Abstract

Energy is regarded as an engine of economic growth and an important ingredient of human survival and development, but it can lead to deterioration of environmental quality. The study investigates the energy environmental Kuznets curve (EEKC) during the 1990–2017 period for 144 countries using models for total energy, renewable energy, and non-renewable energy consumptions. We employ panel mean and quantile regressions, accounting for individual and distributional heterogeneities. It is found that the EEKC sustains among the higher middle-income countries while it cannot be verified at some lower-income quantiles due to the heterogeneous nature of the different groups of countries. The relationship between economic growth, total energy, and non-renewable energy consumption is positive and non-linear. The quantile estimations revealed mixed (positive and non-linear, inverted U-shape, U-shape, and N-shape) EEKC. The maximum and minimum turning values of GDP per capita for total energy consumption (is 43,201.58 and 89,630.49), for renewable energy consumption (53,535.07 and 89,869.41), and for non-renewable energy consumption (42,188.16 and 89,487.71). Urbanization and population growth had positive impacts on energy consumption while these effects become more significant as moving from low to high-income quantiles. The study implies that while the developed nations can adopt energy-efficient policies without compromising on the growth momentum and environment, this might be not recommended for the developing nations and it would be preferable for these countries to “grow first and clean up later.” The study indicates the importance of the developed nations to support the developing countries to achieve economic growth along the EEKC by transferring energy-efficient technologies.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Currently, human life is facing great challenge due to modern infrastructure development and rapid environmental degradation (Aguila 2020). Massive greenhouse gases (GHGs) are emitted in the environment because of economic growth fueled by fossil fuel consumption that warms the atmosphere (Toma et al. 2020). According to Abeydeera et al. (2019), GHG production is the main factor behind CO2 emissions. Burning of excessive fossil fuels produce CO2 emissions in abundance leading to rise in Earth’s temperature and unexpected variations in climate. In the future, unclean energy resources will influence power and energy policies (Khan et al. 2021). Therefore, there is need to control CO2 emissions and other pollutants through energy innovation, more efficient environmental regulations, and multilateral environmental agreements. This requires more thorough investigation of energy-environmental nexus as the guidebook for policymakers to resort to environmentally friendly energy sources.

Environmental Kuznets curve (EKC) is the most celebrated tool to investigate the relationship between economic expansion and environmental quality. Although this hypothesis explains a critical sustainable development issue, it draws a huge amount of criticism from academics and researchers. However, despite considerable criticism, EKC has not lost its curious attraction and fascination showing its undeniable survival power (Husnain et al. 2021). The well-known debate on EKC that started in the early 1990s is still alive (Harbaugh et al. 2002) and continues to haunt researchers and academics while explaining the link between environment and economic growth. It establishes an inverted U-shaped relationship between pollution and income, that is, “a certain inevitability of environmental degradation along a country’s development path at an earlier stage of development, and a significant improvement at a later stage, both because of economic growth” (Panayotou 1993). Thus, it is a useful indicator to understand whether an increase in income and wealth ameliorates ecological footprint and environmental pressure (Mäler 2013).

Global sustainability is closely linked to the current debate on the relationship between environmental degradation and income per capita. Extensive empirical literature exists on EKC and a substantial portion of these studies focus on knowing the causal relationship between GHG emissions and economic expansion (Abdullah et al. 2017; Ansari et al. 2020; Zhang, 2021). Over the last few decades, the world has seen unprecedented economic growth that has affected the environment to a considerable level. The fast economic growth requires large amounts of energy to support rapid industrial growth. This can threaten the sustainable development of the economy and worsen the environmental quality (Adom and Kwakwa 2014).

For all economies, the maximization of economic growth is fundamental. However, it raises concerns because of its close association with environmental degradation explained by the so called EKC (Ansari et al. 2020) which suggests growth performance automatically resolves environmental issues. Some studies state the non-applicability of EKC to poor countries that are uncertain to find the level of development where the environment starts improving because of economic growth. Poor countries often compromise their environmental standards in search of much-needed economic growth achieved through foreign direct investment and international competitiveness (Aşıcı and Acar 2016). Due to lower prices of inputs and environmental regulations in developing nations, developed countries shift their polluting industries to low-income economies leading to a phenomenon called “Pollution Haven Hypothesis” (Copeland and Taylor 1994). Empirical evidence suggests that economic activities expand because of increase in energy consumption (Hongxing et al. 2021), in turn, environmental quality deteriorates due to energy led carbon emissions (Musah et al. 2021). Environment and natural resources deplete as a result of increased production, in the process of economic expansion, which uses more energy. People change their consumption behavior from low emission products to high emission products including air conditioners and automobiles in the periods of prosperity, thereby increasing the emissions level in the atmosphere (Musah et al. 2021). However, if the renewable energy has high share in the energy mix, it is not necessary that increased energy use may worsen carbon emission (Hossain 2011).

Rising environmental and health concerns associated with CO2 emissions require the adoption of clean energy methods to fulfill energy demands to reduce global warming (Lau et al. 2019). Renewable energy sources are regarded as potential factors that can mitigate emissions (Dogan et al. 2021; Baek 2016). From an investment standpoint, renewable energy has been acknowledged as more profitable with immense market potential. A transition towards renewables ensures energy security, alleviates poverty, and stimulates economic growth by promoting cleaner production and reducing ever-increasing CO2 emissions (Ulucak 2020). Renewables shield environmental pressure and reduce foreign dependency. Hence, renewables can effectively help validate energy security and improve environmental quality (Luqman et al. 2019). Thus, unfolding the role of renewable energy at different stages of development is crucial to devising effective policies to mitigate environmental issues without compromising economic growth.

The energy-growth nexus in the context of EKC is a less studied area (Luzzati and Orsini 2009) which is equally important as the environment-growth relationship. The traditional empirical literature on the subject is mainly concerned with the identification of the causal relationship between energy consumption and economic growth and overlooks the possibility of a quadratic association between the variables (Asafu-Adjaye 2000). However, due to the realization of pressure that energy consumption may exert on the environment while achieving sustainable development, in the recent past, the trend has changed and this relationship is being studied under the EKC hypothesis (Suri and Chapman 1998). Most of the energy use comes from fossil fuel that emits a large amount of GHGs in the environment and raises concerns about the sustainability of the environment. A handful of studies can be found that have examined the energy environmental Kuznets curve (EEKC) for a country as well as for specific regions. For example, Pablo-Romero and De Jesús 2016 test the hypothesis for Latin America. Aruga (2019) examines this relationship for Asia–Pacific countries but to the best of our understanding, no study has tested the EEKC hypothesis by considering the role of income for the whole world.

The EKC between energy consumption and economic development commonly known as energy-EKC has also been investigated in some of the past studies. In the countries where nonrenewable energy is intensively used, the EEKC is more relevant (Mahmood et al. 2021). Accelerated energy consumption is an outcome of increasing economic growth, hence it seems logical to comprehensively assess the effect of different phasis of economic growth on energy use with the help of cubic EEKC hypothesis. In empirical literature, usually the EEKC has been tested considering a quadratic association between economic growth and energy consumption, hence testing of the EEKC using cubic terms at global level is warranted. Therefore, this study uses quantile panel regression model to test EEKC in a global perspective using both quadratic and cubic relationship of energy variable and economic growth.

Controlling for population increase and urbanization is critical due to their closeness with environment. Population increase can affect carbon emissions. Numerous studies have found the positive association between population increase and carbon emissions (Wang et al. 2013). Likewise, Li et al. (2021) mention that increase in population does not attract energy efficiency initiatives thus leading to further increase in carbon emissions. As a result of economic expansion, people move from rural areas to urban areas to enjoy high living standard including access to quality education, improved sanitation conditions, and advanced infrastructure. This increased influx of people towards major commercial centers is linked to abiotic deterioration of the environment that includes forest, sea, soil, and air quality (Li et al. 2021). The demand for construction, production, and transportation arises as a result of strong economic trend that may damage the environment by using massive amounts of non-renewable energy.

The contribution of this study is manyfold. First, for a better interpretation of the findings, a glance is placed at the patterns of countries grouped according to income level instead of grouping them according to their geographical location. Second, investigating the EEKC hypothesis globally is particularly interesting as it contains countries experiencing a different level of economic development (low, middle, high-income). The study result is expected to provide strong inputs in the public policy domain on the environment and sustainable energy. If the EEKC holds in a group of countries, it would mark the start of an era where energy consumption starts declining with economic growth. This will reveal that energy consumption in such a group of countries does not increase and cause no environmental degradation (Aruga 2019). However, if the hypothesis of EEKC is denied for a particular group of countries, it would imply the non-existence of a turning point for energy consumption. In this case, it will suggest that economic growth will intensify environmental pressure through an increase in energy consumption implying the importance of adopting energy-saving technology in the particular group of economies to reduce its environmental impact.

Thirdly, this study divides total energy consumption into renewable energy and non-renewable energy consumption and thus estimates EEKC for both types of energy to better understanding the relationship between energy consumption and economic growth. Especially the role of renewable energy is important from developing countries’ standpoints because of its high infrastructure cost (Iram et al. 2020). Furthermore, to avoid ever-deteriorating ecological footprint and economic troubles caused by traditional sources of energy in developing nations, it is important to substitute fossil fuel in economic activities with renewable energy sources (Inglesi-Lotz and Dogan 2018).

The fourth contribution is methodological since we apply quantile regression to understand the role of different income levels in determining the EEKC hypothesis. Mean value estimators obtained from panel models can lead to misleading results. The quantile regressions enable us to evaluate the dependent variable at various points of its condition distribution and highlight the comprehensive scenario of the nexus among the variables (Cade and Noon 2003). The motivation behind applying the quantile regression approach is to identify the heterogeneous nature of various income groups and changing market conditions. Hübler (2017) stated that the quantile regressions address outliers effectively compared to methods based on the mean. Therefore, the quantile regression is an interesting method to analyze the EEKC hypothesis as it allows the estimation of different slopes for different quantiles.

Finally, this analysis tests this hypothesis both for renewable and non-renewable energy consumption to better understand the implications of this relationship by introducing some control variables like urbanization and population growth. Such determinants of energy consumption have often been ignored in previous empirical studies, and hence, makes our findings more reliable and consistent for the policy framework.

Literature review

In energy literature, how economic growth impacts energy consumption has been the subject of ever-extending debate (Csereklyei and Stern 2015) and hence produced voluminous literature on the subject (Araç and Hasanov 2014; Pablo-Romero and De Jesús 2016). However, the majority of these studies does not investigate this nexus in the framework of the EKC hypothesis. The first study that tested the EKC hypothesis concerning energy consumption was carried out by (Suri and Chapman 1998). Before this study, energy-related pollutants were more common to represent environmental quality and many of the empirical studies tested EKC without energy consumption data. Pablo-Romero and De Jesús (2016) used data for 22 Latin American and Caribbean countries over the 1990–2011 period on energy consumption and per capita gross value added and found no support in favor of EEKC for this region. Raza et al. (2020) employed data from next-11 and BRICS countries for the period 1990–2015 to test the residential energy EKC and reported cointegration between all the variables (economic growth, financial development, and energy consumption) in the long run. Furthermore, residential energy consumption has negative impact on environmental quality. To examine the existence of the EEKC hypothesis, Luzzati and Orsini (2009) used data for 113 economies period covering from 1971 to 2001 and reported the non-existence of any inverted-U-shaped association between GDP and energy consumption. Using panel quantile regression approach, Awan et al. (2022a) provide fresh evidence regarding the nexus between global energy efficiency and CO2 emissions by using data from 107 countries for the period 1996–2014 and conclude that energy efficiency significantly reduces CO2 emissions. Furthermore, inverted U-shaped nexus between GDP and CO2 was observed validating the EKC. Using data for 188 countries ranging from 1993 to 2010, Chen et al. (2016) investigated the link between energy consumption, economic growth, and CO2 emissions, and pointed out that there does not exist an inverted-U shaped association between economic growth and energy consumption. By using different energy proxies such as renewable and non-renewable energy, natural gas consumption, and oil and cool consumption, Mahmood et al. (2021) investigated the energy-EKC for Egypt using data from 1965 to 2019 and confirm the existence of long run energy-EKC hypothesis.

Aruga (2019) tested the EEKC using yearly data for 19 Asia–Pacific countries for the period 1984–2014 and pointed out that an inverted U-shaped relationship between energy consumption and economic growth exists for the whole region. However, this relationship does not hold for lower-middle-income countries. Using data from 8 rounds of HIES spanning 1998–2019, Awan et al. (2022b) investigated the energy poverty trends and predictor of energy poverty in Pakistan and point out that during the last two decades, there has been increase in energy poverty despite significant economic progress. They found female-headed families, less education, and households with a low endowment as major predictor of energy poverty. Bilgili et al. (2022) used EKC to examine the environment-gender nexus for the panel of 36 countries and confirm the existence of an inverted U-shaped EKC. Furthermore, they reported that male and female labor participation differently impacts the environment especially in the agriculture sector. Kocoglu et al. (2021) used quantile regression technique and threshold analysis to study the non-linearity between urbanization and CO2 emissions for 15 emerging economies for the period 1995–2015. Their findings revealed that an inverted U-shaped relationship exists between urbanization and CO2 emissions. Haider et al. (2022) used the ARDL bounds testing method to study the relationship between nitrous oxide emissions and economic growth in Canada, controlling for exports and agriculture land use, for the period of 1970–2020. Their findings confirmed the existence of EKC both for total N2O emissions and agricultural induce N2O emissions.

Our reading of the literature led us to group these studies into three main strands. The first strand of studies is mainly concerned about the important role of economic growth as the determinant of energy consumption (Jiang and Ji 2016; Song and Zheng 2012) assuming that energy intensity and economic growth are linearly associated. It is known that energy intensity declines in anticipation to increases in per capita income due to improvements in energy efficiency (Mahmood and Ahmad 2018). However, it is asserted that energy intensity escalates when the income level rises in a country (Sineviciene et al. 2017).

The second strand of literature focuses on the convergence hypothesis across countries. Two types of convergences are considered: beta convergence and sigma convergence (Deichmann et al. 2018). In beta-convergence, it is identified whether energy intensity in less efficient countries decreases faster than those of more efficient whereas sigma convergence deals with the decreasing size of energy intensity across countries. The convergence hypothesis is supported by the majority of empirical studies (Hajko 2014; Kiran 2013) but different factors like economic structural breaks (Karimu et al. 2017), sector of the economy (Jiang et al. 2018), size of data set and geographical difference (Liddle 2010), and types of estimates (Hajko 2014) can influence this result. For example, no evidence of convergence hypothesis found in Africa, Caribbean, and Latin American countries while in Eurasian and OECD economies convergence hypothesis exists. Working on the data of 97 countries for the period 1971–2003, Le Pen and Sévi (2010) showed the absence of global convergence hypothesis with weak support of local convergence.

The third thread of literature is related to validating the EKC called EEKC in the context of energy consumption. The EEKC postulates the inverted U-shaped relationship between energy consumption and economic expansion which is backed by many empirical studies (Jakob et al. 2012). However, like the EKC, the EEKC is not based on solid grounds, and results obtained from the empirical literature are vulnerable to variable selection and level of economic development. For example, it is found that in Germany, energy intensity inverted U-shaped curve reduces when the variable trade is included in the model (Kander et al. 2017). Some authors opine that the bell shape relationship between energy consumption and economic growth does not reflect the reality (Lescaroux 2011). Several factors like variable choice, initial conditions, and the use of energy-efficient technology determine the shape of the energy-growth relationship. Likewise, energy prices and inclusion/exclusion of energy used for trade can potentially impact the shape and nature of this association (Kander et al. 2017; Richmond and Kaufmann 2006). On the other hand, many empirical studies could not validate the EEKC hypothesis (Luzzati and Orsini 2009; Csereklyei and Stern 2015). In addition to the well-known U-shaped link, a handful of studies identify an S-shaped relationship between energy intensity and economic growth (Smil 2003; van Benthem 2015).

The worldwide economic expansion has created millions of jobs and increased access to wide variety of food especially in the developing economies (Luo and Tung 2007). Energy sector is the backbone of the development in market expansion, globalization, and industrialization. The world energy consumption has far reaching repercussions for the socioeconomic development to society (Bilgen, 2014). However, urbanization based on enhanced energy consumption is polluting the environment and increase in population is also responsible for the degradation of environmental quality. Sheng et al. (2017) stated that urbanization consumes massive amounts of energy and negatively affect environmental quality. According to Dogan and Inglesi-Lotz (2020), urbanization is a prominent determinant of CO2 emissions and causes environmental variation while Pata (2018) stated that urbanization causes CO2 emissions through increased economic growth and financial development. Furthermore, residential and industrial sectors energy demand increases because of urbanization (Lee et al. 2018). Robalino-López et al. (2015) demonstrate that growth in population can lead to increase in CO2 emissions. Therefore, this study includes urbanization and population growth as control variables in the model.

The short-lived survey of the empirical literature reveals many weaknesses of the existing literature. Firstly, the majority of the studies focus on a single country or a group of countries (Aruga 2019; Inglesi-Lotz and Dogan 2018) but global evidence is needed for intensive analysis of the EEKC hypothesis and sound policy framework. Secondly, mixed findings emerge from all three strands of literature that necessitate global evidence on the EEKC hypothesis. Based on the aforementioned reasons, this work can be distinguished from the previous studies in the following way: (i) for the first time, this study provides a worldwide perspective of EEKC by considering the level of development in each group of countries, (ii) cross-sectional dependence is common among countries because of a high degree of socio-economic integration (Dogan et al. 2020) which standard panel data techniques cannot account for. We utilize second-generation panel data techniques that assume cross-section dependence, (iii) although there are country-specific and region-specific studies that investigate EEKC for renewable or non-renewable energy, this study used both types of energy to validate EEKC worldwide.

Data and methodology

This study used secondary time series data collected from well-known international institutions. The sampled countries were stratified and selected based on their income level classified by the World Bank (see Table 1). Due to the unavailability of data, all countries are not included in the sample. We included 20 countries from lower-income countries (LICs), 41 countries from lower middle-income countries, 38 countries from higher middle-income countries, and 45 countries from higher income countries.

Model specification, estimation technique, and procedures

This study has estimated three different models to examine the EEKC. The first model used total energy consumption as a dependent variable, while in the second and third models, renewable energy consumption and non-renewable energy consumption are taken as dependent variables respectively. The motivation behind comparing the three models is when we focus solely on total energy consumption, we may miss some countries that consume more renewable and non-renewable energies. For instance, from Europe, only Germany (ninth) is found in the top ten total energy consumers (Enerdata 2021). However, we can find that Germany, UK, Spain, France, and Italy, among the top ten renewable energy consumers (Statista 2021).

Three models are specified as follows:

ECON, RECON, and NRECON represent total energy consumption, renewable energy consumption, and nonrenewable energy consumption respectively. GDP is the per capita income, URBAN is urbanization, and POP is population growth. The choice of control variables, urbanization, and population growth is based on the existing empirical literature. For instance, the most recent studies used urbanization (Liu and Peng 2018; Maneejuk et al. 2020; Sultana et al. 2021; Topcu and Girgin 2016; Wang and Yang 2019) and population growth (Begum et al. 2015; Chaurasia 2020; Nepal and Paija 2019; Vo 2021).

Cross-sectional dependence

The first step in panel data estimation is to examine the presence of cross-sectional dependence (CD) (Xiaoman et al. 2021, as CD is a common and serious issue in panel data settings and, if not appropriately addressed, may yield unreliable and biased estimates (Pesaran 2007). The CD may emerge from grouping the countries into panels based on income levels that demonstrate cross-sectional dependence. In literature, the four widely used tests of CD are the Pesaran CD test, the Pesaran LM test, the Breusch-Pagan LM test, and Free’s CD test. To deal with the issue in the framework of apparently discrete regression models, the LM static test of Breusch and Pangan (1980) is valid only for infinite T and fixed N. Biasness of LM test statistic gets worse with large N and also not suitable for finite T (De Hoyos and Sarafidis 2006). Thus, to validate cross-sectional dependence between the panel units, this study employs panel CSD (cross-sectional dependence) tests of Frees (1995) and Pesaran (2007).

Unit root test

After applying the CD test, the order of integration is tested. Two types of panel unit root tests, first-generation and second-generation, can determine the order of integration of a series (stationarity property of variables). First-generation unit root tests such as LLC (Westerlund 2007) and IPS (Im et al. 2003) are not suitable to estimate stationarity among the series (Dogan et al. 2020) in the presence of CD. Consequently, we use cross-sectionally augmented Im-Pesaran-Shin (CIPS) unit root tests (Pesaran 2007) as it is capable of taking account of both heterogeneity and cross-sectional dependence with the null of no stationarity in case of all the panel units within the panel against at least one stationary panel unit as an alternative hypothesis. Pesaran unit root test based on truncated CADF statistics (i.e., \({t}_{i}(N,T)\)) is given as:

Panel estimation/cointegration

Engle-Granger-based cointegration tests (e.g., Kao 1999; Pedroni 1999, 2004) and Fisher-type (Choi 2001) are useful when there is no CD. The main advantage of the Pedroni residual-based test relative to the others is that it accounts for heterogeneity by using specific parameters (Demissew Beyene and Kotosz 2020). However, the most common panel cointegration tests when there is CD are (Groen and Kleibergen 2003; Westerlund and Edgerton 2007) Durbin-Hausman test (Gengenbach et al. 2016; Persyn and Westerlund 2008) and Banerjee and Carrion-i-Silvestre (2017) cointegration test. The current study uses the Westerlund panel cointegration test (Westerlund 2007) to examine the cointegration of total energy, renewable energy, and nonrenewable energy consumptions with the explanatory variables. This technique is divided into the group (Gt and Ga) and panel (Pt and Pa) statistics: the Gt and Ga statistics test whether cointegration exists for at least one individual series and the Pt and Pa statistics pool information over all the individual series to test whether cointegration exists for the panel as a whole (Persyn and Westerlund 2008).

FMOLS, DOLS, fixed effect

The current study employs FMOLS, DOLS, and FE models. The selection of these different models was motivated by the result of cointegration tests. Besides, these models have their unique differential characteristics. For instance, both FMOLS and DOLS take care of small sample and endogeneity bias. Furthermore, they use the white heteroskedastic standard errors. This study also considered both the parametric and non-parametric tests by employing FMOLS and DOLS, respectively. Unlike FMOLS and DOLS, the FE is a static model and capable of taking account of panel cross-section with a varying intercept based on the introduction of dummy for FE in the framework, while in the random effects framework, the intercept is supposed to be a random variable (Akbar et al. 2011).

Based on the general panel FMOLS equations of Pedroni (2001), our FMOLS model is specified as:

where \(i and t\) represent the ith country in tth time period, t is a linear time trend, \({\beta }_{1i}-{\beta }_{5i}\) are long-run coefficients, and \({\mu }_{it}\) is the error term.

Quantile regression

Due to cointegration results, this study employs FMOLS, DOLS, FE, and quantile regressions to estimate the data set. According to Cade and Noon (2003), findings and policy implications derived from panel mean regressions may lead to spurious results; however, quantile regressions provide a more complete picture of the relationships of the variables. Besides, panel quantile regression captures the heterogeneity of different income groups and market conditions (Allard et al. 2018). Therefore, this study employs a panel quantile approach along with panel mean regression.

Therefore, to further evaluate the validity of dependence pattern and cointegration among the studied variables derived from FMOLS, DOLS, and FE, we employ the PQR (panel quantile regression) framework (Cheng et al. 2018). Following Sheng et al. (2017) and Wu and Lin (2022), we included URBAN and POP in the same model, which may lead to multicollinearity problems. However, we examined the presence of multicollinearity and found none. PQR is characterized for its differential characteristic of taking account of marginal influence throughout the distribution (Kaza 2010), i.e., taking account of outliers affecting specified percentiles of the distribution. Other econometric frameworks focus on the average influence, which in general overestimate/underestimate or cannot detect the true dependence (Binder and Coad 2011). The PQR offers more in-depth and thorough dependence between the series across the restricted distribution (Zhang et al. 2015).

Results and discussion

Panel model estimation results

As stated in the methodological section, we apply panel unit root tests to determine the order of each series which is important to identify estimation techniques. To decide which type of unit root and cointegration tests are more appropriate, it is mandatory to test the CD. The CD test Frees (1995) confirms cross-sectional dependence in the errors.Footnote 1 Therefore, this study employed the second-generation unit root tests called the CIPS test (Pesaran 2007). The results show that the target variables are stationary at a 1% level of significance at the first difference I(1) for all countries, LICs, LMICs, and HMICs.Footnote 2

After determining the variables’ order of integration, testing for cointegrations is the next step in panel data econometrics. Among the existing cointegration tests that allow CD, this study employed the Westerlund panel cointegration test (Westerlund 2007). The rationale for using these cointegration tests (Westerlund and Edgerton 2007) is that most panel cointegration tests have failed to reject the null hypothesis of no cointegration due to failure of common-factor restriction (Banerjee and Carrion-i-Silvestre 2017). However, the Westerlund (2007) test does not require any common factor restriction (Abdullah et al. 2017) and allows for a large degree of heterogeneity. Besides, all target variables (energy consumption and GDP per capita) in this study are integrated at order one in all sampled countries.

This study conducted two panel cointegration tests between the target variables (energy consumption and GDP per capita) and all variables in the models. Except for LICs (in all models), the cointegration result between energy consumptions and GDP per capita shows that two out of four statistics of Westerlund and Edgerton (2007) are statistically significant in all groups and models. Likewise, except for HMICs (M1 and M3) and HICs (M1), the cointegration results for all variables show two out of four statistics statistically significant. Regarding the cumulative cointegration tests for the two-panel tests, all statistics of Westerlund (2007) are statistically significant except for the LICs (in all models) and HMICs (in M1 and M3), implying that the null hypothesis of no cointegration is strongly rejected. This means that except for the LICs (in all models) and HMICs (in M1 and M3), there are long-run relationships among the variables in the models (see Table 2).

After the cointegration tests, the next step is to estimate the model using both static and dynamic panel models. Specifically, the study employed the FEFootnote 3 model due to the absence of cointegration in LICs (in all models) and HMICs (in M1 and M3). The presence of cross-sectional dependence limits the study from employing alternative dynamic panel models such as panel ARDL (PMG, MG, DFE) and system GMM (Forte et al. 2014; Menegaki 2019). However, several recent studies employed FMOLS or DOLS, while the cross-sectional dependence test strongly rejects the null hypothesis of no CD (Konstantakopoulou 2020; Mitić et al. 2017; Neagu 2019).

The FMOLS results presented in Table 3 show that except for HICs (in M2), the target-independent variables (GDPPC, GDPPC2, and GDPPC3) have a significant positive, negative, and positive effect on all types of energy consumptions, respectively. Like most scholars, when we consider only the coefficient signs, the study found an N-shaped relationship between GDPPC and energy consumption in all groups of countries except for HICs. This N-shaped result implies that energy consumption is high at an early stage of economic growth (energy consumption is increasing with increasing GDPPC). However, when the economy rises further, energy consumption declines. This may not be long-lasting; instead, energy consumption will grow again with economic growth unless some measure is taken. Despite the differences in methodologies, case studies, scope, variables used, and others (hereafter ceteris paribus/other things are constant), this finding is in line with Luzzati and Orsini (2009), Pablo-Romero and De Jesús (2016), Mahmood (2021), and Mahmood et al. (2021). However, the current study is unique because we examined variables’ relationships beyond the signs of the coefficients (observing the number of observations before and after turning points). Accordingly, the maximum and minimum turning values of GDPPC for M1 (is 43,201.58 and 89,630.49), for M2 (53,535.07 and 89,869.41), and for M3 (42,188.16 and 89,487.71). This implies that the relationship between GDPPC and the total energy consumption is positive and non-linearFootnote 4 but does not follow either inverted U-shaped or N-shaped form. This is because most countries’ GDPPC in most periods (above 90.7% of the total observations) remained below the maximum threshold values. For instance, for M1, around 3808 observations are below 43,201.58 GDPPC, 324 observations are between 43,201.58 and 89,630.49 GDPPC, and only 44 periods are above 89,630.49 GDPPC. Therefore, the relationship between GDPPC and total energy consumption is dominantly positive and non-linear. Ceteris paribus, this finding coincides with Moosa and Burns (2022).

Similarly, the FMOLS result of M1 and M3 for LMICs has no stationary points, but they reach at max at 3096.77 and 3034.48 GDPPC, respectively, and most periods are below these thresholds. Therefore, the relationship between GDPPC and the total (non-renewable) energy consumption is dominantly positive and non-linear but does not follow either inverted U-shaped or N-shaped. Likewise, the max and min turning points for M2 are 3359.81 and 4910.86 GDPPC, respectively, but around 90% of the periods are below the maximum threshold. Therefore, we can conclude that the relationship between GDPPC and energy consumption is positive and non-linear in LMICs. Ceteris paribus, this result coincides with Moosa and Burns’s (2022) results.

The FMOLS result of M1 for HICs has max and min stationary values at 64,776.77 and 94,376.22 GDPPC, respectively. Similarly, the max and min turning values for M3 are 52,890.61 and 92,616.62 GDPPC, respectively. But most observations (91.3% and 85.75%) are below the maximum threshold value in both models. Hence, the relationship between GDPPC and the total (nonrenewable) energy consumption is positive and non-linear in HICS. Other things being constant, this conclusion concurs with Moosa and Burns (2022). The FMOLS result of M2 for HMICs has max and min turning values at 7601.46 and 17,000.52 GDPPC, respectively. But most observations (75.7%) are below the maximum threshold value. Hence, the relationship between GDPPC and renewable energy consumption is dominantly positive and non-linear, which is similar to Moosa and Burns (2022), ceteris paribus.

Similarly, the DOLS result of total sampled countries confirmed a positive and non-linear relationship between GDPPC and total (nonrenewable) energy. However, the DOLS result of M1 and M3 for LMICs has no stationary points, but they reach maximum at 3739.66 and 2337.23 GDPPC, respectively and most periods are below these thresholds. Therefore, the relationship between GDPPC and the total (non-renewable) energy consumption is dominantly positive. However, the max and min turning points for M2 are 3362.63 and 4446.70 GDPPC, respectively, but most periods are below the maximum turning point. Therefore, we can conclude that the relationship between GDPPC and energy consumption is positive and non-linear in LMICs, in line with Moosa and Burns (2022). The DOLS result for HICs the max and min turning point for M1 (42,851.67 and 98,185.35) and M3 (39,980.88 and 98,373.36) GDPPC, respectively, and most of the values are below the maximum threshold values. Therefore, the relationship between GDPPC and the total (nonrenewable) energy consumption is positive and non-linear. However, the U-shaped EEKC was observed in M2 of HMICs. This is because most periods are found below the minimum (38.8%) and between the min and max (60.5%) thresholds. Other things being constant, this result is consistent with that of Filippidis et al. (2021). Likewise, the FE result revealed that the relationship between GDPPC and energy consumption is positive and non-linear for the LICs and HMICs.

Quantile regression results

Table 4 shows that except for some variables,Footnote 5 the correlations between independent variables are below the rule of thumb value (0.7) for stronger correlation (Allard et al. 2018). However, when URBAN and POP are estimated in the same model, this might lead to multicollinearity problems. Therefore, this study employed the multicollinearity (VIF) test and confirmed that no multicollinearity exists in all models. All the VIF values are below 5, with the highest value of 3.00, which implies an absence of multicollinearity (see Table 4).

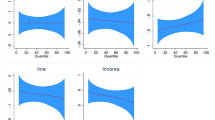

Besides using the panel estimation techniques, this study also employed the quantile estimation by choosing nine quantiles (10th, 20th, 30th, 40th, 50th, 60th, 70th, 80th, and 90th). Though the panel mean results showed a positive and non-linear relationship between GDPPC and energy consumption for most models and groups of countries, the quantile estimations revealed mixed (positive and non-linear, inverted U-shaped, U-shaped, and N-shaped) EEKC. The results in Table 5 show the quantile estimation of models 1–3 for total sampled countries. Similar to the FMOLS, DOLS, and FE results, a positive and non-linear (not follows either inverted U-shaped or N-shaped) EEKC was observed at the 70–90th quantile for model 1. This is because most countries have GDPPC below the maximum threshold level (see Fig. 1). However, U-shaped EEKC is observed in 10th and 20th quantiles. This is because most countries have GDPPC below the minimum and maximum threshold values (see Fig. 2).

The result also confirmed that from 10 to 30th and at 60th quantiles, a U-shaped EEKC is observed for model 2. However, a positive and non-linear relationship between GDPPC and renewable energy was observed in the last quantile.

Table 5 also confirmed a positive and non-linear relationship between GDPPC and nonrenewable energy consumption in 30th, 50th, and 70–90th quantiles, but it is U-shaped in the 20th quantile in model 3. According to Allard et al. (2018), these mixed and inconclusive results can be due to heterogeneity between and within these income groups; therefore, they recommended decomposing the countries based on their income level. Except for 20th and 40th quantiles, urbanization has a positive and significant effect on all types of energy consumptions. However, population growth significantly reduces all types of energy consumption in the 50–90th quantiles.

Table 6 shows the quantile estimation of the models for the LICs group. For model 1, N-shaped EEKC is observed in the 10th and 20th quantile (see Fig. 3), but it is U-shaped in 40–80th. Besides, from 20th to the 50th quantile, there is a U-shaped EEKC in model 2. Table 6 also confirmed that model 3 has an N-shaped EEKC in 10th and 20th quantiles, but it is U-shaped in the 40–70th. Therefore, the result for LICs is also mixed and inconclusive for all models. Urbanization has a positive and significant effect on total (at 10–20th and 60–80th), renewable (at 10th, 20th, and 80th), and nonrenewable energy consumption (at 20th and 90th) quantiles. Population growth has a positive and significant effect on total (at 40th, 50th, and 80th), renewable (at 70th and 80th), and nonrenewable energy consumption (at 50th and 60th) quantiles. However, the reverse is true for models 1 and 3 at the 10th quantile.

The results in Table 7 show the quantile estimation of all models for the LMICs group. In both models 1 and 3, there is an N-shaped EEKC in the quantiles from 20 to 70th. However, at the 80th quantile, both models have no specific stationary values but reach maximum at 1815.18 and 1718.03 GDPPC respectively. Consequently, most countries’ GDPPC in most periods is below and above the maximum threshold values. Therefore, there is an inverted U-shaped EEKC at the 80th quantile in models 1 and 3. Our conclusion is also supported by research from Luzzati and Orsini (2009), Aboagye (2017), Hundie and Daksa (2019), and Aruga (2019).

Similarly, since most periods are below the minimum threshold values, we can say an inverted U-shaped (30–80th quantiles) EEKC existed in model 2. Urbanization has a negative and significant effect on total (at 20th, 30th, and 50th), renewable (at 50–90th), and nonrenewable energy consumption (at 10–30th) quantiles. However, it significantly increases renewable energy consumption at 10th and 20th quantiles. Population growth has a negative and significant effect on total (at 50th, 70–90th), renewable (at 10th, 20th, 40th, 50th, and 90th), and nonrenewable energy consumption (at 70–90th) quantiles.

The results in Table 8 show the quantile estimation of model 1–3 for HMIC groups. For all models, the study found U-shaped EEKC in 50–80th quantiles. Besides, there is U-shaped EEKC in models 1 and 2 at quantiles between 50 and 90th. However, there is an inverted U-shaped EECK in model 1 at the 20th quantile. Except for model 2 at the 10th quantile, urbanization significantly increases all types of energy consumptions at all quantiles. However, population growth has a negative and significant effect on all energy consumption at 50–90th quantiles. Similarly, it significantly reduces renewable energy consumption at 20–40th quantiles. But it significantly increases both total and nonrenewable energy consumptions at 10th and 20th quantiles.

Table 9 shows the quantile estimation result of all models for the HICs group. There is an inverted U-shaped EEKC observed in 70–90th quantiles for model 1. Similarly, there is an inverted U-shaped EEKC for model 3 in the 30–90th quantiles. However, the result confirmed that the relationship between GDPPC and renewable energy consumption is positive and non-linear at the 50th and 70th quantiles because most observations are found between the minimum and maximum threshold values of GDPPC. Except for at the 20th (for model 1), 10th and 80th (for model 2), and 90th quantile (for model 3), urbanization significantly increases all types of energy consumptions. However, population growth significantly reduces all types of energy consumption at the 30–90th quantiles. Moreover, it has a negative and significant effect on renewable and nonrenewable energy consumption at the 20th quantile.

The quantile results for HICs and other groups of countries are mixed and inconclusive; therefore, the EEKC should be studied carefully and thoroughly. Commonly, the panel mean estimations might lead to non-representative results for the sampled countries but employing quantile regressions like this study shows the relationship between income and energy consumption varies between quantiles; hence, policy recommendations based on quantile regression might be effective compared to the mean regressions.

Finally, Koenker and Bassett (1982) and Newey and Powell (1987) advocated the use of slope equality and symmetry testing to look at the heterogeneous distribution of the estimated quantile parameters. The quantile slope equality and symmetric quantiles test compare all coefficients from the estimated equation quantiles from 0.1 to 0.9 using the Wald test statistic. Table 10 shows that the homogeneity null hypothesis is rejected at a 1% level of significance.

Discussion

Analyzing the empirically established close nexus between energy consumption and economic growth has been a fascinated topic for researchers and academics. The importance of this nexus further increased as energy consumption deteriorates the environment and put pressure on countries to adopt renewable energy sources instead of fossil fuel that damages the environment through CO2 emissions. Furthermore, investigating the transition in the association between economic growth and energy consumption by type or total and for economies grouped in the context of the development stage is crucial because each group of countries is heterogeneous in terms of energy consumption and renewable energy share in the total energy mix. Hence, this study investigates the EEKC by type or total energy consumption globally to have deeper insights into the energy policy framework.

Both panel models and quantile regressions indicated that energy consumption and economic growth are cointegrated in the long run in all groups except in LICs. Based on the FMOLS model, we conclude that the relationship between GDPPC, total energy, and non-renewable energy consumption is positive and non-linear but does not follow either inverted U-shaped or N-shaped form. On the other hand, quantile estimations revealed mixed (positive and non-linear, inverted U-shape, U-shape, and N-shape) EEKC.

The mixed results can be attributed to the heterogeneity between and within these income groups (Allard et al. 2018). This means that the hypothesis of transition in energy consumption is occurring only in developed nations and there is no room for developing countries to implement energy-efficient policies to mitigate environmental challenges as it may compromise their much-needed economic growth. Our findings suggest that the optimal policy for low-income countries is to “grow first, clean up latter.” They can adopt energy conservation policies once they surpass the threshold income level and catch the high-income countries. Moving on to the EEKC is not a difficult task for low-income countries as we demonstrate that developed countries are growing while using energy-efficient technologies. Probably, developing countries can learn from developed nations in framing energy policies that effectively worked for them and achieve sustainable development. The developed countries in the world need to support developing countries to achieve development goals by transferring economic and technological support.

The overall findings of the study suggest that the EEKC should be studied carefully and thoroughly to analyze the nexus between energy consumption and economic growth and results should be interpreted with relation to the countries’ development stage. The same policy framework is not applicable for each group of economies as the EEKC hypothesis is not overwhelmingly accepted. While framing energy conservative policies, regulators should consider the degree of development in each country. Renewable energy may be an efficient substitute for the traditional sources of energy including fossil fuel and can help outpace environmental pressures (Zoundi 2017).

Conclusions

This paper investigated the energy environmental Kuznets curve for 144 countries divided into three groups, low income, middle income, and high-income countries based on world bank criteria 2021. Results obtained from panel regression and cointegration analysis support the existence of EEKC for high-income countries, while these results cannot be verified in the case of middle and low-income countries at lower quantiles. This means that the hypothesis of transition in energy consumption is occurring only in developed nations and there is no room for developing countries to implement energy-efficient policies to mitigate environmental challenges as it may compromise their much-needed economic growth. Moving on to the EEKC is not a difficult task for low-income countries as we demonstrate that developed countries are growing while using energy-efficient technologies. Probably, developing countries can learn from developed nations in framing energy policies that effectively worked for them and achieve sustainable development. In the same vein, the developed countries in the world need to support developing countries to achieve development goals by transferring economic and technological support.

For future research, it is important to investigate what type of support developed nations could lend to developing countries to achieve the goal of economic development in the context of the EEKC. In addition, other control variables such as inflation, financial development, and the foreign direct investment might need to be considered in the EEKC model. As we studied the EEKC hypothesis globally for the first time, the econometric model used in the analysis is in a simple form. However, it includes two control variables (urbanization and population growth) that are the key determinants of energy consumption. To pursue further research, future models may include other meaningful variables like energy price, income disparity energy poverty, and so on.

Notes

Results are available on request.

Results are available on request.

Using Hausman test, FE model is more efficient than RE; hence FE is selected. Moreover, we compared the RE with pooled OLS using Breusch and Pagan Lagrangian multiplier test for RE. The result refuses the pooled OLS model. Therefore, the most efficient model for this study is FE.

Expressed by a significant coefficient of quadratic and cubic terms of GDPPC.

ECON and RECON, ECON and NRECON, RECON and NRECON, URBAN and POP.

References

Abdullah SM, Siddiqua S, Huque R (2017) Is health care a necessary or luxury product for Asian countries? An answer using panel approach. Heal Econ Rev 7(1):1–12

Abeydeera L, Willhelm HU, Mesthrige JW, Samarasinghalage TI (2019) Global research on carbon emissions: a scientometric review. Sustainability 11(14):3972

Aboagye S (2017) The policy implications of the relationship between energy consumption, energy intensity and economic growth in Ghana. OPEC Energy Rev 41(4):344–363

Adom PK, Kwakwa PA (2014) Effects of changing trade structure and technical characteristics of the manufacturing sector on energy intensity in Ghana. Renew Sustain Energy Rev 35:475–483

Aguila Y (2020) A global pact for the environment: the logical outcome of 50 years of international environmental law. Sustainability 12(14):5636

Akbar A, Imdadullah M, Ullah M A, Aslam M (2011) Determinants of economic growth in Asian countries: a panel data perspective. Pakistan Journal of Social Sciences (PJSS), 31(1)

Allard A, Takman J, Uddin GS, Ahmed A (2018) The N-shaped environmental Kuznets curve: an empirical evaluation using a panel quantile regression approach. Environ Sci Pollut Res 25(6):5848–5861

Ansari MA, Ahmad MR, Siddique S, Mansoor K (2020) An environment Kuznets curve for ecological footprint: evidence from GCC countries. Carbon Manag 11(4):355–368. https://doi.org/10.1080/17583004.2020.1790242

Araç A, Hasanov M (2014) Asymmetries in the dynamic interrelationship between energy consumption and economic growth: evidence from Turkey. Energy Econ 44:259–269

Aruga K (2019) Investigating the energy-environmental Kuznets curve hypothesis for the Asia-Pacific region. Sustainability 11(8):2395

Asafu-Adjaye J (2000) The relationship between energy consumption, energy prices and economic growth: time series evidence from Asian developing countries. Energy Econ 22(6):615–625

Aşıcı AA, Acar S (2016) Does income growth relocate ecological footprint? Ecol Ind 61:707–714

Awan A, Bilgili F, Rahut DB (2022a) Energy poverty trends and determinants in Pakistan: empirical evidence from eight waves of HIES 1998–2019. Renew Sustain Energy Rev 158:112157

Awan A, Kocoglu M, Banday TP, Tarazkar MH (2022b) Revisiting global energy efficiency and CO2 emission nexus: fresh evidence from the panel quantile regression model. Enviro Sci Pollut Res 1–14

Baek J (2016) Do nuclear and renewable energy improve the environment? Empirical evidence from the United States. Ecol Ind 66:352–356

Banerjee A, Carrion-i-Silvestre JL (2017) Testing for panel cointegration using common correlated effects estimators. J Time Ser Anal 38(4):610–636

Begum RA, Sohag K, Abdullah SMS, Jaafar M (2015) CO2 emissions, energy consumption, economic and population growth in Malaysia. Renew Sustain Energy Rev 41:594–601

Bilgen SELÇUK (2014) Structure and environmental impact of global energy consumption. Renew Sustain Energy Rev 38:890–902

Bilgili F, Khan M, Awan A (2022). Is there a gender dimension of the environmental Kuznets curve? Evidence from Asian countries. Environ Deve Sustain 1–32

Binder M, Coad A (2011) From Average Joe’s happiness to Miserable Jane and Cheerful John: using quantile regressions to analyze the full subjective well-being distribution. J Econ Behav Organ 79(3):275–290

Breusch TS, & Pagan AR (1980) The Lagrange Multiplier Test and its Ap plications to Model Specification in Econometrics. Rev Econ Stud 47:239–253

Cade BS, Noon BR (2003) A gentle introduction to quantile regression for ecologists. Front Ecol Environ 1(8):412–420

Chaurasia A (2020) Population effects of increase in world energy use and CO2 emissions: 1990–2019. J Popul Sustain 5(1):87–125

Chen PY, Chen ST, Hsu CS, Chen CC (2016) Modeling the global relationships among economic growth, energy consumption and CO2 emissions. Renew Sustain Energy Rev 65:420–431

Cheng C, Ren X, Wang Z, Shi Y (2018) The impacts of non-fossil energy, economic growth, energy consumption, and oil price on carbon intensity: evidence from a panel quantile regression analysis of EU 28. Sustainability 10(11):4067

Choi I (2001) Unit root tests for panel data. J Int Money Financ 20(2):249–272

Copeland BR, Taylor MS (1994) North-South trade and the environment. Q J Econ 109(3):755–787

Csereklyei Z, Stern DI (2015) Global energy use: decoupling or convergence? Energy Econ 51:633–641

Deichmann U, Reuter A, Vollmer S, Zhang F (2018) Relationship between energy intensity and economic growth: new evidence from a multi-country multi-sector data set. World Bank Policy Res Work Pap (8322)

De Hoyos RE, & Sarafidis V (2006) Testing for cross-sectional dependence in panel-data models. Stata J 6(4):482–496

del Pablo-Romer MP, De Jesús J (2016) Economic growth and energy consumption: the energy-environmental Kuznets curve for Latin America and the Caribbean. Renew Sustain Energy Rev 60:1343–1350

Demissew Beyene S, Kotosz B (2020) Testing the environmental Kuznets curve hypothesis: an empirical study for East African countries. Int J Environ Stud 77(4):636–654

Dogan E, Ulucak R, Kocak E, Isik C (2020) The use of ecological footprint in estimating the environmental Kuznets curve hypothesis for BRICST by considering cross-section dependence and heterogeneity. Sci Total Environ 723:138063

Doğan B, Driha OM, Balsalobre Lorente D, Shahzad U (2021) The mitigating effects of economic complexity and renewable energy on carbon emissions in developed countries. Sustain Dev 29(1):1–12

Dogan E, & Inglesi-Lotz R (2020) The impact of economic structure to the environmental Kuznets curve (EKC) hypothesis: evidence from European countries. Environ Sci Pollut Res 27(11):12717–12724

Filippidis M, Tzouvanas P, Chatziantoniou I (2021) Energy poverty through the lens of the energy-environmental Kuznets curve hypothesis. Energy Econ 100:105328

Forte F, Mudambi R, Navarra P M (2014) A handbook of alternative theories of public economics. Edward Elgar Publishing

Frees EW (1995) Assessing cross-sectional correlation in panel data. J Econom 69(2):393–414

Gengenbach C, Urbain J, Westerlund J (2016) Error correction testing in panels with common stochastic trends. J Appl Economet 31(6):982–1004

Groen JJJ, Kleibergen F (2003) Likelihood-based cointegration analysis in panels of vector error-correction models. J Bus Econ Stat 21(2):295–318

Haider A, Rankaduwa W, ul Husnain, M. I., & Shaheen, F. (2022) Nexus between agricultural land use, economic growth and N2O emissions in Canada: is there an environmental Kuznets curve? Sustainability 14(14):8806

Hajko V (2014) The energy intensity convergence in the transport sector. Procedia Econom Finance 12:199–205

Harbaugh WT, Levinson A, Wilson DM (2002) Reexamining the empirical evidence for an environmental Kuznets curve. Rev Econ Stat 84(3):541–551. https://doi.org/10.1162/003465302320259538

Hongxing Y, Abban OJ, Boadi AD, Ankomah-Asare ET (2021) Exploring the relationship between economic growth, energy consumption, urbanization, trade, and CO2 emissions: a PMG-ARDL panel data analysis on regional classification along 81 BRI economies. Environ Sc Pollut Res 28(46):66366–66388

Hossain MS (2011) Panel estimation for CO2 emissions, energy consumption, economic growth, trade openness and urbanization of newly industrialized countries. Energy Policy 39(11):6991–6999

Hübler M (2017) The inequality-emissions nexus in the context of trade and development: a quantile regression approach. Ecol Econ 134:174–185

Hundie SK, Daksa MD (2019) Does energy-environmental Kuznets curve hold for Ethiopia? The relationship between energy intensity and economic growth. J Econ Struct 8(1):1–21

Husnain MI, Nasrullah N, Khan MA, Banerjee S (2021) Scrutiny of income related drivers of energy poverty: a global perspective. Energy Policy 157:112517. https://doi.org/10.1016/j.enpol.2021.112517

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econom 115(1):53–74

Inglesi-Lotz R, Dogan E (2018) The role of renewable versus non-renewable energy to the level of CO2 emissions a panel analysis of sub-Saharan Africa’s Βig 10 electricity generators. Renew Energy 123:36–43

Iram R, Zhang J, Erdogan S, Abbas Q, Mohsin M (2020) Economics of energy and environmental efficiency: evidence from OECD countries. Environ Sci Pollut Res 27(4):3858–3870

Jakob M, Haller M, Marschinski R (2012) Will history repeat itself? Economic convergence and convergence in energy use patterns. Energy Econ 34(1):95–104

Jiang L, Ji M (2016) China’s energy intensity, determinants and spatial effects. Sustainability 8(6):544

Jiang L, Folmer H, Ji M, Zhou P (2018) Revisiting cross-province energy intensity convergence in China: a spatial panel analysis. Energy Policy 121:252–263

Kander A, Warde P, Henriques ST, Nielsen H, Kulionis V, Hagen S (2017) International trade and energy intensity during European industrialization, 1870–1935. Ecol Econ 139:33–44

Kao C (1999) Spurious regression and residual-based tests for cointegration in panel data. J Econom 90(1):1–44

Karimu A, Brännlund R, Lundgren T, Söderholm P (2017) Energy intensity and convergence in Swedish industry: a combined econometric and decomposition analysis. Energy Econ 62:347–356

Kaza N (2010) Understanding the spectrum of residential energy consumption: a quantile regression approach. Energy Policy 38(11):6574–6585

Khan MI, Kamran Khan M, Dagar V, Oryani B, Akbar SS, Salem S, Dildar SM (2021) Testing environmental Kuznets curve in the USA: what role institutional quality, globalization, energy consumption, financial development, and remittances can play? New evidence from dynamic ARDL simulations approach. Front Environ Sci 576

Kiran B (2013) Energy intensity convergence in OECD countries. Energy Explor Exploit 31(2):237–247

Kocoglu M, Awan A, Tunc A et al (2022) The nonlinear links between urbanization and CO2 in 15 emerging countries: Evidence from unconditional quantile and threshold regression. Environ Sci Pollut Res 29:18177–18188. https://doi.org/10.1007/s11356-021-16816-9

Koenker R, Bassett Jr G (1982) Robust tests for heteroscedasticity based on regression quantiles. Econometrica: J Econom Soc 43–61

Konstantakopoulou I (2020) Further evidence on import demand function and income inequality. Economies 8(4):91

Lau LS, Choong CK, Ng CF, Liew FM, Ching SL (2019) Is nuclear energy clean? Revisit of environmental Kuznets curve hypothesis in OECD countries. Econ Model 77:12–20

Le Pen Y, Sévi B (2010) On the non-convergence of energy intensities: evidence from a pair-wise econometric approach. Ecol Econ 69(3):641–650

Lee CT, Lim JS, Van Fan Y, Liu X, Fujiwara T, Klemeš JJ (2018) Enabling low-carbon emissions for sustainable development in Asia and beyond. J Clean Prod 176:726–735

Lescaroux F (2011) Dynamics of final sectoral energy demand and aggregate energy intensity. Energy Policy 39(1):66–82

Li K, Zu J, Musah M, Mensah IA, Kong Y, Owusu-Akomeah M, … Agyemang JK (2021) The link between urbanization, energy consumption, foreign direct investments and CO2 emanations: an empirical evidence from the emerging seven (E7) countries. Energy Explor Exploit 01445987211023854

Liddle B (2010) Revisiting world energy intensity convergence for regional differences. Appl Energy 87(10):3218–3225

Liu X, Peng D (2018) Study on the threshold effect of urbanization on energy consumption. Theor Econ Lett 8(11):2220

Luo Y, Tung RL (2007) International expansion of emerging market enterprises: a springboard perspective. J Int Bus Stud 38(4):481–498

Luqman M, Ahmad N, Bakhsh K (2019) Nuclear energy, renewable energy and economic growth in Pakistan: evidence from non-linear autoregressive distributed lag model. Renew Energy 139:1299–1309

Luzzati T, Orsini M (2009) Investigating the energy-environmental Kuznets curve. Energy 34(3):291–300

Mahmood T, Ahmad E (2018) The relationship of energy intensity with economic growth: evidence for European economies. Energ Strat Rev 20:90–98

Mahmood H, Alkhateeb TTY, Tanveer M, Mahmoud DH (2021) Testing the energy-environmental kuznets curve hypothesis in the renewable and nonrenewable energy consumption models in Egypt. Int J Environ Res Public Health 18(14):7334

Mahmood H (2021) Investigating the N-shaped energy-environmental Kuznets curve hypothesis in Saudi Arabia. 670216917

Mäler KG (2013) Economic growth and the environment. Encyclopedia of Biodiversity: Second Edition, 110(2), 25–30https://doi.org/10.1016/B978-0-12-384719-5.00433-0

Maneejuk N, Ratchakom S, Maneejuk P, Yamaka W (2020) Does the environmental Kuznets curve exist? An international study. Sustainability 12(21):9117

Menegaki AN (2019) The ARDL method in the energy-growth nexus field; best implementation strategies. Economies 7(4):105

Mitić P, Munitlak Ivanović O, Zdravković A (2017) A cointegration analysis of real GDP and CO2 emissions in transitional countries. Sustainability 9(4):568

Moosa IA, Burns K (2022) The energy Kuznets curve: evidence from developed and developing economies. Energy J 43(6)

Musah M, Kong Y, Mensah IA, Antwi SK, Osei AA, Donkor M (2021) Modelling the connection between energy consumption and carbon emissions in North Africa: evidence from panel models robust to cross-sectional dependence and slope heterogeneity. Environ Dev Sustain 23(10):15225–15239

Neagu O (2019) The link between economic complexity and carbon emissions in the European Union countries: a model based on the environmental Kuznets curve (EKC) approach. Sustainability 11(17):4753

Nepal R, Paija N (2019) Energy security, electricity, population and economic growth: the case of a developing South Asian resource-rich economy. Energy Policy 132:771–781

Newey WK, Powell JL (1987) Asymmetric least squares estimation and testing. Econometrica: J Econom Soc 819–847

Panayotou T (1993) Empirical tests and policy analysis of environmental degradation at different stages of economic development. International Labour Organization

Pata UK (2018) The effect of urbanization and industrialization on carbon emissions in Turkey: evidence from ARDL bounds testing procedure. Environ Sci Pollut Res 25(8):7740–7747

Pedroni P (1999) Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxford Bull Econ Stat 61(S1):653–670

Pedroni P (2004) Panel cointegration: asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Economet Theor 20(3):597–625

Pedroni P (2001) Fully modified OLS for heterogeneous cointegrated panels. In Nonstationary panels, panel cointegration, and dynamic panels. Emerald Group Publishing Limited.

Persyn D, Westerlund J (2008) Error-correction–based cointegration tests for panel data. Stand Genomic Sci 8(2):232–241

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Economet 22(2):265–312

Raza SA, Shah N, Khan KA (2020) Residential energy environmental Kuznets curve in emerging economies: the role of economic growth, renewable energy consumption, and financial development. Environ Sci Pollut Res 27(5):5620–5629

Richmond AK, Kaufmann RK (2006) Energy prices and turning points: the relationship between income and energy use/carbon emissions. Energy J 27(4)

Robalino-López A, Mena-Nieto Á, García-Ramos JE, Golpe AA (2015) Studying the relationship between economic growth, CO2 emissions, and the environmental Kuznets curve in Venezuela (1980–2025). Renew Sustain Energy Rev 41:602–614

Sheng P, He Y, Guo X (2017) The impact of urbanization on energy consumption and efficiency. Energy Environ 28(7):673–686

Sineviciene L, Sotnyk I, Kubatko O (2017) Determinants of energy efficiency and energy consumption of Eastern Europe post-communist economies. Energy Environ 28(8):870–884

Smil V (2003) Energy at the crossroads: global perspectives and uncertainties. MIT Press, Cambridge, Mass

Song F, Zheng X (2012) What drives the change in China’s energy intensity: combining decomposition analysis and econometric analysis at the provincial level. Energy Policy 51:445–453

Statista Global Reneable Energy Consumption by Country (2021). https://www.statista.com/statistics/237090/renewable-energy-consumption-of-the-top-15-countries/

Sultana N, Rahman M M, Khanam R (2021) Environmental kuznets curve and causal links between environmental degradation and selected socioeconomic indicators in Bangladesh. Environ Dev Sustain 24(4):5426–5450

Suri V, Chapman D (1998) Economic growth, trade and energy: implications for the environmental Kuznets curve. Ecol Econ 25(2):195–208

Toma P, Miglietta PP, Morrone D, Porrini D (2020) Environmental risks and efficiency performances: the vulnerability of Italian forestry firms. Corp Soc Responsib Environ Manag 27(6):2793–2803

Topcu M, Girgin S (2016) The impact of urbanization on energy demand in the Middle East. J Int Glob Econ Stud 9(1):21–28

Ulucak R (2020) How do environmental technologies affect green growth? Evidence from BRICS economies. Sci Total Environ 712:136504

van Benthem AA (2015) Energy leapfrogging. J Assoc Environ Resour Econ 2(1):93–132

Vo DH (2021) Renewable energy and population growth for sustainable development in the Southeast Asian countries. Energy Sustain Soc 11(1):1–15

Wang Q, Yang X (2019) Urbanization impact on residential energy consumption in China: the roles of income, urbanization level, and urban density. Environ Sci Pollut Res 26(4):3542–3555

Wang P, Wu W, Zhu B, Wei Y (2013) Examining the impact factors of energy-related CO2 emissions using the STIRPAT model in Guangdong Province, China. Appl Energy 106:65–71

Westerlund J (2007) Testing for error correction in panel data. Oxford Bull Econ Stat 69(6):709–748

Westerlund J, Edgerton DL (2007) A panel bootstrap cointegration test. Econ Lett 97(3):185–190

World Energy & Climate Statistics Year Book (2021). https://yearbook.enerdata.net

Wu W, Lin Y (2022) The impact of rapid urbanization on residential energy consumption in China. PLoS One 17(7):e0270226

Xiaoman W, Majeed A, Vasbieva DG, Yameogo CEW, & Hussain N (2021) Natural resources abundance, economic globalization, and carbon emissions: Advancing sustainable development agenda. Sustain Dev 29(5):1037–1048

Zhang J (2021) Environmental Kuznets curve hypothesis on CO2 emissions: evidence for China. J Risk Financ Manag 14(3):93

Zhang YJ, Peng HR, Liu Z, Tan W (2015) Direct energy rebound effect for road passenger transport in China: a dynamic panel quantile regression approach. Energy Policy 87:303–313

Zoundi Z (2017) CO2 emissions, renewable energy and the environmental Kuznets curve, a panel cointegration approach. Renew Sustain Energy Rev 72:1067–1075

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Material preparation, data collection, and analysis were performed by Sisay Demissew Beyene. The first draft of the manuscript was written by Muhammad Iftikhar ul Husnain. Kentaka Aruga commented and improved the previous versions of the manuscript. All authors read and approved the final manuscript.

Data availablity.

The data that support the findings of this study are available from the corresponding author (MIH) upon reasonable request.

Corresponding author

Ethics declarations

Ethics approval

Not applicable.

Consent to participate

All authors have read the manuscript carefully and gave explicit consent to submit it to Environmental Science and Pollution Research.

Consent for publication

All authors whose names appear on the submission approved the version to be published.

Conflict of interest

The authors declare no competing interests.

Additional information

Responsible Editor: Roula Inglesi-Lotz

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Husnain, M.I.u., Beyene, S.D. & Aruga, K. Investigating the energy-environmental Kuznets curve under panel quantile regression: a global perspective. Environ Sci Pollut Res 30, 20527–20546 (2023). https://doi.org/10.1007/s11356-022-23542-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-23542-3