Abstract

We use quantile vector autoregression (QVAR) to identify the connection between six variables related to digitalization (proxied by a number of Internet users and mobile cellular subscriptions), green technology development, green energy consumption, carbon dioxide emissions, and economic complexity index from 1996 to 2019 in Vietnam. The dynamic connectedness of the system is 62% and 14% in the short and long term, respectively. Their connectedness is intense for highly positive and negative quantiles (over 80% quantile). In contrast, economic complexity transmits shocks in the short term and manifests itself even more in the long term. Green technology development is the central receiver of short- and long-term shocks. Besides, digitalization captured by a number of Internet users has switched from shock transmitters to shock receivers in the short term. Other metrics like mobile cellular subscriptions, green energy consumption, and CO2 emissions are mainly shock-receiver-driven. In the short term, there was volatility, especially from 2009 to 2013, due to unprecedented events like destructive changes in political, economic, and financial issues in the globe. Our findings are critical for economists and policymakers in promoting a country’s digitalization, green technology performance, and green energy on the path toward sustainable development.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Sustainability is considered a key component of modern economies (Arslan et al. 2022; Azam et al. 2023; Jackman and Moore 2021; Khan et al. 2022b). Sustainability of the environment is one of the most important aspects of sustainable development (Zakari et al. 2022a), in which energy security and environmental sustainability play a critical role in alleviating poverty (Taghizadeh-Hesary et al. 2022) and sustainable economic growth (Arslan et al. 2022). In the literature, there is a vast number of empirical studies on determinants of environmental sustainability, such as the role of green innovation (Liu et al. 2022; Zakari et al. 2022a); abundant energy resources and education (Zakari et al. 2022c; Liu et al. 2022) and alternative and nuclear energy (Khan et al. 2022a); economic growth, international trade, clean energy investment (Lyu et al. 2021); industrial value-added, capital formation, urbanization, population growth, and biocapacity (Yang and Khan 2021); the energy consumption, tourism growth (Khan and Hou 2021), or the partnership between countries (Tawiah et al. 2021). According to a recent study, sustainable consumption and production of oil are crucial to promoting environmental sustainability (Zakari et al. 2022b). Although scholars have paid considerable attention to environmental sustainability's determinants and influences, many aspects still need further investigation.

Global Risk Report in 2021 identified emerging environmental problems as the top global risks based on likelihood and impact. Protecting the environment has become an essential component of proactive management in Vietnam (Pulipaka and Garg 2021; Saleem et al. 2021). A clean and healthy environment is a top priority for companies (Grieger and Cummings 2022; Rijal and Khanna 2020), including preserving ecosystems, maintaining air quality, and preserving resources. There is no doubt that environmental practices play a significant role in reducing corporate expenses, enhancing business reputation, gaining a competitive edge, and reducing the bottom line of companies (Liu et al. 2019). Several companies are implementing effective measures to combat these challenges, including workplace recycling, green community encouragement, the establishment of sustainable committees, and continuing digitization (Kraus et al. 2021; Krause and Tolaymat 2018). Additionally, due to industrialization and urbanization, Vietnam has prioritized environmental practices (Ha et al. 2021; Le et al. 2022). Recent years have seen a rapid deterioration of Vietnam’s environment. Over the past 2 decades, significant progress has been achieved in reducing greenhouse gas emissions and mitigating climate change; however, there need to be more opportunities to increase efforts to protect nature, conserve natural resources, and mitigate climate change. Several alarming problems have been faced by Vietnam in recent years, including the loss of biodiversity, the consequences of climate change, and excessive natural resource usage (Le et al. 2021; Ha 2022). In recent years, the phrase “digitalization” has been spread with an increase in public disclosure and, in several cases, has been abused or utilized deceptively (Tilen and Andrej 2018). Understanding the distinction between digital, digitization transformation, and digitalization is critical. The term “digitization” refers to the automation of routines and processes, such as analog-to-digital conversion into digital information. In contrast, digitization refers to the incorporation of digital components, and digital transformation is the complete introduction to product or service offerings of new business models and digital platforms (Feroz et al. 2021). According to Brennen and Kreiss (2016), digitization and digitalization employ a digital instrument for product or service offerings, while digital transformation is the more thorough introduction, which is then saved as a PDF. However, in the situation of digitization, the PDF format is then saved on a computer’s hard drive, but in terms of digitalization, the PDF is subsequently uploaded through the Internet to a cloud service, which may be viewed at any time and from any location (Ha et al. 2022a).

The amount of productivity knowledge a country accumulates also dictates its economic activities (Hidalgo 2021; Hidalgo and Hausmann 2009). Economic complexity (EC) is an indicator that indicates a country’s ability to acquire productivity knowledge, according to Chu (2020) and Tauseef Hassan et al. (2023). Hausmann and Hidalgo (2011) explain that a country’s ability to produce various products reflects its knowledge. Diversified products are those a country can produce competitively, while ubiquity refers to the number of countries able to produce a particular product efficiently. Product complexity and sophistication are probably higher in a developed economy. Consequently, it is commonly acknowledged that its broadening and sophistication products determine a country’s product knowledge or production complexity.

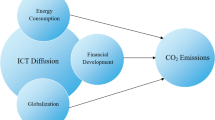

Inconsistent theoretical arguments are provided about the correlation between digital technologies, ecological sustainability, and energy security in the literature. Introducing a new link between digitalization and energy security is presented by Moyer and Hughes (2012). According to the International Futures (IFs) comprehensive evaluation system, information and communications technologies can increase productivity, decrease energy intensity, as well as lowering the cost of renewable energy by putting down pressure on the energy system. It has been shown that ICT can have both positive and negative effects on household energy consumption, according to Lange et al. (2020). As a result, digitalization is likely to harm energy consumption. Although this argument rests without using an analytical model or any empirical support, it cannot stand alone. As opposed to this, Dwivedi et al. (2022) contend that electronic technologies assist in model innovation in business and thus address obstacles in the shift to sustainable energy. A crucial aspect of energy security is sustainability, which is provided by digitalization. Bassam (2021) explains the link between digitalization and energy security. Converting information into digital form helps energy providers to control and balance the supply–demand grid more effectively with the help of the digital revolution of the energy retail.

Before Poshakwale and Ganguly (2015), researchers concentrated on explaining the factors contributing to economic growth and development. Human capital, physical capital, and technology all contribute to economic development (Giordano and Giugliano 2015; Kurt and Kurt 2015). Economic and production systems have become more complex since economists began paying attention to them (Hartmann 2014; Oosterlaken 2015; Tauseef Hassan et al. 2023). A complex economy contributes to economic growth (Hausmann and Hidalgo 2011; Hidalgo 2021), minimizes income inequality (Hartmann et al. 2017), or reduces the shadow economy. However, Nguyen et al. (2020) do not discuss the driving force behind economic complexity. It has been shown that economic complexity (Hidalgo and Hausmann 2009), Internet usage (Lapatinas 2019), institutions (Hartmann et al. 2017; Lapatinas and Litina 2019), trade liberalization (Hartmann et al. 2017), or financial development (Chu 2020; Nguyen et al. 2020) are correlated with income levels (Hidalgo and Hausmann 2009). A strong political system encourages investment in innovation and technology, which improves exports’ quality, as Faruq (2011) stated. A sophisticated product is often developed by tacitly accumulating the knowledge associated with specialization and innovation. There is no explicit and transparent presentation of them. Several people have focused on the connection between technological advancement and digital transformation implementation to achieve economic sophistication. Digitalization directly and indirectly influences economic growth because it influences internalization, financial development, and the quality of institutions.

It can be described as using infrastructures and digital technologies in various business, economics, and social aspects. Many individuals nowadays use information technology in production and business. Using Internet and mobile phone usage levels, Visser (2019) illustrates how digitization affects life quality. The digitalization of the economy also has a positive impact on social behavior. In industrialized countries, healthcare personnel and doctoral benefit from information technology and the Internet, making it easier to care for people. Because the Internet and cell phone use are prevalent, everyone on the planet can engage and communicate more effectively with fewer connection delays and lower costs (Suvankulov et al. 2012). A high level of growth requires ICT adoption to transition to a new economic structure (Lapatinas 2019). Increasingly, electronic devices and the Internet are becoming irreplaceable in human socioeconomic and environmental activities (Visser 2019; Wang and Hao 2018), including education (Bonk 2009), health services (Korp 2006; McMullan 2006), commercial activities (Clarke and Wallsten 2006; Visser 2019), and politics (Layne and Lee 2001; West 2004). Consequently, digitalization is believed to improve a system’s security, ecological sustainability, and economic complexity.

Through innovative mechanisms (El-Haggar 2007; Zhang et al. 2017), operational expenses while increasing worker safety and intelligent, sustainable manufacturing could be applied among enterprises. Digitalization and digitization use a digital tool to scan an analog contract record into a digital record, which is then saved in PDF format (Brennen and Kreiss 2016). Digitalizing involves storing the PDFs on a PC hard disk, whereas digitization involves uploading them to a cloud service over the Internet, which can be accessed anytime, anywhere.

However, to our best knowledge, no paper provides an in-depth analysis of the link between digitalization, economic complexity, green technology, and environmental issues in the case of developing economies. The primary objective of this article is to investigate a link between these variables in Vietnam. One of the biggest challenges for scholars in exploring the nexus among variables in our designed system in developing countries like Vietnam is the availability of relevant information and database. The traditional approaches in previous studies seem to be inappropriate for the yearly data in a short period. Therefore, there have been arguments among the results obtained from these approaches. Notably, the findings obtained from previous studies are not novel and do not create significant scientific values for policymakers in designing policies to promote an attraction of foreign aid while still securing the sustainability of the ecological and energy system.

This article will overcome these limitations by applying novel econometric techniques to study the relationship between digitalization, economic complexity, green technology, and energy consumption. First and foremost, this is the first research to investigate the relationship between digitization and economic complexity, environmental technologies, green energy consumption, and CO2 emissions. The study also suggested methods for evaluating volatility interconnections between different issues better suited to examining these interconnections. Our article explores the interlinkages between various issues in the context of Vietnam using a quantile vector autoregression (QVAR). As a third point, our study investigates the interconnectedness between volatility resulting from digitalization, technologies, economic complexity, energy, and environmental issues as influenced by global political, economic, and financial issues. The advantages of our techniques are to help us identify transmission pathways between digitization and economic complexity, environmental technologies, green energy consumption, and CO2 emissions. Due to the advantages of our novel approach, short- and long-term decisions are taken into account, which is expected to provide essential insights for economists and policymakers and help them design and implement economic and environmental policies more effectively.

Afterward, the paper is structured as follows: The “Literature review and hypothesis development” section includes a literature review and hypothesis building. A description of the model, the data, and the estimation method is provided in the “Statistical investigation and methods” section. The “Results” section summarizes empirical results and discusses them. The paper concludes in the “Policy implications and conclusions” section.

Literature review and hypothesis development

Digitalization and economic complexity

According to Khan and Hou (2021), economic growth is often sacrificed for environmental sustainability. The quality of the environment is harmed in order to achieve a higher level of economic development (Khan et al. 2021a). As shown in Khan et al. (2021b), there is a strong positive correlation between energy consumption and economic growth, both in the short and long run. Furthermore, in the process of development, scholars indicate a short and long relationship between urbanization (Awan et al. 2022) development, population growth, industrial development (Jie et al. 2023), and environmental degradation. An analysis of the impacts of natural resources, energy consumption, and certain economic and social factors on ecological quality is presented by Khan et al. (2021a). New evidence on the association between energy intensity, financial development, and ecological sustainability has been found recently in the Asia Pacific Economic Cooperation countries by Khan et al. (2021c) and in OECD countries by Khan et al. (2021b). While previous studies have examined both causes and influences of environmental sustainability, they have not fully accounted for the attendants of ecological sustainability. More recently, scholars are more likely to concentrate on the importance of digitalization. For example, Thanh et al. (2022) empirically analyze a link between digitalization and energy security, while Ha et al. (2022b) quantify its environmental consequences. Recent studies focused more on the interconnection between different markets to explain the source of volatility in a typical market (Adekoya et al. 2022; Antonakakis et al. 2022; Asai et al. 2020; Chatziantoniou et al. 2022; Ha et al. 2022a; Le 2022). Hence, studying the dynamic connectedness between digitalization, environmental technology, economic complexity, and environmental issues is vital.

The prior literature supports our belief that digitalization affects economic complexity, directly and indirectly. Digitalization directly affects economic complexity, according to Banga (2019) and Sweet and Eterovic Maggio (2015), since it is associated with innovation and new knowledge. Increasing a country’s economic complexity means accumulating more productive knowledge (Chu 2020). It is possible to improve product knowledge accumulation by combining innovation activities with digital transformation processes. According to Rachinger et al. (2018), digitalization influences the business model innovation of a country, improving knowledge over time. Using digital transformation as an example, Coronado-Medina et al. (2020) found an increase in absorptive knowledge capacity, as a result of which product innovation is promoted. Economic complexity performance is also improved by product innovation. Nguyen et al. (2020) also show a positive relationship between economic complexity and digitization, represented by internet usage. Therefore, economic complexity rises directly and positively with digitalization.

A further benefit of digitalization on the economy can be seen in the literature, which illustrates how it may enhance economic complexity. As a starting point, previous studies have shown that digitalization has multiple positive economic impacts, including positive impacts on economic growth (Niebel 2018), trade (Adeleye et al. 2021), and productivity (Cardona et al. 2013), which in turn positively affect economic complexity (Hidalgo and Hausmann 2009). Digitalization has positively impacted financial markets, as demonstrated in the literature. There is a reduction in labor and intermediate costs associated with digitalization, and at the same time, there is an increase in industrialization (Herzog et al. 2017; Pop 2020). Additionally, digitalization helps cross-border firms achieve higher operational efficiency (Dethine et al. 2020), generates new investment opportunities for foreign investors (Damgaard et al. 2018), and creates new markets. Also, digitalization makes economic activities more efficient, increasing the efficiency of financial services and ultimately enhancing competitiveness. Svirydzenka (2016) examines financial development through two dimensions: institutions of financial development (banks, insurance companies, funds, etc.). Pradhan et al. (2016) conducted an empirical study and concluded that information and communication technologies adversely affect financial institutions’ development. Representatives, agents, and brokers can communicate more efficiently with digital technology at a lower cost, but face-to-face communication cannot be replaced completely. In parallel with these positive influences, there are negative effects as well. As a result, the impact of digitalization has yet to be determined consistently. Digitalization and financial development are closely related, while financial development is closely related to economic complexity. According to Fan et al. (2015), lenders are more likely to produce high-quality products when credit is prevalent. A flourishing financial sector will invest more capital in economic activities, thus stimulating research and development and product upgrading (Canh and Dinh Thanh 2020; Svirydzenka 2016). In this way, financial complexity develops due to digital transformation (Dutta and Sobel 2018).

Thirdly, previous documents also pointed out the vital influence of politics on a country’s long-term growth (Acemoglu and Verdier 1998; Acemoglu and Zilibotti 2001). Therefore, political institutions’ nature and outlook can improve the economy’s quality and output while also increasing its complexity by investing in human capital accumulation, development, research, and innovation. Good institutions will enact effective policies, such as guaranteeing property rights and enforcing contracts, laws, and regulations, leading to increased benefits from knowledge and accumulation of human capital. The higher the human capital countries have, the more quickly they catch up with trends in learning and mastering complex manufacturing jobs (Zhu and Li 2017). According to Zhu and Fu (2013), human capital favorably influences the level of sophistication in exports. There is a positive relationship between human capital and economic complexity (Hausmann et al. 2014). Besides human capital, institutions also positively influence economic complexity through innovation activities. Sweet and Eterovic Maggio (2015) suggest that an increase in economic complexity can boost a country’s productive capacity to produce sophisticated goods. Furthermore, complexity provides important information about innovation for achieving economic prosperity (Hausmann et al. 2014). Hausmann et al. (2007) demonstrate that the capability to export sophisticated goods highly depends on the institutional environment that stimulates entrepreneurs to engage in innovative activities.

In the following discussion, we indicate that the effectiveness of applying the digitalization process influences the quality of governance of that institution (Gulati et al. 2014). In general, digitalization is recognized as a favorable influence on better institutional quality. According to Accenture (2014), digitalization alters the relationship between citizens and government. The Internet and mobile improve communication efficiency with lower costs than face-to-face chatting and gradually bridge the distance between individuals. The advancement of ICT has facilitated the government to gather citizens’ opinions and analyze and share information better, resulting in punctual and appropriate policy enactment. Simultaneously, the Internet promotes the government to manage data, store, and track residents’ information and boosts coordination between departments (Agarwal and Maiti 2020). Institutional transparency will be enhanced if the government manages information and data is appropriately collected. According to Sabbagh et al. (2012), digitalization influences government efficiency through transparency in public service delivery. Pina et al. (2007) advocate this suggestion based on empirical evidence in the USA, Canada, Australia, New Zealand, and 15 EU countries. The findings reveal that information technology improves the governance effectiveness of institutions. Information technology is one of the most important dimensions in reducing corruption and improving governance (Shim and Eom 2008). Digitalization improves government information infrastructure, thus enhancing the efficiency of the decision-making process, encouraging interaction between citizens and government, and increasing public accountability. The digital transformation process in revenues and expenditures enhances fraud detection, resulting in a reduction in corruption. A higher degree of digitization increases the transparency of information, thereby decreasing uncertainty (Bertot et al. 2016; Klitgaard 1988). As supervision becomes more stringent, public institutions must pay more attention to acting according to ethics (Davies and Fumega 2014) and legislation (Rose-Ackerman 1999). Information exchange between government and citizens becomes more efficient, leading it to a powerful tool against corruption (Adam and Fazekas 2018). The level of corruption decreases as the prevalence of digitalization increases (Garcia-Murillo 2013), thus, governance also becomes more effective.

Economic complexity and digitalization

Poorly developed economic complexity characterizes the evolution of economic complexity has been controversial in the past due to the difficulty of leveraging the productive capacities of economies at this stage. Products produced in these countries are typically simple and are comparatively distant from each other. According to Hidalgo et al. (2007), a number of natural-based products are included in this production stage, including fishing, tropical crops, clothing, mining, and agriculture. As a result of the high dependence on natural resources and product proximity, there are fewer prospects for new manufacturing operations and a limited selection of occupations (Elgin and Oztunali 2014). With its gradual transformation from the periphery to the core of the international trade network, the economy is now progressing to higher economic sophistication (Hausmann et al. 2014). A shift to heavy industrial products is necessary in order to reduce dependence on natural resources (Stern 2004). With the economy reaching its core structure, improvements and increases in production capacity will boost product development and diversity of industry sectors. Consequently, a broader range of occupational and educational opportunities will be available to workers at all levels (Adam 2020).

A more complex economy suggests an improvement in industrial productivity. This leads to enhancing the digital transformation process according to new socioeconomic and institutional conditions. It is generally assumed that scale determines profitability. Therefore, the more intricate the economy, the higher the degree of specialization and, consequently, the higher the profit (Constantine 2017; Lee and Vu 2020). As Hartmann et al. (2017) argue, complexity is a reliable predictor of economic growth and development, even sustained long-term, due to the increased resilience of economies with diversified production structures to economic shocks (Barnes et al. 2015; Joya 2015). In addition to the socioeconomic environment, the political-institutional environment also contributes significantly to the complexity of an economy (Vu 2021; Zhu and Fu 2013). By improving income, businesses and the public sector will access increased funding, enhancing digital transformation in various industries.

Digitalization and energy efficiency

The benefits of digitalization can be attributed to either its impact on human capital or financial development as a technological advance. Due to the invention of the Internet and its widespread use, the amount of information has increased exponentially. People could gain access to a broader spectrum of knowledge more quickly and efficiently with the help of more efficient search tools and low-cost access to the World Wide. Aside from the acquisition of information, big data, cloud computing, and multiple communication methods have made it possible to transmit and integrate information more efficiently and affordably among individuals and specialists in a wide variety of locations and times (Spiezia 2011). The information assists workers in improving their expertise conducting more research and development initiatives, as well as acquiring new professional skills on a regular basis. As a result of this process, human capital is improved, which benefits technical innovation activities (Ferro 2011; Haini 2019). There is no limit to the effect of this on a nation. Through the Internet platform, information is disseminated, exchanged, and employment is migrated more rapidly, resulting in transborder knowledge exchange and technological spillover. By doing so, we optimize the value of human capital and assist the international dissemination of innovative technologies across diverse sectors (Basu and Fernald 2007; Ceccobelli et al. 2012). Solid financial development in the digital age supports technology advancements and industrial structure upgrades. The development of financial models and a more significant number of credit channels have been enabled, and the matching of financing suppliers with enterprises spanning borders and time zones has been facilitated (Salahuddin and Alam 2016; Salahuddin and Gow 2014). Sources of funding and credit have grown, in turn, provide financial assistance for the implementation of R&D initiatives, particularly in green technologies, and to comply with the requirements of environmental laws and regulations (Faisal et al. 2018; Owusu-Agyei et al. 2020; Tamazian et al. 2009).

Each step of the manufacturing and its coordination is expected to be more efficient as the production equipment’s intelligence level increases. As a result of technological advances, low-energy equipment is now available, which can be replaced using high-energy machinery (Airehrour and Ray 2016), and technology-intensive products can be substituted for traditional products requiring a lot of resources (Li et al. 2019). Internet technology allows the transmission of information technology production impacts to other departments of information technology, as well as between digital firms and non-digital companies, when green manufacturing and management techniques are optimized for developing new products, productivity, and market expansion. The resource reallocation shift will offer more resources to more efficient, technologically intensive businesses due to the productivity gap between sectors that rely on technology and those that rely on traditional resources. Consequently, the industrial structure is being upgraded to include more technology-intensive industries (Qin et al. 2022), while energy-intensive and low-polluting industries are depleted. In the context of digitalization, two forces could accelerate this process: firms exchanging new ideas and the creation of robust competitive mechanisms (Vassileva et al. 2012). Thus, by improving industrial buildings, energy efficiency may be raised while consumption can be lowered. Several empirical studies, including Collard et al. (2005), have demonstrated digitalization’s beneficial effects on energy efficiency.

Digitalization and green production and consumption

Digitalization could increase the consumption of clean and renewable energy by individuals and businesses. This could explain the demand side of the equation if digitalization plays a role in economic growth and globalization. By lowering transaction costs and distorting time, space, and boundaries between goods and services trade, the digitalization of the economy facilitates national and international trade (Zu et al. 2022). The effectiveness and efficiency of governance can be improved through e-government by reducing corruption (Adam 2020; Ali et al. 2021). In addition to enhancing national income and economic growth, digitalization contributes to the advancement of human capital, structural improvement, and trade. The desire for happiness and environmental stewardship will likely increase in a highly digitalized nation with economic development and high earnings (Galeotti et al. 2009; Lee and Lee 2009; Martínez-Zarzoso and Maruotti 2011). There is a likely increase in consumer demand for eco-friendly products that produce and use fewer fossil fuels. Conversely, the companies themselves switch to eco-friendly products and green manufacturing in order to remain competitive, adapt to environmental regulations that are becoming increasingly demanding, and improve social acceptance (Sinclair-Desgagné 2008; Kennett and Steenblik 2006). Due to technologies for the environment, green capital items (with low environmental impacts) rapidly replaced brown capital goods (Kemp-Benedict 2014). As a result, production sectors consume a large amount of non-fossil fuels, particularly renewable energy sources. By lowering the cost of spatial transactions and removing information asymmetry, digitalization is transforming societies, markets, and economies toward more globalization. The spillover effects of R&D on green production and consumption could also contribute to technological innovation (Ali et al. 2021). With the globalization of the economy and finance, green technologies may become more widespread, reducing the consumption of fossil fuels. Foreign direct investment and international trade flows may influence supply chains (Bi et al. 2015; Bakhsh et al. 2017; Zaidi et al. 2019).

From the perspective of the supply side, Moyer and Hughes (2012) stated that information and communication technology (ICT) fosters environmentally friendly consumption and production by reducing the cost of renewable energy. As a result of the application of smart grids, an energy infrastructure type that monitors and matches energy supply and demands continuously, transmission efficiency can be improved, intermittency can be addressed, as well as renewable energy generation and consumption costs can be reduced. Also, this infrastructure facilitates the exchange of information between individuals and firms. Using digital technology, Verma et al. (2020) assert that renewable energy can be efficiently produced, distributed, and integrated into existing centralized energy systems, leading to rapid increases in biomass consumption. Because of sophisticated machine learning algorithms and other artificial intelligence technologies, we can decentralize the energy system, improve weather forecasts, and analyze consumption trends and technology performance better, effectively engage people across the value chain, as well as empowering pro-consumers (who act as both consumers and producers of renewable energy) to participate actively.).

Additionally, the efficiency of the bioenergy industry depends upon labor inputs, capital inputs, innovation systems, market connections, and enabling environments in order to achieve technological efficiency, cost-effectiveness, and general growth (Alsaleh et al. 2017, 2020; Abdulwakil et al. 2020). Bioenergy product development and market penetration may be enhanced through digitization, including digital connectivity, digital governance, digital business, and digital talents. This relationship is of considerable significance because it has the potential to improve human resources (Spiezia 2011), facilitate innovation activities and spillover effects from research and development (Ferro 2011; Ceccobelli et al. 2012; Haini 2019), connect investors to global markets (Salahuddin and Alam 2016; Salahuddin and Gow 2016; Ahmedov 2020), as well as enhance institutional quality (Ali et al. 2021; Adam 2020). Additionally, digitalization will positively affect bioenergy and business models that rely on environmentally friendly methods of production. By doing so, Todd and McCauley (2021) seeks to remove barriers in the sustainable energy transition to create a more environmentally friendly and sustainable economic environment. The penetration of information and communication technologies throughout the Chinese manufacturing industry has resulted in greater pipe-end incorporation, pollution treatment plants, cleaner production technologies and reduced environmental impact, as demonstrated by empirical evidence (Wen et al. 2021).

Statistical investigation and methods

Statistical investigation

In this paper, we use year-by-year time series of digitalization, which includes the number of individuals using the Internet (% of the population) (INU), mobile cellular subscriptions (per 100 people) (MOBSUB), green technology development (EI), renewable energy consumption (REC), CO2 emissions (CO2), and the Economic Complexity Index (ECI). Our study’s period spanned from 1996 to 2019, with data on INU, MOBSUB, and EI collected from the World Bank database, REC, and CO2 data sourced from the Our World in Data database. Finally, ECI was collected from the Observatory of Economic Complexity (OEC). This is the longest data period that we can collect for the year data on foreign aid and renewable and nonrenewable energy consumption in Vietnam. After data collection, we calculated the growth rates of the above data series and used them in the empirical analysis. In the next section, we investigate the trend of these variables. Figure 1 demonstrates a pattern of these series.

The descriptive statistics of included series are presented in Table 1, which shows that the average of the data series is positive. Specifically, INU and EI are highly volatile because of the large variance compared to the average. INU is leptokurtic and right-skewed, and EI is platykurtic and left-skewed. Based on the test of Jarque and Bera (1980), the results show that INU, EI, and ECI are not normally distributed. The ERS unit root test (Elliott et al. 1996) shows that these series are not stationary. Finally, the weighted portmanteau test (Fisher and Gallagher 2012) shows INU, MOBSUB, and CO2 have autocorrelation on returns. Otherwise, there is no autocorrelation on the data series for squared returns. It is clear from these results that our proposed method—QVAR—is appropriate. This article aims to investigate the dynamic connectedness between digitalization, green technology, economic complexity, and environmental issues.

Empirical approach

Quantile vector autoregression

All connection measurements may be calculated later on. To begin, we compute net pairwise connection. Using this model, we calculate all connectedness metrics using a quantile vector autoregression or QVAR (p).

They depict dimensional endogenous variable vectors, the quantile of an indicator, lag lengths in QVAR models, dimensional error vectors with variance–covariance matrixes, and conditional mean vectors. The strategy of the world is used to translate QVAR (p) to QVMA():

Consequently, our research estimate the decomposition of generalized forecast error variance (GFEVD) (Pesaran and Shin 1998; Koop et al. 1996;), which is the center of the connectedness technique.Footnote 1 As GFEVDs have a general structure, it could be applied to assess the shock’s impact that series j has on variable i with regard to its forecast error variances:

where \({\widetilde{\Upsilon}}_{ij}(\breve{\text{U}})\) clarifies the consequences of \(j\) th series on the variance of the ith series’ prediction inaccuracy at horizon \(\breve{\text{U}}\). The rows of \({\widetilde{\Upsilon}}_{ij}(\breve{\text{U}})\) then standardized their sum does not even equal one, which yields \({\widetilde{\Upsilon}}_{ij}\). Next, identities by standardization are then standardized:

In a later phase, all connection measures may be computed. First, we compute the net pairwise connectivity as follows:

If \({NPDC}_{ij}(\breve{\text{U}})>0\) \(({NPDC}_{ij}(\breve{\text{U}})<0\), it signifies that series j has a greater (lesser) influence on series I than the other way around.

Depending on their directional connectivity, \(i\) shock to one indicator will have an impact on all others \(j\).

A shock to one indicator will have an impact on all others based on their total directional connectedness to each other

When an indicator \(i\) a receives a shock, the total directional connectedness FROM the other indicators \(j\) is described as follows:

Since it is the difference between TO and TO other systems, the net total directional connectivity might be considered the influence series i has on the system under consideration.

If the \({\mathrm{NET}}_{i}\) > 0 (\({\mathrm{NET}}_{i}\) < 0), every other serie i has a more significant (lesser) influence on all other series than they are on us. Consequently, we can call it as an e-shock transmitter (receiver). To calculate the total connectedness index (TCI), which measures how interconnected a network is, we can use the following formulas:

The metric thus indicates how a surprise in one series affects all others—the market’s risk increases with its value and vice versa.

The focus of this study has been on the evaluation of time-domain connectivity. The frequency area is also being evaluated for connectedness. We can investigate connectivity in the frequency range through the spectral decomposition approach developed by Stiassny (1996). The function is explored in the following manner: \(\mathfrak{Z}\left({{\varvec{e}}}^{-{\varvec{i}}{\varvec{\omega}}}\right)=\boldsymbol{ }{\sum }_{\mathrm{\breve{\text{u}}}=0}^{\boldsymbol{\infty }}{e}^{-iwh}{\mathfrak{Z}}_{\mathrm{\breve{\text{u}}}}\), where \(i= \sqrt{-1}\) and \(\omega\) stands want the frequency to correspond to the spectral density of \({x}_{t}\) at frequency \(\omega ,\) This is represented by a Fourier transformation of the QVMA(∞):

Frequency GFEVD is calculated by combining spectral density and GFEVD. GFEVD needs to be normalized in the frequency domain just as it must be in the time domain. The following formula can be used to accomplish this:

where \({\widetilde{\Upsilon}}_{ij}\left(\omega \right)\) states that at certain frequencies in the spectrum of the ith variable, a shock in the jth series can be assigned to that portion of the spectrum. It may be viewed as a within-frequency indicator.

We measure short and long-term connectedness by combining all frequencies within a certain range instead of using a single frequency, \(d=\left(a,b\right):a,b \epsilon \left(-\pi ,\pi \right), a<b:\)

Using this information, we can calculate the same connectedness estimation as described earlier. The same method can be used to evaluate them. Despite the fact that estimates of frequency interconnectivity are provided. Information on the spread over particular frequency ranges does not provide information about the spread within that frequency range:

Although all measurements provide precise ranges, they do not provide information regarding the overall impact. By the methodology overall, Baruník and Křehlík (2018) suggested that all contribution metrics for each frequency be used. Band should be weighed by \(\Gamma \left(\mathrm{d}\right)=\frac{{\sum }_{i,j=1}^{N}{\widetilde{\Upsilon}}_{ij}\left(d\right)}{N}.\)

Our final demonstration demonstrates Baruník and Křehlík (2018) frequency-domain measurements and the Diebold and Yilmaz 2012, Diebold and Yılmaz 2014) time-domain estimates:

Results

Average dynamic connection varies over time

Table 2 presents the average outcome of the interlinkages among numerous indications in the network based on the entire data set from 1996 to 2019. An indicator’s response to a shock is illustrated in particular by the components along the diagonal of this table. A non-diagonal component, on the other hand, describes the effect of other indicators on this indicator (TO) and the impact of this indicator’s instability (FROM) on other indicators. As shown in the columns, each indicator affects the forecaster’s error variance independently, while Table 2 illustrates how each indicator affects the forecaster’s error variance independently. For the entire data set, the average TCI value is 76.76%. Approximately 76.76% of the volatility is attributed to changes in the network of indicators being studied. The results indicate that personal effects account for approximately 22.24% of the system’s mistake variance. The last row of Table 2 shows the contribution of each indicator. Economic complexity (EC) significantly impacts shock and volatility transfer to other system indicators. Therefore, economic complexity has a strong impact on and is a major cause of shocks to other indicators. It is worth noting that the green technology development (EI) is very susceptible to the influence of other actors present in the network, in which the impact of EC is the largest and is the main cause of shock for this index. In addition, EC also has a significant impact on other digitalization and energy indicators, such as a number of individuals using the Internet (INU), mobile cellular subscriptions (per 100 people) (MOBSUB), and renewable energy consumption (REC).

Based on the division of the observational segments into short and long durations, this study examines the concept that indicator roles vary over time. It is possible to clarify some of the short-term histories of the system based on all of the indicators together (TCI is 62.45%). The system’s forecast uncertainty fluctuations can also be attributed to approximately 38% of the personal effects to be considered in the near future. In the long run, the number has significantly decreased to 14.30%. Over both short and long periods, evidence supports the idea that these indicators follow one another.

A notable feature of economic complexity (EC) is that it transmits insignificant network shocks in the short run, but in the long run, it causes a marked increase, as does renewable energy consumption (REC). In both durations, green technology development (EI) has been the net recipient of network shocks; however, in the long run, EI has received fewer shocks. In the short term, individuals using the Internet (INU) and mobile cellular subscriptions (MOBSUB) are net transmitters, but in the long term, they become net receivers. Furthermore, INU received the most network shocks in the long run.

Total dynamic connectedness

Figure 2 illustrates complete dynamic connectedness findings across quantiles. On the graph, warmer colors imply a greater connection. Based on the results, the color at the 20% to 80% percentile is warmer than the lower 20% and upper 80% percentiles. To put it another way, the impact appears to be symmetrical. In addition, 50% represents the median quantile of connectedness over the entire period. It is well recognized in the literature that the findings concerning the e-spread shocks for each indicator are highly connected. The information presented in this particular instance will be of great value to both investors and risk managers. Due to long-duration dynamics, these seven indicators serve as shock transmitters or receivers. In contrast, the short-duration net spread mechanism provides a valuable overview of the situation. Our article examines the net total directional connectedness of these two durations. During the period 2009–2012, there was an increase in the number of links in the network, which may stem from external shocks that took place during this period, for example financial and economic crisis in Europe, specifically the Great Recession of 2009, and others political issues like North Korea’s escalating tensions (Denmark 2011). The phenomenon of increasing connectivity in the network also took place in the period 2016–2018. This can be explained by major events in the globe. The interconnectedness around the middle of the y-axis is quite symmetrical, which suggests that spillovers between extremely positive returns behave similarly to those associated with negative returns.

The literature has highlighted the interconnectedness of the results regarding the net spread shocks for each indicator. Investors and risk managers will likely find this particular instance to be of great value. Due to long-duration dynamics, the seven indicators are entirely responsible for their roles as shock transmitters and receivers. As opposed to this, the short-duration net spread mechanism provides valuable insight. This article examines the net total directional connectedness during these two time periods.

We notice that the role of economic complexity (EC) depends on the study period. Its role in the near future surpasses in the long term. In the short term, the green technology development (EI) remains a net shock receiver during our sample. The period 2009–2012 shows that the number of individuals using the Internet (% of the population) (INU) switched from net transmitters to net receivers around 2011 in the short term. This is similar to CO2 emissions (CO2) and Renewable Energy Consumption (REC), respectively, around 2010 and 2011. However, in the long term, this phenomenon does not take place on the INU but still acts as a net transmitter during the whole period. In contrast to CO2 and REC, in the long term, there was a transition from net receiver to net transmitter in around 2013. As mentioned above, during this period, the world economy faced many major political and economic problems, such as the financial crisis, economic recession in Europe, and political problems in North Korea.

In contrast, mobile cellular subscriptions (per 100 people) (MOBSUB) are transitioning from net receiver to net transmitter in the short term, but in the long term, they remain in the state of net transmitter until the end of about 2013 and become net receivers after that. In general, the world’s political, economic, and financial issues in the period 2009–2013 have had a significant influence, showing a change in the role of indicators in networks. However, the series did not have too many fluctuations from that period on. The roles of the studied series were also quite similar and did not change too prominently in the short term and the long term Fig. 3.

Then, we examine the net total directional connectedness over quantiles. In Fig. 4, you can see these results. Warmer colors indicate net indicator transmitters on these graphs. Green technology development (EI) and economic complexity (EC) had the consistent responses among all the indicators. The impact of the problems on the world economy mentioned above in the period 2009–2013 is significant. In general, green technology development was the main net receiver of shocks across the percentiles; however, in 2009–2013, EI acted as a transmitter. For economic complexity, it was the main transmitter of shocks but acted as the receiver at the 80% percentile or higher for the period 2009–2013. Digitalization captured by a number of individuals using the Internet (INU) received the most fluctuations, as seen in Fig. 4 a. Specifically, percentiles from 20 to 80% act as receivers, and below 20 to 80% act as transmitters. This expression is the opposite of mobile cellular subscriptions (MOBSUB) and Renewable Energy Consumption (REC). Specifically, MOBSUB switched from receiver to transmitter around 2013. Finally, CO2 emissions (CO2) acted as the main receiver across the percentiles and throughout the study period.

Furthermore, in order to properly comprehend the dynamics of volatility in geopolitical risks, we examine pairwise dynamics in detail. Both short-term and long-term indicators are affected by economic complexity (EC). Figure 5 displays the results. Specifically, green technology development (EI) was most clearly dominated by EC in both durations, and this state was maintained throughout the study period. In addition, EI’s role is also clearly demonstrated as a main net receiver of shocks in both durations. This status is maintained throughout the study period. The same situation occurs when considering the relationship between EI and REC. Digitalization metrics, such as the number of individuals using the Internet and mobile cellular subscriptions (MOBSUB), also influence EI in both durations. The influence of political, economic, and financial issues in the period 2009–2013 is also reflected in the fluctuations in indicator pairs. Remarkably, the role of EC on Internet users between 2011 and 2014 changed from receiver to transmitter. This status also appears in the relationship between renewable energy consumption and mobile cellular subscriptions to economic complexity.

Policy implications and conclusions

This research aims to explore the interlinkages between digitalization, green technology development, renewable energy consumption, CO2 emissions, and economic complexity in the context of a QVAR framework. In this study, we provide greater flexibility, which allows us to obtain the net pairwise connectedness measurements. For this study, we collected yearly data in Vietnam, where there has been a paucity of data on green technology and environmental issues. We found dynamic links between studied series in our proposed system. Furthermore, this research demonstrates a temporal fluctuation of their connectedness driven by the global political and economic issues occurring during the research period. Economic complexity is the main transmitter of shocks in the short term and manifests even more in the long term. In contrast, green technology development is the primary receiver of shocks and manifests itself prominently in both the short and long term. Digitalization captured by a number of Internet users, in the short term, switched from transmitter to receiver. Other metrics like mobile cellular subscriptions or renewable energy consumption and CO2 emissions are mainly receiver-driven, especially in the long run. In the short term, there was volatility, especially from 2009 to 2013, which can be partly explained by the destructive changes in political, economic, and financial issues in the world at that time.

Theoretical significances

In our research, we propose an in-depth explanation of the interconnectivity between these indicators, namely digitalization, green technology, economic complexity, and green energy, over quantiles in the case of developing countries. Digitalization, economic complexity, green technology, green energy, and environmental issues are spread across pairwise connectedness. Regulators and investors rely on our information and warnings regarding uncertain occurrences and policies.

Practical policy implications

The interconnections among spillover effects and determinants have raised policy implications for investors and authorities. Our recommendations are derived from the article’s theoretical knowledge and empirical findings between digitalization and economic complexity. Policymakers need to develop policies that will lessen the vulnerability of these indicators and reduce the amount of risk or uncertainty the market faces. The significant relationships between the six variables indicate those authority evaluations may be insufficiently diverse or excessively varied. Also discussed are the increasing connections between unanticipated and highly unpredictable events, like the economic downturn in Europe or North Korea’s military problems. In addition, these results can urge politicians to enhance the country’s digitalization development, a potential development demand in the present day.

Future research directions and limitations

Three factors limit the results of this study. First, it should be noted that no general rule or pattern describes how risk events affect spillovers over a quantile, either total, net, or pairwise. Second, the extent of the spread contributes significantly to the relationship between variables in the designed system. Large-spread markets are likely to be severely affected by changes and shocks caused by other indicators. The authorities should focus on risk sources with varying frequencies to mitigate the adverse effects of outside shocks. Global regulatory rules are being integrated for different metrics. Reducing long-term fluctuation spreads’ harmful implications and short-term gain spreads are essential. It should be noted that diversification also has substantial portfolio benefits, given that many researchers are considering the spillover effect across multiple metrics in their research. We have temporarily halted in the current project.

Data availability

Data available on request due to privacy/ethical restrictions.

Notes

Due to its ability to recover results regardless of varying ordering, The GFEVD is favoured above its orthogonal equivalent. counterpart. The GFEVD can also be employed when there is no theoretical framework for detecting error patterns, according to Lastrapes and Wiesen (2021).

References

Abdulwakil MM, Abdul-Rahim AS, Alsaleh M (2020) Bioenergy efficiency change and its determinants in EU-28 region: evidence using least square dummy variable corrected estimation. Biomass Bioenergy 137:105569. https://doi.org/10.1016/j.biombioe.2020.105569

Acemoglu D, Verdier T (1998) Property rights, corruption and the allocation of talent: a general equilibrium approach. Econ J 108(450):1381–1403. https://doi.org/10.1111/1468-0297.00347

Acemoglu D, Zilibotti F (2001) Productivity differences*. Q J Econ 116(2):563–606. https://doi.org/10.1162/00335530151144104

Adam IO (2020) Examining E-Government development effects on corruption in Africa: the mediating effects of ICT development and institutional quality. Technol Soc 61:101245. https://doi.org/10.1016/j.techsoc.2020.101245

Adam I, Fazekas M (2018) Are emerging technologies helping win the fight against corruption in developing countries? Pathways for Prosperity Commission Background Paper Series 21:1–34

Adekoya OB, Akinseye AB, Antonakakis N, Chatziantoniou I, Gabauer D, Oliyide J (2022) Crude oil and Islamic sectoral stocks: asymmetric TVP-VAR connectedness and investment strategies. Resour Policy 78:102877. https://doi.org/10.1016/j.resourpol.2022.102877

Adeleye BN, Adedoyin F, Nathaniel S (2021) The criticality of ICT-trade nexus on economic and inclusive growth. Inf Technol Dev 27(2):293–313. https://doi.org/10.1080/02681102.2020.1840323

Agarwal A, Maiti D (2020) ICTs and effectiveness of governance: a cross-country study. In Maiti D, Castellacci F, Melchior A (eds) Digitalisation and Development: Issues for India and Beyond. Springer, pp. 321–343. https://doi.org/10.1007/978-981-13-9996-1_12

Ahmedov I (2020) The impact of digital economy on international trade. European Journal of Business and Management Research 5(4):Article 4. https://doi.org/10.24018/ejbmr.2020.5.4.389

Airehrour D, Ray S (2016) Greening and optimizing energy consumption of sensor nodes in the internet of things through energy harvesting: challenges and approaches

Ali M, Raza SA, Puah CH, Arsalan T (2021) Does e-government control corruption? Evidence from South Asian countries. J Financ Crime 29(1):258–271. https://doi.org/10.1108/JFC-01-2021-0003

Alsaleh M, Abdul-Rahim AS, Mohd-Shahwahid HO (2017) Determinants of technical efficiency in the bioenergy industry in the EU28 region. Renew Sust Energ Rev 78:1331–1349. https://doi.org/10.1016/j.rser.2017.04.049

Alsaleh M, Zubair AO, Abdul-Rahim AS (2020) Productivity growth and its determinants of the bioenergy industry in the EU28 region: empirical evidence using Malmquist productivity index. Business Strategy & Development 3(4):531–542. https://doi.org/10.1002/bsd2.115

Antonakakis N, Cunado J, Filis G, Gabauer D, de Gracia FP (2022) Dynamic connectedness among the implied volatilities of oil prices and financial assets: new evidence of the COVID-19 pandemic. Int Rev Econ Financ. https://doi.org/10.1016/j.iref.2022.08.009

Arslan HM, Khan I, Latif MI, Komal B, Chen S (2022) Understanding the dynamics of natural resources rents, environmental sustainability, and sustainable economic growth: new insights from China. Environ Sci Pollut Res 29(39):58746–58761. https://doi.org/10.1007/s11356-022-19952-y

Asai M, Gupta R, McAleer M (2020) Forecasting volatility and co-volatility of crude oil and gold futures: effects of leverage, jumps, spillovers, and geopolitical risks. Int J Forecast 36(3):933–948. https://doi.org/10.1016/j.ijforecast.2019.10.003

Awan A, Sadiq M, Hassan ST, Khan I, Khan NH (2022) Combined nonlinear effects of urbanization and economic growth on CO2 emissions in Malaysia. An application of QARDL and KRLS. Urban Clim 46:101342. https://doi.org/10.1016/j.uclim.2022.101342

Azam W, Khan I, Ali SA (2023) Alternative energy and natural resources in determining environmental sustainability: a look at the role of government final consumption expenditures in France. Environ Sci Pollut Res Int 30(1):1949–1965. https://doi.org/10.1007/s11356-022-22334-z

Bakhsh K, Rose S, Ali MF, Ahmad N, Shahbaz M (2017) Economic growth, CO2 emissions, renewable waste and FDI relation in Pakistan: new evidences from 3SLS. J Environ Manag 196:627–632. https://doi.org/10.1016/j.jenvman.2017.03.029

Banga K (2019) Digital technologies and ‘value’ capture in global value chains. https://doi.org/10.35188/UNU-WIDER/2019/677-7

Barnes AP, Hansson H, Manevska-Tasevska G, Shrestha SS, Thomson SG (2015) The influence of diversification on long-term viability of the agricultural sector. Land Use Policy 49:404–412. https://doi.org/10.1016/j.landusepol.2015.08.023

Baruník J, Křehlík T (2018) Measuring the frequency dynamics of financial connectedness and systemic risk*. J Financ Economet 16(2):271–296. https://doi.org/10.1093/jjfinec/nby001

Bi K, Huang P, Ye H (2015) Risk identification, evaluation and response of low-carbon technological innovation under the global value chain: a case of the Chinese manufacturing industry. Technol Forecast Soc Chang 100:238–248. https://doi.org/10.1016/j.techfore.2015.07.005

Brennen JS, Kreiss D (2016) Digitalization. In: The international encyclopedia of communication theory and philosophy. John Wiley & Sons, Ltd, pp 1–11. https://doi.org/10.1002/9781118766804.wbiect111

El Bassam N (2021) Chapter Nineteen—Drivers for digitalization of energy. In El Bassam N (Ed.), Distributed renewable energies for off-grid communities (Second Edition). Elsevier, pp. 443–446. https://doi.org/10.1016/B978-0-12-821605-7.00003-9

Basu S, Fernald J (2007) Information and communications technology as a general-purpose technology: evidence from US industry data. German Econ Rev 8(2):146–173. https://doi.org/10.1111/j.1468-0475.2007.00402.x

Bertot J, Estevez E, Janowski T (2016) Digital public service innovation: framework proposal. https://doi.org/10.1145/2910019.2910108

Bonk CJ (2009) The world is open: how web technology is revolutionizing education. 3371–3380. https://www.learntechlib.org/primary/p/31963/. Accessed 13 Oct 2022

Canh PN, Dinh Thanh S (2020) Exports and the shadow economy: non-linear effects. The Journal of International Trade & Economic Development 29(7):865–890. https://doi.org/10.1080/09638199.2020.1759676

Cardona M, Kretschmer T, Strobel T (2013) ICT and productivity: conclusions from the empirical literature. Inf Econ Policy 25:109–125. https://doi.org/10.1016/j.infoecopol.2012.12.002

Ceccobelli M, Gitto S, Paolo M (2012) ICT capital and labour productivity growth: a non-parametric analysis of 14 OECD countries [MPRA Paper]. https://mpra.ub.uni-muenchen.de/68642/. Accessed 25 Jan 2022

Chatziantoniou I, Abakah EJA, Gabauer D, Tiwari AK (2022) Quantile time–frequency price connectedness between green bond, green equity, sustainable investments and clean energy markets. J Clean Prod 361:132088. https://doi.org/10.1016/j.jclepro.2022.132088

Chu LK (2020) The effects of financial development on economic sophistication: evidence from panel data. Appl Econ Lett 27(15):1260–1263. https://doi.org/10.1080/13504851.2019.1676866

Clarke GRG, Wallsten SJ (2006) Has the internet increased trade? Developed and developing country evidence. Econ Inq 44(3):465–484. https://doi.org/10.1093/ei/cbj026

Collard F, Fève P, Portier F (2005) Electricity consumption and ICT in the French service sector. Energy Econ 27(3):541–550. https://doi.org/10.1016/j.eneco.2004.12.002

Constantine C (2017) Economic structures, institutions and economic performance. J Econ Struct 6(1):2. https://doi.org/10.1186/s40008-017-0063-1

Coronado-Medina A, Arias-Pérez J, Perdomo-Charry G (2020) Fostering product innovation through digital transformation and absorptive capacity. Int J Innov Technol Manag. https://doi.org/10.1142/S0219877020500406

Damgaard J, Elkjaer T, Johannesen N (2018) Piercing the veil. Financ Dev 0055(002). https://doi.org/10.5089/9781484357415.022.A016

Davies T, Fumega S (2014) Mixed incentives: Adopting ICT innovations for transparency, accountability, and anti-corruption. U4 Issue, 2014:4. https://www.cmi.no/publications/5172-mixed-incentives. Accessed 27 July 2022

Denmark AM (2011) Proactive deterrence: the challenge of escalation control on the Korean Peninsula. 7

Dethine B, Enjolras M, Monticolo D (2020) Digitalization and SMEs’ export management: impacts on resources and capabilities. Technol Innov Manag Rev 10(4):18–34. https://doi.org/10.22215/timreview/1344

Diebold FX, Yilmaz K (2012) Better to give than to receive: predictive directional measurement of volatility spillovers. Int J Forecast 28(1):57–66. https://doi.org/10.1016/j.ijforecast.2011.02.006

Diebold FX, Yılmaz K (2014) On the network topology of variance decompositions: measuring the connectedness of financial firms. J Economet 182(1):119–134. https://doi.org/10.1016/j.jeconom.2014.04.012

Dutta N, Sobel RS (2018) Entrepreneurship and human capital: the role of financial development. Int Rev Econ Financ 57:319–332. https://doi.org/10.1016/j.iref.2018.01.020

Dwivedi YK, Hughes L, Kar AK, Baabdullah AM, Grover P, Abbas R, Andreini D, Abumoghli I, Barlette Y, Bunker D, Chandra Kruse L, Constantiou I, Davison RM, De’ R, Dubey R, Fenby-Taylor H, Gupta B, He W, Kodama M, … Wade M (2022) Climate change and COP26: Are digital technologies and information management part of the problem or the solution? An editorial reflection and call to action. International J Inform Manag 63:102456. https://doi.org/10.1016/j.ijinfomgt.2021.102456

Elgin C, Oztunali O (2014) Pollution and informal economy. Econ Syst 38(3):333–349. https://doi.org/10.1016/j.ecosys.2013.11.002

El-Haggar SM (2007) Sustainable industrial design and waste management cradle-to-cradle for sustainable development. Elsevier Academic Press, Cambridge, MA. - References—Scientific Research Publishing. (n.d.). Retrieved November 20, 2021, from https://www.scirp.org/(S(lz5mqp453edsnp55rrgjct55))/reference/referencespapers.aspx?referenceid=1999031. Accessed 27 July 2022

Elliott G, Rothenberg TJ, Stock JH (1996) Efficient tests for an autoregressive unit root. Econometrica 64(4):813–836. https://doi.org/10.2307/2171846

Faisal F, Tursoy T, Berk N (2018) Linear and non-linear impact of internet usage and financial deepening on electricity consumption for turkey: empirical evidence from asymmetric causality. Environ Sci Pollut Res 25(12):11536–11555. https://doi.org/10.1007/s11356-018-1341-7

Fan H, Lai EL-C, Li YA (2015) Credit constraints, quality, and export prices: theory and evidence from China. J Comp Econ 43(2):390–416. https://doi.org/10.1016/j.jce.2015.02.007

Faruq HA (2011) How institutions affect export quality. Econ Syst 35(4):586–606. https://doi.org/10.1016/j.ecosys.2011.05.001

Feroz AK, Zo H, Chiravuri A (2021) Digital transformation and environmental sustainability: a review and research agenda. Sustainability 13(3):3. https://doi.org/10.3390/su13031530

Ferro E (2011) Signaling and technological marketing tools for exporters. The World Bank. https://doi.org/10.1596/1813-9450-5547

Fisher TJ, Gallagher CM (2012) New weighted portmanteau statistics for time series goodness of fit testing. J Am Stat Assoc 107(498):777–787. https://doi.org/10.1080/01621459.2012.688465

Galeotti M, Manera M, Lanza A (2009) On the robustness of robustness checks of the environmental Kuznets curve hypothesis. Environ Resource Econ 42(4):551–574. https://doi.org/10.1007/s10640-008-9224-x

Garcia-Murillo M (2013) Does a government web presence reduce perceptions of corruption? Inf Technol Dev 19(2):151–175. https://doi.org/10.1080/02681102.2012.751574

Giordano C, Giugliano F (2015) A tale of two fascisms: labour productivity growth and competition policy in Italy, 1911–1951. Explor Econ Hist 55:25–38. https://doi.org/10.1016/j.eeh.2013.12.003

Grieger K, Cummings CL (2022) Informing environmental health and risk priorities through local outreach and extension. Environ Syst Decis 42(3):388–401. https://doi.org/10.1007/s10669-022-09864-0

Gulati GJ“Jeff,” Williams CB, Yates DJ (2014) Predictors of on-line services and e-participation: a cross-national comparison. Gov Inform Quart 31(4):526–533. https://doi.org/10.1016/j.giq.2014.07.005

Ha LT (2022) Interlinkages of cryptocurrency and stock markets during COVID-19 pandemic by applying a TVPVAR extended joint connected approach. J Econ Stud. https://doi.org/10.1108/JES-01-2022-0055

Ha LT, Nam PX, Thanh TT (2021) Effects of bribery on firms’ environmental innovation adoption in Vietnam: mediating roles of firms’ bargaining power and credit and institutional constraints. Ecol Econ 185:107042. https://doi.org/10.1016/j.ecolecon.2021.107042

Ha LT, Huong TTL, Thanh TT (2022a) Is digitalization a driver to enhance environmental performance? An empirical investigation of European countries. Sustain Prod Consum. https://doi.org/10.1016/j.spc.2022.04.002

Ha LT, Thanh TT, Linh VM (2022) An exploration of sources of volatility in the energy market: an application of a TVP-VAR extended joint connected approach. Sustain Energy Technol Assess 53:102448. https://doi.org/10.1016/j.seta.2022.102448

Haini H (2019) Internet penetration, human capital and economic growth in the ASEAN economies: evidence from a translog production function. Appl Econ Lett 26(21):1774–1778. https://doi.org/10.1080/13504851.2019.1597250

Hartmann D, Guevara MR, Jara-Figueroa C, Aristarán M, Hidalgo CA (2017) Linking economic complexity, institutions, and income inequality. World Dev 93:75–93. https://doi.org/10.1016/j.worlddev.2016.12.020

Hartmann D (2014) Economic complexity and human development: how economic diversification and social networks affect human agency and welfare. Taylor & Francis. https://library.oapen.org/handle/20.500.12657/30038

Hausmann R, Hwang J, Rodrik D (2007) What you export matters. J Econ Growth 12(1):1–25. https://doi.org/10.1007/s10887-006-9009-4

Hausmann R, Hidalgo CA (2011) The network structure of economic output. J Econ Growth 16(4):309–342. https://doi.org/10.1007/s10887-011-9071-4

Hausmann R, Hidalgo CA, Bustos S, Coscia M, Simoes A, Yildirim MA (2014) The Atlas of economic complexity: mapping paths to prosperity. MIT Press

Herzog K, Winter G, Kurka G, Ankermann K, Binder R, Ringhofer M, Maierhofer A, Flick A (2017) The digitalization of steel production. BHM Berg- Huettenmaenn Monatsh 162(11):504–513. https://doi.org/10.1007/s00501-017-0673-9

Hidalgo CA (2021) Economic complexity theory and applications. Nat Rev Phys 3(2):92–113. https://doi.org/10.1038/s42254-020-00275-1

Hidalgo CA, Hausmann R (2009) The building blocks of economic complexity. Proc Natl Acad Sci 106(26):10570–10575. https://doi.org/10.1073/pnas.0900943106

Hidalgo CA, Klinger B, Barabási A-L, Hausmann R (2007) The product space conditions the development of nations. Science 317(5837):482–487

Jackman M, Moore W (2021) Does it pay to be green? An exploratory analysis of wage differentials between green and non-green industries. J Econ Dev 23(3):284–298. https://doi.org/10.1108/JED-08-2020-0099

Jarque CM, Bera AK (1980) Efficient tests for normality, homoscedasticity and serial independence of regression residuals. Econ Lett 6(3):255–259. https://doi.org/10.1016/0165-1765(80)90024-5

Jie H, Khan I, Alharthi M, Zafar MW, Saeed A (2023) Sustainable energy policy, socioeconomic development, and ecological footprint: the economic significance of natural resources, population growth, and industrial development. Util Policy 81:101490. https://doi.org/10.1016/j.jup.2023.101490

Joya O (2015) Growth and volatility in resource-rich countries: does diversification help? Struct Chang Econ Dyn 35:38–55. https://doi.org/10.1016/j.strueco.2015.10.001

Kemp-Benedict E (2014) Shifting to a green economy: lock-in, path dependence, and policy options. Stockholm Environment Institute. https://www.jstor.org/stable/resrep00545. Accessed 27 July 2022

Kennett M, Steenblik R (2006) Environmental goods and services a synthesis of country studies. OECD, pp 13–38. https://doi.org/10.1787/9789264035782-4-en

Khan I, Hou F (2021) The dynamic links among energy consumption, tourism growth, and the ecological footprint: the role of environmental quality in 38 IEA countries. Environ Sci Pollut Res 28(5):5049–5062. https://doi.org/10.1007/s11356-020-10861-6

Khan I, Hou F, Le HP (2021a) The impact of natural resources, energy consumption, and population growth on environmental quality: fresh evidence from the United States of America. Sci Total Environ 754:142222. https://doi.org/10.1016/j.scitotenv.2020.142222

Khan I, Hou F, Le HP, Ali SA (2021b) Do natural resources, urbanization, and value-adding manufacturing affect environmental quality? Evidence from the top ten manufacturing countries. Resour Policy 72:102109. https://doi.org/10.1016/j.resourpol.2021.102109

Khan I, Zakari A, Ahmad M, Irfan M, Hou F (2021c) Linking energy transitions, energy consumption, and environmental sustainability in OECD countries. Gondwana Res. https://doi.org/10.1016/j.gr.2021.10.026

Khan I, Hou F, Zakari A, Irfan M, Ahmad M (2022a) Links among energy intensity, non-linear financial development, and environmental sustainability: new evidence from Asia Pacific Economic Cooperation countries. J Clean Prod 330:129747. https://doi.org/10.1016/j.jclepro.2021.129747

Khan I, Tan D, Hassan ST, Bilal (2022b) Role of alternative and nuclear energy in stimulating environmental sustainability: impact of government expenditures. Environ Sci Pollut Res 29(25):37894–37905. https://doi.org/10.1007/s11356-021-18306-4

Klitgaard R (1988) Controlling Corruption. University of California Press. https://www.jstor.org/stable/10.1525/j.ctt1pnj3b. Accessed 27 July 2022

Koop G, Pesaran MH, Potter SM (1996) Impulse response analysis in nonlinear multivariate models. J Economet 74(1):119–147. https://doi.org/10.1016/0304-4076(95)01753-4

Korp P (2006) Health on the internet: implications for health promotion. Health Educ Res 21(1):78–86. https://doi.org/10.1093/her/cyh043

Kraus S, Schiavone F, Pluzhnikova A, Invernizzi AC (2021) Digital transformation in healthcare: analyzing the current state-of-research. J Bus Res 123:557–567. https://doi.org/10.1016/j.jbusres.2020.10.030

Krause MJ, Tolaymat T (2018) Quantification of energy and carbon costs for mining cryptocurrencies. Nat Sustain 1(11):11. https://doi.org/10.1038/s41893-018-0152-7

Kurt S, Kurt Ü (2015) Innovation and labour productivity in BRICS countries: panel causality and co-integration. Procedia Soc Behav Sci 195:1295–1302. https://doi.org/10.1016/j.sbspro.2015.06.296

Lange S, Pohl J, Santarius T (2020) Digitalization and energy consumption. Does ICT reduce energy demand? Ecol Econ 176:106760. https://doi.org/10.1016/j.ecolecon.2020.106760

Lapatinas A (2019) The effect of the Internet on economic sophistication: an empirical analysis. Econ Lett 174:35–38. https://doi.org/10.1016/j.econlet.2018.10.013

Lapatinas A, Litina A (2019) Intelligence and economic sophistication. Empir Econ 57(5):1731–1750. https://doi.org/10.1007/s00181-018-1511-y

Lastrapes WD, Wiesen TFP (2021) The joint spillover index. Econ Model 94:681–691. https://doi.org/10.1016/j.econmod.2020.02.010

Layne K, Lee J (2001) Developing fully functional E-government: a four stage model. Gov Inf Q 18(2):122–136. https://doi.org/10.1016/S0740-624X(01)00066-1

Le T-L, Abakah EJA, Tiwari AK (2021) Time and frequency domain connectedness and spill-over among fintech, green bonds and cryptocurrencies in the age of the fourth industrial revolution. Technol Forecast Soc Chang 162:120382. https://doi.org/10.1016/j.techfore.2020.120382

Le TH (2022) Connectedness between nonrenewable and renewable energy consumption, economic growth and CO2 emission in Vietnam: new evidence from a wavelet analysis. Renew Energy 195:442–454. https://doi.org/10.1016/j.renene.2022.05.083

Le TH, Hoang PD, To TT (2022) Is product proximity a driver for better energy security? Global evidence of nonlinear relationships between product proximity and energy security. Int J Sustain Dev World Ecol 0(0):1–21. https://doi.org/10.1080/13504509.2022.2025500

Lee C-C, Lee J-D (2009) Income and CO2 emissions: evidence from panel unit root and cointegration tests. Energy Policy 37(2):413–423. https://doi.org/10.1016/j.enpol.2008.09.053

Lee K-K, Vu TV (2020) Economic complexity, human capital and income inequality: a cross-country analysis. Jpn Econ Rev 71(4):695–718. https://doi.org/10.1007/s42973-019-00026-7

Li F, Frederick S, Gereffi G (2019) E-commerce and industrial upgrading in the Chinese apparel value chain. Journal of Contemporary Asia 49(1):24–53. https://doi.org/10.1080/00472336.2018.1481220

Liu H, Khan I, Zakari A, Alharthi M (2022) Roles of trilemma in the world energy sector and transition towards sustainable energy: a study of economic growth and the environment. Energy Policy 170:113238. https://doi.org/10.1016/j.enpol.2022.113238

Liu R, Koehler A, Gailhofer P, Gensch C-O, Wolff F (2019) Impacts of the digital transformation on the environment and sustainability

Lyu L, Khan I, Zakari A, Bilal (2021) A study of energy investment and environmental sustainability nexus in China: a bootstrap replications analysis. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-16254-7

Martínez-Zarzoso I, Maruotti A (2011) The impact of urbanization on CO2 emissions: evidence from developing countries. Ecol Econ 70(7):1344–1353. https://doi.org/10.1016/j.ecolecon.2011.02.009

McMullan M (2006) Patients using the internet to obtain health information: how this affects the patient–health professional relationship. Patient Educ Couns 63(1):24–28. https://doi.org/10.1016/j.pec.2005.10.006

Moyer JD, Hughes BB (2012) ICTs: do they contribute to increased carbon emissions? Technol Forecast Soc Chang 79(5):919–931. https://doi.org/10.1016/j.techfore.2011.12.005

Nguyen CP, Schinckus C, Su TD (2020) The drivers of economic complexity: international evidence from financial development and patents. Inte Econ 164:140–150. https://doi.org/10.1016/j.inteco.2020.09.004

Niebel T (2018) ICT and economic growth – comparing developing, emerging and developed countries. World Dev 104:197–211. https://doi.org/10.1016/j.worlddev.2017.11.024

Oosterlaken I (2015) Economic complexity and human development: how economic diversification and social networks affect human agency and welfare. J Hum Dev Capabilities 16(1):156–157. https://doi.org/10.1080/19452829.2015.1006465

Owusu-Agyei S, Okafor G, Chijoke-Mgbame AM, Ohalehi P, Hasan F (2020) Internet adoption and financial development in sub-Saharan Africa. Technol Forecast Soc Chang 161:120293. https://doi.org/10.1016/j.techfore.2020.120293

Pesaran HH, Shin Y (1998) Generalized impulse response analysis in linear multivariate models. Econ Lett 58(1):17–29. https://doi.org/10.1016/S0165-1765(97)00214-0

Pina V, Torres L, Acerete B (2007) Are ICTs promoting government accountability?: a comparative analysis of e-governance developments in 19 OECD countries. Crit Perspect Account 18(5):583–602. https://doi.org/10.1016/j.cpa.2006.01.012

Pop LD (2020) Digitalization of the system of data analysis and collection in an automotive company. Procedia Manuf 46:238–243. https://doi.org/10.1016/j.promfg.2020.03.035

Poshakwale S, Ganguly G (2015) International shocks and growth in emerging markets. Glob Financ J 26:29–46. https://doi.org/10.1016/j.gfj.2015.01.003

Pradhan RP, Arvin MB, Hall JH, Nair M (2016) Innovation, financial development and economic growth in Eurozone countries. Appl Econ Lett 23(16):1141–1144. https://doi.org/10.1080/13504851.2016.1139668