Abstract

We examine the cross-sectional relation between leverage and future returns while considering the dynamic nature of capital structure and potentially delayed market reactions. Prior studies find a negative relation between leverage and future returns that contradicts standard finance theory. We decompose leverage into optimal and excess components and find that excess leverage tends to drive this negative relation. We also find that excess leverage predicts firm fundamentals and that the negative relation between excess leverage and future returns may be explained by investors’ failure to react promptly to information contained in excess leverage about future financial distress and asset growth.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Standard treatments of cost of capital for equity valuation purposes implicitly rely on static asset-pricing models in which leverage affects stock returns through betas on systematic factors; higher leverage implies greater exposure to systematic risks and, hence, a positive relation between leverage and expected return. However, after decomposing a book-to-market factor and controlling for systematic risk, Penman et al. (2007) observe a puzzling negative relation between leverage and future returns. This warrants a closer look at the role of leverage in equity valuation that reaches beyond the scope of standard treatments. A related literature documents a negative relation between financial distress intensity and future returns (for example, Dichev 1998, Griffin and Lemmon 2002, Vassalou and Xing 2004, Campbell et al. 2008, and Chava and Purnanandam 2010),Footnote 1 suggesting a further way in which leverage may affect equity valuation.Footnote 2

In this study, we examine the relation between leverage and future returns in the context of a dynamic view of capital structure.Footnote 3 Prominent in our analysis is the interplay between leverage and the forecasting of future fundamentals such as profitability, asset growth, and the probability of financial distress. Specifically, we assume that leverage is subject to random shocks that induce distortions from optimal leverage—distortions that we refer to as excess leverage. Leverage is not immediately restored to an optimum due to transaction costs that may vary over firms seeking to increase or decrease leverage conditional on whether they are under or over-levered. Accordingly, there is a predictable element to excess leverage and, hence, to changes in fundamentals related to leverage. Under this view of capital structure, the optimal and excess components of leverage have very different economic implications for the firm.

One can view optimal leverage as having long-term effects on returns similar to that specified in static asset-pricing models that hold capital structure fixed. Excess leverage has a more complex relation with returns since it reflects a shock to the firm’s long-run debt capacity, to actual leverage, or to both and may carry important information about changes in the firm’s fundamentals as well as in leverage per se. The relation between future returns and current leverage encompasses relations between those returns and both optimal and excess leverage. The latter relation crucially depends on whether the market understands and impounds in price the information content of excess leverage with respect to future changes in the firm’s fundamentals, or whether it only does so with a delay as those changes unfold similar to well-known stock market anomalies (for example, Bernard and Thomas 1990, Jegadeesh and Titman 1993, Sloan 1996, and Hirshleifer 2001).

Our evidence supports a dynamic model of capital structure in which excess leverage contains information about future changes in fundamentals. Moreover, we find that the market only partially updates that information. Decomposing leverage into optimal and excess components, we find that excess leverage appears to explain the negative relation between leverage and future returns, while optimal leverage has no relations with returns after controlling for systematic risk. Further analysis confirms the information content of excess leverage with respect to future fundamentals; that is, firms with high (low) excess leverage are more (less) likely to experience future financial distress and slower (faster) asset growth. Further tests indicate that the relation between excess leverage and future returns is attributable to the market’s failure to react promptly to this information. Generalizing, our results suggest that the relation between excess leverage and future returns is akin to under-reaction phenomena such as the post-earnings-announcement drift (Bernard and Thomas 1990): the market does not fully reflect information contained in excess leverage until a later date.

We extend our inquiry to address the prospect that an omitted risk factor may be driving our results. In particular, George and Hwang (2010) conjecture that leverage may be negatively correlated with future returns due to heterogeneous exposure to systematic distress risk. They predict that firms facing high (low) systematic distress costs choose low (high) financial leverage. In their model, the reduced financial leverage partially offsets the firm’s distress costs and the net effect is that firms with high (low) ex ante distress costs will have low (high) probability of distress but high (low) exposure to systematic distress risk. Our evidence is inconsistent with a risk-based prediction, implying that such an explanation is, at best, incomplete. We generally find that excess leverage positively predicts the probability of distress, and, at the same time, firms with high (low) excess leverage are more (less) exposed to a systematic distress factor, mimicked by the hedge return of a corporate bond portfolio.

Apart from market efficiency, our findings in the context of a dynamic view of capital structure have practical implications for predicting changes in leverage, forecasting future growth, and assessing exposure to financial distress, all of which are relevant to the focus of financial statement analysis on equity valuation (Penman 2010). Specifically, we show that excess leverage is mean reverting and provides incremental explanatory power in regressions of future earnings (asset growth) on book-to-market and recent changes in earnings (assets). We further show that the inclusion of excess leverage enhances the explanatory power of Shumway’s (2001) bankruptcy prediction model. Last, we show that cost of capital is likely to be higher for firms with high excess leverage given their higher betas on the distress risk factor.

We use Graham’s (2000) “kink” as our measure of excess leverage.Footnote 4 The kink is a ratio where the numerator is the maximum interest that could be deducted for tax purposes before expected marginal benefits begin to decline. The denominator is actual interest incurred so that one can interpret the kink as the ratio of a firm’s debt capacity to its actual debt.Footnote 5 To the extent that optimal leverage is likely to be in the region where marginal tax benefits begin to decline, the kink can be viewed as a proxy for one minus excess leverage deflated by actual leverage. For ease of interpretation as a measure of excess leverage, we multiply the kink by minus one; hence, a high (so transformed) kink measure denotes high excess leverage (over-levered) and vice versa.

The kink is a suitable measure of excess leverage for several reasons.Footnote 6 First, the power of our tests depends on how precisely we capture firm specific values of excess leverage. The kink is based on detailed firm level information in the form of forecasts of future earnings and their volatility. The procedure also considers the entire spectrum of the U.S. tax code, including progressive rates and complications such as loss carry-forwards and carry-backs, investment tax credits, and the alternative minimum tax the impacts of which vary across firms. Second, the kink measure reflects financial distress because the risk of operating losses reduces the tax benefits of interest and thus reduces the kink’s numerator. Third, the value of tax benefits is a major factor in capital structure (Scott 1976). Fourth, inasmuch as the kink depends on earnings levels and volatility, both of which are associated with credit ratings (Kaplan and Urwitz 1979), the kink reflects not only the tax benefits of debt but also factors associated with credit ratings that, along with earnings volatility, CFOs identify as important determinants of their debt policy decisions (Graham and Harvey 2001). These factors also bear on agency costs not directly encompassed by the kink; to wit, earnings volatility is sensitive to asset substitution, and financial distress is inversely related to the tightness of debt covenants that control for agency costs.

The kink exhibits strong mean reversion tendencies, implying that current excess leverage predicts future changes in leverage or debt capacity. The elements driving reversion for positive and negative excess leverage are different. Under-levered firms tend to increase excess leverage (move toward the optimum) by increasing debt, while over-levered firms display less of a tendency to decrease their debt. The increase in the average kink for over-levered firms arises from a combination of performance-based delisting (an indicator of financial distress) and an improvement in the debt capacity of surviving firms. We also note that the firms closest to an optimum have the highest leverage, not the extreme over-levered firms, implying that excess leverage and leverage are imperfectly correlated; therefore, optimal leverage and excess leverage are quite distinct measures.

Our study contributes to the literature in three major respects. First, we find that excess leverage at the very least partially explains a previously observed negative relation between leverage and future returns. Second, we find that the relation between excess leverage and future returns is primarily driven by associations between excess leverage and future changes in fundamentals, including future asset growth and financial distress. This implies that inefficient use of the forecasting value of excess leverage accounts for its relation with returns. Third, our findings are generally supportive of a dynamic view of capital structure and suggest that excess leverage can be used to forecast future changes in fundamentals for use in financial statement analysis and equity valuation.

The remainder of the paper is organized as follows. In the next section, we describe the sample and the mechanics of calculating kink. In Sect. 3, we examine the properties of the kink as a measure of excess leverage. In Sect. 4, we present the main results of our study. In Section, we report on the robustness of the results to alternative measures of excess leverage. In Sect. 6, we conclude.

2 Data and descriptive statistics

2.1 Sample selection

We obtained kink data for 102,377 firm-year observations spanning 1980 through 2006 from John Graham. Firm-years with CUSIPs that do not appear in Compustat, do not have a unique match in the CRSP/Compustat merged database, or do not have SIC and share codes in CRSP are eliminated. We also require there be no missing data for sales (Compustat SALE), assets (AT), common equity (CEQ), net income (NI), market value of equity (shares outstanding (CSHO × price PRCC_F), and market model Beta (computed using Eventus). We further eliminate financial institutions (SIC codes 6000–6999), firms that are not U.S. ordinary common shares (CRSP share codes 10 and 11), firms with nonpositive book value of equity, nonpositive book value of equity plus debt net of financial assets, or nonpositive market value of equity plus debt net of financial assets. Last, we truncate for outlier balance sheet ratios at the 1st and 99th percentiles.Footnote 7 Our final sample consists of 71,589 firm-years. Table 1 summarizes our sample selection process.

2.2 Kink measures

The kink is defined as follows:

where Interest* is the point at which the firm’s marginal tax benefit function starts to slope down as the firm uses more debt. For each dollar of interest payments, the firm’s tax benefit equals the difference between the after-tax value of interest payments to investors and the after-tax value of equity payments to investors. Firms may deduct interest from taxable income so that the corporate tax rate does not impact investors’ after-tax value of interest payments, whereas corporate taxes reduce the after-tax value of equity payments to investors. The value of tax deductions varies as the firm uses more or less debt.

A firm’s marginal tax rate is defined as the present value of taxes owed on an extra dollar of income. Due to the presence of net operating loss carry-backs and carry-forwards, as well as the investment tax credit, the tax code is intrinsically dynamic. If a corporation has a tax loss, it can only claim an immediate refund to the extent that it offsets taxes paid in the prior 3 years. It can carry forward any remaining loss for 18 years to offset future taxable income. As a result, the value of a tax deduction depends not only on its impact on current year taxes but also on how it affects future taxable income and the firm’s current stock of loss carry-forwards and tax credits. Because of the asymmetric treatment of tax losses, tax deductions are more valuable to firms with a low risk of taxable losses due to, for example, high earnings levels.

In order to incorporate the effect of current interest deductions on future taxable income, Graham (2000) forecasts future earnings as in Shevlin (1990) and estimates the firm’s entire marginal corporate tax curve by simultaneously considering uncertainty about the firm’s future earnings, the progressivity of the statutory tax code, and various special provisions such as carry-forwards and carry-backs for net operating losses, the investment tax credit, and the alternative minimum tax. Graham forecasts future earnings assuming that earnings before interest and taxes (EBIT) follow a random walk with drift, where he estimates firm-specific drift μ i and volatility σ i based on Compustat data prior to the forecast period:

and the disturbance ε it is normally distributed with mean zero and standard deviation σ i .

To estimate the before-financing marginal tax rate, a forecast of EBIT i,t+k for years t + 1 through t + 18 is obtained from Eq. 2 initialized by EBIT it and updated with random draws from the distribution of ε it . Then, the present value of the tax bill from t − 3 (for carry-backs) to t + 18 (for carry-forwards) is calculated assuming the statutory tax rules are fixed at year t’s specification. Next, $10,000 is added to current year EBIT it , and the present value of the tax bill is recalculated. The difference between the two tax bills (divided by $10,000) represents a single estimate of the firm’s marginal tax rate. The same procedure is repeated 50 times to obtain 50 estimates. These estimates are averaged to determine the expected marginal tax rate for a single firm-year. To estimate the marginal tax rate curve, point estimates of the marginal tax rates are calculated assuming the interest deduction is 0, 20, 40, 60, 80, 100, 120, 140, 160, 200, 300, 400, 500, 600, 700, and 800% of the actual interest paid.Footnote 8

2.3 Key variables

Apart from measures of excess leverage, key variables in our study are measured as follows:

Buy-and-hold return: | Compounded annual return from CRSP beginning at the start of the fourth month following the firm’s fiscal year-end. We replace missing delisting returns as in Shumway (1997) and Shumway and Warther (1999) and assume any proceeds are invested in the firm’s CRSP size decile portfolio |

Net debt (ND): | Debt (Compustat current portion of long-term debt DLC plus long-term debt DLTT) plus preferred stock (preferred stock PSTK plus preferred dividends in arrears DVPA less preferred treasury stock TSTKP) less cash (CHE) |

Market value of equity (MVE): | Price (PRCC_F) times shares outstanding (CSHO) |

Book value of equity (BVE): | Common equity (CEQ) plus preferred treasury stock (TSTKP) less preferred dividends in arrears (DVPA) |

Net operating assets (NOA): | Book value of equity plus net debt |

Market value of NOA(PNOA): | Market value of equity plus net debt |

Beta: | Estimated using the Eventus software from a market model using the most recent 255 trading days’ data and the CRSP value-weighted index as a proxy for the market return |

2.4 Descriptive statistics

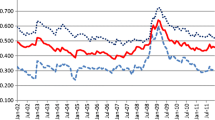

Table 2 provides descriptive statistics for our sample. From Panel A, we observe that the mean and median kinks of 2.8 and 2.0, respectively, for our sample are somewhat higher than the corresponding values of 2.4 and 1.2 for Graham (2000), which spans a different time period.Footnote 9 The fact that mean and median kinks are greater than one has been the basis for Graham’s (2000) claim that firms are under leveraged on average.Footnote 10 Financial leverage as measured by the ratio of net debt to market value of equity (ND/MVE) displays large right skewness. While the mean ND/MVE is 0.434, the median is only 0.165, suggesting that some firms have very highnet debt compared with the market value of equity. The 25th percentile of ND/MVE is negative because approximately 30% of the firms in our sample have cash holdings that exceed debt and preferred stock. Few firms in our sample have preferred stock and many have large cash holdings.

Important in our later analysis, we note that excess leverage as measured by the kink multiplied by minus one is positively correlated with financial leverage (Pearson and Spearman correlations of 0.416 and 0.336, respectively). In other words, debt and excess debt are positively correlated. However, as we report later, firms with the highest leverage are in the mid-range of the kink-based measure, suggesting further that excess leverage measured in this fashion contains different information than leverage, per se.

3 Properties of excess leverage

We conjecture that firms experience random shocks that distort their capital structure. Subsequent to such shocks, firms balance transaction costs associated with undoing distortions against benefits lost by allowing distortions to continue. Table 3 presents evidence that excess leverage mean reverts. We sort firms into groups based on the magnitude of the kink. We cannot group firms into exact quintiles because the kink measure only takes on discrete values. Group 1 includes kinks from −6 to −8, group 2 includes kinks from −3 to −5, group 3 includes kinks from −1 to −2, group 4 includes kinks from −0.2 to −0.8, and group 5 includes firm-years with a kink of zero. Panels A, B, and C depict mean reversion in excess leverage, market leverage, and book leverage, respectively, out 3 years for a constant sample of firms that have data for all 3 years. Table 3, Panel D, shows the percentage of firms that delist for performance-based reasons within the 3-year time frame.

In Table 3, Panel A, groups 1 and 2 (under-levered) show significant increases in excess leverage from year t to year t + 3, while groups 4 and 5 (over-levered) show significant decreases in excess leverage in the same time span, measured by a Fama and MacBeth (1973) type t statistics with a Newey-West correction for serial correlation with two lags for the two overlapping periods. Group 3 shows no significant change in the kink over the next 3 years. This evidence is consistent with the notion that the kink is a proxy for excess leverage and that the value for excess leverage is not significantly different from zero for the middle portfolio. We note that excess leverage as captured by the kink has a high level of persistence suggesting that distortions from optimal leverage have a sticky component.Footnote 11

In an effort to better understand what may underlie mean reversion in kinks, in Table 3, Panels B and C, we compare changes in leverage ratios for each excess leverage group, out 3 years. We find significant evidence that the most under-levered firms (group 1) increase leverage over the next 3 years and that the moderately over-levered firms (group 4) decrease leverage. However, changes in leverage ratios for the most over-levered firms (group 5) are not significant. For these firms we observe that the constant sample we use to assess mean reversion excludes firms that are delisted within the 3-year horizon subsequent to measuring excess leverage. Panels A, B, and C therefore exclude firms that were unable to recover from financial distress. Also, it may be that earnings growth, which impacts the kink’s numerator, rather than leverage reductions drive the decrease in surviving firms’ excess leverage.

A reasonable conjecture is that highly levered firms experience a higher frequency of financial distress and bankruptcy. As a result, the distressed firms are likely to be delisted from the exchanges and disappear from our sample as we extend the time horizon. The evidence is consistent with this conjecture. Table 3, Panel D, reports significantly more delisting for over-levered firms: 18.0% (2.4%) of firms ingroup 5(group 1) experience a performance-related delisting within 3 years. Moreover, there is an increase in percent delisting moving from group 4 to 5 of 8.8%, suggesting that the most severely over-levered firms are those experiencing financial distress going forward. We further note that the asymmetry in mean reversion of leverage ratios for firms with high (low) excess leverage should be expected because firms face differential transactions costs in moving toward an optimum. In general, a firm with high, stable earnings can more easily borrow money than a firm with low, volatile earnings can reduce its debt burden.

The delisting results in Table 3 suggest that excess leverage is negatively correlated with distress risk. This finding is inconsistent with Molina’s (2005) conjecture that under-estimated probability of distress may be the counter-weight to balance the apparent excess leverage proxied by the kink. However, this finding could possibly be consistent with George and Hwang’s (2010) argument that firms with high (low) distress costs have high (low) exposure to systematic risk associated with distress. They argue that this relation causes firms with high exposure to distress costs to employ low levels of leverage to avoid those costs; net, these firms may actually experience less distress than firms with low exposure to systematic financial distress. In Sect. 4, we directly test this hypothesis but find the opposite result. In other words, over-levered (under-levered) firms seem to face high (low) distress risk, both because they are more (less) likely to fall into distress and because they are more (less) exposed to a systematic distress factor.

4 Relations between excess leverage, future returns, and fundamentals

4.1 Excess leverage and abnormal returns

We adopt the specification in Penman et al. (2007) to estimate the relation between excess leverage and future returns. In particular, we estimate the following cross-sectional regression based on firm characteristics:

where R i,t+1 denotes 1-year buy-and-hold return beginning at the start of the fourth month after firm i’s fiscal year-end t and Excess Leverage is measured by the kink.Footnote 12

We estimate Eq. 3 in each year and present the average estimates and the associated Fama and MacBeth (1973) t-statistics.Footnote 13 We control for size, enterprise book-to-market (net debt plus book value of equity divided by net debt plus market value of equity), and beta, which are firm characteristics commonly thought to predict future returns based on either theory or empirical analysis. In addition, we control for firms’ research and development intensity because Bates et al. (2009) find that R&D intensive firms tend to have high cash holdings, a form of negative leverage; we control for firms’ proportions of foreign sales because Foley et al. (2007) find that firms with profitable foreign subsidiaries tend to hold cash in order to defer repatriation taxes.Footnote 14 Finally, we control for firms’ stock option plans because Graham et al. (2004) find that firms substitute the tax shield from employee stock option compensation for the tax shield from interest. Because data on stock option plans are limited for most of our sample period, we proxy for the extent of stock option plans using the percentage of a firm’s shares that are reserved for conversion [Compustat CSHRT/(CSHRT + CSHO)] as in Huson et al. (2001).

Table 4 presents the results of regressions for several models based on Eq. 3. The coefficients on enterprise book-to-market, size, and beta are broadly consistent with prior literature. While the enterprise book-to-market ratio significantly predicts future returns with a coefficients ranging from 0.088 to 0.102 (all significant at the 1% level), neither size nor firm beta predict returns. The result on size differs from that documented by Fama and French (1992) because our data cover a more recent sample period (Horowitz et al. 2000).

Table 4, Models 1 and 2, replicate the finding in Penman et al. (2007) that debt is negatively associated with future returns. Model 3 adds the kink measure of excess leverage, which has a coefficient of −0.007 (significant at 1%). The coefficient on net debt is no longer significant in this specification, which suggests that excess leverage rather than leverage per se accounts for the negative relation between debt and returns. A similar result obtains in Model 4 where the coefficient on debt is insignificant. Model 2, which excludes excess leverage, and Model 4, which includes it, both show that cash has a positive association with returns, (significant at 5%). Although not the focus of this paper, the fact that cash can consistently predict future returns is unexpected and warrants future research.

Model 5 adds controls for foreign sales, R&D intensity, and stock option plans. We find that the coefficient on the kink is essentially unchanged and continues to be highly significant. Cash and enterprise book-to-market continue to have a positive association with returns. Among the three added control variables, only the proportion of foreign sales is statistically significant with a coefficient of −0.05 (significant at 1%).

In order to directly consider excess leverage, we separate debt into optimal debt and excess debt whereFootnote 15:

This computation of excess debt is only valid for firms with nonzero debt, so when including this variable, we add two indicator variables for zero debt firms. The first is a simple indicator for firms with zero debt, and the second is one for firms with zero debt and a kink of zero, where a zero kink indicates that their earnings are such that they would not obtain full deductibility even on their first dollar of interest. The zero debt indicator proxies for (negative) excess leverage of zero debt firms for which interest deductions would have value. The sum of the zero debt and zero debt/zero kink indicators proxies for the excess leverage of zero debt firms for which interest deductions would have no value.

Table 4, Model 6, adds the indicator variables to the regression of Model 5 and Model 7 and presents the regression with debt split into excess and optimal components. The coefficient on excess debt is −0.022 (significant at 1%), while the coefficient on optimal debt is insignificant. An untabulated test shows that the difference in coefficients of optimal and excess debt is significant at the 10% level (t statistic of 1.814).Footnote 16

Based on the evidence in Table 4, we surmise that excess leverage, as measured by the kink, captures information relevant to future returns. Debt levels have diminished effects on returns after controlling for excess leverage, suggesting that excess leverage tends to drive the negative association between debt and returns. These observations hold after controlling for foreign sales and R&D, which may affect both debt policy and expected returns, and after controlling for shares held for conversion, which represent nondebt tax shields. The next subsection investigates why excess leverage predicts returns.

4.2 Excess leverage and future fundamentals

This subsection examines whether the association between excess leverage and returns is due to an association between excess leverage and firms’ future fundamentals. Given that firms make forward looking capital structure decisions, the firm’s current excess leverage could be a state variable that carries information about the evolution of the firm’s fundamentals. Market mispricing could arise if the investors do not fully understand such information. As we have shown in the prior sections, firms’ current excess leverage can help to predict future changes in leverage. This subsection adds an examination of the associations between excess leverage and the probability of future financial distress, future earnings changes, and future asset growth. We ultimately find that excess leverage is informative about these fundamentals. Moreover, we provide evidence that these associations could partially account for the relation between excess leverage and future returns, which suggests that prices fail to fully impound the information that excess leverage provides about future fundamentals.

We estimate the association between excess leverage and the probability of future financial distress using Shumway’s (2001) bankruptcy prediction model. In particular, we estimate logit regressions of distress probability (whether the firm is delisted due to performance reasons in the next 3 years) on excess leverage, while controlling for profitability (net income divided by total assets), book leverage (total liability divided by total assets), firm size relative to the market, prior performance (abnormal returns in the last fiscal year), and stock volatility. The results are presented in Table 5.

Table 5, Model 1, presents the benchmark model where only control variables are included. The results are broadly consistent with Shumway (2001). All coefficients have the correct signs, and all but past abnormal market returns are statistically significant. Despite the high correlation between the kink and leverage, when we add excess leverage as measured by the kink in Model 3, the coefficient for excess leverage is highly significant. The Pseudo R 2 also increases, and the higher area under the receiver operating characteristic (ROC) curve indicates that the model better identifies distressed firms. The positive coefficients confirm that high (low) excess leverage firms are more (less) likely to become distressed in the next 3 years. Thus, excess leverage as measured by the kink appears to have incremental value for predicting financial distress.

We now turn our attention to whether excess leverage predicts future profitability, asset growth, or both. We conjecture that excess leverage should negatively predict future profitability and asset growth because under (over) leverage could be the consequence of a positive (negative) shock to debt capacity or an increase (decrease) in financial slack. In order to measure the association between excess leverage and changes in profitability over the k years subsequent to measuring excess leverage, we estimate:

where excess leverage is measured by the kink. A similar regression can be defined for asset growth, (Assets t+k − Assets t )/(k × Assets t ).

Table 6 presents the results of this analysis. In Panel A, we report results from regressing future average changes in earnings (before interest but after tax) for both 1 and 2 years in the future on excess leverage, book-to-market, and the preceding year’s earnings change. Across the two columns representing 1- and 2-year time horizons, the average coefficient estimate on the change in earnings is significantly negative, consistent with mean reversion in profitability. Supporting the idea that the book-to-market ratio is inversely related to growth in earnings, we find that the average coefficient estimate on book-to-market is −0.018 (significant at 1%) when the dependent variable is the next year’s change in earnings. However, this effect diminishes to −0.005 (significant at 10%) over a 2-year horizon. Excess leverage has an insignificant relation with future earnings changes out 1 year but is significantly negative (at 10%) out 2 years.

In Table 6, Panel B, the dependent variable is cumulative asset growth. Similar to results in Panel A, book-to-market continues to have a significant negative average coefficient estimate at both 1-year and 2-year horizons. The average coefficient estimate on the change in assets is significantly positive, suggesting that firms experiencing profits from past investments invest more in the future. Relevant to our analysis, we find that the average coefficient estimate on excess leverage is significantly negative at the 1-year horizon (coefficient of −0.003, significant at 5%). The estimate for the 2-year horizon is insignificant, suggesting that firms with negative excess leverage have high next year asset growth that tapers off in the subsequent year.

We have generally found that excess leverage contains a significant amount of information about the likelihood of financial distress and future changes in asset growth. It also provides some information about future earnings changes over a 2-year horizon. In particular, we note that under-levered (over-levered) firms are more (less) likely to increase leverage, avoid financial distress, and increase asset growth, factors positively related to equity returns. If the market fails to fully appreciate these implications, one could find a delayed reaction in the future.

To test for a delayed market reaction to information contained in excess leverage, we employ the following regression model:

where the control variables include the future realized fundamentals. Without the added control variables, Eq. 6 is reduced to Eq. 3, where only size, beta, and the book-to-market ratio are included as controls in the cross-sectional regressions. The added controls will cause the coefficients on excess leverage to fall if the return prediction power of the kink is partially derived from the market’s failure to understand the relation between excess leverage and those particular controls. Similar analysis has been employed by Abarbanell and Bernard (1992) and Brous and Shane (2001) in their examinations of the post-earnings announcement drift.

The results are presented in Table 7. In Model 1, we replicate the result that excess leverage is negatively related to future returns. In Models 2, 3, 4, and 5, we introduce next year’s change in leverage, next year’s change in profitability, next year’s asset growth, and the performance related delisting in the next 3 years, one by one to the regression equation. Model 6 includes all of these controls.

Table 7, Models 2 and 3, demonstrate that the relation between future returns and excess leverage is not affected by the inclusion of the future change in leverage or the future change in earnings 1 year out. Controlling for future asset growth, as in Model 4, slightly decreases the relation between the kink and returns. The coefficient estimates on excess leverage decrease from −0.006 (significant at 1%) to −0.005 (significant at 5%). This suggests that the positive relation between the kink and future returns could be due, in part, to the market’s failure to understand the information in excess leverage about next year’s asset growth.

We find a stronger result in Table 7, Model 5, when we control for the performance related delisting in the next 3 years, as in Table 5. The coefficient on excess leverage decreases to −0.003 and is no longer significant.Footnote 17 Finally, when we control for the four future fundamental variables simultaneously in Model 6, the coefficient on excess leverage becomes an insignificant −0.002. This suggests that roughly 2/3 of the positive association between the kink and future returns is due to the association between the kink and future fundamentals.

The cumulative evidence from Tables 5, 6, and 7 collectively strongly suggests that the significant relation between excess leverage and future returns reported in Table 4 is an artifact of information about future changes in fundamentals that the market does not fully price.

4.3 Distress risk and the relation between returns and leverage

The previous subsection provides evidence that the negative association between leverage and returns stems from the ability of excess leverage to predict future financial distress and asset growth, which investors fail to impound in prices. In this section, we test whether the abnormal returns can be explained by firms’ exposure to systematic distress risk. This test helps to differentiate the risk-based explanation proposed by George and Hwang (2010) and the market inefficiency interpretation of our results to this point.

We estimate time series regressions of portfolio returns on conventional risk factors, augmented by an additional factor that proxies for distress risk. In particular, we consider the following model:

where R p,t denotes the excess return for month t on a portfolio p of firms, measured as the difference between portfolio return and the 1-month Treasury bill return; Market t denotes the excess return for the market portfolio in month t; SMB t denotes the month t return on a factor mimicking portfolio for size; HML t denotes the month t return on a factor mimicking portfolio for book-to-market; UMD t denotes the month t return on a factor mimicking portfolio for momentum. The data on these factor portfolios are obtained from Ken French via WRDS. The first four risk factors are due to Carhart (1997). The additional financial distress risk factor, FDR, is mimicked by a hedge portfolio that is long in BAA rated bonds and short in AAA rated bonds.Footnote 18 The portfolios are rebalanced once a year, at the end of March, based on the ranks of excess leverage as of the fiscal year-end.Footnote 19

The results in Table 8 show that the differential exposure to distress risk factor cannot explain the relation between the kink and future returns. Contrary to the distress risk prediction, firms with high excess leverage have high exposure to the distress factor, and the exposure decreases monotonically as we move to lower excess leverage portfolios. A similar, nearly monotonic pattern is found for exposure to the SMB factor. Portfolios do not exhibit recognizable patterns in their exposures to the market and UMD, though portfolios in the middle quintiles have higher exposure to HML than the extreme quintiles. Overall, the results are inconsistent with the suggestion that the kink is a proxy for systematic distress risk. Rather, the under-levered firms are less risky than over-levered firms in the sense of having less exposure to risk factors.

Another interesting finding in Table 8 is that the regression intercepts (Jensen’s alpha) decrease monotonically from group 1 (under-levered firms) to group 5 (over-levered firms). The spread between group 5 and group 1 is about 7% on an annualized basis for each measure of excess leverage. This suggests that excess leverage (especially under-leverage) is negatively correlated with superior stock performance after controlling for conventional risk factors. While the predictability of future returns could be an artifact of omitted risk factors, the analysis in the previous subsection suggests that it is more likely due to market inefficiency. Specifically, the relation appears to stem from the market’s failure to price the low distress risk and high earnings or asset growth of under-levered firms.

5 Robustness

The results we have presented up to this point are based on Graham’s kink as our proxy for excess leverage. A question arises as to whether our general conclusions hold when we use alternative proxies for excess leverage. The capital structure literature is large and rapidly developing, our read of which suggests that there is still no consensus on how to measure optimal or excess leverage. While we have reasons to believe, as laid out in earlier sections, that Graham’s kink is good choice for excess leverage, we expect our results to hold at least qualitatively using alternative proxies.

We consider two alternative proxies for excess leverage: one is a new kink measure constructed by Blouin et al. (2010), and the other is derived from a regression-based model suggested by Lemmon et al. (2008).Footnote 20 The Blouin et al. (2010) kink resembles Graham’s (2000) calculation except that they forecast earnings using a nonparametric simulation procedure rather than a random walk. Although Blouin et al.’s earnings expectation model provides a better forecast of future earnings volatility, an important feature for estimating the overall level of marginal tax rates, its accuracy in terms of point estimates, upon which a cross-sectional study such as ours depends, does not seem to do well. In particular, the median taxable income forecast error for their nonparametric model is very large (−1.7% of firms’ total assets),while it is only −0.13% for Graham’s random walk model (Table 2, Panel A of Blouin et al. 2010). We conjecture that substantially larger noise might be induced by Blouin et al.’s heavy emphasis on the use of industry information over firm level information in earnings forecasting.

Not surprisingly, we find that the two kink measures of excess leverage have significant positive correlation (Pearson and Spearman correlations of 0.609 and 0.601, respectively). After grouping group firms based on Blouin et al.’s kink, we find that their kink, market leverage, and book leverage display similar mean reversion properties to those reported for the measure based on Graham’s kink in Table 3. We repeat our tests from Table 4 and observe that the coefficient on excess leverage is again significantly negative. However, the coefficient on leverage continues to be significant when excess leverage is included in the regressions, albeit at a lower (10% vs. 5%) significance level, tempering our earlier conclusion that excess leverage is the sole driver of the negative association between leverage and future returns.

The findings on the incremental predictive content of excess leverage with respect to financial distress remain intact under Blouin et al.’s measure of excess leverage; excess leverage continues to be significant in the augmented Shumway (2001) model regressions similar to those in Table 5. Whereas Table 6 shows that the kink predicts negative (does not predict) 1-year-ahead asset (earnings) growth, Blouin et al.’s kink does not predict asset growth but does have an unexpected significant (at the 10% level) positive association with earnings growth.Footnote 21 Replicating Table 7, the association between their kink and earnings growth appears to play no role in its relation with returns, while controlling for future performance-related delistings renders the relation between returns and their kink insignificant. Last, employing factor models similar to those in Table 8, we obtain essentially the same results as before with the monotone ordering of Jensen’s alpha, indicating higher abnormal returns for portfolios of under-levered firms and a similar hedge portfolio return of 6% compared with 7% reported earlier for the kink.

An alternative approach to estimate optimal leverage is to assume that optimal leverage is determined by factors in a linear fashion. The precision of estimates is influenced by (a) the efficacy of the linear model and (b) the scale of the measurement error in the determinants. This strand of literature is in rapid development, and we adopted a recent model by Lemmon et al. (2008).

The distinctive feature of Lemmon et al. (2008) is their recognition of stickiness in leverage. In practice, firms are slow to adjust their leverage. Models that ignore the stickiness of leverage produce poor estimates of the speed of adjustment, which feeds into a poor estimate of an optimum.Footnote 22 In order to accommodate the stickiness of leverage, they include firm fixed effects in the model to reflect the extent to which leverage persistently differs from optimal leverage. We define the excess leverage in this setting as the sum of these persistent deviations and residuals, because both are not explained by the known determinants of firm’s capital structure.

Here again the properties of quintile groups formed from rankings of the regression-based excess leverage display similar properties to those reflected in Table 3. We repeat the returns regressions of Table 4 and find that the coefficient on regression-based excess leverage is significant, while the coefficient on leverage is insignificant. This complements our results based on excess leverage using the Graham (2000) kink. Similar to the kink in Table 6, we find that regression-based excess leverage has incremental information content with respect to future asset growth. As with the Blouin et al. kink, the regression-based excess leverage coefficient is significant and unexpectedly positive.Footnote 23 In Shumway-type regressions similar to those in Table 5, regression-based excess leverage is significant in predicting financial distress, but only when other variables are excluded. Similar to the kink-based measures in Table 7, the regression-based excess leverage loses significance in predicting future returns after controlling for future performance-related delistings. The orderings of abnormal returns as measured by Jensen’s alpha in a factor model are once again nearly monotone ranging from positive and significant for under-levered to negative and insignificant for over-levered portfolios. This again suggests that market inefficiency accounts for the relation between excess leverage and returns.

In sum, the two kink-based and regression-based measures of excess leverage produce quite similar results apart from the continued significance of the negative coefficient of leverage in returns regressions when we estimate excess leverage using the Blouin et al. kink. All three measures have incremental information content with respect to future changes in fundamentals. Regressions that control for future changes in fundamentals indicate that they account for the relation between returns and the excess leverage measures. Finally, all three measures yield similar hedge portfolio abnormal returns in a factor model inclusive of financial distress factor-mimicking portfolio returns.

Because both the kink and the Blouin et al.kink have skewed distributions (See Table 2, Panel A) on account of dividing by actual interest, we conduct a final set of robustness tests to ensure that our results are not driven by scale effects. We replicate Tables 4 through 7 using logs of the kinks rather than the kinks in order to reduce skewness.Footnote 24 The results are qualitatively similar to those we obtain using the untransformed kink variables.Footnote 25 In particular, the relation between excess leverage and returns appears to be driven primarily by the ability of excess leverage to predict future financial distress.

6 Conclusion

Prior studies have found an apparently anomalous negative relation between leverage and future stock returns. Under a dynamic view of leverage, at any point in time a firm may exhibit under or over leverage due to random shocks with the distortion in leverage only gradually resolved over time because of transactions costs. In this view of leverage, the firm’s current excess leverage becomes a state variable that carries information about the firm’s future fundamentals such as changes in leverage and assets and the probability of financial distress. It follows that leverage may impact future returns not only through the conventional “leverage effect,” where risk is magnified by the use of debt, but also through possible market inefficiencies when the market does not fully react to the information contained in excess leverage about future fundamentals.

We find that excess leverage contains significant information about the firm’s future asset growth and probability of financial distress. However, the market may not fully understand the link between excess leverage and future fundamentals. We find evidence that excess leverage predicts future returns. This phenomenon appears to be primarily driven by the market’s delayed reaction to the information in excess leverage about future asset growth and financial distress. Because of the positive correlation between excess leverage and leverage as measured by debt levels, leverage is negatively correlated with future returns in the absence of controls for excess leverage. When both leverage and excess leverage are considered simultaneously, returns tend to be more closely associated with excess leverage.

We find that excess leverage exhibits properties consistent with a dynamic view of capital structure. Neither the omission of distress costs nor a distress risk factor appears to explain the relation between excess leverage and returns. Contrary to the distress cost explanation, high excess leverage firms are found to have higher (lower) probability of financial distress and higher (lower) exposure to a distress risk factor. Other potential explanations related to stock options as a tax shield, foreign repatriation taxes, and R&D intensity are also not supported by cross-sectional analysis of the relation between the kink and future returns.

The above findings are based on Graham’s (2000) kink as the measure of excess leverage. In order to assess the robustness of these findings to other measures of excess leverage, we consider another kink based on Blouin et al. (2010) and a regression measure based on Lemmon et al. (2008).Notwithstanding some differences in specific results, the findings under these alternative measures of excess leverage qualitatively reinforce our conclusion that the predictive content of excess leverage with respect to future changes in fundamentals is not fully understood by the market.

Notes

Chava and Purnanandam (2010) show that distress risk has a positive association with an ex ante measure of cost of capital.

The phenomena are related in that leverage is positively correlated with financial distress.

We elaborate on how this measure is constructed in Sect. 2.

As noted below, we consider alternative measures of excess leverage in Sect. 5.

These ratios include book-to-market, net debt-to-market, net operating assets-to-market value of net operating assets, and the difference between book-to-market and net operating assets-to-market value of net operating assets.

We obtain similar results using log kinks as mentioned in Sect. 5.

Blouin et al. (2010) project earnings volatility that more closely matches actual volatility leading to an estimate of average leverage that, in conjunction with estimated distress costs, does not support a conclusion that firms are, in aggregate, under levered. Our interest is in cross-sectional associations of excess leverage with fundamentals and future returns rather than aggregate leverage.

As we comment in Sect. 5, this persistence has implications for regression-based measures of excess leverage.

We obtain similar results estimating the regression using two-way, firm/year, clustered standard errors.

We compute firms’ foreign sales from the Compustat segments database.

Expression (4) is a rough approximation that assumes: (1) the optimal debt level corresponds to a kink of one, (2) the interest rate at the optimal debt level is comparable to the firm’s current rate, (3) the firm holds debt in perpetuity, and (4) the actual interest used in computing the kink only includes actual interest expense. In this case, the kink equals Interest*/Interest = (Debt* × Rate*)/(Debt × Rate) = Debt*/Debt. This implies that Debt* = Debt × Kink and Excess Debt = Debt − Debt* = (1 − Kink) × Debt. If (1) is violated, the computation is valid if all firms’ optimal debt levels correspond to the same value of the kink, which would be reflected in the regression coefficients but not their significance. Assumption (4) is violated because the kink is based on actual interest plus imputed interest that includes a portion of rent expense (Graham et al. 1998; Blouin et al. 2010). Alternative means to compute direct estimates of (negative) excess debt are to assume any additional leverage is in the form of perpetual debt borrowed at Baa rates as in Blouin et al. (2010). There does not appear to be a straightforward way to compute positive excess debt because of the need to allocate the debt change to imputed versus actual interest and to infer the amount of debt that corresponds to a given reduction in interest expense.

Specifically, we compute a Fama-MacBeth t statistic for the difference in coefficients using the time series of the optimal and excess debt coefficients from Model 7. The tests in Model 7 are similar if we restrict the sample to firms with positive debt except that the coefficient on optimal debt is −0.017 (t statistic of −1.802, significant at 10%) and the difference in coefficients is 0.008 (t statistic of 1.678, p-value of 10.4%).

If we alternatively include the full sample and replace missing values of future change variables with zeros, controlling for future delistings similarly reduces the coefficient on the Kink to −0.004 (significant at 10%).

We obtained yields from Federal Reserve H-15 reports and convert to returns using the log-linear approximate relation between returns and yields as defined in Campbell et al. (1997).

Because kinks take on discrete values, we are unable to form exact quintiles. Portfolio 1 contains 15,766 firm-years for kinks of −6 to −8. Portfolio 2 contains 12,939 firm-years for kinks between −3 and −5. Portfolio 3 contains 18,035 firm-years for kinks between −1 and −2 (i.e., near optimal leverage). Portfolio 4 contains 9,049 firm-years for kinks between −0.2 and −0.8. And Portfolio 5 contains 15,800 firm-years for kinks of zero (the maximum).

The tabulated results are available upon request. To save space, we only discuss the key findings.

The positive relation could be due in part to the fact that these regressions only include surviving firms. We note in our discussion of Table 3 that over-levered firms that survive tend to maintain debt levels and move toward optimal leverage by increasing their capacity to bear debt as indicated by their earnings.

The models simultaneously estimate optimal leverage and the speed of adjustment. The estimate of optimal leverage requires dividing estimated regression coefficients by the estimated speed of adjustment.

This again could be partially driven by the fact that the estimates in Table 6 only include surviving firms.

The tabulated results are available from the authors upon request. There are two somewhat noteworthy differences. First, in returns regressions similar to those reported in Table 4, optimal debt is significant at the 10% level using the transformed kink variable (excess debt continues to be significant at the 1% level). Second, both of the transformed kink measures have a positive association with 2-year-ahead asset growth. As mentioned earlier, such positive associations could be due in part to the fact that the Table 6 regressions include only surviving firms and are thus affected by the fact that over-levered firms that do not delist tend to reduce excess leverage by improving their operating performance.

References

Abarbanell, J., & Bernard, V. (1992). Tests of analysts’ overreaction/underreaction to earnings as an explanation for anomalous stock price behavior. Journal of Finance, 47, 1181–1207.

Bates, T., Kahle, K., & Stulz, R. (2009). Why do U.S. firms hold so much more cash than they used to? Journal of Finance, 64, 1985–2021.

Bernard, V., & Thomas, J. (1990). Evidence that stock prices do not fully reflect the implications of current earnings for future earnings. Journal of Accounting and Economics, 13, 305–340.

Blouin, J., Core, J., & Guay, W. (2010). Have the tax benefits of debt been overestimated? Journal of Financial Economics, 98, 195–213.

Brennan, M., & Schwartz, E. (1984). Optimal financial policy and firm valuation. Journal of Finance, 39, 593–607.

Brous, P., & Shane, P. (2001). Investor and (Value Line) analyst underreaction to information about future earnings: The corrective role of non-earnings-surprise information. Journal of Accounting Research, 39, 387–404.

Campbell, J., Hilscher, J., & Szilagyi, J. (2008). In search of distress risk. Journal of Finance, 63, 2899–2939.

Campbell, J., Lo, A., & MacKinlay, A. (1997). The econometrics of financial markets. Princeton, NJ: Princeton University Press.

Carhart, M. (1997). On persistence in mutual fund performance. Journal of Finance, 52, 57–82.

Chava, S., & Purnanandam, A. (2010). Is default risk negatively related to stock returns? Review of Financial Studies, 23, 2523–2559.

Dichev, I. (1998). Is the risk of bankruptcy a systematic risk? Journal of Finance, 53, 1131–1147.

Fama, E., & French, K. (1992). The cross-section of expected stock returns. Journal of Finance, 47, 427–465.

Fama, E., & MacBeth, J. (1973). Risk, return, and equilibrium: Empirical tests. Journal of Political Economy, 81, 607–636.

Foley, C., Hartzell, J., Titman, S., & Twite, G. (2007). Why do firms hold so much cash? A tax-based explanation. Journal of Financial Economics, 86, 579–607.

George, T., & Hwang, C. (2010). A resolution of the distress risk and leverage puzzles in the cross section of stock returns. Journal of Financial Economics, 96, 56–79.

Graham, J. (2000). How big are the tax benefits of debt? Journal of Finance, 55, 1901–1941.

Graham, J., & Harvey, C. (2001). The theory and practice of corporate finance: Evidence from the field. Journal of Financial Economics, 60, 187–243.

Graham, J., Lang, M., & Shackelford, D. (2004). Employee stock options, corporate taxes, and debt policy. Journal of Finance, 59, 1585–1618.

Graham, J., Lemmon, M., & Schallheim, J. (1998). Debt, leases, taxes and the endogeneity of corporate tax status. Journal of Finance, 53, 131–162.

Griffin, J., & Lemmon, M. (2002). Book-to-market equity, distress risk, and stock returns. Journal of Finance, 57, 2317–2336.

Hirshleifer, D. (2001). Investor psychology and asset pricing. Journal of Finance, 56, 1533–1597.

Horowitz, J., Loughran, T., & Savin, N. (2000). Three analyses of the firm size premium. Journal of Empirical Finance, 7, 143–153.

Huson, M., Scott, T., & Wier, H. (2001). Earnings dilution and the explanatory power of earnings for returns. The Accounting Review, 76, 589–612.

Jegadeesh, N., & Titman, S. (1993). Returns to buying winners and losers: Implications for stock market efficiency. Journal of Finance, 48, 65–91.

Kaplan, R., & Urwitz, G. (1979). Statistical models of bond ratings: A methodological inquiry. Journal of Business, 52, 231–261.

Lemmon, M., Roberts, M., & Zender, J. (2008). Back to the beginning: Persistence and the cross-section of corporate capital structure. Journal of Finance, 63, 1575–1608.

Molina, C. (2005). Are firms underleveraged? An examination of the effect of leverage on default probabilities. Journal of Finance, 60, 1427–1459.

Myers, S. (1984). The capital structure puzzle. Journal of Finance, 39, 575–592.

Penman, S. (2010). Financial statement analysis and security valuation. New York, NY: McGraw-Hill/Irwin.

Penman, S., Richardson, S., & Tuna, I. (2007). The book-to-price effect in stock returns: Accounting for leverage. Journal of Accounting Research, 45, 427–467.

Scott, J. (1976). A theory of optimal capital structure. Bell Journal of Economics, 7, 33–54.

Shevlin, T. (1990). Estimating corporate marginal tax rates with asymmetric tax treatment of gains and losses. Journal of the American Taxation Association, 11, 51–67.

Shumway, T. (1997). The delisting bias in CRSP data. Journal of Finance, 52, 327–340.

Shumway, T. (2001). Forecasting bankruptcy more accurately: A simple hazard model. Journal of Business, 74, 101–124.

Shumway, T., & Warther, V. (1999). The delisting bias in CRSP’s Nasdaq data and its implications for the size effect. Journal of Finance, 54, 2351–2379.

Sloan, R. (1996). Do stock prices fully reflect the information in accruals and cash flows about future earnings? The Accounting Review, 71, 289–316.

Vassalou, M., & Xing, Y. (2004). Default risk and equity returns. Journal of Finance, 59, 831–868.

Acknowledgments

We thank John Graham and Jennifer Blouin, John Core and Wayne Guay for making their data available. We have received helpful comments from David Aboody, Ruihao Ke, Zhiyang Li, Laura Liu, Stephen Penman, James Ohlson, Richard Sloan, and seminar participants at Barclays Global Investors, Cal Poly—San Luis Obispo, CKGSB-Tsinghua-PKU Accounting Conference, Duke University, MIT, University of Minnesota Empirical Mini-Conference, SAIF Summer Finance Camp, Purdue, and Stanford.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Caskey, J., Hughes, J. & Liu, J. Leverage, excess leverage, and future returns. Rev Account Stud 17, 443–471 (2012). https://doi.org/10.1007/s11142-011-9176-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11142-011-9176-1