Abstract

Theoretical models suggest monetary policy is transmitted to commodity prices. We quantify this channel using several empirical methods under daily data. In early 2009, the US real interest rate became negative, with sample mean varying from 1.75 % (in the mid-1997 to January 28, 2009, subsample) to \(-1.50\,\%\) (in January 29, 2009, to mid-September 2013 subsample). Gold displays higher risk-adjusted returns earlier, while copper and oil have higher risk-adjusted returns more recently. Shocks to the exchange rate and the real interest rate in VARs explain almost 30 % for oil and 32 % for copper more recently when impulse responses are more significant. The time-varying correlation of oil with the real interest rate in the more recent period is \(-0.462\), and its correlation with the exchange rate is \(-0.460\), compared to \(-0.089\) and \(-0.120\), respectively, in the earlier period. Vine copula methods identify a dependence pattern of C-vine copula with t-copula in almost every pair among commodity prices, the real value of the US dollar and the US real interest rate.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Commodity prices, monetary policy and exchange rates are all related to each other. For example, when the US Federal Reserve raises interest rates, the US dollar tends to become stronger and commodity prices get weaker. On the other hand, a sell-off in commodities markets may drive investors into currencies often deemed less risky investments, such as the Euro, Swiss franc and Japanese yen, thus making dollar lower. It is interesting to model dynamic linkages among all of the three markets and identify the dependence structure across them, which can help investors optimize portfolio diversification. A vast literature links commodity prices to monetary policy, and another links commodity prices to exchange rates. This paper connects these two literatures from the perspective of daily returns of commodity prices (oil, gold, copper, and cotton), the real value of the US dollar against major currencies, and the US real interest rate, defined as the difference between the nominal short-term interest rate (the Federal Funds target rate) and expected inflation. The time span runs from mid-1997 (when data on 5-year Treasury Inflation Protected Securities became available) to September 2013. Due to the magnitude of the most recent (2008–2009) US recession, we break the sample into two periods in order to illustrate the recent accommodative monetary policy in the USA, as well as to quantify the commonly mentioned time-varying correlation properties associated with asset returns.

This research connects the commodity price run-up in the 2000s to US recent monetary policy. Berthelsen (2013) summarizes some of the financial links as follows: “... Commodity prices as a group nearly doubled between 1998 and 2008 as measured by the Dow Jones-UBS Commodity Index, with some index components such as oil and gold rising as much as sevenfold during that time and leading to talk of a commodities “supercycle” among analysts and strategists. But prices never regained their peak after the 2008 financial crisis, and have been drifting down since mid-2011. The trend has worsened this year, leading investors and analysts to call the end of the supercycle. The index slid 10.5 % in the first half of the year, with raw materials dearest to China’s growth—industrial metals such as copper, aluminum and nickel—posting declines of as much as 20 %.”

Commodity prices are also related to other markets, such as stocks. Kilian and Park (2009) estimate recursive models with shocks to oil production, real economic activity, real oil prices and stock returns. They identify the fundamental supply and demand shocks underlying the innovations to the real price of oil and show that these shocks explain one-fifth of the long-run variation in US real stock returns. These shocks can be related to the real interest rate and to the exchange rate since the rate of change of currency is associated with nominal interest rate differentials and rising inflation (affected by oil prices) lowers real returns. Also, in equity markets wealth effects become important and not only stock returns reflect expected (discounted) cash flows but they may have an impact on the real economy and then on the market for internationally traded commodities. The dynamic correlations between stock markets and 25 commodities prices are examined in Creti et al. (2013). Using DCC-GARCH methodology, the authors show that the dynamic correlations between commodity and stock markets are very volatile, especially during the 2007–2009 financial crisis. Byrne et al. (2013) investigate the relationship between commodity prices and macroeconomic fundamentals as well as the relationship between commodity prices and risk, proxy for stock market uncertainty. The paper concludes that looser monetary policy may lead to higher commodity prices. In addition, Sadorsky (2014) uses VARMA-AGARCH and DCC-AGARCH methods to model volatilities and conditional correlations between emerging market stock prices, copper prices, oil prices and wheat prices, and Arouri et al. (2015) apply VAR-GARCH framework to exploring both return and volatility spillovers between gold prices and stock market in China over the period from March 22, 2004, through March 31, 2011.

Several theoretical frameworks link real interest rates to commodity prices. Byrne et al. (2013) review the literature on bond returns and commodity prices, as well as the role of uncertainty. Using annual data from 1901 to 2008, they document that real interest rates and uncertainty are both found to be negatively related to a common factor. Other works with long time spans for commodity research include Mollick et al. (2008), Harvey et al. (2010) and Enders and Holt (2012), who invariably address the long-term decline in commodity prices (the Prebisch–Singer hypothesis). Using shorter time spans, empirical work has documented the relations between commodity prices and real interest rates under vector autoregressions (VARs) as well. Akram (2009) finds that oil prices increase with negative movements in US real interest rates in his quarterly VAR model from 1990:1 to 2007:4 with OECD industrial production, real interest rates, effective real exchange rate and the real price of oil. In particular, shocks to real interest rates account for more than 20 % of the forecast error variance in oil prices, and real exchange rate fluctuations account for a little lower than 20 %. Arora and Tanner (2013) revisit this for monthly frequency VARs from 1975:1 to 2012:5 and conclude that the response of oil prices to real interest rates is consistent with the storage reasoning, with oil prices becoming more responsive to real interest rates after 2000. By estimating a model of the prices of oil and other storable commodities, Frankel (2014) finds a negative effect of interest rates on the demand for inventories and therefore on commodity prices and positive effects of expected future price gains on inventory demand and therefore on today’s commodity prices.

There are two main reasons for the negative relationship between dollar prices of commodities and the value of the dollar: (1) Commodities are usually priced in dollars. When the value of dollar depreciates, it will take more dollars to buy the same amount of a commodity as before the depreciation; and (2) the depreciation of the value of the dollar against other currencies will create a purchasing power and commodity demand for foreign investors. This will eventually promote the dollar prices of commodities. With respect to oil and exchange rates, co-integration methods in Lizardo and Mollick (2010) suggest that increases in real oil prices lead to stronger currencies of net oil exporters (Canada, Mexico or Russia) and weaker currencies of net importers, such as Japan, with monthly data starting in the mid-1970s to 2007:12. Sari et al. (2010) examine oil, precious metals and the U.S. dollar/euro exchange rate in VARs and report weak linkages between changes in exchange rates and oil price returns with daily data from January 1999 to October 2007. Beckmann and Czudaj (2013) use monthly data from January 1974 to November 2011 and find co-integrating relationships between oil prices and the real broad index (USD vs. 26 currencies) and with the major index (USD vs. 7 major currencies). Their results are generally consistent with USD depreciation coinciding with increases in oil prices, with mixed results found when the interest rate is included in the long-run model. Employing copula methods, Reboredo (2012) presents evidence of oil prices and exchange rate dependence being weak, to rise only in the aftermath of the global financial crisis. Aloui et al. (2013) study the conditional dependence structure between crude oil prices and US dollar exchange rates using a copula-GARCH approach. They find evidence of significant and symmetric dependence for almost all the oil–exchange rate pairs considered over the 2000–2011 period. Choudhria and Schembrib (2014) examine the Canada–US real exchange rate since the early 1970s to test two popular explanations of the long-run real exchange rate based on the influence of sectoral productivities and commodity prices. Ahumada and Cornejo (2015) explore long-run effects of commodity prices on the real exchange rate in Argentina and find that a rise in commodity prices appreciates the exchange rate when controlling by domestic determinants. De Truchisa and Keddadb (2016) examine the volatility dependence between crude oil market and four US dollar exchange rates by means of both fractional co-integration and copula techniques. They find increasing linkages just before the 2008 market collapse and more recently in the aftermath of the European debt crisis and conclude that dependence is sensitive to market conditions.

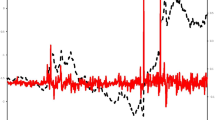

In this study, we are not only examining the relationships among commodities, real interest rate and US Dollar but also comparing the relationships across changes in US monetary policy. We investigate further how these three markets are correlated with each other in the multivariate sense. Specifically, we use vector autoregressions (VARs) to model dynamic linkages among commodities, the US real interest rate and the dollar and apply vine copula methods to identify the structure of dependence across these three markets, which can help investors optimize portfolio diversification. We adopt the theoretical model by Frankel (1986), based on Dornbusch’s (1976) famous overshooting model of exchange rates, to commodity prices and the real interest rate. Empirically, we estimate the returns of commodity prices responding to monetary policy and exchange rates from both the VAR-type short-term responses and the multivariate Dynamic Conditional Correlation (DCC)-GARCH model proposed by Engle (2002). The former captures dynamic responses across markets and the latter allows for time-varying correlation, which is usually assumed in financial markets. We identify two subsamples to test changes in the relations among the series over time by picking up the date at which the real interest rate becomes negative. This makes the key building block of the theoretical model in this paper clear, i.e., commodity prices respond to real interest rates. According to the upper left chart of Fig. 1, following the expansionary monetary policy in the USA to deal with the most recent recession, the real interest rate became negative and has remained so until the present. The US dollar has also broadly weakened against major currencies. We thus split the data into two subsamples: The first one is from mid-1997 to January 28, 2009, and the second one from January 29, 2009, to mid-September 2013.Footnote 1 The mean of the real interest rate in the first subsample is 1.75 %, and that in the second one is \(-1.50\,\%\).

Movements of commodity prices (oil, gold, copper and cotton), ex-ante real interest rates and US dollar index. Notes Separate vertical lines indicate the dates that there is a big cut in target Federal Fund rate, September 24, and when real interest rate drops below zero, January 28, 2009, respectively

Accounting for the value of the US dollar against major currencies, we use daily data and several methodologies in this paper to quantify commodity price responses to both the real value of the dollar and the US real interest rate. Of particular interest is the recent expansionary monetary policy in the USA following the 2008–2009 recession. Aloui et al. (2011) report substantial changes in the degree of tail-dependence caused by the global financial crisis. With theoretical models suggesting monetary policy is transmitted to commodity prices, we employ VAR dynamic responses and DCC-GARCH time-varying correlations methods first to quantify this channel under daily data.

We find in VARs that shocks to the exchange rate and the real interest rate virtually play no role in the variance decompositions of oil in earlier times, but they explain almost 30 % more recently (and 32 % for copper), with markedly negative impulse responses. Under negative real rates, positive shocks to the value of the US dollar and the real interest rate lead to decrease in the price of commodities, with higher responses for oil and copper. The time-varying correlation is much higher too more recently. For example, the correlation between oil prices and the real interest rate is \(-0.462\) for the second subsample and \(-0.089\) for the first one, that between oil prices and the exchange rate is \(-0.460\) for the second and \(-0.120\) for the first and that between the exchange rate and the real interest rate is 0.321 for the second and \(-0.004\), which is not statistically significant, for the first. Very similar patterns are found for copper and cotton. Gold prices, however, vary inversely with real interest rates in the more recent period, but its dynamic correlation with exchange rate is steady. Overall, the recent US monetary policy is associated with stronger dynamic responses and a higher level of dynamic correlation.

While VAR and DCC-GARCH models allow us to examine dynamic relationships among commodity prices, the US dollar and the real interest rate, these methods are silent on the dependence structure among the series, which has been of more interest since the global financial crisis of 2008–2009. To address this, we apply the vine copula methodology. During recent years, vine copula methods (Joe 1996; Bedford and Cooke 2001, 2002; Aas et al. 2009) have appeared in the literature to capture multivariate dependence flexibly and effectively. See also Dißmann et al. (2013) and references therein. This method has been widely applied in finance and economics. For example, Riccetti (2013) applies vine copula method to the macroasset allocation of portfolios containing a commodity component, and Arreola Hernandez (2014) fits vine copula models and portfolio optimization methods with respect to five risk measures to investigate the dependence risk and resource allocation characteristics of two 20-stock coal–uranium and oil–gas sector portfolios from the Australian market in the context of the global financial crisis of 2008–2009. More applications can be found in de Melo Mendes et al. (2010), Low et al. (2013), Weiß and Supper (2013), Abbara (2014), Brechmann et al. (2014), Markwat (2014), Allen et al. (2014), Brechmann et al. (2015) and Huang et al. (2016), who analyze the real interest rate—stock market link using vine copula models. However, multivariate dependence among commodity prices, the real value of the US dollar and the US real interest rate has not been addressed yet in the literature, which is explored in the current paper using vine copula methods.

2 The model and the hypothesis

Our empirical work below is based on Frankel (1986), who applied Dornbusch’s (1976) famous overshooting model of exchange rates to commodity prices. The building blocks of the model are the following. First, there is one equation for expected rate of change of oil prices \((\hat{p}_\mathrm{o}^\mathrm{e} )\) as the sum of short-term nominal interest rate (i) and storage costs (sc):

Second, the rate of change of goods (manufactured) prices, \((\hat{p}_\mathrm{m} )\) is assumed to depend on a gradual adjustment over time to excess demand between manufactures and potential output \((y^*)\) in that sector \(\left( {d-y^{*}} \right) \), plus a term representing the expected secular rate of inflation \((\mu )\), which is itself linked to money growth rate as in:

Excess demand is in turn written as an increasing function of the price of oil relative to manufactures and a decreasing function of the real interest rate (\(r^*\) is a constant):

We substitute (3) in (2) and then recall the money market equilibrium with the liquidity function \((m-p=\phi y-\lambda i)\), where m is the log of nominal money supply, p is the log of the price level, y is the log of output, and parameters \(\phi \) and \(\lambda \) are the elasticities in money-demand form. Further, the price level is a weighted average of manufacture prices and oil prices with respective weights \([\alpha \hbox { and } (1-\alpha )]: p=\alpha p_\mathrm{m} +\left( {1-\alpha } \right) p_\mathrm{o}\). Substitution and differencing, together with rational expectations, lead to two equations in rate of change form, one for manufactures and the other for oil. The one for oil, in particular, is given by

where \(\theta \) is the speed of adjustment between oil prices and its expected value in the law of motion for expected price of oil. Frankel (1986) provides the mathematical details on \(\theta \), being directly related to \(\pi \), the speed of adjustment in manufactured goods. According to (4), if a change in macroeconomic policy has lowered the real interest rate \(\left( {i-\mu } \right) \) below \(\hbox {r}^*\), then oil prices have risen above their long-run equilibrium path \(p_\mathrm{o}^*\) . Of course, the long-run equilibrium path of oil will imply equal levels \(p_\mathrm{o}^*=p_\mathrm{m}^*=p^{*}=m^{*}-\phi y^{*}+\lambda \left( {r^{*}+\mu } \right) \), using the money-demand function. Interestingly, substituting this last equation in (4) yields

An unanticipated increase in the expected long-run rate of money growth \(\mu \) increases the current (long-run) \(p_\mathrm{o}^*\) and thus the current \(p_\mathrm{o}\). In this case, this model of commodity prices shows both the negative effect of the real interest rate and the positive effect of the expected long-run money growth rate, which will be depreciating the domestic currency.

We will apply the insights of this model to the price of oil (WTI given the focus on US monetary policy and its transmission to commodity prices) and the expansion of US Federal Reserve in recent years, which has led Fed to accumulate assets of more than $4 trillion, mostly in US Treasuries but also in mortgage backed securities bought by Fed. Cecchetti (2009) discusses the responses by the Federal Reserve in the early stages of the crisis. Intuitively, an expansion of Fed balance sheet lowers substantially the domestic real interest rate, which pushes up oil prices internationally.

An important link is the exchange rate channel: While an expansion of domestic money depreciates the USD against other currencies, lower US interest rates suggest by the ex-ante uncovered interest parity (UIP) condition that the rate of depreciation of the USD must fall. It is therefore important to control for exchange rate effects when verifying the link between real interest rates and oil prices. There are, of course, many ways to identify a change in monetary policy. We focus on a market-driven indicator based on when the real interest rate became (and remained) negative for the time of the subsample period.

3 The data

This paper explores the dynamic relationships among commodity prices, the real value of the US dollar and the US real interest rate. All data series are collected from Datastream database at a daily frequency from July 1997 to September 2013. Commodities used in this study include crude oil, precious metal gold, industrial metal copper and agricultural raw material cotton.Footnote 2 Crude oil prices, OIL_WTI, are prices of West Texas Intermediate (WTI), expressed in US dollars per barrel. Gold prices, GOLD, are prices of precious metal gold that are traded in London Metal Exchange and measured in US dollars per troy ounce. Copper prices, COPPER, are the price of grade A industrial metal copper that are also traded in London Metal Exchange and quoted in US dollars per metric ton. Cotton prices, COTTON, are Mill-Delivered prices of cotton and quoted in US cents per pound. As for the exchange rate, EX_MAJ is a weighted average of the foreign exchange value of the US dollar against a subset of the major index currencies including the Euro Area, Canada, Japan, UK, Switzerland, Australia and Sweden. The index has base March 1973=100, and an increase means a USD appreciation. Following the conventional approach, ret_OIL_WTI, ret_GOLD, ret_COPPER, ret_COTTON and ret_EX_MAJ represent first differences of log of (consecutive) daily prices of OIL_WTI, GOLD, COPPER, COTTON and EX_MAJ, respectively. The ex-ante real interest rate used in this study is computed using the formula for the ex-ante real interest rate (\(real\_interest_t \), or rr) at time \(t: real\_interest_t =FFR_t -\left( {treasury_t -TIPS_t } \right) \), where \(FFR_t\) is the target Federal Fund rate at time \(t, treasury_t \) and \(TIPS_t \) are the yields in 5-year US T-note and in 5-year US Treasury Inflation Protected Security at time t, respectively.Footnote 3 The term \(\left( {treasury_t -TIPS_t } \right) \) is also called expected inflation at time t and represents US Treasury market-based expectations of inflation: “the excess of the nominal interest rate over the TIPS rate, \(\ldots \), which we will call the interest rate differential, provides a rough measure of expected inflation.” Abel et al. (2014, p. 273).

We identify two subsamples to test changes in the relationships among the series over time. According to the graph of \(real\_interest_t\) in Fig. 1 (top right), there are other dates that \(real\_interest\) drops below zero, yet it moved back up after some time. We split the data at January 29, 2009, since \(real\_interest\) drops below zero and stays negative after that date, indicating a sustained period of negative real interest rate.Footnote 4

The summary statistics of variables used in this study are presented in Table 1. Panel A reports descriptive statistics on or before January 28, 2009, while Panel B reports descriptive statistics after January 28, 2009. According to Table 1, the increase in commodity price returns in the later period is visible. The mean price of GOLD increases by 217 % in the later period (from $436.32 per barrel to $1383.77 per barrel), which is the highest rate of increase among all commodities considered in this paper. OIL and COPPER prices have a close rate of increase (100 % for OIL_WTI mean price and 123 % for COPPER mean price), while COTTON, an agricultural commodity, has the lowest rate of increase of 65 % in the later period. To adjust for the investment risk in these commodities, Sharpe ratios are calculated for each of the commodity price returns by dividing the mean by its associated standard deviation. For the period on or before January 28, 2009, GOLD has the highest risk-adjusted return (0.0212), followed by OIL_WTI (0.0088) and COPPER (0.0065). COTTON has negative risk-adjusted return of \(-0.0120\) for this period. For the period after January 28, 2009, COPPER and OIL have higher risk-adjusted returns (0.0390 and 0.0333, respectively), GOLD has the lowest risk-adjusted return (0.0192), and COTTON switches from a negative risk-adjusted return to a positive risk-adjusted return of 0.0222. For the exchange rate market, the US dollar shows a depreciation against major trade-partners’ currencies as EX_MAJ decreases from a mean of 91.78–74.49 across periods. A careful examination into the data shows that the period before January 28, 2009, contains a faster rate of depreciation of US dollar than the period after January 28, 2009. As already mentioned, average real interest rates, rr, have a positive mean (1.75 %) in the period on and before January 28, 2009, and a negative one \((-1.5\,\%)\) after. This change of more than 3 % across subperiods reflects the accommodative US monetary policy in the more recent period, following the financial crisis of 2008–2009.

To visualize the relationship of each commodity series, we plot each of them in various panels in Fig. 1 against the real interest rate and the US dollar major index. Overall, there are negative co-movements between commodities prices and the real interest rate, which are more visible in the recent period. This finding provides initial support for the theoretical negative relationship between commodity prices and the real interest rate discussed in the model above. One possible interpretation is that during Quantitative Easing (QE) periods large amounts of funds went into gold and other commodities, which serve well as inflation hedges relative to stock and credit markets. Graphs of commodities prices and the US dollar index suggest negative co-movements between commodities prices and US dollar, especially in the second subsample.

4 Methodological frameworks

To examine how commodity prices, US dollar index and the real interest rate react to their shocks across subsamples, we adopt an unrestricted vector autoregression (VAR) model. A VAR model has been frequently used to analyze the impact of oil price shocks on other economic series and financial series (see, e.g., Sadorsky 1999; Huang et al. 2005; Kilian and Park 2009; Lee et al. 2012), and the upward behavior of commodity prices in response to the real interest rate in Akram (2009). Contrary to structural VAR which imposes restriction on certain variables, we allow for unrestricted dynamic relationships among the series following the 3-way flows across commodity, currency and interest rate markets. Our unrestricted VAR model is estimated by

where \(R_t \) is a vector of the three series studied in this paper (ret_EX_MAJ, diff_rr and one of the following: ret_OIL_WTI, ret_GOLD, ret_COPPER, ret_COTTON). \(B_0 \) is a \(3\times 1\) column vector of constant terms, \(B_i \) is a \(3\times 3\) matrix of unknown coefficients, and \(\varepsilon _{1t}\) is a \(3\times 1\) column vector of error terms. p is the number of lags which is determined based on Akaike information criterion and final prediction error as proposed by Hamilton (1994).

We also examine time-varying co-movements among commodity prices, US dollar index and the real interest rate across subsamples. We employ the multivariate DCC-GARCH model proposed by Engle (2002). The DCC-GARCH model allows estimation of the dynamic changes in conditional correlation among the aforementioned series. One important advantage of the DCC-GARCH model over traditional constant correlation method is the allowance for the estimation of time-varying correlation coefficients of standardized residuals (hence controlling for heteroscedasticity). To be consistent with the VAR model above, we use a trivariate DCC-GARCH (1,1) framework with three series: each of the commodity price returns, the US dollar index and the real interest rate.

In the trivariate DCC-GARCH(1,1) model, the system equation contains multiple mean equations and conditional variance equations. A representation of the mean equations is a reduced form of VAR model similar to Eq. (6), with one lag only:Footnote 5

where \(R_t\) is a vector of the three series studied in this paper (ret_EX_MAJ, diff_rr and one of the following: ret_OIL_WTI, ret_GOLD, ret_COPPER, ret_COTTON). \(\varepsilon _t =( {\varepsilon _{it} ,\varepsilon _{jt} ,\varepsilon _{kt} } )^{\prime }\) is a vector of three error terms that can be rewritten as \(\varepsilon _t =H_t^{1/2} \varepsilon _t \), where \(\varepsilon _t =( {\varepsilon _{it} ,\varepsilon _{jt} ,\varepsilon _{kt} } )^{\prime }\) is an independently and identically distributed (i.i.d.) sequence of random vectors with mean zero and covariance matrix \(H_t \). \(\varepsilon _t \) is also called standardized residuals. The matrix \(H_t \) represents the Cholesky decomposition of

where \(\Omega _{t-1} \) represents the past information up to time \(t-1\). Therefore, \(\varepsilon _{it}\sim N\left( {0,H_t } \right) .\) The time-varying variances of the returns are generated by

In addition, the conditional covariance between two return series can be specified as

from which the time-varying conditional correlations (\(\rho _{ij,t} )\) between two returns can be estimated.

According to Engle (2002), estimating the mean equations (7)–(9) and the variance–covariance equations (10)–(16) simultaneously in one step is not practical because of the large number of parameters involved. Using a two-stage approach—estimating the mean equations (7)–(9) first and then using the residuals to formulate the variance–covariance equations—is a more tractable method. The DCC model can be estimated by maximizing the log-likelihood function

where \({\uptheta }\) is the 21 \(\times \) 1 parameter vector.

As mentioned in Sect. 1, multivariate dependence has become more interesting after the 2008–2009 financial crisis. We apply vine copula method to identify the dependence pattern among commodity prices, the real value of the US dollar and the US real interest rate. Under the vine copula method, a general multivariate distribution is decomposed into a cascade of pair-copulas.

The selecting and estimating procedure introduced in Dißmann et al. (2013) will be used in the subsequent vine copula analysis. Under this procedure, an automated strategy are used first to jointly search for an appropriate regular vine (R-vine) tree structure, pair-copula families and the parameter values of the chosen pair-copula families. This is a sequential approach starting by identifying the first tree, its pair-copula families and their parameter estimates. The specification of the second tree utilizes transformed variables which depend on the choices made in the first tree, and so on until the last tree. For each tree selection, a maximum spanning tree algorithm is used and edge weights are chosen appropriately to reflect large dependencies, pair-copulas are chosen independently using AIC, and the sequential estimation approach suggested by Aas et al. (2009) is used to estimate the corresponding pair-copula parameters. Once an appropriate R-vine distribution is found, maximum likelihood estimation method is used to jointly estimate all parameters, using the sequential estimates as starting values.

R-vine is a special case of vine,Footnote 6 and two special cases of R-vine, canonical (C-) and drawable (D-) vines,Footnote 7 are generally addressed in the literature. The most commonly applied one is the C-vine. Therefore, if our found R-vine is not a C-vine, we apply the Vuong test (Vuong 1989) to see whether the found R-vine is statistically different from a C-vine. If the found R-vine is not statistically different from a C-vine, the C-vine is selected. The n-dimensional density corresponding to a C-vine is given by

where F is the distribution function, f is the density function, and c is the copula density function.

Since maximum likelihood estimation method is used in the vine copula model fitting, in order for this estimation method to be valid, we first apply an AR(1)–GARCH(1,1) model to filter out autocorrelations in our data. Then, applying the above-mentioned selecting and estimating, we find the most appropriate R-vine copula model to fit the dependence structure among commodity prices, the real value of the US dollar and the US real interest rate. In selecting pair-copulas, we considered the following copulas: Gaussian, Student t, Clayton, Gumbel, Frank, Joe, BB1, BB6, BB7 and BB8 copulas. Finally, the selected vine copula model is verified by the goodness-of-fit test proposed by Schepsmeier (2013).

5 Results

5.1 Correlation analysis

Table 2 reports the correlation matrices in returns (or first differences in the case of the real interest rate), used in both VAR and DCC-GARCH models. A table with the correlation coefficients of the series in levels is available upon request. The results from Table 2 are generally consistent with the graphic patterns in Fig. 1. According to Table 2, all commodity prices show negative correlations with the real interest rate, and these negative correlations are much larger in the recent period with \(-0.4563\) for ret_OIL_WTI, \(-0.1305\) for ret_GOLD, \(-0.3338\) for ret_COPPER and \(-0.1763\) for ret_COTTON. Commodity price returns are negatively correlated with the US dollar index. While ret_OIL_WTI, ret_COPPER and ret_COTTON show increases (in absolute value) in their correlation with dollar index across periods, ret_GOLD shows a decrease (in absolute value, from \(-0.525\) to \(-0.328\)) with the exchange rate. Among commodities, ret_COTTON is correlated the least with others. In general, these findings suggest that commodity price returns move inversely with EX_MAJ, but they also suggest gold commoves less with the other commodities and with currency fluctuations in the second subperiod.

5.2 Variance decompositions and impulse response functions

From the VAR models described in the methodology section, we extract the forecast error variance decompositions as well as the generalized impulse response functions using Monte Carlo simulations with 5000 replications. While the forecast error variance decompositions show how much of the variance of a variable can be explained by shocks to another variable in the model, the use of generalized impulse response functions allows estimations of responses of variables to shocks of other variables in the VAR model. Tables 3, 4, 5 and 6 report, for up to a 5-day forecasted horizon period, the variance decompositions of the VAR models in (6) for ret_OIL_WTI, ret_GOLD, ret_COPPER and ret_COTTON, respectively. Based on Akaike information criterion (AIC) and final prediction error (FPE), we employ p = 11, 12, 12 and 2 lags in VAR models for ret_OIL_WTI, ret_GOLD, ret_COPPER and ret_COTTON, respectively, in the first subperiod. For the second subperiod, p = 2 lags are used in all VAR models.Footnote 8

According to Table 3, for the period on or before January 28, 2009, the variance of dollar index returns, difference in real interest rate and oil price returns are significantly explained only by their own shocks. At day 5, shocks to dollar index returns explain 98.98 % of its own variance. Shocks in real interest rate difference explain 99.00 % of the variance of real interest rate difference, and shocks in oil price returns explain 97.18 % of the variance of oil price returns. Before January 28, 2009, the short-term relationships among exchange rate, monetary policy and a commodity price (oil price) are thus very weak. In the period after January 29, 2009, onwards, however, after 5-day shocks in dollar index returns are able to explain 9.63 % of the variance of real interest rate differences. Moreover, shocks in dollar index returns and real interest rate differences are able to explain 18.51 and 12.30 %, respectively, of the variance of oil price returns. In the more recent period with negative real interest rates throughout, the linkages among exchange rate markets, monetary policy and oil are much stronger than before.

Impulse response function of VAR model A before January 28, 2009, B after January 28, 2009, for ret_EX_MAJ, diff_rr and ret_OIL_WTI. Notes Using Monte Carlo method with 5000 repetitions, the responses to generalized one standard deviation innovations ± 2 standard error (confidence bands) are plotted in the y-axis and time (days) is plotted in the x-axis

Impulse response function of VAR model A before January 28, 2009, B after January 28, 2009, for ret_EX_MAJ, diff_rr and ret_GOLD. Notes Using Monte Carlo method with 5000 repetitions, the responses to generalized one standard deviation innovations \(\pm \) 2 standard error (confidence bands) are plotted in the y-axis and time (days) is plotted in the x-axis

Impulse response function of VAR model A before January 28, 2009, B after January 28, 2009, for ret_EX_MAJ, diff_rr and ret_COPPER. Notes Using Monte Carlo method with 5000 repetitions, the responses to generalized one standard deviation innovations ± 2 standard error (confidence bands) are plotted in the y-axis and time (days) is plotted in the x-axis

Impulse response function of VAR model A before January 28, 2009, B after January 28, 2009, for ret_EX_MAJ, diff_rr and ret_COTTON. Notes Using Monte Carlo method with 5000 repetitions, the responses to generalized one standard deviation innovations ± 2 standard error (confidence bands) are plotted in the y-axis and time (days) is plotted in the x-axis

Among the other commodities, GOLD is the one that contrasts the most from others. According to Table 4, for the period on or before January 28, 2009, the variances of gold price returns are well explained (19.17 %) by shocks of dollar index returns. This decreases to 11.38 % for the period after January 28, 2009. While shocks to changes in the real interest rate are able to explain well other commodity price returns in the second period, it is not the case for gold price returns (only 0.3 %). Similar to oil and other models, after 5-day shocks in dollar index returns are able to explain 9.85 % of the variance of real interest rate differences in the VAR for gold. In the more recent period, as shown in Table 5, the variance of copper price returns is explained by shocks of dollar index returns up to 29.08 % (in 5 days), the most among all commodities, and by shocks of real interest rate differences at 3.47 % (in 5 days). Consistent with previous tables, while shocks of dollar index returns have no impact on the variance of real interest rate differences only in the period on or before January 28, 2009, they explain up to 9.74 % variance of real interest rate differences in second period. Similar results are found in Table 6 for cotton VAR model, except that shocks of real interest rate differences have almost no impact (up to 5 days of only 0.74 and 0.92 %) on the variance of cotton price returns across subperiods.

Figures 2, 3, 4 and 5 report the impulse response of VAR models for ret_OIL_WTI, ret_GOLD, ret_COPPER, ret_COTTON, respectively, for the 5-day forecasted period. The responses to generalized one standard deviation innovations ± 2 standard error (confidence bands) are plotted in the y-axis, and time (days) is plotted in the x-axis. Following the theoretical model in Sect. 2, we focus on the responses of real interest rates and oil prices. The exchange rate has long been considered to play an essential role in deciding how much goods and services should be exported and imported. Therefore, prices of those goods and services are determined by the exchange rate.Footnote 9 Indeed, results of the variance decompositions from Tables 3, 4, 5 and 6 confirm that dollar index returns are largely determined by their own shocks.Footnote 10 In other words, our results favor the exchange rate as a determining role in this study.

In general, while the real interest rate has a small reaction due to shocks of the dollar index return in the first period, it responds positively and significantly during the later period. The magnitudes of response associating to 1 % increase in the dollar index returns vary closely around 0.0137 % increase in the real interest rate across the models in day 1. This implies that a stronger USD leads to a higher real price of US dollar-based assets. In addition, the real interest rate reacts negatively to shocks of commodity prices, and the magnitude of the reaction is larger in the period after January 28, 2009. One possible reason is that commodity prices push up inflation, thus making the real interest rate fall. On the relationship between dollar index and commodity markets, there are negative and significant effects maintained throughout the period of this study. However, the effects between shocks of dollar index returns on commodity price returns in the period after January 28, 2009, are much larger than that in the first period. Specifically, after January 28, 2009, the 1 % increase in the standard deviation of the dollar index shock leads to a \(-0.39\,\%\) decrease in oil price return, \(-0.17\,\%\) decrease in gold price return, \(-0.42\,\%\) decrease in copper price return and \(-0.26\,\%\) decrease in cotton price return. Positive increases to innovations in the value of the US dollar lead to falling commodity price returns (especially in the second subperiod), and this negative relationship seems to be stronger for oil, copper and cotton. And there are also declines in the value of the USD when innovations in commodity prices increase.

In line with the correlation analysis, there is a small effect/no effect between shocks to the real interest rate change and commodity price returns in the period on or before January 28, 2009, while there is a negative and significant effect in the second period. Specifically, after January 28, 2009, the 1 basis point increase in real interest rate shock leads to a significant \(-0.41\,\%\) decrease in oil price return (Fig. 2B), \(-0.07\,\%\) decrease in gold price return (Fig. 3B), \(-0.26\,\%\) decrease in copper price return (Fig. 4B) and \(-0.16\,\%\) decrease in cotton price return (Fig. 5B). The negative relationship between real interest rates and commodity price returns is again stronger for oil and copper.

5.3 Trivariate DCC-GARCH (1,1)

Tables 7, 8, 9 and 10 report the estimation results of trivariate DCC-GARCH (1,1) models for ret_OIL_WTI, ret_GOLD, ret_COPPER, ret_COTTON, respectively, before and after our selected break point of January 28, 2009. To check for model diagnostics, we use the methods proposed by Hosking (1980), Li and McLeod (1981) and McLeod and Li (1983) to verify the appropriateness of the parsimonious GARCH (1,1) specification. These multivariate versions of the Portmanteau statistic do not reject the null hypothesis of no serial correlation in the standardized and squared standardized residuals, respectively, up to 20 lags, indicating that the models are well specified. Tables 7, 8, 9 and 10 show that the estimates of the two DCC parameters, \(\lambda _1\) and \(\lambda _2 \), are always statistically significant, suggesting that the second moments of the studied series are indeed time-varying. The coefficients for the lagged shock-squared terms and variance in the variance equation are highly significant in all models, which is consistent with time-varying variance. In addition, the sum of estimated coefficients of Arch and Garch term in the variance equation is close to unity for all models, implying that the volatilities are highly persistent.

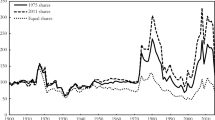

According to Table 7, the time-varying correlation between oil prices and the real interest rate extracted from DCC-GARCH(1,1) model decreases significantly from \(-0.089\) to \(-0.462\) across periods. A similar pattern is found in the relationship between oil price and dollar index: The time-varying correlation decreases significantly from \(-0.120\) to \(-0.460\). These results are consistent with those found in the correlation analysis and in the VAR model. These patterns can also be seen clearly in Fig. 6 which shows pair-wise time-varying conditional correlation coefficients between returns/differences of commodities and the dollar index/real interest rate.

As for GOLD in Table 8, the dynamic correlation between its return and the real interest rate decreases to a statistically significant \(-0.230\) in the second subsample, while the dynamic correlation between the dollar index and gold returns remain visibly negative: \(-0.460\) and \(-0.473\) across subperiods. See also Fig. 6, row 2. According to Table 9, decreases in the correlation coefficients between copper prices and the real interest rate as well as with the dollar index are also found. The time-varying correlation coefficient between copper prices and the real interest rate drops significantly from \(-0.025\) to \(-0.342\) across periods, and the correlation coefficient between copper prices and the dollar index drops significantly from \(-0.155\) to \(-0.581\) as well. These decreasing patterns can also be seen clearly in Fig. 6 when time-varying conditional correlation coefficients are used. Table 10 also indicates decrease in correlation coefficient between cotton prices and the real interest rate as well as the dollar index, but to a less extent. The correlation coefficient between cotton prices and the real interest rate drops significantly from \(-0.048\) to \(-0.181\) across periods, and that between cotton prices and dollar index decreases significantly from \(-0.057\) to \(-0.282\). These results match those found in the unconditional correlation analysis and in the VAR model reported earlier.

Time-varying conditional correlations among commodity prices (oil, gold, copper and cotton), ex-ante real interest rates and US dollar index. Notes Separate vertical lines indicate the dates that there is a big cut in target Federal Fund rate (on September 24, 2008), and when real interest rate drops below zero (on January 28, 2009), respectively

Time-varying conditional correlations between ex-ante real interest rates and US dollar index from different DCC-GARCH models. Notes Separate vertical lines indicate the dates that there is a big cut in target Federal Fund rate, September 24, and when real interest rate drops below zero, January 28, 2009, respectively

Importantly, the relationship between the real interest rate and the dollar index is found in each of the DCC-GARCH(1,1) models. Regardless the models used, we always find a significant increase in this relationship from no time-varying correlation (insignificant correlations) to roughly 0.31 (for gold in Table 8 and cotton in Table 10) or 0.32 (for oil in Table 7) and 0.33 (for copper in Table 9) after January 28, 2009. These increasing patterns can also be seen clearly in Fig. 7 when time-varying conditional correlation coefficients for various models are examined. In the more recent period, an increase in the real value of the US dollar is associated with higher rate of return of US-based assets. This is against the ex-ante UIP condition typically employed in order to make financial assets equally attractive at home and abroad.

5.4 Dependence pattern among series

In this section, we use the vine copula method to model the dependence among commodity price, real value of the dollar and the US real interest rate. After transforming the real interest rate series into return form, we fit each series with a skewed normal AR(1)–GARCH(1,1) filter and obtain the copula data. Applying the selecting and estimating procedure described in Sect. 4, the vine copula modeling results are obtained (see Table 11 and Fig. 8).

Vine copula structures A before January 28, 2009, B after January 28, 2009. Notes Since the dependence during the first subperiod is not very strong, we only present the vine copula structures for the second subperiod, with the structure for first subperiod available upon request. (a) Vine copula structure for the multivariate distribution of all four commodity returns (ret_OIL_WTI, ret_GOLD, ret_COPPER and ret_COTTON) with exchange rate return (ret_EX_MAJ) and real interest rate return (ret_rir). The letters in the figure represent different series: a for oil price return, b for gold price return, c for copper price return, d for cotton price return, e for exchange rate return and f for real interest rate return. (b) Vine copula structure for the multivariate distribution of oil/copper price return (ret_OIL_WTI/ret_COPPER) with exchange rate return (ret_EX_MAJ) and real interest rate return (ret_rir). The numbers in the figure represent different series: 1 for oil/copper price return, 2 for exchange rate return and 3 for real interest rate return. (c) Vine copula structure for the multivariate distribution of gold/cotton price return (ret_GOLD/ret_COTTON) with exchange rate return (ret_EX_MAJ) and real interest rate return (ret_rir). The numbers in the figure represent different series: 1 for gold/cotton price return, 2 for exchange rate return and 3 for real interest rate return

Table 11 verifies the negative relationship between commodity price returns and exchange rate returns, as shown by negative copula parameters. The strongest dependence occurs at the pair-copula of gold price return and exchange rate return before January 28, 2009, and that of copper price return and exchange rate return after January 28, 2009, whose copula parameters \(-0.4615\) and \(-0.5353\) are the largest in absolute value. Almost all pair-copulas are Student t copulas, with the fattest tail in the pair-copula of gold price return and exchange rate return during the second subperiod, which has the smallest number of degrees of freedom 5.1673. This phenomenon reflects higher volatility and dependence risk among different markets during the second subperiod. It is also noted that, from the first subperiod to the second, vine structures change for gold and cotton, as indicated by the third column. Specifically, the pair-copula in the first tree changes from 13 ({gold/cotton price return, real interest rate return}) in the first subperiod to 23 ({exchange rate return, real interest rate return}) in the second. This indicates that the dependence between gold/cotton and real interest rate is stronger than that between exchange rate and real interest rate in the first subperiod, while the dependence between exchange rate and real interest rate is stronger than that between gold/cotton and real interest rate in the second subperiod. The vine structures for oil and copper are the same for both subperiods, but dependence and tail-dependence are stronger in the second subperiod, as shown by copula parameter value and number of degrees of freedom.

Figure 8A, B displays the vine copula structures before and after January 28, 2009, respectively. Panel (a) in Fig. 8A shows that the gold price return is the central leading force in the six-series co-movement in the first subperiod, while Panel (a) in Fig. 8B shows that the copper price return is the central leading force in the second subperiod. Panels (b) and (c) in Fig. 8A show that in the first subperiod, the vine copula structure of each of the four commodity price returns with exchange rate return and real interest rate return is exactly the same, with commodity price returns as the central series leading the co-movement with exchange rate return and real interest rate return. However, we can see from Panels (b) and (c) in Fig. 8B that in the second subperiod, the vine copula structure of gold/cotton price return with exchange rate return and real interest rate return deviates, with exchange rate return leading its co-movement with commodity price returns and real interest rate return. Figure 8A, B also shows that all vine copula structures are canonical vines (C-vines). C-vine is one of the two special cases of regular vines discussed in Aas et al. (2009). A typical property of C-vines is that there is a central variable (or pair) in each tree of the vine structure, and the relationships of this variable (or pair) with each of other variables (or pairs) capture the dependence in a specific tree.

Schepsmeier (2013) extends the goodness-of-fit test for copulas introduced by Huang and Prokhorov (2014) and develops a goodness-of-fit test for regular vine copula models. We apply this method bootstrapped 200 times to test whether the C-vine copulas detailed in Fig. 8 and Table 11 are appropriate. The testing results indicate that p value in each and every case is unanimously 1, which strongly suggests that our vine copula modeling is a good fit.

6 Concluding remarks

This paper verifies the link among several commodity prices, the real value of the US dollar against major currencies and the US real interest rate, using three complementary methodologies under daily data from July 1997 to September 2013. Gold displays higher risk-adjusted returns in the earlier period followed by oil and copper, while more recently copper and oil have higher risk-adjusted returns, followed by cotton. Shocks to exchange rates and real interest rates in VARs play virtually no role in the variance decompositions of oil earlier but explain almost 30 % more recently (32 % for copper). In VARs positive shocks to the value of the US dollar and to real interest rates lead to decreases in commodity returns, especially for oil and copper, which was illustrated theoretically with the help of the model by Frankel (1986).

The time-varying correlation from DCC-GARCH models is also much higher more recently. For oil, the time-varying correlation is \(-0.462\) between oil and the real interest rate (\(-0.460\) between oil and the exchange rate), compared to \(-0.089\) and \(-0.120\), respectively, for the earlier period. For copper, the time-varying correlation is \(-0.342\) between copper and the real interest rate (\(-0.581\) between oil and the exchange rate), compared to \(-0.025\) and \(-0.155\), respectively, for the earlier period. Similar patterns are found for cotton. Gold, however, is different. The time-varying correlation between gold and the real interest rate increases (in absolute value) over time (from 0.040 to \(-0.230\)), while the dynamic correlation between gold and the exchange rate remains about the same, with \(-0.460\) in the earlier period and \(-0.473\) in the recent one. For gold, there has been no marked increase in the dynamic correlation between gold returns and the value of the dollar. This is supportive of a steady link between gold returns and currency.Footnote 11 While a full explanation warrants further examination, gold is a safe-haven asset. It has been known as an excellent long-term hedge against inflation. Despite some short-term price fluctuations, gold has been shown to maintain its purchasing value (see, e.g., Chua and Woodward 1982; Worthington and Pahlavani 2007; Blose 2010; Wang et al. 2011). In addition, gold is an excellent commodity to hedge against financial crisis. Baur and Lucey (2010) study US, UK and German stock and bond returns and gold returns and find that gold is a safe haven in extreme stock market conditions. Therefore, gold is fundamentally different from the other three commodities reported in this study.

Overall, the loose US monetary policy is associated with stronger dynamic responses and higher dynamic correlations. Multivariate dependence among various series has become more interesting after last financial crisis. Since the above-mentioned VAR and DCC-GARCH models are silent on it, we apply the vine copula methodology and find that multivariate dependence structures change from the first to second subperiod. The C-vine copula model with t-copula in almost each pair is found to be the most appropriate to model the multivariate dependence in both subperiods, with different leading series in each. It is confirmed that tail-dependence is stronger in the second subperiod. We obtain negative pair-copula parameters between commodity price returns and exchange rate returns, with the strongest dependence for the pair of copper price and exchange rate returns, while the relationships between commodity and real interest rate returns are negative only for oil and copper.

Notes

On December 5, 2008, the effective Federal Funds rate was moved down to 0.12 %, after levels of 0.52 % on December 1 and 1.04 % on October 15. From December 2008 onwards, the FF rate remained within the current very low levels (0.06–0.25 % range), based on daily data from the US Federal Reserve of St. Louis at http://research.stlouisfed.org/fred2/categories/118.

Other commodities were also included, such as aluminum, silver and wheat, but their behavior was very similar to one of the four commodities reported herein.

We also use yields in 10-year US T-note and 10-year TIPS for robustness check, and the results are insensitive. However, the studied sample will be shorter if using 10-year US T-note and 10-year TIPS because the data on 10-year TIPS were not introduced until January 2, 2003.

An anonymous referee suggested we test econometrically for one or more structural breaks. Performing the Bai–Perron tests to first differences of real interest rates, we find the break to be December 1, 2008, which is very close (9 weeks before) to our choice of late-January 2009. Our preferred break point has the real interest rate staying below zero throughout the second subsample, a clear measure of accommodative monetary policy.

The definitions of vine and R-vine can be found on page 1042 of Bedford and Cooke (2002).

For technical details and examples of R-, C- and D-vine copulas, see, e.g., pp. 54–55 of Dißmann et al. (2013).

Under this choice of lag length, application of VAR residual serial correlation LM tests at 5 lags suggests good properties in general for all models (using statistical significance at 5 % level). For example, in the case of OIL we do not reject the null hypothesis of no correlation using 1 % level since LM-stat = 6.15 (p value of 0.725) in the first subperiod. And we do not reject the null hypothesis of no correlation using 5 % level since LM-stat = 16.20 (p value of 0.063) in the more recent period.

The authors agree with one of the anonymous referees that the exchange rate is largely influenced by the monetary policy and the related expectations about future interest rates. We notice that relations among the exchange rate, oil prices and the real interest rate are dynamic and complicated. The exchange rate could be influenced by monetary policy and oil prices. However, we find results favoring the exchange rate as a determining role in this study.

For the ret_OIL_WTI VAR model, for example, dollar index returns respond to their own shocks by 98.98 % (first period) and 98.95 % (second period) after 5 days. For the ret_GOLD VAR, dollar index returns respond to their own shocks by 99.23 % (first period) and 99.07 % (second period) after 5 days. For the ret_COPPER VAR, dollar index returns respond to their own shocks by 99.19 % (first period) and 99.28 % (second period) after 5 days. For ret_COTTON VAR, dollar index returns respond to their own shocks by 99.23 % (first period) and 99.35 % (second period) after 5 days.

Pukthuanthong and Roll (2011) use daily data from 1971 through 2009 and show that higher gold prices is correlated with a weaker currency for all of them (not just USD, but also EUR, JPY and GBP) and conclude that gold returns in a currency are associated with currency depreciation most of the time (with occasional deviation from their usual negative relation, twice for the USD in their sample).

References

Aas K, Czado C, Frigessi A, Bakken H (2009) Pair-copula constructions of multiple dependence. Insur Math Econ 44:182–198

Abbara OZM (2014) Assessing stock market dependence and contagion. Quant Finance 14:1627–1641

Abel A, Bernanke B, Croushore D (2014) Macroeconomics, 8th edn. Pearson, Upper Saddle River

Ahumada H, Cornejo M (2015) Long-run effects of commodity prices on the real exchange rate: evidence from Argentina. Economica 61:1–31

Akram QF (2009) Commodity prices, interest rates and the dollar. Energy Econ 31(6):838–851

Allen DE, McAleer M, Singh AK (2014) Risk measurement and risk modelling using applications of vine copulas. Working paper

Aloui R, Ben Aïssa MS, Nguyen DK (2011) Global financial crisis, extreme interdependencies, and contagion effects: the role of economic structure? J Bank Finance 35(1):130–141

Aloui R, Ben Aïssa MS, Nguyen DK (2013) Conditional dependence structure between oil prices and exchange rates: a copula-GARCH approach. J Int Money Finance 32:719–738

Arora V, Tanner M (2013) Do oil prices respond to real interest rates? Energy Econ 36(1):546–555

Arouri M, Lahiani A, Nguyen DK (2015) World gold prices and stock returns in China: insights for hedging and diversification strategies. Econ Model 44:273–282

Arreola Hernandez J (2014) Are oil and gas stocks from the Australian market riskier than coal and uranium stocks? Dependence risk analysis and portfolio optimization. Energy Econ 45:528–536

Baur DG, Lucey BM (2010) Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financ Rev 45(2):217–229

Beckmann J, Czudaj R (2013) Oil prices and effective dollar exchange rates. Int Rev Econ Finance 27:621–636

Bedford T, Cooke RM (2001) Probability density decomposition for conditionally dependent random variables modeled by vines. Ann Math Artif Intell 32(1):245–268

Bedford T, Cooke RM (2002) Vines: a new graphical model for dependent random variables. Ann Stat 30:1031–1068

Berthelsen C (2013) Losses mount in resource markets. The Wall Street Journal, Abreast of the Market, 22 July 2013

Blose LE (2010) Gold prices, cost of carry, and expected inflation. J Econ Bus 62(1):35–47

Brechmann E, Czado C, Paterlini S (2014) Flexible dependence modeling of operational risk losses and its impact on total capital requirements. J Bank Finance 40:271–285

Brechmann EC, Heiden M, Okhrin Y (2015) A multivariate volatility vine copula model. Econom Rev 1–28

Byrne JP, Fazio G, Fiess N (2013) Primary commodity prices: co-movements, common factors and fundamentals. J Dev Econ 101(1):16–26

Cecchetti SG (2009) Crisis and responses: the Federal Reserve in the early stages of the financial crisis. J Econ Perspect 23(1):51–75

Choudhria EU, Schembrib LL (2014) Productivity, commodity prices and the real exchange rate: the long-run behavior of the Canada–US exchange rate. Int Rev Econ Finance 29:537–551

Chua J, Woodward RS (1982) Gold as an inflation hedge: a comparative study of six major industrial countries. J Bus Finance Account 9(2):191–197

Creti A, Joëts M, Mignon V (2013) On the links between stock and commodity markets’ volatility. Energy Econ 37:16–28

de Melo Mendes BV, Mendes Semeraro M, Cmara Leal RP (2010) Pair-copulas modeling in finance. Financ Mark Portf Manag 24:193–213

De Truchisa G, Keddadb B (2016) On the risk comovements between the crude oil market and U.S. dollar exchange rates. Econ Model 52(Part A):206–215

Dißmann J, Brechmann EC, Czado C, Kurowicka D (2013) Selecting and estimating regular vine copulae and application to financial returns. Comput Stat Data Anal 59:52–69

Dornbusch R (1976) Expectations and exchange rate dynamics. J Polit Econ 84(6):1161–1176

Enders W, Holt MT (2012) Sharp breaks or smooth shifts? An investigation of the evolution of commodity prices. Am J Agric Econ 94(3):659–673

Engle RF (2002) Dynamic conditional correlation—a simple class of multivariate GARCH models. J Bus Econ Stat 20(3):339–350

Frankel JA (1986) Expectations and commodity price dynamics: the overshooting model. Am J Agric Econ 68(2):344–348

Frankel JA (2014) Effects of speculation and interest rates in a “carry trade” model of commodity prices. J Int Money Finance 42:88–112

Hamilton JD (1994) Time series analysis. Princeton University Press, Princeton

Harvey DI, Kellard NM, Madsen JB, Wohar ME (2010) The Prebisch–Singer hypothesis: four centuries of evidence. Rev Econ Stat 92(2):367–377

Hosking J (1980) The multivariate portmanteau statistic. J Am Stat Assoc 75(371):602–608

Huang W, Prokhorov A (2014) A goodness-of-fit test for copulas. Econ Rev 33(7):751–771

Huang BN, Hwang MJ, Peng HP (2005) The asymmetry of the impact of oil price shocks on economic activities: an application of the multivariate threshold model. Energy Econ 27(3):455–476

Huang W, Mollick AV, Nguyen KH (2016) U.S. stock markets and the role of real interest rates. Q Rev Econ Finance 59:231–242

Joe H (1996) Families of m-variate distributions with given margins and m(\(\text{ m }-1\))/2 bivariate dependence parameters. In: Ruschendorf L, Schweizer B, Taylor MD (eds) Distributions with fixed marginal and related topics. Institute of Mathematical Statistics, Hayward, pp 120–141

Kilian L, Park C (2009) The impact of oil price shocks on the U.S. stock market. Int Econ Rev 50(4):1267–1287

Lee BJ, Yang CW, Huang BN (2012) Oil price movements and stock markets revisited: a case of sector stock price indexes in the G-7 countries. Energy Econ 34(5):1284–1300

Li WK, McLeod AI (1981) Distribution of the residual autocorrelation in multivariate ARMA time series models. J R Stat Soc Ser B (Methodol) 43(2):231–239

Lizardo R, Mollick AV (2010) Oil price fluctuations and U.S. dollar exchange rates. Energy Econ 32(2):399–408

Low RKY, Alcock J, Faff R, Brailsford T (2013) Canonical vine copulas in the context of modern portfolio management: are they worth it? J Bank Finance 37(8):3085–3099

Markwat T (2014) The rise of global stock market crash probabilities. Quant Finance 14:557–571

McLeod AI, Li WK (1983) Diagnostic checking ARMA time series models using squared-residual autocorrelations. J Time Ser Anal 4(4):269–273

Mollick AV, Faria JR, Albuquerque PH, León-Ledesma M (2008) Can globalization stop the decline in commodities’ terms of trade? The Prebisch–Singer hypothesis revisited. Camb J Econ 32(5):683–701

Pukthuanthong K, Roll R (2011) Gold and the Dollar (and the Euro, Pound, and Yen). J Bank Finance 35:2070–2083

Reboredo JC (2012) Modelling oil price and exchange rate co-movements. J Policy Modell 34(3):419–440

Riccetti L (2013) A copula-GARCH model for macro asset allocation of a portfolio with commodities. Empir Econ 44:1315–1336

Sadorsky P (1999) Oil price shocks and stock market activity. Energy Econ 21(5):449–469

Sadorsky P (2014) Modeling volatility and correlations between emerging market stock prices and the prices of copper, oil and wheat. Energy Econ 43:72–81

Sari R, Hammoudeh S, Soytas U (2010) Dynamics of oil prices, precious metals, and exchange rates. Energy Econ 32:351–362

Schepsmeier U (2013) A goodness-of-fit test for regular vine copula models. Working paper. http://arxiv.org/abs/1306.0818

Vuong QH (1989) Likelihood ratio tests for model selection and non-nested hypotheses. Econometrica 57:307–333

Wang KM, Lee YM, Thi TBN (2011) Time and place where gold acts as an inflation hedge: an application of long-run and short-run threshold model. Econ Model 28(3):806–819

Weiß GNF, Supper H (2013) Forecasting liquidity-adjusted intraday value-at-risk with vine copulas. J Bank Finance 37(9):3334–3350

Worthington AC, Pahlavani M (2007) Gold investment as an inflationary hedge: cointegration evidence with allowance for endogenous structural breaks. Appl Financ Econ Lett 3(4):259–262

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Huang, W., Mollick, A.V. & Nguyen, K.H. Dynamic responses and tail-dependence among commodities, the US real interest rate and the dollar. Empir Econ 53, 959–997 (2017). https://doi.org/10.1007/s00181-016-1165-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-016-1165-6