Abstract

This paper considers the evidence on real commodity prices from 1900 to 2015 for 40 commodities, representing 8.72 trillion US dollars of production in 2011. In doing so, it suggests and documents a comprehensive typology of real commodity prices, comprising long-run trends, medium-run cycles, and short-run boom/bust episodes. The main findings can be summarized as follows: (1) real commodity prices have been on the rise—albeit modestly—from 1950; (2) there is a pattern—in both past and present—of commodity price cycles, entailing large and long-lived deviations from underlying trends; (3) these commodity price cycles are themselves punctuated by boom/bust episodes which are historically pervasive.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Every few decades, the global economy witnesses a protracted and widespread commodity boom. And in each boom, the common perception is that the world is quickly running out of key raw materials. The necessary consequence of this demand-induced scarcity is that economic growth must inexorably grind to a halt. On the other hand, economists are often quick to counter that such thinking is contradicted by the long-run history of real commodity prices. Building on an extensive academic and policy literature charting developments in the price of commodities relative to other goods, this side of the debate holds that the price signals generated in the wake of a global commodity boom have always been sufficiently strong to induce a countervailing supply response (cf. Ehrlich 1968; Ehrlich and Ehrlich 1990; Moyo 2012; Sabin 2013; Simon 1981, 1996).

What is missing from this debate is a comprehensive body of evidence on real commodity prices and a consistently applied methodology for characterizing their long-run evolution. To that end, this paper considers the evidence on real commodity prices from 1900 to 2015 for 40 commodities. Individually, these series span a wide range of economically important commodities. Collectively, they represent a significant proportion of global economic activity.

This paper also suggests and documents a complete typology of real commodity prices over the past 115 years. In this framework, real commodity price series are composed of long-run trends, medium-run cycles, and short-run boom/bust episodes. As such, there a few key findings of the paper. First, perceptions of the trajectory of real commodity prices over time are vitally influenced by how long a period is being considered and by how particular commodities are weighted when constructing commodity price indices. Applying weights drawn from the value of production in 1975, real commodity prices are estimated to have increased by 34.20% from 1950 to 2015. This suggests that much of the conventional wisdom on long-run trends in real commodity prices may be unduly swayed by events either in the very distant or very recent past. It also suggests a potentially large, but somewhat underappreciated distinction in between “commodities to be grown” which have experienced secular declines in real prices versus “commodities in the ground”—in particular, energy products—which have experienced secular increases in real prices over the long run.

Second, there is a consistent pattern of commodity price cycles which entail long-lived deviations from these underlying trends in both the past and present.Footnote 1 In this paper as in others, it follows (cf. Cuddington and Jerrett 2008; Erten and Ocampo 2013; Jerrett and Cuddington 2008); commodity price cycles are thought of as comprising medium-run swings in real commodity prices. These are demand-driven episodes closely linked to historical episodes of mass industrialization and urbanization which interact with acute capacity constraints in many product categories—in particular, energy, metals, and minerals—in order to generate above-trend real commodity prices for years, if not decades, on end. However, once such a demand shock emerges, there is generally a countervailing supply response as formerly dormant exploration and extraction activities take off and induced technological change takes hold. Thus, as capacity constraints are eased, real commodity prices revert back to—and below—trend.Footnote 2

Significantly, this paper finds that fully 20 of the 40 commodities under consideration are in the midst of such cycles, demonstrating above-trend real prices starting from 1994 to 1999. The common origin of these commodity price cycles in the late 1990s underlines an important theme of this paper, namely that long-run patterns can be easy to miss if we confuse cycles for trends.

Third, this paper offers a straightforward methodology for determining real commodity price booms and busts which punctuate the aforementioned commodity price cycles. These boom/bust episodes are found to be historically pervasive and, thus, potentially relevant for commodity-exporting nations. This exercise also underlines one of the key outputs of this paper in the form of long-run series on commodity-specific price booms and busts which will be of interest to researchers looking for plausibly exogenous shocks to either domestic economies or global markets.

The rest of the paper proceeds as follows. Section 2 sets out the underlying data, while Sect. 3 provides the methodology behind and the evidence on long-run trends, medium-run cycles, and boom/bust episodes in real commodity prices. Section 4 concludes.

2 New data on old prices

The data used in this study comprise all consistently defined, long-run annual spot prices for commodities with at least 5 billion US dollars of production in 2011. Reliable data collection begins for the majority of price series in 1850 while no price series enters the data set later than 1900. All told, this paper considers the evidence on 40 individual commodity price series which are drawn from seven product categories—animal products, energy products, grains, metals, minerals, precious metals, and soft commodities—and which are enumerated in Table 1. As Table 1 also demonstrates, the series are not only large in number, but also economically significant representing 8.72 trillion US dollars of production in 2011.Footnote 3 Finally, the individual price series are expressed in US dollars and deflated by the US CPI underlying Officer (2012), supplemented by updates taken from the BLS. The choice of the CPI as deflator—although not entirely uncontroversial—most closely relates to this paper’s theme of assessing the direction of commodity prices in real terms over the long run.Footnote 4 However, none of the results presented below are materially altered by the consideration of alternative measures of economy-wide prices such as the US GDP deflator, US manufacturing prices, or the US PPI. Finally, an appendix to this paper details the sources for the individual series.

Figure 1 abstracts from commodity-specific developments and instead applies three different sets of weights in the construction of real commodity price indices: shares drawn from the value of production in 1975, shares drawn from the value of production in 2011, and equal shares. Relying on the series drawn from the value of production in 2011 is likely unsatisfactory, in that it puts the most weight on precisely those commodities which ex-post have risen the most. Likewise, relying on the series drawn from equal weights is somewhat unsatisfactory, in that it assigns as much as importance to rye with 5.57 billion USD in production in 2011 as petroleum with 3.16 trillion USD in production in 2011. In what follows, we focus our attention on the series drawn from the value of production in 1975 which represents a rough compromise between these two extremes.

Using weights from the value of production prior to 1975 is problematic for a few facts. First, reliable data on global production for all commodities are impossible to come by prior to the 1960s. Second, and most importantly, the prices of certain key commodities were dictated by government and industry as opposed to being determined by market forces. The case of gold and the role of the US Treasury in maintaining its nominal value from 1934 to 1972 are very one well-known example. A less well-known, but even more important example comes from the actions of the Texas Railroad Commission in dictating global petroleum prices from the 1930s up to the first oil shock in 1973 (Yergin 1991).

The picture emerging from this exercise is a pattern of potentially rising real commodity prices from the 1950s.Footnote 5 However, there is an implicit danger in simply “eyeballing” these series or comparing the level of real commodity prices in the present with values drawn from the past. Namely, we run the risk of conflating currently evolving cycles with long-run trends. The following section lays out the methodology used to decompose real commodity prices into long-run trend and medium-run cyclical components.

3 Trend-cycle decomposition

Borrowing from the large body of work in empirical macroeconomics on trend-cycle decomposition, a burgeoning literature in identifying medium-run commodity price cycles has recently emerged (cf. Cuddington and Jerrett 2008; Erten and Ocampo 2013; Jerrett and Cuddington 2008). The common theme of this literature is that commodity price cycles can be detected by use of the Christiano–Fitzgerald band pass filter which decomposes the natural log of the real price of commodity i in time t, ln(Pit), into three components: a long-run trend in excess of 70 years in duration, LRTt; a medium-run cycle of 20–70 years duration, MRCt; and all other shorter cyclical components, SRCt. This entails estimating three orthogonal components for the log of the real commodity price series, or namely \(\ln (P_{it} ) \equiv {\text{LRT}}_{it} + {\text{MRC}}_{it} + {\text{SRC}}_{it}\).

Broadly, the work of Christiano and Fitzgerald (2003) has as its basic insight that time-series data—like the real commodity price series under consideration here—can be characterized as the sum of periodic functions. Their work then establishes the ideal (infinite sample) band pass filter, allowing for slowly evolving trends and imposing no restrictions on the distribution of the underlying data. Furthermore, they suggest a finite-sample asymmetric band pass filter which allows for the extraction of filtered series over the entire sample, thus, ensuring that no data from either the beginning or end of the sample are discarded.Footnote 6 Conveniently for my purposes, this filter does not require either symmetry or time-invariance. That is, it can be used in real time as observations drawn from the beginning of a period can be filtered only using future values and observations drawn from the end of a period can be filtered only using past values.

The results presented below are not materially altered when different durations are used for defining trends and cycles. In these cases, the magnitudes marginally differ from those reported below, but general tendencies for estimated trends and cycles do not. For example, a trend comprising cyclical components in excess of 50 years and a cycle comprising cyclical components with periods of 10–50 years in duration generates an estimated cumulative increase in real commodity prices from 1900 to 2015 of 23.15% (vs 23.32% as reported below), while the last trough and peak in real commodity prices are estimated to have occurred in 1998 and 2010, respectively (vs 1996 and 2010 as reported below).Footnote 7

3.1 Long-run trends in real commodity prices

Figure 2a depicts the estimated long-run trend for the real commodity price index drawn from 1975 value-of-production shares, while Table 2 calculates on a commodity-by-commodity basis the cumulative change in the long-run trend in 2015 versus benchmark dates. From Table 2, it is seen that natural gas and petroleum have uniformly registered increases in real prices since 1900. Slightly more surprising is the presence of precious metals as well as chromium, lamb, and manganese in the same category. This leaves six commodities with a positive, but slightly more mixed performance over the past 115 years: copper and potash which have a consistent upward trend from 1950 and beef, coal, and steel which demonstrate a long-run upward trend, but which have eased off somewhat from their all-time highs in the 1970s.

On the opposite end of the spectrum, soft commodities have been in collective and constant decline since 1900. Indeed, a broader interpretation of soft commodities often includes grains and hides which suffer from the same fate. The list of secular decliners is rounded out by aluminum, bauxite, iron ore, lead, pork, sulfur, and zinc. Thus, energy products and precious metals are clearly in the “gainer” camp; grains and soft commodities are clearly in the “loser” camp; and metals and minerals are left as contested territory.

However, Fig. 2a suggests that if anything real commodity prices in the aggregate have been modestly on the rise if evaluated on the basis of the value of production. Again, applying weights drawn from 1975 suggests that real commodity prices have had annualized rates of increase of 0.18% from 1900, of 0.45% from 1950, and of 0.13% from 1975 (or equivalently, have increased by 23.32, 34.20, and 5.54% from 1900, 1950, and 1975, respectively).

How then are these results reconciled with the conclusions of Cashin and McDermott (2002), for instance, who find that real commodity prices have been declining by roughly 1% per year since the mid-nineteenth century? First, Cashin and McDermott rely on a commodity price index which applies weights equal to the value of world imports, rather than the value of world production as here. Second, there is a fairly substantial difference in the composition of commodities with only 11 of their 18 commodities matching the 40 under consideration in this paper. Finally and most importantly, there is a massive difference in the composition of product categories: their index only spans the metals and soft commodities categories. Although metals are somewhat of a mixed bag, soft commodities—both broadly and narrowly defined—have been the biggest of “losers” over the past 115 years.

These two sets of findings then suggest a potentially very large, but somewhat underappreciated distinction in between “commodities to be grown” versus “commodities in the ground”.Footnote 8 Figures 3a and 4a make this distinction clear by separating the two types of commodities along the lines suggested above. We can also drill down further as in Fig. 5a and consider “commodities in the ground, ex-energy”. In this last case, the long-run trend would be decidedly more muted as the peaks of the mid-1970s were eroded into the 2000s and have only recently turned around. However, it seems that much of the conventional wisdom on long-run trends in real commodity prices may have been unduly swayed by the experience of product categories characterized by persistent downward trends dating from the 1960s.

3.2 Medium-run cycles in real commodity prices

In recent years, the investing community has run with the idea of commodity price cycles (Heap 2005; Rogers 2004). In this view, commodity price cycles are medium-run events corresponding to deviations from underlying trends in commodity prices of roughly 20–70 years in length. These are demand-driven episodes closely linked to historical episodes of mass industrialization and urbanization which interact with acute capacity constraints in many product categories—in particular, energy, metals, and minerals—in order to generate above-trend real commodity prices for years, if not decades, on end. However, once such a demand shock emerges, there is generally a countervailing supply response as formerly dormant exploration and extraction activities take off and induced technological change takes hold. Thus, as capacity constraints are eased, real commodity prices revert back to—and below—trend.

Figure 2b displays the detrended real commodity price index and the cyclical component evident in the medium-run for the former. The scaling on the left-hand-side of the figures is in logs, so a value of 1.0 in Fig. 2b represents a 174% deviation from the long-run trend. Thus, the cyclical fluctuations are sizeable. The complete cycles in real commodity prices which deliver deviations from trend of at least 20% can be dated from 1903 to 1932 and from 1965 to 1996. The commodity price index is also estimated to be in the midst of a currently evolving cycle which began in 1996 and which is estimated to have peaked in 2010.Footnote 9 Collectively, this suggests a large role for not only American industrialization/urbanization in the early 20th century and European/Japanese re-industrialization/re-urbanization in the mid-20th century, but also Chinese industrialization/urbanization in the early 21st century in determining the timing of past cycles.

By replicating this exercise for the 40 commodities underlying the index, it is found that fully 20 of our 40 commodities demonstrate above-trend real prices starting from 1994 to 1999 but again in the context of an as-of-yet incomplete cycle.Footnote 10 Critically, 13 of these are in the energy products, metals, minerals, and precious metals categories (that is, “commodities in the ground” as depicted in Fig. 4b). The common origin of these commodity price cycles in the late 1990s underlines an important implicit theme of this paper, namely that long-run patterns can be easy to miss if we confuse cycles for trends. That is, much of the recent appreciation of real commodity prices simply represents a recovery from their multi-year—and in some instances, multi-decade—nadir around the year 2000.Footnote 11

Thus, we have been able to establish a consistent pattern of evidence supportive of: (1) the contention that real commodity prices might best be characterized by modest upward trends when evaluated on the basis of the value of production; and (2) the notion of commodity price cycles being present in both the past and present as well as for a broader range of commodities than has been previously considered. What is missing, however, is any sense of the nature of short-run movements in real commodity prices to which the following section turns.

3.3 Short-run boom/bust episodes in real commodity prices

In exploring the short-run dynamics of real commodity prices, one important question looms large in this context: how exactly should real commodity price booms and busts be characterized? Here, we follow the lead of Mendoza and Terrones (2012) and take as our basic input the deviations from the combined long-run trend and medium-run cycle in logged real prices for commodity i in time t, or \({\text{SRC}}_{it} = \ln (P_{it} ) - {\text{LRT}}_{it} - {\text{MRC}}_{it}\). Let zit represent the standardized version of SRCit—that is, for any given observation, we simply subtract the sample mean of all the deviations and divide by the sample standard deviation.Footnote 12

Commodity i is defined to have experienced a boom when we identify one or more contiguous dates for which the condition zit > 1.282 holds as this value defines the 10% upper tail of a standardized normal distribution. A boom peaks at \(t_{\text{boom}}^{*}\) when the maximum value of zit is reached for the set of contiguous dates that satisfy the threshold condition. A boom starts at \(t_{\text{boom}}^{s} \;{\text{where}}\)\(t_{\text{boom}}^{s} < t_{\text{boom}}^{*}\) and zit > 1.00. A boom ends at \(t_{\text{boom}}^{e} \;{\text{where}}\;t_{\text{boom}}^{e} > t_{\text{boom}}^{*}\) and zit > 1.00.

Symmetric conditions define busts. Commodity i is defined to have experienced a bust when we identify one or more contiguous dates for which the condition zit < − 1.282 holds as this value defines the 10% lower tail of a standardized normal distribution. A bust troughs at \(t_{\text{bust}}^{*}\) when the minimum value of zit is reached for the set of contiguous dates that satisfy the threshold condition. A bust starts at \(t_{\text{bust}}^{s} \;{\text{where}}\;t_{\text{bust}}^{s} < t_{\text{bust}}^{*}\) and zit < − 1.00. A bust ends at \(t_{\text{bust}}^{e} \;{\text{where}}\;t_{\text{bust}}^{e} > t_{\text{bust}}^{*}\) and zit < − 1.00.

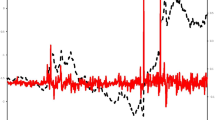

For illustration purposes, the reader is referred to Fig. 6a through 6c which present the evidence on real commodity price booms and busts. Figure 6a depicts the log of the real commodity price index from 1900 to 2015 along with the summation of the estimated long-run trend and medium-run cycle. Figure 6b depicts the (standardized) difference of logged real prices from the summation of these two series. Thus, the vertical scale is in terms of standard deviations. Finally, Fig. 6c combines the real commodity price index along with the episodes of boom and bust determined by the algorithm given above. It indicates the presence of nine booms (in green) and nine busts (in red) for real commodity prices over the past 115 years. Reassuringly, the timing of these episodes suggests that in this context real commodity price booms do not mechanically generate real commodity price busts, nor vice versa. Furthermore, while the threshold values of 1.282/1.00 and − 1.282/− 1.00 are admittedly arbitrary, a mechanical approach as used in the paper removes discretion on the part of the researcher. One can then judge its applicability in how it measures up to known shocks to global commodity markets such as the Great Depression, the Oil Price Shocks of the 1970s, various financial crises, and the World Wars. Causal observation of Fig. 6c suggests a very strong correspondence between these events and the statistically identified real commodity booms and busts outlined above.

Another notable feature of the series in Fig. 6c is the distinct lack of both booms and busts in the period from 1938 through 1969. Putting the war years aside, this period of relative tranquility then almost exactly corresponds with the operation of the Bretton Woods system. It might, therefore, be tempting to read into this correlation that periods of fixed nominal exchange rates as under the Bretton Woods system are necessarily associated with fewer—and potentially shorter and smaller—real commodity price booms and busts (on this point, see Jacks, 2013). However, it is not clear a priori that the fettering of both gold and petroleum prices in this period as mentioned in Sect. 2 was not responsible for some of the turbulence in global commodity markets in the 1970s and 1980s.

Just as in the case of commodity price cycles, it is possible to replicate this exercise for the 40 commodities underlying the index. Doing so yields 326 complete commodity price booms and 276 complete commodity price busts across the 40 commodities. In related work, Jacks (2013) considers the case of Australia and constructs country-specific indicators of boom/bust episodes from 1900 to 2010, finding asymmetric linkages in between booms/busts and the business cycle. This exercise points towards the need for more rigorous work relating commodity price volatility and economic growth using the data on booms and busts from this paper (Jacks et al. 2011; van der Ploeg and Poelhekke 2009).

4 Conclusion

Drawing motivation from the current debate surrounding the likely trajectory of commodity prices, this paper has sought to forward our understanding of real commodity prices in the long-run along two dimensions. First, the paper has provided a comprehensive body of evidence on real commodity prices for 40 economically significant commodities from 1900. Second, the paper has provided a consistently applied methodology for thinking about their long-run evolution. In doing so, it suggests and documents a complete typology of real commodity prices, comprising long-run trends, medium-run cycles, and short-run boom/bust episodes. The findings of the paper can be summarized as follows. First, real commodity prices have been modestly on the rise from 1900. Second, there is a pattern—in both past and present—of commodity price cycles which entail large and multi-year deviations from these long-run trends. Third, these commodity price cycles are punctuated by booms and busts which are historically pervasive and, thus, potentially relevant for commodity-exporting nations.

Notes

Here, it is very important to emphasize that the notion of cycles is not meant to evoke a sense of regularity—much less, predictability—in commodity price dynamics but instead provides us with a convenient means of statistically characterizing deviations from long-run trends.

In related work, Jacks and Stuermer (2018) consider the dynamic effects of commodity demand shocks, commodity supply shocks, and storage demand or other commodity-specific demand shocks on real commodity prices in the long run. There, commodity demand shocks strongly dominate commodity supply shocks in driving prices and are growing in importance over time.

Neglecting energy products, these production values are still in excess of 4.54 trillion USD. Furthermore, there is likely very little room for sample selection issues in driving the results presented below. In particular, there may be concerns about the potential influence of once-important, but now-irrelevant commodities or once-irrelevant, but now-important commodities which would be ruled out on the basis of the criteria laid out here. For example, uranium had no wide commercial application until the atomic age and, thus, remains outside of the sample. At the same time, production of uranium in 2011 was valued at 6.65 billion USD—that is, a mere 0.08% of the current sample’s cumulative value of production in the same year.

Naturally, to the extent that the quality of commodities has remain unchanged over time, any upward bias in the US CPI induced by insufficient correction for changes in the quality of other goods over time will lead to a downward bias in the calculation of increases in real commodity price documented below.

The accompanying chartbook (available at http://www.sfu.ca/~djacks) documents the evolution of real prices on a commodity-by-commodity basis from 1850 to 2015. Visual inspection of these series reveals the well-known “big variability” of real commodity prices (Cashin and McDermott 2002). With respect to long-run trends in the real commodity price data, there are a few clear patterns across product categories. Notwithstanding some common global shocks like the peaks in real prices surrounding World War I, the 1970s, and the 2000s as well as the troughs in the 1930s and 1990s, there is a divergence in between those commodities exhibiting a secular downward trend—notably, grains and soft commodities—and those exhibiting a secular upward trend—notably, energy and precious metals.

To implement the band pass filter, Christiano and Fitzgerald assume that the underlying data-generating process is integrated of order one (that is, it is a random walk). Even though the simulations in their paper strongly suggest that the filter remains unaffected by potential misspecification of the data-generating process, it is very easy to check this assumption. Testing for a unit root in the differenced commodity price index series yields the following set of results under the following set of unit root tests:

-

1.

Levin–Lin–Chu adjusted t = − 3.3139 [p value = 0.0050]

-

2.

Breitung lambda = − 6.8269 [p value = 0.0000]

-

3.

Im–Pesaran–Shin Z − t-tilde-bar = − 6.9422 [p value = 0.0000]

-

4.

Fisher–Philips–Perron inverse Chi squared = 72.0873 [p value = 0.0000]

Even though all of these tests embed different assumptions and entail different strengths and weaknesses, all of them entail the use of the null hypothesis that the differenced commodity price index series contains a unit root. Critically, this hypothesis is decisively rejected across all tests, and so it seems justified to invoke the assumption that the series is indeed integrated of order one.

-

1.

In what follows, there is also little material difference in estimated trends or cycles when alternate asymmetric band pass filters are used. For example, using the Butterworth band pass filter, the results remain broadly unaffected in that: (1) the Christiano–Fitzgerald filter estimates an index value of 160.99 in 2015 versus the Butterworth filter which estimates an index value of 154.59 in the same year; and (2) the Christiano–Fitzgerald filter estimates complete cycles for the years from 1903 to 1932 and from 1965 to 1996 versus the Butterworth filter which estimates complete cycles for the years from 1900 to 1932 and from 1966 to 1997. In this instance, the use of the Hodrick–Prescott filter has been avoided as: (1) it is well known that it is slow in establishing turning points in long-run trends and, thus, the HP filter estimates that real commodity prices have continued to rise, even in the face of the significant reversal in real commodity prices dating from 2011; (2) recent work by Hamilton (2017) strongly advises against the use of the HP filter in that it “produces series with spurious dynamic relations that have no basis in the underlying data-generating process” (p. 2).

Thus, “commodities to be grown” would include all animal products, grains, and soft commodities and “commodities in the ground” would include all energy products, metals, minerals, and precious metals.

The accompanying chartbook also provides a complete set of figures for real commodity price cycles and boom/bust episodes on a commodity-by-commodity basis.

These commodities are composed of chromium, cocoa, copper, corn, cottonseed, gold, iron ore, lead, nickel, petroleum, phosphate, platinum, potash, rice, rubber, rye, silver, steel, tin, and wool.

Given the dramatic decline in real commodity prices starting in 2014, it may also be instructive to have a sense of how sensitive the estimation of long-run trends and medium-run cycles is to innovations at the end of the sample. To that end, we can estimate two sets of long-run trends/medium-run cycles. The first set is the long-run trend and medium-run cycle estimated from the full sample of data from 1900 to 2015 as depicted in Fig. 2a, b. There, the estimated (logged) value of the long-run trend in 2010 is 4.8636 while the last trough and peak in real commodity prices are estimated to have occurred in 1996 and 2010, respectively. The second set is the long-run trend and medium-run cycle estimated from a restricted sample of data from 1900 to 2010 only. In this case, the estimated (logged) value of the long-run trend in 2010 is 5.0145 while the last trough in real commodity prices is estimated to have occurred in 1996 but with an indeterminate peak. Thus, there is a perhaps unsurprising dependence in between the estimated long-run trend and the terminal sample values of real commodity prices. At the same time, there is a perhaps surprising independence in between the estimated medium-run cycle and the terminal sample values of real commodity prices.

This standardization was motivated by two elements: (1) for expositional purposes, it makes it much easier to speak of thresholds as defined by the number of (unitary) standard deviations since the values of the standard deviations will vary by commodity; and (2) while the SRC terms effectively act as white-noise residual terms, they generally have near, but not exactly zero means. For instance, the SRC term for the real commodity price index depicted in Fig. 6c has a mean of 0.0101. Furthermore, using the raw series on SRC terms, we fail to reject the null hypothesis that the sample came from a normally distributed population when using the standard tests of normality like Jarque–Bera and Kolmogorov–Smirnov.

References

Cashin P, McDermott CJ (2002) The long-run behavior of commodity prices: small trends and big variability. IMF Staff Pap 49(2):175–199

Christiano L, Fitzgerald T (2003) the band pass filter. Int Econ Rev 44(2):435–465

Cuddington JT, Jerrett D (2008) Super cycles in real metal prices? IMF Staff Pap 55(4):541–565

Ehrlich PR (1968) The population bomb. Ballantine Books, New York

Ehrlich PR, Ehrlich AH (1990) The population explosion. Simon Schuster, New York

Erten B, Ocampo JA (2013) Super cycles of commodity prices since the mid-nineteenth century. World Dev 44(1):14–30

Hamilton JD (2017) Why you should never use the Hodrick–Prescott filter. NBER Working Paper 23429

Heap A (2005) China—the engine of commodities super cycle. Citigroup Smith Barney

Jacks DS (2013) From boom to bust: a typology of real commodity prices in the long run. NBER Working Paper 18874

Jacks DS, Stuermer M (2018) What drives commodity price booms and busts? Energy Econ (forthcoming)

Jacks DS, O’Rourke KH, Williamson JG (2011) Commodity price volatility and world market integration since 1700. Rev Econ Stat 93(3):800–813

Jerrett D, Cuddington JT (2008) Broadening the statistical search for metal price super cycles to steel and related metals. Resour Policy 33(4):188–195

Mendoza EG, Terrones ME (2012) An anatomy of credit booms and their demise. NBER Working Paper 18379

Moyo D (2012) Winner take all: China’s race for resources and what it means for the world. Basic Books, New York

Officer LH (2012) The annual consumer price index for the United States, 1774–2011. http://www.measuringworth.com/uscpi. Accessed 6 Feb 2015

Rogers J (2004) Hot commodities: how anyone can invest and profit in the world’s best market. Random House, New York

Sabin P (2013) The bet. Yale University Press, New Haven

Simon J (1981) The ultimate resource. Princeton University Press, Princeton

Simon J (1996) The ultimate resource 2. Princeton University Press, Princeton

van der Ploeg F, Poelhekke S (2009) Volatility and the natural resource curse. Oxf Econ Pap 61(4):727–760

Yergin D (1991) The prize. Simon & Schuster Inc., New York

Acknowledgements

This paper was prepared for the ANU Centre for Economic History/Centre for Applied Macroeconomic Analysis conference on “Commodity Price Volatility, Past and Present” held in Canberra. I thank the conference organizers for their hospitality and providing the impetus for this paper. I also thank the University of New South Wales for their hospitality while this paper was completed, Stephan Pfaffenzeller and Nigel Stapledon for help with the data, and the editor and two referees for their comments. I also appreciate comments received from seminars at Adelaide, the Federal Reserve Bank of Dallas, Hong Kong University of Science and Technology, New South Wales, Oxford, Peking University Guanghua School of Management and School of Economics, Shanghai University of Finance and Economics, Shanghai University of International Business and Economics, UIBE, and Wake Forest as well as from the EH-Clio Lab Annual Meeting and the Muenster Workshop on the Determinants and Impact of Commodity Price Dynamics. Finally, I gratefully acknowledge the Social Science and Humanities Research Council of Canada for research support.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

This appendix details the sources of the real commodity prices used throughout this paper. As such, there are a few key sources of data: the annual Sauerbeck/Statist (SS) series dating from 1850 to 1950; the annual Grilli and Yang (GY) series dating from 1900 to 1986; the annual unit values of mineral production provided by the United States Geographical Survey (USGS) dating from 1900; the annual Pfaffenzeller, Newbold, and Rayner (PNR) update to Grilli and Yang’s series dating from 1987 to 2010; and the monthly International Monetary Fund (IMF), United Nations Conference on Trade and Development (UNCTAD), and World Bank (WB) series dating variously from 1960 and 1980. The relevant references are:

-

Grilli, E.R. and M.C. Yang (1988), “Primary Commodity Prices, Manufactured Goods Prices, and the Terms of Trade of Developing Countries: What the Long Run Shows.” World Bank Economic Review 2(1): 1–47.

-

Pfaffenzeller, S., P. Newbold, and A. Rayner (2007), “A Short Note on Updating the Grilli and Yang Commodity Price Index.” World Bank Economic Review 21(1): 151–163.

-

Sauerbeck, A. (1886), “Prices of Commodities and the Precious Metals.” Journal of the Statistical Society of London 49(3): 581–648.

-

Sauerbeck, A. (1893), “Prices of Commodities During the Last Seven Years.” Journal of the Royal Statistical Society 56(2): 215–254.

-

Sauerbeck, A. (1908), “Prices of Commodities in 1908.” Journal of the Royal Statistical Society 72(1): 68–80.

-

Sauerbeck, A. (1917), “Wholesale Prices of Commodities in 1916.” Journal of the Royal Statistical Society 80(2): 289–309.

-

The Statist (1930), “Wholesale Prices of Commodities in 1929.” Journal of the Royal Statistical Society 93(2): 271–87.

-

“Wholesale Prices in 1950.” Journal of the Royal Statistical Society 114(3): 408–422.

A more detailed enumeration of the sources for each individual series is as follows.

-

Aluminum: 1900–2010, GY and PNR; 2011–2015, UNCTAD

-

Barley: 1850–1869, SS; 1870–1959, Manthy, R.S. (1974), Natural Resource Commodities—A Century of Statistics. Baltimore and London: Johns Hopkins Press; 1960–2015, WB

-

Bauxite: 1900–2015, USGS

-

Beef: 1850–1899, SS; 1900–1959, GY; 1960–2015, WB

-

Chromium: 1900–2015, USGS

-

Coal: 1850–1851, Cole, A.H. (1938), Wholesale Commodity Prices in the United States, 1700–1861: Statistical Supplement. Cambridge: Harvard University Press; 1852–1859, Bezanson, A. (1954), Wholesale Prices in Philadelphia 1852–1896. Philadelphia: University of Pennsylvania Press; 1880–1948, Carter, S. et al. (2006), Historical Statistics of the United States, Millennial Edition. Cambridge: Cambridge University Press; 1949–2010, United States Energy Information Administration; 2011–2015, BP Statistical Review of World Energy 2015

-

Cocoa: 1850–1899, Global Financial Data; 1900–1959, GY; 1960–2015, WB

-

Coffee: 1850–1959, Global Financial Data; 1960–2015, WB

-

Copper: 1850–1899, SS; 1900–2010, GY and PNR; 2011–2015, UNCTAD

-

Corn: 1850–1851, Cole, A.H. (1938), Wholesale Commodity Prices in the United States, 1700–1861: Statistical Supplement. Cambridge: Harvard University Press; 1852–1859; Bezanson, A. (1954), Wholesale Prices in Philadelphia 1852–1896. Philadelphia: University of Pennsylvania Press; 1860–1999, Global Financial Data; 2000–2015, United States Department of Agriculture National Agricultural Statistics Service

-

Cotton: 1850–1899, SS; 1900–1959, GY; 1960–2015, WB

-

Cottonseed: 1874–1972, Manthy, R.S. (1974), Natural Resource Commodities—A Century of Statistics. Baltimore and London: Johns Hopkins Press; 1973–2015, National Agricultural Statistics Service

-

Gold: 1850–1999, Global Financial Data; 2000–2015, Kitco

-

Hides: 1850–1899, SS; 1900–1959, GY; 1960–2015, UNCTAD

-

Iron ore: 1900–2015, USGS

-

Lamb: 1850–1914, SS; 1915–1970, GY; 1971–2015, WB

-

Lead: 1850–1899, SS; 1900–2010, GY and PNR; 2011–2015, UNCTAD

-

Manganese: 1900–2015, USGS

-

Natural gas: 1900–1921, Carter, S. et al. (2006), Historical Statistics of the United States, Millennial Edition. Cambridge: Cambridge University Press; 1922–2015, United States Energy Information Administration

-

Nickel: 1850–2010, USGS; 2011–2015, IMF

-

Palm oil: 1850–1899, SS; 1900–1959, GY; 1960–2015, WB

-

Peanuts: 1870–1972, Manthy, R.S. (1974), Natural Resource Commodities—A Century of Statistics. Baltimore and London: Johns Hopkins Press; 1973–1979, National Agricultural Statistics Service; 1980–2015, WB

-

Petroleum: 1860–2000, Global Financial Data; 2001–2015, IMF

-

Phosphate: 1880–1959, Manthy, R.S. (1974), Natural Resource Commodities—A Century of Statistics. Baltimore and London: Johns Hopkins Press; 1960–2015, WB

-

Platinum: 1900–1909, USGS; 1910–1997, Global Financial Data; 1998–2015, Kitco

-

Pork: 1850–1851, Cole, A.H. (1938), Wholesale Commodity Prices in the United States, 1700–1861: Statistical Supplement. Cambridge: Harvard University Press; 1852–1857, Bezanson, A. (1954), Wholesale Prices in Philadelphia 1852–1896. Philadelphia: University of Pennsylvania Press; 1858–1979, Global Financial Data; 1980–2015, IMF

-

Potash: 1900–2015, USGS

-

Rice: 1850–1899, SS; 1900–1956, GY; 1957–1979, Global Financial Data; 1980–2015, IMF

-

Rubber: 1890–1899, Global Financial Data; 1900–1959, GY; 1960–2015, WB

-

Rye: 1850–1851, Cole, A.H. (1938), Wholesale Commodity Prices in the United States, 1700–1861: Statistical Supplement. Cambridge: Harvard University Press; 1852–1869, Bezanson, A. (1954), Wholesale Prices in Philadelphia 1852–1896. Philadelphia: University of Pennsylvania Press; 1870–1970, Manthy, R.S. (1974), Natural Resource Commodities—A Century of Statistics. Baltimore and London: Johns Hopkins Press; 1971–2015, National Agricultural Statistics Service

-

Silver: 1850–2015, Kitco

-

Steel: 1850–1998, USGS; 1999–2015, WB

-

Sugar: 1850–1899, SS; 1900–1959, GY; 1960–2015, WB

-

Sulfur: 1870–1899, Manthy, R.S. (1974), Natural Resource Commodities—A Century of Statistics. Baltimore and London: Johns Hopkins Press; 1900–2010, USGS

-

Tea: 1850–1899, SS; 1900–1959, GY; 1960–2015, WB

-

Tin: 1850–1899, SS; 1900–2010, GY and PNR; 2011–2015, UNCTAD

-

Tobacco: 1850–1865, Clark, G. (2005), “The Condition of the Working Class in England, 1209–2004.” Journal of Political Economy 113(6): 1307–1340; 1866–1899, Carter, S. et al. (2006), Historical Statistics of the United States, Millennial Edition. Cambridge: Cambridge University Press; 1900–1959, GY; 1960–2015, WB

-

Wheat: 1850–1999, Global Financial Data; 2000–2015, United States Department of Agriculture National Agricultural Statistics Service

-

Wool: 1850–1899, SS; 1900–1979, GY; 1980–2015, IMF

-

Zinc: 1850–2000, Global Financial Data; 2001–2015, IMF

Rights and permissions

About this article

Cite this article

Jacks, D.S. From boom to bust: a typology of real commodity prices in the long run. Cliometrica 13, 201–220 (2019). https://doi.org/10.1007/s11698-018-0173-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11698-018-0173-5