Abstract

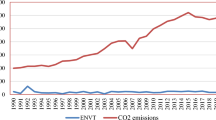

The fact is that output volatility and carbon dioxide (CO2) emissions move together over the period. This empirical study examines the dynamic effect of output volatility on CO2 emissions using the advance nonlinear panel autoregressive distributed lag (ARDL) approach. The empirical analysis is executed for ten high emitters Asian countries covering the period from 1990 to 2019. The findings reveal that positive change in output volatility increases CO2 emissions and negative change in output volatility decreases CO2 emissions in the long run in Asia. The results also show that digitization also positively impacts environmental quality in Asia due to green globalization. The findings are also robust and similar in an alternative indicator of the environment. An important policy is that reducing volatility in output is a suitable way of environmental sustainability, particularly for Asian countries.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The present and future well-being of the competitive economy depends on the stability of its economic system. A predictable economic environment is necessary for economic growth, capital mobility, investment, and energy consumption. Conversely, economic uncertainty hinders major economic factors like output growth, employment, capital flows, and investment (Montiel and Servén 2006). Therefore, worldwide, the stability of the economy remains one of the central policy objectives. In the mid of 1980s, the obstinate reduction in volatility is noticed in the USA and several other regions of the world that captured the consideration of several researchers to recognize the fundamental reasons behind the obstinate decline in volatility. Meanwhile, the research work which is done by Kydland and Prescott (1982), Nelson and Plosser (1982), King et al. (1988), and Long Jr and Plosser (1983) started a debate among policymakers and economists about the foundations of fluctuations in macroeconomics. Iseringhausen and Vierke (2019) noted that initially, the labor force's government role and demographic factors were assumed as important factors of stability in macroeconomics in the OECD countries. Afterward, the studies associated output volatility with trade openness (Mohey-ud-Din and Siddiqui 2018, financial performance (Majeed and Noreen 2018), environment (Majeed and Mazhar 2019a, b), the uncertainty of terms of trade (Hakura 2009), population (Mobarak 2005), inflation volatility (Majeed and Noreen 2018), and economic growth Badinger 2009; Ozturk and Acaravci 2013).

Recently, the study done by Majeed and Mazhar (2019a, b) reported that climatic degradation is a fundamental factor of output volatility. The study also pointed out that ecosystem changes significantly contribute to influencing uncertainty in economic conditions. The increase in climatic shocks and environmental degradation results in increasing uncertainties of production by affecting the productivity of agriculture in agricultural regions. Additionally, drought, extreme climatic conditions, losses in major crops like wheat and maize, and reduction in arable land increase the output and production uncertainty in the agricultural sector (WESS 2013). The degradation of the environment in the case of air pollution hampers both human capital and natural resources that increase the development instability by deteriorating the productivity of capital (Gwangndi et al. 2016).

By applying nonlinear econometric methods, the study carries new understandings on the nexus between output volatility and environmental degradation. Currently, the interest of researchers is increasing towards spatial analysis in the climatic and regional sciences. As regions and countries are not entirely independent, they have closely collaborated, and their collaboration is crucial to integrate with the econometric analysis for attaining the correct results (Fingleton and Le Gallo 2008). In Kolb’s (2011) view, the speedy rise in economic incorporation has produced many prospects for disseminating the benefits all over the worldwide economy along with allocating the uncertainties and risks with the world. In this respect, Antonakakis and Badinger (2012) contended that along with increasing economic dependence, economic growth and its volatility spillover from international economies to the domestic economies.

Abate (2016) reported that macroeconomic instability of a country not only dampens the development of its own economy but also spillovers to economies of other countries and impedes its growth rates by producing the instabilities in production and consumption that disrupt physical and human investment; thus, it also influenced the environment. Florax and Van der Vlist (2003) noted that economic instability has also badly affected environmental quality as a worldwide challenge in the last few decades. Chiefly, the whole world has perceived the global issue of climatic change and numerous other issues of environment that result in increasing resource wars in the form of oil wars, water wars, and diamond wars both at national and international levels. These environmental issues like greenhouse gas emissions, soil erosion and exhaustion, and deforestation do not only respect the border of the country, it also flourishes directly to the nearer localities (Pereira 2015).

Moreover, Ramirez and Loboguerrero (2002) noted that economies are connected with each other through numerous channels like technological and knowledge diffusion, digitalization, capital outflows and inflows, environmental, economic, and political policies that exert possible spillover regional and cross border impacts. The shocks are easily transmitted through globalization from one region to another region. Most importantly, trade openness also affects regional environmental quality. Under the objective of promoting trade internationally, the regulatory authorities usually overlook the implementation of environmental protection rules that result in deteriorating the quality of the environment (Managi and Kumar 2009). The use of information and communication technology (ICT) has transformed human society altogether. It has become an important contributor to the growth of developed and emerging economies (Jin and Cho 2015; Salahuddin and Alam 2016; Erumban and Das 2016; Xinmin et al. 2020; Usman et al. 2021; Su et al. 2021). Moreover, the role of ICT is not limited to one or two sectors of the economy but spreads to banking and finance (Agboola 2006; Osabuohien 2008; Hafeez et al. 2018), education (Sanchez et al. 2011), health care (Honka et al. 2011; Shiferaw and Zolfo 2012; Chaabouni and Saidi 2017), energy (Ozturk 2010; Ishida 2015; Salahuddin and Alam 2016), and industries (Wang et al. 2010). Though the beneficial impacts of ICT are quite a lot, its hazardous effects are also under discussion particularly its role in polluting the environment (Danish et al. 2018; Chen et al. 2019).

The previous study does not highlight the output volatility and environmental nexus. Some studies, for instance, Antonakakis and Badinger (2012) and Lin and Kim (2013), reported the output volatility and economic growth for developed and developing economies. Similarly, Gavin and Hausmann (1998) assess the macroeconomic volatility and economic development for Latin Americans, while Ullah et al. (2020) elaborate on the relationship between GDP volatility and CO2 for Pakistan. A key objective of the study is that we examine the asymmetric impact of output volatility on CO2 for Asian economies. Thus the asymmetric impact of output volatility on environmental pollution is a novel contribution to the environmental and economic literature. There is a lack of literature on this topic as only one study offers the empirical investigation of output volatility-environmental degradation nexus by employing panel data technique (Majeed and Mazhar 2019a, b). According to our knowledge, the current study is the first one that investigates the asymmetric effects of output volatility on environmental degradation. This study is more important for the policymakers as well as authorities for environmental quality. In the next sections, we have covered the literature, model and methodology, results and discussion, and conclusion of the study.

Literature review

The theoretical background associated with macroeconomic volatility of business cycles can be drawn back to the earlier twentieth century when the economists of different schools of thought anticipated various sources of output volatility. The comprehensive debate on the issue of the business cycle started after the occurrence of the great depression. Keynes figured out the sticky nature of prices and wages that limit the speedy regulation of macroeconomic equilibrium and the factors of demand-side tend to create instabilities in output.

Furthermore, the Sun-spot theory and the real business cycle (RBCs) theory determine the contribution of the environment in macroeconomic instability. The RBCs school of thought describes that technological productivity and innovations shocks are the fundamental causes behind fluctuations in the business cycle. Likewise, the pioneer of Sun-spot theory Jevons (1878) elaborates sunspots as the fundamental source of economic instability. According to this theory, Sunspots fluctuate the weather of the earth that directly affects the productivity of output by producing structural changes in the agricultural sector. These structural changes have transferred to each sector of the economy, thus also affect the quality of the environment as well the health of the economy. A total of 1.34 billion Chinese lives in vulnerable and highly vulnerable area (He et al. 2018; Zuo et al. 2020; He et al. 2021). The minimization of construction and demolition waste is an imperative approach to tackle challenges of waste management (Yuan et al. 2021; He et al. 2021). Government subsidy has less impact on waste reduction as an incentive policy (Liu et al. 2020). To control CO2 emission, a carbon tax is encouraging to use electric vehicles for better environment (Li et al. 2020).

The intrinsic linkages of growth stability and environmental quality can be figured out through intergenerational equity and ecological modernization theories. Streamflow and sediment load dynamics are primarily instigated by an increase in temperature (Tian et al. 2020; Zhao et al. 2020; Zuo et al. 2020). The ecological modernization theory ruminates the productivity of the environment as natural capital like capital and labor productivity. The theory recommends the better usage of natural resources using green and clean technologies to have stable and higher growth rates. Also, the consequences of intergenerational equity theory recommend that stability of growth can be attained by concentrating on social impartiality between future, present, and past generations with the effective utilization of services of the ecosystem. This argument is also supported by Gavin and Hausmann (1998) and Badinger and Breuss (2008). Similarly, the “value belief norms theory,” “the environmental Kuznets curve hypothesis,” and “the environmental transition theory” reveal the role of time frame, priorities of people for a higher quality of the environment, and education that tend to achieve sustainable growth after a time lag. The environmental transition theory reveals that at the initial level of transition, the economy’s structure converges to the industrial sector from the agricultural industry; the demand for urban infrastructure and energy raises that result in more carbon emissions. Then, when the per capita income of cities or economies rises, the emphasis is averted towards higher protection of the environment.

Just like environmental transition theory, the environment Kuznets curve hypothesis postulates that at initial levels of growth, carbon emission rises as much attention is given to development. But, after achieving the highest level, the economic development-carbon emissions nexus becomes negative because people start demanding a better quality environment. In the end, the value belief norm theory reveals how the psychology of the environment influences the quality of the environment. According to the followers of this belief, environmental preservation and environmental degradation are initiated by people’s values and beliefs they have about the services of the ecosystem, like if they provide more value to the environment, then they will ruminate themselves more responsible for pollution-related activities. Resultantly, pro-environmental kind of behavior is encouraged; otherwise, individuals do not consider their accountability for environmental issues. Thus, theoretical literature suggests that economic growth or output volatility is interconnected with the environment.

Based on the theoretical background, policymakers and researchers tried numerous empirical exercises to investigate the impact of output volatility on the environment. Volatility is not good for economic growth, because it adversely affects investment, saving, growth, distribution of income, and poverty. Similar findings are also funded by Inter-American Development Bank (1995), Flug et al. (1998), and Gavin and Hausmann (1998). In the case of UAE, Darrat et al. (2005) found the presence of volatility reducing the influence of financial expansion in the long run. The findings conclude that monetary policy and technological progress contribute more significantly in bringing variations in output. Conversely, fiscal policy also affects the stability of growth but at a smaller magnitude (Hondroyiannis and Papapetrou 2000). In the case of Greek economy, Chapsa et al. (2011) found the causal linkage between inflation uncertainty and output uncertainty. In case of South Africa, Bhoola and Kollamparambil (2011) noted that monetary policy contributes in the alleviation of output volatility. In case of Indian economy, Ghosh (2013) found financial deepening, government expenditure, and institutional quality as instability-reducing factors. Generally, these results conclude that country-specific issues play a leading role in mounting/waning output instability in the country. Another strand in literature investigated the influences of demographics, financial development, government expenditure, remittances, trade openness, and democracy on output volatility (Mobarak 2005; Bejan 2006; Bugamelli and Paterno 2011; Iyidogan and Turan 2017; Majeed and Noreen 2018; Iseringhausen and Vierke 2019). These studies reported that along with domestic components, external factors of the economies like remittances and trade openness contribute more dominantly in explaining instability in output.

Gounder and Saha (2007) noted that variations of GDP per capita are initiated by production uncertainties in the manufacturing and agriculture sector and adversely affect the environment. Ullah et al. (2020) found the harmful influence of output instability on the environment. Maddison (2006) and You et al. (2019) reported the strong influences of carbon emissions of neighboring countries on the carbon emissions of local country. The developed countries transfer their pollution to the developing economies through “pollution trading” that challenge environmental protections by permitting polluters to transfer their pollution emissions by selling and purchasing their right of pollution to each other. Samreen and Majeed (2020) also found the existence of a significant and positive influence of pollution emissions of neighboring economies on pollution emission of local economies. Zhao et al. (2021) reported that domestic environmental structure is largely exaggerated by the income per capita, biocapacity, and environmental footprint of neighboring countries. In their views, an upsurge in awareness regarding ecological diffusion and protection of cleaner technological production and capital flows mainly influences the domestic environmental footprint. Abildtrup et al. (2013) concluded the negative influence of the use of land on supply cost of water both within the supplied region and the surroundings and nearby region. Abate (2016) reported the negative influence of instability on GDP per capita; however, Daud and Podivinsky (2011) discovered negative influence of debt on GDP per capita. On other hand, Stanca (2010) reported that welfare is very crucial because of aggregate economics and analogous social circumstances of neighboring countries. In crux, theoretical and empirical literature suggests that output volatility or macroeconomic volatility is bad for economic factors.

Model, methods, and data

Recent theoretical and empirical research suggests that a volatile output leads to significantly decrease investment and economic growth, harms the distribution of income, and increases poverty. Majeed et al. (2021) noted that output volatility negatively affects each sector of the economy, i.e. agriculture, industrial, and services sectors; it also affects environmental quality. Based on the literature, output volatility is considered one of the important factors of economic growth as well environment (Badinger and Breuss 2008; Lin and Kim 2013, Ullah et al. 2020). The basic model is:

Equation (1) is the Asian economies CO2 model, where CO2, itis the carbon emission to Asia which is assumed to depend on the output volatility denoted by OVit, where t indicates the time period from 1990 to 2019 and i represents cross-sections from 1, 2, …10. We expect an estimate of β1 to be negative. Equation 1 gives us the long-run effects of exogenous variables on CO2 emissions. We also used the ICT, trade, and government expenditure variables as control variables in the analysis. We also evaluate the short-term effects; therefore, we need to include the short-run dynamic adjustment process into Eq. (1). The model is:

where “Δ” represents the first difference, π is a constant term, β1 and β5 are the long-run coefficients estimates, π1pand π5p are the short-run coefficients estimates, and μit is an error term. Equation (2) gives us short- and long-term coefficient estimates of the linear panel ARDL model. However, for the validity of long-run effects, a cointegration must be established and Pesaran et al. (2001) revealed the F test and ECM or t-test to establish cointegration. One of the assumptions of the panel ARDL model is that variables could be a mixture of I(0) and I(1). While nonlinear approach decomposes the output volatility variables into two partial sums, a positive partial sum (OV+it ) is supposed to capture positive changes of output volatility, and a negative partial sum (OV−it) is supposed to capture the negative changes. Under this modern approach, a positive and negative change of output volatility is not expected to have symmetric effects on CO2 emissions. We are following the Shin et al. (2014) approach to decompose the output volatility variable in panel form which is as follows:

where OV+it is the partial sum of positive changes and reflects an increase in output volatility, while OV−it is the partial sum of negative changes and reflects a decrease in output volatility. We re-formulated Eq. (2) into a new error correction formats as follows:

The nonlinear ARDL panel model adopted in this study is assembled by incorporating long-term and short-term nonlinear terms of output volatility and followed the Shin et al. (2014) approach. Unlike the linear version of the panel ARDL, the nonlinear equation is referred to as asymmetric panel ARDL that allows us asymmetric responses of output volatility on CO2 emissions. We also estimate the nonlinear panel ARDL through the pooled mean group (PMG) or mean group (MG) estimators, and after that, we assess the appropriate estimators through the Hausman test. This approach is the workhorse of the modern time series dataset. The main edge of this approach is that it allows us to incorporate the nonlinear variables in our analysis and estimates the short and long run in a single step.

The study uses CO2 emissions as a dependent variable measured in kilotons. For robust analysis, we also used GHEs emissions. Output volatility variable is used as an independent variable and the remaining three factors used control variables in our analysis. The independent variables selection is based on study of Majeed et al. (2021). The data on CO2 emissions, GHEs, ICT, trade, and government expenditure are obtained from the World Bank. The dataset on years of schooling is provided by Barro and Lee (2010). Our study uses annual data for 10 Asian economies (China, India, Iran, Japan, Malaysia, Saudi Arabia, Thailand, Turkey, UAE, and Vietnam) from 1990 to 2019, and the selection of time frame is based on data availability. All variables are converted into natural logarithm, except ICT form for consistent and robust estimates. Table 1 gives information about variables definitions and data sources. The detailed descriptive analysis and correlation matrix are also given in Table 2. The next section has also reported the results of the ARDL and NARDL models.

Results and discussion

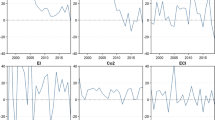

Before estimating the model, as a preliminary analysis, stationarity properties of the data have been tested by using Levin–Lin–Chu (LLC), Im–Pesaran–Shin (IPC), and augmented Dickey–Fuller (ADF). In Table 3, the results of LLC tests confirm that output volatility and carbon emissions are stationary at the first difference; however, all other variables of the model are stationary at I(0). The remaining two tests are also reported in the mixed order of integration. In order to proceed with regression analysis, ARDL and NARDL estimation techniques have been used. Table 4 provides the ARDL and NARDL estimates for carbon emissions. The long-run coefficient of output volatility variable is statistically insignificant; it suggests that output volatility exerts no significant influence on pollution emissions in the long run. However, in the short run, the coefficient estimate of output volatility is positive and statistically significant at the 10 percent level. The coefficient estimate shows that due to 1% upsurge in output volatility, pollution emissions increase by 0.402% in the short run.

The influence of ICT on pollution emissions is significant at 10% level in the long run; however, the short-run coefficient estimate of this variable is statistically insignificant. The negative estimate of ICT proposes that a 1% increase in ICT results in decreasing pollution emissions by 0.09% in the long run. The coefficient of trade is also statistically significant only in the short run at 10% level. The coefficient estimate of this variable is negative which postulates that due to an increase in trade, the pollution emissions reduce by 1.308%. In precise, both variables ICT and trade result in reducing pollution emissions in the long run. However, GE is positively associated with pollution emissions in the long run at 10% level of statistical significance but the estimate of this variable is again statistically insignificant in the short run. The positive association suggests that due to the upsurge in GE, pollution emissions also increase by 0.05%. In case of ARDL, the estimate for ECM (−1) is statistically significant and negative at 10% level. The coefficient −0.153 indicates that within 1 year, almost 15% disequilibrium of carbon emissions will be adjusted back towards long-run equilibrium.

In this study, an asymmetric association between output volatility and pollution emissions has also been investigated. To perform this task, the output volatility has been decomposed into negative and positive partial sum to dig out the asymmetric influence of output volatility on carbon emissions in selected countries of Asia. The short-run and long-run asymmetry in the association are examined using the Wald test. The coefficient estimate of Wald test confirms the existence of long-run asymmetry in the association between output volatility and carbon emissions at 1% level of significance. However, the Wald test does not confirm this association in the short run.

The long-run results show that the asymmetry in the influence of positive shock (OV_positive) and negative shock (OV_negative) in output volatility on pollution emissions in selected Asian countries is statistically significant. The long-run coefficient of positive change in output volatility is statistically significant at 5% level associated with a positive sign. The estimate confirms that one unit positive shock in output volatility upsurges pollution emissions by approximately 0.619% in the long run. Conversely, a unit negative change in output volatility results in decreasing pollution emissions by approximately 0.108% in the long run, and the influence of this estimate is statistically significant at 5% level. The results of long-run estimates confirm that the influence of positive shock in output volatility on pollution emissions in selected Asian countries is stronger than the reducing impact of a unit negative shock in output volatility. The results are similar with Ullah et al. (2020), who found that increase in GDP volatility has harmful effects on the environment, while a decrease in GDP volatility has a favorable impact on the environment. Similarly, Sohail et al. (2021) noted that policy uncertainty and output volatility raise the non-renewable energy consumption that is a key source of CO2 emissions. A positive shock of output volatility has a positive effect on carbon pollution, suggesting that volatility raises the non-renewable consumption of energy in economic activities. Another interesting finding is that higher output volatility is affecting the environment more than lower output volatility. The short-run coefficient estimate of positive shocks in output volatility is statistically insignificant; however, the coefficient estimate of negative shocks in output volatility is also statistically insignificant in the short run. There is still large controversy, whether it is a negative or positive effect on CO2 emissions. The negative impact of output volatility on CO2 emissions thus confirms that more unstable economies are more likely to grow faster due to the extra use of dirty energy consumption that leads to more energy consumption. A similar finding is already found by Ullah et al. (2020) for Pakistan, who noted that GDP stability increases CO2 emissions.

As long as other variables are concerned, ICT is negatively associated with pollution emissions in the long run at 1% level of significance. However, the coefficient estimate of this variable is statistically insignificant in the short run. The influence of trade on pollution emissions is significant at 10% level in the short run; however, the long-run coefficient estimate of this variable is statistically insignificant. The negative estimate of trade proposes that a 1% increase in trade has to decrease pollution emissions by 0.032% in the short run. In the long run, coefficient estimate of government spending is positive and statistically significant at 1% level. The coefficient estimate shows that due to 1% upsurge in government spending, pollution emissions increase by 0.026% in the long run. However, the short-run coefficient of the government spending variable is statistically insignificant; it suggests that government spending exert no significant influence on pollution emissions in the short run.

As far as the ECM coefficient of NARDL is concerned, the coefficient estimate for ECM (−1) is statistically significant and negative at a 1% level. The coefficient −0.274 indicates that within one year, almost 27% disequilibrium of pollution emissions will converge back towards long-run equilibrium. While log-likelihood is also shown, the goodness of fit and F-test are also reported the Cointegration. To check the robustness of our model, we have used GHEs as the dependent variable and investigated the effect of output volatility on greenhouse emissions. The robust analysis is shown in Table 5; the study has a similar coefficient estimated for focused and controlled variables using ARDL and NARDL techniques.

Conclusion and policy

Output volatility is a serious and controversial concern of policymakers across the Asian economies as it negatively affects the economy of each sector. This paper gives us an empirical assessment of output volatility and CO2 emissions relationship in the light of an advance econometric framework. This study also used the GHEs for alternative proxied for robust analysis. This study provides evidence on the dynamic effect of output volatility on CO2 emissions using panel data of 10 economies over the period 1990 to 2019. For analysis, we used ICT, trade, and government spending as control variables. The analysis has been carried out by using both symmetric ARDL and asymmetric ARDL panel data models for the sake of comparison and extended the analysis. These models estimate through MG and PMG, while on the basis of Hausman specification tests, the results of preferred PMG models are only reported.

The results from the estimated coefficients of ARDL and NARDL model reported three types of relationships between output volatility and pollution emissions in selected Asian countries. These results include short-run association, long-run association, and the speed of convergence to attain equilibrium. The empirical results for ARDL model show that output volatility has a significant increasing effect on pollution emissions in the short run, but output volatility has an insignificant influence on pollution emissions in the long run. However, the empirical results of NARDL model suggest that the influence of positive shock in output volatility on pollution emissions in selected Asian economies is significantly different (both in magnitude and direction) from that of negative shocks in the long run. The results for long-run asymmetries suggest that positive shock in output volatility has a significant positive influence on pollution emissions, while negative shock in output volatility has a significant reducing influence on pollution emissions. However, the coefficient estimates of positive shocks and negative shocks in output volatility are statistically insignificant in the short run. Thus output volatility is also behaved asymmetrically in the environment and fact pronounced. On the other hand, additional results in terms of the control variables suggest that a negative effect of ICT and trade on pollution emissions and positive effect of government spending on pollution emissions in the long run in both regressions; however, in the short run, the effect of all these variables on pollution emission is statistically insignificant in case of ARDL, Trade exerts a positive influence on pollution emissions in case of NARDL. Our robust analysis gives us similar estimates for ARDL and NARDL. The remaining control variables, ICT and trade, also carry correct signs, and findings are similar to the theory and empirical insights.

The empirical analysis gives us evidence in the provision of the need for commitments regarding the achievement of sustainable development goals (SDGs) that can support offsetting pollutant emissions across and within Asian economies. The countries should work together for achieving this common goal and providing incentives for investment and diffusion of green and clean technologies. The national and sub-national authorities should also strengthen the execution of environmental policies to improve environmental quality. The restrictions on dirty industrial and agricultural productivity in highly polluted Asian economies could also be beneficial for avoiding negative environmental externalities. Our empirical analysis also enforced the importance of output stability as well as economic certainties because economic disturbance in one country can also affect many other countries. The regulatory authorities should also play their role to minimize the economic uncertainties by improving the environment. Therefore, Asian governments should more focus on adopting ICTs for reducing CO2 emissions to upsurge inclusive development. Governments of these countries should increase Research and Development (R & D) expenditures, which would help in developing ICT products that are conducive to the environment. Besides, authorities should levy heavy taxes on the industries that are emitting CO2 and other greenhouse gasses during the production process. During the analysis, this study did not include other relevant new CO2 determinants such as stock market volatility, price volatility, and exchange volatility. Future empirical studies can extend this work in the added stock market volatility, price volatility, and exchange volatility variables in the model.

References

Abate GD (2016) On the link between volatility and growth: a spatial econometrics approach. Spat Econ Anal 11(1):27–45

Abildtrup J, Garcia S, Stenger A (2013) The effect of forest land use on the cost of drinking water supply: A spatial econometric analysis. Ecological Economics 92:126–136. https://doi.org/10.1016/j.ecolecon.2013.01.004

Agboola A (2006) Information and communication technology (ICT) in banking operations in Nigeria: an evaluation of recent experiences. Retrieved December 25(2007):56

Antonakakis N, Badinger H (2012) International spillovers of output growth and output growth volatility: evidence from the G7. Int Econ J 26(4):635–653

Badinger H (2009) Fiscal rules, discretionary fiscal policy and macroeconomic stability: an empirical assessment for OECD countries. Appl Econ 41(7):829–847

Badinger H, Breuss F (2008) Trade and productivity: an industry perspective. Empirica 35(2):213–231

Barro R, Lee JW (2010) A New Data Set of Educational Attainment in the World, 1950-2010. https://doi.org/10.3386/w15902

Bejan, M. (2006) Trade openness and output volatility. Available at SSRN 965824

Bhoola F, Kollamparambil U (2011) Trends and determinants of output growth volatility in South Africa. Int J Econ Financ 3(5):151–160

Bugamelli M, Paterno F (2011) Output growth volatility and remittances. Economica 78(311):480–500

Chaabouni S, Saidi K (2017) The dynamic links between carbon dioxide (CO2) emissions, health spending and GDP growth: A case study for 51 countries. Environ Res 158:137–144

Chapsa X, Katrakilidis C, Tabakis N (2011) Dynamic linkages between output growth and macroeconomic volatility: Evidence using greek data (2011). International Journal of Economic Research 2(1):152–165

Chen M, Zhou C, Meng C, Wu D (2019) How to promote Chinese primary and secondary school teachers to use ICT to develop high-quality teaching activities. Educ Technol Res Dev 67(6):1593–1611

Danish, Khan N, Baloch MA, Saud S, Fatima T (2018) The effect of ICT on CO2 emissions in emerging economies: does the level of income matters? Environ Sci Pollut Res Int 25(23):22850–22860. https://doi.org/10.1007/s11356-018-2379-2

Darrat AF, Abosedra SS, Aly HY (2005) Assessing the role of financial deepening in business cycles: the experience of the United Arab Emirates. Appl Financ Econ 15(7):447–453

Daud SN, Podivinsky J (2011) An accumulation of international reserves and external debt: evidence from developing countries. Global Economic Review 40:229–249

Erumban AA, Das DK (2016) Information and communication technology and economic growth in India. Telecommun Policy 40(5):412–431

Fingleton B, Le Gallo J (2008) Estimating spatial models with endogenous variables, a spatial lag and spatially dependent disturbances: finite sample properties. Pap Reg Sci 87(3):319–339

Florax RJ, Van Der Vlist AJ (2003) Spatial econometric data analysis: moving beyond traditional models. Int Reg Sci Rev 26(3):223–243

Flug K, Spilimbergo A, Wachtenheim E (1998) Investment in education: do economic volatility and credit constraints matter? Journal of Development Economics 55(2):465–481. https://doi.org/10.1016/s0304-3878(98)00045-5

Gavin M, Hausmann R (1998) Macroeconomic Volatility and Economic Development. In: Borner S., Paldam M. (eds) The Political Dimension of Economic Growth. International Economic Association Series. Palgrave Macmillan, London. https://doi.org/10.1007/978-1-349-26284-7_5

Ghosh S (2013) The economics and politics of output volatility: Evidence from Indian states. Int Rev Appl Econ 27(1):110–134

Gounder R, Saha S (2007) Economic Volatility, Economic Vulnerability and Foreign Aid: Empirical Results for the South Pacific Island Nations. Project Report. Massey University, New Zealand

Gwangndi MI, Muhammad YA, Tagi SM (2016) The impact of environmental degradation on human health and its relevance to the right to health under international law. Eur Sci J 12(10)

Hafeez M, Chunhui Y, Strohmaier D, Ahmed M, Jie L (2018) Does finance affect environmental degradation: evidence from One Belt and One Road Initiative region? Environ Sci Pollut Res 25(10):9579–9592

Hakura DS (2009) Output volatility in emerging market and developing countries: what explains the “Great Moderation” of 1970-2003? Czech J Econ Fin 59(3):229–254

He L, Shen J, Zhang Y (2018) Ecological vulnerability assessment for ecological conservation and environmental management. J Environ Manag 206:1115–1125. https://doi.org/10.1016/j.jenvman.2017.11.059

He X, Zhang T, Xue Q, Zhou Y, Wang H, Bolan NS, Jiang R, Tsang DCW (2021) Enhanced adsorption of Cu(II) and Zn(II) from aqueous solution by polyethyleneimine modified straw hydrochar. Sci Total Environ 778:146116–146116

Hondroyiannis G, Papapetrou E (2000) Do demographic changes affect fiscal developments? Public Fin Rev 28(5):468–488

Honka A, Kaipainen K, Hietala H, Saranummi N (2011) Rethinking health: ICT-enabled services to empower people to manage their health. IEEE Rev Biomed Eng 4:119–139

Inter-American Development Bank (1995) Overcoming volatility. Special chapter in the Economic and Social Progress in Latin America

Iseringhausen M, Vierke H (2019) What Drives Output Volatility? The Role of Demographics and Government Size Revisited. Oxf Bull Econ Stat 81(4):849–867

Ishida H (2015) The effect of ICT development on economic growth and energy consumption in Japan. Telematics and Informatics 32(1):79–88

Iyidogan PV, Turan T (2017) Government size and economic growth in Turkey: a threshold regression analysis. Prague Econ Papers 2017(2):142–154

Jevons WS (1878) Commercial Crises and Sun-Spots. Nature 19:33–37. https://doi.org/10.1038/019033d0

Jin S, Cho CM (2015) Is ICT a new essential for national economic growth in an information society? Gov Inf Q 32(3):253–260

King RG, Plosser CI, Rebelo ST (1988) Production, growth and business cycles. Journal of Monetary Economics 21(2-3):195–232. https://doi.org/10.1016/0304-3932(88)90030-x

Kolb RW (Ed.). (2011). Financial contagion: the viral threat to the wealth of nations (Vol. 604). John Wiley & Sons

Kydland FE, Prescott EC (1982) Time to build and aggregate fluctuations. Journal of the Econometric Society, Econometrica, pp 1345–1370

Li J, Wang F, He Y (2020) Electric vehicle routing problem with battery swapping considering energy consumption and carbon emissions. Sustainability 12(24):10537. https://doi.org/10.3390/su122410537

Lin SC, Kim DH (2013) The link between economic growth and growth volatility. Empirical Economics 46(1):43–63. https://doi.org/10.1007/s00181-013-0680-y

Liu J, Yi Y, Wang X (2020) Exploring factors influencing construction waste reduction: A structural equation modeling approach. J Clean Prod 123185:123185. https://doi.org/10.1016/j.jclepro.2020.123185

Long JB Jr, Plosser CI (1983) Real business cycles. J Polit Econ 91(1):39–69

Maddison WP (2006) Confounding asymmetries in evolutionary diversification and character change. Evolution 60(8):1743–1746

Majeed MT, Mazhar M (2019a) Environmental degradation and output volatility: a global perspective. Pakistan J Commerce Soc Sci (PJCSS) 13(1):180–208

Majeed MT, Mazhar M (2019b) Financial development and ecological footprint: a global panel data analysis. Pakistan J Commerce Soc Sci (PJCSS) 13(2):487–514

Majeed MT, Noreen A (2018) Financial development and output volatility: a cross-sectional panel data analysis. Lahore J Econ 23(1):97–141

Majeed MT, Tauqir A, Mazhar M, et al (2021) Asymmetric effects of energy consumption and economic growth on ecological footprint: new evidence from Pakistan. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-13130-2

Managi S, Kumar S (2009) Trade-induced technological change: analyzing economic and environmental outcomes. Econ Model 26(3):721–732

Mobarak AM (2005) Democracy, volatility, and economic development. Rev Econ Stat 87(2):348–361

Mohey-ud-Din G, Siddiqi MW (2018) Determinants of GDP fluctuations in selected south asian countries: A macro-panel study. Pak Dev Rev 55(4):483–497

Montiel P, Servén L (2006) Macroeconomic stability in developing countries: how much is enough? World Bank Res Obs 21(2):151–178

Nelson CR, Plosser CR (1982) Trends and random walks in macroeconmic time series: some evidence and implications. J Monet Econ 10(2):139–162

Osabuohien ES (2008) ICT and Nigerian banks reforms: analysis of anticipated impacts in selected banks. Global J Business Res 2(2):67–76

Ozturk I (2010) A literature survey on energy–growth nexus. Energy Policy 38(1):340–349

Ozturk I, Acaravci A (2013) The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ 36:262–267

Pereira JC (2015) Environmental issues and international relations, a new global (dis) order-the role of International Relations in promoting a concerted international system. Rev Brasil Política Int 58(1):191–209

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3), 289–326

Ramirez, M. T., Loboguerrero, A. M. (2002) Spatial dependence and economic growth: evidence from a panel of countries. Borradores de Economia Working Paper, (206)

Salahuddin M, Alam K (2016) Information and Communication Technology, electricity consumption and economic growth in OECD countries: a panel data analysis. Int J Electr Power Energy Syst 76:185–193

Samreen I, Majeed M (2020) Spatial econometric model of the spillover effects of financial development on carbon emissions: a global analysis. Pakistan Journal of Commerce and Social Science 14:569–602.

Sánchez J, Salinas Á, Harris J (2011) Education with ICT in South Korea and Chile. Int J Educ Dev 31(2):126–148

Shiferaw F, Zolfo M (2012) The role of information communication technology (ICT) towards universal health coverage: the first steps of a telemedicine project in Ethiopia. Glob Health Action 5(1):15638

Shin Y, Yu B, Greenwood-Nimmo M (2014) Modelling asymmetric cointegration and dynamic multipliers in an ARDL framework. In: W.C., Horrace

Sohail MT, Xiuyuan Y, Usman A, Majeed MT, Ullah S (2021) Renewable energy and non-renewable energy consumption: assessing the asymmetric role of monetary policy uncertainty in energy consumption. Environ Sci Pollut Res:1–10

Stanca L (2010) The geography of economics and happiness: Spatial patterns in the effects of economic conditions on well-being. Social Indicators Research 99(1):115–133

Su CW, Xie Y, Shahab S, Faisal C, Nadeem M, Hafeez M, Qamri GM (2021) Towards achieving sustainable development: role of technology innovation, technology adoption and CO2 emission for BRICS. Int J Environ Res Public Health 18(1):277

Tian P, Lu H, Feng W, Guan Y, Xue Y (2020) Large decrease in streamflow and sediment load of Qinghai–Tibetan Plateau driven by future climate change: a case study in Lhasa River Basin. Catena 187:104340. https://doi.org/10.1016/j.catena.2019.104340

Ullah S, Apergis N, Usman A, Chishti MZ (2020) Asymmetric effects of inflation instability and GDP growth volatility on environmental quality in Pakistan. Environ Sci Pollut Res:1–13

Usman A, Ozturk I, Hassan A, Zafar SM, Ullah S (2021) The effect of ICT on energy consumption and economic growth in South Asian economies: an empirical analysis. Telematics Inform 58:101537

Wang Q, Bowling NA, Eschleman KJ (2010) A meta-analytic examination of work and general locus of control. Journal of Applied Psychology 95(4):761–768. https://doi.org/10.1037/a0017707

WESS (2013) World Economic and Social Survey 2013: Sustainable Development Challenges. https://n9.cl/34uy1

Xinmin W, Hui P, Hafeez M, Aziz B, Akbar MW, Mirza MA (2020) The nexus of environmental degradation and technology innovation and adoption: an experience from dragon. Air Qual Atmos Health 13(9):1119–1126

You W, Li Y, Guo P, Guo Y (2019) Income inequality and CO2 emissions in belt and road initiative countries: the role of democracy. Environmental Science and Pollution Research. https://doi.org/10.1007/s11356-019-07242-z

Yuan H, Wang Z, Shi Y, Hao J (2021) A dissipative structure theory-based investigation of a construction and demolition waste minimization system in China. J Environ Plan Manag:1–27. https://doi.org/10.1080/09640568.2021.1889484

Zhao X, Gu B, Gao F, Chen S (2020) Matching model of energy supply and demand of the integrated energy system in coastal areas. J Coast Res 103(sp1):983. https://doi.org/10.2112/SI103-205.1

Zhao W, Hafeez M, Maqbool A, Ullah S, Sohail S (2021) Analysis of income inequality and environmental pollution in BRICS using fresh asymmetric approach. Environ Sci Pollut Res:1–11

Zuo X, Dong M, Gao F, Tian S (2020) The modeling of the electric heating and cooling system of the integrated energy system in the coastal area. J Coast Res 103(sp1):1022. https://doi.org/10.2112/SI103-213.1

Availability of data and material

The datasets/ materials used and/or analyzed for present manuscript are available from the corresponding author on reasonable request.

Author information

Authors and Affiliations

Contributions

Carlos Samuel Ramos Meza stipulated the idea. Rinat Zhanbayev, Hazrat Bilal, Mubbashra Sultan, and Zehra Betul Pekergin have done the data acquisitions, analysis, and written the whole draft. Carlos Samuel Ramos Meza and Hafiz Muhammad Arslan read and approved the final version.

Corresponding author

Ethics declarations

Ethical approval

Not applicable.

Consent to Participate

I am free to contract any of the people involved in the research to seek further clarification and information.

Consent to publish

Not applicable.

Conflict of interest

The authors declare no competing interests.

Additional information

Responsible Editor: Ilhan Ozturk

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ramos-Meza, C.S., Zhanbayev, R., Bilal, H. et al. Does digitalization matter in green preferences in nexus of output volatility and environmental quality?. Environ Sci Pollut Res 28, 66957–66967 (2021). https://doi.org/10.1007/s11356-021-15095-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-15095-8