Abstract

Acknowledging sustainability as a challenge of utmost importance, organizations face questions on dealing with different dimensions of sustainability. Respective actions include a fundamental shift in the purpose of business and almost every aspect of how it is conducted, or in short: an integration of sustainability in organizations’ business model. However, as sustainability is no altruistic end in itself, respective transformation must resonate with organizations’ economic conditions and their position in the market. But when does it pay off for organizations to integrate sustainability in their business model? Within this research paper we find answers by applying a game-theoretic framework and examining competition strategies for organizations integrating sustainability in their business model. Hereby we consider different market scenarios where symmetric and asymmetric, weak and strong, as well as a varying number of organizations interact. Our results suggest different strategies organizations can apply to gain competitive advantage.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The “earth overshoot day” marks the date when we, all of humanity, have used more from nature in a single year than our planet is able to renew. In 2018, this day was as early as never before on August 1. As a consequence, we used 1.7 earths this year instead of the single one we inhabit (Earth Overshoot Day 2018). This clearly illustrates the severity of today’s environmental degradation, which is mostly man-made (Dunlap et al. 2000; Fonseca et al. 2018; Van Bommel 2018). The consequences already manifest: a recent scientific report by 13 federal U.S. agencies predicts that if significant steps are not taken to combat global warming, the damage will lead to a 10% decrease in the size of the American real economy by the end of the current century (Davenport and Pierre-Louis 2018). But which actor is the most suitable one to take the steps demanded so urgently?

Associated with global warming is the emission of greenhouse gases. In 2016, the industrial sector accounted for 22% of America’s greenhouse gas emissions (United States Environmental Protection Agency [EPA] 2017). Thus, as a considerable source of greenhouse gas production, business organizations (which we refer to as “organizations” from now on) hold a prominent position in achieving a higher level of sustainability (Abdelkafi and Täuscher 2016; Brehmer et al. 2018). Furthermore, customers are increasingly concerned about climate change, and are also fond of sustainable business models such as the sharing economy (Hamari et al. 2016). To address this demand, transformation towards sustainability has been integrated in organizations for years, but mostly in singular business activities. For example, supply chain management focused on the integration of environmentally sound choices into supply chains (e.g., Srivastava 2007), and marketing management focused on the promotion of sustainably produced products (e.g., Collins et al. 2007). However, when facing today’s challenges, a holistic and more strategic approach on the integration of sustainability not only in single business activities and processes, but in organizations’ core business models, is necessary (Bini et al. 2018; Müller and Pfleger 2014).

Such a sustainability integrated business model is called “business model for sustainability” (BMfS) and describes a fundamental shift in the purpose of business and almost every aspect of how it is conducted. The concept of BMfS is relatively new (Abdelkafi and Täuscher 2016; Oghazi and Mostaghel 2018). Thus, their functionality, their application in the real world, and the determinants for their success in the market, are not yet well understood (Piscicelli et al. 2018). In fact, there is debate on how BMfS could translate environmental benefits into economic profit and in particular in competitive advantage for an organization (Bocken et al. 2018; Bryson and Lombardi 2009; Lloret 2016). The analysis of an organization’s competitive advantage requires an analysis of the market and the behavior of other competitors. In academia, this has not happened so far. One reason might be that actual research in the field of BMfS and research on business model concepts in general take a single-actor or “egocentric” perspective of one focal organization (Breuer et al. 2018). However, particularly in the context of sustainability, scholars point out the importance of a multi-actor approach (Breuer et al. 2018; Stubbs and Cocklin 2008). This is where this work starts, as we analyze favorable competitive dynamics and market conditions of organizations innovating their business model towards sustainability. Particularly, we address the following research question: When does it pay off for organizations to integrate sustainability in their business model?

To fill this knowledge gap, we contribute by using a game-theoretic framework where we consider different market scenarios with symmetric and asymmetric, weak and strong, as well as varying numbers of interacting organizations. Our results suggest different strategies organizations can apply to gain competitive advantage. The formal model can be applied by scholars and practitioners to specific industry settings or different natures of market settings with large degrees of freedom. The most important implication of our study is that organizations should consider the likely competitive effects, the market they are in as well as their market position, before revealing a sustainability business model innovation. To be more precise, in today’s context of global economy and fierce competition, the “prize” will go to those organizations that will excel not only from a sustainability but also from a competition perspective.

The remainder of the paper is organized as follows: In the following section, we state the theoretical backgrounds of sustainability, sustainability business models, and related topics. We then postulate the assumptions our model is built upon, establish the market setting, define rules, and constitute the game. Further, we describe the implementation of our model and present respective results. We conclude by pointing out research contribution, managerial implications, and limitations.

Theoretical background

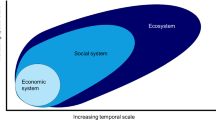

Sustainability

Sustainability primarily received attention on the public agenda in the 1980s with the publication of the Brundtland Commission report (Brundtland et al. 1987). Since then, a vast stock of literature has formed to define the concept of sustainability and all of its aspects. Because of its general understanding, accessibility and meaning, we adhere to the original Brundtland version, which defines sustainability as “development which meets the needs of the present without compromising the ability of future generations to meet their own needs” (Brundtland et al. 1987, p. 43). The construct of sustainability focuses on planet, people, and profit. Those dimensions of environmental, social, and economic sustainability are referred to as triple bottom line (Elkington 1998). Today, humanity has entered an era of complex and persistent environmental sustainability challenges that are threatening the viability of our globe (Fang et al. 2015; Lang et al. 2012; Lindberg et al. 2018). These challenges have called for perception of three different kinds of actors, who are turning their attention to the question of how we can make the world a better place and have sustainability on their agenda: nations, individuals and organizations.

First, nations are widespread determined to affect fundamental change in current political, social, and economic practices to achieve environmental sustainability (Elliot 2011). Conferences, agreements and treaties dedicated to the combat of environmental downturns prove this determination (e.g., the yearly climate summit of the United Nations). Second, there is little dispute on the effects of degradation on human beings, which puts them in the center of concerns (Elliot 2011). Additionally, by their demand, individuals influence the economic behavior of organizations. Understanding the effects of environmental degradation on everyday life, individuals demand more sustainable products, and therefore spur organization accordingly (Hamari et al. 2016; Jansson et al. 2010). Third, organizations are broadly recognized as an essential contributor to combat environmental degradation (Dean and McMullen 2007; Elliot 2011). One reason for this salient role is that organizations have a total economic turnover greater than that of many nations (Elliot 2011). With these possibilities, organizations can bring about far-reaching changes and improvements – locally, nationally, and globally (Brundtland et al., p. 16; Elliot 2011; Melville 2010).

Sustainability business research

Business researchers have studied the topic of environmental sustainability for decades (Malhotra et al. 2013). Building upon and extending the literature overview provided by Melville (2010), different fields of research have been dedicated to this topic: operations researchers have examined the adoption of environmental quality standards (Isaksson and Steimle 2009; Milne and Gray 2013), lean production and environmental performance (Chiarini 2014; King and Lenox 2001), and sustainable supply chains (Brandenburg et al. 2014; Seuring and Müller 2008). Marketing researchers have examined consumer adoption of green products and the marketing of sustainable business initiatives (Collins et al. 2007; Gordon et al. 2011; Jansson et al. 2010; Nath et al. 2013). Business economists have analyzed regulatory mechanisms, such as voluntary programs that act as information diffusion programs (Lyon and Maxwell 2007; Prakash and Potoski 2012). Management researchers have examined antecedents of an organization’s environmental management activities (Banerjee et al. 2003; Hofer et al. 2012) and have published research reviews and critiques (Dyllick and Muff 2016; Salzmann et al. 2005). Scholars of information technology (IT) have dedicated their work to the adoption of green IT in the business context (Marett et al. 2013).

In addition to these established fields of research, another sustainability topic has gained momentum in the past few years: business model transformation towards sustainability and their interrelations with sustainability innovations (Bini et al. 2018; Boons and Lüdeke-Freund 2013; Evans et al. 2017; Müller and Pfleger 2014). First, the latter mentioned sustainability innovations describe an organization’s ability to innovate in the domain of sustainability which can reach from small incremental steps to radical disruptive innovations (Evans et al. 2017). More specifically, respective innovations refer to a reconfiguration of specific business aspects envisaged to make real and substantial improvements, such as the integration of technology innovations, the development of superior production processes and operating procedures, or the exercising of strong market, social and political influence (Evans et al. 2017; Schaltegger and Wagner 2011). Second, business models and their transformation towards sustainability are an emerging mechanism to integrate sustainability innovations into business (Antikainen et al. 2015; Evans et al. 2017; Jolink and Niesten 2015; Schaltegger et al. 2012). In other words, business models are seen as the vehicle enabling sustainability innovations (Evans et al. 2017; Teece 2010; Zott et al. 2011). Thus, the aim of this underlying work is to advance research on sustainability innovations, by adopting a respective business model perspective. This requires a detailed understanding of the unit of analysis, which we provide in the following.

Business models for sustainability

Starting with the concept of business models in general, there is a lack of agreement on their definition in academia (Boons and Lüdeke-Freund 2013; Evans et al. 2017). However, commonly accepted explanations consider that a business model refers to the logic of how an organization does business, and explain how the organization creates, delivers and captures value (Evans et al. 2017; Teece 2010). On a generic level, Boons and Lüdeke-Freund (2013) distinguish the following four key elements describing a business model concept:

-

(1)

Value proposition: value embedded in products and services offered.

-

(2)

Supply chain: structure and management of upstream relationships with suppliers.

-

(3)

Customer interface: structure and management of downstream relationships with customers.

-

(4)

Financial model: costs & benefits from (1)–(3) and their distribution across business model stakeholders.

With respect to the concept of transforming business models for supporting sustainability innovations (see section “Sustainability Business Research” above), different labels such as “business models for sustainability (abbreviated with BMfS as introduced above)” or “sustainability business models” (Abdelkafi and Täuscher 2016) are used in literature. Just like there is no general accepted definition of business models, there is a lack of consensus and established theoretical grounding in economics and business studies regarding BMfS too (Abdelkafi and Täuscher 2016; Evans et al. 2017; Schaltegger et al. 2016; Schoormann et al. 2016). Originally, BMfS refer to two classic articles (i.e., Hart and Milstein 1999; Lovins et al. 1999), which envision them as a way to reduce negative social and ecological impacts (Boons and Lüdeke-Freund 2013). Similarly, Geissdoerfer et al. (2018) describe BMfS as a modification of the conventional business model concept towards the incorporation of environmental principles and the integration of sustainability in a business value proposition. Within our work, we build upon literature and understand BMfS as models, where concepts of the triple bottom line (environmental, social, and economic sustainability) shape the driving force of an organization and its decision making. Hereby, environmental and social goals are coequal to the goal of creating economic success (Joyce and Paquin 2016; Stubbs and Cocklin 2008).

Within BMfS, various forms exist. A popular one is the concept of a circular business model (Bocken et al. 2014; Geissdoerfer et al. 2018). As traditional BMfS, also circular business models have reached increasing attention among academia and practitioners as a mean to promote sustainability (Bressanelli et al. 2018). Abdelkafi and Täuscher (2016) describe them as the rationale of how an organization creates, delivers, and captures value with and within closed material loops. The general concept underlying a circular economy, is that it involves value creation by exploiting value retained in used products to generate new offerings. Thus, circular business models profit from the flow of materials and products over time. Further sub-categories of BMfS exemplarily include closed-loop business models, national capitalism, or product service systems (Bocken et al. 2014; Geissdoerfer et al. 2018).

Besides the popularity of circular business models and an increasing research trend in this field (Ghisellini et al. 2015; Loorbach and Wijsman 2013), there is a lack of theoretical grounding of BMfS, which is reflected in a scarce number of case studies and empirical analyses (Evans et al. 2017; Schoormann et al. 2016). For detailed and comprehensive literature reviews of BMfS, please refer to Abdelkafi and Täuscher (2016, pp. 76–77) or Schoormann et al. (2016), who inter alia state that literature on BMfS identifies archetypes (Bocken et al. 2014), ideal types (Stubbs and Cocklin 2008), presents case studies (Lueg et al. 2015), or develops methodologies toward the innovation of BMfS (Bocken et al. 2013). Additionally, research scholars also discuss motivations, benefits as well as efforts of BMfS (Fellner et al. 2017; Ritzén and Sandström 2017; Rizos et al. 2015). In this context, scholars particularly postulate that assessing if and when benefits of business model transformation unfold, is complex to assess in advance and, thus, highlight the need for an integrated perspective before starting transformation. We discuss this issue in the following.

Motivations for BMfS and the need of an integrated perspective

Switching from a non-sustainable (i.e., “linear”) model of economy to a more sustainable one, has recently attracted attention from major global companies, such as Google, Unilever, Renault, or further key players attending the world economic forum, such as policy makers (Evans et al. 2017; Ghisellini et al. 2015; Lewandowski 2016). According to related research, organizations’ motivation for transforming their business models towards a BMfS or respective sub-forms such as circular economy business models, can be classified as fourfold: huge environmental and societal benefits, changing customer demands, economic value potential, and the need to hold a pole position in the new sustainability market. In the following, we describe each motivation in detail.

First, there is a pressing need to transition to sustainability (Geissdoerfer et al. 2017). As already stated in the introduction above, environmental problems such as biodiversity loss, water, air, and soil pollution, resource depletion, or excessive land use highlight, that the natural environment is under immanent pressure to collapse (Geissdoerfer et al. 2017; Seidel et al. 2017). These problems are threatening the integrity of natural ecosystems that are essential for humanity’s survival (Ghisellini et al. 2015). A study of seven European Nations found that a shift to a more sustainable (e.g., circular) economy would reduce each nation’s greenhouse-gas emissions by up to 70% (Stahel 2016; Wijkman and Skånberg 2015). As the relationship between industry and environment is crucial for industrial performance, listed environmental impacts have pressure on industrial business and are threatening the stability of economies (Ghisellini et al. 2015; Lieder and Rashid 2016). This effect can be mitigated by BMfS which are expected to lead to a more sustainable development and a harmonious society (Ghisellini et al. 2015; Loorbach and Wijsman 2013). Adopting this rationale, the concept of BMfS has also gained momentum on the agendas of policy makers (Geissdoerfer et al. 2017; Zink and Geyer 2017). The European Union for example, released a Circular Economy Action Plan that proposes measures for transitioning Europe towards a circular economy and sketches out future challenges to shaping the economy and paving the way towards a climate-neutral, circular economy (European Commission 2019).

Second, from a strategic management perspective, a business model primarily serves customer needs (Schaltegger et al. 2012; Schaltegger et al. 2016). As already mentioned in the introduction above, customers are increasingly concerned about sustainability issues, seek sustainability in their consumption, and are fond of sustainability-oriented business models (Antikainen et al. 2015; Hamari et al. 2016; Moktadir et al. 2018). Thus, there is also huge pressure to provide a more sustainable alternative to the current linear economic model from the customers’ side (Moktadir et al. 2018). These changing customer habits come along with several benefits, such as attracting new customers and increasing market share in sustainability oriented customer segments, higher customer retention and customer value as a result of sustainability-oriented relationships, or reducing sustainability risks for customers which results in higher customer loyalty (Rizos et al. 2015; Schaltegger et al. 2012).

Third, organizations are increasingly aware of the opportunities and respective financial benefits coming along with sustainability-driven business models and have started to realize their value potential for themselves and their stakeholders (Lewandowski 2016). Financial benefits are exemplarily derived from radically improved resource efficiency, waste reduction (waste is turned into secondary raw materials), cost savings such as net material costs and reduced demand for virgin materials which in turn mitigates price-volatility of raw-material markets (e.g., for iron ore) and supply risks, or increased employment potentials (Despeisse et al. 2017; Fellner et al. 2017; Ritzén and Sandström 2017; Rizos et al. 2015).

Fourth, with respect to listed benefits coming along with BMfS, arguably, frontrunner organizations that orient themselves towards sustainability market decisions develop a competitive advantage. This competitive advantage is i.a. grounded in the co-creation of new sustainability markets and on the short term in the development renewed ambition and enthusiasm (Loorbach and Wijsman 2013). Further, moving towards sustainability-driven business models requires fundamental changes in the whole organization and involves all stakeholders. Such a transition is certainly of disruptive nature. Thus, fostering the uptake of BMfS requires a comprehensive and detailed analysis of potential opportunities such a business model could yield and related costs (Ritzén and Sandström 2017). Such an analysis is rather complex. The high complexity relates to how to preliminary assess the effort of business model transformation, the impact of subsequent sustainability innovations, and how to understand the effects on the whole business network (Evans et al. 2017; Ritzén and Sandström 2017). Evans et al. (2017) therefore argues in this context that: “A main source of complexity in business model innovation is given by the uncertainty of impacts and behaviors of network members regarding the three sustainability dimensions. A simulation model, therefore, should be built to support a focal firm to identify value flows and exchanges, which could reveal opportunities for business model innovations and de-risk experimentation” (Evans et al. 2017, p. 605). Our research exactly addresses this rationale postulated by Evans et al. (2017) and we use game theory to study the market conditions and competitive dynamics that should be considered before innovating business models towards BMfS.

Game theory and BMfS

Game theory has been recognized as indispensable to the understanding of environmental problems (Finus 2002, 2008; Vrieze 2012). Vrieze (2012) even states that game theory can help the world and its population to survive. Popular applications of game theory in the context of environmental sustainability are international environmental agreements (e.g., Chander and Tulkens 2006; Finus 2002), or the preservation of resources (e.g., Dolinsky 2015).

Also in the business context, game theory is kindly regarded, as the essence of business success lies in making sure to play the right game (Brandenburger and Nalebuff 1995; Seifi and Crowther 2018). However, with reference to business models, Casadesus-Masanell and Zhu (2013) state, that their study offers the first formal model for business model innovation in a game-theoretic framework. The research paper focuses on sponsor-based business model innovations where an organization monetizes its products through sponsors rather than setting prices to its customer base. After an extensive literature review (also a cited reference search of Casadesus-Masanell and Zhu (2013)), we found little to no further research of the application of a game-theoretic framework in the context of business model innovation. Baniak and Dubina (2012) provide a comprehensive literature review on trends of game-theoretic applications in the context of business innovations but also miss out the field of business models. Thus, to the best of our knowledge, this study is a primer in using a game-theoretic framework to analyze business model innovation – in general and in particular in the context of sustainability.

In the following we propose the game-theoretic framework to examine when such radical change in business models in favor of sustainability pays off.

Research model

For building an economic research model, we apply fundamental theoretical concepts of auction and game theory. While auction theory defines the market setting, the game-theoretic framework defines the game in terms of number of players, strategies, payoffs, information sets, and equilibria. The resulting model is implemented as a n-player and m-prize all-pay auction model and tested in different simulated market scenarios.

Model assumptions

We implement our model in the game-theoretic framework that abstracts from reality, reflecting the most important characteristics from reality (Kreps 1990). In general, the game-theoretic framework defines a game by three elements: i) players, ii) strategies and iii) payoffs (Gibbons 1994). Applied on our research question, the game is characterized by i) the organizations which participate in the market, which have ii) different options to decide on strategies of sustainable behavior and iii) receive payoffs based on the interaction of the different market participants.

To sufficiently define the game, we establish a microeconomic model which considers market realities whilst capturing the three characterizing game elements players, strategies and outcomes (i.e., i), ii), and iii)). For this purpose, we follow the microeconomic theory which identifies the market in terms of size and structure, number of players (i.e., organizations), prices and production costs (for products), and demand preferences (of customers) as major influences on the market outcome (Mas-Colell et al. 1995). Tables 1, 2, and 3 exemplify market structure and general market setting as well as scenario-specific parameters used in this work. Please note that the parametrization of these variables enables us to simulate real-world market situations and influences the possible outcome of an organization’s decision, e.g. an organization’s consequence of implementing a sustainable policy, given that other organizations in the market lack implementing such measures and the customers are modeled to not showing any preference to buy products from sustainable organizations.

Specifically, we make several assumptions on the market structure: we assume that at the beginning (t = 0), there is only one market which we refer to as “regular market” from this point on. In this market organizations have no level of sustainabilityFootnote 1 introduced in their business model yet. Further, we assume, that in this regular market a sustainability market potential (i.e., triggered by customers with preferences for sustainability) exists. If organizations decide to integrate sustainability in their business model, we assume a market split in t = 1 into a regular and a sustainability market. In this situation, total demand also splits and sustainability conscious customers shift their demand to the sustainability market. Hereby we assume no growth in the total demand between t = 0 and t = 1 and, thus, omit customers leaving or entering the market. The demand shift in the market happens once and instantly. We assume all market participants to have complete information about the sustainability levels integrated in the business model of organizations and observable exact outcomes. This implies that organizations are rewarded in terms of market share in the sustainability market on the basis of the implemented sustainability level in their business model.

Second, we apply the concept of “homo oeconomicus” and assume organizations are rational and risk-neutral players who aim at maximizing their overall payoffs. Further, we neglect capacity considerations by assuming organizations to perfectly adjust to demand. Referring to the efforts made to integrate sustainability in the business model, we assign a sustainability cost factor, which depends on an organization’s favored sustainability level.

Third, with reference to the products sold by organizations, we assume them to be homogenous within one industry. Hereby we specifically assume that an organization’s integration of sustainability in its business model does not change the product itself, but has effects on the business level (e.g., supply chains) and positively influences customers’ willingness to pay, allowing to charge higher prices for a still homogenous product. This assumption differentiates our model from a market in which investments in improved product quality directly influence product features and lead to heterogeneous products. In such a case, organizations would be able to offer two products simultaneously and allow customers to self-select the preferred product only based on price. Further, as we aim to capture the impact of an integration of sustainability in the business model imposes on organizations’ economic performance, we assume the production cost per unit of a specific organization to remain constant.

Market setting – All-pay auction

We use the economic idea of an all-pay auction and establish a market setting where organizations of the same industry (i.e., players) undertake efforts to integrate sustainability at a certain level in their business model (i.e., place their bets). After the auction, the market splits into a regular and a sustainability market and a share of customers with preferences for sustainability migrate to the sustainability market, which now represents the auction prize. Please note that the total market demand by assumption remains unchanged. However, the market volume changes due to the higher price for products from the sustainable organization(s). In the case of a single-prize auction, only one prize is allocated to the players and, thus, the organization with the highest bid gains market share in the sustainability market, whereas all other organizations do not get any compensation for their efforts made (i.e., all-pay). The single-prize all-pay auction establishes a hypothesis of a market in which customers solely reward the most sustainable organization, whereas the multi-prize auction serves as an alternative mechanism in which customers reward sustainability initiatives of multiple organizations (e.g., because they cannot identify the most sustainable but a number of most sustainable organizations).

As stated in our assumptions, organizations in the sustainability market will be able to charge a higher price for the still homogenous product. But as they are unable to charge higher prices from customers in the sustainability market than from customers in the regular market, organizations winning the auction exit the regular market and lose their former market share. The other players gain in market share in the regular market proportional to their previous market shares (pro rata assignment), i.e. the non-sustainable market demand is distributed among the remaining players.

Table 1 exemplifies this idea in a single-prize all-pay auction. Here we establish a market setting where different organizations (Organizations A, B, C, and D) of the same industry hold a certain market position in the regular market in t = 0. All organizations now decide to integrate sustainability in their business models and compete for the sustainability market in t = 1. The player with the highest bid (in this example Organization D) wins and gains total market share (i.e., acts as unique player) in the sustainability market to compensate for his efforts.

Besides the simple all-pay auction form with only one winner (“single-prize model”), we will also examine situations with multiple winners (“multi-prize model”) and (for completion) technical limiting cases (“zero bidding”) in this research paper.

Single-prize all-pay auction

Within this research paper, we examine different forms of an all-pay auction. However, each form has an equal starting point: in t = 0 there is a sustainability market potential γ ∈ [0,1] in in the regular market for which players can compete. As soon as the auction starts, organizations can place their bids and start implementing sustainability in their business model. Hereby, the costs for implementation depend on an organization’s sustainability cost factor (αi) and on the sustainability level (xi) introduced.

At first, we examine a single-prize all-pay auction, which states that only one player wins the prize and is compensated for his sustainability investments. Please note that with reference to the link between business model transformation and sustainability innovations stated in section “Sustainability Business Research” above, we define sustainability investments as costs associated with sustainability innovations (e.g., costs for integrating technology innovations, or costs for developing and switching to superior production processes and operating procedures), which are in turn enabled by business model transformation. The players’ payoffs depend on the sustainability level (xi) integrated in the business model and are formulated by the function πi(x), x = (x1, …, xn).

As organizations are per assumption risk-neutral, we use expected profits in the payoffs in case we are dealing with probabilistic payoffs. The pay-off function consists of two parts: first, the profit from operating in the assigned market after the all-pay auction, and second, the cost of integrating sustainability in the business model. First, the profit is calculated as follows: If organization i loses the auction and continues in the regular market (see eq. 1.I in Fig. 1), it obtains a market share proportional to its old market share i.e., \( \frac{\delta_i}{1-\overline{\delta}}\ast \left(1-\gamma \right)\ast Q \). If organization i wins, its market share equals γ ∗ Q (see eq. 1.II in Fig. 1). The profit from operating in the assigned market is therefore the respective market share multiplied by the profit per product, (pi − ci) in the regular market or \( \left(\tilde{p}_{i}-{c}_i\right) \) in the sustainability market. Please note that we model prices and costs exogenously, and by assumption organizations make profits in both markets (i.e. \( \left({p}_i-{c}_i\right),\left(\tilde{p}_{i}-{c}_i\right)>0\Big) \), as otherwise organizations would leave the market. Further note, that depending on xi, we may need to decide the winner of the auction by coin toss. When there is a tie among players, we determine the winner at random where every organization i has the same winning probability \( P\left(i\ wins\right)=\frac{1}{m} \) for m tied players. In the case of organization i ties with another organization, we compute the expected payoff, which has the representation of eq. 1.III in Fig. 1. The organization receives an expected \( \frac{Q}{k}\left[\gamma \ast \left(\tilde{p}_{i}-{c}_i\right)\right] \) in the case it wins the coin toss and an expected \( \frac{Q}{k}\left[\left(1-\gamma \right)\ast \left({p}_i-{c}_i\right)\sum \limits_{j=1,j\ne i}^k\frac{\delta_i}{1-{\delta}_j}\right] \) in the case it remains in the regular market. Finally, if only other organizations tie – see eq. 1.IV in Fig. 1, it receives an expected \( \left(1-\gamma \right)\ast Q\ast \left({p}_i-{c}_i\right)\left(\frac{1}{k}\sum \limits_{j=1}^k\frac{\delta_i}{1-{\delta}_j}\right) \). Finally, once the net profit is calculated for any case, costs of sustainability investment αixi are deducted. Figure 1 illustrates respective formulas.

Multi-prize all-pay auction

The multi-prize all-pay auction states that multiple players win the prize and are compensated for their sustainability investments. In this case, multiple organizations migrate to the sustainability market. Respective payoffs πi(x) are formulated in Fig. 2, Part A and are explained in this section.

In analogy to the single-prize model, players can be tied and a winner must be found. For two tied players, we toss a coin and for more than two players, we draw the number of remaining prizes out of the tied players, i.e., the organizations play a lottery. Thinking of this as a combinatorial problem, we need to find the probability for organization i that tied with players j to m + k to be among the m − j + 1 winners drawn from all tied players. Eq. 2.B1 and eq. 2.B2 in Fig. 2 are immediate results from the hypergeometric distribution. The probability distribution associated with this problem is a hypergeometric distribution, with eq. 2.C1 in Fig. 2 immediately resulting from this consideration. We note that for the expectation conditioned on organization i losing, we only draw from m + k − j tied players since i cannot win in the lottery anymore.

The payoff function interpretations are generally similar to the one prize all-pay auction in Fig. 1. In eq. 2.AIV in Fig. 2 the case of ties including organization i, its expected payoff is given by \( P\left(i\ \mathrm{wins}\right)\ast \gamma \ast Q\ast \frac{x_i}{\overline{x}}\ast \left(\tilde{p}_{i}-{c}_i\right) \) in the case i wins the toss and \( P\left(i\ loses\right)\ast \left(1-\gamma \right)\ast Q\ast E\left[\frac{\delta_i}{1-\overline{\delta}}|i\ \mathrm{loses}\right]\ast \left({p}_i-{c}_i\right)-{\alpha}_i{x}_i \) in the case i loses the coin toss. If organization i wins the auction and migrates to the sustainability market, it obtains the market share relative to its and the other winners’ bids in the regular market, i.e., \( \frac{x_i}{\overline{x}}\ast \gamma \ast Q \) (see eq. 2.AIII in Fig. 2).

When putting \( \overline{x}={x}_1+\dots +{x}_m \) and \( \overline{\delta}={\delta}_1+\dots +{\delta}_m \), we note that \( \overline{x} \) and \( \overline{\delta} \) may be random variables, depending on the outcome of the draw. Respective formula are stated in Fig. 2, Part B and Part C.

With reference to the market share in the sustainability market, the winning organizations depend on the other winners’ bids. Analogue to the single-prize auction, this market share is now multiplied by \( \frac{x_i}{\overline{x}} \). Thus, if one organization integrates twice as much of sustainability in its business model than its counterpart, it is awarded twice as much market share in the sustainability market (pro rata assignment).

Limiting cases

The above stated single- and multi-prize all-pay auctions omit the following limiting cases, which we introduce for reasons of completion:

-

a.

In a single- and multi-prize auction no organization transforms its business model towards sustainability and bid xi = 0.

-

b.

In a multi-prize auction an organization with a bid of xi = 0 may be awarded for its sustainability efforts but gains no market share due to xi = 0.

Referring to the first special situation (a.), this resembles the market in its regular state (t = 0), where no player places a bid and, thus, in t = 1 we fall back to an identical market situation and calculate the players’ payoffs with no change in the market.

Referring to the second special situation (b.), we assume at least one player with xi ≠ 0 and players xj = … = xm + k = 0. In this case, prizes would be given to players who did not place a bid. Therefore, we reduce the number of prizes in a way that only players with a bid of xi > 0 can be rewarded. Without doubt, one could think of different ways to address the zero-bidding problem in the payoffs, however our analyses indicated that results are robust to other allocation methods.

Discretization of the model

In the theoretical model, players can set continuous levels of sustainability xi, whereas in our implementation players are limited to a fixed number of sustainability strategies. Therefore, we set levels discretely between 0 and 1 with a step size of 0.1. The step interval of 0.1 is chosen to limit computational complexity.

When simulating the outcome of a game, we start by filling the payoff matrix \( \Pi \in {R}^{l^n xn} \) for the specific situation, in which every dimension represents an organization and the number of rows represents its number of strategies. The last dimension represents the payoffs associated with the organizations’ strategies, i.e., sustainability levels.

Model implementation

We implement the model as n-player and m-prize all-pay auction in Python and define the game as follows:

-

1.

Set of players in the game: Our model incorporates n (finite) competing organizations.

-

2.

Strategy for each player: The decision variable xi represents the level of sustainability integrated in the business model of an organization and is a standardized value between 0 (no sustainability is integrated, i.e., linear economy) and 1 (maximum level of sustainability is integrated).

-

3.

Payoffs: Payoffs result from organizations’ profits which depend on the integrated level of sustainability in their business model and the above payoff functions for the corresponding setting.

-

4.

Rules of the game: The model assumes complete information, simultaneous moves of all players and a one-stage game (i.e., the game is only played once).

We make use of the normal form, an illustrative representation of games, allowing us to identify Nash equilibria. We limit the analysis to pure strategies. The Nash equilibrium concept is characterized by every player choosing its best responses for every player given the other players behavior in all possible situations, i.e., in all possible states of the world given all players choices of behavior. Hence, we automatically calculate all payoffs and optimal behaviors given every possible state of the world, implementing functions in Python calculating payoffs and Nash equilibria for varying γ-levels, number of players, and prizes. Please note that the high dimensionality of the normal form of the payoff matrix, i.e. \( \Pi \in {R}^{l^n xn} \), does not allow for a proper visualization of the normal form if more than two players interact with each other (Gibbons 1994).

Identification of Nash equilibria in pure strategies in a payoff matrix

We calculate best response matrices for every player. Therefore, we mark the best response in a \( {\left\{0,1\right\}}^{l^n} \) matrix and reduce these n matrices we found for the players to one by applying a logical “and”-operation. The identified 1’s in the equilibrium matrix are the resulting Nash equilibria in pure strategies. Although from the position of the 1’s in the matrix one can determine the corresponding strategies, one still needs to reason for the identified equilibria.

When considering the size of the involved payoff matrix Π, we observe that it grows exponentially with the number of players or the number of strategies involved. The computational complexity for finding these equilibria in pure strategies is \( \mathcal{O}\left({n}^2{l}^n\right) \). A simple profiling of the associated Python code indicated that calculating the involved payoff matrix is the extensive part. As there is in general no linearity or regularity to be found in the payoff matrix, we need to calculate every tuple of payoffs individually for every strategy combination. This makes our calculations for player numbers greater than seven or strategy numbers greater than ten very extensive, having to write every field of the matrix for itself. Nevertheless, for reasonable player and strategy numbers, our algorithm for calculating Nash equilibria in pure strategies performs very well.

Simulation scenarios

We apply our theoretical model in the following four simulated market scenarios:

-

(1)

Five symmetric players compete for one and two prizes.

-

(2)

The number of symmetric players in scenario (1) in the one-prize setting is varied (i.e., n ϵ {3,4,6,7}).

-

(3)

The symmetry assumption is dissolved, and a more generalized asymmetric market scenario is created: A “strong player” (high market share, low costs for integrating sustainability to the business model) competes with four symmetric players (“weak players”) for one and two prizes.

-

(4)

As scenarios (1)–(3) indicate multiple market outcomes within the friction interval (see below), we provide guidelines on how to handle such friction intervals. One player with no sustainability costs (otherwise symmetric) competes with two symmetric players. We denote the player without implementation costs zero-bid organization.

Scenario (1) serves as the reference scenario in which we investigate similar (symmetric) organizations that compete for a single prize, i.e. a setting in which customers reward only the most sustainable organization with the market entry as well as in a two-prize setting, in which customers award two sustainable organizations. (2) is examined to investigate the robustness of results if the number of players is varied. This scenario also represents the fundamental microeconomic question of market effects of atomistic vs. oligopolistic markets. We investigate a non-symmetric market setting in scenario (3) to allow a more realistic market setting and include the dimension of market leadership, such that one can study the interactions between larger and smaller players. The final scenario examines a frequently observed market in which one player has a strategic advantage over the other players and has zero implementation costs (i.e. due to a superior business model or sustainable business culture). We aim to study under which circumstances this advantage of zero bidding costs constitutes the corresponding player as sustainability leader and how stable this result is.

When simulating these scenarios, comparability of the results is of considerable importance. Therefore, all four scenarios derive their parameters from one basic setting stated in Table 2. In this basic setting, every organization has the profit margin of 17.6% in the regular and 35.0% sustainability market. Originally, each of them earns Q ∗ δi ∗ (pi − ci) = 3 in a five-player setting, which means that efforts on sustainability may cost them as much as 2/3 of their profits. Please note that the basic parameter choices can be varied w.l.o.g. as long as organizations make profits in the regular market (and hence, also in the sustainable market).

Now, depending on the scenario, we change the parameters as stated in Table 3. This change aims at enhancing visibility of occurring effects. We employ a higher sustainability cost factor in scenario (4) to clearly carve out the contrast between the organizations.

Results

For each scenario, stated results refer to the level of sustainability implemented in organizations’ business models and payoffs (i.e., profits).

Scenario (1)

Simulation results for five symmetric players competing for one prize are stated in Fig. 3. Results for sustainability levels indicate, that players symmetrically start to integrate sustainability in their business model, if the sustainability market potential in the regular market γ is ≥ 0.1. However, a Nash equilibrium in pure strategies only occurs, if γ reaches a critical value. Within this scenario this critical mass in sustainability demand γ is 0.3. From this point on, the number of equilibria spike, which we refer to as friction interval (grey-shaded area in Fig. 1). If γ ≥ 0.5, the model predicts that all organizations symmetrically play a maximum sustainability strategy in the resulting unique Nash equilibrium (\( {x}_i^{0.5}=1\forall i\in \left\{1,\dots, 5\right\}\Big) \), yielding a maximum market sustainability.

Results for organizations’ profits indicate that if the sustainability market potential is low (e.g., γ ∈ [0.2, 0.4]), organizations lose profits compared to the regular market scenario, but are (over)compensated when γ > 0.7. From γ > 0.7 on, organizations increase the total market profit compared to t = 0.

Simulation results for five symmetric players competing for two prizes are stated in Fig. 4. Results for sustainability levels indicate, that although two winners share the sustainability market, the critical value of γ remains unchanged. However, the simulation yields a larger number of situations where no Nash equilibrium in pure strategies can be found. This effect can be linked to the synthetic setting in which players are perfectly symmetric and, thus, play a coordination game in which only one player implements a maximum sustainability strategy xi = 1 while others implement xj= 0.

Results for organizations’ profits indicate that when comparing this two-prize to the one-prize setting, individual players’ aggregated payoff (due to the symmetry of the equilibrium) is robust against an increasing number of prizes for scenarios for γ > 0.5.

Scenario (2)

Simulation results for a varying number of symmetric players of Scenario (1) with one prize are interpreted via the mean of all players and are stated in Fig. 5. Results for sustainability levels indicate that if γ ≥ 0.4, at least one player plays a maximum sustainability strategy. Analogue to Scenario (1), we find that the number of equilibria spikes within the friction interval. Further, we identify the number of equilibria to increase in tendency with an increasing number of players, such that a larger number of players calls in tendency for coordination game market settings, which we interpret as the potential need for governmental guidance in transforming more atomistic industries towards more sustainability.

Additionally, we examine that the location and size of the friction interval changes with the number of players. With reference to the interval’s location, organizations start to invest in sustainability at a lower γ, when the number of players grows. This effect can be linked to the smaller market share of each organization in the regular market for which it becomes more profitable to compete for the prize, even if multiple others also compete. With reference to the interval’s size, the friction interval grows symmetrically in both directions with an increasing number of players. However, we examine that averagely implemented sustainability levels are robust against an increase in the number of players, which implies that the implemented strategy does not systematically vary upon the number of players and that the amount of organizations sharing a market does not strongly influence the resulting sustainability under symmetrical players.

Results for organizations’ profits indicate a slight decrease with an increasing number of players. This effect can be linked to the modelling of expected profits in the case of identical bids: as an increasing number of players compete in the auction and implement maximum sustainability levels, an increasing amount of industry profits is invested into the sustainability competition.

Scenario (3)

Simulation results for one strong (x1) and four weak players (x2-x5) competing for one prize are stated in Fig. 6. Results for sustainability levels indicate that no Nash equilibrium in pure strategies occurs for small sustainability levels. Further, we examine that the strong player only invests in sustainability, if γ is large enough. The larger the share of a strong player in the regular market, the later he will invest in sustainability. If γ ≥ 0.4, the strong player’s expected profit of winning – even if weak players participate in the auction – exceeds the costs of sustainability investments in the strong players’ response function. Thus, the strong player invests \( {x}_i^{\gamma }=1 \) if the critical value \( {\gamma}_{critical}^{strong}=0.4. \)(the average implementation in multiple Nash equilibria in the friction intervals is 1, i.e., in each equilibrium the strong player implements xstrong = 1). Nevertheless, when looking at the Nash equilibria within the friction interval, each weak player i would invest either \( {x}_{weak}^{\gamma }= \) 0 or \( {x}_{weak}^{\gamma } \) = 1 in our model setting for potentially competing against the strong leader in the coin toss. Hereby, the weak players play coordination games to compromise on one player to compete in the auction, since the market within the friction interval is too small and unprofitable if all weak players compete.

Results for organizations’ profits indicate, that the strong players’ total expected profit function is strictly decreasing with increasing γ, whereas profit functions of weak players are non-monotonous in γ. This effect can be linked to the opportunity of weaker organizations to challenge the market leader. However, as both observations are immediate consequences of the assumed allocation of the sustainability market in a tie case, this result illustrates a sensitivity of the outcomes with respect to its underlying allocation rules.

We additionally examine the extent to which sustainability strategies depend on our exogenously-modelled profit margins. Therefore, we perform a sensitivity analysis: we can change the margins by varying the price in the sustainability market \( \tilde{p}_{i} \) or by decreasing the cost for sustainability investments αi. Results of this analysis indicate that for low margins (< 25%), no sustainability strategies are played. Results of a varying profit in the sustainability market are stated in Fig. 7.

With reference to the weak players, increasing margins shift the critical point of sustainability investment to the left. This intuitive result indicates that a lower sustainability level γ is sufficient for weak organizations to participate in the auction.

In contrast, with reference to strong players, even at margins of 65%, they will not invest if γ = 0.2, although intuitively, it should become profitable. This is because a situation can occur where strong organizations must compete with the weak ones in the coin toss. Hence, the scenario indicates that even strong market participants can be deterred in implementing sustainability by the sheer existence of competitors even if the profitability is very high. This result complements the analysis of (2), in which the number of players in a symmetric game has little influence in the implemented sustainability level by suggesting that asymmetric market structure have different market dynamics than symmetric ones.

Scenario (4)

Simulation results for one player with no costs of implementing sustainability (x1) and two symmetric players with sustainability cost (x2-x3) compete for one prize are stated in Fig. 8. Results indicate that if γ ≤ 0.8, there is only one plausible equilibrium in the friction interval where the no-cost player implements sustainability, whereas the other two symmetric players do not. This is plausible, as weaker players, given the no-cost player plays xno cost > 0, make a sure profit when staying in the regular market while they otherwise must play a coordination game in the other equilibria and risk to make a smaller profit.

The results indicate that a strategic (sustainability cost) advantage in implementing corporate sustainability can mean a strategic competition advantage and effectively prevent the market entry of players without such capabilities. In addition, our results indicate that the market entry of weaker organization is prevented until a very high sustainability demand (in our case γ > 0.7), and their profits are further decreased, such that sustainability leadership can pay off well for a zero-bid player. Moreover, the results indicate that even if the sustainability demand is very high and the weaker candidates finally enter the auction to get access to the sustainability market, the expected profit for the zero-cost player is larger than when γ is very low (in our case γ < 0.4).

Finally, scenario 4 complements previous the results of previous scenarios such that asymmetric markets can lead to higher sustainability implementation if there is a player with superior capabilities (i.e. cost advantages regarding sustainability.

Discussion

This research sets out to establish a research model for examining the conditions under which an integration of sustainability in an organization’s business model pays off. We introduce a game-theoretic model of an all-pay auction setting which captures the competition for a market share in a sustainability market. We test the model in different market scenarios where we examine symmetric and asymmetric, weak and strong, as well as scenarios with a varying number of players.

This research offers four major theoretical contributions. First, we examine that organizations willingness to integrate sustainability in their business models increases with the sustainability market potential γ in the regular market. However, γ must reach a critical value before investments are started. Therefore, a preference for sustainability in a market is the main driver of business model transformation in our model. Additionally, we observe symmetric players to not on average start investing in sustainability much earlier in a more atomistic market. This result is not intuitive, especially in the one-prize setting in which the small organization could exclusively enter the sustainability market, translating to higher profits.

Second, we examine balancing effects of γ: Strong players only invest in sustainability, if γ is large enough. Otherwise, strong players are worse off if implemented sustainability efforts are compensated by a smaller sustainability market. However, the higher γ, the more likely it is that the strong player gets challenged by one weak player. In contrast, the introduction of insecurity about competitors’ sustainability efforts tends to let the strong player get deterred from sustainability efforts. This shows that the larger the sustainable market is, the larger the relative benefit of even weak organizations to implement sustainable policies. However, this ecologically beneficial behavior of the weak can deter the strong player (with more market share) from sustainability.

Third, we perform a sensitivity analysis examining the effect of profit margins. By varying the margins, we examine that additional margins – even if substantial – play a negligible role for sustainability investments of large players but trigger weak players to start sustainability investments earlier. Again, we argue that the reason for this observation is the relative attractiveness of leaving the regular market, which increases if the margin difference between regular and sustainable market grows. These observations suggest that customers who increasingly motivate sustainable actions especially influence the decisions of weak players.

Fourth, our model suggests that if an organization can achieve very low (or zero) relative sustainability implementation costs (e.g. through superior operations or a sustainable business culture), becoming a zero bidding cost player, it can establish systematic market entry barriers to its competitors and increase its own profits. Although the simulation result implies negative effects resulting from the economic regulation and welfare loss perspective, this incentive may lead to higher sustainability.

Managerial implementations

Apart from the above-mentioned theoretical contributions, our work also has clear managerial implications: First and foremost, to have the option to enter a sustainability market and satisfy needs of sustainability conscious customers, organizations need to actively communicate introduced levels of sustainability e.g., via marketing and communication measures.

Further, results imply that organizations should undertake market research to examine the sustainability market potential e.g., in form of customers’ preference for sustainability. Especially in an asymmetric market setting (i.e., existence of one/a little number of strong market players), weak players should consider starting sustainability investments at an early sustainability demand level, potentially resulting in deterring the larger competitors from entering the sustainable market. This result holds especially the larger the number of players and the smaller the number of prizes.

Finally, our model suggests that organizations which manage to become zero bidding cost players, could set up market barriers and improve their economic performance by implementing cheap / costless sustainability measures and secure a strategic competitive advantage. Hence, transforming the business to more sustainability not only has positive effects on societies but also improve performance metrics within the organization.

Limitations

The limitations of our study are fivefold:

First, our analysis of the all-pay auction generally fits into previous literature regarding all-pay auction which predicts bidders to either bid very low or very high (Klose and Kovenock 2015). Although we can confirm that an extreme bidding behavior explains parts of the previous literature, our results indicate that there is no such simple answer especially in situations where competition for sustainability is not very profitable for the market participants, as observed within the friction interval. Thus, the applied game-theoretic solution concept of Nash equilibria in pure strategies can explain only parts of such competition behavior. To further examine the friction interval, more advanced equilibrium concepts need to be applied to better predict organizational strategy. We indicate one such plausibility approach in scenario (4).

Second, although we also see our contribution in building a basic model and research framework as foundation for future research and that it can be enhanced through the implementation of more advanced equilibrium concepts, we are aware of the shortcoming that despite careful considerations, we feed the model with microeconomic data which remain theoretical and are difficult to empirically observe. We have performed sensitivity and scenario analyses to account for the shortcomings induced by the theoretical research method.

Third, all observed results are subject to the very strong assumption of modelling a static game. As the world is dynamic and sustainability is not a one-time decision-making process, we cannot include considerations of time in our model, e.g., punishment effects in the market when an implicit hygiene requirement of sustainability in the market is not met. In consequence, the suggested results are to be considered carefully especially due to the lack of the time dimension. In particular, the results are indicating that a strong player would tend to invest late in sustainability because it’s more profitable for him to serve the conventional market are probably not robust when one includes multi-period competitions. It would become less profitable to disregard sustainability in the long-term corporate strategy.

Fourth, we observe that the number of prizes in the game does not strongly influence the behavior of the customers. This is due to the expected value assumption for the payoffs. Since the number of prizes serve as a distribution indication on the market and a larger number indicates that the reward for investment splits more evenly, the indicated results should be evaluated in the further examination. Thus, the assumption of the organizations to include expectations of profits is crucial to this outcome. Although this assumption is uncritical for organizations that are active in multiple product markets and therefore are diversified, for organizations only active in one or a small number of product markets this assumption would not be met.

Fifth, comparing and contrasting our findings with insights from existing studies might be insightful. However, this is difficult to implement: first, as stated above, to the best of our knowledge, our study is a primer in using a game-theoretic framework to analyze business model innovation – in general and in particular in the context of sustainability. Second, related studies vary in employed concepts of auction and game theory. In particular, they choose different market settings, number of players, strategies, payoff functions, information sets or equilibria, and of course: contexts. Thus, we propose a systematic review of the literature on auction and game theory in a general context of competing for new markets, which may result in the identification of adequate existing studies, for future research.

Conclusion

We establish a research model for examining under which conditions an integration of sustainability in an organization’s business model pays off. To this end, we apply auction- and game-theoretic approaches and develop a n-player and m-prize all-pay auction model. The model is tested in different simulation scenarios, which bring fourth three key findings: First, the sustainability potential in a regular market must reach a critical value before organizations start investing into sustainability. Second, the structure of the market plays a significant role, as players with a low market share can deter high-market share players from investing into sustainability, reducing the overall sustainability efforts. Also, additional margins gained from a sustainability market, play a negligible role for strong players, while triggering weak players to start investments earlier especially in atomistic markets. Third, the transformation towards a truly sustainable organization can help gaining and defending strategic market leadership and foster economic performance. Aiming at applying our research to various contexts, we establish a model that not only describes and interprets the outcomes in our proposed theoretical framework, but is also applicable to extended cases, more advanced game-theoretic concepts or empirical data for further research.

Notes

Please note: According to our description of BMfS, the “level of sustainability” either refers to a situation where organizations fully integrated sustainability (maximum level) in their business model or only did so in parts. Whereas in the first case, social and environmental goals are coequal to the goal of creating economic performance, they are subordinated to certain extents in the latter case.

References

Abdelkafi, N., & Täuscher, K. (2016). Business models for sustainability from a system dynamics perspective. Organization & Environment, 29(1), 74–96.

Antikainen, M., Lammi, M., Paloheimo, H., Rüppel, T., & Valkokari, K. (2015). Towards circular economy business models: Consumer acceptance of novel services. In Proceedings of the ISPIM Innovation Summit, Brisbane, Australia, December 6-9.

Banerjee, S. B., Iyer, E. S., & Kashyap, R. K. (2003). Corporate environmentalism: Antecedents and influence of industry type. Journal of Marketing, 67(2), 106–122.

Baniak, A., & Dubina, I. (2012). Innovation analysis and game theory: A review. Innovation, 14(2), 178–191.

Bini, L., Bellucci, M., & Giunta, F. (2018). Integrating sustainability in business model disclosure: Evidence from the UK mining industry. Journal of Cleaner Production, 171, 1161–1170.

Bocken, N. M. P., Short, S., Rana, P., & Evans, S. (2013). A value mapping tool for sustainable business modeling. Corporate Governance, 13, 482–497.

Bocken, N. M. P., Short, S., Rana, P., & Evans, S. (2014). A literature and practice review to develop sustainable business model archetypes. Journal of Cleaner Production, 65, 42–56.

Bocken, N. M. P., Schuit, C. S. C., & Kraaijenhagen, C. (2018). Experimenting with a circular business model: Lessons from eight cases. Environmental Innovation and Societal Transitions, 28, 79–95.

Boons, F., & Lüdeke-Freund, F. (2013). Business models for sustainable innovation: State-of-the-art and steps towards a research agenda. Journal of Cleaner Production, 45, 9–19.

Brandenburg, M., Govindan, K., Sarkis, J., & Seuring, S. (2014). Quantitative models for sustainable supply chain management: Developments and directions. European Journal of Operational Research, 233(2), 299–312.

Brandenburger, A. M., & Nalebuff, B. J. (1995). Use game theory to shape strategy. Harvard Business Review, 73(4), 57–71.

Brehmer, M., Podoynitsyna, K., & Langerak, F. (2018). Sustainable business models as boundary-spanning systems of value transfers. Journal of Cleaner Production, 172, 4514–4531.

Bressanelli, G., Adrodegari, F., Perona, M., & Saccani, N. (2018). Exploring how usage-focused business models enable circular economy through digital technologies. Sustainability, 10(3), 639.

Breuer, H., Fichter, K., Lüdeke-Freund, F., & Tiemann, I. (2018). Sustainability-oriented business model development: Principles, criteria, and tools. International Journal of Entrepreneurial Venturing, 10(2), 256–286.

Brundtland, G., Khalid, M., Agnelli, S., Al-Athel, S., & Chidzero, B. (1987). Report of the world commission on environment and development: Our common future. Oxford: Oxford University Press.

Bryson, J. R., & Lombardi, R. (2009). Balancing product and process sustainability against business profitability: Sustainability as a competitive strategy in the property development process. Business Strategy and the Environment, 18(2), 97–107.

Casadesus-Masanell, R., & Zhu, F. (2013). Business model innovation and competitive imitation: The case of sponsor-based business models. Strategic Management Journal, 34(4), 464–482.

Chander, P., & Tulkens, H. (2006). The core of an economy with multilateral environmental externalities. In P. Chander, J. Drèze, K. C. Lovell, & J. Mintz (Eds.), Public goods, environmental externalities and fiscal competition: Selected papers on competition, efficiency and cooperation in public economics by Henry Tulkens (pp. 153–175). Springer Science & Business Media: New York.

Chiarini, A. (2014). Sustainable manufacturing-greening processes using specific lean production tools: An empirical observation from European motorcycle component manufacturers. Journal of Cleaner Production, 85, 226–233.

Collins, C. M., Steg, L., & Koning, M. A. S. (2007). Customers' values, beliefs on sustainable corporate performance, and buying behavior. Psychology & Marketing, 24(6), 555–577.

Davenport, C., & Pierre-Louis, K. (2018). U.S. Climate Report Warns of Damaged Environment and Shrinking Economy. Retrieved from https://www.nytimes.com/2018/11/23/climate/us-climate-report.html. Accessed 4 Dec 2018

Dean, T. J., & McMullen, J. S. (2007). Toward a theory of sustainable entrepreneurship: Reducing environmental degradation through entrepreneurial action. Journal of Business Venturing, 22(1), 50–76.

Despeisse, M., Baumers, M., Brown, P., Charnley, F., Ford, S. J., Garmulewicz, A., et al. (2017). Unlocking value for a circular economy through 3D printing: A research agenda. Technological Forecasting and Social Change, 115, 75–84.

Dolinsky, M. (2015). Sustainable systems-game theory as a tool for preserving energy resources. Energy, Sustainability and Society, 5(1), 6.

Dunlap, R. E., van Liere, K. D., Mertig, A. G., & Jones, R. E. (2000). New trends in measuring environmental attitudes: Measuring endorsement of the new ecological paradigm: A revised NEP scale. Journal of Social Issues, 56(3), 425–442.

Dyllick, T., & Muff, K. (2016). Clarifying the meaning of sustainable business: Introducing a typology from business-as-usual to true business sustainability. Organization & Environment, 29(2), 156–174.

Earth Overshoot Day. (2018). Earth Overshoot Day 2018 Livestream. Retrieved from https://www.overshootday.org/; Accessed 4 Dec 2018http://www.webcitation.org/74SYPTXnS. Accessed 4 Dec 2018

Elkington, J. (1998). Partnerships from cannibals with forks: The triple bottom line of 21st-century business. Environmental Quality Management, 8(1), 37–51.

Elliot, S. (2011). Transdisciplinary perspectives on environmental sustainability: A resource base and framework for IT-enabled business transformation. MIS Quarterly, 35(1), 197–236.

European Commission. (2019). Circular Economy: Implementation of the Circular Economy Action Plan. Retrieved from http://ec.europa.eu/environment/circular-economy/index_en.htm. Accessed 25 May 2019

Evans, S., Vladimirova, D., Holgado, M., van Fossen, K., Yang, M., Silva, E. A., & Barlow, C. Y. (2017). Business model innovation for sustainability: Towards a unified perspective for creation of sustainable business models. Business Strategy and the Environment, 26(5), 597–608.

Fang, K., Heijungs, R., Duan, Z., & de Snoo, G. R. (2015). The environmental sustainability of nations: Benchmarking the carbon, water and land footprints against allocated planetary boundaries. Sustainability, 7(8), 11285–11305.

Fellner, J., Lederer, J., Scharff, C., & Laner, D. (2017). Present potentials and limitations of a circular economy with respect to primary raw material demand. Journal of Industrial Ecology, 21(3), 494–496.

Finus, M. (2002). Game theory and international environmental cooperation: Any practical application? In C. Böhringer, M. Finus, & C. Vogt (Eds.), Controlling global warming: Perspectives from economics, game theory and public choice (pp. 9–104). Northampton: Edward Elgar Publishing, Inc..

Finus, M. (2008). Game theoretic research on the Design of International Environmental Agreements: Insights, critical remarks, and future challenges. International Review of Environmental and Resource Economics, 2(1), 29–67.

Fonseca, L., Domingues, J., Pereira, M., Martins, F., & Zimon, D. (2018). Assessment of circular economy within Portuguese organizations. Sustainability, 10(7), 2521.

Geissdoerfer, M., Savaget, P., Bocken, N. M. P., & Hultink, E. J. (2017). The circular economy–a new sustainability paradigm? Journal of Cleaner Production, 143, 757–768.

Geissdoerfer, M., Vladimirova, D., & Evans, S. (2018). Sustainable business model innovation: A review. Journal of Cleaner Production, 198, 401–416.

Ghisellini, P., Cialani, C., & Ulgiati, S. (2015). A review on circular economy: The expected transition to a balanced interplay of environmental and economic systems. Journal of Cleaner Production, 114, 11–32.

Gibbons, R. (1994). Primer in game theory. Harlow: Prentice Hall Books.

Gordon, R., Carrigan, M., & Hastings, G. (2011). A framework for sustainable marketing. Marketing Theory, 11(2), 143–163.

Hamari, J., Sjöklint, M., & Ukkonen, A. (2016). The sharing economy: Why people participate in collaborative consumption. Journal of the Association for Information Science and Technology, 67(9), 2047–2059.

Hart, S. L., & Milstein, M. B. (1999). Global sustainability and the creative destruction of industries. MIT Sloan Management Review, 41(1), 23.

Hofer, C., Cantor, D. E., & Dai, J. (2012). The competitive determinants of a firm's environmental management activities: Evidence from US manufacturing industries. Journal of Operations Management, 30(1–2), 69–84.

Isaksson, R., & Steimle, U. (2009). What does GRI-reporting tell us about corporate sustainability? The TQM Journal, 21(2), 168–181.

Jansson, J., Marell, A., & Nordlund, A. (2010). Green consumer behavior: Determinants of curtailment and eco-innovation adoption. Journal of Consumer Marketing, 27(4), 358–370.

Jolink, A., & Niesten, E. (2015). Sustainable development and business models of entrepreneurs in the organic food industry. Business Strategy and the Environment, 24(6), 386–401.

Joyce, A., & Paquin, R. L. (2016). The triple layered business model canvas: A tool to design more sustainable business models. Journal of Cleaner Production, 135, 1474–1486.

King, A. A., & Lenox, M. J. (2001). Lean and green? An empirical examination of the relationship between lean production and environmental performance. Production and Operations Management, 10(3), 244–256.

Klose, B., & Kovenock, D. (2015). The all-pay auction with complete information and identity-dependent externalities. Economic Theory, 59(1), 1–19.

Kreps, D. (1990). Game theory and economic modeling. The Journal of Economic Education, 23(2), 189–191.

Lang, D. J., Wiek, A., Bergmann, M., Stauffacher, M., Martens, P., Moll, P., Swilling, M., & Thomas, C. J. (2012). Transdisciplinary research in sustainability science: Practice, principles, and challenges. Sustainability Science, 7(1), 25–43.

Lewandowski, M. (2016). Designing the business models for circular economy—Towards the conceptual framework. Sustainability, 8(1), 43.

Lieder, M., & Rashid, A. (2016). Towards circular economy implementation: A comprehensive review in context of manufacturing industry. Journal of Cleaner Production, 115, 36–51.

Lindberg, M. B., Markard, J., & Andersen, A. D. (2018). Policies, actors and sustainability transition pathways: A study of the EU’s energy policy mix. Research Policy, 103668.

Lloret, A. (2016). Modeling corporate sustainability strategy. Journal of Business Research, 69(2), 418–425.

Loorbach, D., & Wijsman, K. (2013). Business transition management: Exploring a new role for business in sustainability transitions. Journal of Cleaner Production, 45, 20–28.

Lovins, A., Lovins, L., & Hawken, P. (1999). A road map for natural capitalism. Harvard Business Review, 1–14.

Lueg, R., Pedersen, M. M., & Clemmensen, S. N. (2015). The role of corporate sustainability in a low-cost business model–a case study in the Scandinavian fashion industry. Business Strategy and the Environment, 24(5), 344–359.

Lyon, T. P., & Maxwell, J. W. (2007). Environmental public voluntary programs reconsidered. Policy Studies Journal, 35(4), 723–750.

Malhotra, A., Melville, N. P., & Watson, R. T. (2013). Spurring impactful research on information systems for environmental sustainability. MIS Quarterly, 37(4), 1265–1274.

Marett, K., Otondo, R. F., & Taylor, G. S. (2013). Assessing the effects of benefits and institutional influences on the continued use of environmentally munificent bypass Systems in Long-Haul Trucking. MIS Quarterly, 37(4), 1301–1312.

Mas-Colell, A., Whinston, M., & Green, J. (1995). Microeconomic theory (1st ed.). New York: Oxford University Press.

Melville, N. P. (2010). Information systems innovation for environmental sustainability. MIS Quarterly, 34(1), 1–21.

Milne, M. J., & Gray, R. (2013). W(h)ither ecology? The triple bottom line, the global reporting initiative, and corporate sustainability reporting. Journal of Business Ethics, 118(1), 13–29.

Moktadir, M. A., Rahman, T., Rahman, M., Ali, S. M., & Paul, S. K. (2018). Drivers to sustainable manufacturing practices and circular economy: A perspective of leather industries in Bangladesh. Journal of Cleaner Production, 174, 1366–1380.

Müller, A.-L., & Pfleger, R. (2014). Business transformation towards sustainability. Business Research, 7(2), 313–350.

Nath, V., Kumar, R., Agrawal, R., Gautam, A., & Sharma, V. (2013). Consumer adoption of green products: Modeling the enablers. Global Business Review, 14(3), 453–470.

Oghazi, P., & Mostaghel, R. (2018). Circular business model challenges and lessons learned - an industrial perspective. Sustainability, 10(3), 739.

Piscicelli, L., Ludden, G. D. S., & Cooper, T. (2018). What makes a sustainable business model successful? An empirical comparison of two peer-to-peer goods-sharing platforms. Journal of Cleaner Production, 172, 4580–4591.