Abstract

We examine the safe haven property of gold for stock and bond markets of G-7 countries. In doing so, we use the novel vector autoregressive for value-at-risk and the cross-quantilogram methods. These quantile-dependence measures help to examine how gold returns react to stock/bond returns when the markets are in a bearish state. The gold market is comparatively less sensitive to bond market innovations and more sensitive to stock market innovations. The tail dependence analysis, through cross-quantilogram, indicates that stock/bond returns significantly and positively spillover to the gold markets when both markets are in a bearish state. Furthermore, the findings of time-varying quantile dependence analysis, obtained by recursive sample estimations, are analogous to the full sample results. Hence, the evidence suggests that gold does not act as a safe haven for the stock and bond markets. Implications of the results are discussed.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

A fundamental principle in financial risk management and investments is that of diversification, illustrated by the expression ‘do not put all your eggs in one basket,’ meaning that you should not invest all your money in a single asset class. Diversification, in terms of time maturity of financial securities, economy market sectors, firm market capitalization, investor risk profile, geographical location for firm operation and index tracking, can be addressed with relative ease. However, diversification, with respect to asset class and subclass, remains a challenging task for portfolio risk managers, particularly in light of the increasing integration between financial markets and in the aftermath of ‘black swan’ events, such as the dot-com bubble burst of 2000–2002, the global financial crisis of 2008–2009 and the Eurozone debt crisis of 2010–2012 (Bekiros et al. 2017; Śmiech and Papież 2017; Arreola-Hernandez et al. 2016; Basher and Sadorsky 2016). This is particularly true considering that asset classes, such as stocks and bonds, differ from each other in terms of uncertainty and risk profile, with stock securities and the stock markets in which they trade being more attune to the dynamics of the domestic, regional and global economies. Stock markets, for instance, tend to promptly react to changes in market confidence, while bond markets are not directly impacted by changes in it due to their guarantees on return on assets and on asset liquidation in case of bankruptcy. Bond markets’ risk and return dynamics also, unlike those of stock markets, appear to be more clearly driven by economy-business cycle phases, as interest and inflation rates only tend to change when the upside or downside risk in the economy is imminent.Footnote 1 Given these risk and return differences between stock and bond markets, it is important to assess the role of gold as a safe haven for these two asset classes separately.

Baur and Lucey (2010) examine the safe haven property of gold focusing on opportunities and conditions that are favorable for investors. A safe haven is specifically perceived as an “ideal location where money can be stored during times of increasing market uncertainty” (Kaul and Sapp 2006). The hedge and safe haven hypothesis of Baur and Lucey (2010) defines an asset to be a (strict) hedge if it is (strictly negatively) uncorrelated or negatively correlated with another asset on average. An asset is a diversifier if that is, on average, positively (but not perfectly) correlated with another asset. Finally, the safe haven is an asset which is uncorrelated or negatively correlated with another asset during the times of financial stress or turmoil in the markets. They examine the role of gold as safe haven for stock and bond investors of the US, UK and Germany. By regressing extreme low quantiles of stock/bond returns on those of gold returns, they find that gold is a hedge against stocks on average and a safe haven in extreme stock market conditions. It is important to highlight that they only consider the bearish state (lower quantile levels) of stock/bond markets, and in that regard, we argue that the impact of extreme lower values of stock/bond returns on the average values of gold returns does not provide a complete picture of the entire distribution of both assets. To classify an asset as the safe haven, a negative correlation should exist when both the hedge and the hedged assets are under market stress. Previous empirical studies show that gold returns have weak correlation with stock and bond markets returns on average and a positive tail dependence during times of financial uncertainty (see e.g., Raza et al. 2016; Gorton and Rouwenhorst 2006; Bekiros et al. 2015, 2017). This existing literature only considers the extreme quantiles of stock returns and assumes that the joint distribution of both gold and stock returns is normal. As such, the results are unlikely to accurately capture the extreme tail co-movements. We cater for such issues using the approach of White et al. (2015) and Han et al. (2016), as these allow measuring the impact and directional quantile dependence between gold and stock/bond market returns.

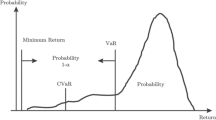

In our study, further investigating the safe haven hypothesis of Baur and Lucey (2010), we re-examine the safe haven property of gold for stock and bond markets of G-7 countries. We draw our empirical results by implementing the novel vector autoregressive (VAR) for value-at-risk (VaR) approach of White et al. (2015) and the cross-quantilogram of Han et al. (2016). These two modeling approaches are complementary (serving as a robustness check) in that the former enables us to identify the presence or absence of dependence between the lowest quantiles (VaR estimates), while the latter can be used to examine the directionality of interdependence (spillover influence) from stock/bond returns to gold returns for different combinations of the returns’ quantiles. We classify gold as safe haven investment if there is significant negative dependence between the lowest quantiles (bearish market state) of stocks/bonds returns and the gold returns. However, gold is considered a diversifier (hedge) if it shows less than perfect positive (no or negative) dependence with stocks/bonds returns across the range of quantiles, other than the lowest quantiles of the stock/bond returns (see Fig. 1 for pictorial representation).

Our selection and application of the quantile-based methodologies is motivated by the fact that these provide detailed information about the directionality of spillover effects and spillover transmissions under both bearish and bullish market scenarios (determined by lower and upper quantiles of the returns distribution). These quantile-based approaches have three main advantages. First, they are robust to misspecifications, as they allow the underlying dependence structure to vary across distributions, i.e., different levels of return quantiles. Second, they are designed to not only account for the dependence-in-mean but also for dependence in the tails of the pairs of variables’ joint distributions. Thirdly, the CQ approach provides a model-free correlation measure between two time series across the quantiles of each distribution. This method is based on quantile hits and, therefore, does not depend on any moment condition. Both advantages are essential aspects of the modelling design, particularly if the variables are skewed and highly leptokurtic.

Our findings indicate that the risk diversification property of gold is specific to market states. Gold does not act as a safe haven for the stock and bond markets of G-7 countries because the lower tail dependence of gold returns with that of stock and bond markets is generally positive. However, gold returns are less sensitive to bond market innovations and more sensitive to stock market innovations. The significant positive spillover from the stock and bond markets to gold returns during bearish market conditions indicates that the tail risk of stock and bond markets positively impacts the gold returns. Our findings regarding the safe haven property of gold in relation to stock markets are similar to those of Baur and Lucey (2010) and Baur and McDermott (2010). When both gold and stock/bond markets are under stress, a positive dependence indicates that both markets may co-crash. Bekiros et al. (2017) show that financialization of commodities results in accessibility for gold trading and creates a close connection between stock and gold markets. Although the ability of gold does not hedge stock markets’ tail risk during bearish market conditions, gold might still serve its traditional role as a diversifier during normal times. We also find that gold might better protect the losses in bond markets and that underestimating diversification potential of gold for bond investments may lead to lower diversification benefits. Finally, considerable variations in the tail dependence structure of the investable assets’ distributions require investors’ attention when making portfolio and risk management decisions.

The remainder of this paper is organized as follows. Section “Related Literature” provides a brief overview of the existing relevant literature. Section “Methodology” explains the methodology employed to draw the empirical results. Section “Data and Preliminary Analysis” justifies the datasets used, and section “Empirical Results” discusses the empirical results and final section concludes the paper.

Related Literature

In recent financial literature (Reboredo 2013a, b; Gürgün and Ünalmış 2014; Beckmann et al. 2015; Bekiros et al. 2015; Bredin et al. 2015; Bekiros et al. 2017), a stream of research emerges focusing on the hedge and safe haven properties of gold for portfolio diversification during market downturns. In general, metal commodities with ‘safe haven’ properties are shown to negatively correlate, or not correlate, with other asset classes regularly considered in portfolios of financial securities, thus maintaining or increasing in value under certain market circumstances (Baur and Lucey 2010; Baur and McDermott 2010).Footnote 2 A ‘safe haven’ asset, more specifically, helps alleviate the effects of market innovations on the primary asset class held by a fund manager, and lowers the risk of a diversified portfolio under periods of uncertainty and financial turmoil.Footnote 3 The most sought-after less risky assets, such as gold, would, in general, exhibit a positive correlation with other assets in bullish markets and a negative correlation in bearish markets. This is to say that a ‘safe’ asset is safe at all times, while a ‘safe haven’ asset is only safe in market downturns (Flavin et al. 2014).

Because the aim of the present study is to explore the safe haven status of gold for G-7 countries’ stock and bonds, we review and summarize the previous literature examining the role of gold as a safe haven investment in Table 1.

While summing up the debate, it is noted that the precious metals remain a valuable option during highly volatile market scenarios, with investors rebalancing their portfolios and flying to safety through the inclusion of negatively correlated or low positively correlated less risky assets, such as gold (Low et al. 2016; Nguyen et al. 2016; Iqbal 2017). This defensive strategy of diversification is aimed at minimizing the risk of investment positions while additionally improving the risk-adjusted return during market downturns (Chkili 2016). Traditionally, gold is seen as a safe investment, as it serves as a means of hedging against large inflation shocks and financial uncertainty (Agyei-Ampomah et al. 2014). Earlier studies examining the correlation between gold and other asset classes demonstrate that gold is a zero beta asset and has a weak correlation with other assets, both in times of financial turbulence and in tranquil periods (Chua et al. 1990; Ciner 2001; Hillier et al. 2006; Jaffe 1989; Kaul and Sapp 2006; McCown and Zimmerman 2006; Michaud et al. 2006; Sherman 1986; Upper 2000). Bredin et al. (2015) document that gold acts as a safe haven for equity investors in the long run. Beckmann et al. (2015) show that the safe haven characteristic of gold is market-specific.

Gürgün and Ünalmış (2014) demonstrate that gold acts as a safe haven for both domestic and international investors in extreme market downturns. Ciner et al. (2013) argue that gold is a monetary asset and can be regarded as a safe haven against exchange rate fluctuations. The studies by Joy (2011) and Reboredo (2013a, b) find that gold is an effective safe haven against extreme USD rate movements, with portfolio risk managers and policymakers relying on gold to preserve or stabilize oil exporter purchasing power. Investors, in general, seek a safe haven in response to severe market shocks that occur over a short time period (Baur and McDermott 2010; Mensi et al. 2015, 2016). Baur and McDermott (2016) forecast gold prices by employing multiple domestic and international economic factors, such as oil shocks, inflation expectations, interest and exchange rate changes, and stock market volatility. The dynamic model averaging (DMA) technique they consider allows the forecasting model and coefficients to change over time. Their findings indicate that gold markets offer efficient information; however, they are difficult to forecast.

Bouri et al. (2017) and Raza et al. (2016) suggest that gold is a factor in analyzing stock returns and volatility when implementing co-integration models for stock returns from developed and emerging economies. Several studies investigate the hedging property of gold using different econometric techniques, such as quantile regression (Balcilar et al. 2017; Iqbal 2017; Shahzad et al. 2017). Their findings indicate that the hedging ability of gold is market-specific and time-specific. Chkili (2016) applies the asymmetric dynamic conditional correlation (ADCC) GARCH model and finds that adding gold to stock portfolios enhances their risk-adjusted returns. Basher and Sadorsky (2016) implement dynamic conditional correlation (DCC), asymmetric dynamic conditional correlation (ADCC), and generalized orthogonal (GO) GARCH models to determine the hedging effectiveness of gold, crude oil, bonds, and a volatility index (VIX) for emerging markets. Their findings reveal that gold and crude oil provide the most efficient hedging. Gold has gained creditability as a special financial asset that preserves portfolio value against extreme currency shocks and provides diversification benefits against currency swings, inflation shocks, and adverse stock movements (Aye et al. 2016; Arouri et al. 2015; Park and Shi 2016; Reboredo and Castro 2014; Wang and Lee 2016).

Methodology

The VAR for VaR Approach

The vector autoregressive (VAR) model for value-at-risk (VaR) is a quantile-based regression technique proposed by White et al. (2015) to study the interdependence between quantiles of random variables. The quantile of a random variable depends upon past innovations, lagged quantiles, and covariates. Several advantages distinguish the newly proposed method from the standard techniques. For instance, the quantile regression approach is highly robust to outliers, a desirable feature in financial modeling. This quantile regression is a semi-parametric approach and, as such, imposes minimal distributional assumptions on the data-generating process (DGP). In addition to that, the VAR for VaR framework allows for the determination of tail dependence between variables without relying on time-varying first-order and second-order moments (i.e. the mean and variance of the observations’ distribution). The effectiveness of the model was assessed by considering its setup for two random variables, \( X_{1t} \;{\text{and}}\; X_{2t} , \) for a given confidence level \( \alpha \in (0,1) \). All the information available at time t is given by \( F_{t - 1} \), which represents all past information. The quantile \( q_{it} \) at time t for a random variable \( X_{it} \) such that i = 1, 2, conditional on \( F_{t - 1,} \) is as follows:

The conditional quantiles of two random variables related to a VAR specification can be written as:

the bivariate-derived quantile can be written in matrix form as follows:

In the methodology’s “Appendix”, we provide further details on the analytics of this methodology.

The Pseudo Quantile Impulse Response Function

The one-off impulse function derived from the conditional quantile model is identified as the pseudo-impulse response function (White et al. 2015), which makes it possible to capture the impact of one-off intervention at time t on the particular quantile. The given pseudo quantile impulse response functions (QIRF) for \( Y_{it } \) is shown by

and can be written as:

and can be written as:

where \( \tilde{q}_{i,t + s} \) is the \( \alpha \)th conditional quantile of the affected series

and \( q_{i;t + s} \) represents the \( \alpha \)th conditional quantile of the unaffected series Yit+s. More specifically, White et al. (2015) defines the QIRF as follows:

and \( q_{i;t + s} \) represents the \( \alpha \)th conditional quantile of the unaffected series Yit+s. More specifically, White et al. (2015) defines the QIRF as follows:

The generalization of the QIRF follows:

In this study, the conditional VaR (CoVaR) is the VaR of gold returns conditional on stock (bond) returns falling below its \( \alpha \)th quantile, which is represented as \( q_{i}^{\alpha } \). It can be written as follows: \( Pr\left( {Y_{j} < CoVaR_{\alpha }^{\left| j \right.\left| i \right.} \left| {Y_{i} } \right. < q_{i}^{\alpha } } \right) = \alpha . \)

Directional Spillover Through Cross-Quantilogram

In order to measure the directional spillover influence of the stationary time series at different quantiles, Linton and Whang (2007) propose the univariate-quantilogram, which was later extended to the bivariate cross-quantilogram (CQ) by Han et al. (2016). The advanced CQ technique offers more flexibility in estimating the lead-lag relationship between time series at different lags and quantiles, simultaneously. The two stationary time series can be defined as \( \{ x_{i,t} , t \in Z\} \) for i = 1, 2. In the present study, \( x_{1,t} \) and \( x_{2,t} \) represent the stock (or bond) and gold returns, respectively. The density and distribution functions of series \( x_{i,t} \) are given by \( f_{i} ( \cdot ) \) and \( F_{i} ( \cdot ), \) respectively. The quantile of \( x_{i,t} \) is represented as \( q_{i} ( \propto_{i} ) = inf\{ v:F_{i} (v) \ge \alpha_{i} \} \) for \( \alpha_{i} \in (0,1) \), and the expression of two-dimensional series of quantiles are represented by \( (q_{1} ( \propto_{1} )q_{2} ( \propto_{2} ))^{\tau } \), for α ≡ \( ( \propto_{1} , \propto_{2} )^{\tau } \).

The cross-quantilogram for the α-quantile with k lags can be written as:

For k = 0, ± 1, ± 2, … where \( \varPsi_{a} (\mu ) \) ≡ 1 \( [\mu < 0] - a \), 1 \( [ \cdot ] \) denotes the indicator function, and 1 \( [x_{i,t} \le q_{i} (\alpha_{i} )] \) is called quantile hit, or quantile exceedance process. At different quantiles, the serial dependence between two time series is captured through Eq. (9). In the present framework, to measure the safe haven properties of gold, we measure the cross-correlation between stock returns (or volatility) and gold by \( \rho_{\alpha } (k) \) below or above a quantile \( q_{ret} (\alpha_{ret} ) \) or \( q_{vol} (\alpha_{vol} ) \) at time t, vis-à-vis gold being above or below the quantile \( q_{gold} (\alpha_{gold} ) \) at time t − 1. When \( \rho_{\alpha } (1) = 0 \), it indicates that gold returns are below or above a quantile \( q_{gold} (\alpha_{gold} ) \) at time t, but this, on average, does not provide useful information when explaining whether the stock returns (or volatility) will be lower or higher than the quantile \( q_{ret} (\alpha_{ret} ) \) in the next trading month. When \( \rho_{\alpha } (k) \ne 0 \), this indicates that a strong directional spillover influence generated through stock returns (or volatility) for gold at \( \alpha \) = \( \alpha_{ret} (\alpha_{bs} ) \) or \( \alpha_{vol} (\alpha_{gold} ) \) exists. The statistical tests are given by the null hypothesis \( H_{0} : \rho_{\tau } (k) \) = 0 for all \( k \in \, 1, \, \ldots ,{\text{ p}} \), against the alternative hypothesis \( H_{1} : \rho_{\alpha } (k) \ne 0 \). The null hypothesis indicates that there is no spillover effect transmission or reception between security markets (stock and bond) and gold, while the alternative hypothesis denies the absence of any type of directional influence and spillovers.

The cross-quantilogram of the sample counterparts can be estimated as follows:

where \( \hat{q}_{\text{i}} (\alpha_{\text{i}} ) \) indicates the unconditional sample quantile of \( x_{{{\text{i}},t}} , \) as proposed by Han et al. (2016). In “Appendix”, we provide further details on the analytics of this methodology.

Data and Preliminary Analysis

The dataset consists of daily observations of stock and bond (10-year) market indices from the G-7 countries (Canada, France, Germany, Italy, Japan, the UK, and the USA), and daily international gold prices denominated in local currencies.Footnote 4 The stock and bond price series for Canada, France, Germany, Japan, UK, and the USA span from January 1989 to December 31, 2015, while those for Italy begin in April 1998 and end on December 31, 2015. The two most important events within the investigated period are the Eurozone debt crisis and the financial crisis of 2008-09. Our motivation for the selection of index data—as opposed to using company-specific data from the G7 countries’ stock markets—is that this specific data type is a representation of aggregate values from an entire country’s stock or bond market sectors and better reflects the price effect those markets may have on the international price of gold.

Additionally, the impact of G7 markets’ stock and bond returns on the gold returns may differ, as the size and total capitalization of markets varies. All prices are denominated in local currencies and all stock and bond indices have been obtained from DataStream International. The gold prices series are sourced from the World Gold Council. In implementing the aforementioned models, we transform each of the stock, bond, and gold price series into natural logarithmic returns.

The descriptive statistics and unit root test results of the stock and bond returns, as well as their correlation matrix vs. gold are presented in Table 2. Panel A shows that the German and US stock markets have the highest historical mean returns, as compared to the stock and bond markets of other G-7 countries. It is also observed that the stock and gold returns have higher standard deviations compared to the bond markets returns. The Italian stock market is the most volatile (1.54), while the Japanese bond market appears to be the most stable (0.28). The Jarque–Bera test statistics are significant at the 1% level for all returns series, supporting the hypothesis of non-normality. The Augmented Dickey Fuller (ADF) test statistic is also significant at the 1% level for each series, meaning that the null hypothesis of a unit root for all return series is rejected; thus, the returns series are deemed suitable for regression analysis. Further, the pairwise unconditional correlation between the gold-stock and gold-bond pairs indicates that gold returns have a significant positive correlation with the stock markets of France and Japan and a negative correlation with the stock markets of Germany, the UK, the USA, and Italy. However, the pairwise unconditional correlation between gold and the stock market of Canada is not statistically significant. With the exception of the Italian bond market, which correlates negatively with gold, all other G7 countries bond markets have a significant positive correlation with gold.

The time trends of the time series in log form, for better comparisons, are shown in Fig. 2a–c. The G-7 stock markets exhibit similar trends over the period of analysis. Interestingly, all stock markets display an increasing trend until the end of 2002, while a downward trend pattern is observed in 2003. All stock markets confirm a steady growth in the pre-global financial crisis period and suffer a sharp fall during and after the global financial crisis. Finally, all markets experience an upward trend, followed by a downward phase. Panel B shows the time trends of bond indices and shows a continuous and steady upward trend over the entire period. On the contrary, gold prices exhibit several ups and downs over the sample period. More interestingly, gold prices show a sharp increase during the global financial crisis and reach their highest during the recent Eurozone debt crisis.

Empirical Results

VAR for VaR Estimation

In this section, we discuss the bivariate VAR for VaR estimatesFootnote 5 and their standard errors reported in Table 3. The impact of the conditional quantiles of G-7 countries’ stock and bond returns on the quantiles of gold returns and vice versa are displayed in Panels A and B, respectively. The diagonal autoregressive coefficients for the B matrices (b11, b22) are close to unity for both security markets. Their values lie between 0.88 and 0.96, and all of them are statistically significant, indicating that the VAR processes are significantly auto-correlated, supporting what is typically found in the literature (White et al. 2015).Footnote 6 The off-diagonal matrix coefficients (\( b_{12} \), \( b_{21} \)) measure the tail dependence, hence if significantly different from zero, this will imply that the null hypothesis of no co-dependence can be rejected. For the cases of Canada, Japan, and Italy, these coefficients are insignificant (for usual levels of significance). For France, Germany, the UK, and the USA, these coefficients are significant, and negative for the gold-stock pairs. The b21 coefficients reflect the impact of stock quantiles on the quantiles of gold returns. For the gold-bond pairs, the \( b_{21} \) coefficient is negative and significant only for France.

All in all, the results show a significant and positive tail-dependence between gold returns and the returns of stocks from the G-7 countries. The gold market is mainly isolated from the bond markets during extreme bearish market states.

Next, the impulse response functions (IRFs) are drawn from the estimated bivariate VAR for VaR, along with the respective 95% confidence intervals. Figure 3 displays the IRFs of gold quantiles to a two standard deviation shock of stock and bond quantiles. The identification of a shock relies on Choleski decomposition and assumes that shocks to stock/bond markets can simultaneously affect the gold quantiles. The horizontal axis shows the time in days and the vertical axis depicts the change in VaR of gold. The change in VaR of gold to a two standard deviation shock of stock (bond) returns is shown through black (gray) lines. The pseudo impulse response functions are used to track how long it takes for gold to absorb those shocks. A shock is completely re-absorbed when the pseudo impulse response function converges to zero over time.

Quantile impulse responses of gold returns to two standard deviation shock in stock/bond returns. Notes: these figures show the quantile (5% level) impulse-response functions to two standard deviation shock of the stock/bond markets along with respective 95% confidence intervals. The impulse responses are drawn from a bivariate VAR for VaR. The identification of a shock relies on a Choleski decomposition and assumes that shocks to stock/bond markets can simultaneously affect the gold and stock/bond markets

A look at the pseudo IRFs reveals how the VaR of gold reacts to shocks in the stock and bond returns of the G7 markets. For instance, gold has little or no tail dependence with the bond markets of Canada, Germany, Japan, and the UK. This finding indicates the probable safe haven potential of the gold markets for the bond markets of these countries. However, the VaR of gold significantly increases in response to the stock market tail shocks, and these shocks are quickly transmitted, i.e. approximately within 2 weeks (16 days in almost all cases). More specifically, a two standard deviation shock to the stock markets of France, Germany, UK, USA and Italy produce an initial increase in the daily VaR of the gold of about 0.2%. The increase in the daily VaR is relatively lower in Canada and Japan, about 0.1% and 0.05% respectively. These findings indicate that gold may not act as a safe haven for the stock markets of G-7 countries.

Cross-Quantile Correlation

Next, we examine the directional spillover from different quantiles of stock and bond returns to different quantiles of gold using the CQ approach. We present the outcome of the CQ approachFootnote 7 in the shape of heatmap plots in Fig. 4. In each of those plots, the x-axis corresponds to stock/bond quantiles while the y-axis corresponds to the quantile of gold returns. The quantile-based dependence can be easily observed as we only show the significant quantiles through the color map (shown at the end of the figure).

Cross-correlation heatmaps between stock/bond returns and gold returns—full sample. Notes: these figures show the cross-correlations between stock/bond returns and gold returns in the shape of heatmaps. The quantile results with no directional predictability are indicated with a zero value. The x-axis corresponds to the quantile of the stock/bond returns and the y-axis to the quantile of gold returns. The quantile-levels where the Box–Ljung tests are statistically significant are shown through colored rectangles, and the color code is shown at the end of these figures, where the blue (red) color region indicates negative (positive) predictability of gold returns through stock/bond returns (color figure online)

The lowest quantiles of stock returns (0.05–0.25) positively and significantly impact the lowest quantiles of gold returns (0.05–0.25) in all cases. Implying that when both the markets are in a bearish state, extreme negative stock returns will be followed by negative gold returns, and consequently, gold is not a safe haven. From the bond markets, the positive and significant cases of spillover from the lowest quantiles (0.05–0.25) of bond returns to the lowest quantiles of gold returns (0.05–0.25) are relatively lower. Due to lack of significant negative correlation between the bearish states of both markets, we can conclude that gold is not a safe haven for the stock and bond markets of the G7 economies and that gold can, at best, be regarded as a hedge and/or a diversifier for the stock and bond markets.

The economic and financial landscape has substantially changed in the last two decades, especially after the global financial crisis, due to the financialization of the commodities markets, which may have led to stronger linkages between the financial markets. This can result in a shift in the cross-correlations among different asset classes, especially the tail dependence of gold and other financial assets.Footnote 8 To capture the variations in the tail dependence between gold and stock/bond returns over time, we use a recursive sampling approach by selecting an initial estimation sub-sample of 500 days, and the window length increases by 22 days (approx. 1 month) for every step, the process continues until the end of the sample period is reached.

The cross-quantile correlation between gold and stock/bond returns are estimated for each of the recursive samples. As a matter of interest, we only consider the 5% quantile for both time series, indicating a bearish state in the considered markets. Because the recursive estimates advance by approximately 1 month, we obtain monthly measures of cross-quantile correlation between the two time series, which are plotted in Fig. 5. The figures show a time-varying tail dependence pattern between the gold and stock/bond returns. In these figures, the vertical (horizontal) axis presents the quantilogram correlation (time span of the recursive window). These figures indicate two general findings. First, there is a shift in tail dependence pattern over time, and second, the lower tail dependence of gold returns with stocks and bonds is generally zero or positive. Overall, our static and dynamic analysis of dependence between the lower tails of stock/bonds and gold returns provide no evidence in support of safe haven property of gold for G-7 markets.

Recursive directional predictability (quantile level = 5%) from stock/bond returns to gold returns. Notes: the vertical (horizontal) axis represents the quantile hits for the gold returns (time) for the 5% quantiles of both gold and stock/bond returns. The recursive sampling (first window of 500 days) and the window length increases by 1 month (approximately 22 days) for every step, until the end of sample period is reached

Conclusion

History has shown that financial uncertainty and market downturns are principal drivers of gold price appreciation, while periods of stock market tranquility and economic booms tend to cause its depreciation. This controversial behavior has intrigued academics, portfolio risk managers, and ordinary investor, not only because of the economic counter-balancing effect that gold price appreciation has on gold-producing countries (e.g. China, Australia, Russia, the USA, Canada, and South Africa) during times of financial turbulence, but also because of the hedging and safe haven properties of gold in stressed market scenarios (Reboredo 2013a, b; Gürgün and Ünalmış 2014; Beckmann et al. 2015; Bekiros et al. 2015, 2017; Bredin et al. 2015).

The present work re-examines the safe haven property of gold for stock and bond markets of G-7 countries. Comparative advantages of our modelling framework and research design, relative to those previously considered, are that (a) we focus on the lowest tails of both hedged and hedging assets when conducting our analysis; (b) we consider bond and stock markets from the seven largest advanced economies of the world. The empirical results show that the gold does not act as a safe haven for the stock and bond markets of G-7 countries. The gold market is less sensitive to bond market innovations and more sensitive to stock market innovations. The lower tail dependence of gold with stock and bond markets is generally positive. The flight to safety phenomenon, in accordance with conventional wisdom, suggests that common macroeconomic conditions, such as expected inflation or economic prospects, drive the investable assets universe.

Notes

For example, when the ramification effects of the economic boom or recession start to speed up in a way that preoccupies central bankers and finance ministers.

Gorton et al. (2012) distinguish the concept of ‘safe’ asset from ‘safe haven’ asset by referring to the former as an asset whose value is insensitive to information. For instance, highly rated government bonds and treasuries are insensitive to information and immune to adverse selection in trading, making them reliable investment vehicles in periods of high volatility (Dang et al., 2012; Gorton and Pennacchi, 1990).

According to modern portfolio theory, an investor can improve risk-adjusted returns by holding a well-diversified asset portfolio (Zhang et al., 2017). Moreover, the increasing globalization and integration of financial security markets and market sectors of economies has motivated investors and financial analysts to pay greater attention to commodities (e.g., precious metals and energy) given their weak correlation with other asset classes (e.g. stocks and bonds) and their risk and returns drivers being different from those of stock and bond returns.

We also considered the gold prices denominated in US dollar terms, and the overall conclusions are same. Those results are available from the authors on request.

We also estimate the multivariate VAR model using gold, stocks, and bonds together, and the resulting quantile impulse responses of gold returns to stock and bond returns are shown in “Appendix” Fig. 6. The results are quantitatively the same, and thus the estimates are not reported here for brevity. We are thankful to the anonymous referee for highlighting this point.

For the bi-variate VAR for VaR analysis, the Matlab codes are available at www.simonemanganelli.org.

The R software was used for the CQ analysis and the codes to implement CQ analysis are freely available at https://sites.google.com/site/whangyjhomepage/research/software.

Shahzad et al. (2017) argue that structural breaks in the co-movement between two time-series can result in parameter instability and a change in the direction of cross-dependence between the variables.

References

Agyei-Ampomah, S., D. Gounopoulos, and K. Mazouz. 2014. Does gold offer a better protection against losses in sovereign debt bonds than other metals? Journal of Banking and Finance 40: 507–521.

Arreola-Hernandez, J., S. Hammoudeh, D.K. Nguyen, M.A. Al Janabi, and J.C. Reboredo. 2016. Global financial crisis and dependence risk analysis of sector portfolios: a vine copula approach. Applied Economics 49: 1–19.

Arouri, M.E.H., A. Lahiani, and D.K. Nguyen. 2015. World gold prices and stock returns in China: insights for hedging and diversification strategies. Economic Modelling 44: 273–282.

Aye, G.C., T. Chang, and R. Gupta. 2016. Is gold an inflation-hedge? Evidence from an interrupted Markov-switching cointegration model. Resources Policy 48: 77–84.

Balcilar, M., M. Bonato, R. Demirer, and R. Gupta. 2017. The effect of investor sentiment on gold market return dynamics: evidence from a nonparametric causality-in-quantiles approach. Resources Policy 51: 77–84.

Basher, S.A., and P. Sadorsky. 2016. Hedging emerging market stock prices with oil, gold, VIX, and bonds: a comparison between DCC, ADCC and GO-GARCH. Energy Economics 54: 235–247.

Baur, D.G., and B.M. Lucey. 2010. Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financial Review 45 (2): 217–229.

Baur, D.G., and T.K. McDermott. 2010. Is gold a safe haven? International evidence. Journal of Banking and Finance 34 (8): 1886–1898.

Baur, Dirk G., & Glover, Kristoffer J. (2012). The destruction of a safe haven asset? SSRN. Electronic Journal, http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2142283.

Baur, D.G., and T.K. McDermott. 2016. Why is gold a safe haven? Journal of Behavioral and Experimental Finance 10: 63–71.

Beckmann, J., T. Berger, and R. Czudaj. 2015. Does gold act as a hedge or a safe haven for stocks? A smooth transition approach. Economic Modelling 48: 16–24.

Bekiros, S., S. Boubaker, D.K. Nguyen, and G.S. Uddin. 2017. Black swan events and safe havens: the role of gold in globally integrated emerging markets. Journal of International Money and Finance 73: 317–334.

Bekiros, S., J. Arreola-Hernandez, S. Hammoudeh, and D. Khuong-Nguyen. 2015. Multivariate dependence risk and portfolio optimization: an application to mining stock portfolios. Resources Policy 46: 1–11.

Bouri, E., A. Jain, P.C. Biswal, and D. Roubaud. 2017. Cointegration and nonlinear causality amongst gold, oil, and the Indian stock market: evidence from implied volatility indices. Resources Policy 52: 201–206.

Bredin, D., T. Conlon, and V. Potì. 2015. Does gold glitter in the long-run? Gold as a hedge and safe haven across time and investment horizon. International Review of Financial Analysis 41: 320–328.

Choudhry, T., S.S. Hassan, and S. Shabi. 2015. Relationship between gold and stock markets during the global financial crisis: evidence from nonlinear causality tests. International Review of Financial Analysis 41: 247–256.

Chkili, W. 2016. Dynamic correlations and hedging effectiveness between gold and stock markets: evidence for BRICS countries. Research in International Business and Finance 38: 22–34.

Chkili, W. 2017. Is gold a hedge or safe haven for Islamic stock market movements? A Markov switching approach. Journal of Multinational Financial Management 42: 152–163.

Chua, J.H., G. Sick, and R.S. Woodward. 1990. Diversifying with gold stocks. Financial Analysts Journal 46 (4): 76–79.

Ciner, C. 2001. On the long run relationship between gold and silver prices A note. Global Finance Journal 12 (2): 299–303.

Ciner, C., C. Gurdgiev, and B.M. Lucey. 2013. Hedges and safe havens: An examination of stocks, bonds, gold, oil and exchange rates. International Review of Financial Analysis 29: 202–211.

Cohen, G., and M. Qadan. 2010. Is gold still a shelter to fear. American Journal of Social and Management Sciences 1 (1): 39–43.

Dang, T. V., Gorton, G., & Holmström, B. 2012. Ignorance, debt and financial crises. Working paper, Yale University and Massachusetts Institute of Technology.

Flavin, T.J., C.E. Morley, and E. Panopoulou. 2014. Identifying safe haven assets for equity investors through an analysis of the stability of shock transmission. Journal of International Financial Markets, Institutions and Money 33: 137–154.

Ghazali, M.F., H.H. Lean, and Z. Bahari. 2015. Sharia compliant gold investment in Malaysia: hedge or safe haven? Pacific-Basin Finance Journal 34: 192–204.

Gorton, G., and G. Pennacchi. 1990. Financial intermediaries and liquidity creation. The Journal of Finance 45 (1): 49–71.

Gorton, G., and K.G. Rouwenhorst. 2006. Facts and Fantasies about Commodity Futures (Digest Summary). Financial Analysts Journal 62 (2): 47–68.

Gorton, G., S. Lewellen, and A. Metrick. 2012. The safe-asset share. The American Economic Review 102 (3): 101–106.

Gürgün, G., and İ. Ünalmış. 2014. Is gold a safe haven against equity market investment in emerging and developing countries? Finance Research Letters 11 (4): 341–348.

Han, H., O. Linton, T. Oka, and Y.J. Whang. 2016. The cross-quantilogram: measuring quantile dependence and testing directional predictability between time series. Journal of Econometrics 193 (1): 251–270.

Hillier, D., P. Draper, and R. Faff. 2006. Do precious metals shine? An investment perspective. Financial Analysts Journal 62: 98–106.

Hood, M., and F. Malik. 2013. Is gold the best hedge and a safe haven under changing stock market volatility? Review of Financial Economics 22 (2): 47–52.

Ibrahim, M.H. 2012. Financial market risk and gold investment in an emerging market: the case of Malaysia. International Journal of Islamic and Middle Eastern Finance and Management 5 (1): 25–34.

Ivanov, S.I. 2013. The influence of ETFs on the price discovery of gold, silver and oil. Journal of Economics and Finance 37 (3): 453–462.

Iqbal, J. 2017. Does gold hedge stock market, inflation and exchange rate risks? An econometric investigation. International Review of Economics and Finance 48: 1–17.

Jaffe, J.F. 1989. Gold and gold stocks as investments for institutional portfolios. Financial Analysts Journal 45: 53–59.

Joy, M. 2011. Gold and the US dollar: hedge or haven? Finance Research Letters 8 (3): 120–131.

Kaul, A., and S. Sapp. 2006. Y2K fears and safe haven trading of the US dollar. Journal of International Money and Finance 25 (5): 760–779.

Linton, O., and Y.J. Whang. 2007. The quantilogram: with an application to evaluating directional predictability. Journal of Econometrics 141 (1): 250–282.

Low, R.K.Y., Y. Yao, and R. Faff. 2016. Diamonds vs. precious metals: what shines brightest in your investment portfolio? International Review of Financial Analysis 43: 1–14.

Lucey, B.M., and S. Li. 2015. What precious metals act as safe havens, and when? Some US evidence. Applied Economics Letters 22 (1): 35–45.

McCown, J. R., & Zimmerman, J. R. (2006). Is gold a zero-beta asset? Analysis of the investment potential of precious metals. http://ssrn.com/abstract=920496.

Mensi, W., S. Hammoudeh, and A.K. Tiwari. 2016. New evidence on hedges and safe havens for Gulf stock markets using the wavelet-based quantile. Emerging Markets Review 28: 155–183.

Mensi, W., S. Hammoudeh, J.C. Reboredo, and D.K. Nguyen. 2015. Are Sharia stocks, gold and US Treasury hedges and/or safe havens for the oil-based GCC markets? Emerging Markets Review 24: 101–121.

Michaud, R., Michaud, R., & Pulvermacher, K. (2006). Gold as a strategic asset. World Gold Council, London. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2402862.

Nguyen, C., M.I. Bhatti, M. Komorníková, and J. Komorník. 2016. Gold price and stock markets nexus under mixed-copulas. Economic Modelling 58: 283–292.

Park, J. S., & Shi, Y. (2016). Hedging and speculative pressures and the transition of the spot-futures relationship in energy and metal markets. International Review of Financial Analysis (Article in press—http://www.sciencedirect.com/science/article/pii/S1057521916301867).

Politis, D.N., and J.P. Romano. 1994. The stationary bootstrap. Journal of the American Statistical Association 89 (428): 1303–1313.

Raza, N., S.J.H. Shahzad, A.K. Tiwari, and M. Shahbaz. 2016. Asymmetric impact of gold, oil prices and their volatilities on stock prices of emerging markets. Resources Policy 49: 290–301.

Reboredo, J.C. 2013a. Is gold a safe haven or a hedge for the US dollar? Implications for risk management. Journal of Banking and Finance 37 (8): 2665–2676.

Reboredo, J.C. 2013b. Is gold a hedge or safe haven against oil price movements? Resources Policy 38 (2): 130–137.

Reboredo, J.C., and M.A. Rivera-Castro. 2014. Gold and exchange rates: downside risk and hedging at different investment horizons. International Review of Economics and Finance 34: 267–279.

Sakemoto, R. 2018. Do precious and industrial metals act as hedges and safe havens for currency portfolios? Finance Research Letters 24: 256–262.

Selmi, R., W. Mensi, S. Hammoudeh, and J. Bouoiyour. 2018. Is Bitcoin a hedge, a safe haven or a diversifier for oil price movements? A comparison with gold. Energy Economics 74: 787–801.

Shahzad, S.J.H., N. Raza, M. Shahbaz, and A. Ali. 2017. Dependence of stock markets with gold and bonds under bullish and bearish market states. Resources Policy 52: 308–319.

Sherman, E.J. 1986. Gold investment: theory and application. Englewood Cliffs: Prentice Hall.

Śmiech, S., and M. Papież. 2017. In search of hedges and safe havens: revisiting the relations between gold and oil in the rolling regression framework. Finance Research Letters 20: 238–244.

Upper, C. (2000). How Safe was the ‘Safe Haven’? Financial Market Liquidity during the 1998 Turbulences. Working Paper No. 1/00 version 0.1, Deutsche Bundesbank.

Wang, K.M., and Y.M. Lee. 2016. Hedging exchange rate risk in the gold market: a panel data analysis. Journal of Multinational Financial Management 35: 1–23.

Wen, X., and H. Cheng. 2018. Which is the safe haven for emerging stock markets, gold or the US dollar? Emerging Markets Review 35: 69–90.

White, H., T.H. Kim, and S. Manganelli. 2015. VAR for VaR: measuring tail dependence using multivariate regression quantiles. Journal of Econometrics 187 (1): 169–188.

White, H., Kim, T. H., Manganelli, S., (2008). Modeling Autoregressive Conditional Skewness and Kurtosis with Multi-Quantile CAViaR (November 12, 2008). Working Paper No. 957, ECB. https://ssrn.com/abstract=1291165.

Zhang, J., Z. Jin, and Y. An. 2017. Dynamic portfolio optimization with ambiguity aversion. Journal of Banking and Finance 79: 95–109.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

The VAR for VaR approach

The generalization of the VAR for VaR model of White et al. (2015) is formulated considering the following assumptions: the order of the quantile indices is \( 0 < \alpha_{i1} < \cdots < \alpha_{ip} < 1 . \) For \( j = 1, \ldots ,p \), the \( \alpha_{ij} \)th quantile of \( X_{it} , \) conditional on \( F_{t - 1} \), and denoted as \( q_{i,j,t}^{*} \), is defined as \( q_{i,j,t}^{*} = inf \) {y:\( F_{it} \) (y) ≥ \( \alpha_{ij} \)}. Therefore, if \( F_{it} \) is increasing, \( q_{i,j,t}^{*} = F_{it}^{ - 1} \left( {\alpha_{ij} } \right) \). Alternatively \( q_{i,j,t}^{*} \) can be expressed as:

where \( dF_{it} ( \cdot ) \) is the Lebesgue–Stieltjes probability density function (PDF) of \( X_{it} \), conditional on \( F_{t - 1} \). Let the stationary ergodic sequence of random \( {\text{k}} \times 1 \) vectors \( [\psi_{t} ] \) and real vectors \( \beta_{ij}^{*} \) = \( (\beta_{i,j,1}^{*} \),…,\( \beta_{i,j,k}^{*} \)) and \( \gamma_{i,j,t}^{*} = (\gamma_{i,j,t,1}^{*} , \ldots ,\gamma_{i,j,t,n}^{*} ); \) then for each vector \( \gamma_{i,j,t,k}^{*} \), there is a p× 1 vector such that, for i = 1,…,n and j = 1,…,p, and all t:

The structure of the above equation is derived from the multi-quantile version of the conditional autoregressive value-at-risk (MQ-CAViaR) of White et al. (2008). In line with White et al. (2015), the bivariate generating process for the pair of variables \( Y_{t} = \{ Y_{1t} ,Y_{2t} \} \) is specified as

where \( \alpha_{t} ,\beta_{t} , \) and \( \gamma_{t} \) are Ft measurable, while all \( \epsilon_{t} \) elements follow a standard normal distribution and are independent and identically distributed (iid). The standard deviations of \( Y_{1t} ,Y_{2t} \) are obtained by \( \sigma_{1t} = \alpha_{t} \) and \( \sigma_{2t} = \sqrt {\beta_{t}^{2} } + \gamma_{t}^{2} \), respectively. The above-mentioned \( \alpha_{t} \),\( \beta_{t} \) and \( \gamma_{t} \) follow GARCH-type restrictions:

By substituting \( \sigma_{1t} \) = \( \varphi (\alpha )q_{it} \), from the above equation, the \( \alpha \)th quantile related to the DGP takes the following form, defined as the MVMQ-CAViaR (1,1):

From the above-mentioned equations, we have that \( c_{i} (\alpha ) \) = \( \overline{{c_{i} }} \varphi^{ - 1} (\alpha ) \),

and

and

hence, the bivariate derived quantile in matrix form that results is equal to Eq. (4) from subsection The VAR for VaR Approach or \( q_{t} = c + A\left| {Y_{t - 1} } \right| + Bq_{t - 1} \) (Fig. 6).

hence, the bivariate derived quantile in matrix form that results is equal to Eq. (4) from subsection The VAR for VaR Approach or \( q_{t} = c + A\left| {Y_{t - 1} } \right| + Bq_{t - 1} \) (Fig. 6).

Quantile impulse responses of gold returns to two standard deviation shock in stock/bond returns—multivariate VAR analysis. Notes: these figures show the quantile (5% level) impulse-response functions to two standard deviation shock to the stock/bond market along with respective 95% confidence intervals. The impulse responses are drawn from a multivariate VAR for VaR. The identification of a shock relies on a Choleski decomposition and assumes that shocks to stock and bond markets can simultaneously affect the gold market as well as stock and bond markets

Directional Spillover Through Cross-Quantilogram

The quantile version of the Ljung–Box–Pierce statistic used to test for Eq. (10) in subsection “Directional Spillover Through Cross-Quantilogram” is defined as \( H_{0} : \rho_{\alpha } (k) \) = 0 for all \( {\text{k }} \in { 1}, \, \ldots ,{\text{ p}} \), against the alternative hypothesis of \( H_{1} : \rho_{\alpha } (k) \ne 0 \) for \( {\text{k }} \in { 1}, \, \ldots ,{\text{ p}} \), under the following statistic:

The asymptotic distribution of CQ contains ‘noise’ under the null hypothesis of no directional spillover influence. Han et al. (2016) use the stationary bootstrap (SB) of Politis and Romano (1994) to approximate the null distribution and to conduct the inference.

This procedure is based on a portmanteau test \( \hat{Q}_{\alpha }^{(p)} \) for directional predictability from one time series to the other for up to p lags over the quantile pair \( \alpha = (\alpha_{1} ,\alpha_{2} ) \). Unlike the usual bootstraps, this test is a block bootstrap procedure that permits handling inherent serial dependence in the data by allowing random block lengths. Suppose that \( B_{{{\text{Ki}}, {\text{Li}}}} = \{ (x_{1,t} x_{2,t - k} )\}_{{t = k_{i} }}^{{L_{i} - 1}} \) is the i-th block with length Li starting from Ki; then, Li indicates an independent and identically distributed variable with Pr (Li = s) = \( \gamma (1 - \gamma )^{s - 1} \), and s = 1, 2,… for \( \gamma \in \) (0, 1). Finally, in this framework, Ki is an iid sequence drawn from a uniform distribution \( \{ 1,2, \ldots T\} . \) We replace the pair \( (x_{1,t} x_{2,t - k} ) \) by \( (x_{1,j} x_{2,j - k} ) \) with j = k + (t mod (T − k)) because the upper limit \( B_{ki, Li} \) may exceed the sample size T, when t > T. Further, to obtain the bootstrapped confidence interval, we conduct pseudo re-sampling based on the sequence of blocks and employ the cross-quantilogram and its associated portmanteau.

Rights and permissions

About this article

Cite this article

Shahzad, S.J.H., Raza, N., Roubaud, D. et al. Gold as Safe Haven for G-7 Stocks and Bonds: A Revisit. J. Quant. Econ. 17, 885–912 (2019). https://doi.org/10.1007/s40953-019-00163-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40953-019-00163-1