Abstract

Firms pursuing technological alliances to gain competitive advantages have become a ubiquitous phenomenon in today’s business environment. This article examines which technological alliance portfolio configuration is better for focal firm performance using a portfolio rather than a dyadic perspective. To assess technological alliance portfolio effects on Korean pharmaceutical and biotechnology firms, we adopted three explanatory variables—number of alliances, number of partners, and spanning structural holes. The growth rate of revenue and the growth rate of profit are used as dependent variables. We identify two characteristics of technological alliance portfolios from the two-step generalized method of moments estimates. First, we find that between two firms with the same number of alliances, the firm with the larger number of partners would have a better performance. This result is unlike those in previous studies because it distinguishes between the number of alliances and number of partners based on the network theory. Second, we find that spanning structural holes affects firm performance rather like a double-edge sword—it positively affects the growth rate of profit but negatively affects the growth rate of revenue of firms. In short, spanning structural holes is simultaneously beneficial for firm profitability and unfavorable for firm growth. This result differs from those of earlier studies because it shows that a firm spanning structural holes among alliance partners produces either a positive or a negative effect, suggesting that a firm should vary its strategy depending on whether it prioritizes profitability or growth.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Firms entering technological strategic alliances have become a common phenomenon in today’s business landscape (Contractor and Lorange 2002; Gulati 1998). For instance, Apple, the consumer electronics company, recently established a strategic alliance with Nuance, which has developed a cutting-edge voice recognition technology, to create a voice-based personal assistance application for Apple’s iPhone OS. Similarly, Sony announced its strategic alliance with AU Optronics, the first manufacturer in Taiwan to mass produce TV panels, in developing the OLED TV, a television that uses new light-emitting diode technology. Meanwhile, Toyota is collaborating with BMW to develop a next-generation lithium-ion battery for an eco-friendly car. Firms pursue technological strategic alliances to gain a competitive advantage in markets with increasing competition. Hence, a technological strategic alliance could be considered an important asset (Hoffmann 2007; Kanter 1994).

In today’s business environment, most firms no longer depend on a single alliance, but rather maintain entire networks of alliances with different partners in order to access a broad range of resources (Hoffmann 2005, 2007; Lavie 2007; Parise and Casher 2003; Wassmer 2010). Such networks of alliances are also called “alliance portfolios.” Research on alliance portfolios, which belong to the broader field of strategic alliances, emerged after 2000 with the development of the social network theory in sociology. In alliance portfolios, alliances are assumed to have the same weight (Lavie 2007).

Firms differ in the configuration of their alliance portfolios, and consequently differ in the external resources and capabilities they can access (Gulati and Gargiulo 1999). A focal firm’s alliance portfolio can be regarded as an inimitable and non-substitutable resource, as well as a means to access unique capabilities (Wassmer and Dussauge 2011; Zaheer and Bell 2005).

Several studies have indicated that a firm’s alliance portfolio influences its behavior and outcomes (e.g., Ahuja 2000a; Powell et al. 1996; Walker et al. 1997). Recent studies examine the influence of certain alliance portfolio characteristics on a firm’s ability to realize potential benefits (Das and Teng 2002), paying significant attention to the phenomenon of alliance portfolio from different perspectives (Goerzen 2007). However, in spite of the growing consensus that such networks matter, the specific effects of the different elements of an alliance portfolio on organizational performance remain unclear (Ahuja 2000a; Wassmer 2010). Thus, the effect of an alliance portfolio on individual firm performance is still a critical question for both managers and scholars (Dyer and Singh 1998; Gulati et al. 2000a; Koka and Prescott 2002; Wassmer 2010). Gulati et al. (2000a) suggested that the behaviors and performances of firms can be more fully understood by examining the network of relationships in which they are embedded.

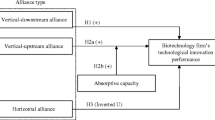

According to Wassmer (2010), alliance portfolios are a relatively new research area in the broader field of strategic alliances. Themes in this area cluster around three major issues, namely the emergence, configuration, and management of alliance portfolios. This study examines the second issue, specifically, portfolio size (i.e., number of alliances, number of partners) and structural portfolio characteristics (i.e., spanning structural holes). These two items are among the six main issues in the configuration of alliance portfolios, and are indicated by the shaded areas in Fig. 1. We expect this new research perspective will help overcome the dyadic perspective, and more specifically, help determine enduring relationship patterns among firms in strategic alliances (Lavie 2007).

Research areas in alliance portfolios and the six prominent issues in alliance portfolio configuration Source: Wassmer (2010). Alliance portfolios: A review and research agenda. Journal of Management, 36(1), 146

From a comprehensive perspective, this study determines which technological alliance portfolio configuration (e.g., Baum et al. 2000) leads to better performance in Korean pharmaceutical and biotechnology (hereafter, bio) firms. In particular, we focus on two main issues—whether there are better alliance portfolios available to a focal firm and whether different alliance portfolios lead to different performances. We have chosen to focus on Korean pharmaceutical and bio firms, which have been engaging in singular alliances since the 1990s to gain competitive advantages, and are in knowledge-intensive industries where collaborations are important for gaining competitive advantages. In order to determine the beneficial alliance portfolio configurations, we examined the relationship between firms’ network configurations and performance. In this study, three network configuration variables, namely number of alliances, number of partners, and spanning structural holes, are used as explanatory variables, each of which helps configure a focal firm’s alliance portfolio. The growth rate of revenue is used as a dependent variable representing firm growth, and the growth rate of profit is used as a dependent variable representing firm profitability. Examining the configuration of focal firms’ networks of alliances can shed light on the role of network structure in firm performance and the effective flow of capabilities and benefits among firms.

Unlike in previous studies, we distinguish between the number of alliances and number of partners based on the network theory and examine how the three alliance portfolio characteristics (i.e., number of alliances, number of partners, and spanning structural holes) affect the two performance measures (i.e., growth rate of revenue and growth rate of profit), while also considering the network decay effect. Our main findings are as follows. First, in contrast to previous studies that emphasized the importance of number of alliances, we did not find any evidence that the number of alliances affects firm performance. Second, we found that the number of partners positively affects firm performance. With these two results, in addition, we discussed the relationship between number of alliance and number of partners, the importance of which was emphasized by Wassmer (2010). Lastly, we found that spanning structural holes is simultaneously beneficial for firm profitability and unfavorable for firm growth. This result differs from those of earlier studies that show a firm spanning structural holes among alliance partners produces either a positive or a negative effect, suggesting that a firm should vary its strategy depending on whether it prioritizes profitability or growth.

In the remainder of this paper, we establish our hypotheses, describe our methods, and outline our results. We discuss our findings from the statistical results. Finally, we present our concluding remarks with implications for managers and scholars.

2 Theory and hypotheses

2.1 Size of alliance portfolio

Past studies on portfolio size focus on either the number of alliances or number of partners. According to network theory, the number of alliances in the alliance portfolio of a firm represents the number of ties, while the number of partners represents the number of nodes. However, few studies distinguish between these two concepts. It is possible that scholars view the two concepts as similar, or have difficulty identifying partner firms, which is essential for distinguishing between the two concepts. Figure 2 illustrates the difference between the two concepts. Firms (a), (b), and (c) have the same number of alliances, as indicated by the numbers on top of each blue line. However, they have different numbers of partners in each alliance network. In the figure, firm (a) has one partner in six alliances, while firms (b) and (c) have three and six partners in six alliances, respectively. This study distinguishes between these two concepts and their effects on firm performance.

Many studies have argued that having a large number of alliances positively affects firm performance (Baum et al. 2000; Deeds and Hill 1996; Oliver 2001; Owen-Smith and Powell 2004). Although there are numerous performance measures and industries, in general, having a large number of alliances positively affects a firm’s financial and innovation performances.

In social network theory, a position in which a firm has a large number of alliances is called a position with a high degree centrality or a central position. This central position is preferred because it provides firms with a broader range of benefits and opportunities than available to firms in the periphery (Perry-Smith and Shalley 2003). In general, firms in central positions benefit from more opportunities for learning and a broader range of resources, which in turn positively affect the firms’ performance. Also, firms in a central position benefit from the asymmetry of information, enabling them to influence resources (Pfeffer and Salancik 1978). Through their central positioning, firms can access resources and knowledge to respond to new market opportunities.

Also, number of alliances has been used as a proxy of social capital (Chen and Ronowski 2009). Social capital can be defined as “the sum of the resources, actual or virtual, that accrue to an individual or a group by virtue of possessing a durable network of more or less institutionalized relationships of mutual acquaintance and recognition” (Bourdieu and Wacquant 1992: 119). Studies on number of alliances as social capital focus on the benefits of social capital (Ahuja 2000b; Baker 1990; Gulati 1998). Accordingly, we hypothesize that:

Hypothesis 1:

The more a focal firm’s alliances, the greater its subsequent performance.

Studies on the number of partners in an alliance portfolio are relatively scarce. Studies on firms’ partners focus on the benefits of having such partners. Partners in a strategic alliance can be compared to the friends we have in our social life. Having more friends means we have more people to converse with. Similarly, having more partners in an alliance means we have more partners to collaborate with.

A firm can enjoy numerous benefits from having multiple partners, including the ability to systematically develop an area of expertise by delegating specific parts of products or practices, which in turn leads to better performance (Capaldo 2007). Also, having diverse partners from several industries provides opportunities for accessing novel information (Baum et al. 2000; Beckman and Haunschild 2002; Powell et al. 1996; Schilling and Phelps 2007; Uzzi 1996, 1997). In addition, the more a focal firm’s partners, the better its chances of forming good partnerships (Gulati 1998, 1999; Podolny and Stuart 1995; Powell et al. 1996). A focal firm with many partners also has numerous opportunities to pursue new market trends or innovations, which then affects its performance (Gulati 1998; Powell et al. 1996). Prior empirical studies suggested that knowledge heterogeneity resulting from having numerous partnerships in a network benefits performance by broadening a firm’s perspective, increasing available resources, and improving its problem-solving capability (Goerzen 2007; Hambrick et al. 1996; Hargadon and Sutton 1997; Pelled et al. 1999; Rodan and Galunic 2004). Beckman and Haunschild (2002) also found that firms with many partners that have different experiences tend to perform better than those without such partners. Thus, in a competitive environment, having many partners significantly affects a focal firm’s performance, owing to the superiority of the information, knowledge, and resources a firm can access from the alliance portfolio. Accordingly, we hypothesize that:

Hypothesis 2:

The more a focal firm’s partners, the greater its subsequent performance.

2.2 Spanning structural holes

Social capital obtained from a network can be categorized into linking social capital and communal social capital (Wu and Wei 2004). The concept of linking social capital focuses on the benefits of a focal firm in a brokering position. Many prior studies based on the structural hole theory of Burt (1992) emphasized the importance of this strategy in an open network (Bae and Gargiulo 2004; Dyer et al. 2008; Zaheer and Bell 2005). On the other hand, the concept of communal social capital focuses on the benefits of a focal firm’s embeddedness in a closed network (Coleman 1988, 1990; Granovetter 1985).

Spanning structural holes, which is expressed as linking social capital, has several advantages (Burt 1992). A focal firm that spans structural holes enriches its position by having greater access to mutually unconnected partners. Burt (1992) suggested that spanning structural holes or reducing redundancy among partners is favorable for obtaining diverse information and gaining advantage over competitors. Bae and Gargiulo (2004) found that spanning structural holes positively affects a firm’s profitability (i.e., return on assets, return on equity). Zaheer and Bell (2005) showed that spanning structural holes is positively related to a firm’s market share. Dyer et al. (2008) obtained a similar result from their analysis of the Tata Group in India. In particular, they found that spanning structural holes benefits the firm’s performance through the availability of novel information. Accordingly, we hypothesize that:

Hypothesis 3a:

Spanning structural holes enhances a focal firm’s performance.

Meanwhile, according to the communal social capital view, densely embedded networks where a focal firm has numerous interconnected partners are favorable for the firm; such social structures are called closed networks (Coleman 1988, 1990; Walker et al. 1997). In this social structure, a focal firm benefits from the exchange of information, reduced opportunism, and lower costs of monitoring on the basis of trust (Zaheer and Venkatraman 1995). The degree of connectivity among a firm’s partners leads to more productive collaboration in terms of resource sharing and access to novel information (Ahuja 2000a). Accordingly, we form the following hypothesis:

Hypothesis 3b:

Adensely embedded network enhances a focal firm’s performance.

3 Method

3.1 Research setting

The effects of alliances have not yet been clearly identified (Wassmer 2010). Most previous studies measured the effects of alliances after 1 year (Ahuja 2000a; Koka and Prescott 2002, 2008; Padula 2008; Powell et al. 1996; Zaheer and Bell 2005). Swaminathan and Moorman (2009) measured the effects constantly for 5 years. We adopted the method by Stuart (2000), who stated that the effect of an alliance weakens over time during a 5-year period. For example, 5 years prior to the current year, the effect received a weight of 0.2; 4 years prior, it is 0.4; 3 years prior, it is 0.6, and so on. If a focal firm formed an alliance with a partner at time t-2, the effect of the alliance at time t for the focal firm is 0.8. For the purposes of this study, these cumulative effects are called the decay effect. This decay concept can be explained by network decay (Burt 2000), which states that the liability of new ties is evident from the slower decay in older relationships (Fig. 3).

3.2 Data

We investigated the technological alliances of 48 leading Korean pharmaceutical and bio firms that are listed (or registered) on the Korea securities dealers’ automated quotation and the Korea composite stock price index. Specifically, we tested our hypotheses on a longitudinal data set measuring the effects of alliance portfolio configuration. Co-patenting is used as an indicator of technological alliance (Lecocq and Van Looy 2009). Following prior research, the year of technological alliance is identified as the date of patent application rather than the date the patent was granted (Baum et al. 2000). The technological alliance data was obtained from the WIPS online patent search, a commercial service providing information on patents. We found data on 372 co-patents, with each co-patent involving two to six participants. We assigned the same weight to alliances between a focal firm and partner firms regardless of the number of participants in a co-patent. Until 1990, alliance was a rare phenomenon (Barney and Hesterly 2006); thus, this study only examined data beginning that year. The firms’ financial data were collected from the Korea investor’s service value database for 1995–2009.

3.3 Measurements: dependent variables

To measure the performance of the firms used in this study, we used two variables—the growth rate of revenue and the growth rate of profit. The growth rate of revenue was used to represent growth. Meanwhile, the growth rate of profit was used to represent profitability. According to Glancey (1998), if a firm is profit-oriented, its strategies for growth and profitability move in the same direction. However, if a firm is growth-oriented, it can achieve its goals by reducing the margins on its most profitable products; in short, its strategies for growth and profitability may not coincide. Similarly, in this study, we used the two variables separately because the effects of alliance portfolios on each variable could differ.

3.4 Measurements: technological alliance portfolio variables

In an alliance portfolio, a focal firm is said to be embedded because it coordinates with its partners through the processes of knowledge transfer and resource sharing (Galbraith 1977; Gresov and Stephens 1993; Tsai 2001). Before explaining our method for calculating the values of the four explanatory variables, we explain the relationships within a complex alliance portfolio. Figure 4 illustrates the cumulative network of technology alliances for the period 1990–2008. The red and blue nodes represent the pharmaceutical and bio firms respectively, while the nodes in other colors represent firms in other industries. Figure 4 shows that focal firms have different egocentric alliance configurations in terms of number of alliances, number of partners, and spanning structural holes.

Although this cumulative alliance portfolio conveniently illustrates the overall network structure, the units for longitudinal analysis are 5-year cumulative networks that consider the decay effect. Thus, we need to understand the structure of the cumulative networks in 5-year increments. Figure 5 presents the two periods of time, namely 1995–1999 and 2000–2004, for which the decay effect was considered. The image on the left is less complicated than that on the right, which demonstrates that the number of partners and number of alliances increase over time. In addition, the overall network configurations are similar to the cumulative network of technology alliances during 1990–2008, illustrated in Fig. 4, albeit the complexity and the tie strength are lower.

3.4.1 Number of alliances

This variable is based on the concept of degree centrality proposed by Freeman (1979), which measures the number of ties of a node. In considering the decay effect, a single tie strength increases from 0.2 to 1.0. Thus, this variable represents the sum of the tie strength between a focal firm and its partners. In other words, it is an absolute value of how much a focal firm interchanges with its partners. To measure this effect on performance at t, we made 15 cumulative adjacent matrixes from t − 1 to t − 5 considering the decay effect. Equation (1) represents this adjacent matrix. Then, the number of alliances of firm 1 can be calculated as follows: \( w_{11}^{t} + w_{12}^{t} \; + \cdots \; + w_{1M}^{t} \).

3.4.2 Number of partners

The number of partners of a focal firm is represented by the number of nodes to which a node is adjacent. This value considers the number of partners to which a firm is connected regardless of the strength of the ties. In short, it represents how many partners are affecting the focal firm. From the Eq. (1), the number of partners of a focal firm can be represented as the sum of the indicator function I, like in Eq. (2) below. In other words, it is the sum of the row in the Eq. (1), counting a row only if \( w_{ij}^{t} \) is not zero.

3.4.3 Structural hole

We used the same equation as Burt’s (1992) to calculate the structural hole score considering the decay effect (Borgatti et al. 2002; Zaheer and Bell 2005). The more a focal firm’s unique partners, the higher its structural hole score. In other words, if all the available information can be transferred to the focal firm, it is considered as a nearly perfect strategy of the structural hole:

3.5 Controls

First, we controlled for past performance. Firms that performed well in the past are likely to maintain their good performance (Tsai 2001). Thus, we included performance measures for previous years (1994–2008). Second, we also controlled for firm size and debt-equity ratio as they also affect firm performance (Kim 2005). Firm size is measured by the natural log of annual assets, while debt-equity ratio is debt divided by equity. Third, we also considered firm age as a control (Goerzen 2007; Zaheer and Bell 2005). Firms that have been in existence longer are more likely to perform better because of numerous advantages, including an established reputation, brand value and recognition, and developed social networks (Zaheer and Bell 2005). Firm age was calculated by the number of years following the year of establishment of a firm. Fourth, we also controlled for the internal capability of firms (Lee et al. 2001; Oliva et al. 2011). The capability of a firm can be divided into internal and external capabilities (Lee et al. 2001; Zaheer and Bell 2005). External capability refers to a firm’s competitive advantage through network effects, while internal capability refers to a firm’s own abilities. To measure the internal capability of the firms, we collected the firms’ yearly single patent counts for 1990–2008 from WIPS, and used the value of cumulative number of patents for 5 years to represent recent internal capability. Lastly, year dummies are also included in the models to control for economy-wide shocks (Uotila et al. 2009).

3.6 Data analysis

We estimated the model using the two-step generalized method of moments (GMM) by Arellano and Bond (1991), which involves transforming the equation into first differences and uses lagged values of the endogenous variables as instruments, using the data for the 48 leading Korean pharmaceutical and bio firms. The data sets are unbalanced longitudinal data sets due to the differences in the foundation years of the firms. This procedure is used to obtain estimates for the dynamic longitudinal model, using STATA version 11.0. This methodology should satisfy two tests—the Sargan test and the second-order serial correlation test [AR(2)]. The Sargan test is used for over-identifying restrictions for the GMM estimators, and the AR(2) to test for second-order serial correlation. The instrumental variables in the GMM used the first and second lags to overcome reliability issues. The set of models is comprised of three models for analyzing the two performances. We introduced the baseline model first and then added the variables’ number of alliances and number of partners to determine the relationships between the two variables in the second model. Lastly, the third model uses the complete model.

4 Results

Table 1 presents the correlation matrix and descriptive statistics for the three datasets, while Table 2 shows the standardized coefficients for the independent variables. None of the models encountered problems regarding over-identifying restrictions and second-order serial correlation. Therefore, all the models are suitable for the two-step GMM.

4.1 Tests of hypotheses

We found that hypotheses 1, which postulate that the number of alliances positively affects firm performance, are not supported in any of the models. For hypothesis 2, which postulates that the number of partners positively affects firm performance, we found supporting results. Lastly, for hypothesis 3a, which postulates that spanning structural holes positively affects firm performance, we found supporting evidence for the growth rate of profit, but a contradicting result for the growth rate of revenue, thereby supporting hypothesis 3b, which postulates that densely embedded networks positively affect firm performance.

5 Discussion

This study focuses on the external networks of focal firms, which have recently received significant attention in the strategic alliance literature and gives another paradigm to explaining firm performance. This viewpoint complements the resource-based view, which emphasizes the importance of internal capability for better performance (Gulati et al. 2000a; Wassmer 2010; Zaheer and Bell 2005). Although there have been several prior studies on the positive effects of external networks (Ahuja 2000a; Gulati et al. 2000b; Zaheer and Bell 2005), this study was motivated by two new goals. First, we sought to determine the relationships between number of alliances and number of partners by identifying the partners of focal firms in an alliance portfolio. Second, we sought to determine whether different alliance portfolios affect firm performances differently depending on the characteristics of the performance measures. To accomplish these goals, we examined firm performance in two respects: the growth rate of revenue and the growth rate of profit. The findings and implications are discussed below.

Many studies have argued the positive effects of network size in terms of number of alliances. However, our research results showed no evidence of this positive effect. This result has two implications. First, it suggests that there may be inefficiencies when firms maintain several alliances, with the set of alliances changing over time. Such inefficiencies may stem from unnecessary or costly alliances, which may be a reason why we did not find a positive or negative effect of number of alliances. Second, this result also suggests that there may be more important factors affecting firm performance (e.g., the quality or diversity of partners) other than the number of alliances. Although the effect of alliances, which is based on the concept of degree centrality, has always been considered a beneficial factor of firm performance, the result suggests that we should approach number of alliance as an aspect of the function of benefits and costs (Wassmer and Dussauge 2011).

Meanwhile, the result for network size in terms of number of partners suggests that a larger number of partners is better for performance, based on several models (H2a). In this study, we clearly distinguished between the concepts of number of alliances and number of partners, and consequently, were better able to explain the effects of alliance portfolio configuration. Furthermore, this approach is in line with Wassmer’s (2010) recommendations for future research, which encouraged further examining the relationship between alliances and partnerships:

A promising research opportunity would be to combine the two dimensions and conduct some comparative research on different alliance portfolio configurations (e.g., alliance portfolios with many alliances and many partners vs. alliance portfolio with many alliances but few partners, i.e., many close partners.) (2010: 163)

Wassmer’s quote above argues the necessity of distinguishing between these two concepts (i.e., number of alliances and number of partners), and the importance of integrating them. Figure 6 illustrates how the number of alliances and the number of partners affect the growth rate of revenue and the growth rate of profit. We compared two firms in terms of number of alliances and number of partners from model 2, assuming the control variables are constant. We deleted the relationships among partners because we are focusing on the number of alliances and number of partners. Since the estimated coefficient for the number of partners is positive, increasing the value of this variable is better for the performance of the two firms. Alliance configurations such as that of firm A, which has a larger number of partners, are better for performance than that of firm B. This suggests that more substantial partners may be better for performance.

The results for the effect of spanning structural holes on performance are rather unclear because the results for the two performance measures differed. To broaden our understanding of the effects of spanning structural holes, a performance measure needs to be specified. The results showed that spanning structural holes positively affects the growth rate of profit but negatively affects the growth rate of revenue. In other words, while spanning structural holes is beneficial for profitability, it is not for growth (i.e., a densely embedded network configuration is better for growth); in this sense, spanning structural holes is rather like a double-edge sword. This result gives new insight that contradicts traditional social capital perspectives, namely linking social capital and communal social capital. Figure 7 illustrates the effects of spanning structural holes. Our results suggest that a focal firm should span structural holes in order to achieve profitability at the expense of growth.

According to Ahuja (2000a: 451), “When developing a collaborative milieu and overcoming opportunism are essential to success, closed networks are likely to be more beneficial. When speedy access to diverse information is essential, structural holes are likely to be advantageous.” Ahuja’s statement assumes that the need to overcome opportunism and the need for diverse information exist separately, as shown below in Fig. 8. This argument might prompt us to understand spanning structural holes fragmentarily. Based on our results, however, completely beneficial alliance portfolio structures, that is, closed networks or spanning structural holes, do not exist in reality. In other words, spanning structural holes is like a double-edge sword—it positively affects the growth rate of profit but negatively affects the growth rate of revenue of firms.

Conceptual graph of Ahuja’s (2000a) statement

Why is spanning structural holes better for firm profitability, and worse for firm growth? A focal firm that spans structural holes gains access to diverse, non-redundant information and knowledge, and consequently earns greater profits from the high value products resulting from the utilization of such information and knowledge. An example of this effect is Apple’s iPhone, which was not borne by entirely new technologies but rather by a combination of existing technologies. However, a firm that spans structural holes could simultaneously lose its core competencies partly from the opportunism of its partners (Ahuja 2000a; Barney and Hesterly 2006; Zaheer and Bell 2005), which may cause it to lose its main sources of revenue, that is, its relatively low value products, thereby adversely affecting its overall revenue. The results suggest that this outcome occurs when a firm’s alliance portfolio spans structural holes.

This study examined technological alliance portfolio configurations and firm performance among Korean pharmaceutical and bio firms. The results may not necessarily be generalizable to all industries. Thus, additional research in other industries is required to determine the ideal alliance portfolio configurations for different industries. The development of new variables in portfolio configurations will also lead to richer results and interpretations.

6 Concluding remarks

According to Wassmer (2010), research on alliance portfolio configurations has been growing gradually. While we are proud to complete a research in this relatively new area, additional empirical studies are necessary to produce useful results for researchers and managers in a variety of intuitions and organizations. A firm’s capability can be divided into internal and external capabilities (Zaheer and Bell 2005). RBV scholars concentrated on internal capability, while network scholars focused on external capability. This study focused on the effects of network structures in firms’ access to external resources. We found that alliance portfolio configurations may affect the performance of a focal firm depending on the characteristics of the relevant markets or industries. We hope that our empirical study may guide researchers and managers. We will also attempt to expand this research to other industries and develop new variables in alliance portfolio configurations.

References

Ahuja G (2000a) Collaboration networks, structural holes, and innovation: a longitudinal study. Admin Sci Q 45(3):425–455

Ahuja G (2000b) The duality of collaboration: inducements and opportunities in the formation of inter-firm linkages. Strategic Manag J 21(3):317–343

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Bae J, Gargiulo M (2004) Partner substitutability, alliance network structure, and firm profitability in the telecommunications industry. Acad Manag J 47(6):843–859

Baker WE (1990) Market networks and corporate behavior. Am J Sociol 96(3):589–625

Barney JB, Hesterly WS (2006) Strategic management and competitive advantage: concepts and cases. Pearson Prentice Hall, Old Tappan

Baum JAC, Calabrese T, Silverman BS (2000) Don’t go it alone: alliance network composition and startups’ performance in Canadian biotechnology. Strategic Manag J 21(3):267–294

Beckman CM, Haunschild PR (2002) Network learning: the effects of partners’ heterogeneity of experience on corporate acquisitions. Admin Sci Q 47(1):92–124

Borgatti SP, Everett MG, Freeman LC (2002) Ucinet for Windows: Software for social network analysis. Harvard Analytic Technologies, Cambridge

Bourdieu P, Wacquant LJD (1992) An invitation to reflexive sociology. University of Chicago Press, Chicago

Burt RS (1992) Structural holes. Harvard University Press, Cambridge

Burt RS (2000) Decay functions. Soc netw 22(1):1–28

Capaldo A (2007) Network structure and innovation: the leveraging of a dual network as a distinctive relational capability. Strateg Manag J 28(6):585–608

Chen S, Ronowski M (2009) The changing importance of structural holes and social capital in an emerging industry: evidence from the Internet industry. Front Entrepreneurship Res 26(13):1–13

Coleman JS (1988) Social capital in the creation of human capital. Am J Sociol 94:95–120

Coleman JS (1990) Foundations of social theory. Harvard University Press, Cambridge

Contractor FJ, Lorange P (2002) The growth of alliances in the knowledge-based economy. Int Bus Rev 11(4):485–502

Das TK, Teng BS (2002) Alliance constellations: a social exchange perspective. Acad Manag Rev 27(3):445–456

Deeds DL, Hill CWL (1996) Strategic alliances and the rate of new product development: an empirical study of entrepreneurial biotechnology firms. J Bus Ventur 11(1):41–55

Dyer JH, Singh H (1998) The relational view: cooperative strategy and sources of inter-organizational competitive advantage. Acad Manag Rev 23(4):660–679

Dyer JH, Singh H, Kale P (2008) Splitting the pie: rent distribution in alliances and networks. Manag Decis Econ 29(2 3):137–148

Freeman LC (1979) Centrality in social networks: conceptual clarification. Soc Netw 1(3):215–239

Galbraith J (1977) Organization design. Addison-Wesley, Boston

Glancey K (1998) Determinants of growth and profitability in small entrepreneurial firms. Int J Entrepreneurial Behav Res 4(1):18–27

Goerzen A (2007) Alliance networks and firm performance: the impact of repeated partnerships. Strategic Manag J 28(5):487–509

Granovetter M (1985) Economic action and social structure: the problem of embeddedness. Read Econ Sociol 91(3):63–68

Gresov C, Stephens C (1993) The context of inter-unit influence attempts. Admin Sci Q 38(2):252–276

Gulati R (1998) Alliances and networks. Strategic Manag J 19:293–317

Gulati R (1999) Network location and learning: the influence of network resources and firm capabilities on alliance formation. Strategic Manag J 20(5):397–420

Gulati R, Gargiulo M (1999) Where do interorganizational networks come from? Am J Sociol 104(5):1439–1493

Gulati R, Nohria N, Zaheer A (2000a) Guest editors’ introduction to the special issue: strategic networks. Strategic Manag J 21(3):199–201

Gulati R, Nohria N, Zaheer A (2000b) Strategic networks. Strategic Manag J 21(3):203–215

Hambrick DC, Cho TS, Chen MJ (1996) The influence of top management team heterogeneity on firms’ competitive moves. Admin Sci Q 41(4):659–684

Hargadon A, Sutton RI (1997) Technology brokering and innovation in a product development firm. Admin Sci Q 42(4):716–749

Hoffmann WH (2005) How to manage a portfolio of alliances. Long Range Plan 38(2):121–143

Hoffmann WH (2007) Strategies for managing a portfolio of alliances. Strategic Manag J 28(8):827–856

Kanter RM (1994) Collaborative advantage: the art of alliances. Harv Bus Rev 72(4):96–108

Kim YM (2005) Board network characteristics and firm performance in Korea. Corp Gov Int Rev 13(6):800–808

Koka BR, Prescott JE (2002) Strategic alliances as social capital: a multidimensional view. Strategic Manag J 23(9):795–816

Koka BR, Prescott JE (2008) Designing alliance networks: the influence of network position, environmental change, and strategy on firm performance. Strategic Manag J 29(6):639–661

Lavie D (2007) Alliance portfolios and firm performance: a study of value creation and appropriation in the US software industry. Strategic Manag J 28(12):1187–1212

Lecocq C, Van Looy B (2009) The impact of collaboration on the technological performance of regions: time invariant or driven by life cycle dynamics? Scientometrics 80(3):845–865

Lee C, Lee K, Pennings JM (2001) Internal capabilities, external networks, and performance: a study on technology based ventures. Strategic Manag J 22(6–7):615–640

Oliva FL, Sobral MC, dos Santos SA, de Almeida MIR, de Grisi CCH (2011) Measuring the probability of innovation in technology-based companies. J Manuf Technol Manag 22(3):365–383

Oliver AL (2001) Strategic alliances and the learning life-cycle of biotechnology firms. Org Stud 22(3):467–489

Owen-Smith J, Powell WW (2004) Knowledge networks as channels and conduits: the effects of spillovers in the Boston biotechnology community. Org Sci 15(1):5–21

Padula G (2008) Enhancing the innovation performance of firms by balancing cohesiveness and bridging ties. Long Range Plan 41(4):395–419

Parise S, Casher A (2003) Alliance portfolios: designing and managing your network of business-partner relationships. Acad Manag Executive 17(4):25–39

Pelled LH, Eisenhardt KM, Xin KR (1999) Exploring the black box: an analysis of work group diversity, conflict, and performance. Admin Sci Q 44(1):1–28

Perry-Smith JE, Shalley CE (2003) The social side of creativity: a static and dynamic social network perspective. Acad Manag Rev 28(1):89–106

Pfeffer J, Salancik G (1978) The external control of organizations. Harper and Row, New York

Podolny JM, Stuart TE (1995) A role-based ecology of technological change. Am J Sociol 100(5):1224–1260

Powell WW, Koput KW, Smith-Doerr L (1996) Inter-organizational collaboration and the locus of innovation: networks of learning in biotechnology. Admin Sci Q 41(1):116–145

Rodan S, Galunic C (2004) More than network structure: how knowledge heterogeneity influences managerial performance and innovativeness. Strategic Manag J 25(6):541–562

Schilling MA, Phelps CC (2007) Inter-firm collaboration networks: the impact of large-scale network structure on firm innovation. Manag Sci 53(7):1113–1126

Stuart TE (2000) Inter-organizational alliances and the performance of firms: a study of growth and innovation rates in a high technology industry. Strategic Manag J 21(8):791–811

Swaminathan V, Moorman C (2009) Marketing alliances, firm networks, and firm value creation. J Mark 73(5):52–69

Tsai W (2001) Knowledge transfer in intra-organizational networks: effects of network position and absorptive capacity on business unit innovation and performance. Acad Manag J 44(5):996–1004

Uotila J, Maula M, Keil T, Zahra SA (2009) Exploration, exploitation, and financial performance: analysis of S&P 500 corporations. Strategic Manag J 30(2):221–231

Uzzi B (1996) The sources and consequences of embeddedness for the economic performance of organizations: the network effect. Am Sociol Rev 61(4):674–698

Uzzi B (1997) Social structure and competition in inter-firm networks: the paradox of embeddedness. Admin Sci Q 42(1):35–67

Walker G, Kogut B, Shan W (1997) Social capital, structural holes and the formation of an industry network. Org Sci 8(2):109–125

Wassmer U (2010) Alliance portfolios: a review and research agenda. J Manag 36(1):141–171

Wassmer U, Dussauge P (2011) Value creation in alliance portfolios: the benefits and costs of network resource interdependencies. Eur Manag Rev 8(1):47–64

Wu X, Wei Y (2004) The analysis on competitive advantage of firms in the context of synergic development: Based on the perspective of social capital. In Proceedings from the 2004 International Eng. Manage. Conference, Singapore

Zaheer A, Bell GG (2005) Benefiting from network position: firm capabilities, structural holes, and performance. Strategic Manag J 26(9):809–825

Zaheer A, Venkatraman N (1995) Relational governance as an inter-organizational strategy: an empirical test of the role of trust in economic exchange. Strategic Manag J 16(5):373–392

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kim, HS., Choi, SY. Technological alliance portfolio configuration and firm performance. Rev Manag Sci 8, 541–558 (2014). https://doi.org/10.1007/s11846-013-0117-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11846-013-0117-1

Keywords

- Strategic alliance

- Alliance portfolio

- Social network analysis

- Two-step generalized method of moments (GMM)