Abstract

Private wealth is becoming increasingly important in planning for retirement and protecting against life risks; however, limited research has addressed the gender wealth gap in Canada. This gap remains largely unexplored because of the collection of wealth data at the household level in existing surveys within the country, which obscures disparities within couples. To overcome this limitation, this article uses new personal wealth data from an original survey conducted in 2022 in the province of Québec (N: 4816). The analyses were performed using quantile regression and decomposition at the 70th, 80th, and 90th quantiles. The results reveal significant wealth inequalities favoring men that appear even more pronounced among partnered adults than those who are unpartnered. The gender wealth gap is partly explained by differences in income and ownership of real estate other than the principal residence between men and women. However, a substantial portion of this gap remains unexplained. These findings highlight the need to collect wealth data at both household and individual levels in Canada to better understand gender-based economic disparities. They also call for more research on the processes underpinning the gender wealth gap by suggesting that it does not simply reflect the wage gap between men and women.

Résumé

Le patrimoine individuel joue un rôle de plus en plus important dans la planification de la retraite et la protection contre les risques de la vie. Toutefois, peu de recherches ont porté sur l’écart de patrimoine entre les hommes et les femmes au Canada. Cet écart reste largement inexploré en raison de la collecte des données sur le patrimoine réalisée exclusivement au niveau des ménages dans les enquêtes existantes au pays, ce qui occulte les disparités au sein des couples. Pour pallier cette limite, cet article utilise de nouvelles données sur le patrimoine individuel tirées d’une enquête originale menée en 2022 dans la province de Québec (N : 4 816). Les analyses ont été réalisées à l’aide de régressions quantiles et de décompositions aux 70e, 80e et 90e percentiles. Les résultats révèlent d’importantes inégalités de richesse en faveur des hommes, qui semblent encore plus prononcées chez les adultes en couple que chez ceux qui ne le sont pas. L’écart de richesse entre les genres s’explique en partie par les différences de revenus et de propriété de biens immobiliers autres que la résidence principale entre les hommes et les femmes. Toutefois, une part importante de cet écart reste inexpliquée. Ces résultats soulignent la nécessité de collecter des données sur le patrimoine individuel au Canada afin de mieux comprendre les disparités économiques fondées sur le genre. Ils invitent également à des recherches plus approfondies sur les processus qui sous-tendent l’écart de patrimoine entre les hommes et les femmes, en suggérant qu’il ne reflète pas simplement l’écart salarial entre eux et elles.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Research on economic inequality has long focused on the distribution of income, but more recently, a growing number of researchers place the spotlight on wealth, defined as the value of private capital assets, net of any debts (Killewald et al., 2017; Spilerman, 2000). One reason for considering this resource is that income may not be representative of normal economic conditions, for example, if there is a momentary loss of employment. Wealth is a more stable indicator of economic conditions that also reflects economic history (Spilerman, 2000). It is also more closely related to well-being than income, since asset ownership provides security against contingencies and access to certain essential services, such as housing in the case of home ownership (M. S. Sherraden & McBride, 2010). Finally, wealth accumulation is increasingly important in retirement planning, as public and private pension systems have become less generous (Ebbinghaus, 2015; Foster, 2011; McCarthy, 2017).

Existing studies have shown that wealth is even more unequally distributed than income in contemporary Western societies (Keister & Lee, 2014; Pfeffer, 2018; Piketty, 2014; Saez & Zucman, 2016), that substantial ethno-racial disparities in wealth exist (Conley, 2010; Krivo & Kaufman, 2004), and that family background greatly influences capital accumulation (Pfeffer & Killewald, 2018). More recently, a growing body of research has also explored wealth disparities along gender lines. This stream of research finds that women are significantly disadvantaged compared to men in this regard and that the gender wealth gap is not only due to the well-known wage inequality between men and women. Other factors, such as disparities in inheritance receipts, also play a key role (Bessière & Gollac, 2023; Cordova et al., 2022; Deere & Doss, 2006; Denton & Boos, 2007; Frémeaux & Leturcq, 2022; Lee, 2022; Maroto & Aylsworth, 2017; Sierminska et al., 2010).

In several countries, however, research on the gender wealth gap remains underdeveloped. Canada falls squarely in this category, with just two studies on the topic conducted in this national context, to our knowledge (Denton & Boos, 2007; Pugliese & Chaumont-Goneau, 2022). Data limitations constitute the main reason for this lack of research. In several states, including Canada, large national surveys on household finances (such as Statistics Canada’s Survey of Financial Security) collect information on assets and debts at the household level, without distinguishing between the proportions belonging to each family member. This practice impedes a gendered analysis of accumulated wealth for all individuals residing with another adult, including those in couples. To overcome this issue, several previous studies on the gender wealth gap have opted to focus their analysis exclusively on men and women living alone or with minor children (Ruel & Hauser, 2013; Schneebaum et al., 2018). Indeed, this is what the most recent Canadian study has done (Pugliese & Chaumont-Goneau, 2022). The other existing Canadian study has compared household wealth differences between men and women, instead of their individual wealth levels (Denton & Boos, 2007). While those kinds of approaches provide useful information on the gender wealth gap, they paint an incomplete portrait by overlooking inequality among people in a coresidential couple, who make up 48% of adults in Canada (Statistics Canada, 2023). This paper helps to address this issue by marshalling data from an original survey that measured wealth at the individual level in the province of Québec in 2022 to provide the first estimate of the gender wealth gap among single and partnered individuals in the Canadian context. We ask: how large is this gap at different points along the wealth distribution? Also, what part of this gap is explained by taking into consideration factors such as income disparities between men and women? And what part remains unexplained?

In the remainder of this article, we first describe the process of wealth accumulation over the life course and review the existing literature on the gender wealth gap. We then discuss our methods and present our results.

2 The Process of Wealth Accumulation

Wealth is acquired over the life course through several mechanisms, beginning with active savings out of current income. Many factors influence the propensity to save, including one’s income level, with more affluent people saving more easily than those who have little left once basic necessities have been paid for (Dynan et al., 2004; M. W. Sherraden, 2007). According to the life-cycle model of personal savings, age is also a key predictor of active savings (Ando & Modigliani, 1963). As individuals seek to smooth out their consumption over time, they save during their active period and then liquidate their assets during retirement (Browning & Lusardi, 1996). Some authors, however, have questioned the idea that asset holdings decrease in older age, on the grounds that savings are not aimed just at preparing for retirement. Another key motive for saving is the building up of wealth to pass on to children, which implies that it is preserved even after retirement (Arrondel & Masson, 2006; Gale & Scholz, 1994).

This critique of the life-cycle model evokes a second key mechanism of wealth accumulation: the reception of inheritances and transfers, which come mostly from parents and other family members (De Nardi & Fella, 2017; Piketty et al., 2014). Those transfers are common (Keister et al., 2019): in Canada, one study noted that in 2016, 50% of Canadians aged 50 to 75 reported having inherited at least once (Tal, 2016). Although the amounts received are often small, they can nonetheless meaningfully facilitate the acquisition of assets such as a home or business (Fleury et al., 2016; Lee et al., 2020). Furthermore, for a few high net worth families, intergenerational transfers are of substantial monetary value (De Nardi & Fella, 2017; Pfeffer & Killewald, 2018), and they play a crucial role in reproducing wealth inequalities (Keister et al., 2019; Killewald et al., 2017; Piketty, 2014).

Finally, a third mechanism of wealth accumulation lies in returns to capital (Campanale, 2007), as households invest their savings in different combinations of assets that exhibit varying levels of profitability (Bricker et al., 2019; Bucciol & Miniaci, 2015). Investment returns are partly a matter of luck and circumstances, but also of risk tolerance, financial knowledge, and the quality of available advisory services (Gaudecker, 2015; Lusardi et al., 2017). Those factors are distributed unevenly across populations and groups, with wealthy individuals, for example, being on average more knowledgeable about financial matters and investment opportunities than their less affluent counterparts (resulting, in part, from formal and informal education) and better served by financial professionals (Bessière & Gollac, 2023; Buckland, 2010). Furthermore, credit access is essential for many asset acquisitions, including homeownership (Fleury et al., 2016) and starting private businesses. Yet some social groups, including racialized people, face financial exclusion, which limits their ability to generate returns (Wherry et al., 2019).

3 Gender and Wealth Accumulation

Existing research suggests that women are disadvantaged relative to men in all three mechanisms of wealth accumulation: active savings, family transfers, and returns to invested capital. Indeed, women’s incomes are more modest than men’s (Marier & Skinner, 2008; Schirle, 2015). Even though pure wage discrimination has been abolished in most countries, women still face horizontal and vertical segregation in the labor market. On the one hand, female-dominated occupations are paid less than male-dominated ones (England, 2010). On the other hand, social norms create individual, organizational, and policy barriers preventing women to climb in the hierarchy (Taparia & Lenka, 2022). For both mechanisms, gender stereotypes and sexism explain part of the discrimination women face on the labour market (Weichselbaumer, 2004). Another critical mechanism behind the gender wage gap relates to family formation. Structurally and culturally encouraged to take on most of the reproductive work, more women than men withdraw from paid work after the birth of a child (Budig & England, 2001; Florian, 2018; Kapelle & Vidal, 2022). The wage gap reduces women’s ability to save compared to men (Grabka et al., 2015; A. W. Lee, 2022; Nutz & Lersch, 2021; Ruel & Hauser, 2013; Schneebaum et al., 2018). Additionally, their work interruptions lower their contributions to public and employer-sponsored pension regimes (Rose, 2014; Young, 2011).

Several studies also find that women are less likely to receive inheritances and gifts from their parents than men (Bessière & Gollac, 2023; Cox, 2003; Pugliese & Chaumont-Goneau, 2022). According to Bessière and Gollac (2023), this reality stems from complex socio-legal dynamics. On one hand, reflecting the normativity surrounding gender roles, (elder) sons are often seen as more legitimate and competent heirs than daughters to preserve the value of the estate. This is particularly noticeable when it comes to the transfer of a family business (Gollac, 2008). Daughters, on the other hand, are socialized to preserve family harmony, and they more easily give up negotiating their share of inheritances, further reducing their chances of being the beneficiaries (Bessière & Gollac, 2023). Inheritance laws will facilitate this type of inequality if they value testamentary freedom rather than universal rules of estate distribution (Beckert, 2008). In Québec (like elsewhere in Canada), individuals are mostly free to choose their heirs by writing a will (Brown & Gardiner, 2018). However, evidence suggests that deaths frequently occur without existing wills (Pugliese et al., 2023). In those cases, Québec succession laws dictate an equal division of the estate between children (if the deceased does not have a married spouse; if there is one, two-thirds of the estate is divided equally between children). While this type of provision seems likely to remove inequities between brothers and sisters, Bessière (2022) showed that this is not always the case in practice. Legal and tax professionals who assist survivors propose various techniques to enable unequal estate distributions, including the undervaluation of assets transmitted to a favored heir (often for his takeover of a family business), even when the law stipulates otherwise.

It is important to note, however, that gender gaps in the receipts of private transfers do not seem universal. For one thing, they appear to be more pronounced among wealthy families than poorer ones (Cox, 2003), which may be related to the importance of family businesses within these groups (Wodtke, 2016). Also, a study comparing several European countries found that men are more likely to receive an inheritance in some countries, while the opposite is true in others (Greece, Austria, and Belgium) (Schneebaum et al., 2018). In Canada, one recent analysis found that single women are less likely to report having received their residence as inheritance than single men (Pugliese & Chaumont-Goneau, 2022).

Finally, studies have also documented differences in the investment practices of men and women and lower returns to capital among the latter, including in the aftermath of financial crises (Sierminska et al., 2010; Szymborska, 2022). While the underlying reasons for this disparity are not well understood, some have argued that women are more averse to risk than men, leading them to invest less heavily in high-return (but volatile) assets, such as corporate shares or private businesses (Rybczynski, 2015). Other researchers have contextualized women’s “risk aversion” by emphasizing that their lower incomes and parenting responsibilities may cause them to adopt more cautious financial behaviors (Jianakoplos & Bernasek, 1998; Thébaud, 2015). Additionally, these same factors (lower incomes and parental responsibilities) may limit women’s access to credit and professional financial services compared to men (Herlin-Giret, 2019). Finally, some researchers have pointed out that, as a result of gender socialization related to money issues, girls’ financial knowledge is less developed than boys’, which may ultimately foster inequalities in investment decision-making (Bessière & Gollac, 2023).

A growing number of studies show that those disadvantages of women in the three accumulation mechanisms (savings, transfer receipts, and investment returns) compound into a significant gender wealth gap among single men and women. For example, Schneebaum et al. (2018) estimated that single men’s average net worth is 15% greater compared to that of single women in France, the difference reaching 23.2% in Italy and 33% in Germany. Studies also show that the wealth gap is more acute higher up the wealth distribution. In Canada, Pugliese and Chuamont-Goneau (2022) found a greater wealth gap between single men and women at the 90th percentile of the wealth distribution than at the 50th or 25th percentile, and the same pattern was observed in several European countries (Schneebaum et al., 2018).

Empirical studies have sought to parse out the relative weights of disparities in savings, transfers, and investment strategies/returns in shaping the overall gender wealth gap. Findings indicate that a large part is explained when accounting for income disparities, which can feed the wealth gap through their effect on both active savings and investment strategies, as we noted (Grabka et al., 2015; A. W. Lee, 2022; Nutz & Lersch, 2021; Ruel & Hauser, 2013; Schneebaum et al., 2018). Yet, the gender wealth gap does not boil down to a by-product of income disparities, as taking the latter into consideration typically does not explain the entirety of the gap and the explanatory power of this factor even appears to be fading out in recent years, as per one recent US study (Lee, 2022). This is especially true at the top of the wealth distribution (Pugliese & Chaumont-Goneau, 2022; Schneebaum et al., 2018), where income disparities account for a relatively small share of the wealth gap. Once income inequalities have been adjusted for, the remaining wealth gap is explained in part by disparities in inheritance receipts, as well as by differences in types of assets owned, reflecting men’s and women’s contrasting investment strategies. However, in many studies, a wealth gap remains unexplained even when all of those observable endowments and characteristics are controlled for, a reality some attribute to disparities in returns to wealth and potentially to differences in financial literacy and opportunities between men and women (Ruel & Hauser, 2013; Schneebaum et al., 2018).

4 Conjugality and Gender Wealth Inequalities

Whereas wealth disparities between unpartnered men and women are well established, it is not uncommon (in both popular and academic discourses) to assume that conjugality dissipates the gaps because couples pool their assets (Metzger, 2018).To justify this assumption, some authors evoke values of conjugal solidarity that are thought to prompt couples to share (Bennett, 2013). Others refer instead to the specialization thesis, according to which, in the name of efficiency, spouses negotiate the disengagement of one partner (usually the woman, in different-sex couples) from the labor market (to take over domestic work) in exchange for access to the other’s economic resources (Becker, 1991). However, several studies challenge this egalitarian and negotiated view of the couple and even argue that conjugality forms a key pillar of men’s advantages over women in wealth accumulation. For example, studies indicate that the sexual division of labor within unions is rarely the result of frank and informed discussions between spouses, as the contemporary normativity of love encourages partners to hide the material dimensions of their relationship in favor of the purely affective elements (Belleau et al., 2020). Instead, many women reduce their work output as the needs of their families become apparent, prompted by gender socialization rather than negotiation, and without guaranteed access to their partner’s resources (Bessière & Gollac, 2023). Surely, men benefiting from this practice most often share a portion of their income (Belleau & Proulx, 2010). But they more rarely provide access to their assets, especially those that they inherited or acquired before the union (Bessière & Gollac, 2023; Lersch & Vidal, 2016; Pugliese & Belleau, 2021), which may be in part because couples often view equal control over, but not necessarily equal ownership of, assets as the key to distributive justice in marriage (Tisch & Lersch, 2021). Moreover, in a cultural context where transactional rationalities are framed as oppositional to romantic feelings, marital redistributions take place on an informal and irregular basis, through ad hoc gifts or an income-proportion distribution of certain expenses (Belleau et al., 2020; Pahl, 1989; Vogler, 1998). This suggests that couples might not always pool and share all their wealth; the few data sources available on wealth distribution within couples (mostly in France, Germany, and the UK) confirm this hypothesis. Indeed, studies building on these data show that significant wealth inequalities exist within unions (Frémeaux & Leturcq, 2022; Grabka et al., 2015; Kan & Laurie, 2014; Kapelle & Lersch, 2020; Nutz & Gritti, 2022). Moreover, whereas it is acknowledged that marriage is associated with a “wealth premium” and tends to boost the wealth of partners due to scale economies and institutional incentives to save during marriage (Frémeaux & Leturcq, 2022; Kapelle & Lersch, 2020; Lersch, 2017 ; Niimi, 2022), studies have found that wealth increases more after marriage for men than women (Lersch, 2017; Niimi, 2022).

Family law and matrimonial regimes could, in theory, address those within-union wealth inequalities. In Québec, for instance, marriage establishes a family patrimony comprising several assets (including the principal residence, pensions, and certain other retirement savings acquired during marriage). In cases of divorce, each spouse has the right to half of this patrimony’s value, and, in the event of death, half goes to the surviving spouse (and the other to the deceased’s estate) (Lavallée et al., 2017; Roy, 2011). Regarding assets that fall outside of this patrimony, their distribution in case of divorce or death depends on the chosen matrimonial regime. The default and most common one in Québec is partnership of acquests, which gives each spouse a claim to half of assets acquired during the marriage at separation or death (Belleau, 2012). Those provisions can equalize wealth between partners, albeit only upon union termination. During the marriage, assets can and often are owned (and benefited from) individually (Boertien & Lersch, 2021; Kan & Laurie, 2014; Lersch & Vidal, 2016; Pugliese & Belleau, 2022). Moreover, while those provisions give spouses equal rights to a variety of assets in case of union dissolution, the reverse accounting strategies described by Bessière (2022) in practice facilitate unequal divisions. Importantly, accumulations that have preceded marriage, as well as all donations and inheritances received during the union, are excluded from the family patrimony and acquests (Cardenas, 2018). They are not equalized by marriage, in Québec as in most of North America and Europe (Frémeaux & Leturcq, 2022; Perelli-Harris & Gassen, 2012).

More critically, a growing proportion of couples are not married, even among those that have formed a family. This is especially true in Québec, where over 60% of births are to unmarried mothers (Institut de la statistique du Québec, 2021) and more than 40% of partnered people are in an unmarried, cohabiting union (Statistics Canada, 2022). Cohabiting partners typically have weaker or no mutual obligations at union termination (Perelli-Harris & Gassen, 2012). In the context of Québec, each former cohabiting partner leaves only with assets that were in their name in case of separation (Lavallée et al., 2017; Roy, 2011). In the event of death, the surviving unmarried partner has no rights to the deceased’s estate, unless specifically named in the will (Pugliese et al., 2023). Because of those weaker legal incentives to redistribute wealth between partners at the end of unions for unmarried couples, the growth of cohabitation appears to have fueled the gender wealth gap, as has been observed in France (Frémeaux & Leturcq, 2020).

5 The Present Study

Insights from previous research stress the importance of considering not just unpartnered people, but also those who are in a married or unmarried coresidential relationship, when studying the gender wealth gap. Unfortunately, in Canada, the main survey on household finances—The Survey of Financial Security—collects wealth only at the household level, which glosses over all within-union disparities, and this has meant previous studies had to focus on the gender wealth gap among single people alone or compare the household wealth of men and women, instead of their personal wealth levels. In this context, the objective of this paper is to draw on an original survey that collected personal level wealth data in the province of Québec to describe the gender wealth gap among both partnered and unpartnered adults of that province. We also explore how the wealth gap varies across conjugal status groups and along the wealth distribution. Finally, we explore what part of the gap is explained when taking into consideration factors such as income, financial transfers received, assets owned, financial literacy, and several demographic factors (such as age and education). Unfortunately, our data do not allow us to explore how other potentially important contributing factors, such as receipts of inheritances, shape the gender wealth gap.

6 Methodology

6.1 Data

Our data were obtained from l’Enquête sur l’endettement parmi les ménages Québécois (EEMQ). It was conducted in Québec between January and February 2022 as part of a larger project on the issue of over-indebtedness. The survey’s primary objective was to understand the prevalence of struggling to keep up with debt reimbursement schedules in Québec. The target population was people aged 18 years and older, currently residing in Québec. An oversample of lower-income people (below the national average of $45,000/year) and younger respondents, as detailed in Supplementary Table 1, was included to facilitate the analyses within this group. Our research team designed the questionnaire, which was then administered (in French or English) by the survey firm Léger Opinion by phone (through random number generation, N = 1800; 37% of the sample) and online (through invitations sent to Léger’s web panel Leo, N = 3016; 63% of the sample) for a final sample size of 4816 respondents. Details on response rates are presented in Supplementary Table 2.

In the present study, we imputed missing values, except for variables with under 1% of missing values (see details in section 6.3 Missing Data). In total, 87 cases had missing values on one or more of the variables after the imputation procedure (they include 9 people who identified "other" as their gender whom we decided to exclude from the analysis due to the small sample size). Those 87 cases were excluded from the analytic sample, for a final sample size of 4729 respondents.

Mixing phone and web panels is increasingly common, as although web surveys have higher non-response rates, they reach younger populations more efficiently (Dillman et al., 2014). Studies have also shown that data obtained through the web and phone exhibit similar distributions (Yeager et al., 2011). Léger Opinion calculated probability weights to account for the oversamples. Weights were also adjusted to more closely match census distributions on several socioeconomic variables (adjustments were calculated based on age, gender, region, mother tongue, and income). The phone and web portions of the survey were independently weighted using the same demographic profiles. The weighting factors were determined through iterative proportional fitting. All analyses presented here use these weights. Supplementary Tables 3, 4, and 5 compare our weighted and unweighted data with the 2014 Canadian Financial Capability Survey, the 2019 Survey of Financial Security, and the 2016 Census.

6.2 Main Variables

6.2.1 Outcome Variable

The outcome variable was net wealth, defined as the total value of personal assets minus the total value of personal debts. The value of personal assets was determined using the following question: “According to your estimation, what is the approximate current total value of your assets? For those owned jointly, consider only the value of the portion that belongs to you.” This question was asked immediately following another one that asked respondents whether or not they own (alone or jointly) the following assets: a residence, other real estate, private businesses, financial assets (stocks, bonds, mutual funds, or other savings in or outside of RRSPs/TFSAs), or other assets (such as art, gold, other valuable objects). The value of personal debts was measured through the following question: “What is the total value of your debts according to your estimation? For jointly held debts, consider only the part that belongs to you (for example, half of a joint mortgage).” This question was asked immediately after one that asked respondents whether or not they have the following types of debts: mortgages, reversed mortgages, car loans, student loans, unpaid credit card balances, unpaid bills, and/or other debts (such as credit margins, personal loans, and payday loans). Individuals who declared having no assets were assigned a zero value for assets, and the same was done for debts. Note that we did not ask people with jointly owned assets or debts to provide the proportion they attributed to them, we simply asked them to take only their part into consideration in their personal wealth estimation. This limitation is further discussed in the discussion section of the paper. Table 1 shows descriptive statistics for the outcome and all other variables in the study.

6.2.2 Predictors

The main predictor in this study was gender. Respondents could choose between man, woman, and other, and we used man as the reference category for our analyses. Only nine respondents chose other. As noted earlier, we excluded these respondents instead of grouping them with either men or women.

6.2.3 Control Variables

We included several control variables that could affect wealth and vary by gender. Age was treated as a continuous variable, and we included age squared to capture the curvilinear association with net wealth. Marital status was a four-category variable: married, cohabiting, widowed/separated/divorced, and single. Another variable indicates whether the respondent has children living in the household, has never had children, or has only children who do not live at home. We also controlled for educational attainment through a variable that indicated whether the highest diploma achieved was high school or less, college (i.e., Cégep) or certificate, or university degree. The variable immigrant status is binary, distinguishing between those native to Canada and those born in a different country.

One variable indicates whether respondents identified an ethnic identity that can be considered racialized in Québec. It was coded based on the following question: “What are your ethnic backgrounds?” Respondents were asked to select as many answers as desired from predefined options and/or to describe their backgrounds in their own words. While most respondents selected a single choice from the options provided, some chose two or three or added details in an open format after selecting the “other” option. We classified as racialized respondents who chose the following backgrounds, whether or not they also chose Caucasian (White): First Nations/Métis/Inuit, Latin American, Arab, Black, South Asian, Southeast Asian, East Asian, Chinese, Filipino, Korean, and/or Japanese. The individuals who identified as White (and did not select other options) are coded as White. For 181 respondents who selected only “other” and provided an open response, their answer did not allow us to classify them as racialized or White (for example, they reported Canadian or Québécois as their identity). They were coded as missing values.

We also adjusted for respondents’ personal income, which we obtained through the question, “Approximately what was your personal income before taxes during the last 12 months?” This implies that personal income is based on self-assessment. Another variable indicated whether respondents received financial support from a family member or friend in the past 5 years (based on the question, “Have you received money, assets, valuables, or any other financial aid from members of your family or friends (whether as a gift or not) over the past 5 years, such as from your spouse, parents, etc.?”). We also controlled for the types of assets owned by respondents via four dummy variables indicating whether the respondents possessed the following assets: their home, other real estate, financial assets, and personal businesses. We controlled for financial literacy by distinguishing between those who provided the correct answer (vs. incorrect) to the following question: “What do you think might affect the total amount of interest paid on a loan?” There were four possible responses to this question: the credit score of the borrower, the value of the loan, the period taken to repay the loan, and all of the above (correct answer). This relatively restricted measure of credit knowledge constitutes the sole indicator of financial literacy in our data (reflecting the mission of the survey to better understand difficulties with debt). Finally, we also controlled for the data collection method (via phone or web).

6.3 Missing Data

Some variables in our dataset contain a significant proportion of missing values, particularly gross wealth (i.e., the value of assets), personal income, and the value of debts. Gross wealth was not observed in 34.72% of cases (27.66% for men and 40.75% for women). About 22% of the respondents did not answer the question about personal income, with 15% of men and 27% of women failing to respond. Debt value had 11.32% missing values (9.86% among men and 12.58% among women). As Supplementary Table 6 illustrates, the proportion of missing values is less than 5% for all other variables. There is no straightforward way to compare the proportion of missing values to what is observed in data from other wealth surveys because respondents were asked to estimate the total value of their assets, debt, and annual income in our survey, whereas in most others, they are asked to estimate the value of multiple asset, debt, and income types. Available missing data information from the two main Canadian wealth surveys, however, suggests the proportion of missing values observed in our data is comparable. First, in the Canadian Financial Capability Survey conducted in 2014 by Statistics Canada, 42.97% of people owning financial assets (31.48% of the sample) did not report the value of those assets, while 24.80% of people owning a residence, a car, or other valuable goods did not report their combined value (Statistics Canada, 2019a). Regarding the 2019 installment of the Survey of Financial Security (also conducted by Statistics Canada), the study documentation does not report the percentage of missing values but instead the percentage of the total value of several asset types that were imputed because they were not observed. Eight percent of the total value of residences was imputed, while 20% of the value of financial assets held outside of pensions was imputed (Statistics Canada, 2019b). Overall, those figures indicate that missing data is frequent in wealth surveys in Canada, as is observed in our own data, which is likely due to people being unsure of the current value of their assets and debts or uncomfortable sharing this information in a survey.

To address this issue, other wealth surveys in Canada and around the world typically impute missing data. The Canadian Survey of Financial Security uses single imputation and the nearest neighbor method (assigning the observed value of the closest respondent in the data based on sociodemographic variables) (Statistics Canada, 2019b). Other wealth surveys, including the German Socio-Economic Panel (SOEP) and the US Survey of Consumer Finances (SCF), instead use multiple imputation (Board of Governers of the Federal Reserve System, n.d..; Grabka & Westermeier, 2015). Whereas single imputation replaces each missing value with a single expected one, multiple imputation involves replacing each missing value with at least two acceptable values (known as replicates) that represent a distribution of possibilities (Rubin, 1987, 1988). The various imputation replicates are obtained by modeling an expected value based on complete variables in the dataset and adding a random term. Each of the multiple imputed datasets are then analyzed individually using a common complete data estimation method. Finally, those results are combined to obtain valid inferences (Harel & Zhou, 2007). We followed the SOEP and SCF examples and opted for multiple imputation in this study.

We imputed all missing values except for variables with missing values under 1 percent. We excluded these variables from the imputation, because by taking them into account, the Stata software displayed a convergence error. Cases with missing values on those variables were excluded from the analytic sample (87, or 1.8% of all the observations). The variables that were not imputed are: age, gender, marital status, level of education, immigrant status, presence of children, and financial literacy. As indicated above, significant differences exist between men and women in the proportion of missing values, especially regarding gross wealth and income. Thus, to ensure the representativeness of the results by gender, we performed multiple imputation by gender using Stata’s “mi impute chained” command (Enders, 2010). We created 20 replicates and used the “mi estimate” command in Stata to combine the results, which averaged the coefficients across imputations.

6.4 Analytical Strategy

Our first set of analyses is descriptive and seeks to measure and describe the gender wealth gap at different points of the wealth distribution. To do this, we first present the 10th, 25th, 50th, 75th, 90th, and 99th percentiles of personal wealth for men and women. We also present those same figures for the different conjugal status categories. The second set of analyses explores whether factors such as income, asset ownership, and transfers can account for a part of the gender wealth gap through regression and decomposition analyses. Because net wealth displays a highly asymmetrical distribution, linear regression was inappropriate (Plotnick, 2009; Schmidt & Sevak, 2006). Instead, we used quantile regressions, which are less sensitive to outliers in the dependent variable than are mean-based estimates (Meriküll et al., 2021). We specifically applied the unconditional quantile regression suggested by Firpo et al. (2009, 2018). This method transforms the dependent variable (net wealth) using a centered influence function (RIF) and then performs a linear regression on the transformed variable at different quantiles. The net worth of individual wealth is modeled at the tth quantile using the following equation:

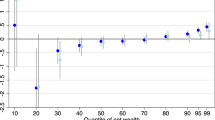

where RIF(wi, qt) refers to the centered influence function of the net worth of individual i’s wealth at the tth quantile qt, X represents the matrix of independent variables, β is a vector of coefficients on the independent variables, and ε is the vector of errors. The coefficients can be interpreted as the marginal effects of the explanatory variable (similar to ordinary least squares regression) at different quantiles (Anglade et al., 2017). Our regressions estimate the wealth gap between men and women at the 70th, 80th and 90th percentiles. This is because our descriptive results show that the gender wealth gap becomes increasingly significant only at the top of the distribution (see Fig. 1). To explore the contribution of various factors to the gap, we begin by predicting the 70th, 80th and 90th net wealth percentile with gender, the sociodemographic variables (age, education level, marital status, presence of children, immigration status, and racial minority), and the data collection method variable. This model provides a basic description of the differences between men and women in Québec, adjusted only for sociodemographics. Then, we add the income variable to the first model. The third model includes the variable for financial transfers received in the past 5 years. The fourth adds the asset ownership variables (house, real estate, financial assets, and personal business). Finally, the fifth model incorporates the financial literacy variable into the analysis. Between each of those models, we observe the resulting change in the gender gap to understand the contribution of the different factors.

For more precision on the contributions of those various variables, we also used the Oaxaca-Blinder decomposition method based on RIF regressions. The decomposition formula at the tth quantile is as follows:

where \(\overline{{\boldsymbol{W}}_{\boldsymbol{M},\boldsymbol{t}}}\) and \(\overline{{\boldsymbol{W}}_{\boldsymbol{W},\boldsymbol{t}}}\) represent the net wealth of men and women at the tth quantile. This equation decomposes the gender gap at that percentile of wealth into two terms. The first term, \(\left(\overline{{\boldsymbol{X}}_{\boldsymbol{M}}}-\overline{{\boldsymbol{X}}_{\boldsymbol{W}}}\right){\boldsymbol{\beta}}_{\boldsymbol{M},\boldsymbol{t}}\), is the “explained” component of the wealth gap. It specifically captures the portion of the gap caused by differences in characteristics (i.e., in the values taken by the different predictors in the model among men and women). The second term, \(\left({\boldsymbol{\beta}}_{\boldsymbol{M},\boldsymbol{t}}-{\boldsymbol{\beta}}_{\boldsymbol{W},\boldsymbol{t}}\right)\overline{{\boldsymbol{X}}_{\boldsymbol{W}}}\), represents the “unexplained” component of wealth inequality between men and women. It captures the portion of the wealth gap between men and women that observable characteristics cannot explain and that result from different returns in the variables (Meriküll et al., 2021). The decomposition is conducted for the wealth gap at the 70th, 80th and 90th percentiles. Since many of the covariates within the decomposition models also likely affect a person’s probability of being at the top of the wealth distribution, we present descriptive statistics for people at or above the 70th, 80th, and 90th percentiles in the Appendix (see Supplementary Table 7).

7 Results

7.1 Descriptive Results

Figure 1 shows net wealth percentiles among men and women. The figure indicates that below the 50th percentile, there is little difference between women and men, and women may even be slightly wealthier than men at the very bottom of the wealth distribution. However, beginning at around the 50th percentile of net wealth, a gap favoring men becomes apparent and grows larger as we move towards the top of the distribution. Indeed, at the 99th percentile, men’s net wealth is nearly double that of women. Men’s net wealth is 1.5 times greater compared to women’s at the 90th percentile and 1.44 times greater at the 75th.

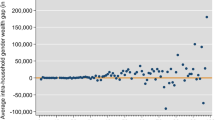

Figure 2 and Table 2 describe the gender differences in net wealth within the various conjugal status groups at various percentiles. We observe significant net wealth differences in all groups, but they seem greater among partnered people than among the unpartnered. Indeed, only in the cohabiting group is average wealth significantly lower among women than men (by $120,059.40). In the other groups, the difference in average net wealth is not significant, but considerable wealth gaps are observed at the 90th percentile. At that percentile, men’s wealth is 1.53 times higher than women’s in the married group ($1,207,548.90, compared to $788,114.70), 1.65 times higher in the cohabiting group ($931,145.60 for men, compared to $562,821.10 for women), and 1.47 times higher in the single group. Among people who are either married or cohabiting, significant gaps are also observed at the 50th and 75th percentiles. For example, among married people, men’s wealth is approximately 1.46 times higher than women’s at the 50th percentile ($298,381.46 for men, compared to $204,108.60 for women). Within the cohabiting group, men’s wealth is approximately 2.39 times higher than women’s at the 50th percentile ($144,905.31 for men, compared to $60,509.29 for women). In contrast, there is no significant gap at those percentiles among people who are single or those who are widowed/divorced/separated. Those results stress the importance of considering not just unpartnered adults but also people in a couple when analyzing the gender wealth gap.

7.2 Model Results

We present the results of our estimates for the 70th, 80th, and 90th percentiles. These results show the factors associated with net wealth value and those that help explain wealth disparities between men and women. Table 3 presents the results of the nested quantile regression models for the 90th percentile. The results for the 70th and 80th percentiles can be found in Supplementary Tables 8 and 9.

Model 1 estimated the differences between men and women based solely on sociodemographic variables and the data collection method. The results show that at the 70th percentile, considering these factors, women’s net wealth is $82,185.30 less than that of men. At the 80th and 90th percentiles, women have lower net wealth values by $121,658.50 and $295,017.40, compared to men. It is also noteworthy that, at the 70th, 80th, and 90th percentiles, age and education level were significantly correlated with net wealth value. At the 70th percentile, unlike the 80th and 90th, our results show that widows, separated individuals, and singles have less wealth than married individuals. However, at the 70th percentile, no significant difference was observed between married individuals and those who were in an unmarried cohabiting relationship.

The second model incorporates the income variable, which is strongly and significantly correlated with net wealth at all percentiles. An increase of one dollar in income is associated with a $1.60 increase in net wealth at the 70th percentile. At the 80th and 90th percentiles, such an increase leads to an increase in the net wealth value by $2.10 and $3.80, respectively. Taking income into account also reduces the wealth disparity between men and women at these percentiles. At the 70th percentile, the inclusion of income reduces the net wealth gap by 20.4%, decreasing it from $82,185.30 to $65,458. At the 80th and 90th percentiles, reductions were 17.6% and 12.6%, respectively. This shows that income contributes less to reducing wealth disparities between men and women as we increase the net value scale.

The third model assesses the impact of the variable of financial support received. It is not significantly associated with net wealth value at these percentiles. Its inclusion only slightly changes the wealth gap between men and women compared with the previous model.

Model 4 adds several variables indicating the types of assets held. Owning real estate (personal home or other types) or a personal business significantly increases net wealth value. For instance, at the 70th percentile, those who own real estate (excluding primary residences) have a higher net wealth by approximately $220,727.50, compared to those who do not. These figures rise to $337,813.30 and $473,131.10 for the 80th and 90th percentiles, respectively. Holding financial assets is not significantly associated with net wealth value at the 80th and 90th percentiles. However, at the 70th percentile, those holding financial assets had a higher net wealth of $66,458.40. Adding those variables reduces the gender wealth gap at all percentiles. At the 90th percentile, for example, it drops to $224,767.50 from $257,446.80, a 13% decrease.

Finally, the fifth model incorporates financial literacy. Although correctly answering a question about financial knowledge is positively associated with net wealth at the 80th and 90th percentiles, this relationship is not statistically significant. At the 70th percentile, this association was negative but not significant. The inclusion of financial literacy had only a slight effect on the gender variable coefficient. Overall, between Models 1 and 5, the gender-based wealth gap decreases by 34.7% at the 70th percentile, 33.7% at the 80th percentile, and 24.4% at the 90th percentile. The types of assets held and income are the most influential variables.

Table 4 summarizes the findings from the Oaxaca-Blinder decomposition at the 70th, 80th, and 90th percentiles. These findings corroborate the conclusions drawn from our regressions across different percentiles. Specifically, the decomposition reveals that women have a net wealth that is $73,890 lower than that of men at the 70th percentile. At the 80th and 90th percentiles, the estimated wealth gap increases to $135,792.70 and $282,257.80, respectively.

As for the explanation behind these wealth disparities between genders, our analytical variables account for approximately 32% (or $23,811.90) of the gap at the 70th percentile. They explain around 28% and 22% of the wealth gap between men and women at the 80th and 90th percentiles, respectively. Income and real estate assets other than one’s home have the most weight in explaining the wealth gaps across different percentiles. Income disparities between men and women account for 62.4% of the explained portion of the gap at the 90th percentile (which is around 14% of the overall gap). At the 70th and 80th percentiles, they account for 64.8% and 59.4% of the explained gap, respectively. As for the differences in non-home real estate ownership, they account for roughly 39% of the explained gap at the 70th percentile. At the 80th and 90th percentiles, they account for approximately 30% and 24%, respectively.

8 Discussion and Conclusion

This paper explored the gender wealth gap in the Canadian province of Québec. Our results indicate that women own significantly less net wealth than men, with men’s wealth ranging from 1.4 and 2.4 times greater than women’s, depending on conjugal status and at what percentile net wealth is compared. Those findings make several contributions to existing research on gender-based economic inequalities. First, while the gender wealth gap is increasingly studied, in light of the growing importance of this resource in a context of population aging, research conducted in Canada is extremely limited. This is largely because the main surveys on household finances in the country collect assets and debt data only at the household level, masking inequalities within couples. This data limitation has led scholars in earlier studies to describe the gender wealth gap between men and women who do not live with another adult or to overlook within-household inequalities by comparing household wealth across gender groups.

In contrast, the current study drew from original data that measured the value of assets and debts at the individual level to offer the first estimate of the gender wealth gap among both people who are in a coresidential couple and those who are not in the Canadian context. Our results show that wealth gaps are observed in all conjugal status groups, including among partnered people. In fact, the gender wealth gap even seems greater among the latter than among people who are single, divorced, separated, or widowed. Also, the gender wealth gap appears potentially stronger among partnered people who are unmarried than among those who are married—with men in an unmarried cohabiting couple owning 2.39 times more wealth than women in the same conjugal status at the 50th percentile. This echoes previous studies that have stressed that unmarried couples are less prone than married ones to share, co-own, or redistribute their assets and incomes, especially when they are aware of the legal differences between marriage and cohabitation and may therefore have opted for cohabitation precisely for the greater financial independence and wealth individualization it allows (Frémeaux & Leturcq, 2020; Pugliese & Belleau, 2021, 2022). Also, recall that, in contrast to married people, unmarried ones do not have a default legal right to their partner’s personal assets in cases of separation or death. In combination with our results showing important gender wealth disparities among cohabiting people, this insight calls for more research on how these couples arrive at their conjugal asset ownership arrangements and whether they are fully aware of the consequences.

Our results also add to mounting evidence that the wealth gap between men and women is especially strong among the wealthy. Indeed, previous research conducted in a wide range of European countries and the US found that the gender wealth gap is greater (and often significant only) at the 90th percentile or above (Lee, 2022; Schneebaum et al., 2018). The present study found evidence of a similar pattern in the context of Québec, with the wealth gap growing exponentially stronger higher up the wealth distribution, and men’s net worth being more than twice that of women at the 99th percentile. The reasons for this are still relatively misunderstood. In part, a larger wealth gap among the very wealthy could be due to the gendered patterns in the intergenerational transmission of large fortunes, especially when they include private businesses, as others have suggested (Bessière & Gollac, 2023). Our results therefore call for more research investigating wealth transmission practices (both post-mortem via will-writing and inter vivos via donations) in the context of Canada and Québec.

Previous studies tend to suggest that the gender wealth gap is not just a reflection or consequence of the well-known wage disparity between men and women, and the present study aligns with this view (Lee, 2022; Schneebaum et al., 2018). Indeed, our decomposition analysis indicated that adjusting for income differences between men and women explained only about 15% of the wealth gap at the 90th percentile. However, our measure of income is not one that grasped the wage gap accumulated over the life course. In particular, the gaps resulting from women’s past work interruptions are not accounted for. In future studies, it will be important to track respondents’ income and employment histories, as well as marital histories, as did Bonnet et al. (2022), to estimate with more precision what part of the gender wealth gap is explained by income disparities and what part remains unexplained.

Previous research had also found that the gender wealth gap resides in part in the different investment strategies and types of assets owned between men and women, with women’s gap in private business ownership appearing as an especially important factor (Pugliese & Chaumont-Goneau, 2022). In this study, asset ownership explained part of the wealth gap, but the major factor was women’s gap in ownership of real estate other than the primary residence. This may be due to the historically large importance of real estate acquisitions (e.g., small apartment buildings) as an investment strategy among the French-speaking middle class in Québec (Choko & Harris, 1990). There are, however, virtually no qualitative studies exploring how individuals and households decide on their investment strategies, and much less on any differences between men and women. Our results call for more research in this area.

Finally, our wealth data had limitations that highlight opportunities for future research. In particular, the survey questionnaire asked respondents to provide an approximate estimate of the current value of the sum of all their personal assets and of their debts. People might not know those figures precisely, for example, if they purchased their residence a long time ago or if they do not follow very closely their financial investments. Mentally summing up the values of multiple asset items may also be an uneasy task, and being asked to consider only one’s personal share of any assets and debts that are jointly owned only adds to the difficulty. To ease those estimation issues, Canada’s main national wealth survey (the Survey of Financial Security) asks respondents to provide the value of each type of asset their household owns (i.e., their residence, stocks, and insurance). We opted instead to ask just one question on the total value of assets (and another on the total value of debts) primarily to keep the survey as short as possible, as was recommended by the survey firm to maximize completion rates. Another limitation of our data resides in the sampling design. Given that wealth is extremely unequally distributed and concentrated, wealth surveys typically oversample wealthy households (for example, by oversampling high-income postal codes). Because our data was collected as part of an overarching project on over-indebtedness, we did not do that and even oversampled lower-income households, which are at a higher risk of struggling with debt. This means that our data likely do not represent the very top of the wealth distribution and that our results at the 90th percentile need to be interpreted with this caveat in mind, they do not represent the “true” 90th percentile of the population. Given the unavailability of wealth data at the personal level in Canada, we believe our data collection approach and the present study are justified and nevertheless make an important contribution, by offering the very first overview of the gender gap in personal wealth in all conjugal status groups in the Canadian context and by showcasing the importance of measuring the wealth gap among coupled people. However, we believe it will be extremely important for future studies to improve the measurement of personal wealth. In particular, we recommend that the existing high-quality household finance surveys in Canada (such as the Survey of Financial Security that does oversample wealthy people) include additional questions to their instruments going forward that are aimed at measuring wealth at the personal level, not just at the household level. A possible strategy consists of asking whether assets and debts are personally or jointly owned and the percent owned in the latter case, as is done in other surveys, including Germany’s Socio-Economic Panel. Improving household and personal wealth measurements in this direction will greatly improve researchers’ ability to estimate and understand the causes of the gender wealth gap.

References

Ando, A., & Modigliani, F. (1963). The “life cycle” hypothesis of saving: Aggregate implications and tests. The American Economic Review, 53(1), 55–84.

Anglade, B., Useche, P., & Deere, C. D. (2017). Decomposing the gender wealth gap in Ecuador. World Development, 96, 19–31. https://doi.org/10.1016/j.worlddev.2017.02.003

Arrondel, L., & Masson, A. (2006). Altruism, exchange or indirect reciprocity: what do the data on family transfers show? In S.-C. Kolm & J. M. Ythier (Eds.), Handbook of the Economics of Giving, Altruism and Reciprocity (Vol. 2, pp. 971–1053). Elsevier. https://doi.org/10.1016/S1574-0714(06)02014-8

Becker, G. S. (1991). A Treatise on the Family. Harvard University Press.

Beckert, J. (2008). Inherited wealth (English ed). Princeton University Press.

Belleau, H. (2012). Quand l’amour et l’État rendent aveugle: Le mythe du mariage automatique. Presses de l’Université du Québec.

Belleau, H., Piazzesi, C., & Seery, A. (2020). Conjugal love from a sociological perspective: theorizing from observed practices. Canadian Journal of Sociology, 45(1), 1. https://doi.org/10.29173/cjs29434

Belleau, H., & Proulx, R. (2010). Équilibre et déséquilibre des comptes amoureux contemporains: Le revenu familial remis en question. l’exemple québécois. Recherches familiales, 7(1), 85–101. https://doi.org/10.3917/rf.007.0085

Bennett, F. (2013). Researching within-household distribution: overview, developments, debates, and methodological challenges. Journal of Marriage and Family, 75(3), 582–597. https://doi.org/10.1111/jomf.12020

Bessière, C. (2022). Reversed accounting: Legal professionals, families and the gender wealth gap in France. Socio-Economic Review, 20(1), 233–256. https://doi.org/10.1093/ser/mwz036

Bessière, C., & Gollac, S. (2023). The gender of capital: How families perpetuate wealth inequality (J. Rogers, Trans.). Harvard University Press.

Board of Governers of the Federal Reserve System. (2020). Codebook for 2019 Survey of Consumer Finances. Board of Governers of the Federal Reserve System.

Boertien, D., & Lersch, P. M. (2021). Gender and Changes in Household Wealth after the Dissolution of Marriage and Cohabitation in Germany. Journal of Marriage and Family, 83(1), 228–242. https://doi.org/10.1111/jomf.12705

Bonnet, C., Martino, E. M., Rapoport, B., & Solaz, A. (2022). Wealth inequalities among seniors: The role of marital histories across cohorts. Review of Economics of the Household, 21(3), 815–853. https://doi.org/10.1007/s11150-022-09633-7

Bricker, J., Moore, K. B., & Thompson, J. (2019). Trends in household portfolio composition. In A. Haughwout & B. Mandel (Eds.), Handbook of US Consumer Economics (pp. 53–96). Academic Press. https://doi.org/10.1016/B978-0-12-813524-2.00003-2

Brown, C., & Gardiner, K. T. (2018). The rights of unmarried cohabitants in Canada. Trusts & Trustees, 24(1), 86–96. https://doi.org/10.1093/tandt/ttx189

Browning, M., & Lusardi, A. (1996). Household saving: Micro theories and micro facts. Journal of Economic Literature, 34(4), 1797–1855.

Bucciol, A., & Miniaci, R. (2015). Household portfolio risk. Review of Finance, 19(2), 739–783. https://doi.org/10.1093/rof/rfu002

Buckland, J. (2010). Are low-income Canadians financially literate? Placing financial literacy in the context of personal and structural constraints. Adult Education Quarterly, 60(4), 357–376. https://doi.org/10.1177/0741713609358449

Budig, M. J., & England, P. (2001). The wage penalty for motherhood. American Sociological Review, 66(2), 204. https://doi.org/10.2307/2657415

Campanale, C. (2007). Increasing returns to savings and wealth inequality. Review of Economic Dynamics, 10(4), 646–675. https://doi.org/10.1016/j.red.2007.02.003

Cardenas, L. (2018). Married couple, single recipient: Understanding the exclusion of gifts and inheritances from default matrimonial regimes. Canadian Journal of Family Law, 31(2), 1–54.

Choko, M., & Harris, R. (1990). The local culture of property: A comparative history of housing tenure in Montreal and Toronto. Annals of the Association of American Geographers, 80(1), 73–95. https://doi.org/10.1111/j.1467-8306.1990.tb00004.x

Conley, D. (2010). Being black, living in the red: Race, wealth, and social policy in America (10th anniversary ed. with a new afterword). University of California press.

Cordova, K., Grabka, M. M., & Sierminska, E. (2022). Pension wealth and the gender wealth gap. European Journal of Population, 38(4), 755–810. https://doi.org/10.1007/s10680-022-09631-6

Cox, D. (2003). Private transfers within the family: Mothers, fathers, sons and daughters. In A. H. Munnell & A. Sundén (Eds.), Death and Dollars: The Role of Gifts and Bequests in America (605). Brookings Institution Press.

De Nardi, M., & Fella, G. (2017). Saving and wealth inequality. Review of Economic Dynamics, 26, 280–300. https://doi.org/10.1016/j.red.2017.06.002

Deere, C. D., & Doss, C. R. (2006). The gender asset gap: What do we know and why does it matter? Feminist Economics, 12(1–2), 1–50. https://doi.org/10.1080/13545700500508056

Denton, M., & Boos, L. (2007). The gender wealth gap:Structural and material constraints and implications for later life. Journal of Women & Aging, 19(3–4), 105–120. https://doi.org/10.1300/J074v19n03_08

Dillman, D. A., Smyth, J. D., & Christian, L. M. (2014). Internet, phone, mail, and mixed-mode surveys: The tailored design method (4th ed.). Wiley.

Dynan, K. E., Skinner, J., & Zeldes, S. P. (2004). Do the rich save more? Journal of Political Economy, 112(2), 397–444. https://doi.org/10.1086/381475

Ebbinghaus, B. (2015). The privatization and marketization of pensions in Europe: A double transformation facing the crisis. European. Policy Analysis, 1(1), 56–73. https://doi.org/10.18278/epa.1.1.5

Enders, C. K. (2010). Applied Missing Data Analysis. Guilford Publications.

England, P. (2010). The gender revolution: Uneven and stalled. Gender and Society, 24(2), 149–166. https://doi.org/10.1177/0891243210361475

Firpo, S., Fortin, N. M., & Lemieux, T. (2009). Unconditional quantile regressions. Econometrica, 77(3), 953–973. https://doi.org/10.3982/ECTA6822

Firpo, S., Fortin, N. M., & Lemieux, T. (2018). Decomposing wage distributions using recentered influence function regressions. Econometrics, 6(2), 2. https://doi.org/10.3390/econometrics6020028

Fleury, C., Lizotte, M., & Paré, P.-O. (2016). L’Accession à la propriété chez les jeunes ménages québécois au cours de la dernière décennie. Recherches sociographiques, 57(1), 47–77. https://doi.org/10.7202/1036621ar

Florian, S. M. (2018). Motherhood and employment among Whites, Hispanics, and Blacks: A life course approach. Journal of Marriage and the Family, 80(1), 134–149. https://doi.org/10.1111/jomf.12448

Foster, L. (2011). Privatisation and pensions: What does this mean for women? Journal of Poverty and Social Justice, 19(2), 103–115. https://doi.org/10.1332/175982711X573978

Frémeaux, N., & Leturcq, M. (2020). Inequalities and the individualization of wealth. Journal of Public Economics, 184, 104145. https://doi.org/10.1016/j.jpubeco.2020.104145

Frémeaux, N., & Leturcq, M. (2022). Wealth accumulation and the gender wealth gap across couples’ legal statuses and matrimonial property regimes in France. European Journal of Population, 38(4), 643–679. https://doi.org/10.1007/s10680-022-09632-5

Gale, W. G., & Scholz, J. K. (1994). Intergenerational transfers and the accumulation of wealth. Journal of Economic Perspectives, 8(4), 145–160. https://doi.org/10.1257/jep.8.4.145

Gaudecker, H.-M. V. (2015). How does household portfolio diversification vary with financial literacy and financial advice? The Journal of Finance, 70(2), 489–507. https://doi.org/10.1111/jofi.12231

Gollac, S. (2008). Travail indépendant et transmissions patrimoniales: Le poids des inégalités au sein des fratries. Economie et Statistique, 417(1), 55–75. https://doi.org/10.3406/estat.2008.7688

Grabka, M. M., Marcus, J., & Sierminska, E. (2015). Wealth distribution within couples. Review of Economics of the Household, 13(3), 459–486. https://doi.org/10.1007/s11150-013-9229-2

Grabka, M. M., & Westermeier, C. (2015). Editing and multiple imputation of item non-response in the wealth module of the German Socio-Economic Panel (272 SOEP Survey Papers). Deutsches Institut für Wirtschaftsforschung (DIW).

Harel, O., & Zhou, X.-H. (2007). Multiple imputation: Review of theory, implementation and software. Statistics in Medicine, 26(16), 3057–3077. https://doi.org/10.1002/sim.2787

Herlin-Giret, C. (2019). Rester riche: Enquête sur les gestionnaires de fortune et leurs clients. Le Bord de l’eau.

Institut de la statistique du Québec. (2021). Le bilan démographique du Québec. Édition 2021. Gouvernement du Québec.

Jianakoplos, N. A., & Bernasek, A. (1998). Are women more risk averse? Economic Inquiry, 36(4), 620–630. https://doi.org/10.1111/j.1465-7295.1998.tb01740.x

Kan, M. Y., & Laurie, H. (2014). Changing patterns in the allocation of savings, investments and debts within couple relationships. The Sociological Review, 62(2), 335–358. https://doi.org/10.1111/1467-954X.12120

Kapelle, N., & Lersch, P. M. (2020). The accumulation of wealth in marriage: Over-time change and within-couple inequalities. European Sociological Review, 36(4), 580–593. https://doi.org/10.1093/esr/jcaa006

Kapelle, N., & Vidal, S. (2022). Heterogeneity in family life course patterns and intra-cohort wealth disparities in late working age. European Journal of Population, 38, 59–92. https://doi.org/10.1007/s10680-021-09601-4

Keister, L. A., Benton, R. A., & Moody, J. W. (2019). Cohorts and wealth transfers: Generational changes in the receipt of inheritances, trusts, and inter vivos gifts in the United States. Research in Social Stratification and Mobility, 59, 1–13. https://doi.org/10.1016/j.rssm.2019.01.002

Keister, L. A., & Lee, H. Y. (2014). The one percent: Top incomes and wealth in sociological research. Social Currents, 1(1), 13–24. https://doi.org/10.1177/2329496513510900

Killewald, A., Pfeffer, F. T., & Schachner, J. N. (2017). Wealth inequality and accumulation. Annual Review of Sociology, 43, 379–404. https://doi.org/10.1146/annurev-soc-060116-053331

Krivo, L. J., & Kaufman, R. L. (2004). Housing and wealth inequality: Racial-ethnic differences in home equity in the United States. Demography, 41(3), 585–605. https://doi.org/10.1353/dem.2004.0023

Lavallée, C., Belleau, H., & Guilhermont, É. (2017). La situation juridique des conjoints de fait québécois. Droit et cultures. Revue internationale interdisciplinaire, 73, 73. https://doi.org/10.4000/droitcultures.4073

Lee, A. W. (2022). The gender wealth gap in the United States: Trends and explanations. Social Science Research, 107, 102745. https://doi.org/10.1016/j.ssresearch.2022.102745

Lee, H., Myers, D., Painter, G., Thunell, J., & Zissimopoulos, J. (2020). The role of parental financial assistance in the transition to homeownership by young adults. Journal of Housing Economics, 47, 101597. https://doi.org/10.1016/j.jhe.2018.08.002

Lersch, P. M. (2017). The marriage wealth premium revisited: Gender disparities and within-individual changes in personal wealth in Germany. Demography, 54(3), 961–983. https://doi.org/10.1007/s13524-017-0572-4

Lersch, P. M., & Vidal, S. (2016). My house or our home? Transitions into sole home ownership in British couples. Demographic Research, 35(6), 139–166. https://doi.org/10.4054/DemRes.2016.35.6

Lusardi, A., Michaud, P.-C., & Mitchell, O. S. (2017). Optimal financial knowledge and wealth inequality. Journal of Political Economy, 125(2), 431–477. https://doi.org/10.1086/690950

Marier, P., & Skinner, S. (2008). The impact of gender and immigration on pension outcomes in Canada. Canadian Public Policy, 34(Supplement 1), S59–S78. https://doi.org/10.3138/cpp.34.Supplement.S59

Maroto, M., & Aylsworth, L. (2017). Assessing the relationship between gender, household structure, and net worth in the United States. Journal of Family and Economic Issues, 38, 556–571. https://doi.org/10.1007/s10834-017-9521-z

McCarthy, M. A. (2017). Dismantling solidarity: Capitalist politics and American pensions since the New Deal. Cornell University Press.

Meriküll, J., Kukk, M., & Room, T. (2021). What explains the gender gap in wealth? Evidence from Administrative Data. Review of Economics of the Household, 19, 501–547. https://doi.org/10.1007/s11150-020-09522-x

Metzger, C. (2018). Intra-household allocation of non-mandatory retirement savings. The Journal of the Economics of Ageing, 12, 77–87. https://doi.org/10.1016/j.jeoa.2018.02.001

Niimi, Y. (2022). Are married women really wealthier than unmarried women? Evidence from Japan. Demography, 59(2), 461–483. https://doi.org/10.1215/00703370-9735271

Nutz, T., & Gritti, D. (2022). Dyadic employment biographies and within-couple wealth inequality in Britain and Western Germany. Journal of Marriage and Family, 84(2), 552–569. https://doi.org/10.1111/jomf.12811

Nutz, T., & Lersch, P. M. (2021). Gendered employment trajectories and individual wealth at older ages in Eastern and Western Germany. Advances in Life Course Research, 47, 100374. https://doi.org/10.1016/j.alcr.2020.100374

Pahl, J. (1989). Money and Marriage. St. Martin’s Press.

Perelli-Harris, B., & Gassen, N. S. (2012). How similar are cohabitation and marriage? Legal approaches to cohabitation across Western Europe. Population and Development Review, 38(3), 435–467. https://doi.org/10.1111/j.1728-4457.2012.00511.x

Pfeffer, F. T. (2018). Growing wealth gaps in education. Demography, 55(3), 1033–1068. https://doi.org/10.1007/s13524-018-0666-7

Pfeffer, F. T., & Killewald, A. (2018). Generations of advantage. Multigenerational correlations in family wealth. Social Forces, 96(4), 1411–1442. https://doi.org/10.1093/sf/sox086

Piketty, T. (2014). Capital in the Twenty-First Century (A. Goldhammer, Trans.). The Belknap Press of Harvard University Press.

Piketty, T., Postel-Vinay, G., & Rosenthal, J.-L. (2014). Inherited vs self-made wealth: Theory & evidence from a rentier society (Paris 1872–1927). Explorations in Economic History, 51, 21–40. https://doi.org/10.1016/j.eeh.2013.07.004

Plotnick, R. D. (2009). Childlessness and the economic well-being of older Americans. The Journals of Gerontology Series B: Psychological Sciences and Social Sciences, 64B(6), 767–776. https://doi.org/10.1093/geronb/gbp023

Pugliese, M., & Belleau, H. (2021). The management of retirement savings among financially heterogamous couples. Social Policy and Society, 20(4), 580–598. https://doi.org/10.1017/S1474746420000627

Pugliese, M., & Belleau, H. (2022). Mine, yours, ours, or no one’s? Homeownership arrangements among cohabiting and married couples. Canadian Review of Sociology/Revue Canadienne de Sociologie, 59(S1), 48–73. https://doi.org/10.1111/cars.12394

Pugliese, M., Belleau, H., & Biron-Boileau, C. (2023). Conjugal testamentary practices in Canada: The gendered effect of children from other unions. Journal of Marriage and Family, 85(1), 134–152. https://doi.org/10.1111/jomf.12870

Pugliese, M., & Chaumont-Goneau, M. (2022). Les inégalités de genre en matière de patrimoine chez les personnes seules dans les contextes canadiens et québécois. Cahiers québécois de démographie, 49(1), 1–37.

Rose, R. (2014). Les femmes et la retraite. Relations, 771, 23–23.

Roy, A. (2011). L’évolution de la politique législative de l’union de fait au Québec. In H. Belleau & A. Martial (Eds.), Aimer et compter? (pp. 113–114). Presses de l’Université du Québec.

Rubin, D. B. (1987). Multiple imputation for nonresponse in surveys. Wiley.

Rubin, D. B. (1988). An overview of multiple imputation. Proceedings of the Survey Research Methods Section of the American Statistical Association, 79, 84.

Ruel, E., & Hauser, R. M. (2013). Explaining the gender wealth gap. Demography, 50(4), 1155–1176. https://doi.org/10.1007/s13524-012-0182-0

Rybczynski, K. (2015). Gender differences in portfolio risk across birth cohort and marital status. The Canadian Journal of Economics / Revue Canadienne d’Economique, 48(1), 28–63. https://doi.org/10.1111/caje.12118

Saez, E., & Zucman, G. (2016). Wealth inequality in the United States since 1913: Evidence from capitalized income tax data. The Quarterly Journal of Economics, 131(2), 519–578. https://doi.org/10.1093/qje/qjw004

Schirle, T. (2015). The gender wage gap in the Canadian provinces, 1997–2014. Canadian Public Policy, 41(4), 309–319. https://doi.org/10.3138/cpp.2015-012

Schmidt, L., & Sevak, P. (2006). Gender, marriage, and asset accumulation in the United States. Feminist Economics, 12(1–2), 139–166. https://doi.org/10.1080/13545700500508445

Schneebaum, A., Rehm, M., Mader, K., & Hollan, K. (2018). The gender wealth gap across European countries. Review of Income and Wealth, 64(2), 295–331. https://doi.org/10.1111/roiw.12281

Sherraden, M. S., & McBride, A. M. (2010). Striving to save: Creating policies for financial security of low-income families. University of Michigan Press.

Sherraden, M. W. (2007). Can the poor save? Saving & asset building in individual development accounts. Routledge.

Sierminska, E., Frick, J. R., & Grabka, M. M. (2010). Examining the gender wealth gap., 62(4), 669–690. https://doi.org/10.1093/oep/gpq007

Spilerman, S. (2000). Wealth and stratification processes. Annual Review of Sociology, 26, 497–524. https://doi.org/10.1146/annurev.soc.26.1.497

Statistics Canada. (2019a). Canadian Financial Capability Survey 2014 Study Documentation. Statistics Canada.

Statistics Canada (2019b) Survey of Financial Security: Public Use Microdata File 2019 User Guide. Statistics Canada.

Statistics Canada. (2022). The Daily—State of the union: Canada leads the G7 with nearly one-quarter of couples living common law, driven by Quebec. Statistics Canada.

Statistics Canada. (2023). Estimates of population as of July 1st, by marital status or legal marital status, age and sex. https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1710006001, accessed October 31st 2023

Szymborska, H. K. (2022). The evolution of gender wealth inequality in the United States in a changing institutional context. Feminist Economics, 28(2), 32–63. https://doi.org/10.1080/13545701.2022.2042583

Tal, B. (2016). The looming bequest boom—What should we expect? Mortality, 200, 250.

Taparia, M., & Lenka, U. (2022). An integrated conceptual framework of the glass ceiling effect. Journal of Organizational Effectiveness: People and Performance, 9(3), 372–400. https://doi.org/10.1108/JOEPP-06-2020-0098

Thébaud, S. (2015). Business as Plan B: Institutional foundations of gender inequality in entrepreneurship across 24 industrialized countries. Administrative Science Quarterly, 60, 671–711. https://doi.org/10.1177/0001839215591627

Tisch, D., & Lersch, P. M. (2021). Distributive justice in marriage: Experimental evidence on beliefs about fair savings arrangements. Journal of Marriage and Family, 83(2), 516–533. https://doi.org/10.1111/jomf.12694

Vogler, C. (1998). Money in the household: Some underlying issues of power. The Sociological Review, 46(4), 687–713. https://doi.org/10.1111/1467-954X.00136

Weichselbaumer, D. (2004). Is it sex or personality? The impact of sex stereotypes on discrimination in applicant selection. Eastern Economic Journal, 30(2), 159–186.

Wherry, F. F., Seefeldt, K. S., & Alvarez, A. S. (2019). Credit where it’s due: Rethinking financial citizenship. .

Wodtke, G. T. (2016). Social class and income inequality in the United States: Ownership, authority, and personal income distribution from 1980 to 2010. AJS; American Journal of Sociology, 121(5), 1375–1415. https://doi.org/10.1086/2F684273

Yeager, D. S., Krosnick, J. A., Chang, L., Javitz, H. S., Levendusky, M. S., Simpser, A., & Wang, R. (2011). Comparing the accuracy of RDD telephone surveys and Internet surveys conducted with probability and non-probability samples. Public Opinion Quarterly, 75(4), 709–747. https://doi.org/10.1093/poq/nfr020

Young, C. (2011). Pensions, privatization, and poverty: The gendered impact. Canadian Journal of Women and the Law, 23(2), 661–685. https://doi.org/10.3138/cjwl.23.2.661

Availability of Data and Materials

The data source is available upon request to the first author:

Funding