Abstract

The US manufacturing sector, which consists of industries that produce durable and nondurable goods, accounts for about 30 % of all the final energy consumed in the country. In this study, manufacturing sector data coming primarily from the Annual Survey of Manufacturers are used to estimate the total impact of one mode of energy efficiency policy, market persuasion programs, on aggregate electricity consumption and energy expenditures. Using a panel model consisting of data for 184 industries, the findings indicate that the cumulative effects since 2002 of this policy mode is a reduction in 2010 electricity consumption of 5.4 %, of electricity expenditures of 2.4 %, and of all other fuel expenditures of 5.7 %. These estimates are derived after controlling for changes in output, other production inputs, and economic conditions. Particular attention in this study is given to the effects of a permanent shift in demand, and temporary business cycle shock, on model external validity.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The manufacturing sector of the US economy, consisting of industries that produce durable and nondurable goods, North American Industrial Classification System (NAICS) 31 through 33, accounted for about 30 % of the final energy consumed in the country in 2010 (EIA 2011). Due to its importance for economic growth and energy supplies, many econometric studies have examined the energy consumption of individual manufacturing industries and its relationships to changes in output, inputs, and economic conditions. However, the national impact of US manufacturing sector energy efficiency programs, which have grown in size and scope for the past decade, has received little attention. This study addresses this increasingly important policy area.

Electricity consumption is the primary focus of this study; however, aggregate electricity expenditures and expenditures on fuels other than electricity are also analyzed using similar econometric models and similar data sources. Major energy efficiency programs that currently target the manufacturing sector include the US Department of Energy’s Energy Efficiency and Renewable Energy Advanced Manufacturing Office (AMO, formerly the Industrial Technologies Program); the US Environmental Protection Agency (EPA) Energy Star program; and demand side management (DSM) and market transformation (MT) programs administered by local electricity and natural gas utilities and publically funded third parties. In addition to targeting electricity and natural gas use, the two federal programs, AMO and Energy Star, target the consumption of all major fuels, including petroleum and coal products.

Seen from the national perspective as a collection of complementary voluntary programs that share a single purpose, promoting reductions in energy use, they make up an ad hoc national energy efficiency policy for the US manufacturing sector. This ad hoc policy can be seen as having two related modes of operation, one involving the financing of energy efficiency improvements and the other involving market persuasion. AMO’s Commercial Technology program, which funds research, development, and commercialization of new industrial technologies, is an example of the former, and Energy Star, which focuses on providing industries with technical information and management support, is an example of the latter. Unlike a formal national policy, the patchwork of programs that make up this ad hoc policy has no single set of goals or timeline.

Although there can be no doubt that financing and market persuasion programs are synergistic and that their impacts are not strictly separable in the material world, no less in econometric models, with the help of a national, industry-level database, the Annual Survey of Manufacturers (ASM), this study attempts to isolate the policy impacts that are mainly due to market persuasion programs. Program operators and policymakers expect that, over time, these will be substantial not only because of the thousands of manufacturing firms, large and small, having direct contact with these programs, but because the information, technical practices, and corporate energy efficiency ethic encouraged by these programs is likely to spread from firm to firm and plant to plant. This diffusion effect is a positive externality referred to as policy spillover. Over the long-term, the success of energy efficiency policy, like most broad national policies, depends on the extent to which spillover benefits exceed the immediate benefits gained by those few consumers having direct contact with individual programs.

In this study, measured energy consumption and energy expenditures are terms that are used interchangeably with the broader concept of energy demand. In addition, following the survey questions used by ASM, annual energy consumption and expenditures refer to purchased fuels reported by manufacturers in the survey year. Purchased energy excludes fuels traded among plants and electricity generated by combined heat and power facilities that does not end up being sold.

The following section contains a review of the literature on econometric models of energy consumption and a description of the conceptual foundations for this study’s policy impact models and policy impact estimator. Data sources, model specification, and model estimation procedures are described in “Model specification.” “Policy impact findings” contains the policy impact findings and “Tests of permanent shift and temporary shock” contains diagnostic tests for assessing the validity of the policy impact model and the interpretation of its findings. “Discussion and conclusion” offers a brief discussion and conclusion.

Input demand function and policy impact estimator

Although this is the first econometric studies to specifically focus on the impact of US manufacturing sector energy efficiency policy on national energy consumption and energy expenditures, there is a long list of studies dating back to the 1960s that use econometric models to analyze these subjects in all sectors of the economy. Bohi (1981) and its update, Bohi and Zimmerman (1984), along with Dahl (1993), are just three of many detailed literature surveys of early energy demand studies. The typical outcome variable in these studies is energy intensity in some form, such as energy per capita or energy per unit of output. Estimated price and income elasticities tended to receive the most attention as these are useful for resources planning.

Largely as a result of electric utility DSM programs, in the mid-1990s, econometric studies began to examine the impacts of voluntary public programs on aggregate energy demand. One of the first of these, Parfomak and Lave (1996), investigated the effects of combined commercial and industrial sector DSM programs on electricity sales for the years 1970 to 1993 using a panel model consisting of data from 39 investor-owned electric utilities. Later, Loughran and Kulick (2004), Auffhammer et al. (2008), Rivers and Jaccard (2011), and Arimura et al. (2012) estimated panel models employing total DSM program expenditures for the combined residential, commercial, and industrial sectors as their policy activity variable.

Two recent econometric attempts to estimate the impacts of energy efficiency programs contain energy demand models that are specific to the industrial sector. Bernstein et al. (2003) estimated individual panel models for each of the four sectors of the economy (residential, commercial, and transportation in addition to industrial) for the 48 contiguous states and the years 1977 through 1999. Using model residuals as an estimate of energy efficiency, states were ranked and forecasts were produced out to the year 2020 of national energy efficiency potential. Horowitz (2007) estimated separate sector-level state panel models for base and treatment periods for the residential, commercial, and industrial sectors for states identified, largely by reported DSM savings, as having weak commitments to energy efficiency. Estimates of energy efficiency policy impacts were derived using the models to produce counterfactuals for states with moderate and strong energy efficiency policy commitments.

Focusing on the industrial sector, of which the manufacturing industries accounted for about 60 % of value added and 80 % of electricity consumption in 2010, it is instructive to differentiate its energy demand function from those of other sectors. All energy consumption is motivated by the demand for a final service or good of some kind. For the residential, commercial, and transportation sectors, energy demand is driven by desired levels of mobility, comfort, communication, and other personal services. However, in the industrial sector, energy demand is determined by levels of physical output, the production of which requires not only capital equipment, but other fuels, labor, raw materials, purchased services, and so on. These relationships, be they at the plant or the industry level, have fixed and variable components and are driven by engineering possibilities and economic choices.

An industrial sector energy input demand function such as in Eq. (1) is the foundation for the empirical models used in this study. It shows that levels of energy consumption are determined by levels of output and inputs, where inputs in the broad sense include not only material resources but market and public policy conditions. For an aggregate input demand function that spans more than one industry i and time period t:

where any of the variables can be expressed in monetary or physical units, e.g., E is either energy consumption or energy expenditures, P represents energy prices, G represents levels of output, M represents economy-wide conditions or macroeconomic forces, N represents one or more final or intermediate factors of production, F represents industry-specific fixed effects, T represents time-specific effects, and R represents energy-related public policy. This general energy input demand function does not impose restrictions of any kind on the relationships among the variables. However, translating this function into a tractable statistical model does; few, if any, datasets are large and detailed enough to solve the difficult statistical problems that arise from modeling complex relationships.

One model restriction that is commonly applied to econometric models is to hold output, G, fixed so that the relationship between E and the independent variables does not depend on it. This is done by forming a ratio with E as the numerator and G as the denominator. This transformation of the dependent variable from a level to a ratio, which creates a more uniform scale between cross sections and between time periods, helps reduce or eliminate violations to intrinsic regression model assumptions that have worse consequences than the imposed restriction. All the models in this study, though referred to as electricity and expenditure models, use ratios for their dependent variables. After model estimation, these ratios are converted back to levels to calculate policy impacts.

For policy impact analysis, the central feature of this input demand function is the variable, R, representing public policy activities. This variable is not available in a form that is usable in the econometric models in this study. In the absence of measures of R that can be included in the energy demand models, policy impacts are estimated in a way that is analogous to the way the future policy impacts are projected with large energy and environmental forecasting models. In these, energy consumption is forecast under a hypothetical change in policy regime (such as higher energy taxes) and under a business-as-usual regime (no change in energy taxes). Then, policy impacts are calculated as the difference between the two. In the same vein, to calculate historical policy impacts, a model estimated for a specified time period (referred to as the model estimation or in-sample period) is used to predict a counterfactual for a specified period outside the model estimation period (an out-of-sample period). The key difference between this approach and the policy forecasting approach is that the in-sample and out-of-sample periods must be part of the same regime. If they are, then with the policy impact model controlling for all relevant market factors, the net difference between the counterfactual and actual values is attributable to systematic, nonmarket factors, e.g., energy efficiency policy. This policy impact estimator is implemented in this study by withholding a single year, 2010, from the model estimation period.

Equation (2) describes the policy impact estimator, where CF is the policy counterfactual and A is actual energy consumption for industry i, and t* is the out-of-sample year, 2010:

Using this estimator with a large sample of industries, the random errors that cause some industry counterfactuals to be higher than actual energy use, and others to be lower, will cancel each other out. This follows from the fact that the net residual for the in-sample period is, by model construction, zero. If the out-of-sample period is then similar in character to the in-sample period, the net residual for the out-of-sample period will be close to zero, too. This should hold for at least a few out-of-sample years, no less for the year adjacent to the model estimation period, 2010. With random error removed, a sizeable remaining residual implies that an unmeasured systematic factor is present. The policy impact estimator in Eq. (2) assigns this systematic factor to energy efficiency policy.

To be confident that the systematic factor can be interpreted as the impact of energy efficiency policy, the policy impact model can be for tested for external validity. External validity refers to the generalizability of the model’s estimates to the out-of-sample period, which will be strong only in so far as the drivers of energy use in the model estimation period and the out-of-sample period are not significantly different. This is not always the case because long-term market and nonmarket trends, though gradual, can eventually result in permanent demand shifts that are discernible. At the other end of the spectrum, temporary shock, such as caused by a business cycle, can be quickly manifested in demand behavior and then disappear, but not before it unduly influences model estimates or the data used for producing counterfactuals in the out-of-sample period. If either of these phenomena, permanent shift or temporary shock, weaken the external validity of the model, then the systematic factor in the out-of-sample period could contain more than energy efficiency policy effects. The detailed investigation of these issues follows in a later section.

Model specification

Historical data representing the arguments in the energy input demand function can be found in ASM for 184 manufacturing industries (five-digit NAICS 31111 through 33999) for the 14 years from 1997 to 2010 (ASM 2011). This survey does not include the agriculture and forestry and fishing, mining, utilities, and construction industries (NAICS 11, 21, 22, and 23, respectively) that, together with manufacturers, make up the full industrial sector. These four categories of industries accounted for 182,295 GWh of electricity consumption in 2010 or 23 % more than the manufacturing sector alone (SEDS 2011).

ASM is an annual national economic survey of about 50,000 manufacturers. Among other things, the ASM dataset contains estimates of purchased megawatt hours, expenditures on megawatt hours, and expenditures on all other fuels besides electricity. However, it does not contain estimates of total Btu purchased from all fuels besides electricity or of expenditures on individual fuels other than electricity. ASM also contains industry value of shipments and value added, where the former includes the total value of all products produced and shipped and the latter is derived by subtracting the cost of intermediate inputs, i.e., the cost of materials, supplies, fuel, purchased electricity, and contract work. Value added consists of total compensation of employees, taxes on production and imports less subsidies, and gross operating surplus. Gross operating surplus includes consumption of fixed capital, proprietors’ income, corporate profits, and net transfer payments.

To estimate gross operating costs, which include short-term capital equipment costs, depreciation, and profits, the ASM estimate of industry total labor compensation is subtracted from ASM industry value added. To disaggregate the value of intermediate inputs, total expenditures on energy (electricity plus other fuels) is subtracted from the total difference between value of shipments and value added, leaving a variable that largely represents the industry costs for purchased materials and services. ASM also provides data on capital expenditures. These represent longer-term investments in buildings, machinery, and equipment of all kinds. Finally, the Federal Resource Board (FRB) database provides indexes of industrial capacity utilization and production for the manufacturing sector as a whole, and the Bureau of Economic Analysis (BEA) and Bureau of Labor Statistics (BLS) provide various deflators for inputs and output.

Table 1 contains brief definitions of the industry-specific variables and their sources, and Table 2 contains descriptive statistics for these variables for 2002 and 2010. The former year is chosen, for reasons described further on, as the beginning of the model estimation period and the latter is the year for which policy impacts are estimated. All monetary values in this study are expressed in constant 2010 US dollars.

Equation (3) shows the details of the electricity consumption model, where b i are the estimated coefficients for fixed industry effects and b t are the estimated coefficients for fixed time effects; b 1 through b 9 are estimated coefficients for the independent variables, and e it is the model error term. In estimating this panel model (and the two companion models of electricity expenditures, XMWHX, and expenditures on all fuels other than electricity, XBTUX), all continuous variables are transformed into natural logarithms. This functional form is chosen not only for its practicality, but because there is empirical evidence that constant returns to scale exist with respect to energy intensity, as measured by energy over value added, in the manufacturing industries (e.g., Boyd et al. 2011). The electricity expenditure model specification is the same as the electricity consumption model save for the electricity price variable, and the other fuels expenditure model is the same save for substituting the manufacturing sector industrial production index for the capacity utilization index. To control for cross-section heteroscedasticity, the model is estimated using feasible generalized least squares and White corrections for the standard errors.

Like for all the models in this study, the fixed cross-section effects control for missing variables that are time invariant but industry-specific, and the fixed period effects control for missing variables that are industry invariant but time specific. These model components are notable because at least two relevant independent variables are unavailable: industry energy prices for fuels other than electricity and observed energy efficiency policy activity. Fixed effects compensate for these omissions and prevent model misspecification.

Another notable feature of this model is the inclusion of present year, and two prior years, industry capital expenditures variables. These not only add to the number of production inputs that are controlled for in the model, and the delayed effects of large investments, but help isolate the effects of energy efficiency market persuasion programs from energy efficiency finance programs. They do so because they represent both energy efficiency investments and conventional investments in buildings, plant expansion, and equipment. Unfortunately, because energy efficiency-related investments cannot be differentiated from all other investments, nothing about the impacts of energy efficiency finance programs can be concluded from these variables’ coefficients. However, having the net effects of capital investments controlled for allows the policy impacts that are derived from the model to be interpreted as primarily due to the market persuasion mode of energy efficiency policy.

Policy impact findings

Table 3 contains the findings for the three policy impact models, each of which is estimated for the 2002–2009 period (by convention, to save space fixed effects are not listed). Since the main focus of energy efficiency policy is electricity use, the central model for this study is the electricity consumption model on the left. The coefficients of this model indicate, holding output fixed, that electricity consumption declines with increases in electricity prices, labor expenditures, and gross operating costs. On the other hand, energy consumption increases with increases in expenditures on materials and services, expenditures on fuels other than electricity, and expenditures on investments. Electricity consumption also increases with increasing capacity utilization. All of the estimated coefficients are statistically significant save for the present year capital expenditure coefficient. Regarding this variable and the two lags, it is important to reiterate that positive capital investment coefficients do not necessarily mean that investments in energy efficient buildings, machinery, and equipment do not produce energy savings. This is because the coefficients represent the combined effects of all capital investments. Lastly, the adjusted R 2 for all three models are relatively high; for these and all of the other panel models in this study, the R 2 are estimated using mean-normalized variables and are adjusted for losses in degrees of freedom.

Table 4 contains the estimated energy efficiency policy impacts for 2010 derived from the difference between the summed counterfactuals and the actual values. Based on the electricity consumption model, the cumulative impact of the market persuasion mode of manufacturing sector energy efficiency programs is a reduction in electricity use in 2010 of 43,946 GWh. Using 2002 total manufacturing sector electricity consumption as the baseline (813,408 GWh), the relative electricity consumption savings in 2010 due to the 9 years of policy is 5.4 %. Consistent with the high R 2 of the model, the mean absolute forecast error (MAPE) for the in-sample period is 7.6 %, indicating a high level of model forecast accuracy. [Unlike the calculation in Eq. (2) which defines policy impact as the total net residual, MAPE is calculated as the sum of the absolute values of the residuals]. As expected, forecast accuracy is lost when systematic, nonmarket effects are embedded in the 2010 forecasts; MAPE increases to 11.6 %.

Tables 3 and 4 contain similar information for the energy expenditures models. The electricity expenditure model appears to produce coefficient estimates that are similar to those of the electricity consumption model; however, this is not the case for the other fuels expenditures model, which includes expenditures for natural gas, coal, oil, wood, and so on. The estimated energy efficiency policy impact for the electricity expenditure model is savings of 2.6 % relative to 2002 expenditures. This impact is less than half the electricity consumption impact and likely reflects the effects of rising electricity prices from 2007 to 2010. For other fuel expenditures, the policy-related savings is estimated to be 5.7 % relative to 2002 expenditures. The full in-sample and 2010 MAPE forecast statistics for the electricity expenditure model are almost identical to those of the electricity consumption model. The MAPE statistics for the other fuel expenditures model are higher than for the other models, but still indicate a high degree of accuracy.

While for conventional forecasting applications it is useful to construct confidence intervals using the forecast standard errors, this approach cannot be successfully applied in the current context. For the GWh consumption model, the total counterfactual standard error for 2010 is 12.1 % of the total counterfactual. This means that for the estimated policy impacts to be statistically significant at the 90 % confidence level, the total counterfactual would have to be 20 % higher than total actual consumption. Not only is an energy efficiency policy impact of this size unrealistic over the study time period, but such a statistical relationship would suggest poor model specification in general, not just the growing cumulative impact of nine years of energy efficiency policy.

An alternative way of assessing the accuracy of the estimated policy impacts is to generate new forecasts for 2010 using different in-sample periods, and then to compare results. As such, the GWh consumption model is rerun for the 2002–2008 period and again for the 2002–2010 period. These two models, referred to as the short model and the long model, are found in Table 6. The findings indicate that the policy impacts estimated from the former model are 4.8 % of 2002 GWh consumption. From the latter model, which included a fixed time effects for 2010 (whose value was −0.015 and not statistically significant), the policy impacts are 3.3 % of 2002 gigawatt hours consumption. These alternative estimates are within the range of the findings of the preferred policy impact model and thus lend them support.

Tests of permanent shift and temporary shock

Another element of uncertainty in the policy impact estimates arises from the question of model external validity, that is, the degree to which the in-sample and out-of-sample periods are similar. As noted above, in the context of this study, threats to strong external validity arise from two factors. The first is the likelihood that, over a long period of time, major changes in technology, politics, or economic factors gradually, but permanently, shifted how energy is purchased and consumed. The second arises from the possibility that a temporary shock, such as the recent business cycle, influenced either the in-sample or out-of-sample data values in ways that would cause the estimated counterfactuals and, thus, the estimated policy impacts, to be confounded. Both of these issues were investigated prior to the final selection of the models’ in-sample period.

Due to the economic events occurring before and after 2002, for the final models, the period of 2002–2009 was chosen as the one in which model external validity would be best. The 1997–2001 period was one in which there was a relatively brief recession in 2001 and in which, beginning earlier in the decade of the 1990s, there were major efforts at the state level to deregulate and restructure the electric utility industry. Utility restructuring had a particularly strong effect on large consumers and manufacturers, whose relationships with power generators and distributors were renegotiated. This period also lacked large-scale, national manufacturing sector programs such as AMO and Energy Star, not to mention smaller local energy efficiency programs. DSM programs were declining in this period, and MT programs were just beginning.

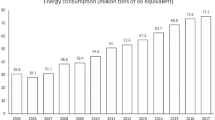

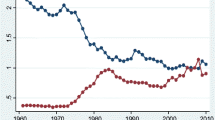

The 9-year period of 2002–2010 saw changes in economic and energy supply conditions and an expansion of manufacturing sector energy efficiency programs both at the state and national levels. For most of this period, manufacturing sector real value added grew more rapidly than in the earlier period. As seen in Fig. 1, robust growth took place between 2002 and 2007, with real value added averaging almost 5 % per year and plunging in 2009. In Fig. 2, it can be seen that the trend in manufacturing sector electricity consumption followed steadier, if similar, trends to that of value added in the 1997–2001 and 2002–2010 periods.

Differences between the earlier period and the later period are also found in average electricity prices and average electricity intensity. As seen in Fig. 3, average real electricity prices stayed above 7.5 cents/kWh through 2003. Similarly, as shown in Fig. 4, from 2002, forward electricity intensity (electricity consumption divided by value added) appears to have been on lower path than in the earlier period.

To provide quantitative evidence that model external validity was strengthened by excluding the early years from the model estimation period, the F test of the equality of the coefficients (Chow test) was performed for the electricity consumption model. Table 5 contains the unconstrained model estimates, meaning the model for the entire span of years and the model for the early period, 1997–2001 (the third model needed for the F test, the policy impact models, is in Table 3). Of immediate note is that the R 2 of the unconstrained model and the policy impact model differs considerably from the early period model. More importantly, the F test indicates that there is a statistically significant difference in the coefficients of the early period model and the policy impact model. Similar results are obtained when the capital expenditure lagged terms are removed from the model and when fixed time effects are excluded. These findings confirm that model external validity was improved by removing 1997 through 2001 from the model estimation period.

The second major threat to model external validity is the recent business cycle shock; manufacturing sector value added and electricity consumption declined dramatically in 2009 and rebounded in 2010. In 2009, real value added plunged from its 2007 high by 25.6 % and then, with the economic recovery underway, real value added increased in 2010 by 12.5 %. Likewise, in 2009, electricity consumption was 16.8 % below its 2007 level, and in 2010, it rebounded by 6.6 %.

To investigate how this temporary shock affected the policy impact model and could have affected the counterfactuals, the model was re-estimated for the shorter 2002–2008 period and the longer 2002–2010 period. The findings for these two models are displayed in Table 6. Alongside each model are t tests comparing the values of their coefficients with those of the policy impact model (in Table 3). These tests are performed to determine whether or not the temporary shock of the business cycle influenced the policy impact model coefficients and weakened the model’s external validity.

In Table 6, the columns marked “t score” contain pairwise values calculated as the difference of the coefficients of the two models divided by the square root of the sum of the squared standard errors of the coefficients, and the values in the columns marked “Prob.” show the probability, based on the t distribution, that there is a statistically significant difference between the coefficients of the models. Each one of these tests indicates that there is no major difference between the short model and the policy impact model coefficients, and the long model and the policy impact model coefficients. This evidence indicates that the business cycle shock did not alter any of the policy impact model coefficients in any significant way nor influence the values of the counterfactuals in 2010.

In summary, tests of the model estimation period and the effects of the business cycle shock suggest that the electricity consumption policy impact model has strong external validity. These findings imply that there are no obvious systematic factors that could also be present in the energy efficiency policy impacts estimated for 2010.

Discussion and conclusion

According to the policy impact estimates, due to the combined effects of energy efficiency market persuasion programs, electricity consumption in 2010 was reduced by 43,946 GWh and electricity and other fuel expenditures were reduced by 2.6 and 5.7 %, respectively, relative to 2002 expenditures. An important caveat to these findings is that they are based on the premise that energy efficiency policy impacts cumulated over a nine year period. As such, model misspecification due to an omitted policy variable was expected to be minimal in the early years of the in-sample period, but to grow over time to the point where its effect could be detected in the 2010 forecasts. However, the possibility that the model excluded other important variables that led to these findings, such as nonpolicy induced technical change and shifts in managerial practice, cannot be ruled out. Care has been taken to construct detailed, externally valid econometric models that leave as little room as possible for alternative interpretations. Yet, models are representations of reality, not reality itself, and thus their findings incorporate known, and unknown, sources of uncertainty.

Given the magnitude of the policy findings, it would seem that some fraction of the impacts, perhaps even a large fraction, could be due to policy spillover. This is because a critical element of market persuasion programs is promoting market growth through word of mouth, trade information outlets, advertising, and publicity. As part of their outreach mission, programs like EPA’s Energy Star, along with its program partners, encourage corporate management to add energy efficiency to their goals and priorities. They also offer free tools and resources that help benchmark energy performance and convey best practices for savings energy. Furthermore, in return for voluntarily becoming more energy efficient, companies are often given official local and national recognition and certification. This creates positive, socially responsible corporate images for participating companies. More importantly, it sets an example for the entire industry to follow. It remains for future studies to investigate the phenomenon of national spillover further. As time goes on and additional data becomes available, this subject may become more amenable to econometric analysis than it is at present.

Due to the nature of energy efficiency programs in general, and manufacturing sector programs in particular, it is not possible to directly compare the policy findings of this study to the recorded impact estimates of individual programs that are based on more widely known bottom–up evaluations. An obvious example of the difficulty this entails is provided by the electricity efficiency program impacts that are reported at the national level from the Consortium for Energy Efficiency (CEE 2011). CEE has 352 utility and nonutility members operating efficiency programs that were collectively responsible for about 86 % of expenditures on electric and natural gas DSM and MT programs in North America. In its annual report, cumulative annual energy savings estimates from bottom–up studies are reported not only for these two kinds of programs combined, but for both commercial and industrial sector programs combined. Separating the impacts of the manufacturing sector, market persuasion from the CEE’s aggregate estimates demands, in and of itself, analyses that are beyond the scope of the current effort.

This being said, comparison of bottom–up estimates of program savings with econometric estimates of the kind produced in this study seems like a subject worth pursuing in future studies. In addition to the obvious difficulties in sorting individual programs by type and sector and history, this pursuit would require careful attention to the conceptual differences between energy consumption and expenditure analyses using aggregate time series data and econometric models, and studies using cross-section microdata collected from program participants and nonparticipants. Thus far, little has been done in this area. Instead, in recognition of some of the information gaps in bottom–up studies, it is common practice to adjust program savings estimates using net-to-gross (NTG) factors. A prominent example of this practice is in the State of California, in which the Database for Energy Efficiency Resources (DEER 2011) is used by regulator to adjust the savings estimates of investor-owned utility programs. However, the potentially large degree of policy spillover due to energy efficiency programs has yet to be incorporated into the DEER NTG factors.

The findings of this study suggest that energy efficiency market persuasion programs as a whole have produced sizeable benefits in the manufacturing sector since 2002 in the form of reduced electricity consumption and reduced energy expenditures on electricity and other fuels. In turn, this study also raises important questions, such as what fraction of the estimated impacts are due to policy spillover, and what the nature of the synergy is between programs that focus on financing energy efficiency investments and those that focus on energy efficiency market persuasion. Future econometric studies that have a narrower scope and that can incorporate the data from bottom–up studies may be able to address these deeper issues. Such empirical studies are essential to fully appreciate the comprehensive, long-term social benefits of energy efficiency programs and policies.

References

Arimura, T. H., Shanjun, L., Richard, G. N., & Karen, P. (2012). “Cost-effectiveness of electricity energy efficiency programs. The Energy Journal, 33(2), 63–100.

ASM (Annual Survey of Manufacturers) (2011). www.census.gov/manufacturing/asm. US Census Bureau, Washington.

Auffhammer, M., Carl, B., & Meredith, F. (2008). Demand side management and energy efficiency revisited. The Energy Journal, 91(3).

Bernstein, M. K., Kateryna, F., Sam, L., & David, L. (2003). State-level changes in energy intensity and their national implications. MR-1616-DOE. Santa Monica: Rand.

Bohi, D. R. (1981). Analyzing demand behavior. Baltimore: Johns Hopkins University Press for Resources for the Future.

Bohi, D. R., & Zimmerman, M. B. (1984). An update on econometric studies of energy demand behavior. Annual Review of Energy, 9, 105–154.

Boyd, G., Kuzmenko, T., Szemely, B., & Zhang, G. (2011). Preliminary analysis of the distributions of carbon and energy intensity for 27 energy intensive trade exposed industrial sectors, working paper EE 11–03, Nicholas institute for environmental policy solutions. Chapel Hill: Duke University.

CEE. (2011). State of the efficiency program industry: Expenditures, impacts, & budgets 2011. Boston: Consortium for Energy Efficiency.

Dahl, C. (1993). A survey of energy demand elasticities in support of the development of the NEMS. Washington: US Department of Energy.

DEER (2011). www.deeresources.com. California Energy Commission, California Public Utilities Commission, San Francisco–Sacramento.

EIA (Energy Information Administration). (2011). Annual energy outlook. Washington: US Department of Energy.

Horowitz, M. J. (2007). Changes in electricity demand in the United States from the 1970s to 2003. The Energy Journal, 28(3), 93–119.

Loughran, D. S., & Kulick, J. (2004). Demand side management and energy efficiency in the United States. The Energy Journal, 25(1), 19–43.

Parfomak, P. W., & Lave, L. B. (1996). How many kilowatts are in a negawatt? verifying ex post estimates of utility conservation impacts at the regional level. The Energy Journal, 17(4), 59–87.

Rivers, N., & Jaccard, M. (2011). Electric utility demand side management in Canada. The Energy Journal, 32(4), 93–116.

SEDS (2011). www.eia.gov. Energy Information Administration, Washington.

Acknowledgments

This research was funded by the US Environmental Protection Agency. The author would like to thank Elizabeth Dutrow and Caterina Hatcher as well as the anonymous referees for their comments and suggestions. The author takes sole responsibility for all errors and opinions found within.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Horowitz, M.J. Purchased energy and policy impacts in the US manufacturing sector. Energy Efficiency 7, 65–77 (2014). https://doi.org/10.1007/s12053-013-9200-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12053-013-9200-3