Abstract

The European Union Emissions Trading System (EU ETS) is the largest cap-and-trade system in the world. Price instability and allowance oversupply are two characteristics that affect the objectives and the efficiency of this policy. In this work, we investigate the impact of storing allowances (“banking”) on the allowance price and the power of the financial sector in the trading network of the ETS. To that end, we use data from the EU Transaction Log (EUTL) along with data on the most important allowance price determinants. We apply a multiple regression analysis that considers many important price determinants that are both endogenous and exogenous to the ETS, and quantify how the allowance price depends on the total volume of stored allowances. Our analysis indicates that banking is a notable—though not the dominant—price determinant, and quantifies its significance. Moreover, we study the role of financial nodes in the ETS trading network. Analyzing the betweenness centrality of financial, regulated, and governmental entities in the trading network of ETS over a period of more than 10 years, we provide strong evidence of the significant power of financial entities in the ETS trading network, which arises due to their role as intermediaries in allowance trading. Our work could provide the basis for a compact and relatively simple tool to evaluate and estimate the performance of one of the most prominent environmental policies, the EU ETS.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The European Union Emissions Trading System (EU ETS) (European Parliament 2003) was introduced in 2005 as the main tool for European countries to meet the obligations of the Kyoto Protocol (United Nations 1998). It is a complex multinational cap-and-trade system, the largest of its kind in the world. The ETS covers thousands of industrial installations and several aviation companies in Europe (European Commission 2015). It aims not only to reduce air pollution from greenhouse gas (GhG) emissions in a cost-effective and environmentally friendly way, but also to promote investment in low-emission technologies throughout Europe (European Commission 2015). The EU ETS was instigated in 2005 and is currently in its third phase of operation.

Under the cap-and-trade principle, the total volume of GhG emissions in Europe is limited by a cap on the total volume of allowances, which decreases annually. Every year, regulated entities (i.e., corporations responsible for GhG emissions) must surrender allowances that compensate for their annual GhG emissions. A European Union allowance (EUA) gives its owner the right to emit one metric ton of carbon dioxide (\(\mathrm{CO}_2\)) [or the equivalent volume of other greenhouse gases, such as nitrous oxide (\(\mathrm {N}_2\mathrm {O}\)) and perfluorocarbons (PFCs)]. Within the GhG emissions cap, every regulated entity receives for free or buys (in an auction or from other ETS participants) allowances to compensate for its volume of emissions. Regulated entities with excess (i.e., unused) allowances can either store them for future use or trade them with other ETS participants. The former practice is known as banking. Excess allowances can be sold either to other regulated entities or to financial entities (i.e., corporations that do not emit GhGs and participate in the ETS only through allowance trading), thus creating a secondary allowance market within the ETS. Financial derivatives of allowances and a limited number of credits from “green” projects around the world may also be traded on the secondary market (see European Commission 2015).

Since its very beginning, the EU ETS has been of considerable interest to both scholars and policy makers—especially its market side and some observed instabilities in the allowance price (see Ellerman et al. 2015a; Hintermann et al. 2015; Martin et al. 2015). Some previous works have commented on how the allowance price is susceptible to exogenous economic shocks, to various structural changes between phases, and to strategic planning by ETS participants (see Hintermann 2010; Rickels et al. 2015; Creti et al. 2012; Chung et al. 2018). Banking makes it possible to store allowances, which results in an increase in the supply of allowances in the future. The fact that banking was not allowed between phase I (2005–2007) and phase II (2008–2012) of the ETS caused, in combination with the allowance oversupply, a notable decrease in the allowance price towards the end of phase I (see Ellerman et al. 2015a). Therefore, it is interesting to investigate how participants interact in the ETS trading network, and to what extent their strategic decisions about banking affect the allowance price.

Contribution

In the work reported in this paper, we investigated the impact of banking on the allowance price and the power of the financial sector in the trading network of the ETS. Our study was based on data collected from the EU Transaction Log (EUTL 2019), along with various data that we collected from different data sources, including information on the most important price determinants (e.g., coal, oil, and natural gas prices, economic and production indices). The EUTL provides detailed information about the date and the volume of every allowance transaction from the beginning of the ETS until 3 years ago (see also the “Transaction log and account holder classification” section). Using this information, we were able to determine the volume of allowances owned by any entity participating in the ETS at any point in time, as well as the annual volume of free allowances and surrendered allowances for each regulated entity. Moreover, we were able to reproduce the ETS trading network and understand which entities played a crucial role in allowance trading in each phase of the system.

A key step in our study was to identify all of the entities (firms or bureaus: account holders in the terminology of EUTL; see also the “Accounts and account types” section) and classify them into three types: regulated, financial, and governmental, according to their main role in the system. Our classification, described in the “Account holder classification” section, is principled and easy to reproduce. We believe that our classification approach is more accurate than previous approaches; see, for example, Betz and Schmidt (2016) and Borghesi and Flori (2016), or the classification based on a regular expression analysis of the account holder legal names (Karpf et al. 2018).

Another key step in our analysis was to calculate (as accurately as possible) the volume of banked allowances over time (see the section “Calculation of banking volume”). Banking is the volume of allowances owned by a regulated entity in excess of the volume that the entity is obliged to surrender at the end of the current system’s cycle (the compliance cycle or compliance year). So, the banking of a regulated entity is defined only on an annual basis at the end of the compliance year. Therefore, we introduced the notion of a wallet (see the section “Calculation of banking volume”), which allowed us to estimate the volume of stored allowances for any entity on a monthly basis.

We applied a multiple linear regression to determine the relationships of the explanatory variables (the calculated banking/wallet along with other data derived from the EUTL and the most important price determinants) with the EUA price (see the section “Banking volume as a price determinant”). Our analysis indicates that banking is a notable—though not the dominant—price determinant, and quantifies its significance (see also the section “Discussion of the results”). To the best of our knowledge, ours is the first work to provide detailed statistical evidence supporting the theory that banking affects the allowance price (and smoothens its fluctuations over time).

Last but not least, we employed a network science approach to understand and quantify the role of financial entities in the ETS trading network. In network science, the interactions of people or organizations are studied using notions and techniques from graph theory. Network science is an interdisciplinary area of research with many diverse applications in fields such as sociology (Watts and Strogatz 1998), recommendation systems (Stan et al. 2014), finance (Roy and Sarkar 2011), and marketing (Webster and Morrison 2004). In this work, we reproduced the ETS trading network, with each entity represented by a node and each transaction by an edge. Analyzing the betweenness centrality (see Section 2.2.4 in Jackson 2008) of the regulated, financial, and governmental entities during all quarters from the beginning of the ETS in 2005 until March 2016, we obtained strong evidence for the significant power of financial entities in the ETS trading network, which arises due to their role as intermediaries in allowance trading (see the section “Analysis of the allowance trade network” for more details). More specifically, we discovered that financial entities dominate the set of entities with the highest betweenness centrality scores, and that this phenomenon is amplified as we move towards higher percentiles (with respect to the betweenness centrality distribution; see the section “Betweenness centrality distribution in the ETS trading network”).

Structure of the paper

We start (in the section “The European Union Emissions Trading System: operation and facts”) with a primer on the operation and structure of the ETS, where we include some details about the volume of free allowances, verified emissions, and allowance price. In the section “Related work,” we discuss some previous investigations that are relevant to our study. Then, in the section “Transaction log and account holder classification,” we discuss data available in the EUTL, different account types, and our classification of account holders into regulated, financial, and governmental entities. Next, the section “Calculation of banking volume” presents all the details of the banking and monthly wallet calculations for regulated and financial entities. The multiple regression analysis that is used to quantify the impact of banking on the allowance price is outlined in the section “Banking volume as a price determinant.” After that, the betweenness centrality analysis of the ETS trading network, which quantifies the significance of the financial entities, is presented in the section “Analysis of the allowance trade network." We conclude the paper with a brief summary of our findings and some directions for further research in the section “Conclusions and future work.”

The European Union Emissions Trading System: operation and facts

The EU ETS is the largest cap-and-trade system in the world, regulating 31 European countries (the 28 EU members and Iceland, Norway, and Liechtenstein). Cap and trade is an environmental policy where the regulator (the EU) imposes an upper limit on the overall emissions (the cap) for a given period (a year). The cap is divided into allowances, and any regulated emitter (a regulated entity) must possess and submit an amount of allowances equal to its actual emissions by the end of the regulating period. The idea is that the cost of the allowances internalizes the negative externality caused by the polluter. The cap imposes a bound on overall air pollution and incentivizes the regulated entities to invest in emission abatement technologies. However, different companies from different industry sectors cannot abate with the same ease and at the same cost. Furthermore, the regulator does not expect entities to provide information on the emission abatement options that they utilize. In theory, allowance trading allows regulated entities to determine the least expensive option (a mix of abatement investment and allowance acquisition) to meet their production requirements.

In this section, we outline the structure, basic principles, and main functionality of the EU ETS. We deliberately avoid presenting detailed information on the history of the ETS. For more detailed information about the structure, design principles, functionality, and history of the ETS, readers should refer to European Commission (2015).

Allowances, the cap, and compliance cycles

There are two types of allowances within the EU ETS: EU Allowances (EUAs) for stationary installations and EU Aviation Allowances (EUAAs) for aviation corporations.Footnote 1 For simplicity and brevity, we mostly refer to both of these types of allowances as EUAs (or simply “allowances”) in this paper. In 2013, which marks the beginning of phase III of the ETS, the cap was set slightly above 2 billion EUAs for stationary installations and 38 million EUAAs for aviation (European Commission 2015). During phase III (2013–2020), the cap has reduced annually by 1.75%. The annual reduction target has been set to 2.2% for phase IV (2021–2030).

The ETS operates on an annual basis. According to the European Commission (2015), regulated firms receive free allowances (if they are eligible) each February,Footnote 2 and submit the necessary amount of allowances for compliance by the end of April the following year.Footnote 3 The term compliance cycle is used for the periodic process of allocating free EUAs, monitoring emissions, and surrendering EUAs.

Free allocation and auctioning

During phase I of the ETS (2005–2007), most of the EUAs (95%) were allocated for free based on historical emissions data; the rest were auctioned to firms. The percentage of free EUAs then dropped annually. During phase III (2013–2020), almost half of the EUAs have been bought through an auction.

As for the allocation of free EUAs, each firm in the same industry sector receives the same volume of free EUAs per unit activity (the exact definition of “unit activity” depends on the sector). After phase III, the volume of free EUAs per unit activity in each sector will be calculated based on the average emissions of the 10% most efficient installations within the particular sector—a quantity usually referred to as the benchmark (European Commission 2015). The calculation of the free allowance volume therefore rewards the regulated firms that do their best to reduce their emissions. There are two notable exceptions from the free allowance calculation method described above. Industry sectors or installations that are at risk of carbon leakageFootnote 4 may receive more free EUAs, which may cover up to 100% of their emissions. On the other hand, power generators have not received any free allowances since 2013 (with the exception of power generators in certain member states where the modernization of the power generation sector is subsidized).

Auctioning is designed to be the main allowance allocation mechanism within the ETS. The auction format is single round, sealed bid, and uniform price (European Commision 2010, 2015). Auctions are organized frequently (several times per week) through auction platforms such as European Energy Exchange AG (EEX 2019) and ICE Futures Europe (ICE 2019). Table 1 summarizes the volume of verified emissions and free allowances since 2015 and the volume and the average price of EUAs bought in auctions since 2012. The table shows that there has been a gradual decrease in the volume of free allowances, a gradual increase in the volume of auctioned ones, and a significant change in the average price of auctioned allowances in the last few years.

Allowance trading, offsets, and banking

Regulated firms and other financial entities participating in the EU ETS can trade allowances either privately (moving allowances from one firm/entity to another) or through allowance brokers (which match buyers and sellers). Trading can also be performed in the spot market on allowance exchanges (e.g., EEX, ICE) or through EUA futures or forward contracts. A spot transaction is an immediate settlement, which means that the allowances are delivered and paid directly, while a futures/forward transactionFootnote 5 takes place at a predetermined price and time in the future. In principle, the possibility of allowance trading (in its various forms) introduces flexibility into the ETS, helping to stabilize the EUA at a level comparable to the average marginal abatement cost across different industry sectors.

Moreover, the EU ETS allows the use of certain credits (known as offsets) from flexible mechanisms under the Kyoto Protocol (United Nations 1998; European Parliament 2003; European Commission 2015). Instead of buying EUAs, a regulated firm could invest in projects that reduce GhG emissions elsewhere in the world. Since 2013, offsets have been exchanged with EUAs before surrendering.Footnote 6

EUAs are also bankable across years (and, since phase II, across different phases). Participating entities may store allowances for future use; this is an important characteristic of the EU ETS called banking. More information about it can be found in the “Calculation of banking volume” section.

Early failures and remedies

In order to set the initial cap in 2005, the EU used historical data on emission volumes. When the verified emissions were calculated and published for the first time, it was evident that the actual needs had been overestimated and the cap was too loose. The financial crisis of 2008 resulted in less industrial activity, and thus in a lower demand for allowances. As the overall annual supply of allowances was greater than the annual demand, a substantial volume of allowance surplus accumulated. This trend only changed in 2015, when the demand for EUAs exceeded supply for the first time (European Environmental Agency 2017). Yet, in 2017, the total surplus was about 1.7 billion allowances, a volume large enough to cover the total demand for a whole year (European Environmental Agency 2017)!

As a short-term measure to decrease the excessive volume of allowance surplus, the EU postponed the auction of 0.9 billion allowances that had been scheduled to take place in 2014–2016 (European Commission 2015). This practice is usually referred to as back-loading. Back-loading does not reduce the overall supply but it does smoothen its distribution over time. A long-term solution would be the creation of a market stability reserve, which could mitigate the effect of any significant deviation between allowance supply and demand. Roughly speaking, a market stability reserve could remove allowances from the system during periods of excessive surplus and inject allowances into the system during periods of excessive deficit, thus constantly balancing supply and demand in a smooth and prompt way.

Related work

This paper contains results from two related areas: (1) EUA price formation and determinants and (2) EUA market structure and network characteristics.

EUA price formation and determinants

Since the launch of the ETS in 2005, allowance price determinants have been studied extensively due to the importance of understanding allowance price dynamics. In theory, the EUA price is determined by business-as-usual emissions and marginal abatement costs. More specifically, given a predetermined emissions cap, the allowance price should be equal to the marginal abatement costs of the regulated entities (Montgomery 1972; Phaneuf and Requate 2017). GhG emission abatement can be achieved either by investing in cleaner technologies or by reducing production levels (Delarue et al. 2010).

Early studies on the drivers of the EUA price showed that energy prices, weather variations, offset usage, industrial activity, and economic variations were significant EUA price determinants. Since fuel switching is considered a short-run investment for abatement, and as natural gas and coal prices are strongly correlated with power production levels and price, they affect the demand for allowances and the EUA price (Christiansen et al. 2005; Convery and Redmond 2007). Brent prices (oil) are considered the main driver of natural gas prices, and ultimately of the EUA price (Kanen 2006; Alberola et al. 2008). Weather variations also affect the EUA price. Considering the fact that energy demand is a U-shaped function of the average temperature, extremely high or low temperatures tend to increase power consumption, which should result in an increase in the EUA price (Mansanet-Bataller et al. 2007; Alberola et al. 2008). Another factor that affects the EUA price, by increasing the allowance supply, is the usage of Kyoto offsets (see the section “Allowance trading, offsets, and banking”) for compliance. Klepper and Peterson (2006) showed that offset usage reduces the allowance price by one-third.

Following the literature discussed above, more recent studies on this topic have also focused on identifying the EUA price determinants as the system changes between phases I and III. Experimental evidence suggests that during the recent economic crisis, reduced production levels led to lower GhG emissions and to a significant decrease in the EUA price (Declercq et al. 2011; Grubb et al. 2012; Ellerman et al. 2015a). Many recent studies have also included production and economic indices in order to capture the effects of macroeconomics on the EUA price. Hintermann (2010) examines the peculiar price fall that occurred at the end of phase I, and to what extent the EUA price was determined by market fundamentals related to aggregate marginal abatement costs. By constructing a model that is a function of important price determinants, he finds that the model provides a good fit well after the price crash, whereas the variables that explained the EUA price in the precrash period are lagged allowance price changes. He concludes that more searching is needed to identify the true allowance price drivers, and he proposes four future fields of interest for this issue, including market power and hedging by firms. Rickels et al. (2015) also examine the impacts of various fundamental factors such as fuel prices, economic activity, and weather variations on the EUA price. Based on data up to 2010, their results show significant influences of gas, coal, and oil prices, of economic activity, and of some weather variations. The overall results suggest that the price dynamics are better explained by a fundamentals-based model than a purely autoregressive model, but time series characteristics are intrinsic to the problem and are needed to enhance forecasting. Creti et al. (2012) investigate whether the EUA price determinants for phase I still hold for phase II of the EU ETS. They highlight that, while the oil price, equity price index, and the switching price between gas and coal were significant determinants of the EUA price in the second phase of the EU ETS, the switching price did not play a key role in the first phase. Koch et al. (2014) use a Newey–West estimator for OLS regression on the EUA price during phase II of the EU ETS. In this analysis, the authors take into consideration fuel prices and economic indicators. They also introduce variables relating to wind and solar electricity production and find that these variables are the second most important price determinant. Upon calculating the equilibrium prices, the EUA price was found to be close to its equilibrium value, whereas it was overvalued at the beginning of phase II and undervalued at the end of 2009. Chung et al. (2018) use Granger causality to show that the EUA price has a one-sided causal effect on the electricity price and the natural gas price, while the causal relationship between CERs and EUAs disappears. Secondly, they show that during phase III, all variables except for the minimum temperature have been positively correlated to the EUA price. Finally, using forecast error variance decomposition, they compare the correlations between the variables and the EUA price. The greatest influence on the current EUA price is the past EUA price, followed by the electricity price, and lastly the natural gas price.

While all the above factors have been well studied in relation to predicting the EUA price, some are missing from the literature on EUA price determinants. For example, institutional decisions concerning the overall cap (which determines the initial allocation) may have an impact on the EUA price (Alberola et al. 2008). The overallocation of free allowances in phase I led to a dramatic price decrease at the end of that phase (Ellerman et al. 2015a). Therefore, the volume of free allowances was reduced in phase II, and the power sector stopped receiving free allowances in phase III (European Commission 2015).

Another highly important “missing” factor is the role of banking. The possibility of banking (and borrowing) allowances is considered a price stabilizing tool, as it limits the supply of allowances during a period and prices stay at higher levels, while borrowing has the opposite effect (Maeda 2004). Hintermann (2010) shows that without banking across phases, any economic variation has an impact on allowance prices. Ellerman et al. (2015a) highlight the importance of banking for establishing a floor on prices, comment upon the differences between the price drops of 2007 and 2012, and emphasize that the EUA price in 2012 did not reach zero. From an investment point of view, Bredin and Parsons (2016) suggest that there is no other cost of banking a EUA except for the opportunity cost of money when contrasted with other commodities, and they suggest that the negative convenience yield for future prices after 2008 may imply that cash and carry arbitrage has been very popular in the market. By interviewing market participants, Neuhoff et al. (2012) attempt to identify the market actors (power, industry, financial sector) that are banking the allowances for future use. They find that power generators bank allowances to hedge carbon for future use, while industry actors’ banking strategies vary across firms. They also find that financial instruments play a more speculative role in the market. Banks primarily buy and simultaneously sell forward or futures contracts, while other financial actors invest in carbon together with other assets.

To the best of our knowledge, neither the actual total volume of transactions nor the actual volume of banking have been tested as price determinants. The work in this paper therefore constitutes a significant contribution in that it quantifies the volume of allowances traded and the volume of banking using data on the actual transactions from the EUTL registry. By calculating these factors until April 2016, along with the aforementioned fundamental price determinants, we observed their significance in price formation.

EUA market structure and network characteristics

Another interesting related topic is to observe and understand the market structure through the actual level of trading. Due to its complex nature, details on transactions (which are available through the EUTL) may facilitate the discovery of more information on trading patterns by constructing the transaction network (Ellerman et al. 2015a; Hintermann et al. 2015; Martin et al. 2015). To that end, Karpf et al. (2018) analyzed the EU ETS system as a network and found structural elements that induce market inefficiencies. That is, they identified a lack of easily accessible trading institutions, which led the industrial nodes of the network to use local connections and financial intermediaries. The resulting network structure induced increased bid-ask spread, among other issues. Similarly, when Borghesi and Flori (2016) analyzed the system from a country-level perspective instead of a firm-level perspective, they found that person holding accounts—which approximated the intermediaries in the network—played a prominent role in the network when a variety of centrality measures such as PageRank, degree, average neighborhood in/out degree, and degree of centrality were used. Due to the size and the complexity of the market, a social network approach is quite helpful to understand participant behavior as well as the market structure in general.

Transaction log and account holder classification

For administrative and transparency purposes, the EU operates an electronic accounting system known as the European Union Transaction Log (EUTL), which ensures the accurate accounting of the allowances within the ETS (European Commission 2013). The EUTL records and authorizes all allowance transactions. It can be accessed through its website (EUTL 2019), which provides access to public information and to reports on the operation and the performance of the EU ETS. Moreover, it enables public access to all transactions that took place up to 3 years ago. The EUTL is one of the main sources of data used in our study.

In this section, we provide more details about accounts and account holders in the EU ETS, and we explain how we classified each account holder as either a regulated entity, a governmental entity, or a (purely) financial entity based on its main role in the ETS. This classification played a central role in our data analysis, as discussed in later sections.

Accounts and account types

Every entity (legal or natural) participating in the EU ETS has at least one but potentially many different accounts within the EUTL (European Commission 2013), each of which serves a different purpose. For example, a corporation with many stationary installations may have a different account for each installation and possibly a few additional accounts for trading and participating in auctions. The entity that opens and manages an account is the account holder. In the dataset that we obtained from the EUTL in May 2019, we identified more than 40,000 accounts in total. About 18,000 of them were open in May 2019 (an account is open if it currently allows its owner to participate in transactions within the ETS). We also identified about 16,500 different account holders in our dataset. About 9500 of them were associated with at least one open account in May 2019, about 13,000 of them had participated in at least one transaction in the past, and about 8500 account holders were associated with open accounts and had participated in at least one transaction. For administrative purposes, any account in the EUTL must be associated with one of the 31 participating countries (which is usually, but not always, the country where the corresponding account holder is located).

The EUTL does not classify account holders according to their role in the system, but it considers 51 different account types. Most of these are degenerate in the sense that they each include just a single account for which the corresponding account holder is the European Commission. Table 2 shows the account types for which there are a significant number of accounts.

Typical examples of account types include the Operator Holding Account and Aircraft Operator Account, which are associated with stationary installations and commercial aircraft, respectively. Trading Accounts allow their owners to trade allowances, while Person Holding Accounts are generally used for trading or financial purposes (Karpf et al. 2018; Borghesi and Flori 2016). The EUTL logs signification information for each stationary installation and commercial aircraft associated with an Operator Holding Account or Aircraft Operator Account, including the volume of free allowances, verified emissions, and surrendered allowances for each compliance year, and the corresponding sector. The number of account types corresponding to stationary installations and commercial aircraft logged in the EUTL is about 17,000. About 12,500 of them were open accounts in May 2019.

Account holder classification

Our data analysis involved aggregating allowance activity per account holder per unit time (e.g., yearly, monthly, weekly) and classifying account holders into three groups: regulated, governmental, and purely financial, based on their main allowance activities in the ETS. In the following, we discuss the rules we used for account holder classification.

Regulated entities

Regulated entities have the obligation to surrender allowances for their GhG emissions yearly. An account holder is regarded as a regulated entity (or simply “regulated”) if it holds an Operator Holding Account or an Aircraft Operator Account (i.e., if it operates a stationary installation or an aircraft).

Governmental entities

Governmental entities are the European Commission and the ministries and administration bureaus of the countries participating in the ETS. The main role of governmental entities is to supply the system with allowances (free or sold at auction) and to receive the surrendered allowances. An account holder is classified as a governmental entity (or simply “governmental”) if it cannot be classified as regulated and it holds an administrative account (see also Table 2). Moreover, the owners of the EEX and ICE auction platforms are also classified as governmental entities, as their main role is to supply the system with allowances through auctions.

Financial entities

Purely financial entities participate in the ETS to serve their own interests, and mostly store allowances or trade them with regulated or other financial participants. An account holder is classified as a purely financial entity (or simply “financial”) if it cannot be classified as regulated or governmental and holds an account type associated with allowance trading (see also Table 2). Note that regulated entities may also hold accounts associated with allowance trading.

Calculation of banking volume

We use the term banking (or banking volume) to refer to the allowance volume owned by a regulated or financial entity in excess of the volume that the entity is obliged to surrender at the end of a compliance year. Since banking is central to our study, we now explain in detail how we calculate the banking (and the so-called wallet) using data from the EUTL.

A compliance year T is the time interval corresponding to a compliance cycle. Since compliance years are not aligned with calendar years, we adopt the convention that compliance year T starts on May 1 of calendar year T and ends on April 30 of calendar year \(T+1\). The following transactions are associated with compliance year T:

-

Any allocation of free allowances received for compliance year T, no matter when the free allowances are actually transferred to the associated entity,

-

Any allowance submission for compliance associated with compliance year T, no matter when the surrendered allowances are actually transferred from the associated entity, and

-

Any allowance transaction that takes place in compliance year T and is neither an allocation of free allowances nor a compliance submission.

For an entity i and a time interval t, \(\sigma _{i,t}\) denotes the total allowance volume acquired by entity i during time interval t, and \(\xi _{i,t}\) denotes the total allowance volume transferred from entity i to some other entity during time interval t. The wallet of an entity i at time \(\tau\) is the net allowance volume that entity i has exchanged with other entities in the system from some fixed point in time up to time \(\tau\) (we usually compute the wallet from the beginning of the phase studied or since the system first started). More precisely, the wallet (or the wallet volume) \(\varPhi _{i,\tau }\) of entity i at some point in time \(\tau\) is

where \(\tau ' < \tau\) is any fixed day before \(\tau,\) and \(t = [\tau '+1, \tau ]\) is the time interval starting at the day after \(\tau '\) and ending at \(\tau\). Moreover, for any entity i and any time interval \(t = [\tau '+1, \tau ]\), we let

denote the change in the wallet of entity i during time interval t. Note that, due to noise in the EUTL data (also encountered by Betz and Schmidt 2016), we can only calculate (quite accurate) estimations of the wallets of the entities participating in the ETS.

The banking of an entity i for compliance year T is the total allowance volume owned by entity i at the end of compliance year T after fulfilling its compliance obligations and without taking into account any acquired free for the compliance year \(T+1\). Banking is roughly the allowance an entity possesses in excess. It is only meaningful on an annual basis, and computing it can be a complicated task. Free allocation and the surrender of EUAs for compliance year T may take place at a time outside T. As a result, for any free allocation or surrender of EUAs, it is not always straightforward to ascertain the compliance year with which it is associated.

The wallet is well defined at any point in time and a natural approximation of banking. More precisely, the banking (or the banking volume) \(B_{i,T}\) of entity i for compliance year T is

where \(\varPhi _{i,T}\) denotes the wallet of entity i at the end of compliance year T (i.e., on April 30 of the calendar year \(T+1\)).

Since most of the data analyzed here is obtained monthly, we calculate the wallets of regulated and financial entities at the end of each month.

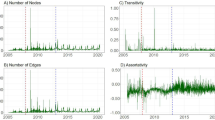

In Fig. 1, we plot the allowance prices and the total wallet volumes of regulated and financial entities. The total wallet volume is calculated from the beginning of the system in 2005 until May 2016, which was the most recent point with data available in the EUTL when our analysis was performed. The EUA price data set starts from April 2008. EUAs from phase I (2005–2007) were not eligible from 2008 on, so they can be considered to be different products (with a different price) that became obsolete and vanished.

The spikes in the total wallet volume of the regulated entities are caused by the allocation of free allowances and the allowance submission at the end of the compliance year. Note that it was not permissible to transfer allowances issued in phase I of the ETS to phase II, which caused the total wallet volume to become negligible at the end of the compliance year 2007. The total wallet volume of the regulated entities exhibited an upward trend during phase II and decreased after phase III started. The reason for this is that power generators stopped receiving any free allowances when phase III started (European Commission 2015). As for the financial entities, while their total wallet volume is significant, it is much less (by almost 2 billion allowances) than the total wallet volume of regulated entities. Their wallet volume increased significantly until the end of phase II and has been stable since the beginning of phase III.

Banking volume as a price determinant

A key objective of this study is to understand and quantify the effect of banking, approximated by the wallet (see the section “Calculation of banking volume”), as a determinant of allowance price. To that end, we calculated the wallet volumes using data from EUTL (2019) and analyzed them together with several price determinants used in previous studies (Creti et al. 2012; Rickels et al. 2015; Chung et al. 2018; Hintermann 2010). In this section, we present the methodology and the details of our analysis along with a discussion of our main results.

Data sources and general approach

To perform the present analysis, we noted the findings from previous literature concerning the EUA determinants for phase II and phase III of the EU ETS (Christiansen et al. 2005; Kanen 2006; Alberola et al. 2008; Mansanet-Bataller et al. 2011; Rickels et al. 2015; Aatola et al. 2013). In our work, we included those variables and introduced others such as the traded and stored volumes of allowances, which could have new effects on the EUA price. In our analysis, we focused on the influence of the act of storing and trading allowances on the EUA price in both phase II and phase III. Briefly, we collected various data from many different sources, including (i) climate and production data from Eurostat; (ii) data on the EUA price and energy prices aggregated from financial websites; (iii) EUA auction price data and auction volumes and various statistics from EEX (2019); (iv) aggregated data from the EUTL provided by the European Environmental Agency (2018); and (v) available data on free, surrendered, and traded allowances from the EUTL (2019). Table 3 summarizes the variables used in our analysis and the corresponding data sources.

EUA price We collected the EUA futures closing price daily time series from EEX. We focused on the futures price of the EUAs due to the particularly high trading volumes (Mansanet-Bataller et al. 2011; Creti et al. 2012; Alberola et al. 2008; Aatola et al. 2013; Rickels et al. 2015; Koch et al. 2014; Chung et al. 2018; Carnero et al. 2018).

Fuel prices The link between EUA prices and fuel prices (coal, gas, and oil) exists because some industries covered by the EU ETS can switch the fuels used in their production processes (Mansanet-Bataller et al. 2011; Alberola et al. 2008; Chevallier 2009; Hintermann et al. 2015; Creti et al. 2012; Koch et al. 2014). Fuel switching is the preferred short-term investment. Different fuels emit different amounts of carbon dioxide (\(\mathrm{CO}_2\)) in relation to the energy they produce when burned. For example, natural gas has a relatively low \(\mathrm{CO}_2\)-to-energy content, so any change in fuel mix between natural gas and coal will have an impact on the allowance demand and thus the \(\mathrm{CO}_2\) allowance price. We collected our coal, natural gas, and oil price data from the World Bank.

Cooling degree days (CDD) and heating degree days (HDD) We used these variables to capture weather changes, which have been used as a price determinant in many studies (Kanen 2006; Christiansen et al. 2005; Mansanet-Bataller et al. 2011; Rickels et al. 2015; Chung et al. 2018; Carnero et al. 2018). Rickels et al. (2015) and Christiansen et al. (2005) argue that extreme temperatures (i.e., heating or cooling degree days) can influence energy demand and thus EUA demand. The HDD and CDD are weather-based technical indices that are designed to reflect the energy requirements of particular buildings for cooling (air-conditioning) and heating, respectively.

If \(T_m\le 15^\circ \mathrm{C},,\) then [HDD = \(\sum _{i} (18^\circ \mathrm{C} - T_{im})]\), else \([\mathrm{HDD} = 0]\), where \(T_{im}\) is the mean air temperature on day i.

If \(T_m\ge 24^\circ \mathrm{C}\) then [CDD = \(\sum _{i} (T_{im} - 21^\circ \mathrm{C})\)] else \([\text{CDD} = 0],\) where \(T_{im}\) is the mean air temperature on day i.

HDD and CDD data are presented as temperature sums in \(^\circ \mathrm{C} \; d\). Whenever either of these two indices is high, it means that there is an increased need for heating or cooling (i.e., a higher energy demand) and thus more \(\mathrm{CO}_2\) emissions. We collected the index data from Eurostat.

Economic sentiment index (ESI) and industrial production index (IPI) We used the indices ESI and IPI as proxies for economic activity. Many studies have considered economic variables in order to capture economic variations that affect the EUA price (Aatola et al. 2013; Chevallier 2009; Creti et al. 2012; Rickels et al. 2015; Mansanet-Bataller et al. 2011; Chung et al. 2018; Carnero et al. 2018). Specifically, Mansanet-Bataller et al. (2011), Koch et al. (2014), and Chung et al. (2018) have also used IPI and ESI in their studies. The role of economic activity is straightforward: in times with lower economic activity, productions level are lower and thus emissions decrease, while emissions increase in times with high economic activity. Correspondingly, the demand for EUAs changes. IPI is a monthly volume index that measures the development of industrial production, and ESI is a monthly indicator made up of five sectoral confidence indicators with different weights: the industrial confidence indicator, services confidence indicator, consumer confidence indicator, construction confidence indicator, and retail trade confidence indicator. We collected the index data from Eurostat.

Allowance trading volumes Alberola et al. (2008) and Hintermann et al. (2015) suggest that EUA trading volumes and institutional decisions concerning the overall cap should be included in the literature for EUA price fundamentals. In our analysis, we computed the allowance trading volumes for every entity in the EU ETS. We focused on the in and out volumes, i.e., the allowances that entities acquire or transfer. More specifically, we computed the incoming volumes of financial and regulated entities (InVolReg, InVolFin), i.e., the total volume of allowances acquired by financial or regulated entities, respectively. Correspondingly, we considered the outgoing volumes of allowances (OutVolReg, OutVolFin), i.e., the total allowance volume transferred by financial or regulated entities, respectively. To be more specific, and in accordance with the notation introduced in the “Calculation of banking volume” section, we note that for a given time interval t,

We also accounted for the total trading volumes of each category considered in the “Account holder classification” section. More specifically, given a time interval t, we defined the total trading volume of financial (regulated) entities, i.e., TVolFin (TVolReg), as the sum of the allowances exchanged during t where any financial (regulated) entity either acquires or transfers allowances. Due to the fact that the cap and thus the initial allocation of allowances is done on an annual basis, we could not use a proxy to include it in our analysis. However, the free allocated allowances as well as the auction volume are captured by the incoming volume of regulated entities.

Theoretically, it could be expected that the EUA price would be negatively and positively correlated with the supply and the demand, respectively. The incoming and outgoing volumes are not immediately correlated with supply and demand. However, it would be reasonable to expect that strong buying and selling pressures would cause the price to increase or decrease significantly, respectively.

Banking volumes Ellerman et al. (2015a, b) argue that although banking was considered a significant factor in firms’ behavior in the US SO2 Emissions Trading Program, this subject has been neglected in the empirical literature on the EU ETS. In theory, when banking is allowed and firms face the prospect of a declining cap, they will initially reduce emissions more than required in order to gain from intertemporal cost minimization (Ellerman et al. 2015b). The provision of banking stabilizes the EUA price, as it limits the supply of allowances in a period and thus prices stay at higher levels (European Commission 2015; Maeda 2004; Hintermann et al. 2015). Hintermann (2010) shows that in the absence of banking across phases, economic fluctuations impact EUA prices. Ellerman et al. (2015a) also compared the price drop of 2007 with the price drop of 2012 and highlighted the importance of banking in establishing a floor on prices. The fact that the EUTL tracks every transaction made in the EU ETS gave us the ability to calculate banking by keeping track of a continuous proxy, i.e., wallet (see the section “Transaction log and account holder classification”). We computed monthly wallets for regulated and financial entities, and we call these variables RegWallet and FinWallet, respectively.

In a nutshell, our approach was to apply linear regression analysis to phase II and phase III of the EU ETS, with the EUA future price as the dependent variable, in order to understand and quantify the effect of each variable in Table 4 on the EUA future price. More specifically, we considered the monthly averages of the data and performed a series of steps. First, it was necessary to ensure that the data from phase II and phase III were stationary. We then estimated models that we optimized by omitting the less significant variables. Next, we carried out a stepwise regression to optimize the selection of variables and check whether any important variables had been missed. After that, we checked for structural breaks in phase II and then divided our dataset into two more time intervals. Finally, we obtained four linear regression models, one for each time interval; the results gained from those models are summarized in Tables 5, 6, 7, and 8. These steps were implemented in MATLAB/Octave, R, and Gretl, and more details about them are given in the next section. Finally, in the “Discussion of the results” section, we comment on the details of our final models.

Regression analysis

We initially employed classical least square regression models in our econometric analysis (Aatola et al. 2013; Rickels et al. 2015; Koch et al. 2014). Our first step was to select a relatively small set of explanatory (or independent) variables that (along with the wallet volume) were considered likely to be significant determinants of the EUA price (i.e., fuel prices, economic indices, trading volumes, and wallet). Starting from the full model, which included the chosen explanatory variables and their lags, we continued by omitting the less significant coefficients one by one and then repeating the procedure. This allowed us to avoid overparametrization and inefficient estimators. We selected the models based on statistical tests of the coefficients, their significance, the \(R^2\) values, and the AIC and BIC criteria. We followed the technique outlined in Koch et al. (2014) and Aatola et al. (2013), and we performed estimations with Newey–West HAC standard errors to account for possible heteroscedasticity.

To aid the selection of a meaningful subset of explanatory variables, we also performed a stepwise regression to check that we had not overlooked any important regressor. Stepwise regression selects a model by automatically adding or removing individual predictors a step at a time, based on their statistical significance. The outcome of stepwise regression is a set of possible significant price determinants. We applied this “selection” process to all explanatory variables in Table 3, with the EUA future price as a dependent variable, for every period marked in Fig. 2. To check the validity of the results obtained by performing these steps, we also performed a lasso regression. The lasso is a shrinkage and selection method for linear regression that involves minimizing the residual sum of squares while ensuring that the sum of the absolute value of the coefficients is less than a constant (Tibshirani 1996). This constraint tends to push the values of some coefficients to zero, leading to a smaller subset of regressors. We verified that, in most cases, the stepwise algorithm gave the same results as the lasso algorithm (i.e., the same set of explanatory variables). Both stepwise regression and lasso regression were performed in MATLAB via the stepwisefit and lasso algorithms, respectively.

To eliminate excessive noise and variance from the data, we wanted to analyze monthly averages of each variable. Therefore, the number of data points was relatively small (about 100 data points during the period from January 2008 to May 2016), so a large set of explanatory variables could have resulted in overfitting.

Testing for stationarity Data stationarity is a necessary condition for a meaningful linear regression analysis (Priestley and Rao 1969). As a first step, we had to ensure that our data were stationary by removing trends and seasonality from every variable. For example, the wallet data for regulated entities (see Fig. 1) exhibit obvious seasonality, an upward trend since 2013, and a downward trend after that. The transaction volume increases just before the end of each compliance year (when the free allowances are allocated and allowances are surrendered for compliance) and just before the end of each calendar year (when most of the futures contracts expire). Similar seasonality effects are apparent for other variables as well. We used the augmented Dickey–Fuller (ADF) test with breakpoints (with a null hypothesis that the time series is nonstationary; Dickey and Fuller 1979) in the presence of structural breaks (Perron 1997; see the discussion of structural breaks below), where a rejection of the null hypothesis indicates that the series does not need to be transformed to achieve stationarity. We log-transformed and differentiated the data as needed and then reapplied the ADF test to the transformed time series. Log transformation was useful in our analysis because the values of some of the independent variables (see the EUTL data in Table 3) were much larger in scale than values of the EUA price. Hence, we were interested in the relative (or percentage) changes in those variables at their original scales. Our data were converted into stationary values by taking the first differences, i.e., all time series were integrated of order I(1), in accordance with other studies (Alberola et al. 2008; Chevallier 2009; Aatola et al. 2013; Koch et al. 2014; Chung et al. 2018; Carnero et al. 2018).

Lag-length selection Selecting the appropriate lag length is an important step in the procedure, as selecting too few lags can result in autocorrelated residuals, and selecting too many lags can lead to overfitting. Lag length selection can be performed on either an ad-hoc basis or using a variety of statistical criteria (Hafer and Sheehan 1989). Due to the fact that the number of observations in each time period is relatively small, we checked for the appropriate number of lags using the Akaike information criterion (AIC), the Schwarz Bayesian information criterion (BIC), and the Hannan–Quinn information criterion (HQ) with a limited horizon. As a first step, we set the maximum lag length to 4 lags. Then we chose 2 lags as the appropriate lag length for our study, taking into consideration both the results of the statistical criteria and the number of observations. In most cases, the statistical criteria showed that a lag length of 1 lag was the appropriate choice.

Checking for structural breaks The financial crisis in 2007–2010 clearly affected the global and European economies, with production conditions and business as usual in Europe changing dramatically. Reduced emissions were inevitable, even without the existence of the EU ETS (Declercq et al. 2011; Grubb et al. 2012; Ellerman et al. 2015a) due to lower production levels. As shown in Fig. 2, the EUA price oscillates around different values during the periods 2009–2012 and 2012–2016, with a sudden fall observed in 2012, just before the onset of the third phase.

The recession, the structural changes in the EU ETS (e.g., phase changes), and the plots of the data indicate that the system changes behavior over time.

After estimating the linear model for phase II, we performed a Chow test for a structural break in December 2011. The test rejected the null hypothesis of no structural break at the given date with a P value of 0.00365504. Moreover, to verify that this was the only structural break during the entire time period under examination, we employed the algorithm described by Bai and Perron (2003) to simultaneously estimate multiple breakpoints. This algorithm computes the optimal breakpoints endogenously based on the data at hand. Using the R language, we applied the algorithm and found that the optimal number of breakpoints was 1. This breakpoint occurred in December 2011. These results support our expectations based on visual inspection of the data, so it was necessary to consider two more periods in our analysis:

-

Period 1: 2008–2011 (recession period)

-

Period 2: 2012–2016 (postrecession period).

After dividing the dataset into these periods, we applied the ADF unit root test with breakpoints to test the period 1 and period 2 datasets for stationarity. The results of the test are shown in Table 14 in the Appendix.

Performing residual diagnostics After estimating the linear models for phases II and III and then periods 1 and 2, the next step was to check if the model provides an adequate description of the data. We checked the residuals of every model for autocorrelation, heteroscedasticity, and normality. Namely, we used (a) the Ljung–Box Q test and the Breusch–Godfrey LM test (null hypothesis: no autocorrelation) to check for residual autocorrelation, (b) Engle’s ARCH test (null hypothesis: no ARCH effect is present) to check for residual heteroscedasticity, and (c) the normality test (null hypothesis: residuals are normally distributed) to test for normally distributed residuals. Testing for multicollinearity: All the models are also tested for multicollinearity. As Tables 15, 16, 17, 18, 19, 20, 21 and 22 indicate, no multicollinearity was detected. For the descriptive statistics see tables 9 and 10.

Discussion of the results

The details of our final regression models are summarized in Tables 5, 6, 7, and 8. The residual diagnostics for our final models are shown in the Appendix (see Tables 11, 12, and 13). From the Q–Q plots shown in Fig. 3a–d, we can conclude that the errors in our four models tend to be normally distributed. In the model fit plots shown in Figs. 4, 5, 6, and 7, the red line represents the fitted values for the model, while the blue line represents the actual EUA price. From the residual plots presented in Figs. 4, 5, 6, and 7, we can see that the transformed data are significantly linearly related, as the residuals appear to be randomly scattered around zero. We also calculated the correlations between all pairs of the explanatory variables used in each model and found that these correlations were relatively weak during every period.

The results of our regression analysis indicate that the wallet volume of financial entities was a statistically significant EUA price determinant during phase II, period 1, and period 2. All three models indicate that changes in the value of the financial wallet have a negative effect on the EU ETS. This finding is in accordance with the theoretical expectations presented by Hintermann et al. (2015). The results for phase III (Table 8) imply that the wallet of financial entities was not a significant EUA price determinant during this phase, even though phase III and period 2 are overlapping time intervals. However, the total trading volume of financial entities was a significant EUA price determinant in phase III, suggesting that the overall activity of these entities plays an important role.

The total trading volume of financial entities was a significant price determinant in phases II and III, which indicates that the overall activity of financial entities affects the EUA price. In phase II, the overall activity of financial entities impacted the EUA price negatively, while the opposite was true in phase III. This result needs further investigation. Another interesting fact is that the total trading activity of regulated entities significantly and negatively affected the EUA price during period 2. However, as mentioned above, period 2 overlaps phase III, so our results are inconclusive in terms of the impacts of the activities of these types of entities, and in terms of which entities exerted the greatest influence on the EUA price.

The results for period 1 are more straightforward, as it is clearly apparent that the allowance volumes acquired by regulated and financial entities were significant influences on the EUA price. The acquisition of allowances by financial entities had a negative influence on the EUA price, while the opposite was the case when allowances were acquired by regulated entities.

Natural gas is considered the main option for fuel switching, and such switching represents an abatement opportunity (Christiansen et al. 2005; Alberola et al. 2008; Rickels et al. 2015). The results for phase II and period 1 indicate that the natural gas price had a negative effect on the EUA price, which contradicts theoretical expectations. However, it should be noted that we considered the spot price of natural gas in our study, and Rickels et al. (2015) also found that the spot price of gas negatively impacted the EUA price.

According to Rickels et al. (2015), the oil price does not influence the EUA price directly, as only a few power generators still use oil as a fuel. However, the oil price is often analyzed because it is an indicator of economic activity (Rickels et al. 2015; Koch et al. 2014) and it affects the gas price (Alberola et al. 2008; Kanen 2006). Tables 5 and 6 (for phase II and period 1) indicate a positive relation between the oil price and the EUA price. For phase II, the EUA price was also positively related to the industrial production index (IPI). Both results are in accordance with the conclusions of data analyses performed by Rickels et al. (2015), Mansanet-Bataller et al. (2011), and Alberola et al. (2008), and with the theoretical expectations of Aatola et al. (2013). A proxy for economic activity was also found to be significant for the most recent time periods (period 2 and phase III); however, that proxy was the ESI. The coefficient of the ESI during phase III was positive and in accordance with the theory and the results of Koch et al. (2014) for phase II. However, there was a negative sign related to its lag which, along with its negative sign in period 2, suggests the need for further investigation.

Analysis of the allowance trading network

Another key objective of our study was to understand and quantify the power of financial entities in the EUA market. To that end, we adopted a network science approach. A network or graph is a structure G(V, E) that consists of a set of entities (the nodes V) and a set of pairs of nodes (the edges \(\{u,v\} \in E,\) where \(u, v \in V\)). An edge corresponds to a relation between nodes. When we use the term “ETS trading network,” we are referring to the network of transactions recorded in the EUTL, where the nodes are the account holders and the edges correspond to transactions between account holders. Due to the fact that the network changes over time, we decided to aggregate the transactions that occurred during a specific time period (per quarter) into a single network and perform betweenness centrality calculations (see the “Betweenness centrality” section below) on the network for each period. This allowed us to examine how the nodes’ centralities evolved over time. We used the account holder classification described in the “Account holder classification” section. We wanted to test the hypothesis that the financial entities had significant power in the ETS trading network due to their role as intermediary nodes in allowance trading.

A fundamental concept in network science is that of the centrality of a node. A node’s centrality quantifies the importance of the node in the network due to its role as an intermediary in the overall network structure (see Sect. 2.2.4 in Jackson 2008 for more details about node centrality measures and their use). In this section, we show how we quantified the “power” of financial entities in the ETS trading network by calculating and comparing the betweenness centrality scores (see Sect. 2.2.4 in Jackson 2008) of the regulated, financial, and governmental entities.

Betweenness centrality

The betweenness centrality of a node is the fraction of shortest paths that include the node. A path between nodes u and v is a sequence of \(n-1\) distinct edges \((e_1,\ldots , e_{n-1})\) for which there is a sequence of n nodes \((u_1 \equiv {\mathbf {u}}, u_2, \ldots , u_{n-1}, u_n \equiv {\mathbf {v}})\), where \(e_j \equiv \{u_{j-1}, u_j\}\). Formally, the betweenness centrality of a node k is a normalization of the number of shortest paths between all other pairs of nodes that include node k. For a network with n nodes, the betweenness centrality of node k is defined as

where P(i, j) denotes the number of shortest paths between nodes i and j, and \(P_k (i,j)\) denotes the number of shortest paths between i and j that include node k.

In social network theory, a node that occurs in many of the shortest paths between two other nodes is considered a node that can control communication and information exchange between those two other nodes. Therefore, nodes with high betweenness centrality scores are considered to have a greater capacity to connect other nodes (Jackson 2008, p 20, 62).

In the case of the ETS, the account holders (the nodes) are exchanging EUAs. Thus, a flow of allowances is always circulating within the network. If a node v occurs within a high proportion of the shortest paths between many node pairs, then v “controls” a considerable proportion of the allowance flow.

Betweenness centrality distribution in the ETS trading network

For our study, we generated the ETS trading network for each quarter during the period from January 2005 to March 2016 using data from the EUTL. The nodes of each network were the account holders that participated in at least one allowance transaction (including receiving free allowances or surrendering allowances for compliance) in the corresponding quarter. An edge between two nodes denoted that a transaction took place between them in the corresponding quarter. It should be noted that each edge was undirected and unweighted (i.e., it did not include any information on the direction and volume of the corresponding transaction). Figure 11 in the Appendix depicts the EUA trading network for the third quarter of 2015.

For each network obtained for each quarter across the period from January 2005 to March 2016, we calculated the betweenness centrality of each node. Because the networks were quite large and the precision of the betweeness centrality calculation was limited, we focused on the nodes that had the top 20% (or the top 3%, or the top 1%) betweenness centrality scores in the quarter of interest, as, on average, only 23.86% of the nodes had nonnegligible betweenness centrality scores in each quarter. We were interested in estimating the fractions of financial, regulated, and governmental entities among the account holders with high betweenness centrality scores in each quarter.

Observing a constantly high fraction of financial entities among the account holders with the highest betweenness centrality scores (especially if the fraction of financial entities is much larger than the fraction of regulated entities, and the fraction of financial entities increases as we move to smaller percentiles of the highest-scoring nodes) provides a strong indication that the financial entities play a central role and have significant power in the ETS trading network due to their role as intermediaries in allowance trading.

Figure 8 depicts the percentage of each account holder type (financial, regulated, governmental) in the set of nodes with the highest 20%, 3%, and 1% of the betweenness centrality scores during each quarter from January 2005 until March 2016. After the first few quarters, it is clear that financial entities dominated the set of nodes with the highest betweenness centrality scores, especially when only the top 3% and top 1% of nodes were considered.

In Fig. 8b (top 3% of nodes) and Fig. 8c (top 1% of nodes), the percentage of financial entities is much larger than the percentage of regulated entities. This phenomenon is also observed in Fig. 9, where we present the average fraction over all quarters from January 2005 to March 2016 of each account holder type in the set of nodes with the highest betweenness centrality scores. We can see that as we move towards smaller betweenness centrality percentiles of the highest-scoring nodes (i.e., from the top 20% to the top 3% to the top 1%), the fraction of regulated entities drops significantly, whereas the fraction of financial entities and the fraction of governmental entities increase.

Moreover, we observe that the percentage of regulated entities increased significantly during the first and second quarters in each year. The reason for this is that regulated nodes receive free allowances in the first quarter (in February) and surrender allowances for compliance in the second quarter (in April) each year. Therefore, more regulated entities participate in transactions during the first two quarters in each year, which results in a higher percentage of regulated entities in the set of nodes with the highest betweenness centrality scores during these quarters. To provide further evidence for this explanation, we present, in Fig. 10, the percentage of each account holder type (financial, regulated, governmental) in the set of nodes with the top 20% betweenness centrality scores during each month in 2012. In Fig. 10, the fraction of regulated entities among the entities with high betweenness centrality scores peaks in February and again in April. The percentage of regulated entities also increases in December, when most futures contracts expire and the corresponding transactions actually take place.

Conclusions and future work

In the work reported in this paper, we analyzed the EU ETS. Using the EU Transactions Log (EUTL) database, we classified all market participants into three major groups: regulated entities, financial entities, and governmental entities.

The main focus of this work was the banking provision of the EU ETS. The allowances were bankable from one year to the next, except at the end of 2007 (i.e., between phase I and phase II). Our first task was to observe how and to what extent the EUA price is affected by the storage of allowances by market participants. To that end, we first calculated the banking performed by both financial and regulated participants, which was achieved by keeping track of their daily transactions. Then we created a variable to measure the allowances stored by both the regulated and financial entities, which we called the monthly wallet.

By performing a multiple linear regression on the EUA price that included the stored and traded allowances of every entity in the system along with important price determinants (i.e., fuel prices, weather conditions, and economic activity), we found that the wallet of financial entities is a significant EUA price determinant. The coefficient of the financial wallet is negative in all linear models, which may imply that attempts by financial entities to acquire and store allowances cause the EUA price to decrease. Interestingly, upon moving from phase II to phase III, the financial wallet became less significant. However, the results of our model for phase III indicate that the total trading volume of financial entities is a significant EUA price determinant. Overall, we observe that the trading decisions of financial entities are an important influence on the EUA price.

We also aimed to test the hypothesis that financial entities act as intermediaries in the carbon market, and to quantify this power precisely. To that end, we performed a social network analysis of the EU ETS system. We generated a graph from the EUTL data set for each quarter from 2005 until early 2016. In order to observe and measure the role of a node (i.e., a participant in the market—an entity), we examined the betweenness centrality. By focusing on the nodes with the highest betweenness centrality scores, we verified the hypothesis that financial nodes play an important role as intermediaries, and thus have higher centrality values. By comparing the entity compositions of different percentiles of betweenness, we observed that as the betweenness centrality scores of the set of nodes considered increase, the percentage of regulated entities drops significantly, in contrast to the percentages of financial and governmental entities.

In general, we observed that financial institutions play a central role in the market, and their banking decisions are a significant determinant of the EUA price. More research is needed to better understand the provision of banking and its influence on the EUA price.

In agreement with Karpf et al. (2018), we observed that the EU ETS networks exhibit a core–periphery structure; in other words, most of the nodes are only connected to a subset of highly connected nodes (the core). One interesting direction for further research would be to identify the tiny subset of ETS participants that consistently embodies the core of each network—assuming that such a subset exists. If it does, it would be possible to use this subset of participants to extract considerable information concerning the EU ETS network. More precisely, it would be of great interest to find out whether and to what extent the EUA price can be explained by tracking the wallet and exchange volume of this small group of ETS participants.

Moreover, we performed a regression analysis of the financial wallet to test its inverse relationship with the EUA price. The results of this analysis are shown in Tables 23 and 24 in the Appendix. An interesting extension to the present investigation would be to estimate a vector autoregressive model (VAR) to highlight possible interdependencies of the variables and gain a better understanding of their relationships.

Nevertheless, allowance banking has been largely ignored in the literature on the EU ETS. Our goal is to shed some light on this topic and to motivate further research into this banking that will reveal its implications for the EU ETS. The EUA price is considered an indication of how well the system performs; a consistently high price implies decreasing emissions. Our analysis provides an indication that banking can help to explain the observed behavior and the formation of the EUA price.

Notes

Aviation has been regulated since mid-2012.

Inspecting the EUTL dataset, we found that the actual date on which regulated firms received their free allowances varied to some extent.

It is possible for a regulated firm to surrender an appropriate amount of allowances after the end of April. Late surrenders are, however, subject to a fine of €100 per allowance.

Carbon leakage refers to the situation where a corporation transfers its production or activity to other countries with weaker emission constraints.

The main difference between futures and forward contracts is that a futures contract is standardized whereas a forward contract is tailor-made.

Prior to 2013, offsets enlarged the existing surplus of allowances.

References

Aatola P, Ollikainen M, Toppinen A (2013) Price determination in the EU ETS market: theory and econometric analysis with market fundamentals. Energy Econ 36:380–395. https://doi.org/10.1016/j.eneco.2012.09.009, http://www.sciencedirect.com/science/article/pii/S014098831200223X

Alberola E, Chevallier J, Cheze B (2008) Price drivers and structural breaks in European carbon prices 2005–2007. Energy Policy 36(2):787–797. https://doi.org/10.1016/j.enpol.2007.10.029, http://www.sciencedirect.com/science/article/pii/S030142150700482X

Bai J, Perron P (2003) Computation and analysis of multiple structural change models. J Appl Economet 18(1):1–22. https://EconPapers.repec.org/RePEc:jae:japmet:v:18:y:2003:i:1:p:1-22

Betz RA, Schmidt TS (2016) Transfer patterns in phase I of the EU emissions trading system: a first reality check based on cluster analysis. Clim Policy 16(4):474–495. https://doi.org/10.1080/14693062.2015.1028319

Borghesi S, Flori A (2016) EU ETS facets in the net: how account types influence the structure of the system. fEEM working paper no. 008.2016. https://doi.org/10.2139/ssrn.2741004

Bredin D, Parsons J (2016) Why is spot carbon so cheap and future carbon so dear? The term structure of carbon prices. Energy J 37(3):83–107

Carnero M, Olmo J, Pascual L (2018) Modelling the dynamics of fuel and EU allowance prices during phase 3 of the EU ETS. Energies 11(11):3148

Chevallier J (2009) Carbon futures and macroeconomic risk factors: a view from the EU ETS. Energy Econ 31(4):614–625

Christiansen AC, Arvanitakis A, Tangen K, Hasselknippe H (2005) Price determinants in the EU emissions trading scheme. Clim Policy 5(1):15–30. https://doi.org/10.1080/14693062.2005.9685538

Chung CY, Jeong M, Young J (2018) The price determinants of the EU allowance in the EU emissions trading scheme. Sustainability 10(11):1–29. https://doi.org/10.3390/su10114009

Convery FJ, Redmond L (2007) Market and price developments in the European Union emissions trading scheme. Rev Environ Econ Policy 1(1):88–111. https://doi.org/10.1093/reep/rem010, http://oup.prod.sis.lan/reep/article-pdf/1/1/88/6932902/rem010.pdf

Creti A, Jouvet PA, Mignon V (2012) Carbon price drivers: phase I versus phase II equilibrium? Energy Econ 34(1):327–334. https://doi.org/10.1016/j.eneco.2011.11.001, http://www.sciencedirect.com/science/article/pii/S0140988311002751

Declercq B, Delarue E, D’haeseleer W (2011) Impact of the economic recession on the European power sector’s CO2 emissions. Energy Policy 39(3):1677–1686. https://doi.org/10.1016/j.enpol.2010.12.043, http://www.sciencedirect.com/science/article/pii/S0301421510009432

Delarue ED, Ellerman AD, D’Haeseleer WD (2010) Short-term CO2 abatement in the European power sector: 2005–2006. Clim Change Econ 01(02):113–133. https://doi.org/10.1142/S2010007810000108

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74(366a):427–431

EEX (2019) EEX (European Energy Exchange AG) auction platform. https://www.eex.com/en/market-data/environmental-markets/eua-primary-auction-spot-download. Accessed 28 July 2020

Ellerman AD, Marcantonini C, Zaklan A (2015a) The European Union emissions trading system: ten years and counting. Review of environmental economics and policy. 10(1):89–107. https://doi.org/10.1093/reep/rev014, http://oup.prod.sis.lan/reep/article-pdf/10/1/89/7969727/rev014.pdf

Ellerman AD, Valero V, Zaklan A (2015b) An analysis of allowance banking in the EU ETS. Robert Schuman Centre for Advanced Studies Research Paper No. RSCAS 29. European University Institute, Badia Fiesolana

European Commision (2010) Commission Regulation (EU) no. 1031/2010 of 12 November 2010 on the timing, administration and other aspects of auctioning of greenhouse gas emission allowances pursuant to Directive 2003/87/EC of the European Parliament and of the Council establishing a scheme for greenhouse gas emission allowances trading within the community. https://eur-lex.europa.eu/eli/reg/2010/1031/oj. Accessed 19 Nov 2019

European Commission (2013) Commission Regulation (EU) no. 389/2013 of 2 May 2013 establishing a Union Registry pursuant to Directive 2003/87/EC. http://data.europa.eu/eli/reg/2013/389/oj. Accessed 19 Nov 2019

European Commission (2015) European Union Emissions Trading System handbook. https://ec.europa.eu/clima/sites/clima/files/docs/ets_handbook_en.pdf. Accessed 19 Nov 2019

European Environmental Agency (2017) Trends and projection in the EU ETS in 2017; the EU emissions trading system in numbers. EWA report no 18/2017. Publications Office of the European Union, Luxembourg