Abstract

The paper analyzes some models of a Limit Order Book, determined as a Nash equilibrium among a large number of traders, in infinite time horizon. We study how the size and shape of the LOB are related to the expected profit rate of traders posting limit orders, and to the random distribution of incoming external buy or sell orders. Formulas are derived which show how the volatility of the stock, and the presence of better informed external agents, determine (i) an increase in the bid-ask spread and (ii) a liquidity reduction, i.e. a decrease in the total amount of stocks posted for purchase or for sale. We also analyze models including “fast” and “slow” traders, that can react more or less quickly to changes in the fundamental value of the stock.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

A bidding game related to a continuum model of the Limit Order Book (LOB) was recently considered in Ref. [5, 6, 8, 9], proving the existence and uniqueness of a Nash equilibrium and determining the optimal strategies for the various agents. In the basic model, it is assumed that an external buyer asks for a random amount \(X>0\) of a given asset. This external agent will buy the amount X at the lowest available price, as long as this price does not exceed some (random) upper bound \(\overline{P}\). One or more sellers offer various quantities of this same asset at different prices, competing to fulfill the incoming order, whose size is not known a priori.

Having observed the prices asked by his competitors, each seller must determine an optimal strategy, maximizing his expected payoff. Because of the presence of the other sellers and of the upper bound \(\overline{P}\), asking a higher price for an asset reduces the probability of selling it.

The models considered in Ref. [5, 6, 8, 9] all have the form of a “one shot game". All players’ payoffs are completely determined as soon as one single incoming order is received. The later paper [7] considered a two-sided LOB, where both sell and buy orders are posted. Moreover, it included a time-dependent model, with a finite number of incoming buy or sell orders. However, the fundamental value of the stock was always assumed to remain constant in time.

The present paper is concerned with problems in infinite time horizon, also allowing for random fluctuations in the fundamental value \(\beta =\beta (t)\) of the traded asset. A key modeling assumption is that all traders posting limit orders have the expectation of increasing their wealth at least at rate \(\gamma >0\). More precisely, call

the wealth of a trader at any time \(t\ge 0\). Then, for any \(0<s<t<+\infty \) the expected wealth should be

If this rate of increase cannot be achieved, agents will simply move away from the given LOB, and conduct their trading activity on some other platform.

The other key ingredient of the model is the random distribution of incoming buy and sell orders. Namely: the size of the orders, and the time frequency with which they arrive. We will show that, together with the growth rate \(\gamma \), this distribution entirely determines the size and shape of the LOB, in terms of a Nash equilibrium among a large number of traders posting limit orders. At an intuitive level, if the LOB contains a large number of limit orders, there is high competition among traders and this drives down their expected profit. As a consequence, some of the traders will move out, until the holdings of the remaining ones increase exactly at the desired rate (1.1).

In a later section consider the possibility that better informed external buyers or sellers may occasionally anticipate random jumps in the fundamental value of the stock. When this happens, one of the two sides of the LOB can be wiped out, resulting in a loss for the traders posting limit orders. Compared with the previous model, we show that in this case the bid-ask spread becomes larger. Moreover, as the volatility of the stock increases, a liquidity reduction is observed. Namely, the total amount of stock offered on the LOB for buy of for sale decreases.

Finally, we analyze a model with two groups of traders: “slow" traders, whose profits can be curtailed by better informed external agents at times when the value of the stock jumps, and “fast" traders, who can instantly access information and adjust their bids at jump times. We show that, if traders of the two groups have different expectations \(\gamma '<\gamma \) on the rate of increase (1.1) of their holdings, they can be simultaneously present on the LOB. In a typical situation, calling \(\beta \) the current value of the stock, fast traders will post their bids to sell stock within a range of prices \(p\in [p_-, \widehat{p}]\), while slow traders will post their bids at prices \(p\in [\widehat{p}, p_+]\), with \(\beta<p_-<\widehat{p} < p_+\). We also identify cases where either

-

(1)

All fast traders are squeezed out from the LOB, because the competition with slow traders does not allow them to achieve the high growth rate (1.1) that they expect, or

-

(2)

All slow traders are squeezed out from the LOB, because their profit is curtailed by (i) the competition of fast traders and (ii) the losses due to stock volatility combined with the presence of better informed agents.

The remainder of the paper is organized as follows. Section 2 introduces the basic model, collecting the main assumptions. In Sect. 3 we study the Nash equilibrium profile of the “sell" and “buy" portions of the LOB, for an asset whose fundamental value remains constant. In Sect. 4 we describe the modifications needed in the case when the value of the asset has random jumps. Section 5 introduces a model where better informed external agents may occasionally anticipate random jumps in the fundamental value of the stock. A model with “fast" and “slow" traders is then analyzed in Sect. 6. Finally, some examples where the LOB profile can be explicitly computed are worked out in Sect. 7.

Throughout our analysis, as in Ref. [10, 13] we consider a “mean field limit", modeling a large number of agents. Each trader posts buy or sell orders for an amount of stock which is small, compared with the overall size of the LOB. For a rigorous derivation of this mean field limit see Theorem 9.1 in Ref. [5].

For various other models of the LOB considered in the literature we refer to Ref. [1,2,3,4, 11]. See also the surveys [12, 14] and references therein.

2 The Basic Model

We consider a situation involving an infinite sequence of incoming orders \(X_1,X_2,\ldots \), arriving according to a Poisson process. Each can be either a buy order or a sell order. The random variables \(X_j\), \(j\ge 1\), describing the amount of stock that the external agents want to buy (or sell), are mutually independent. As in Ref. [9], we assume that the sizes of the incoming buy or sell orders \(X_{buy}\), \(X_{sell} \) are random variables, with tail distributions

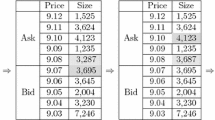

In our basic model, the maximum price that a buyer is willing to pay (or the minimum price that an external seller is willing to accept) is not known a priori. More precisely, calling \(\beta >0\) the current fundamental value of the stock, we assume that the external agent will agree to the transaction only as long as the price ranges within an interval \(\bigl [Q_s\beta ,~Q_b\beta \bigr ]\), where also \(Q_s,Q_b\) are independent random variables (Fig. 1), with \(0<Q_s\le 1\le Q_b\),

To fix ideas, throughout the following we shall assume (see Fig. 1)

- (H1):

-

The tail distribution functions \(\Psi _b,\Psi _s\) are continuous, strictly decreasing, with \(\Psi _b(0)=\Psi _s(0)=1\), \(\Psi _b(s),\Psi _s(s)\rightarrow 0\) as \(s\rightarrow +\infty \).

- (H2):

-

The function \(h_b(\cdot )\) is non-increasing, piecewise continuous with at most one jump at \(s=1+\delta \). Similarly, the function \(h_s(\cdot )\) is non-decreasing, piecewise continuous with at most one jump at \(s=1-\delta '\), for some \(\delta , \delta '>0\). Moreover

$$\begin{aligned} h_b(s) = \left\{ \begin{array}{rl} 1\quad &{}\hbox {if}\quad s\le 1,\\ 0\quad &{}\hbox {if}\quad s > 1+\delta ,\end{array}\right. \qquad \qquad h_s(s) = \left\{ \begin{array}{rl} 1\quad &{}\hbox {if}\quad s\ge 1,\\ 0\quad &{}\hbox {if}\quad s < 1-\delta '.\end{array}\right. \end{aligned}$$

The arrival times of these incoming orders are assumed to be random. More precisely, calling \(0= t_0<t_1<t_2<\cdots \) the times when buy orders arrive, we assume that the differences \(t_j-t_{j-1}\) are independent random variables, with probability distribution

Similarly, calling \(0= t'_0<t'_1<t'_2<\cdots \) the times when sell orders arrive, we assume that the differences \(t'_j-t'_{j-1}\) are independent random variables, with probability distribution

At any given time, we describe a limit order book in terms of a continuous function \(U(\cdot )\), as shown in Fig. 2. The following notation will be used:

-

\(\beta >0\) denotes the fundamental value of the stock. This is assumed to be known by all agents. One can think of \(\beta \) as the average value at which a unit amount of the stock is traded on various platforms around the world.

-

For \(p<\beta \), \(U=U_b(p/\beta )\) is the total amount of stock that traders on the LOB bid to buy at price \(\ge p\).

-

For \(p>\beta \), \(U=U_s(p/\beta )\) is the total amount of stock that traders on the LOB offer to sell at price \(\le p\).

-

The maximum bid price \(p_B\) and the minimum ask price \(p_A\) are defined as

$$\begin{aligned} p_B~=~\sup \bigl \{ p<\beta ;~U_b(p/\beta )>0\bigr \},\qquad p_A~=~\inf \bigl \{ p>\beta ;~U_s(p/\beta )>0\bigr \}.\nonumber \\ \end{aligned}$$(2.5) -

\(p^+\) is the highest price at which some trader offers to sell stock, while \(p^-\) is the lowest price at which some trader offers to buy stock.

-

\(K_b\), \(K_s\) is the total amount of stock that agents posting orders on the LOB offer to buy or sell, respectively,

According to the above definitions, as shown in Fig. 2 one has

When \(U(\cdot )\) is absolutely continuous w.r.t. Lebesgue measure, for \(p>\beta \) one can consider the density \(\phi (p)= \beta ^{-1}U_s(p/\beta )\) of stocks posted for sale at price p. This function satisfies

Similarly, the density \(\phi (p)= -\beta ^{-1}U_b(p/\beta )\) of the “buy" part of the LOB satisfies

Remark 2.1

It is convenient to define the functions \(U_b\) and \(U_s\) in terms of the relative price \(p/\beta \). Indeed, thanks to this choice we obtain formulas for \(U_b(\cdot )\) and \(U_s(\cdot )\) that are independent of the fundamental value \(\beta \) of the stock. This is particularly useful when one considers models where \(\beta =\beta (t)\) varies randomly in time.

An external order of size X is executed as follows (Fig. 3).

CASE 1: A buy order in the amount \(X_b\) with maximum acceptable price \(Q_b\beta \). In this case the external buyer will take all stocks whose price ranges in the interval \(\bigl [\beta ,\, p(X_b,\,Q_b)\bigr ]\), where

CASE 2: A sell order in the amount \(X_s\) with maximum acceptable price \(Q_s\beta \). In this case the external seller will fulfill all the bids whose price ranges in the interval \(\bigl [p(X_b,\,Q_b), \,\beta \bigr ]\), where

In both cases it is understood that, if the sets on the right hand sides of Eqs. (2.9) or (2.10) are empty, then no stock is bought or sold.

A possible shape of the limit order book, where \(\phi \) is the density function at Eqs. (2.7)–(2.8). If the external order has size \(X>0\) and is a buy order, all the stocks in the shaded region with price \(p\in [p_A,p(X,Q)]\) as in Eq. (2.9) will be sold. If the external order is a sell order, all the buy orders in the shaded region with price \(p\in [p(X,Q), p_B]\) as in Eq. (2.10) will be executed

To obtain a mathematically tractable problem, the following modeling assumptions will be made.

- (A1):

-

The amount of buy or sell orders posted by each individual trader is small, compared with the total amounts of orders \(K_b, K_s\) posted on the LOB.

- (A2):

-

At any time \(t\ge 0\) the LOB is in equilibrium. In other words, posting a “sell" order at any price \(p\in [p_A, p^+]\) yields the same expected growth rate (1.1) to a trader’s wealth, while while asking a price \(p\notin [p_A, p^+]\) yields an equal or lesser profit rate. Similarly, posting a “buy" order at price \(p\in [p^-, p_B]\) yields the same expected growth rate (1.1), while offering to buy stock at an price \(p\notin [p^-, p_B]\) yields an equal or lesser profit rate.

Remark 2.2

By the analysis in Ref. [5], the assumption (A1) can be justified by taking a suitable limit, in a model with a large number of small traders. An important consequence of this assumption is that the expected wealth w(t) of a trader is a linear function of his initial holdings, in cash or in stock. For this reason, it will be sufficient to analyze the case where the trader initially holds a unit amount of cash, or a unit amount of stock.

The assumption (A2) requires some explanation. Traders make a profit by buying the asset at a price \(p<\beta \) and selling it at a price \(p>\beta \), similarly to a bank that buys and sells foreign currencies. Their profit increases with the size and frequency of incoming external orders. If a trader posts a “sell" order at a high price, he will make a larger profit from the sale, but he will have to wait a longer time before his stock is actually sold. If a second trader asks for a lower price, his stock will likely be sold more quickly, but the profit margin will be small. During any given time interval [0, T], the trader buying and selling stock at prices closer to the fundamental value \(\beta \) will perform a larger number of transactions, but at each time his profit margin will be smaller. In the end, the expected growth rate of the wealth of all traders active on the LOB will be the same.

Because of the competition among traders, when the total amount of asset \(K_s,K_b\) posted on the LOB is large, this will reduce the expected profit of each trader posting limit orders. An underlying assumption of our model is that there exists a large pool of traders, who can decide to post limit orders on the given LOB (if this yields the desired expected growth rate of their wealth), or move away their activity to some other trading platform (if trading on the given LOB is not sufficiently profitable).

As it will be shown by subsequent analysis, for a given \(\gamma >0\) there exist unique sizes \(K_b\), \(K_s\) of the “buy" and “sell" portions of the LOB that yield the expected growth rate \(\gamma \) for the wealth of all active traders. In particular, the model accounts for a “liquidity reduction", i.e. the shrinking of the total volume of bids on the LOB, as a result of high volatility of the stock, combined with the presence of better informed external agents.

Remark 2.3

In a model with finite time horizon \(t\in [0,T]\), the players’ strategies depend on time. Indeed, every player must take into account how much time is left until the end of the game. On the other hand, the models considered in this paper have infinite time horizon, and the optimal strategies do not depend explicitly on time.

A key identity, which we use to determine the players’ optimal strategies, is the following. Let any time interval [0, T] be given. Consider a trader whose initial wealth is \(w(0)=w_0\), and assume that at a random time \(t_1\in [0,T]\) its wealth increases to \(w_1\), as a result of a first transaction. Then, conditional to this event, according to Eq. (1.1) his expected wealth at time T should be

Indeed, the additional growth is due to possible further transactions taking place during the remaining time interval \([t_1,T]\).

This identity will be repeatedly used to derive explicit formulas for the function U describing the shape of the LOB. It is important to observe that these formulas do not depend on the particular choice of the time T, which is used only as a tool for the analysis.

Remark 2.4

In the literature, a common way to formulate an optimization problem for each player in infinite time horizon is

where w(t) is the player’s wealth at time t and \(\gamma ^*>0\) is a discount factor. To add some novelty (and interest) to the present analysis, instead of Eq. (2.11) we shall assume that each player strives to achieve the growth rate (1.1). We expect that similar results could also be proved for a model based on Eq. (2.11).

3 An Asset with Constant Fundamental Value

We first study the case where the fundamental value \(\beta \) of the stock remains constant in time. As it will be shown later, the same analysis applies to a stock whose random value is a martingale.

3.1 The “sell" portion of the LOB.

Let the constants \(\mu , \gamma >0\) be given, together with the tail distribution functions \(\Psi _b(\cdot ), h_b(\cdot )\), as in Eqs. (2.1)–(2.2). We begin by giving a precise definition of Nash equilibrium for a profile \(U_s(\cdot )\) of the “sell" portion of the LOB. Toward this goal, call

the set of prices at which some stock is offered for sale.

Next, fix any time \(T>0\). Consider a trader who initially holds a unit amount of stock, so that at time \(t=0\) his wealth is \(w(0)=\beta \). Assume that he puts his asset on sale at some price \(p>\beta \). Two possibilities can then occur:

-

(i)

During the time interval [0, T] no external “buy" order arrives. In this case, at time T the trader’s wealth is still \(w(T)=\beta \). By Eq. (2.3) this happens with probability \(e^{-\mu T}\).

-

(ii)

At some time \(t_1\le T\) a first “buy" order arrives.

-

If the trader sells his unit amount of stock, his wealth increases from \(\beta \) to p. This happens with probability \(\Psi _b\bigl (U_s(p/\beta )\bigr ) h_b(p/\beta )\).

-

If the trader does not sells his unit amount of stock is sold, his wealth remains equal to \(\beta \). This happens with probability \(1-\Psi _b\bigl (U_s(p/\beta )\bigr ) h_b(p/\beta )\).

In both cases, during the remaining interval \([t_1, T]\) by Eq. (1.1) the trader’s expected wealth will increase by the factor \(e^{\gamma (T-t_1)}\).

-

Recalling that by Eq. (2.3) the probability density of the first arrival time of a buy order is \(\mu e^{-\mu t_1}\), the expected trader’s wealth at the time T is thus computed by

Again in view of Eq. (1.1), this expected wealth should be \(\beta e^{\gamma T}\).

A concept of Nash equilibrium for the LOB profile \(U_s(\cdot )\) can now be formulated by requiring that

-

(i)

For any price \(p\ge \beta \), one has \(\mathcal{E}(p,T)\le \beta \,e^{\gamma T}\).

-

(ii)

For every price \(p\in \mathcal{P}_{sell}\) at which some bid is made, one has \(\mathcal{E}(p,T)= \beta \,e^{\gamma T}\).

Remarkably, the above conditions do not depend on \(\beta , T\), but only on the ratio \(p/\beta \). Indeed, starting with the inequality

after some simplifications one obtains

This leads to

Definition 3.1

Let the constants \(\mu , \gamma >0\) be given, together with the tail distribution functions \(\Psi _b(\cdot ), h_b(\cdot )\). We say that a profile \(U_s(\cdot )\) provides a Nash equilibrium for the “sell" portion of the LOB if

-

(i)

For any price \(p >\beta \), the inequality (3.3) holds.

-

(ii)

For every price \(p\in \mathcal{P}_{sell}\) at which some bid is made, (3.3) is satisfied as an equality.

To obtain a formula for the profile \(U_s(\cdot )\) of the “sell" portion of the LOB, we observe that, by the assumption (H1), the function \(\Psi _b\) has a well defined, strictly decreasing inverse \(\Psi _b^{-1}: \,]0,1]\mapsto [0, +\infty [\,\). Motivated by Eq. (3.3) we introduce the function

Here and throughout the sequel, for convenience we adopt the convention

We then define (see Fig. 4)

Theorem 3.1

Let the constants \(\mu , \gamma >0\) be given, together with the tail distribution functions \(\Psi _b(\cdot ), h_b(\cdot )\), satisfying (H1)–(H2). Then the formulas (3.4)–(3.6) yield the unique profile \(U_s(\cdot )\) of the “sell" portion of the LOB which yields a Nash equilibrium.

The total amount \(K_s\) of stock put on sale on the LOB is a decreasing function of the expected growth rate \(\gamma >0\). In particular, \(K_s=0\) if

Proof

1. By the assumptions (H1)–(H2), the right hand side of Eq. (3.6) is a continuous, non-negative, non-decreasing function of \(\xi \). With the above definition we show that, if \(U_s(p/\beta )\) describes the amount of stock put on sale at price \(\le p\), this yields a Nash equilibrium.

Indeed, if \(p\in \mathcal{P}_{sell}\) is a price at which some asset is put on sale, then the equality \(U_s(p/\beta )= V_s(p/\beta )\) must hold. By the previous analysis, the relation (3.3) is thus satisfied as an equality.

On the other hand, for every price \(p>\beta \), either \(V_s(p/\beta )\) is not defined, or else \(U_s(p/\beta )\ge V_s(p/\beta )\). In both cases, the inequality (3.3) holds.

2. We now prove uniqueness. Let \(\widetilde{U}\) be another profile, that also yields a Nash equilibrium for the “sell" portion of the LOB. As in Eq. (3.1), call

If \(\widetilde{U}(\xi _1) < U_s(\xi _1)\) at some point \(\xi _1>\beta \), consider the point

as shown in Fig. 4 Then

Therefore, at the point \(\xi _1'\) one has

This contradicts part (i) of Definition 3.1, showing that \(\widetilde{U}\) does not yield a Nash equilibrium.

On the other hand, if \(\widetilde{U}(\xi _2) > U_s(\xi _2)\) at some point \(\xi _2>\beta \), consider the point

as shown in Fig. 4. Then

Therefore, at the point \(\xi _2'\in \widetilde{\mathcal{P}}\) one has

This contradicts part (ii) of Definition 3.1, showing that \(\widetilde{U}\) does not yield a Nash equilibrium.

3. Since \(\Psi _b, \Psi ^{-1}_b\) are strictly decreasing, the fact that \(V_s, U_s\) are decreasing functions of \(\gamma \) follows immediately from the definitions (3.4)–(3.6). In particular

is a non-increasing function of \(\gamma \). \(\square \)

Remark 3.1

In the special case where the maximum acceptable price is deterministic:

The formula (3.6) reduces to

3.2 The “buy" portion of the LOB.

To analyze the “buy" portion of the LOB, consider a trader who initially holds a unit amount of cash, and offers to buy stock at price \(p<\beta \). Fix any time interval [0, T] and call \(t_1'>0\) the first random time when an external sell order arrives. Recalling (2.4), by the same arguments used at Eq. (3.2), the expected wealth of this trader at time T is computed by

By Eq. (1.1), this expected value should be \(e^{\gamma T}\). Calling

the set of prices at which the traders bid to buy stock, by Eq. (3.10) we are led to

Definition 3.2

Let the constants \(\nu , \gamma >0\) be given, together with the tail distribution functions \(\Psi _s(\cdot ), h_s(\cdot )\). We say that a profile \(U_b(\cdot )\) provides a Nash equilibrium for the “buy" portion of the LOB if

-

(i)

For any price \(p< \beta \), one has the inequality

$$\begin{aligned} \left( { \beta \over p}-1\right) \cdot \Psi _s \bigl (U_b(p/\beta )\bigr ) \cdot h_s\left( {p/\beta }\right) ~\le ~{\gamma \over \nu }. \end{aligned}$$(3.12) -

(ii)

For every price \(p\in \mathcal{P}_{buy}\) at which some bid is made, Eq. (3.12) is satisfied as an equality.

Retracing the steps in the proof of Theorem 3.1, the “buy" portion \(U_b(\cdot )\) of the LOB can be obtained by setting

Here we are again adopting the convention \(\Psi _s^{-1}(z)\doteq 0\) for \(z\ge 1\).

4 An Asset with Fundamental Value Modeled by a Jump Process

In this section we assume that the fundamental value \(\beta (t)\) of the stock is piecewise constant in time, and jumps at random times \(0<\tau _1<\tau _2<\cdots \) These times will be modeled by a Poisson arrival process with rate \(\lambda \), namely

Setting

We assume that, at the jump times \(\tau _j\), the ratios

are independent, identically distributed random variables, with expected value

and tail distribution

For some nonincreasing function \(\Phi (\cdot )\). We assume that, when the fundamental value \(\beta (t)\) jumps, this immediately becomes common knowledge to all agents. Both portions of the LOB will thus retain the same shape as before, will all prices being multiplied by the same ratio Z.

To analyze the “sell" portion of the LOB, we consider the times \(0<t_1<t_2<\cdots \) where either one of the two following cases occurs:

-

(i)

An external buy order arrives.

-

(ii)

The fundamental value of the stock has a jump.

Since these two events are independent, and occur with frequency \(\mu \), \(\lambda \), respectively, we now have

To obtain the profile \(U_s(\cdot )\) of the “sell" part of the LOB, we argue as in the previous section. Fix a time interval [0, T] and consider a trader who initially holds a unit amount of stock, with fundamental value \(\beta _0\), and puts it on sale at price \(p>\beta _0\). Since his initial wealth is \(w(0)=\beta _0\), at time T, the expected value of his holdings should be \(E\bigl [w(T)\bigr ]=e^{\gamma T}\beta _0\).

At the first time \(t_1\) when either (i) or (ii) occurs, two alternatives can happen:

-

(1)

The value of the stock jumps from \(\beta _0\) to a random value \(\beta _1\). This happens with probability \({\lambda \over \mu +\lambda }\). In this case, by Eqs. (4.3)–(4.4) at time \(t_1\) the expected wealth of the trader is \(E\big [w(t_1)] = E[\beta _1] = \eta \beta _0\,\).

-

(2)

An external “buy" order arrives. This happens with probability \({\mu \over \mu +\lambda }\). In this case, taking into account the probability that the trader does or does not sell his asset, as in Eq. (3.2) we find

$$\begin{aligned} E\big [w(t_1)] ~=~ \beta _0 + (p-\beta _0) \, \Psi _b \bigl (U_s(p/\beta _0)\bigr ) \, h_b({p/\beta _0}). \end{aligned}$$(4.7)

In both cases, during the remaining time interval \([t_1, T]\) the expected wealth of the trader should increase by the factor \(e^{(T-t_1)\gamma }\).

Recalling that by Eq. (4.6) the probability density of the random time \(t_1\) is \((\mu +\lambda )e^{-(\mu +\lambda )t}\), combining the above formulas we obtain

After some simplifications one obtains

We thus say that the profile \(U_s(\cdot )\) of the “sell" portion of the LOB provides a Nash equilibrium if the conditions (i)–(ii) in Definition 3.1 hold, with Eq. (3.3) replaced by

Notice that, if \(\lambda =0\) or \(\eta =1\), this formula reduces to Eq. (3.3).

Concerning the “buy" portion of the LOB, we observe that a change in the fundamental value \(\beta (t)\) of the stock does not affect the wealth of a trader posting “buy" orders, who does not own that stock. Therefore, Definition 3.2 remains unchanged also in the case a stock with variable fundamental value.

The same arguments used in the proof of Theorem 3.1 now yield:

Proposition 4.1

Assume that the fundamental value \(\beta (t)\) of the stock has random jumps as in Eqs. (4.1)–(4.4), with \((\eta -1)\lambda <\gamma \).

-

(i)

The “sell" portion of the LOB is described by Eq. (3.6), where the function \(V_s\) is now defined by

$$\begin{aligned} V_s(\xi )~=~\Psi _b^{-1} \left( {\gamma +(1-\eta )\lambda \over \mu } \cdot {1\over (\xi -1) \, h_b(\xi )}\right) , \end{aligned}$$(4.11) -

(ii)

The “buy" portion of the LOB is still described by the formulas (3.13)–(3.14).

Remark 4.1

If the jump process describing the fundamental value of the stock is a martingale, i.e., if \(\eta =1\), then the formula (4.11) reduces to Eq. (3.4).

On the other hand, when \(\eta >1\) the right hand side of Eq. (4.11) becomes smaller. In this case the profile of the “sell" portion of the LOB is the same as in the case of a stock with constant fundamental value, but where the traders expect the smaller growth rate

This can be explained by observing that, if \(\eta >1\), traders already make some profit by simply holding the stock. To achieve the growth rate \(\gamma \), a smaller additional profit from their trading activity is required.

We also remark that, if \((\eta -1)\lambda \ge \gamma \), then the agents can achieve a growth rate \(\ge \gamma \) of their wealth simply by holding the stock and watching its value increase. In this case the Eq. (4.11) is not meaningful.

5 A Model with Informed External Agents

The model at Eqs. (4.1)–(4.5) with random jumps in the fundamental value of the stock becomes more interesting if we include the possibility that an external agent gets hold of the information before any of the traders has time to react and change the prices posted on the LOB. As a consequence, at the jump time \(\tau _j\) one has:

-

If the fundamental value of the stock increases, i.e. \(\beta _{j}> \beta _{j-1}\), then all assets that traders offered to sell at a price \(<\beta _{j}\) are immediately bought.

-

If the value decreases, i.e. \(\beta _{j}< \beta _{j-1}\), then all of the assets that the traders offered to buy at a price \(>\beta _{j}\) are immediately sold.

To simplify the analysis, in the remainder of the paper we shall assume that the maximum and minimum acceptable prices are deterministic. That means:

Similar results can be proved in the general case, at the price of more lengthy formulas.

Starting with the model at Eqs. (4.1)–(4.5) we assume that, at each time when a jump occurs, with positive probability \(\varepsilon >0\) an external agent gets hold of the information in advance. To understand how this new scenario affects the “sell" portion of the LOB, we consider the random times \(0<t_1<t_2<\cdots \), where either a buy order arrives, or else the fundamental value of the stock has a jump. As before, the time increments \(t_k-t_{k-1}\) between one event and the next are i.i.d. exponential random variables, with tail distribution (4.6).

To analyze the LOB profile, fix a time interval [0, T] and consider a trader who initially holds a unit amount of stock, and puts it on sale at some price \(p>\beta _0\). His initial wealth is \(w(0)= \beta (0)=\beta _0\).

At the first random time \(t_1\), three possibilities can now occur:

-

(1)

a buy order arrives.

-

(2)

the fundamental value \(\beta \) of the stock has a jump, and nothing else happens,

-

(3)

\(\beta \) has a jump, and an informed external agent wipes out one side of the LOB,

The corresponding probabilities are

If the first alternative holds, then at time \(t_1\) by Eqs. (4.7) and (5.1), the expected wealth of a trader posting a sell order at price p is computed by

If the second alternative holds, at time \(t_1\) the expected wealth is computed by

If the third alternative holds, recalling (4.5) the expected wealth of a trader posting a sell order at price p is computed by

In all cases, during the remaining time interval \([t_1, T]\) the expected wealth of the trader should increase by the factor \(e^{(T-t_1)\gamma }\). Here and throughout the following, one should be reminded that the tail distribution function \(\Phi \) is decreasing, hence \(- d\Phi (s)\) yields a positive measure.

In this more general setting, accounting for the possible presence of better informed external agents, in view of Eqs. (5.3)–(5.5) the formula (4.8) is replaced by

After some simplifications one obtains

Notice that Eq. (5.7) reduces to Eq. (4.9) when \(\varepsilon =0\). Using the identity

by the earlier analysis, from Eq. (5.7) one obtains:

Proposition 5.1

In the above setting, if at each time of jump an informed external agent is present with probability \(\varepsilon \ge 0\), the “sell" portion of the LOB is described by

Note that we are always using the convention (3.5). We observe that here the argument of \(\Psi _b^{-1}\) is a non-increasing function of p. Hence \(U_s(\cdot )\) is non-decreasing.

Remark 5.1

We recall that the tail distribution function \(\Phi (\cdot )\) introduced at Eq. (4.5) is non-increasing. Therefore, the right hand side of Eq. (5.9) is an increasing function of \(\varepsilon \). Since \(\Psi _b, \Psi ^{-1}_b\) are strictly decreasing, this implies that, if a larger number of informed external agents are present, the total amount of assets offered for sale on the LOB will decrease.

In the special case where the value of the stock is a martingale, i.e. \(\eta =E[Z]=1\), the above formula reduces to

For \(\varepsilon >0\) fixed, the argument of \(\Psi _b^{-1} (\cdot )\) on the right hand side of Eq. (5.10) is an increasing function of \(\lambda \). This formula shows how the total amount of stock offered for sale on the LOB decreases, as the volatility of the stock becomes larger.

An entirely similar formula can be obtained for the “buy" portion \(U_b(\cdot )\) of the LOB. As in Eq. (2.4), let \(\nu \) be the rate at which external “sell" orders arrive, and call \(\beta _0\) the initial value of the stock. Consider the random times \(0<t_1'<t_2'<\cdots \), where either a sell order arrives, or else the fundamental value of the stock has a jump.

To analyze the LOB profile, fix a time interval [0, T] and consider a trader who initially holds a unit amount of cash, and offers to buy stock at some price \(p<\beta _0\). His initial wealth is thus \(w(0)= 1\).

At the first random time \(t_1'\), three mutually exclusive possibilities can now occur:

-

(1)

a sell order arrives.

-

(2)

the fundamental value \(\beta \) of the stock has a jump, and nothing else happens,

-

(3)

\(\beta \) has a jump, and an informed external agent wipes out one side of the LOB,

The corresponding probabilities are

If the first alternative holds and the trader posted a buy order at price \(p<\beta _0\), then at time \(t_1'\) his expected wealth is

If the second alternative holds, then at time \(t_1'\) the expected wealth of a trader holding cash does not change:

If the third alternative holds and the trader posted a buy order at price \(p\in \bigl [ (1-\delta ')\beta _0,\, \beta _0\bigr [\,\), at time \(t_1'\) his expected wealth is

In view of Eqs. (5.12)–(5.14), the same arguments used at Eq. (5.6) now yield

After the usual simplifications, one obtains

and hence

By the inequality in Eq. (5.14), the argument of \(\Psi _s^{-1} (\cdot )\) on the right hand side of Eq. (5.16) increases with \(\lambda \varepsilon \). In particular, for a fixed \(\varepsilon >0\), since \(\Psi ^{-1}_s\) is a strictly decreasing function, this shows how the total amount of stock that traders bid to buy on the LOB decreases as the volatility of the stock grows.

6 Fast and Slow Traders

A key modeling assumption that we have used so far is that agents posting limit orders are indistinguishable from each other. They all share the same information, and expect that their trading activity will produce the same growth rate \(\gamma \) in their wealth.

In this last section we analyze a model including different types of agents. Namely: “fast traders", who can instantly access information about the change in the fundamental value of the stock and react accordingly, and “slow traders", whose bids may be wiped out by better informed external agents, at times where the fundamental value of the stock jumps, as described in Sect. 5.

This entire section will be focused on the “sell" portion of the LOB, since the analysis of the “buy" portion is similar. We will show that bids from both fast and slow traders can coexist, but only if the two groups have different expectations on the growth rate of their wealth. As before, to simplify the analysis we shall assume deterministic acceptable prices (5.1).

Call \(\beta =\beta (t)\) the current value of the stock. At the first time \(\tau >t\) when the value of the stock has a jump, assume that a better informed external agent shows up with probability \(\varepsilon >0\). The expected wealth of a trader initially holding a unit amount of stock, and posting a “sell" order at price \(p>\beta \) will be

Similarly, the expected wealth of a trader initially holding a unit amount of cash, and posting a “buy" order at price \(p<\beta \) will be

In the following, we call

Before we proceed with the analysis, a convenient definition of “Nash equilibrium" must be given. Call

respectively the set of prices at which fast traders or slow traders offer to sell their stock. In view of Eqs. (4.10) and (5.7)–(5.8) we now introduce

Definition 6.1

Let the constants \(\mu ,\varepsilon >0\) and \(\gamma '<\gamma \) be given, together with the tail distribution functions \(\Psi _b(\cdot ), h_b(\cdot )\), and \(\Phi (\cdot )\). We say that the two functions \(U^{fast}\), \(U^{slow}\) yield a Nash equilibrium for the “sell" portion of the LOB if, setting \(U=U^{fast}+U^{slow}\), the following holds.

-

(i)

For any price \(p\in \,\bigl ]\beta , \, (1+\delta )\beta \bigr ]\), one has the inequality

$$\begin{aligned} \left( {p\over \beta }-1\right) \Psi _b \bigl (U(p/\beta )\bigr )~\le ~{\gamma +(1-\eta )\lambda \over \mu }. \end{aligned}$$(6.4) -

(ii)

For every price \(p\in \mathcal{P}^{fast}\), Eq. (6.4) is satisfied as an equality.

-

(iii)

For any price \(p\in \,\bigl ]\beta , \, (1+\delta )\beta \bigr ]\), one has the inequality

$$\begin{aligned} \left( {p\over \beta }-1\right) \, \Psi _b \bigl (U(p/\beta )\bigr )+ {\lambda \varepsilon \over \mu }\int _{p/\beta }^{+\infty } \left( s-{p\over \beta } \right) \, d\Phi (s)~\le ~{\gamma '+(1-\eta )\lambda \over \mu } . \end{aligned}$$(6.5) -

(iv)

For every price \(p\in \mathcal{P}^{slow}\), Eq. (6.5) is satisfied as an equality.

Remark 6.1

According to (i)–(ii), fast traders can achieve a growth of their expected wealth at rate \(\gamma \) by posting “sell" orders at any price \(p\in \mathcal{P}^{fast}\), but not higher than \(\gamma \) by posting bids at any other price. According to (iii)-(iv), slow traders can achieve a growth of their expected wealth at rate \(\gamma '\) by posting “sell" orders at any price \(p\in \mathcal{P}^{slow}\), but not higher than \(\gamma '\) by posting bids at any other price.

We recall that, if only “fast" traders with expected growth rate \(\gamma \) were present, then by the analysis in Sect. 4 for \(p\le (1+\delta )\beta \) the profile of the LOB would be described by

On the other hand, if only “slow" traders with expected growth rate \(\gamma '\) were present, then by the analysis in Sect. 5 for \(p\le (1+\delta )\beta \), the profile of the LOB would be given by

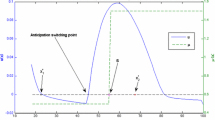

The general situation, where both groups of traders can be present, is now described (Fig. 5).

Theorem 6.1

In the above setting, for any \(\varepsilon >0\) and \(0<\gamma '<\gamma \), there exists a price \(\widehat{p}\ge \beta \) and a Nash equilibrium provided by continuous functions \(U^{fast}\), \(U^{slow}\) such that

-

Fast traders post “sell" orders at prices \(p\in \mathcal{P}^{fast}\subseteq \,[\beta , ~\widehat{p}]\)

-

Slow traders post “sell" orders at prices \(p\in \mathcal{P}^{slow}\subseteq \bigl [\widehat{p}, ~\beta (1+\delta )\bigr ]\).

More precisely, one has

The two continuous functions \(U^{fast}\) and \(U^{slow}\) are uniquely determined by the requirements (i)–(iv) in Definition 6.1.

Proof

1. We begin by determining a suitable price \(\widehat{p}\) and constructing a Nash equilibrium in the form (6.8)–(6.9). Solving the equation

by Eqs. (6.6)–(6.7) one is led to

We observe that the function

is continuous and non-increasing. Indeed, for any \(\xi <\xi '\) one has

Moreover, the right hand side approaches zero as \(\xi '\rightarrow \xi \).

2. Three possible alternatives must be considered.

CASE 1: \(g(1+\delta )< \gamma -\gamma '< g(1)\). In this case, by continuity there exists a price \(\widehat{p}\in \bigl ]\beta , ~(1+\delta )\beta \bigr [\) such that \(g(\widehat{p}/\beta ) = \gamma -\gamma '\).

We claim that the definitions (6.8)–(6.9) yield a LOB profile in Nash equilibrium. Indeed, since the function \(g(\cdot )\) at Eq. (6.12) is non-increasing, it follows

Consider first a fast trader who puts his asset on sale at some price \(p\le \widehat{p}\). By Eqs. (6.8) and (6.10), for \(p\le \widehat{p}\) we have

Hence by Eq. (6.6) this will yield an expected growth rate \(\gamma \) of his wealth. On the other hand, if he were to put assets on sale at some price \(p>\widehat{p}\), since now \( U(p/\beta ) = U^S(p/\beta ) \ge U^F(p/\beta ) \), his expected growth rate cannot be larger than \(\gamma \).

Next, consider a slow trader who puts his asset on sale at some price \(p\ge \widehat{p}\). By Eqs. (6.9) and (6.10), for \(p\ge \widehat{p}\) we have

Hence by Eq. (6.7) this will yield an expected growth rate \(\gamma '\) of his wealth. On the other hand, if he were to put assets on sale at some price \(p<\widehat{p}\), since now \(U(p/\beta ) = U^F(p/\beta ) \ge U^S(p/\beta )\), his expected growth rate cannot be larger than \(\gamma '\).

CASE 2: \(g(1+\delta ) \ge \gamma -\gamma '\). In this case we have \(U^F(s)\ge U^S(s)\) for all \(s\in [1, 1+\delta ]\). The Nash equilibrium solution is obtained by setting \(\widehat{p}= \beta (1+\delta )\), and hence

Notice that in this case all slow traders are squeezed out from the LOB, because their profit is curtailed by (i) the competition of fast traders and (ii) the losses due to stock volatility combined with the presence of better informed agents.

The fact that Eq. (6.14) yields a Nash equilibrium follows immediately from

Indeed, by the analysis in Sect. 4, \(U^F(\cdot )\) yields an equilibrium profile when only fast traders are present.

CASE 3: \(g(1) \le \gamma -\gamma '\). In this case we have \(U^S(s)\ge U^F(s)\) for all \(s\in [1, 1+\delta ]\). The Nash equilibrium solution is obtained by setting \(\widehat{p}= \beta \), and hence

Notice that in this case all fast traders are squeezed out from the LOB, because the competition with slow traders does not allow them to achieve the high growth rate that they expect.

The fact that Eq. (6.15) yields a Nash equilibrium now follows from

Indeed, by the analysis in Sect. 5, \(U^S(\cdot )\) yields an equilibrium profile when only slow traders are present.

3. It remains to show that the Nash equilibrium is unique. Assume that \(\widetilde{U}^{fast}, \widetilde{U}^{slow}\) yield a Nash equilibrium where all fast traders achieve a growth rate \(\gamma \) and all slow traders achieve a growth rate \(\gamma '\). We claim that this equilibrium profile is the same as the one at Eqs. (6.8)–(6.9) constructed in the previous steps.

As in Eqs. (6.2)–(6.3), call \(\widetilde{\mathcal{P}}^{fast}\) and \(\widetilde{\mathcal{P}}^{slow}\) the corresponding sets of prices at which fast and slow traders put stock on sale, respectively. Moreover, set

According to Definition 6.1, one must have:

This already implies

To prove the converse inequality, assume that there exists \({\bar{s}}\) such that

This trivially implies \( \widetilde{U}({\bar{s}})>0\). Consider the point

Since \(\widetilde{U}\) is not constant on any neighborhood of \(s^*\), this implies that either \(s^*\in \widetilde{\mathcal{P}}^{fast}\) or \(s^*\in \widetilde{\mathcal{P}}^{slow}\). Observing that

in both cases we are led to a contradiction.

4. The previous step has shown that

-

(1)

For all \(s\in [1, 1+\delta ]\) one has

$$\begin{aligned} \widetilde{U}^{fast}(s)+\widetilde{U}^{slow}(s)\,=\, \max \bigl \{ U^F(s),\, U^G(s)\bigr \}. \end{aligned}$$(6.18) -

(2)

Fast traders post their bids only at prices p where \(U^F(p/\beta )\ge U^S(p/\beta )\), while slow traders post their bids only at prices where \(U^S(p/\beta )\ge U^F(p/\beta )\).

It remains to show that the above conditions (1)–(2) completely determine the functions \(\widetilde{U}^{fast},\widetilde{U}^{slow}\). This will be the case if the set

contains at most one point.

Assume that, on the contrary, \(\xi _1, \xi _2\in \Omega \), with \(\xi _1<\xi _2\). By step 1 this implies \(g(\xi _1)=g(\xi _2)=\gamma -\gamma '\). Since the function g is non-increasing, it follows

This leads to a contradiction, because the right hand side can be constant only if \(\Phi (s)=0\) for all \(s>\xi _1\). But in this case the right hand side would be zero, while the left hand side is strictly positive. This completes the proof of uniqueness. \(\square \)

7 Examples

Example 1

Consider a stock whose fundamental value \(\beta \) remains constant. The computation of the LOB profile is particularly simple in the case where the random size of incoming “buy" orders has a negative exponential tail distribution, and the acceptable prices are deterministic:

In this case, the “sell" portion of the LOB satisfies

As in Eq. (3.9), we thus obtain

Here \(p_A\) is the price at which the right hand side in Eq. (7.2) vanishes:

The total amount of stock put on sale is

It is clear that, as the rate \(\gamma \) of expected growth increases, the minimum ask price \(p_A\) increases, while the total volume \(K_s\) of stock posted for sale on the LOB decreases. If \(\gamma \ge \mu \delta \), then \(K_s=0\).

Example 2

Let \(\Psi _b, h_b\) be as in Eq. (7.1), but now assume that the fundamental value \(\beta (t)\) is subject to random jumps, as in Eqs. (4.1)–(4.4). According to Remark 4.1, the profile \(\Psi _s(\cdot )\) of the “sell" portion of the LOB will be the same as in the case where \(\beta (t)\) is constant, replacing the expected growth rate \(\gamma \) with \(\gamma ' = \gamma +(1-\eta ) \lambda \).

Example 3

Let \(\Psi _b, h_b\) be again as in Eq. (7.1), and let the fundamental value \(\beta (t)\) of the stock be a jump process, with jumps occurring at random times \(\tau _j\) as in Eq. (4.1). At each time \(\tau _j\), we now assume that the random variable \(Z=\beta _j/ \beta _{j-1}\) describing the jump can take two only values: \(Z^+, Z^-\), with probability \(\theta \) and \(1-\theta \) respectively. This implies

In the following we also assume

Notice that, by the last inequality, if an external informed agent can anticipate an upward jump in the stock value, then the entire “sell" portion of the LOB will be wiped out. In particular, Eq. (7.4) implies that on \([1+\delta , \, +\infty [\,\) the tail distribution function \(\Phi \) has a single downward jump of size \(\theta \). Hence the Stiltjes integral is computed by

In the present setting we obtain

As in Eq. (5.9), this yields

Here \(p_A\) is the value at which the right hand side of Eq. (7.5) vanishes. An elementary computation yields

This shows that the minimum ask price increases with \(\varepsilon \), to compensate for the higher risk. Setting \(p=(1+\delta )\beta \), one computes the total amount of assets put on sale on the LOB:

As expected, this is a decreasing function of \(\varepsilon \). Indeed, the higher is the risk for a trader to lose part of his wealth to a better informed external agent, the smaller will be the number of traders posting “sell" orders on the LOB.

In the special case where the jump process is a martingale, the above formula reduces to

By Eq. (7.7) we see that, for any fixed \(\varepsilon >0\), the size \(K_s\) of the LOB shrinks as the volatility of the stock (measured by the frequency \(\lambda \) of the jumps) increases. When the volatility reaches a value such that

posting limit orders becomes too risky, and no trader can remain active on the LOB.

Example 4

Consider again the situation described in Example 3, assuming that the jump process is a martingale, so that \(\eta = E[Z]=1\). Assume that two groups of traders, slow and fast, are present, with expected growth rates \(0<\gamma '<\gamma \) respectively. By Eq. (7.5), the shape of a LOB with only slow traders would be

On the other hand, by Eq. (7.2) the shape of a LOB with only slow traders would be

Solving the equation \(U^S(\xi )= U^F(\xi )\) for \(\xi \in [1, \, 1+\delta ]\), we are led to

Three cases must be considered:

CASE 1: \(\lambda \varepsilon \,\theta \bigl (Z^+-1-\delta \bigr )\,\ge ~\gamma -\gamma '\).

In this case \(U^F(\xi )\ge U^S(\xi )\) for all \(\xi \in [1,\, 1+\delta ]\), hence the equilibrium solution is given by \(U^{fast}=U^F\) while \(U^{slow}\equiv 0\). This is the case where slow traders are pushed out from the LOB because the risk of losses, due to high volatility and the presence of better informed agents, is too high.

CASE 2: \(\lambda \varepsilon \,\theta \bigl (Z^+-1\bigr )~\le ~\gamma -\gamma '\).

In this case \(U^S(\xi )\ge U^F(\xi )\) for all \(\xi \in [1,\, 1+\delta ]\), hence the equilibrium solution is given by \(U^{slow}=U^S\) while \(U^{fast}\equiv 0\). This is the case where fast traders are pushed out from the LOB, because the competition with slow traders does not allow them to achieve the high growth rate they expect.

CASE 3: \(\lambda \varepsilon \,\theta \bigl (Z^+-1-\delta \bigr )~<~\gamma -\gamma '\, <\,\lambda \varepsilon \,\theta \bigl (Z^+-1\bigr )\).

In this case the Eq. (7.10) has a solution \(\widehat{\xi }\in \,]1, 1+\delta [\,\). We thus have \(U^F(\xi )\ge U^S(\xi )\) for \(\xi \le \widehat{\xi }\) and \(U^S(\xi )\ge U^F(\xi )\) for \(\xi \ge \widehat{\xi }\). The Nash equilibrium solution is given by Eqs. (6.8)–(6.9), with \(\widehat{p}= \beta \widehat{\xi }\).

This is the case where both fast and slow traders can be present on the LOB. As the risk factor \(\lambda \varepsilon \) increases, so does \(\widehat{\xi }\). As a consequence, the amount of fast traders increases while slow traders decrease.

References

Back K, Baruch S (2004) Information in securities markets: Kyle meets Glosten and Milgrom. Econometrica 72:433–465

Back K, Baruch S (2013) Strategic liquidity provision in limit order markets. Econometrica 81:363–392

Bank P, Kramkov D (2015) A model for a large investor trading at market indifference prices. I: single-period case. Finance Stoch 19:449–472

Bank P, Kramkov D (2015) A model for a large investor trading at market indifference prices. II: continuous-time case. Ann Appl Probab 25:2708–2742

Bressan A, Facchi G (2013) A bidding game in a continuum limit order book. SIAM J Control Optim 51:3459–3485

Bressan A, Facchi G (2014) Discrete bidding strategies for a random incoming order. SIAM J Financial Math 5:50–70

Bressan A, Mazzola M, Wei H (2020) A dynamic model of the limit order book. Discr Cont Dyn Syst B 25:1015–1041

Bressan A, Wei D (2014) A bidding game with heterogeneous players. J Optim Theory Appl 163:1018–1048

Bressan A, Wei H (2016) Dynamic stability of the Nash equilibrium for a bidding game. Anal Appl 14:591–614

Cardaliaguet P, Porretta A (2020) An introduction to mean field game theory. In Mean Field Games, Springer Lecture Notes in Math. 2281, CIME Found. Subser., Springer, pp. 1–158

Cetin U, Jarrow R, Protter P (2004) Liquidity risk and arbitrage pricing theory. Finance Stoch 8:311–341

Gould MD, Porter MA, Williams S, McDonald M, Fenn DJ, Howison SD (2013) Limit order books. Quant Finance 13:1709–1742

Lasry J-M, Lions P-L (2007) Mean field games. Jpn J Math 2:229–260

Parlour C, Seppi DJ (2008) Limit order markets: a survey. In: Proceedings of the handbook of financial intermediation and banking, edited by A. Thakor and A. Boot, Elsevier

Funding

Not applicable.

Author information

Authors and Affiliations

Contributions

The authors contributed in equal measure to the results presented in this paper. Some of these results were included in the Ph.D. dissertation of Hongxu Wei, at the Pennsylvania State University.

Corresponding author

Ethics declarations

Conflict of interest

The authors have no conflict of interest as defined by Springer, or other interests that might be perceived to influence the results and/or discussion reported in this paper.

Ethical Approval

Not applicable.

Consent to Participate

Not applicable.

Consent to Publication

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Bressan, A., Wei, H. Infinite Horizon Nash Equilibrium Models of a Limit Order Book. Dyn Games Appl (2024). https://doi.org/10.1007/s13235-024-00583-6

Accepted:

Published:

DOI: https://doi.org/10.1007/s13235-024-00583-6