their profit without considering the convenience level because the convenience level of each firm is equal to zero. The profit functions of the two firms offering the offline channel are as follows:

Substituting \( x_{0} \) into both the profit functions mentioned above, we can get the equilibrium solutions for this sub-game. Solving the first order conditions of the two profit functions at the same time, we derive the following optimal prices \( p_{OO}^{1*} \) and \( p_{OO}^{2*} \) when both firms offer the offline channel:

According to the optimal prices, we derive the product demands of the two firms and then get their profits as follows:

3.2 Sub-Game (O,B)/Sub-Game (B,O): Competition When Only One Firm Offers the BOPS Channel

Under sub-game \( \left( {O,B} \right) \) or sub-game \( \left( {B,O} \right) \), only one firm offers the BOPS channel while its competitor offers the offline channel. Without loss of generality, we consider that Firm 1 chooses to offer the offline channel while Firm 2 chooses to offer the BOPS channel, since the sub-game \( \left( {B,O} \right) \) is symmetrically identical.

In this sub-game, consumers who are indifferent to the purchase channels, located at \( x_{1} \), can divide the market into two segments. Consumers locating on the left of \( x_{1} \) prefer to purchase from the offline channel of Firm 1 while consumers located on the right of \( x_{1} \) prefer to purchase from the BOPS channel of Firm 2. Solving the indifference equation \( U_{O}^{1} = U_{B}^{2} \), we derive the point of indifference thus:

In equilibrium, Firm 1 sets the price \( p_{OB}^{1} \) to maximize its profit from the offline channel, while Firm 2 sets the price \( p_{OB}^{2} \) and the convenience level \( s_{OB }^{2} \) to maximize its profit from the BOPS channel. The profit functions for the two firms are as follows:

There is no doubt that the profit function of Firm 1 is concave in \( p_{OB}^{1} \). To ensure the concavity of the profit function of Firm 2, we get a constraint \( 4k > r^{2} \) by solving for the Hessian matrix of \( \pi_{OB}^{2} \). Therefore, we can get the optimal convenience level of Firm 2 and the optimal prices of the two firms:

Based on the optimal convenience level and the optimal prices, we can derive the demand of Firm 1’s offline channel and the demand of Firm 2’s BOPS channel:

Therefore, the profits of the two firms are as follows:

3.3 Sub-Game (B,B): Competition Between Two Firms Offering the BOPS Channel

Under sub-game \( \left( {B,B} \right) \), the two firms choose to offer the BOPS channel with different convenience levels. Let \( x_{2 } \) represent the position of the marginal customer. Consumers can be divided into two segments: those who are located on the left of \( x_{2} \) choose to buy from the BOPS channel of Firm 1 and consumers who are located on the right of \( x_{2} \) choose to buy from the BOPS channel of Firm 2. By setting consumer utility function \( U_{B}^{1} = U_{B}^{2} \), we work out the point of indifference and the customers here are indifferent about purchasing from Firm 1 or Firm 2.

Given the consumers’ choices, the two firms determine the different convenience levels for the channel and the prices for the products to obtain their maximum profits. The profit functions when both firms offer the BOPS channel are as follows:

We derive a constraint that guarantees the concavity of the profit functions, which is given by \( 4k > r^{2} \). Solving \( \frac{{\partial \pi_{BB}^{1} }}{{\partial s_{BB}^{1} }} = 0 \),\( \frac{{\partial \pi_{BB}^{1} }}{{\partial p_{BB}^{1} }} = 0 \),\( \frac{{\partial \pi_{BB}^{2} }}{{\partial s_{BB}^{2} }} = 0 \), and \( \frac{{\partial \pi_{BB}^{2} }}{{\partial p_{BB}^{2} }} = 0 \) simultaneously, we get the optimal convenience levels and the optimal prices of the two firms:

From the above optimal convenience levels and the optimal prices, we can obtain the demands of the BOPS channels of both Firm 1 and Firm 2 as follows:

Accordingly, the profit functions of the two firms are as follows:

4 Market Equilibrium Analysis

In the previous section, by adopting the concept of sub-game perfectness and solving the three-stage game backward, we derive the optimal convenience levels, the optimal prices, and the optimal profits of the two firms associated with the four possible market configurations. Based on the results shown above, we can obtain the following market equilibrium.

Proposition 1

(Market equilibrium under different conditions):

-

(1)

Sub-game (O,O) is an equilibrium in which both firms offer the offline channel, if and only if \( v_{1} > A_{1} v_{2} + 3 \) and \( v_{2} > A_{1} v_{1} + 3 \).

-

(2)

Sub-game (B,O) is an equilibrium in which only firm 1 offers the BOPS channel, if and only if \( v_{1} > A_{2} v_{2} + \frac{{3k - r^{2} }}{k\theta } \) and \( v_{2} < A_{1} v_{1} + 3 \).

-

(3)

Sub-game (O,B) is an equilibrium in which only firm 2 offers the BOPS channel, if and only if \( v_{1} < A_{1} v_{2} + 3 \) and \( v_{2} > A_{2} v_{1} + \frac{{3k - r^{2} }}{k\theta } \).

-

(4)

Sub-game (B,B) is an equilibrium in which both firms offer the BOPS channel, if and only if \( v_{1} < A_{2} v_{2} + \frac{{3k - r^{2} }}{k\theta } \) and \( v_{2} < A_{2} v_{1} + \frac{{3k - r^{2} }}{k\theta } \).

Where \( A_{1} = \frac{{3\theta \sqrt {k\left( {4k - r^{2} } \right)} - 6k + r^{2} }}{{3\sqrt {k\left( {4k - r^{2} } \right)} - 6k + r^{2} }}, A_{2} = \frac{{\theta \left( {6k - r^{2} } \right)\sqrt {4k - r^{2} } - 4\sqrt k \left( {3k - r^{2} } \right)}}{{\theta \left( {6k - r^{2} } \right)\sqrt {4k - r^{2} } - 4\theta \sqrt k \left( {3k - r^{2} } \right)}}. \)

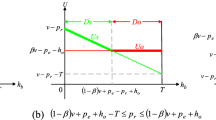

According to Proposition 1, we can derive some meaningful strategic implications. When a firm takes a decision on whether to provide the BOPS channel, the firm needs to take into consideration the inherent value that consumers can get while buying from its competitor. The variable market factors could also influence the firm’s channel strategy, including the channel acceptance \( \theta \), convenience sensitivity r, and cost coefficient k. In order to provide a more intuitive description of Proposition 1, we depict the market equilibrium outcomes under different conditions in Fig. 1, with \( v_{1} \) on the horizontal axis and \( v_{2 } \) on the vertical axis. For the sake of simplicity, we adopt the italic capitals (O,O), (O,B), (B,O), and (B,B) to represent the corresponding four sub-games.

From Fig. 1 we can find that if a firm has a significant advantage in inherent value, it is optimal for the firm to choose to provide consumers with the BOPS channel while for the competitor the offline channel is optimal. When the inherent value from Firm 1 is apparently higher than the inherent value from Firm 2, Firm 1 offering the BOPS channel and Firm 2 offering the offline channel could both obtain more profits than adopting any other strategy combination, as shown in region f-n-i. Symmetrically, when the inherent value for a purchase from Firm 2 is much higher than the inherent value for a purchase from Firm 1, it is more profitable for Firm 2 to offer the BOPS channel and for Firm 1 to offer the offline channel, as shown in region d-m-g.

In addition, if the inherent value for a purchase provided by the two firms is not significantly different, there would be two situations. When both firms bring low inherent value to consumers, the state of equilibrium is one where both firms choose to sell through the BOPS channel, as shown in region d-m-e-n-f. In general, for a firm that provides low inherent value for consumers, if the firm sells through the physical store, the cost of developing the offline channel will affect the total profits greatly.

In contrast, when both firms can bring considerable inherent value to consumers, it is optimal for both firms to adopt the offline channel, as shown in region g-m-h-n-i. That is, if the inherent value of the two firms is both high enough, each firm would choose the offline channel, regardless of its competitor’s strategy. To a certain extent, the high inherent value for a purchase from the firm can generate enough attraction for consumers, so there is no need for the firm to employ the BOPS channel to attract consumers.

For a set of the parameter values, as shown in the region h-m-e-n, two feasible equilibriums exist. One is where both firms adopt the offline channel, and the other is where both firms adopt the BOPS channel. In other words, each firm finds it profitable to adopt the same channel strategy as its competitor within this range of parameter values.

After analyzing the equilibrium outcomes of the game, sometimes, we find that the equilibrium is not the Pareto optimal. That is, we find that the two firms may be caught in a prisoner’s dilemma in some situations, as stated in Proposition 2.

Proposition 2

(Prisoner’s dilemma condition): When both firms choose the BOPS channel, Firm i would be better off when neither chooses it if and only if \( v_{j} - v_{i} < \frac{{\left( {6\sqrt k - 3\sqrt {4k - r^{2} } } \right)\left( {3k - r^{2} } \right)}}{{2\sqrt k \left( {3k - r^{2} } \right) - 3k\theta \sqrt {4k - r^{2} } }} \).

According to Proposition 2, we find that if the two firms choose to sell through the BOPS channel when the difference in terms of the inherent value for a purchase between two firms is not significant, both firms would get more profits through the offline channel rather than the BOPS channel. That is, the two firms would be caught in a prisoner’s dilemma because of the intensified competition when \( \left| {v_{j} - v_{i} } \right| \) is small enough. On this occasion, both firms are likely to adopt the BOPS strategy to increase the demands and compete for the market, but the extra cost of adopting the BOPS channel can have a significant negative impact on their profits. Nevertheless, if Firm i has a significant disadvantage in the inherent value for a purchase over Firm j, then Firm i obtains more profits when both firms adopt the BOPS channel to sell their products.

Now, we analyze how the profit of a firm changes with an increase in channel acceptance of BOPS \( \theta \) and the results are shown in Proposition 3.

Proposition 3

(Impact of heterogeneous channel acceptance on profits):

-

(1)

When only Firm i offers the BOPS channel in equilibrium, it always benefits from an increase in \( \theta \). An increase in \( \theta \) has a negative effect on Firm j’s profit.

-

(2)

When both firms offer the BOPS channel, for Firm i and Firm j, an increase in \( \theta \) has a positive effect on Firm i’s profit and a negative effect on Firm j’s profit if the inherent value of Firm i is higher than the inherent value of Firm j (i.e.,\( v_{i} > v_{j } \)).

Proposition 3 shows that if only one firm adopts the BOPS channel, the firm’s profit will continue to rise as consumers become more acceptable to the BOPS channel. However, with the increase in the channel acceptance, more consumers are willing to buy products from the BOPS channel, thus leading to the decrease in competing firm’s profit earned from the offline channel.

On the other hand, when both firms choose to sell their products through the BOPS channel, the profits of both firms do not necessarily increase in the channel acceptance due to the difference in the inherent value provided by the two firms. The firm can obtain more profit from an increase in channel acceptance only if it can bring consumers more inherent value than its competitor. However, the increase in Firm j’s demand may not be enough to offset the lost profit due to the price reduction and the extra cost for offering the BOPS channel, which explains why the profit of the firm, whose inherent value for a purchase is not dominant, will decrease with the increase of channel acceptance.

5 Conclusion

In this paper, we investigate whether two competing firms offer the BOPS channel by considering four pairs of channel strategies, and if they do, then when. By analyzing the equilibrium outcomes, we find that whether a firm adopts the BOPS channel or not depends largely on the difference between the inherent values that consumers obtain from each of the two firms. In particular, when one firm provides an obviously higher inherent value over its competitor, adopting the BOPS channel is the optimal option for this firm, but for the other firm, the offline channel should be chosen. Furthermore, we find that competing firms are caught in a prisoner’s dilemma when they offer the BOPS channel under certain conditions.

Our work has several implications for managers who make decisions on whether to provide the offline channel or the BOPS channel in a duopoly. First, when the inherent value gap for a purchase between the two firms is not particularly large, if both firms provide high enough inherent value, they should adopt the offline channel strategy. In this scenario, offline sales are attractive enough for consumers, that there is no need for firms to adopt the BOPS channel. Second, if a firm has an obvious advantage in inherent value for a purchase, then the firm should offer the BOPS channel and its competitor should offer the offline channel. The firm with an inherent value advantage will have a dual appeal to consumers by using the BOPS channel to improve its convenience level. However, for the other firm, adopting the BOPS channel means incurring a high cost and earning little profit. Thus, providing an offline channel is the best choice.

This paper can be extended in the following directions. First, to simplify the theoretical model, some factors that influence the popularity of the BOPS channel, including the strict return policy, the extra fee for BOPS consumers, and the unreasonable store recommendation, are indirectly reflected in the parameter of heterogeneous channel acceptance. However, if these factors are shown directly in the model, there can be some instructive discoveries. Second, in the current work, we analyze the competition between two firms in the context of each firm adopts only one channel. However, what we observe in practice are mostly hybrid channels, that is, many firms actually sell products through multiple channels, such as the online channel, the offline channel, the BOPS channel and so on. Taking into account all the channels offered by both firms may be an interesting direction.

References

Feng, Y., Guo, Z., Chiang, W.K.: Optimal digital content distribution strategy in the presence of the consumer-to-consumer channel. J. Manage. Inform. Syst. 25, 241–270 (2009). https://doi.org/10.2753/mis0742-1222250408

Gao, F., Su, X.: Omnichannel retail operations with buy-online-and-pick-up-in-store. Manage. Sci. 63, 2478–2492 (2017). https://doi.org/10.1287/mnsc.2016.2473

Cao, J., So, K.C., Yin, S.: Impact of an “online-to-store” channel on demand allocation, pricing and profitability. Eur. J. Oper. Res. 248, 234–245 (2016). https://doi.org/10.1016/j.ejor.2015.07.014

Li, Y., Liu, H., Lim, E.T.K., Goh, J.M., Yang, F., Lee, M.K.O.: Customer’s reaction to cross-channel integration in omnichannel retailing: the mediating roles of retailer uncertainty, identity attractiveness, and switching costs. Decis. Support Syst. 109, 50–60 (2018). https://doi.org/10.1016/j.dss.2017.12.010

Gallino, S., Moreno, A., Stamatopoulos, I.: Channel integration, sales dispersion, and inventory management. Manage. Sci. 63, 2813–2831 (2017). https://doi.org/10.1287/mnsc.2016.2479

Gao, F., Su, X.: Online and offline information for omnichannel retailing. Manuf. Serv. Oper. Manag. 19, 84–98 (2017). https://doi.org/10.1287/msom.2016.0593

Gallino, S., Moreno, A.: Integration of online and offline channels in retail: the impact of sharing reliable inventory availability information. Manage. Sci. 60, 1434–1451 (2014). https://doi.org/10.1287/mnsc.2014.1951

Liu, Y., Zhou, D., Chen, X.: Channel integration of BOPS considering off-line sales effort differences. J. Syst. Eng. 33, 90–102 (2018). https://doi.org/10.13383/j.cnki.jse.2018.01.009

Jin, M., Li, G., Cheng, T.C.E.: Buy online and pick up in-store: design of the service area. Eur. J. Oper. Res. 268, 613–623 (2018). https://doi.org/10.1016/j.ejor.2018.02.002

Gao, F., Su, X.: Omnichannel service operations with online and offline self-order technologies. Manage. Sci. 64, 3595–3608 (2017). https://doi.org/10.1287/mnsc.2017.2787

Etzion, H., Pang, M.S.: Complementary online services in competitive markets: maintaining profitability in the presence of network effects. MIS. Q. 38, 231–248 (2014). https://doi.org/10.25300/MISQ/2014/38.1.11

Chen, J., Guo, Z.: Strategic sourcing in the presence of uncertain supply and retail competition. Prod. Oper. Manag. 23, 1748–1760 (2014). https://doi.org/10.1111/poms.12078

Jena, S.K., Sarmah, S.P.: Price competition and co-operation in a duopoly closed-loop supply chain. Int. J. Prod. Econ. 156, 346–360 (2014). https://doi.org/10.1016/j.ijpe.2014.06.018

Xiao, T., Xia, Y., Zhang, G.P.: Strategic outsourcing decisions for manufacturers competing on product quality. IIE Trans. 46, 313–329 (2014). https://doi.org/10.1080/0740817x.2012.761368

Ding, Y., Gao, X., Huang, C., Shu, J., Yang, D.: Service competition in an online duopoly market. Omega 77, 58–72 (2018). https://doi.org/10.1016/j.omega.2017.05.007

Zhao, M., Dong, C., Cheng, T.C.E.: Quality disclosure strategies for small business enterprises in a competitive marketplace. Eur. J. Oper. Res. 270, 218–229 (2018). https://doi.org/10.1016/j.ejor.2018.03.030

Hotelling, H.: Stability in competition. Econ. J. 39, 41–57 (1929). https://doi.org/10.1007/978-1-4613-8905-7_4

Yoo, W.S., Lee, E.: Internet channel entry: a strategic analysis of mixed channel structures. Market. Sci. 30, 29–41 (2011). https://doi.org/10.1287/mksc.1100.0586

Chen, L., Nan, G., Li, M.: Wholesale pricing or agency pricing on retail platforms: the effects of customer loyalty. Int. J. Electron. Comm. 24, 576–608 (2018). https://doi.org/10.1080/10864415.2018.1485086

Iyer, G.: Coordinating channels under price and nonprice competition. Market. Sci. 17, 338–355 (1998). https://doi.org/10.1287/mksc.17.4.338

Moorthy, K.S.: Product and price competition in a duopoly. Mark. Sci. 7, 141–168 (1988). https://doi.org/10.1287/mksc.7.2.141

Acknowledgments

This research was partially supported by research grant from the National Science Foundation of China (No. 71471128) and the Key Program of National Natural Science Foundation of China (No. 71631003).

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2019 Springer Nature Switzerland AG

About this paper

Cite this paper

Wang, R., Chen, L., Feng, H., Nan, G., Li, M. (2019). Competitive Analysis of “Buy Online and Pick Up in Store” Channel. In: Xu, J., Zhu, B., Liu, X., Shaw, M., Zhang, H., Fan, M. (eds) The Ecosystem of e-Business: Technologies, Stakeholders, and Connections. WEB 2018. Lecture Notes in Business Information Processing, vol 357. Springer, Cham. https://doi.org/10.1007/978-3-030-22784-5_7

Download citation

DOI: https://doi.org/10.1007/978-3-030-22784-5_7

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-22783-8

Online ISBN: 978-3-030-22784-5

eBook Packages: Computer ScienceComputer Science (R0)