Abstract

Since the iron and steel sector contributes considerably to industrial CO2 emissions, it is important to identify the underlying factors driving steel demand. Using a panel dataset, this paper examines the interrelation of steel demand with GDP and its composition, in particular the investment share since investment goods can be expected to be particularly steel-intensive. Our analysis confirms that there seems to be an increase of steel demand in an initial stage of economic development and a decline after economies have reached a certain level of per capita income. Moreover, we find some evidence that carbon leakage does not seem to play a role in the steel sector.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The iron and steel sector contributes considerably to industrial CO2 emissions. In Germany, e.g., its share in total emissions of the industry sector was approximately 10 % in 2008 (RWI 2008, p. 16), which is about twice its share in industry turnover. Two major factors will determine future CO2 emissions in the steel sector. The first is technological progress which could lead to more efficient production technologies. However, coke and coal which are the main source of CO2 emissions do not only serve as a fuel in the melting process but also for casting and rolling the steel. Coke is furthermore needed for the reduction of iron ore, which makes it difficult to trim down its use beyond a certain level, even if substantial progress has been made in this direction. Nevertheless, advanced economies use coke more efficiently, as a rule, than emerging economies. Thus, technological progress in steel making and the dissemination of technologies are one important factor that will drive the sector’s future CO2 emissions. The second major factor driving CO2 emissions from the steel sector is future steel demand, which is in the focus of this paper.

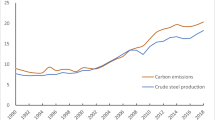

Looking at the historical development of global steel production, we can distinguish three phases (Fig. 1). The first phase, ending in the mid-1960s, was marked by postwar reconstruction which led to an increase in steel demand and production. In this period, the advanced economies were the main drivers of steel demand. It was the time when existing industries were reconstructed from war damages, new industries were established, and the infrastructure was developed. On the demand side, the increase of motorization was an additional driver. This period was followed by a phase of almost stagnation lasting until the late 1990s. The factors driving steel demand were still at work at this time, although less powerful, but the increase of demand for machines and cars was overcompensated by the reduction of the amount of steel needed per unit of the final product, which became possible through new techniques. It is also often argued that the two oil price shocks lowered steel demand (Tilton 1990). However, the mechanisms behind are not quite clear. On the one hand, the crises had a negative impact on GDP, and on the other hand, the price hike for oil spread over to metals (Tcha and Takasina 2002). Thus, it is not clear whether the decline of steel demand was more an income or a substitution effect.

The third phase in global steel demand began in the late 1990s when production started to grow markedly again. Driving force now were the emerging markets, which entered a stage of economic development which resembled very much the stage of advanced economies during the 1950s and 1960s. Most important in this context is China where apparent steel consumption in 2009 was four times as high as that in 1999. In recent years, almost every second ton of crude steel produced in the world came out of a Chinese steel mill (Table 1), but other countries contributed to the surge of steel production, too. In India, e.g., steel consumption per capita increased by 60 %, even if starting from a level which was much lower than that in China. However, due to the country’s size and growing population, its share in global steel production approached 5 % recently. In the meantime, India takes the fifth position among the world’s most important steel-producing countries.

This paper tries to identify driving factors of global steel consumption. The analysis will be based on a comparison of the variation of apparent steel use/consumptionFootnote 1 per capita between countries and over time. In the second section, some theoretical consideration on the relation between steel use and income are presented. Furthermore, the problems associated with calculating steel intensity of GDP are discussed. In the third section, the estimations for the entire sample are displayed. In the fourth section, differences between advanced economies and developing countries are elaborated. In the final part, the results are summarized.

Steel consumption and income levels

The amount of steel consumed in an economy is mainly linked to two factors: on the one hand, the importance of the industry sector and its structure, and on the other hand, the income of its population and its demand for steel-intensive products such as cars. To some extent, these factors are unique to each country, and as far as this is concerned, neither history nor international comparisons will provide many insights into the future of global steel demand. In the subsequent analyses, they will be treated as country-specific effects. However, there are also strong similarities among countries and over time that may give some guidance for global future trends.

These similarities originate mainly from “economic laws.” Firstly, Engel’s law may apply in this context. It describes the observation that the income share of the expenditure for food declines with rising income. This creates opportunities to increase spending on more sophisticated products, which in turn gives rise to a more capital-intensive production and a more developed infrastructure. As a consequence, steel demand can be expected to increase with rising income. However, this increase will be limited if not reverted by another “law;” the empirical relevance of which is also well documented. Already in the 1930s, Fisher (1935) and Clark (1940) discovered that the demand for tertiary products will increase relative to total expenditure after incomes having reached a certain level, whereas the demand for secondary (manufacturing) products will decline relatively.

Taking both ideas together, it can be assumed that the relation between income and demand for steel is hump-shaped. In the first stage, steel demand will increase relative to economic activity with rising living standards, but it will decline when income surpasses a level at which consumer’s preferences shift towards services. Relating steel demand to GDP, this pattern is addressed in the literature as “intensity of use hypothesis” (Crompton 1999, 2000; Wårrel and Olsson 2009; Wårrel 2014).

Wårrel and Olsson (2009) tested the intensity of use hypothesis for a panel of 61 countries over a period of 35 years. They could confirm the assumed hump-shaped relation between steel use and per capita income only after having introduced a time trend or a set of time dummies as additional variables, which they consider to be a measure of technological progress which shifts the ratio downward over time. This interpretation suggests that the cross-section dimension of the panel can help to identify the steel/GDP relation at a given time, whereas the time dimension helps to isolate a technological factor. However, the approach they use has two important problems. Firstly, their definition of intensity of steel use is difficult to interpret. Secondly, GDP is not only the denominator on the left-hand side of their equation but also used as nominator on the right-hand side. This may cause endogeneity problems.

Generally, steel intensity is defined as steel consumption per unit of GDP. Yet, the actual measurement is not straightforward. Whereas its numerator is a technical entity, the denominator is a statistical construct which is influenced by many factors. To adjust it for inflation, it must be measured in constant prices, and to make it comparable between countries, it is often converted into a single currency. Therefore, steel consumption per unit of GDP depends heavily on the base year chosen for the price adjustment and on the exchange rate used.

To be able to learn from the cross section as well as from the time series dimension of a panel, it is important to select a transformation of GDP which is neutral over time as well as between countries. That means that the choice concerning the base year for price and exchange rate adjustment should neither influence the growth rates of GDP nor the ranking of the countries concerning their income. When GDP at constant prices and exchange rates is used, as e.g. Wårrel and Olsson (2009) did in their analysis, the transformation is not neutral in the cross-sectional dimension, since currencies might be over- or undervalued in the base year. In 2000, e.g., the Euro was undervalued vis-à-vis the US dollar, whereas the Euro was overvalued in 2008. Thus, the difference in per capita income between the US and the Euro area would be larger at constant exchange rates of 2000 compared to figures calculated under the assumption of constant exchange rates of 2008. These considerations cast doubts whether GDP per capita in constant prices and exchange rates is a good choice for making international comparisons. We therefore will use GDP in purchasing power parities because it is not influenced by over- or undervaluation of currencies.

The potential endogeneity problem results from the fact that GDP is not only the denominator of steel intensity but also used as numerator on the right-hand side variable in the regression. In particular, changes in the base year for calculating real rates influence income levels and steel intensity in opposite direction, which also may spoil the regression results. Therefore, a different approach will be used here, which is admittedly less elegant, but burdened with considerably less methodological problems: The analyses will focus on steel consumption per capita. This variable is comparable between countries as well as over time. Furthermore, it should not cause the mentioned endogeneity problem since population is used as a denominator on both sides of the equation.Footnote 2

Estimation results

Nevertheless, the problem of scaling GDP cannot be avoided entirely in our regressions since the variable also appears on the right-hand side of our regressions. As already said, we will mostly use GDP in current purchasing power parities (PPP). By doing so, the comparison between countries will neither be influenced by the valuation of a country’s currency nor will it depend on the base year chosen. Thus, it forms in our view the ideal representation of GDP. However, to evaluate the sensitivity of our results with respect to different GDP measures, we will, in an initial step, also use two other variants of GDP. Therefore, we also run the regression for GDP per capita in current US dollars and for GDP in US dollars at 2000 prices and exchange rates.

Besides income, additional factors can be expected to be at work. It can be assumed that the structure of aggregate demand will matter, too. Since investment in structures and equipment is more steel-intensive than consumption, the investment quota—defined as the share of investment in GDP—may be a good representative to reflect this factor. As the investment quota varies considerably over the business cycle, this variable further provides some adjustment for differences in the position in the business cycle the countries may be in.

Data on steel consumption per capita were taken from the statistics of the International Iron and Steel Institute. The use of steel is measured as steel deliveries (or production) plus steel imports and minus steel exports. However, this measure does not take into account indirect trade in steel which is embodied in products such as cars, machines, etc. (Molajoni and Szewczyk 2012). Therefore, it is labeled as apparent steel use, in contrast to true steel use, which also considers indirect trade in steel. True steel use would be a better measure of a country’s actual steel consumption. However, currently, no data are provided on it.Footnote 3

Per capita income in internationally comparable prices and in current US dollars per person where taken from the IMF World Economic Outlook Database, GDP per capita in US dollars at 2000 prices from Feri. Data on investment as a percentage of GDP were obtained from World Bank sources. The period under inspection is from 1980 to 2009. The panel covers 44 countries (Table 2). We did not include countries of extremely low income or apparent steel use in our sample, since the quality of the data is quite often poor. As data for some years are missing for some countries, the analyses are based on an unbalanced panel which contains 1,245 observations. To start with, we estimate the following equation by pooled OLS using the three different GDP/capita measures:

with the respective country i in year t. Since it can be assumed that steel consumption increases initially with rising income and will decline after a certain income level is reached, per capita income will enter the regressions linearly and additionally in a quadratic transformation.

Table 3 shows that the estimated coefficients are significant at a 99 % level for all explanatory variables. The investment quota is positively correlated with steel consumption. Furthermore, for the three different GDP per capita measures, all coefficients show the expected sign: Per capita income has a positive impact and squared per capita income a negative, generating a hump-shaped relation between income and steel consumption. However, depending on the GDP per capita measure, we obtain different income levels at which steel consumption per capita reaches its maximum other things being equal.Footnote 4 For GDP per capita in US dollars at 2000 prices, this is the case at an income of 24.800 US dollars, for GDP per capita in current US dollars at an income of 36.100 US dollars. The difference of more than 11,000 US dollars makes evident that the results depend heavily on the transformation of GDP.

In the next step, we use PPP GDP and introduce country- as well as time-specific effects into our regressions. As can be seen in Table 4, the estimated turning point where steel consumption per capita reaches its maximum ($28.000) is only slightly influenced by the fact whether these fixed effects are included or not. When country- and time-fixed effects are included in the regression, the turning points are somewhat higher than that in the version without these effects. The maximum is at $28.700 using time-fixed effects, at $29.000 when including country-fixed effects, and at $31.800 when country- and time-fixed effects are considered. The coefficient of the investment quota becomes smaller when taking into account time-fixed effects which underpins that this variable also covers some cyclical effects that are in part time-specific. Furthermore, the time-fixed effects in Eqs. (2) and (4) show a downward trend (Fig. 2). Interpreting the time-fixed effects as a measure of technological progress, this result supports the idea that technological progress and the dissemination of technologies reduce steel consumption per capita over time. Zhang (2012) derives similar results in the context of CO2 emissions embodied in Chinese exports. He argues that technology transfer and international support could lead to lower greenhouse gas emission in the production processes and be decisive for a sustainable economic development in China.

The advanced economies with the highest incomes (USA, Switzerland, and Norway) had surpassed the income level at which steel consumption per capita reaches its maximum ($30.000) in the late 1990s. Other advanced economies, among which are Germany, Japan, and France, reached the peak some years later. None of the emerging economies in the sample except Taiwan has entered already the region in which steel consumption per head can be expected to decline (see also the country list in Table 2). They are still on the upward branch of the consumption curve, and steel consumption per capita will therefore continue to rise.

Differences between advanced and developing economies

As mentioned in the introduction and indicated by the decreasing time-fixed effects, technological progress can be a factor that will reduce future steel consumption. Thus, for future trends in steel consumption (and therefore also for the CO2 emissions caused by the steel industry), it may be decisive how fast-developing countries will adapt technologies which are already at hand in the advanced economies. To get some indication about the previous experience, two subgroups are analyzed in the following. The first group, which is labeled as advanced economies, contains all countries having reached income levels at which steel consumption per capita is projected to decline (30.000 international dollars). The countries which are still on the upward branch of the steel consumption/income curve are labeled here as developing economies, although many European countries with relatively low income can be found in this group as well.

To assess whether steel consumption is generally smaller in developing countries, a dummy variable is included in the following regressions that is 1, if a country is a “developing” economy in this sense, and 0 in all other cases.Footnote 5 Such country-specific dummy variables must be used carefully in panel analyses, as they might be correlated with country-specific effects. Therefore, only time-fixed effects are considered in the subsequent regressions. Furthermore, the investment quota is additionally interacted with the developing dummy variable to examine whether investment is more or less steel-intensive in developing countries. The results are shown in Table 5.

The intercept dummy in Eq. (5) in Table 5 is negative and significant. It implies that steel consumption per capita in developing countries is—other factors being equal—on average 84.8 kg per head lower compared to advanced economies. Including this dummy has only a small impact on the coefficient of per capita income. Moreover, the coefficient of the interaction term in Eq. (6) is negative, which could be an indication that investment is less steel-intensive in developing countries. At a first glance, this result may be surprising, since investment in many developing countries is concentrated on infrastructure projects and primary industries which are rather steel-intensive as a rule. However, it must be considered rather that we are looking at apparent steel consumption. As developing countries import a high share of the investment goods, the steel embodied in these products influences apparent steel consumption only in the exporter’s country and has no impact on the steel balance of the importer’s country. This fact also may explain the negative intercept dummy for developing countries in Eq. (5), which is insignificant in Eq. (6) which additionally includes the interaction term.Footnote 6

Conclusions

This paper presents some new estimates of the relation between apparent steel consumption per head and income levels. It confirms that there seems to be an increase of steel intensity in an initial stage of economic development and a decline after economies have reached a certain level of per capita income. This level seems to be reached at GDP per capita of about 30,000 dollars on a purchasing power basis. A second factor influencing steel consumption is the share of investment in GDP, which, however, seems to impact steel consumption differently in advanced and in developing economies. Whereas it drives steel consumption strongly in the first group, its influence is considerably lower in the second group. This can be explained by the fact that most developing countries are importers of investment goods which are quite often steel-intensive.Footnote 7 Imports of finished goods, however, do not influence apparent steel consumption.

A similar measurement problem arises when calculating a country’s carbon emissions. The United Nations Framework Convention on Climate Change (UNFCCC) measures a country’s carbon emissions according to the production in this country and not according to domestic absorption (consumption and investment). Thus, the measure does not account for the emissions contained in imported goods. Associated with this measurement problem, another environmental related problem has gained much attention in the public debate and in the empirical literature (see, e.g., Aichele and Felbermayr 2012) which is often referred to as “carbon leakage,” “race to the bottom,” or “pollution haven hypothesis.” It occurs if companies in particularly emission- and pollution-intensive sectors, such as the chemical industry, relocate their production from countries with high environmental standards to countries with less stringent environmental policy regimes to avoid the cost associated with pollution or emission abatement policies in their home country. The goods produced in these countries would then be imported by the advanced countries, but the emissions caused by the production would not be attributed to the advanced countries. However, in the empirical literature, there is no consensus whether or not carbon leakage really exists. In contrast to Aichele and Felbermayr (2012), several other empirical studies find no or only weak evidence for carbon leakage, e.g., Eskeland and Harrison (2003) and Manderson and Kneller (2012).

In the case of steel, two different factors seem to be at work in this context. On the one hand, energy efficiency of the iron and steel industry in major developing or emerging countries, such as China and Russia, is lower than that in the developed countries.Footnote 8 Since these countries are net exporters of steel, this may cause carbon leakage. On the other hand, developing countries tend to import a relevant share of the steel they use indirectly via steel-intensive products. Thus, the pollution associated with manufacturing these products is registered in advanced economies, which can be interpreted as a kind of carbon leakage in the opposite direction. Thus, the extent of carbon leakage in the iron and steel sector is uncertain. However, if developing countries imported a high share of their steel-intensive products, the global steel use and also the overall emissions intensity of the steel sector would benefit from steel- and pollution-saving technologies in the advanced economies.

Notes

Apparent steel use measures a country's crude steel production plus net crude steel exports."

However, there still might be an endogeneity problem, since apparent steel use per capita could be correlated with country-specific effects.

There is an ongoing research project at World Steel Association to calculate such data.

The coefficients of per capita income and per capita income squared determine at which income level steel consumption reaches its maximum.

In the case of advanced economies, the dummy is 0 for the whole sample period.

Running the regression for developing and advanced economies separately, leads to similar results

According to calculations of Bussiere et al. (2011, p. 35), the import content of total investment tends to be larger in developing countries.

The energy consumption per ton of steel in China was about 15–20 % higher than international best practice (Zhang et al. 2012).

References

Aichele R, Felbermayr G (2012) The carbon footprint of nations. J Environ Econ Manag 63(3):336–354

Bussiere, M., Callegari, G., Ghironi, F., Sestieri, G. and N. Yamano (2011), Estimating trade elasticities: demand composition and the trade collapse of 2008-09. NBER Working Paper 17712. Cambridge MA, NBER

Clark, C. (1940), The conditions of economic progress. London: MacMillan & Co. Ltd. 3rd edn., largely rewritten 1957.

Crompton P (1999) Forecasting steel consumption in South-East Asia. Res Policy 25(2):111–123

Crompton P (2000) Future trends in Japanese steel consumption. Res Policy 26:103–114

Eskeland GS, Harrison AE (2003) Moving to greener pastures? Multinationals and the pollution haven hypothesis. J Dev Econ 70(1):1–23

Fisher, AGB (1935) Production, primary, secondary and tertiary. In: The economic record, 15.6 (1939), 24-38.

Manderson E, Kneller R (2012) Environmental regulations, outward FDI and heterogeneous firms: are countries used as pollution havens? Environ Resour Econ 51(3):317–352

Molajoni P and Szewczyk A (2012) Indirect trade in steel: definitions, methodology and applications. Working paper, World Steel Association

RWI (2008) Die Klimavorsorgeverpflichtung der deutschen Wirtschaft—Monitoringbericht 2005-2007. RWI Projektberichte

Tcha M, Takashina G (2002) Is world metal consumption in disarray? Res Policy 28(1):61–74

Tilton J (1990) World metal demand: trends and prospects. Resources for the Future, Washington DC

Wårrel, L. and A. Olsson (2009), Trends and development in the intensity of steel use: an econometric analysis. Paper presented at the 8th ICARD, June 23-26. 2009, in Skellefteå, Sweden.

Wårrel L (2014) Trends and developments in long-term steel demand—the intensity-of-use hypothesis revisited. Res Policy 39:134–143

Zhang B, Wang Z, Yin J, Su L (2012) CO2 emission reduction within Chinese iron & steel industry: practices, determinant and performance. J Clean Prod 33:167–178

Acknowledgments

We thank Christoph M. Schmidt for his valuable comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Döhrn, R., Krätschell, K. Long-term trends in steel consumption. Miner Econ 27, 43–49 (2014). https://doi.org/10.1007/s13563-014-0046-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13563-014-0046-8