Abstract

This study explores the relationship between greenhouse gas (GHG) emissions, financial development and disaggregated energy consumption among the top 10 countries with the highest CO2 emissions (Canada, China, Germany, India, Iran, Japan, Korea Republic, Russia, UK and US). The study uses panel data for the period 1990–2014 within a multivariate framework. The econometric techniques of cross-sectional dependence unit root test, panel co-integration (Levine, Lin and Chun; Breitung; Im, Pesaran and Shin; Fisher-Augmented Dickey Fuller and Fisher-Phillips Perrron) tests, fully modified ordinary least squares (FMOLS) and Dumitrescu and Hurlin Granger causality tests are applied for the unit root test, co-integration, estimation of long-run coefficients as well as inference on the causal relationship respectively. Pesaran’s cross-sectional unit root test shows that variables are integrated of the first order. Pedroni’s heterogeneous panel co-integration tests reveal a long-run equilibrium relationship between the dependent and independent variables. The Granger-causality results indicate both short-run and long-run causality among renewable, fossil fuel energy and financial development and GHG emissions. The results’ findings have important policy implications for environmental quality, and thus, GHG emissions’ reduction using a higher percentage of energy from renewable energy. In addition, there is need for countries to increase financial support on renewable energy infrastructure construction as well as transformation of fossil fuel energy utilization.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Energy is a basic means of survival. The demand for energy and its allied services stem from meeting social and developmental needs, and this situation is growing. Expected economic growth is connected with the expanded application of energy, and it is anticipated that nations will continue to raise their demands for energy, especially for fossil fuels, over the coming years. But the world’s growing of energy consumption is also a big problem, because most of that energy comes from hydrocarbons (fossil fuels), which emit greenhouse gases and drive climate change.

There is concern that human activities are affecting the heat/energy-exchange balance between Earth, the atmosphere, and space, and inducing global climate change, often termed “global warming.” Human activities, particularly the burning of fossil fuels, have contributed to increased atmospheric carbon dioxide (CO2) and other trace greenhouse gases. If these gases continue to accumulate in the atmosphere at current rates, most scientists believe significant global warming would occur through intensification of Earth’s natural heat-trapping “greenhouse effect.” Possible impacts might be seen as both positive and negative, depending on regional or national variations (Maranga et al. 2010).

With increasing concern over the environmental challenges of GHGs, the participants to the UNFCCC (United Nations Framework Convention on Climate Change) have held several conferences since 1992 to determine what steps could be taken so as to regulate for the concerns of GHGs and hence climate change. The first notable result of the UNFCCC conference was the Kyoto Protocol, adopted in 1997, which elicited commitments from many advanced countries to limit their emission of GHGs. In the Kyoto Protocol agreement, advanced countries were tasked to limit their combined greenhouse gas emissions of 5.2% compared 1990 level. The regional block countries were given national targets: European Union was tasked to reduce emissions by 8% and some others. USA was tasked to reduce emissions by 7% while Japan was to reduce emissions by 6%. Australia was allowed to increased emissions by 8%. Iceland just like Australia was permitted to increase GHG emissions to 10% (UNFCCC 2015). Following the Kyoto Protocol is the Doha Agreement of 2012 and many countries joined the Paris COP (Conference of the Parties) to the UNFCCC in 2015, which was the twenty-first conference of the UNFCCC. The parties at the Paris Protocol agreed to work on the modalities of reducing climate change, the idea of which depicted a general agreement of the represented participants of the 196 parties that attended the conference. The key outcome was the establishment of the goal to reduce warming of the earth to less than 2 °C related to pre-industrial levels (UNFCCC 2015). Accomplishing this objective requires a drastic reduction in the amount of GHGs over the coming few decades.

Therefore, the success of reducing the world CO2 emissions heavily depends on two parts, the commitment of major emitters and the type and efficiency of energy use. The ten countries considered world leading economies and the largest CO2 emitters include: China, USA, UK, Canada, Germany, India, Iran, Japan Russia and Korea Republic. The total average GDP of the highest CO2 emitting countries is more than 75% of the global GDP since 1991, and the average GDP growth rate is 3.39% as compared to the world average GDP growth rate of 2.7%, during 1990–2014. The countries are also the largest energy consumers and emitters of CO2 worldwide. The average CO2 emissions of these countries are more than 75% of the global CO2 emissions during 1990–2014. The annual CO2 per capita emissions of these countries are 5.7 t CO2, which is nearly 1.5 times higher than the average global per capita emissions (Climate Change Performance Index 2016). Figure 1 displays the total CO2 emissions (in metric tons) of these countries.

The figure further shows that China surpasses USA in terms of total CO2 emissions from 2005. India and Russia are next in the list of the highest CO2 emitting countries. In 2014, the largest emitting countries, which together account for two-thirds of total global emissions, were: China (with a 29% share in the global total), the United States (14%), India (7%), the Russian Federation (5%) and Japan (3.5%). The 2014 changes within the group of ten highest emitters of CO2, together accounting for 75% of total global emissions, varied widely, but, overall, these countries saw a decrease of 0.5% in CO2 emissions in 2014 (Jos et al. 2016).

However, renewable energy sources have surfaced as a relevant component in the global energy consumption mix that could help in reducing GHG emissions due to its ability to emit less or no carbon. Given the outgrowth of renewable energy in the deliberations of a sustainable energy future, it is essential to understand the dynamic role of this clean energy alongside efficient fossil fuel energy consumption in carbon reduction and climate change mitigation strategies. These are the aspects this study seeks to address. Global primary energy consumption increased in 2014 by 1.0%, which was similar to 2013 but well below the 10-year average of 1.9%, even though fossil fuel prices fell in 2014 in all regions. In 2014, coal consumption decreased, globally, by 1.8%, while global oil and natural gas consumption increased by 1.9% and 1.7%, respectively. These shifts in fossil fuel consumption also affected the fuel mix. The largest decreases in coal consumption were seen in the United States and China, partly counterbalanced by increases in India and Indonesia. For oil consumption, the largest increases were in China, India and United States. The global increase in the use of natural gas was mainly due to increased consumption in the United States and the European Union, with smaller increases seen in Iran and China (Jos et al. 2016).

The production of nuclear energy increased by 1.3% and hydroelectricity by 1.0%; resulting in respective shares of 10.7% and 16.4% in total global power generation, and 4.4% and 6.8% in global primary energy consumption. In 2014, significant increases of 15.2% were observed in other renewable electricity sources, notably wind and solar energy. With double-digit growth for the 12th year in a row, these now provide almost 6.7% of global power generation, close to a doubling over the past 5 years (3.5% in 2010). Their share in 2014 increased to 2.8% of total global primary energy consumption, also doubling their share since 2010 (Jos et al. 2016). In fact, renewable technologies, such as wind and solar energy, geothermal have seen considerable progress, and these technologies could facilitate a zero-carbon energy future (Kebede et al. 2010; Daly and Farley 2011; Kamal 2013).

In addition to the renewable and non-renewable energy variable, another factor that has attracted the attention of researchers in the environment-growth-energy nexus is financial development. Evidence abounds that global economies have witnessed a tremendous rate of economic growth and a high level of financial development over the last 25 years (Ma and Jalil 2008; Jalil et al. 2010). However, this rapid growth in economic activity and financial sector development has been accompanied by environmental degradation. Despite its importance, the relationship between CO2 emission, financial development, energy consumption and economic growth has not received much attention in the case of highest leading CO2 emissions emitters. Although several studies such as Wang et al. (2014); Omri (2013); Cowan et al. (2014); Alkhanthan (2013); Shahbaz et al. (2013); Saboori and Sulaiman (2013); Mudakkar et al. (2013); Alizna et al. (2014); Sbia et al. (2014); Salahuddin and Gown (2014); Sebri and Ben-Salha (2014) have recently focused on the issue based on country specific and panel data at the provincial, regional and global level, such studies have ignored the importance of financial development. However, the role of financial development in the context of economic growth and its effect on the environment is quite important for several reasons: Jalil and Feridun (2011), for example, report that after controlling for per capita real income growth, financial development is negatively correlated with CO2 emissions in China’s case. This suggests that financial development has led to a reduction in environmental pollution. Frankel and Romer (1999) have pointed out that the financial development in a country may attract foreign direct investment (FDI) and higher degrees of research and development (R&D). This, in turn can, increase the level of economic growth, and hence, affect the dynamics of environmental performance. Similarly, Birdsall and Wheeler (1993) and Frankel and Rose (2002) have argued that the developing countries may have access, through financial development, to new, environmental-friendly technology.

The recent literature also documented evidence of the linkages between financial development and FDI inflows. For example Ang (2008) pointed out that financial deepening in Malaysia leads to higher FDI inflows. Similarly, it has been found that financial liberalization plays a positive role in innovative (R&D) activity in the case of Korea (Ang 2010) and India (Madsen et al. 2010). Furthermore, Tamazian and Rao (2010) document evidence that the increase in FDI inflows and R&D activities reduce environmental pollution. On the other hand, Jensen (1996) notes that financial development may lead to increased industrial activities, which, in turn, may lead to industrial pollution. It is against this backdrop that the present article investigates the relationship between financial development and renewable energy on environmental pollution among the ten leading CO2 emitting countries. Therefore, the current study looks at the role of financial development as another contributing factor, alongside renewable energy, in reducing emissions and mitigating climate change.

The new trend in the theory of energy and environmental economics is to decompose the impacts of renewable and non-renewable energy use patterns, not only as they pertain to economic growth but to greenhouse gases and climate change, which is the major issue this study seeks to address. The present study, as a contribution to the trend of the theoretical and empirical frameworks on energy-environment linkages, differs from the previous work in several respects. First, a number of the existing studies (Lean and Smyth 2010; Arouri et al. 2012; Farhani and Ben Rejeb 2012; Hamit-Haggar 2012; Al-Mulali and Sab 2012; Al-Mulali et al. 2013; Ozcan 2013; Xue et al. 2014; Kivyiro and Arminen 2014) focus on the use of aggregated energy consumption without considering the intermittent role of each type of energy consumption in reducing the incidence of CO2 emissions and climate change.

Second, the available literature has paid attention to panel analyses of several country groups such as the Middle East and North African (MENA) countries; Sub-Saharan African (SSA) countries; BRICS (Brazil, Russia, India, China, and South Africa); Portugal, Italy, Greece, Spain, and Turkey (PIGST); the European Union (EU); and the OECD (Organization for Economic Cooperation and Development). The countries that have been indexed as economies with the highest CO2 emissions have not been examined in the energy-growth-environment literature. Specifically, this study is the most all-encompassing study on disaggregated energy use, covering the leading ten economies globally with the highest CO2 emission. The ten countries’ episodes, as economies with the leading emitters of CO2, make them of particular interest.

Third, it is evident that quite a number of the studies that have investigated the environment-growth-energy-financial development theory used traditional panel estimation techniques, such as the Im-Pesaran-Shin and the Levin-Lin-Chu non-stationary tests, or the Johansen co-integration tests which do not account for the dependency of the units across the groups in the estimations. Ignoring the absence of independence across units and heterogeneity across the panel can cause the existence errors in forecasting and could lead to bias results. Therefore, the current study fills the literature gap by employing heterogeneous panel estimation techniques with cross-section dependence episodes, as economies with the leading emitters of CO2; make them of particular interest, such as by using cross sectional dependence unit root tests and fully modified ordinary least squares (FMOLS). The application of such methods minimizes the inherent problems in cross-sectional dependence and heterogeneity, providing consistent and robust empirical estimates.

Several basic policy questions remain. First, is fossil fuels energy consumption the principal cause of CO2 emissions and other traced GHGs? Second, assuming the unpredictability of the strength, timing, speed, and regional effects of possible climate change, what role does renewable energy play in reducing GHG emissions? Finally, what role does financial development exhibit in reducing GHG emissions? To help answer these questions, the study examine whether the process of burning fossil fuels energy is the principal cause of CO2 emissions and other traced GHGs that cause climate change. The study also assesses the role of renewable energy use in reducing GHG emissions. Lastly, the paper seeks to determine whether financial development plays a role in reducing the incidence of GHG emissions. Hence, this study aims to examine the effects of energy mix and financial development on GHG emissions reduction. Study uses annual data from 1990 to 2014 on the highest CO2 emitting countries and employed several robust panel econometric techniques. For instance, the cointegration among the variables is explored using the Fisher-type Johansen panel co-integration test while the long-run emission elasticities are estimated using the fully modified ordinary least square (FMOLS) method, and finally the short-run dynamic causal relationship is examined using the heterogeneous panel causality test otherwise known as the Dumitrescu and Hurlin Granger causality test.

The remainder of the paper is organized as follows: Following the introduction in Sect. 1 is Sect. 2 which reviews the existing literature; Sect. 3 sets forth the methodology and analytical framework; Sect. 4 explains the estimation strategy and data analysis; Sect. 5 discusses the empirical results; and Sect. 6 summarizes the conclusions that emerge from the study with policy implications.

2 Theoretical review

This section discusses the nexus between the cause of anthropogenic greenhouse gas emissions and its proposed link with the mitigation strategies. It is made up of the link between energy consumption (renewable and non-renewable), economic growth, population rise, financial development and greenhouse gas emissions.

2.1 Human activities (Fossil fuel energy consumption)-environmental degradation nexus

Anthropogenic gases absorb the long-distanced particles from the earth surface and the air body which ordinarily would spread and disappear to the space. The interrelationship and the distribution of these gases within the air body of atmosphere are accountable for both the favorable climate on the surface of the planet and the non-conducive long term atmospheric conditions on other planets. It is the changing of the mixture of these gases that modifies the stable circumstances of the atmosphere (Kurukulasuriya et al. 2006; Wang et al. 2009).

Evidence proves that human activities such as burning of fossil fuels, cutting humid forests, and introducing more of the other greenhouse gases into the atmospheric air body, humans are forming a heat cover susceptible of causing global warming (Intergovernmental Panel on Climate Change 2007; Metcalf 2009; Behrens et al. 2016).

Some mathematical expressions are utilized to show the main factors driving human caused emissions of GHG, with emphasis on carbon dioxide. One of these is the IPAT identity (Chertow 2000; Steinberger and Krausmann 2011):

The IPAT identity relates a nation’s environmental impact (such as carbon dioxide emissions) in a given time period to the mathematical product of population, “affluence” (which can be measured as economic growth per capita), and technology (which can be measured in emissions per unit of GDP). This connection can be modified to yield what is called the Kaya identity (Xiangzhao and Ji 2008; Jung et al. 2012; O’Mahony, 2013):

These equations are useful in understanding the complex factors influencing changes in CO2 emissions. The Kaya identity tells us that, a country with a high population, or with high per capita GDP (GDP/population) of energy, or with high energy intensity (energy/GDP) especially the non-renewables, or with high carbon intensity (CO2/energy), will have higher CO2 emissions. An important characteristic of a multiplicative identity such as IPAT or KAYA is that it can be shown as the addition of the growth rates of each component (Jung et al. 2012). Thus, an alternative version of the Kaya identity is:

2.2 Population-energy consumption model

The multiplication of an economy’s population and its energy consumption rate gives the overall energy use which can be expressed in a simple mathematical equation. In recent times and the forecasted near period, there are complicated interconnections between variations in population, economic advancement, and energy use. Notwithstanding its accumulated and uncomplicated formation, the model is supportive in establishing the three large components that facilitate the tenacity of variations in overall energy consumption (Holdren 1991; Miller and Spoolman 2011; Barnett and Beasley 2015; Hamilton et al. 2015; Tietenberg and Lewis 2016). The items in this decomposition are expressed as:

2.3 Economic development and environmental quality relationship

CO2 emissions have continually increased in the previous decades as a result of human actions, principally by the utilization of non-renewable of coal, oil and natural gas and the alterations in the utilization of land that are exactly connected with the growth and development of the economy. The causal effect between the growth of the economy and its development and various pointers of environmental quality has been broadly examine in the late years by the environmental Kuznets curve (EKC) analyses worldwide, regionally or country wise by different researchers. For example, Grossman and Krueger (1991) initially came up with the EKC postulate using various indicators of the environment. According to the EKC curve, the link between the different environmental quality indicators and GDP per capita exhibits an inverted U-shape. Under the EKC curve, CO2 emission is usually set as a linear, quadratic, or cubic polynomial function of GDP per capita (Apergis and Ozturk 2015; Hamilton et al. 2015; Marsiglio et al. 2015; Shahbaz et al. 2015; Muhammad et al. 2016).

2.4 Financial development and environmental quality nexus

CO2 and other trace GHG emissions do not only depend on factors such as expansion of the economy, population and energy use as the driving forces but financial development can also be another factor that can affect greenhouse gas emissions. Financial development plays a key function in limiting risk and uncertainties for the deprived clusters and raising the chance of people to use financial, health and educational services thereby possessing an exact effect on growth and development. Financial development may include rise in the distribution of foreign direct investment; improved capital market; banking activities; reformed guidelines and domestic financial structure can raise growth of the economy and impact on the desire for energy (Sadorsky 2012; Shahbaz 2013). In this case, financial advancement reduces CO2 emissions. One of the principal solutions to the reduction in the rise in GHG emissions is investment in clean energy projects. Thus, promoting clean energy of renewable technology requires well-functioning financial markets that provide easier access to debt and equity financing. Stock and credit markets development alongside foreign direct investment are regarded as the most significant avenues of financing clean energy projects (Paramati et al. 2016). Higher levels of investment in clean energy may be promoted through the development of both stock and credit markets. This may in turn grant investors access to more avenues of funding, the equity and credit financing (Paramati et al. 2016). However, one of the huge challenges to application of clean energy is its enormous straightforward capital outlays. IFC (2011) asserted that the energy sector is capital demanding compared to other industries because the commencement of production in such energy undertaking requires huge initial investment. In a related development, Sadorsky (2010) and Zhang (2011) are of the opinion that financial development raises carbon emissions because the development of the capital market helps integrate firms to limit the cost of funding, raise financial leverages in order to purchase developed investments, spend in advanced ventures and then raise the amount of energy utilization and carbon emissions. The broad development is to increase energy consumption. Financial sector can encourage CO2 emissions through promoting productive activities (Azam et al. 2015; Jin et al. 2016). Financial development may practically upgrade experimentation and advanced activities and firmly encourage industrial activities, and thus impact environmental quality (Ozturk and Acaravci 2013; Ortega and Peri 2014; Tahir et al. 2014; Campbell 2013; Shahbaz 2013; Kilic et al. 2014).

2.5 Renewable energy and the environment nexus

Renewable energy offers significant opportunities for further growth that can facilitate the transition to a global sustainable energy supply by the middle of this century. Renewable energy also serves a vital role in the global emission reduction target of 50% by 2050. Given the important role that the renewable energy plays, it not only meets the energy needs of many countries, but also mitigates emissions. Despite this, limited research is conducted to examine the relationship between renewable energy consumptions and environmental degradation. Sadorsky (2009) finds that real GDP per capita and the CO2 emission per capita had positive effects on renewable energy consumption in the G7 countries during 1980–2005. However, Apergis and Payne (2010a); Apergis et al. (2010) find that renewable energy consumption does not contribute to reductions in emissions. The reason may be the lack of adequate storage technology to overcome intermittent supply problems and electricity producers rely heavily on emission to generate energy sources to meet peak load demand. These mixed results may be due to the limited proportion of renewable energy in total energy consumption. Menyah and Wolderufael (2010) show the unidirectional causality from CO2 emissions to renewable energy consumption over the period 1960–2007. Furthermore, Salim and Rafiq (2012) show that CO2 and income are the major determinants of renewable energy consumption in Brazil, China, India and Indonesia. In addition, the short-run bidirectional causal relationship between renewable energy consumption and CO2 emissions is also found in these countries. More recently, Shafiei and Salim (2014) explore the determinants of CO2 emissions for the OECD countries during 1980–2011. Riti and Shu (2016; Riti et al. 2017a, b; 2018) concluded that non-renewable energy of fossil fuels increases economic growth and degrades the environment by increasing the rate of CO2 emissions, renewable energy on the other hand increases economic growth in favour of environmental quality. The empirical results show that non-renewable energy consumption increases CO2 emissions, whereas renewable energy consumption decreases it.

2.6 Empirical literature

On the empirical literature, recently, indicator of financial development was added to the environment-growth-energy model via the analyses of researchers such as Jalil and Feridun (2011); Ozturk and Acaravci (2013); Al-Mulali and Sab (2012); Shahbaz (2013); Shahbaz et al. (2013); Ziaei (2015); Farhani and Ozturk (2015); Dogan and Seker (2016a); Dogan and Turkekul (2016). According to these theorists, the purpose of adding the indicator of financial development in the analysis of the relationship between GDP per capita, energy use and environmental variable is not far-fetched: indicator of financial development may draw FDI and advanced degree of research and development which can accelerate economic growth (Frankel and Romer 1999) and hence affect dynamism of environmental performance. Second, improvement in the financial sector may provide less developed nations with the opportunity to apply for advanced technology which may enhance clean and eco-friendly production. Third, financial development may exacerbate environmental degradation through industrial pollution. For example, Jalil and Feridun (2011) in their paper analyzed the significance of GDP, energy use, openness in terms of trade and financial development on CO2 emissions in China from 1953 to 2006. Results from their analysis refute the long run financial development-environmental quality nexus while CO2 emissions is significantly driven by GDP per capita, energy use, openness in terms of trade.

More recently, Ozturk and Acaravci (2013) examined the causal interaction among energy consumption, financial development, GDP per capita, openness in terms of trade and CO2 emission in Turkish economy. Their result from bounds-testing to long run equilibrium shows claims of co-integration while financial development in the long run shows no any significant impact on CO2 emissions. Similarly, Shahbaz et al. (2013) in their study researched on the dynamic interaction among the variables of financial instability and the environment in a multivariate framework with GDP, openness in terms of trade and energy consumption in Pakistan from 1971 to 2009. The outcome of their analysis suggests co-integration among the investigated variables while environmental degradation is largely driven by instability of the financial system. Furthermore, Farhani and Ozturk (2015) examined the causal interaction among the environment-growth energy- financial development nexus with openness in terms of trade and urbanization as additional determinants of environmental degradation. The outcome of their analysis reveals that financial development plays an important role in Tunisian economy as financial development takes place at the expense of environmental pollution. Sehrawat et al. (2015) on their part studied the dynamic interaction of environment-growth-energy linkage for Indian economy. According to their result, financial development appears to have increased environmental degradation. In addition, the main contributors of environmental degradation are economic growth, energy consumption and urbanization. Dogan and Seker (2016a) examined the influence of real output, renewable and non-renewable energy use, openness in terms of trade and improvement in the indicators of financial system on CO2 emissions in the environmental Kuznets Curve framework for the countries with the index of renewable energy attractiveness. The analyzed data shows that energy use from renewable, openness in terms of trade and indicator of financial development limit CO2 emissions while fossil fuel energy use contributes to the worsening of the environment. However, their results lend support for the existence of environmental Kuznets Curve hypothesis. Other empirical works such as Iwata et al. (2010); Hossain (2011); Nasir and Rehman (2011); Jayanthakumaran et al. (2012); Omri (2013); Shahbaz et al. (2013); Sulaiman et al. (2013); Al-Mulali et al. (2015a, b); Dogan et al. (2015); Gokmenoglu et al. (2015); Omri et al. (2015); Salahuddin et al. (2015); Seker et al. (2015); Tang and Tan (2015); Al-Mulali and Ozturk (2016); Dogan and Seker (2016b) applied financial development and trade openness in addition to energy use and output per capita in analyzing the environment-growth energy nexus so as to indicate the contribution of financial development in explaining variations in CO2 emissions.

Richard (2010) explored the link between financial instability and CO2 emission using the sample of 16 developed and 20 developing countries. The results estimated by applying static and dynamic models demonstrated the positive impact of financial instability on environmental degradation. The economic growth and population density were the main contributing factors to increase environmental pollution in sampled countries. The results also confirmed the validity of EKC hypothesis. In contrast, Brussels (2010) study did not find any detrimental impact of financial crisis on the environment. Further, Brussels noted that financial crisis reduced carbon emissions by 24% in Estonia, 22% in Romania, 16% in Italy and Spain and 13% in UK. Similarly, Enkvist et al. (2010) empirical findings demonstrated little impact of global crisis on carbon emissions. Cong et al. (2008) found the insignificant impact of oil price shocks on real stock returns of most Chinese stock market indices. Shahbaz (2013) investigated the link between financial instability and environmental pollution in the case of Pakistan. Empirical findings confirmed the positive impact of financial instability, economic growth and energy consumption on environmental degradation in long-run. The results showed that energy consumption is a dominant factor to harm environmental quality and EKC also exist in this particular case. Ziaei (2015) investigated the effects of financial indicator shocks on energy consumption and CO2 emissions and vice versa for 13 European and 12 East Asia and Oceania countries from 1989 to 2011. Although energy consumption and CO2 emission shocks on financial indicators such as private sector credit is not very pronounced in both groups of countries, the strength of energy consumption shock on stock return rate in European countries was greater than East Asian and Oceania countries. Conversely shocks to stock return rate influenced energy consumption especially in long horizon in the case of East Asia and Oceania countries. The above mentioned literature shows that none empirical studies exist in the relationship between GHG emissions, economic growth, energy consumption and financial development and population in the context of ten leading countries in CO2 emissions. The present study is an attempt to fill this gap.

3 Data and methodology

3.1 Data description

This study measures data spanning 25 years (1990–2014) of a panel of ten countries (Canada, China, Germany, India, Iran, Japan, Korea Republic, Russia, UK and US) rank among the world’s top ten CO2 emitters in 2016. The study obtains data on CO2 emissions per capita (E), GDP per capita (Y), total population (PO), share of renewable energy (RE) and non-renewable energy (FU) in total energy consumption and domestic credits of financial sector (FD) from the World Bank database, World Development Indicators (2016). The study uses domestic credits of financial sector instead of money supply due to the monetization nature of money supply in most developing countries. All the selected data are transformed into natural logarithms to be interpreted as elasticities except those variables that are already in percentages. All the analysis variables are as defined in Table 1.

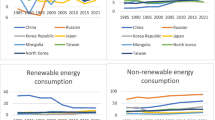

Although developed countries play a leading role in economic growth, developing countries such as China, India, and Korea Republic make outstanding achievements. Figure 2a–f shows the average growth rates of variables (CO2 emission, fossil fuel, renewable energy, financial development, GDP and total population) per annum from 1990 to 2014.

Excluding Canada, Germany, Russia, UK and US that experienced negative annual average growth rates, CO2 emissions (E) in other countries increased on average per annum with China leading with 5.491% per annum. All the sample countries represented positive average economic growth, and China has achieved the highest average growth rate of GDP per capita (Y) with 9.268 percent followed by India and Korea Republic with 4.812% and 4.552% respectively. The lowest annual growth rate of GDP (Y) occurs in Japan with 0.869 percent (Fig. 2f)). Less than half of the countries realized positive average growth rates of fossil fuel energy consumption (FU) with India leading with 1.31% annual growth rate, followed by China with 0.607% annual growth rate and Japan with 0.507 annual growth rate. Other countries have negative annual growth rate of fossil fuel consumption with UK having the least annual growth rate consumption of fossil fuel which stands at − 0.378 (Fig. 2b). The share of renewable energy consumption in most countries increased yearly on average. UK (11.511%), Germany (8.315%), Korea Republic (4.700%), US (3.537%), Iran (1.140%), Japan (1.140%) and Canada (0.118%) are the countries achieving positive average growth rates. Only three countries share: China (− 2.756%), India (− 1.939%) and Russia (− 0.184) were negative (Fig. 2c). All the countries witnessed positive average annual growth rate of domestic credit of financial sector proxied for financial development (FD) except Iran that has an average negative growth rate of financial development. The Korea Republic leads the average annual growth rate of financial development with 5.936%, followed by Canada with an average growth rate of 4.545% per annum while Iran has − 1.137% average growths rate per annum (Fig. 2d). Figure 2e records the growth rate per annum of total population with all the countries having positive average growth rate per annum except Russia which shows negative average annual growth rate. India leads with 1.667% while Russia has − 0.127%.

Table 2 represents descriptive statistics of the variables for all the selected countries from 1990 to 2014. The descriptive statistics of each series, collectively and country by country consist of their mean, median, maximum, minimum, standard deviation, Jarque–Bera statistic and its corresponding probability value before the transformation into logarithms. The study also reveals the pairwise correlations between analysis variables.

Statistical results in Table 2, panel A suggest that the average value of CO2 emissions of the ten countries is 9.223 per capita metric tons with a standard deviation of 5.294 per capita metric tons. In addition the, the overall mean value of GDP per capita and its standard deviation stand at 23376.25 and 18134.70 billion US dollars respectively. Total population of the sampled countries has a mean value of 3.47 × 108 million people with a standard deviation of 4.58 × 108 million people. Fossil fuel energy of the sampled countries on the other hand has a mean value of 83.324 with a standard deviation of 9.566, percentage of total energy consumption (kg oil equivalent). The mean value of renewable energy and its standard deviation stand at 12.518 and 15.725 respectively, percentage of total energy consumption (kg oil equivalent). Financial development (domestic credit of financial sector as a ratio of GDP) on the other hand has a mean value of 131.464 with a standard deviation value of 81.341, a ratio of GDP. This shows that large variances exist in the data of the analyzed variables except fossil fuel energy that has a minimum variance.

An important statistic apart from the mean and standard deviation in a descriptive statistic is the Jarque–Bera test statistic. The Jarque–Bera is a test statistic for testing whether the series is normally distributed or not. Normality tests are a form of model selection and are used to determine whether a data sample is well modelled by a normal distribution. If the normal model fits the data well, then the data will be well modelled by a normal distribution. Modelling on underlying variables can be realized (Letters 2001).The test measures the difference of the skewness and kurtosis of the series with those from the normal distribution. The null hypothesis states that the variables are not normally distributed. Each of the variables was tested at 5% level of significance. If the probability value is greater than 5%, it implies that the variable in question is statistically significant at the 5%; otherwise, it is not significant at that level. From the results in Table 2, the Jarque–Bera statistics with probability values greater than the 5% significance level reveal that the series under consideration are normally distributed and therefore the data are well modelled.

Looking at the descriptive statistics country by country (panel C) and considering emissions per capita, the US leads on the average while India is the least due to population. The various small standard deviations are indications of minimum variance properties of the variable. The values of the Jarque–Bera statistics with their corresponding probability values greater than 5% indicate that the series are normally distributed and well modelled. In addition, the US leads in terms of GDP per capita ($44458b) while India is the least with $929b all the countries’ GDP per capita exhibit minimum variances and are also normally distributed. In terms of fossil fuel on the average, Iran leads in the consumption of fossil fuel energy (99.192, a percentage of total energy) while India has the least percentage (64.464%). The variable also shows small variances and are normally distributed except Japan that the variable is skewed positively with a probability value of 0.001. In the case of renewable energy consumption, India leads with 48.922% on the average while Iran has the least value (0.973%). The minimum variance properties is also displayed with the variable normally distributed except Korea Republic that its renewable energy variable is not normally distributed. Statistics also reveal that financial development variable has Japan leading with 296.526 ration of domestic credit of financial sector to GDP while Iran has the least (42.485 ratio of domestic credit of the financial sector to GDP). Their various standard deviation values, Jarque–Bera statistics indicate that the variable in all the countries exhibit minimum variance properties and normal distribution properties. In terms of population wise, China surpasses all the countries with an average total population of 1.27 billion while Canada has the lowest population of 31million on the average. The statistics further show that the distribution of the population variable is normal.

The second segment of Table 2, panel B is the correlation matrix. Correlation analysis is a test that explains the relationship between two or more variables. Although it does not measure a cause effect relationship through a regression analysis, it gives a glimpse of the strength of the relationship as the first steps of the statistical analysis of the variables in question. From the correlation matrix, CO2 emissions has a positive relationship with GDP per capita (Y), population (PO) and fossil fuel energy consumption (FU) variables while negatively related with the share of renewable energy consumption in total energy use and financial development (FD). The correlation coefficient between CO2 emissions and GDP is 0.7484 indicating that the relationship between the two variables is 74.84%. In addition, the correlation coefficients between CO2 emissions, population and fossil fuel energy consumption stand at 0.5669 and 0.2161 in the positive direction respectively. This is an indication that the relationship between CO2 emissions and population on one hand and between CO2 emissions and fossil fuel on the other hand is 56.69% and 21.61% respectively. CO2 emissions have a negative relationship with both renewable energy consumption, and financial development. Size of renewable energy consumption has weaker positive relationship (− 0.4916) with CO2 emissions and weaker negative relationship (− 0.4173) with financial development. In addition, the correlation coefficients of the remaining independent variable are interesting. GDP and population have negative relationship (− 0.5793) while GDP and fossil fuel energy consumption are positively related (0.0375). GDP and renewable energy are negatively related (− 0.4159) while same GDP and financial development are positively related (0.7692).

3.2 Empirical models

This study follows the econometric methods proposed by Halicioglu (2009) and Jayanthakumaran et al. (2012) for time series and Narayan and Narayan (2010) for heterogeneous panel data. Under the STIRPAT (Stochastic impacts by regression on population, affluence and technology) model, the study establishes a multiple linear quadratic regression equation to investigate relationships between CO2 emissions per capita (E), GDP per capita (Y), total population (PO), renewable energy consumption, a percentage of total energy use (RE), fossil fuel energy consumption, a percentage of total energy use (FU), and domestic credit of financial sector as a proxy for financial development (FD). All data are transformed into natural logarithm forms. This avoids problems with respect to the dynamic properties of samples. Log transformation of data is a valued method, as estimated coefficients in a regression equation can be interpreted as elasticities. Thus, the study is able to assess the potential effects of each variable.

York et al. (2003) first introduced the STIRPAT, IPAT and ImPACT models in their work as a tool to analyze the driving forces of environmental impacts. Scholars such as Sadorsky (2014) also used the IPAT model to assess the impact of demographic (P), economic (A), and technologic (T) factors on the environment. The IPAT model cannot be generalized because it encounters a problem when analyzing a situation. The model allows only one factor to change while other factors are kept constant, hence capturing an impartial impact on the dependent variable (Zhu et al. 2012; Chikaraishi et al. 2015). To address this issue, Chikaraishi et al. (2015) reframed the IPAT model into a stochastic model (STIRPAT), where the driving forces behind environmental degradation are assessed statistically. STIRPAT model is further refined by Donglan et al. (2010) and extended by including supplementary factors, like quadratic terms or different modules of P, A, or T. Presently, Poumanyvong and Kaneko (2010); Martinez-Zarzoso and Maroutti (2011); Zhu et al. (2012); Donglan et al. (2010); Chun-sheng et al. (2012); Feng et al. (2009); Madlener and Sunak (2011), and Shafiei and Salim (2014) have successfully utilized the STIRPAT model for analysis of the impacts of various dynamic forces on the diversity of environmental degradation. The STIRPAT model can be written in exponential form as the following equation:

The model takes the following linear form, after taking the logarithms:

where P stands for the size of the population; A stands for GDP per capita in real term; T represents technology; and I stands for pollutant emissions (the dependent variable); εit is the residual; α is the intercept; β, γ, and δ are the slope coefficients of P, A, and T, respectively. The suffixes i and t represent the country and years, respectively. The STIRPAT model is modified by adding decomposing factors of PAT and their impact on the environment is analyzed. In STIRPAT model, T is also decomposable like P and A (Chikaraishi et al. 2015). In this study, CO2 emission is used to quantify pollutant emission (I); financial development and GDP per capita capture affluence of an economy (A); total population is used as a replacement of the population (P) and technology (T) representing with total energy consumption (renewable and non-renewable) introduced in the STIRPAT model. The improved model can be written as follows:

where i = 1 to 10 and t = 1990 to 2014, indicating the country and year, respectively. δ0i and ρi denote country fixed effects and deterministic time trends corresponding to each panel. νit denotes the estimated residuals from the long-run equilibrium equation as a deviation characterization. As all the variables are transformed into logarithmic form, the parameters (α1, α2, α3, α4, α5,) refer to long-run elasticities corresponding to each independent variable in the modelling. In addition, the study used the GDP per capita as a linear variable to evaluate the how economic growth affects CO2 emissions. This aims to capture the environmental quality response to changes resulting from rapid economic growth. Under this scenario, the study expects the sign of α1i to be positive, α2i to be positive, α3i to be positive. Specific development of renewables due to economic factors could affect the sign of α4i. The study expects α4i to be negative assuming that the renewable energy producers make use of cleaner production technologies with high renewable energy utilization rate. α5i is expected to be positive or negative depending on the specific application of financial development in environment friendly technology.

4 Empirical analysis

Empirical methodologies of this study contain the following stages:

-

1.

Applying the panel unit root tests to examine the stationarity,

-

2.

Examining the co-integration relationships between analysis variables by applying the Pedroni co-integration technique,

-

3.

Using the Granger causality tests to examine short and long-run Granger causalities, and

-

4.

Estimating the long-run coefficients of variables by applying the FMOLS estimators.

4.1 Unit root tests

A panel data model requires stationarity tests of variables before regression. If a series does not have constant mean and variance, it is non-stationary. This could lead to spurious regression. To avoid spurious regression and to ensure the validity of estimation results, the study tests the stationarity of panel series. Unit root tests are the most common methods to check the stationarity and order of integration of data. They generally start with level data. If unit roots exist in a series, data are non-stationary. Then there would be need to take the difference of data and repeat tests until the series is stationary. Only stationary data integrated of same order are useful for the following panel analysis (Levin et al. 2002).

The study uses five traditional unit root tests (Levine, Lin and Chun; Breitung; Im, Pesaran and Shin; Augmented Dickey Fuller-Fisher and Phillips Perrron-Fisher), estimated with the intercept and deterministic trend for examining the integration order of variables. Assuming a common unit root process across countries, the study establishes a group of tests, including the t statistic of the test in Levin et al.’s studies Levin et al. (2002) and Breitung (1999). The hypotheses are stated as follows:

4.2 See appendix 1 for the various unit root estimation techniques

Table 3 presents the results calculated from unit root tests at level and after the first difference. For the GDP variables, none of the five tests rejects the null hypothesis of non-stationary at level. For the share of renewable energy consumption, the null can be rejected at the 1% significance level for all five tests before and after the first difference. While for CO2 emissions, the share of fossil fuel energy consumption, financial development and total population, none of the tests reject the null at level. After all variables being taken the first difference, the five unit root tests reject the null at the 1% significance level. Stationary data are the prerequisite of panel co-integration tests and vector error correction modelling.

To inquire about the cross-sectional dependency in panel data, a lot of tests are available in literature, and the most regularly used tests are Baltagi Feng, and Kao bias-corrected scaled LM (2012), Pesaran scaled LM (2004), Pesaran (2004a, b), and Breusch and Pagan (1980) are used in this study. The abovementioned test results are presented in Table 4. All the results presented in below table did not confirm the existence of cross sectional dependency, showing that the first generation panel unit root tests are more appropriate to apply. The output of the result indicates that stationarity of the variables is attained at first differencing whereas the variables have unit root at levels. The tests suggest that CO2 emissions (E), renewable energy use (RE), fossil fuel energy use (FU), financial development (FD), economic growth (Y) and population (PO) are all integrated of orders one, I(1).

4.3 Co-integration tests

Results of unit root tests indicate that the variables are integrated of order one. The study then uses co-integration tests to examine whether the variables share long-run equilibrium relationships after the first difference. If long-run equilibrium exists, regression residuals of variables are stationary. Thus, regression estimates will be effective. Examination of the co-integration relationships between analysis variables is carried out by using the two sets of panel co-integration tests proposed by Pedroni (2004a, b). The first set is based on four panel statistics, from which include the v-statistic, rho-statistic, PP-statistic, and ADF-statistic. The second set is based on three group statistics, namely the rho-statistic, PP-statistic, and ADF statistic. Taking into account the common and individual autoregressive coefficients for the ten highest CO2 emitting countries, these statistics are classified on within-dimension and between-dimension, respectively. Pedroni co-integration tests are based on residuals estimated from Eq. (5). Furthermore, the null hypothesis is that no co-integration relationships exist between variables, whereas the alternative hypothesis is co-integration. Pedroni tests precede other co-integration techniques such as homogeneous tests, mainly because the former consider the heterogeneity across these countries. Thus, the following formulas are used for the co-integration analyses:

4.4 See appendix 2 for the various co-integration test techniques

Table 5 reports the results of the Pedroni co-integration tests. Two types of co-integration tests are suggested by Pedroni (1999) and Pedroni (2004a, b). One is the time series-cross section analyses which are dwelt on the ‘within dimension’ criteria and which has to do with four statistics: panel v, panel ρ, panel PP, and panel ADF-statistics. These statistics necessarily augment the parameters of the auto regression across various countries for the non-stationarity analyses on the analyzed error terms. Differences and time factors arising from countries are taking into consideration by these statistics. The next one involves three statistics namely: group ρ, group PP, and group ADF-statistics. These statistics are anchored on averages of the separate parameters of the auto regression connected with the non-stationarity tests of the error terms for each country in the panel. The seven analyses are expected to be normally distributed asymptotically (Pedroni 1999). In the model, statistic and weighted statistic from panel PP-statistic, panel ADF-statistic, group PP-statistic, and group ADF-statistic tests certify that the null hypothesis should be rejected at the 1% significance level. For the model, four among seven tests support the rejection. Pedroni co-integration tests confirm long-run co-integration relationships between CO2 emissions, GDP per capita, total population, fossil fuel energy consumption, renewable energy consumption, and financial development. This is an indication that co-integration exists among the interested variables.

4.5 Panel FMOLS estimation

After co-integration relationships between variables are confirmed, FMOLS estimator is used to obtain the coefficients of the analysis variables in the modelling of the panels. Pedroni (2004a, b) proposed the FMOLS methodology in 2004. This study selects FMOLS rather than conventional OLS approach, as OLS estimated parameters are spurious in panel co-integration regression. It obeys the asymptotically biased distribution and is subject to redundant parameters related to serial correlation in the data (Pedroni 2004a, b; Kao and Chiang 2000). This study proposes FMOLS as alternative econometric approach, since it solves the endogeneity and serial correlation problems. As a non-parametric methodology, the FMOLS also accounts for cross sectional heterogeneity. It corrects auto correlation and heteroscedasticity by eliminating the correlation between the explanatory variable and the random interference term. The FMOLS estimator can be constructed as described by Pedroni (2001) as:

where \( \hat{\beta }^{*}_{FM,i} \) is the traditional FMOLS estimator applied in ith member of the panel. The associated statistic is given in Eq. (7):

Consequently, the study obtains the uniform estimator of the covariance parameter estimator and the asymptotic normality distribution of the FMOLS estimator. Thus, the traditional Wald statistic can be used to test covariance parameters, avoiding the influence of redundant parameters on the limit distribution of the test statistic. Table 6 reports the estimated results using FMOLS for the modelling process.

The FMOLS results suggest that at 1% and 5% levels, the parameters are statistically significant except PO which is significant at the 10% level. The magnitude of the coefficient with respect to income (Y) is 0.426. This implies that a 1% increase in Y would lead to an increase in emissions (E) by 0.426%. In addition, the magnitude of the coefficients of population (PO) is 0.585. This shows that a 1% increase in total population would lead to a 0.585% rise in emissions (E.) Likewise, the magnitude of the coefficients of fossil fuel (FU), renewable energy (RE) and financial development (FD) are, 0.022, − 0.035 and − 0.047. The implication is that a 1% increase in FU and RE can change E by 0.022% and 0.035 in the positive and negative directions respectively. The statistical significant negative coefficient of FD confirms that an increase in financial development leads to an improvement in the environmental performance in the ten countries indexed as the highest CO2 emissions’ countries. More specifically, the magnitude, − 0.047 implies that a 1% increase in financial development will reduce environmental pollution at 0.047%. These results are in line with Tamazian et al. (2009). The result of this analysis is in line with the works of Menyah and Wolderufael (2010); Apergis et al. (2010) and Bergmann’s (2006), Apergis and Ozturk (2015), Riti and Shu (2016), Riti et al. (2017a, b, c) on the theoretical underpinnings regarding the effect of renewable energy on emissions. Therefore renewable energy consumption reduces greenhouse gases (GHGs) and mitigates climate change thus ensuring environmental quality. In comparison to the outcome of other FMOLS parameters that apply panel data, the sum of the elasticity of renewable and fossil fuel with respect to emissions is lower (0.035 + 0.022 = 0.057) than the 1.338% reported by Salahuddin et al. (2015) for Gulf Cooperation Council countries and Apergis and Payne (2010a, b, c) for nine South American countries. Concerning financial development and emissions, the result (− 0.047) is also slightly greater than the − 0.031% reported by Salahuddin et al. (2015) for Gulf Cooperation Council countries.Footnote 1 Tamazian et al. (2009) argue that the inclusion of the energy variable in the regression model may explain most of the CO2 emissions, and suggest that these variables should be dropped. However, this paper disintegrates energy consumption into renewable and non-renewable of fossil fuels and finds out that the exclusion of energy variable would amount to variable omission bias. The disintegration of energy enables the effect of energy consumption on emissions to be disentangled.

An interesting finding in the results is that the estimate of fossil fuel energy consumption in the long run emissions equation which is highly significant with a positive sign in the considered case. The finding of a positive effect of fossil fuel energy use is consistent with Riti and Shu (2016), Riti et al. (2017a, b, 2018), Wang et al. (2018), Liu (2005) and Ang (2007, 2008, 2009), among others. In addition, the results on the relationship between energy use especially non-renewable and CO2 emissions are in line with the findings of Ang (2009). Therefore, the results that carbon emissions are mainly determined by fossil fuel energy consumption are in line with the extant body of literature. Population coefficient however is not statistically significant at the 5 percent level, although have a positive effects on emissions. The positive impact of population on emissions is in line with World Bank (2016); Riti et al. (2017a, b, 2018).

4.6 Dumitrescu and Hurlin heterogeneous causality

A new short run causality test based on heterogeneous panels was developed by Dumitrescu and Hurlin (2012). Under the Dumitrescu and Hurlin, short run causality among the variables under consideration is applied and tested while the error correction value obtained from the residuals of Eq. (5) is used to test the long run causality of the model. The results of short-run and long run causalities are shown in Table 7. The outcomes indicate that in the short run, there is bi-directional causality between per capita GDP, population, financial development and emissions revealing feedback effects. In addition, in the short run, renewable energy consumption uni-directionally Granger causes emissions revealing growth hypothesis. Another interesting phenomenon about the result is the conservative hypothesis found in the causality between fossil fuel energy consumption and emission where emissions uni-directionally Granger cause fossil fuel. Long run causality indicates bi-directional causality between emissions and the error correction mechanism indicating feedback effects. The findings indicate that an increase in per capita GDP, fossil fuel, renewable energy, financial development, population, can affect emissions and vice versa. Then Dumitrescu and Hurlin causality confirms that there is a relationship among emission, per capita GDP, population, fossil fuel energy consumption, renewable energy consumption and financial development in short run and long run across 10 highest CO2 emitting countries.

These findings indicate: firstly, increasing the share of renewable energy consumption and financial development may lead to CO2 emissions reduction. In addition, increase in GDP would lead to increase in energy. Economic growth in most countries demands more energy consumption, including both fossil fuels and renewable energy. Current high renewables investment costs may force most countries to depend more on fossil fuels and less on renewables. Thus, economic growth, renewable energy consumption and CO2 emissions can grow simultaneously. Secondly, it is the share of renewable energy consumption that may be more important in mitigating CO2 emissions. Growth in renewable energy consumption without equivalent reduction in consuming fossil fuels will not contribute to carbon emissions’ reduction. Therefore, research on the role of renewable energy consumption and financial development on carbon emissions’ reduction is important and interesting.

5 Conclusion and implications for policy

With the increasing concerns over the environmental challenges of GHG emissions, the UNFCCC have held several annual conferences since 1995 to determine what policies can be taken in order to control for the issues of greenhouse gas emissions (GHGs) and climate change. This study attempts an examination of the contribution of disaggregated energy use (renewable and fossil fuel) and financial development to GHG emissions reductions and climate change mitigation. In specific terms, the paper utilizes a panel data set for top ten countries with the highest CO2 emission: the US, China, Russia, India, Japan, Germany, Canada, Iran, the UK and the Republic of Korea over the time frame of 1990–2014 to ascertain the long run impacts as well as the causal relationship between disaggregated energy (renewable and fossil fuel) consumption, financial development and emissions taking into account GDP per capita and population. The study applies new conventional panel techniques of analysis that take into consideration the presence of heterogeneity and cross-sectional dependence across countries for the analysis. The results from cross sectional dependence unit root tests indicate stationarity of variables at first difference. Pedroni’s dynamic panel co-integration analysis reveals a long run relationship between emissions per capita, energy use (renewable and fossil fuel), financial development, GDP per capita and population.

The long-run coefficients suggest that a 1% increase in renewable and fossil fuel energy decreases and increases emissions by 0.035% and 0.022% respectively; a 1% increase in financial development reduces emissions by 0.047%; a 1% increase in per capita GDP raises emission by 0.426% and a 1% increase in population increases emission by 0.585%.

In addition, the existence of a bi-directional causality most of the variables and emissions of GHGs is detected when Dumitrescu-Hurlin panel Granger causality is performed in the estimation. The outcome of the analysis gives credence to the emissions-reduction postulate which reveals the contribution of renewable energy use in the carbon emissions’ reduction mechanism of these top 10 countries with the highest emissions of CO2. The result further provides insight to policy makers on the combination of energy mix alongside financial development that can reduce GHG emissions and mitigate climate change and ensure sustainable green environment.

While policies targeted at conserving and limiting energy use may have adverse impacts on the growth of the economy, environmental impacts of fossil fuel consumption should be considered by policy makers in the formulation and implementation of reliable energy combination policies that reduce the long-term deleterious impacts consistent with reliance of fossil fuels production and consumption. Efforts should be geared towards the development of clean energy technology that is renewable via financial development. Since climate change is caused by the rise in emission of GHGs due to human activities, it is clear that reducing the speed of these GHG emissions should serve as a rallying point to mitigate climate change challenges.

Given the fact that CO2 forms the greater percentage of GHGs, a rise in CO2 is the major reason that triggered climate change in the past years. The reduction of the anthropogenic creation of this gas lies primarily in the set of mitigation efforts that humans will have to make. Any joined action for the reduction of the human-caused emissions of CO2, should be viewed as global challenges that transcend international boundaries. In this regards, the collaboration and the coordinated efforts of all countries is required to reduce the potential harmful environmental effects of climate change. The study advocates the use of renewable energy sources such as solar, wind and geothermal energy for the production and consumption of sources of power. There is need for countries to increase financial support on renewable energy infrastructure construction as well as transformation of fossil fuel energy utilization. Increasing the use of renewable energy sources will substitute the use of fossil fuels in energy production and reduce incidence of GHG emissions that drive climate change. Future research on this and related topics should focus on the transmission mechanism to which financial development affects the environment.

Notes

Results are available upon request from authors.

References

Al-mulali, U., Lee, J. Y., Mohammed, A. H., & Sheau-Ting, L. (2013). Examining the link between energy consumption, carbon dioxide emission, and economic growth in Latin America and the Caribbean. Renewable and Sustainable Energy Reviews, 26, 42–48.

Al-Mulali, U., & Ozturk, I. (2016). The investigation of environmental Kuznets curve hypothesis in the advanced economies: the role of energy prices. Renewable and Sustainable Energy Reviews, 54, 1622–1631.

Al-Mulali, U., Ozturk, I., & Lean, H. H. (2015a). The influence of economic growth, urbanization, trade openness, financial development, and renewable energy on pollution in Europe. Natural Hazards, 79(1), 621e644.

Al-Mulali, U., & Sab, C. N. B. C. (2012). The impact of energy consumption and CO2 emission on the economic growth and financial development in the Sub Saharan African countries. Energy, 39(1), 180e186.

Al-Mulali, U., Tang, C. F., & Ozturk, I. (2015b). Estimating the environment Kuznets curve hypothesis: Evidence from Latin America and the Caribbean countries. Renewable and Sustainable Energy Reviews, 50, 918e924.

Ang, J. (2007). CO2 emissions, energy consumption, and output in France. Energy Policy, 35, 4772–4778.

Ang, J. (2008). The long-run relationship between economic development, pollutant emissions, and energy consumption: evidence from Malaysia. Journal of Policy Modeling, 30, 271–278.

Ang, J. (2009). CO2 emissions, research and technology transfer in China. Ecological Economics, 68(10), 2658–2665.

Ang, J. (2010). Research, technological change and financial liberalization in South Korea. Journal of Macroeconomics, 32, 457–468.

Apergis, N., & Ozturk, I. (2015). Testing environmental Kuznets curve hypothesis in Asian countries. Ecological Indicators, 52, 16–22.

Apergis, N., & Payne, J. E. (2010a). Renewable energy consumption and economic growth: evidence from a panel of OECD countries. Energy Policy, 38(1), 656e660.

Apergis, N., & Payne, J. E. (2010b). The emissions, energy consumption, and growth nexus: evidence from the commonwealth of independent states. Energy Policy, 38(1), 650–655.

Apergis, N., & Payne, J. E. (2010c). Renewable energy consumption and economic growth: evidence from a panel of OECD countries. Energy Policy, 38(1), 656–660.

Apergis, N., Payne, J. E., Menyah, K., et al. (2010). On the causal dynamics between emissions, nuclear energy, renewable energy, and economic growth. Ecological Economics, 69(11), 2255–2260.

Arouri, M. E. H., Youssef, A. B., M’henni, H., & Rault, C. (2012). Energy consumption, economic growth and CO2 emissions in Middle East and North African countries. Energy Policy, 45, 342e349.

Azam, M., Khan, A. Q., Zaman, K., & Ahmad, M. (2015). Factors determining energy consumption: Evidence from Indonesia, Malaysia and Thailand. Renewable and Sustainable Energy Reviews, 42, 1123–1131.

Barnett, J., & Beasley, L. (2015). Adapting to climate change and limiting global warming. Ecodesign for cities and suburbs. Berlin: Springer.

Behrens, P., Rodrigues, J. F. D., Brás, T., & Silva, C. (2016). Environmental, economic, and social impacts of feed-in tariffs: A Portuguese perspective 2000–2010. Applied Energy, 163, 309–319.

Bergmann, E. A. (2006). Essays on the economics of renewable energy. Glasgow: University of Glasgow.

Birdsall, N., & Wheeler, D. (1993). Trade policy and industrial pollution in Latin America: where are the pollution havens? Journal of Environment and Development, 2(1), 137–149.

Breitung, J. (1999). The local power of some unit root tests for panel data Sfb. Discussion Papers, 15(15), 161–177.

Breusch, T., & Pagan, A. (1980). The Lagrange Multiplier Test and its application to model specification in econometrics. Review of Economic Studies, 47, 239–254.

Brussels, J. C. (2010). Economic crisis cuts European carbon emissions. London: Financial Times.

Campbell, D. L. (2013). Estimating the impact of currency unions on trade: solving the glick and rose puzzle. The World Economy, 36(10), 1278–1293.

CCPI. (2016). The climate change performance index: Background and methodology. Retrieved August 15, 2018 from https://germanwatch.org/en/2623.

Chertow, M. R. (2000). The IPAT equation and its variants. Journal of Industrial Ecology, 4(4), 13–29.

Chikaraishi, M., Fujiwara, A., Kaneko, S., Poumanyvong, P., Komatsu, S., & Kalugin, A. (2015). The moderating effects of urbanization on carbon dioxide emissions: a latent class modeling approach. Technological Forecasting and Social Change, 90, 302–317.

Chun-sheng, Z., Shu-wen, N., & Xin, Z. (2012). Effects of household energy consumption on environment and its influence factors in rural and urban areas. Energy Procedia, 14, 805–811.

Cong, R. G., Wi, Yi-Ming, Jiao, Jian-Lin, & Fan, Ying. (2008). Relationships between oil price shocks and stock market: an empirical analysis from China. Energy Policy, 36(9), 3544–3553.

Cowan, W. N., Chang, T., Inglesi-Lotz, R., & Gupta, R. (2014). The nexus of electricity consumption, economic growth and CO2 emissions in the BRICS countries. Energy Policy, 66, 359–368.

Daly, H. E., & Farley, J. (2011). Ecological economics: principles and applications. Washington: Island Press.

Dickey, D. A., & Fuller, W. A. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of American Statistical Association, 74(366), 427–431.

Dogan, E., & Seker, F. (2016a). Determinants of CO2 emissions in the European Union: the role of renewable and non-renewable energy. Renewable Energy, 94, 429e439.

Dogan, E., & Seker, F. (2016b). The influence of real output, renewable and nonrenewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renewable and Sustainable Energy Reviews, 60, 1074e1085.

Dogan, E., Seker, F., & Bulbul, S. (2015). Investigating the impacts of energy consumption, real GDP, tourism and trade on CO2 emissions by accounting for cross-sectional dependence: a panel study of OECD countries. Current Issues in Tourism, 20(16), 1701–1719.

Dogan, E., & Turkekul, B. (2016). CO2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environmental Science and Pollution Research, 23(2), 1203e1213.

Donglan, Z., Dequn, Z., & Peng, Z. (2010). Driving forces of residential CO2 emissions in urban and rural China: an index decomposition analysis. Energy Policy, 38(7), 3377–3383. https://doi.org/10.1016/j.enpol.2010.02.011.

Dumitrescu, E.-I., & Hurlin, C. (2012). Testing for Granger non-causality in heterogeneous panels. Economic Modelling, 29(4), 1450–1460.

Enkvist, P., Denkil, J., & Lin, C. (2010). Impact of financial crisis on carbon economics: version 2.1 of the global greenhouse gas abatement cost curve. New York: Mckinsey and Company.

Farhani, S., & Ben Rejeb, J. (2012). Energy consumption, economic growth and CO2 emissions: Evidence from panel data for MENA region. International Journal of Energy Economics and Policy (IJEEP), 2(2), 71–81.

Farhani, S., & Ozturk, I. (2015). Causal relationship between CO2 emissions, real GDP, energy consumption, financial development, trade openness, and urbanization in Tunisia. Environmental Science and Pollution Research, 22(20), 15663e15676.

Feng, K. S., Hubacek, K., & Guan, D. B. (2009). Lifestyles, technology and CO2 emissions in China: a regional comparative analysis. Ecological Economics, 69(1), 145–154.

Frankel, J., & Romer, D. (1999). Does trade cause growth? The American Economic Review, 89(3), 379–399.

Frankel, J., & Rose, A. (2002). An estimate of the effect of common currencies on trade and income. Quarterly Journal of Economics, 117(2), 437–466.

Gokmenoglu, K., Ozatac, N., & Eren, B. M. (2015). Relationship between industrial production, financial development and carbon emissions: the Case of Turkey. Procedia Economics and Finance, 25, 463e470.

Grossman, G. M. & Krueger, A. B. (1991). Environmental impacts of a North America free trade agreement. National Bureau of Economic Research Paper No. 3914. https://doi.org/10.3386/w3914.

Halicioglu, F. (2009). An econometric study of CO2, emissions, energy consumption, income and foreign trade in Turkey. Energy Policy, 37(3), 1156–1164.

Hamilton, B. Nerneth, D. G. & Kuriansky, J. (2015). Ecopsychology [2 volumes]: Advances from the intersection of psychology and environment protection (Practical and Applied Psychology). Volume 1, Science and Theory.

Hamit-Haggar, M. (2012). Greenhouse gas emissions, energy consumption and economic growth: A panel cointegration analysis from Canadian industrial sector perspective. Energy Economics, 34(1), 358–364.

Holdren, J. P. (1991). Population and the energy problem. Population and Environment, 12(3), 231–255.

Hossain, M. S. (2011). Panel estimation for CO2 emissions, energy consumption, economic growth, trade openness and urbanization of newly industrialized countries. Energy Policy, 39(11), 6991e6999.

IFC. (2011). International Finance Corporation (IFC) annual report 2011: Highlights from the IFC annual report 2011. Retrieved July 22, 2016 from https://documents.worldbank.org/curated/en/822281468162849713/Highlights-from-the-annual-report-2011.

Im, K. S., Pesaran, M. H., & Shin, Y. (2003). Testing for unit roots in heterogeneous panels. Journal of Economics, 115(1), 53–74.

IPCC. (2007). Climate change 2007—mitigation of climate change. Contribution of working group III to the fourth assessment report of the Intergovernmental Panel on Climate Change. Retrieved September 2018, from https://www.ipcc.ch/site/assets/uploads/2018/03/ar4_wg2_full_report.pdf.

Iwata, H., Okada, K., & Samreth, S. (2010). Empirical study on the environmental Kuznets curve for CO2 in France: the role of nuclear energy. Energy Policy, 38(8), 4057e4063.

Jalil, A., & Feridun, M. (2011). The impact of growth, energy and financial development on the environment in China: A cointegration analysis. Energy Economics, 33(2), 284–291.

Jalil, A., Feridun, M., & Ma, Y. (2010). Finance–growth nexus in China revisited: new evidence from principal components and ARDL bounds tests. International Review of Economics and Finance, 19, 189–195.

Jayanthakumaran, K., Verma, R., & Liu, Y. (2012). CO2, emissions, energy consumption, trade and income: A comparative analysis of China and India. Energy Policy, 42(1), 450–460.

Jensen, V. (1996). The pollution haven hypothesis and the industrial flight hypothesis: some perspectives on theory and empirics. Working Paper 1996.5, Centre for Development and the Environment, University of Oslo.

Jin, J., Kiridaran, K., & Gerald, J. L. (2016). Discretion in bank loan loss allowance, risk taking and earnings management. Accounting and Finance, 58(1), 171–193.

Jos, G. J., Olivier (PBL), Greet Janssens-Maenhout (EC-JRC), Marilena Muntean (EC-JRC), Jeroen A.H.W. Peters (PBL). (2016). Trends in global CO2 emissions, 2016 Report. PBL Netherlands Environmental Assessment Agency. The Hague, 2016PBL publication number: 2315. European Commission, Joint Research Centre, Directorate Energy, Transport and Climate JRC Science for Policy Report: 103428.

Jung, S., An, K. J., Dodbiba, G., & Fujita, T. (2012). Regional energy-related carbon emission characteristics and potential mitigation in eco-industrial parks in South Korea: Logarithmic mean Divisia index analysis based on the Kaya identity. Energy, 46(1), 231–241.

Kamal, S. (2013). The Renewable Revolution: How we can fight climate change, prevent energy wars, revitalize the economy and transition to a sustainable future. London: Routledge.

Kao, C., & Chiang, M. H. (2000). On the estimation and inference of a cointegrated regression in panel data. Advance Economics, 15(1), 109–141.

Kebede, Ellene, Kagochi, John, & Jolly, Curtis M. (2010). Energy consumption and economic development in Sub-Sahara Africa. Energy Economics, 32(3), 532–537.

Kilic, C., Bayar, Y., & Arica, F. (2014). Effects of currency unions on foreign direct investment inflows: the European economic and monetary union case. International Journal of Economics and Financial Issues, 4(1), 8.

Kivyiro, P., & Arminen, H. (2014). Carbon dioxide emissions, energy consumption, economic growth, and foreign direct investment: Causality analysis for Sub-Saharan Africa. Energy, 74, 595606.

Kurukulasuriya, P., Mendelsohn, R., & Hassan, R. (2006). Will African agriculture survive climate change? The WB Economic Reviews, 20(3), 367–388.

Lean, H. H., & Smyth, R. (2010). CO2 emissions, electricity consumption and output in ASEAN. Applied Energy, 87(6), 1858–1864.

Letters, E. (2001). Testing normality in econometric models. Environmental Science and Technology, 35(13), 2690–2697.

Levin, A., Lin, C. F., & Chu, C. S. J. (2002). Unit root tests in panel data: asymptotic and finite sample properties. Journal of Economics, 108(1), 1–24.

Liu, X. (2005). Explaining the relationship between CO2 emissions and national income—the role of energy consumption. Economics Letters, 87, 325–328.

Ma, Y., & Jalil, A. (2008). Financial development, economic growth and adaptive efficiency: a comparison between China and Pakistan. China and World Economy, 16(6), 97–111.