Abstract

Both financial development and technological innovation are critical issues for policy-makers and academics in high-quality economic development. From the perspective of the geographical structure of the financial supply, this paper measures the number of financial institutions within a certain radius around an enterprise using the information on its geographical location and that of surrounding financial institutions to explore the impact of financial density on the enterprise’s innovation quality, as well as the transmission mechanism. Rising financial density improves enterprise innovation quality, and this enhancement effect is mainly manifested in patent generality rather than patent originality. As the geographic radius expands, the effect of financial density on enterprise innovation quality increases and then decreases. Financial accessibility and competitive banking channels are the primary transmission mechanisms of financial density on enterprise innovation quality. In addition, the promotional effect of financial density on enterprise innovation quality is heterogeneous according to regional, industry, and enterprise characteristics. Finally, further analysis indicates that financial density will promote both innovation quality and quantity by motivating firms to engage in patent R&D behaviors that are highly technologically advanced. In addition, financial density enhances enterprises’ innovation efficiency by increasing bank competition. Similarly, financial density is also conducive to increasing enterprises’ commercial credit and financial liabilities. Therefore, the government should accelerate the development of an inclusive financial system, improve the coverage and penetration rates of the spatial layout of financial institutions, and encourage high-quality economic development by encouraging technologically advanced and innovative firms.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Innovation is an enduring source of economic growth and an essential engine for enhancing economic strength and fostering competitive advantage (Rosenberg, 2006). As innovation is a long-term, continuous process accompanied by high investment risks, firms are at risk of a shortage of external financing for innovation activities (Hall & Lerner, 2010). Innovation requires a stable source of external financing, and bank credit is one of the most essential sources of stable and sustainable external financing for firms. Considering the “local preference” for bank credit decisions (Presbitero & Rabellotti, 2014), the location of financial institutions directly impacts the credit facilities available in a region. This situation implies that a firm’s access to external finance increases when more financial institutions are located nearby.

Because of reforms to state-owned banks and the promotion of interest rate marketization, China’s financial market structure has undergone profound changes. The rapid rise of Chinese financial institutions, such as joint-stock and urban commercial banks, has accelerated the reorganization of the financial market characterized by state-owned monopolies. Financial licensing data provided by the China Banking Regulatory Commission indicate that the number of banking financial institution outlets nationwide increased from 6719 in 1978 to 226,700 in 2020, an annual growth rate of over 9%. Figures 1 and 2 plot the regional distribution of the number of financial institutions in 1998 and 2021, respectively. By comparing Figs. 1 and 2, it can be seen that the number of financial institutions in China continues to increase and shows an uneven spatial distribution. The increasing number of financial institutions means businesses’ financial density is increasing. Does the increase in financial density promote the quality of business innovation? One view is that the geographical location of financial institutions has an impact on the local credit supply (De Young et al., 2008) and that the increase in the number of financial institutions near firms may increase the availability of innovation finance for firms, thus facilitating their innovation activities. However, the majority of these arguments are based on studies of mature markets in developed economies. China needs to explore and test the relationship between financial density and firm innovation quality as a transitional economy that relies on a bank-dominated financial system.

Thus, this paper examines the impact of financial density on corporate innovation quality by including the geographic structure of financial supply in the research framework. The relevant literature is on the determinants of technological innovation. Schumpeter (1911) focused early on the impact of financial development on technological innovation, suggesting that financial development ensures the adequacy of credit facilities, which is a critical factor in promoting technological innovation. However, existing studies have measured financial development with various macrolevel indicators, which inevitably leads to certain endogeneity issues. In addition, some studies have examined the determinants of firms’ technological innovation in terms of R&D funding (Garner et al., 2002), government subsidies (Hottenrott & Peters, 2012), and tax incentives (Rao, 2016). However, the literature is scarce discussing the factors influencing firm technological innovation from a financial geography supply perspective, and even fewer studies have directly examined the impact of financial density on firm innovation quality. Another relevant strand of the literature focuses on the economic effects of geographical distance changes between financial institutions and firms. The analysis in this literature has focused on credit markets, such as bank competition (Cornaggia et al., 2015; Xia & Liu, 2022), lending rates (Bellucci et al., 2013), default risk (Milani, 2014), bank geographic diversification (Deng et al., 2021), and bank-firm relationships (Herpfer et al., 2022). In contrast to the existing studies, this paper measures the number of financial institutions around a firm by calculating the geographical distance between the firm and the financial institutions, thereby quantifying the financial density at the microfirm level. This paper also focuses on the economic effects of geographical distance changes between financial institutions and firms on innovation quality vs. quantity to better respond to the urgent need for substantial technological innovation capacity in countries with transitional economies.

Compared with existing studies, this paper makes three main contributions. First, distinguishing from most related studies focusing on financial development and enterprise innovation (Hsu et al., 2014), this paper incorporates geographic distance into the research framework and comprehensively examines the impact of financial density on an enterprise’s innovation quality. In this paper, we investigate how financial density affects an enterprise’s innovation quality in terms of patent originality and patent generality and test whether there is an “optimal geographic radius” problem in terms of the impact of the increase in the number of financial institutions in the neighborhood of an enterprise under different geographic radii on the enterprise’s innovation quality. This paper finds that with the increase in geographic radius, the promotion effect of the increase in the number of financial institutions in the neighborhood of the enterprise on the enterprise’s innovation quality will rise first and then fall and reaches the maximum value when the geographic radius reaches 20 km. This promotion effect is mainly manifested in patent universality rather than patent originality, which is an innovative point of view of this paper.

Second, while scholars have conducted a wealth of exploratory research on the financing constraint channel, very little literature has addressed the increases in financial accessibility and bank competition due to increasing financial density. This paper theoretically reveals the dual mechanism of financial density on corporate innovation quality and tests it empirically based on Chinese data. The mechanism of financial density on firm innovation quality is discussed, providing microevidence to quantify the impact of financial market reforms on the real economy of developing countries and offering new insights into the structural reform of the financial supply side.

Third, this paper explores the heterogeneous effects of financial density on enterprise innovation quality at three levels: macro, industry, and micro. Currently, most of the literature focuses on enterprise innovation from a single perspective, such as ownership structure (Liu & Xiong, 2022), financing constraints (Chen et al., 2023), technology level (Niu et al., 2023), and different regions (Cao et al., 2023). Fewer studies have systematically explored the promotional effect of financial density on enterprise innovation quality from multiple perspectives. Therefore, this paper examines the heterogeneous effects of financial density on enterprise innovation from multiple perspectives, such as the degree of regional marketization, the degree of capital intensity of the industry, and the size of the firm. In addition, in the further test section, this paper explores whether financial density affects the quantity and efficiency of innovation of enterprises and further compares the effects and mechanisms of financial density on the quality, quantity, and efficiency of enterprises’ innovation.

Literature Review and Research Hypotheses

Literature Review

The financial system has identification and screening functions. A mature financial system can provide research and development (R&D) funding for enterprises’ technological innovation projects (Liu & Song, 2020) and allocate capital rationally to more promising and innovative firms (Nanda & Rhodes-Kropf, 2016). The literature has rarely directly explored financial density’s impact on enterprise innovation quality. Early scholars focused more on the impact of macro-level financial development on innovation, arguing that a higher level of financial development in a region is more conducive to enhancing local technological innovation (Lee & Wang, 2022). Subsequently, some scholars began to focus on the spatial agglomeration of financial resources, using the EG index (Wen et al., 2023), the spatial Gini coefficient, the location entropy index (Yuan et al., 2022), and the composite index (Yuan et al., 2019) to measure financial agglomeration, and found that financial agglomeration affects the level of technological innovation in a region (Wen et al., 2023). However, the EG index does not consider the differences in the spatial distribution of financial resources and the size of geographic regions, the spatial Gini coefficient does not consider the differences in the size of enterprises in various industries, and the location entropy index does not consider the differences in the number of regional financial institutions. In addition, the above literature still focuses more on financial agglomeration at the provincial or city level, ignoring the existence of spatial imbalance in credit resources. In the Chinese context, there are significant imbalances in the level of financial development in different regions (Dollar & Wei, 2007), and the financial systems in each region are relatively independent and highly segmented (Huang & Chen, 2022), which leads to severe imbalances in the allocation of credit resources at the microfirm level, even if these firms are located in the same city. Using macro-level aggregated data may create endogeneity problems that are difficult to circumvent. The number of financial institutions in a firm’s neighborhood can represent, to some extent, the ease of access to credit resources (Agarwal & Hauswald, 2010), and an improved external financing environment contributes to a firm’s R&D activities (Buera & Shin, 2013). Therefore, this paper adopts the number of financial institutions in the firm’s neighborhood to construct firm-level indicators, which to some extent, alleviates the endogeneity problem due to the “heterogeneity” of different firms.

The relationship between financial agglomeration and technological innovation has not yet been agreed upon in existing studies. Some scholars believe that the spatial agglomeration of financial resources is conducive to improving technological innovation. The externality of agglomeration can promote resource sharing and knowledge spillovers among firms, thus promoting technological innovation (Yan et al., 2022). Other scholars believe that the spatial agglomeration of financial resources is not necessarily conducive to technological innovation. Li and Ma (2021) argued that despite the concentration of bank branch institutions, enterprises focusing on technological innovation have difficulty obtaining sufficient funds for technological research and development due to narrow financing channels, the complexity of financing approvals, and extended financing approval periods. In addition, according to Wen et al. (2023), excessive financial agglomeration may inhibit the development of regional technological innovation. The reason for the inconsistency in previous studies may be that the role of “geography” has been neglected. Geographic distance plays a vital role in bank lending (Nguyen, 2019), and financial institutions represented by banks must rely on both “hard” and “soft” information to make lending decisions (Li et al., 2022). Therefore, the geographical distance between financial institutions and firms affects the cost and quality of information transfer between innovative firms and financial institutions. Innovation is characterized by high investment and risk (Backman & Wallin, 2018), which leads to the need for a high degree of confidentiality when investing in and developing new projects. In contrast to “hard” information such as company financial statements and credit ratings, this “soft” information cannot be made public in the financial markets.” Effective communication of “soft” information requires long-term, face-to-face contact between banks and firms. Although technological tools such as credit scoring partially facilitate banks’ access to enterprises’ “soft” information, the cost of communicating “soft” information is reduced when more financial institutions are near firms. Backman and Wallin (2018) argue that geographic proximity helps financial institutions to understand, among other things, business conditions, and information that cannot be encoded. In addition, there may be a “threshold radius” in terms of geographic distance for firms to access external financing (Skrastins & Vig, 2019). Is there a “threshold radius” for the effect of financial density on enterprises’ innovation quality in the Chinese context? At what geographical radius does financial density have the greatest beneficial effect on enterprises’ innovation quality, i.e., is there an “optimal geographical radius”? Existing research has rarely addressed this question.

Regarding the transmission mechanism, the microtransmission mechanism of financial density on enterprises’ innovation quality is not yet clear. Existing studies exploring the economic effects of the spatial agglomeration of financial resources focus more on macro-level mechanisms of action, such as regional industrial structure (Yan et al., 2022) and economic scale (Xie et al., 2021). Bin and Hao (2022) found that increasing the number of financial institutions represented by banks promotes banking competition. Jing et al. (2020) found that increased competition in the banking sector enhances enterprises’ innovation output. In addition, financial accessibility is closely related to a firm’s ability to access external finance (Berger et al., 2017). Unlike banking competition, financial accessibility measures the extent to which a firm’s access to financial services is accessible. An increase in the number of financial institutions, represented by banks, around a firm reduces the geographic frictional cost of accessing financial services (Lee & Luca, 2019), indirectly proving that an increase in financial density increases the financial accessibility of a firm. Adegboye and Iweriebor (2018) found that ease of access to bank credit is a positive force that drives firms to undertake various innovations. This paper, therefore, examines whether the “financial accessibility” channel and the “banking competition” channel are the microtransmission mechanisms through which financial density affects the quality of enterprises’ innovations.

In contrast to the literature that focuses on innovation quantity (Zhu et al., 2020), this paper focuses on the effect and transmission mechanism of financial density on enterprises’ innovation quality and further analyzes the specific manifestations of the impact of financial density on the quality of enterprises’ innovations in terms of patent generality and patent originality. Innovation quantity is the basis of innovation quality (Liping, 2020), and innovation efficiency reflects the time requirement of enterprise technological innovation activities. An increase in the quantity of innovation is conducive to enhancing independent creativity (Yu et al., 2019). An increase in innovation efficiency means that firms can introduce new products quickly, thereby gaining a greater competitive advantage (Ghasemaghaei & Calic, 2020). Existing studies have rarely explored the effects of financial density on the quantity, quality, and efficiency of innovation and the differences in the mechanisms of action. Therefore, this paper focuses on the relationship between financial density and enterprises’ innovation quality and further explores the effects of financial density on enterprises’ innovation quantity and innovation efficiency and the differences in the transmission mechanisms.

Research Hypotheses

The number and type of financial institutions in China have increased significantly after nearly four decades of reform. Increasing the number of financial institutions surrounding enterprises and gradually increasing financial density impact firm innovation quality due to the rapid establishment of branches of joint-stock and urban commercial banks in various counties. First, from the rent-seeking perspective, an increase in financial density leads to increased competition in the banking sector around enterprises and discourages banks from engaging in corrupt lending practices (Barth et al., 2009), thus facilitating enterprises’ access to innovative loans. Second, from the financing costs perspective, an increase in financial density encourages banks to lower their lending threshold to gain more customers, which helps firms obtain external funding for technological innovation and improve innovation quality. Finally, the increase in financial density allows firms to gain a voice and alleviates financing dilemmas, resulting in improved firm innovation quality. Therefore, the following research hypothesis is proposed in this paper:

-

H1: Increasing financial density will have a facilitating effect on enterprise innovation quality.

Increasing financial density may have a catalytic effect on innovation quality by increasing financial accessibility and intensifying bank competition. In terms of banking competition channels, the increase in financial institutions has gradually weakened the absolute monopoly of China’s five largest state-owned banks. This change has introduced a degree of structural change to the Chinese financial system, which is dominated by the absolute monopolies of the five largest state-owned banks and has promoted the formation of a competitive pattern in the Chinese banking system characterized by competition among a variety of different types of banks. A firm is more likely to obtain external financing when the competition is greater among its nearby banks, thereby improving its innovation quality. Benfratello et al. (2008), Chava et al. (2013), and Chong et al. (2013) have shown that increased competition in the banking sector reduces the distortionary effects of credit rationing in the banking system and increases the availability and access of bank loans to firms, particularly small- or medium-sized enterprises, thus facilitating firm innovations.

In terms of financial accessibility channels, an increase in financial density increases the accessibility of firm financial services. Karlan and Morduch (2010) define financial accessibility as the facilities used to access credit resources and savings funds, such as financial institution outlets. Due to the frictional costs of financial markets at the geospatial level, capital input factors do not easily move freely between regions (Amore et al., 2013), and an increase in financial density helps to reduce the geographical frictional costs faced by firms. Specifically, increasing financial density reduces the information costs of financial transactions, which are obtained through long-term and face-to-face contacts and are crucial in the credit placement of financial institutions (Hollander & Verriest, 2016). Second, increased financial density reduces the firm’s transportation costs (Lee & Luca, 2019), facilitating the firm’s access to external financing and enabling them to engage in innovative R&D efforts. Overall, increased financial density reduces information transaction costs between financial institutions and firms, reduces the firm’s geographical friction costs and transportation costs, and increases the firm’s access to financial services, thus promoting innovation quality. Therefore, this paper proposes the following research hypothesis:

-

H2: Financial density contributes to business innovation quality mainly by increasing bank competition and enhancing financial accessibility.

Different levels of marketization, capital intensity, and firm size may influence financial density’s effect on innovation quality. From a macro perspective, the marketization of the environment negatively affects information-gathering costs. A higher marketization degree results in a better quality of corporate information disclosure, improved information transmission, and lower information search costs for financial institutions. Conversely, in regions with a lower degree of marketization, the ability of financial institutions to obtain information may be more dependent on the distance between the financial institution and the enterprise. That is, when an enterprise has more surrounding financial institutions, it has a higher likelihood of obtaining a loan. From a meso perspective, the characteristics of a firm’s industry impact the risks faced by innovative R&D projects. Typically, companies in capital-intensive industries invest in high-technology innovation projects that require external financing. As a result, an increased number of nearby financial institutions may significantly impact such companies. From a microperspective, an increase in financial density reduces the quality of collateral financial institutions required to provide collateral-based loans. Therefore, firms with lower assets have greater access to external financing, which benefits innovation quality. In this context, the following research hypothesis is proposed:

-

H3: Increasing financial density has a more significant impact on innovation quality for firms in low-market areas, in high capital-intensive industries, and for small- and medium-sized enterprises.

Data and Methodology

Data

This paper uses the following data sources: (1) 1998–2013 Annuals Surveys of Industrial Firms (ASIF) and China National Intellectual Property Administration (CNIPA). Combining panel data across years and excluding non-GAAP observations are consistent with Brandt et al. (2012). By referring to the matching methods of the existing Chinese industrial enterprise database and the corporate patent database, the final sample is obtained from 180,499 observations of industrial enterprises from 1998 to 2013. (2) Financial license data issued by the China Banking and Insurance Regulatory Commission (CBIRC). According to the “Rules for the Preparation of Financial License Institution Codes (for Trial Implementation)” issued by the China Banking Regulatory Commission and the dates of establishment and withdrawal of financial institutions, only a sample of financial institutions for the current year is retained in this paper. (3) Other data are from the China City Statistical Yearbook (CCSY) and China Industrial Enterprises Innovation Survey (CIEIS).

Innovation Quality

A general challenge is measuring firm innovation quality in the Chinese context, for which patent citations are commonly used (Hsu et al., 2014). However, the enterprise patent database of the China National Intellectual Property Administration cannot provide accurate and practical information on the number of citations of an enterprise’s patents, so a method is required for determining an enterprise’s innovation quality. This paper uses a method developed by Aghion et al. (2019). Patent knowledge breadth is primarily measured by the complexity of the knowledge contained within a patent. Patent knowledge breadth reflects innovation quality regarding the complexity and breadth of the knowledge in patents. It helps to overcome the shortcomings of using only the quantitative dimension of patents to measure a company’s innovation quality. Referring to Akcigit et al. (2016), and Hu et al. (2022), firm innovation quality (PQ) is defined as:

where Pimt represents the cumulative number of invention and utility patents under the m patent major group classification for enterprise i in year t, and Pit represents the total number of patents under all patent major group classifications for enterprise i in year t. When PQ is larger, the difference is greater between the patent classification numbers at each broad group level. When the firm uses a greater breadth of knowledge to create patents, its innovation quality is likely to be higher. Firms that use a broad range of knowledge to create patents are likely to have higher innovation quality. We sum the knowledge breadth information at the granted patent level to the firm level after calculating their indicators. Since the distribution of patents at the firm level is highly uneven and extreme, the median method is used to summarize the knowledge breadth information. Design-based patents are excluded from the PQ calculation, as the numbering system for design-based patents differs from other patent systems and does not allow for an accurate assessment of innovation quality.

For insight into the impact of financial density on enterprises’ innovation quality, with reference to Acharya and Xu (2017) and Raiteri (2018), this paper further explores the effect of financial density on enterprises’ innovation quality in terms of patent originality and patent generality. Patent originality (Originality) and patent generality (Generality) are defined as follows:

Equation (2) in totali indicates that enterprise i applies for a specific patent citation, nj indicates the patent in the industry j in the citation amount, and the Generality value is larger, indicating that the specific patent is cited in the industry width of the higher, the higher the degree of generality of the patent. Equation (3) in totalic and njc, respectively, indicates the total number of cited front patents in the patent application of enterprise i and the number of citations in industry j, respectively. The larger the value of Originality indicates that the patent citation implicates a larger patent breadth, the higher the creation of the cross-cutting nature of the industry, and the greater the possibility of a high degree of originality.

Financial Density

Our independent variable is financial density, measured by the logarithm of the number of financial institutions (FD) within a certain radius around the firm’s headquarters. Based on the geographical coordinates of the firm’s headquarters and financial institutions, we refer to Avramidis et al. (2022) and use the spatial coordinate distance formula to calculate the distance between the firm and the financial institutions. Then, we count the logarithmic value of the number of financial institutions within 20 km of the firm’s location. This is done as follows. In this paper, based on the address information of enterprises provided by Chinese industrial enterprises and that for financial institutions provided by the database of financial license information, firms and financial institutions existing in the current year were retained on a yearly basis. Using the R programming language and the Baidu map API, enterprises and financial institutions were determined based on the current year’s latitude and longitude coordinates. As a first step, the spatial distance coordinate formula was used to determine the distance between industrial enterprises and financial institutions within the same county administrative region. Then, the geographical distance of financial institutions in the same county administrative region was calculated using the spatial distance coordinate formula. The number of financial institutions within a 5-, 10-, 15-, 20-, 25-, and 30-km circle around the firm was counted. The corresponding logarithmic values were taken to obtain a firm-time-level measure of financial density. It should be noted that the difference between this paper and Avramidis et al. (2022) lies in that we identify whether it is in the same county range according to the latitude and longitude and latitude data of enterprises and financial institutions and then calculate the geographical distance between enterprises and banking institutions in the same county and then measure the number of financial institutions around the enterprise. This is because there is a precise business segmentation between the cities where the same bank branch in China is located, making it difficult for companies to achieve cross-city loans (Chong et al., 2013). Thus, even if financial institutions are geographically close, the likelihood of a firm’s access to external financing for technology R&D is unlikely to be affected by other financial institutions in other counties. Compared with the previous literature at the national level and regional levels, constructing enterprise-level variables by using geographic information can alleviate endogeneity problems to a large extent. However, when previous studies used pooled data to investigate the economic consequences of financial variables, they would omit such variables as institutional status, which made it challenging to identify the real effects of financial variables.

Control Variables

In this paper, the control variables are selected from both firm characteristics and regional characteristics, and the reasons for selection, data sources, and measurement methods are shown in Tables 1 and 2.

The first variable is the age of the firm (Age), which we calculate as the current year minus the year when the firm was registered and take the natural logarithm. The second variable is the firm’s debt ratio (Lev), calculated as the ratio of the firm’s debt to its assets in the current year. The third variable is the company’s profitability of assets (Roa), calculated as the ratio of the company’s profit for the year to its total assets. The fourth variable is firm size (Size), which is one of the most important factors influencing a firm’s patenting activity (Fischer & Henkel, 2012). We use the logarithm of a firm’s fixed assets to calculate firm size. Fifth, we include the state-owned enterprise (SOE) dummy variable to control for the confounding factor of ownership. The sixth variable is firm exports (EX), where exporting (vs. nonexporting) firms are more likely to generate innovation (Golovko & Valentini, 2011). The firm’s exports are analyzed as a dummy variable defined as 1 if exports exceed zero and 0 otherwise. Considering the macroeconomic situation of the city where the firm is located, we also choose the city GDP growth rate and the city GDP per capita change rate as control variables. As the logarithm of the GDP of the city in which the firm is located, the city GDP growth rate (GDP) is calculated. City GDP per capita (GDPPC) is calculated by taking the logarithm of the GDP per capita of the city in which the firm is located.

Mechanism Variables

Two mechanism variables are introduced in this paper. Table 2 summarizes their measurement methods and data sources. The first is financial accessibility (Dist). Using the methodology of Bellucci et al. (2013), the shortest spherical distance is calculated using firm latitude and longitude and the nearest financial institution as a proxy variable for financial accessibility. A smaller Dist variable implies greater financial accessibility.

Another indicator is bank competition (HHI_B). According to the literature (Chemmanur et al., 2020), bank competition indicators are calculated as the squares of the market shares of each bank in each region in terms of loan volume or outlet. In large part, they reflect the competitive environment among regional banks only. In the Chinese context, individual banks have an apparent heterogeneity in terms of banking system types, including the five largest state-owned, joint-stock, and urban commercial banks and in terms of the number of established market monopolies, capital size, and policy advantages. Consequently, the traditional approach does not accurately reflect the changing patterns and characteristics of bank competition in China. Therefore, referring to Akins et al. (2016) and Xia et al. (2021), information on the number of business outlets of each type of banking institution within 5 km of a firm is used to construct a bank competition index:

where bankbranchikt denotes the number of business outlets of k banking institutions within 5 km of firm i in year t, and N denotes the number of all bank types in the county. A higher value for the bank competition indicator calculated by this method represents a higher competition level. Using this method of measuring bank competition accurately reflects information on market competition between different banking systems near an enterprise in a specific context in China.

Other Variables

In the further test section, this paper examines the effect and mechanism differences of financial density on enterprises’ innovation quantity and innovation efficiency. The relevant variables are set as follows:

(1) The number of enterprises’ innovations (Patent), which is measured using the total number of enterprises’ patent applications plus one taking the logarithm (Su et al., 2023). (2) Invention patents (Invention), measured by adding 1 to the logarithm of the number of patent applications filed by enterprises. (3) Utility patents (Utility), measured by the number of utility patents filed by enterprises plus one and taking the logarithm. (4) Design patents (Design) are measured by adding one to the number of corporate applications for design patents and taking the logarithm of the number of applications. (5) Innovation efficiency (PIE), referring to Zhu and Wang (2022) approach, measured using the DEA algorithm of the BBC model.

In addition, we examine the effect of financial density on a firm’s business credit and financial liabilities in the further tests section. The relevant variables are as follows: (6) Business credit, measured using two indicators. The first is measured using the ratio of the sum of the firm’s accounts payable and the firm’s advance receipts to total assets (Credit). The second indicator (d_Credit) is measured by using the ratio of accounts receivable in advance (RA) to total assets (TA) and then subtracting the ratio of accounts payable in advance (PA) to total assets (TA). This indicator measures a company’s business credit from both creditor and debtor perspectives. It is calculated as follows:

(7) Financial liabilities, which are measured using two indicators of a firm’s level of financial liabilities. The first is the corporate leverage ratio (Levratio), which is measured using the ratio of the sum of a firm’s long-term and short-term borrowings to its total assets. The second is the corporate debt dummy variable (Levover), which takes the value of 1 if the firm’s over-indebtedness ratio is greater than 0, and vice versa. The over-indebtedness ratio is measured with reference to Caskey et al.’s (2012) methodology, which estimates the firm’s capital structure by using the indicators of profitability, industry leverage, asset growth rate, tangible assets, and firm size to predict and obtain the firm’s target gearing ratio. After that, the firm’s over-indebtedness ratio is measured using the difference between the firm’s actual leverage ratio and the target leverage ratio.

Model Specification

Basic Model

Based on the previous theoretical analysis, this paper constructs the following econometric model to identify the impact of financial density on corporate innovation quality:

where explanatory variable lnPQjkit is firm innovation quality in period t of firm i in industry k in region j calculated using the knowledge breadth method and the explanatory variable lnFDjkit is the density of financial institutions based on the firm level. Controls is the set of control variables. FE = {δj, δk, δi, δt} represents region, industry, firm, and year fixed effects, and εjkit represents the random disturbance term.

Conduction Mechanism Model

This study hypothesizes that financial density can indirectly affect the quality of enterprises’ innovation by enhancing financial accessibility and bank competition. To test this hypothesis empirically, drawing on Xu et al. (2020) concept of mechanism testing, the following model is set up:

where Mjkit is the mechanism variable, including financial accessibility (Dis) and bank competition (HHI_B), and the other variable settings are consistent with the benchmark model. To further test the existence of the financial accessibility channel and the bank competition channel, we use the moderating effects model to test again whether the financial accessibility channel and the bank competition channel are the main mechanisms of action of financial density in affecting the quality of corporate innovation, and the model is set as follows:

In Eq. (9), Mgjkit is a dummy variable defined according to the mean value of financial accessibility and bank competition, including a dummy variable for financial accessibility (Dis_g) and a dummy variable for bank competition (HHI_B_g). Dis_g takes the value of one if the firm’s financial accessibility is higher than the overall sample mean; otherwise, Dis_g is zero. HHI_B_g takes the value of one if firms face higher bank competition than the overall sample mean, otherwise HHI_B_g is zero. We focus on the interaction term coefficient ∂2.

Results

Descriptive Statistics

The descriptive statistics of the continuous variables are displayed in Table 3. The variables are relatively stable, with small dispersion and data fluctuation without abnormal values. The spatial distribution of financial institutions reveals that there are more financial institutions within a 5-km radius of an enterprise located in the same county as the enterprise, with an average of 22 (e3.1). The average number of financial institutions within 30 km of the business is 110 (e4.7), according to the mean value of FD_30km. Comparing the FD_5km, FD_10km,…, and the mean value of FD_30km, we can see that as the radius of the enterprise rises, on average, there are progressively more financial institutions nearby.

In addition, we provide information on the distribution of industrial firms and financial institutions in Shanghai, China. As shown in Fig. 3, the distribution of industrial firms and financial institutions within the various administrative districts of Shanghai is relatively balanced and random, which implies the importance of further exploring the impact of financial density.

Baseline Regression Analysis

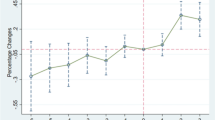

Table 4 shows the estimation results of financial density’s effect on firm innovation quality derived from Eq. (6). We separately estimate Eq. (6) without control variables and Eq. (6) that includes control variables. The estimation results are in A and B of Table 4. From the estimation results, the estimated coefficients without including control variables are relatively larger, perhaps due to the overestimation of the effect of financial density on the quality of firm innovation by ignoring the interference of other factors. Furthermore, combining the estimated coefficients from columns (1)–(6) in A and B of Table 4, it can be seen that an increase in the number of financial institutions in the vicinity of a firm can contribute to an increase in the quality of innovation and that there is an “optimal geographical radius” for this contribution. The estimated coefficient of financial density (FD_5km), measured by the number of financial institutions within a 5-km radius of the firm, is the smallest at 0.007. The estimated coefficient of financial density (FD_20km), measured by the number of financial institutions within a 20-km radius of the firm, is the largest at 0.015. After that, as the geographic radius increases, the coefficient of the financial density influence on the quality of enterprise innovations steadily declines; the values for FD_25km and FD_30km are 0.012 and 0.009, respectively. The findings above demonstrate that increasing financial density raises innovation quality and that this effect rises and then falls with geographic distance, highlighting the significance of the “geographic factor” when examining the link between financial density and innovation quality. Subsequently, to report the results briefly, we use the logarithm of the number of financial institutions within 5 km of the enterprise to measure financial density.

Endogeneity

A potential endogeneity problem exists in this paper: firms with high innovation levels tend to be located in areas with higher economic development levels. This phenomenon attracts more financial institutions, leading to the establishment of more financial institutions near firms with high levels of innovation. This situation is referred to as the endogenous locational selection problem of financial institutions. This paper uses two-stage least squares (2SLS) for the empirical estimation to overcome this problem. Two instrumental variables were chosen for this study: the average number of financial institutions per county in that year (Chong et al., 2013), and a variable constructed based on the number of financial institutions per county in 1984 (Xu et al., 2020). Specifically, we estimate the following equations:

The first is the more commonly used instrumental variable measure. We use the second instrumental variable because the former China Banking Regulatory Commission issued policies in 2007 and 2009. These two policies relaxed controls on establishing branches of joint-stock commercial and urban commercial banks, which helped to reduce the administrative barriers to establishing financial institutions and market entry costs and increased financial density around enterprises. This factor is correlated with the core explanatory variables in this paper and meets the correlation requirement for instrumental variables. In addition, the model of the Chinese banking system in 1984 was dominated by four state-owned banks, and the way financial resources were allocated at that time had the apparent characteristics of a planned economy (Jiang et al., 2017). As a result, the incentives for corporate innovation have a weaker impact on the locational choice decisions of financial institutions, safeguarding the exogeneity of the instrumental variables. Specifically, a deregulated dummy variable is generated in the first step. The sample period is divided into three intervals—namely, 1998–2006, 2007–2009, and 2010–2013—according to the time when the bank branches were designated for deregulation. To identify each sample interval, the deregulation dummy variables were assigned as 1, 2, and 3. In the second step, the product of the number of county bank branches in China in 1984 and the deregulation dummy variable were used as the instrumental variable for FD.

Columns (1) and (2) in Table 5 represent the regression results for the instrumental variables based on the number of financial institutions in the county and bank access deregulation in 1984. In Table 5, columns (3) and (4) show the results of the regression analyses using the mean number of financial institutions in each county in all years as the instrumental variable. Overall, the results in Table 5 show that both the Kleibergen-Paap rk LM test and the Cragg-Donald Wald F test reject the null hypothesis that the instrumental variables are underidentified and weak. This result demonstrates a strong correlation between the instrumental variables and the explanatory variables. After accounting for endogeneity, financial density still has a facilitative effect on firm innovation quality, and the regression results for both instrumental variables are significantly higher than the baseline coefficients.

Robustness Analysis

Considering that other endogenous issues may confound the positive impact of financial density on corporate innovation quality, the causal relationship between the two is identified below.

First, the core variable measures are changed. This paper uses patent citations plus one and then takes the logarithm (Cit) as a proxy for the explanatory variables. Second, regressions are conducted on a sample of firms located near provincial boundaries. Topographical features tend to be associated with ease of access and may have lower land prices, which reduces the cost of production for firms and leads to higher firm performance, attracting financial institutions to set up branches in the area. Therefore, our results may be biased by ignoring topographical features, leading to biased estimation. This paper, therefore, attempts to mitigate this problem by using regressions on a sample of firms located near provincial boundaries. Third, the sample of the four major municipalities directly under the Central Government of China is excluded. Because such municipalities have higher economic development, financial market development, and policy preferences than general cities, this paper eliminates four major Chinese municipalities to avoid the influence of potential outliers. Fourth, we further control for province fixed effects and municipal and provincial dimensions to measure the clustering robustness criteria errors. Fifth, consider the problem of omitted variables. Education can provide human capital for innovation and thus favors innovative activities. Referring to Zhang et al. (2020), the higher quality of college graduates can reflect the education level of a region, and this paper uses the number of college students per 10,000 people in a city to measure the education level of a region (Edu). In addition, government spending is irreplaceable for innovation, reducing the cost and risk of R&D and stimulating enterprises’ R&D programs. In this paper, we refer to Li et al. (2018), which utilizes government expenditure on science and technology to measure a city’s government expenditure (GT). Sixth, a Tobit regression is used to test the model again, considering that the patent data are “subsumed data” with a lower bound of zero.

As shown in Table 6, columns (1), (2), (3), and (4) indicate that financial density facilitates firm innovation. The core explanatory variable in this paper is the number of financial institutions within a specific geographical distance from the firm, which depends primarily on the firm’s geographical location. Therefore, this paper follows Cameron and Miller’s (2015) suggestion of clustering at the city and province levels. According to the results of columns (4) and (5), shown in Table 6, the overall financial density coefficients are statistically significant under both clusters, indicating that the estimates are robust. In addition, financial density’s positive effect on innovation quality persists when controlling for government expenditure (GE) and education level (Edu).

Columns (1)–(2) in Table 7 show the regression results using the Tobit regression model, while columns (3)–(4) cluster the robust standard errors at the county and city levels, respectively. The regression results all indicate a facilitative effect of financial density on firm innovation quality, suggesting that the estimation results in this paper are robust.

Specific Manifestations of Improved Firm Innovation Quality

The regression results of the benchmark model suggest that rising financial density promotes the quality of innovation; what are the specific aspects of this promotion effect? To this end, this paper further explores the promotional effect of financial density on enterprises’ innovation quality regarding patent generality and originality. The more industries a particular patent cites, the higher the degree of technology genericity. A higher breadth of front-loaded patents indicates better patent innovation crossover and a higher likelihood of originality (Su, 2022). Referring to the approach of Acharya and Xu (2017) with Raiteri (2018), whether the increase in financial density promotes the originality and generality of enterprises’ patents are examined in terms of the degree of patent originality (Originality) and the degree of patent generality (Generality). The explanatory variables in the baseline model are replaced with the degree of patent originality and the degree of patent generality in the regression, and the effect of financial density on patent originality and patent generality is also considered to determine whether there is the same “optimal geographical radius” phenomenon. The regression results are shown in Table 8.

Table 8 shows the results of the test of financial density on patent originality and patent generality, where FD_5km, FD_20km, and FD_30km are financial densities measured in terms of the number of financial institutions within 5 km, 10 km, and 30 km around the enterprise, respectively. Columns (1)–(3) show the results of the impact of financial density on the originality of the firm’s patents. The results show that increased financial density does not affect enterprises’ patent originality. Columns (4)–(6) show the results of the impact of financial density on enterprises’ patent generality. The results show that rising financial density enhances enterprises’ patent generality. By comparing the size of the coefficients of FD_5km, FD_20km, and FD_30km, we can see that there is also the phenomenon of “optimal geographic radius” in the promotion effect of financial density on the enterprises’ patent generalization. With the expansion of the geographic radius, the increase in the number of financial institutions in the neighborhood of the enterprise will first increase and then decrease the promotion effect of the enterprise’s patent generality. Taken together, the effect of increasing financial density on the innovation quality of enterprises is more on the generality of patents than on the originality of patents.

Mechanism Test

Our previous theoretical analysis suggests that financial density may affect innovation quality through both financial accessibility and bank competition channels. To test the transmission mechanism, this study uses financial accessibility (Dist) and bank competition (HHI_B) as the mechanism variables.

Drawing on Xu et al. (2020) concept of mechanism testing, first, the effects of financial density on financial accessibility and bank competition are estimated separately. Second, the effects of financial accessibility and bank competition on innovation quality are examined separately to obtain information on how financial density affects innovation quality by influencing financial accessibility and bank competition. Furthermore, suppose an increase in financial density improves innovation quality by increasing financial accessibility and bank competition. In that case, it can be hypothesized that, for firms with lower financial accessibility and lower bank competition, an increase in financial density significantly impacts innovation quality. This paper, therefore, uses the mean of the mechanism variables as the criterion for grouping the sample. We define dummy variables Dis_g and HHI_B_g as follows: firms in the sample that are larger than the mean value of the mechanism variable are in the high group and are assigned a value of 1; the other firms are assigned a value of 0. A regression model is then fitted with the interaction terms between financial density and Dis_g and HHI_B_g to further verify these channels’ existence. The results are presented in Table 9.

The estimated coefficient of FD_5km in column (1) of Table 9 is significantly negative. This result suggests that an increase in financial density leads to a decrease in the distance between firms and financial institutions and enhances their financial accessibility. By controlling for financial density, Column (2) estimates the impact of financial accessibility on firm innovation quality. The estimated coefficient of Dist is significantly negative at the 5% level. This result suggests that an increase in financial accessibility improves innovation quality. In column (3), the sample is grouped according to the Dist variable mean. The interaction term results are significantly positive, suggesting that firms with lower financial accessibility experience a more significant impact on innovation quality because of financial density. Further validating the existence of a financial accessibility channel is that firms with low financial accessibility benefit from financial density to improve their innovation quality.

Columns (4) to (6) of Table 9 report the test results for the bank competition channel. The estimated coefficient of FD_5km in column (4) is significantly positive at the 1% level, indicating that an increase in financial density leads to increased bank competition faced by firms. Meanwhile, column (5) estimates the effect of bank competition on firm innovation quality, controlling for financial density. The estimated coefficient of HHI_B is significantly positive at the 5% level, indicating that increased bank competition improves firm innovation quality. Column (6) groups the sample by the mean of the HHI_B variable. The interaction term results show that the financial density effect on a firm’s innovation quality is more pronounced in the group with lower bank competition. This result suggests that financial density is beneficial for firms with less bank competition to improve their innovation quality. Combined with the coefficient results in column (4), this finding suggests that financial density promotes firm innovation quality by increasing bank competition and, thus, the existence of a bank competition channel.

The empirical results indicate that financial accessibility and bank competition are the mechanisms by which financial density affects innovation quality. As financial density increases, financial institutions can collect high-quality information about enterprises and improve financial service availability for firms, thus contributing to innovation quality by reducing the search costs for financial products and the information costs of financial transactions. Additionally, an increase in financial density increases the competition level among banks, thus improving the firm's access to external financing and innovation quality.

Heterogeneity

Chinese firms vary widely in size, capital intensity, and economic development based on the industry and region in which they operate. Consequently, financial density may have a variable impact on innovation quality for firms of different sizes, in different industries with different capital intensities, and at different levels of marketization. First, this paper adopts Fan et al. (2011) China marketization level index to measure the marketization level of the region where the firms are located, a measure that has been applied in many studies (Ren et al., 2023; Zhang et al., 2023) and is positively correlated with the degree of local marketization. The marketization index can comprehensively assess the level of marketization in each region in terms of five dimensions: non-state economic development, product market development, factor market development, government-market relationship, and market intermediation, and legal environment (Zhang et al., 2023), which may also affect the effectiveness of financial density in promoting the quality of firm innovation. Specifically, this paper follows the method of Ren et al. (2023) to divide the sample by the mean of the marketization level of the overall sample if the marketization level of the region where the firms are located is higher than the mean of the marketization level of the overall sample, it is a high marketization region, and vice versa, it is a low marketization region. Second, regarding Lee et al. (2022), this paper uses the mean of the ratio of fixed assets to total assets at the industry level to measure the capital intensity of the firm’s industry; if the capital intensity of the firm’s industry is higher than that of all the industries in the overall sample, then it is a high capital-intensive industry, and vice versa, it is a low capital-intensive industry. Third, reference is made to China’s Small and Medium Enterprises Promotion Law which uses the number of employees of an enterprise as a criterion to classify large enterprises and SMEs. This paper uses the mean value of the number of enterprise employees of the overall sample to classify the sample into large enterprises and SMEs. Specifically, if the number of employees of an enterprise is greater than the mean value of the number of employees of the enterprise in the overall sample, it is a large enterprise, and vice versa, it is a small or medium-sized enterprise. Last, to avoid the small sample bias present in the traditional Wald test, this paper utilizes a bootstrap method to determine whether the differences between groups are significant.

The regression results for each sample are presented in Table 10. The p values obtained using the bootstrap method showed that the three subgroups differed statistically significantly. The results in columns (1) and (2) show that the coefficients of the effect of financial density on firm innovation quality are more significant at low marketization levels. We argue that regions with lower (vs. higher) market development levels have not yet established a complete credit system. Additionally, financial institutions are less experienced and equipped to provide services, which makes collecting information more difficult for financial institutions. Therefore, the effect of increased financial density around a firm on innovation quality is supposed to be stronger in areas with low marketization levels.

According to the results in columns (3) and (4), financial density affects innovation quality only in high capital-intensive industries. Patented R&D projects are affected by the characteristics of a company’s industry. Because innovation projects require large amounts of capital, companies in capital-intensive industries invest in high-technology innovation projects (Sahaym et al., 2010). Therefore, financial density is more likely to influence the innovation quality of firms in high capital-intensive industries. In contrast, low capital-intensive industries mainly depend on the firm’s resources and labor; the technology upon which the industry relies is relatively low, resulting in less R&D activity, and increasing the financial density around a firm does not significantly influence the quality of its innovation.

The results in columns (5) and (6) show that the absolute value of the coefficient on FD_5km is greater in the SME sample. This result suggests that increasing financial density makes a more significant marginal contribution to promoting innovation quality in SMEs. As SMEs have a relatively single source of financing, they depend more on bank financing; hence, financial density significantly impacts their innovation quality. Chinese SMEs are more productive than average enterprises (Wei et al., 2017), and increased financial density prompts financial institutions to focus on more-productive SMEs, alleviating their innovation financing constraints and increasing the quality of their innovation results.

Further Tests

Innovation Quantity and Innovation Efficiency

Innovation quantity is the basis for innovation quality, and having a certain number of patents implies that firms are likely to have a better accumulation of technology, which is more conducive to improving innovation quality. An increase in the quality of innovations may also lead to an increase in the number of innovations. If a firm achieves a major innovation, it may also have a linkage effect on the number of innovations, thus contributing to an increase in the number of patents held by the firm. The quantity of innovations is the total amount of innovation required from the firm. However, an increase in the innovation quantity is not enough; if there are fewer original innovations, fewer major innovations, and no better quality innovations, it is difficult for an enterprise to achieve an excellent competitive advantage. Innovation efficiency is the time requirement of enterprise innovation. Innovation efficiency refers to the degree to which intelligent manufacturing enterprises currently achieve input minimization or output maximization, aiming at comprehensively evaluating the real level of technological innovation activities of enterprises through various aspects such as resource utilization, technology development, and production management. Under a limited time, bringing new products to the market as early as possible can have a better chance of obtaining a larger market share and thus realizing greater benefits. Therefore, this paper further explores the effect of financial density on enterprises’ innovation quantity and firm innovation efficiency, as well as the transmission mechanism.

Table 11 shows the results of the regression of financial density on innovation quantity. Column (1) presents the regression test results examining the effect of financial density on patent applications. The coefficient of FD_5km indicates that an increase in financial density leads to an increase in enterprises’ total patent applications. Furthermore, we examine whether there is a difference in the mechanism that impacts financial density on innovation quantity and quality. The results in column (2) show that controlling for financial density, an increase in financial accessibility is beneficial in boosting enterprises’ innovation quantity. Moreover, if financial density has a boosting effect on enterprises’ innovation quantity by enhancing financial accessibility, then we can infer that the boosting effect of financial density on enterprises’ innovation quantity will be more significant among firms with low financial accessibility. According to the results presented in column (3), in the enterprise group with low financial accessibility, financial density has a more significant promotion effect on enterprises’ innovation quantity. The results in columns (4) and (5) show that financial density promotes enterprises’ innovation quantity by increasing bank competition. By combining the regression results in columns (2)–(5), it is evident that an increase in financial density increases firm innovation quantity through the channels of financial accessibility and bank competition. This suggests that financial density promotes innovation quantity primarily through the channel of financial accessibility, as well as through the channel of bank competition. Concerning the results of the benchmark regression, it is evident that an increase in financial density has a positive effect on enterprises’ innovation quality and innovation quantity. Innovation quantity is the basis of innovation quality, and it is not easy to achieve better innovation quality without accumulating a certain innovation quantity. However, the growth of innovation quantity does not mean improving innovation quality. Consequently, why can financial density increase innovation quantity and quality simultaneously? Patents covering inventions are more innovative than other patents, usually representing relatively high-quality innovations (Zhao et al., 2022). Unlike other types of patents, appearance patents are relatively low-tech and do not require substantive examination during application (Hu et al., 2020). Therefore, this paper further divides enterprise patent applications into invention-type, utility-type, and appearance-type patents according to patent categories. By examining the impact of financial density on patent quantity in different categories, this paper examines why financial density increases both innovation quality and quantity. Columns (6) to (8) indicate that the increase in financial density increases the number of invention patents (Invention) and utility patents (Utility), but not appearance patents (Design). As a whole, the increase in financial density can promote both innovation quantity and enterprise innovation quality simultaneously by stimulating enterprises to increase the research and development of invention patents with relatively high levels of innovation and utility patents with moderate levels of innovation, which in turn promotes enterprises’ substantive innovation behaviors and, therefore, improves innovation quality.

Table 12 reports the regression results of financial density on enterprises’ innovation efficiency. Columns (1) and (2) are the regression results of financial density on enterprises’ innovation efficiency without and with control variables. The coefficients of FD_5km are significantly positive, indicating that rising financial density improves enterprises’ innovation efficiency. This paper further examines the differences in the mechanisms by which financial density affects enterprises’ innovation efficiency and quality. Columns (3)–(4) are the results of the test of the financial accessibility channel, which show that the financial accessibility channel is not the primary transmission mechanism of financial density to enhance enterprises’ innovation efficiency. Columns (5)–(6) present the test results for the bank competition channel. The results show that controlling for financial density, an increase in bank competition promotes enterprises’ innovation efficiency, and the promotional effect of financial density on enterprises’ innovation efficiency is more significant at low levels of bank competition. The previous regression results have shown that an increase in financial density promotes bank competition and combined with the results in columns (5)–(6) of Table 12, and it can be seen that the bank competition channel is the primary transmission mechanism through which financial density promotes enterprises’ innovation efficiency. This may be because innovation factor flow can promote innovation efficiency (Fan et al., 2020). Bank credit funds are an essential source of enterprise innovation and R&D funds, and the intensification of bank competition is conducive to optimizing the allocation efficiency of credit resources and prompting the rational flow of resources used for technological innovation. Therefore, rising financial density can enhance enterprise innovation efficiency by increasing bank competition.

Impact of Financial Density on Commercial Credit

Commercial credit is the delayed delivery of loans between Chinese firms and is an important source of financing that allows for a period of delay before payment. According to alternative financing theory, commercial credit exists in large quantities because of credit rationing, i.e., firms that have difficulty obtaining loans from banks turn to commercial credit creditors for financing (Petersen & Rajan, 1997). According to buyer’s market theory, commercial credit exists in abundance because of the willingness of suppliers to provide commercial credit to their customers to sell their products as quickly as possible due to the strength of the buyer.

The previous results demonstrate that an increase in the number of financial institutions in the vicinity of a firm can improve innovation quality by alleviating the financing constraints firms face. Does the number of financial institutions in a firm’s vicinity alleviate the financing constraints other capital-needy firms face through the commercial credit channel? To examine the impact of financial density on a firm’s business credit, this paper replaces the explanatory variables of the baseline regression model with indicators measuring business credit. The first indicator uses the sum of a firm's accounts payable and prereceivables as a measure of business credit as a proportion of total assets (Credit). The second indicator is calculated as the ratio of accounts receivable to total assets, which measures business credit from the creditor’s perspective. It accounts payable to total assets, which measures business credit from the debtor’s perspective. Here, the difference between the two (d_Credit) is used as a measure of business credit. The estimates in column (1) of Table 13 show that increasing the number of perimeter entry institutions helps enhance business credit. The estimation of column (2) shows that an increase in the number of financial institutions around a firm can contribute to the lending firm becoming a net provider of business credit. A side note suggests that financial density is, to some extent, a channel through which business credit alleviates the financing distress of firms.

Impact of Financial Density on Financial Indebtedness

This paper argues that bank competition is one of the mechanisms through which financial density affects the quality of corporate innovation. According to the market power hypothesis, bank competition resulting from an increase in the number of financial institutions around a firm will improve the supply-side environment faced by the firm in terms of book-entry financing, which will increase the firm’s leverage and level of indebtedness. However, an increase in leverage does not mean a more reasonable level of indebtedness. For example, suppose the increase in the number of financial institutions in the vicinity of a firm can make the actual leverage ratio smaller than the target leverage ratio. In that case, the increase in financial density can improve the firm’s capital structure compared to an overindebted firm whose actual leverage ratio is greater than the target leverage ratio. Based on the above, this paper uses the sum of the long-term and short-term borrowing to total assets ratio to measure corporate leverage (Levratio) and the difference between actual and target leverage to measure corporate overindebtedness. The dummy variable (Levover) is set to 1 if the overindebtedness ratio is greater than 0 and 0 otherwise. An econometric model is constructed to examine the effects of financial density, overindebtedness, and the interaction between the two on corporate leverage, as described above. The estimated coefficients of the FD_5km variable are significantly positive, indicating that financial density helps increase a firm’s leverage and debt levels. In contrast, the estimated coefficient of the interaction term is significantly negative, indicating that financial density significantly boosts the leverage of nonover-indebted (relatively underfinanced) firms compared to overindebted firms, suggesting that an increase in financial density helps to optimize the capital structure of firms.

Conclusion

The study of financial development and economic growth is a persistent and cutting-edge issue in development economics and a significant reform issue for developing countries such as China. For most developing countries, reforming and strengthening the role of their financial systems in supporting the sustainable development of the real economy is a priority reform strategy in line with national conditions. However, the process of economic development in developing countries cannot avoid a shift from a factor-driven to an innovation-driven development model. The most critical question is whether the country’s financial system can effectively support the improvement of the manufacturing sector’s innovation capacity at the microlevel. However, few studies have focused on the impact of financial density around firms on innovation quality. The current development of China’s real economy suffers from a lack of motivation and innovation capacity, and the external financing environment constrains enterprises’ innovation activities. To address this significant issue, this study investigates the impact of financial density around Chinese industrial enterprises on their innovation quality from 1998 to 2013.

First, we used web crawling techniques to build a new dataset of 18,192 industrial firms in China. We counted the number of financial institutions within 5, 10, 15, 20, 25, and 30 km of an enterprise by crawling the latitude and longitude of industrial and financial institutions and calculating the geographical distance between financial institutions and firms within the same county. Drawing on the patent width method recently used by Aghion et al. (2019), this study measured the innovation quality of Chinese industrial firms from 1998 to 2013. Based on matched data from China Industrial Enterprise Database, the China Patent Database, and the China Financial Institution Licensing Database, we explore the effect of financial density on enterprises’ innovation quality from the perspective of financial geographic structure and analyze the specific manifestations of the effect of financial density on enterprises’ innovation quality in terms of patent originality and patent generality. Second, we use two instrumental variables, such as the mean of the number of financial institutions per county over the years and an instrumental variable constructed using the number of financial institutions in the county and the deregulation of bank access in 1984, to address potential endogeneity issues. Third, we test the mechanism of the role of financial density on firm innovation quality by examining the transmission effects of the financial accessibility and bank competition channels. Fourth, we further explore whether financial density affects enterprises’ innovation quantity and innovation efficiency while affecting enterprises’ innovation quality and test for differences in the transmission mechanisms. In addition, this paper examines the impact of financial density on enterprises’ business credit and financial liabilities.

This paper finds that financial density positively affects enterprises’ innovation quality, mainly in terms of patent originality rather than patent generality, and that there exists an “optimal geographical radius,” where an increase in financial density within a 20-km radius of a firm has the greatest effect on enterprises’ innovation quality. This facilitative effect is more pronounced at low levels of marketization and in highly capital-intensive industries. We argue that the increase in financial density around firms should have a stronger effect on innovation quality in regions with low levels of market development, where the cost of information gathering by financial institutions is higher. The risks faced by patent R&D projects are also related to the characteristics of the firm’s industry. Firms in capital-intensive industries usually invest in high-technology innovation projects. They, therefore, have a higher need for external funding, so financial density is more likely to influence the firm’s innovation quality in highly capital-intensive industries. By dividing the size of firms, we also find that financial density has a more significant impact on the innovation quality of small and medium-sized firms. This may be because SMEs are more dependent on bank financing due to their relatively single source of financing. Financial institutions focus more on SMEs with higher productivity, which increases their access to external financing and ultimately improves their innovation quality.

The mechanism test found that the financial accessibility channel and the bank competition channel are important transmission mechanisms for the impact of financial density on a firm’s innovation quality. Rising financial density has improved financial accessibility for enterprises, which helps financial institutions collect high-quality information about firms, reduces adverse selection and moral hazard in the credit market, reduces the financing constraints firms face, and ultimately affects firm innovation quality. The increase in financial density also increases the level of competition among banks. As a result, it increases the firm’s access to external financing, which impacts its innovation quality.

Further tests show that financial density affects enterprises’ innovation quantity and efficiency. The increase in financial density will motivate enterprises to research and develop invention and utility model patents with higher technological requirements, thus increasing the number of invention patents and utility model patents of enterprises and realizing the double enhancement effect of the quantity and quality of enterprise innovation. In addition, financial density will optimize the flow of innovation factors by improving bank competition, thus improving enterprise innovation efficiency. Finally, financial density is also conducive to increasing enterprises’ commercial credit and financial liabilities.

Despite the contribution of this paper, this study has several limitations. Due to data availability, our survey is based on a database of industrial firms from 1998 to 2013. The patent innovation capability of Chinese firms has also changed significantly since 2013, so future testing should be considered with an updated database. Second, the research object of this paper is mainly firms, and future researchers may consider conducting research mainly at the patent level.

Data Availability

The data that support the findings of this study are available on request from the corresponding author.

References

Acharya, V., & Xu, Z. (2017). Financial dependence and innovation: The case of public versus private firms. Journal of Financial Economics, 124(2), 223–243. https://doi.org/10.1016/j.jfineco.2016.02.010

Adegboye, A. C., & Iweriebor, S. (2018). Does access to finance enhance SME innovation and productivity in Nigeria? Evidence from the World Bank Enterprise Survey. African Development Review, 30(4), 449–461. https://doi.org/10.1111/1467-8268.12351