Abstract

This paper follows van der Ploeg (Metroeconomica 37(2):221–230, 1985)’s research program in testing both its extension of Goodwin (in: Feinstein (ed) Socialism, capitalism and economic growth, Cambridge University Press, Cambridge, 4, 54–58, 1967) predator–prey model and the Minsky Financial Instability Hypothesis (FIH) proposed by Keen (J Post Keynes Econ 17(4):607–635, 1995). By endowing the production sector with CES technology rather than Leontief, van der Ploeg showed that the possible substitution between capital and labor transforms the close orbit into a stable focus. Furthermore, Keen (1995)’s model relaxed the assumption that profit is equal to investment by introducing a nonlinear investment function. His aim was to incorporate Minsky’s insights concerning the role of debt finance. The primary goal of this paper is to incorporate additional properties, inspired by van der Ploeg’s framework, into Keen’s model. Additionally, we outline possibilities for production technology that could be considered within this research program. Using numerical techniques, we show that our new model keeps the desirable properties of Keen’s model. However, we also demonstrate that when the economy is endowed with a class of CES production function that includes the Cobb–Douglas and the linear technology as limit cases, the unique stable equilibrium is an economically desirable one. Finally, we propose a modified extension that includes speculative component in the economy as in Grasselli and Costa-Lima (Math Financ Econ 6(3):191–210, 2012) and investigate its effect on the dynamics. We conclude that CES production function is a more suitable assumption for empirical purposes than the Leontief counterpart. Finally, we show, using numerical simulations, that under plausible calibration, the model endowed with CES production function eventually lose the cyclical property of Goodwin’s model with and without the speculative component.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

It has been half a century since Goodwin [3] developed a model of endogenous real growth cycles. Based on a simple and well known dynamic–the nonlinear Lotka-Volterra prey–predator model–Goodwin’s model appeals in its simplicity and can be easily applied by researchers in a variety of fields (physics, biology, etc.). Goodwin’s growth cycle is a simple dynamic model of distributional shares of outputFootnote 1 and of (un)employment. In his model, he shows how accumulation takes the form of a cycle. The solution of the model describes a family of closed cycles in the state variables (workers’ share and employment).Footnote 2

In the 1980s, Van der Ploeg merged what he called “the neo-Keynesian” and the “neo-classical views.” He extended the Goodwin-Lotka-Volterra model by incorporating constant elasticity of substitution, or CES production technology, thus capital and labor no longer being complementary factors of production. By doing so, he relaxed the original assumption of a constant capital-to-output ratio made by Goodwin. The advantage of this relaxation is that both the Leontief technology underlying Goodwin’s model and the more general technology underlying Solow’s [16] model are incorporated as special cases. Furthermore, van der Ploeg showed that the choice of incorporating CES technology destroys the conservative nature of the Goodwin system, i.e. transforms a closed orbit in a stable focus. Therefore, perpetual cycles are replaced by damped cycles or monotonic convergence to the balanced growth equilibrium. The primary economic rationale of van der Ploeg’s extension would be that improved profit will stimulate investment and thus increase output. This gain in output would in turn stimulate jobs and push wages up by wage negotiation. Through internal financing, firms would substitute labor by capital by firing and installing new capital. For example, in Goodwin’s model, a higher wage share results in lower profits. The latter will negatively impact output growth and employment due to lower investment. This lower investment will eventually lead to a new boom in the “class struggle” cycle, which in turn will lead to a decrease in wages and increase in profits. In van der Ploeg’s model, when substitution between factors of production is considered, a given period of high employment rate–the apex of the cycle–will induce a substitution of labor by capital rather than an increase in wages. Such substitution will allow for the dampening of employment and wage variations.

In van der Ploeg’s framework, the equality between investment and profits always holds. In this paper, we propose to relax the equality by incorporating a Minskyan framework including debt. Minsky’s Financial Instability Hypothesis (hereafter: FIH) links the expansion of credit with the rise of asset prices and the inherent fragility of the financial system. Although Minsky made his points clear, aided by convincing diagrams and incisive exploration of data, he refrained from presenting his ideas as a mathematical model. This task was taken up by Keen [8], where a system of differential equations was proposed as a simplified model incorporating the basic features of Minsky’s hypothesis. By adding a new dimension to Goodwin’s model, Keen’s dynamic model changes a conservative system into a dissipative one in which the dynamics display sensitive dependence on initial conditions. Specifically, this new model has a stable equilibrium defined in terms of the employment rate, the profit rate, and the debt-to-output ratio. Additionally, the system will converge to this equilibrium if the initial conditions are sufficiently close to what we will call the Good equilibrium. However, for other initial conditions, the model bifurcates (see Pomeau and Manneville [15]) and undergoes an unstable cyclical breakdown towards what we will call the Bad equilibrium.

This paper shows that when the economy is endowed with CES production function, the properties of Keen’s model are preserved. Except that, under the assumption of a class of production function being bounded by the Cobb–Douglas and the linear, the equilibrium that led to the collapse (i.e., the Bad equilibrium) is no longer locally stable. We also show that the basin of attraction towards the Good equilibrium is substantially larger when substitution is allowed. Finally, we indicate that the model with CES production function would be a more suitable candidate for estimation purposes than the Leontief counterpart. All these conclusions hold whenever speculation is added to the economic landscape.

This paper is organized as follows: Sect. 2 outlines the model that departs from Keen [8] by incorporating CES production technology. Section 3 introduces the equilibria and the study of their local stability. Section 4 presents different properties deduced from the study of the basins of attraction. Section 5 extends the model by allowing for speculation. Finally, Sect. 6 offers concluding remarks and suggestions for further works.

2 The model

Keen [8] assumed Leontief production technology in which the inputs of production–capital and labor–are not substitutable. The production function is defined as followsFootnote 3

where \(Y^k\) is the real output, \(K^k\) the stock of productive capital, \(L^k\) the labor force and \(a > 0\) the labor productivity. In this framework, the capital-to-output parameter, \(\nu > 0\), is constant and technology is assumed to be used at its maximal capacity. van der Ploeg [18] relaxed the assumption that capital and labor cannot be substituted with each other by endowing the economy with CES production function

where \(A > 0\) is the factor productivity (or efficiency parameter) and \(b \in (0;1)\) reflects the capital intensity of the production. The short-run elasticity of substitution between capital and labor is given by \(\sigma _\eta := \frac{1}{1+\eta }\). The labor productivity is driven by a constant rate of growth \(a_l\). It should be recalled that the CES production function allows for three limit cases: (i) when \(\eta \rightarrow + \infty \), one retrieves the Leontief production function; (ii) \(\eta \rightarrow 0\) leads to the Cobb–Douglas production; (iii) if \(\eta \rightarrow -1\) one recovers the linear production function.Footnote 4\(^{,}\)Footnote 5

Real wages are set according to a short-run Phillips curve and we assume that the production sector behaves like a large oligopoly which adjusts the quantity produced so as to maximize its profit.Footnote 6 The first-order condition that characterizes the profit maximizing behavior implies that real wages equal their marginal return

Thus, van der Ploeg broke Goodwin’s assumption of a constant capital-to-output ratio, making it time-varying and defined by (see “Appendix A”):

where \(\omega := \text {w}L/Y\) is the wage-to-output ratio. We endow \(\nu _\eta \) with a subscript \(\eta \) since the dynamics will strongly depend upon \(\eta \)’s value. Whenever \(\eta \rightarrow +\infty \), the capital-to-GDP ratio is constant as in the Leontief case. The full model derivation of the Minskyan classical growth cycle model is available in “Appendix A”. It boils down to a three-dimensional system

where N is the active population, assumed to grow at a constant rate \(\beta \), and \(\lambda := L/N\) is the employment rate, which determines the level of wages through the short-term Phillips curve : \(\frac{\dot{\text {w}}}{\text {w}}=\Phi (\lambda )\). The second aggregate behavior is given by the function \(\kappa (.)\), that controls the investment-to-output ratio and depends upon the profit share \(\pi := 1 - \omega - r d\). In the latter, d stands for the debt-to-output ratio and \(r > 0\) for the constant short term interest rate. Finally, the parameter \(\delta > 0\) refers to the depreciation rate of capital.

In system (2), whenever \(\eta \rightarrow + \infty \) and \(A = 1/{\bar{\nu }}\), Keen’s [8] model is retrieved. Thus, we recover Leontief production function and, as previously stated, a constant capital-output ratio.

The growth rate of the economy is given byFootnote 7

Here, as in both the van der Ploeg and Keen models, the behavior of households is fully accommodating in the sense that, given investment \(I := \kappa (\pi )Y\), consumption is determined by the macro balance

precluding a more general specification of household saving propensity.Footnote 8 Table 1 makes the stock-flow consistency of the model explicit. For this paper, we adopt the convention that

where the net borrowing D is the difference between firm loans, L, and firms deposits, \(M^f\). Furthermore, the model (2) is retrieved from Table 1 by assuming \(r = r^M = r^L\).

With this set-up, we can readily verify that the accounting identity that requires investment to be equal to savings always holds.Footnote 9

For the numerical simulations that follow, most of the parameters are borrowed from Keen [9] and are explained in “Appendix B”. Figure 1 shows the \((\omega ,\lambda ,d)\)-space, or the phase space, of Keen’s model converging towards the Good equilibrium. Qualitatively, we observe that Goodwin’s cyclical behavior is dampened when the trajectory approaches its equilibrium value. Remember that, in the CES setting, Fig. 1 refers to the limit case

of a constant capital-to-output ratio.

Turning to the time-varying behavior of the capital-to-output ratio, Figs. 2 and 3 show the counterpart model where the elasticity of substitution for capital and labor are \(\sigma _{500} = \frac{1}{1 + 500} \approx 0.2\%\) and \(\sigma _{100} = \frac{1}{1 + 100} \approx 1\%\), respectively. By allowing for substitution between capital and labor (while maintaining other parameters and beginning again near the Good equilibrium), we observe that the cycles are more muted when \(\eta \) is lower. This characteristic echoes the stable focus behavior demonstrated by van der Ploeg as opposed to the closed orbit showed by Goodwin’s dynamics.

A primary rationale to explain the difference might be that a gain in profit boosts investment and output. Thus, employment will increase and so will total wages. Indeed, when \(\eta > 0\), the wage share, \(\omega \), increases according to the wage negotiation curve

This rise in \(\omega \) will increase the capital-to-output ratioFootnote 10\(\nu _\eta \) since

It follows that firms will tend to substitute labor by capital by firing and installing new capital, because the growth of the capital-output ratio enters negatively in the evolution of the employment rate (see “Appendix A”).

Figure 4 shows the time series for the wage share \(\omega \) as obtained by the three different settings used for the production function. These simulations clarify the difference in the evolution of the wage share and its cyclical properties (especially the amplitude of the cycles). The blue curve represents the Leontief technology. Consistently with Figs. 2 and 3, it demonstrates a more volatile behavior than its counterparts: (i) the CES with \(\eta = 500\) (in red); and (ii) the CES with \(\eta = 100\) (in green). We qualitatively observe that the amplitude of cycles decreases as \(\eta \) increases, while their periodicity remains similar. In other words, the qualitative change induced by the allowance of the capital-labor substitution affects only the amplitude of cycles, remaining unchanged the long-run trend.Footnote 11 Finally, Fig. 5 illustrates the behavior of the system in a case with low substitution (\(\eta =100\)), with the usual parameters (see “Appendix B”).

3 Equilibria

All equilibria can be found by an exhaustive examination of three cases. First, \(\omega _{1}\ne 0\), meaning that the wage share is not zero. This point will be labeled as the Good equilibrium. Second, \(\omega _{2}=0,\,\lambda _{2}\ne 0\), which provides an economically meaningless equilibrium. Finally, \(\omega _{3}=0,\,\lambda _{3}=0\), which provides two equilibria: a Trivial and a Bad equilibrium.

3.1 The good equilibrium

Prior to the derivation of this equilibrium, it is worth mentioning that the point \((\omega _{1},\lambda _1,d_1)\) refers to the Good equilibrium. Using the equilibrium condition of \(\omega _{1}\), we find that \(\lambda _{1}=\Phi ^{-1}\left( a_l\right) \). Next, using the equilibrium condition of \(\lambda _{1}\), \(\kappa (.)\) can be written in terms of \(\omega _{1}\) so that

Plugging Eq. (3) into the equilibrium condition of \(d_{1}\) yields \(d_{1}\) as a function of \(\omega _{1}\):

Plugging Eq. (4) into the \(\kappa (.)\) of Eq. (3) leads to a nonlinear equation that \(\omega _{1}\) should satisfy. Depending on the specification chosen for \(\kappa \),Footnote 12 we solve this equation numerically so that we get \(\omega _{1}\). Next, we find \(d_{1}\) using Eq. (4). As with the Goodwin and Solow models, at the equilibrium point, the real growth rate of the economy is given by

Proposition 1

The Good equilibrium exists if \(\kappa \left( 1-\frac{r}{r-a_l-\beta }\left( 1-\zeta _1\left( 0\right) \right) \right) < \zeta _1\left( 0\right) \).

Proposition 2

\(\omega _1\) is positive if \(\left( \frac{A\zeta _1}{a_l+\beta +\delta }\right) ^\eta >b\).

The proofs for both propositions can be found in “Appendix C”.

3.2 The slavery equilibrium

This second equilibrium is economically meaningless. It would suggest that wages are null while employment is still positive, and would be interpreted as characterizing Slavery. Its derivation can be sketched in the same manner as before. The following function \(\zeta _{2}(.)\) can be derived from system (2) so that

Equation (5) together with system 2 gives

Finally, plugging Eq. (6) into Eq. (5) gives a value satisfied by \(\lambda _{2}\). Hence, \(d_{2}\) can be deduced from Eq. (6). Note that whenever \(\eta \rightarrow +\infty \) we retrieve Grasselli and Costa Lima [6] results. We show in “Appendix E” that for our benchmark specification, this equilibrium exists.

3.3 The trivial and the bad equilibria

This condition gives us two kinds of equilibria. On the one hand, the trivial equilibria can be found by solving system 2, so that

is an equilibrium point for (2), and with \(d_3\) being any solution of

Note that this condition for finding the equilibrium is similar to Grasselli and Costa-Lima [6] if we identify \(A (1/b)^{-1/\eta } = \nu \). Therefore, we expect this equilibrium to be unstable in the same way that \(({\bar{\omega }}_3, {\bar{\lambda }}_3)\) is a saddle point for the Goodwin model.

On the other hand, another equilibrium with infinite debt can be found using the change of variable: \(\frac{1}{d} =: u\). We get that

with \(\pi (u) := 1 - \omega - r/u\). Hence, the point \(({\bar{\omega }}_3, {\bar{\lambda }}_3, {\bar{u}}_3 ) = (0,0,0)\), or \(({\bar{\omega }}_3, {\bar{\lambda }}_3, {\bar{d}}_3 ) = (0,0,+\infty )\) is an equilibrium. It can be interpreted as representing the collapse of the economy induced by over-indebtedness, where employment and wage converge towards 0 and debt increases constantly towards infinity. This equilibrium is labeled as the Bad equilibrium.

3.4 Local stability study

This subsection seeks to present the Jacobian matrices of the two models previously presented (both with and without the change of variable). This step will help us to analyze the local stability of the equilibria displayed above. Note that behavioral functions \(\Phi (.)\) and \(\kappa (.)\) are similar to those of Keen [9]. For the sake of clarity, in what follows, we use \(\kappa (\pi ) := \kappa (1-\omega -rd)\). The Jacobian associated with system (2) is

with

At the equilibrium point \(({\bar{\omega }}_3, {\bar{\lambda }}_3, {\bar{d}}_3) = (0,0,{\bar{d}}_3)\), the Jacobian moves down to a lower triangular matrix

with

The Jacobian’s real eigenvalues are given by diagonal entries and it is not easy to determine the sign of \(d_3\). Nevertheless, we note that, for a sufficiently large value of \(\pi _3 := 1 - r d_3\), \(\epsilon _2'\) is positive, whereas a sufficiently small value of \(\pi _3\) (i.e., a large enough value of \(d_3\)) makes \(\epsilon _4'\) non-negative. We conclude that this equilibrium point is likely to be unstable.

Although Grasselli and Costa-Lima [6] could analytically retrieve all equilibria, our model is too intricate to do so. Thus, we will later compute the eigenvalues of the Jacobian matrices corresponding to each equilibrium under reasonable calibration.

In order to analyze the local stability of the Bad equilibrium point \((0,0,+\infty )\), we denote \(\kappa (\pi (u)) := \kappa (1-\omega -r/u)\) and the corresponding Jacobian matrix of system (8) is

with

Despite the previous comment on the equilibrium points, since \({\bar{\omega }} = 0\) and \({\bar{\lambda }} = 0\), the Jacobian matrix is diagonal at this point. Thus, its eigenvalues are summarized by the diagonal terms

The sign of the eigenvalues will depend on the parameter \(\eta \), which is assumed to belong to the set \(]0; +\infty [\). Indeed, when assuming \(\Phi (0) < 0\), where wages decrease below some positive employment rate threshold, the first eigenvalue has the opposite sign of \(\eta \). Furthermore, the remaining eigenvalues are negative if and only if

Finally, given that \(\Phi (0)<0\), the Bad equilibrium is stable if and only if \(\eta >0\) and the previous conditions are fulfilled.Footnote 13

It is worth mentioning that depending on \(\eta \) and due to the condition of \(\kappa _0=\underset{\pi \in {\mathbb {R}}}{\inf } \kappa \in {\mathbb {R}}\), boundary condition of phenomenological function \(\Phi (.)\) will have a significant effect on the stability of the Bad equilibrium. Indeed, by taking reasonable values for r and \(\delta \), if \(\Phi (0) < -(1+\eta )(a_l + \delta + \beta ) + a_l\) then \(\kappa _0 < 0\) if one wants to guarantee the local stability of the Bad equilibrium.

To numerically study the properties of other equilibria, we use a baseline calibration that closely follows Keen [9].Footnote 14 Our model differs from Keen [9]’s in that we assume that the productive sector is endowed with CES technology. We remind the reader that the capital-to-output ratio is not constant and equals

In building the capital stock dataset, database makers assume an initial capital-to-output stock of about 3 (see Mc Isaac [11]). In order to retrieve similar results for the Leontief case, we will assume that \(\nu _\eta (t) \rightarrow 3\) whenever \(\eta \rightarrow +\infty \), which implies that \(A = 1/3\). On the other hand, the ratio \((1-\omega (t))/b\) should oscillate around 1 since b represents the share of capital in the production function in Eq. (1). In order to find a reasonable value, we will assume that \(b = 1 - \omega *\), where \(\omega *\) is the Good equilibrium value of the Leontief model counterpart. Finally, the parameter \(\eta \) will be tested for different values of \(\sigma = 1/(1+\eta )\). First, we will test \(\sigma = 0\), i.e. the Leontief case, where \(\eta \rightarrow + \infty \). Second, the case where \(\sigma \approx 1^+\)—close to the Cobb–Douglas case, i.e. \(\eta \rightarrow 0\)—will be investigated. Third, the intermediary case between the last two, where \(\sigma = 1\%\) (or \(\eta = 100\)) will be displayed.

Table 2 provides a summary of the tables available in “Appendix D”. An “o” means that the equilibrium is stable whereas an “x” stands for local instability. As expected, the Good is always stable while the trivial and the slavery are always unstable.

Simulation of a trajectory converging towards the good equilibrium with the calibration of “Appendix B” and \(\eta = 500\). The initial conditions for \(\lambda \) and d are set to their equilibrium values while \(\omega \) is initiated at 0.8055877 (at 0.06 from its equilibrium value). The initial condition is located at the bottom of the figure

Figure 6 provides an example of a trajectory that converges towards a Good equilibrium. The simulation begins at a point slightly behind the convergent spiral, at the bottom of the figure. At the beginning of the simulation, the trajectory displays ample cycles with a debt-to-output ratio that increases over the time. In other words, it shows large fluctuations of \(\omega \), the wage share, and \(\lambda \), the employment rate. However, cycles will be less pronounced over time and after reaching a given level of debt-to-output, the productive sector begins deleveraging until it reaches its equilibrium point, at which of the state variable displays a finite value.

Simulation of a trajectory towards the bad equilibrium with the calibration of “Appendix B” and \(\eta = 500\). The initial conditions corresponds to the darkest blue point and is the same as in Fig. 6 except for \(\omega =0.8055876\). (Color figure online)

Figure 7 gives an example where the economy is no longer attracted by the Good equilibrium. The only difference between Figs. 6 and 7 is the initial condition of \(\omega \), which results in slightly higher profits. In the short to medium run, we observe a trajectory that is qualitatively similar to Fig. 6. However, when the system arrives in a region where the economy should deleverage, as in this example, the debt burden is too high and the productive sector can no longer reduce its debt. At this point, the nonfiancial corporate’s debt grows indefinitely. Moreover, starting from this debt burden moment, the wage share is getting closer to unity at the apex of each cycle. As shown by system (2), the decrease in employment and the increase of the debt-to-output ratio (that is the convergence towards the Bad attractor) will speed-up as \(\omega \rightarrow 1^-\).Footnote 15

4 Numerical study of the basins of attraction

This section aims at quantitatively and qualitatively analyzing the specificity of each model presented above according to the respective basins of attraction. We consider three cases: (i) \(\eta \rightarrow + \infty \); (ii) \(\eta = 100\); and (iii) \(\eta = 0.5\);Footnote 16 Furthermore, we perform a sensitivity analysis of the following key parameters: \(a_l\), the rate of labor productivity growth; \(\beta \), the rate of population growth; \(\delta \), the depreciation rate of capital; and r the short term interest rate.

4.1 Methodology for the basins of attraction

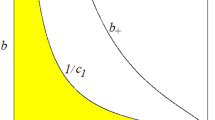

We adopt a simple approach to evaluate the basins of attraction. We simulate our system taking initial conditions at each points of a grid in the \((\omega , \lambda , d)\) space (typically, this grid consists of 325 points in the cuboid \([0.5; 0.95]\times [0.6; 1]\times [0; 3]\)). At the time horizon of \(t=200\), we compute the Euclidian distance of the set of simulated variables to their equilibrium values. We consider that a simulation converges towards the equilibrium whenever that distance falls below a chosen precision (0.5 in practice). Although our programs are flexible and allow us to evaluate many basins of attraction, depending on the choices of the equilibrium, the grid, the precision, the time horizon and the time-steps (for the Runge-Kutta fourth-order method used in the simulations), we stick to the specification described above and evaluate mainly the basin of attraction of the Good equilibrium, the only one which is always stable. We finally plot the basins and compute their volume using Delaunay triangulation. The points of the basin are black if they converge to the good equilibrium, green for convergence to other equilibria, and yellow if they diverge.Footnote 17

4.2 Main results

Figure 8 plots the basin of attraction of the Good equilibrium in the Leontief case. In other words, every economy that is initialized in that set will numerically converge towards the Good equilibrium. When the debt is low, the wage share must be high in order to keep the profit share at reasonable levels. In other words, if the wage share is not high enough, profit will be high and the investment share would skyrocket as a consequence. This would drive the economy to the Minskyan paradigm. In contrast, when the debt is high, the wage share should remain low. A consequence of low wage share would be higher profit, which provides a suitable situation for financial instability through the investment function since most of the value added would go to the debt services and no longer to workers and investment. A high wage share coupled with a high debt will prevent firms from deleveraging and, therefore from reducing their debt.

Figure 9 shows the example of the basin of attraction of an economy endowed with CES production function where \(\eta = 0.5\) (that is close to the Cobb–Douglas production function). In the numerical analysis of the set of points under consideration, nearly all of the explored state space is covered. However, the area where wage share, debt ratio, and employment levels are high does not lead to a convergence towards the good equilibrium. The latter case represents low profits and the incapacity of the corporate sector to deleverage, preventing the economy from converging towards the Good equilibrium.

Figure 10 displays the basin of attraction of the Bad equilibrium for the system of Eq. (8) with \(\eta = 0.5\) (that is close to Cobb–Douglas technology). Recall that, in this system \(u = 1/d\). The basin of attraction of the Bad equilibrium lies in an area where \(u \le 0.1\) (i.e. \(d \ge 10\)). The numerical analysis shows that, at such high levels of debt, the system will not converge to the Bad equilibrium only at low level of wage share together with low level of employment–that is when income distribution is favoring banks (through debt repayment) and firm’s self-funded investment.

4.3 Sensitivity analysis

Table 3 shows the percentage of initial condition points that converge towards the Good equilibrium. For instance, 52 represents the percentage of points within the considered area that converges under the benchmark calibration when \(\eta = 0.5\). Given a higher elasticity of substitution \(\sigma = 1/(1+\eta )\), the basin of attraction is usually larger. This is well illustrated by Fig. 8, the basin of attraction of the Leontief case. Figure 9 plots the basin of attraction of the CES function with \(\sigma = 2/3\). Note that CES production technology qualitatively shows a significantly larger basin of attraction than the Leontief one, even with very low substitution. Generally, the lower \(\eta \), the larger the basin of attraction. Indeed, the basin of attraction of \(\eta = 0.5\) shows uniformly a higher basin of attraction. Moreover, for the case \(\eta = 0.5\), the only parameter that changes the value reported in Table 3 is the real interest rate r. For a higher value of r, the basin of attraction generally increases in volume, while for a lower value, it significantly decreases. The higher sensitivity of debt in the profits induced by the higher interest rate prevents, in almost all cases, the economy from falling into a state of the economy that is not desired.

In system (2), an increase of the labor productivity growth rate, the depreciation rate of capital, or population growth negatively impact the employment rate dynamics. Thus, in the case with almost no substitution (\(\eta =10^{15}\)), an increase in one of these parameters moderates booms in the business cycles. This is similar to what substitution would induce (a decrease of the employment rate due to a lower relative cost of labor). This explains why in the Leontief case, Table 3 exhibits larger basins of attraction as \(a_l\), \(\delta \) and \(\beta \) increase. As soon as we allow for a limit degree of substitution, from almost \(0\%\) to \(1/(100+1) \approx 1\%\), the surface of the basin of attraction substantially increases and highlights the the transformation recorded by difference of the Leontief to the CES case. This change is somewhat similar to van der Ploeg’s results for the model’s trajectory behaviors. However, these parameters only have a modest effect on the size of the basins of attraction when substitution is higher. Indeed, Fig. 11 plots the phase portrait of the state variable with the baseline calibration (see “Appendix B”) and a coefficient \(\eta = 0.5\). In this simulation, the calibrated elasticity of substitution between capital and labor is \(\frac{1}{1+0.5} \approx 66.66\%\), which is consistent with most of the empirical findings surveyed by Klump et al. [10].Footnote 18 However, this simulation no longer shows the primary rationale of the Goodwin’s endogenous economic fluctuations. In other words, under what is ostensibly the most realistic calibration, our finding is that the model is no longer able to replicate the business cycles after the introduction of a reasonable substitution between factors of production. More research is needed to understand whether this is an inherent shortcoming feature of Goodwin-Keen inspired models or if the a cyclical behavior (see Solow [17], or [7]) could be recovered obtained with some additional refinement.

5 Speculation

This section aims at analyzing the destabilizing property of speculation. Indeed, as emphasized by Grasselli et al. [6] for the Keen’s model, the model presented so far fails even more at capturing Minsky’s well known conclusion that “stability—or tranquility—, in a world with a cyclical past and capitalist financial institutions is destabilizing.” To see whether we can retrieve the destabilizing impact found by Grasselli et al. [6], we endow the system with the same speculation scheme specification, that is to rewrite the debt evolution so that

with, S, the speculative component whose dynamics is

where \(g_K(\omega , d) = \frac{{\dot{K}}}{K}\) is the growth of the productive capital.Footnote 19 It is worth mentioning that, as noticed by Grasselli and Nguyen [4], the additional flow of credit, S, corresponds to a purchase of existing financial assets. The additional source of net borrowing of firms from banks is used in turn to buy financial assets held by the Firms sector itself. S does not appear either in the consolidated balance sheet for the Firms sector of Table 1, nor in the transactions and flow of funds matricesas the purchase is made through the intra-firm market. Defining the ratio of speculation to economic output by, \(s := S/Y\), it is easy to see that the additional speculative term leads to the following four-dimensional system

5.1 Equilibria

We follow Grasselli and Costa-Lima [6]’s guideline in deriving the equilibria of the model augmented by the speculative component. Therefore, we restrain ourselves into the meaningful ones, corresponding to the locally stable equilibria previously examined, as a four-dimensional system shows three options based on equilibria that are locally stable in Sect. 3.4.

First, it is easy to show that the equilibrium \((\omega _1, \lambda _1, d_1, 0)\) exists and is a endomorphic embedding of the Good equilibrium found in Sect. 3.1. Moreover, this equilibrium point corresponds to an economy without speculation, as one may expect.

Second, possible high level debt is captured through the change of variable \(u = 1/d\), with which the system becomes

we can observe that \(({\bar{\omega }}_2, {\bar{\lambda }}_2, {\bar{u}}_2, \bar{s_2}) = (0,0,0,0)\) is an equilibrium of System (10). The latter is equivalent to the previous Bad equilibrium as it corresponds to collapsing wages and employment, and exploding debt, and the absence of speculation.

Third, we study the former system’s counterpart to study for high level of speculation. That implies the change of variable \(x = 1/s\), so that

It is not clear that (0, 0, 0, 0) could be an equilibrium of System (11) because of \(u^2/x\), we therefore introduce the ratio \(v = \frac{s}{d} = \frac{u}{x}\), leading to the system

with \(\pi (v,x) = 1- \omega - r/vx\). We observe that, under the same condition of Grasselli and Costa-Lima [6], both (0, 0, 0, 0) and \((0,0,\Psi \left( \kappa _0 A \left( \frac{1}{b}\right) ^{1/\eta } - \delta \right) - r, 0)\) are equilibria of System (12). In terms of the original system, the equilibrium (0, 0, 0, 0) of system (12), is the point

where wages and employment are collapsing while debt and speculation become infinitely large with debt that is growing faster than the speculation since in the case \(v \rightarrow 0^+\) or at the same pace for \(v \rightarrow \Psi \left( \kappa _0 A \left( \frac{1}{b}\right) ^{1/\eta } - \delta \right) - r\).

5.2 Modified local stability

We first derive the Jacobian of System (9):

with

Let suppose that \(p_3(y)\) is the characteristic polynomial of the Jacobian \(J(\omega _1,\lambda _1,d_1)\) at the Good equilibrium point. Therefore, the characteristic polynomial of the \(J(\omega ,\lambda ,d,p)\) at the point \((\omega _1, \lambda _1, d_1, 0)\) is

We previously numerically showed that the three-dimensional model under consideration has roots of \(p_3\) that are negative. Assuming that the previous Good equilibrium’s growth rate of the economy holds, a necessary and sufficient condition for \((\omega _1, \lambda _1, d_1, 0)\) to be asymptotically locally stable is equivalent to

This founding is similar to Grasselli and Costa-Lima: the speculation can destabilize the Good equilibrium as its growth is greater than the growth of the economy.

Furthermore, when evaluating the Jacobian matrix for the modified System (10) at the equilibrium point (0, 0, 0, 0), one finds

with

Denoting the growth rate of the economy at infinite debt by

we note that a condition for this equilibrium \(({\bar{\omega }}_2, {\bar{\lambda }}_2, {\bar{u}}_2, \bar{p_2})\) to be stable is

In other words, the speculation can have a destabilizing property on the Bad equilibrium whenever the speculative component decreases faster than the growth rate of the economy. Indeed, this mechanism would allow the debt-to-output ratio to stay at finite levels.

Finally, the Jacobian matrix of System (12) at the point (0, 0, 0, 0) reduces to

whereas at \((0,0,\Psi \left( \kappa _0 A \left( \frac{1}{b}\right) ^{1/\eta } - \delta \right) - r, 0)\), with the additional assumption,

we have

with

Therefore, provided that \(g_0 < \Psi (g_0)\), and given that we assume \(\iota _1<0\) and \(\iota _2<0\), the equilibrium \(({\bar{\omega }}_3,{\bar{\lambda }}_3,{\bar{d}}_3,{\bar{p}}_3) = (0,0,+ \infty , \pm \infty )\) is stable. As in Grasselli and Costa-Lima’s paper, this equilibrium remains stable either \(\Psi (g_0) < r\) or \(\Psi (g_0) > r\), the only difference would be that the ratio, p / d, will be attracted by 0 instead of \(\Psi (g_0) - r\). Either way, \(d \rightarrow +\infty \) and \(p \rightarrow +\infty \) are guaranteed since v remains positive.

5.3 Numerical study of the basins of attraction

This section reproduces the methodology in Sect. 4 for System (9).

5.3.1 The basins of attraction

Using the same calibration as in Sect. 4, we compare the results in terms of basins of attraction. For compatibility with the previous exercise, we select four initial points of the speculation-to-output ratio, s, and discuss the geometrical deformation (Fig. 12).

5.4 Sensitivity analysis

The sensitivity analysis follows the same methodology as in the previous section. We used a quadri-dimensional grid of 320 for \((\omega , \lambda , d, s) \in [0.65; 0.95]\times [0.7; 1]\times [0; 3]\times [0.01; 0.1]\).

Table 4 is the speculative augmented model counterpart of Table 3. Similarly, the higher the \(\eta \) is, the bigger the basin of attraction is. However, each entry of Table 4 is strictly lower than its counterpart. This shows the destabilizing effect of speculation in the economy. Interestingly, the numerical simulations show different reaction of a change of parameter. Indeed, almost all the changes lead to an opposite response compare to Table 3, to the exception of an increase of the interest rate, r, in the Leontief case. A higher \(a_l\), \(\beta \), or \(\delta \) decreases the volume of the basin of attraction. For the case of \(\delta \), the result is not surprising. Indeed, an increase of \(\delta \) will have a direct impact on the economic growth driven by capital accumulation. Therefore, a shrinking \(\delta \) in a speculative economy implies less economic outcomes for potentially high debt repayments. For the case of \(a_l\), one can see from the wage share equation of System 9 that an economy with a high \(a_l\) (comparatively to an economy with a low one) will steer wages down and, thus, boost profits. This is likely to lead the economy towards a highly speculative one and therefore potentially unstable. For the case of \(\beta \), the channel would be slight different from the one of \(a_l\) as the direct impact of the increase in the population growth rate is through the employment rate, \(\lambda \). As a result, the lowered employment rate likely decrease the wage share and lead to the same narrative than for the previous case.

Projection of the basin of attraction of the good equilibrium for the Leontief production technology on the hyperplane \((\omega , \lambda , d, s=0.1)\). Projections on other values for s give similar results: no visible convex set of points in the good attractor given the distance between points of the grid. The good equilibrium point is \((\omega , \lambda , d, s)=(0.865, 0.972, 1.50, 0)\)

For the sake of illustration, Fig. 13 compares the trajectories of the model with and without speculation. As the initial condition of the speculation goes up, the debt-to-output rate shows higher levels that potentially lead to unsustainable trajectories.

6 Conclusions and suggestions for further work

This paper presented multiple insights on how the class of CES production functions may significantly alter the dynamical landscape of Keen’s model. The moderating effect induced by the flexibility of the use of factors of production on the dynamics of the system is a primary rationale of this paper’s model. Substitution allows to mitigate the influence of wages on employment rate (and vice versa), so that both adjust more rapidly towards their equilibrium values. This result holds for speculative and nonspeculative economies.

Interestingly, numerical simulations showed that van der Ploeg’s extension plugged into Keen’s model increases the set of points that converges towards the Good equilibrium. In other words, given the same behavioral conditions, the volume of the basin of attraction of the economically desirable equilibrium is greater for economies where some substitution can take place. Therefore, an intermediate conclusion would be that substitution between factors of production leads to the convergence of any reasonable initial condition towards the Good equilibrium. Provided that substitution is strong enough (i.e.\(\eta <0\)), it even ensures that the Bad equilibrium is no longer stable. This conclusion is reinforced in the presence of speculative schemes.

Furthermore, using numerical techniques, we showed that when substitution is allowed, the change in the volume of the basin of attraction is globally less sensitive to a change of parameters. Consequently, a model with CES function would be more suitable as a model for estimation. Indeed, when using statistical methods, the exact inference of a parameter is strongly unlikely. Thus, an economy endowed with CES production shows more robust properties to cope with numerical errors of the type inherent to the statistical analysis or flaws in the data. Additionally, realistic calibration of the model showed monotonic convergence rather than dampened cycles. Since the emergence of business cycles is an empirical fact (at least for some advanced economies), this inability to replicate business cycles under some calibration either suggests that the Keen model relies on complementary factors or that the phenomenological functions are not well calibrated.

This paper contributed to a growing body of work that has developed theoretical models based on the Goodwin-Lotka-Volterra model. The methodology used in this paper may be seen as a starting point for further analysis. We have tested the sensitivity of the model to key parameters; another extension would be to test the robustness of the results with respect to changes in the behavioral functions. These changes would presumably affect the vector field of the system more substantially. Another natural extension might include testing the properties of CES production function with three inputs (for instance by adding energy as in Acurio [1]), two of which can be substituted with each other, while the third remains complementary. This would shed light on possibilities for the recovery of endogenous cycles in the model.

A different sort of application would involve dropping Say’s law and modeling the behavior of the demand side. This would require either the introduction of the utilization rate of capital or an allowance for inventories. Such an application has been made by Grasselli and Nguyen-Huu [5], who showed that the economy does not converge towards an equilibrium and exhibit limit cycles. This extension may be a way to reconcile the CES technology with the endogenous cycle theory within the Goodwin framework. Furthermore, another way to capture cycles in case of high sustainability between factors would be introduce money with a Taylor rule. This extension may be able to cope with monetary cycles that in turn could influence the real economy through that pattern.

In sum, we have seen that the basin of attraction changes substantially when substitution is allowed. Here, we simply compared various models according to the volume of the basin of attraction associated with each equilibrium. An alternative viewpoint would consist of measuring the “strength” with which an equilibrium is attracting the economy. This could be achieved, e.g., by relying on the Freĭdlin-Wentzell theory (see Freĭdlin and Wentzell [2]). Converting the model into stochastic differential equations by adding a Brownian motion would allow for the study of the probability that a given sample path will remain far from an equilibrium. In other words, we would be able to compute the probability that the system shifts from the basin of attraction of the Good equilibrium to the Bad equilibrium. An expected result would be that the probability of straying out of the Good equilibrium is lower when substitution is higher. The stochastic model would also–through Malliavin calculus–allow for a sensibility test and would help to develop a sturdy understanding of the sensitivity of the model to a change of parameter. This research may strengthen the conclusion of the paper concerning the capability of CES technology to cope with a change of parameter.

Two final extentions are worth considering. First, one might study the structural stability of the dynamical system of each model (CES versus Leontief) in order to test whether the qualitative behavior of the trajectories is affected by \(A^1\)-small perturbations. Second, one might analyze possible Hopf bifurcation after introducing lags in the Phillips curve (or in the capital accumulation equation). This change transforms the system from ordinary differential equations to delay differential equations.

Notes

In the sense of the GDP at factor cost, where the income approach of the GDP is summarized as the distribution of wages and profits.

For a complete overview of Goodwin’s modern dynamics and its economic interpretation, we refer the reader to the paper of Grasselli and Costa-Lima [6].

The superscript k stands for Keen.

We confine ourselves to \(\eta \in ]0,+\infty [\) (that is an elasticity of substitution that lies in the set ]0, 1[). The reason is twofold: (i) such short term elasticity would imply an above unity substitution between capital and labor in a very short term that is very unlikely (see Klump et al. [10]); and (ii) such values values would break the predator–prey logic of the clockwise behavior suggested by Goodwin and shown by the data (Solow [17], Harvie [7], Mohun et al. [12], or Mc Isaac [11]).

Throughout the article, the consumption price is normalized to 1.

This minimal rationality argument is analogous to the assumption in Goodwin’s model that the allocation of capital and labor is always at the diagonal of the \((K^k,L^k)\)-plan, so that we have not only \(Y^k = \min \left( \frac{K^k}{\nu }, a L^k \right) \) but also \(Y^k = \frac{K^k}{\nu } = a L^k\).

See “Appendix A” for the computation.

Studying the consequences of dropping Say’s law will be the task of a forthcoming paper.

We note that according to Nguyen-Huu and Pottier [14], the channel of debt financing is not fully determined by the model. Indeed, it does not distinguish between loanable funds and endogenous money creation since both rationales induce the same set of equations.

Figure 5 includes the evolution of the capital-to-output ratio for benchmark parameters and \(\eta =100\).

In addition, it can be noticed that the equilibrium points differ slightly depending on the value of \(\eta \).

It can be shown that, with the simplest possible case of an affine function, a closed-form expression for the equilibrium is not available.

Thus, if the elasticity of substitution is too high, i.e. above that of Cobb–Douglas (as in the linear case e.g.), the Bad equilibrium is unstable.

See “Appendix B” for the details.

It can be noticed that the variation of \(\lambda \) is unbounded as \(\omega \rightarrow 1^-\). Therefore, it is very likely that the Lyapunov function shows unbounded variation making the variational domain be in \({\mathcal {D}}_{(\omega ,\lambda ,d)} = [0,1]\times [0,1]\times {\mathbb {R}}\). We leave the proof for further research. For more insights see Grasselli and Costa-Lima [6] or Costa-Lima and Ngyen-Huu [13].

The case \(\eta = 0.5\) is identified as being the closest to the Cobb–Douglas. However, as shown in “Appendix F”, when we derive the model with Cobb–Douglas production technology, we found that the wage share is no longer time-varying and equals, at all times, the output elasticity \(1-b\). Therefore, the original Goodwin prey–predator (between the employment rate and the wage share) logic does not hold anymore, as previously eluded.

Klump et al. [10] surveyed a number of studies intended for developed countries in various timeframes (ca. 1800–2000). Almost 75% of the estimated elasticities showed a value between 0.5 and 1.

Note that in Grasselli et al. [6], the growth rate of output equals that of capital, as \(\nu \) is constant. We chose to align the growth in speculation with the growth rate of capital, as its objects is precisely existing assets. However, aligning the speculation with output would have been equally compatible with Grasselli et al. [6].

For \(\eta <0\), \(\zeta _1\left( 0\right) \) takes high values (often above 1), so that the previous inequality holds.

This equivalence would be the opposite for a negative value of \(\eta \).

In the simulation, the value 0 would lead to numerical errors, therefore we choose the value 0.1 as the lowest value that does not show numerical error. Similarly, \(+\infty \) has been approached by \(10^{15}\) to show the behavior of the the model near the Leontief case.

References

Acurio Vasconez, V.M.: What if oil is less substitutable? A new-Keynesian model with oil, price and wage stickiness including capital accumulation. Documents de travail du Centre d’Economie de la Sorbonne 15041 (2015)

Freĭdlin, M.I., Wentzell, A.D.: Random perturbations of dynamical systems. Number 260 in Grundlehren der mathematischen. Wissenschaften. Springer (1998)

Goodwin, R.: A growth cycle In: Feinstein, C.H. (ed.) Socialism, Capitalism and Economic Growth. Cambridge University Press, Cambridge, (4):54–58 (1967)

Grasselli, M., Nguyen-Huu, A.: Inflation and speculation in a dynamic macroeconomic model. J. Risk Financ. Manag. 8, 285–310 (2015)

Grasselli, M., Nguyen-Huum, A.: Inventory growth cycles with debt-financed investment. Working papers chair energy and prosperity (2016)

Grasselli, M.R., Costa Lima, B.: An analysis of the keen model for credit expansion, asset price bubbles and financial fragility. Math. Financ. Econ. 6(3), 191–210 (2012)

Harvie, D.: Testing Goodwin: growth cycles in ten OECD countries. Camb. J. Econ. 24, 349–376 (2000)

Keen, S.: Finance and economic breakdown: modeling Minsky’s ’financial instability hypothesis’. J. Post Keynes. Econ. 17(4), 607–635 (1995)

Keen, S.: A monetary Minsky model of the great moderation and the great recession. J. Econ. Behav. Org. 86(C), 221–235 (2013)

Klump, R., McAdam, P., Willman, A.: The normalized CES production function: theory and empirics. J. Econ. Surv. 26(5), 769–799 (2012)

Mc Isaac, F.: Testing Goodwin with a stochastic differential approach—the united states (1948–2017). AFD Research Papers Series, (61) (2017)

Mohun, S., Veneziani, R.: Goodwin cycles and the U.S. economy, 1948–2004. MPRA Papers 30444. University Library of, Munich, Germany (2006)

Nguyen-Huu, A., Costa-Lima, B.: Orbits in a stochastic Goodwin–Lotka–Volterra model. J. Math. Anal. Appl. 419(1), 48–67 (2014)

Nguyen-Huu, A., Pottier, A.: Debt and investment in the keen model: a reappraisal. Chair energy and Prosperity working paper (2016)

Pomeau, Y., Manneville, P.: Intermittent transition to turbulence in dissipative dynamical systems. Commun. Math. Phys. 74(2), 189–197 (1980)

Solow, R.: A contribution to the theory of economic growth. Q. J. Econ. 70(1), 65–94 (1956)

Solow, R.: Nonlinear and multisectoral macrodynamics: essays in honour of Richard Goodwin, chapter Goodwin’s growth cycle: reminiscence and rumination, pp. 31–41. Palgrave Macmillan, UK, London (1990)

van der Ploeg, F.: Classical growth cycles. Metroeconomica 37(2), 221–230 (1985)

Author information

Authors and Affiliations

Corresponding author

Additional information

This work benefited from the financial support of the Chair Energy and Prosperity, under the aegis of the Fondation du Risque. The authors are grateful to the anonymous referee for its fruitful comments and suggestions. We are also grateful to Gaël Giraud, Matheus Grasselli, Ivar Ekeland, Adrien Nguyen-Huu, and Emmanuel Bovari for their generous comments. Any remaining errors are, of course, our own.

Appendices

Appendices

1.1 A Getting the reduced form of the system

We assume that the productive sector is endowed with CES technology so that

Additionally, we make the assumption that wages are set at marginal rate of productivity, so that:

For simplicity, we define \(L^e := e^{a_l t} L\), so that the following relationship holds

By taking the derivative of (13) and using (14)

with \(\omega \), the share of total real wages (\(W := \text {w}L\)) in the production:

Let \(a := Y/L\) be the labor productivity, one has \(\omega = \text {w}/a\). The growth rate of the wage share is given by

Using Eq. (15), one gets the following growth rate for labor productivity

Suppose that the growth rate of wages is given by a short-term Phillips Curve

The dynamic of the wage share is given by

The population grows according to

The employment rate is defined by \(\lambda := \frac{L}{N}\), while the capital-output ratio is given by \(\nu := \frac{K}{Y}\). Hence, the employment rate dynamic

The profit share in the production is given by

where r is the short-term interest rate set by the central bank, and paid by producers, while d is the ratio of real debt-to-production (i.e \(\frac{D}{Y}\)). The capital accumulation is given by

where \(\delta \) is the depreciation rate of capital, \(\kappa (\pi )\) is a function of the profit share, and \(\nu \) is the time-varying capital-to-output ratio. From the expression of \(\frac{\partial Y}{\partial K}\) and knowing that Y is homogeneous of degree one, we obtain

Its growth rate is given by

Therefore, the growth rate of employment is

The debt dynamic is the difference between investment and the profits made by the corporate sector, in other words

The growth rate of production is given by

Thus, the ratio of real debt on production is

Hence, its dynamic is

To wrap up, and for the sake of clarity, the tree-dimensional system is

1.2 B Parameter values

See Fig. 14.

The calibration is almost entirely borrowed from Keen [9] to the exception of the speculation function that is borrowed from Grasselli and Costa-Lima [6]. The time frequency between t and \(t+1\) is considered to be one year.

Phenomenological functions behaviors according to the parameters in Table 5

Phenomenological functions behaviors according to the parameters in Table 5

The same generalized exponential function is used for both the relationship between investment as a share of output, and the short term Phillips Curve

Figure 15 displays the behaviors of the phenomenological functions using the calibration given by Table 5.

1.3 C Proofs for Propositions 1 and 2

Proposition 1

The Good equilibrium exists if \(\kappa \left( 1-\frac{r}{r-a_l-\beta }\left( 1-\zeta _1\left( 0\right) \right) \right) < \zeta _1\left( 0\right) \).

Proof

The right hand side of Eq. (3) is a function of \(\omega _1\) that equals 0 at \(\omega _1 = 1\) and \(\zeta _1\left( 0\right) =\frac{a_l+\beta +\delta }{A}b^{\frac{1}{\eta }}\) at 0; while the left hand side equals \(\kappa _0\) for \(\omega _1=1\) and \(\kappa \left( 1-\frac{r}{r-a_l-\beta }\left( 1-\zeta _1\left( 0\right) \right) \right) \) for \(\omega _1=0\). Since both sides are continuous function of \(\omega \), it suffices that \(\kappa \left( 1-\frac{r}{r-a_l-\beta }\left( 1-\zeta _1\left( 0\right) \right) \right) < \zeta _1\left( 0\right) \) to ensure the existence of the Good equilibrium. As \(\eta >0\), \(1-\frac{r}{r-a_l-\beta }\left( 1-\zeta _1\left( 0\right) \right) \) is often negative \(\big (\)it is negative as long as \(\frac{a_l+\beta +\delta }{A}>\frac{1}{1-\zeta _1\left( 0\right) }\big )\), so that \(\kappa _0<\zeta _1\left( 0\right) \) ensures the existence of the equilibrium (because \(\kappa \) is increasing).Footnote 20 As \(\zeta _1\left( 0\right) \in \left[ 0;\frac{a_l+\beta +\delta }{A}\right] \) in this case, assuming e.g. \(\kappa \left( 0\right) =0\) is a sufficient condition for the existence of the Good equilibrium.

Proposition 2

\(\omega _1\) is positive if \(\left( \frac{A\zeta _1}{a_l+\beta +\delta }\right) ^\eta >b\).

Proof

As Eq. (3) rewrites \(\omega _1=1-b\left( \frac{A\zeta _1}{a_l+\beta +\delta }\right) ^{-\eta }\), one just needs that \(\left( \frac{A\zeta _1}{a_l+\beta +\delta }\right) ^\eta >b\) to ensure a positive \(\omega _1\). As \(\eta > 0\), this is equivalent to \(\zeta _1\) being above \(\frac{a_l+\beta +\delta }{A}b^{\frac{1}{\eta }}\).Footnote 21 Hence, as long as the image of \(\kappa \) is entirely on the right side of this value, \(\omega _1\) is positive. \(\square \)

1.4 D Numerical results for the stability of equilibrium

Table 6 displays the numerical eigenvalues of the Jacobian at the Good equilibrium point, where \((\omega _1, \lambda _1, d_1)\) are all finite. Remember, to be locally stable, the Jacobian matrix at this equilibrium point has to be negative definite. This would mean that the eigenvalues are all non-positive. In this exercise, they all show local stability at the Good equilibrium value.Footnote 22

For the sake of completeness, Tables 7 and 8 show respectively the eigenvalues of the Trivial and the Slavery equilibria. We observe that, as expected, non of these trials display a local stability for that equilibrium point.

The eigenvalues of the Bad equilibrium are shown in Table 9 and confirm that, whenever \(\eta \in ]-1;0[\), the only stable equilibrium that may be asymptotically globally stable is the good.

1.5 E Existence of the slavery equilibrium

Let us take the last two equations of the main system when \(\omega \rightarrow 0\).

At the equilibrium, whenever \(\lambda >0\), one finds, by injecting 16 into 17:

As \(\kappa \) is bounded, one can neglect the term in \(\omega \). Defining \(s=A b^{-\frac{1}{\eta }}\), \(e=r+\delta >0\) and \(z\left( d\right) =-\kappa \left( 1-rd\right) \in \left[ -1;0\right] \) one thus obtains

If \(s<e\), the left hand side is a continuous and non-negative function of d which passes through the origin and is equivalent to \(d\left( e-s\kappa _{0}\right) \) at \(+\infty \). Hence, the equation has a solution and \(s<e\) is a sufficient condition for the existence of a Slavery equilibrium.

For \(\eta <0\), s converges decreasingly towards 0 when \(\eta \) tends to 0, so there exists an interval \(]-\eta _{min};0[\) within which the existence of the equilibrium is insured.

Note that for \(\eta >0\), as \(b<1\), s decreases with \(\eta \) and converges towards A, so that if there is a substitutability \(\eta _{0}\) such that \(s_{\eta _{0}}<e=r+\delta \), the existence of the Slavery equilibrium is insured below this substitutability (for \(\eta >\eta _{0}\)). That being said, for the benchmark specification, this inequality does not hold. One can then derive a less restrictive sufficient condition: \(e-s\kappa _{0}>0\). Finally, if \(\kappa _{0}<\nicefrac {b^{\frac{1}{\eta }}\left( r+\delta \right) }{A}\), a Slavery equilibrium exists (with an equilibrium value for the debt potentially very high). For our benchmark specification with \(\eta =1\) (resp. \(\eta =\infty \), resp. \(\eta =-0.5\)), it suffices that \(\kappa _{0}<0.02\) (resp. \(\kappa _{0}<0.15\), resp. \(\kappa _{0}<8.2\)) for the equilibrium to exist.

1.6 F Getting the reduced form of the system with Cobb–Douglas production function

We assume that the productive sector is endowed with a constant return to scale Cobb–Douglas technology so that

Additionally, we make, as previously, the assumption that wages are set at marginal rate of productivity, so that:

For simplicity, we define \(L^e := e^{a_l t} L\), so that the following relationship holds

By taking the derivative of (13) and using (14)

with \(\omega \), the share of total real wages (\(W := \text {w}L\)) in the production:

Let \(a := Y/L\) be the labor productivity, one has \(\omega = \text {w}/a\). The growth rate of the wage share is given by

Using Eq. (20), one gets the following growth rate for labor productivity

Suppose that the growth rate of wages is given by a short-term Phillips Curve

The dynamic of the wage share is given by

The population grows according to

The employment rate is defined by \(\lambda := \frac{L}{N}\), while the capital-output ratio is given by \(\nu := \frac{K}{Y}\). Hence, the employment rate dynamic

The profit share in the production is given by

where r is the short-term interest rate set by the central bank, and paid by producers, while d is the ratio of real debt-to-production (i.e \(\frac{D}{Y}\)). The capital accumulation is given by

where \(\delta \) is the depreciation rate of capital, \(\kappa (\pi )\) is a function of the profit share, and \(\nu \) is the time-varying capital-to-output ratio. By dividing Eq. 18, by the output, Y, we are able to obtain

Its growth rate is given by

Therefore, the growth rate of employment is

The debt dynamic is the difference between investment and the profits made by the corporate sector, in other words

The growth rate of production is given by

Thus, the ratio of real debt on production is

Hence, its dynamic is

To wrap up, and for the sake of clarity, the three-dimensional system is

Rights and permissions

About this article

Cite this article

Bastidas, D., Fabre, A. & Mc Isaac, F. Minskyan classical growth cycles: stability analysis of a stock-flow consistent macrodynamic model. Math Finan Econ 13, 359–391 (2019). https://doi.org/10.1007/s11579-018-0231-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11579-018-0231-6

Keywords

- Prey–predator

- Goodwin model

- Keen model

- Minsky’s financial instability hypothesis

- Dynamical systems

- Speculation