Abstract

In this paper, we construct a Stackelberg-Cournot tripartite game model and discuss the impact of tariff policy on the privatization of the state-owned enterprise, environmental tax, pollutant emission, and social welfare in an open economic system. We find that with the increase in tariff, the proportion of privatization of the state-owned enterprise increases, environmental tax falls, and environmental pollution alleviates. The relationship between social welfare and tariff is inverted U-shaped. A closed trade environment is most conducive to environmental protection, but the environmental tax at this time is very detrimental to social welfare. When social welfare is optimal, environmental damage is not the smallest.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The rapid economic development has led to aggravation of environmental pollution. China pays more and more attention to environmental protection. In terms of policies and regulations, China is gradually in line with international standards. In 2018, the “Environmental Protection Tax Law of the People’s Republic of China” was promulgated to reduce pollutant emissions by imposing an environmental tax on enterprises. Chinese capita PM2.5 emissions of provinces in 2012, 2014, 2016, and 2018 are shown in Fig. 1. We can see that with the attention of the government, pollutant emissions have been reduced.

In recent years, in order to promote further economic development, many state-owned enterprises try to increase the proportion of privatization. Because of the special social responsibilities of state-owned enterprises, social welfare is included in enterprises’ goals. Improving the environment is essential to improving social welfare. With the development of globalization, foreign companies enter the domestic market. Domestic companies may increase production to protect domestic market. However, pollutant emissions will also increase. Levying an environmental tax can help reduce pollutant emissions and protect the environment. Considering the above issues, we aim to discuss the role of tariffs on the reform of state-owned enterprises and environmental taxes in an open economy.

In the early stage, Matsumura (1998) proposed that proper privatization of state-owned enterprises would help to optimize social welfare. On the basis of the mixed oligarchs’ theory, a group of scholars has carried out researches on the effects of privatization on pollutant emissions. These researches can be roughly divided into two categories. In the first type of studies, scholars assumed that companies produce similar products (Xie et al. 2012). In the second type of studies, scholars brought product differences into the hybrid oligopoly model (Rupayan & Bibhas 2015). Both types of studies have verified that partial privatization is conducive to reducing pollutant emissions and achieving optimal social welfare. Some scholars have brought foreign private enterprises into the hybrid oligarchic model, studying the relationship between the privatization of state-owned enterprises and tariffs in an open economy. Ye and Deng (2010) all thought that partial privatization is conducive to the increase of social welfare. Some scholars have included the privatization of state-owned enterprises, environmental taxes, and tariffs into the mixed oligarchic model for discussion. Xie et al. (2015) found that the time sequence of companies entering the market and the size of the foreign capital shares will have different effects on the optimal trade policy and environmental pollution. Tht et al. (2016) found that privatization can help restore the environment if environmental damage is mild, and privatization may harm the environment if environmental damage is high. Xu et al. (2016) found that the optimal environmental tax is always lower than the marginal environmental damage, and the optimal privatization is always a partial privatization. Lee and Wang (2018) considered how foreign competition and the burden of taxation will affect privatization policy. They found that output subsidies, import tariffs, and partial privatization can improve social welfare when the burden of taxation with foreign competitors is too large. The government may improve the social welfare by using production taxes, tariff policy, and partial privatization.

In addition to constructing game models, scholars used to make dynamic analysis. The application of dynamic theory and chaos theory to the analysis of game models is very common. Most scholars assumed that the market is an oligopoly market and established a dynamic oligopoly game model basing on bounded rationality; then, dynamic analysis was carried out. They used different equations to construct oligopoly game models such as price competition, output competition, and cost competition to analyze the stability of the Nash equilibrium point of the system. The dynamic game model was mainly manifested in the form of duopoly, triple oligarch, and quadruple oligopoly (Elsadany 2012; Ma & Sun 2018). These game models are always used in supply chain and stability analysis (Xie et al. 2020). Some scholars have applied this type of method in different fields, just like advertising market (Mu et al. 2010), electricity market (Zhu et al. 2022), household appliances market (Lou & Ma 2018), electric vehicle field (Bao et al. 2020; Ma & Xu 2022), solar photovoltaic (Xu & Ma 2021), and agricultural field (Liu et al. 2020; Liu & Zhan 2019; Su et al. 2014, 2018a, 2018b). There were even recycling system (Zhu et al. 2021; Ma & Hao 2018) and trade friction (Wang et al. 2019) in the research field. Some scholars have explored the improvement of the model, such as Ma and Ren (2016) and Yan and Sun (2017).

Most scholars only cared about the effects of a single policy, ignoring the interaction between multiple policies in an open environment. In this article, we comprehensively consider the tariff policy, the environmental tax policy, and the privatization reform policy of state-owned enterprises. By constructing a Stackelberg-Cournot three-stage game model, we investigate the impact of tariffs on the reform of state-owned enterprises’ shareholding system and environmental taxes. Using this model helps us understand the interaction between variables.

The structure of this paper is arranged as follows. In the second part, we construct a Stackelberg-Cournot tripartite game model basing on some assumptions. In the third part, we solve the Nash equilibrium of the game model and analyze the impact of the tariff on the privatization of state-owned enterprises, environmental tax, pollutant emission, and social welfare. In the last part, we summarize the conclusions of the research and propose some suggestions.

Modelling

Oligopoly competition is very common in some industries. In reality, various elements are intertwined with each other, and it is difficult to use a single model to describe every detail. Therefore, we construct a simplified model to describe oligopoly competition through some assumptions.

An industry is considered to be oligopoly competition, and the companies are the participants in the game. State-owned enterprises, private enterprises, and foreign enterprises are representative enterprises in the market. We select these three types of companies as participants in the game. So we make the following assumption.

Assumption 1

There are three enterprises in the domestic market, namely enterprise 1, enterprise 2, and enterprise 3. Among them, enterprise 1 is a state-owned enterprise, enterprise 2 is a domestic private enterprise, and enterprise 3 is a foreign private enterprise. These three enterprises produce homogeneous products, and \({q}_{i}\left(t\right)\) represents the output of the enterprise \(i\left(i=\mathrm{1,2},3\right)\) at time \(t\).

In the simple model, all the products produced by the company are purchased by consumers. Therefore, the utility function of representative consumers and consumer surplus may be related to the output quantity. We refer to the research of Fanti and Gori (2012) and Ma et al. (2021) and then make the following assumptions.

Assumption 2

We assume that all consumers are the same, and the representative consumer’s utility function of \({q}_{1},{q}_{2},{q}_{3}\) is.

where \({a}_{1}>0,{a}_{2}>0,{a}_{3}>0,{b}_{1}>0,{b}_{2}>0,{b}_{3}>0\); \({d}_{1}\in \left(-\mathrm{1,1}\right)\;\left(i=\mathrm{1,2},3\right)\) represents the horizontal product differentiation. When \({d}_{i}\in \left(\mathrm{0,1}\right)\) these products are imperfect substitutable. As \({d}_{i}\) approaches 0, the difference between products becomes larger. When \({d}_{i}=1\), the products of the three firms are homogeneous. When \({d}_{i}\in \left(-\mathrm{0,1}\right)\), these products are complements. The value \({d}_{i}=1\) reflects the existence of complete complementarity. Note that we abbreviate the output as \({q}_{i}\left(i=\mathrm{1,2},3\right)\).

Since three companies produce homogeneous products, we set \({d}_{i}=1\). Then, the utility function is

Assumption 3

We assume that the inverse demand functions of products at time t are.

In this article, since we assume that the products of the three oligarchs are homogeneous, \({d}_{1}={d}_{2}={d}_{3}=1\). Hence, we have the inverse demand functions

From Eqs. (1) and (2), consumer surplus can be expressed as

The cost of an enterprise usually includes fixed costs and variable costs, and variable costs can be approximated in a linear form. So we made the following assumption.

Assumption 4

The three companies have no technical differences in product production and their marginal costs are same. Then, their cost functions are the same.

Enterprises 1, 2, and 3 all produce pollutant emissions during the production process. Enterprises adopt emission reduction measures to reduce pollution, and certain costs are usually incurred in the process. In this article, we focus on the pollutant emissions of state-owned enterprises and domestic private enterprises, the pollutant emissions of foreign private enterprises have negligible impact on domestic social welfare. So the pollutant discharge and pollution cost of enterprise 3 are not considered here. Regarding corporates’ pollution emissions, we have made the following assumptions.

Assumption 5

The total emissions of enterprise \(i\left(i=\mathrm{1,2}\right)\) is \({e}_{1}\left(t\right)\left(i=\mathrm{1,2}\right)\). For the convenience of analysis, we refer to the research of Rupayan and Bibhas (2015), assuming that every unit product produced by a company will emit \({\theta }_{i}>0\left(i=\mathrm{1,2}\right)\) pollutant. Therefore, the company’s pollutant emission is \({\theta }_{i}{q}_{i}\left(t\right)\). We set the company’s emission reduction to \({h}_{i}\left(t\right)\), and the company’s actual pollutant emission is.

for \(i=\mathrm{1,2}\). The setting of corporate abatement costs draws on the method of Ulph (1996), and the corporate abatement cost is expressed as \(\frac{{v}_{i}{\left({h}_{i}\left(t\right)\right)}^{2}}{2}\), where abatement cost parameter \({v}_{i}>\left(i=\mathrm{1,2}\right)\). The environmental damage caused by pollutant discharge is \(\left(e\left(t\right)\right)\). Its relationship with pollutant emissions is

where the pollution parameter \(\varepsilon >0\).

In order to protect the environment and control the discharge of pollutants, the government will levy an environmental tax on enterprises. Hence, we make the following assumption.

Assumption 6

Government imposes \(x\left(t\right)\) as the environmental tax on each unit of pollutants discharged.

In an open economic system, in order to protect domestic industries, the domestic government often imposes tariffs on imported products. Therefore, we make the following assumption.

Assumption 7

The government imposes a specific tariff on the foreign firm (enterprise 3) and the tariff rate is \(\left(t\right)\).

Using assumptions 1–7, the profit of enterprises 1, 2, and 3 can be written as the following forms.

where \({\pi }_{i}\left(t\right)\) represents the profit of enterprise \(\mathrm{i}\left(i=\mathrm{1,2},3\right)\).

Private enterprises usually aim at maximizing profits, while state-owned enterprises have a different objective function from private enterprises due to their special social responsibilities. Hence, we make the following assumption.

Assumption 8

The objective function of the state-owned enterprise is.

The objective function of a state-owned enterprise is composed of the profit of the state-owned enterprise and \({W}_{p}\left(t\right)\). We continue to make the following assumptions.

Assumption 9

Suppose that the state-owned enterprise does not care about environmental damage and the government’s tax revenue, and then \({W}_{p}\left(t\right)={\pi }_{1}\left(t\right)+{\pi }_{2}\left(t\right)+CS\left(t\right)\) The parameter \(k\left(t\right)\left(0\le k\left(t\right)\le 1\right)\) represents the privatization ratio of state-owned enterprise. If \(\mathrm{k}\left(t\right)=0\), enterprise 1 is a completely state-owned enterprise, and if \(\mathrm{k}\left(t\right)=1\), enterprise 1 is completely privatized.

However, in order to facilitate the distinction, no matter how privatized enterprise 1 is, enterprise 1 will still be referred to as a state-owned enterprise later.

The government takes the maximization of social welfare as the objective function. So we make the following assumptions.

Assumption 10

The country’s social welfare expression is.

The game in this article is divided into three stages in orderFootnote 1: In the first stage, according to the optimization of social welfare, state-owned enterprises determine the privatization ratio. According to assumptions 1–10, the privatization reform of state-owned enterprise in the first stage is

In the second stage, the government formulates an environmental tax to maximize social welfare. According to assumptions 1–10, in the second stage, the government formulated an environmental tax plan, which is

In the third stage, under the constraints of the privatization ratio and the environmental tax, enterprise 1, enterprise 2, enterprise 3 determine outputs and pollutant emission reduction and then achieve the maximum goal of these enterprises. According to assumptions 1–10 and Eqs. (3) and (4), the plan of the business objectives of the third stage is

Note that

Nash equilibrium analysis

According to the general method of solving this kind of game problem, we adopt the reverse induction method to solve it.

Since the main purpose of this article is to examine the impact of tariffs on the degree of privatization of state-owned enterprises, environmental pollution, and social welfare, it is assumed that the tariff \(r\left(t\right)\) is given exogenously. In order to simplify the analysis below, we might as well set \({\theta }_{1}=1,{v}_{1}=1,\varepsilon =1,{a}_{1}=a,{b}_{i}=1\). In order to visualize the relationship between variables with images, we will assume \(f=1,c=0.01,a=1,b=1\) when drawing figures. First, we analyze the third stage. At this stage, each enterprise determines the emission reduction and output according to the objective function.

Proposition 1

Under the conditions of mixed tri-oligarchic competition, the privatization of state-owned enterprises increases with the increase in the tariff.

Proof

Since \({e}_{1}\left(t\right)\) are functions of \({h}_{1}\left(t\right)\) and \({\theta }_{i}\), while \({p}_{i}\left(t\right)\) are functions of \({q}_{1},{q}_{2},{q}_{3}\) for \(i=\mathrm{1,2},3\), according to the first-order condition of the objective function of state-owned enterprise, we have.

Since \(\frac{{\partial }^{2}{O}_{1}\left(t\right)}{\partial {\left({q}_{1}\left(t\right)\right)}^{2}}<0,\frac{{\partial }^{2}{O}_{1}\left(t\right)}{\partial {\left({h}_{1}\left(t\right)\right)}^{2}}<0\), the optimal condition of the objective function of enterprise 1 is satisfied. From the first-order condition of the objective function of the domestic private enterprise, we have

Similarly, \(\frac{{\partial }^{2}{\pi }_{2}\left(t\right)}{\partial {\left({q}_{2}\left(t\right)\right)}^{2}}<0,\frac{{\partial }^{2}{\pi }_{2}\left(t\right)}{\partial {\left({h}_{2}\left(t\right)\right)}^{2}}<0\), enterprise 2 also has the maximum value of the objective function. From the first-order condition of the objective function of the foreign enterprise, we have

Using of Eqs. (6), (7), and (8), the output and emission reduction of enterprise 1, enterprise 2, enterprise 3 at this stage are obtained as follows

Next, let us consider the second stage of the game. The government sets the environmental tax rate according to the principle of maximizing social welfare. According to (5) and (9), we get

where

From the first-order condition of Eq. (10), the environmental tax formulated by the government is

In the first stage of the game, the government determines the degree of privatization of state-owned enterprises from the perspective of maximizing social welfare. Using Eqs. (11) and (10), we get

where

From the first-order condition of Eq. (12), the optimal privatization ratio expression is obtained

Substituting Eq. (13) into Eq. (9), we obtain the output of enterprise 1, enterprise 2, and enterprise 3 as follows

Equation (14) shows equilibrium outputs of three firms.

Furthermore, we obtain the expression of profit and consumer surplus as Eq. (15)

where

Since there is a foreign enterprise included in the mixed oligarchic model, the export volume \({q}_{3}\left(t\right)\) of enterprise 3 to the country should be greater than or equal to 0. According Eq. (14), we can know that \(\frac{2\left(a-c\right)-5r\left(t\right)}{13}\ge 0\), because \(r\left(t\right)>0\), then \(a-c\ge 0\). Taking first-order derivative of Eq. (13) with respect to \(\left(t\right)\), we can get that \(\frac{\partial k\left(t\right)}{\partial r\left(t\right)}=\frac{65\left(a-c\right)}{\left(12c-12a+17r\left(t\right)\right)}\ge 0\). This completes the proof.

In reality, the number of imported products cannot be less than 0, so \({q}_{3}^{*}\left(t\right)=\frac{2\left(a-c\right)-5r\left(t\right)}{13}\ge 0.\) We have assumed \(f=1,c=0.01,a=1,b=1\), then \(0\le r\le 0.396\) Once r exceeds the range, other variables stop changing. So in Fig. 2, there is a constant branch. The relationship between r and \(k\) is shown in Fig. 2, and the relationship between r, k, and \({O}_{1}\) is shown in Fig. 3.

Proposition 2

Under the conditions of mixed three-oligarchic competition, the government’s optimal environmental tax will increase with the increase of the tariff.

Proof

Substituting Eq. (13) into Eq. (11), the reaction function of the environmental tax rate \(x\left(t\right)\) with the tariff \(r\left(t\right)\) is obtained.

Taking first-order derivative of Eq. (16) with respect to \(\left(t\right)\), we can get that \(\frac{\partial x\left(t\right)}{\partial r\left(t\right)}=-\frac{1}{13}<0\). This completes the proof.

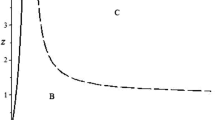

We have known that \(0\le r\le 0.396\). So in Fig. 4, there is still a constant branch. The relationship between r and x is shown in Fig. 4, and the relationship between r, k, and x is shown in Fig. 5.

Proposition 3

Under the conditions of mixed tri-oligopoly competition, society’s pollutant emissions decrease with the increase of the tariff.

Proof

According to Eqs. (13) and (16), we have the total pollutant emissions of the society \(\left(t\right)={e}_{1}\left(t\right)+{e}_{2}\left(t\right)=\frac{3\left(a-c\right)-r\left(t\right)}{13}\). Doing the first-order derivation on this basis, we get \(\frac{\partial e\left(t\right)}{\partial r\left(t\right)}=-\frac{1}{13}<0\). This completes the proof.

Because \(0\le r\le 0.396\), there is also a constant branch in Fig. 6. The relationship between r and e is shown in Fig. 6, and the relationship between r, x and e is shown in Fig. 7.

Proposition 4

Under the conditions of mixed tri-oligarchic competition, the country’s social welfare and the tariff are in an inverted U-shaped relationship.

Proof

Substituting Eq. (13) into Eq. (12), we can further obtain the social welfare of the country as.

Calculate the first derivative of Eq. (17) with respect to \(\left(t\right)\), we get \(\frac{dW\left(t\right)}{dr\left(t\right)}=\frac{a-c-9r\left(t\right)}{13}\). When \(-c\ge 9r\left(t\right)\), \(\frac{dW\left(t\right)}{dr\left(t\right)}\ge 0\); when \(a-c<9r\left(t\right)\), \(\frac{dW\left(t\right)}{dr\left(t\right)}<0\). This completes the proof.

There is a constant branch in Fig. 8 because \(0\le r\le 0.396\). The relationship between r and W is shown in Fig. 8; the relationship between r, e, and W is shown in Fig. 9; the relationship between r, k, and W is shown in Fig. 10; and the relationship between r, x and W is shown in Fig. 11.

Conclusion and policy implications

In this article, by constructing a three-stage game model of mixed oligarchy, we analyze the impact of the import tariff on the state-owned enterprise shareholding reform, environmental pollution and social welfare in an open economic environment. After research in this article, we get some decisions.

-

1.

Under the conditions of mixed three-oligarchic competition, the privatization of the state-owned enterprise increases with the increase in tariff. With the increase in the tariff, the export of foreign company is suppressed, and domestic consumer surplus is lost. Although the government revenue increases with the tariff, the loss of consumer surplus may worsen social welfare. In this case, the government prefers to improve the profitability of the state-owned enterprise by increasing its proportion of privatization, so as to maintain the stability of social welfare.

-

2.

The government’s optimal environmental tax increases with the increase of the the tariff. The export of foreign company is suppressed because of a higher tax. In order to meet market demand, the overall production volume of domestic enterprises has been increased, and there are more and more pollutant emissions. For the purpose of environmental protection, the government will increase the environmental tax.

-

3.

Society’s pollutant emissions have been decreased with the increase of the tariff. The increase in the tariff causes the government to levy a higher environmental tax. Levying an environmental tax helps to reduce domestic companies’ pollutant emissions, thereby protecting the environment.

-

4.

The relationship between social welfare and tariff is in an inverted U shape. From the view of real economics, although the highest tariff is conducive to protecting the environment and increasing the level of privatization, it is not conducive to social welfare. When the tariff is lower than the prohibitive tariff, with the increase of the tariff, the privatization of the state-owned enterprise becomes higher, outputs are reduced, pollutant emissions are reduced, and the environment is improved. So the environmental tax and pollutant emissions will be decreased with a relatively small growth of the tariff. However, too high tariff will hinder import and the competitiveness of the domestic market will be declined, which raises the price of product, reduces the output and profit of the state-owned enterprise, adversely affects consumers, and leads to consumer surplus losses. Since social welfare includes the interests of enterprises, consumers, the government, and environment, although the government gets more tariff revenue and the environment is improved, the losses from consumers and enterprises are larger, which leads to a decrease in social welfare.

Based on the research and analysis of this article, we have the following policy suggestions. The environmental tax rate reaches the highest without trade, and the total pollutant emissions of domestic enterprises are the lowest at this time. When social welfare is maximized, the environmental tax corresponding to the tariff is not the level that is most conducive to environmental protection. Too low tariff or too high tariff does not benefit for maximizing social welfare. This shows that there is a conflict in the formulation of environmental policy and tariff policy. In an open economic system, the government has formulated scientific and reasonable tariffs by analyzing domestic and foreign economic conditions and other factors. Privatization of state-owned enterprises will help incentivize state-owned enterprises to be more profitable, and internal company management systems will become more effective. Therefore, in order to optimize social welfare, we believe that more consideration should be given to protecting the environment. In this regard, we make the following suggestions.

-

1.

The government should implement excess progressive tax rates when levying environmental taxes. Through scientific and technical methods to calculate the pollutant discharge of enterprises, the government levies more taxes on enterprises that discharge excessive pollutants, increasing the cost of such enterprises to discharge pollution. In this way, it can play the purpose of restraining the pollutant discharge of enterprises.

-

2.

Scientific research departments should actively carry out research on environmental protection technology. The application of technology can improve the treatment efficiency of pollutants, reduce the costs of enterprises, and protect the environment. Thus, the welfare of society will be improved.

-

3.

The government should strengthen the publicity of environmental protection, encourage enterprises to produce environmentally friendly products, and strengthen enterprises’ awareness of environmental protection. At the same time, the government should also encourage the public to consume low-polluting products.

Data availability

The data that supports the findings of this study are available in the supplementary material of this article.

Notes

In accordance with the timing of the mixed reform of state-owned enterprises and the environmental tax policy, we regard the reform of the state-owned enterprise shareholding system as the first stage of the game and the formulation of the environmental tax as the second stage. If the shareholding reform of state-owned enterprises and the formulation of environmental taxes are regarded as occurring at the same time, a two-stage game is constructed, and the final result is exactly the same as the three-stage game.

References

Bao B, Ma J, Goh M (2020) Short- and long-term repeated game behaviours of two parallel supply chains based on government subsidy in the vehicle market. Int J Prod Res 58(24):1–24

Elsadany AA (2012) Competition analysis of a triply game with bounded rationality. Chaos, Solitions Fractals 45:1343–1348

Fanti L, Gori L (2012) The dynamics of a differentiated duopoly with quantity competition. Econ Model 29(2):421–427

Lee JY, Wang L (2018) Foreign competition and optimal privatization with excess burden of taxation. J Econ 125(1):189–204

Liu LX, Wang TT, Xie L et al (2020) Influencing factors analysis on land-lost farmers’ happiness based on the rough DEMATEL method. Discret Dyn Nat Soc 4:1–10

Liu L, Zhan X (2019) Analysis of financing efficiency of Chinese agricultural listed companies based on machine learning. Complexity 5:1–11

Lou W, Ma J (2018) Complexity of sales effort and carbon emission reduction effort in a two-parallel household appliance supply chain model. Appl Math Model 64(12):398–425

Ma JH, Xu TT (2022) Optimal strategy of investing in solar energy for meeting the renewable portfolio standard requirement. J Oper Res Soc. https://doi.org/10.1080/01605682.2022.2032427

Ma JH, Zhu LQ, Guo YN (2021) Strategies and stability study for a triopoly game considering product recovery based on closed-loop supply chain. Oper Res Int Journal 21(4):2261–2282

Ma J, Hao R (2018) Influence of government regulation on the stability of dual-channel recycling model based on customer expectation. Nonlinear Dyn 94:1775–1790

Ma J, Ren W (2016) Complexity and hopf bifurcation analysis on a kind of fractional-order IS-LM macroeconomic system. Int J Bifurc Chaos 26(11):1650181

Ma J, Sun L (2018) Complexity analysis about nonlinear mixed oligopolies game based on production cooperation. IEEE Trans Control Syst Technol 26(4):1532–1539

Matsumura T (1998) Partial privatization in mixed duopoly. J Public Econ 70(3):473–483

Mu LL, Chen LW, Zhang JL (2010) Complexity of game behavior in non-equlibrium real estate market. J Syst Eng 12:824–828

Rupayan P, Bibhas S (2015) Pollution tax, partial privatization and environment. Resour Energy Econ 40:19–35

Su X, Duan S S, Guo S, et al. (2018a) Evolutionary games in the agricultural product quality and safety information system: a multiagent simulation approach. Complexity, (2):185497.

Su X, Liu H L, Hou S Q. (2018b) The trilateral evolutionary game of agri-food auality in farmer-supermarket direct purchase: a simulation approach. Complexity, (2): 684185.

Su X, Wang Y, Duan SS et al (2014) Detecting chaos from agricultural product price time series. Entropy 16(2):6415–6433

Tht A, Ccw B, Jrc C (2016) Can privatization be a catalyst for environmental R&D and result in a cleaner environment? Resour Energy Econ 43(2):1–13

Ulph A (1996) Environmental policy and international trade when governments and producers act strategically. J Environ Econ Manag 30(3):265–281

Wang H, Wang Y, Guo S (2019) Research on dynamic game model and application of China’s imported soybean price in the context of China-US economic and trade friction. Complexity 11:6048186

Xie L, Ma J, Goh M (2020) Supply chain coordination in the presence of uncertain yield and demand. Int J Prod Res 1:1–17

Xie SX, Wang XS, Shang LY (2012) Mixed duopoly competition, pollutant emission and environmental tax. J Shandong Univ Finance 1:59–64

Xie SX, Wang Z, Hu K (2015) Foreign capital shares, trade policies and pollutant discharges of partial privatized state-owned enterprises. J World Econ 38(6):49–69

Xu L, Cho S, Lee SH (2016) Emission tax and optimal privatization in Cournot-Bertrand comparison. Econ Model 55(6):73–82

Xu T, Ma J (2021) Feed-in tariff or tax-rebate regulation? Dynamic decision model for the solar photovoltaic supply chain. Appl Math Model 89(1):1106–1123

Yan H, Sun X (2017) Impact of partial time delay on temporal dynamics of Watts-Strogatz Small-World neuronal networks. Int J Bifurc Chaos 27(7):1750112

Ye GL, Deng GY (2010) Optimal tariff and partial privatization: a mixed duopoly model with product differentiation. China Econ Q 9(2):597–608

Zhu MH, Li X, Zhu LQ et al (2021) Dynamic evolutionary games and coordination of multiple recycling channels considering online recovery platform. Discret Dyn Nat Soc 8:9976157

Zhu MH, Li X, Ma J et al (2022) Study on complex dynamics for the waste electrical and electronic equipment recycling activities oligarchs closed loop supply chain. Environ Sci Pollut Res 29:4519–4539

Acknowledgements

We thank the reviewers and associate editor for their careful reading and helpful comments on the revision of paper.

Funding

This work was supported by the Taishan Scholars Program (tsqn20161042), National Natural Science Foundation of China (Grant Nos. 11601270 and 72102121), and Shandong Provincial Natural Science Foundation (Grant No. ZR2021MA038).

Author information

Authors and Affiliations

Contributions

Hui Wang, Yi Wang, Zongxian Wang: Thesis architecture design, writing the original draft.

Hui Wang: Project administration, modeling and drafting the manuscript.

Yi Wang: Formal analysis and reviewing.

Zongxian Wang: Supervision and revising the paper.

Corresponding authors

Ethics declarations

Ethics approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Conflict of interest

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

ESM 1

(XLSX 11 KB)

Rights and permissions

About this article

Cite this article

Wang, H., Wang, Y. & Wang, Z. Research on the economic impact of environmental tax under the background of state-owned enterprise shareholding reform in an open economic system. Environ Sci Pollut Res 29, 81481–81491 (2022). https://doi.org/10.1007/s11356-022-21603-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-21603-1