Abstract

Buy online and pickup in-store (BOPS), a novel omnichannel retail model that provides customers with a seamless channel experience, is increasing prevalence in the electronic commerce era. This paper develops a theoretical model to investigate the co-opetition strategy of an omnichannel supply chain where a manufacturer sets up a BOPS channel in cooperation with a retailer. Two game models in the absence and presence of the BOPS contract are constructed considering consumer type and channel preference. The results show that adding the BOPS contract increases the online price, while it leads to a higher offline price when the retailer’s BOPS operation cost is small. The manufacturer is willing to introduce the BOPS contract by increasing wholesale price when the retailer’s BOPS operation cost is large. The retailer is likely to take part in the BOPS contract when it obtains a high unit payment provided by the manufacturer or the retailer’s BOPS operation cost is low. Our results provide managerial insights for online companies and physical companies to implement the BOPS strategy, and subsequently, adjust their prices and channel structures to maximize revenues.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

With the increasing development of electronic commerce, online shopping has ushered in explosive growth as a convenient and fast retail channel. E-Marketer (2021) reports that retail e-commerce sales worldwide are expected to climb 16.8% in 2021, reaching $4.921 trillion.Footnote 1 However, consumers cannot experiment with items in advance when they purchase online and eventually evolve into product returns [18, 45, 50]. Buy-online-and-pickup-in-store (BOPS), a newly emerging omnichannel retailing model that provides consumers the chance to experiment with items in advance, presents a rapid development in recent years [27, 38, 41]. Amazon, one of the world’s largest e-commerce companies, provides consumers with BOPS service to increase market volume. Consumers can place orders on Amazon’s official website and then pick up their orders at Amazon’s 4-star physical stores. One can also observe in the clothing industry that, for example, consumers can browse Uniqlo’s website and order through a computer or mobile device. Following this, consumers can visit Uniqlo’s brick-and-mortar stores to touch and feel the clothes and then pick them up if the clothes match their preferences.

Retail enterprises such as Amazon, Uniqlo, Best Buy, and Walmart can solve the last-mile delivery problem by implementing the BOPS service [17]. Furthermore, the BOPS service gives those enterprises a chance to make full use of physical stores to reach consumer terminals. Additionally, it can realize cross-promotion and cross-sell between channels [6, 11, 26]. According to a recent report, 64% of Europe’s top 500 retailers have implemented BOPS services; 40% of Best Buy’s online sales and 50% of Walmart’s online sales involve BOPS services.

Generally, the BOPS service is implemented by enterprises that show strong integration capabilities of online and offline information, logistics, and inventory. However, some physical enterprises are limited by network technology or the traffic of online sales. They may expand the online market by drawing support from the online platform giant. For instance, Gome, an electric appliance company in China, opens its official flagship store on Alibaba.com to expand its online business. In contrast, some online retail enterprises are hindered by the scale and number of physical stores. They always stretch their footprints to offline with brick-and-mortar stores, providing product display, experience, and after-sales service [24]. For example, Uniqlo establishes a BOPS partnership with 7-Eleven stores. Consumers who purchase from Uniqlo’s online store can pick up the goods at a nearby 7-Eleven convenience store.

Plainly, the BOPS contract based on online and offline operators is becoming more and more extensive. Online retail enterprises and physical store enterprises can achieve resource sharing and complementary advantages between channels [11, 20, 37]. Nevertheless, the operating modes, operating costs, and online and offline order fulfillment methods are quite different between operators in the BOPS contract, which may lead to the issues of channel competition, interest conflict, and double marginal effect. The co-opetition relationship between shareholders such as Uniqlo and 7-Eleven becomes complicated enough to operate the BOPS service.

Previous studies related to channel co-opetition are mainly in a dual-channel environment where the manufacturer sets up online sales channels based on the retailer’s brick-and-mortar stores [10, 13, 16, 43, 44]. This stream of literature has ignored consumers’ channel switching behaviors and the cross-channel effect. Additionally, omnichannel topics concerning channel switching and cross-channel effect mainly focus on the scenario where the retailer is a single operator for the online, offline, and BOPS channels [4, 9, 19, 34], litter attention has been paid to the omnichannel situation composed of multiple participants. Therefore, the following problems are serious challenges facing the omnichannel system.

Q1: How to effectively integrate online and offline channels to provide BOPS service considering consumer experiment preference and channel conversion?

Q2: Can the BOPS contract benefits the omnichannel participants? Under what conditions are the online player and offline player willing to reach the BOPS contract?

Q3: How to design price and operational strategies accounting for the cooperation and competition relationship between omnichannel participants?

Motivated by the above-mentioned management dilemma, this paper develops a theoretical model to investigate the co-opetition strategy of an omnichannel supply chain where a manufacturer not only opens an online sale channel and sells via the retailer’s offline channel but also sets up a BOPS channel in cooperation with the retailer. In the BOPS contract, the manufacturer provides the retailer with unit payment for each BOPS sale, encouraging the retailer to participate in the contract. We also consider consumers’ channel preference behavior by dividing them into omnichannel consumers and offline consumers. We first examine the base model in the absence of the BOPS contract as an operation benchmark. We then investigate the situation where the manufacturer and retailer reach the BOPS contract and conduct a comparison for those two game models. Furthermore, we study the consumer surplus to identify the economics of each model. Our model suggests management insights for the omnichannel players to identify whether and when to reach the BOPS contract and how to remain omnichannel competitive.

Our study provides several contributions. First, we contribute to the operation strategies of the omnichannel supply chain by suggesting optimal retail price, wholesale price, and channel structure. We find that the online price decreases with consumer online hassle cost, while the offline price and retailer profit increase with consumer online hassle cost. Moreover, the manufacturer derives a higher profit by increasing wholesale price when consumer online hassle cost is large. In the absence of the BOPS contract, when there are more omnichannel consumers, the manufacturer and retailer will increase their prices, resulting in a higher profit for the manufacturer but a lower profit for the retailer. In contrast, in the presence of the BOPS contract, the manufacturer is not necessarily benefiting from the omnichannel consumers, depending on the incremental profit margin and costs. The retailer should grasp the chance to reach the BOPS contract with the manufacturer when more omnichannel consumers enter the market.

Second, we propose a new BOPS contract composed of multiple omnichannel participants and explore whether it is profitable to introduce the BOPS contract. We find that adding the BOPS channel increases the online price, and it increases the offline price when the manufacturer’s BOPS operation cost is large or the retailer’s BOPS operation cost is small. Besides, the introduction of the BOPS contract results in a higher profit for the manufacturer when the retailer’s BOPS operation cost is large. Moreover, it leads to profit improvement for the retailer when the manufacturer’s BOPS operation cost is large and the retailer’s BOPS operation cost is small. Additionally, the retailer derives a higher profit if the additional purchase brings enough advantage to the retailer to increase the offline price. In this instance, the manufacturer can free rides on the retailer, thereby deriving a higher profit.

Third, we contribute to the omnichannel supply chain system by identifying the consumer surplus of the BOPS contract. The result implies that adding the BOPS channel leads to a higher consumer surplus when the manufacturer’s BOPS operation cost is small and the retailer’s BOPS operation cost is large. Furthermore, a higher consumer surplus can be achieved when consumers make additional purchases via the BOPS channel.

The remainder of this paper is organized as follows. In the next section, we review related literature. In Sect. 3, we elaborate on the research problem and state model assumptions. We construct the theoretical models in the absence of the BOPS contract in Sect. 4 and in the presence of the BOPS contract in Sect. 5. We compare those two models in Sect. 6 and conduct numerical analysis in Sect. 7. Section 8 relaxes some model assumptions to explore the robustness. In Sect. 9, we summarize the paper. All the derivations of the Propositions and Corollaries are provided in Appendix.

2 Literature review

There are two research streams closely related to our study, that is, channel strategies and omnichannel operation. This section reviews the most relevant research.

There has been significant research on channel strategies. Most extant studies paid attention to the pricing strategy to manage the channel conflict and channel coordination issues (e.g., [8, 10, 30, 43, 49]. In the subarea of channel conflict, Chen, Zhang, and Sun [8] researched pricing strategies for a dual-channel supply chain where the manufacturer sells products via the self-online direct channel and the retailer’s offline channel. They showed that the addition of the direct channel reach a win–win outcome. Matsui [30] explored the price competition in a dual-channel supply chain. They implied that it is not an optimal choice for supply chain members to design the wholesale price and direct price simultaneously. Niu, Cui, and Jie [33] investigated the pricing and channel conflict issues when the supplier opens an online direct channel. They found that fairness concern and channel power play a significant role in determining the supplier’s decision. Zhou, Zhao, and Wang [51] examined price decision-making in a dual-channel supply chain considering asymmetric channel information. They revealed that the manufacturer outperforms the retailer in capturing channel information. Pun, Chen, and Li [35] declared that the manufacturer is unwilling to implement a dual-channel structure when customers can freeride on the pre-sales service of channels.

Previous research related to channel conflict focused on discussing the establishment of online direct channels based on the distribution channels of traditional retailers [13, 16], Li et al. [21]. Most studies conclude that manufacturers reduce wholesale prices to prevent excessive reduction of retailers’ physical store demand, thereby alleviating double marginalization [43]. Double marginalization problems are usually solved through coordination strategies. The literature discussing channel coordination—the second branch of channel strategies—focus on the design of channel contracts, such as wholesale price contracts [10], profit-sharing contracts [42], cost-sharing contract [44], and two-part tariff contract [8]. However, the above literature whether channel conflict and channel coordination have ignored consumers’ channel switching behaviors.

Closer to our study are research considering cross-channel strategies. For instance, Nie et al. [32] examined the roles of the cross-channel effect on two competing brick-and-mortar retailers who add online channels to implement an online-and-offline strategy. Radhi and Zhang [36] studied the impact of cross-channel returns on order quantities of physical and online channels. Bian, Zhao, and Liu [3] examined two manufacturers’ cross-distribution channel strategies and their collusion incentives. Huang, He, and Chen [15] explored the cross-market sales channel strategies of luxury brand manufacturers who sell products via two separate markets. Notably, those studies state the cross-channel purchase as the model that consumers search for goods, compare goods prices, and determine purchase decisions in different channels. The main point is adding online/offline channels to satisfy consumers’ channel preferences. However, little research has addressed consumers’ channel experiments and channel transfer behavior, and the resulting cross-sale effect.

Our research is also relevant to the omnichannel operation. There are different types of omnichannel models explored by scholars, such as “Preorder-online, pickup-in-store” [47, 48], “Reserve-online-pick-up-and-pay-in-store” [45], “Online-to-offline” [7], “Buy-online-and-pickup-in-store” [20], and “Showroom” [12]. Furthermore, some scholars define omnichannel as the model that retailers open online, offline, and APP channels simultaneously to provide multi-channel service [39]. While other scholars divide omnichannel from the perspective of the shipping model, such as Ship-to-store [1] and Ship-from-store [2]. A common feature of those omnichannel models is that enterprises provide consumers an opportunity to experiment with different channels and transfer from one channel to another to realize their purchases.

Among the above-mentioned omnichannel models, one of the most popular and researched models is BOPS. For example, Cao et al. [5] examined the role of BOPS service on channel demand, pricing, and revenue of retailers. They found that the introduction of the BOPS channel enables the retailer to win higher profits under some simple conditions. Gao and Su [11] built an analytical model to research the role of the BOPS initiative on channel operation strategies. They found that a BOPS revenue-sharing policy between channels can mitigate incentive conflicts. Shi, Dong, and Cheng [38] showed that adopting the BOPS strategy will lead to a higher profit for the retailer when there are more informed consumers. Jin, Li, and Cheng [19] developed a theoretical model to study the BOPS strategy and its service area. They proved that the size of the BOPS service area is determined by BOPS customers’ arrival rate and unit inventory cost. Niu, Mu, and Li [34] clarified that the store pick-up service will raise the retail price but reduce the online demand size. Kong et al. [20] compared the consistent and inconsistent pricing strategies of online and offline channels when retailers adopt a BOPS policy. They found that the inconsistent pricing strategy outperforms the consistent pricing strategy under a low BOPS channel operating cost. Lin, Zhou, and Hou [27] investigated the influence of BOPS on price and quality decisions in an omnichannel supply chain.

After reviewing the BOPS-related studies, we find that those works treat the retailer as a single operator for the online, offline, and BOPS channels. Unlike the existing omnichannel environment, our work considers an omnichannel supply chain composed of multiple channel operators—one manufacturer sells products via the self-online channel, the retailer’s offline channel, and the BOPS channel cooperated with the retailer, which leads to a more complex channel competition and double marginal effect. More closely, [21, 22, 25] examined an omnichannel supply chain system where a manufacturer cooperates with a retailer to provide a BOPS strategy, whereas they focused on the cooperative advertising strategy. Table 1 summarizes the most relevant literature and the contribution of this paper. Our research not only proposes optimal operation strategies for the omnichannel supply chain composed of multiple channel operators, but also fully identifies the competitive and cooperative relationship between omnichannel players, and suggests management insights on whether and when to adopt the BOPS contract.

3 Problem statement and model assumption

3.1 Omnichannel supply chain

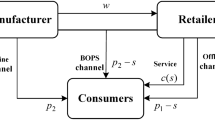

Consider an omnichannel supply chain composed of one dominant manufacturer and one retailer. The manufacturer sells products through the self-online channel with a retail price pe and an offline channel operated by a brick-and-mortar retailer with wholesale price w. The manufacturer opts to open a BOPS channel in cooperation with the retailer, satisfying the channel transfer and experiment preference of consumers. In the BOPS channel, consumers can order products on the manufacturer’s online platform and then pick up products in the retailer’s store, showing a cross-channel behavior. The cross-channel behavior may lead to the issues of channel competition, interest conflict, and double marginal effects between the manufacturer and retailer, which subsequently leads to the changing in pricing and co-opetition relationship. Furthermore, consumers may make additional purchases for other goods when they pick up the products in the brick-and-mortar store. To address those issues, we adopt the utility theory to characterize the competition relationship between channels. Moreover, we design a revenue distribution mechanism to model the interest conflict. We investigate the impact of the BOPS contract on operational strategies by comparing equilibrium solutions in the case of the BOPS and in the case without the BOPS. Additionally, we conduct an extension section to research the problem of the additional purchase.

In the BOPS channel, to encourage the retailer to participate in the contract, the manufacturer provides the retailer with a unit payment η for each BOPS sale. As in [21, 22, 25], η is long-term and always determined through negotiation, indicating that η is exogenous. Meanwhile, the manufacturer incurs an extra operation cost cM for the BOPS contract, which represents the operating cost of coordinating the online and offline logistics and information [47, 48]. Similarly, due to the cost of storing products and addressing the pick-up process, the retailer bears an extra cost cR for the BOPS contract [27].

The manufacturer sets a uniform price pe for the online and BOPS channels, which is a common assumption in omnichannel literature (e.g., [27, 29, 47, 48]. The retailer resales the product via the offline channel in retail price pr (pr > w > 0), satisfying pr = w + m, where m indicates the profit margin [23, 28].

3.2 Consumers

Consumers obtain a valuation v from purchasing a product. Since consumers cannot touch and try-on online products, they value the online product with a discount valuation βv, where β (0 < β < 1) indicates the channel acceptance [46]. Regarding the BOPS channel, although consumers order online, they can touch and feel the product when picking it up in-store. Thus, consumers obtain a v when purchasing from the BOPS channel, which is consistent with the offline channel [14].

Consumers incur an offline hassle cost hs if they purchase from the offline channel, indicating the travel costs in the process of visiting the physical store. Note that the geographical locations of consumers are distinct and consumers who reside further away from the physical store may generate a higher travel cost. Therefore, we assume that hs is uniformly distributed within 0 to T, i.e., \(\tilde{\xi }_{{1 - 1}}\), with a density of 1. A similar assumption can be found in related omnichannel topics, such as Cao, So, and Yin [5, 47, 48]. For the consumers who purchase from the online channel, they have to bear an online hassle cost ho, including the shipping cost, browse cost, and time cost of waiting for shipping [5]. For the BOPS market, consumers first browse the website to search for products and incur a cost associated with ho; they then travel to the store and offset a travel cost associated with hs. Let hb denotes the consumer’s BOPS hassle cost. Here, hb should be i) a proportion of ho because consumers do not need to undertake the shipping cost and time cost of waiting for shipping compared to online purchases; ii) a proportion of hs because consumers pick up their online orders directly without offsetting time or costs to search products. As in Kong et al. [20], we assume that hb is a function of ho and hs, that is, hb = ξ1ho + ξ2hs, where ξ1 (0 < ξ1 < 1) and ξ2 (0 < ξ2 < 1) imply the proportion of ho generated in the BOPS channel and the proportion of hs generated in the BOPS channel, respectively.

There are two types of customers, namely, omnichannel consumers (μ) and offline consumers (1-μ) [47, 48]. The former will consider available channels when making a purchase. They will purchase from the online channel or offline channel if the BOPS channel has not been opened; they will choose the online channel or BOPS channel or offline channel when the BOPS channel is established. The latter only purchase in-store, corresponding to those who are old-fashioned or show a low inconvenience cost to buy from the store [5].

3.3 Event sequence and notations

The event sequence of the omnichannel system is as follows. First, the dominant manufacturer decides whether to open the BOPS channel in cooperation with the retailer, and the retailer chooses whether to accept the BOPS contract. Second, the manufacturer designs the online price pe and the wholesale price w. Following this, the retailer sets the offline price pr to maximize its profit. Finally, consumers select a preference channel based on net utility. To research the co-opetition strategy of omnichannel supply chain members, we study two cases: the benchmark in the absence of the BOPS contract (a typical dual-channel; denoted by Strategy DC) and the omnichannel supply chain in the presence of the BOPS contract (denoted by Strategy OC). Table 2 summarizes the notations of this paper.

4 The benchmark in the absence of the BOPS contract

4.1 Model setup

In the benchmark, the manufacturer sells products via the online channel and the retailer’s offline channel. Consumers own a utility \(U_{o} = \beta v - p_{e} - h_{o}\) when they purchase online and \(U_{s} = v - p_{r} - h_{s}\) when they purchase offline. Accordingly, consumers maximize their utilities by strategically opting for online and offline channels.

-

1.

Omnichannel consumers. Omnichannel consumers (μ) purchase from the online channel within threshold \(\tilde{\xi }_{1 - 3}\), and from the offline channel within threshold \(U_{s} \ge \max \left\{ {U_{o} ,0} \right\}\). By deriving Us > Uo, we have \(p_{r} < \left( {1 - \beta } \right)\;v + p_{e} + h_{o} - h_{s}\). To ensure Us > Uo is absolutely true, pr should be satisfied \(p_{r} < \min \left\{ {\left( {1 - \beta } \right)v + p_{e} + h_{o} - h_{s} } \right\}\). Since hs follows uniformly distributed over 0 to T, then we have \(\min \left\{ {\left( {1 - \beta } \right)v + p_{e} + h_{o} - h_{s} } \right\} = \left( {1 - \beta } \right)v + p_{e} + h_{o} - T\). Therefore, when \(p_{r} < \left( {1 - \beta } \right)\;v + p_{e} + h_{o} - T\), all omnichannel consumers buy via the offline channel (See Fig. 1a). In contrast, by deriving Uo > Us, we have \(p_{r} > \left( {1 - \beta } \right)\;v + p_{e} + h_{o} - h_{s}\). Then \(p_{r} > \max \left\{ {\left( {1 - \beta } \right)\;v + p_{e} + h_{o} - h_{s} } \right\}\) should be satisfied to ensure Uo > Us is absolutely true. Similarly, \(\max \left\{ {\left( {1 - \beta } \right)\;v + p_{e} + h_{o} - h_{s} } \right\} = \left( {1 - \beta } \right)\;v + p_{e} + h_{o}\). Thus, when \(p_{r} > \left( {1 - \beta } \right)\;v + p_{e} + h_{o}\), all omnichannel consumers buy via the online channel (See Fig. 1c). In threshold \(p_{r} \in \left[ {\left( {1 - \beta } \right)\;v + p_{e} + h_{o} - T,\left( {1 - \beta } \right)\;v + p_{e} + h_{o} } \right]\), neither Us > Uo nor Uo > Us is absolutely true. Omnichannel consumers will selectively purchase from the online or offline channel (See Fig. 1b).

Note that, this study focuses on the situation that the online and offline channels are coexisting. As such, the condition \(p_{r} \in \left[ {\left( {1 - \beta } \right)\;v + p_{e} + h_{o} - T,\left( {1 - \beta } \right)v + p_{e} + h_{o} } \right]\) is assumed to be satisfied. Referring to Fig. 1b, the market demand of the offline and online channels are \(D_{s}^{DC - O} = \left( {1 - \beta } \right)\;v + p_{e} - p_{r} + h_{o}\) and \(D_{o}^{DC - O} = T - \left[ {\left( {1 - \beta } \right)\;v + p_{e} - p_{r} + h_{o} } \right]\), respectively. Here, the superscript “O” indicates the omnichannel consumers.

-

2.

Offline consumers. Offline consumers (1-μ) purchase from the offline channel if and only if \(U_{s} = v - p_{r} - h_{s} \ge 0\), and quit the market otherwise. Then the corresponding demands of the offline channel can be given as \(D_{s}^{DC - S} = v - p_{r}\), where the superscript “S” indicates the offline consumers.

Accordingly, the decision problem in Strategy DC is given as follows.

The first and second items on the right-hand side of ΠMDC correspond to the revenue of omnichannel consumers and offline consumers, respectively (note that omnichannel consumers purchase from the online channel DoDC−O or offline channel DsDC−O if the BOPS channel has not been opened). The first and second items on the right-hand side of ΠRDC correspond to the revenue of omnichannel consumers and offline consumers, respectively. In addition, consumer surplus (CS) is given by:

where the superscript star implies the equilibrium solution.

By using the standard backward induction approach, the equilibrium price, demand, and profit configuration can be characterized through the following proposition.

Proposition 1

In Strategy DC, given the condition of \(p_{r}^{DC} \in \left[ {\left( {1 - \beta } \right)v + p_{e}^{DC} + h_{o} - T,\left( {1 - \beta } \right)v + p_{e}^{DC} + h_{o} } \right]\), the equilibrium price, market demand, and profit of the manufacturer and retailer are summarized in Table 3.

Proposition 1 shows that when the manufacturer and retailer have not reached the BOPS contract, the dominant manufacturer derives a maximization profit ΠMDC* by setting a retail price and wholesale price configuration (peDC*, wDC*). As a Stackelberg follower, the retailer gains a maximization profit ΠRDC* by setting an offline retail price prDC*. Note that, equilibrium solutions are determined by some special parameter values. We conduct the following section to explore operation strategies.

4.2 Equilibrium analysis

In this section, we investigate the impact of main parameters on equilibrium solutions, including β, v, ho, T, and μ. The following corollary summarizes the results.

Corollary 1

In Strategy DC, the impact of main parameters on equilibrium solutions is given in Table 4.

Where \(\hat{\beta }_{{1}} = \frac{1}{2 - \mu }\), \(\hat{\beta }_{{2}} = \frac{{v + 2\left( {h_{o} - T} \right)}}{{v\left( {2 - \mu } \right)}}\), \(\hat{T}_{{1}} = \frac{{\left( {{1} - \mu } \right)^{2} \left( {\beta v - h_{o} } \right)}}{{2}}\), \(\hat{h}_{{o{1}}} = \frac{{2T - v\left( {1 - \beta \left( {2 - \mu } \right)} \right)}}{{{2} - \mu }}\), \(\hat{v}_{1} = \frac{{\mu h_{o} \left( {\beta \left( {2 - \mu } \right) - 1} \right) - 2\mu T\beta }}{{\left( {1 - 2\mu \beta } \right)^{2} + {2}\mu \beta^{2} \left( {{1} - \mu } \right)}}.\)

Corollary 1 reveals some insights. First, β derives a higher online price and a larger online market, while it leads to a lower offline price and a fewer offline market. A high β implies that the online channel is acceptable, as such, the manufacturer can capture more omnichannel consumers and then charge a higher online price. Naturally, the offline channel is at a disadvantage and then results in less market. To this end, the retailer reduces the offline price to compete with the online channel. Note that the offline market demand associated with offline consumers increases with β. Since the retailer reduces the offline price, thence, it is natural for offline consumers to buy more. In addition, the manufacturer derives a higher profit when the online channel is attractive (i.e., \(\beta > \hat{\beta }_{{2}}\)); while the retailer’s profit decreases with β because the offline channel is less attractive under a larger β.

Second, the role of v matches our theoretical prediction, in that, the higher the v, the higher the price charged by supply chain enterprises. Besides, when \(\beta < \hat{\beta }_{{1}}\), a higher v results in a stronger competitive advantage for the offline channel, then the demand of the offline channel will be higher, while the demand of the online channel will be lower. In addition, the profit of the manufacturer first decreases and then increases with v. The reason behind this is that consumers are unwilling to purchase products in a low valuation v (i.e., βv), which leads to a low market and profit for the manufacturer. In contrast, a sufficiently large v enables the manufacturer to derive more profit. Differently, the profit of the retailer increases with v because the offline demand has a full valuation v.

Third, concerning the impact of ho, a higher ho result in a lower online price but a higher offline price. The intuition behind this is that the manufacturer reduces the online price to attract consumers when the online hassle cost is large; and subsequently, the offline channel is at an advantage in channel competition and then the retailer raises the offline price. As a result, the online market will be lower and the offline market will be larger. Note that the offline market associated with offline consumers decreases with ho. It follows that the retailer raises the offline price when ho is large. In this instance, offline consumers are unwilling to purchase products due to low utility. Additionally, the manufacturer derives a high profit when ho is relatively large (i.e., \(h_{o} > \hat{h}_{{o{1}}}\)). Note that the manufacturer’s revenue is generated from the online, BOPS, and offline channels in an omnichannel environment. An increased or decreased revenue for a special channel may not absolutely lead to a higher or lower total profit. Here, a large ho may stimulate omnichannel consumers to purchase through the BOPS or offline channel, allowing the BOPS and offline channels to capture more markets. In this situation, the manufacturer can benefit from the offline channel through the leverage of wholesale price. Totally, although the revenue of the online channel may be lower when ho is high, the revenue brought from the BOPS and offline channels will be large enough to generate an enhanced profit. In business practice, with the increase in the hassle cost of online purchases (e.g., consumers have to pay for the shipping fee, spend more time waiting for products to be delivered, and so forth), Meituan.com, an online platform in China, tends to deliver consumers’ online orders to convenience stores such as Tianfu and Tangjiu. Consumers can pick up their goods in those convenience stores after receiving the picking information. According to the data of Meituan.com, the omnichannel markets will increase by 67% year on year in 2022.

Fourth, regarding the T, we find that the larger the T, the large the markets captured by the manufacturer and retailer. This is because supply chain enterprises are likely to cover consumers under a large T. At this point, the manufacturer raises the online price and wholesale price, then the retailer responds by increasing the offline price. However, offline consumers buy less when T is relatively large because the retailer charges a high offline price.

In addition, the higher the μ, the more likely the omnichannel consumers to choose the online channel rather than the offline channel. As a result, the manufacturer can increase the online price, and then the retailer responds by charging a higher offline price. However, the retailer derives less profit with large μ because the retailer captures fewer offline consumers. Note that the impact of μ on the profit of the manufacturer cannot be proved analytically, we thus turn to numerical studies in Sect. 7.

5 Omnichannel supply chain in the presence of the BOPS contract

5.1 Model setup

In this section, we investigate the scenario where the manufacturer opens the BOPS channel in cooperation with the retailer. Based on the model assumption, the utility of consumers for the online, BOPS, and offline channels are \(U_{o} = \beta v - p_{e} - h_{o}\), \(U_{b} = v - p_{e} - \xi_{1} h_{o} - \xi_{2} h_{s}\), and \(3 > \beta \mu\), respectively. Consumers maximize their utilities by opting for the optimal channel.

(1) Omnichannel consumers. Omnichannel consumers purchase from the online channel within threshold \(U_{o} \ge \max \left\{ {U_{b} ,U_{s} ,0} \right\}\); from the BOPS channel within threshold \(U_{b} \ge \max \left\{ {U_{o} ,U_{s} ,0} \right\}\); from the offline channel within threshold \(U_{s} \ge \max \left\{ {U_{o} ,U_{b} ,0} \right\}\). By comparing the magnitude of channel utilities, we have seven channel configurations under different conditions, which are given in Table 5.

Observation 1

When p r is small, omnichannel consumers will purchase from the offline channel (e.g., Situations I, II, III, and IV); and from the online channel otherwise (e.g., Situations V, VI, and VII). When h is small, omnichannel consumers will opt for the online channel (e.g., Situations II and VII), while they will opt for the BOPS channel if ho o is relatively large (e.g., Situations IV and VI).

Observation 1 matches our theoretical prediction that a low price leads to more demand; a small hassle cost results in greater demand. Note that, this study explores the co-opetition strategy between the manufacturer and retailer and investigates the channel competition among available channels. As such, we focus on the situation that the online, BOPS, and offline channels are coexisting, namely, Situation III. In this situation, we illustrate its market segmentation in Fig. 2.

Where \(h_{s1} = \frac{{p_{e} - p_{r} + \xi_{1} h_{o} }}{{1 - \xi_{2} }}\), \(h_{s2} = \left( {1 - \beta } \right)v + p_{e} - p_{r} + h_{o}\), \(h_{s3} = \frac{{\left( {1 - \beta } \right)v + \left( {1 - \xi_{1} } \right)h_{o} }}{{\xi_{2} }}\).

The market demand of the online, BOPS, and offline channels can be derived from Fig. 2, namely, \(D_{s}^{OC - O} = h_{s1} - 0 = \frac{{p_{e} - p_{r} + \xi_{1} h_{o} }}{{1 - \xi_{2} }}\), \(D_{b}^{OC - O} = h_{s3} - h_{s1} = \frac{{\left( {1 - \xi_{2} } \right)\left( {1 - \beta } \right)v + \left( {1 - \xi_{{1}} - \xi_{2} } \right)h_{o} - \xi_{2} \left( {p_{e} - p_{r} } \right)}}{{\xi_{2} \left( {1 - \xi_{2} } \right)}}\), and \(D_{o}^{OC - O} = T - h_{s3} = \frac{{\xi_{2} T - \left( {1 - \beta } \right)v - \left( {1 - \xi_{1} } \right)h_{o} }}{{\xi_{2} }}\).

(2) Offline consumers. Offline consumers purchase from the offline channel if and only if \(U_{s} = v - p_{r} - h_{s} \ge 0\), and quit the market otherwise. The market segmentation of offline consumers in Strategy OC is consistent with Strategy DC. To this end, the corresponding demands of the offline channel can be \(D_{s}^{OC - S} = v - p_{r}\).

Accordingly, the decision problem of Strategy OC is given as follows.

The revenue of the manufacturer and retailer is generated from omnichannel consumers and offline consumers, which is consistent with Eq (1). In contrast, there is an additional term \(D_{b}^{{OC - O}}\) due to the opening of the BOPS channel. Besides, consumer surplus is as follows:

Deriving the above decision model, we have Proposition 2.

Proposition 2

In Strategy OC, given the threshold \(p_{r}^{OC} \in \left( {\max \left\{ {p_{r2} ,p_{r3} } \right\},p_{r4} } \right]\) and \(h_{o} \le h_{o2}\), the equilibrium price, market demand, and profit of the manufacturer and retailer are summarized in Table 6.

Proposition 2 shows that after reaching the BOPS contract, the dominant manufacturer can derive a maximization profit ΠMOC* by setting the equilibrium price and wholesale price configuration (peOC*, wOC*). The retailer, as a Stackelberg follower, gains a maximization profit ΠROC* by setting the equilibrium offline price prOC*. Note that equilibrium solutions are determined by some special parameter values. Therefore, we conduct the following section to explore the operation strategies.

5.2 Equilibrium analysis

In this section, we examine the impact of main parameters on equilibrium solutions, including the normal parameters β, v, ho, T, and μ; and the BOPS contract related parameters cM, cR, η, ξ1, and ξ2. The following corollaries disclose the results.

Corollary 2

In Strategy OC, the impact of main parameters on equilibrium solutions is given in Table 7.

There are several noteworthy observations from Corollary 2. First, concerning the impact of β, it is easy to infer that the larger the β, the larger the online market the manufacturer captures, while the offline demand will be lower under a channel competition environment. Second, we find that v leads to higher online, offline, and wholesale prices. This is because the higher the valuation the consumers perceive the product, the higher the price the supply chain enterprises charge to maximize their marginal profits, which is consistent with Strategy DC. However, the BOPS channel captures a higher market with increasing v when β is relatively low (i.e., \(\beta < \tilde{\beta }\)). The rationale is that the online channel is less acceptable under a low β. In this situation, the BOPS channel shares a large proportion of omnichannel consumers, which results in higher market demand. Besides, it is intuitive to find that offline consumers buy more under a high valuation. Third, the role of ho in Strategy OC is in line with Strategy DC. Conversely, the demand of the BOPS channel decreases with ho when μ is small (i.e., \(\Pi_{R}^{OC}\)). The chief factor driving this result is that there are fewer omnichannel consumers when μ is low. In this instance, those consumers purchase less via the online or BOPS channel when ho is large. Note that, the action of T in Strategy OC is in line with Strategy DC. Therefore, we will not repeat the management analysis.

In addition, there are some interesting findings associated with the BOPS-related parameters (See Table 7). Concerning the BOPS operation cost (i.e., cM and cR), the larger the cM, the higher the price the manufacturer and retailer set. This is because the manufacturer and retailer raise their prices to balance marginal profit. Kong et al. [20] also argued that retailers will raise the online price to compensate for the increase in operating costs, whereas they focus on the scenario where the retailer is a single operator for the online, offline, and BOPS channels. Additionally, the larger the cR, the lower the offline price the retailer charges. The reason behind this is that the retailer is unwilling to reach the BOPS contract if cR is large. To this end, the retailer will lower its price to attract omnichannel consumers who originally make a BOPS purchase but transfer to an offline purchase. In this instance, the manufacturer charges a higher wholesale price to derive more revenue from the offline channel. Besides, a high cj (j = M,R) leads to a low BOPS market but a large offline market. The result is intuitive, in that, the BOPS channel is unreachable under a large cj, then the BOPS market will be lower. While the offline channel catches a chance to capture omnichannel consumers, resulting in a higher market.

Another worth-noting issue relates to the impact of unit payment η. From Table 7, we observe that a high η leads to high online and offline prices. It follows that the manufacturer raises its online price to ensure its marginal profit. The retailer then follows the pricing strategy of the manufacturer in a competitive environment. Of specific interest would be the learning that the manufacturer will lower its wholesale price when η is high. An explanation for this is that the manufacturer sells products via the BOPS and offline channels simultaneously. Note that, these two channels are opened in cooperation with the retailer. In this regard, the action of η is a “wholesale price” which plays a leverage role in coordinating the relationship of channel stakeholders. When η is relatively large, the retailer enjoys a wholesale discount in the BOPS channel. Thus, the manufacturer will also lower its wholesale price to entice the retailer to order more, resulting in a larger offline market.

The action of ξ1 is similar to that of ho because a high ξ1 indicates a large online hassle cost the manufacturer offsets. Detail analysis can refer to the action mechanism of ho. Different from the action of ho, the online market increases with ξ1. It follows that when consumers opt for the online and BOPS channels, the larger the ξ1, the higher the proportion of online hassle cost generated in the BOPS channel. In this situation, the BOPS channel is less attractive, and then the online channel captures more omnichannel consumers.

Note that the impact of μ, η, cM, cR, ξ1, and ξ2 on profit cannot be proved analytically, we thus turn to numerical studies in Sect. 7.

6 Model comparison

In this section, we explore whether it is profitable for the manufacturer and retailer to implement the BOPS contract. The following corollaries characterize the results.

Corollary 3

The introduction of the BOPS contract does not necessarily increase or decrease the market demand of the online and offline channels, but depends on the system parameters. Specifically,

-

i.

\(D_{o}^{OC - O*} < \left( \ge \right)D_{o}^{DC - O*}\) when \(\xi_{1} < \left( \ge \right)\tilde{\xi }_{1 - 1}\).

-

ii.

\(\left( {D_{o}^{OC - O*} + D_{b}^{OC - O*} } \right) > \left( \le \right)D_{o}^{DC - O*}\) when \(\xi_{1} < \left( \ge \right)\tilde{\xi }_{1 - 2}\).

-

iii.

\(D_{s}^{OC - O*} < \left( \ge \right)D_{s}^{DC - O*}\) when \(\xi_{1} < \left( \ge \right)\tilde{\xi }_{1 - 3}\).

-

iv.

\(D_{s}^{OC - S*} > \left( \le \right)D_{s}^{DC - S*}\) when \(\xi_{1} < \left( \ge \right)\tilde{\xi }_{1 - 4}\).

Where \(\left| {H^{OC} } \right| > 0\) are given in Table 9 of Appendix A.

Corollary 3(i) shows that when the proportion of online hassle cost generated in the BOPS channel ξ1 is relatively small, the introduction of the BOPS channel decreases the online demand. This is because the BOPS channel shares a proportion of omnichannel consumers under a low ξ1, then the demand of the online channel will be lower. Even though, the total online demand (including the demand of online and BOPS channels) in Strategy OC is larger than that of Strategy DC when ξ1 is small (i.e., Corollary 3(ii)). Directly, the adding BOPS channel is attractive in a low ξ1, which results in a larger total online market. Besides, since more omnichannel consumers purchase via the BOPS channel under a low ξ1, it is natural to gather that the offline demand associated with omnichannel consumers is lower in Strategy OC than in Strategy DC (i.e., Corollary 3(iii)). In contrast, when ξ1 is small, the offline demand associated with offline consumers will be larger (i.e., Corollary 3(iv)). An explanation for this is that the retailer lowers its offline price if ξ1 is small (Refer to Corollary 2). Therefore, offline consumers will buy more. Plainly, omnichannel enterprises could strive to reduce hassle costs and improve the convenience of consumers in the BOPS channel, so as to attract more consumer groups. For example, Freshhema, an omnichannel company in China, builds an omnichannel network system by linking online platforms and physical stores to provide consumers with convenience. Consumers can freely choose pick-up stores through Freshhem’s app, which reduces the hassle cost for consumers.

Corollary 4

When reaching the BOPS contract, the pricing strategies are as follows:

-

\(p_{e}^{OC * } > p_{e}^{DC*}\).

-

\(p_{r}^{OC*} < \left( \ge \right)p_{r}^{DC*}\) when \(\eta < \left( \ge \right)\tilde{\eta }\) or \(c_{M} < \left( \ge \right)\tilde{c}_{M}\) or \(c_{R} > \left( \le \right)\tilde{c}_{R}\).

-

\(w^{OC*} > \left( \le \right)w^{DC*}\) when \(\eta < \left( \ge \right)c_{R}\).

Where \(\tilde{\eta }\), \(p_{r}^{OC}\), and \(D_{o}^{OC - O}\) are given in Table 9 of Appendix A.

Corollary 4(i) reveals that the manufacturer raises the online price if it opens the BOPS channel. This finding is inconsistent with the dual-channel supply chain system because the manufacturer traditionally lowers its online price when introducing the online direct channel [13, 21, 21, 22, 22, 25, 25]. The chief factor driving this result is that consumers have a higher valuation for the BOPS channel (i.e., v) than the online channel (i.e., βv) since they can touch and feel the product in the BOPS channel. In this regard, the consumer’s reserve price for a homogeneous product will be higher. Therefore, our result suggests online retail companies raise the online price to derive a higher profit margin when reaching a BOPS contract with physical retailers.

Second, from Corollary 4(ii), we find that when η is relatively large, the retailer will increase the offline price in the BOPS contract, and vice versa. It follows that the manufacturer increases the online price under a large η. Then the retailer follows the pricing policy of the manufacturer to derive a higher profit margin. Besides, when cM is large or cR is small, the retailer will also increase its offline price. The intuitive is that a large manufacturer’s BOPS operating cost enables the retailer to enjoy a channel advantage and then raise the price; a low retailer BOPS operating cost also leads to a higher price.

Furthermore, Corollary 4(iii) shows that the adding of the BOPS channel decreases the wholesale price when η is large. This result matches the above-mentioned analysis, that is, when η is relatively large, a large discount is provided by the manufacturer in the BOPS contract. To this end, the manufacturer will also lower its wholesale price to entice the retailer to order more. Obviously, the retailer can increase the offline price if it has strong negotiation skills in the BOPS contract. In this situation, the manufacturer should reduce its wholesale price to strive for profit space.

7 Numerical analysis

In this section, we turn to numerical analysis to study the impact of key parameters on profit as well as verify the main results. The setting of the parameters is i) based on empirical data collected from the real-world case; ii) to guarantee the existence of equilibrium and for the sake of convenience.

7.1 Impact of μ on the profit of the manufacturer in the benchmark

To study the impact of μ on the manufacturer’s profit with different ho, β, and v, given the model condition \(p_{r}^{DC} \in \left[ {\left( {1 - \beta } \right)v + p_{e}^{DC} + h_{o} - T,\left( {1 - \beta } \right)v + p_{e}^{DC} + h_{o} } \right]\) in Proposition 1, we assume i) v = 3, β = 0.9, T = 0.6 with varying ho; ii) v = 3, T = 0.6, ho = 0.2 with varying β; iii) β = 0.9, T = 0.6, ho = 0.2 with varying v to research managerial insights, as shown in Fig. 3.

We observe from Fig. 3 that in most cases, the profit of the manufacturer increases with μ regardless of the magnitude of ho, β, and v. The logic behind this is that, the higher the μ, the omnichannel consumers are likely to choose the online channel rather than the offline channel. As a result, the manufacturer who operates the online channel can increase the online price. To this end, the manufacturer derives higher profits with a large online market and profit margin.

7.2 Impact of key parameters on equilibrium solutions in the presence of the BOPS contract

In this section, we first study the impact of μ on prices and profits. Given the model condition \(D_{s}^{OC - O}\) and \(D_{s}^{OC - S}\) in Proposition 2, we assume that v = 3, β = 0.9, T = 0.6, ho = 0.2, ξ1 = 0.6, ξ2 = 0.7, cM = 0.1, cR = 0.08, η = 0.3. Figure 4 illustrates the result.

We find from Fig. 4 that i) online, offline, and wholesale prices increase with μ; ii) in most cases, the profit of the manufacturer increases with μ, while the profit of the retailer decreases with μ. The intuition behind this is that the manufacturer will raise the online price to maximize its profit margin when there are more omnichannel consumers. Naturally, the manufacturer will be better off. In this regard, the retailer, as a Stackelberg follower, will also increase its price in a channel competition context. Even though, since there are fewer offline consumers, the total offline market will be lower, resulting in a decrease in the profit of the retailer. Therefore, when more omnichannel consumers enter the market, physical companies should grasp the chance to reach the BOPS contract with the online platform and follow the pricing strategy of the online platform to avoid losses.

Next, we investigate the influence of η, cM, cR, ξ1, and ξ2 (i.e., parameters associated with BOPS contract) on profit. The common setting is v = 3, β = 0.9, T = 0.6, ho = 0.2, μ = 0.7. Moreover, we fix ξ1 = 0.6, ξ2 = 0.7, cM = 0.1, cR = 0.08 to study the impact of η in Fig. 5(a); fix ξ1 = 0.6, ξ2 = 0.7, η = 0.3 to study the impact of cM and cR in Fig. 5(b); fix cM = 0.1, cR = 0.08, η = 0.3 to study the impact of ξ1 and ξ2 in Fig. 5(c).

We observe that, from Fig. 5a, the profit of the manufacturer decreases with η, while the profit of the retailer increases with η. Essentially, the manufacturer’s profit margin in the BOPS channel will be lower if η is large. To this end, the manufacturer derives less profit when opening the BOPS channel. In contrast, the retailer can derive a high profit through the BOPS contract when η is relatively large.

Figure 5b indicates that in most cases, cM and cR increase the profit of the manufacturer and retailer. This result mismatch our theoretical prediction that a higher operation cost leads to a higher profit. Recall Corollary 2, the manufacturer employs a high-price strategy to balance its profit margin under a large cM, and the retailer follows by raising its offline price. In this regard, they may derive a higher profit when the incremental profit margin is sufficiently large to offset the cost. Besides, the retailer reduces its offline price when cR is large. Then the retailer can capture a large offline market including omnichannel consumers and offline consumers. In this situation, the retailer still has an opportunity to derive a higher profit. Consequently, it can be deduced that when the BOPS operation cost is large, a high-price policy of the manufacturer and a low-price policy of the retailer provides an additional profit-making opportunity.

Let us note that, from Fig. 5c, the larger the ξ2, the higher the profit the manufacturer derives and the lower the profit the retailer captures. A natural explanation is that the manufacturer reduces its online price to attract consumers when ξ2 is large, while the retailer increases its offline price to enjoy the channel advantage. At this point, omnichannel consumers will transfer from the BOPS channel to the online channel or from the offline channel to the online channel, which increases the profit of the manufacturer. Since offline consumers may quit the market under a large offline price, the retailer is likely worse off due to the reduced offline market size.

7.3 Comparison of Strategy DC and Strategy OC

In this section, we first compare the market demand and price for Strategy DC and Strategy OC. Here, the setting satisfies the model condition in Strategy DC and Strategy OC, simultaneously. Thus, let v = 3, β = 0.9, T = 0.6, ho = 0.2. Figure 6 presents the comparison in terms of market demand between Strategy DC and Strategy OC with varying ξ1 and ξ2. Figure 7 shows the comparison in terms of price between Strategy DC and Strategy OC with varying η, cM, and cR.

Figure 6 indicates that whether the introduction of the BOPS channel leads to a higher or lower market demand depends on ξ1. When ξ1 is sufficiently high, the introduction of the BOPS channel increases the online and offline demands associated with omnichannel consumers; while it reduces the total online demand and the offline demand associated with offline consumers. Those findings verify the results of Corollary 3. Furthermore, Fig. 7 implies that the manufacturer will raise the online price when implementing the BOPS contract. This is because consumers can touch and feel the product in the BOPS channel, thereby increasing experiment valuation. However, the manufacturer increases the wholesale price only if η is low; and the retailer increases the offline price when η is relatively large in the BOPS contract. Those results match the results of Corollary 4.

Next, we compare the magnitude of profit and consumer surplus between Strategy DC and Strategy OC. Figure 8 illustrates the optimal strategy with changing cM and cR.

Figure 8 implies that the manufacturer intends to open the BOPS channel when cR is large. Referring to Table 7, the retailer lowers its offline price to attract omnichannel consumers under a large cR, which may increase the offline market. In this situation, the manufacturer benefits from the retailer by charging a high wholesale price. Apparently, wholesale price plays an important role in integrating the revenue of the manufacturer. Furthermore, the offline market associated with omnichannel consumers increases with cR, which once again provides an additional profit-making opportunity for the manufacturer. Different from the logic of the manufacturer, the retailer is willing to open the BOPS channel under a large cM and a low cR. Recall Corollary 4, the retailer raises the offline price when cM is large and cR is small. As such, the retailer derives a higher margin profit by adding the BOPS channel. Moreover, recall Corollary 2, the retailer captures i) a large proportion of omnichannel consumers under a large cM; ii) a large proportion of offline consumers under a small cR. In this situation, the retailer is likely to take part in the BOPS contract due to an increasing profit. We can also find that the adding of the BOPS channel does not definitely increase consumer surplus, and it happens only if cR is large. Under a high cR, the retailer will lower the offline price. In this regard, there exists an opportunity for consumers to gain a higher consumer surplus.

By observing Fig. 8d we find that when cM and cR are relatively large, the implementation of the BOPS contract (i) benefits the manufacturer and retailer; (ii) increases consumer surplus. As mentioned above, under a high cM and cR, a low offline price is charged, a large omnichannel market is captured, and a high wholesale revenue is derived, which leads to a global optimum.

We continue to study the profitability of the BOPS contract under different μ and η, revealing in Fig. 9. We note that, from Fig. 9, the manufacturer is willing to adopt the BOPS contract when η is small; while the retailer intends to participate in the BOPS contract when η is large. It is easy to infer that the manufacturer is willing to introduce the BOPS contract when the unit payment offered by the manufacturer is small, and vice versa. Besides, consumer surplus in Strategy OC outperforms Strategy DC when η and μ are low. The reason behind this is that a small η and μ indicates a low price (Refer to Table 7; Figs. 3 and 4), which increases the consumer surplus.

Particularly, there exists a region with a middle η such that Strategy OC outperforms Strategy DC in terms of profit and consumer surplus simultaneously. Apparently, omnichannel supply chain enterprises should negotiate a suitable η to reach the BOPS contract, ensuring the expected benefits for the manufacturer and retailer. Saha and Bhattacharya [37] also argued that there should be a revenue-sharing agreement for every BOPS order between the online operator and store operator in an omnichannel ecosystem. In business practice, retail companies, such as Home Depot, Macy’s, and Pepperfry, will always negotiate a commission with their company-owned and franchisee stores when constructing BOPS service.

So far, we have conducted a detailed investigation on the profitability of the BOPS contract. We suggest that online companies and physical companies should highlight the parameters associated with the BOPS contract to introduce the BOPS channel, such as cM, cR, η, and μ. Specifically, online companies can introduce the BOPS channel when cR is large, forcing physical companies to lower offline price and thereby benefiting from high wholesale price. Physical companies can take part in the BOPS channel when the profit margin (e.g., η and pr) and offline market are sufficiently large. Besides, online companies and physical companies must identify the consumer attribute to adopt the BOPS contract: online companies should avoid losing the omnichannel market due to the high-price policy, and physical companies should grasp the chance to reach the BOPS contract with online companies when more omnichannel consumers enter the market.

8 Extensions

In the previous section, we assume that consumers only pick up their online orders when visiting the brick-and-mortar store. According to the study by USP (2015), 45% of the consumers will make additional purchases for other goods when they pick up products in the brick-and-mortar store. Zhang, Xu, and He [45], Gao and Su [11], and Li et al. [26] believe that offline retailers would generate a “cross-selling benefit” under the BOPS service. When the BOPS contract derives additional purchases for the brick-and-mortar retailer, then some interesting issues naturally arise. That is, how will the retailer weigh the benefit of additional purchases and unit payment to make BOPS decision? What is the impact of additional purchases on the manufacturer’s compensation policy? What are the changes in channel competition, pricing strategy, and profit relationship of the omnichannel supply chain?

To address the above-mentioned practice issues, we extend Strategy OC to the situation where omnichannel consumers make additional purchases for other products when picking up their online orders in-store (denoted by Strategy OC-E). Let α denote the additional purchases that every BOPS consumer made. For those additional purchases market (i.e., \(D_{b}^{OC - O}\)), the retailer offsets a wholesale price \(\varpi\) and derives a revenue \(D_{b}^{OC - O} \left( {a - \varpi } \right)\); the manufacturer gains a wholesale revenue \(D_{b}^{OC - O} \varpi\). Here, we assume that \(\varpi\) is fixed because we focus on the operation strategy of original products and the role of a. The timeline of Strategy OC-E is consistent with Strategy OC. As such, the decision model can be developed to the following.

Since consumers who make additional purchases via the BOPS channel do not need to offset excess hassle cost, thence, the adding consumer surplus for those consumer groups should be \(\mu \int_{{\frac{{p_{e}^{OC - E*} - p_{r}^{OC - E*} + \xi_{1} h_{o} }}{{1 - \xi_{{2}} }}}}^{{\frac{{\left( {1 - \beta } \right)v + \left( {1 - \xi_{{1}} } \right)h_{o} }}{{\xi_{{2}} }}}} {\left( {v - a} \right)} \;dh_{s}\). Thus, consumer surplus is given by:

Deriving the above decision model, we have Proposition 3.

Proposition 3

In Strategy OC-E, given the threshold \(p_{r}^{OC - E} \in \left( {\max \left\{ {p_{r2} ,p_{r3} } \right\},p_{r4} } \right]\) and \(h_{o} \le h_{o2}\), the equilibrium price and market demand of the manufacturer and retailer are summarized in Table 8.

Proposition 3 shows that when the manufacturer and retailer reach the BOPS contract and consumers make additional purchases, the dominant manufacturer maximizes its profit by setting price configuration (peOC−E*, wOC−E*). The retailer gains a maximization profit by setting price prOC−E*.

Next, we research the robustness of our main results. All the derivations are provided in Appendix B. We find that, from Table 10, most of our previous results remain unchanged. Besides, some new findings associated with additional purchases are as follows. First, offline price increases with a. The reason behind this is that the larger the a, the higher the additional profit the retailer derives from the offline channel without incurring BOPS operating cost. Then the retailer will raise the offline price to benefit from the spillover effect of the BOPS contract. Second, it is worth highlighting that wholesale price decreases with a. Generally, the manufacturer raises the wholesale price to derive more offline profit when the offline price is high (a consensus in a typical dual-channel supply chain, such as [13, 31], while the current result presents the opposite rule. The chief factor driving this result is that the retailer captures an additional offline demand (i.e., \(D_{b}^{OC - O}\)) without employing a low-price policy. However, the manufacturer cannot control this market segment through the leverage of wholesale price. As such, the retailer enjoys a channel advantage in the BOPS contract and the manufacturer lowers the wholesale price to stimulate the retailer to reach the BOPS contract. This result offers important implications for managers in the omnichannel system: a high additional purchase enables physical companies to capture a competitive advantage in the BOPS contract and forces online companies to develop a low-wholesale price policy.

Now, we compare the profit and consumer surplus between Strategy OC-E and Strategy OC to explore the role of additional purchases. Since the manufacturer may conduct a differentiated compensation policy (characterized by η) when there are additional purchases, as such, we study the equilibrium strategies by changing a and η. Figure 10 plots the result.

The optimal strategy between Strategy OC-E and Strategy OC with changing a and η. The setting is v = 3, β = 0.9, T = 0.6, ho = 0.2, ξ1 = 0.6, ξ2 = 0.7, η = 0.3, μ = 0.7, \(\varpi = 1\), satisfying the model conditions \(p_{r}^{OC - E} \in \left[ {\left( {1 - \beta } \right)v + p_{e}^{OC - E} + h_{o} - T,\left( {1 - \beta } \right)v + p_{e}^{OC - E} + h_{o} } \right]\), \(p_{r}^{OC - E} \in \left( {\max \left\{ {p_{r2} ,p_{r3} } \right\},p_{r4} } \right]\) and \(h_{o} \le h_{o2}\).

Some interesting results are observed in Fig. 10. First, Strategy OC-E outperforms Strategy OC for the manufacturer. This is because i) the manufacturer captures an additional wholesale revenue for other products; ii) the manufacturer captures a higher BOPS market when consumers make additional purchases. Second, in most cases, the retailer will be better off when there are additional purchases. However, the retailer may derive a lower profit in Strategy OC-E than in Strategy OC when a and η are simultaneously small. According to Table 10, when a and η belong to a small value, the offline price is lower in Strategy OC-E than Strategy OC, while the wholesale price is larger. It indicates a low-profit margin for the retailer, thereby leading to a low profit. The critical learning is that the retailer is not affirmatively benefiting from consumer additional purchases, it happens when the additional purchase brings enough advantage for the retailer to set a high price. Therefore, physical companies should identify an appropriate time to design a high-price policy to benefit from the additional purchase. Third, in most instances, Strategy OC-E outperforms Strategy OC in terms of consumer surplus, except in the case that a is sufficiently small and η is sufficiently large. This is because i) a small a implies consumers enjoy fewer benefits from the additional purchases (they do not need to offset BOPS hassle cost for additional markets); ii) a large η results in a high price (see Table 10). In this instance, the consumer surplus in Strategy OC-E will be lower. Totally, when a is relatively large, the overall revenue (including profit and consumer surplus) of the omnichannel supply chain is better in Strategy OC-E than in Strategy OC (see Fig. 10(d)). This is because additional purchases enable the manufacturer to benefit from the wholesale revenue, and allow the retailer to derive increasing profit through the BOPS contract.

9 Conclusion

This paper studies an omnichannel supply chain in which the manufacturer sets up BOPS in cooperation with the retailer. We address the problem of whether it is beneficial for the manufacturer and retailer to adopt the BOPS contract concerning consumer type, channel preference, and channel competition. We also investigate consumer surplus to research the economics of the omnichannel system. Our theoretical model provides decision-makers with technical operational recommendations, as follows.

First, operational strategy for the omnichannel supply chain. Online price decreases with consumer online hassle cost, while offline price increases with consumer online hassle cost. The profit of the retailer increases with consumer online hassle cost, whereas the manufacturer derives a higher profit only if the consumer online hassle cost is relatively large. In the absence of the BOPS contract, when there are more omnichannel consumers, both the manufacturer and retailer increase their prices. In this situation, the manufacturer will be better off, while the retailer derives less profit. In the presence of the BOPS contract, the manufacturer is not necessarily benefiting from omnichannel consumers. It should weigh the benefit generated from the incremental profit margin and its cost. Differently, the retailer should grasp the chance to reach a BOPS contract with the manufacturer when more omnichannel consumers enter the market. We can observe in business practice that many offline companies closed down during the COVID-19. Actually, those offline enterprises are more incentive to open a BOPS channel to expand their online market, capturing omnichannel consumers so as to avoid losses.

Second, the impact of the BOPS contract. The introduction of the BOPS channel increases the online price, while it increases the offline price when the manufacturer’s BOPS operation cost is large or the retailer’s BOPS operation cost is small. Adding the BOPS channel does not definitely decrease or increase the profits for the manufacturer and retailer. Specifically, the BOPS contract results in a higher profit for the manufacturer when the retailer’s BOPS operation cost is relatively large, and it leads to a large profit for the retailer when the manufacturer’s BOPS operation cost is large and the retailer’s BOPS operation cost is small. Furthermore, adding the BOPS channel captures a higher consumer surplus when the manufacturer’s BOPS operation cost is small and the retailer’s BOPS operation cost is large. In addition, omnichannel supply chain enterprises should negotiate a suitable unit compensation policy to reach the BOPS contract, ensuring the expected benefits for players. For example, in the community group buying industry, Duoduo vegetables and supermarkets usually negotiate a commission rate of 8%-10% in the BOPS contract; Freshhema offers its offline physical store with a 10% commission rate.

Third, BOPS strategy with additional purchases. A high additional purchase in the process of picking up products enables the retailer to enjoy a competitive advantage in the BOPS contract. Then the retailer can force the manufacturer to develop a low-wholesale price policy. This is why a large body of online retail companies stretch their footprints to offline with brick-and-mortar stores, such as Amazon, Alibaba.com, JD.com, and so forth. Besides, the retailer derives a higher profit if the additional purchases bring enough advantage for the retailer to raise the offline price. In this instance, the manufacturer can benefit from the offline channel and derive a higher profit.

There are some limitations in this paper. First, when identifying the market segmentation of omnichannel consumers, there exist different channel configurations based on consumers’ channel selections. However, we focus on the channel configuration that the online, BOPS, and offline channels are coexisting. One may extend this study to the situation considering all channel configurations. Second, in the BOPS contract, the manufacturer and retailer reach a BOPS relationship through a unit payment and we assume that the unit payment is exogenous. Actually, as a “wholesale price”, the unit payment plays a leverage role in coordinating the relationship of stakeholders. As such, it is interesting to explore the operation strategy when the unit payment is a decision variable. Third, we assume that the valuation consumers obtained from purchasing products (i.e., v) is constant. However, customers may be heterogeneous in their marginal willingness to pay for products. The situation where the valuation v follows a uniform distribution [0,1] would be a beneficial extension of this work.

References

Akturk, M. S., Ketzenberg, M., & Heim, G. R. (2018). Assessing impacts of introducing ship-to-store service on sales and returns in omnichannel retailing: A data analytics study. Journal of operations management, 61(7), 15–45.

Bayram, A., & Cesaret, B. (2020). Order fulfillment policies for ship-from-store implementation in omni-channel retailing. European Journal of Operational Research. https://doi.org/10.1016/j.ejor.2020.01.011

Bian, J., Zhao, X., & Liu, Y. (2020). Single vs cross distribution channels with manufacturers’ dynamic tacit collusion. International Journal of Production Economics, 220, 107456.

Boden, J., Maier, E., & Dost, F. (2020). The effect of electronic shelf labels on store revenue. International Journal of Electronic Commerce, 24(4), 527–550.

Cao, J., So, K. C., & Yin, S. (2016). Impact of an “online-to-store” channel on demand allocation, pricing and profitability. European Journal of Operational Research, 248(1), 234–245.

Cao, L., & Li, L. (2015). The impact of cross-channel integration on retailers’ sales growth. Journal of Retailing, 91(2), 198–216.

Chen, Z., Fang, L., & Su, S. (2021). The value of offline channel subsidy in bricks and clicks: An o2o supply chain coordination perspective. Electronic Commerce Research, 21(2), 599–643.

Chen, J., Zhang, H., & Sun, Y. (2012). Implementing coordination contracts in a manufacturer stackelberg dual-channel supply chain. Omega, 40(5), 571–583.

Chen, Z., & Peng, J. (2021). Should the assembly system with direct omnichannel introduce integrated management service? a game-theoretical modelling study. Electronic Commerce Research. https://doi.org/10.1007/s10660-020-09450-z

Choi, T. M., & Guo, S. (2020). Is a ‘free lunch’ a good lunch? The performance of zero wholesale price-based supply-chain contracts. European Journal of Operational Research, 285(1), 237–246.

Gao, F., & Su, X. (2017). Omnichannel retail operations with buy-online-and-pick-up-in-store. Management Science, 63(8), 2478–2492.

Gao, F., & Su, X. (2017). Online and offline information for omnichannel retailing. Manufacturing & Service Operations Management, 19(1), 84–98.

Guan, X., Liu, B., Chen, Y. J., & Wang, H. (2020). Inducing supply chain transparency through supplier encroachment. Production and Operations Management, 29(3), 725–749.

He, P., He, Y., & Xu, H. (2020). Buy-online-and-deliver-from-store strategy for a dual-channel supply chain considering retailer’s location advantage. Transportation Research Part E: Logistics and Transportation Review, 144, 102127.

Huang, H. F., He, Y., & Chen, J. (2020). Cross-market selling channel strategies in an international luxury brand’s supply chain with gray markets. Transportation Research Part E: Logistics and Transportation Review, 144, 102157.

Huang, S., Guan, X., & Chen, Y. J. (2018). Retailer information sharing with supplier encroachment. Production and Operations Management, 27(6), 1133–1147.

Ishfaq, R., & Raja, U. (2018). Evaluation of order fulfillment options in retail supply chains. Decision Sciences, 49(3), 487–521.

Jin, D., Caliskan-Demirag, O., Chen, F., & Huang, M. (2019). Omnichannel retailers’ return policy strategies in the presence of competition. International Journal of Production Economics. https://doi.org/10.1016/j.ijpe.2019.107595

Jin, M., Li, G., & Cheng, T. C. E. (2018). Buy online and pick up in-store: Design of the service area. European Journal of Operational Research, 268(2), 613–623.

Kong, R., Luo, L., Chen, L., & Keblis, M. F. (2020). The effects of bops implementation under different pricing strategies in omnichannel retailing. Transportation Research Part E Logistics and Transportation Review, 141, 102014.

Li, G., Zheng, H., & Liu, M. (2020). Reselling or drop shipping: Strategic analysis of e-commerce dual-channel structures. Electronic Commerce Research, 20(8), 475–508.

Li, M., Zhang, X., & Dan, B. (2020). Cooperative advertising and pricing in an O2O supply chain with buy-online-and-pick-up-in-store. International Transactions in Operational Research, 28(4), 2033–2054.

Li, W., & Chen, J. (2018). Backward integration strategy in a retailer Stackelberg supply chain. Omega, 75, 118–130.

Li, X., Li, Y., Cai, X., & Shan, J. (2016). Service channel choice for supply chain: Who is better off by undertaking the service? Production & Operations Management, 25(3), 516–534.

Li, Z. H., Yang, W. S., Liu, X. H., & Si, Y. Y. (2020). Coupon promotion and its two-stage price intervention on dual-channel supply chain. Computers & Industrial Engineering, 145(12), 106543.

Li, Z. H., Yang, W. S., Jin, H. S., & Wang, D. (2021). Omnichannel retailing operations with coupon promotions. Journal of Retailing and Consumer Services. https://doi.org/10.1016/j.jretconser.2020.102324

Lin, X., Zhou, Y. W., & Hou, R. (2020). Impact of a “Buy-online-and-pickup-in-store” Channel on Price and Quality Decisions in a Supply Chain. European Journal of Operational Research. https://doi.org/10.1016/j.ejor.2020.03.064

Lou, Y., Feng, L., He, S., He, Z., & Zhao, X. (2020). Logistics service outsourcing choices in a retailer-led supply chain. Transportation Research Part E: Logistics and Transportation Review. https://doi.org/10.1016/j.tre.2020.101944

Mandal, P., Basu, P., & Saha, K. (2020). Forays into omnichannel: An online retailer’s strategies for managing product returns. European Journal of Operational Research. https://doi.org/10.1016/j.ejor.2020.10.042

Matsui, K. (2017). When should a manufacturer set its direct price and wholesale price in dual-channel supply chains? European Journal of Operational Research, 258(2), 501–511.

Modak, N., & Kelle, P. (2019). Managing a dual-channel supply chain under price and delivery-time dependent stochastic demand. European Journal of Operational Research, 272(1), 147–161.

Nie, Z., & L., Yan, H., & Yang, W. (2019). Retailers’ distribution channel strategies with cross-channel effect in a competitive market. International Journal of Production Economics, 213(7), 32–45.

Niu, B., Cui, Q., & Jie, Z. (2017). Impact of channel power and fairness concern on suppliers market entry decision. Journal of the Operational Research Society, 68, 1–12.

Niu, B., Mu, Z., & Li, B. (2019). O2O results in traffic congestion reduction and sustainability improvement: Analysis of “online-to-store” channel and uniform pricing strategy. Transportation Research Part E: Logistics and Transportation Review, 122(2), 481–505.

Pun, H., Chen, J., & Li, W. (2020). Channel Strategy for Manufacturers in the Presence of Service Freeriders. European Journal of Operational Research., 287, 460–479.

Radhi, M., & Zhang, G. Q. (2019). Optimal cross-channel return policy in dual-channel retailing systems. International Journal of Production Economics, 210, 184–198.

Saha, K., & Bhattacharya, S. (2021). ‘Buy online and pick up in-store’: Implications for the store inventory. European Journal of Operational Research. https://doi.org/10.1016/j.ejor.2020.10.006

Shi, X. T., Dong, C. W., & Cheng, T. C. E. (2018). Does the buy-online-and-pick-up-in-store strategy with pre-orders benefit a retailer with the consideration of returns. International Journal of Production Economics, 206, 134–145.

Tao, Z. Y., Gou, Q. L., & Zhang, J. Z. (2018). A local seller’s app channel strategy concerning delivery. International Journal of Production Research. https://doi.org/10.1080/00207543.2018.1535725

UPS, 2015. UPS Online Shopping Study: Empowered Consumers Changing the Future of Retail. Press Release, June 3, United Parcel Service of America, Atlanta.

Wu, J. H., Zhao, C. C., Yan, X. H., & Wang, L. F. (2020). An integrated randomized pricing strategy for omni-channel retailing. International Journal of Electronic Commerce, 24(3), 391–418.

Yan, R., Zhi, P., & Sanjoy, G. (2018). Reward points, profit sharing, and valuable coordination mechanism in the o2o era. International Journal of Production Economics, 215, 34–47.

Yoon, D. H. (2016). Supplier encroachment and investment spillovers. Production and Operations Management, 25(11), 1839–1854.

Zhang, C., Liu, Y., & Han, G. H. (2021). Two-stage pricing strategies of a dual-channel supply chain considering public green preference. Computers & Industrial Engineering, 151, 106988.

Zhang, J. Z., Xu, Q. Y., & He, Y. (2018). Omnichannel retail operations with consumer returns and order cancellation. Transportation Research Part E: Logistics and Transportation Review, 118, 308–324.

Zhang, P., He, Y., & Shi, C. V. (2017). Retailer’s channel structure choice: Online channel, offline channel, or dual channels? International Journal of Production Economics, 191, 37–50.

Zhang, P., He, Y., & Zhao, X. (2019). “preorder-online, pickup-in-store” strategy for a dual-channel retailer. Transportation Research Part E: Logistics and Transportation Review, 122, 27–47.

Zhang, S., Zhang, J., & Zhu, G. (2019). Retail service investing: An anti-encroachment strategy in a retailer-led supply chain. Omega, 84, 212–231.

Zhao, J. (2020). Will the community o2o service supply channel benefit the elderly healthcare service supply chain? Electronic Commerce Research. https://doi.org/10.1007/s10660-020-09425-0