Abstract

The rapid growth of industrial digitalization and financial support are the main driving forces for the green transformation of China’s economy. Aiming to explore how digitalization and financial development impact ecological efficiency (eco-efficiency), this study proposes a unified research framework by integrating multiple technologies using the panel data that covered 30 China’s provinces from 2006 to 2018. First, China’s provincial digital development index is constructed to measure the level of digitalization, and regional eco-efficiency is estimated by a non-radial data envelope analysis (DEA) model. Based on that, the panel data regression model and panel vector autoregression (PVAR) model are used to explore the direct effects and dynamic effect of digitalization and financial development on eco-efficiency, respectively. Then, the threshold regression model is employed to check the threshold effect of the two variables on eco-efficiency. The following conclusions are drawn: (1) Both digitalization and financial development have a significantly positive correlation with regional eco-efficiency, indicating that China’s digitalization and financial development in recent years have both improved regional eco-efficiency. (2) Eco-efficiency has positive and longer responses to the impulse coming from digitalization and financial development, and the response of ecological efficiency to financial development is greater than its response to digitalization. (3) Threshold effects exist in the impact mechanism of digitalization on regional eco-efficiency. This indicates that the level of financial support is too low to promote the improvement in ecological efficiency. Eco-efficiency can be improved only to a certain extent. The research conclusions provide a policy reference for improving eco-efficiency and promoting China’s green development.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The coordinated development of the ecological environment and economic growth is the pursuit of human society. As the largest developing country in the world, China has witnessed a rapid economic growth over the past 40 years since 1978 and has created a miracle in the history of world economy. However, its heavy reliance on high fossil energy consumption has resulted in an ecological crisis, such as air pollution and degraded water quality. According to China’s Ecological and Environment Bulletin in 2020, the degree of air pollution in more than 40% of Chinese cities exceeds the nation’s air quality criterion. More than one-third of Chinese cities have experienced acid rain damage. Such an ecological crisis has posed a serious threat to human health; therefore, improving ecological efficiency (eco-efficiency) (see the “Eco-efficiency” section for details) is highly crucial for sustainable development in China.

Meanwhile, in recent years, the wave of digitalization has swept across China, bringing significant opportunities to China’s economic transition and recasting the mode of production. Both the internet penetration rate and number of netizens have increased in recent years, contributing to 7.8% of the GDP accoording to The 47th Statistical report on internet development in China. Regarding environmental protection, digitalization supports ecological environment monitoring, data collection, analysis, law enforcement, evaluation, and decision-making by changing production technology, management systems, and information exchange methods (Hsu et al. 2020).

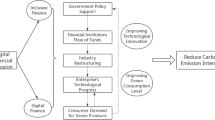

In the future of the digitalization era, how to use digitalization to improve the green development level of the economic system is key to the high-quality development of China’s economy. However, whether digitalization can promote eco-efficiency is still controversial. Supporters believe that digitalization plays a monitoring role in energy use and pollutant emissions, which is conducive to enterprises’ accurate energy conservation and emission reduction decisions (Lange and Santarius 2020; Hao et al. 2021a, b). In contrast, opponents believe that the application of electronic and communication equipment increases energy consumption and further aggravates greenhouse gas emissions (Salahuddin and Alam 2016). In addition, financial development is considered to play a significant role in fundraising, adjustment of asset structure, and rational resource allocation in modern society. Finance can effectively fulfil resource allocation for economic activities by guiding the investment direction of capital flow (Jaud et al. 2018). Having recognized the key role of financial development in protecting the ecological environment, the Chinese government has utilized financial tools to drive regional green development since 2016 and has issued guidelines for building a green financial system. For example, the Central Economic Work Conference held in 2021 clearly pointed out that one of the key tasks of the financial sector in the future is to serve the strategic deployment of carbon peaking and carbon neutrality. In this circumstance, what kind of impact it will have on eco-efficiency for the economic system when digitalization meets finance is a very important and interesting issue.

There are many studies on the relationship between financial development and eco-efficiency (e.g. Hao et al. 2020; Li et al. 2021a, b) or digitalization and eco-efficiency (e.g. Lin and Zhou 2021; Wu et al. 2021). However, there is still a lack of in-depth research on how the combination of financial development and digitalization affects ecological efficiency and whether there are differences in the impact of financial development and digitalization on ecological efficiency at different stages. It is not yet possible to directly judge the specific implementation effect of digitalization and financial development on regional eco-efficiency, nor is it possible to know the specific dynamic process of the impact of digitalization and financial development on regional eco-efficiency.

In this regard, this study focuses on how digitalization and financial development impact regional eco-efficiency by integrating multiple technologies. China’s provincial digital development index is constructed to measure the level of digitalization, and regional eco-efficiency is estimated by a non-radial data envelope analysis (DEA) model. Based on that, the fixed effect model and the panel vector autoregression (PVAR) model are used to explore the direct (impact) effects and dynamic (impact) effect of digitalization and financial development on regional eco-efficiency. Threshold regression models are employed to check the threshold effect of the two valuables on eco-efficiency and reflect the stage difference due to the level of digitalization and financial development. The contribution of this paper regards three aspects. (1) This study proposes a unified research framework combining financial development, digitalization, and regional eco-efficiency, which complements the deficiency of studies that consider this topic only from a single perspective. (2) Considering the rapid growth of China’s financial and digital industries in recent years, this study explores the direct effect, dynamic effect, and threshold effect of digitalization on regional eco-efficiency using the fixed effect model, the PVAR model, and the threshold regression model, respectively, providing an in-depth analysis of the impact mechanism of eco-efficiency, especially exploring the role of digital industrialization in economic development and ecological protection. (3) To obtain reliable empirical evidence, the strategies used include replacing the explained variable, reducing the sample time interval, increasing the sample time interval, and using other estimation methods. To address the potential endogeneity problems, we adopt the number of post offices and the number of banks in 1984 as the instrumental variables for digitalization and financial development, respectively (Wu et al. 2021). The findings provide important theoretical support for China to improve eco-efficiency and implement a green development strategy.

The remainder of the paper is organized as follows. The second section introduces the relevant literature on financial development, digitalization, and eco-efficiency, and the third section proposes the methodology used in this study. The fourth section presents the data and indicators. The fifth section presents the results and discussion, and the sixth section draws conclusions and policy implications.

Literature review

Eco-efficiency

Eco-efficiency is a type of comprehensive efficiency linking environmental protection and economic development. It aims to create economic value while increasing environmental productivity and reducing ecological costs. Some scholars and international organizations consider eco-efficiency as the ratio of economic growth to environmental costs. According to this concept, activities that create economic value while reducing environmental damage contribute to eco-efficiency. Research related to eco-efficiency has become increasingly popular (Luo et al. 2021; Sun and Wang 2021; Kounetas et al. 2021; Zhu et al. 2020). The main methods are used to calculate eco-efficiency include the ratio evaluation method, the ecological footprint method, material flow analysis, and DEA. Among them, DEA, based on multiple inputs and outputs, has been the most widely used method for evaluating eco-efficiency in recent years (Sueyoshi et al. 2021; Ezici et al. 2020; Wang et al. 2019; Chen et al. 2021).

However, the traditional DEA model cannot identify effectiveness for the decision-making units (DMUs) whose efficiency scores reach the maximum (the value is 1). Thus, the super efficiency DEA model is proposed to allow the relative efficiency scores higher than 1 to obtain different scores than the DMUs on the production frontier. Additionally, to address the slack issues in the DEA model, Tone (2002) further improved the SBM along with the super efficiency DEA model and proposed the super-SBM to freely satisfy the expansion or contraction of input and output indicators (Chen and Liu 2022). The superefficient DEA model is widely used to evaluate green economy efficiency (Su and Zhang 2020) and energy efficiency (Baloch et al. 2021).

The link between eco-efficiency and economic and social factors has gradually attracted the attention of scholars. Lahouel (2016) conducted a comparative analysis of 17 consumer companies in France and found that company size and eco-efficiency have an inverse relationship. With environmental regulations divided into command-control regulations, market incentive regulations, and voluntary regulations, Ren et al. (2018) found that environmental regulation types had significantly different impacts on eco-efficiency across regions. Ren et al. (2020) found that the factors influencing the overall eco-efficiency in descending order are economic growth, marketization, and social investment. Han et al. (2021) posited that industrial upgrading influences eco-efficiency.

Digitalization and eco-efficiency

With the development of the Internet, digital technologies represented by big data, cloud computing, artificial intelligence, the Internet of Things (IoT), block chain, and 5G technologies have profoundly changed production and lifestyles (Gray and Rumpe 2015). Digitalization has promoted the emergence of new equipment, technologies, and business models, thus having a great impact on economic activity and human lives (Li et al. 2020). However, whether digitalization can improve eco-efficiency is a matter of debate. On the one hand, supporters confirm that digitalization can optimize resource allocation in various ways (e.g. Wang et al. 2021a, b; Tang et al. 2022). In fact, the introduction of computers into the manufacturing industry results in higher productivity, thus accelerating the decoupling of economic growth and environmental pollution (Wang and Feng 2019; Meng et al.2018). For example, communication technology can monitor the discharge of toxic substances through electronic monitoring, remote sensing, and other methods. In addition, information technology can bring environmental benefits through alternative materials and energy, such as replacing paper obtained from wood pulp and trees with electronic paper ( Lange & Santarius 2020), thus reducing the consumption of natural resources to a certain extent. On the other hand, opponents show that the production and consumption process of digitalization–related devices, including computers, mobile phones, cables, and various peripheral devices, may release harmful emissions and a very large amount of e-waste (Salahuddin and Alam 2016; Lange and Santarius 2020). They contain potentially harmful materials, such as lead, and cadmium in particular has posed a great threat to environmental protection (Ilankoon et al. 2018). In addition, the application of electronic and communication equipment will increase energy consumption and further aggravate greenhouse gas emissions (Salahuddin and Alam 2016).Footnote 1

Financial development and eco-efficiency

At present, environmental protection is receiving increasing attention from the government. Measures have been taken to encourage financial capital to support enterprises for emission reduction and green development (Wang et al. 2021a, b; Yang 2021). Specifically, financial development can affect eco-efficiency through the following paths: (1) Providing financial support. Enterprises must pay high costs to reduce pollution, which can entail a lack of sufficient funds. When government subsidies for emission reduction are not sufficient, financial institutions, such as banks or financing companies, connect capital demanders and capital suppliers to provide financial support to broaden financing channels and further relax credit constraints for ecological technology innovation (Shahbaz and Lean 2012; Xu et al. 2020). Some empirical studies have demonstrated a positive relationship between finance support and eco-efficiency (An et al. 2021; Li et al. 2021a, b; Chen and Ma 2021). (2) Optimizing capital allocation. With the greater value of the ecological environment, industries with resource conservation and fewer emissions encouraged by the government have a bright future. Thus, capital flows towards cleaner and more competitive industries to obtain higher profits. According to this logic, the environmentally friendly industry is supported to obtain financing at a low cost, thus improving regional eco-efficiency (Zhang and Lv 2021). (3) Enhancing enterprise supervision. On the one hand, after enterprises receive financial support, the financial system has the right to supervise and guide enterprises towards the improvement in ecological efficiency. On the other hand, enterprises are supervised by authorities, such as by the regulations required by the securities market and banking industry. For example, in the securities market, forced disclosure of the corporate environmental information system makes listed enterprises prefer a green reputation (Wang et al. 2020; Zhang et al. 2021).

To intuitively understand the relevant research context, this paper summarizes the research that has investigated the links among digitalization, financial development, and eco-efficiency in Table 1.

Methodology

Models to calculate eco-efficiency

According to Tone (2002), this paper considers undesirable outputs such as wastewater as the output side into the super-SBM model. Then, the model calculates eco-efficiency as follows:

Here, there are n DMUs, and each DMU is composed of m inputs, \({r}_{1}\) desirable outputs and \({r}_{2}\) undesirable outputs; \(x\), \(y\), and \(z\) are the corresponding input, desirable output, and undesirable output vectors, respectively; \(ree\) is the regional eco-efficiency.

In addition, to conduct a robust test for the estimated results, the non-radial and non-direction SBM models proposed by Fukuyama and Weber (2008) are used:

Here, (\({g}^{\mathrm{x}}\), \({g}^{\mathrm{y}}\), \({g}^{\mathrm{z}}\)) are the direction vectors representing input decrease, desirable output increase, and undesirable output decrease, respectively; (\({s}_{u}^{x}\), \({s}_{v}^{y}\), \({s}_{q}^{z}\)) are the slacks of input and desirable and undesirable outputs, respectively. Other variables are the same as the super-efficiency DEA model (1).

Direct effect tests using the fixed effect model

Fixed effect panel model considers the unobserved individual and time factor into the model in order to mitigate endogenous problems caused by missing variable deviations. Here we use it to verify the direct effect on the impact mechanism of digitalization and financial development on eco-efficiency. As discussed in the above section, digitalization and financial development are our interesting variables to observe the impacting mechanism for eco-efficiency. Besides, we also introduce control variables such as R&D investment, industrial structure upgrading, education development, and intellectual property protection. Thus, the fixed effect panel model to test the relationship between financial development, digitalization, and eco-efficiency is as follows:

where \(i\) and \(t\) represent individual and time, respectively; \(ree\) refers to eco-efficiency estimated by models (1) and (2); \(fd\) refers to financial development; \(dig\) denotes digitalization variable; and \(tech\), \(upg, ipp\), and \(edu\) represent R&D investment, industrial structure upgrading, education development, and intellectual property protection, respectively. \({\beta }_{0}\) is the intercept term; \({\beta }_{1}\sim {\beta }_{6}\) are the estimated coefficients;\({u}_{i}\) represents the individual fixed effect reflecting features that do not change over time, such as climate, geography, and natural endowment; \({\delta }_{t}\) represents the time fixed effect to control the characteristics of individual changes in all time, such as macroeconomic cycles and business cycles; and \({\varepsilon }_{it}\) is the random error term, which is assumed to be independent and identically distributed.

Dynamic effect tests using panel vector autoregressive model

In view of both digitalization and financial development being relatively dynamic variables, we further explore their dynamic impulse to eco-efficiency using PVAR. The advantages of this model are as follows: (1) It can utilize full information, both time and cross-sectional data and thus control the individual’s heterogeneity by relaxing the restrictive requirements of the VAR method on the length of the time series; (2) there is no need to distinguish endogenous variables and exogenous variables, making it convenient to examine the dynamic response of each variable to an impact (Charfeddine and Kahia 2019). The specific form of the PVAR model established in this paper is as follows:

where \({y}_{\mathrm{it}}\) is a column vector including three endogenous variables (\(ree\), \(fd\), \(id\)); \(i\) and \(t\) represent individual and time, respectively; and \(p\) denotes the lag order of the model; \({\beta }_{0}\) represents the intercept term vector, \({\beta }_{\mathrm{j}}\) represents the parameter matrix of the lagged variable;\({\vartheta }_{\mathrm{i}}\) is individual effect column vector; \({\mu }_{\mathrm{t}}\) is the time-effect column vector, which represents the influence of time change on the cross-section individual; and \({\varepsilon }_{\mathrm{it}}\) is the “white noise” disturbance term. In the process of empirical testing, this study uses the mean difference within-group and forward-mean differencing methods to eliminate time and individual effects.

Threshold effect tests using panel threshold regression

Threshold regression models are used to explore non-linear relationships between variables (Khan et al. 2019). Digitalization and financial development may have non-linear impacts on eco-efficiency at different stages. In the early stages, their impact on eco-efficiency may be relatively small or even not significant. However, at the mature stage, the magnitude of the impact on eco-efficiency may become more significant. Thus, panel threshold regression models are used to explore such non-linear impacts. This method can endogenously identify threshold value according to the characteristics of the data itself, thus avoiding the bias caused by subjectively dividing the threshold value (Kremer et al. 2013). This paper selects digitalization and financial development as the threshold variables. According to the requirements of Hansen’s single threshold model, the specific model is set as follows:

Equations (5) and (6) only give a single threshold panel model. However, in many cases, there may be existing multiple thresholds. Suppose there are two thresholds, the model should be set to:

where \(I(\bullet )\) in the model represents the index function, and \(C\), \({C}_{1}, \mathrm{and }{C}_{2}\) are the specific threshold values. The meanings of other symbols are the same as the above model (3).

Data and indicators

This study selects 30 provincial regions in Mainland China (excluding Tibet, Hong Kong, Macao, and Taiwan) from 2006 to 2018 as our sample.

Data and indicators for DEA

Referring to previous studies (e.g. Chen et al. 2021; Wu et al. 2021), in super-SBM and SBM models, the input variables include labour force, capital stock, and energy consumption, while the desirable output is regional GDP and the undesirable outputs include waste gas discharge, industrial wastewater discharge, and industrial solid waste discharge.

Labour force is denoted by the number of employees per unit at the end of the year; capital stock is estimated according to the formula \({K}_{\mathrm{t}}=\left(1-\delta \right){K}_{\mathrm{t}-1}+{I}_{\mathrm{t}}\), where \({K}_{\mathrm{t}}\),\({K}_{\mathrm{t}-1}\) are the capital stock of the t period and the t − 1 period, respectively, δ is the depreciation rate of capital (δ = 9.6%). and \({I}_{\mathrm{t}}\) is the investment amount of fixed assets calculated at the current price in the t year.

The energy consumption for a region is comprehensive indexes for all types of fossil energy categories by conversion factors to convert them into 10,000 tons of standard coal. Regional GDP can be obtained directly from the China Statistical Yearbook. The undesirable outputs are represented as the weighted average of industrial wastewater, waste gas, and solids discharge.

The related data and indicators are abstracted from the China Statistical Yearbook.

Data and indicators in economic regression models

For economic regression models (3)–(8), the explanatory variables are calculated by Formula (1) or (2), while the explanatory variables related are obtained as follows.

-

(1)

Digitalization development

With the widening and deepening of the digital economy, a sole indicator is biased to measure the level of digitalization in a comprehensive and objective manner (Su et al. 2020). Based on global principal component analysis technology, this study constructs China’s provincial digital development index including Digital penetration, digital infrastructure, digital information resources, digital business transactions, and digital development environment. First, those digital indicators are standardized to eliminate the evaluated bias due to inconsistent data units. Second, to check whether financial indicators are suitable for factor analysis, Bartlett’s sphere test and KMO test are used. Third, this study extracts the common factors and calculates their scores according to the value of variance contribution rate of the factors. Here, we choose the indicators whose cumulative variance contribution rate exceeds 80% as the five principal components to calculate the comprehensive score. The finally designed measurement system of China’s digitalization level is shown in Table 2.

To facilitate comparison and understanding, we standardize the calculated comprehensive score of digitalization into the interval [0, 1]:

where \({S}_{\mathrm{i}}\) is the provincial digital development score of province\(i\), and \(Max({\mathrm{S}}_{\mathrm{i}} )\) and \(Min({S}_{i})\) are the maximum and minimum values of the corresponding digitalization development score, respectively.

-

(2)

Financial development

In previous studies, financial development is usually measured by the ratio of financial sector to GDP. However, in view of the financing channel for most enterprises being dominated by the banking system in China, financial development needs to be closely related to credit activities of banks. Referencing to the literature by Hao et al. (2020), we use the ratio of the balance of deposits and loans of the financial sector to the GDP as the proxy of regional financial development (\(fd\)).

-

(3)

Control variables

Besides the core explanatory variables, a series of variables that may affect eco-efficiency are also incorporated into the model as control variables. Among them, industrial structure upgrading (\(upg\)) is calculated as the added value of the secondary industry is divided by that in tertiary industry; R&D development (\(tech\)) is represented as R&D/GDP; educational development (\(edu\)) is described by the average schooling year of local residents of each province; according to Hao et al. (2021a, b), intellectual property protection (ipp) is comprehensive indexes using the entropy method by four dimensions, including judicial protection and administrative protection, human capital, and economic development.

Descriptive statistics

The data in the “Data and indicators in economic regression models” section are from yearly Statistical Yearbooks in China reported by the official website or database. To eliminate the influence of the nominal price, this study converts the nominal variables into actual values using deflated price-related data based on the year 2006. Related descriptive statistics for those data are shown in Table 3.

Results and discussion

Direct effects analysis

We first draw a scatter plot of eco-efficiency to digitalization to directly reflect the relationship between them. As shown in Fig. 1, we found that digitalization is positively correlated with eco-efficiency; however, this correlation is non-linear.

The results of the fixed effect panel data model in Formula (1) are shown in Table 4. According to the regression results, both digitalization and financial development have a significantly positive correlation with regional eco-efficiency, indicating that China’s digitalization and financial development in recent years have both improved regional eco-efficiency. In fact, since the “Equator Principles”Footnote 2 were put forward in 2002, China has been actively guiding capital flow to green industries to promote the adjustment of its economic structure. For example, in 2007, the People’s Bank of China published regulations to supervise and guide financial institutions in favour of environmentally friendly enterprises. In addition, China has taken measures to promote the in-depth integration of digitalization and greening to accelerate technological innovation and improve regional eco-efficiency.

In addition, as shown in Table 4, the finding that digitalization is beneficial for eco-efficiency is consistent with the findings of Li et al. (2020) and Lin and Zhou (2021). There are reasons for this: One reason is that digital technology can bring about energy efficiency improvement and pollution reduction through data-driven decisions (e.g. big data mining); another reason is that digitalization is an important carrier for technology innovation and diffusion across regions (Lin and Zhou 2021). In addition, as an effective resource allocation tool, digitalization reshapes resource utilization efficiency and drives the upgrading of industries (Ren et al. 2021).

In terms of control variables, we observe the following: (1) R&D investment has a significant effect on regional eco-efficiency, which is consistent with Khan et al. (2019), because the increase in R&D investment is beneficial for ecological technology innovation, thus decreasing pollution emissions; (2) intellectual property protection has also stimulated the innovation of energy-saving and environmentally friendly technologies to a certain extent, so it is also positively correlated with regional eco-efficiency (Hao et al. 2021a, b); (3) the development of the secondary sector with higher emissions commonly aggravates environmental pollution, while the increase in the tertiary industry improves environmental quality (Hao et al. 2020). This is also verified by the positive coefficient of industrial structure upgrading (upg).

Robustness tests

To check the robustness of the estimated results, we take strategies including replacing the variable of eco-efficiency ree1 with ree2, reducing the sample time interval, increasing the sample time interval, and adopting the FGLSFootnote 3 estimated method. The estimated results are shown in Table 5. We find the coefficients of digitalization and financial development to still be significantly positive, and the difference in the magnitude of those coefficients is very small in the three cases. This indicates that the estimated results in Table 4 are robust.

Resolution of potential endogeneity problems

We adopt 2SLS to address the potential endogeneity problems. According to previous research, historical data may be a good instrumental variable. We use the number of post offices (post) in 1984 as the IV for digitization (Wu et al. 2021). The reasons are as follows: Before the separation of postal services and telecommunications services in 1998, post offices in China are the organization that handles postal and telecommunication services (Jiang et al. 2022). The distribution of post offices affects the distribution of fixed telephones to a certain extent. Referring to Agrawal (2021), many Internet and digital connections are made through cables or telephone lines and historical infrastructure can predict current-day Internet and digital development. Therefore, this paper selects the number of post offices in 1984 as an IV for regional digitization, which can satisfy the correlation requirement. Besides, post offices in the early days are difficult to affect the regional ecological efficiency, meeting the requirement of exclusivity. Accordingly, this paper selects the number of post offices in 1984 as an IV for regional digitization. Table 6 shows that after considering potential endogeneity problems, digitization can still promote eco-efficiency.

Dynamic effect analysis

Before the PVAR model is established, the panel unit root test determining whether the sample data are stationary is conducted to prevent spurious regression that may be caused by nonstationary data. The common root test (LLC test) and different root test (ADF-Fisher test) are employed for comprehensive comparison (the results are shown in Table 7). We can see that all core variables pass LLC and ADF-Fisher tests at a statistical level of 1%, indicating that the data are stationary.

The determination of the lag length is vital for the VAR model because parameter estimation relies on the correct specification. Here, we utilize the AIC and BIC information criterion to determine the lag order. According to the results in Table 8, the first-order lag for financial development and the second-order lag for digitalization are included in the VAR system because they have the minimum value of AIC and BIC.

To explore the whole dynamic process of the regional eco-efficiency response to the shock from digitalization and financial development, the impulse response over ten periods is tracked by 500 Monte-Carlo simulations using Stata software. Figure 2 shows the standard deviation impulse response graph of financial development and digitalization to regional eco-efficiency. Here, the horizontal axis represents the time intervals, while the vertical axis is the response of the dependent variable impacted by the independent variable; the solid line in the middle is the impulse value of a variable in response to a one standard deviation impact from digitalization and financial development, respectively; the upper and lower bounds are the 95% confidence interval. To analyse the impulse response graph, we have the following findings:

Regional eco-efficiency has a positive reaction to a standard deviation impulse from financial development. Such a response reaches the peak in the first period, then slowly decreases, and lasts 10 periods. This indicates that financial development promotes regional eco-efficiency, and this impact lasts for a long time. This is because financial development not only helps address the lack of enterprise capital in the short term (Shahbaz and Lean 2012) but is also beneficial for industrial structure upgrading by building capital flow into resource-saving and environmentally friendly sectors in the long run ( Jiang et al. 2020).

Similar to the response from financial development, regional eco-efficiency presents a positive reaction for a standard deviation impulse from digitalization, and such an impact lasts 10 periods. The reason is that digital technology development needs to go through the whole process of cultivation and growth. Once the scale effect of the digital economy is formed, the impact of the digital economy on ecological efficiency is long term and effective. Another phenomenon is that the response of ecological efficiency to financial development is greater than its response to digitalization.

Threshold effect analysis

Figure 1 shows that digitalization has a positive non-linear relationship with regional eco-efficiency. We further explore the complex relationship between them using the threshold regression model, as discussed in the “Threshold effect tests using panel threshold regression” section. First, we need to check the threshold effects and the number of threshold values. F-statistics based on the bootstrap simulation method are used for verification with financial development as threshold variables.

According to the results in Table 9, financial development accepts the dual threshold hypothesis, indicating that the threshold effect of the impacting mechanism for eco-efficiency is verified. Then, Table 10 presents the threshold estimated value taking financial development as threshold variables. In the model with digitalization as the core explanatory variable, the two threshold estimators for financial development are 0.841 and 0.937, respectively.

According to the results presented in Tables 9 and 10, the estimated results of the threshold regression model are shown in Table 11.

The results in Table 11 show that the impact of digitalization on regional eco-efficiency is not significant when financial development is lower than the second threshold, while it is significant when it exceeds the second threshold. This shows that immature digitalization cannot promote eco-efficiency, while well-developed digitalization is beneficial for the improvement in eco-efficiency. The reason is that in the advanced stage, the industrial digitalization and digital industry further integrate with the financial and environmental protection industries to promote the improvement in ecological efficiency. However, in the early stage of the digital industry, due to a lack of financial and technical support, this integration is very weak.

Heterogeneity effect analysis

The above regression analysis shows that digitization affects eco-efficiency, but whether this effect differs between different geographic regions and regions with economic development levels requires further analysis.

Regional heterogeneity test

Studies have shown that location conditions are one of the factors that affect digitization. In order to examine whether there are significant regional differences in the impact of digitization on eco-efficiency, this paper divides the sample into eastern, central, and western regions for regional heterogeneity test. The results are shown in Table 12. It can be seen that for the eastern and central regions, the development level of the digital economy will promote the improvement of eco-efficiency in the region, but the ecological effect of digitization is not significant in the western region. The possible reason is that compared with the western region, the eastern and central regions have a better foundation for economic development and can provide better element support for digital development. Moreover, the industrial structure of the eastern and central regions has a high tendency of “service-oriented”.

Economic heterogeneity test

The impact of digitalization on eco-efficiency may be related to the level of economic development. Therefore, this paper divides all provinces into two groups based on the median of GDP. Specifically, all provinces are divided into a group of provinces with a high level of economic development and a group of provinces with a low level of economic development. The heterogeneity result is shown in Table 12. The result shows that digitalization significantly improves eco-efficiency, and the ecological effects of digitalization are significantly different in provinces with different economic development levels. Specifically, the higher the level of economic development in a region, the more obvious the effect of digitalization on ecological efficiency in the region. The possible reason is that in regions with a higher level of economic development, there are sufficient funds, talents, and technologies to vigorously promote digitization, and the effect of digitization on ecological efficiency can be better presented.

Conclusions and policy implications

This study focuses on the relationship between financial development, digitalization, and regional eco-efficiency using 30 Chinese provincial regions from 2006 to 2018 as a sample. The regression fixed effect model, the PVAR model, and the threshold regression model are used to explore the impact mechanism of financial development and digitalization on regional eco-efficiency. Here, two methods, namely, the super-SBM and the SBM, are employed to measure regional eco-efficiency, and robustness tests are carried out to check the empirical results. The following conclusions are drawn: (1) Both digitalization and financial development have a significantly positive correlation with regional eco-efficiency, thus indicating that China’s digitalization and financial development in recent years have both improved regional eco-efficiency. (2) Eco-efficiency has a positive and longer response to the impulse from digitalization and financial development, and the response of ecological efficiency to financial development is greater than its response to digitalization. (3) Threshold effects exist in the impact mechanism of financial development and digitalization on regional eco-efficiency. In the early stage, neither digitalization nor financial development has a significant relationship with eco-efficiency. However, when they exceed the threshold value, such an impact becomes significant.

These results not only are conducive to understanding the factors that affect regional eco-efficiency but also help the government and enterprises accurately grasp the law of eco-efficiency development to make specific measures to improve eco-efficiency. Based on these findings, the following policy implications are proposed:

-

(1)

According to our findings, financial development has a long-term positive effect on regional eco-efficiency. Thus, the government should pay more attention on how to utilize financial tools to support green development. For example, the government should formulate differentiated borrowing standards according to enterprises’ emissions levels to guide the flow of social resources to cleaner and environmentally friendly industries.

-

(2)

The findings of this study reveal the role of digitalization in promoting regional eco-efficiency. Thus, investment in digital infrastructure is needed to strengthen digital development. The government should value the opportunity of this technological revolution to develop digital platforms and enhance the ability of industrial collaborative innovation; moreover, big data, cloud computing, and the Internet of Things (IoT) can be used to supervise the process of production and operation to help traditional high-polluting industries reduce emissions and improve green operational management.

-

(3)

According to our empirical results, only when the levels of digitalization and financial development are both higher enough can improve eco-efficiency significantly. Therefore, regions should strengthen the interaction of digital technologies and the financial system. On the one hand, the government should create new modes, such as financial digital platforms, to deepen financial digitalization; on the other hand, digital technology should be combined with green development to promote industrial structure upgrading and green development through digital strategies. Finally, the government should integrate greening, digitalization, and finance into one unified framework, thereby effectively improving the eco-efficiency of the Chinese region.

In conclusion, this study aims to analyse the influencing mechanism of digitalization and financial development on eco-efficiency. However, there are some limitations to this study. First, in the DEA model used to calculate regional eco-efficiency, the heterogeneity of ecological conditions (e.g. pollutant characteristics and energy structure) across regions in China are neglected. We intend to pay more attention to such topics in the future. Second, this study takes 30 provincial regions as the sample due to the lack of enterprise-level sample data. However, focusing on microenterprise will provide a deeper insight into the interaction of the three variables (digitalization, financial development, and eco-efficiency) than that at the provincial level. Therefore, we will use enterprise-level data to study the impact of digitalization and financial development on eco-efficiency in the future.

Data availability

All data generated or analysed during this study are included in this published article.

Notes

Studies have shown that the energy consumed by various information technology products to ensure their function of “instant start” accounts for 5–15% of residential energy use (IEA, 1998).

In 2002, the International Finance Corporation and ABN AMRO, a subsidiary of the World Bank, proposed a corporate loan standard at a meeting of internationally renowned commercial banks held in London. This standard requires financial institutions to conduct a comprehensive assessment on the possible environmental and social impacts when investing in a project and use financial leverage to promote environmental protection and the harmonious development of the surrounding society. These are the well-known “Equator Principles”.

Feasible generalized least squares (FGLS) estimates the coefficients of a multiple linear regression model and their covariance matrix in the presence of nonspherical innovations with an unknown covariance matrix.

References

Agrawal DR (2021) The internet as a tax haven? Am Econ J Econ Pol 13(4):1–35

An S, Li B, Song D, Chen X (2021) Green credit financing versus trade credit financing in a supply chain with carbon emission limits. Eur J Oper Res 292(1):125–142

Baloch ZA, Tan Q, Khan MZ, Alfakhri Y, Raza H (2021) Assessing energy efficiency in the Asia-Pacific region and the mediating role of environmental pollution: evidence from a super-efficiency model with a weighting preference scheme. Environ Sci Pollut Res 28(35):48581–48594

Charfeddine L, Kahia M (2019) Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: a panel vector autoregressive (PVAR) analysis. Renewable Energy 139:198–213

Chen YF, Liu LS (2022) Improving eco-efficiency in coal mining area for sustainability development: an emergy and super-efficiency SBM-DEA with undesirable output. J Clean Prod 339:130701

Chen YF, Ma YB (2021) Does green investment improve energy firm performance? Energy Policy 153(1):112252

Chen X, Despeisse M, Johansson B (2020) Environmental sustainability of digitalization in manufacturing: a review. Sustainability 12(24):10298

Chen YF, Miao JF, Zhu ZT (2021) Measuring green total factor productivity of China’s agricultural sector: a three-stage SBM-DEA model with non-point source pollution and CO2 emissions. J Clean Prod 318:128543

Ezici B, Eğilmez G, Gedik R (2020) Assessing the eco-efficiency of US manufacturing industries with a focus on renewable vs non-renewable energy use: an integrated time series MRIO and DEA approach. J Clean Prod 253:119630

Fernández-Viñé MB, Gómez-Navarro T, Capuz-Rizo SF (2013) Assessment of the public administration tools for the improvement of the eco-efficiency of small and medium sized enterprises. J Clean Prod 47:265–273

Fukuyama H, Weber WL (2008) Japanese banking inefficiency and shadow pricing. Math Comput Model 48(11–12):1854–1867

Goldbach K, Rotaru AM, Reichert S, Stiff G, Gölz S (2018) Which digital energy services improve energy efficiency? A multi-criteria investigation with European experts. Energy Policy 115:239–248

Gray J, Rumpe B (2015) Models for digitalization. Softw Syst model 14:1319–1320

Han Y, Zhang F, Huang L, Peng K, Wang X (2021) Does industrial upgrading promote eco-efficiency?─A panel space estimation based on Chinese evidence. Energy Policy 154:112286

Hao Y, Ye B, Gao M, Wang Z, Chen W, Xiao Z, Wu H (2020) How does ecology of finance affect financial constraints? Empirical evidence from Chinese listed energy-and pollution-intensive companies. J Clean Prod 246:119061

Hao Y, Ba N, Ren S, Wu H (2021a) How does international technology spillover affect China’s carbon emissions? A new perspective through intellectual property protection. Sustain Prod Consum 25:577–590

Hao Y, Guo Y, Wu H (2021b) The role of information and communication technology on green total factor energy efficiency: does environmental regulation work? Bus Strateg Environ 31(1):403–424

Hsu A, Yeo ZY, Weinfurter A (2020) Emerging digital environmental governance in China: the case of black and smelly waters in China. J Environ Plan Manage 63(1):14–31

Ilankoon I, Ghorbani Y, Chong MN, Herath G, Moyo T, Petersen J (2018) E-waste in the international context–a review of trade flows, regulations, hazards, waste management strategies and technologies for value recovery. Waste Manage 82:258–275

Jalil A, Feridun M (2011) The impact of growth, energy and financial development on the environment in China: a cointegration analysis. Energy Econ 33(2):284–291

Jaud M, Kukenova M, Strieborny M (2018) Finance, comparative advantage, and resource allocation. Rev Finance 22(3):1011–1061

Jiang M, Luo S, Zhou G (2020) Financial development, OFDI spillovers and upgrading of industrial structure. Technol Forecast Soc Chang 155:119974

Jiang X, Zhou Z, Zhang B (2022) Digital financial inclusion and the relative poverty of migrant workers’ family. J Cent Univ Finance Econ 3:45–58

Khan Z, Sisi Z, Siqun Y (2019) Environmental regulations an option: asymmetry effect of environmental regulations on carbon emissions using non-linear ARDL. Energy Sources, Part a: Recover, Utilization, Environ Effects 41(2):137–155

Kounetas KE, Polemis ML, Tzeremes NG (2021) Measurement of eco-efficiency and convergence: evidence from a non-parametric frontier analysis. Eur J Oper Res 291(1):365–378

Kremer S, Bick A, Nautz D (2013) Inflation and growth: new evidence from a dynamic panel threshold analysis. Empir Econ 44(2):861–878

Lahouel BB (2016) Eco-efficiency analysis of French firms: a data envelopment analysis approach. Environ Econ Policy Stud 18(3):395–416

Lange S, Santarius T (2020) Smart green world?: Making digitalization work for sustainability. Routledge

Li L, Zheng Y, Zheng S, Ke H (2020) The new smart city programme: evaluating the effect of the internet of energy on air quality in China. Sci Total Environ 714:136380

Li DK, Chen YF, Miao JF (2021a) Does ICT create a new driving force for manufacturing?—Evidence from Chinese manufacturing firms. Telecommun Policy 46:102229

Li Y, Liu T, Song Y, Li Z, Guo X (2021b) Could carbon emission control firms achieve an effective financing in the carbon market? A case study of China’s emission trading scheme. J Clean Prod 314:128004

Lin B, Zhou Y (2021) Does the internet development affect energy and carbon emission performance? Sustain Prod Consum 28:1–10

Liu J, Qian Y, Yang Y, Yang Z (2022) Can artificial intelligence improve the energy efficiency of manufacturing companies? Evidence from China. Int J Environ Res Public Health 19(4):2091

Luo Y, Lu Z, Muhammad S, Yang H (2021) The heterogeneous effects of different technological innovations on eco-efficiency: evidence from 30 China’s provinces. Ecol Ind 127:107802

Meng Y, Yang Y, Chung H, Lee PH, Shao C (2018) Enhancing sustainability and energy efficiency in smart factories: a review. Sustainability 10(12):4779

Ren S, Li X, Yuan B, Li D, Chen X (2018) The effects of three types of environmental regulation on eco-efficiency: a cross-region analysis in China. J Clean Prod 173:245–255

Ren W, Zhang Z, Wang Y, Xue B, Chen X (2020) Measuring regional eco-efficiency in China (2003–2016): a “Full World” perspective and network data envelopment analysis. Int J Environ Res Public Health 17(10):3456

Ren S, Hao Y, Xu L, Wu H, Ba N (2021) Digitalization and energy: how does internet development affect China’s energy consumption? Energy Econ 98:105220

Salahuddin M, Alam K (2016) Information and communication technology, electricity consumption and economic growth in OECD countries: a panel data analysis. Int J Electr Power Energy Syst 76:185–193

Shahbaz M, Lean HH (2012) Does financial development increase energy consumption? The role of industrialization and urbanization in Tunisia. Energy Policy 40:473–479

Su S, Zhang F (2020) Modeling the role of environmental regulations in regional green economy efficiency of China: empirical evidence from super efficiency DEA-Tobit model. J Environ Manage 261:110227

Su CC, Liu J, Zhou B (2020) Two levels of digitalization and Internet use across Europe, China, and the US. Int J Commun 14:5838–5859

Sueyoshi T, Zhang R, Qu J, Li A (2021) New concepts for environment-health measurement by data envelopment analysis and an application in China. J Clean Prod 312:127468

Sun Y, Wang N (2021) Eco-efficiency in China's Loess Plateau region and its influencing factors: a data envelopment analysis from both static and dynamic perspectives. Environ Sci Pollut Res 1–15

Tang C, Xue Y, Wu H, Irfan M, Hao Y (2022) How does telecommunications infrastructure affect eco-efficiency? Evidence from a quasi-natural experiment in China. Technol Soc 69:101963

Tone K (2002) A strange case of the cost and allocative efficiencies in DEA. J Oper Res Soc 53(11):1225–1231

Wang M, Feng C (2019) Decoupling economic growth from carbon dioxide emissions in China’s metal industrial sectors: a technological and efficiency perspective. Sci Total Environ 691:1173–1181

Wang X, Ding H, Liu L (2019) Eco-efficiency measurement of industrial sectors in China: a hybrid super-efficiency DEA analysis. J Clean Prod 229:53–64

Wang S, Wang H, Wang J, Yang F (2020) Does environmental information disclosure contribute to improve firm financial performance? An examination of the underlying mechanism. Sci Total Environ 714:136855

Wang G, Zhang G, Guo X, Zhang Y (2021a) Digital twin-driven service model and optimal allocation of manufacturing resources in shared manufacturing. J Manuf Syst 59:165–179

Wang X, Zhao H, Bi K (2021b) The measurement of green finance index and the development forecast of green finance in China. Environ Ecol Stat 28(2):263–285

Wang R, Zhao X, Zhang L (2022) Research on the impact of green finance and abundance of natural resources on China’s regional eco-efficiency. Resour Policy 76:102579

Wu H, Xue Y, Hao Y, Ren S (2021) How does internet development affect energy-saving and emission reduction? Evidence from China. Energy Econ 103:105577

Xu B, Costa-Climent R, Wang Y, Xiao Y (2020) Financial support for micro and small enterprises: economic benefit or social responsibility? J Bus Res 115:266–271

Yang B (2021) Research on the coordination of green finance and green economy with the goal of sustainable development. Mod Econ Manag Forum 2(4):154–156

Zhang M, Lv Z (2021) The influencing factors of financial support efficiency of new generation high-tech industry in China: evidence from listed companies. Theor Econ Lett 11(4):771–788

Zhang D, Tong Z, Zheng W (2021) Does designed financial regulation policy work efficiently in pollution control? Evidence from manufacturing sector in China. J Clean Prod 289:125611

Zhu B, Jiang M, Zhang S et al (2020) Resource and environment economic complex system: models and applications. Science Press, Beijing

Funding

The authors are grateful for financial support from the Beijing Natural Science Foundation of China (9192006), Nature science foundation of China (71704047) and the Capital Circulation Research Base of China (JD-ZD-2021–003).

Author information

Authors and Affiliations

Contributions

Conceptualization, methodology, funding acquisition: Jiujiu Cui,Zhenling Chen, Wenju Wang, Guangqian Ren, Xiaofang Gao. Analysis and interpretation: Jiujiu Cui, Zhenling Chen, Wenju Wang. Writing, review and editing: Jiujiu Cui, Guangqian Ren, Xiaofang Gao. Final approval of the article: Jiujiu Cui, Wenju Wang, Zhenling Chen, Guangqian Ren, Xiaofang Gao. Overall responsibility: Jiujiu Cui, Wenju Wang, Zhenling Chen, Guangqian Ren, Xiaofang Gao.

Corresponding author

Ethics declarations

Ethics approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Written informed consent for publication was obtained from all participants.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Ilhan Ozturk

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Cui, J., Wang, W., Chen, Z. et al. How digitalization and financial development impact eco-efficiency? Evidence from China. Environ Sci Pollut Res 30, 3847–3861 (2023). https://doi.org/10.1007/s11356-022-22366-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-22366-5