Abstract

This paper proposes a green finance index that may help policymakers and investors take more favorable actions based on the development of green finance. After analysis and organization of the development process of green finance and related green finance and index concepts, this paper uses the improved fuzzy comprehensive evaluation method to construct a measurement model suitable for measuring the development level of green finance based on the principle of fuzzy mathematics. The index weight adopts the entropy method and improved Analytic Hierarchy Process (AHP) joint determination. At the same time, using the relevant statistical indicators of China's green credit from 2011 to 2019, and using the constructed model, the level of China's green finance development during this period was evaluated. Finally, the obtained data and classical gray model methods were used to predict China's green development level from 2020 to 2024. The research results show that: This model is a good measure of the level of development of green finance, and China's green finance index has generally shown a rapid growth trend over the past nine years, with the fastest growth rate between 2013 and 2014. From the perspective of the weight of each index affecting the green financial index, the weight of new energy, green transportation projects and new energy vehicles ranked in the top three, and the impact of these three indexes on China's green financial index is significant. In the future, China's green financial development level will continue to improve.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

With the progress of society and development of society, the economic development behavior of simply pursuing profits has gradually withdrawn from the historical stage. A series of financial models focusing on environmental protection and sustainable development, such as green finance, environmental finance, and sustainable finance, have been widely accepted and valued. From the perspective of the transmission mechanism of green finance, research in developed countries is often carried out from a market perspective and pays more attention to market forces. Investors' funding and the exercise of shareholders' voting rights directly affect the company's decision-making, thereby guiding or promoting the development of green finance. However, green finance in developing countries such as China is often transmitted through government departments and related financial institutions so as to achieve policy promotion (Zhang et al. 2016; Yang and Ma 2017). Regardless of the transmission mechanism and development of green finance, realizing the construction of a green financial system, rationally assessing the level of green finance development, and improving the green financial system framework and incentive policies are urgent issues that need to be resolved.

At present, the research results on green finance mainly focus on the theoretical discussion on the development history, connotation, policy and transmission mechanism of green finance and the promotion of the experience of green finance practice. It is undeniable that the academic results of these studies have played an important role in understanding the relevant theories of green finance and summarizing past experience and methods. However, in order to promote in-depth development of green finance, we can not do without in-depth exploration at the theoretical level and the quantification of the development level of green finance. A reasonable measurement of the green finance index can study the dynamic relationship between the development of green finance and the operation of the macro-economy, which is conducive to the evaluation of the development process of green finance. The development evaluation of green finance is an extension and deepening of existing theories.

The main contributions of this article are reflected in the following aspects. From the perspective of academic theory: First, it provides a quantitative measurement model to measure the development level of China's green finance and academic analysis of similar mechanisms; second, in the direction of green finance, a measurement model combining entropy method and improved AHP method is adopted to expand the application range of the model. From the perspective of practical applications: First, by correctly measuring the level of green finance development, the achievements of green finance can be more intuitively reflected in any year or time period; second, through the analysis of the green finance index, a quantitative analysis method is provided for the actual work of the government, so that the government can strengthen a certain field more effectively and realize a more efficient green finance promotion mechanism; third, forward-looking forecasts can enable government departments to take action in advance and formulate more effective policies to support the growth of green finance. The market will also receive relevant signals in advance and take favorable actions.

The structure of the paper is arranged as follows: Sect. 2 is a literature review, introducing the meaning of green finance index and related content of its evaluation and measurement. Section 3 is the construction of the model, including the selection of weight indicators and methods. Section 4 is about using the model to measure China's green finance development level and forecast. Section 5 is the conclusion and policy implications.

2 Literature review 2.1 The meaning of green financial index

When it comes to the green finance index, we have to first discuss the development process and related concepts of green finance. Back in 1974, Germany took the lead in establishing the world's first policy-oriented environmental protection bank. By 1992, after the adoption of the "Rio Declaration" and "21st Century Agenda" and the signing of the "United Nations Framework Convention on Climate Change" and "Convention on Biological Diversity", environmental protection, energy conservation and emission reduction have become the focus of attention around the world, and green finance has also developed rapidly. In 1997, the signing of the Kyoto Protocol further promoted research on green finance (Deng 2012). In 2002, the well-known "Equator Principles" was jointly proposed by the International Finance Corporation and ABN-AMRO BANK. The adoption of The Paris Agreement in 2015 marked the beginning of a global economic activity transition to a greener, low-carbon and sustainable direction. By the end of 2017, 92 financial institutions in 37 countries around the world announced their adoption of Equator Principles, and project financing accounted for approximately 85% of global financing (Chen et al. 2018; Peng et al. 2018). In 2019, the International Seminar “ON GREENING THE FINANCIAL SYSTEM IN CENTRAL AND SOUTH ASIA” was held in Kazakhstan. More than 130 representatives from 19 countries participated in the conference. Issues were discussed and suggestions were made on how to build a green financial system in Central and South Asia (Green Finance Committee of CFA 2019). At the same time, the discussion on the concept of green finance has never stopped. This was the case until 2016 when the International Finance Organization (IFC) proposed a broad definition of green finance at the G20 summit as: All investment and financing activities that provide environmental benefits. It includes not only environmental finance, but also broader sustainable development goals, such as reducing environmental pollution, improving resource use efficiency, protecting biodiversity, and so on. It also includes the management of environmental risks by the financial system (Green Finance Research Group 2016).

An index is often called a statistical index, which is an important statistical method to analyze the quantitative changes of social and economic phenomena. They can be divided into individual indexes and total indexes according to the scope of the phenomena they reflect. The former reflects the relative number of changes in individual economic phenomena, such as the price index of individual goods; the latter reflects the relative number of changes in all economic phenomena, such as the index of total industrial output value and the total index of consumer price (Jia et al. 2009). Various indexes in our lives often provide us with conveniences, such as GDP, Engel coefficient, CPI, etc., which makes it easier to measure and compare the economic level of countries or regions. In the stock market, FTSE China A50 Index, Dow Jones industrial average index, S & P 500 index and Nasdaq 100 index, etc., make it easy for us to acquire the stock market quotation around the world no matter where we are. The index is often objective and easy to compare.

Indices are often objective and easy to compare. The green finance index in this article adopts a method of weighting the indicators involved so as to reflect the relative statistics of the green finance development level and change trend in a certain region or field over a period of time.

2.1 Evaluation measure of green finance

Due to the late start of research on green finance-related theories, there is no international unified green finance evaluation index system, and scholars have mainly focused on theoretical research. Through the literature review, this paper believes that the research on green financial evaluation mainly focuses on two aspects:

One is to measure the development level of green finance in a region from a macro perspective. Zeng et al. (2014) combined with the composition of China's existing green financial services, evaluated green finance from five dimensions and used the subjective method of expert scoring and the objective method of asset size in various financial fields to determine the weight of the index. Akin et al. (2016) developed a financial friendliness index based on factor analysis and nonlinear weighting to compare the degree of financial risk-sharing and support among countries. Hayat et al. (2018) formed the financial development index through econometric analysis, thus revealing that in the short term, Pakistan's financial development index and energy price are significantly related to energy consumption. Li et al. (2018) divided the green financial development index system into two categories: Green financial market performance index and green financial ecological environment index, thus building the green financial development index. The research group of Wuxi central sub-branch of the people's Bank of China (2019) evaluated the sustainability of green financial development from three dimensions of green financing, green investment and green society, and measured and evaluated the comprehensive level of sustainable development of green finance in China by building a comprehensive evaluation system of sustainable development of green finance. Mohsin et al. (2020) used the DEA-like weight distribution method through this DEA-like comprehensive index to expand a low-carbon financial index and used it to measure the development level of low-carbon finance in developing countries and underdeveloped countries.

Second, based on the micro perspective, to measure the green financial situation of a certain field or institution. Street et al. (2001) constructed indicators for the relationship between green service channels of banks and green finance, and compared the performance of three channels of physical outlets, self-service, and automated facilities, virtual banks in terms of energy conservation, emission reduction, and environmental protection. Hof et al. (2011) used a comprehensive fairness model method to evaluate four climate finance programs designed for developing countries based on the three criteria of adequacy, predictability, and fairness. WWF, China Banking Regulatory Commission and Price Waterhouse Coopers (2014) jointly released the report, using the form of a questionnaire to compare and evaluate the green finance behaviors of 12 Chinese banks such as China Development Bank, Industrial and Commercial Bank of China and 10 other banks following the Equator Principle, such as Citibank. The research group of Shizuishan central sub-branch of the people's Bank of China (2018) constructed the evaluation system of China's Green Financial Development Based on the Balanced Scorecard evaluation system of EVA, and achieved the measurement of the overall situation of each bank's green financial development by setting the indicators of green credit and asset quality, social effect, organizational management, learning and growth. The bidding research group of Nanchang center sub-branch of the People's Bank of China (2018) constructed the green financial index evaluation system of 11 green financial innovation pilot areas in China from four dimensions of capital support, capital allocation, enterprise supervision, and financial responsibility.

3 Construction of green financial evaluation index model

The fuzzy comprehensive evaluation method is a comprehensive evaluation method based on fuzzy mathematics. The comprehensive evaluation method transforms qualitative evaluation into quantitative evaluation based on the membership theory of fuzzy mathematics, that is, using fuzzy mathematics to make an overall evaluation of things or objects restricted by multiple factors. It comprehensively judges the subordination status of the evaluated object from multiple indicators, and divides the change interval of the evaluated object. On the one hand, it can take into account the hierarchical nature of the object, so that the ambiguity of evaluation standards and influencing factors can be reflected; on the other hand, people’s experience can be fully utilized in the evaluation to make the evaluation results more objective and in line with actual conditions. The advantage of this analysis method is that it can combine qualitative and quantitative factors, expand the amount of information, increase the number of evaluations, and make the evaluation conclusion more credible. In addition, it has the characteristics of being a strong system providing clear results, can better solve vague and difficult to quantify problems, and is suitable for solving various non-deterministic problems.

Based on the principle of fuzzy mathematics, this paper uses an improved fuzzy comprehensive evaluation method to construct an index model to measure the development level of green finance. The green finance evaluation index can well reflect the direction and degree of the overall change of green finance in a certain area or field. Furthermore, it can explain the actual effect of changes in the relevant influencing factors by observing the value of the green financial evaluation index, it can also better and more objectively reflect the overall change of green finance in a certain area or field.

The idea of compiling the evaluation index is to standardize the data according to the standard deviation of each evaluation index, and then a comprehensive evaluation index is synthesized based on the determined weights. It is very difficult to determine the weights accurately. The key lies in how to accurately grasp the impact of various inputs on green finance. Simply put, the first step is to determine the mean of each indicator and calculate the sample standard deviation. The actual value is defined as \(x_{i} (i = 1,2, \cdots ,m)\). The second step is to dimensionless process the indicators, that is, to standardize the data. In order to ensure the effective synthesis of different measurement indicators, the dimensional relationship between variables needs to be eliminated so that the data are comparable. The third step is to determine the weight of the indicator. In the process of synthesizing the comprehensive evaluation index, each index needs to be weighted to reflect the different roles of the index, and the method of determining the weight directly affects the accuracy of the comprehensive evaluation index. This part is also the one which most needs to be discussed, which will be explained later. The fourth step is to calculate the green finance index value. The results of dimensionless processing of various indicators and the corresponding weight coefficients are based on the formula:

3.1 Determine the weight of the evaluation index

The determination of the weight of each evaluation index is very important in studying the evaluation of the development level of green finance, which directly affects the accuracy of the evaluation results (Liu and Lin 2006). At present, the weight is usually determined by subjective experience and expert surveys or factor analysis. Because subjective weighting methods rely on experts' knowledge of the importance of indicators to give weight to indicators, such methods rely on experts to a certain extent. Although the factor analysis method avoids the influence of human factors and subjective factors, the weighting result fails to objectively reflect the actual importance of the indicator, and sometimes there is a certain gap between the weighting result and the actual. Therefore, this article adopts the combination weighting method for weighting, combining subjective weighting method (improved AHP method) and objective weighting method (entropy weight method) to form a new comprehensive weight (He and Chen 2004) for green finance to evaluate the development level, that is, AHP-entropy comprehensive weighting method. Through the improved fuzzy comprehensive evaluation method, the weight assignment uses the analytic hierarchy process, and the entropy weight method is used to modify it. The interaction between the indicators is comprehensively considered, and the weights obtained are more in line with the actual situation.

3.1.1 Choice of subjective empowerment law

The subjective weighting method is to determine the weight coefficient of each evaluation object according to the subjective cognition and preference of the judge. It is a qualitative analysis method, which mainly includes the analytic hierarchy process (Deng et al. 2012), direct judgment method, and Delphi method (Tian et al. 2004). Among them, the analytic hierarchy process refers to the relative importance value given by the experts by comparing the evaluation indicators one by one, so as to construct a judgment matrix, and then mathematically calculate the judgment matrix after the consistency test, and finally obtain the weight coefficient. This method is suitable for the evaluation problem of hierarchical structure between qualitative and quantitative indicators, which is consistent with the model to be constructed in this paper, but its disadvantage is that there is a problem of consistency verification and correction of the judgment matrix given by the subject, so this paper refers to Jin et al. (2004), Xu et al. (2005), Bu et al. (2013) and Hu et al. (2014), using the Accelerating Genetic Algorithm (AGA) (Jin et al. 2001) to check and correct the new model of fuzzy comprehensive evaluation (AHP-FCE) for judging the consistency of matrices and calculating the weight of each element in AHP is used in the evaluation model of green finance development level.

The steps for determining weights based on the improved analytic hierarchy process are as follows:

-

(1)

Without loss of generality, there are \(n\) evaluation indicators to compose the evaluation index sample data for all \(m\) programs as \(\left\{ {x\left( {i,j} \right)\left| {i = 1} \right.\sim n,j = 1\sim m} \right\}\), each \(x\left( {i,j} \right)\) indicator value is non-negative. In order to construct a judgment matrix and eliminate the dimensional effect of each evaluation index, so that the modeling has universality, it is necessary to standardize the sample data set \(\left\{ {x\left( {i,j} \right)} \right\}\). In order to keep the change information of each evaluation index value as much as possible, the standardized processing formula for the larger and better index can be taken as

$$r\left( {i,j} \right) = x\left( {i,j} \right)/\left[ {\mathop x\nolimits_{\max } \left( i \right) + \mathop x\nolimits_{\min } \left( i \right)} \right]$$(1)The standardized processing formula for smaller and better indicators can be taken as

$$r\left( {i,j} \right) = \left[ {\mathop x\nolimits_{\max } \left( i \right) + \mathop x\nolimits_{\min } \left( i \right) - x\left( {i,j} \right)} \right]/\left[ {\mathop x\nolimits_{\max } \left( i \right) + \mathop x\nolimits_{\min } \left( i \right)} \right]$$(2)The standardized processing formula for the Vietnam-China-China Excellence Index can be taken as

$$r\left( {i,j} \right) = \left\{ {\begin{array}{*{20}l} {x\left( {i,j} \right)/\left[ {\mathop x\nolimits_{mid} \left( i \right) + \mathop x\nolimits_{\min } \left( i \right)} \right],\mathop x\nolimits_{\min } \left( i \right) \le x\left( {i,j} \right){ < }\mathop x\nolimits_{mid} \left( i \right)} \\ {\left[ {\mathop x\nolimits_{\max } \left( i \right) + \mathop x\nolimits_{mid} \left( i \right) - x\left( {i,j} \right)} \right]/\left[ {\mathop x\nolimits_{\max } \left( i \right) + \mathop x\nolimits_{mid} \left( i \right)} \right],\mathop x\nolimits_{mid} \left( i \right) \le x\left( {i,j} \right){ < }\mathop x\nolimits_{\max } \left( i \right)} \\ \end{array} } \right.$$(3)In the formula: \(\mathop x\nolimits_{\min } \left( i \right)\)、\(\mathop x\nolimits_{\max } \left( i \right)\)、\(\mathop x\nolimits_{mid} \left( i \right)\) are the minimum, maximum, and intermediate optimal values of the \(i\) th indicator in the solution set; \(r\left( {i,j} \right)\) is the standardized evaluation index value, that is, the value of the relative membership of the \(j\)-th scheme to the \(i\)-th evaluation index, \(i = 1\sim n\), \(j = 1\sim m\).

Using these values \(r\left( {i,j} \right)\) as elements can form a fuzzy evaluation matrix \(R = \left( {r\left( {i,j} \right)} \right)_{n \times m}\) of evaluation indexes.

-

(2)

Construct a judgment matrix \(R = \left( {r\left( {i,j} \right)} \right)_{n \times m}\) for determining the weight of each evaluation index according to the fuzzy evaluation matrix \(B = \left( {\mathop b\nolimits_{ij} } \right)_{n \times n}\). The essence of fuzzy comprehensive evaluation is an optimal process. From the perspective of comprehensive evaluation, if the change degree of sample series \(\left\{ {r\left( {i1,j} \right)\left| {j = 1\sim m} \right.} \right\}\) of evaluation index \(i1\) is greater than that of sample series \(\left\{ {r\left( {i2,j} \right)\left| {j = 1\sim m} \right.} \right\}\) of evaluation index \(i2\), the comprehensive evaluation information transmitted by evaluation index \(i1\) pass more than evaluation index \(i2\). Therefore, the sample standard deviation \(s\left( i \right) = \left[ {\sum\limits_{j = 1}^{m} {\left( {r\left( {i,j} \right) - \overline{{\mathop r\limits_{i} }} } \right)^{2} } /m} \right]^{0.5}\) of each evaluation index can be used to reflect the degree of influence of each evaluation index on the comprehensive evaluation, and used to construct the judgment matrix B. Where \(\overline{{r_{i} }} = \sum\limits_{j = 1}^{m} {r\left( {i,j} \right)/m}\) is the mean of the sample series under each evaluation index, \(i = 1\sim n\). Therefore, according to Eq. (4), a judgment matrix with a judgment scale of 1–9 can be obtained.

$$b_{ij} = \left\{ {\begin{array}{*{20}l} {\frac{s\left( i \right) - s\left( j \right)}{{\mathop s\nolimits_{\max } - \mathop s\nolimits_{\min } }}\left( {\mathop b\nolimits_{m} - 1} \right) + 1,s\left( i \right) \ge s\left( j \right)} \\ {1/\left[ {\frac{s\left( j \right) - s\left( i \right)}{{\mathop s\nolimits_{\max } - \mathop s\nolimits_{\min } }}\left( {\mathop b\nolimits_{m} - 1} \right) + 1} \right],s\left( i \right){ < }s\left( j \right)} \\ \end{array} } \right.$$(4)In the formula: \(\mathop s\nolimits_{\min }\) and \(\mathop s\nolimits_{\max }\) are the minimum and maximum values of \(\left\{ {s\left( i \right)\left| {i = 1\sim n} \right.} \right\}\), respectively; the relative importance parameter values \(\mathop b\nolimits_{m} = \min \left\{ {9,{\text{int}} \left[ {\mathop s\nolimits_{\max } /\mathop s\nolimits_{\min } + 0.5} \right]} \right\}\), min and int are respectively a small function and a rounding function.

-

(3)

Solve the maximum eigenvalue of the judgment matrix and its corresponding eigenvector

At present, for the calculation method of the judgment matrix, the geometric average method, arithmetic average method, eigenvector method and least square method are commonly used. Among them, the eigenvector method means that a vector \(C\) exists and has only one maximum eigenvalue \(\lambda_{\max }\), and the component vectors of \(C\) are all positive component vectors. The vector \(A\) is obtained according to the formula \(AC = \lambda C\) and normalized, and the weighted result is obtained.

-

(4)

Consistency inspection

For practical applications, for example, the judgment matrix composed of expert opinions may not be consistent, which is affected by factors such as the expert's knowledge level and actual experience. It is not possible to require the judgments made by each expert to be completely consistent; as long as these judgments are within a certain allowable range, it is desirable.

Suppose the importance of A, B, and C: A is greater than B, B is greater than C, and C is greater than A. According to the transitivity of the inequality, it is known that A is more important than C, which contradicts the third inequality. Therefore, in actual application, each judgment needs to be tested to avoid the above errors. The consistency check is to use the judgment matrix to remove the negative mean of the other eigenvalues of the maximum eigenvalue \(\lambda_{\max }\) as a numerical index to measure whether the judgment matrix is consistent, that is, the consistency inspection index CI:

$$CI = \frac{{\mathop \lambda \nolimits_{\max } - n}}{n - 1}$$(5)The smaller the CI value, the better the consistency; otherwise, the opposite is true. For the judgment of complex things, it is enough to use only the CI value for testing. Therefore, we introduce the RI average random consistency index. For the 1 ~ 11 order judgment matrix, the values of RI are shown in Table 1.

Table 1 Consistency indicators Through the above steps, the weight \(W_{A}\) of the improved AHP can be solved.

3.1.2 Choice of objective empowerment law

The method of observing weight is to determine the weight coefficient based on the relationship between actual data. Because it is not affected by subjective consciousness, it is more objective. The objective weighting methods mainly include the principal component analysis method (Zheng et al. 2008), entropy weight method (Huang et al. 2012), coefficient of variation method (Guo 2011), and multiplier method. Among them, the entropy weight method is provided by the actual data of each evaluation index to determine the weight, that is, the greater the degree of difference between the indicators, the smaller the entropy value. At this time, the indicator provides more information, and the final weight index is larger; and vice versa. The entropy weight method can truthfully reflect the mutual influences and effects between indicators, and is suitable for a comprehensive evaluation of multi-index systems. In recent years, it has been widely applied and studied. The objective weighting method in this article will also use the entropy weight method.

The calculation steps of the entropy weight method are as follows:

First, normalize the raw data.

The original data is an \(n \times m\) matrix composed of \(n\) evaluation indicators and \(m\) evaluation objects, that is:

Use formulas for smaller and better indicators

After normalization, a judgment matrix is obtained

Then, according to the definition of entropy, there are \(n\) evaluation indexes and \(m\) evaluation objects. The entropy of the \(i\)-th index is defined as:

In the formula:\(\mathop f\nolimits_{ij} = \mathop y\nolimits_{ij} /\sum\limits_{j = 1}^{m} {\mathop y\nolimits_{ij} }\),Obviously when \(\mathop f\nolimits_{ij} = 0\), \(\ln \mathop f\nolimits_{ij}\) is meaningless, making it \(\ln f_{ij} = 0\).

Then the entropy weight can be calculated using the following formula:

Through the above formula, the weight \(W_{S}\) of the entropy weight method is obtained.

3.2 Calculation of green finance evaluation index

Through the calculation of the indicator weight in the previous article, the green finance index is finally obtained by the following formula:

4 The development level and forecast of China's green finance

As the concept of green finance has become more and more valued by the international community, the related issues have gradually reached consensus among all parties, China, whose concept of green finance developed later, has continued to make great strides in recent years to achieve a great leap forward.

Since 2015, the Chinese government has issued a number of important documents related to green finance, including the programmatic document “Guiding Opinions on Building a Green Financial System” released in 2016 and the “Green Credit Guidelines”,“Bond Issuance Guidelines”,“Green Investment Guidelines”etc. In 2019, relevant departments have successively issued “The Green Industry Guidance Catalogue” and “The Notice on the Evaluation of Green Credit Performance of Banking Deposit Financial Institutions”, which are standards for green finance related standards. The implementation and improvement of the performance of financial institutions' green credit provide a favorable reference. This article will use the constructed AHP-entropy weight comprehensive weighting method to evaluate the development of China's green finance from 2011 to 2019 and based on the classic gray model to predict the development of China's green finance.

4.1 Variable selection

Considering that China's green credit occupies an absolutely dominant position in the green financial market at this stage, with the scale accounting for about 95%. In addition, according to the Chinese and English bilingual version of the "2019 China Banking Social Responsibility Report" issued by the China Banking Association, as of the end of 2019, the green credit balance of 21 major banks has exceeded 10 trillion yuan (China Banking Association 2020). The credit balance of these 21 banks is also the official data used by the Chinese government to generally express the total amount of green credit at this stage. The 21 major banking institutions include the China Development Bank, the Export–Import Bank of China, the Agricultural Development Bank of China, and 18 other banks (See Appendix A). The 21 major banks, as the main force of China's green credit business, started their green credit statistics earlier, and the system was more standardized, and passed the China Banking Regulatory Commission's special system built-in data check function. Therefore, the evaluation system constructed in this paper is mainly green credit, not involving green bonds, green trusts or green insurance.

With regard to the greenness of green credit, through literature review and summary, green credit generally refers to the loan behavior that financial institutions fully consider environmental protection, social responsibility, and other multiple objectives in the process of providing loan financing, so as to achieve the purpose of supporting the development of environmental protection and new energy industry and promoting the harmonious development of society and nature. Through its definition, it can fully reflect its greenness. In addition, among the green financial instruments, green credit accounts for the largest proportion, and has the strongest policy effect and market response. Through the policy and market orientation of green credit, more enterprises make efforts to improve production processes and technologies, enhance the awareness of environmental protection and energy conservation and emission reduction, so as to achieve faster and lower-cost financing.

The data in this paper are from the official website of China Banking and Insurance Regulatory Commission (CBIRC). This institution is a ministerial-level institution directly under the State Council of China and one of China's most authoritative supervision and management institutions. With reference to the “Key Evaluation Indicators of Green Credit Implementation” issued by the China Banking Regulatory Commission in 2014 (China Banking Regulatory Commission 2014) and the “Information Disclosure Notes on Green Credit Statistics” released in 2018 (China Banking and Insurance Regulatory Commission 2018a, b, c), combined with related information about the green credit statistics of 21 major banks in China disclosed by the CBRC in 2018 (China Banking and Insurance Regulatory Commission 2018a, b, c) and relevant information recently released by the China Banking and Insurance Regulatory Commission, sorting out that green credit includes two major parts, and these two parts are also the secondary indicators in the calculation link of this article: One is to support loans for energy conservation and environmental protection projects and services; the other is to support three major strategies which loan to the manufacturing end of the emerging industries. The third-level indicators include 15 sub-items under two second-level indicators (China Banking and Insurance Regulatory Commission 2018a, b, c): Green agriculture development projects, Green forestry development projects, Industrial energy-saving water-saving environmental protection projects, etc., and a total of 12 loans to support energy-saving and environmental protection projects and services; Energy-saving and environmental protection, New energy, New energy vehicles, and a total of 3 loans to support the three strategic emerging industries production and manufacturing loans. See Table 2 for details.

4.2 Index measurement results and analysis

In the calculation process of subjective weighting method, this paper uses MATLAB software to process the judgment matrix data to make the calculation easier (See Appendix B), that is, the weight \(W_{A}\) of the improved AHP is

And through calculation, the weight \(W_{S}\) of the entropy weight method (objective weighting method) is obtained as

Because this paper uses the improved analytic hierarchy process and entropy weight method \((m = 2)\), and has no preference (\(\varepsilon\) takes 0.5), the simple arithmetic average method can be used to combine the weights, as follows:

Finally, the weight \(W\) of each indicator is established as shown in Table 2.

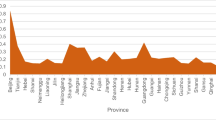

Through the weight calculation of the above indicators, the comprehensive evaluation index of China's green finance in 2011–2019 can be obtained as shown in Table 3 (Fig. 1):

From the results of the index and the rate of change, it can be known that from 2011 to 2019, China's green financial comprehensive evaluation index has been increasing year by year, and the growth rate is fast. Among them, China's green comprehensive evaluation index has the fastest growth rate from 2013 to 2014, reaching 26.27%. From the perspective of the weights of various indicators affecting the comprehensive evaluation index of green finance, the weights of new energy, green transportation projects and new energy vehicles are in the top three, which are 0.2082, 0.1160, and 0.0922, respectively. These three indicators have a greater impact to the index of China's green comprehensive evaluation.

4.3 Prediction

In addition to the 2011–2019 China Green Finance Comprehensive Evaluation Index based on calculations, this paper also uses the classical gray model GM (1, 1) to predict the index for the five-year period from 2020 to 2024 (See Appendix C). Among them, the gray prediction has the advantages of simple operation and less data required, and generally, only 4 data can be predicted based on the gray sequence.

The specific formula and steps are as follows:

-

(1)

Accumulation of original data.

Original sequence

$$x^{(0)} = (x^{(0)} (1),x^{(0)} (2), \cdots x^{(0)} (n))$$Now accumulate \(x^{(0)}\) (AGO) to get a new sequence \(x^{{({1})}}\):

\(x^{{(1)}} = (x^{{(1)}} (1),x^{{(1)}} (2),x^{{(1)}} (3) \cdots x^{{(1)}} (n)) = (x^{{(0)}} (1),x^{{(0)}} (1) + x^{{(0)}} (2),x^{{(0)}} (1) + x^{{(0)}} (2) + x^{{(0)}} (3) \cdots )\) Among them, \(x^{{({1})}} ({\text{k}})\) represents the accumulation of data sequence \(x^{(0)}\) corresponding to the previous k items:

$$x^{{({1})}} ({\text{k}}) = \sum\limits_{{{\text{i}} = 1}}^{k} {x^{(0)} ({\text{i}})} ,k = 1,2,3, \cdots ,n$$ -

(2)

Find the first-order linear differential equation of the gray derivative of the sequence \(x^{{({1})}} (t)\)

$$\frac{{dx^{(1)} }}{dt} + ax^{(1)} = u$$Among them, \(a\) and \(u\) are undetermined coefficients, respectively called development coefficient and gray effect, the effective interval of \(a\) is \(( - 2,2)\), and the matrix formed by a and u is \(\hat{a} = \left( {\begin{array}{*{20}c} a \\ u \\ \end{array} } \right)\). As long as obtaining parameters \(a\) and \(u\), can be determined \(x^{(1)} (t)\), and then find the predicted values \(x^{(0)} (t)\).

-

(3)

Take the mean value of the accumulated data to generate \(B\) and the constant term \(Y_{n}\), namely

$$B = \left[ {\begin{array}{*{20}c} {0.5(x^{(1)} (1) + x^{(1)} (2))} \\ {0.5(x^{(1)} (2) + x^{(1)} (3))} \\ {0.5(x^{(1)} (n - 1) + x^{(1)} (n))} \\ \end{array} } \right]$$$$Y_{n} = (x^{(0)} (2),x^{(0)} (3), \cdots ,x^{(0)} (n))^{{\text{T}}}$$ -

(4)

Solve the gray parameter \(\hat{a}\) by the least square method, then

$$\hat{a} = \left( {\begin{array}{*{20}c} a \\ u \\ \end{array} } \right) = (B^{T} B)^{ - 1} B^{T} Y$$ -

(5)

Substitute the gray parameter \(\hat{a}\) into \(\frac{{dx^{(1)} }}{dt} + ax^{(1)} = u\)

$$\hat{x}^{(1)} (t + 1) = (x^{(0)} (1) - \frac{u}{a})e^{ - at} + \frac{u}{a}$$ -

(6)

Discrete the function expressions \(\hat{x}^{(1)} (t + 1)\) and \(\hat{x}^{(1)} (t)\), and make the difference between the two in order to restore the original sequence of \(\hat{x}^{(0)}\), and obtain the approximate data sequence \(\hat{x}^{(0)} (t + 1)\) as follows

$$\hat{x}^{(0)} (t + 1) = \hat{x}^{(1)} (t + 1) - \hat{x}^{(1)} (t)$$ -

(7)

Model checking.

Calculate the residual \(e^{(0)} (t)\) and relative error \(q(x)\) between \(x^{(0)}\) and \(\hat{x}^{(0)} (t)\)

$$e^{(0)} (t) = x^{(0)} - \hat{x}^{(0)} (t)$$$$q(x) = e^{(0)} (t)/x^{(0)} (t)$$-

Model prediction

-

Use the tested grey model to make predictions

$$\hat{x}^{(0)} = [\underbrace {{\hat{x}^{(0)} (1),\hat{x}^{(0)} (2), \cdots \hat{x}^{(0)} (n)}}_{{\text{Simulation of the original sequence}}},\underbrace {{\hat{x}^{(0)} (n + 1), \cdots ,\hat{x}^{(0)} (n + m)}}_{{\text{Simulation of future series}}}]$$

Among them, m is a positive integer.

-

Through the above steps, the following values and trends are obtained (Table 4, Fig. 2):

From the predicted index results and changes, it can be seen that China's green finance index has shown a continuous upward trend and has maintained a rapid growth trend.

5 Conclusion and policies implications

This article has potential limitations. First of all, since green credit occupies a large proportion of green finance, reaching its rate as high as 95%, it is reasonable to use green credit data to measure green finance in this article, but there are other factors that affect green finance, such as green bonds, green funds, and green insurance. etc., so there are certain limitations. Secondly, the use of green credit data in this paper is the amount of loans that serve green projects and green-related industries, which is equivalent to considering only the originating end of green funds. However, some indicators such as energy saving, various emissions and pollutant content are lacking in existing data, so this article does not consider them. Finally, although this method is an improvement over some previous documents and does not rely on subjective methods to determine the weights, there are still some possible ways to improve to make the results more accurate, which is also a problem that needs to be explored in the future.

Through the above research, this article draws the following conclusions:

-

(1)

In this paper, the entropy method and improved AHP method are used to determine the corresponding index weight, namely AHP entropy weight comprehensive weight method. In this method, the improved AHP method overcomes the subjectivity of AHP itself, solves the problem of checking and modifying the consistency of the judgment matrix, and improves the accuracy of calculation. At the same time, the combination of objective and subjective weighting method is used to determine the index weight more reasonably. From the perspective of the weight of each index affecting the green financial index, the weight of new energy, green transportation projects and new energy vehicles rank the top three, and the impact of these three indexes on China's green financial index is significant.

-

(2)

The measurement model constructed by the AHP-entropy comprehensive weighting method can better evaluate the level of green finance development and can obtain more accurate and factual index results. Taking China as an example, the evaluation of China's green finance development level from 2011 to 2019 shows that China's green finance index has generally shown a rapid growth trend. Among them, China's green comprehensive evaluation index has the fastest growth rate from 2013 to 2014. The results of this evaluation are basically consistent with the development of green finance that has taken place.In the past 9 years, due to the vigorous promotion of the Chinese government and frequent green finance policies, China's green finance continued to develop well, and the growth rate of green credit was as high as 17.9% from 2013 to 2014.

-

(3)

In this article, the classic gray model is used to predict China's green finance development in the next five years. Through the prediction, it is found that China's green finance development level will continue to improve in the future. Moreover, the data predicted by this method is closer to the index result, and the trend of change is basically the same, which proves that the forecast result is credible. As shown below (Fig. 3):

In order to better promote the overall development of China's green finance, this article puts forward the following policy recommendations. First, build a unified green finance evaluation system. In view of the inconsistency of green finance evaluation standards and the unclear classification of green finance, it is necessary to implement green standards suitable for China’s national conditions. Second, encourage the adoption of various green financial transmission mechanisms. While issuing the policy, the concept advocated by the government must be closely integrated with the market environment, so as to realize the real landing of green finance. Third, strengthen the statistics and disclosure of green finance data. Green finance covers a lot of content, such as green bonds, green funds, green insurance, etc. There is no relevant department or website for unified disclosure, and the statistics and disclosure of data still need to be strengthened. Fourth, expand the scope of application of green finance indexes. In the process of accelerating the establishment of the green finance index, moderately expand its application in the ecological environment and regional economic development.

References

Akin T, Iqbal Z, Mirakhor A (2016) The composite risk-sharing finance index: implications for Islamic finance. Rev Financ Econ 31:18–25

Bidding Task Force of the People’s Bank of China Nanchang Center Sub-branch (2018) Research on evaluation and statistical supervision of green finance development. Finan Econ 11:29–35

Bu T-T, Zhang J-H, Wu X, Liu W-X (2013) Black start scheme evaluation of power system based on entropy weight method and improved AHP. Modern Electr 30(5):36–40

Chen N-W, Huang H-H, Lin C-H (2018) Equator principles and bank liquidity. Int Rev Econ Finance 55:185–202

China Banking Regulatory Commission,WWF, PWC (2014) The Sustainable Performance of Chinese Banking and International Financial Institutions Comparative Study

China Banking Regulatory Commission (2014) Key Evaluation Indicators of Green Credit Implementation, http://www.cbrc.gov.cn/chinese/home/docDOC_ReadView/FC5E38D62BE54E3D836E441D6FC2442F.html, Accessed 19 November 2019

China Banking and Insurance Regulatory Commission (2018) Disclosure of green credit statistical information, http://www.cbirc.gov.cn/cn/view/pages/ItemDetail.html?docId=171047, Accessed 20 October 2020

China Banking and Insurance Regulatory Commission (2018) Deepen information disclosure and promote sustainable and healthy development of green credit, http://www.cbirc.gov.cn/cn/view/pages/ItemDetail.html?docId=171282&itemId=915&generaltype=0, Accessed 20 October 2020

China Banking and Insurance Regulatory Commission (2018) Summary of green credit statistics of 21 major domestic banks, http://www.cbirc.gov.cn/cn/view/pages/ItemDetail.html?docId=171047, Accessed 20 October 2020

China Banking Association (2020) 2019 China Banking Industry Social Responsibility Report, https://www.china-cba.net/Index/show/catid/14/id/36020.html, Accessed 20 October 2020

Deng X (2012) Review of green finance research. J Zhong Univ Econ Law 6:67–71

Deng X, Li J-M, Jian H, Chen J-Y, Zhao J-F (2012) Analytic hierarchy process weight calculation method analysis and Application Research. Pract Understand Math 7:93–100

Green Finance Committee of CFA (2019) Central Asian countries jointly discuss the construction of green financial system, http://www.greenfinance.org.cn/displaynews.php?id=2629, Accessed 7 November 2019

Green Finance Research Group (2016) G20-2016 Comprehensive Report on Green Finance, International Financial Organization (IFC). Hangzhou, China

Guo W-Q, An Y-L, Liu S-X (2011) Study on the driving forces of rocky desertification in guizhou province based on variation coefficient method. Meteorol Environ Res 2(2):76–79

He H, Chen M-Y (2004) Defect and improvement of GM (1,1) model prediction formula. J Wuhan Univ Sci Technol 26(7):81–83

Hof AF, Elzen MGJ, Beltran AM (2012) Predictability, equitability and adequacy of post-2012 international climate financing proposals. Environ Sci Policy 14(6):615–627

Hu Q-F, Fan L, Dong Z-J, Zhou H-M, Yang Y, Li Y-J (2014) Application of improved AHP based on fuzzy comprehensive evaluation in landslide risk assessment. J Yangtze River Acad Sci 31(5):29–33

Huang G-Q, Wang M-X, Wang G-L (2012) Research on the improvement of entropy method in efficiency evaluation. Comput Eng Aappl 28:245–248

Hayat F, Daniel M, Pirzada S, AliKhan A (2018) The validation of Granger causality through formulation and use of finance-growth-energy indexes. Renew Sustain Energy Rev 81(2):1859–1867

Jia J-P, He X-Q, Jin Y (2009) Statistics, 4th edn, China Renmin University Press, pp 406.

Zeng X-W (2014) Measurement analysis of China's green finance development. China Yanan Cadre Coll J 6: 112–121.

Jin J-L, Yang X-H, Ding J (2001) An improved scheme of standard genetic algorithm accelerated genetic algorithm. Syst Eng Theory Pract 21(4):8–13

Jin J-L, Wei Y-M, Ding J (2004) Fuzzy evaluation model based on Improved AHP. J Hydraulic Eng 3:65–70

Li C-W, Cai Y-W, Jiang J-J (2018) Construction and thinking of green finance development index. Gansu Finance 9:31–35

Liu S-F, Lin Y (2006) Grey information: theory and practical applications. Springer, London

Mohsin M, Taghizadeh-Hesary F, Panthamit N, Anwar S, Abbas Q, Vo X V (2020) Developing Low Carbon Finance Index: Evidence From Developed and Developing Economies, Finance Research Letters, Article 101520

Peng H, Feng T, Zhou C-B (2018) International experiences in the development of green finance. Am J Indust Bus Manag 8(2):385–392

Research Group of Shizuishan City Sub-branch, People’s Bank of China (2018) Development status of green finance and construction of evaluation system. Western Finance 5:78–82

Research Group of the People’s Bank of China Wuxi Downtown Branch (2019) Research on comprehensive evaluation of sustainable development of green finance in China. Financ Aspect 2:44–50

Street P, Monaghan PE (2001) Assessing the sustainability of bank service channels: the case of the Co-operative Bank, Sustainable Banking: The Greening of Finance. Sheffield

Tian J, Zhang P-Z, Wang K (2004) Research on expert opinion integration model based on Delphi method. Theory Pract Syst Eng 1:57–69

Xu J-G, Li H-H, Wu J (2005) Comparison of economic development level of different regions in China—fuzzy comprehensive evaluation model based on Improved AHP. Chin Manag Sci 13:595–599

Yang P, Ma J (2017) Comparison of green finance development models between China and Britain. China Finance 22:62–64

Zheng C-H, Jiao L-C, Li Y-Z (2008) Support vector classifier based on principal component analysis. J Syst Eng Electron 1:184–190

Zhang C-H, Xie M-Z, “Greening China’s Financial System” Task Force of the Development Research Center of the State Council (2016) The logic and framework of developing China’s green finance. Financial Forum 2:17–28

Author information

Authors and Affiliations

Corresponding author

Additional information

Handling Editor: Luiz Duczmal.

Appendices

Appendix A

The 21 major banking institutions include: China Development Bank, Export Import Bank of China, Agricultural Development Bank of China, Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, China Construction Bank, Bank of Communications, China CITIC Bank, China Everbright Bank, Huaxia Bank, Guangdong Development Bank, Ping An Bank, China Merchants Bank, Pudong Development Bank, Industrial Bank, China Minsheng Bank, Evergrowing bank, China Zheshang Bank, China Bohai Bank and Post Savings Bank of China.

Appendix B

With the help of MATLAB software, the judgment matrix is processed to make the calculation easier.

Start the MATLAB software and input in the command window:

clc.

clear all.

%%Consistency test and weight vector calculation.

[n,n] = size(B);

[v,d] = eig(B);

r = d(1,1);

CI = (r-n)/(n-1);

RI = [0 0 0.52 0.89 1.12 1.24 1.36 1.41 1.46 1.49 1.52 1.54 1.56 1.58 1.59];

CR = CI/RI(n);

if CR < 0.1

CR_Result = 'Pass';

else.

CR_result = 'Fail';

end.

%%Weight vector calculation.

w = v(:,1)/sum(v(:,1));

w = w';

%%Result output.

disp('Calculation report of weight vector of the judgment matrix:');

disp(['Consistency indicators:',num2str(CI)]);

disp(['Consistency ratio:',num2str(CR)]);

disp(['Consistency test results:',CR_Result]);

disp(['Eigenvalues:',num2str(r)]);

disp(['Weight vector:',num2str(w)]);

Output results:

Calculation report of weight vector of the judgment matrix:

Consistency index: 0.0074337.

Consistency ratio: 0.0046753.

Consistency test result: passed.

Characteristic value: 15.1041.

Weight vector: 0.066149 0.069312 0.029018 0.10879 0.065566 0.053291 0.030963 0.059657 0.12215 0.043634 0.048855 0.071576 0.019772 0.056393 0.15487.

That is to say, the weight \(W_{A}\) of the improved AHP is

Appendix C

Also use MATLAB software for prediction.

Start the MATLAB software and input in the command window:

X = [2011,2012,2013,2014,2015,2016,2017,2018,2019,2020,2021,2022,2023,2024];

Y = [2011,2012,2013,2014,2015,2016,2017,2018,2019];

B = [2838.007872,3306.99793,3694.050601,4664.444747,5591.202845,6239.958816,7163.469794,8484.417873,9908.6653];

A = [2838.007872,3349.710125,3909.546787,4562.948884,5325.55399,6215.613213,7254.427922,8466.859612,9881.924868,11,533.48981,13,461.08062,15,710.82945,18,336.57853,21,401.16876];

plot(Y,B,'-*b');

hold on.

plot(X,A,'-or');

legend('real','prediction');

xlabel('Time(y)');ylabel('Index');

Rights and permissions

About this article

Cite this article

Wang, X., Zhao, H. & Bi, K. The measurement of green finance index and the development forecast of green finance in China. Environ Ecol Stat 28, 263–285 (2021). https://doi.org/10.1007/s10651-021-00483-7

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10651-021-00483-7