Abstract

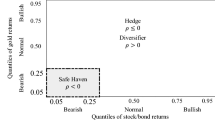

This study examines the effects of economic policy uncertainty (EPU) index shocks on stock-bond correlations in the case of Thailand. The method of research used applied the EPU index as a proxy for economic policy uncertainty in Thailand, and employed a dynamic copula method with the EPU index as an additional exogenous variable to create a conditional correlation. The data set used in this study is the monthly return of stock (SET) and bond (10-year government bond) data from June 2005 to June 2020. The empirical results show that the high EPU index affects the stock-bond correlations. Due to the high level of the EPU results, the investors have no confidence in the economy and paid attention to the economic policy uncertainty and tended to adjust the proportion of holdings in risky assets or stocks and safe-haven assets or bonds to be consistent.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Baker, S. R., Bloom, N., & Davis, S. J. (2016). Measuring economic policy uncertainty. The Quarterly Journal of Economics, 131(4), 1593–1636.

Antonakakis, N., Chatziantoniou, I., & Filis, G. (2013). Dynamic co-movements of stock market returns, implied volatility and policy uncertainty. Economics Letters, 120(1), 87–92.

Jones, P. M., & Olson, E. (2013). The time-varying correlation between uncertainty, output, and inflation: Evidence from a DCC-GARCH model. Economics Letters, 118(1), 33–37.

Peiser, W. (2000). Cohort replacement and the downward trend in newspaper readership. Newspaper Research Journal, 21(2), 11–23.

Luangaram, P., & Sethapramote, Y. (2018). Economic impacts of Political Uncertainty in Thailand (No. 86). Puey Ungphakorn Institute for Economic Research.

Punwong, S., Kaewsompong, N., & Tansuchat, R. (2021). Impact of economic policy uncertainty on the stock exchange of Thailand: Evidence from the industry-level stock returns in Thailand. In Behavioral predictive modeling in economics (pp. 393–406). Springer.

Castelnuovo, E., & Tran, T. D. (2017). Google it up! a google trends-based uncertainty index for the united states and Australia. Economics Letters, 161, 149–153.

Liemieux, J., & Peterson, R. (2011). Purchase decline as a moderator of the effects of price uncertainty on search behavior. Journal of Economic Psychology, 32, 33–44.

Sueppel, R. (20181). Understanding the correlation of equity and bond returns. Retrieved from https://www.sr-sv.com/understanding-equity-bond-return-correlation

Ilmanen, A. (2003). Stock-bond correlations. The Journal of Fixed Income, 13(2), 55–66.

Li, X. M., Zhang, B., & Gao, R. (2015). Economic policy uncertainty shocks and stock-bond correlations: Evidence from the US market. Economics Letters, 132, 91–96.

Siddiqui, D. A. (2019). Analyzing stock-bond correlation in emerging markets.

Asgharian, H., Christiansen, C., & Hou, A. J. (2016). Macro-finance determinants of the long-run stock-bond correlation: The DCC-MIDAS specification. Journal of Financial Econometries, 14(3), 617–642.

Chang, K. L. (2012). The time-varying and asymmetric dependence between crude oil spot and futures markets: Evidence from the Mixture copula-based ARJI-GARCH model. Economic Modelling, 29(6), 2298–2309.

Maneejuk, P., & Yamaka, W. (2019). Predicting contagion from the US financial crisis to international stock markets using dynamic copula with google trends. Mathematics, 7(11), 1032.

Tobback, E., Naudts, H., Daelemans, W., de Fortuny, E. J., & Martens, D. (2018). Belgian economic policy uncertainty index: Improvement through text mining. International Journal of Forecasting, 34(2), 355–365.

Brogaard, J., & Detzel, A. (2015). The asset-pricing implications of government economic policy uncertainty. Management Science, 61(1), 3–18.

Xiong, X., Bian, Y., & Shen, D. (2018). The time-varying correlation between policy uncertainty and stock returns: Evidence from China. Physica A: Statistical Mechanics and its Applications, 499, 413–419.

Balcilar, M., Gupta, R., Kim, W. J., & Kyei, C. (2019). The role of economic policy uncertainties in predicting stock returns and their volatility for Hong Kong, Malaysia and South Korea. International Review of Economics and Finance, 59, 150–163.

Bartsch, Z. (2019). Economic policy uncertainty and dollar-pound exchange rate return volatility. Journal of International Money and Finance, 98, 102067.

Patton, A. J. (2006). Estimation of multivariate models for time series of possibly different lengths. Journal of Applied Econometrics, 21(2), 147–173.

Glosten, L., Jagannathan, R., & Runkle, D. (1993). Relationship between the expected value and volatility of the nominal excess returns on stocks. Journal of Finance, 48, 1779–1802.

Joe, H. (1997). Multivariate models and multivariate dependence concepts. CRC Press.

Joe, H., & Xu, J. J. (1996). The estimation method of inference functions for margins for multivariate models.

Sklar, M. (1959). Fonctions de repartition an dimensions et leurs marges. Publ. inst. statist. univ. Paris, 8, 229–231.

Lin, T. C. (2015). Reasonable investor(s). Boston University Law Review, 95(2), 461–518.

Fang, L., Yu, H., & Li, L. (2017). The effect of economic policy uncertainty on the long-term correlation between US stock and bond markets. Economic Modelling, 66, 139–145.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Kaewsompong, N., Chitkasame, T. (2022). Economic Policy Uncertainty and Stock-Bond Correlations: Evidence from the Thailand Market. In: Sriboonchitta, S., Kreinovich, V., Yamaka, W. (eds) Credible Asset Allocation, Optimal Transport Methods, and Related Topics. TES 2022. Studies in Systems, Decision and Control, vol 429. Springer, Cham. https://doi.org/10.1007/978-3-030-97273-8_24

Download citation

DOI: https://doi.org/10.1007/978-3-030-97273-8_24

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-97272-1

Online ISBN: 978-3-030-97273-8

eBook Packages: Intelligent Technologies and RoboticsIntelligent Technologies and Robotics (R0)