Abstract

In order to expand the pool of opportunity and access external R&D, many pharmaceutical firms have accumulated portfolios of alliances with other industry participants over the past decade. Academic research has amply demonstrated that such alliance portfolios can contribute to firm innovativeness and profitability. Yet, alliance portfolios don’t always pay off and much remains to be done to arrive at a theory of effective alliance portfolio management. This chapter pursues a number of contributions to this area. First, the author offers an overview of the key dimensions of portfolio management: scale, partners, governance, technology diversity, cost, and dynamics. Second, the author singles out the technological diversity of the alliance portfolio and elaborates on its definition and measurement. Third, the author addresses three challenges that relate to managing technologically diverse alliance portfolios in the pharmaceutical industry. The first challenge is theoretical in nature: the author contrasts two competing theoretical perspectives that raise different expectations with regard to optimal portfolio diversity, and he motivates why the real options perspective may prove to outperform the learning theory perspective. The second challenge stems from the observation that not all firms benefit equally from similar levels of alliance portfolio diversity: the author argues that such differences across firms can be explained by differences in the commitment of managerial resources to implementing a portfolio strategy and by differences in internal routines and capabilities. The third challenge relates to the changing nature of collaboration: the evolution of biotechnology as a scientific field, the emergence of nanotechnology, the increasing potential of personalized medicine, and particular institutional changes such as healthcare reforms have reshaped the pharmaceutical landscape and require novel approaches to alliance portfolio management.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

5.1 Introduction

Pharmaceutical firms rely increasingly on external R&D as they organize and restructure to optimize their pipelines. Eli Lilly, for example, is transforming itself from a fully integrated pharmaceutical company to a fully integrated pharmaceutical network to “expand the pool of opportunity” (Lechleiter 2010). There are many ways in which pharmaceutical firms can expand the pool of opportunity.

First, the licensing exchange market offers opportunities as pharmaceutical firms can purchase, or license-in, externally developed technology. For years, licensing agreements have been a primary source of opportunity for many pharmaceutical firms to build and sustain their drug pipelines (Simonet 2002).

Another route to internalize externally developed knowledge is by acquiring the entire dedicated technology company. Especially pharmaceutical firms that face reduced internal productivity tend to acquire other firms to replenish their research pipelines (Higgins and Rodriguez 2006). Zhao (2009) finds that while reduced innovativeness motivates a firm to engage in acquisitions, acquisitions in turn do more than only compensate for the decrease in innovativeness and also effectively increase the firm’s innovation efforts.

A third route to benefit from external knowledge is by allying with other industry partners and jointly developing new technologies. In this chapter, I focus on such alliances and I will argue that alliances offer the benefit of strategic flexibility, as opposed to purchasing licenses or acquiring companies. Eli Lilly, for example, has formed a Corporate Business Development group for forming alliances to innovate more efficiently and more effectively (Eli Lilly 2011).

As companies are increasingly engaging in alliance activities to expand the pool of opportunity, a new phenomenon has emerged: the alliance portfolio, which refers to a firm’s collection of alliances. The effects of alliance portfolios on firm innovativeness and profitability have been studied in strategy and organization behavior (e.g., Hoffmann 2007; Ozcan and Eisenhardt 2009; Sarkar et al. 2009; Wassmer 2010) as well as marketing (Cui 2013; Cui and O’Connor 2012; Wuyts and Dutta 2008; Wuyts et al. 2004a). This domain of research is important, for at least two reasons.

First, from an academic perspective, the study of alliance portfolios in the pharmaceutical industry can be approached from different perspectives, all of which have their merit: a resource perspective, as alliances are vehicles to access external resources that may complement internal resources; a relational perspective, as alliance portfolios offer unique governance problems; a risk perspective, as alliance portfolios, if properly designed, serve a risk reduction function; and a cost perspective, as the cumulative investment costs associated with expansive alliance portfolios can be very substantial.

Second, from a managerial perspective, pharmaceutical companies differ in terms of their understanding of the phenomenon and their ability to shift focus from an alliance approach to a portfolio approach. Even if they do realize that a portfolio is more than the sum of its parts, not all firms are equally equipped to reap the benefits from their alliance portfolios.

In this chapter, I will first derive key dimensions of alliance portfolio management on the basis of previous research. Subsequently, I will single out the technological diversity of the alliance portfolio as my focus of attention. Diversity exposes the firm to nonredundant knowledge, which in turn contributes to firm innovativeness and performance. Its importance in a science-based field such as the pharmaceutical industry is illustrated by GlaxoSmithKline’s (GSK’s) business development strategy: “Our Worldwide Business Development group is a global team of scientific, transaction, and alliance management experts building diverse collaborations relating to compounds (early stage discovery programs through to marketed products) and technologies” (GlaxoSmithKline 2011—italics added).

Interestingly, the literature has not been conclusive regarding the effects of portfolio diversity. First, I argue that this can be partly explained by the use of problematic proxy measures for technology diversity; hence, I will contrast technology diversity with other facets of diversity. Second, the lack of generalizable insights can be caused by (1) imperfect behavioral assumptions of established theories, (2) a lack of attention to firm differences, and (3) the changing nature of collaboration in the pharmaceutical industry. After contrasting technology diversity with other facets of diversity, I elaborate on these three challenges.

The first challenge consists of contrasting competing perspectives on why firms benefit from portfolio diversity. I focus on two alternative perspectives: the learning perspective and the real options perspective. The learning perspective holds that firms seek to assimilate knowledge from their individual alliance partners. The real options perspective holds that firms consider their alliances as real options on new products under uncertainty and form diverse alliances to spread their bets and delay choice until uncertainty is resolved. This comparison of theories is more than a thought exercise as learning theory and real options theory lead to different implications as to the composition of an optimal alliance portfolio.

A second challenge is to acknowledge firm differences. While not all firms benefit equally from portfolio diversity, firm differences are not commonly accounted for in interfirm network studies. I argue that differences among firms in their commitment of managerial resources to portfolio management and in their internal R&D strategies help explain why some firms benefit more than other firms from portfolio diversity.

A third challenge is more contextual: technological developments such as the rise of nanotechnology and institutional developments such as healthcare reforms change the very nature of collaboration and alliance portfolios in the pharmaceutical industry. From a discussion of these three questions, I will derive next steps for academic research as well as recommendations for managers in the pharmaceutical industry.

5.2 Key Dimensions of Portfolio Management

The literature has identified four principal dimensions of portfolio management that relate to scale, partners, governance, and technology. The literature has been remarkably silent on two other relevant dimensions, namely the costs and dynamics associated with alliance portfolio management (see Wassmer’s 2010 review article for a notable exception).

The first portfolio descriptor relates to the scale of the alliance portfolio, mostly operationalized as portfolio size (Goerzen 2007; Hoffmann 2007; Wuyts et al. 2004a). Portfolio size is a simple count of the number of alliances that make up the portfolio and gives a first impression of access to external knowledge.

The second core descriptor relates to the partners that are selected for the respective alliances. Apart from some obvious partner descriptors, such as the need for high-quality partners (Rothaermel 2001), the most prominent variable that describes the mix of partners in an alliance portfolio is repeated partnering (Goerzen 2007; Jiang et al. 2010; Wuyts et al. 2004a). The key insight is that collaborating repeatedly with the same partners helps in transferring knowledge but constrains accessing novel knowledge. Wuyts et al. (2005) provided empirical support for an inverted-U effect of repeated partnering on the value of learning.

The third key dimension relates to the governance of the alliances that make up the alliance portfolio. Prior research shows that firms in knowledge-intensive industries should balance strong and weak ties because weak ties help firms stay ahead of developments in novel knowledge domains (Uzzi 1997; Rowley et al. 2000).

A fourth key descriptor is the portfolio’s technological diversity (Wuyts et al. 2004a), sometimes referred to as efficiency (Hoffmann 2007). Other scholars have identified other forms of diversity such as industry diversity (or dispersion, see Hoffmann 2007), product market diversity (Ansoff 1958), and governance diversity (Jiang et al. 2010).

The fifth dimension of portfolio management, costs, has received less attention. Portfolio management, however, requires not only opportunity management but also cost management. Allying with new alliance partners increases partner qualification, coordination, and governance costs; diversifying across technological fields increases investment costs, such as training and educating employees, investing in equipment and machinery, and initial investments in the alliance partner.

Finally, also the sixth dimension has received very little attention: alliance portfolio management is intrinsically dynamic. On the one hand, firms should stay on the lookout for new opportunities in rapidly developing fields and be prepared to adapt to changes in the technological environment. On the other hand, even a snapshot of an alliance portfolio will reveal a dynamic aspect: alliances are signed at different stages of the new drug development process. Early literature on technology portfolio management in marketing already suggested that firms should strive for a balanced allocation of resources along the stages of technology development (Capon and Glazer 1987, p. 10). Following a similar logic, one can infer that an alliance portfolio should balance early and late stage alliance projects to sustain a balanced drug pipeline. This inference, however, lacks empirical substantiation and requires further study.

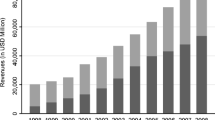

Assembling the pieces, alliance portfolio management should incorporate the dimensions of scale, partners, governance, technology, costs, and dynamics (see Fig. 5.1). Clearly, these dimensions are not orthogonal. A portfolio that covers a large diversity of technologies tends to be very costly, which is illustrated by Wuyts et al.’s (2004a) finding that the profitability of technological diversity can be decomposed into a positive effect via radical product innovation and a direct negative direct effect that is likely caused by high investment costs. Also, technological diversity can drive dynamic adaptation as technological diversity increases the firm’s ability to identify and select new external opportunities, a finding often ascribed to the firm’s increased absorptive capacity (Cohen and Levinthal 1990). When discussing Challenge 2 below, I will elaborate on new advances in the absorptive capacity literature (e.g., King and Lakhani 2011; Lewin et al. 2011) that are helpful in this regard.

Having laid out different dimensions of alliance portfolio management, I now narrow down the focus in this chapter to the key role of diversity in portfolio strategy. Below, I will first discuss several facets of diversity and motivate my focus on technology diversity. Then, I will discuss three new challenges that we face today as we try to grasp the true effects of technology diversity in the pharmaceutical industry.

5.3 The Diverse Facets of Diversity

Diversity is a concept that has received much attention in the strategy literature. The multifaceted nature of diversity, however, has been insufficiently acknowledged. Different studies have examined different forms of diversity, including technology diversity, partner diversity, industry diversity, and product market diversity. Arriving at generalizations about diversity is difficult if these differences in conceptualizations and operationalizations are not accounted for. In particular, I focus on how technological diversity differs from the two most common alternative diversity constructs, namely (1) partner diversity and (2) industry or market diversity.

5.3.1 Technology Diversity

An examination of trade and academic literature, as well as prior conversations with industry professionals, has indicated that the main motivation for pharmaceutical firms to build alliance portfolios is to stay ahead of the technological developments. Despite the large body of research on diversification and the economic importance of technology-intensive industries, there is relatively little systematic evidence with regard to technology diversity. Technologically diversified firms spread their technology development efforts across a diverse range of technology domains (e.g., Miller 2006). A few prior studies underscore its key role in corporate economics (e.g., Granstrand 1998) and suggest that technology diversity enables the firm to take options on technological opportunities (Pavitt et al. 1989) and contributes to firm performance (Suzuki and Kodama 2004). Unfortunately, researchers have been very liberal in their measurement of technological diversity, using proxy measures as diverse as partner diversity and industry diversity, making it difficult to arrive at empirical generalizations.

5.3.2 Partner Diversity

Partner diversity refers to forging agreements with different partners rather than with the same partners over time.Footnote 1 Partner diversity is thus the counterpart of repeated partnering (Wuyts et al. 2004a). In the network literature, partner diversity has often been interpreted as a proxy for access to non-redundant knowledge bases (Reagans and Zuckerman 2008). This quite impressive leap from construct to measure is often justified on the basis of the strength-of-weak-ties argument which holds that weak ties are more likely to give access to non-redundant knowledge bases. This argument emerged as a post hoc interpretation of unexpected research findings in a study on simple bits of information, namely job leads (Granovetter 1973).

When knowledge is more complex, however, weak ties have the disadvantage that they are not effective as vehicles for knowledge transfer (Hansen 1999). It is an important insight that what makes weak ties interesting in situations, such as those analyzed by Granovetter, is not their inherent weakness itself but essentially the non-redundancy that they are associated with. Consequently, non-redundancy turned into a core concept in later network literature, such as in structural holes theory (Burt 1992) and bridging theory (DiMaggio 1992; McEvily and Zaheer 1999).

Using partner diversity as a measure of non-redundancy of knowledge bases is problematic. First, one partner may work in diverse technology domains simultaneously and keep up or even shape the scientific developments in those domains over time, making it a useful source of non-redundant knowledge for the allying firm. Second, switching partners regularly does not necessarily expose the allying firm with non-redundant knowledge bases as all partners may be active in the same technology domain and have similar technological expertise. Third, partner diversity captures also relational elements that influence collaboration. Collaborating regularly with the same partners can lead to better knowledge transfer and the development of trust (Wuyts et al. 2004a). In sum, not only is partner diversity likely a flawed proxy for non-redundancy, its effects on firm innovativeness and performance mask possibly contrasting sub-effects if relational factors are not explicitly accounted for.

5.3.3 Industry and Product Market Diversity

The most commonly studied type of diversification is industry diversification (e.g., Montgomery 1985), calculated on the basis of industries entered into by the firm (mostly defined in terms of 4-digit SIC codes). Some studies on industry diversification have argued that it confers competitive advantages (e.g., Caves 1981), but according to other studies it reduces the firm’s competitive position in each individual industry because of a lack of resource commitment (e.g., Montgomery 1985).

The decision to enter new product markets is, however, more at the core of day-to-day managerial decision making than the decision to enter new industries. Interestingly, it has been argued that the benefits of diversification are most apparent when diversifying within a given industry (Soni et al. 1993; Stern and Henderson 2004; Varadarajan 1986). Ansoff (1958) conceptualized product market diversity as the product market makeup of the firm, where a market is defined in terms of “the job which the product is intended to perform” (p. 393).

For instance, drugs that reduce blood pressure, such as ACE-inhibitors, differ along different submarkets. While some patients are in need of an ACE-inhibitor only, an ACE-inhibitor with a diuretic is targeted at patients with kidney problems, implying different product markets based on different patient needs. While related, product market diversity differs from technology diversity. Product market diversity relates to the variety of downstream patient groups that the pharmaceutical company targets, whereas technology diversity relates to the upstream technology domains that the pharmaceutical firm draws from to serve its target markets.

In the excerpt below, I briefly summarize a research project that was focused on pharmaceutical firms’ internal product market diversification and technology diversification. A key take-away is that while product market diversity and technology diversity are related, they are empirically distinct constructs that exert separate effects on firm profitability. More precisely, their effects are positive and log-linear, indicating decreasing returns to diversification. The log-linear nature of the effects may be explained by the focus in this study on internal rather than external diversification: internal resource constraints may cause resource allocation problems when diversifying internal R&D too intensively. Since externalizing R&D provides firms with access to external resources, an effective response to internal resource constraints, the positive log-linear effects of internal technology diversity may not generalize to alliance portfolio diversity.

Illustration: Technology Diversity Versus Product Market Diversity

To substantiate that different forms of diversity are empirically distinguishable, I briefly reflect on a pharmaceutical study into the performance consequences of product market diversity and technology diversity (Wuyts et al. 2010). The study is limited to diversity within firm boundaries and corroborates that technology diversity differs empirically from closely related forms of diversity.

Product market diversity is likely a profitable strategy. A pharmaceutical firm with a strong reputation in a given therapeutic class, access to distribution channels, and accumulated knowledge on testing and approval procedures may carry over these benefits to any new product market it enters giving it an edge over less experienced competitors. Also technology diversity is likely a profitable strategy as it is associated with experimentation and recombination, better match with customer requirements, and more valuable innovations, all of which increase performance (Argyres 1996; Clark and Fujimoto 1991; Kodama 1992). Because of internal resource commitments, firms likely experience decreasing returns to further internal diversification: we expect log-linear effects of diversity on profitability.

To test whether both types of diversity exert separate effects on performance, we analyzed 29 pharmaceutical firms over 2 decades (1982–2001). The firms produced around 80 % of the drugs listed in the Food and Drug Administration (FDA) database and close to 75 % of the patents owned by all pharmaceutical firms. We operationalize “product markets” as therapeutic classes. For each sample firm, we collect information on its approved new drugs (NDAs) from the U.S. FDA. Following Ellison et al. (1997), we use the Uniform System of Classification (USC) of Intercontinental Medical Statistics (IMS) which categorizes drugs into therapeutic classes on the basis of 5-digit codes. The degree of therapeutic substitutability is much greater within than across these therapeutic classes. For example, the anti-infective drugs Keflex and Ceclor (Eli Lilly), Duricef and Ultracef (Bristol Myers Squib), and Velosef and Anspor (SmithKline Beecham) share the same USC code (15310) and are close therapeutic substitutes (Ellison et al. 1997). On the basis of therapeutic classes, we construct an entropy measure of product market diversity (Palepu 1985). Our measure of technology diversity is based on patent classes, which capture the notion of distinct “technological areas” (Lerner 1994; Moser and Nicholas 2004). Much of the pharmaceutical industry’s intellectual property is captured in patents. Patent information and classifications are obtained from the US Patent and Trademark Office (USPTO) and Community of Science (COS) databases for the sample firms. Each patent is assigned a 9-digit US classification code by USPTO, which corresponds to a position within the hierarchical technology classification system. This system has been used in a number of papers to study issues related to innovation and technology (e.g., Lerner 1994; Moser and Nicholas 2004; Paruchuri 2010). Analogous to the measure of product market diversity, we apply an entropy measure for technology diversity. Profitability is measured as Return on Assets on the basis of COMPUSTAT databases.

We find that product market diversity and technology diversity are related, as their correlation is 0.49. Regression analysis showed, however, that they are distinct as both exert a separate positive significant log-linear effect on profitability. The effects remain unchanged when we include control variables (advertising, R&D, and capital intensity) or when we estimate more complex system models where both types of diversity are endogenized.

5.4 Technological Diversity of Alliance Portfolios in the Pharmaceutical Industry: Three Challenges

Having addressed the multifaceted nature of diversity and singled out technology diversity, I now turn to three challenges that need to be addressed to advance our knowledge on technology diversity in alliance portfolios in the pharmaceutical industry.

5.4.1 Challenge 1: Competing Theoretical Perspectives

In order to understand the consequences of a diverse alliance portfolio, insight into firm motivations is essential, especially in case different theoretical perspectives lead to different normative recommendations. As much of the prior alliance literature has relied on learning theory, several authors source from learning theory to study alliance portfolios. The learning perspective suggests that an alliance should be arranged such that knowledge transfer and integration are optimized. That perspective has important consequences. If each alliance should allow for knowledge transfer, all ties should be strong given the scientific nature of knowledge.

Building portfolios of strong ties, however, severely constrains the level of diversity one firm can manage: close ties require time and resource commitments, and mobilizing and coordinating knowledge transfer is difficult (Koka and Prescott 2008). In addition, on top of time and resource constraints, assimilating knowledge from very diverse partner firms creates problems of overload and complexity (Ahuja and Lampert 2001). Further, learning theory has highlighted the importance of knowledge integration and recombination, which again constrains the level of diversity any firm should pursue: assimilating and integrating highly diverse knowledge from technology domains, more diverse than a single firm can manage, can pose insurmountable difficulties (Fleming and Sorenson 2001). If learning theory applies and these hindrances add up, a diverse alliance portfolio creates unwieldy management structures (Goerzen and Beamish 2005). Following this line of logic, Phelps (2010) recently argued that diversity is beneficial at moderate levels (i.e., an inverted-U-shaped effect). Interestingly, though, he did not find empirical support for that argument; on the contrary, Phelps found evidence for a positive linear effect. Since this finding rejects the arguments derived from learning theory, we may want to look for alternative explanatory theories.

Interestingly, the assumptions of knowledge assimilation in each alliance and integration across alliances also seem to contradict what we observe in practice, i.e., large pharmaceutical firms’ actual strategies. Pharmaceutical firms increasingly incorporate options in their deal structures (Ernst & Young 2010): they make initial investments in risky alliances with the option to further invest in the future, when uncertainty is reduced and the most promising alliances can be identified. Option logic in alliance portfolio management thus refers to the possibility to postpone choice.

Option-based collaborations are the primary vehicle for GSK to develop new medicines, as indicated by the following quote from their Worldwide Business Development brochure: “We seek organizations that have a robust discovery engine and the capability of developing compounds to clinical proof of concept, at which point GSK would have the option for further development and commercialization” (italics added). This approach is quite different from SmithKline Beecham’s approach in the 1990s when it determined project portfolio composition and resource allocation in one and the same phase (Sharpe and Keelin 1998). A real options approach implies that (part of) resource allocation decisions are postponed to a later phase.

Similar to GSK, Eli Lilly makes equity investments in promising emerging companies that have the potential to contribute to firm value in the long run (Lechleiter 2010). As a final example, Novartis allies with biotechnology firms in diverse technology domains to increase the likelihood that some of these alliances will successfully produce superior drugs (Novartis Venture Fund activity reports). In sum, pharmaceutical firms do not seem to consider each alliance as a source of knowledge that should be assimilated and integrated, contrary to what learning theory assumes; rather, they increasingly adopt a real options perspective with regard to their alliance portfolio to more effectively deal with risk.Footnote 2

Formally, an investment in a real option (a particular domain of knowledge) conveys the right, but not the obligation, for a firm to make further investments or defer such investments in the future (McGrath and Nerkar 2003). Real options reasoning can be applied in any context characterized by uncertainty regarding the link between investments and outcomes, time dependence of future events on current decisions, and a possibility to exercise options (Chatterjee et al. 1999; Kogut and Kulatilaka 1994).

Central to real options reasoning is that the value of an options portfolio increases with its diversity. If real options reasoning is adopted by most firms, we should expect a positive linear or even convex effect of portfolio diversity on profitability. Arguably, not all firms choose to strategically bet on different horses; it is well accepted that specialization can also be beneficial as firms gain in-depth knowledge that may give them a competitive edge (Fleming 2001; Katila and Ahuja 2002). Given the observations in managerial practice, in particular in evolving science-based industries such as pharmaceuticals, the effect of portfolio diversity on profitability may well be U-shaped, where the most profitable firms are those that gain a competitive edge by specializing in only a few technology domains and those that spread their bets by taking real options in diverse technology domains. Firms that fail to specialize or diversify are stuck in the middle.

In conclusion, alternative theoretical perspectives lead to vastly different expectations. The very scant empirical evidence does not appear to support the learning theory perspective; moreover, observations of managerial practice suggest that pharmaceutical firms have increasingly adopted a real options perspective, which is based on different behavioral assumptions. More empirical research is required to contrast alternative perspectives, and in particular to examine the explanatory power of real options theory, in order to derive informed managerial recommendations. In his recent review paper on alliance portfolios, Wassmer (2010) calls for more research on the profitability consequences of alliance portfolio composition. I suggest we start with improving our understanding of technological diversity.

Importantly, there may also be an additional reason why previous research studies have not delivered clear-cut generalizations: firms differ. Some firms are better equipped than other to benefit from a diverse alliance portfolio, but we know very little about firm heterogeneity. What distinguishes those firms that not only compose diverse alliance portfolios but also manage to reap the benefits? This question brings us to Challenge 2.

5.4.2 Challenge 2: Firm Heterogeneity

Not all firms benefit equally from alliance portfolio diversity. Yet, the portfolio literature has not paid much attention to firm differences. A possible explanation is that the portfolio literature draws on network theory, where characteristics of the actors are seldom accounted for (a limitation of the literature that is often referred to as “over-socialization”). The lack of attention to firm characteristics contrasts sharply with the key role of firm differences in the innovation and strategy literature. An important challenge that needs to be addressed to advance our understanding of alliance portfolios is to explicitly account for firm heterogeneity. Below, I argue that differences across firms in terms of (1) managerial resources committed to portfolio management and (2) the presence of internal routines to deal with extramural knowledge help explain why some firms benefit more from a diverse alliance portfolio than other firms.

First, when firms take a portfolio perspective, they need to commit appropriate managerial resources. The commitment of managerial resources is likely to improve the articulation and implementation of a portfolio strategy as well the evaluation of its performance. Bamford and Ernst (2002) underscored the importance of top level involvement in alliance portfolio management: “Unless a corporate executive accepts responsibility for overseeing all or most of a company’s alliances, no one will take the time to identify broader performance patterns or to assess the company’s alliance strategy” (p. 31). Eli Lilly recognizes that alliance portfolios risk becoming a drain on valuable resources if not sustained by top management: “we at Lilly must maintain a focus on the core capabilities and senior management skills necessary to manage a diverse and growing portfolio” (Lechleiter 2010, p. 23).

Recent studies in the marketing field have pointed to the key role of top management in explaining differences in innovativeness across firms. Yadav et al. (2007) find that the future focus of banks’ CEOs hastens their adoption of online banking, while Rao et al. (2008) report that, in the biotechnology context, the composition of a firm’s board of directors (i.e., the presence of technical directors) increases abnormal stock returns to new product announcements. Finally, Wuyts and Dutta (2008) find that biotechnology firms’ position in the network of interlocked directory boards influences their success with obtaining new licensing deals. Thus, there is ample evidence that top management plays a role in explaining differences in innovativeness and performance, opening up a research opportunity for portfolio studies.

Second, the company should also have the appropriate internal routines to deal with the exposure to diverse technological knowledge that results from portfolio diversity. One of the flagships of successful drug co-development, Merck Research Laboratories, attributes its successful external knowledge sourcing strategy to its internal innovative strategy (Pisano 2002). Even though academic scholars have acknowledged for quite some time that internal strategic choices and capabilities affect a firm’s ability to screen external opportunities (Arora and Gambardella 1994; Veugelers and Cassiman 1999), very little progress has been made both from a theory and from an empirical point of view.

Interestingly, however, very recent advances in the absorptive capacity literature offer a theoretical angle that may help revive the research that links internal firm characteristics with external knowledge sourcing. According to the traditional notion of absorptive capacity (Cohen and Levinthal 1990), direct associations between a firm’s internal knowledge and external knowledge aid in the assimilation, transfer, and use of new knowledge. A more recent insight that is gaining acceptance in the absorptive capacity literature, however, is that firms’ ability to value and absorb external knowledge is a function of higher-order internal routines (i.e., behavioral regularities that result from cumulative experiences). These routines constitute the building blocks of firm capabilities that are essential in benefiting from external linkages. Lewin et al. (2011) consider the internal higher-level routines for managing variation and selection as critical for the development of absorptive capacity. King and Lakhani (2011) focus on internal invention as a way to learn about alternative problem-solving modes that can subsequently be practiced when confronted with external ideas.

Admittedly, the discussions of higher-order routines and capabilities are rather abstract; moreover, they are inherently intangible and notoriously difficult to measure: these are serious hindrances for empirical testing (Lewin et al. 2011). How can the recent insights from the absorptive capacity literature be used to derive actionable managerial recommendations? Future research on alliance portfolios and firm capabilities should highlight what concrete firm actions or strategies help generate the routines and capabilities that facilitate external knowledge sourcing. As mentioned earlier, routines result from accumulated experiences. What are the firm actions that produce these experiences? If we can identify firm actions that help build the routines for valuing extramural knowledge, we can derive concrete recommendations that help managers benefit from an alliance portfolio.

The most logical starting point, in my view, is to examine the strategies that firms employ to generate knowledge internally. These strategies generate experiences that help value extramural knowledge. In order to identify what strategies may be most effective to this end, we need to understand the challenges of dealing with a diverse alliance portfolio. For example, Ahuja and Lampert (2001) identify three organizational pathologies in the realm of breakthrough innovations: “a tendency to favor the familiar over the unfamiliar; a tendency to prefer the mature over the nascent; and a tendency to search for solutions that are near to existing solutions rather than search for completely de novo solutions” (p. 522). The diversity of alliance portfolios and the associated need for a broad outlook on the technological field form a fourth challenge. Firms that organize their internal knowledge creation strategy to meet these four challenges may build the necessary routines to benefit from a diverse alliance portfolio (see Wuyts and Dutta 2012 for a further elaboration of these ideas and first evidence from the biopharmaceutical industry).

5.4.3 Challenge 3: The Changing Nature of Collaboration

A third challenge for alliance portfolio research and practice is particular to the pharmaceutical industry: technological and institutional developments will likely change the nature of collaboration. The evolution of biotechnology, the emergence of nanotechnology, the notion of personalized medicine, and industrial and institutional changes are among the factors that change the nature of collaboration.

Evolution of biotechnology. When biotechnology emerged as a commercially viable path to developing new drugs in the mid 1980s, pharmaceutical firms sought to keep track of the emerging technological field by allying with biotechnology firms. Even though still today there is a functional divide between biotechnology firms and pharmaceutical firms in the industry, the distinction is not as clear-cut as several pharmaceutical firms developed strong biotechnology capabilities by the end of the 1990s (Vassolo et al. 2004). This change in the functional divide of the industry has implications for the nature of collaboration.

The development of a science-based industry naturally follows a pattern similar to the development of science itself. The latter is discussed in the philosophy of science and in particular in the literature on paradigms. A new paradigm fundamentally alters the approach used for search and problem-solving; thus, biotechnology can be categorized as a genuine new paradigm. It is intrinsic to scientific development that after the emergence of a new paradigm, a period of paradigm refinement and articulation is required as paradigms are open-ended, leaving many things unexplained (Kuhn 1962). Translated to the rise of biotechnology in the pharmaceutical industry, arguably the late 1980s and the 1990s correspond to the emergence of the paradigm in this industry. If the year 2000 denotes approximately the moment where biotechnology has become ingrained in the capabilities of pharmaceutical firms, the last decade is characterized by paradigm development and refinement.

Put differently, biotechnology has gradually moved from an emerging technological field to an established (developing) field. This development is important for both the study and management of firms in the biopharmaceutical industry, as an emerging technological field is characterized by exceptional uncertainty and complexity (Macher 2006) and the nature of scientific inquiry (e.g., persistence in a particular area of research and sensitivity to social dynamics of the research community) differs in early versus late stages of an emerging field (Rappa and Debackere 1995). In sum, even though there are no signs that the technological developments in biotechnology will abate in the near future, the way biotechnology firms as well as pharmaceutical firms select and collaborate with their partners is likely different from the 1980s and 1990s, i.e., from the period that has been subject to empirical scrutiny.

Emergence of nanotechnology. While many pharmaceutical firms continue to invest in biotechnology, other scientific fields are emerging. First, since the 2001 US National Nanotechnology Initiative, nanotechnology is becoming more and more important. Also in the pharmaceutical industry, nanoparticles have different areas of application, such as in biomarkers and diagnostics for early disease detection and drug delivery and efficacy improvements (Netzsch Fine Particle Technology, 2008).Footnote 3 Pharmaceutical companies consider nanotechnology a promising platform to improve drug design and streamline drug development (Hobson 2009). The consequences of nanotechnology for pharmaceutical firms may not be clear-cut, yet it is worthwhile to follow up on this emerging scientific field in the study of alliance portfolios.

Personalized medicine. Another potentially interesting development relates to the increasing potential of personalized medicine. Most of the prior literature on innovativeness in the pharmaceutical industry, including the studies on alliance portfolios, focused on the generation of radical innovations or blockbuster drugs. Some have argued, however, that if the promise of personalized medicine is to materialize, new business models are required that are not focused on the quest for one winner but rather on the creation of a broad palette of more effective and profitable, targeted treatments (Aspinall and Hamermesh 2007). Such a development may have consequences for optimal portfolio management. Technological uncertainty coupled with resource restrictions will likely continue to motivate pharmaceutical firms to take options on alternative technologies. However, once select options are exercised, their exploitation may differ if the desired outcome is no longer a one-fits-all drug but a series of variants on a particular treatment.

Industry and institutional change. Pharmaceutical firms are confronted not only with scientific developments but also with a changing industry environment. Recent developments in IT and telecommunications have stimulated pharmaceutical firms to forge alliances with players in other industries (Ernst & Young 2010). To obtain a full picture of a firm’s alliance portfolio, researchers as well as managers will have to look beyond the biopharmaceutical industry. Possibly, new portfolio constellations will consist of multiple sub-portfolios (e.g., sub-portfolios in biotechnology, nanotechnology, and ICT), bringing additional complexity to resource allocation decisions. The risk for unwieldy management structures (Goerzen and Beamish 2005) as well as the need for top management guidance and strong internal routines and capabilities may become even more pronounced.

Finally, the alliance literature has been remarkably silent on the role of the institutional environment. Yet, future research on alliance portfolios may need to account for the dramatic changes that the institutional environment is experiencing, at least in the United States. To give one example, healthcare reforms have changed the nature of individual partnerships where contractual milestones that were previously related to clinical-trial outcomes only, now often also relate to commercial targets (Ernst & Young 2010).

5.5 Conclusion

I conclude with a recapitalization of insights and a discussion of implications for managers and academicians with an interest in the pharmaceutical industry.

5.5.1 Recap

The study of alliance portfolios in the pharmaceutical industry remains a topic of high importance. This chapter focused on the key role of technological diversity in alliance portfolios. As a cautionary note, I pointed to the diverse facets of diversity and the need to carefully select the type of diversity to be studied and to select an appropriate measure. This message may not come across as thought-provoking. Yet, the gap between construct and measures in the previous literature is worrisome because some of the measures used to capture technological diversity also captured other theoretically relevant constructs (e.g., tie strength and partner diversity). Such confounds complicate the derivation of generalizations. An excerpt from a research study on intrafirm diversification showed that even two closely linked aspects of diversity—technological diversity and diversity of therapeutic classes—are empirically distinguishable and exert differential effects on performance.

Subsequently, I outlined three major challenges that are food for thought for practitioners and provide research opportunities for academics. A first challenge relates to competing theoretical perspectives. The traditional learning perspective may not be the optimal perspective to understand portfolios in a fast-moving field such as the pharmaceutical industry. The scant empirical evidence does not appear to be supportive of the assertions that firms try to assimilate knowledge from each alliance and integrate knowledge across alliances. Managerial practice suggests we need to use a different perspective: option contracts are increasingly popular in the biopharmaceutical industry. Real options reasoning is bound to gain ground in this literature. More empirical research on the profitability consequences of portfolio diversity is necessary to explain performance differences across firms.

A second challenge relates to the need to account for contingencies, as not all firms benefit equally from similar portfolio compositions. It is insufficient to control for unobserved heterogeneity in an econometric way; on the contrary, the added value of future research will be more likely situated in making heterogeneity observable. New developments in the absorptive capacity literature may prove helpful, if concrete factors are derived from these abstract discussions. The explicit study of dimensions of internal knowledge creation, for example, may help explain why some firms benefit more from diverse alliance activity than other.

Third, the nature of collaboration in the pharmaceutical industry is changing. Biotechnology has moved from an emerging paradigm to an accepted source for opportunity search and problem-solving (i.e., for new drugs); new technological developments such as in the area of nanotechnology need to be followed up and eventually be incorporated in the study of alliance portfolios; developments in other industries have broadened the set of potential partners for pharmaceutical firms to include actors in IT, telecommunications, and the like; and the institutional changes in the healthcare sector lead to a reconsideration of milestones and targets in individual alliances.

5.5.2 Implications for Managerial Practice

I illustrated that some large firms already actively pursue an alliance portfolio strategy in the pharmaceutical industry. For those firms that don’t, the need to shift from managing alliances to managing the portfolio of alliances is a first key take-away. Portfolio studies have shown repeatedly that alliance portfolios do impact firm performance above and beyond the impact of the individual alliances. The entire discussion on technological diversity, for example, is pointless if firms shape their strategies at the alliance rather than the alliance portfolio level.

A second key take-away for managers is that technological diversity occupies a central place in portfolio management. Diversity is worth pursuing in a science-based field such as pharmaceuticals, especially if the alliances are drafted as option contracts. When the pharmaceutical firm considers and structures alliances as real options on new drugs, it can restrict its resource commitments to initial investments and postpone the decision to invest more, to later point in time when it is clearer if the alliance lives up to the promise. Ample evidence in the finance and management literatures shows that diversifying an option portfolio reduces risk and enhances performance outcomes (e.g., Aggarwal and Samwick 2003; Gavetti and Levinthal 2000). A real options perspective is therefore more than just another theory; it is a motivator for firms to diversify their alliance portfolio and deal with technological uncertainty in a more cost-efficient way and with higher likelihood of positive payoffs. In particular, McGrath and Nerkar (2003) provide a very clear insight into the fundamentals of real options reasoning.

A third key take-away is that not all firms appear to benefit equally from a diverse alliance portfolio: senior management commitment and internal knowledge creation processes explain why some firms benefit more than other. On the one hand, testimonials from pharmaceutical industry experts and recent papers in the marketing literature show that top-down commitment enables companies to take and benefit from strategic actions. While following logically from prior related studies, empirical evidence of the importance of senior management involvement in alliance portfolio management is scant as this branch of the literature is still in its infancy. On the other hand, I argued that the firm’s internal knowledge creation processes determine how well it can benefit from diverse alliance activity. The first evidence (Wuyts and Dutta 2012) indicates that external knowledge sourcing is a complement rather than a substitute for internal knowledge development.

A fourth key take-away is that alliance portfolio management is dynamic (one of the dimensions of portfolio management, see Fig. 5.1). In an environment that is continuously changing along multiple dimensions, ranging from scientific breakthroughs to the legislative environment, what constitutes an optimal portfolio today may be source of constraint rather than opportunity tomorrow. As a practical consequence, alliance portfolio management should not be reduced to a task force that shapes the alliance portfolio strategy once and for all; rather, the assertions regarding the future developments of the field and the received wisdom of the environment that may guide portfolio decisions at one point should be regularly challenged.

Concretely, to tackle some of the current developments, individual alliance deals may need to be forged increasingly as option contracts. Further, the decision which alliance options to exercise will likely rely increasingly on commercial goals next to technological goals. In addition, a more complex, multilevel approach to portfolio management is likely to emerge—with an umbrella portfolio consisting of several sub-portfolios that cover main areas such as biotechnology, nanotechnology, and ICT. Finally, the primary goal of portfolio management, identifying one-fits-all blockbuster drugs, may need to gradually change to the identification of a broad palette of targeted treatments, in response to the promise of personalized medicine.

5.5.3 Implications for Academia

In previous research, the pharmaceutical industry has proven to be a fertile ground for research on external R&D, alliances, and technology licensing. The pharmaceutical industry is a prototypical example of a science-based industry with both high economic and societal values. Pragmatic concerns such as data availability undoubtedly helped trigger research in this industry. Also marketing scholars have become increasingly interested in the pharmaceutical industry, which is a manifestation of a widening interest domain that extends well beyond the “traditional” consumer packaged goods industries. It is a positive development that for more than a decade, marketing scholars have turned to the study of innovation in technology- and science-based industries. This necessary expansion has also opened up the marketing field to the study of new phenomena. This chapter covered one such phenomenon, external knowledge sourcing. More than one and a half decades ago, Powell et al. (1996) observed a change of the locus of innovation in the biopharmaceutical industry from the individual firm to network constellations. While in the marketing field, alliance research was initially restricted to individual alliances, more recent studies on interorganizational linkages in technology-intensive industries have looked beyond the dyad (e.g., Wuyts et al. 2004a, b; Yli-Renko and Janakiraman 2008).

The new challenges in managerial practice may guide academic scholars in formulating research questions and seeking for empirical generalizations in portfolio management. To tie back to the key role of portfolio diversity, it is noteworthy that alliance diversity can be both a cause and a consequence of new opportunities. While some studies looked into the emergence of alliance portfolios as a result of business strategy (Hoffmann 2007), other studies looked into their consequences for business strategy (e.g., Wuyts et al. 2004a). The latter was also my perspective in this chapter; rather than distinguishing cause from effect, however, we may want to acknowledge and examine the dynamic iterative process between portfolio composition and business strategy to further advance this field. This is only one possible route to advance. New research avenues emerge also more directly from the topics covered in this chapter, leading to new questions that hopefully future research will investigate. I conclude with four such research questions:

-

What is the optimal alliance portfolio composition, in light of the six dimensions of alliance portfolio management identified in Fig. 5.1? Addressing this question requires a more integrative approach than prior research has offered.

-

Do firm characteristics such as top management involvement and internal knowledge creation processes help explain variation across firms in how much they benefit from alliance portfolio diversity? Addressing this question requires a contingency perspective, which is uncommon in the alliance and network literatures but fundamental to the strategy literature at large.

-

Which other factors—such as alliance contractual specifications and portfolio governance approaches—help explain variation across firms in how much they benefit from alliance portfolio diversity?

-

How should pharmaceutical firms shape their alliance portfolio management approach to be receptive to a changing environment; in the case of the pharmaceutical industry, to address scientific developments beyond biopharmaceuticals such as nanotechnology, the promise of personalized medicine, and healthcare reforms? This approach requires a stronger institutional embedding of alliance portfolio studies than we have witnessed thus far.

Notes

- 1.

Note that some authors have defined partner diversity differently, such as the diversity of structurally equivalent partner types (e.g., Baum et al. 2000); also these operationalizations fail to capture actual redundancy and suffer from similar problems as discussed in this paragraph.

- 2.

Interestingly, a further analysis of the data described in the excerpt showed that internally diversified firms faced lower turbulence in terms of profitability and stock prices, which may be indicative of reduced vulnerability to risk as a consequence of diversification.

- 3.

NETZSCH Fine Particle Technology, LLC, downloaded from http://www.pharmamanufacturing.com/whitepapers/.

References

Aggarwal RK, Samwick AA (2003) Why do managers diversify their firms? Agency reconsidered. J Finance 58(1):71–118

Ahuja G, Lampert CM (2001) Entrepreneurship in the large corporation: a longitudinal study of how established firms create breakthrough inventions. Strateg Manage J 22(6/7):521–543

Ansoff HI (1958) A model for diversification. Manage Sci 4(4):392–414

Argyres N (1996) Capabilities, technological diversification and divisionalization. Strateg Manage J 17(5):395–410

Arora A, Gambardella A (1994) Evaluating technological information and utilizing it: scientific knowledge, technological capability, and external linkages in biotechnology. J Econ Behav Organ 24(1):91–114

Aspinall MG, Hamermesh RG (2007) Realizing the promise of personalized medicine. Harv Bus Rev 85(10):108

Bamford J, Ernst D (2002) Managing an alliance portfolio. McKinsey Q 3:29–39

Baum JAC, Calabrese T, Silverman BS (2000) Don’t go it alone: alliance network composition and startups’ performance in Canadian biotechnology. Strateg Manage J 21(3):267–294

Burt RS (1992) Structural holes: the social structure of competition. Harvard University Press, Cambridge

Capon N, Glazer R (1987) Marketing and technology: a strategic coalignment. J Market 51(3):1–14

Caves RD (1981) Diversification and seller concentration: evidence from change, 1963–1972. Rev Econ Stat 63:289–293

Chatterjee S, Lubatkin MH, Schulze MS (1999) Toward a strategic theory of risk premium: moving beyond CAPM. Acad Manage Rev 24(3):556–567

Clark KB, Fujimoto T (1991) Product development performance: strategy, organization, and management in the world auto industry. Harvard Business School Press, Boston

Cohen WM, Levinthal DA (1990) Absorptive capacity: a new perspective on learning and innovation. Adm Sci Q 35(1):128–152

Cui AS (2013) Portfolio dynamics and alliance termination: the contingent role of resource dissimilarity. J Market 77(3):15–32

Cui AS, O’Connor G (2012) Alliance portfolio resource diversity and firm innovation. J Market 76(4):24–43

DiMaggio P (1992) Nadel’s paradox revisited: relational and cultural aspects of organizational structures. In: Nohria N, Eccles R (eds) Networks and organization: structure, form, and action. Harvard Business School Press, Boston

Eli Lilly (2011) http://www.lilly.com/research-development/partnering/Pages/CorporateBusinessDevelopment.aspx. Consulted June 2013

Ellison SF, Cockburn I, Griliches Z, Hausman J (1997) Characteristics of demand for pharmaceutical products: an examination of four cephalosporins. Rand J Econ 28(3):426–446

Fleming L (2001) Recombinant uncertainty in technological search. Manage Sci 47(1):117–132

Fleming L, Sorenson O (2001) Technology as a complex adaptive system: evidence from patent data. Res Policy 30(7):1019–1038

Gavetti G, Levinthal DA (2000) Looking forward and looking backward: cognitive and experiential search. Adm Sci Q 45(1):113–137

GlaxoSmithKline (2011)

Goerzen A (2007) Alliance networks and firm performance: the ımpact of repeated partnerships. Strateg Manage J 28(5):487–509

Goerzen A, Beamish PW (2005) The effect of alliance network diversity on multinational enterprise performance. Strateg Manage J 26(4):333–354

Granovetter M (1973) The strength of weak ties. Am J Sociol 78:1360–1380

Granstrand O (1998) Towards a theory of the technology-based firm. Res Policy 27(5):465–479

Hansen MT (1999) The search-transfer problem: the role of weak ties in sharing knowledge across organization subunits. Adm Sci Q 44(1):82–111

Higgins MJ, Rodriguez D (2006) The outsourcing of R&D through acquisitions in the pharmaceutical ındustry. J Financ Econ 80:351–383

Hobson DW (2009) Opportunities and challenges in pharmaceutical nanotechnology. Pharm Technol 33(7):177–178

Hoffmann WH (2007) Strategies for managing a portfolio of alliances. Strateg Manage J 28:827–856

Jiang RT, Tao QT, Santoro MD (2010) Alliance portfolio diversity and firm performance. Strateg Manage J 31:1136–1144

Katila R, Ahuja G (2002) Something old, something new: a longitudinal study of search behavior and new product introduction. Acad Manage J 45(6):1183

King AA, Lakhani KR (2011) The contingent effect of absorptive capacity: an open innovation analysis. Harvard Business School Working Paper 11–102

Kodama F (1992) Technology fusion and the new R&D. Harv Bus Rev 70(4):70–78

Kogut B, Kulatilaka N (1994) Operating flexibility, global manufacturing, and the option value of a multinational network. Manage Sci 40(1):123–139

Koka BR, Prescott JE (2008) Designing alliance networks: the influence of network position, environmental change, and strategy on firm performance. Strateg Manage J 29:639–661

Kuhn TS (1962) The structure of scientific revolutions. The University of Chicago Press, Chicago

Lechleiter J (2010) Using FIPNet to supercharge the innovation engine. In: Beyond Borders—Global Biotechnology Report 2010. Ernst & Young

Lerner J (1994) The importance of patent scope: an empirical analysis. Rand J Econ 25(2):319–333

Lewin AY, Massini S, Peeters C (2011) Microfoundations of internal and external absorptive capacity routines. Organ Sci 22(1):81–98

Macher JT (2006) Technological development and the boundaries of the firm: a knowledge-based examination in semiconductor manufacturing. Manage Sci 52(6):826–843

McEvily B, Zaheer A (1999) Bridging ties: a source of firm heterogeneity in competitive capabilities. Strateg Manage J 20:1133–1156

McGrath RG, Nerkar A (2003) Real options reasoning and a new look at the R&D investment strategies of pharmaceutical firms. Strateg Manage J 25(1):1–25

Miller DJ (2006) Technological diversity, related diversification, and firm performance. Strateg Manage J 27(7):601–619

Montgomery CA (1985) Product-market diversification and market power. Acad Manage J 28(4):789–798

Moser P, Nicholas T (2004) Was electricity a general purpose technology? Evidence from historical patent citations. Am Econ Rev 94(2):388

Ozcan P, Eisenhardt KM (2009) Origin of alliance portfolios: entrepreneurs, network strategies, and firm performance. Acad Manage J 52(2):246–279

Palepu K (1985) Diversification strategy, profit performance, and the entropy measure of diversification. Strateg Manage J 6(3):239–255

Paruchuri S (2010) Intraorganizational networks, interorganizational networks, and the impact of central inventors: a longitudinal study of pharmaceutical firms. Organ Sci 21(1):63–81

Pavitt K, Robson M, Townsend J (1989) Technological accumulation, diversification and organization in UK companies, 1945–1983. Manage Sci 35(1):81–99

Phelps CC (2010) A longitudinal study of the influence of alliance network structure and composition on firm exploratory innovation. Acad Manage J 53(4):890–913

Pisano GP (2002) Discovering the future: R&D strategy at Merck. Harvard Business School, Case Study 601-086

Powell WW, Koput KW, Smith-Doerr L (1996) Interorganizational collaboration and the locus of innovation: networks of learning in biotechnology. Adm Sci Q 41:116–145

Rao RS, Chandy RK, Prabhu JC (2008) The fruits of legitimacy: why some new ventures gain more from innovation than others. J Market 72(4):58–75

Rappa MA, Debackere K (1995) An analysis of entry and persistence among scientists in an emerging field of science: the case of neural networks. R&D Manage 25(3):323–341

Reagans RE, Zuckerman EW (2008) Why knowledge does not equal power: the network redundancy trade-off. Ind Corp Change 17(5):903–944

Rothaermel FT (2001) Incumbent’s advantage through exploiting complementary assets via interfirm cooperation. Strateg Manage J 22(Special Issue):687–699

Rowley T, Behrens D, Krackhardt D (2000) Redundant governance structures: an analysis of structural and relational embeddedness in the steel and semiconductor industries. Strateg Manage J 21(Special Issue 3):369–386

Sarkar MB, Aulakh PS, Madhok A (2009) Process capabilities and value generation in alliance portfolios. Organ Sci 20(3):583–600

Sharpe P, Keelin T (1998) How SmithKline Beecham makes better resource-allocation decisions. Harv Bus Rev 76(2):45–52

Simonet D (2002) Licensing agreements in the pharmaceutical industry. Int J Med Market 2(4):329–341

Soni PK, Lilien GL, Wilson DT (1993) Industrial innovation and firm performance: a re-conceptualization and exploratory structural equation analysis. Int J Res Market 10:365–380

Stern I, Henderson AD (2004) Within-business diversification in technology-intensive industries. Strateg Manage J 25(5):487–505

Suzuki J, Kodama F (2004) Technological diversity of persistent innovators in Japan—two case studies of large Japanese firms. Res Policy 33:531–549

Uzzi B (1997) Social structure and competition in interfirm networks: the paradox of embeddedness. Adm Sci Q 42:35–67

Varadarajan PR (1986) Product diversity and firm performance: an empirical investigation. J Market 50(2):43–57

Vassolo RS, Anand J, Folta TB (2004) Non-additivity in portfolios of exploration activities: a real options-based analysis of equity alliances in biotechnology. Strateg Manage J 25(11):1045–1061

Veugelers R, Cassiman B (1999) Make and buy in innovation strategies: evidence from Belgian manufacturing firms. Res Policy 28:63–80

Wassmer U (2010) Alliance portfolios: a review and research agenda. J Manage 36(1):141–171

Wuyts S, Dutta S (2008) Licensing exchange: insights from the biopharmaceutical industry. Int J Res Market 25(4):273

Wuyts S, Dutta S (2012) Benefiting from alliance portfolio diversity: the role of past internal knowledge creation strategy. J Manage forthcoming (first online March 23, 2012)

Wuyts S, Dutta S, Stremersch S (2004a) Portfolios of interfirm agreements in technology-intensive markets: consequences for innovation and profitability. J Market 68(2):88–100

Wuyts S, Stremersch S, Van den Bulte C, Franses P-H (2004b) Vertical marketing systems for complex products: a triadic perspective. J Market Res 41(4):479

Wuyts S, Colombo M, Dutta S, Nooteboom B (2005) Empirical tests of optimal cognitive distance. J Econ Behav Organ 58(2):277–302

Wuyts S, Dutta S, Qu S (2010) Balancing advertising and R&D expenditures in technology-intensive industries: a dual diversification perspective. Working Paper

Yadav MS, Prabhu JC, Chandy RK (2007) Managing the future: CEO attention and innovation outcomes. J Market 71(4):84–101

Yli-Renko H, Janakiraman R (2008) How customer portfolio affects new product development in technology-based entrepreneurial firms. J Market 72(3):131–148

Ernst & Young (2010) In: Beyond borders—global biotechnology report 2010

Zhao X (2009) Technological innovation and acquisitions. Manage Sci 55(7):1170–1183

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer Science+Business Media New York

About this chapter

Cite this chapter

Wuyts, S. (2014). New Challenges in Alliance Portfolio Management. In: Ding, M., Eliashberg, J., Stremersch, S. (eds) Innovation and Marketing in the Pharmaceutical Industry. International Series in Quantitative Marketing, vol 20. Springer, New York, NY. https://doi.org/10.1007/978-1-4614-7801-0_5

Download citation

DOI: https://doi.org/10.1007/978-1-4614-7801-0_5

Published:

Publisher Name: Springer, New York, NY

Print ISBN: 978-1-4614-7800-3

Online ISBN: 978-1-4614-7801-0

eBook Packages: Biomedical and Life SciencesBiomedical and Life Sciences (R0)