Abstract

‘Reputation’ is increasingly recognized for its influence in creating stakeholder support and engagement with companies. Both researchers and practitioners would therefore benefit from having a rigorous instrument to measure reputations and the ability to develop predictive modeling of reputation’s impact on stakeholder outcomes. The RepTrak® System evolved from studies conducted by Reputation Institute since 2000 to provide a systematic tool for tracking and analyzing stakeholder perceptions that could help companies better manage their reputation and its effects on stakeholder behaviors. Prior research has demonstrated the validity of the RepTrak® Pulse as a short form measure of ‘corporate reputation’. This study reports empirical tests developed to validate the seven dimensions that the RepTrak® System uses to predict corporate reputation and stakeholder support. Although these seven dimensions have been verified internally by Reputation Institute, this methodology and its validation have not been reported publicly, limiting researchers’ and practitioners’ abilities to use the seven dimensions in their respective efforts. To shed light on the model’s structure, this paper reports tests conducted to validate the measures empirically across five stakeholder groups in six countries. Multivariate analyses confirm the existence and stability of the seven underlying dimensions in the factor structure, each of which is constructed from a set of 3–4 underlying attributes. The modeling therefore validates the RepTrak® scorecard as a tool for measuring and tracking multi-stakeholder perceptions of companies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

INTRODUCTION

‘Reputation’ is increasingly recognized for its influence on stakeholder support and engagement with companies (Fombrun, 1996, 2012). Both researchers and practitioners would therefore benefit from having a rigorous instrument to measure reputations and the ability to develop predictive models of reputation’s impact on stakeholder outcomes. Recognizing a growing need by both practitioners and academics for a better conceptual and empirical tool for assessing and managing reputation – and the lack of validated instruments for doing so – Reputation Institute launched a global project in 1998 to understand and measure the diverse factors associated with corporate reputation. The first measurement instrument that resulted from our initial exploration was the Reputation Quotient (RQ), a six-dimension scale constructed from 20 attributes (Fombrun et al., 2000). The four-attribute RepTrak® Pulse measure was pulled out of the RQ in 2005 and used to create a separate measure of a person’s emotional attachment to a company (eg, Christian, 1959). Ponzi et al. (2011) demonstrated the reliability and validity of the RepTrak® Pulse scale as a measure of reputation, and since 2005 it has been extensively tested and shown to have high face and content validity (Sarstedt et al., 2013).

The full RepTrak® System was created in 2005–2006 to provide executives with an analytical instrument that could be used, not only to track and assess stakeholder perceptions of companies, but that would also enable a more comprehensive understanding of the underlying informational drivers of reputation that elicit emotional attachment. The system is based on measuring a company’s overall reputation using the RepTrak® Pulse and decomposing that emotional attachment into an underlying set of dimensions and attributes, and predicting their effects on stakeholder support.

The rigorous methodological underpinnings of the model and its validation have not been reported publicly to date, limiting the ability researchers and practitioners have to use the dimensions in their work. The purpose of this paper is to report empirical tests done to validate the seven dimensions of the RepTrak® System and predict corporate reputation and stakeholder support across five stakeholder groups in six countries.

The RepTrak® System recognizes the fact that a company’s overall reputation is rooted in the perceptions of its stakeholders (Newburry, 2010), each of which responds to different signals or informational inputs (Spence, 1973; Prabhu and Stewart, 2001; Basdeo et al., 2006). By examining the kinds of informational inputs that influence stakeholder perceptions of a company, we can better predict the dimensions that are likely to trigger stakeholders’ emotional reactions of admiration, liking and trust toward a firm – its reputation.

Stakeholder management is an important component of corporate strategy in general (eg, Freeman, 1984; Donaldson and Preston, 1995) and the study of corporate reputation in particular (Fombrun, 1996; Fombrun, 2012). Social-constructionists view reputation as a composite of different types of stakeholder perceptions of a firm (Rindova and Martins, 2012). They note that perceptions of firms come from many sources, many of which would not be considered ‘valid signals’ by traditional economic theory (Rindova and Martins, 2012). Signaling theory (Spence, 1973) relies on information economics to discuss the behavior of interacting actors under conditions of information asymmetry and uncertainty. In a marketplace, sellers send signals to buyers through strategic actions such as prices, warrantees or return policies to demonstrate the quality of their products and other firm competencies (Basdeo et al., 2006). More broadly, companies send signals to their various stakeholder groups in order to influence how they are perceived (Prabhu and Stewart, 2001; van Riel, 2012). However, these stakeholders also receive signals from other sources, such as formal media (eg, newspapers, TV; Van Den Bogaerd and Aerts, 2014; Mason, 2014), social media (eg, blogs; Fan et al., 2013), friends and industry competitors, all of which influence the perceptions individuals have of firms, and in turn, their reputations.

The strategic objective of corporate communication is to align stakeholders with the goals of the organization (van Riel, 2012) in order to ensure that stakeholders develop a sense of trust in a company (Srivastava and Chakravarti, 2009; Van Der Merwe and Puth, 2014). However, stakeholders respond to different signals, making it critical for practitioners to understand and communicate across the multiple facets of companies to which stakeholders are exposed, hence the need for a multidimensional framework for measuring reputation internationally.

In the next section, we examine seven types of information signals that past literature suggests as influencers on the formation of corporate reputation, and which make up the dimensions of the RepTrak® System. Since reputation assessments have been shown to vary across stakeholder groups (van Riel and Fombrun, 2007; van Riel, 2012) and across national and other environmental contexts (eg, Michaelis et al., 2008; Deephouse et al., 2009; Brammer and Jackson, 2012), we assess the reliability and validity of the seven dimensions by examining the stability of the model when tested across five stakeholder groups in multiple industries, in six countries, specifically: key opinion leaders (in Brazil), the general public (in the United States), investors (in Spain), physicians (in Switzerland) and customers of the insurance industry (in Denmark and Sweden). While it would be difficult and costly to test the universal validity of the model across all stakeholder groups and research settings, by demonstrating the validity of the RepTrak® System across a diverse set of respondents, industries and countries, we suggest that the system has the potential for generalizability.

Overall, the research we report in this paper makes the following contributions. First, we validate the seven-dimensional RepTrak® framework derived from prior literature that addresses the need to manage stakeholders in general and on each of these seven reputation dimensions in particular. Second, we empirically demonstrate the soundness of the model as an instrument that can be applied across stakeholders, industries and countries. Third, we suggest that because the RepTrak® System is a tool that was rigorously developed and validated, it has practical relevance for tracking and analyzing the reputations of companies globally.

REPUTATION AND ITS DIMENSIONS

Prior literature suggests that a distinction can be made between stakeholder assessments based on a generalized view of reputation and assessments based on specific dimensions. Lange et al. (2011) conducted a literature review from which they identified three major reputation conceptualizations: being known, being known for something and generalized favorability. ‘Being known’ and ‘generalized favorability’ are broad perceptions of a company. By contrast, ‘being known for something’ suggests a dimensional basis for reputation measurement. Consistent with this interpretation, Lange et al. (2011: 166–167) noted that the critical distinction between ‘being known for something’ and the ‘generalized favorability’ dimension ‘is that the latter reflects the perceiver’s approach – avoidance reactions to the generalized global perceptions of the firm, while the former reflects perceiver expectations for particular desired or undesired organizational attributes or outcomes’. The distinction between a company’s overall reputation and specific reputation dimensions is also analogous to the distinction between a company’s overall brand and its product brands (eg, Smith et al., 2010), and between general and specific brand images (Sonnier and Ainslie, 2011).

Building on the international qualitative work already completed by Reputation Institute to develop the RQ instrument (Gardberg and Fombrun, 2002; Gardberg, 2006), Reputation Institute extended the research by conducting a wide range of interviews with reputation managers, senior communications managers and functional heads (eg, human resources, marketing and finance) of global companies headquartered around the world. These executive interviews were supplemented by consumer focus groups, a number of which were run in the United States, Europe and Asia, as well as in nine countries of Latin America (Carreras et al., 2013). This broad range of stakeholder interviews and focus groups conducted between 1999 and 2006 were used to identify the seven dimension structure of corporate reputation. We review these dimensions below in terms of their conceptual roots. We then empirically validate the RepTrak® model for analyzing corporate reputation based on these seven dimensions.

Products/Services

Most stakeholders know of a company from its product and service offerings in the marketplace, and its reputation is likely to be influenced by perceptions of its product brands (Rao et al., 1999; Smith et al., 2010). Some are more familiar, others less so, depending on the particular characteristics of the company’s touch points with specific stakeholders. All stakeholders, and customers more so than others, can be expected to develop perceptions of a company based on its products and services – the quality of its offering, the price at which it sells, its perceived value, the customer support provided and the belief in the company’s willingness to stand behind its products and services (Dawar and Parker, 1994; Lange et al., 2011). Signals from the marketplace can also color the impressions that non-customer stakeholders have of any company – and so the degree to which those stakeholders will experience the company as admirable, likeable, trustworthy and well regarded. Game theory models posit that reputations, in fact, are built mainly from investments companies make to increase product quality (Milgrom and Roberts, 1986). RepTrak®’s ‘products/services’ dimension therefore assesses perceptions of a company’s offerings based on whether they are thought to be high in quality, in value and service, and in their ability to meet customers’ needs.

Innovation

As an important firm asset (Fang et al., 2011), innovation inherently relates to doing something new or differently, and so readily generates an emotional reaction of respect and admiration for the innovator, and therefore reputation. Research confirms that there is a relationship between innovation and reputation, and recognizes that positive regard is often dependent upon effective communication about an innovation (Courtright and Smudde, 2009). Companies that adapt quickly to change, launch new products and develop new ideas are more likely to earn respect and admiration – and many publications such as Forbes, Bloomberg and Business Week compile and publish rankings of innovative companies, thereby conveying information that adds visibility to innovators. These publications signal to all observers about a company’s innovativeness – thereby adding to their reputation. RepTrak®’s ‘innovation’ dimension assesses perceptions of a company as innovative and adaptive.

Workplace

Our qualitative research suggests that most stakeholders like and respect companies that maintain good workplaces. Research asserts that satisfied employees are more likely to commit to long-term involvement, less likely to turn over and so more likely to act as ambassadors of the company and give a good employer a favorable rating. In turn, a firm’s reputation as a good workplace is critical in recruiting a high-quality workforce (Alniacik et al., 2012; Nolan et al., 2013). Various publications highlight how companies treat their employees. Fortune regularly releases ‘The 100 Best Companies to Work For’ and Forbes publishes a list of ‘The 25 Best Places to Work’. Both broadcast workplace signals into the reputational marketplace that add visibility to employers who treat their employees well. Special interest stakeholders are regularly influenced by segment-specific publications publishing lists and information about the employment practices of companies, such as Working Mother Magazine’s ‘100 Best Companies for Working Moms’ and the Human Rights Campaign’s ‘Corporate Equality Index’ that assesses the diversity policies of employers. Newburry et al. (2014) used the workplace dimension of reputation to examine issues related to foreignness and internationalization as they impact the attractiveness of employers in Latin America. Similarly, Martin et al. (2011) examined the relationship between employer branding and reputation. Signals that convey information about how fairly a company treats employees are likely to generate trust and respect among most stakeholders – and so contribute to building favorable reputations for those companies. RepTrak®’s ‘workplace’ dimension assesses perceptions of a company’s practices in maintaining an environment that shows concern for employees, and for treating and rewarding them fairly and equitably.

Governance

Davis (2005: 143) defined corporate governance as the ‘structures, processes and institutions within and around organizations that allocate power and resource control among participants’. Given the growing complexities of multinational firms, governance is increasingly recognized as a key issue for firms (eg, Kim et al., 2011; Ghosh and John, 2009). Having adequate governance structures in place to manage corporate reputation is recognized as a key component of reputation management (Casado et al., 2014). Stakeholders are regularly exposed to information about a company’s governance whether from media, from auditors or from government agencies. The more a company is perceived as ethical and transparent, the more likely it is to generate admiration and trust in the minds of most stakeholders – and hence to build reputation because ‘… the corporation tends to be viewed less as property and more as a public entity with a broad range of responsibilities to creditors, workers, the public, and others’ (Soleimani et al., 2014: 4). Companies themselves often become signatories to institutional codes of conduct to signal to stakeholders their principles and commitments, generate confidence that their internal practices are sound – and thereby build reputation. RepTrak®’s ‘governance’ dimension assesses stakeholder perceptions of a company as ethical, fair and transparent.

Citizenship

Qualitative inputs suggest that stakeholders tend to respect and admire a company for their good deeds (eg, Orlitzky and Swanson, 2012). Moreover, empirical evidence suggests that corporate citizenship is a legitimacy building strategic asset (Sridhar, 2012) that leads to various forms of company support (Aaron et al., 2012), and can even provide a buffer that protects firms in times of crisis (Mio and Fasan, 2012). As such, companies commonly expend significant dollar amounts and marketing efforts to promote these activities and thereby build up a company’s image (Gottschalk, 2013; Morris et al., 2013; Vlachos et al., 2013). Empirically, corporate social performance has been one of the main correlates of corporate reputation (Lange et al., 2011). By acting responsibly and communicating about it, companies signal that they are good citizens, deserving of praise, and thereby build trust and reputation. Good citizenship is itself a multidimensional construct, one commonly understood to encompass notions of environmental sustainability and responsible behavior (Tichy et al., 1997). Past research suggests that corporate citizenship can cut both ways (eg, Koschate-Fischer et al., 2012). Some stakeholders credit companies for acting like good citizens and view it as a form of relationship marketing, while others see it as a distraction and an unnecessary drain on corporate resources. RepTrak®’s ‘citizenship’ dimension assesses stakeholder perceptions of a company as environmentally friendly, a supporter of good causes and a positive contributor to society.

Leadership

CEOs can be important catalysts for generating admiration and trust with stakeholders (Flatt et al., 2013; Halff, 2013). Studies of celebrity CEOs (Treadway et al., 2009), star CEOs (Wade et al., 2008) and CEO Brands (Bendisch et al., 2013) defend the importance of leadership in conveying a company’s success and performance to the financial community and other stakeholders. Moreover, research confirms that managers do differ in their strategic abilities (Goldfarb and Yang, 2009). Appealing leaders attract favorable media coverage and investor endorsements, thereby signaling to all stakeholders the credibility of the company’s activities, increasing confidence and trust in the company, and thereby building corporate reputation. Published rankings of CEOs induce favorable perceptions of a company’s leaders, and can build an appealing halo for the company itself (Gaines-Ross, 2002; Westphal and Deephouse, 2011). RepTrak®’s ‘leadership’ dimension is intended to assess perceptions of leaders as excellent and visionary managers, and strong endorsers of their companies.

Performance

A common signal that influences how stakeholders assess companies is ‘financial performance’. Although stakeholders place different expectations on organizations, strong financial performance is in part the consequence of satisfying these diverse objectives (Donaldson and Preston, 1995; Waddock and Graves, 1997; Walsh et al., 2003). Past and current profitability are important signals to investors about the company’s operating success. It also signals the likelihood of continuing profitability – indicating a company with strong future prospects for growth. Expectations of future profitability are important to all valuation models – and therefore are a powerful signal about the strength of a company’s business model. Profitability and growth prospects have been shown to influence ratings of the ‘world’s most-admired’ companies (Fombrun and Shanley, 1990), and have been consistent correlates of reputation in other academic studies (Lange et al., 2011). RepTrak®’s ‘performance’ dimension is therefore based on a set of attributes that assess stakeholder perceptions of a company’s overall financial performance, profitability and growth prospects.

Table 1 describes the seven-dimension model and 23 attributes of the RepTrak® scorecard. In the next section, we examine the validity of this model across a varied set of stakeholders, industries and countries.

METHODOLOGICAL APPROACH

To explore the cross-stakeholder validity of the RepTrak® System, we selected five studies conducted in 2010–2011. Each study was selected from past studies conducted by Reputation Institute that used a common survey instrument with sufficient sample size across different stakeholder groups and countries. Although no finite number of samples could demonstrate universal validity of the dimensions across all stakeholders and countries, by selecting a diverse set of stakeholders and countries, we seek here to demonstrate that the seven-dimension structure has reasonable validity across a broad range of respondents and geographical settings. In each study, structural equation modeling (SEM) was then applied to examine the reliability and validity of the multidimensional framework. SEM has several advantages over more traditional techniques, particularly when the model to be evaluated is not directly observable.

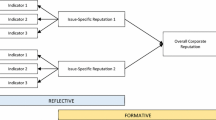

The hypothesized model we are testing postulates that corporation reputation can be measured using 23 observed variables that load into a first-order structure that consists of seven latent variables labeled as Products/Services, Innovation, Workplace, Governance, Citizenship, Leadership and Performance. These seven dimensions describe a single second-order factor structure measuring ‘Reputation’.

A review of the theoretical SEM-related literature on corporate reputation has revealed a number of different constructed measures with a mix of formative and reflective models. A discussion of this literature is beyond the scope of this paper. However, our data-led methodological approach pointed us to a ‘reflective’ specified model, which refers to the case that observable variables (or attributes) are ‘reflective’ or representative of a defined reputation construct – in our case, the RepTrak® Pulse. As reflective, the overall model should be unidimensional and the items correlated. The model is graphically illustrated in Figure 1.

The next section describes the sample and data cleaning procedures we applied. We then present the results of the first and second-order confirmatory factor analyses conducted using AMOS v22.0 software. A maximum likelihood estimation model was adopted because it provided the most stable results for our sample sizes.

SAMPLE AND DATA

Five stakeholder data sets were selected for their ability to represent a cross-section of commonly measured stakeholders, industries and countries (see Table 2):

-

Study 1: A representative sample of the general public in the United States.

-

Study 2: A sample of key opinion leaders in Brazil.

-

Study 3: A sample of investors and customers assessing banks in Spain.

-

Study 4: A sample of doctors assessing a pharmaceutical company in Switzerland.

-

Study 5: A sample of customers in Denmark and Sweden assessing insurance companies.

Respondents in the five stakeholder samples were randomly selected from a larger sample set in each country, except for Study 3 in which a study sponsor provided a customer list. Respondents were screened for their familiarity with each of the companies and then asked to assess familiar companies on each of the 23 attributes of the RepTrak® scorecard, scored on 7-point Likert scales ranging from ‘Does not describe well’ to ‘Describes very well’. Respondents also had the option to reply ‘not sure’ to questions posed.

Treatment of Missing Values

Table 2 also shows the sample sizes and missing values in the initial data sets. Listwise deletion was applied to records with missing values in Studies 1, 2, 3 and 5. In Study 4, to deal with the smaller sample size, missing values were replaced with imputed values using EM (Dempster et al., 1977), an algorithm that produces acceptable results even when underlying normality assumptions do not hold or missing data are not completely random (Little, 1992). With a minimum of 20 records per variable, the five data sets were sufficiently large to achieve statistical power (McQuitty, 2004; Schreiber et al., 2006).

Treatment of Outliers

To legitimate multivariate analyses, all variables in the model were presumed to follow normality assumptions. Each data set was therefore examined for violations of normality. Outliers often contribute significantly to departures from normality and to distortions of the covariance matrix. Deleting outliers lowers multivariate skew and kurtosis. Kline (2005) recommends removing outliers if they reduce absolute values of skew to less than 3.0 and kurtosis to less than 10. These violations of multivariate normality can also be evaluated in one step by examining Mardia’s multivariate kurtosis. The analysis identified outliers by calculating Mahalanobis distances for each record in the data set. The larger the distance, the more likely the record was to violate multivariate normality. We deleted observations with distance greater than 100. Table 3 depicts the results of the assessment of the multivariate normality of each stakeholder sample and overall improvement from removing outliers. Since any remaining non-normality could lead to overestimation of χ 2 fit statistics, potentially leading to false rejection of any model tested, we also report additional fit statistics to assess each of the multivariate models tested using SEM.

The final samples analyzed in this paper consisted of 1,813 random respondents drawn from the US general public assessing the 150 largest US companies; 538 key opinion leaders in Brazil assessing 10 of Brazil’s largest companies; 532 bank clients and investors in Spain assessing Spain’s 10 largest banks; 300 physicians in Switzerland assessing the world’s 10 largest pharmaceutical companies; and 500 insurance clients in Denmark and Sweden assessing 9 insurance providers.

DATA ANALYSES AND RESULTS

The results are presented in three parts. First, we examine the reliability and validity of each of the hypothesized dimensions across the data sets using exploratory factor analysis. Second, we carry out a first-order confirmatory factor analysis on each of the studies to test for the validity of the hypothesized seven-dimension factor structure of corporate reputation. Third, we conduct a second-order confirmatory factor analysis to justify the dimensional hierarchy of corporate reputation.

Establishing Reliability

An exploratory factor analysis using principal components was run on the 23 attributes. The researchers selected an equamax non-orthogonal rotation because of its properties to equally distribute explained variance and clarify the underlying structure of unexplored data sets (Hair et al., 2006). Tables 4 and 5 depict diagnostic measures of each study, which included KMO, Bartlett’s test and Communalities. The measures were examined and found to be acceptable.

An examination of the factor-rotated structures in each study revealed a pattern matrix that matched the hypothesized RepTrak® framework, and attributes associated with Innovation, Workplace and Products/Services loaded consistently on the hypothesized dimensions. Two pairs of dimensions cross-loaded within individual studies, namely the Performance and Leadership attributes, and the Citizenship and Governance attributes. However, all four of these dimensions were well-defined when the five data sets were pooled across stakeholders. The total explained variance ranged from 83 to 90 percent across the five studies.

In each study, we examined the reliability of the seven dimensions of the hypothesized model using Cronbach’s α (Nunnally and Bernstein, 1994). Seven Cronbach’s α coefficients were calculated for each study, and a total of 35 tests examined. α coefficients ranged from a low of 0.84 (Physicians-Innovation dimension) to a high of 0.96 (Insurance-Product dimension). Cronbach’s α’s on each test were all above 0.7, indicating strong scale reliability (Nunnally and Bernstein, 1994). In addition, we tested the effect of deleting an attribute on each dimension scale. All dimension alpha coefficients were higher with all of the hypothesized dimension attributes included than with any of the attributes excluded, further supporting scale reliability. These analyses provide support for the internal consistency of the dimensional structure of the RepTrak® System.

Finally, the Exploratory Factor Analysis structure and loadings were examined. Table 6 depicts the standard estimates for each study factor loadings and correlations. The results illuminate that the overall structure is unidimensional and the items are correlated. Each study structure and attribute factor loadings on each dimension provided adequate support for the convergent and discriminant validity of the model.

Confirming Internal Validity: The First-Order Factor Model

A first-order confirmatory factor analysis was run to examine the variance shared by observed variables with the latent or unobserved variables that were hypothesized to explain ‘Corporate Reputation’. The aim of these analyses was to demonstrate that the dimensions of each first-order model converge. We carried out a first-order confirmatory factor analysis with maximum likelihood on the seven-factor measurement model illustrated in Figure 2.

The first-order confirmatory factor analysis produced an acceptable fit across all five studies. While the literature is specific with regards to the fit indices, to assess how well the models represented the data, we followed Hair et al.’s (2010) suggestion regarding a mix of fit indices, and examined χ 2, one incremental fit test (ie, Comparative Fit Index, CFI), one goodness-of-fit index (ie, Trucker-Lewis Index, TLI), and one badness-of-fit index (ie, Root Mean Square Error of Approximation, RMSEA). These indices have been shown in past research to demonstrate very little random variation due to sample size, number of parameters, model misspecification or method of estimation (Fan et al., 1999). The χ 2 test statistic is significant and is discussed below. A CFI of 0.90 and above testifies to strong scale unidimensionality. A CFI and TLI above 0.90 indicates convergent validity. RMSEA values between 0.05 and 0.08 are considered acceptable. Table 7 presents the fit statistics we examined across the five data sets and demonstrates a robust model fit.

The most commonly cited fit index in the literature is the χ 2 test statistic. However, as mentioned earlier, there are several problems with solely relying on this index. The χ 2 test statistic is problematic when used with data that are not multivariate normal; it is extremely sensitive to sample size, and also affected by the number of parameters in the model (Schermelleh-Engel et al., 2003; Satorra and Bentler, 2001). In a large sample, a χ 2 test almost always leads to rejection of the model. To this end, the p-values associated with the computed χ 2 did not exceed 0.05 for each of the five stakeholder groups. However, it is often noted that ‘inconsistency among indices is common, and having the chi-square as the outlier is particularly common’ (Eagle et al., 2001: 13). As such, we concluded that our overall set of analyses demonstrate strong model fit.

Convergent Validity

To assess convergent validity, we examined the loadings of each factor and the average variance extracted (AVE) of the scale. Across studies, each observed variable had a significant loading on its respective latent construct (P<0.001) with values ranging from 0.78 to 0.94. AVE represents the variance in the independent variables accounted for by each latent variable. Across the five studies, AVE was greater than 0.7, which exceeds the recommended 0.5 benchmark value (Fornell and Larcker, 1981), and confirms the measure’s convergent validity.

Discriminant Validity

Establishing discriminant validity is required for latent variables analysis. Fornell and Larcker (1981) argue that lack of discriminant validity creates uncertainty about whether the results confirm a hypothesized structure or whether the results demonstrate statistical inconsistencies (Farrell, 2010). To operationalize discriminant validity, we compared AVE with the amount of shared variance (Farrell, 2010). Shared variance is the amount of variance that the latent variable is able to explain in another latent variable, and is calculated as the square of the correlation estimates or factor loadings.

An appropriate test for discriminant validity involves demonstrating that the AVE of observed attributes of a dimension is significantly larger than the shared variance of the dimensions in the model (Fornell and Larcker, 1981). Table 8 shows that the AVE of each dimension was indeed greater than its shared variance with any other dimension across all studies, with one exception out of 420 tests (Study 1, Innovation<-->Performance), thereby supporting the discriminant validity of the model.

Establishing Construct Validity: The Second-Order Factor Model

The seven endogenous constructs (the reputation dimensions) are viewed as mediating variables into a single second-order latent variable. Second-order factor models were therefore developed from the underlying first-order models. The purpose of these second-order models is to provide external construct validity by confirming that the RepTrak® framework maintains the hypothesized second-order factor structure by converging on the latent reputation construct variable (Spector, 1992). We used the previously validated RepTrak® Pulse measure of corporate reputation as the external dependent variable (Ponzi et al., 2011). Figure 3 describes the model specification whose construct validity we sought to establish.

Table 9 summarizes the goodness-of-fit indices for the five second-order factor models that were tested. Each model provides support for the hypothesis that the seven dimensions of the RepTrak® System are components of a second-order construct that can be described as ‘Corporate Reputation’.

In sum, these analyses confirm the underlying dimensional structure of corporate reputation hypothesized in the RepTrak® System. The results are persuasive because they verified the dimensionality of the corporate reputation measure across five stakeholder groups, in multiple industries and across six geographies. The results therefore provide robust empirical support for the reliability and validity of the RepTrak® System and provide researchers and practitioners the confidence they need to apply the model for measuring corporate reputations across stakeholders, industries and geographies.

DISCUSSION AND CONCLUSIONS

Researchers and practitioners have struggled for years to measure rigorously the reputations of companies (Dowling and Gardberg, 2012). The need for a rigorous comparative measure has been made abundantly clear in conferences and journals for decades. Despite extensive conversations and debate, there remains a lack of consensus about the dimensionality and structure of the construct ‘corporate reputation’ (see, eg, Barnett and Pollock, 2012).

The analyses reported in this paper took a point of departure in various studies that have relied on Reputation Institute’s RepTrak® System for measuring corporate reputations. By applying multivariate analyses to five representative data sets, we provide robust evidence of the reliability, internal validity and external validity of the RepTrak® System’s seven dimensions and 23 attributes.

A first important theoretical implication of this study is the explicit attention given to validating a framework that incorporates both the seven dimensions of reputation and its generalized representation (the RepTrak® Pulse). Doing so should prove invaluable for future academic research by enabling a more thorough understanding of corporate reputation and its influences. It suggests that the emotional appeal of a company – its reputation – can be partly explained by the informational content of the signals to which stakeholders respond.

By demonstrating the effectiveness of the signaling process (eg, Spence, 1973; Prabhu and Stewart, 2001), the model invites researchers to develop more fine-grained theories to explain how specific dimensions of reputation influence outcomes. While a few such studies have been conducted (D’Souza et al., 2013; Newburry et al., 2014; Vidaver-Cohen and Brønn, 2013), we see considerable opportunity to complement the vast majority of past research that has focused narrowly on the generalized reputation construct. Future research should identify the specific impact that the seven dimensions of reputation have on outcomes of interest, including stakeholders’ supportive intent (eg, Newburry, 2010) and its manifestation in a company’s sales, risk profile and financial performance (eg, Smith et al., 2010).

From a practitioner standpoint, a validated management tool with predictive ability is paramount to tracking and managing stakeholder perceptions and relationships. The RepTrak® System provides practitioners a toolbox of complementary measures for both tracking and analysis of reputations and for linking to outcomes. Of particular value to managers is the demonstrated validity of the RepTrak® System to measure cross-industry, cross-stakeholder and cross-country perceptions of stakeholders. Multinational companies need this capability to address the diversity of the global environment in which they operate. Consistent tracking of stakeholder perceptions is one thing. The ability to use the RepTrak® System to predict profitable pathways for improving business outcomes, however, is another. With a validated tool in hand, practitioners are in a better position now to build predictive models to explain where best to allocate their scarce resources in order to optimize outcomes.

This study is not without its limitations, of course. First, our validation relied on five studies of stakeholders in six countries. Given the increasing recognition of the importance of national and other environmental contexts (eg, Prabhu and Stewart, 2001; Michaelis et al., 2008; Berger and Fitzsimons, 2008), future studies should validate the measure with additional stakeholder groups in other cultural contexts. Given known differences between Western and Eastern cultures (eg, Chen et al., 2005), validation of the framework with respondents in Asia is particularly needed. Second, future research should also examine links between RepTrak®’s dimensions and their direct and indirect impacts on supportive behaviors and business outcomes (Newburry, 2010), consistent with similar studies on brand value (eg, Goldfarb et al., 2009). Finally, studies of additional industries and stakeholders could further confirm the generalizability of the measurement system.

Overall, this paper has put forward a robust validation of the RepTrak® System for measuring reputations, one that practitioners can rely upon to track their reputations on a continuous basis, to analyze the underlying dimensional drivers of their reputations and to link to outcome measures of interest to their businesses, such as supportive intent, sales, investor and employee churn, and financial performance (Fombrun, 1996). Given the increasingly recognized importance of reputation to all organizations, the availability of a robust measurement tool such as RepTrak® can help improve how we manage, not only reputational issues, but the intangible economic asset that a corporate reputation represents.

References

Aaron, J.R., McMillan, A. and Cline, B.N. (2012) ‘Investor reaction to firm environmental management reputation’, Corporate Reputation Review, 15 (4), 304–318.

Alniacik, E., Alniacik, U. and Erdogmus, N. (2012) ‘How do the dimensions of corporate reputation affect employment intentions?’ Corporate Reputation Review, 15 (1), 3–19.

Barnett, M.L. and Pollock, T.G. (eds.) (2012) The Oxford Handbook of Corporate Reputation, Oxford University Press, Oxford.

Basdeo, D.K., Smith, K.G., Grimm, C.M., Rindova, V.P. and Derfus, P.J. (2006) ‘The impact of market actions on firm reputation’, Strategic Management Journal, 27 (12), 1205–1219.

Bendisch, F., Larsen, G. and Trueman, M. (2013) ‘Fame and fortune: A conceptual model of CEO brands’, European Journal of Marketing, 47 (3/4), 596–614.

Berger, J. and Fitzsimons, G. (2008) ‘Dogs on the street, pumas on your feet: How cues in the environment influence product evaluation and choice’, Journal of Management Research, 45 (1), 1–14.

Brammer, S. and Jackson, G. (2012) ‘How regulatory institutions influence corporate reputations: A cross-country comparative approach’, in, M.L. Barnett and T.G. Pollock (eds.), The Oxford Handbook of Corporate Reputation, Oxford University Press, Oxford, pp. 297–319.

Carreras, E., Alloza, A. and Carreras, A. (2013) Corporate Reputation, LID Publishing, London.

Casado, A.M., Peláez, J.I. and Cardona, J. (2014) ‘Managing corporate reputation: A perspective on the Spanish market’, Corporate Reputation Review, 17 (1), 46–63.

Chen, H., Ng, S. and Rao, A.R. (2005) ‘Cultural differences in consumer impatience’, Journal of Marketing Research, 42 (3), 291–301.

Christian, R.C. (1959) ‘How important is corporate image?’ Journal of Marketing, 24 (2), 79–80.

Courtright, J.L. and Smudde, P.M. (2009) ‘Leveraging organizational innovation for strategic reputation management’, Corporate Reputation Review, 12 (3), 245–269.

Davis, G.F. (2005) ‘New directions in corporate governance’, Annual Review of Sociology, 31, 143–152.

Dawar, N. and Parker, P. (1994) ‘Marketing universals: Consumers’ use of brand name, price, physical appearance, and retailer reputation as signals of product quality’, Journal of Marketing, 58 (2), 81–95.

Deephouse, D.L., Li, L. and Newburry, W. (2009) ‘Institutional and national culture effects on corporate reputation’. Academy of Management Best Paper Proceedings, August, Chicago, pp. 1–6.

Dempster, A.P., Laird, N.M. and Rubin, D.B. (1977) ‘Maximum likelihood from incomplete data via the EM algorithm’, Journal of the Royal Statistical Society. Series B (Methodological), 39 (1), 1–38.

Donaldson, T. and Preston, L.E. (1995) ‘The stakeholder theory of the corporation: Concepts, evidence, and implications’, Academy of Management Review, 20 (1), 65–91.

Dowling, G.R. and Gardberg, N.A. (2012) ‘Keeping score: The challenges of measuring corporate reputation’, in, M.L. Barnett and T.G. Pollock (eds.), The Oxford Handbook of Corporate Reputation, Oxford University Press, Oxford, pp. 34–68.

D’Souza, C., Taghian, M. and Sullivan-Mort, G. (2013) ‘Environmentally motivated actions influencing perceptions of environmental corporate reputation’, Journal of Strategic Marketing, 21 (6), 541–555.

Eagle, B.W., Miles, E.W. and Icenogle, M.L. (2001) ‘Male and female interpretations of bidirectional work-family conflict scales’, in, C.A. Schriesheim and L.L. Neider (eds.), Equivalence in Measurement, Information Age, Greenwich, CT, pp. 5–23.

Fan, D., Geddes, D. and Flory, F. (2013) ‘The Toyota recall crisis: Media impact on Toyota’s corporate brand and reputation’, Corporate Reputation Review, 16 (2), 99–117.

Fan, X., Thompson, B. and Wang, L. (1999) ‘Effects of sample size, estimation methods, and model specification on structural equation modeling fit indexes’, Structural Equation Modeling, 6 (1), 56–83.

Fang, E., Palmatier, R.W. and Grewal, R. (2011) ‘Effects of customer and innovation asset configuration strategies on firm performance’, Journal of Marketing Research, 48 (3), 587–602.

Farrell, A.M. (2010) ‘Insufficient discriminant validity: A comment on Bove, Pervan, Beatty, and Shiu (2009)’, Journal of Business Research, 63 (3), 324–327.

Flatt, S.J., Harris-Boundy, J. and Wagner, S. (2013) ‘CEO succession: A help or hindrance to corporate reptuation?’ Corporate Reputation Review, 16 (3), 206–219.

Fombrun, C.J. (1996) Reputation: Realizing Value from the Corporate Image, Harvard Business School Press, Boston.

Fombrun, C.J. (2012) ‘The building blocks of corporate reputation: Definitions, antecedents, consequences’, in, M.L. Barnett and T.G. Pollock (eds.), The Oxford Handbook of Corporate Reputation, Oxford University Press, Oxford, pp. 94–113.

Fombrun, C. and Shanley, M. (1990) ‘What’s in a name? Reputation building and corporate strategy’, Academy of Management Journal, 33 (2), 233–256.

Fombrun, C.J., Gardberg, N.A. and Sever, J.M. (2000) ‘A multi-stakeholder measure of corporate reputation’, Journal of Brand Management, 7 (4), 241–255.

Fornell, C. and Larcker, D.F. (1981) ‘Evaluating structural equation models with unobservable variables and measurement error’, Journal of Market Research, 18 (1), 39–50.

Freeman, R.E. (1984) Strategic Management: A Stakeholder Approach, Pitman, Boston.

Gaines-Ross, L. (2002) CEO Capital: A Guide to Building CEO Reputation and Company Success, Wiley, Hoboken, NJ.

Gardberg, N.A. (2006) ‘Reputatie, reputation, réputation, reputazione, ruf: A cross-cultural qualitative analysis of construct and instrument equivalence’, Corporate Reputation Review, 9 (1), 39–61.

Gardberg, N.A. and Fombrun, C.J. (2002) ‘The global Reputation Quotient project: First steps towards a cross-nationally valid measure of corporate reputation’, Corporate Reputation Review, 4 (4), 303–307.

Ghosh, M. and John, G. (2009) ‘When should original equipment manufacturers use branded component contracts with suppliers?’ Journal of Marketing Research, 46 (5), 597–611.

Goldfarb, A., Lu, Q. and Moorthy, S. (2009) ‘Measuring brand value in an equilibrium framework’, Marketing Science, 28 (1), 69–86.

Goldfarb, A. and Yang, B. (2009) ‘Are all managers created equal?’ Journal of Marketing Research, 46 (5), 612–622.

Gottschalk, P. (2013) ‘Limits to corporate social responsibility: The case of Gjensidige Insurance Company and Hells Angels Motorcycle Club’, Corporate Reputation Review, 16 (3), 177–186.

Hair Jr. J.F., Black, W.C., Babin, B.J. and Anderson, R.E. (2010) Multivariate Data Analysis: A Global Perspective 7th edn. Pearson Prentice Hall, Upper Saddle River, NJ.

Hair Jr. J.F., Black, W.C., Babin, B.J., Anderson, R.E. and Tatham, R.L. (2006) Multivariate Data Analysis 6th edn. Pearson-Prentice Hall, Upper Saddle River, NJ.

Halff, G. (2013) ‘The presentation of CEOs in economic downturn’, Corporate Reputation Review, 16 (3), 234–243.

Kim, S.K., McFarland, R.G., Kwon, S., Son, S. and Griffith, D.A. (2011) ‘Understanding governance decisions in a partially integrated channel: A contingent alignment framework’, Journal of Marketing Research, 48 (3), 603–616.

Kline, R.B. (2005) Principles and Practice of Structural Equation Modeling, 2nd edn., Guilford, New York.

Koschate-Fischer, N., Stefan, I.V. and Hoyer, W.D. (2012) ‘Willingness to pay for cause-related marketing: The impact of donation amount and moderating effects’, Journal of Marketing Research, 49 (6), 910–927.

Lange, D., Lee, P.M. and Dai, Y. (2011) ‘Organizational reputation: A review’, Journal of Management, 37 (1), 153–185.

Little, J. (1992) ‘Regression with missing X’s: A review’, Journal of the American Statistical Association, 87 (420), 1227–1237.

Martin, G., Gollan, P.L. and Grigg, K. (2011) ‘Is there a bigger and better future for employer branding? Facing up to innovation, corporate reputations and wicked problems in SHRM’, International Journal of Human Resource Management, 22 (17), 3618–3637.

Mason, A.M. (2014) ‘The impact of media frames and treatment responsibility within the situational crisis communication theory framework’, Corporate Reputation Review, 17 (1), 78–90.

McQuitty, S. (2004) ‘Statistical power and structural equation models in business research’, Journal of Business Research, 57 (2), 175–183.

Michaelis, M., Woisetschlager, D.M., Backhaus, C. and Ahlert, D. (2008) ‘The effects of country of origin and corporate reputation on initial trust: An experimental evaluation of the perception of Polish consumers’, International Marketing Review, 25 (4), 404–422.

Milgrom, P. and Roberts, J. (1986) ‘Price and advertising signals of product quality’, Journal of Political Economy, 94 (4), 796–821.

Mio, C. and Fasan, M. (2012) ‘Does corporate social performance yield any tangible financial benefit during a crisis? An event study of Lehman brothers’ bankruptcy’, Corporate Reputation Review, 15 (4), 263–284.

Morris, S.A., Bartkus, B.R., Glassman, M. and Rhiel, G.S. (2013) ‘Philanthropy and corporate reputation: An empirical investigation’, Corporate Reputation Review, 16 (4), 285–299.

Newburry, W. (2010) ‘Reputation and supportive behavior: Moderating impacts of foreignness, industry and local exposure’, Corporate Reputation Review, 12 (4), 388–405.

Newburry, W., Gardberg, N.A. and Sanchez, J.I. (2014) ‘Employer attractiveness in Latin America: The association among foreignness, internationalization and talent recruitment’, Journal of International Management, 20 (3), 327–344.

Nolan, K.P., Gohlke, M., Gilmore, J. and Rosiello, R. (2013) ‘Examining how corporations use online job ads to communicate employer brand image information’, Corporate Reputation Review, 16 (4), 300–312.

Nunnally, J.C. and Bernstein, I.H. (1994) Psychometric Theory, 3rd edn., McGraw-Hill, New York.

Orlitzky, M. and Swanson, D.L. (2012) ‘Assessing stakeholder satisfaction: Toward a supplemental measure of corporate social performance as reputation’, Corporate Reputation Review, 15 (2), 119–137.

Ponzi, L.J., Fombrun, C.J. and Gardberg, N.A. (2011) ‘RepTrak® Pulse: Conceptualizing and validating a short-form measure of corporate reputation’, Corporate Reputation Review, 14 (1), 15–35.

Prabhu, J. and Stewart, D.W. (2001) ‘Signaling strategies in competitive interaction: Building reputations and hiding the truth’, Journal of Marketing Research, 38 (1), 62–72.

Rao, A.R., Qu, L. and Ruekert, R.W. (1999) ‘Signaling unobservable product quality through a brand ally’, Journal of Marketing Research, 36 (2), 258–268.

Rindova, V.P. and Martins, L.L. (2012) ‘Show me the money: A multidimensional perspective on reputation as an intangible asset’, in, M.L. Barnett and T.G. Pollock (eds.), The Oxford Handbook of Corporate Reputation, Oxford University Press, Oxford, pp. 16–33.

Sarstedt, M., Wilczynski, P. and Melewar, T.C. (2013) ‘Measuring reputation in global markets – A comparison of reputation measures’ convergent and criterion validities’, Journal of World Business, 48 (3), 329–339.

Satorra, A. and Bentler, P. (2001) ‘A scaled difference chi-square test statistic for moment structure analysis’, Psychometrika, 66 (4), 507–514.

Schermelleh-Engel, K., Moosbrugger, M. and Müller, H. (2003) ‘Evaluating the fit of structural equation models: Tests of significance and descriptive goodness-of-fit measures’, Methods of Psychological Research Online, 6 (2), 23–74.

Schreiber, J.B., Nora, A., Stage, F.K., Barlow, E.A. and King, J. (2006) ‘Reporting structural equation modeling and confirmatory factor analysis results: A review’, Journal of Educational Research, 99 (6), 323–337.

Smith, K.T., Smith, M. and Wang, K. (2010) ‘Does brand management of corporate reputation translate into higher market value?’ Journal of Strategic Marketing, 18 (3), 201–221.

Soleimani, A., Schneper, W.D. and Newburry, W. (2014) ‘The impact of stakeholder power on corporate reputation: A cross-country corporate governance perspective’, Organization Science, 25 (4), 991–1008.

Sonnier, G. and Ainslie, A. (2011) ‘Estimating the value of brand-image associations: The role of general and specific brand image’, Journal of Marketing Research, 48 (3), 518–531.

Spector, P.E. (1992) Summated Rating Scales Construction, Sage, Newbury Park.

Spence, M. (1973) ‘Job market signaling’, Quarterly Journal of Economics, 87 (3), 355–374.

Sridhar, K. (2012) ‘The relationship between the adoption of triple bottom line and enhanced corporate reputation and legitimacy’, Corporate Reputation Review, 15 (2), 69–87.

Srivastava, J. and Chakravarti, D. (2009) ‘Channel negotiations with information asymmetries: Contingent influences of communication and trustworthiness reputations’, Journal of Marketing Research, 46 (4), 557–572.

Tichy, N.M., McGill, A.R. and St Clair, L. (eds.) (1997) Corporate Global Citizenship, New Lexington Press, San Francisco.

Treadway, D.C., Adams, G.L., Ranft, A.L. and Ferris, G.R. (2009) ‘A meso-level conceptualization of CEO celebrity effectiveness’, Leadership Quarterly, 20 (4), 554–570.

Van Den Bogaerd, M. and Aerts, W. (2014) ‘Media reputation of a firm and extent of trade credit supply’, Corporate Reputation Review, 17 (1), 28–45.

Van Der Merwe, A.W.A.J. and Puth, G. (2014) ‘Towards a conceptual model of the relationship between corporate trust and corporate reputation’, Corporate Reputation Review, 17 (2), 138–156.

van Riel, C.B.M. (2012) The Alignment Factor: Leveraging the Power of Total Stakeholder Support, Routledge Press, London and New York.

van Riel, C.B.M. and Fombrun, C.J. (2007) Essentials of Corporate Communication: Implementing Practices for Effective Reputation Management, Routledge, London and New York.

Vidaver-Cohen, D. and Brønn, P.S. (2013) ‘Reputation, responsibility, and stakeholder support in Scandinavian firms: A comparative analysis’, Journal of Business Ethics. published online, forthcoming in press doi:10.1007/s10551-013-1673-7.

Vlachos, P.A., Krepapa, A., Panagopoulos, N.G. and Tsamakos, A. (2013) ‘Curvilinear effects of corporate social responsibility and benevolence on loyalty’, Corporate Reputation Review, 16 (4), 248–262.

Waddock, S. and Graves, S. (1997) ‘The corporate social performance – Financial performance link’, Strategic Management Journal, 18 (4), 303–319.

Wade, J.B., Porac, J.F., Pollock, T.G. and Graffin, S.D. (2008) ‘Star CEOs: Benefit or burden’, Organizational Dynamics, 37 (2), 203–210.

Walsh, J.P., Weber, K. and Margolis, J.D. (2003) ‘Social issues and management: Our lost cause found’, Journal of Management, 29 (6), 859–881.

Westphal, J.D. and Deephouse, D.L. (2011) ‘Avoiding bad press: Interpersonal influence in relations between CEOs and journalists and the consequences for press reporting about firms and their leadership’, Organization Science, 22 (4), 1061–1086.

Acknowledgements

The authors thank Professor Naomi Gardberg, Sebastian Taciak, RI Manager – Global Research & Analytics, CRR Editor Cees van Riel and three anonymous reviewers for their helpful comments and suggestions on previous drafts of this paper.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Fombrun, C., Ponzi, L. & Newburry, W. Stakeholder Tracking and Analysis: The RepTrak® System for Measuring Corporate Reputation. Corp Reputation Rev 18, 3–24 (2015). https://doi.org/10.1057/crr.2014.21

Published:

Issue Date:

DOI: https://doi.org/10.1057/crr.2014.21