Abstract

As carbon peaking and carbon neutrality have become a global consensus, more and more countries have introduced relevant policies to adapt to their own countries and formulated corresponding time roadmap. The industrial sector, especially the steel sector, which produces high levels of pollution and carbon emissions, is facing significant pressure to transform its operations to reduce CO2 emissions. Previous studies have shown the importance of financial development (FD) in environmental protection; however, the impact of FD on the CO2 emissions of the steel sector is ignored. This paper examines the impact of FD on the CO2 emissions of the iron and steel industry from a global perspective using comprehensive panel data from a total of 30 countries during the period from 1990 to 2018. Empirical results show that an improved level of FD in a given country reduces the CO2 emissions of the iron and steel industry. The mechanism analysis indicates that FD promotes the upgrading of the structure of the iron and steel industry and the reduction of the CO2 emissions by means of the three-stage least square method. Our results also show that the effect of FD on reducing the CO2 emissions of the iron and steel industry in developing countries is less than its effect in developed countries. Estimation results also show the existence of the environmental Kuznets curve hypothesis in the iron and steel industry. Finally, we discuss the policy implications of achieving carbon neutrality in the steel sector.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The global call for carbon neutrality is becoming more and more intense. The United Nations secretary general António Guterres said that achieving carbon neutrality by 2050 is the most urgent mission facing the world today. Global carbon emissions should be reduced by 45% from 2010 levels by 2030. A number of countries and regions around the world have set carbon–neutral schedules, including the USA, Canada, the Republic of Korea, Japan, and the European Union. These countries and regions have declared a goal of achieving carbon neutrality by 2050, and China has announced a goal of achieving carbon neutrality by 2060. In the case of China, the 14th Five-Year Plan, adopted in 2021, clearly places green development in an important strategic position. The demand for green infrastructure will continue to increase in China. In 2016, China included green finance in the agenda of the G20 summit for the first time. Internationally, The EU steel industry started the ULCOS “Ultra-low CARBON dioxide emissions” project in 2004, aimed at reducing the carbon emissions per ton of steel by 50% by 2050. In 2008, the Republic of Korea issued the strategy of low carbon and green growth, which provides a strong and favorable policy to guarantee the development of green finance, and a series of green finance schemes were launched in 2009.

Financial development (FD) plays a vital role in carbon reduction (Kayani et al. 2020; Khan and Ozturk 2021; Pata 2018). FD can reduce carbon emissions through different channels, including promoting industrial structure and attracting foreign investment (Abokyi et al. 2019) and accelerating technological innovations (Zagorchev et al. 2011). The decarbonization of the steel and iron industry requires application of clean energy (Zhang et al. 2021) and adjustment of industrial structure. For example, Japan’s COURSE 50 low-carbon metallurgy project has been in operation for more than 10 years, and the hydrogen-rich reduction iron-making method is its key core technology (Tonomura 2013). The investment and application of clean energy require very high upfront costs (Tamazian and Bhaskara Rao 2010). High cost becomes an obstacle to carbon reduction in the steel sector, which can be alleviated by FD.

There is no conclusive conclusion on the debate of the rationality of using financial means to curb carbon emissions in the existing literature. FD gives both consumers and enterprises access to low-cost credit that allows consumers to purchase commodities that are highly energy-intensive, and it allows enterprises to expand their scale of production, which requires energy (Kayani et al. 2020; Shahbaz et al. 2017). Thus, FD leads to increased energy consumption, which in turn leads to an increase in the carbon emissions. However, Dogan and Seker (2016) indicated that financial means may be beneficial to curb the emissions and can drive the development of green technologies. This view is consistent with Zaidi et al. (2019). Other studies have found that FD is not related to CO2 emissions (Jamel et al. 2017; Mahdi Ziaei 2015). Few scholars have discussed whether FD can curb the emissions of the iron and steel industry. Unless otherwise specified, “the industry” in the rest of this paper all refers to “the iron and steel industry”.

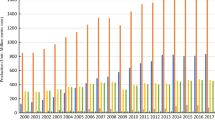

Given the high levels of pollution generated by the steel sector, it is essential to focus on reducing the carbon emissions, which may help meet the goal of carbon neutrality of the world. Figure 1 presents CO2 emissions from fuel combustion and crude steel production of the industry. The two curves demonstrate a rising trend and show that the industry is under great pressure to achieve carbon neutrality. Green production and energy savings are primary tasks for the industry, which struggles to reduce carbon emissions (Zhang et al. 2021). Steel is used in every aspect of modern life, and tracking the carbon emissions reduction of the industry is crucial; however, the low profit margins and high technology costs of the industry pose a serious challenge to carbon reduction. Moreover, energy constraints will lead the decline of the performance of enterprises that consume large amounts of energy (Zhang et al. 2018). The existing literature about the industry mainly discusses clean energy, emerging technologies, and advanced equipment, but it lacks a robust economic analysis of specific factors that affect CO2 emissions in the industry, especially from a global perspective.

Recently, several countries have introduced a series of green related financial policies, so it is urgent to discuss the function of financial research on carbon reduction in the industry. Figure 2 depicts scatter plots and fitting lines between the CO2 emissions of the steel sector and related FD using 30 the data of countries that ranked among the world’s top 40 countries in terms of crude steel production in 2019. We plotted CO2 emissions (based on the emissions of the industry in terms of global \({\mathrm{CO}}_{2}\) Emissions from Fuel Combustion calculated by the International Energy Agency; units, kt; and using the natural log) on the vertical Y-axis against FD (established by the International Monetary Fund, ranging from zero to one) on the horizontal X-axis; the two datasets are from the period 1990 to 2018. The first two rows and the first five items in the third row present the trend in developed countries, and the rest depict the trend in developing countries. According to the report released by the World Resources Institute in the second half of 2017, developed countries, except Japan and the Republic of Korea, reached the carbon peak in our samples. Figure 2 shows that the slope of the fitting line in most developed countries is negative. For the developed countries that reached the carbon peak, except the Netherlands and Sweden, we can see a negative correlation between the two variables. Since Japan and South Korea have not reached the carbon peak, it is meaningful to further study whether FD can restrain the CO2 emissions of the industry in these countries. The Russian Federation, Brazil, Ukraine, and Poland have achieved the carbon peak in our samples of developing countries. We find an interesting phenomenon occurring: there can be a negative relationship between the two variables in developing countries, such as in South Africa and Argentina, which is not found in the samples of developed countries. In addition, although Brazil has reached a carbon peak, the relationship between the CO2 emissions of the steel sector and FD does not show a negative correlation in the fitting line, which is also not reflected in the samples of developed countries. Thus, Fig. 2 indicates that heterogeneity exists between developed countries and developing countries. Since the CO2 emissions of the industry and FD appear to have a positive relationship on the scatter chart in most countries that have not reached the carbon peak, it is of great significance to study whether FD promotes or inhibits CO2 emissions generated by the industry. Such investigation should help the heavily polluting steel industry to move toward carbon neutrality and ultimately meet the goal of the Paris Agreement.

This paper examines the specific impact of FD on the CO2 emissions of the industry, and takes into account the heterogeneity of countries with different developmental stages. Considering the cross-section correlation of the panel data, we employ the Driscoll–Kraay standard error. To test the robustness of our results, the legal origin was employed as part of a group of instrumental variables that reflect FD. The rest of this paper is organized as follows: the second section introduces the literature review; the third section presents a summary of the methods and data; the fourth section reports the empirical results and discussions; and the fifth section presents the conclusions and policy implications.

Literature review

The first segment of this section summarizes the previous findings regarding the nexus between finance and carbon (or environment). The second segment summarizes existing studies about the path and potential of carbon emissions reduction of the industry.

Financial development and carbon emissions

The available literature holds three distinct views on the linkage between finance and carbon: positive, negative, and insignificant. Wang et al. (2020a) reveal a positive relationship between carbon emissions and FD in N-11 countries. Similarly, Kayani et al. (2020) found a long-term significant positive correlation between carbon emissions and FD, as well as studying urban populations in the top ten CO2 emissions countries, using panel data and a fully modified least squares approach. Pata (2018) demonstrated that environmental degradation was exacerbated by FD and urbanization in Turkey. Abbasi and Riaz (2016) argued that evolution in the financial sector alleviates the liquidity constraints faced by listed companies, leading to increased production and energy consumption, which consequently increased carbon emissions. Shahbaz et al. (2017) indicated that more convenient financial services provide more possibilities for consumers to utilize low-cost credit to purchase items that increase carbon emissions in India.

However, other researches hold opposite points. Ulucak et al. (2020) argued that financial globalization makes it possible for emerging economies to have more funds available for green investment and thus effectively curbs environmental degradation. Shahbaz et al. (2018) found that the use of financial means ensures the sustainable development of the environment in France by reducing carbon emissions. This conclusion is contrary to the Shahbaz et al. (2017) study. Zaidi et al. (2019) showed that globalization and FD inhibit carbon emissions in APEC countries. FD can promote investment in green technologies and thus reduce carbon emissions (Tamazian and Bhaskara Rao 2010). Dogan and Seker (2016) indicated that the application of renewable energy, the expansion of trade openness, and the continued development of finance prevented CO2 emissions. Bekhet et al. (2017) showed that FD supports energy emissions reduction. Shahbaz et al. (2013) documented that FD was beneficial for carbon reduction in Malaysia, while energy consumption increased carbon emissions. Jalil and Feridun (2011) suggested that FD in China could curb carbon emissions and help to move more capital into investing in environmental facilities.

The third view is that there is no connection between finance and environment. Dogan and Turkekul (2016) argue that the increase in energy consumption and the growth of the urban population worsen the environment, while FD does not affect environmental evolution, and trade curbs environmental degradation. Mahdi Ziaei (2015) showed that the shock of carbon emissions on financial indicators was not obvious. Jamel et al. (2017) found that the impact of FD on carbon emissions was not significant. Another study indicated that FD had a negligible effect on CO2 emissions in the Middle East and North Africa, possibly because of this area’s weak financial sector (Charfeddine and Kahia 2019).

In general, the development of finance increases household consumption and expands the production of enterprises, which stimulates energy consumption and carbon emissions. However, FD also reduces the cost of financing used in low-carbon technologies, guides the flow of funds to related industries, optimizes industrial infrastructure, and thus reduces carbon emissions. The reason for the controversy is that the countries and regions investigated are heterogeneous and indicators of FD are not identical. For instance, Shahbaz et al. (2017) found that FD has stimulated carbon emissions in India, but the opposite was found in France (Shahbaz et al. 2018). In addition, financial efficiency has contributed to carbon emissions reduction, while FD increased emissions in China (Huang and Zhao 2018). This paper takes into account the overall developmental stage of the country investigated and employs multidimensional FD indicators provided by the International Monetary Fund (IMF).

The impact of financial development on CO2 emissions is asymmetric. On the one hand, enterprises with sufficient funds have the ability to adopt advanced technology and equipment to improve the efficiency of production process, which can reduce energy consumption and achieve carbon reduction. Tamazian and Bhaskara Rao (2010) indicated that FD encourages governments and enterprises to adopt low-carbon technologies to reduce carbon emissions. Zhang (2011) also indicated that FD helps enterprises promote technological innovation and use of low-carbon technologies to improve energy efficiency and reduce CO2 emissions. On the other hand, a sound financial system can finance enterprises’ activities to increase production, which lead to more energy consumption and thus higher CO2 emissions. FD encourages households and businesses to buy energy-intensive machinery and equipment, contributing to further energy consumption (Acheampong 2019; Shahbaz and Lean 2012). FD affects CO2 emissions through different channels but ultimately is linked to energy consumption.

Carbon emission reduction of the iron and steel industry

Existing research on the carbon emissions reduction of the industry mainly focuses on specific technologies. Liu et al. (2021) explicated the application of hydrogen in the steel industry. Hydrogen is considered to have the most potential as a clean energy source in the twenty first century, and many steel enterprises are implementing projects for the application of hydrogen in the industry. Wang et al. (2020b) showed the energy saving potential of the industry and employed mass-thermal network optimization to identify appropriate energy saving technologies. Nwachukwu et al. (2021) showed that biomass can reduce CO2 emissions by up to 43% in Sweden’s current steel technology sector. The highly efficient use of natural gas in electric arc furnace steelmaking is beneficial for decreasing CO2 emissions (Kirschen et al. 2009). A circular economy has reduced the emissions of the Brazilian steel industry by 65% (de Souza and Pacca 2021). Yun et al. (2021) discussed the application and techno-economic assessment of CO2 capture. Their results showed that the membrane-based CO2 capture process can be more cost-effective than the absorption-based process in the environment in which flue gas CO2 concentration is greater than about 30%. The application and implementation of decision support systems can help steel plants reduce their cost pressure and CO2 emissions (Porzio et al. 2013). Song et al. (2018) argued that economic activity is the long-term incentive for CO2 emissions of the industry and technological change helps to meet the goal of carbon reduction.

Through literature review, we found that FD ultimately reduces (or increases) CO2 emissions by reducing (or increasing) energy consumption. Based on this channel, this paper puts forward two hypotheses for the iron and steel industry:

-

H1: FD enabled steel enterprises to obtain more sufficient funds, which encouraged steel enterprises to apply low-carbon technology and equipment, improved the energy consumption structure, and reduced CO2 emissions.

-

H2: FD provided loans with low interest rates to encourage the production expansion of steel enterprises, so that steel enterprises purchase equipment with high energy consumption and low cost, which aggravates the energy consumption, thus leading to the increase of CO2 emissions.

The main contributions of this paper are as follows. First of all, the iron and steel industry has a high degree of industrial relevance. Carbon reduction in the iron and steel industry may help to reduce carbon emissions of other industries and even the total carbon emissions. Regarding the lack of literature on the factors that affect the CO2 emissions of the industry, this paper aims to study the impact of FD on the CO2 emissions of the industry. Second, we extend the existing theory of the impact mechanism of financial development on CO2 emissions to the iron and steel industry. This paper studies whether FD affects CO2 emissions by stimulating the industry to use advanced equipment and improving the energy structure and thus reducing CO2 emissions.

Empirical model and data

Empirical model

The nonlinear relationship between economic growth and CO2 emissions follows that of Acaravci and Ozturk (2010). The selection of control variables refers to Acheampong et al. (2020), and these variables are specific to the industry. Among them, energy consumption is replaced by crude steel production, and the total population variable is eliminated:

where \(\dot{i}\) = 1……30 and \(t\) = 1990……2018; \({\varepsilon }_{it}\) is the stochastic error term; \(\mathit{ln}\;CO_{2it}\) is the logarithms of the CO2 emissions of the industry, which is calculated through the fuel combustion of the industry; \({\beta }_{0}\) is the constant parameter; \({\beta }_{1}\),\({\beta }_{2}\), and \({\beta }_{3}\) are the coefficients to be estimated; \({\phi }_{1}\) is a set of coefficients to be estimated; \({X}_{it}\) is a set of control variables including crude steel production (\(\mathit{ln}\;PROUD_{it})\), urbanization (\(\mathit{ln}\;URBAN_{it})\), and the trade openness of the industry (COPEN); \(F{D}_{it}\) is the FD index; \(\mathit{ln}\;RGDP_{it}\) is the economic growth; and \({v}_{i}\) and \({v}_{t}\) are two-way fixed effects.

Considering that the panel data used may have a cross-sectional correlation dependency problem, we first conducted a cross-sectional correlation test. Cross-sectional dependence will lead to inconsistent estimates (Sarkodie and Strezov 2019). In order to obtain consistent and robust estimated standard errors, Driscoll and Kraay (1998) developed a new algorithm to address this problem. Taking the time effect into account, we adopted the Frees’ test to check for cross-sectional correlation dependency.

Considering the possible correlation between \(F{D}_{it}\) and the error terms that may cause endogeneity, we used the two-stage least square method to check the robustness of our estimated results. Practicable instrumental variables should be closely correlated with \(F{D}_{it}\) and remain strictly exogenous. Under normal circumstances, it is difficult to identify all the factors that can affect the CO2 emissions of the industry. If omitted variables have an impact on \(F{D}_{it}\), that would lead to the endogeneity problem. Therefore, to address the endogeneity problem and produce consistent estimates, legal origins are employed as a set of instrumental variables for \(F{D}_{it}\). Legal origins are a set of dummy variables indicating whether a county’s legal system springs from an English, Socialist, French, German, or Scandinavian tradition. La Porta et al. (1997) argued that legal origins have a long-term influence on contractual institutions. Beck et al. (2003) showed that differences in the ability of legal origins to effectively adapt to evolutionary forces can help to explain the importance of the origin of legal systems on FD.

We adopt a simultaneous equation model and use a simultaneous three-stage least squares method to estimate it with instrumental variables and discover the mechanism of how FD affects the CO2 emissions of the industry. The instrumental variables used in this paper for \(F{D}_{it}\) are invariant with time, so Eq. (3) does not take into account individual fixed effects:

where \(EA{F}_{it}\) is the level of the application of the electric arc furnace.

To investigate the heterogeneity of CO2 emissions from the industry in terms of the FD level of countries with different development levels, Eq. (1) is extended to include the interaction term (\(F{D}_{it}\times D\mathrm{e}v{C}_{it}\)), where \(D\mathrm{e}v{C}_{it}\) is a dummy variable, \(D\mathrm{e}v{C}_{it}\) = 1 represents developing countries, and \(D\mathrm{e}v{C}_{it}\) = 0 represents developed countries:

Data

Table 1 provides the abbreviations, meanings, units, and sources of all of the variables covered in this paper. Data for our research covers the period from 1990 to 2018 for a total of 30 countries, including 17 developed and 13 developing countries. Developed countries are derived from the division of advanced economies by the IMF. These samples are selected from the top 40 countries of crude steel production according to the World Iron and Steel Association in 2019, taking data availability and carbon intensity into account. The samples of developed countries include the USA, Canada, Germany, Japan, the Republic of Korea, Italy, France, Spain, Belgium, the UK, Austria, the Netherlands, Australia, Slovak, Finland, Sweden, and the Czech Republic; samples of developing countries include China, India, the Russian Federation, Turkey, Brazil, Ukraine, Mexico, Poland, Egypt, South Africa, Indonesia, Kazakhstan, and Argentina. The \({\mathrm{CO}}_{2}\) data was based on the emissions of the industry published by the World \({\mathrm{CO}}_{2}\) Emissions from Fuel Combustion as calculated by the IEA. The data regarding crude steel production and the export and import of semi-finished and finished steel was obtained from the World Steel Association. Trade openness is represented using total imports and exports of semi-finished and finished steel as a percentage of crude steel production. Urbanization is proxied using total urban populations, and real GDP per capita constant in 2010 represents the economic growth. The above values are obtained from the World Bank. The proportion of crude steel production of electric arc furnace in total crude steel production comes from the Steel Statistical Year Book 1998 to 2019 published by World Steel Association. Unless otherwise specified, “CO2 emissions” in the rest of this paper all refers to “CO2 emissions of the iron and steel industry.”

The percentage of domestic credit in GDP, the capitalization of the stock market, and stock market turnover were important indexes that were used to represents FD, but these indexes are single measures for FD (Acheampong et al. 2020). Considering the multidimensional nature of FD, this paper employs the Financial Development Index developed by the IMF, including the FD index (FD, an aggregate of the financial institution’s index and the financial market index); the financial markets index (FM, an aggregate of the financial market’s depth index, financial market’s access index, and financial market’s efficiency index); FM’s sub-indicators such as the financial market’s depth index (FMD, size and liquidity), the financial market’s access index (FMA, ability of individuals and companies to access financial services), and the financial market’s efficiency (FME, the level of activity of the capital markets). In this paper, FD is the most critical explanatory variable, while FM, FMD, FMA, and FME are used to assist in interpretation.

Table 2 provides the summary statistics of the variables and shows that the mean of the CO2 emissions of the industry in developing countries is higher than it is in developed countries. Compared with developing countries, real GDP per capita and FD are higher in developed countries. Moreover, trade openness in the industry in developed countries is higher than it is in developing countries. In terms of crude steel production, developing countries produce slightly more than developed countries. These descriptive statistics show us the different characteristics of the same variable between developed and developing countries.

Results and discussions

Empirical results and the robustness of the results are reported and discussed in this section. Before conducting the regression, we considered that a cross-sectional correlation might exist in the panel data that we used. This paper applies the Frees’ test proposed by Frees (1995) to test for any problems related to cross-sectional correlation in the data.

Table 3 reports the results of the Frees’ test when FD, FM, FMA, FMD, and FME are used as FD indicators and indicates that a cross-sectional correlation exists in the two models we used at the 1% significance level. To deal with cross-sectional correlation, the Driscoll–Kraay standard error was employed.

The effect of financial development on CO2 emissions of the iron and steel industry

Table 4 presents the estimates based on Eq. (1) and shows that the estimated coefficients for FD, FM, FMD, and FME are negative and statistically significant at the 5% level or better. The negative effect of financial market access on CO2 emissions of the industry was beyond 10%. For a global perspective, when the other conditions were fixed, the higher the level of a country’s FD, the more effective it was at reducing CO2 emissions from the industry. Before we try to understand why FD can reduce the CO2 emissions of the industry, should we first grasp the specific meaning of FD and other indicators built by the IMF? In the indicators that we use, FD is the most comprehensive, and financial market depth (FMD) is a symbol of the scale and liquidity of the financial markets. Countries with a high value of FMD have the ability to provide a breeding ground for the survival of green finance. On the contrary, that is difficult to survive in a country with a small and illiquid financial market. Ren et al. (2020) found that green finance and new energy technology contribute to carbon reduction. The core role of green finance is to guide funds flow to resource-saving technology development and environmental protection. Only with the support of green finance can iron and steel enterprises reduce CO2 emissions more effectively through the further development of financing. A higher financial market efficiency (FME) value means lower cost financial services and more active involvement from the capital market. Iron and steel enterprises need sufficient capital to achieve ultra-low carbon emissions. Blanford (2009) augured that R&D can be the best source for improving green technologies and reducing carbon emissions. For steel enterprises, researching and developing low-carbon technologies is costly, and reducing CO2 emissions requires sacrificing some profits. The main obstacles to the implementation of clean technology are financial and economic (Bhandari et al. 2019), and FD can lower the threshold of enterprise financing (Jalil and Feridun 2011). Thus, a more active capital market and lower external costs are essential for iron and steel enterprises’ efforts to implement a low carbon strategy. Based on these results, we posit that FD can inhibit the CO2 emissions from the industry.

Our results further indicate that, in other conditions remain unchanged, the expansion of crude steel production leads to the increase of the CO2 emissions of the industry. Crude steel is outside the scope of low-carbon steel, and it is an important indicator that is used to measure the development of the industry. The estimated coefficient of COPEN is negative and statistically significant at 1%, which means the steel trade helps reduce the CO2 emissions of the industry. Dogan and Seker (2016) showed that increase in trade and FD can help countries employ new green technologies through technology spillover. In addition, more imported steel means that no additional crude steel is needed to meet domestic demand. That is, trade can improve the allocation of the resources of the industry and rationalize it, thus reducing CO2 emissions. Urbanization can increase CO2 emissions of the industry at the significance level of 1%. This result implies that an increase in the urban population contributes to the CO2 emissions of the industry. Khezri et al. (2021) and Poumanyvong and Kaneko (2010) found that urbanization can increase the intensity of carbon emissions, because resource-intensive urban living increases demand for infrastructure and transportation (Acheampong et al. 2020). Steel is the most important engineering and construction material and is widely used in cars and construction. Thus, an increase in the urban population will increase the production of steel, which causes a corresponding increase the CO2 emissions of the industry.

The main term of lnRGDP exerts a significant positive effect on the CO2 emissions of the industry at 1%, and its squared term exerts a significant negative effect on that at 1%. This result indicates that the relationship between economic growth and the CO2 emissions of the industry is an inverted U-shaped, which suggests that economic growth initially increases the CO2 emissions of the industry, but CO2 emissions start to decrease after economic growth reached a certain value. The EKC exists in the industry.

Robustness checks and mechanism analysis

Considering the possibility of correlation between FD and the stochastic error term, the omission of variables may lead to endogeneity. To control the endogeneity, we follow the legal origins as a set of instrumental variables for FD, FM, FMA, FMD, and FME to check for robustness. Legal origins are a set of dummy variables that indicate whether a country’s legal system is rooted in the English, Socialist, French, German, or Scandinavian traditions. The specific data of legal origins is obtained from La Porta (1999). In the mechanism study, we employed simultaneous three-stage least squares to estimate Eq. (2) and Eq. (3).

In this section, we first checked the robustness of our basic results that FD contributes to carbon reduction in the industry. Considering that the endogenous variables would be completely collinear with the individual fixed effect, while using the legal origins as the instrumental variable, we adopted the ec2sls method to check the robustness of our results.

Table 5 reports the estimated results of Eq. (1) using the legal origins as the instrumental variable of FD, FM, FMA, FMD, and FME. The results show that FD can significantly inhabit CO2 emissions at the level of 5%. This suggests the robustness of the conclusion that FD does reduce the CO2 emissions. Moreover, FM and FME also can curb the CO2 emissions at the significant level of 10% or better. FMA becomes significant after controlling the endogeneity. The estimated coefficients of crude steel production and urbanization are negative and statistically significant at 1%. An expansion of steel trade openness can reduce the CO2 emissions of the industry at a significant level of 1%. In general, the estimation results of Eq. (1) are robust.

In the remainder of this section, we analyze the mechanism of how FD inhibits the CO2 emissions of the industry. Table 6 shows the estimates based on Eq. (2) and Eq. (3). Empirical results present that the estimated coefficients for FD, FM, FMA, FMD, and FMA are all positive at the significance level 5% level or better when EAF is regarded as the explained variable. FD helps to increase the proportion of crude steel produced by electric arc furnace in the overall process of crude steel production. The total energy consumption and CO2 emissions in electric arc furnace steelmaking processes are significantly lower than those in oxygen steelmaking processes (Sandberg et al. 2001).

The results also show that the estimated coefficients for EAF are negative at 1% level when lnCO2 is regarded as the explained variable. The improvement of EAF is conducive to reducing the CO2 emissions of the industry. Steel enterprises need sufficient funds to optimize their steel production processes, and improving EAF is an important link. FD enables enterprises to obtain funds (Jalil and Feridun 2011), which means that FD is conducive to the transformation of steel enterprises from oxygen-blown converter production to electric arc furnace production. Among FM’s sub-indicators, compared with the other two indicators, FME is the most efficient indicator of improving EAF. Table 4 shows that FME is more effective than FMD in reducing the CO2 emissions of the industry. Activity in the capital markets can ease the cost pressure of the low-carbon transformation of steel enterprises. The traditional steel production model is generally overreliance on fossil energy sources and has a high carbonization of the energy structure. In order to change this energy structure, the industry may face great cost and technology pressure and even give up partial economic benefits. FD has able to relieve the above pressure and encourage the industry to increase investment in the research and development of low-carbon technology, and it promotes the green metallurgical energy structure, which reduces the CO2 emissions of the industry.

In general, we summarize two paths of FD that may help to reduce the CO2 emissions of the industry, as shown in Fig. 3. Crude steel is produced either by oxygen-blown converter or electric arc furnace. Compared with the former, electric arc furnace has the characteristics of less energy consumption and higher cost and belongs to low-carbon equipment. The expansion of the use of electric arc furnace represents that steel enterprises have increased the use of low-carbon equipment. In addition, the steel production process of electric arc furnace depends more on electricity, while the steel production process of blast furnace depends on the use of primary energy, which means that the expansion of steel production proportion of electric arc furnace represents the optimization of energy consumption structure of iron and steel industry to a certain extent. Table 6 actually shows that FD encourages the global iron and steel industry to use low-carbon technology and equipment, reduces their dependence on primary energy, improves the energy consumption structure, and thus reduces CO2 emissions of the iron and steel industry. The results support H1 and deny H2.

Differences of carbon reduction effect of financial development between developed and developing countries

Table 7 presents the estimates based on Eq. (4). We obtained the same findings as Eq. (1); namely, FD presidents a negative and significant effect on CO2 emissions at 1%, which means that FD has the ability to curb the CO2 emissions of the industry after we add the interaction term of FD for countries at different levels of development. Underdeveloped economy inhibits the carbon reduction effect of FD at a significant level of 5%. Thus, we hold the opinion that FD in developing countries can reduce CO2 emissions less than that in developed countries. In general, the financial systems of developing countries are not as environmentally friendly as those of developed countries, especially when it comes to green finance.

Green finance originated in Western developed economies in the 1970s, and developing countries did not engage in it until much later. According to the Climate Bonds Initiative (CBI), global green bond issuance reached 167.3 billion dollars in 2018. The top ten countries that participated in this bond issuance were all developed countries, except for China and India. The USA issued the largest number of green bonds, followed by China and France, and these three countries accounted for 47% of the global issuance. The funds raised by green bonds mainly went to the new energy, construction, and transportation sectors. Emission reduction technology in the industry largely depends on the application of new energy and steel, which (the latter) is the most important material for construction. Developed countries issue more green bonds than developing countries, which mean that the iron and steel industry in developed countries can more easily be supported by green finance that reduces CO2 emissions than that of developing countries. Compared with developed countries, efforts made by developing countries to prevent the CO2 emissions remain in the initial stages (Fu et al. 2014). Low-carbon steelmaking technology in developed countries is more advanced than that of developing countries, and more funds flow into low-carbon products in developed countries than in developing countries. Therefore, compared with developing countries, the FD of developed countries can more effectively prevent the emissions of the industry.

We performed grouped regressions to show the heterogeneity more clearly. Table 8 presents the grouped estimates; we still detect the heterogeneity between developed and developing countries. The estimation results in the developed country group show that FD, FM, FMD, and FME have reduced CO2 emissions at a significant level of 5% or better. In the developing country group, however, the carbon reduction effect of FD and FMD is not obvious. Both FM and FME sever carbon reduction in developed and developing countries at a significant level of 5% or better. To meet the goal of carbon reduction, developing countries should pay more attention to the efficiency of financial markets and provide low-cost credit to steel enterprises.

Conclusions and policy implications

Although there has been considerable research on how to reduce the CO2 emissions of the industry, it has focused mainly on the application of new technologies. In this paper, we established empirical models to examine the relationship between FD and the CO2 emissions of the industry from a global and economic perspective. Taking into account the interactive relationship between the level of national overall development and FD, we adopt interaction terms to extend our basic model. We list and detail our conclusions from this research below.

First, from a global perspective, our empirical results showed that FD, FM, and FME have a significant negative effect on the CO2 emissions of the industry. Due to the externality of the reduction on CO2 emissions, steel enterprises may have to sacrifice profits to achieve carbon neutralization by reducing CO2 emissions. FD can reduce the external cost of capital acquisition; as a result, steel enterprises can more easily obtain capital. Therefore, a more advanced financial system means lower external costs for obtaining sufficient funds to support carbon emissions reduction for steel enterprises. A higher FD level provides a strong incentive for the steel industry to reduce CO2 emissions.

Second, the heterogeneity of the effect of FD on the CO2 emissions of the industry exists in developed and developing countries. The same level of FD has a more significant effect in developed countries than in developing countries on helping the industry reduce CO2 emissions. Green finance in developing countries began later than it did in developed countries, and most of the countries that issue green bonds are developed countries. Thus, steel enterprises in developed countries can get more support from green financing. Low-carbon technology in developed countries is advanced, which may cause financing to flow to low-carbon steelmaking in developed countries at a higher level than it does in developing countries.

Third, the iron and steel industry faces a difficult economic situation, characterized by a low concentration ratio, low profit margins, and being small in scale. In the pursuit of economics of scale to reduce costs, rational steelmakers tend to expand their production scale. This rational behavior may cause financing to flow toward production rather than toward emissions reduction. Kim et al. (2020) suggested that unsuitable types of finance may lead to higher CO2 emissions, but excessive financing may not. To our satisfaction, we found that FD can reduce CO2 emissions by optimizing the steelmaking process (increasing the proportion of steel produced by electric arc furnaces). FD plays a positive role in guiding steel enterprises to transform from high-pollution and high-emission production mode to low-carbon production mode. To achieve the goal of carbon neutrality, policymakers and steel producers must consider carefully the use of financial capital through the process of steelmaking. Especially in developing countries, steel enterprises are generally small in scale and the industrial concentration of the industry is also low. The expansion of production by steel enterprises in pursuit of economies of scale may drive capital obtained from financing to flow to the production side rather than to the emissions reduction side. Therefore, the development of green finance with its unique nature can help to reduce the CO2 emissions.

Based on the above conclusions, it is essential to clarify policy implications. On the path to achieving carbon neutrality, policymakers must pay attention to carbon reduction in the iron and steel industry. The formulation of financial policies should be combined with the current national development. Innovative green financing can create opportunities for the carbon reduction of the iron and steel enterprises. When using financial means to support this carbon reduction, policymakers should adopt public disclosure mechanisms that require steel enterprises to publish reports of their environmental performance. Financing can be used for both emission reduction and the expansion of production; therefore, policymakers should improve the relevant regulatory policies to monitor the flow of funds obtained from green financing in the steelmaking process. The benefits of carbon reduction from FD in the iron and steel industry in developing countries are less than that of developed countries. Therefore, it may be more significant for developing countries to improve their overall financial systems to play its important role in carbon emission reduction. Government, research institutions, and enterprises should actively cooperate to promote the integration of financing into the practice of industry–university–research in the iron and steel industry. Increasing the proportion of crude steel produced by electric arc furnace is conducive to achieving carbon neutrality of the iron and steel industry, in addition to increasing this proportion through financial means.

Data availability

Sources of the data were explained in Table 1. In addition, the datasets and codes used in the paper were available from the authors.

References

Abbasi F, Riaz K (2016) CO2 emissions and financial development in an emerging economy: an augmented VAR approach. Energy Policy 90:102–114

Abokyi E, Appiah-Konadu P, Abokyi F, Oteng-Abayie EF (2019) Industrial growth and emissions of CO2 in Ghana: the role of financial development and fossil fuel consumption. Energy Rep 5:1339–1353

Acaravci A, Ozturk I (2010) On the relationship between energy consumption, CO2 emissions and economic growth in Europe. Energy 35:5412–5420

Acheampong AO (2019) Modelling for insight: does financial development improve environmental quality? Energy Econ 83:156–179

Acheampong AO, Amponsah M, Boateng E (2020) Does financial development mitigate carbon emissions? Evidence from heterogeneous financial economies. Energy Econ 88:104768

Beck T, Demirgüç-Kunt A, Levine R (2003) Law and finance: why does legal origin matter? J Comp Econ 31:653–675

Bekhet HA, Matar A, Yasmin T (2017) CO 2 emissions, energy consumption, economic growth, and financial development in GCC countries: dynamic simultaneous equation models. Renew Sustain Energy Rev 70:117–132

Bhandari D, Singh RK, Garg SK (2019) Prioritisation and evaluation of barriers intensity for implementation of cleaner technologies: framework for sustainable production. Resour Conserv Recycl 146:156–167

Blanford GJ (2009) R&D investment strategy for climate change. Energy Econ 31:S27–S36

Charfeddine L, Kahia M (2019) Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: a panel vector autoregressive (PVAR) analysis. Renewable Energy 139:198–213

de Souza JFT, Pacca SA (2021) Carbon reduction potential and costs through circular bioeconomy in the Brazilian steel industry. Resour Conserv Recycl 169:105517

Dogan E, Seker F (2016) The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renew Sustain Energy Rev 60:1074–1085

Dogan E, Turkekul B (2016) CO2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res Int 23:1203–1213

Driscoll JC, Kraay AC (1998) Consistent covariance matrix estimation with spatially dependent panel data. Rev Econ Stat 80:549–560

Frees EW (1995) Assessing cross-sectional correlation in panel data. J Econ 69:393–414

Fu J-x, Tang G-h, Zhao R-j, Hwang W-s (2014) Carbon reduction programs and key technologies in global steel industry. J Iron Steel Res Int 21:275–281

Huang L, Zhao X (2018) Impact of financial development on trade-embodied carbon dioxide emissions: evidence from 30 provinces in China. J Clean Prod 198:721–736

Jalil A, Feridun M (2011) The impact of growth, energy and financial development on the environment in China: a cointegration analysis. Energy Econ 33:284–291

Jamel L, Maktouf S, Charfeddine L (2017) The nexus between economic growth, financial development, trade openness, and CO2 emissions in European countries. Cogent Econ Finance 5:1341456

Kayani GM, Ashfaq S, Siddique A (2020) Assessment of financial development on environmental effect: implications for sustainable development. J Clean Prod 261

Khan M, Ozturk I (2021) Examining the direct and indirect effects of financial development on CO2 emissions for 88 developing countries. J Environ Manage 293:112812

Khezri M, Karimi MS, Khan YA, Abbas SZ (2021) The spillover of financial development on CO2 emission: a spatial econometric analysis of Asia-Pacific countries. Renew Sustain Energy Rev 145

Kim D-H, Wu Y-C, Lin S-C (2020) Carbon dioxide emissions and the finance curse. Energy Econ 88:104788

Kirschen M, Risonarta V, Pfeifer H (2009) Energy efficiency and the influence of gas burners to the energy related carbon dioxide emissions of electric arc furnaces in steel industry. Energy 34:1065–1072

La Porta R, Lopez-De-Silanes F, Shleifer A, Vishny Rw (1997) Legal determinants of external finance. J Finance 52:1131–1150

La Porta R (1999) The quality of government. J Law Econ Organ 15:222–279

Liu W, Zuo H, Wang J, Xue Q, Ren B, Yang F (2021) The production and application of hydrogen in steel industry. Int J Hydrogen Energy 46:10548–10569

Mahdi Ziaei S (2015) Effects of financial development indicators on energy consumption and CO2 emission of European, East Asian and Oceania countries. Renew Sustain Energy Rev 42:752–759

Nwachukwu CM, Wang C, Wetterlund E (2021) Exploring the role of forest biomass in abating fossil CO2 emissions in the iron and steel industry – the case of Sweden. Appl Energy 288:116558

Pata UK (2018) Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: testing EKC hypothesis with structural breaks. J Clean Prod 187:770–779

Porzio GF, Fornai B, Amato A, Matarese N, Vannucci M, Chiappelli L, Colla V (2013) Reducing the energy consumption and CO2 emissions of energy intensive industries through decision support systems – an example of application to the steel industry. Appl Energy 112:818–833

Poumanyvong P, Kaneko S (2010) Does urbanization lead to less energy use and lower CO2 emissions? A cross-country analysis. Ecol Econ 70:434–444

Ren X, Shao Q, Zhong R (2020) Nexus between green finance, non-fossil energy use, and carbon intensity: empirical evidence from China based on a vector error correction model. J Clean Prod 277:122844

Sandberg H, Lagneborg R, Lindblad B, Axelsson H, Bentell L (2001) CO2 emissions of the Swedish steel industry. Scand J Metall 30:420–425

Sarkodie SA, Strezov V (2019) Effect of foreign direct investments, economic development and energy consumption on greenhouse gas emissions in developing countries. Sci Total Environ 646:862–871

Shahbaz M, Lean HH (2012) Does financial development increase energy consumption? The role of industrialization and urbanization in Tunisia. Energy Policy 40:473–479

Shahbaz M, Solarin SA, Mahmood H, Arouri M (2013) Does financial development reduce CO2 emissions in Malaysian economy? A time series analysis. Econ Model 35:145–152

Shahbaz M, Hoang THV, Mahalik MK, Roubaud D (2017) Energy consumption, financial development and economic growth in India: new evidence from a nonlinear and asymmetric analysis. Energy Econ 63:199–212

Shahbaz M, Nasir MA, Roubaud D (2018) Environmental degradation in France: the effects of FDI, financial development, and energy innovations. Energy Econ 74:843–857

Song Y, Huang J-B, Feng C (2018) Decomposition of energy-related CO2 emissions in China’s iron and steel industry: a comprehensive decomposition framework. Resour Policy 59:103–116

Tamazian A, Bhaskara Rao B (2010) Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Econ 32:137–145

Tonomura S (2013) Outline of Course 50. Energy Procedia 37:7160–7167

Ulucak ZŞ, İlkay SÇ, Özcan B, Gedikli A (2020) Financial globalization and environmental degradation nexus: evidence from emerging economies. Resour Policy 67:101698

Wang R, Mirza N, Vasbieva DG, Abbas Q, Xiong D (2020a) The nexus of carbon emissions, financial development, renewable energy consumption, and technological innovation: what should be the priorities in light of COP 21 Agreements? J Environ Manage 271:111027

Wang RQ, Jiang L, Wang YD, Roskilly AP (2020b) Energy saving technologies and mass-thermal network optimization for decarbonized iron and steel industry: a review. J Clean Prod 274:122997

Yun S, Jang M-G, Kim J-K (2021) Techno-economic assessment and comparison of absorption and membrane CO2 capture processes for iron and steel industry. Energy 229:120778

Zagorchev A, Vasconcellos G, Bae Y (2011) Financial development, technology, growth and performance: evidence from the accession to the EU. J Int Finan Markets Inst Money 21:743–759

Zaidi SAH, Zafar MW, Shahbaz M, Hou F (2019) Dynamic linkages between globalization, financial development and carbon emissions: evidence from Asia Pacific Economic Cooperation countries. J Clean Prod 228:533–543

Zhang L, Long R, Chen H, Huang X (2018) Performance changes analysis of industrial enterprises under energy constraints. Resour Conserv Recycl 136:248–256

Zhang X, Jiao K, Zhang J, Guo Z (2021) A review on low carbon emissions projects of steel industry in the world. J Clean Prod 306:127259

Zhang Y-J (2011) The impact of financial development on carbon emissions: an empirical analysis in China. Energy Policy 39:2197–2203

Funding

This work was supported by the National Natural Science Foundation of China (No. 72073009, 71573251) and the Fundamental Research Funds for the Central Universities (No. FRF-TP-19-048A2, FRF-BR-19–004, FRF-TP-17-014A1, FRF-BR-17-005B).

Author information

Authors and Affiliations

Contributions

Yanmin Shao conceived and proofread the study and suggested revision opinions. Junlong Li designed models and drafted the first manuscript. Xueli Zhang collected the data and revised the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible editor: Nicholas Apergis

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Shao, Y., Li, J. & Zhang, X. The impact of financial development on CO2 emissions of global iron and steel industry. Environ Sci Pollut Res 29, 44954–44969 (2022). https://doi.org/10.1007/s11356-022-18977-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-18977-7